Recapitalization Summary March 5, 2019 NYSE American | LLEX

Disclaimer This presentation contains forward-looking statements. The use of words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “should”, “likely” or similar expressions, indicates a forward-looking statement. These statements and all the projections in this presentation are subject to risks and uncertainties and are based on the beliefs and assumptions of management, and information currently available to management. The actual results could differ materially from a conclusion, forecast or projection in the forward-looking information. The identification in this presentation of factors that may affect Lilis’ future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive. These forward-looking statements are given only as of the date of this presentation. Except as required by law, we do not intend to, and undertake no obligation to, update any forward-looking statements. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. These forward-looking statements include, among other things, statements about Lilis’ expectations, beliefs, intentions or business strategies for the future, statements concerning Lilis’ outlook with regard to the timing and amount of future production of oil, natural gas liquids and natural gas, price realizations, the nature and timing of capital expenditures for exploration and development, plans for funding operations and drilling program capital expenditures, the timing and success of specific projects, operating costs and other expenses, proved oil and natural gas reserves, Lilis’ future results of operations, financial position, liquidity and capital resources, outcomes and effects of litigation, claims and disputes and derivative activities. Factors that could cause Lilis’ actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to: the success of Lilis’ exploration and development efforts; the price of oil, gas and other produced gases and liquids; the worldwide economic situation; changes in interest rates or inflation; the ability of Lilis to transport gas, oil and other products; the ability of Lilis to raise additional capital, as it may be affected by current conditions in the stock market and competition in the oil and gas industry for risk capital; Lilis’ capital costs, which may be affected by delays or cost overruns; cost of production; environmental and other laws and regulations, as the same presently exist or may later be enacted, adopted or changed; Lilis’ ability to identify, finance and integrate any future acquisitions; and the volatility of Lilis’ stock price. See the risks discussed in Lilis’ Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. RESERVE/RESOURCE DISCLOSURE The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions of such terms. Reserve estimates that are intended to meet SEC guidelines are included in our periodic reports filed with the SEC. In this presentation, Lilis sometimes refers to broader, less precise terms when characterizing reserve estimates, such as “resource potential” and “estimated ultimate recovery”, or “EUR”, which the SEC does not permit to be disclosed in SEC filings and are not intended to conform to SEC filing requirements. These estimates are by their nature more speculative than those disclosed in Lilis’ SEC filings and thus are subject to substantially greater uncertainty of being realized. They are based on internal estimates, are not reviewed or reported upon by any independent third party and are subject to ongoing review. Actual quantities recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery of reserves include the scope of Lilis’ actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices (including prevailing oil and gas prices), availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual recoveries of oil and natural gas in place, length of horizontal laterals, actual drilling results, including geological and mechanical factors affecting recovery rates, and other factors. These estimates may change significantly as the development of properties provides additional data. Investors are urged to consider closely the oil and gas disclosures in Lilis’ most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other public filings. No Liability. Recipients are urged to consult with their own independent legal and financial advisors with respect to any investment. This presentation should be independently verified. Neither Lilis nor any of its officers, directors, members, employees or consultants, accept any liability whatsoever for any direct or consequential loss arising from any use of information contain in this presentation. Investing in securities can be speculative and can carry a high degree of risk. 2

Transformative Recapitalization / RBL Increase – Transaction Highlights • Transformative recapitalization transaction that results in a simplified, RBL-only Reduced debt structure Leverage • Projected leverage of approximately 2.0x by year-end 2019 Increased • Increased First Lien RBL Borrowing Base to $125MM (~16% increase) Liquidity • Additional liquidity of $17MM Decreased • Pro forma capital structure features a ~12MM share net reduction in the Common Equity Company’s fully diluted share count Dilution • Creates ~5-year runway free and clear of near-term debt maturities with the RBL Improved Debt maturity date of October 2023 Maturity Profile • Enhances our ability to appropriately manage asset development • Cash flow neutrality remains a strategic objective in 2019 Neutral Impact to Cash Flow • Dividends on new series of preferred equity may be paid-in-kind (PIK) at the option of the Company 3

