- IVR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

-

Institutional

- Shorts

-

DEF 14A Filing

Invesco Mortgage Capital (IVR) DEF 14ADefinitive proxy

Filed: 19 Mar 20, 4:21pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant ☑ | Filed by a Party other than the Registrant ☐ | |

| Check the appropriate box: | ||

| ☐ Preliminary proxy statement | ||

| ☐Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| ☑ Definitive Proxy Statement | ||

| ☐ Definitive Additional Materials | ||

| ☐ Soliciting Material Pursuant to § 240.14a-12 | ||

Invesco Mortgage Capital Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. |

| ☐ | Fee computed below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notice of 2020 Annual Meeting of Stockholders

Proxy Statement

Your vote is important

Please vote by using the Internet, the telephone or by signing, dating and returning a proxy card

Jack Hardin has served as Chair since 2017 and as a

non-executive director of our company since 2014.

Q&A with the Chair of Our Board of Directors

How has the Company weathered recent market volatility?

Despite volatile market conditions in 2019, we were able to increase our dividend in the 4th quarter by 11% after maintaining it level for the first three quarters. The company also issued an additional 30.1 million shares of our common stock in two public offerings resulting in net proceeds of over $468 million in February and August of 2019. We enter 2020 on a strong note, having raised an additional $347 million in common equity in February as we continue to build upon the positive momentum achieved in 2019.

How does the Board approach director recruitment?

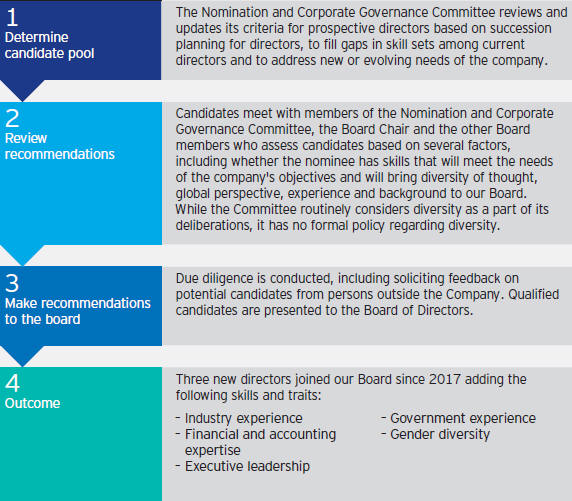

The Board remains committed to ensuring that it is composed of a highly capable group of directors who are well-equipped to oversee the success of the company and effectively represent the interests of our stockholders. Since 2017, we have added three new members to the Board, Carolyn Handlon, Dennis Lockhart, and Loren Starr. The addition of these directors has provided the Board with new qualifications and perspectives. We encourage you to review the qualifications, skills and experience that we have identified as important attributes for directors of our company and how they match up to each of our directors.

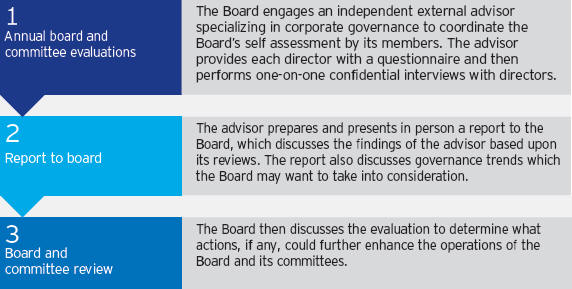

Does the Board conduct a self-evaluation?

Each year the Board, with the assistance of an external advisor specializing in corporate governance, conducts an evaluation of the performance of our Board and each of its committees. Directors participate inone-on-one confidential interviews with the advisor and the Board as a group receivesin-person feedback from the advisor based on those interviews. This information assists the Board in assessing how it can continue to improve its performance.

What does it mean to be externally managed?

We pay a fee to our external manager to manage our company; we have no direct employees. Our manager, in turn, manages and determines compensation of its employees, including our executive officers. Our manager does, however, consult with your Board in an annual discussion of the philosophy, process, and structure of compensation of our executive officers. Accordingly, your board has the opportunity to understand the important elements of the compensation philosophy and structure of its executives and satisfy ourselves that they are not inconsistent with our stockholders’ interests.

In addition, each year the Board’s independent directors engage in a review of the management agreement with our manager in the context of a review of peer company management fees. The Board is focused on ensuring the management fee aligns our manager’s incentives with the interests of our stockholders.

How do I communicate with the Board?

As we conduct the activities of the Board, a key priority is ensuring our company engages in robust engagement with you, the owners of the Company. Please continue to share your thoughts with us on any topic as we value your input, investment and support. The Board has established a process to facilitate communication by stockholders with the Board. Communications can be addressed to the Board of Directors in care of the Office of the Company Secretary, Invesco Mortgage Capital Inc., 1555 Peachtree Street NE, Atlanta, Georgia 30309 or bye-mail to company.secretary@invescomortgagecapital.com.

Where and when is the annual meeting?

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Invesco Mortgage Capital, which will be held on Tuesday, May 5, 2020, at 2:00 p.m., Eastern Time, at Invesco’s Global Headquarters, located at 1555 Peachtree Street N.E., Atlanta, Georgia 30309.

Notice of 2020 Annual Meeting of Stockholders

To our Stockholders:

The 2020 Annual Meeting of Stockholders of Invesco Mortgage Capital Inc. will be held at the following location and for the following purpose:

When | Tuesday, May 5, 2020, at 2:00 p.m., Eastern Time | |||||

Where | 1555 Peachtree Street N.E. Atlanta, Georgia 30309

| |||||

| Items of business | 1 | To elect seven (7) directors to the Board of Directors to hold office until the annual meeting of stockholders in 2021;

| ||||

| 2 | To hold an advisory vote to approve the company’s executive

| |||||

| 3 | To appoint PricewaterhouseCoopers LLP as the company’s

| |||||

| 4 | To consider and act upon such other business as may

| |||||

| Who can vote | Only holders of record of our common stock on March 5, 2020 are entitled to notice of and to attend and vote at the Annual Meeting and any adjournment or postponement thereof. Beginning on March 19, 2020, we mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access this Proxy Statement and our Annual Report via the Internet to eligible stockholders. | |||||||

By Order of the Board of Directors,

Rebecca S. Smith, Secretary

March 19, 2020

| ||||||||||

This summary highlights selected information in this Proxy Statement. Please review the entire Proxy Statement and the company’s Annual Report on Form10-K for the year ended December 31, 2019 before voting.

| ||||||||||

Matters for stockholder voting | ||||||||||

At this year’s Annual Meeting, we are asking our stockholders to vote on the following matters:

| ||||||||||

Proposal

|

Board vote recommendation

| |||||||||

| 1 | Election of directors

| FOR | ||||||||

| 2 | Advisory vote to approve the company’s executive compensation

| FOR | ||||||||

| 3 | Appointment of PricewaterhouseCoopers LLP for 2020

| FOR

| ||||||||

Our Directors and their qualifications | ||||||||||

| The Board believes that all of the directors are highly qualified. As the chart below and biographies show, our directors have the significant leadership and professional experience, knowledge and skills necessary to provide effective oversight and guidance for the company’s strategy and operations. As a group, they represent diverse views, experiences and backgrounds. All the directors satisfy the criteria set forth in our Corporate Governance Guidelines and possess the characteristics that are essential for the proper functioning of our Board. | ||||||||||

| Key: A- Audit C- Compensation NCG- Nomination and Corporate Governance M- Member Ch- Chairperson | ||||||||||||||||||||||||||||

