UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246 |

| (Address of principal executive offices) | | (Zip code) |

Capitol Services, Inc.

108 Lakeland Ave., Dover, Delaware 19901

(Name and address of agent for service)

With Copies to:

Terry Davis

DLA Piper LLP

One Atlantic Center

1201 West Peachtree Street, Suite 2900

Atlanta, GA 30309

| Registrant’s telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | 5/31/25 | |

| | | |

| Date of reporting period: | 11/30/2024 | |

Item 1. Reports to Stockholders.

(a)

Institutional Class (BFSIX)

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about BFS Equity Fund for the period of June 1, 2024 to November 30, 2024. You can find additional information about the Fund at https://funddocs.filepoint.com/bfs/. You can also request this information by contacting us at (855) 575-2430.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $53 | 0.99% |

|---|

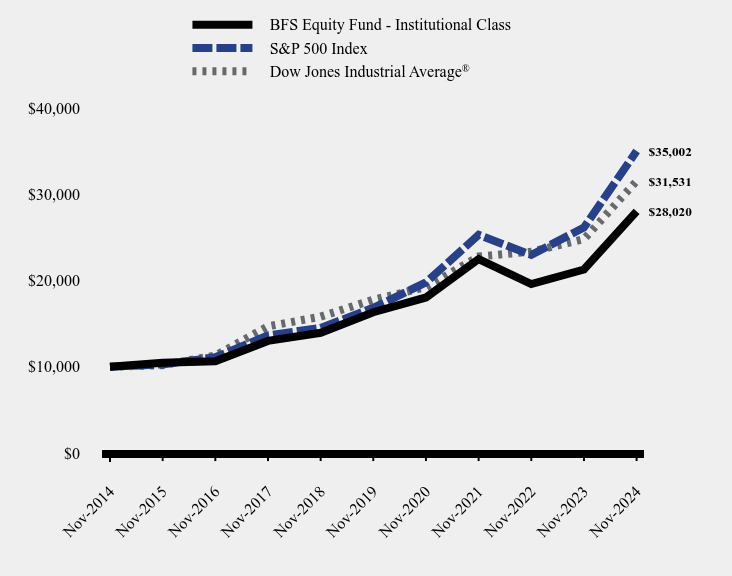

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| BFS Equity Fund - Institutional Class | S&P 500 Index | Dow Jones Industrial Average® |

|---|

| Nov-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Nov-2015 | $10,475 | $10,275 | $10,187 |

|---|

| Nov-2016 | $10,631 | $11,103 | $11,299 |

|---|

| Nov-2017 | $12,997 | $13,642 | $14,690 |

|---|

| Nov-2018 | $13,940 | $14,498 | $15,810 |

|---|

| Nov-2019 | $16,328 | $16,834 | $17,783 |

|---|

| Nov-2020 | $18,033 | $19,773 | $19,221 |

|---|

| Nov-2021 | $22,486 | $25,294 | $22,780 |

|---|

| Nov-2022 | $19,589 | $22,964 | $23,345 |

|---|

| Nov-2023 | $21,271 | $26,142 | $24,791 |

|---|

| Nov-2024 | $28,020 | $35,002 | $31,531 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| BFS Equity Fund - Institutional Class | 31.73% | 11.41% | 10.85% |

|---|

| S&P 500 Index | 33.89% | 15.77% | 13.35% |

|---|

Dow Jones Industrial Average® | 27.19% | 12.14% | 12.17% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$62,628,549

- Number of Portfolio Holdings42

- Advisory Fee (net of waivers)$167,236

- Portfolio Turnover6%

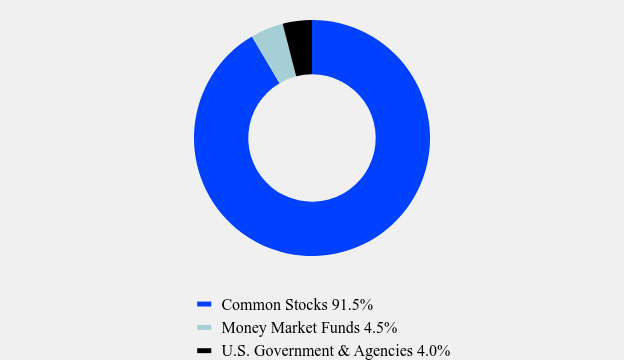

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 91.5% |

| Money Market Funds | 4.5% |

| U.S. Government & Agencies | 4.0% |

What did the Fund invest in?

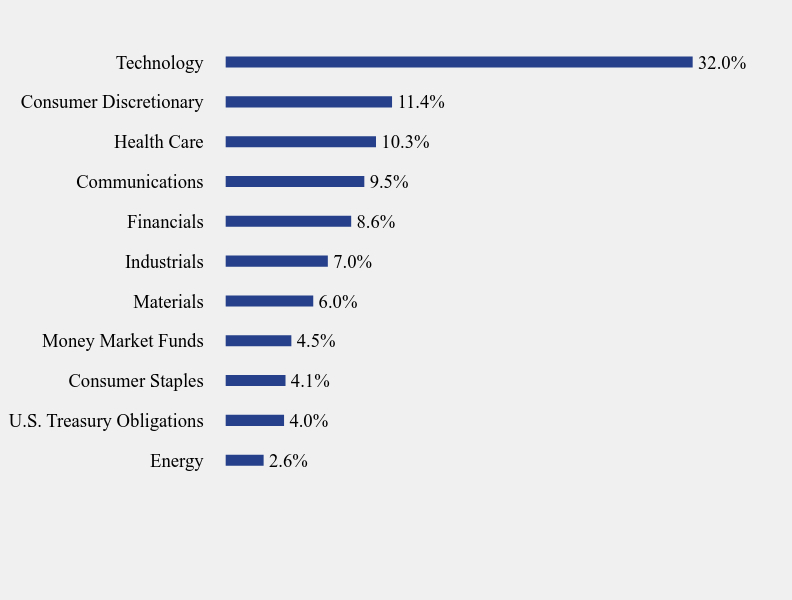

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Energy | 2.6% |

| U.S. Treasury Obligations | 4.0% |

| Consumer Staples | 4.1% |

| Money Market Funds | 4.5% |

| Materials | 6.0% |

| Industrials | 7.0% |

| Financials | 8.6% |

| Communications | 9.5% |

| Health Care | 10.3% |

| Consumer Discretionary | 11.4% |

| Technology | 32.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Microsoft Corp. | 6.1% |

| NVIDIA Corp. | 5.5% |

| Alphabet, Inc., Class A | 5.4% |

| Apple, Inc. | 4.7% |

| Fidelity Investments Money Market Government Portfolio, Institutional Class | 4.5% |

| Meta Platforms, Inc., Class A | 4.1% |

| JPMorgan Chase & Co. | 4.0% |

| Amazon.com, Inc. | 4.0% |

| Fiserv, Inc. | 3.5% |

| Costco Wholesale Corp. | 3.1% |

No material changes occurred during the period ended November 30, 2024.

