2015 Emerging Growth Conference September 2, 2015 WE STAFF I.T. TRUSTED TALENT PARTNER NYSE MKT: MHH Exhibit 99.1 |

Certain statements contained in this presentation are forward-looking statements based on management’s expectations, estimates, projections and assumptions. Words such as “expects,” “anticipates,” “plans,” “believes,” “scheduled,” “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements, which include but are not limited to projections of revenues, earnings, and cash flow. These statements are based on information currently available to the Company and it assumes no obligation to update the forward-looking statements as circumstances change. These statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors, including, without limitation, the level of market demand for its services, the highly competitive market for the types of services offered by the company, the impact of competitive factors on profit margins, market conditions that could cause the Company’s customers to reduce their spending for its services, and the company’s ability to create, acquire and build new lines of business, to attract and retain qualified personnel, reduce costs and conserve cash, and other risks that are described in more detail in the company’s filings with the Securities and Exchange Commission including its Form 10-K for the year ended December 31, 2014. 2 Safe Harbor... Copyright ©2015 Mastech, Inc. All Rights Reserved. mastech.com |

3 COMPANY PROFILE WE STAFF I.T. TRUSTED TALENT PARTNER NYSE MKT: MHH |

Ticker: MHH 2014 Revenue: $113.5MM Headquarters: Pittsburgh, PA Year Founded: 1986 Employees & Consultants: 1,200 Mastech Company Profile… Growth. Experience. Stability. Scale. National Provider of IT Staffing Services in the U.S.A. • Leading U.S. IT Staffing Service Provider • 100% U.S. IT Staffing Services • 29 Years of Staffing Experience • Certified Minority-Owned Business • 936 U.S.-based IT Consultants • Powerful, Integrated U.S. and India-based Recruiting Teams • Strong base of National Retail and Wholesale Clients • End Market Diversity • Strong Industry Fundamentals • Acquired Hudson Global’s U.S. IT Staffing Business in June 2015 with a revenue run-rate of $30 million 14.5% Compound Annual Organic Revenue Growth 2010 -2014 4 |

Strong Organic Growth 14% CAGR – Revenue; 32% CAGR - EPS Revenue Diluted EPS 5 $66.1 $80.5 $90.8 $106.9 $113.5 $0 $20 $40 $60 $80 $100 $120 $140 2010 2011 2012 2013 2014 $0.25 $0.29 $0.49 $0.75 $0.77 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 2010 2011 2012 2013 2014 |