Director qualifications | ||||||||||||||||||||||||||||

Committee memberships

|  |  |  |  |  | |||||||||||||||||||||||

Name

| Age

| Director

| Independent

| Other public

| A

| C

| NCG

| |||||||||||||||||||||

|

John S. Day Former Partner, Deloitte & Touche LLP

| 71 | 2009 | ✓ | 0 | Ch | M | M | ∎ | ∎ | ∎ | |||||||||||||||||

Carolyn B. Handlon EVP Finance and Global Treasurer, Marriott International

| 62 | 2017 | ✓ | 0 | M | Ch | M | ∎ | ∎ | |||||||||||||||||||

Edward J. Hardin Partner, Rogers & Hardin LLP

| 77 | 2014 | ✓ | 0 | M | M | M | ∎ | ∎ | ∎ | ||||||||||||||||||

James R. Lientz, Jr. Former COO, State of Georgia

| 76 | 2012 | ✓ | 0 | M | M | Ch | ∎ | ∎ | ∎ | ||||||||||||||||||

Dennis P. Lockhart Former President and CEO of Federal Reserve Bank of Atlanta

| 73 | 2017 | ✓ | 0 | M | M | M | ∎ | ∎ | ∎ | ||||||||||||||||||

Gregory G. McGreevey Senior Managing Director, Investments, Invesco Ltd.

| 57 | 2016 | – | 0 | – | – | – | ∎ | ∎ | |||||||||||||||||||

Loren M. Starr Senior Managing Director and Chief Financial Officer, Invesco Ltd.

| 58 | 2019 | – | 0 | – | – | – | ∎ | ∎ | ∎ | ||||||||||||||||||

1

Governance highlights

Independence

5 out of our 7 current directors are independent.

All of our Board committees are composed exclusively of independent directors.

Independent Chairperson

We have an independent Chairperson of our Board of Directors, selected by the independent directors.

The Chairperson serves as liaison between management and the other independent directors.

Executive Sessions

The independent directors regularly meet in private without management.

The Chairperson presides at these executive sessions.

Board oversight of risk management

Our Board has principal responsibility for oversight of the company’s risk management process and understanding of the overall risk profile of the company.

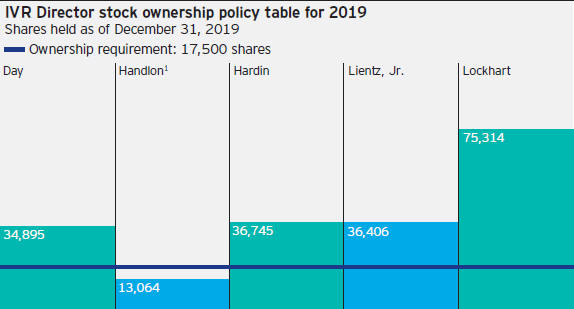

Share ownership requirements

Ournon-executive directors must hold at least 17,500 shares of company common stock within five years of joining the Board.

Our CEO must hold at least 60,000 shares of company common stock.

All other executive officers have share ownership requirements.

Board practices

Our Board annually reviews its effectiveness as a group, with directors participating inone-on-one interviews coordinated by an independent external advisor that reports results of the annual review to the Board.

Nomination criteria are adjusted as needed to ensure that our Board as a whole continues to reflect the appropriate mix of skills and experience.

Accountability

Directors must be elected annually by a majority of votes cast.

Insider trading restrictions

Our insider trading policy prohibits short selling, dealing in publicly-traded options, pledging and hedging or monetization transactions in our equity securities.

Board member highlights

| ||

| ||

Director tenure | ||

The tenure of our current directors ranges from one to eleven years (since our inception). Our directors contribute a wide range of knowledge, skills and experience as illustrated in their individual biographies. We believe the tenure of the members of our Board of Directors provides the appropriate balance of expertise, experience, continuity and perspective to our board to serve the best interests of our stockholders.

| ||

As the Board considers new director nominees, it takes into account a number of factors, including nominees that have skills that will match the needs of the company’s long-term strategy and will bring diversity of thought, perspective, experience and background to our Board. For more information on our director nomination process, seeInformation about our Director Nominees – Director recruitment below. |

3

Proxy Statement

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Invesco Mortgage Capital Inc. (“Board” or “Board of Directors”) for the Annual Meeting of Stockholders to be held on Tuesday, May 5, 2020, at 2:00 p.m. Eastern Time. Please review the entire Proxy Statement and the company’s 2019 Annual Report on Form10-K before voting. In this Proxy Statement, except where the context suggests otherwise, the terms “company,” “we,” “us,” and “our” refer to Invesco Mortgage Capital Inc., together with its consolidated subsidiaries, including IAS Operating Partnership LP, which we refer to as “our operating partnership”; “our manager” refers to Invesco Advisers, Inc., our external manager; “Invesco” refers to Invesco Ltd., together with its consolidated subsidiaries, the indirect parent company of our manager.

Election of Directors

General

Our Board of Directors currently has seven directors, each of whom is serving a term of office that continues until the Annual Meeting in 2020, or until such director’s successor has been duly elected and qualified, or such director is removed from office or such director’s office is otherwise earlier vacated.

The Board has nominated John S. Day, Carolyn B. Handlon, Edward J. Hardin, James R. Lientz, Jr., Dennis P. Lockhart, Gregory G. McGreevey and Loren M. Starr for election as directors of the company for a term ending at the 2021 Annual Meeting. Further information regarding the nominees is shown on the following pages. Each nominee has indicated to the company that the nominee would serve if elected. We do not anticipate that any of our director nominees would be unable to stand for election, but if that were to happen, the Board may reduce the size of the Board, designate a substitute or leave a vacancy unfilled. If a substitute is designated, proxies voting on the original director candidate will be cast for the substituted candidate.

Under our Bylaws, at any meeting held for the purpose of electing directors at which a quorum is present, each director nominee receiving the affirmative vote of a majority of the total votes cast with respect to such nominee at the meeting will be elected as a director. If a nominee for director who is an incumbent director is not elected and no successor has been elected at the meeting, the director is required under our Bylaws to submit his or her resignation as a director. Our Nomination and Corporate Governance Committee would then make a recommendation to the full Board on whether to accept or reject the resignation. If the resignation is not accepted by the Board, the director will continue to serve until the next annual meeting or until his or her successor is duly elected, or his or her earlier resignation or removal. If the director’s resignation is accepted by the Board, then the Board, in its sole discretion, may fill the vacancy or decrease the size of the Board. However, if the number of nominees exceeds the number of positions available for the election of directors, the directors so elected shall be those nominees who have received the greatest number of affirmative votes so long as such nominee also received at least an affirmative majority of the total votes cast in person or by proxy.

Recommendation of the board

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION TO THE BOARD OF EACH OF THE DIRECTOR NOMINEES.

This proposal requires the affirmative vote of a majority of votes cast at the Annual Meeting.

4

| ||

| ||

John S. Day Non-Executive Director | ||

Age 71 |

Tenure 11 Years | |

Committees: – Audit (Chair) – Compensation – Nomination and Corporate Governance

Qualifications: – Executive leadership – Finance and accounting expertise – Public and private company board experience

| ||

| ||

| ||

| ||

Carolyn B. Handlon Non-Executive Director

| ||

Age 62 | Tenure 3 Years | |

Committees: – Audit – Compensation (Chair) – Nomination and Corporate Governance

Qualifications: – Executive leadership – Finance and accounting expertise

| ||

5

|

|

Edward J. Hardin Chairperson,Non-executive director

Age Tenure 77 6 Years

Committees: – Audit – Compensation – Nomination and Corporate |

Governance

Qualifications: – Executive leadership – Legal expertise – Public company board experience

|

|

|

|

James R. Lientz, Jr. Non-executive director

Age Tenure 76 8 Years

Committees: – Audit – Compensation – Nomination and Corporate Governance (Chair)

Qualifications: – Executive leadership – Industry expertise – Public and private company board experience

|

Edward J. Hardin Edward J. Hardin has served as our chairperson since 2017 and a director since 2014. Mr. Hardin has been a partner of the law firm of Rogers & Hardin LLP since its formation in 1976. Mr. Hardin received a B.A. degree from Wesleyan University and a J.D. degree from Vanderbilt University.