BFS Equity Fund - Institutional (BFSIX)

Semi-Annual Shareholder Report - November 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://funddocs.filepoint.com/bfs/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Institutional Class (LSOFX)

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about LS Opportunity Fund for the period of June 1, 2024 to November 30, 2024. You can find additional information about the Fund at https://funddocs.filepoint.com/lsofx. You can also request this information by contacting us at (877) 336-6763.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $131 | 2.53% |

|---|

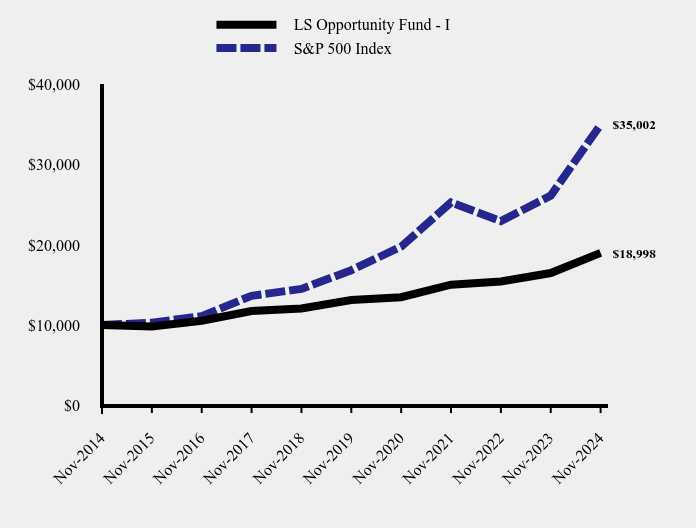

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| LS Opportunity Fund - I | S&P 500 Index |

|---|

| Nov-2014 | $10,000 | $10,000 |

|---|

| Nov-2015 | $9,800 | $10,275 |

|---|

| Nov-2016 | $10,520 | $11,103 |

|---|

| Nov-2017 | $11,733 | $13,642 |

|---|

| Nov-2018 | $12,066 | $14,498 |

|---|

| Nov-2019 | $13,104 | $16,834 |

|---|

| Nov-2020 | $13,466 | $19,773 |

|---|

| Nov-2021 | $15,021 | $25,294 |

|---|

| Nov-2022 | $15,416 | $22,964 |

|---|

| Nov-2023 | $16,478 | $26,142 |

|---|

| Nov-2024 | $18,998 | $35,002 |

|---|

Average Annual Total Returns

| 1 Year | 5 years | 10 Years |

|---|

| LS Opportunity Fund - I | 15.29% | 7.71% | 6.63% |

|---|

| S&P 500 Index | 33.89% | 15.77% | 13.35% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

What did the Fund invest in?

- Net Assets$208,894,125

- Number of Portfolio Holdings96

- Advisory Fee (net of waivers)$1,724,504

- Portfolio Turnover26%

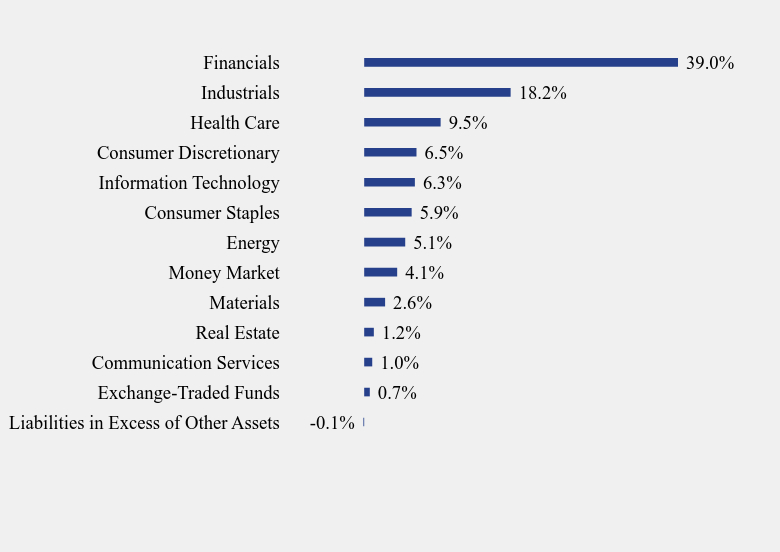

Long Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Exchange-Traded Funds | 0.7% |

| Communication Services | 1.0% |

| Real Estate | 1.2% |

| Materials | 2.6% |

| Money Market | 4.1% |

| Energy | 5.1% |

| Consumer Staples | 5.9% |

| Information Technology | 6.3% |

| Consumer Discretionary | 6.5% |

| Health Care | 9.5% |

| Industrials | 18.2% |

| Financials | 39.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Invesco Treasury Portfolio, Institutional Class | 4.1% |

| Progressive Corp. (The) | 4.1% |

| Eaton Corp. PLC | 3.7% |

| Brown & Brown, Inc. | 3.5% |

| Fairfax Financial Holdings Ltd. | 3.4% |

| Abbott Laboratories | 3.1% |

| Leidos Holdings, Inc. | 2.6% |

| PNC Financial Services Group, Inc. (The) | 2.6% |

| Arthur J. Gallagher & Co. | 2.4% |

| Citigroup, Inc. | 2.4% |

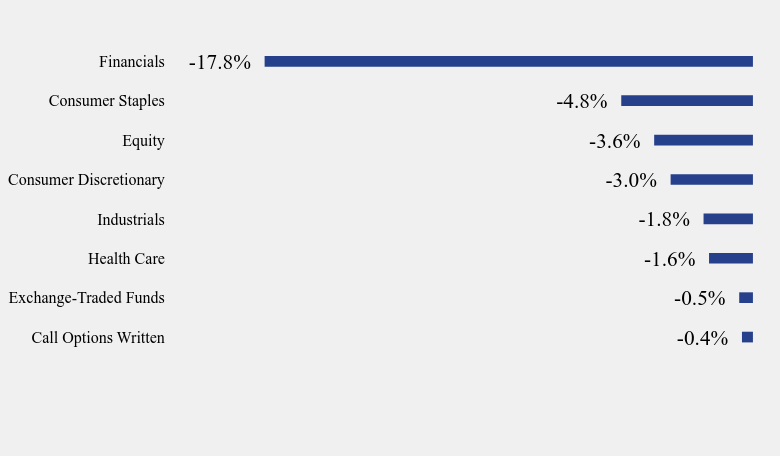

Short Sector Weighting (% of net assets)

| Value | Value |

|---|

| Call Options Written | -0.4% |

| Exchange-Traded Funds | -0.5% |

| Health Care | -1.6% |

| Industrials | -1.8% |

| Consumer Discretionary | -3.0% |

| Equity | -3.6% |

| Consumer Staples | -4.8% |

| Financials | -17.8% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://funddocs.filepoint.com/lsofx), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - November 30, 2024

(b) Not applicable

Item 2. Code of Ethics.

Not Applicable – disclosed with annual report.

Item 3. Audit Committee Financial Expert.

Not Applicable – disclosed with annual report.

Item 4. Principal Accountant Fees and Services.

Not Applicable – disclosed with annual report.

Item 5. Audit Committee of Listed Registrants.

Not Applicable – disclosed with annual report.

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

BFS Equity Fund

FINANCIAL STATEMENTS

November 30, 2024 - (Unaudited)

185 Asylum Street ● City Place II ● Hartford, CT 06103 ● (855) 575-2430

BFS Equity Fund

Schedule of Investments

November 30, 2024 (Unaudited)

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 91.56% | | | | | | | | |

| Aerospace & Defense — 1.56% | | | | | | | | |

| Northrop Grumman Corp. | | | 2,000 | | | $ | 979,300 | |

| | | | | | | | | |

| Banking — 5.50% | | | | | | | | |

| Bank of America Corp. | | | 20,000 | | | | 950,200 | |

| JPMorgan Chase & Co. | | | 10,000 | | | | 2,497,200 | |

| | | | | | | | 3,447,400 | |

| Beverages — 1.04% | | | | | | | | |

| PepsiCo, Inc. | | | 4,000 | | | | 653,800 | |

| | | | | | | | | |

| Biotech & Pharmaceuticals — 0.84% | | | | | | | | |

| Zoetis, Inc., Class A | | | 3,000 | | | | 525,750 | |

| | | | | | | | | |

| Building Products — 1.24% | | | | | | | | |

| Carrier Global Corp. | | | 10,000 | | | | 773,700 | |

| | | | | | | | | |

| Chemicals — 5.37% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 5,000 | | | | 1,671,650 | |

| Ecolab, Inc. | | | 2,000 | | | | 497,540 | |

| Sherwin-Williams Co. (The) | | | 3,000 | | | | 1,192,200 | |

| | | | | | | | 3,361,390 | |

| E-Commerce Discretionary — 3.99% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 12,000 | | | | 2,494,680 | |