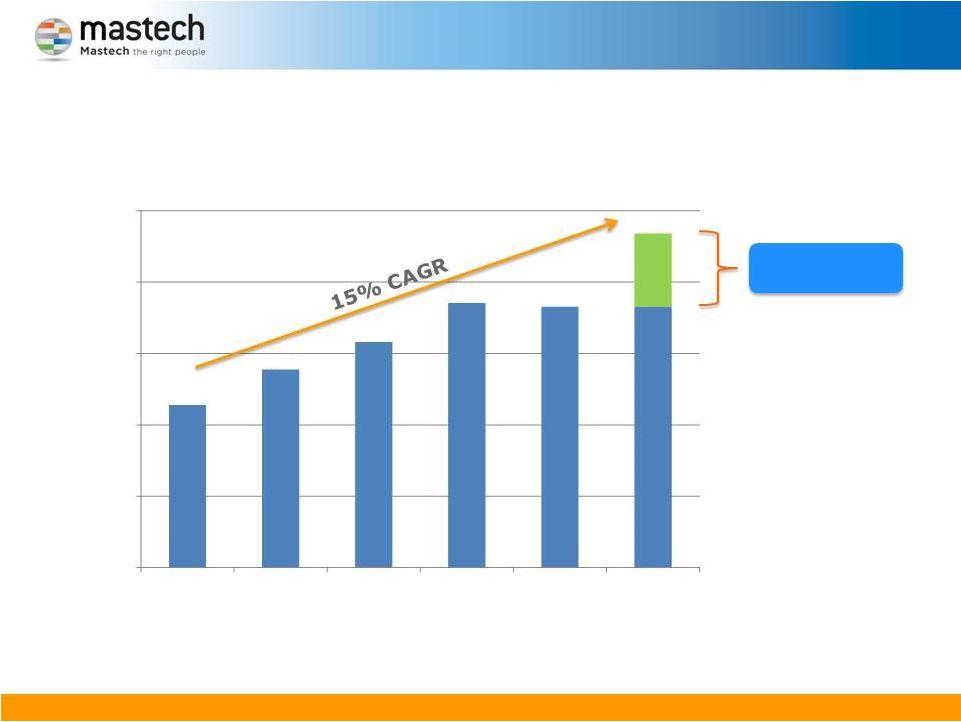

Expanding Consultant Headcount 15% CAGR – Consultants on Billing Consultants on Billing Hudson IT Acquisition adds 200+ COBs 6 456 555 632 742 731 936 0 200 400 600 800 1000 2010 2011 2012 2013 2014 Q2 2015 |

Broad IT Staffing Capabilities IT Staffing Capabilities SOA/Web Services ERP/CRM Business Intelligence & Analytics Data Warehousing & Big Data e-Business Solutions & Mobile Learning and Performance* |

Strong “Brand Name” Wholesale Client Base 8 |

“Great Logo’s”…. A Growing Retail Customer Base 9 |

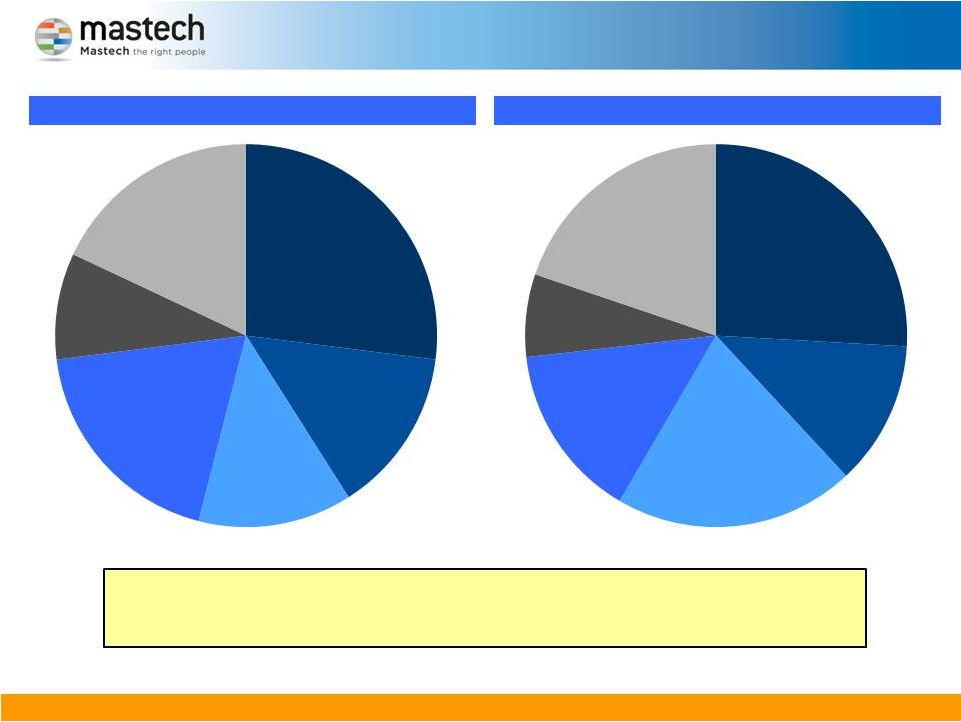

Diverse End Markets “lots of Eggs in lots of baskets” 10 2014 Actual 2014 Pro Forma with Hudson IT Acquisition • Mastech provides IT Staffing services to a diverse set of end markets. • The acquisition of Hudson IT in June 2015 included relationships with several strong healthcare, financial and insurances services, industrial and consumer companies. Financial & Insurance Services 27% Technology 14% Healthcare 13% Telecom 19% Government 9% Other 18% Financial & Insurance Services 26% Technology 12% Healthcare 20% Telecom 15% Government 7% Other 20% |