Director qualifications:

| ||

| ∎ | Executive leadership, corporate governance, legal expertise: Mr. Hardin has spent over 40 years as a corporate and business lawyer in a leading Atlanta law firm, including service as a member of its executive committee. Mr. Hardin has extensive experience with legal and business issues facing public companies in a variety of industries. Mr. Hardin’s broad background is a valuable asset to the Board’s functioning on many of the decisions it is called upon to make. | |

∎

|

Public company board experience: Mr. Hardin has served more than 40 years on boards of directors of other public companies. Mr. Hardin serves on the Board of Grady Memorial Hospital Corporation where he is chair of the Audit Committee. Mr. Hardin is Chairman of the Board of Gateway Center LLC, a homeless services provider, Vice Chairman of the Board of Georgia Works! Inc., a residential transitional work training program,Co-Chairman of the regional Commission on Homelessness, a public private partnership of eight local governments and community leaders, Chairman of the Fulton County Board of Health, Fulton County, Georgia and President of the Georgia Legal Services Foundation which supports indigent legal services. | |

James R. Lientz, Jr. James R. Lientz, Jr. has served as a director since 2012 and as chairperson of the Nomination and Corporate Governance Committee since 2018. Mr. Lientz has more than 35 years of experience in the banking industry and nearly eight in government service. Mr. Lientz served as President of C&S Bank of South Carolina from 1990 to 1992, President of Nationsbank of Georgia from 1993 to 1996 and President,Mid-South Division, of Bank of America from 1996 to 2001. His public sector work was as Chief Operating Officer of the State of Georgia from 2003 to 2010. Mr. Lientz is currently a partner of Safe Harbor Consulting, LLC. Mr. Lientz received a B.S. degree from Georgia Institute of Technology in 1965 and an M.B.A. from Georgia State University in 1971. | ||

Director qualifications: | ||

∎

∎ | Executive leadership, industry experience and public sector leadership: Mr. Lientz has more than 35 years of broad experience in financial-corporate management, specifically within the financial services industry. In addition, he brings to our board a perspective on leadership developed in the private and public sectors, having served as the first Chief Operating Officer for the State of Georgia for seven years. Mr. Lientz’s depth and breadth of board and executive experience uniquely qualify him to provide guidance to our company.

Public and private company board experience: Mr. Lientz serves as a Director of the following private companies: Diversified Trust Company (Chair) since 2015, MidCountry Financial Corp since 2010, and Georgia Banking Company (Chair) since 2010. He also serves as an advisory director of iFolio. Mr. Lientz is a former Director of Georgia Power Company, Brand Holdings, Inc., BlueCross BlueShield of Georgia and NDC Health. | |

6

Dennis P. Lockhart Non-executive director

Age Tenure 73 3 Years

Committees: – Audit – Compensation – Nomination and |

Corporate Governance

Qualifications: – Executive leadership – Industry expertise – Financial and accounting expertise

|

|

Gregory G. McGreevey Director

Age Tenure 57 4 Years

Qualifications: – Executive leadership – Industry expertise

|

Dennis P. Lockhart

Dennis P. Lockhart has served as a director since 2017. Mr. Lockhart is the immediate past President and Chief Executive Officer of the Federal Reserve Bank of Atlanta, a position he held from 2007 until his retirement in 2017. In addition, he served on the U.S. Federal Reserve’s chief monetary policy body, the Federal Open Market Committee from 2007 to 2017. He is currently a Distinguished Professor of Practice in the Sam Nunn School of International Affairs at the Georgia Institute of Technology. Mr. Lockhart served on the faculty of Georgetown University’s School of Foreign Service from 2003 to 2007, and as an adjunct professor at Johns Hopkins University’s School of Advanced International Studies from 2002 to 2007. During his academic service, Mr. Lockhart was chairman of the Small Enterprise Assistance Funds. Earlier he was a managing partner at Zephyr Management LP, president of Heller International Group, chairman of the advisory committee of the U.S. Export-Import Bank, and held various positions with Citigroup (formerly Citigroup/Citibank). Mr. Lockhart received a B.A. from Stanford University, a Master’s in international economics and American foreign policy from Johns Hopkins University, and an honorary doctoral degree from Georgia State University. Mr. Lockhart served as an officer in the U.S. Marine Corps Reserve from 1968 to 1974.

Director qualifications:

| ∎ | Executive leadership, finance and economic policy experience: Mr. Lockhart brings a wealth of finance and economic policy experience to the Board given his 10 years of service with the U.S. Federal Reserve Bank system, including monetary policy and economic regulation. Importantly, Mr. Lockhart also has more than 30 years of experience in the private financial sector which greatly benefits the Board. |

| ∎ | Civic and policy organization experience: Mr. Lockhart also brings valuable perspectives and experience to the Board given his service on variousnon-profit organizations, governance and advisory boards. He has served as a director of the Metro Atlanta Chamber of Commerce from 2007 to present, a director of the World Affairs Council of Atlanta from 2010 to present, a member of the Carter Center Board of Councilors from 2009 to present, and a trustee of the Georgia Research Alliance from 2016 to present. |

Gregory G. McGreevey

Gregory G. McGreevey has served as a director since 2016. Mr. McGreevey has served as Senior Managing Director, Investments, of Invesco Ltd. (“Invesco”) since 2017, with responsibilities including certain of Invesco’s global equities investment teams, US and Canadian equities, equity trading, global fixed income, product development, Global Performance Measurement and Risk Group and investment administration. Previously, he was chief executive officer of Invesco Fixed Income from 2011 to 2017. Prior to joining Invesco, he was president of Hartford Investment Management Co. and executive vice president and chief investment officer of The Hartford Financial Services Group, Inc. from 2008 to 2011. From 1997 to 2008, Mr. McGreevey served as vice chairman and executive vice president of ING Investment Management – Americas Region, as well as business head and chief investment officer for ING’s North American proprietary investments and chief executive officer of ING Institutional Markets. Before joining ING, Mr. McGreevey was president and chief investment officer of Laughlin Asset Management and president and chief operating officer of both Laughlin Educational Services and Laughlin Analytics, Inc. He is a Chartered Financial Analyst. Mr. McGreevey earned a B.B.A. from the University of Portland and an M.B.A. from Portland State University.

Director qualifications:

| ∎ | Executive leadership and industry experience: Mr. McGreevey has nearly 30 years of investment management industry experience, including as an investment professional and in a series of executive management positions. Mr. McGreevey’s deep experience with the fixed income and institutional investment products and his leadership of Invesco’s business in these areas provides the Board with great insight into issues facing the industry. |

7

|

Loren M. Starr Director

|

Age Tenure 58 1 Year |

Qualifications: – Executive leadership – Industry expertise – Finance and Accounting expertise

|

Loren M. Starr

Loren M. Starr has served as a director since August 2019. Mr. Starr has served as senior managing director and chief financial officer of Invesco since 2005. His current responsibilities include finance, accounting, tax, investor relations, and corporate strategy. Prior to joining Invesco, he served from 2001 to 2005 as senior vice president and chief financial officer of Janus Capital Group Inc., after working as head of corporate finance from 1998 to 2001 at Putnam Investments. Prior to these positions, Mr. Starr held senior corporate finance roles with Lehman Brothers and Morgan Stanley & Co. Mr. Starr also serves on the Board of the Georgia Leadership Institute for School Improvement. Mr. Starr earned a B.A. in chemistry and B.S. in industrial engineering from Columbia University, as well as an M.B.A. from Columbia and an M.S. in operations research from Carnegie Mellon University.