| | | | | | | | | |

| Health Care Facilities & Services — 3.08% | | | | | | | | |

| IQVIA Holdings, Inc.(a) | | | 2,000 | | | | 401,680 | |

| UnitedHealth Group, Inc. | | | 2,500 | | | | 1,525,500 | |

| | | | | | | | 1,927,180 | |

| Home Construction — 2.02% | | | | | | | | |

| D.R. Horton, Inc. | | | 7,500 | | | | 1,265,850 | |

| | | | | | | | | |

| Insurance — 1.86% | | | | | | | | |

| Marsh & McLennan Cos., Inc. | | | 5,000 | | | | 1,166,150 | |

| | | | | | | | | |

| Internet Media & Services — 9.52% | | | | | | | | |

| Alphabet, Inc., Class A | | | 20,000 | | | | 3,379,000 | |

| Meta Platforms, Inc., Class A | | | 4,500 | | | | 2,584,440 | |

| | | | | | | | 5,963,440 | |

| Machinery — 4.19% | | | | | | | | |

| Caterpillar, Inc. | | | 1,000 | | | | 406,110 | |

| Deere & Co. | | | 2,500 | | | | 1,164,750 | |

| Parker-Hannifin Corp. | | | 1,500 | | | | 1,054,350 | |

| | | | | | | | 2,625,210 | |

| Medical Equipment & Devices — 5.33% | | | | | | | | |

| Danaher Corp. | | | 6,000 | | | | 1,438,140 | |

| Stryker Corp. | | | 2,500 | | | | 980,375 | |

| Thermo Fisher Scientific, Inc. | | | 1,750 | | | | 926,853 | |

| | | | | | | | 3,345,368 | |

| Metals & Mining — 0.67% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 5,000 | | | | 422,100 | |

See accompanying notes which are an integral part of these financial statements.

BFS Equity Fund

Schedule of Investments (continued)

November 30, 2024 (Unaudited)

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 91.56% - continued | | | | | | | | |

| Oil & Gas Producers — 2.59% | | | | | | | | |

| ConocoPhillips | | | 15,000 | | | $ | 1,625,100 | |

| | | | | | | | | |

| Pharmaceuticals — 1.05% | | | | | | | | |

| Pfizer, Inc. | | | 25,000 | | | | 655,250 | |

| | | | | | | | | |

| Retail - Consumer Staples — 3.11% | | | | | | | | |

| Costco Wholesale Corp. | | | 2,000 | | | | 1,943,760 | |

| | | | | | | | | |

| Retail - Discretionary — 2.61% | | | | | | | | |

| Lowe’s Companies, Inc. | | | 6,000 | | | | 1,634,580 | |

| | | | | | | | | |

| Semiconductors — 7.46% | | | | | | | | |

| Broadcom, Inc. | | | 7,500 | | | | 1,215,600 | |

| NVIDIA Corp. | | | 25,000 | | | | 3,456,250 | |

| | | | | | | | 4,671,850 | |

| Software — 12.27% | | | | | | | | |

| Adobe, Inc.(a) | | | 2,000 | | | | 1,031,860 | |

| Microsoft Corp. | | | 9,000 | | | | 3,811,139 | |

| Oracle Corp. | | | 10,000 | | | | 1,848,400 | |

| Salesforce, Inc. | | | 3,000 | | | | 989,970 | |

| | | | | | | | 7,681,369 | |

| Specialty Finance — 1.22% | | | | | | | | |

| American Express Co. | | | 2,500 | | | | 761,700 | |

| | | | | | | | | |

| Specialty Retail — 2.75% | | | | | | | | |

| Home Depot, Inc. (The) | | | 4,000 | | | | 1,716,520 | |

| | | | | | | | | |

| Technology Hardware — 4.74% | | | | | | | | |

| Apple, Inc. | | | 12,500 | | | | 2,966,625 | |

| | | | | | | | | |

| Technology Services — 7.55% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 3,000 | | | | 920,790 | |

| Fiserv, Inc.(a) | | | 10,000 | | | | 2,209,600 | |

| MasterCard, Inc., Class A | | | 3,000 | | | | 1,598,820 | |

| | | | | | | | 4,729,210 | |

| | | | | | | | | |

| Total Common Stocks (Cost $24,115,880) | | | | | | | 57,337,282 | |

| | | Principal

Amount | | | | |

| U.S. GOVERNMENT & AGENCIES — 3.97% | | | | | | | | |

| United States Treasury Bill, 5.00%, 12/5/2024 | | $ | 1,500,000 | | | | 1,499,445 | |

| United States Treasury Bill, 4.44%, 3/4/2025 | | | 1,000,000 | | | | 988,798 | |

| Total U.S. Government & Agencies (Cost $2,487,877) | | | | | | | 2,488,243 | |

See accompanying notes which are an integral part of these financial statements.

BFS Equity Fund

Schedule of Investments (continued)

November 30, 2024 (Unaudited)

| | | Shares | | | Fair Value | |

| MONEY MARKET FUNDS — 4.47% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Institutional Class, 4.55%(b) | | | 2,800,313 | | | $ | 2,800,313 | |

| Total Money Market Funds (Cost $2,800,313) | | | | | | | 2,800,313 | |

| | | | | | | | | |

| Total Investments — 100.00% (Cost $29,404,070) | | | | | | | 62,625,838 | |

| Other Assets in Excess of Liabilities — 0.00% | | | | | | | 2,711 | |

| NET ASSETS — 100.00% | | | | | | $ | 62,628,549 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of November 30, 2024. |

See accompanying notes which are an integral part of these financial statements.

BFS Equity Fund

Statement of Assets and Liabilities

November 30, 2024 - (Unaudited)

| Assets | | | | |

| Investments in securities at fair value (cost $29,404,070) (Note 3) | | $ | 62,625,838 | |

| Dividends and interest receivable | | | 43,069 | |

| Prepaid expenses | | | 18,801 | |

| Total Assets | | | 62,687,708 | |

| Liabilities | | | | |

| Payable to Adviser (Note 4) | | | 29,847 | |

| Payable to Administrator (Note 4) | | | 8,450 | |

| Other accrued expenses | | | 20,862 | |

| Total Liabilities | | | 59,159 | |

| Net Assets | | $ | 62,628,549 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 28,040,692 | |

| Accumulated earnings | | | 34,587,857 | |

| Net Assets | | $ | 62,628,549 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,410,274 | |

| Net asset value, offering and redemption price per share (Note 2) | | $ | 25.98 | |

See accompanying notes which are an integral part of these financial statements.

BFS Equity Fund

Statement of Operations

November 30, 2024 - (Unaudited)

| Investment Income | | | | |

| Dividend income (net of foreign taxes withheld of $600) | | $ | 299,253 | |

| Interest income | | | 55,848 | |

| Total investment income | | | 355,101 | |

| Expenses | | | | |

| Investment Adviser fees (Note 4) | | | 219,915 | |

| Administration fees (Note 4) | | | 24,075 | |

| Registration expenses | | | 13,974 | |

| Fund accounting fees (Note 4) | | | 12,911 | |

| Legal fees | | | 11,280 | |

| Transfer agent fees (Note 4) | | | 9,296 | |

| Audit and tax preparation fees | | | 9,274 | |

| Compliance services fees (Note 4) | | | 7,939 | |

| Trustee fees | | | 7,593 | |

| Printing and postage expenses | | | 5,373 | |

| Custodian fees | | | 2,264 | |

| Insurance expenses | | | 1,996 | |

| Miscellaneous | | | 18,080 | |

| Total expenses | | | 343,970 | |

| Fees contractually waived by Adviser (Note 4) | | | (52,679 | ) |

| Net operating expenses | | | 291,291 | |

| Net investment income | | | 63,810 | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain on: | | | | |

| Investment securities transactions | | | 1,125,666 | |

| Net change in unrealized appreciation on investments | | | 6,668,791 | |

| Net realized and change in unrealized gain on investments | | | 7,794,457 | |

| Net increase in net assets resulting from operations | | $ | 7,858,267 | |

See accompanying notes which are an integral part of these financial statements.

