Exhibit 99.2

NYSE American | LLEX Corporate Presentation January 2018

Disclaimer Strictly Private and Confidential This presentation contains forward - looking statements . The use of words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “should”, “likely” or similar expressions, indicates a forward - looking statement . These statements and all the projections in this presentation are subject to risks and uncertainties and are based on the beliefs and assumptions of management, and information currently available to management . The actual results could differ materially from a conclusion, forecast or projection in the forward - looking information . The identification in this presentation of factors that may affect Lilis’ future performance and the accuracy of forward - looking statements is meant to be illustrative and by no means exhaustive . These forward - looking statements are given only as of the date of this presentation . Except as required by law, we do not intend, and undertake no obligations to update any forward - looking statements . All forward - looking statements should be evaluated with the understanding of their inherent uncertainty . These forward - looking statements include, among other things, statements about Lilis’ expectations, beliefs, intentions or business strategies for the future, statements concerning Lilis’ outlook with regard to the timing and amount of future production of oil, natural gas liquids and natural gas, price realizations, the nature and timing of capital expenditures for exploration and development, plans for funding operations and drilling program capital expenditures, the timing and success of specific projects, operating costs and other expenses, proved oil and natural gas reserves, liquidity and capital resources, outcomes and effects of litigation, claims and disputes and derivative activities . Factors that could cause Lilis’ actual results to differ materially from those expressed or implied by forward - looking statements include, but are not limited to : the success of Lilis’ exploration and development efforts ; the price of oil, gas and other produced gases and liquids ; the worldwide economic situation ; changes in interest rates or inflation ; the ability of Lilis to transport gas, oil and other products ; the ability of Lilis to raise additional capital, as it may be affected by current conditions in the stock market and competition in the oil and gas industry for risk capital ; Lilis’ capital costs, which may be affected by delays or cost overruns ; cost of production ; environmental and other regulations, as the same presently exist or may later be amended ; Lilis’ ability to identify, finance and integrate any future acquisitions ; and the volatility of Lilis’ stock price . See the risks discussed in Lilis’ Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q . RESERVE/RESOURCE DISCLOSURE The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions of such terms . Reserve estimates that are intended to meet SEC guidelines are included in our periodic reports filed with the SEC . In this presentation, Lilis sometimes refers to broader, less precise terms when characterizing reserve estimates, such as “resource potential” and “estimated ultimate recovery”, or “EUR”, which the SEC does not permit to be disclosed in SEC filings and are not intended to conform to SEC filing requirements . These estimates are by their nature more speculative than those disclosed in Lilis’ SEC filings and thus are subject to substantially greater uncertainty of being realized . They are based on internal estimates, are not reviewed or reported upon by any independent third party and are subject to ongoing review . Actual quantities recovered will likely differ substantially from these estimates . Factors affecting ultimate recovery of reserves include t he scope of Lilis’ actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices (including prevailing oil and gas prices), availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual recoveries of oil and natural gas in place, length of horizontal laterals, actual drilling results, including geological and mechanical factors affecting recovery rates, and other factors . These estimates may change significantly as the development of properties provides additional data . Investors are urged to consider closely the oil and gas disclosures in Lilis’ 2016 Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and other public filings . No Liability . Recipients are urged to consult with their own independent legal and financial advisors with respect to any investment . This presentation should be independently verified . Neither Lilis nor any of its officers, directors, members, employees or consultants, accept and liability whatsoever for any direct or consequential loss arising from any use of information contain in this presentation . Investing in securities can be speculative and can carry a high degree of risk .

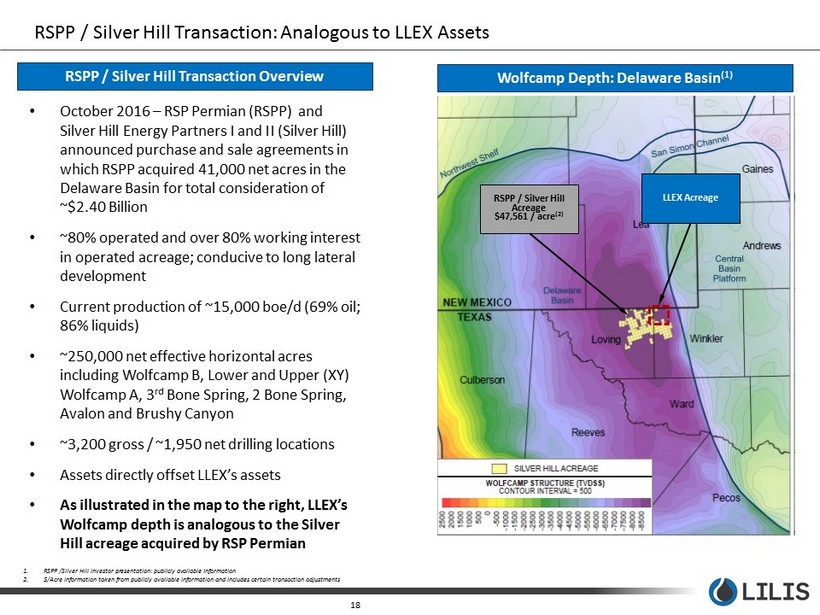

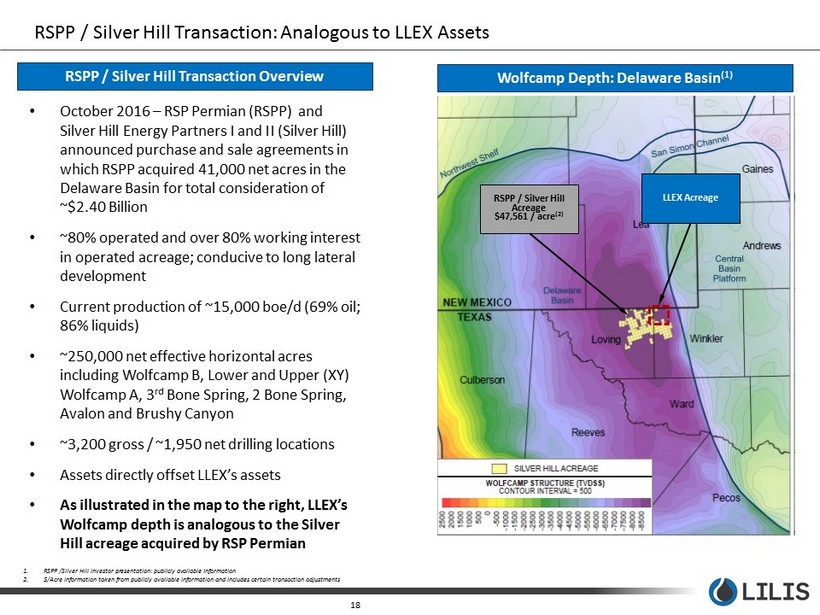

Investment Highlights 1. Based off of strip pricing 8/9/17 on a 1.5 mile and $8.5mm AFE 2. 2018 drilling plan subject to continued internal evaluation, including development targets and well locations. 3. $/acre information taken from publicly available information and includes certain transaction adjustments 3 Pure Play Permian Operator with Core Delaware Position Over 16,200 net acres (91% operated) in the Permian’s Delaware basin Multi - year inventory of over 900 potential net horizontal locations Strong well economics with ~87% IRRs using current strip pricing (1) Pure play Permian Basin operator High Growth Rate with 2018 Development Program Transformative value proposition through conversion of resource potential to production, reserves, and cash flow Currently planned 2018 D&C development plan (2) calling for continued delineation of our acreage both geographically and geologically through testing of eastern acreage and additional benches in upcoming wells On August 10, 2017, we entered into a long - term gas gathering, processing and purchase agreement with Lucid Energy Delaware, LLC; which provides for: • Southeast New Mexico and substantially all of the Texas properties to be dedicated to Lucid • Currently Selling gas in New Mexico and Texas gas commenced initial sales • Unconstrained field production across all of the Lilis properties expected by mid February 2018 • Once fully operational Lucid system will meet all of the Company’s current and future gas production needs and thus provide a permanent gas take away solution Strong Financial Position and Liquidity Ability to fund currently planned 2018 CAPEX and development program with combination of cash, cash flow, warrant proceeds, expansion of debt facilities and potential asset sales The Company has entered into hedging arrangements with various third parties and intend to add hedges on an opportunistic basis in the future in order to manage risk and as market conditions warrant Track Record of Delaware Acreage Acquisition in Prime Area Over 16,200 net acre position through accretive lease acquisitions Highly contiguous block with high WI, operatorship and HBP acreage Acquisition pipeline remains very active with 1,000 – 1,500 net acres committed and expected to be added in the near future Acreage Valuation supported by recent Delaware Basin transaction: including: ( i ) RSP Permian acquisition of Silver Hill transacted at $47,561 / net production adjusted acre (3) and (ii) Oasis Petroleum's acquisition of Forge transacted at $39,788 / net production adjusted acre (3) Since June 2016 merger with Brushy Resources, Lilis has expanded its Delaware Basin acreage footprint by over 370% Experienced and Aligned Management Team Management and Board of Directors beneficially own ~25% of the company and are aligned with shareholder interests Current management and operational teams have worked with Anadarko, AEP, Cobalt, Devon, Occidental, EOG, Burlington, SM Energy, US Energy and Quantum Resources