Director qualifications:

| ∎ | Executive leadership, industry experience, finance and accounting experience: Mr. Starr has extensive experience in the asset management industry, and he has held corporate finance roles throughout his career. Mr. Starr’sin-depth understanding of the asset management business that he has obtained throughout his career and particularly from serving as the Chief Financial Officer of Invesco are invaluable resources for the company and the Board. |

Director independence

For a director to be considered independent, the Board must affirmatively determine that the director does not have any material relationships with the company either directly or as a partner, stockholder or officer of an organization that has a relationship with the company. Such determinations are made and disclosed pursuant to applicable New York Stock Exchange (“NYSE”) or other rules. In accordance with the rules of the NYSE, the Board has affirmatively determined that it is currently composed of a majority of independent directors, and that the following directors are independent and do not have a material relationship with the company: John S. Day, Carolyn B. Handlon, Edward J. Hardin, James R. Lientz, Jr. and Dennis P. Lockhart.

| Board evaluation process

|

|

8

| Director recruitment |

| The Nomination and Corporate Governance Committee identifies and adds new directors using the following process: |

|

| The Nomination and Corporate Governance Committee believes there are certain minimum qualifications that each director nominee must satisfy in order to be suitable for a position on the Board, including: |

| ∎ | a high degree of personal and professional integrity; |

| ∎ | ability to exercise sound business judgment on a broad range of issues; |

| ∎ | sufficient experience and professional or educational background to have an appreciation of the significant issues facing public companies that are comparable to the company; |

| ∎ | willingness to devote the necessary time to Board duties, including preparing for and attending meetings of the Board and its committees; and |

| ∎ | being prepared to represent the best interests of the company and its stockholders and being committed to enhancing stockholder value. |

9

The Nomination and Corporate Governance Committee will consider candidates recommended for nomination to the Board by stockholders of the company. Stockholders may nominate candidates for election to the Board under Maryland law and our Bylaws. Our Bylaws provide that, with respect to an annual meeting of stockholders, nominations of individuals for election to our Board of Directors and the proposal of business to be considered by stockholders may be made only (1) pursuant to our notice of the meeting, (2) by or at the direction of our Board of Directors or (3) by a stockholder who is a stockholder of record both at the time of giving the notice required by our Bylaws and at the time of the meeting, who is entitled to vote at the meeting and who has complied with the advance notice provisions set forth in our Bylaws. The manner in which the committee evaluates candidates recommended by stockholders is generally the same as any other candidate. However, the committee will also seek and consider information concerning any relationship between a stockholder recommending a candidate and the candidate to determine if the candidate can represent the interests of all of the stockholders. The committee will not evaluate a candidate recommended by a stockholder unless the stockholder’s proposal provides that the potential candidate has indicated a willingness to serve as a director, to comply with the expectations and requirements for Board service as publicly disclosed by the company and to provide all of the information necessary to conduct an evaluation. For further information regarding deadlines for stockholder proposals, please see the section of this proxy statement below entitledImportant Additional Information – Stockholder Proposals for the 2021 Annual Meeting.

Communications with the chairperson andnon-executive directors

Any interested party may communicate with the Chairperson of our Board or to ournon-executive directors as a group at the following addresses:

E-mail: company.secretary@invescomortgagecapital.com

Mail: Invesco Mortgage Capital Inc.

1555 Peachtree Street N.E.

Atlanta, Georgia 30309

Attn: Office of the Company Secretary

Communications will be distributed to the Board, or to any of the Board’s committees or individual directors as appropriate, depending on the facts and circumstances of the communication. In that regard, the Board does not receive certain items which are unrelated to the duties and responsibilities of the Board.

In addition, our manager maintains the Invesco Mortgage Capital Compliance Reporting Line for employees of the manager or its affiliates or individuals outside the company to report complaints or concerns on an anonymous and confidential basis regarding questionable accounting, internal accounting controls or auditing matters and possible violations of the company’s Code of Conduct or law.

Persons may submit any complaint regarding accounting, internal accounting controls or auditing matters directly to the Audit Committee of the Board of Directors by sending a written communication appropriately addressed to:

Audit Committee

Invesco Mortgage Capital Inc.

1555 Peachtree Street N.E.

Atlanta, Georgia 30309

Attn: Office of the Company Secretary

10

The Board has adopted Corporate Governance Guidelines.

The Board is elected by stockholders to oversee our management team and to seek to assure that the long-term interests of the stockholders are being served.

The company has chosen to separate the chief executive officer and Board chairperson positions.

Our Board has established a Code of Conduct.

Corporate governance guidelines

The Board has adopted Corporate Governance Guidelines (“Guidelines”) which are available in the corporate governance section of the company’s website at www. invescomortgagecapital.com (the “company’s website”). The information on the company’s website is not intended to form a part of, and is not incorporated by reference into, this Proxy Statement. The Corporate Governance Guidelines set forth the practices the Board follows with respect to, among other matters, the composition of the Board, director responsibilities, Board committees, director access to officers and independent advisors, director compensation and the performance evaluation of the Board.

Board leadership structure

As described in the Guidelines, the company’s business is conductedday-to-day by its officers and its external manager, under the direction of the chief executive officer and the oversight of the Board, to enhance the long-term value of the company for its stockholders. The Board is elected by the stockholders to oversee the officers of the company and our external manager and to seek to assure that the long-term interests of the stockholders are being served. In light of these differences in the fundamental roles of the Board and management, the company has chosen to separate the chief executive officer and Board chairperson positions. The Board believes separation of these roles: (i) allows the Board to more effectively monitor and evaluate objectively the performance of the chief executive officer, such that the chief executive officer is more likely to be held accountable for his performance, (ii) allows thenon-executive chairperson to control the Board’s agenda and information flow, and (iii) creates an atmosphere in which other directors are more likely to challenge the chief executive officer and other members of our senior management team. For these reasons, the company believes that this board leadership structure is currently the most appropriate structure for the company. Nevertheless, the Board may reassess the appropriateness of the existing structure at any time, including following changes in Board composition, in management, or in the character of the company’s business and operations.

Code of conduct

Our Board of Directors has established a code of ethics that applies to our officers, directors and independent contractors and to our manager’s officers, directors and personnel when such individuals are acting for or on our behalf (the “code of conduct”). Among other matters, our code of conduct is designed to deter wrongdoing and to promote:

| ∎ | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| ∎ | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; |

| ∎ | compliance with applicable governmental laws, rules and regulations; |

| ∎ | prompt internal reporting of violations of the code to appropriate persons identified in the code; and |

| ∎ | accountability for adherence to the code. |

Any waiver of the code of conduct for our executive officers or directors may be made only by our Board of Directors or one of our Board committees. The code of conduct is posted on the company’s website. We intend to satisfy the disclosure requirement regarding any amendment to, or a waiver of, a provision of the code of conduct by posting such information on the company’s website.

Our code of conduct contains our Hedging Policy, which is described in detail on page 22 of this Proxy Statement.

11

Board’s role in risk oversight

We believe that risk oversight responsibility rests with the full Board of Directors. Therefore, the Board has principal responsibility for oversight of the company’s risk management processes and for understanding the overall risk profile of the company. Though Board committees routinely address specific risks and risk processes within their purview, the Board has not delegated primary risk oversight responsibility to a committee.

The company has in place an enterprise risk management committee consisting of executive and senior management. The committee meets regularly and maintains dialogue with the Board of Directors regarding the top risks of the company and mitigating actions to address them. By receiving quarterly reports, the Board maintains a practical understanding of the risk philosophy and risk appetite of the company.

In addition, since the company is externally managed, we rely upon the operational and investment risk oversight functions of our manager and its Invesco affiliates. Our manager’s risk management framework provides the basis for consistent and meaningful risk dialogue up, down and across our manager and the company. Our manager’s Global Performance and Risk Committee assesses core investment risks, while our manager’s Corporate Risk Management Committee assesses strategic, operational and all other business risks. A network of business unit specific and geographic risk management committees, under the guidance and standards of the Corporate Risk Management Committee, maintains an ongoing risk assessment, management and monitoring process that provides abottom-up perspective on the specific risk areas existing in various domains of our manager’s business.