BFS Equity Fund

Statements of Changes in Net Assets

November 30, 2024

| | | For the

Six Months Ended

November 30,

2024 | | | For the

Year Ended

May 31,

2024 | |

| | | (Unaudited) | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 63,810 | | | $ | 265,504 | |

| Net realized gain on investment securities transactions | | | 1,125,666 | | | | 236,646 | |

| Net change in unrealized appreciation on investments | | | 6,668,791 | | | | 10,963,647 | |

| Net increase in net assets resulting from operations | | | 7,858,267 | | | | 11,465,797 | |

| Distributions to Shareholders from Earnings (Note 2) | | | — | | | | (244,163 | ) |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 1,172,252 | | | | 1,653,417 | |

| Reinvestment of distributions | | | — | | | | 228,207 | |

| Amount paid for shares redeemed | | | (1,406,810 | ) | | | (3,680,763 | ) |

| Net decrease in net assets resulting from capital transactions | | | (234,558 | ) | | | (1,799,139 | ) |

| Total Increase in Net Assets | | | 7,623,709 | | | | 9,422,495 | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 55,004,840 | | | | 45,582,345 | |

| End of period | | $ | 62,628,549 | | | $ | 55,004,840 | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 48,107 | | | | 80,926 | |

| Shares issued in reinvestment of distributions | | | — | | | | 11,292 | |

| Shares redeemed | | | (58,706 | ) | | | (183,902 | ) |

| Net decrease in shares outstanding | | | (10,599 | ) | | | (91,684 | ) |

See accompanying notes which are an integral part of these financial statements.

BFS Equity Fund - Institutional Class

Financial Highlights

(For a share outstanding during each period)

| | | For the

Six Months Ended November 30,

2024 | | | For the Years Ended May 31, | |

| | | (Unaudited) | | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 22.72 | | | $ | 18.14 | | | $ | 18.52 | | | $ | 21.36 | | | $ | 16.10 | | | $ | 15.40 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.03 | | | | 0.11 | | | | 0.10 | | | | (0.03 | ) | | | (0.02 | ) | | | 0.03 | |

| Net realized and unrealized gain/(loss) on investments | | | 3.23 | | | | 4.57 | | | | (0.28 | ) | | | (0.71 | ) | | | 5.57 | | | | 0.97 | |

| Total from investment operations | | | 3.26 | | | | 4.68 | | | | (0.18 | ) | | | (0.74 | ) | | | 5.55 | | | | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.10 | ) | | | — | | | | — | | | | — | | | | (0.03 | ) |

| Net realized gains | | | — | | | | — | | | | (0.20 | ) | | | (2.10 | ) | | | (0.29 | ) | | | (0.27 | ) |

| Total distributions | | | — | | | | (0.10 | ) | | | (0.20 | ) | | | (2.10 | ) | | | (0.29 | ) | | | (0.30 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 25.98 | | | $ | 22.72 | | | $ | 18.14 | | | $ | 18.52 | | | $ | 21.36 | | | $ | 16.10 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return(a) | | | 14.35 | %(b) | | | 25.87 | % | | | (0.94 | )% | | | (4.71 | )% | | | 34.68 | % | | | 6.32 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 62,629 | | | $ | 55,005 | | | $ | 45,582 | | | $ | 46,766 | | | $ | 48,781 | | | $ | 38,864 | |

| Ratio of net expenses to average net assets | | | 0.99 | %(c) | | | 1.10 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

| Ratio of expenses to average net assets before waiver and reimbursement | | | 1.17 | %(c) | | | 1.32 | % | | | 1.46 | % | | | 1.41 | % | | | 1.46 | % | | | 1.52 | % |

| Ratio of net investment income (loss) to average net assets | | | 0.22 | %(c) | | | 0.53 | % | | | 0.57 | % | | | (0.13 | )% | | | (0.12 | )% | | | 0.21 | % |

| Portfolio turnover rate | | | 6.18 | %(b) | | | 22.31 | % | | | 35.81 | % | | | 61.08 | % | | | 68.77 | % | | | 49.27 | % |

| (a) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (b) | Not annualized. |

| (c) | Annualized. |

See accompanying notes which are an integral part of these financial statements.

BFS Equity Fund

Notes to the Financial Statements

November 30, 2024 - (Unaudited)

NOTE 1. ORGANIZATION

The BFS Equity Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end diversified series of Valued Advisers Trust (the “Trust”) and commenced operations on November 8, 2013. The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board” or the “Trustees”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund’s investment adviser is Bradley, Foster & Sargent, Inc. (the “Adviser”). The investment objective of the Fund is long-term appreciation through growth of principal and income.

The Fund currently offers one class of shares (Institutional), and may offer additional classes of shares in the future.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the six months ended November 30, 2024, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties,

BFS Equity Fund

Notes to the Financial Statements (continued)

November 30, 2024 - (Unaudited)

if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations when incurred. During the six months ended November 30, 2024, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last three tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds of the Trust based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. For financial statement and income tax purposes, the specific identification method is used for determining capital gains or losses. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method. Dividend income from real estate investment trusts (REITs) and distributions from limited partnerships are recognized on the ex-date. The calendar year end classification of distributions received from REITs during the fiscal year are reported subsequent to year end; accordingly, the Fund estimates the character of REIT distributions based on the most recent information available. Income or loss from Limited Partnerships is reclassified among the components of net assets upon receipt of Schedules K-1 (Form 1065). Non-cash income, if any, is recorded at the fair market value of the securities received. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Foreign Currency Translation – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the unrealized gain or loss from investments. Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar

BFS Equity Fund

Notes to the Financial Statements (continued)

November 30, 2024 - (Unaudited)

equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

Share Valuation – The NAV is calculated each day the New York Stock Exchange (the “NYSE”) is open by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding for the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern Time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

BFS Equity Fund

Notes to the Financial Statements (continued)

November 30, 2024 - (Unaudited)

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Debt securities are valued by the Adviser as “Valuation Designee” under the oversight of the Board, by using the mean between the closing bid and ask prices provided by a pricing service. If the closing bid and ask prices are not readily available, the pricing service may provide a price determined by a matrix pricing method. Matrix pricing is a mathematical technique used to value fixed income securities without relying exclusively on quoted prices. Matrix pricing takes into consideration recent transactions, yield, liquidity, risk, credit quality, coupon, maturity, type of issue and any other factors or market data the pricing service deems relevant for the actual security being priced and for other securities with similar characteristics. These securities will generally be categorized as Level 2 securities. If the Adviser decides that a price provided by the pricing service does not accurately reflect the fair value of the securities or when prices are not readily available from a pricing service, securities are valued at fair value as determined by the Adviser, in conformity with guidelines adopted by and subject to review of the Board. These securities will generally be categorized as Level 3 securities.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the Nasdaq over-the-counter market are generally valued at the Nasdaq Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily

BFS Equity Fund

Notes to the Financial Statements (continued)

November 30, 2024 - (Unaudited)

available or are considered unreliable due to market or other events, securities are valued in good faith by the Adviser as “Valuation Designee” under the oversight of the Board. The Adviser has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Adviser pursuant to its policies and procedures. On a quarterly basis, the Adviser’s fair valuation determinations will be reviewed by the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

In accordance with the Trust’s valuation policies and fair value determinations pursuant to Rule 2a-5 under the 1940 Act, the Valuation Designee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Valuation Designee would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Valuation Designee’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Valuation Designee is aware of any other data that calls into question the reliability of market quotations. The Valuation Designee may obtain assistance from others in fulfilling its duties. For example, it may seek assistance from pricing services, fund administrators, sub-advisers, accountants, or counsel; it may also consult the Trust’s Fair Value Committee. The Valuation Designee, however, remains responsible for the final fair value determination and may not designate or assign that responsibility to any third party.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV as reported by the underlying fund companies. These securities are categorized as Level 1 securities.