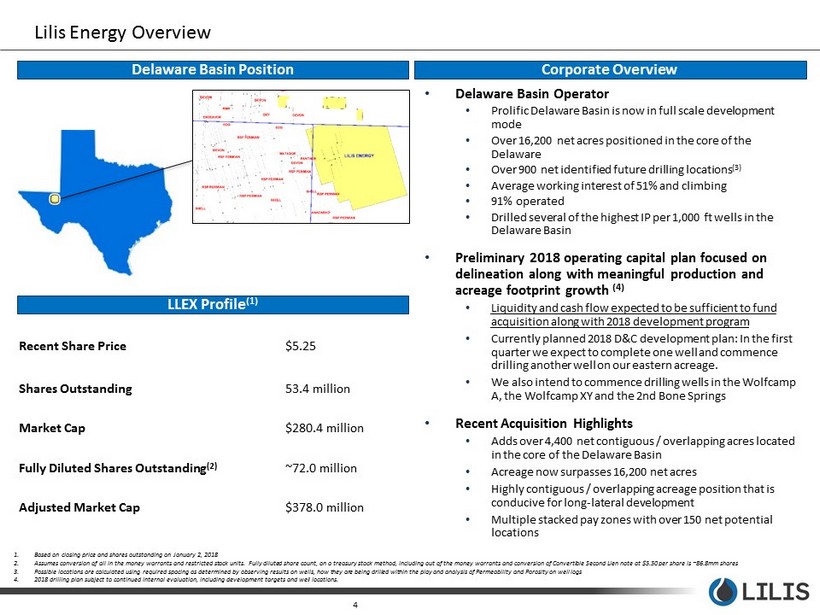

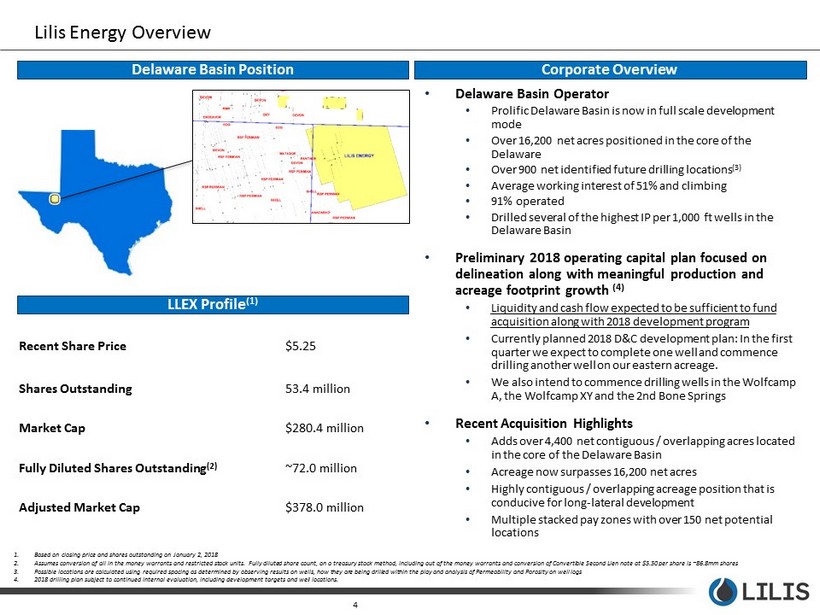

• Delaware Basin Operator • Prolific Delaware Basin is now in full scale development mode • Over 16,200 net acres positioned in the core of the Delaware • Over 900 net identified future drilling locations (3) • Average working interest of 51% and climbing • 91% operated • Drilled several of the highest IP per 1,000 ft wells in the Delaware Basin • Preliminary 2018 operating capital plan focused on delineation along with meaningful production and acreage footprint growth (4) • Liquidity and cash flow expected to be sufficient to fund acquisition along with 2018 development program • Currently planned 2018 D&C development plan: In the first quarter we expect to complete one well and commence drilling another well on our eastern acreage. • We also intend to commence drilling wells in the Wolfcamp A, the Wolfcamp XY and the 2nd Bone Springs • Recent Acquisition Highlights • Adds over 4,400 net contiguous / overlapping acres located in the core of the Delaware Basin • Acreage now surpasses 16,200 net acres • Highly contiguous / overlapping acreage position that is conducive for long - lateral development • Multiple stacked pay zones with over 150 net potential locations Delaware Basin Position LLEX Profile (1) Corporate Overview Lilis Energy Overview 4 Recent Share Price $5.25 Shares Outstanding 53.4 million Market Cap $280.4 million Fully Diluted Shares Outstanding (2) ~72.0 million Adjusted Market Cap $378.0 million 1. Based on closing price and shares outstanding on January 2, 2018 2. Assumes conversion of all in the money warrants and restricted stock units. Fully diluted share count, on a treasury stock m eth od, including out of the money warrants and conversion of Convertible Second Lien note at $5.50 per share is ~86.8mm shares 3. Possible locations are calculated using required spacing as determined by observing results on wells, how they are being dril led within the play and analysis of Permeability and Porosity on well logs 4. 2018 drilling plan subject to continued internal evaluation, including development targets and well locations.

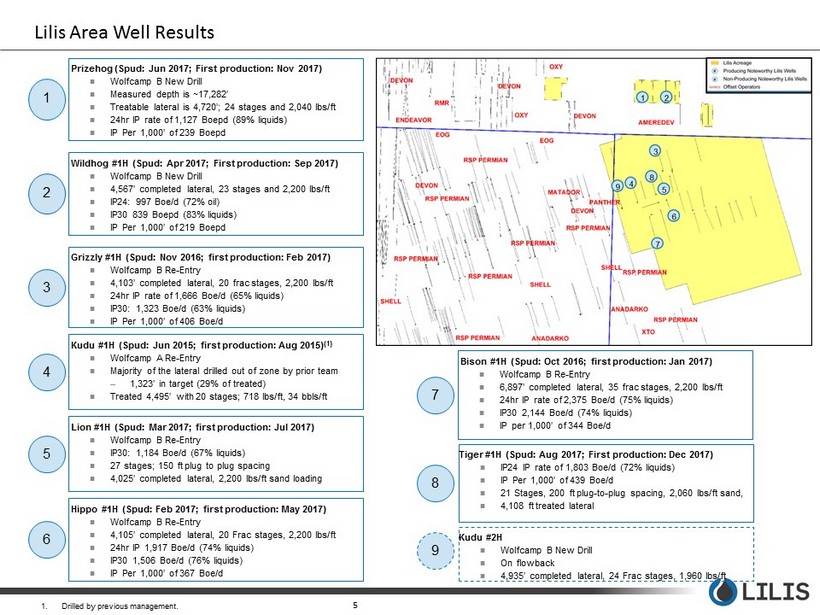

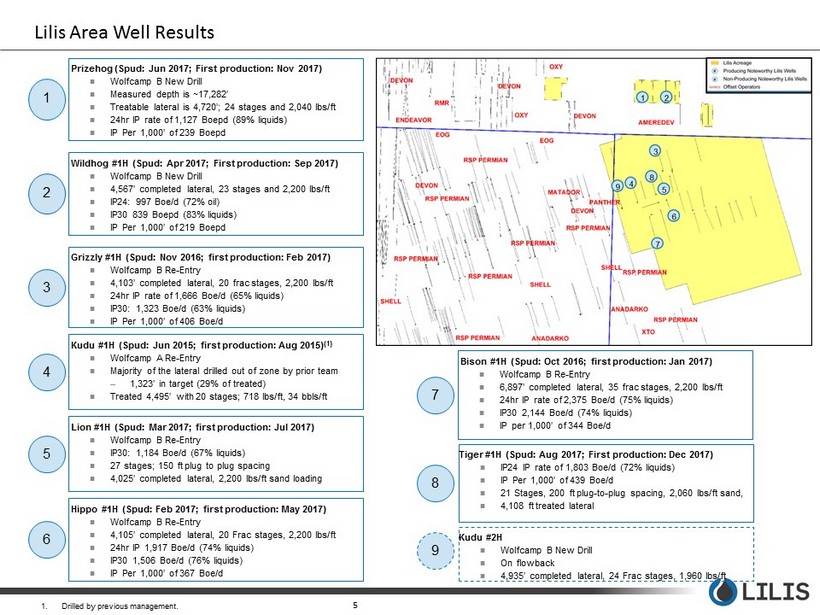

Lilis Area Well Results 5 1. Drilled by previous management. Wildhog #1H (Spud: Apr 2017; First production: Sep 2017) Wolfcamp B New Drill 4,567’ completed lateral, 23 stages and 2,200 lbs/ft IP24: 997 Boe/d (72% oil) IP30 839 Boepd (83% liquids) IP Per 1,000’ of 219 Boepd 2 Grizzly #1H (Spud: Nov 2016; first production: Feb 2017) Wolfcamp B Re - Entry 4,103’ completed lateral, 20 frac stages, 2,200 lbs/ft 24hr IP rate of 1,666 Boe/d (65% liquids) IP30: 1,323 Boe/d (63% liquids) IP Per 1,000’ of 406 Boe/d 3 Lion #1H (Spud: Mar 2017; first production: Jul 2017) Wolfcamp B Re - Entry IP30: 1,184 Boe/d (67% liquids) 27 stages; 150 ft plug to plug spacing 4,025’ completed lateral, 2,200 lbs/ft sand loading 5 Hippo #1H (Spud: Feb 2017; first production: May 2017) Wolfcamp B Re - Entry 4,105’ completed lateral, 20 Frac stages, 2,200 lbs/ft 24hr IP 1,917 Boe/d (74% liquids) IP30 1,506 Boe/d (76% liquids) IP Per 1,000’ of 367 Boe/d 6 Bison #1H (Spud: Oct 2016; first production: Jan 2017) Wolfcamp B Re - Entry 6,897’ completed lateral, 35 frac stages, 2,200 lbs/ft 24hr IP rate of 2,375 Boe/d (75% liquids) IP30 2,144 Boe/d (74% liquids) IP per 1,000’ of 344 Boe/d 7 Kudu #1H (Spud: Jun 2015; first production: Aug 2015) (1) Wolfcamp A Re - Entry Majority of the lateral drilled out of zone by prior team – 1,323’ in target (29% of treated) Treated 4,495’ with 20 stages; 718 lbs/ft, 34 bbls/ft 4 Prizehog (Spud: Jun 2017 ; First production: Nov 2017) Wolfcamp B New Drill Measured depth is ~17,282’ Treatable lateral is 4,720’; 24 stages and 2,040 lbs / ft 24hr IP rate of 1,127 Boepd (89% liquids) IP Per 1,000’ of 239 Boepd 1 8 Tiger #1H (Spud: Aug 2017; First production: Dec 2017) IP24 IP rate of 1,803 Boe /d (72% liquids) IP Per 1,000’ of 439 Boe /d 21 Stages, 200 ft plug - to - plug spacing, 2,060 lbs / ft sand, 4,108 ft treated lateral 9 Kudu #2H Wolfcamp B New Drill On flowback 4,935’ completed lateral, 24 Frac stages, 1,960 lbs / ft

Wildhog BWX State Com #1H – De - Risking Acreage 6

Delaware Basin Structural Cross Section 7 PRODUCING TARGETS Wolfcamp B Primary target to date with 7 active HZ wells on acreage showing strong results Wolfcamp A One active HZ well: Kudu 1H Drilled out of target by prior team & under stimulated Matador well three sections west of Lilis IP’d at >2,200 boe/d Wolfcamp C Vertical PDP well on NM block completed in 2015 Successful Mewbourne horizontal well two blocks south Brushy Canyon Numerous legacy wells on the acreage including horizontal test indicating good potential TARGETS PRODUCING NEARBY Avalon Shale Well developed target nearby in Lea County with numerous operators testing down spacing 1 st Bone Springs Well developed target in Lea County with some nearby activity by EOG and RSP Permian 2nd Bone Spring Viewed as highest potential of untested zones on acreage Over 1,500’ of pay and tremendous OIP support multiple benches within the zone 3 rd Bone Springs De - risked by nearby Concho and RSP Permian activity Wolfcamp XY De - risked by nearby RSP Permian activity in Loving County EOG Whirling Wind EOG Noah Brunson Eastern Acreage