Through this regular and consistent risk communication, the Board has reasonable assurance that all material risks of the company are being addressed and that the company is propagating a risk-aware culture in which effective risk management is built into the fabric of the business.

12

Members: John S. Day (Chair) Carolyn B. Handlon Edward J. Hardin James R. Lientz, Jr. Dennis P. Lockhart

Independence: Each member of the committee is independent under SEC and NYSE rules and financially literate

Audit Committee Financial Experts: Mr. Day and Ms. Handlon qualify under SEC rules and regulations

Meetings in 2019: 4

|

∎ | is comprised of at least three members of the Board, each of whom is “independent” of the company under the NYSE and SEC rules and is also “financially literate,” as defined under NYSE rules;

| |

∎ | members are appointed and removed by the Board;

| |

∎ | is required to meet at least quarterly;

| |

∎ | periodically meets with the internal auditor and the independent auditor in separate executive sessions without members of senior management present;

| |

∎ | has the authority to retain independent advisors, at the company’s expense, whenever it deems appropriate to fulfill its duties; and

| |

∎ | reports to the Board regularly. |

| The committee’s charter is available on the company’s website. The charter sets forth the committee’s responsibilities, which include assisting the Board in fulfilling its responsibility to oversee (i) the company’s financial reporting, auditing and internal control activities, including the integrity of the company’s financial statements, (ii) the independent auditor’s qualifications and independence, (iii) the performance of the company’s internal audit function and independent auditor, and (iv) the company’s compliance with legal and regulatory requirements. |

13

Members: John S. Day Carolyn B. Handlon (Chair) Edward J. Hardin James R. Lientz, Jr. Dennis P. Lockhart

Independence: Each member of the committee is independent under SEC and NYSE rules

Meetings in 2019: 2 |

Members: John S. Day Carolyn B. Handlon Edward J. Hardin James R. Lientz, Jr. (Chair) |

Dennis P. Lockhart

|

Independence: Each member of the committee is independent under SEC and NYSE rules

Meetings in 2019: 3

|

Under its charter, the committee:

|

∎ | is comprised of at least three members of the Board, each of whom is independent” of the company under the NYSE and SEC rules;

| |

∎ | members are appointed and removed by the Board; and

| |

∎ | has the authority to retain independent advisors, at the company’s expense, whenever it deems appropriate to fulfill its duties, including any compensation consulting firm. |

∎ | is comprised of at least three members of the Board, each of whom is “independent” of the company under the NYSE and SEC rules;

| |

∎ | members are appointed and removed by the Board; and

| |

∎ | has the authority to retain independent advisors, at the company’s expense, whenever it deems appropriate to fulfill its duties. |

| The committee’s charter is available on the company’s website. The charter sets forth the committee’s responsibilities, which include (i) establishing procedures for identifying and evaluating potential nominees for director, (ii) recommending to the Board potential nominees for election and (iii) periodically reviewing and reassessing the adequacy of the Guidelines to determine whether any changes are appropriate and recommending any such changes to the Board for its approval. The candidates proposed for election in Proposal No. 1 of this Proxy Statement were unanimously recommended by the committee to the Board. For more information regarding the director recruitment process, seeInformation about DirectorNominees - Director recruitment. |

14

A member of our Board of Directors who is also an employee of Invesco is referred to as an executive director. Executive directors do not receive compensation for serving on our Board of Directors. Under the terms of its charter, the Compensation Committee annually reviews and determines the compensation paid to non-executive directors. In reviewing and making recommendations onnon-executive director compensation, the Compensation Committee considers, among other things, the following policies and principles:

| ||

∎ | that the compensation should fairly pay the directors for the work, time commitment and efforts required by directors of an organization of the company’s size and scope of business activities, including service on Board committees;

| |||

∎ | that a component of the compensation should be designed to align the directors’ interests with the long-term interests of the company’s stockholders; and

| |||

∎ | that directors’ independence may be compromised or impaired for Board or committee purposes if director compensation exceeds customary levels.

| |||

As a part of its annual review, the Compensation Committee engages FTI Consulting, Inc. as a third-party consultant to report on comparablenon-executive director compensation practices and levels. This report includes a review of director compensation at peer company mortgage REITs with an investment focus in the company’s target assets. Following the review of current market practices for directors of peer public companies, the Compensation Committee determined in May 2019 to make no changes to the director compensation structure in effect, which is set forth below. Each fee component is paid in quarterly installments in arrears.

| ||

Base fee |

Eachnon-executive director received an annual base fee for services in the amount of $70,000, payable in cash.

| |

Equity award |

Eachnon-executive director received an annual equity award of $90,000, payable in shares of our common stock.

| |

Chairperson fee |

The Chairperson of the Board received an additional annual cash fee of $40,000.

| |

Audit Committee |

The chairperson of the Audit Committee received an additional annual cash fee of $20,000.

| |

Compensation Committee |

The chairperson of the Compensation Committee received an additional annual cash fee of $10,000.

| |

Nomination and Corporate

|

The chairperson of the Nomination and Corporate Governance Committee received an additional annual cash fee of $10,000. | |

| We also reimburse each of ournon-executive directors for their travel expenses incurred in connection with attendance at Board of Directors and committee meetings.Non-executive directors do not receive any meeting or attendance fees. | ||

15

Stock ownership policy fornon-executive directors – All shares awarded to ournon-executive directors are subject to theNon-Executive Director Stock Ownership Policy. The policy requires that within five years of the later of the effective date of the policy and the date of such director’s first appointment as anon-executive director eachnon-executive director achieve and thereafter maintain an ownership level of at least 17,500 shares. Until such ownership level is achieved, each non-executive director is required to continue to hold 100% of the shares received as compensation from the company.

The following table shows as of December 31, 2019 the status of ournon-executive directors meeting the requirements of the policy.

| 1 | Based on current compensation levels, it is anticipated that Ms. Handlon will attain the share ownership goal within the time period prescribed by the policy. |

Director compensation table for 2019

The following table sets forth the compensation paid to ournon-executive directors for services during 2019.

| Name | Fees earned or paid in cash($)1 | Share awards ($)2 | Total ($) | |||

| John S. Day | 90,000 | 89,973 | 179,973 | |||

| Carolyn B. Handlon | 80,000 | 89,973 | 169,973 | |||

| Edward J. Hardin | 110,000 | 89,973 | 199,973 | |||

| James R. Lientz, Jr. | 80,000 | 89,973 | 169,973 | |||

Dennis P. Lockhart

| 70,000

| 89,973

| 159,973

| |||

| 1 | Includes the annual base fee and, as applicable, additional Chairperson of the Board fee, Chairperson of the Audit committee fee, Chairperson of the Compensation Committee fee and Chairperson of the Nomination and Corporate Governance Committee fee. |

| 2 | Reflects the full grant date fair value of such equity awards, determined in accordance with U.S. generally accepted accounting principles, as granted to each of ournon-executive directors in payment of the quarterly equity award. Equity awards are fully vested as of the date of grant. |

16

The following table presents the grant date fair value for each equity award made to eachnon-executive director during 2019.

|

| |||||||||||||||||||

| Name | Date of grant 2/22/19 ($) | Date of grant 5/10/19 ($) | Date of grant 8/8/19 ($) | Date of grant 11/11/19 ($) | Total grant date fair value ($) | |||||||||||||||

| John S. Day | 22,495 | 22,491 | 22,487 | 22,499 | 89,973 | |||||||||||||||

| Carolyn B. Handlon | 22,495 | 22,491 | 22,487 | 22,499 | 89,973 | |||||||||||||||

| Edward J. Hardin | 22,495 | 22,491 | 22,487 | 22,499 | 89,973 | |||||||||||||||

| James R. Lientz, Jr. | 22,495 | 22,491 | 22,487 | 22,499 | 89,973 | |||||||||||||||

Dennis P. Lockhart

|

| 22,495

|

|

| 22,491

|

|

| 22,487

|

|

| 22,499

|

|

| 89,973

|

| |||||

17

| John M. Anzalone | ||

Chief Executive Officer

| ||

Age 55 | Tenure 11 Years | |

Kevin M. Collins President

| ||

Age 40 | Tenure 11 Years | |

Brian P. Norris Chief Investment Officer

| ||

Age 44 | Tenure 11 Years | |

Information About the Executive Officers of the Company

The following is a list of individuals serving as executive officers of the company as of the date of this Proxy Statement. All company executive officers are elected annually by the Board and serve at the discretion of the Board or our Chief Executive Officer.