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2024:

BFS Equity Fund

Notes to the Financial Statements (continued)

November 30, 2024 - (Unaudited)

| | | Valuation Inputs | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks (a) | | $ | 57,337,282 | | | $ | — | | | $ | — | | | $ | 57,337,282 | |

| U.S. Government & Agencies | | | — | | | | 2,488,243 | | | | — | | | | 2,488,243 | |

| Money Market Funds | | | 2,800,313 | | | | — | | | | — | | | | 2,800,313 | |

| Total | | $ | 60,137,595 | | | $ | 2,488,243 | | | $ | — | | | $ | 62,625,838 | |

| (a) | Refer to Schedule of Investments for industry classifications. |

The Fund did not hold any investments during or at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement on behalf of the Fund, the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund pays the Adviser a fee, computed and accrued daily and paid monthly, at an annual rate of 0.75% of the average daily net assets of the Fund.

The Adviser has contractually agreed to waive or limit its management fee and/or reimburse certain operating expenses until September 30, 2025, but only to the extent necessary so that the Fund’s net expenses, excluding brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1 fees, if any, and indirect expenses (such as “acquired funds fees and expenses”, and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement) do not exceed 0.99% of the average daily net assets of the Fund.

Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following the date of such waiver or reimbursement, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board, and it will automatically terminate upon the termination of the investment advisory agreement between the Trust and the Adviser. For the six months ended November 30, 2024, the Adviser waived fees of $52,679.

BFS Equity Fund

Notes to the Financial Statements (continued)

November 30, 2024 - (Unaudited)

The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions, are as follows:

| Recoverable Through | | | | |

| May 31, 2025 | | $ | 44,864 | |

| May 31, 2026 | | | 92,786 | |

| May 31, 2027 | | | 110,715 | |

| November 30, 2027 | | | 52,679 | |

The Trust retains Ultimus Fund Solutions, LLC (“Ultimus” or “Administrator”) to provide the Fund with administration, fund accounting and transfer agent services, including all regulatory reporting.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer and an Anti-Money Laundering Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund.

The officers of the Trust are members of management and/or employees of the Administrator or of NLCS, and are not paid by the Trust for services to the Fund. Ultimus Fund Distributors, LLC (the “Distributor”) acts as the distributor of the Fund’s shares. The Distributor is a wholly-owned subsidiary of Ultimus. There were no payments made to the Distributor by the Fund for the six months ended November 30, 2024.

The Fund previously adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of shareholder support services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 fees”). The Fund or Distributor may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. When the Investor class of shares converted to the Institutional class of shares on November 3, 2023, the Distribution Plan was terminated.

BFS Equity Fund

Notes to the Financial Statements (continued)

November 30, 2024 - (Unaudited)

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the six months ended November 30, 2024, purchases and sales of investment securities, other than short-term investments, were $3,441,280 and $6,123,563, respectively.

There were no purchases or sales of long-term U.S. government obligations during the six months ended November 30, 2024.

NOTE 6. FEDERAL TAX INFORMATION

At November 30, 2024, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes were as follows:

| Gross unrealized appreciation | | $ | 33,221,768 | |

| Gross unrealized depreciation | | | — | |

| Net unrealized appreciation on investments | | $ | 33,221,768 | |

| Tax cost of investments | | $ | 29,404,070 | |

At November 30, 2024, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses on wash sales.

The tax character of distributions paid for the fiscal year ended May 31, 2024, the Fund’s most recent fiscal year end, was as follows:

| Distributions paid from: | | | | |

| Ordinary income(a) | | $ | 244,163 | |

| Total distributions paid | | $ | 244,163 | |

| (a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At May 31, 2024, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 239,667 | |

| Undistributed long-term capital gains | | | 25,291 | |

| Unrealized appreciation (depreciation) | | | 26,464,632 | |

| Total accumulated earnings | | $ | 26,729,590 | |

NOTE 7. SECTOR RISK

If the Fund has significant investments in the securities of issuers within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss in the Fund and increase the

BFS Equity Fund

Notes to the Financial Statements (continued)

November 30, 2024 - (Unaudited)

volatility of the Fund’s NAV per share. For instance, economic or market factors, regulatory changes or other developments may negatively impact all companies in a particular sector, and therefore the value of the Fund’s portfolio will be adversely affected. As of November 30, 2024, the Fund had 32.0% of the value of its net assets invested in stocks within the Technology sector.

NOTE 8. IDEMNIFICATIONS

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 9. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

Proxy Voting Results (Unaudited)

At a Special Shareholder Meeting at which a quorum was present, held on June 27, 2024, Fund shareholders of record as of the close of business on May 13, 2024 voted to approve the following proposal:

Proposal 1: To elect the following individuals to serve on the Board of Trustees of the Trust:

Martin A. Burns

Susan J. Templeton

| | | Shares Voted in

Favor* | | Shares Voted

Against or Abstain* | | Shares Needed to

Approve* |

| Martin A. Burns | | 82,650,826 | | 53,513 | | Plurality |

| | | (99.94%) | | (0.06%) | | (greater than 50%) |

| Susan J. Templeton | | 82,570,073 | | 134,262 | | Plurality |

| | | (99.84%) | | (0.16%) | | (greater than 50%) |

| * | as a percentage of the total voting securities of the Fund voted at the meeting at which a quorum was present. |

Additional Information (Unaudited)

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the period covered by this report.

Proxy Disclosures

Not applicable

Remuneration Paid to Directors, Officers and Others

Refer to the financial statements included herein.

Statement Regarding Basis for Approval of Investment Advisory Agreement

Not applicable.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (855) 575-2430 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

| TRUSTEES | INDEPENDENT REGISTERED |

Andrea N. Mullins, Chairperson

Ira P. Cohen

Martin A. Burns

Susan J. Templeton | PUBLIC ACCOUNTING FIRM Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115 |

| | |

| OFFICERS | LEGAL COUNSEL |

Matthew J. Miller, Principal Executive Officer and President

Zachary P. Richmond, Principal Financial Officer and Treasurer

Michael Wittke, Chief Compliance Officer

Carol J. Highsmith, Vice President and Secretary | DLA Piper LLP (US)

One Atlantic Center

1201 West Peachtree Street, Suite 2900

Atlanta, Georgia 30309 |

| | |

| INVESTMENT ADVISER | CUSTODIAN |

Bradley, Foster & Sargent, Inc.

185 Asylum Street, City Place II

Hartford, CT 06103 | Huntington National Bank

41 South High Street

Columbus, OH 43215 |

| | |

| DISTRIBUTOR | ADMINISTRATOR, TRANSFER |

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 | AGENT AND FUND ACCOUNTANT Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC

LS Opportunity Fund

Schedule of Investments

November 30, 2024 - (Unaudited)

| | | Shares | | | Fair Value | |

| COMMON STOCKS - LONG - DOMESTIC — 79.84% | | | | | | | | |

| Communication Services — 1.01% | | | | | | | | |

| Alphabet, Inc., Class A(a) | | | 12,436 | | | $ | 2,101,062 | |

| | | | | | | | | |

| Consumer Discretionary — 5.51% | | | | | | | | |

| Darden Restaurants, Inc.(a) | | | 13,321 | | | | 2,348,093 | |

| Expedia Group, Inc.(a) (b) | | | 17,528 | | | | 3,236,019 | |

| Home Depot, Inc. (The)(a) | | | 8,252 | | | | 3,541,181 | |

| Texas Roadhouse, Inc.(a) | | | 11,637 | | | | 2,388,727 | |

| | | | | | | 11,514,020 | |

| Consumer Staples — 4.58% | | | | | | | | |

| Church & Dwight Co., Inc.(a) | | | 28,226 | | | | 3,108,529 | |

| Colgate-Palmolive Co.(a) | | | 35,597 | | | | 3,439,738 | |

| Mondelez International, Inc., Class A(a) | | | 46,549 | | | | 3,023,358 | |

| | | | | | | 9,571,625 | |

| Energy — 3.52% | | | | | | | | |

| Exxon Mobil Corp.(a) | | | 30,592 | | | | 3,608,632 | |

| Hess Corp.(a) | | | 13,729 | | | | 2,020,634 | |

| Murphy Oil Corp.(a) | | | 52,954 | | | | 1,719,417 | |

| | | | | | | 7,348,683 | |

| Financials — 33.44% | | | | | | | | |

| Ameris Bancorp(a) | | | 34,029 | | | | 2,391,558 | |

| Arthur J. Gallagher & Co.(a) | | | 16,296 | | | | 5,088,263 | |

| Brown & Brown, Inc.(a) | | | 64,348 | | | | 7,277,759 | |

| Cboe Global Markets, Inc.(a) | | | 12,322 | | | | 2,659,704 | |

| Citigroup, Inc.(a) | | | 70,585 | | | | 5,002,359 | |

| F.N.B. Corp.(a) | | | 128,748 | | | | 2,208,028 | |

| Fidelity National Information Services, Inc.(a) | | | 34,589 | | | | 2,950,442 | |