U.S. & India Geographic Presence Pittsburgh, PA: Corporate HQ Chicago, IL Dallas, TX Fremont, CA New Delhi Bangalore Denver, CO 11 Boston, MA Orlando, FL Tampa, FL Mastech employs IT consultants in nearly every state in the U.S. Corporate Headquarters Sales/Recruiting Office Recruiting Office Sales/Recruiting Office Added or Enhanced Through Hudson IT Acquisition |

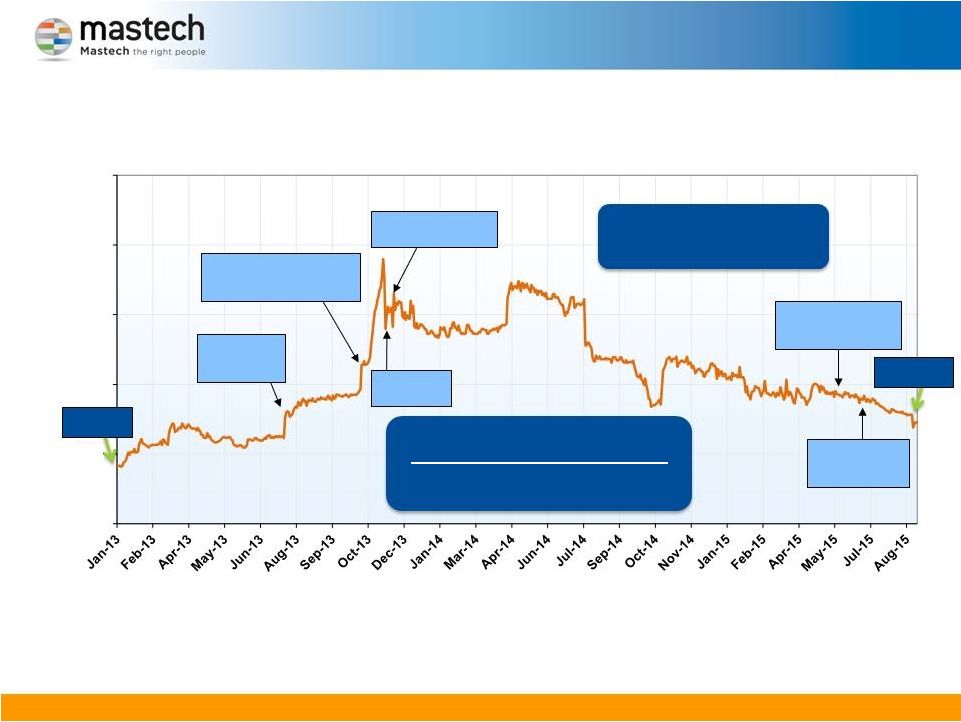

MHH – Stock Price Performance MHH Returns January 2013 – August 2015 Price +76% Special dividend +12% $4.16 $7.31 Sale of Healthcare Unit 5:4 Stock Split 5:4 Stock Split & $0.50 Special Cash Dividend Announced Special Dividend Record Date 12 Hudson IT Acquisition Announced Hudson IT Acquisition Closed EPS Growth: +57% Sales Growth: +25% $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 |