John M. Anzalone

Mr. Anzalone has served as our Chief Executive Officer since 2017. Prior to becoming CEO, Mr. Anzalone served as our Chief Investment Officer since the company’s inception in 2009. Mr. Anzalone joined Invesco’s Fixed Income Division (“IFI”) in 2002, where he is a Senior Portfolio Manager and Head of Structured Securities Portfolio Management. Mr. Anzalone also serves as a member of IFI’s Investment Strategy team, which is responsible for providing investment views for risk positioning and asset allocation across the platform. As the Head of the Structured Securities group, he is responsible for the application of investment strategy across portfolios consistent with client investment objectives and guidelines. Additionally, the team is responsible for analyzing and implementing investment actions in the residential, commercial mortgage-backed and asset-backed securities sectors. Mr. Anzalone began his investment career in 1992 at Union Trust. In 1994 he moved to AgriBank, FCB, where he served as a Senior Trader for six years. Mr. Anzalone is also a former employee of Advantus Capital Management where he was a Senior Trader responsible for trading mortgage-backed, asset-backed and commercial mortgage securities. Mr. Anzalone received a B.A. degree in Economics from Hobart College and an M.B.A. from the Simon School at the University of Rochester. Mr. Anzalone is a Chartered Financial Analyst.

Kevin M. Collins

Mr. Collins has served as President since 2017. Previously, he served as our Executive Vice President Commercial Mortgage Credit from March 2017 to October 2017 and as a Managing Director and our Head of Commercial Mortgage Credit from 2011 to March 2017. He is also the Head of Commercial Mortgage Credit for Invesco Fixed Income. His primary responsibilities include evaluating, selecting and positioning commercial mortgage-backed securities, commercial real estate loans and other real estate debt investments across Invesco-managed institutional and retail fixed income funds, including the company. Prior to joining Invesco in 2007, Mr. Collins structured various capital funding strategies, including bond securitizations and secured lending facilities, for banks and specialty finance companies during his tenure at Credit Suisse First Boston. Mr. Collins graduated with a B.S. in accounting from Florida State University and earned an M.B.A. from the Kellogg School of Management at Northwestern University.

Brian P. Norris

Mr. Norris has served as our Chief Investment Officer since February 2019 after serving as our Interim Chief Investment Officer from September 2018 to February 2019. Prior to his role as CIO, Mr. Norris served as Director, Portfolio Management since 2011 and has worked on behalf of the Company since its inception in 2009. He is also a Senior Portfolio Manager on Invesco’s Structured Securities team, a position he has held since 2014. Mr. Norris joined Invesco in 2001, serving as a portfolio manager from 2006 to 2014 and an account manager from 2001 to 2006. Prior to joining Invesco, Mr. Norris worked as a securities trader with Todd Investment Advisors. He earned a BS degree in Business Administration with a concentration in finance from the University of Louisville and is a Chartered Financial Analyst (CFA) charterholder.

18

R. Lee Phegley, Jr. Chief Financial Officer

| ||

Age 51 | Tenure 6 Years | |

David B. Lyle Chief Operating Officer

| ||

Age 41 | Tenure 11 Years | |

Mario L. Clemente Vice President of Manager

| ||

Age 47 | Tenure 4 Years | |

R. Lee Phegley, Jr.

Mr. Phegley has served as our Chief Financial Officer since 2014. Mr. Phegley also serves as the Chief Financial Officer for Invesco Real Estate Income Trust Inc., anon-traded REIT also managed by our manager. Having joined Invesco in 2006, Mr. Phegley also provides financial leadership to our institutional, alternatives and digital wealth businesses. Prior to joining Invesco Mr. Phegley spent nine years in public accounting with Arthur Anderson LLP and KPMG LLP. Mr. Phegley received a B.A. degree from Baylor University and an M.S. degree in Accountancy from the University of Houston and is a Certified Public Accountant.

David B. Lyle

Mr. Lyle has served as our Chief Operating Officer since 2017. Previously, he served as our Executive Vice President Residential Credit from March 2017 to October 2017 and as our Head of Residential Mortgage Credit from 2011 to March 2017. He is also the Head of Residential Mortgage-Backed Securities (RMBS) Credit for Invesco Fixed Income. His primary responsibilities include the evaluation and oversight of investments inNon-Agency RMBS, credit risk transfer securities, and residential whole loans for institutional and retail fixed income funds, including the company. Mr. Lyle has over 18 years of experience in the RMBS market. Prior to joining Invesco in 2006, Mr. Lyle spent three years at Friedman Billings Ramsey, where he was a Vice President in the Investment Banking ABS group. In this role, he participated in the financing, transaction management and analytics functions of the business. He also spent two years as an Analyst in the mortgage finance group at Wachovia Securities. Mr. Lyle graduated with a bachelor of engineering degree from Vanderbilt University.

Other Manager Personnel

The following individual is deemed to be an executive officer of the company as of the date of this Proxy Statement due to his responsibilities in his role as Vice President of our Manager.

Mario L. Clemente

Mr. Clemente has served as the Head of Structured Investments at Invesco since 2016. He previously served as theco-head of the Investment Solutions group within Invesco Fixed Income from 2014 to 2016. Mr. Clemente joined Invesco in 2014. Prior to joining Invesco, he ran his own consulting firm from 2008 to 2014. Mr. Clemente entered the industry in 1995 and has held various senior investment banking roles with Citi, Natixis and Bank of America. He earned an undergraduate degree in finance and international banking from Hofstra University and an M.B.A in finance from the Stern School of Business at New York University.

19

We are externally managed and do not have any employees. Our executive officers are employees of our manager and do not receive compensation from us.

Highlights of our management agreement

| ||||||

– | All of our executive officers are employees of our manager (or one of its affiliates) and are engaged in additional capacities for our manager (or one of its affiliates). | |||||

– | Our manager is responsible for the compensation of our executive officers and other employees of our manager who provide services to the company. We do not pay any cash or equity compensation to our executive officers, do not provide pension benefits, perquisites or other personal benefits, and have no employment agreements or arrangements to make any payments upon termination from service as an officer. | |||||

– | Our manager receives a management fee equal to 1.50% of our stockholders’ equity, subject to the exclusion ofone-time events due to changes in U.S. GAAP and certainnon-cash items upon approval of a majority of our independent directors, which is used, in part, to pay the compensation of our manager’s employees who provide services to the company. However, no specific portion of the management fee is allocated to the compensation of our executive officers.

| |||||

For additional information about our management agreement, seeCertain Relationships and Related Transactions. |

20

Our manager makes all decisions relating to the compensation of our executive officers based upon a number of objectives and principles.