| Globe Life, Inc.(a) | | | 44,705 | | | | 4,972,984 | |

| Goldman Sachs Group, Inc. (The)(a) | | | 3,499 | | | | 2,129,386 | |

| KeyCorp(a) | | | 150,521 | | | | 2,932,149 | |

| PJT Partners, Inc., Class A(a) | | | 20,575 | | | | 3,443,432 | |

| PNC Financial Services Group, Inc. (The)(a) | | | 24,880 | | | | 5,342,234 | |

| Primerica, Inc.(a) | | | 13,463 | | | | 4,075,923 | |

| Progressive Corp. (The)(a) | | | 32,141 | | | | 8,642,072 | |

| Prosperity Bancshares, Inc.(a) | | | 45,891 | | | | 3,842,454 | |

| SouthState Corp.(a) | | | 37,228 | | | | 4,120,767 | |

| Voya Financial, Inc.(a) | | | 33,391 | | | | 2,771,453 | |

| | | | | | | 69,850,967 | |

| Health Care — 9.54% | | | | | | | | |

| Abbott Laboratories(a) | | | 54,429 | | | | 6,464,532 | |

| Cigna Corp. (The)(a) | | | 10,770 | | | | 3,638,106 | |

| Hologic, Inc.(a) (b) | | | 25,461 | | | | 2,024,150 | |

| Johnson & Johnson(a) | | | 21,974 | | | | 3,406,190 | |

| Merck & Co., Inc.(a) | | | 43,304 | | | | 4,401,418 | |

| | | | | | | 19,934,396 | |

| Industrials — 12.95% | | | | | | | | |

| AMETEK, Inc.(a) | | | 12,018 | | | | 2,336,059 | |

| Carrier Global Corp.(a) | | | 62,880 | | | | 4,865,026 | |

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Schedule of Investments (continued)

November 30, 2024 - (Unaudited)

| | | Shares | | | Fair Value | |

| COMMON STOCKS - LONG - DOMESTIC — 79.84% - continued | | | | | | | | |

| Industrials — 12.95% - continued | | | | | | | | |

| Curtiss-Wright Corp.(a) | | | 8,495 | | | $ | 3,173,987 | |

| Fortune Brands Innovations, Inc.(a) | | | 28,070 | | | | 2,197,881 | |

| General Dynamics Corp.(a) | | | 6,659 | | | | 1,891,223 | |

| Leidos Holdings, Inc.(a) | | | 32,767 | | | | 5,419,662 | |

| Otis Worldwide Corp.(a) | | | 19,616 | | | | 2,020,055 | |

| Paychex, Inc.(a) | | | 13,235 | | | | 1,935,883 | |

| RTX Corp.(a) | | | 26,294 | | | | 3,203,398 | |

| | | | | | | | 27,043,174 | |

| Information Technology — 6.31% | | | | | | | | |

| Littelfuse, Inc.(a) | | | 12,139 | | | | 2,994,327 | |

| Microsoft Corp.(a) | | | 7,367 | | | | 3,119,630 | |

| Teradyne, Inc.(a) | | | 12,968 | | | | 1,426,480 | |

| Trimble, Inc.(a) (b) | | | 56,835 | | | | 4,147,250 | |

| Zebra Technologies Corp., Class A(a) (b) | | | 3,689 | | | | 1,501,423 | |

| | | | | | | | 13,189,110 | |

| Materials — 1.74% | | | | | | | | |

| PPG Industries, Inc.(a) | | | 29,265 | | | | 3,639,688 | |

| | | | | | | | | |

| Real Estate — 1.24% | | | | | | | | |

| Howard Hughes Holdings, Inc. (The)(a) (b) | | | 29,915 | | | | 2,594,827 | |

| | | | | | | | | |

| Total Common Stocks - Long - Domestic (Cost $117,047,081) | | | | | | | 166,787,552 | |

| | | | | | | | | |

| COMMON STOCKS - LONG - INTERNATIONAL — 15.41% | | | | | | | | |

| Consumer Discretionary — 1.01% | | | | | | | | |

| Aptiv PLC(a) (b) | | | 37,771 | | | | 2,097,423 | |

| | | | | | | | | |

| Consumer Staples — 1.30% | | | | | | | | |

| Nestle S.A. | | | 31,208 | | | | 2,709,119 | |

| | | | | | | | | |

| Energy — 1.57% | | | | | | | | |

| Schlumberger Ltd.(a) | | | 74,635 | | | | 3,279,462 | |

| | | | | | | | | |

| Financials — 5.52% | | | | | | | | |

| Everest Re Group, Ltd.(a) | | | 11,161 | | | | 4,325,557 | |

| Fairfax Financial Holdings Ltd. | | | 5,096 | | | | 7,201,820 | |

| | | | | | | | 11,527,377 | |

| Industrials — 5.21% | | | | | | | | |

| Eaton Corp. PLC(a) | | | 20,157 | | | | 7,567,341 | |

| Pentair PLC(a) | | | 30,523 | | | | 3,326,702 | |

| | | | | | | | 10,894,043 | |

| Materials — 0.80% | | | | | | | | |

| Agnico Eagle Mines Ltd.(a) | | | 19,814 | | | | 1,672,698 | |

| | | | | | | | | |

| Total Common Stocks - Long - International (Cost $21,205,489) | | | | | | | 32,180,122 | |

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Schedule of Investments (continued)

November 30, 2024 - (Unaudited)

| | Shares | | | Fair Value | |

| EXCHANGE-TRADED FUNDS — 0.73% | | | | | | |

| Abrdn Physical Platinum Shares ETF(a) (b) | | | 17,502 | | | $ | 1,523,724 | |

| Total Exchange-Traded Funds (Cost $1,678,391) | | | | | | | 1,523,724 | |

| | | Number of | | | Notional | | | Exercise | | | Expiration | | | | |

| Description | | Contracts | | | Amount | | | Price | | | Date | | | | |

| PUT OPTIONS PURCHASED — 0.02% | | | | | | | | | | | | | | | | | | |

| Post Holdings, Inc. | | 149 | | | $ | 1,795,152 | | | $ | 105.00 | | | 3/21/2025 | | | $ | 13,783 | |

| Post Holdings, Inc. | | 114 | | | | 1,373,472 | | | | 110.00 | | | 3/21/2025 | | | | 16,245 | |

| Prudential Financial, Inc. | | 140 | | | | 1,811,740 | | | | 105.00 | | | 1/17/2025 | | | | 2,800 | |

| Wells Fargo Co. | | 292 | | | | 2,224,164 | | | | 52.50 | | | 6/20/2025 | | | | 15,330 | |

| Total Put Options Purchased (Cost $310,164) | | | | | | | | | | | | | | | | | 48,158 | |

| MONEY MARKET FUNDS — 4.15% | | Shares | | | | |

| Invesco Treasury Portfolio, Institutional Class, 4.53%(c) | | 8,661,914 | | | | 8,661,914 | |

| Total Money Market Funds (Cost $8,661,914) | | | | | | 8,661,914 | |

| | | | | | | | |

| Total Investments — 100.15% (Cost $148,903,039) | | | | | | 209,201,470 | |

| Liabilities in Excess of Other Assets — (0.15)% | | | | | | (307,345 | ) |

| NET ASSETS — 100.00% | | | | | $ | 208,894,125 | |

| (a) | All or a portion of the security is held as collateral for securities sold short and written options. The fair value of this collateral on November 30, 2024 was $108,317,963. |

| (b) | Non-income producing security. |

| (c) | Rate disclosed is the seven day effective yield as of November 30, 2024. |