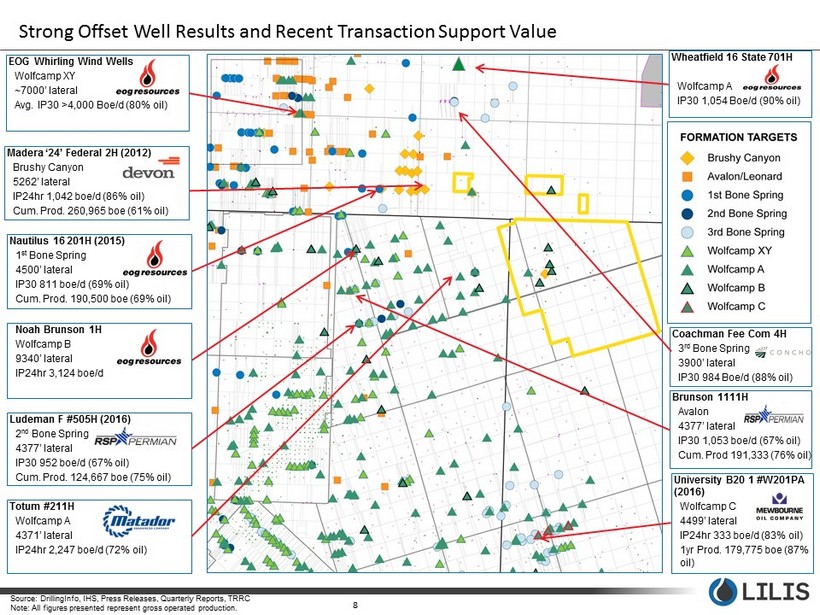

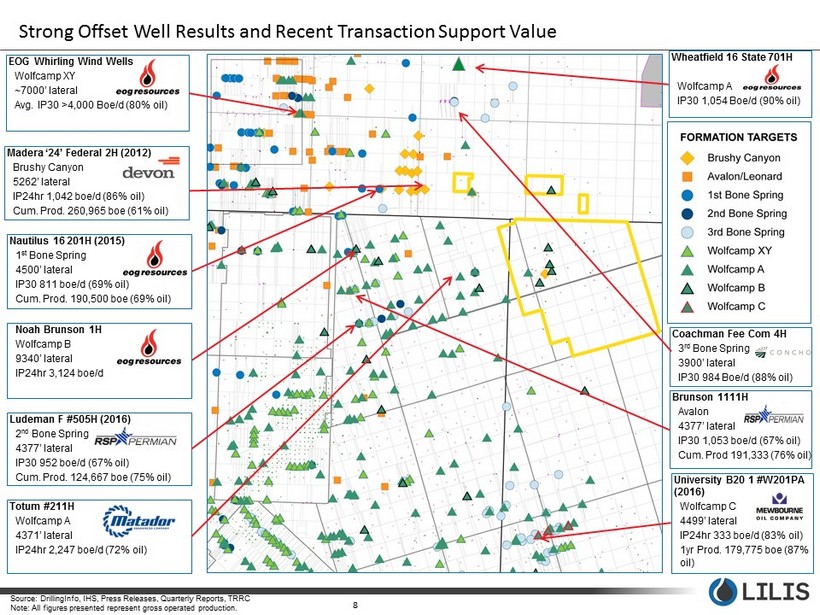

Source: DrillingInfo , IHS, Press Releases, Quarterly Reports, TRRC Note: All figures presented represent gross operated production. Totum #211H Wolfcamp A 4371’ lateral IP24hr 2,247 boe/d (72% oil) Madera ‘24’ Federal 2H (2012) Brushy Canyon 5262’ lateral IP24hr 1,042 boe/d (86% oil) Cum. Prod. 260,965 boe (61% oil) Ludeman F #505H (2016) 2 nd Bone Spring 4377’ lateral IP30 952 boe/d (67% oil) Cum. Prod. 124,667 boe (75% oil) University B20 1 #W201PA (2016) Wolfcamp C 4499’ lateral IP24hr 333 boe/d (83% oil) 1yr Prod. 179,775 boe (87% oil) Nautilus 16 201H (2015) 1 st Bone Spring 4500’ lateral IP30 811 boe/d (69% oil) Cum. Prod. 190,500 boe (69% oil) Brunson 1111H Avalon 4377’ lateral IP30 1,053 boe/d (67% oil) Cum. Prod 191,333 (76% oil) EOG Whirling Wind Wells Wolfcamp XY ~7000’ lateral Avg. IP30 >4,000 Boe/d (80% oil) Noah Brunson 1H Wolfcamp B 9340’ lateral IP24hr 3,124 boe/d Coachman Fee Com 4H 3 rd Bone Spring 3900’ lateral IP30 984 Boe/d (88% oil) Wheatfield 16 State 701H Wolfcamp A IP30 1,054 Boe /d (90% oil) Strong Offset Well Results and Recent Transaction Support Value 8

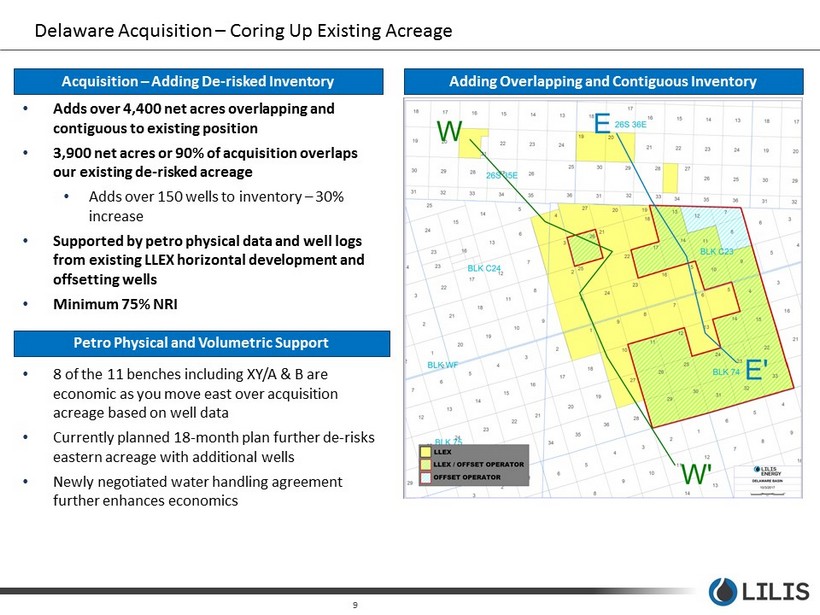

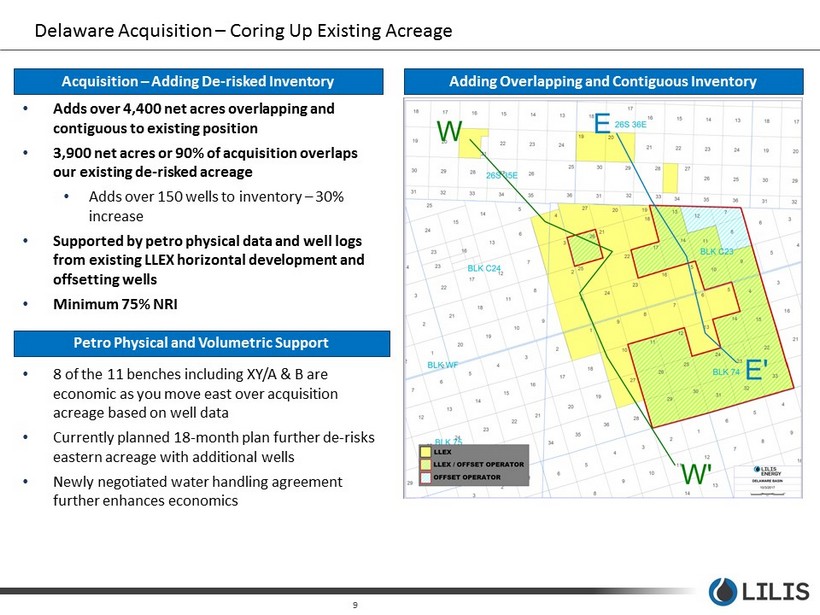

9 Delaware Acquisition – Coring Up Existing Acreage • Adds over 4,400 net acres overlapping and contiguous to existing position • 3,900 net acres or 90% of acquisition overlaps our existing de - risked acreage • Adds over 150 wells to inventory – 30% increase • Supported by petro physical data and well logs from existing LLEX horizontal development and offsetting wells • Minimum 75% NRI Acquisition – Adding De - risked Inventory Adding Overlapping and Contiguous Inventory • 8 of the 11 benches including XY/A & B are economic as you move east over acquisition acreage based on well data • Currently planned 18 - month plan further de - risks eastern acreage with additional wells • Newly negotiated water handling agreement further enhances economics Petro Physical and Volumetric Support