Overview of our manager’s compensation program and philosophy

Our manager makes all decisions relating to the compensation of our executive officers based on such factors as our manager may determine are appropriate. However, our manager consults with the members of the Compensation Committee concerning the compensation policy of our manager that is applied to the individuals that serve as our executive officers. Our manager has structured its compensation programs at every level to achieve the following objectives:

| ∎ | Alignment:align individual awards with client and stockholder success |

| ∎ | Viability:reinforce our manager’s commercial viability by closely linking rewards to economic results at every level |

| ∎ | Meritocracy:reinforce our manager’s meritocracy by differentially rewarding high-performers |

| ∎ | Retention:recognize and retain top talent by ensuring a meaningful mix of cash and deferred compensation |

With respect to investment professionals, which includes some of our executive officers, our manager applies the following compensation principles in making compensation decisions:

Investment performance

| Qualitative assessment

| |||

Measure investment performance against indicators of client success on products for which the investment team is responsible | Ensure sufficient flexibility for management to exercise judgment over bonus funding outcomes, to ensure results make sense for Invesco and the team/individual

| |||

Financial results

| Risk management

| |||

Provide appropriate linkage to our manager’s financial results related to the investment team | Design plans that do not create risks that are reasonably likely to have a material adverse impact on Invesco

| |||

Balance

| ||||

Balance pay for investment performance with economic outcomes

| ||||

| Components of our executive officers’ compensation and their purpose |

| Our manager utilizes a variety of compensation components to achieve its objectives. Our manager’s compensation program that applies to our executive officers consists of base salary and variable incentive compensation. The following table further describes each pay component, as well as its purpose and key measures. |

|

Pay element |

What it does |

Key measures | |||||||

| Base salary | – –

– | Provides competitive fixed pay Reasonable base compensation for day-to-day performance of job responsibilities Evaluated annually, generally remains static unless promotion or adjustment due to economic trends in industry | – – | Experience, duties and scope of responsibility Internal and external market factors | ||||||

| Annual cash bonus | – | Provides a competitive annual cash incentive opportunity | – | Based upon annual investment performance and financial results of the investment products for which the investment team is responsible | ||||||

| Invesco annual deferral award (time-based vesting) | –

– – | Along with annual cash bonus, provides a competitive annual incentive opportunity Aligns with Invesco client and stockholder interests Encourages retention by vesting in equal annual increments over four years | – | Based upon annual investment performance and financial results of the investment products for which the investment team is responsible | ||||||

| Invesco long-term awards (time-based vesting) | –

– – | Recognizes long-term potential for future contributions to Invesco’s long-term strategic objectives Aligns with Invesco client and stockholder interests Encourages retention by vesting in annual increments over four years | – | Based upon annual investment performance and financial results of the investment products for which the investment team is responsible | ||||||

21

Our executive officers’ incentive compensation is funded from an incentive pool which is the source of incentive compensation of all employees of Invesco Ltd.

We have an executive officer stock ownership policy to align the interests of our executive officers with our stockholders.

Our executive officers’ annual incentive compensation is funded from an annual incentive pool which is the source of incentive compensation of all employees of Invesco Ltd. and its affiliates. Each year, the Invesco Ltd. compensation committee examines Invesco’s progress on multiple operating measures, Invesco’s progress toward achieving its long-term strategic objectives and other factors, including pre- cash bonus operating income of Invesco (PCBOI), in setting the size of the incentive pool. The Invesco compensation committee uses a range of34%-48% of Invesco PCBOI in setting the Invesco-wide incentive pool, though it maintains flexibility to go outside either end of this range in circumstances that it deems exceptional. Our executive officers are paid incentive compensation out of the Invesco-wide incentive pool taking into account the compensation principles set forth above. | ||

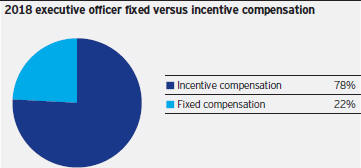

For 2019, our executive officers’ compensation, in the aggregate, was apportioned 22% to fixed compensation and 78% to variable or incentive compensation.

| ||

| ||

Executive officer stock ownership policy

In order to encourage the alignment of interests between our executive officers and our stockholders, we maintain an Executive Officer Stock Ownership Policy. The policy requires that, within five years of the date of such executive officer’s first appointment:

| ∎ | the chief executive officer (“CEO”) achieve an ownership level of at least 60,000 shares; |

| ∎ | the president, chief investment officer, and chief operating officer achieve an ownership level of at least 35,000 shares; and |

| ∎ | the chief financial officer (“CFO”) achieve an ownership level of at least 7,000 shares. |

Our CEO and CFO have achieved their respective ownership level requirements, and we expect our other executive officers will attain their respective ownership requirements within the time period prescribed by the policy.

Insider trading policy

We maintain an insider trading policy, which prohibits short selling, dealing in publicly-traded options, pledging, hedging or monetization transactions in our securities.

Hedging Policy

We have a hedging policy in place for all of our directors, officers, employees and any of their respective (i) family members that reside in the same household as the individual (including a child away at college), (ii) anyone else who lives in the household, and (iii) family members outside of the household that the individual directs or influences control and (iv) any entities, including any corporations, partnerships or trusts that the individual influences or controls as part of our Code of Conduct. Our policy prohibits hedging or monetization transactions, such aszero-cost collars and forward sale contracts, involving our securities; however, limited exceptions are allowed. To date, no exceptions have been made.

22

We believe the structure of the management fee does not create an incentive for excessive or unnecessary risk-taking by our management team and reduces the risk of conflicts of interest with our manager.

Certain risks related to our management fee

Because our management fee is calculated as a percent of stockholders’ equity, subject to specified adjustments, we believe the structure of the management fee does not create an incentive for management to take excessive or unnecessary risks and reduces the risk of conflicts of interests with our manager. Stockholders’ equity as the basis for the calculation does not result in leveragedpay-out curves, steeppay-out cliffs or set unreasonable goals and thresholds, each of which can promote excessive and unnecessary risks. In addition, the management fee may not be increased or revised without the approval of our independent directors.

Consideration of prior advisory vote

Our Compensation Committee noted the significant support received in the 2019 advisory vote on executive compensation (approximately 98% of votes cast), and therefore it has determined that no changes were advisable based on the outcome of that vote.

The Compensation Committee of the company has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of RegulationS-K with management and, based on such review and discussions, the committee recommended to the board that the Compensation Discussion and Analysis be included in this Proxy Statement.

Respectfully submitted by the Compensation Committee:

Carolyn B. Handlon (chairperson)

John S. Day

Edward J. Hardin

James R. Lientz, Jr.

Dennis P. Lockhart

1 Represents the Invesco Mortgage Capital Inc. 2009 Equity Incentive Plan

Compensation Committee Interlocks and Insider Participation

During 2019, the following directors served as members of the Compensation Committee: Mr. Day, Ms. Handlon, Mr. Hardin, Mr. Lientz and Mr. Lockhart. No member of the Compensation Committee was an officer or employee of the company or any of its subsidiaries during 2019, and no member of the Compensation Committee was formerly an officer of the company or any of its subsidiaries or was a party to any disclosable related person transaction involving the company. During 2019, none of the executive officers of the company served on the board of directors or on the Compensation Committee of any other entity that has or had executive officers that served as a member of the Board of Directors or Compensation Committee of the company.

23

Our manager provides theday-to-day management of our operations pursuant to a management agreement between us and our manager.

We grant shares of our common stock to each non-executive director and grant equity awards to personnel of our manager who are not executive officers.

Certain Relationships and Related Transactions

Relationship to our external manager

In 2009 we entered into a management agreement with our manager pursuant to which our manager provides theday-to-day management of our operations. The management agreement requires our manager to manage our business affairs in conformity with the policies and the investment guidelines that are approved and monitored by our Board of Directors. Our manager is entitled to receive from us a management fee. The management fee is equal to 1.5% of the company’s stockholders’ equity per annum, subject to specified adjustments, which is calculated and payable quarterly in arrears. We are also obligated to reimburse certain operating expenses related to the company incurred by our manager, including directors and officers insurance, accounting services, auditing and tax services, legal services, filing fees and miscellaneous general and administrative costs. The management agreement renews forone-year terms unless terminated by either us or our manager. Our manager is entitled to receive a termination fee from us, under certain circumstances.