ETF - Exchange-Traded Fund

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Schedule of Securities Sold Short

November 30, 2024 - (Unaudited)

| | | Shares | | | Fair Value | |

| COMMON STOCKS - SHORT - DOMESTIC - (23.36)% | | | | | | | | |

| Consumer Discretionary - (2.99)% | | | | | | | | |

| Brinker International, Inc.(a) | | | (19,381 | ) | | $ | (2,563,525 | ) |

| Hilton Grand Vacations, Inc.(a) | | | (43,880 | ) | | | (1,860,073 | ) |

| McDonald’s Corp. | | | (6,137 | ) | | | (1,816,613 | ) |

| | | | | | | | (6,240,211 | ) |

| Consumer Staples - (4.83)% | | | | | | | | |

| Campbell Soup Co. | | | (31,185 | ) | | | (1,440,747 | ) |

| Dollar Tree, Inc.(a) | | | (14,866 | ) | | | (1,059,500 | ) |

| Edgewell Personal Care Co. | | | (28,675 | ) | | | (1,048,931 | ) |

| Post Holdings, Inc.(a) | | | (31,641 | ) | | | (3,812,108 | ) |

| Sysco Corp. | | | (35,406 | ) | | | (2,730,157 | ) |

| | | | | | | | (10,091,443 | ) |

| Financials - (12.16)% | | | | | | | | |

| American International Group, Inc. | | | (27,610 | ) | | | (2,122,657 | ) |

| Capitol Federal Financial, Inc. | | | (224,868 | ) | | | (1,502,118 | ) |

| Enterprise Financial Services Corp. | | | (34,684 | ) | | | (2,101,504 | ) |

| Lincoln National Corp. | | | (103,500 | ) | | | (3,678,390 | ) |

| Markel Corp.(a) | | | (1,892 | ) | | | (3,373,285 | ) |

| Marsh & McLennan Cos., Inc. | | | (13,500 | ) | | | (3,148,605 | ) |

| Old Republic International Corp. | | | (128,886 | ) | | | (5,022,688 | ) |

| Park National Corp. | | | (5,876 | ) | | | (1,118,555 | ) |

| Washington Trust Bancorp, Inc. | | | (25,823 | ) | | | (959,066 | ) |

| WSFS Financial Corp. | | | (39,232 | ) | | | (2,354,705 | ) |

| | | | | | | | (25,381,573 | ) |

| Health Care - (1.57)% | | | | | | | | |

| Henry Schein, Inc.(a) | | | (13,322 | ) | | | (1,026,460 | ) |

| UnitedHealth Group, Inc. | | | (3,700 | ) | | | (2,257,740 | ) |

| | | | | | | | (3,284,200 | ) |

| Industrials - (1.81)% | | | | | | | | |

| Johnson Controls International PLC | | | (12,460 | ) | | | (1,044,896 | ) |

| Lockheed Martin Corp., Class B | | | (1,979 | ) | | | (1,047,702 | ) |

| TE Connectivity PLC | | | (11,200 | ) | | | (1,692,544 | ) |

| | | | | | | | (3,785,142 | ) |

| | | | | | | | | |

| TOTAL COMMON STOCKS - SHORT - DOMESTIC (Proceeds Received $43,997,998) | | | | | | | (48,782,569 | ) |

| | | | | | | | | |

| COMMON STOCKS - SHORT - INTERNATIONAL - (5.60)% | | | | | | | | |

| Financials - (5.60)% | | | | | | | | |

| Commonwealth Bank of Australia | | | (52,546 | ) | | | (5,434,162 | ) |

| Invesco Ltd. | | | (144,763 | ) | | | (2,618,763 | ) |

| Muenchener Rueckversicherungs-Gesellshaft AG | | | (3,716 | ) | | | (1,940,438 | ) |

| RenaissanceRe Holdings Ltd. | | | (6,016 | ) | | | (1,721,478 | ) |

| | | | | | | | (11,714,841 | ) |

| | | | | | | | | |

| TOTAL COMMON STOCKS - SHORT - INTERNATIONAL (Proceeds Received $10,203,608) | | | | | | | (11,714,841 | ) |

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Schedule of Securities Sold Short (continued)

November 30, 2024 - (Unaudited)

| | Shares | | | Fair Value | |

| EXCHANGE-TRADED FUNDS - (4.14)% | | | | | | |

| Energy Select Sector SPDR® Fund | | | (11,025 | ) | | | (1,053,218 | ) |

| Vanguard Industrials ETF(a) | | | (16,030 | ) | | | (4,483,591 | ) |

| Vanguard Information Technology ETF | | | (5,009 | ) | | | (3,116,850 | ) |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS (Proceeds Received $8,302,653) | | | | | | | (8,653,659 | ) |

| | | | | | | | | |

| TOTAL SECURITIES SOLD SHORT - (33.10)% (Proceeds Received $62,504,259) | | | | | | $ | (69,151,069 | ) |

| (a) | Non-dividend expense producing security. |

ETF - Exchange-Traded Fund

SPDR - Standard & Poor’s Depositary Receipt

The sectors shown on the schedule of investments and schedule of securities sold short are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/ or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Schedule of Written Options

November 30, 2024 - (Unaudited)

| Description | | Number of

Contracts | | Notional

Amount | | | Exercise

Price | | | Expiration

Date | | | Fair

Value | |

| CALL OPTIONS WRITTEN - (0.39)% | | | | | | | | | | | | | | | | | |

| Goldman Sachs Group, Inc. | | (32) | | $ | (1,947,424 | ) | | $ | 490.00 | | | 1/17/2025 | | | $ | (383,520 | ) |

| Texas Roadhouse, Inc. | | (70) | | | (1,436,890 | ) | | | 155.00 | | | 12/20/2024 | | | | (352,800 | ) |

| Texas Roadhouse, Inc. | | (44) | | | (903,188 | ) | | | 200.00 | | | 4/17/2025 | | | | (74,140 | ) |

| | | | | | | | | | | | | | | | | |

| Total Call Options Written (Premiums Received $267,154) | | | | | | | | | | | | | | | $ | (810,460 | ) |

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Statement of Assets and Liabilities

November 30, 2024 - (Unaudited)

| Assets | | | |

| Investments in securities, at fair value (cost $148,903,039) (Note 3) | | $ | 209,201,470 | |

| Deposits at broker for securities sold short (Note 2) | | | 69,730,567 | |

| Receivable for fund shares sold | | | 4,565 | |

| Dividends receivable | | | 254,781 | |

| Tax reclaims receivable | | | 25,065 | |

| Prepaid expenses | | | 22,692 | |

| Total Assets | | | 279,239,140 | |

| Liabilities | | | | |

| Investments in securities sold short, at fair value (proceeds received $62,504,259) (Note 2) | | | 69,151,069 | |

| Options written, at fair value (premium received $267,154) | | | 810,460 | |

| Payable for fund shares redeemed | | | 3,743 | |

| Dividend expense payable on short positions | | | 46,123 | |

| Payable to Adviser (Note 4) | | | 292,500 | |

| Payable to Administrator (Note 4) | | | 22,147 | |

| Other accrued expenses | | | 18,973 | |

| Total Liabilities | | | 70,345,015 | |

| Net Assets | | $ | 208,894,125 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 156,865,305 | |

| Accumulated earnings | | | 52,028,820 | |

| Net Assets | | $ | 208,894,125 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 10,905,653 | |

| Net asset value, offering and redemption price per share (Note 2) | | $ | 19.15 | |