13 HUDSON IT ACQUISITION WE STAFF I.T. TRUSTED TALENT PARTNER NYSE MKT: MHH |

Mastech-Hudson IT Acquisition 14 Transaction Summary • Target: IT Staffing Division of Hudson Global (Nasdaq:HSON) • Closed Date: June 16, 2015 • Purchase Price: $17 Million Cash • Revenue Run-Rate: $30 Million Transaction Summary • Target: IT Staffing Division of Hudson Global (Nasdaq:HSON) • Closed Date: June 16, 2015 • Purchase Price: $17 Million Cash • Revenue Run-Rate: $30 Million • Immediately accretive to earnings • Adds acquisition growth aspect to overall growth story • Impressive retail client relationships • 200+ billable consultants • Significantly enhances Mastech’s retail channel • New markets in Florida and Massachusetts • Expanded presence in Chicago • Talented management, sales and recruiting talent • Leverage strengths of both organizations for growth – Mastech’s offshore, low cost recruiting model – Hudson’s retail relationship selling skills Increases Mastech’s Revenue Run-Rate by Nearly 30% Increases Mastech’s Revenue Run-Rate by Nearly 30% |

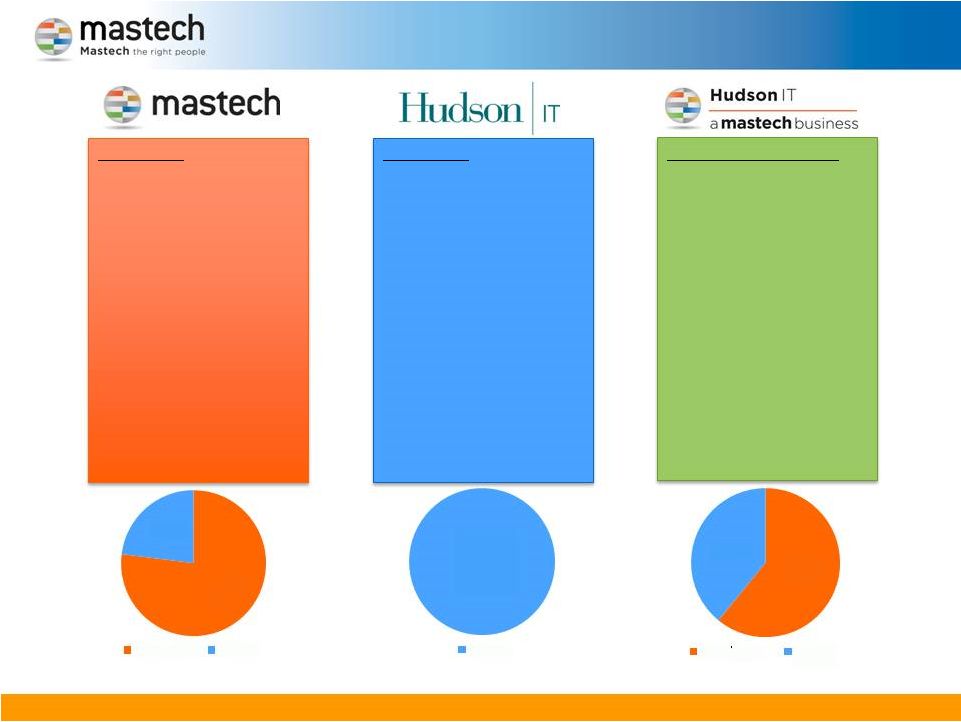

Mastech-Hudson IT: Strong Combination 15 Strengths: • National presence • 100% IT Staffing focus • Centralized, low-cost recruiting model (India-based) • Low operating cost structure • Ability to effectively compete in Vendor Management Systems (VMS) environment • Adept at H1-B recruiting process Strengths: • National presence • 100% IT Staffing focus • Centralized, low-cost recruiting model (India-based) • Low operating cost structure • Ability to effectively compete in Vendor Management Systems (VMS) environment • Adept at H1-B recruiting process Strengths: • Impressive list of direct Fortune 100 clients • 100% IT Staffing focus • Retail relationship selling skills • Highly experienced, U.S.-based sales and recruiting talent • Direct presence in attractive U.S. markets • Strong retail margins Strengths: • Impressive list of direct Fortune 100 clients • 100% IT Staffing focus • Retail relationship selling skills • Highly experienced, U.S.