Invesco Mortgage Capital Inc.

2009 Second Quarter Investor Call

August 11, 2009

Richard J. King

President & Chief Executive Officer

John M. Anzalone

Chief Investment Officer

Donald R. Ramon

Chief Financial Officer

Forward-Looking Statements

This presentation, and comments made in the associated conference call today, may include “forward-looking statements.” Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, targets, expectations, anticipations, assumptions, estimates, intentions and future performance. Forward-looking statements also include statements regarding our ability to acquire and finance targeted assets, our ability to realize an attractive return from our investments and/or to mitigate our risk from those investments and our related financing arrangements, and our ability to realize returns from agency RMBS that are similar to our non-agency RMBS when financed with repurchase agreements. In addition, words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project,” “forecast,” and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements.

Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. There can be no assurance that actual results will not differ materially from our expectations. We caution investors not to rely unduly on any forward-looking statements and urge you to carefully consider the risks described in our our registration statement on Form S-11 and subsequent Forms 10-Q, filed with the Securities and Exchange Commission.

You may obtain these reports from the SEC’s website at www.sec.gov. We expressly disclaim any obligation to update the information in any public disclosure if any forward-looking statement later turns out to be inaccurate.

Discussion Topics

1.

Business Overview

2.

Investment Portfolio

3.

Questions and Answers

Business Overview

Externally managed by Invesco Institutional (N.A.) Inc.

Worldwide Fixed Income

Invesco Real Estate

WL Ross

Completed IPO in July ’09 raising $201.2mn net of

offering costs

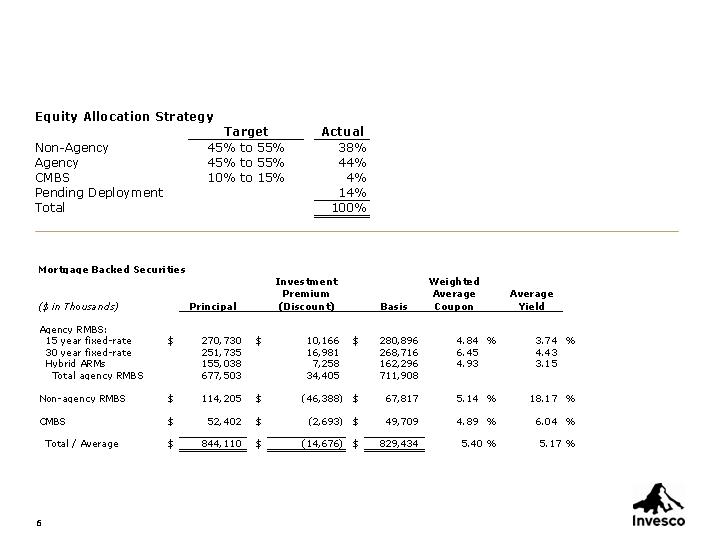

Acquired $829.4mn portfolio

Obtained $630.6mn repo financing for Agency RMBS

Obtained $40.1mn financing under TALF for CMBS

Entered into swaps with $275.0mn notional value

Investment Strategy

RMBS and CMBS with attractive risk-adjusted yields

Obtain government financing when available

Maintain a short duration gap

Diversify balance sheet risk for assets and liabilities

Discussion Topics

1.

Business Overview

2.

Investment Portfolio

3.

Questions and Answers

Portfolio Composition (1)

(1) Portfolio information as of July 17, 2009

Agency RMBS

Agency Hybrids

Predominantly Interest-Only Pools

7 CPR in July ‘09

15 Year Fixed Rate Collateral

Purchased in lieu of Agency Hybrids

Seasoned and Loan Balance Paper

10 CPR in July ‘09

30 Year Fixed Rate Collateral

Concentration in Higher Coupons (6% and 6.5%)

Every Pool is Prepay Protected

14 CPR in July ’09

Slower CPR protects $105 premium paid for Agency RMBS

Non-Agency RMBS

Credit

Mix of Prime and Alt-A Collateral

Focus on 2005 and 2006 Vintages

Senior or Super-Senior Tranches

No exposure to Option ARM Collateral

Positive Yields in “Worst Case” Stress Scenario

Prepayments

Average Purchase Price was $61.35

Our Non-Agency RMBS Paid 18 CPR in July

Expect Prepays to slow to 8-12 CPR

Yields and Financing

Average Projected Yield of 17.5%

No Leverage

* There is no guarantee that the above results will be realized.

CMBS

6.04% Average Yield

3.91% Cost of Financing

Financed through the Fed’s TALF Program

5 Year Term, Maturing in July 2014

2.13% Net Interest Margin

Collateral

Average Purchase Price was $95

All of our Purchases are from the 2005 Vintage

CMBS positions are Match Funded

Expenses and Dividend Policy

G&A Expense

Management fee 1.5% of equity

Public company expense range 1.7% - 1.9%

D&O Insurance, Auditing, Accounting, Tax, Legal, CFO, etc.

Higher than IPO estimates due to reduced offering size

Dividend Strategy

Quarterly dividends beginning with Q3 ’09

Target 100% of taxable income annually

Questions and Answers

2009 Second Quarter Investor Call

August 11, 2009