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Statement of Operations

For the six months ended November 30, 2024 - (Unaudited)

| Investment Income | | | | |

| Dividend income (net of foreign taxes withheld of $7,343) | | $ | 1,666,738 | |

| Interest income | | | 1,546,127 | |

| Total investment income | | | 3,212,865 | |

| Expenses | | | | |

| Investment Adviser fees (Note 4) | | | 1,741,698 | |

| Dividend expense on securities sold short (Note 2) | | | 582,445 | |

| Administration fees (Note 4) | | | 79,681 | |

| Fund accounting fees (Note 4) | | | 26,283 | |

| Registration expenses | | | 17,938 | |

| Compliance services fees (Note 4) | | | 13,732 | |

| Custodian fees | | | 12,389 | |

| Legal fees | | | 11,486 | |

| Printing and postage expenses | | | 11,133 | |

| Transfer agent fees (Note 4) | | | 9,900 | |

| Audit and tax preparation expenses | | | 9,894 | |

| Trustee expenses | | | 7,593 | |

| Short sale and interest expense | | | 1,428 | |

| Miscellaneous | | | 22,493 | |

| Total expenses | | | 2,548,093 | |

| Fees waived by Adviser (Note 4) | | | (17,194 | ) |

| Net operating expenses | | | 2,530,899 | |

| Net investment income | | | 681,966 | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain (loss) on: | | | | |

| Investment securities | | | 6,132,873 | |

| Securities sold short | | | (8,028,065 | ) |

| Written options | | | (155,113 | ) |

| Purchased options | | | (289,922 | ) |

| Foreign currency | | | (9,307 | ) |

| Change in unrealized appreciation (depreciation) on: | | | | |

| Investment securities | | | 18,811,060 | |

| Securities sold short | | | (3,583,200 | ) |

| Written options | | | (370,278 | ) |

| Purchased options | | | (6,787 | ) |

| Foreign currency translations | | | 562 | |

| Net realized and change in unrealized gain on investments | | | 12,501,823 | |

| Net increase in net assets resulting from operations | | $ | 13,183,789 | |

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Statements of Changes in Net Assets

| | | For the

Six Months Ended

November 30,

2024 | | | For the

Year Ended

May 31,

2024 | |

| | | (Unaudited) | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 681,966 | | | $ | 1,169,710 | |

| Net realized gain (loss) on investment transactions | | | (2,349,534 | ) | | | 291,436 | |

| Change in unrealized appreciation on investments | | | 14,851,357 | | | | 24,313,642 | |

| Net increase in net assets resulting from operations | | | 13,183,789 | | | | 25,774,788 | |

| | | | | | | | | |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 16,930,544 | | | | 42,767,896 | |

| Amount paid for shares redeemed | | | (12,162,685 | ) | | | (21,729,896 | ) |

| Net increase in net assets resulting from capital transactions | | | 4,767,859 | | | | 21,038,000 | |

| Total Increase in Net Assets | | | 17,951,648 | | | | 46,812,788 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 190,942,477 | | | | 144,129,689 | |

| End of period | | $ | 208,894,125 | | | $ | 190,942,477 | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 915,051 | | | | 2,466,498 | |

| Shares redeemed | | | (656,699 | ) | | | (1,286,882 | ) |

| Net increase in shares outstanding | | | 258,352 | | | | 1,179,616 | |

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Financial Highlights

(For a share outstanding during each period)

| | | For the

Six Months Ended November 30,

2024 | | | For the Years Ended May 31, | |

| | (Unaudited) | | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 17.93 | | | $ | 15.22 | | | $ | 16.16 | | | $ | 17.01 | | | $ | 13.99 | | | $ | 14.07 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.06 | | | | 0.11 | | | | 0.01 | | | | (0.15 | ) | | | (0.13 | ) | | | (0.07 | ) |

| Net realized and unrealized gain (loss) on investments | | | 1.16 | | | | 2.60 | | | | (0.14 | ) | | | 0.02 | | | | 3.35 | | | | 0.17 | (a) |

| Total from investment operations | | | 1.22 | | | | 2.71 | | | | (0.13 | ) | | | (0.13 | ) | | | 3.22 | | | | 0.10 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | — | | | | — | | | | (0.81 | ) | | | (0.72 | ) | | | (0.20 | ) | | | (0.18 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 19.15 | | | $ | 17.93 | | | $ | 15.22 | | | $ | 16.16 | | | $ | 17.01 | | | $ | 13.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return(b) | | | 6.80 | %(c) | | | 17.81 | % | | | (0.84 | )% | | | (0.77 | )% | | | 23.17 | % | | | 0.62 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 208,894 | | | $ | 190,942 | | | $ | 144,130 | | | $ | 139,445 | | | $ | 132,424 | | | $ | 82,695 | |

| Ratio of net expenses to average net assets(d) | | | 2.53 | %(e) | | | 2.68 | % | | | 2.98 | % | | | 2.87 | % | | | 2.71 | % | | | 2.84 | % |

| Ratio of expenses to average net assets before waiver and reimbursement(d) | | | 2.55 | %(e) | | | 2.73 | % | | | 3.03 | % | | | 2.90 | % | | | 2.78 | % | | | 2.97 | % |

| Ratio of net investment income (loss) to average net assets | | | 0.68 | %(e) | | | 0.72 | % | | | 0.04 | % | | | (1.00 | )% | | | (1.04 | )% | | | (0.52 | )% |

| Portfolio turnover rate | | | 26.19 | %(c) | | | 46.61 | % | | | 74.68 | % | | | 55.37 | % | | | 69.69 | % | | | 69.47 | % |

| (a) | The amount shown for a share outstanding throughout the year does not accord with the change in aggregate gains and losses in the portfolio of securities during the year due to the timing of sales and purchases of fund shares in relation to fluctuating market values during the year. |

| (b) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (c) | Not annualized. |

| (d) | Includes dividend and interest expense of 0.58% for the six months ended November 30, 2024 and 0.73%, 1.03%, 0.92%, 0.76% and 0.89% for the fiscal years ended May 31, 2024, 2023, 2022, 2021 and 2020, respectively. |

| (e) | Annualized. |

See accompanying notes which are an integral part of these financial statements.

LS Opportunity Fund

Notes to the Financial Statements

November 30, 2024 - (Unaudited)

NOTE 1. ORGANIZATION

The LS Opportunity Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end, diversified series of Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board” or the “Trustees”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund’s investment adviser is Long Short Advisors, LLC (the “Adviser”). The Adviser has retained Prospector Partners, LLC (the “Sub-Adviser”) to serve as the sub-adviser to provide portfolio management and related services to the Fund. The Sub-Adviser receives a fee from the Adviser (not the Fund) for these services. The investment objective of the Fund is to generate long-term capital appreciation by investing in both long and short positions within a portfolio consisting of primarily publicly-traded common stock, with less net exposure than that of the stock market in general.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

LS Opportunity Fund

Notes to the Financial Statements (continued)

November 30, 2024 - (Unaudited)

As of and during the six months ended November 30, 2024, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations when incurred. During the six months ended November 30, 2024, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last three tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds of the Trust based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. For financial statement and income tax purposes, the specific identification method is used for determining capital gains or losses. Dividend income and dividend expense are recorded on the ex-dividend date and interest income is recorded on an accrual basis. Dividend income from real estate investment trusts (REITs) and distributions from limited partnerships are recognized on the ex-date. The calendar year end classification of distributions received from REITs during the fiscal year are reported subsequent to year end; accordingly, the Fund estimates the character of REIT distributions based on the most recent information available. Income or loss from Limited Partnerships is reclassified among the components of net assets upon receipt of Schedules K-1 (Form 1065). Non-cash income, if any, is recorded at the fair market value of the securities received. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.