-based sales and recruiting talent • Direct presence in attractive U.S. markets • Strong retail margins Combined Synergies: • Greater national scale • Leverage Mastech’s low-cost recruiting engine with Hudson IT’s retail customers • Take advantage of VMS opportunities within Hudson IT’s client base • Drive growth in new markets for Mastech • Greater focus for Hudson IT as part of Mastech Combined Synergies: • Greater national scale • Leverage Mastech’s low-cost recruiting engine with Hudson IT’s retail customers • Take advantage of VMS opportunities within Hudson IT’s client base • Drive growth in new markets for Mastech • Greater focus for Hudson IT as part of Mastech 77% 23% Wholesale Retail 61% 39% Wholesale Retail 100% Retail |

Acquisition Financing & Capital Availability 16 • Funded $17 million acquisition of Hudson IT through cash on hand and borrowings under Mastech’s credit facility • Net Debt of $13.4 million at June 30, 2015 • Extended revolving credit facility to June 2018 • $9 million term loan ($1.8 million/year principal payments) with an expiration date of June 2020 • Additional available borrowing capacity of approximately $8.3 million under Mastech’s revolving credit line • Attractive borrowing rates on acquisition financing |

IT STAFFING INDUSTRY UPDATE WE STAFF I.T. TRUSTED TALENT PARTNER NYSE MKT: MHH 17 |

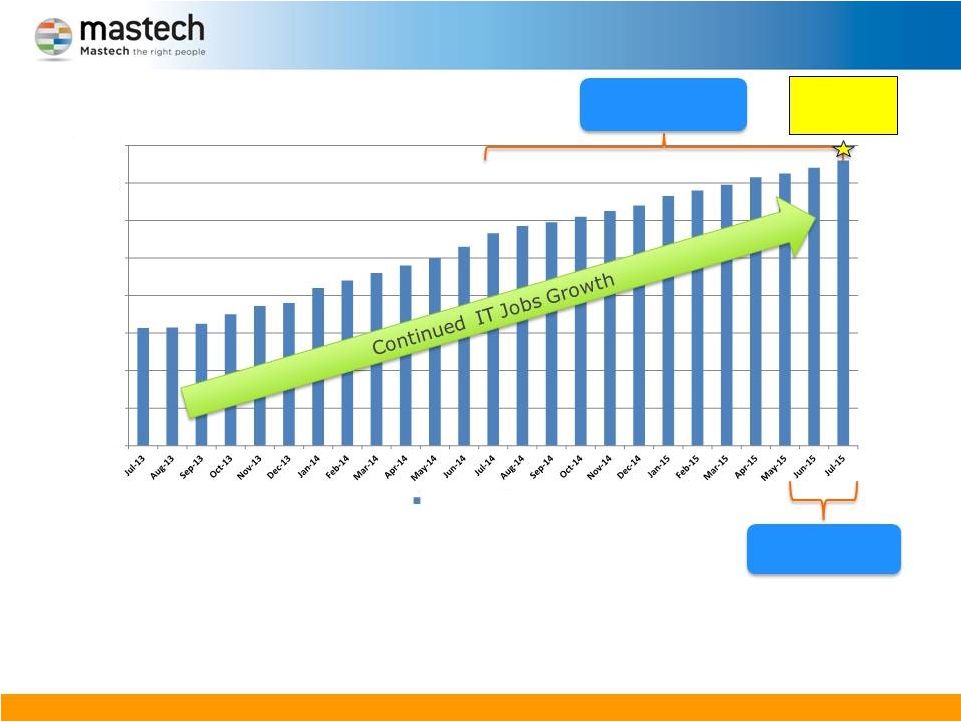

IT Employment Growth Accelerates There are more IT jobs in the US today than at any point in history Source: TechServe Alliance Increase of 15,600 (0.3%) Increase of 15,600 (0.3%) Y/Y Increase of 193,300 (4.1%) Y/Y Increase of 193,300 (4.1%) • IT jobs grew to 4,959,500 this July adding 193,000 IT workers since July 2014 representing 4.1% year-over-year growth • U.S. temporary staffing industry growth predicted to accelerate to 6% growth in 2015 and expand another 5% in 2016 to meet demand All-time IT employment high 18 IT Employment Index 4,200,000 4,300,000 4,400,000 4,500,000 4,600,000 4,700,000 4,800,000 4,900,000 5,000,000 |