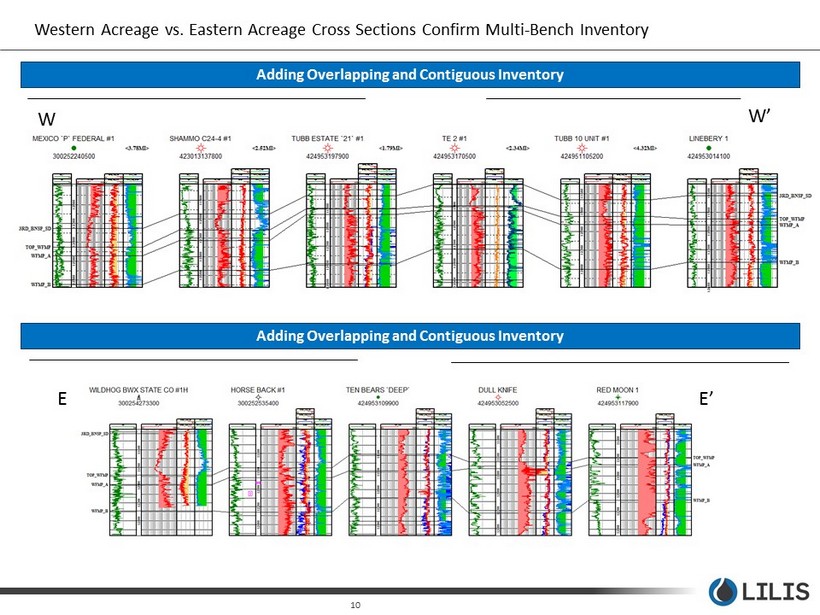

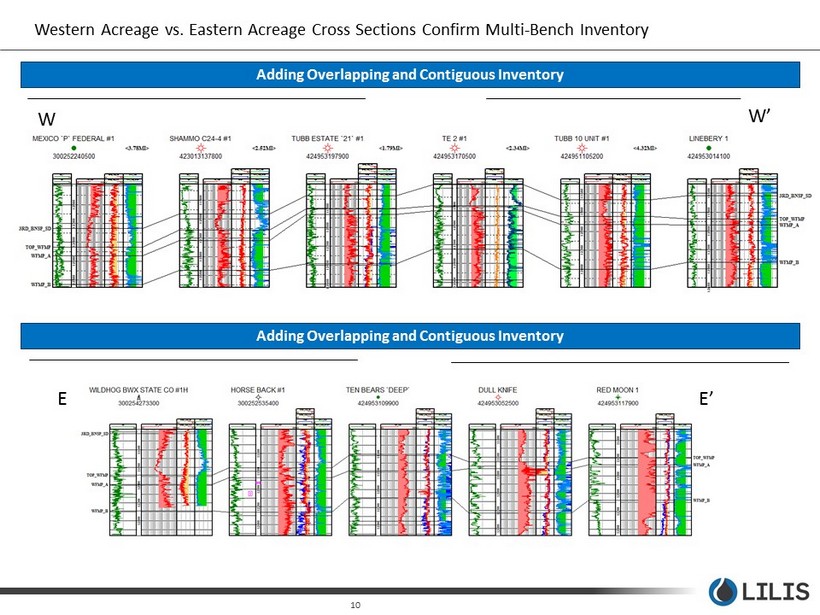

10 Western Acreage vs. Eastern Acreage Cross Sections Confirm Multi - Bench Inventory Adding Overlapping and Contiguous Inventory W’ W E E’ Adding Overlapping and Contiguous Inventory

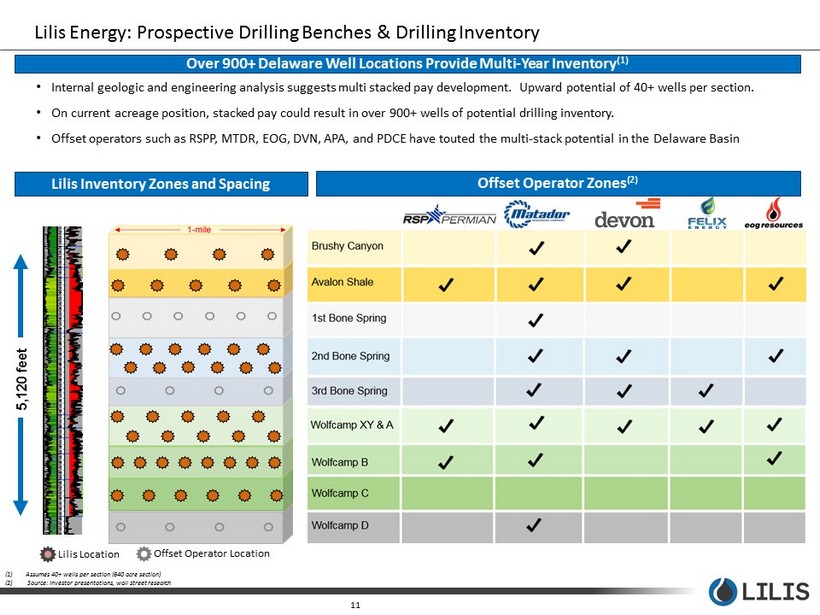

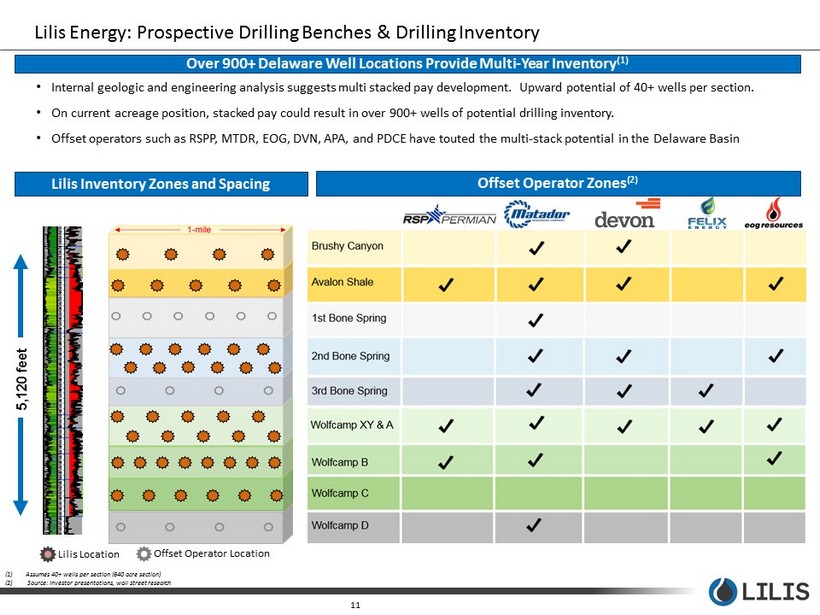

Lilis Energy: Prospective Drilling Benches & Drilling Inventory 11 Lilis Location Offset Operator Location Over 900+ Delaware Well Locations Provide Multi - Year Inventory (1) Offset Operator Zones (2) Lilis Inventory Zones and Spacing (1) Assumes 40+ wells per section (640 acre section) (2) Source: Investor presentations, wall street research • Internal geologic and engineering analysis suggests multi stacked pay development. Upward potential of 40+ wells per section . • On current acreage position, stacked pay could result in over 900+ wells of potential drilling inventory. • Offset operators such as RSPP, MTDR, EOG, DVN, APA, and PDCE have touted the multi - stack potential in the Delaware Basin 5,120 feet

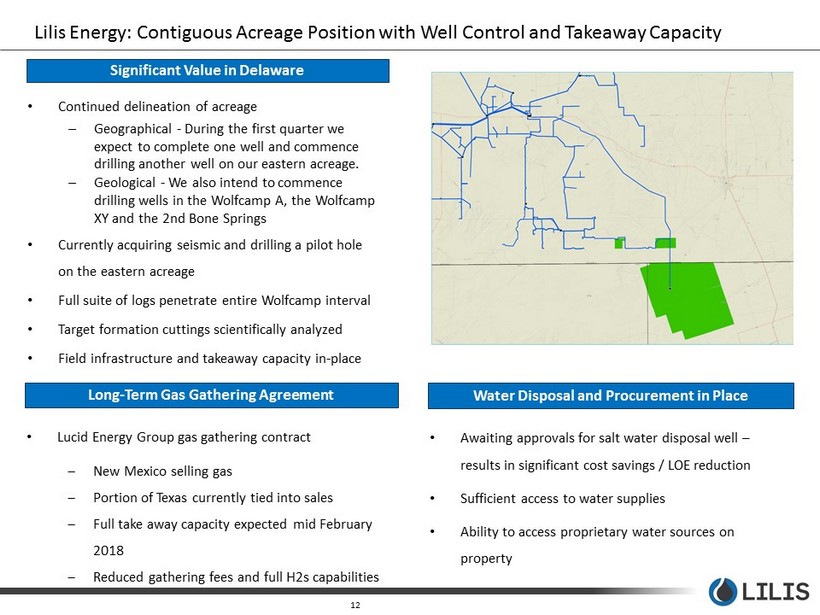

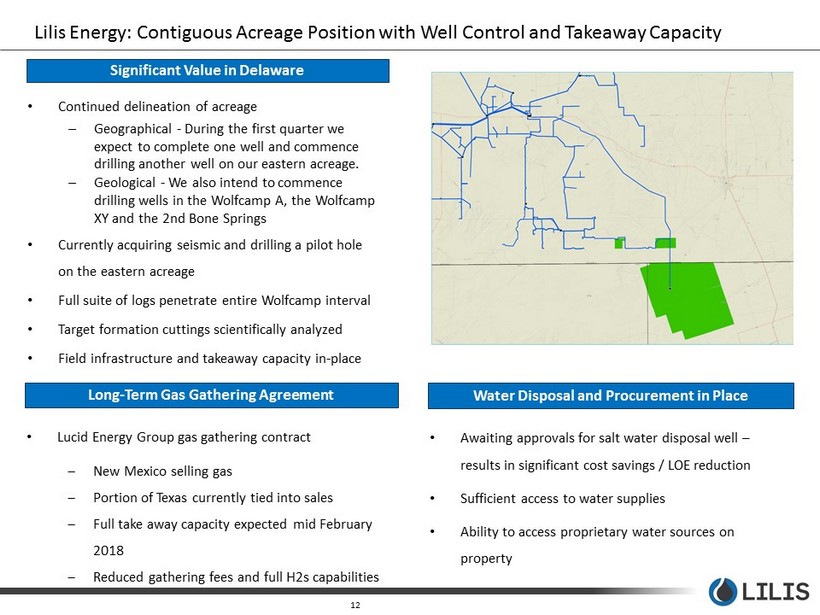

12 Lilis Energy: Contiguous Acreage Position with Well Control and Takeaway Capacity • Continued delineation of acreage – Geographical - During the first quarter we expect to complete one well and commence drilling another well on our eastern acreage. – Geological - We also intend to commence drilling wells in the Wolfcamp A, the Wolfcamp XY and the 2nd Bone Springs • Currently acquiring seismic and drilling a pilot hole on the eastern acreage • Full suite of logs penetrate entire Wolfcamp interval • Target formation cuttings scientifically analyzed • Field infrastructure and takeaway capacity in - place Significant Value in Delaware • Awaiting approvals for salt water disposal well – results in significant cost savings / LOE reduction • Sufficient access to water supplies • Ability to access proprietary water sources on property Water Disposal and Procurement in Place Long - Term Gas Gathering Agreement • Lucid Energy Group gas gathering contract New Mexico selling gas Portion of Texas currently tied into sales Full take away capacity expected mid February 2018 Reduced gathering fees and full H2s capabilities