Our executive officers are employees of Invesco. As a result, the terms of the management agreement between us and our manager were negotiated between related parties, and the terms, including fees and other amounts payable, may not be as favorable to us as if they had been negotiated with an unaffiliated third party. Each year, in connection with the annual renewal of the management agreement, our Audit Committee reviews the management fee in the context of a review of peer company management fees. We believe our management fee structure, 1.5% of stockholders’ equity, subject to the exclusion ofone-time events due to changes in the U.S. GAAP and certainnon-cash items upon approval of the majority of our independent directors, is aligned with portfolio performance and stockholder return as it accounts for both market movement and realized income. With respect to 2019, management fees paid or payable to our manager were approximately $38.2 million, and we reimbursed our manager approximately $8.3 million for operating expenses and costs related to raising capital.

Grants of equity compensation to our manager, its personnel and its affiliates

We adopted the Invesco Mortgage Capital Inc. 2009 Equity Incentive Plan as amended and restated (the “Plan”) to provide incentive compensation to attract and retain qualified directors, officers, advisors, consultants and other personnel, including our manager and its affiliates and personnel of our manager. The Plan provides for grants of stock options, restricted stock, phantom shares, dividend equivalent rights and other equity-based awards.

We grant shares of our common stock to eachnon-executive director as part of such director’s compensation. In addition, we grant equity awards to personnel of our manager who are not our executive officers. We do not intend to grant equity-based awards to our executive officers.

24

Management is required to present for the approval or ratification of the Audit Committee all material information regarding an actual or potential related person transaction.

Related Person Transaction Policy

The Board of Directors has adopted written Policies and Procedures with Respect to Related Person Transactions to address the review, approval, disapproval or ratification of related person transactions. “Related persons” include the company’s executive officers, directors, director nominees, holders of more than five percent (5%) of the company’s voting securities, immediate family members of the foregoing persons, and any entity in which any of the foregoing persons is employed, is a partner or is in a similar position, or in which such person has a 5% or greater ownership interest. A “related person transaction” means a transaction or series of transactions in which the company participates, the amount involved exceeds $120,000, and a related person has a direct or indirect interest (with certain exceptions permitted by SEC rules).

Management is required to present for the approval or ratification of the Audit Committee all material information regarding an actual or potential related person transaction. The policy requires that, after reviewing such information, the disinterested members of the Audit Committee will approve or disapprove the transaction. Approval will be given only if the Audit Committee determines that such transaction is in, or is not inconsistent with, the best interests of the company and its stockholders. The policy further requires that in the event management becomes aware of a related person transaction that has not been previously approved or ratified, it must be submitted to the Audit Committee promptly.

25

Security Ownership of Principal Stockholders

The following table sets forth the common stock beneficially owned as of March 5, 2020 by each stockholder known to us to beneficially own more than five percent of the company’s outstanding common stock. The percentage of ownership indicated in the following table is based on 164,966,357 shares of common stock outstanding as of March 5, 2020.

| Name and address of beneficial owner |

Amount and | Percent of class (%) | ||||||

BlackRock, Inc., 55 East 52nd Street, | 26,725,7032 | 16.2 | ||||||

New York, NY 10055 | ||||||||

The Vanguard Group, 100 Vanguard Boulevard, | 14,790,5123 | 9.0 | ||||||

Malvern, PA 19355

| ||||||||

| 1 | Except as described otherwise in the footnotes to this table, each beneficial owner in the table has sole voting and dispositive power with regard to the shares beneficially owned by such owner. |

| 2 | Information obtained solely by reference to the Schedule 13G/A filed with the SEC on February 4, 2020 by BlackRock, Inc. which reflects sole voting power with respect to 26,388,024 shares of common stock and sole dispositive power with respect to 26,725,703 shares of common stock. |

| 3 | Information obtained solely by reference to the Schedule 13G/A filed with the SEC on February 12, 2020 by The Vanguard Group, which reflects sole voting power with respect to 139,386 shares of common stock, shared voting power with respect to 18,688 common shares of common stock, sole dispositive power with respect to 14,652,837 shares of common stock, and shared dispositive power with respect to 137,675 shares of common stock. |

26

27

Proposal 2 | ||

| ||

| ||

| ||

|

We are externally managed and do not have any employees. Our executive officers are employees of our manager and do not receive compensation from us.

SeeExecutive Compensation for additional detail on our Manager’s compensation programs related to our executive officers.

Advisory Vote on Executive Compensation

General

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) enables our stockholders to vote to approve, on an advisory (nonbinding) basis, the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with the SEC rules. This proposal, commonly known as a“say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement.

We are externally managed by our manager pursuant to a management agreement, which provides that our manager is responsible for managing our affairs. We have no employees, including our executive officers. Our executive officers, all of whom are employees of our manager (or one of its affiliates) and engaged in additional capacities for our manager (or one of its affiliates), do not receive compensation from us. Instead, we pay our manager a management fee, and our manager and its affiliates use the proceeds from the management fee, in part, to pay compensation to its officers and personnel, including our executive officers. No specific portion of the management fee is allocated to the compensation of our executive officers. Our manager makes all decisions relating to the compensation of our executive officers based on such factors as our manager may determine are appropriate. We did not pay, and do not intend to pay, any cash compensation to our executive officers, nor did we make any grants of plan-based awards, stock options or stock grants of any kind to any person who was then an executive officer for the fiscal year ended December 31, 2019. We do not provide our executive officers with pension benefits, perquisites or other personal benefits. We do not have any employment agreements with any persons and have no arrangements to make cash payments to our executive officers upon their termination from service as our officers or a change in control of the company.

Notwithstanding that we do not pay our executive officers compensation, we are required by the SEC to seek an advisory vote from our stockholders to approve the compensation of our executive officers as disclosed in this proxy statement. Accordingly, we will ask our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory(non-binding) basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2020 Annual Meeting of Stockholders pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the Compensation Discussion and Analysis, the compensation tables and related narrative discussion.”

Thesay-on-pay vote is advisory, and therefore not binding on the company, our Board of Directors or the Compensation Committee. Our Board of Directors and our Compensation Committee value the opinions of our stockholders and to the extent there is any significant vote against the named executive officer compensation as disclosed in this Proxy Statement, we will consider our stockholders’ concerns and evaluate whether any actions are necessary to address those concerns. At the 2019 Annual Meeting of Stockholders, 98% of the votes cast were in favor of the advisory proposal to approve our named executive officers’ compensation. Under the Board’s current policy, stockholders are given an opportunity annually to cast an advisory vote on this topic.

28

Recommendation of the board

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT PURSUANT TO THE COMPENSATION DISCLOSURE RULES OF THE SEC.This proposal requires the affirmative vote of a majority of votes cast at the Annual Meeting.

29

Proposal 3

|

Appointment of Independent Registered Public Accounting Firm

General

The Audit Committee of the Board has proposed the appointment of PricewaterhouseCoopers LLP (“PwC”) as the independent registered public accounting firm to audit the company’s consolidated financial statements for the fiscal year ending December 31, 2020 and to audit the company’s internal control over financial reporting as of December 31, 2020.

During and for the fiscal year ended December 31, 2019, PwC audited and rendered opinions on the financial statements of the company and certain of its subsidiaries. PwC also rendered an opinion on the company’s internal control over financial reporting as of December 31, 2019. SeeFees Paid to Independent Registered Public Accounting Firm below. Representatives of PwC are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so. It is also expected that they will be available to respond to appropriate questions.

Recommendation of the board

THE BOARD RECOMMENDS A VOTE “FOR” THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2020.Approval of this proposal requires the affirmative vote of a majority of the votes cast at the Annual Meeting. If the appointment is not approved, the Audit Committee may reconsider the selection of PwC as the company’s independent registered public accounting firm. Even if the selection is ratified, the Audit Committee may, in its discretion, select a different registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the company and our stockholders.

30

All audit andnon-audit services provided to the company and its subsidiaries by PwC during 2019 were either specifically approved orpre-approved.