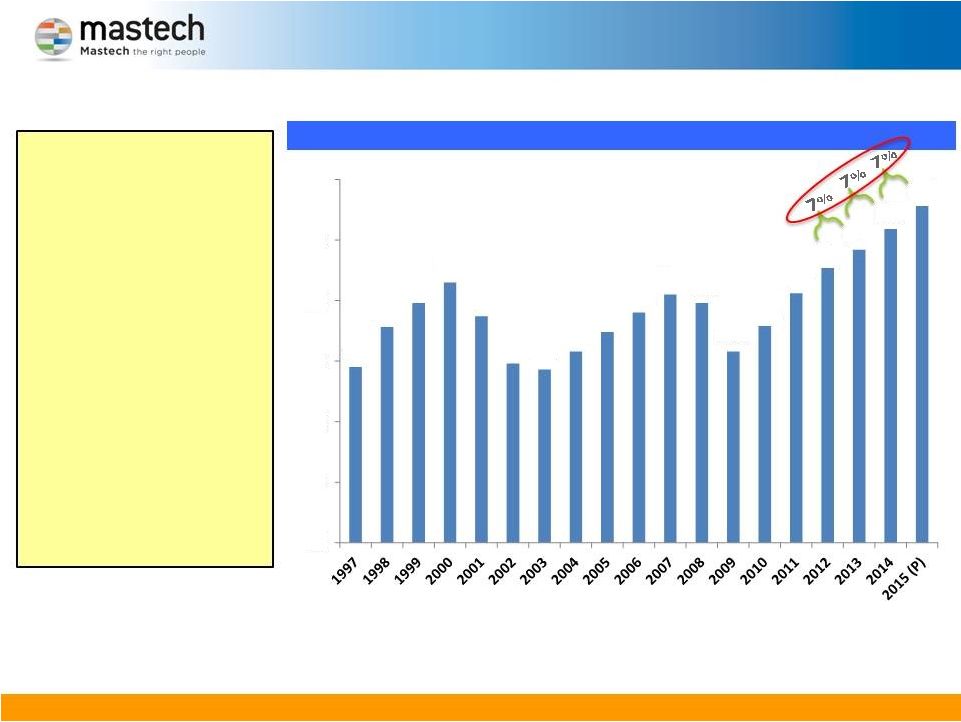

IT staffing revenue continues to increase U.S. Temp. IT Staffing Revenue ($B) (1997-2015P) • U.S. economic growth and increased demand for corporate IT projects is driving temporary IT staffing industry revenue to all-time highs. • IT Staffing Industry revenue projected to grow 7% per year in 2015. • Industry experienced strong growth in 2012 +10%, 2013 +8%, and 2014 +7%. • Severe shortage of qualified IT workers in U.S. is causing wage inflation. 19 Source: Staffing Industry Analysts 0.0 5.0 10.0 15.0 20.0 25.0 30.0 14.5 17.8 19.8 21.5 18.7 14.8 14.3 15.8 17.4 19.0 20.5 19.8 15.8 17.9 20.6 22.7 24.2 25.9 27.8 |