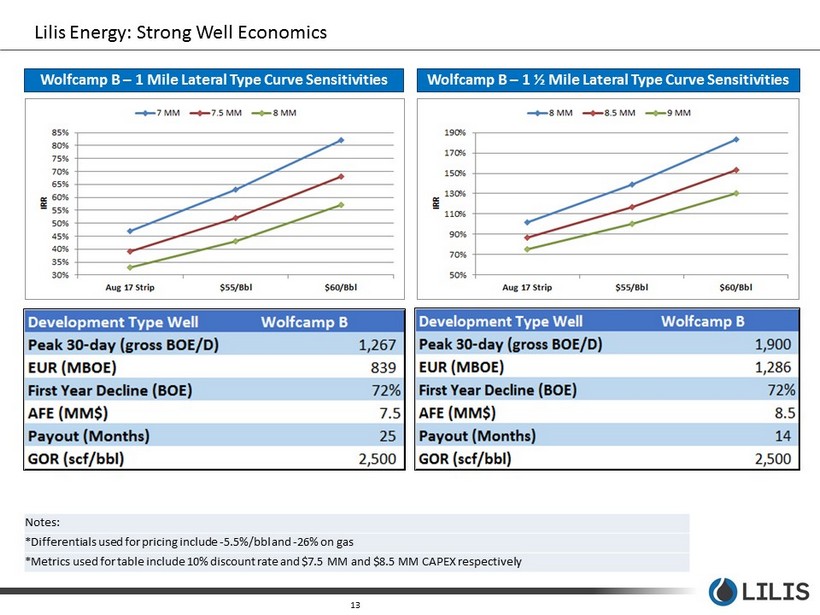

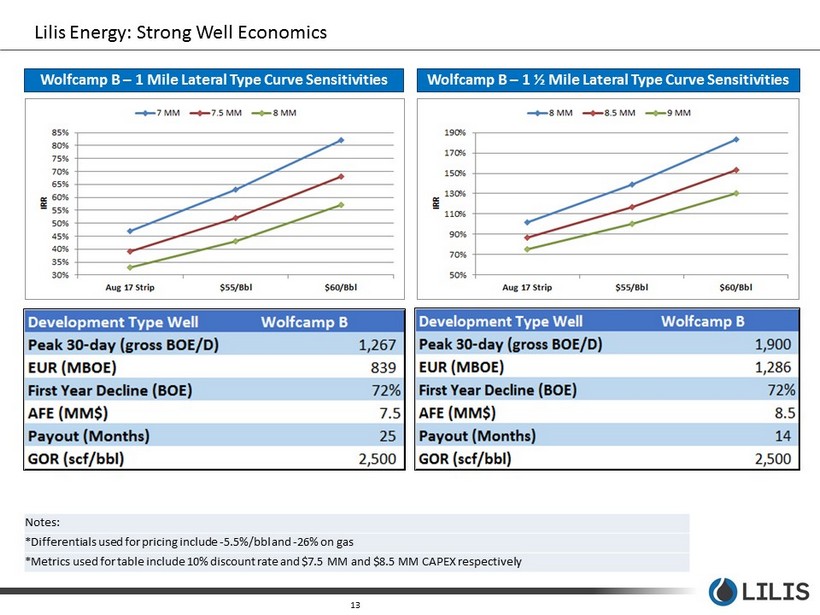

13 Lilis Energy: Strong Well Economics Wolfcamp B – 1 Mile Lateral Type Curve Sensitivities Wolfcamp B – 1 ½ Mile Lateral Type Curve Sensitivities Notes: *Differentials used for pricing include - 5.5%/ bbl and - 26% on gas *Metrics used for table include 10% discount rate and $7.5 MM and $8.5 MM CAPEX respectively

Appendix

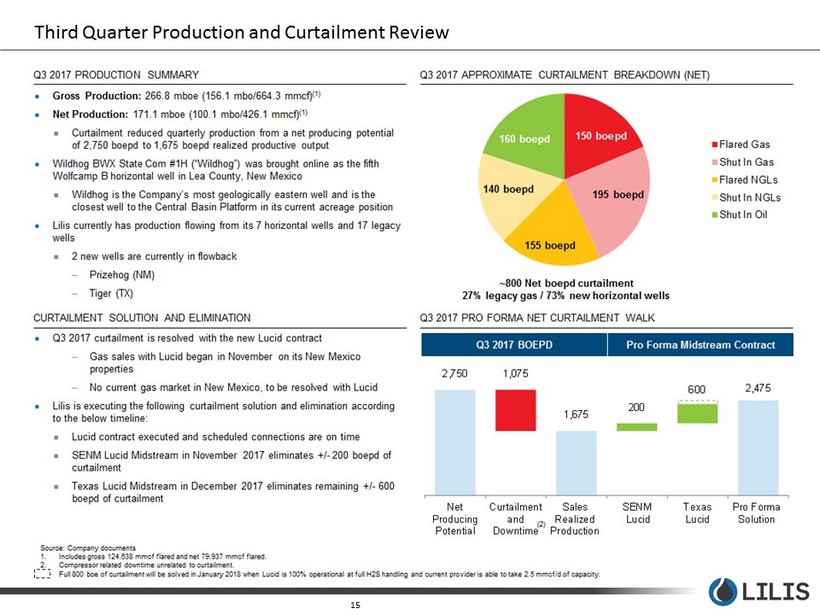

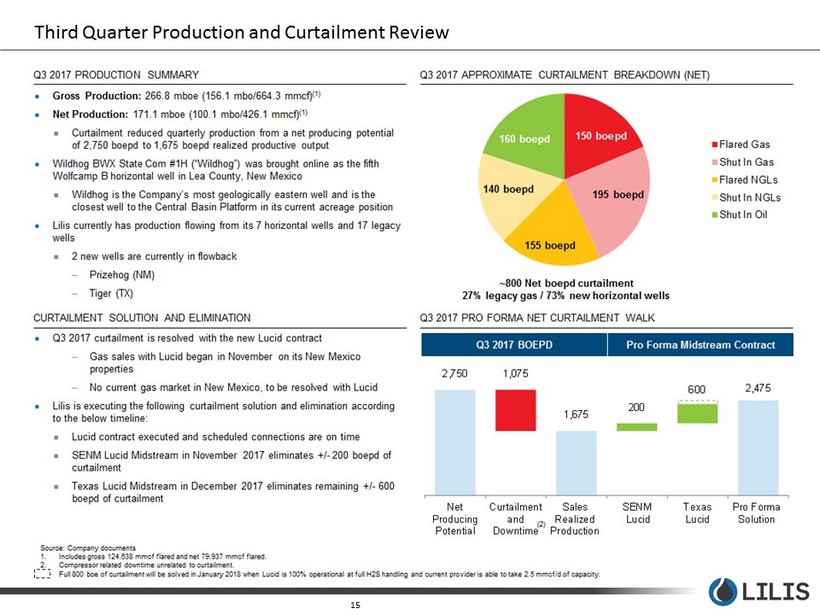

15 Third Quarter Production and Curtailment Review

16 Source: Company disclosure * Share price as of January 3, 2017, Acreage per recent press release, Production per curtailment slide ACREAGE MAP ACQUISITION OVERVIEW Acquired ~20,300 consolidated net acres in the core of the Delaware Basin oil window for $946 million Acreage in Loving, Ward, and Winkler counties Adds 507 net core drilling locations with material upside November 2017 production of ~3.5 mboe/d (~$170 million in PDP value at 30 - Nov - 17 strip pricing) Transaction Multiples Production: $270,286 / boepd Net acres: $46,601 / acre Net core locations: $1,865,878 / location Adjusted Transaction Multiples (assumes production valued at $35,000/boepd) Adj. net acre: $39,788 / acre Adj. net locations: $1,624,260 / location Oasis Delaware Basin Lilis Gross Acres (thousands) 40.5 34.0 Net Acres (thousands) 20.3 16.2* % Operated 90% 83% % Average Core Operated W.I. 76% 60% November 2017 Production (boe/d) ~3,500 ~2,750* November 2017 Production % Liquids 78% ~76% OAS / Forge Transaction Metrics Lilis Per Acre Value $39,788 $22,657 Per Flowing Barrel $35,000 $35,000 Enterprise Value $946 MM $463.3 MM Less Debt $182.9 MM Equity Value $280.4 MM Per Share* $5.25 LLEX IMPLIED VALUATION METRICS ACREAGE METRICS Lilis Acreage Oasis Acreage LOVING REEVES WINKLER WARD PECOS LEA LLEX Comparison - Oasis Delaware Basin Acquisition Overview