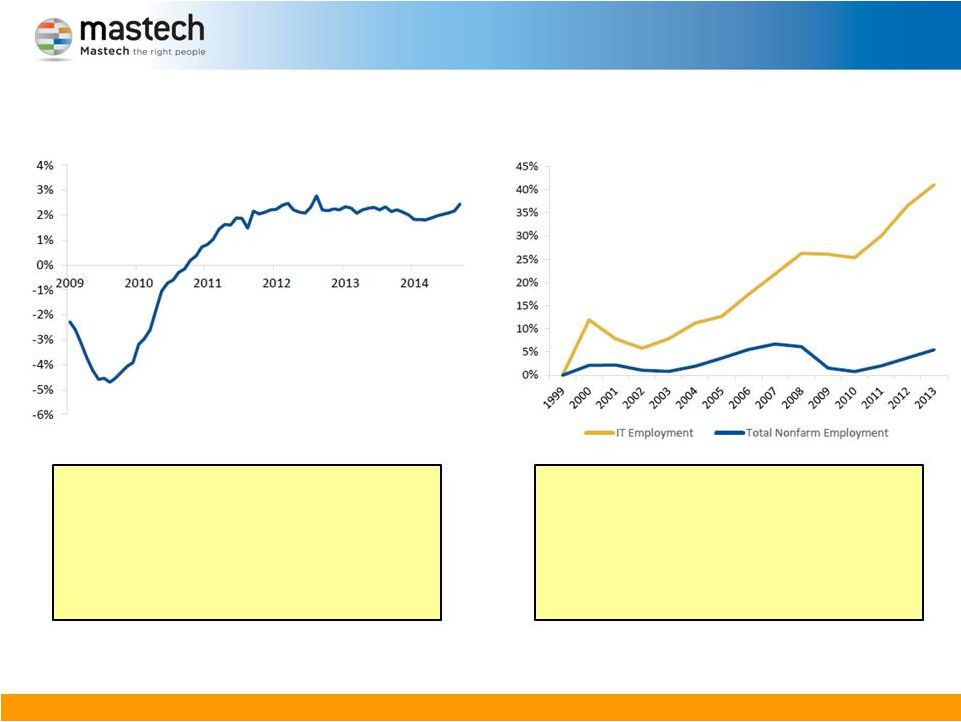

IT staffing growth follows IT job growth… 20 • Recent demand for overall IT employment has helped fuel strong growth in the IT temporary staffing market. • From 1999 through 2013, total IT employment grew more than 41%, versus growth of 5.5% in total nonfarm employment. Source: U.S. Bureau of Labor Statistics and Staffing Industry Analysts Growth in IT employment vs. total nonfarm employment Y/Y change in employment for industries served by IT staffing • Over the past three years, employment growth in the primary markets for IT staffing have hovered around the 2%-3% range. • As primary markets continue to grow and overall IT employment increases, demand for temporary staffing increases in kind. |

MASTECH INVESTMENT HIGHLIGHTS WE STAFF I.T. TRUSTED TALENT PARTNER NYSE MKT: MHH 21 |

U.S. Job Market Recovery Positive for Industry U.S. Job Market Recovery Positive for Industry Fundamental Shift Towards Greater Utilization of Staffing Services Fundamental Shift Towards Greater Utilization of Staffing Services Large Consumers of Staffing Services Employing VMS / MSP Model Large Consumers of Staffing Services Employing VMS / MSP Model Client Focus more about Consultant Quality, Speed to Market and Value Pricing Client Focus more about Consultant Quality, Speed to Market and Value Pricing Industry Trends & Outlook Centralized Recruiting Model; Scalable Cost Structure; Low-Cost Recruitment Engine Strong Brand Recognition with both U.S. Citizens and H1-B Visa Professionals Established, National Client-Base of High-Volume Consumers of IT Staffing Services Favorable Pricing / Value Proposition for Retail & Wholesale Clients Seasoned, Motivated and Capable Management Team What Differentiates Mastech MHH: A Catalyst for Future Growth 22 |

WE STAFF I.T. TRUSTED TALENT PARTNER NYSE MKT: MHH 2015 Emerging Growth Conference September 2, 2015 |