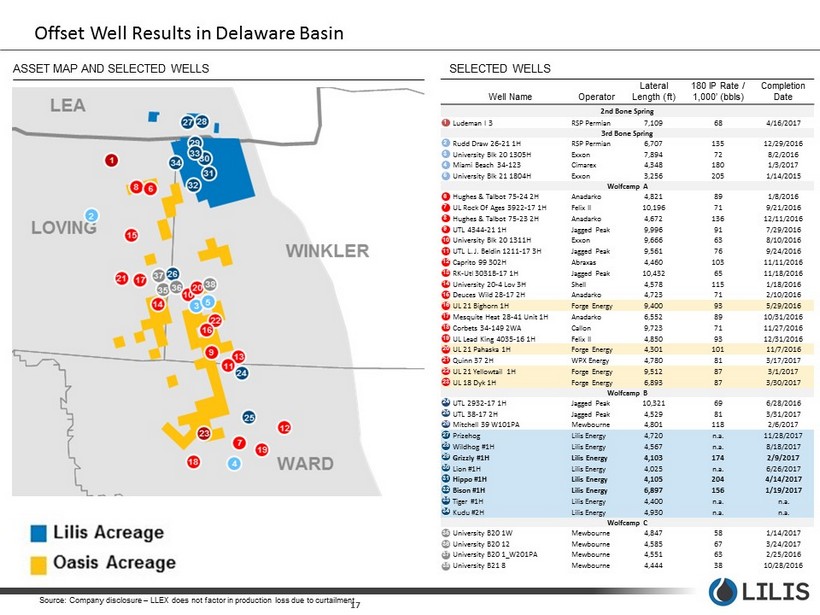

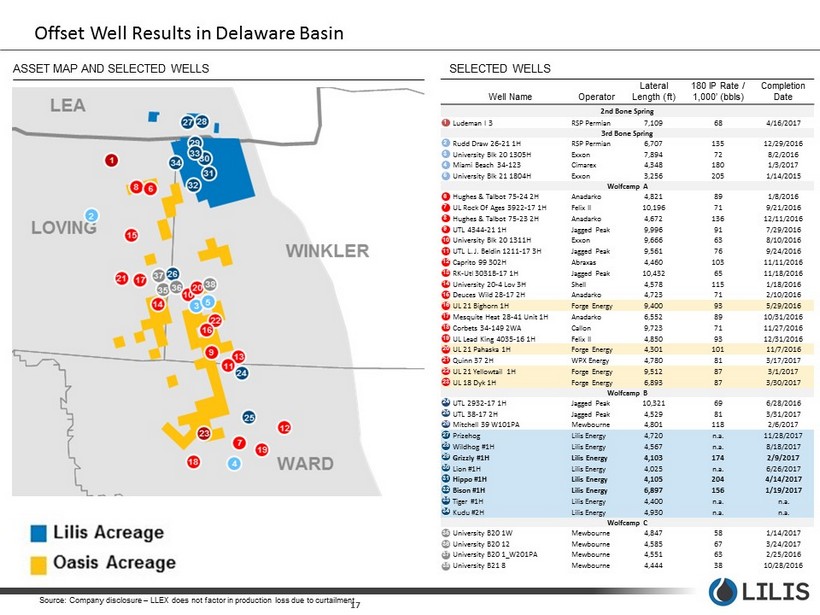

17 Source: Company disclosure – LLEX does not factor in production loss due to curtailment ASSET MAP AND SELECTED WELLS SELECTED WELLS Well Name Operator Lateral Length (ft) 180 IP Rate / 1,000’ (bbls) Completion Date 2nd Bone Spring Ludeman I 3 RSP Permian 7,109 68 4/16/2017 3rd Bone Spring Rudd Draw 26 - 21 1H RSP Permian 6,707 135 12/29/2016 University Blk 20 1305H Exxon 7,894 72 8/2/2016 Miami Beach 34 - 123 Cimarex 4,348 180 1/3/2017 University Blk 21 1804H Exxon 3,256 205 1/14/2015 Wolfcamp A Hughes & Talbot 75 - 24 2H Anadarko 4,821 89 1/8/2016 UL Rock Of Ages 3922 - 17 1H Felix II 10,196 71 9/21/2016 Hughes & Talbot 75 - 23 2H Anadarko 4,672 136 12/11/2016 UTL 4344 - 21 1H Jagged Peak 9,996 91 7/29/2016 University Blk 20 1311H Exxon 9,666 63 8/10/2016 UTL L. J. Beldin 1211 - 17 3H Jagged Peak 9,561 76 9/24/2016 Caprito 99 302H Abraxas 4,460 103 11/11/2016 RK - Utl 3031B - 17 1H Jagged Peak 10,432 65 11/18/2016 University 20 - 4 Lov 3H Shell 4,578 115 1/18/2016 Deuces Wild 28 - 17 2H Anadarko 4,723 71 2/10/2016 UL 21 Bighorn 1H Forge Energy 9,400 93 5/29/2016 Mesquite Heat 28 - 41 Unit 1H Anadarko 6,552 89 10/31/2016 Corbets 34 - 149 2WA Callon 9,723 71 11/27/2016 UL Lead King 4035 - 16 1H Felix II 4,850 93 12/31/2016 UL 21 Pahaska 1H Forge Energy 4,301 101 11/7/2016 Quinn 37 2H WPX Energy 4,780 81 3/17/2017 UL 21 Yellowtail 1H Forge Energy 9,512 87 3/1/2017 UL 18 Dyk 1H Forge Energy 6,893 87 3/30/2017 Wolfcamp B UTL 2932 - 17 1H Jagged Peak 10,321 69 6/28/2016 UTL 38 - 17 2H Jagged Peak 4,529 81 3/31/2017 Mitchell 39 W101PA Mewbourne 4,801 118 2/6/2017 Prizehog Lilis Energy 4,720 n.a. 11/28/2017 Wildhog #1H Lilis Energy 4,567 n.a. 8/18/2017 Grizzly #1H Lilis Energy 4,103 174 2/9/2017 Lion #1H Lilis Energy 4,025 n.a. 6/26/2017 Hippo #1H Lilis Energy 4,105 204 4/14/2017 Bison #1H Lilis Energy 6,897 156 1/19/2017 Tiger #1H Lilis Energy 4,400 n.a. n.a. Kudu #2H Lilis Energy 4,930 n.a. n.a. Wolfcamp C University B20 1W Mewbourne 4,847 58 1/14/2017 University B20 12 Mewbourne 4,585 67 3/24/2017 University B20 1_W201PA Mewbourne 4,551 63 2/25/2016 University B21 8 Mewbourne 4,444 38 10/28/2016 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 20 22 23 17 18 21 24 25 26 27 28 29 19 30 31 32 33 34 35 36 37 38 Offset Well Results in Delaware Basin

18 RSPP / Silver Hill Transaction: Analogous to LLEX Assets Wolfcamp Depth: Delaware Basin (1) 1. RSPP /Silver Hill investor presentation: publicly available Information 2. $/Acre information taken from publicly available information and includes certain transaction adjustments RSPP / Silver Hill Transaction Overview • October 2016 – RSP Permian (RSPP) and Silver Hill Energy Partners I and II (Silver Hill) announced purchase and sale agreements in which RSPP acquired 41,000 net acres in the Delaware Basin for total consideration of ~$2.40 Billion • ~80% operated and over 80% working interest in operated acreage; conducive to long lateral development • Current production of ~15,000 boe/d (69% oil; 86% liquids) • ~250,000 net effective horizontal acres including Wolfcamp B, Lower and Upper (XY) Wolfcamp A, 3 rd Bone Spring, 2 Bone Spring, Avalon and Brushy Canyon • ~3,200 gross / ~1,950 net drilling locations • Assets directly offset LLEX’s assets • As illustrated in the map to the right, LLEX’s Wolfcamp depth is analogous to the Silver Hill acreage acquired by RSP Permian RSPP / Silver Hill Acreage $47,561 / acre (2) LLEX Acreage

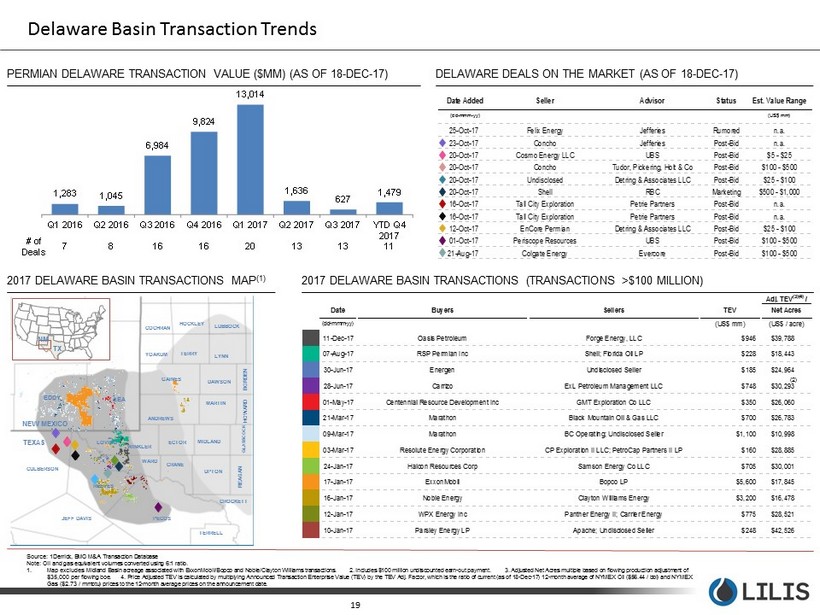

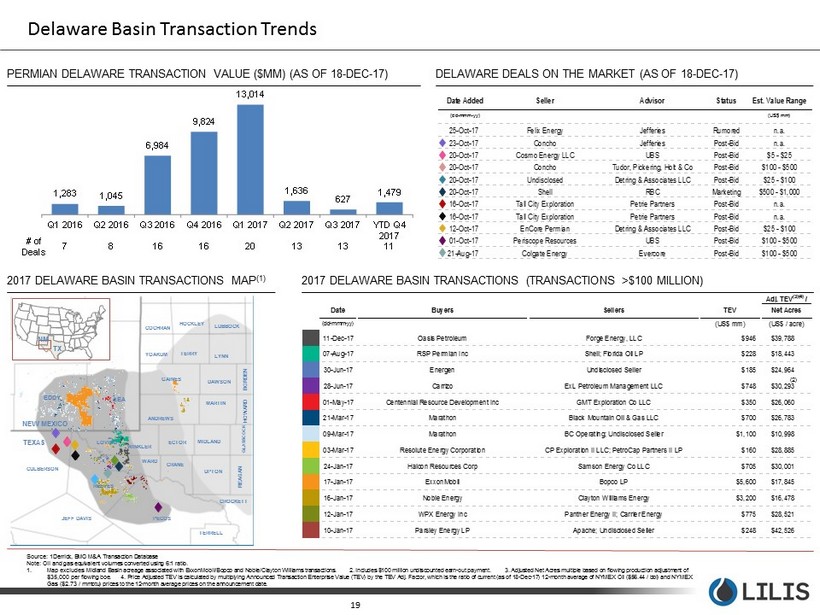

Delaware Basin Transaction Trends 19 Adj. TEV (3)(4) / Date Buyers Sellers TEV Net Acres (dd-mmm-yy) (US$ mm) (US$ / acre) 11-Dec-17 Oasis Petroleum Forge Energy, LLC $946 $39,788 07-Aug-17 RSP Permian Inc Shell; Florida Oil LP $228 $18,443 30-Jun-17 Energen Undisclosed Seller $185 $24,964 28-Jun-17 Carrizo ExL Petroleum Management LLC $748 $30,293 01-May-17 Centennial Resource Development Inc GMT Exploration Co LLC $350 $26,060 21-Mar-17 Marathon Black Mountain Oil & Gas LLC $700 $26,783 09-Mar-17 Marathon BC Operating; Undisclosed Seller $1,100 $10,998 03-Mar-17 Resolute Energy Corporation CP Exploration II LLC; PetroCap Partners II LP $160 $28,885 24-Jan-17 Halcon Resources Corp Samson Energy Co LLC $705 $30,001 17-Jan-17 ExxonMobil Bopco LP $5,600 $17,845 16-Jan-17 Noble Energy Clayton Williams Energy $3,200 $16,478 12-Jan-17 WPX Energy Inc Panther Energy II; Carrier Energy $775 $28,521 10-Jan-17 Parsley Energy LP Apache; Undisclosed Seller $248 $42,526 1,283 1,045 6,984 9,824 13,014 1,636 627 1,479 Q1 2016 7 Q2 2016 8 Q3 2016 16 Q4 2016 16 Q1 2017 20 Q2 2017 13 Q3 2017 13 YTD Q4 2017 11 # of Deals Date Added Seller Advisor Status Est. Value Range (dd-mmm-yy) (US$ mm) 25-Oct-17 Felix Energy Jefferies Rumored n.a. 23-Oct-17 Concho Jefferies Post-Bid n.a. 20-Oct-17 Cosmo Energy LLC UBS Post-Bid $5 - $25 20-Oct-17 Concho Tudor, Pickering, Holt & Co Post-Bid $100 - $500 20-Oct-17 Undisclosed Detring & Associates LLC Post-Bid $25 - $100 20-Oct-17 Shell RBC Marketing $500 - $1,000 16-Oct-17 Tall City Exploration Petrie Partners Post-Bid n.a. 16-Oct-17 Tall City Exploration Petrie Partners Post-Bid n.a. 12-Oct-17 EnCore Permian Detring & Associates LLC Post-Bid $25 - $100 01-Oct-17 Periscope Resources UBS Post-Bid $100 - $500 21-Aug-17 Colgate Energy Evercore Post-Bid $100 - $500 2017 DELAWARE BASIN TRANSACTIONS MAP (1) 2017 DELAWARE BASIN TRANSACTIONS (TRANSACTIONS >$100 MILLION) PERMIAN DELAWARE TRANSACTION VALUE ($MM) (AS OF 18 - DEC - 17) DELAWARE DEALS ON THE MARKET (AS OF 18 - DEC - 17) Source: 1Derrick, BMO M&A Transaction Database Note: Oil and gas equivalent volumes converted using 6:1 ratio. 1. Map excludes Midland Basin acreage associated with ExxonMobil/Bopco and Noble/Clayton Williams transactions. 2. Includ es $100 million undiscounted earn - out payment. 3. Adjusted Net Acres multiple based on flowing production adjustment of $35,000 per flowing boe. 4. Price Adjusted TEV is calculated by multiplying Announced Transaction Enterprise Value (TEV) by the TEV Adj. Factor, which is the ratio of current (as of 18 - Dec - 17) 12 - month average of NYMEX Oil ($56.44 / bbl) and NYMEX Gas ($2.73 / mmbtu) prices to the 12 - month average prices on the announcement date. NM TX ANDREWS CRANE UPTON TERRELL PECOS CROCKETT REAGAN MIDLAND ECTOR MARTIN DAWSON GAINES WINKLER JEFF DAVIS CULBERSON REEVES WARD TERRY YOAKUM COCHRAN HOCKLEY LUBBOCK LYNN LEA EDDY TEXAS NEW MEXICO LOVING GLASSCOCK HOWARD BORDEN (2)

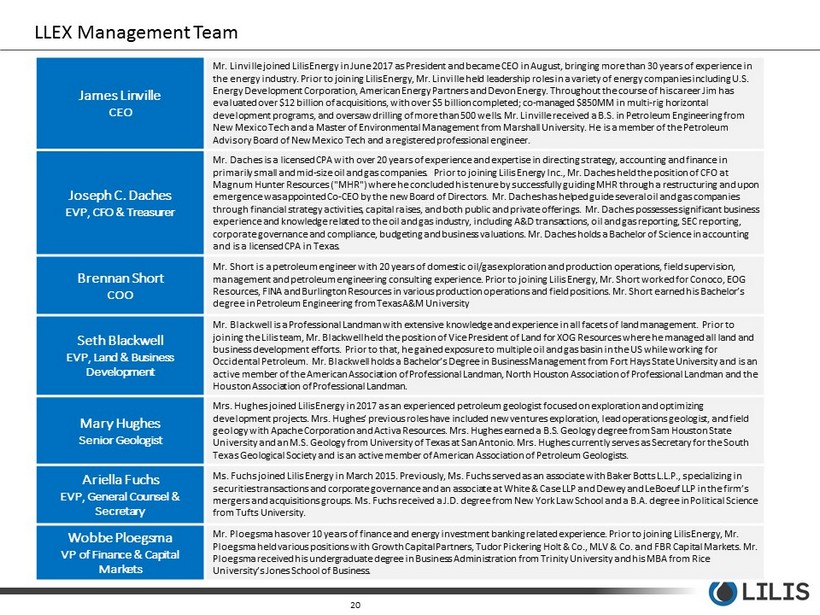

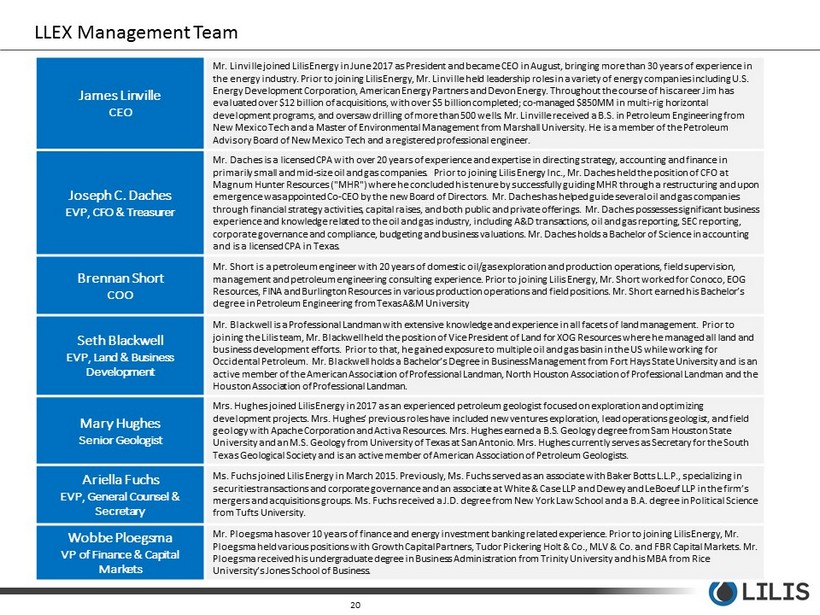

LLEX Management Team James Linville CEO Mr. Linville joined Lilis Energy in June 2017 as President and became CEO in August, bringing more than 30 years of experience in the energy industry. Prior to joining Lilis Energy, Mr. Linville held leadership roles in a variety of energy companies including U.S. Energy Development Corporation, American Energy Partners and Devon Energy. Throughout the course of his career Jim has evaluated over $12 billion of acquisitions, with over $5 billion completed; co - managed $850MM in multi - rig horizontal development programs, and oversaw drilling of more than 500 wells. Mr. Linville received a B.S. in Petroleum Engineering from New Mexico Tech and a Master of Environmental Management from Marshall University. He is a member of the Petroleum Advisory Board of New Mexico Tech and a registered professional engineer. Joseph C. Daches EVP, CFO & Treasurer Mr. Daches is a licensed CPA with over 20 years of experience and expertise in directing strategy, accounting and finance in primarily small and mid - size oil and gas companies. Prior to joining Lilis Energy Inc., Mr. Daches held the position of CFO at Magnum Hunter Resources ("MHR") where he concluded his tenure by successfully guiding MHR through a restructuring and upon emergence was appointed Co - CEO by the new Board of Directors. Mr. Daches has helped guide several oil and gas companies through financial strategy activities, capital raises, and both public and private offerings. Mr. Daches possesses significant business experience and knowledge related to the oil and gas industry, including A&D transactions, oil and gas reporting, SEC reportin g, corporate governance and compliance, budgeting and business valuations. Mr. Daches holds a Bachelor of Science in accounting and is a licensed CPA in Texas. Brennan Short COO Mr. Short is a petroleum engineer with 20 years of domestic oil/gas exploration and production operations, field supervision, management and petroleum engineering consulting experience. Prior to joining Lilis Energy, Mr. Short worked for Conoco, EOG Resources, FINA and Burlington Resources in various production operations and field positions. Mr. Short earned his Bachelor’ s degree in Petroleum Engineering from Texas A&M University Seth Blackwell EVP, Land & Business Development Mr. Blackwell is a Professional Landman with extensive knowledge and experience in all facets of land management. Prior to joining the Lilis team, Mr. Blackwell held the position of Vice President of Land for XOG Resources where he managed all land and business development efforts. Prior to that, he gained exposure to multiple oil and gas basin in the US while working for Occidental Petroleum. Mr. Blackwell holds a Bachelor’s Degree in Business Management from Fort Hays State University and is an active member of the American Association of Professional Landman, North Houston Association of Professional Landman and the Houston Association of Professional Landman. Mary Hughes Senior Geologist Mrs. Hughes joined Lilis Energy in 2017 as an experienced petroleum geologist focused on exploration and optimizing development projects. Mrs. Hughes’ previous roles have included new ventures exploration, lead operations geologist, and field geology with Apache Corporation and Activa Resources. Mrs. Hughes earned a B.S. Geology degree from Sam Houston State University and an M.S. Geology from University of Texas at San Antonio. Mrs. Hughes currently serves as Secretary for the Sou th Texas Geological Society and is an active member of American Association of Petroleum Geologists. Ariella Fuchs EVP, General Counsel & Secretary Ms. Fuchs joined Lilis Energy in March 2015. Previously, Ms. Fuchs served as an associate with Baker Botts L.L.P., specializing in securities transactions and corporate governance and an associate at White & Case LLP and Dewey and LeBoeuf LLP in the firm’s mergers and acquisitions groups. Ms. Fuchs received a J.D. degree from New York Law School and a B.A. degree in Political Sci enc e from Tufts University. Wobbe Ploegsma VP of Finance & Capital Markets Mr. Ploegsma has over 10 years of finance and energy investment banking related experience. Prior to joining Lilis Energy, Mr. Ploegsma held various positions with Growth Capital Partners, Tudor Pickering Holt & Co., MLV & Co. and FBR Capital Markets. Mr. Ploegsma received his undergraduate degree in Business Administration from Trinity University and his MBA from Rice University’s Jones School of Business. 20

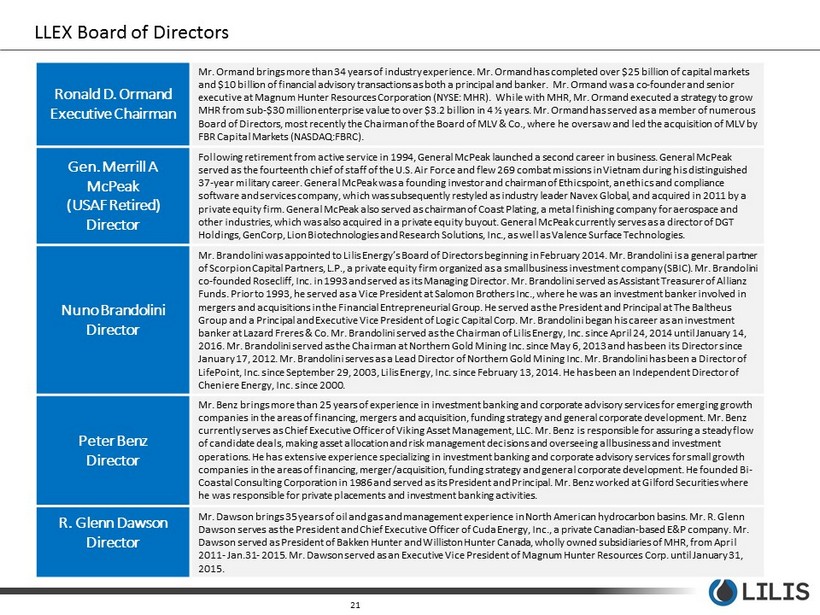

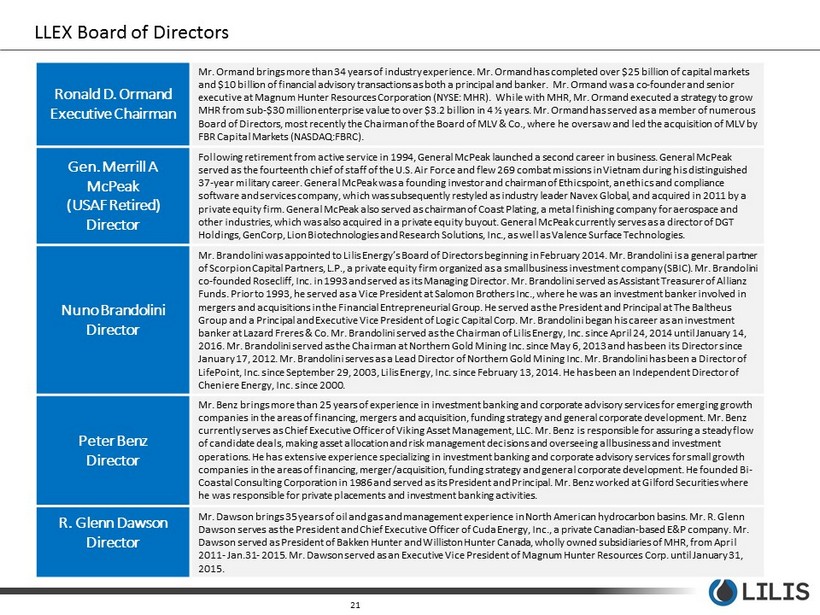

LLEX Board of Directors Ronald D. Ormand Executive Chairman Mr. Ormand b rings more than 34 years of industry experience. Mr. Ormand has completed over $25 billion of capital markets and $10 billion of financial advisory transactions as both a principal and banker. Mr. Ormand was a co - founder and senior executive at Magnum Hunter Resources Corporation (NYSE: MHR). While with MHR, Mr. Ormand executed a strategy to grow MHR from sub - $30 million enterprise value to over $3.2 billion in 4 ½ years. Mr. Ormand has served as a member of numerous Board of Directors, most recently the Chairman of the Board of MLV & Co., where he oversaw and led the acquisition of MLV by FBR Capital Markets (NASDAQ:FBRC). Gen. Merrill A McPeak (USAF Retired) Director Following retirement from active service in 1994, General McPeak launched a second career in business. General McPeak served as the fourteenth chief of staff of the U.S. Air Force and flew 269 combat missions in Vietnam during his distinguishe d 37 - year military career. General McPeak was a founding investor and chairman of Ethicspoint , an ethics and compliance software and services company, which was subsequently restyled as industry leader Navex Global, and acquired in 2011 by a private equity firm. General McPeak also served as chairman of Coast Plating, a metal finishing company for aerospace and other industries, which was also acquired in a private equity buyout. General McPeak currently serves as a director of DGT Holdings, GenCorp, Lion Biotechnologies and Research Solutions, Inc., as well as Valence Surface Technologies. Nuno Brandolini Director Mr. Brandolini was appointed to Lilis Energy’s Board of Directors beginning in February 2014. Mr. Brandolini is a general partner of Scorpion Capital Partners, L.P., a private equity firm organized as a small business investment company (SBIC). Mr. Brandolini co - founded Rosecliff , Inc. in 1993 and served as its Managing Director. Mr. Brandolini served as Assistant Treasurer of Allianz Funds. Prior to 1993, he served as a Vice President at Salomon Brothers Inc., where he was an investment banker involved in mergers and acquisitions in the Financial Entrepreneurial Group. He served as the President and Principal at The Baltheus Group and a Principal and Executive Vice President of Logic Capital Corp. Mr. Brandolini began his career as an investment banker at Lazard Freres & Co. Mr. Brandolini served as the Chairman of Lilis Energy, Inc. since April 24, 2014 until January 14, 2016. Mr. Brandolini served as the Chairman at Northern Gold Mining Inc. since May 6, 2013 and has been its Director since January 17, 2012. Mr. Brandolini serves as a Lead Director of Northern Gold Mining Inc. Mr. Brandolini has been a Director of LifePoint , Inc. since September 29, 2003, Lilis Energy, Inc. since February 13, 2014. He has been an Independent Director of Cheniere Energy, Inc. since 2000. Peter Benz Director Mr. Benz brings more than 25 years of experience in investment banking and corporate advisory services for emerging growth companies in the areas of financing, mergers and acquisition, funding strategy and general corporate development. Mr. Benz currently serves as Chief Executive Officer of Viking Asset Management, LLC. Mr. Benz is responsible for assuring a steady fl ow of candidate deals, making asset allocation and risk management decisions and overseeing all business and investment operations. He has extensive experience specializing in investment banking and corporate advisory services for small growth companies in the areas of financing, merger/acquisition, funding strategy and general corporate development. He founded Bi - Coastal Consulting Corporation in 1986 and served as its President and Principal. Mr. Benz worked at Gilford Securities where he was responsible for private placements and investment banking activities. R. Glenn Dawson Director Mr. Dawson brings 35 years of oil and gas and management experience in North American hydrocarbon basins. Mr. R. Glenn Dawson serves as the President and Chief Executive Officer of Cuda Energy, Inc., a private Canadian - based E&P company. Mr. Dawson served as President of Bakken Hunter and Williston Hunter Canada, wholly owned subsidiaries of MHR, from April 2011 - Jan.31 - 2015. Mr. Dawson served as an Executive Vice President of Magnum Hunter Resources Corp. until January 31, 2015. 21

LLEX Board of Directors Tyler Runnels Director Mr. Runnels was appointed to the Board of Directors in September 2017. He is the Chairman and Chief Executive Officer of T.R. Winston & Company (“TRW”). Mr. Runnels has been with TRW since 1990 and became its Chairman and Chief Executive Officer in 2003 when he acquired control of the firm. He has over 30 years of investment banking experience and has led over $2 billion of debt and equity financings, mergers and acquisitions, initial public offerings, bridge financings, and financial restructurings across a variety of industries, including healthcare, oil and gas, business services, manufacturing, and techn olo gy. Mr. Runnels serves on the Pepperdine University President’s Campaign Cabinet. Mr. Runnels received a B.S. and MBA from Pepperdine University and he holds FINRA Series 7, 24, 55, 63 and 79 licenses. Mark Christensen Director Mr. Christensen is the Founder, President and CEO of KES 7 Capital Inc. in Toronto, Canada and a registrant of the Ontario Securities Commission (OSC). KES 7 is a merchant bank that targets bespoke investments, both public and private, in the energy, healthcare and technology sectors. The company is also one of the largest "grey market" trading houses in the country . Prior to founding KES 7, Mr. Christensen was Vice Chairman, Head of Global Sales and Trading at GMP Securities, one of Canada's largest independent investment banks, where he served as a member of the Executive Committee, Compensation Committee and New Names Committee. Mr. Christensen has experience in a broad range of corporate and capital market transactions, from mergers and acquisitions to public and private financings that total in the tens of billions of dollars. H is background in geology and geophysics has provided him with valuable insight into the energy industry, enabling him to advise both institutional investors and energy companies from around the globe. Mr. Christensen holds a Master of Science degree from the University of Windsor, Canada and a Bachelor of Science degree from the University of Hull, United Kingdom. 22

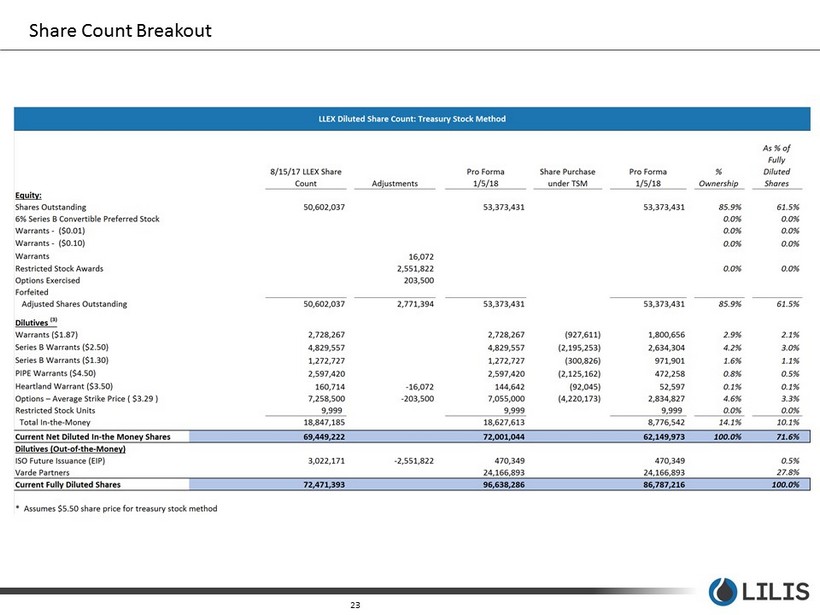

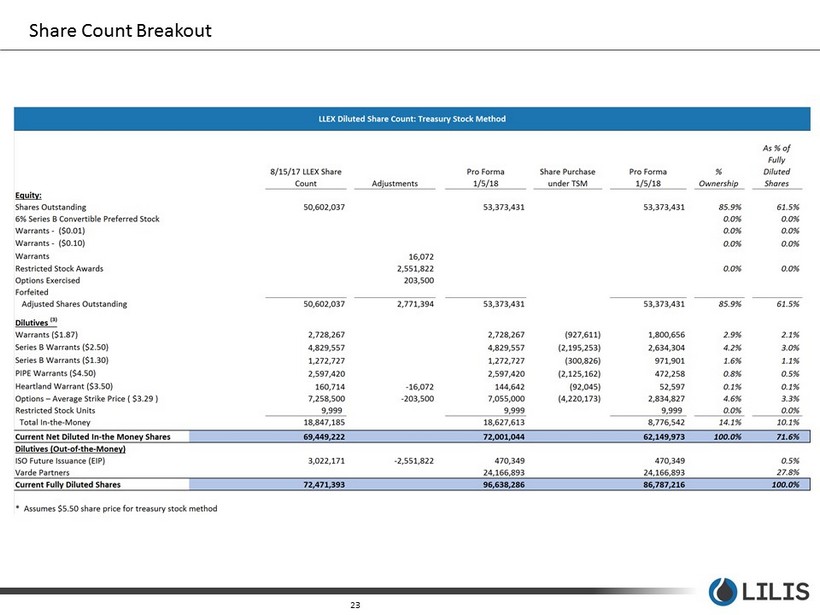

Share Count Breakout 23

NYSE American | LLEX Wobbe Ploegsma VP of Finance & Capital Markets ir@lilisenergy.com 210.999.5400