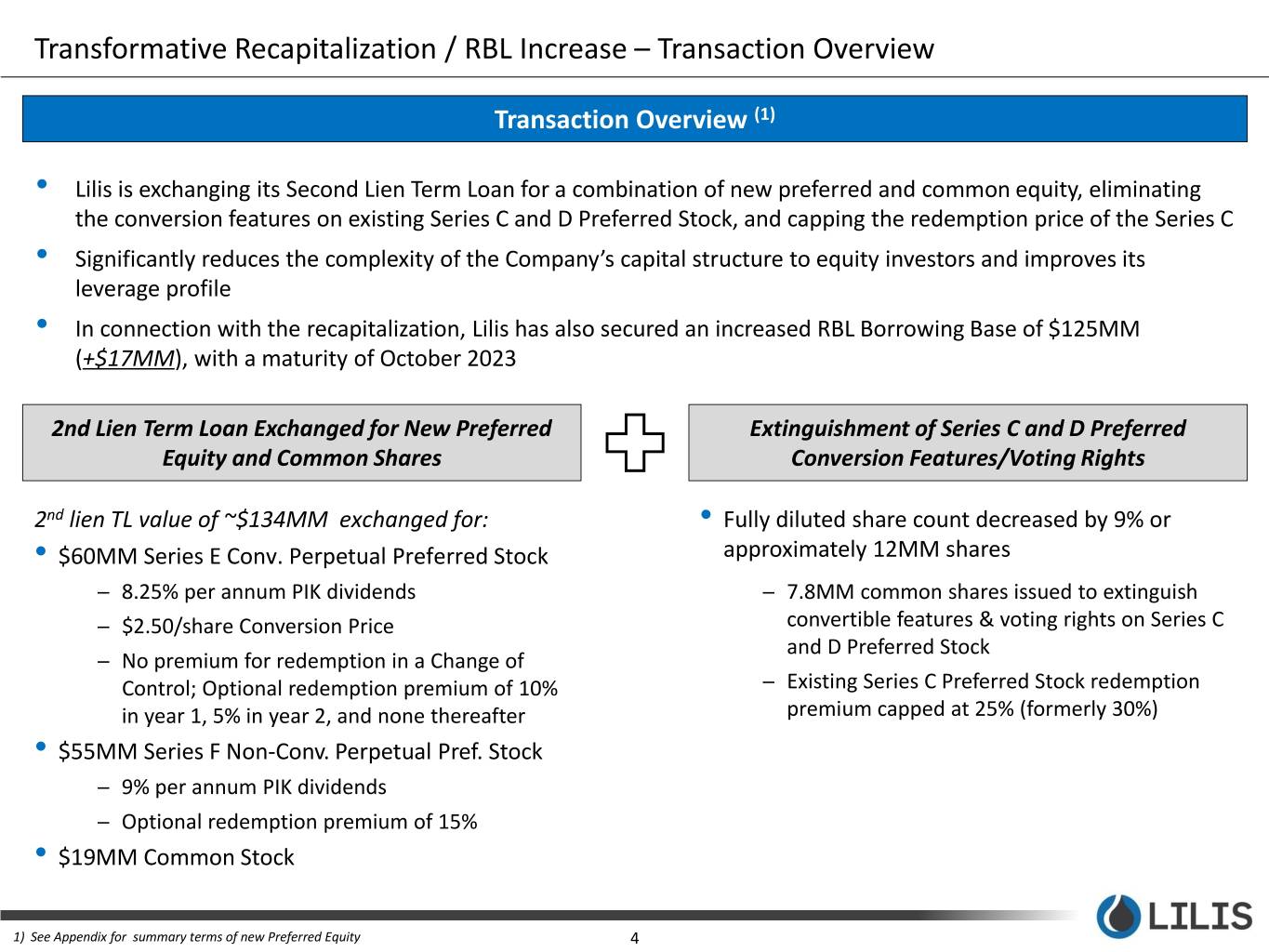

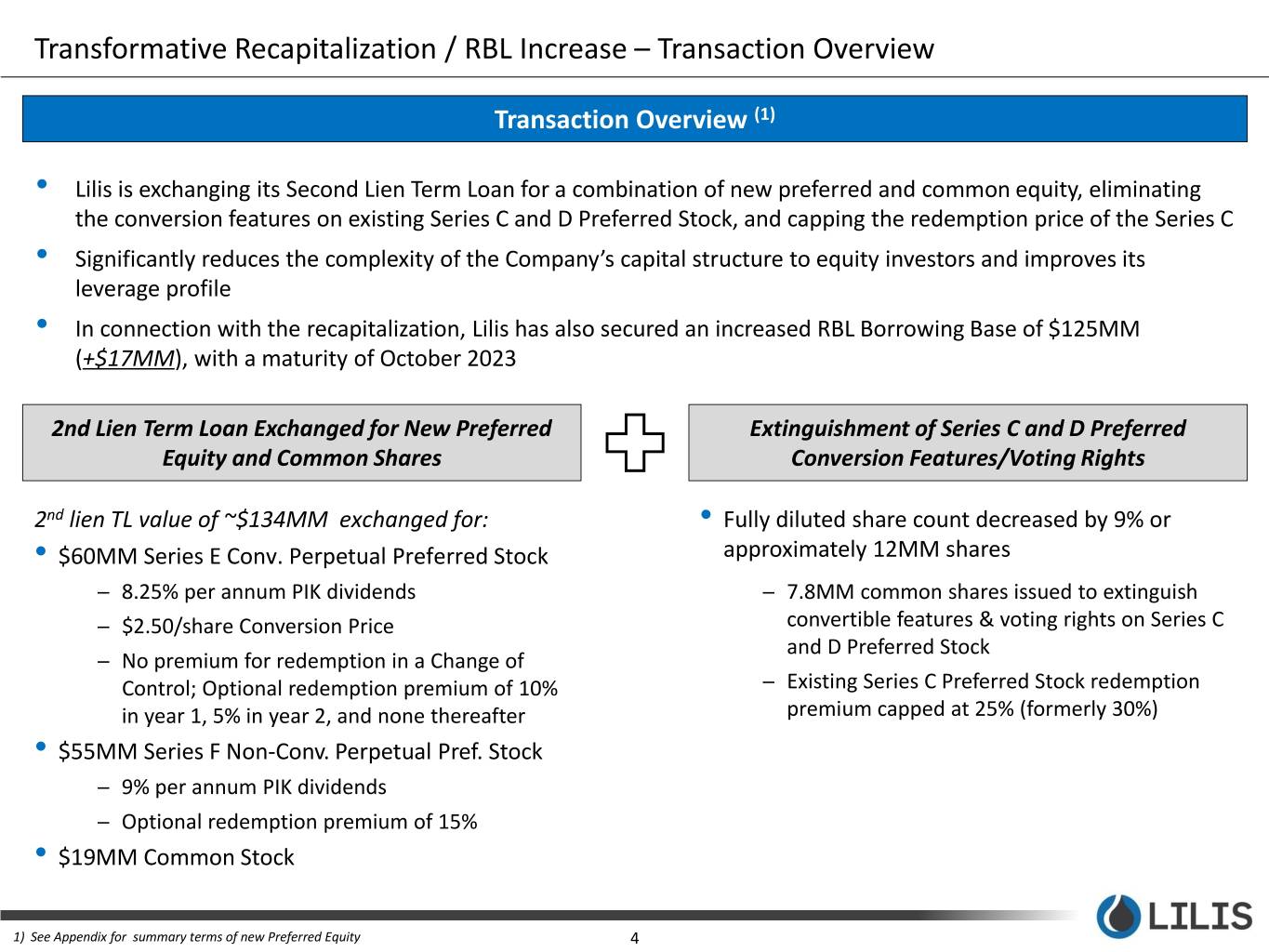

Transformative Recapitalization / RBL Increase – Transaction Overview Transaction Overview (1) • Lilis is exchanging its Second Lien Term Loan for a combination of new preferred and common equity, eliminating the conversion features on existing Series C and D Preferred Stock, and capping the redemption price of the Series C • Significantly reduces the complexity of the Company’s capital structure to equity investors and improves its leverage profile • In connection with the recapitalization, Lilis has also secured an increased RBL Borrowing Base of $125MM (+$17MM), with a maturity of October 2023 2nd Lien Term Loan Exchanged for New Preferred Extinguishment of Series C and D Preferred Equity and Common Shares Conversion Features/Voting Rights 2nd lien TL value of ~$134MM exchanged for: • Fully diluted share count decreased by 9% or • $60MM Series E Conv. Perpetual Preferred Stock approximately 12MM shares ─ 8.25% per annum PIK dividends ─ 7.8MM common shares issued to extinguish ─ $2.50/share Conversion Price convertible features & voting rights on Series C and D Preferred Stock ─ No premium for redemption in a Change of Control; Optional redemption premium of 10% ─ Existing Series C Preferred Stock redemption in year 1, 5% in year 2, and none thereafter premium capped at 25% (formerly 30%) • $55MM Series F Non-Conv. Perpetual Pref. Stock ─ 9% per annum PIK dividends ─ Optional redemption premium of 15% • $19MM Common Stock 1) See Appendix for summary terms of new Preferred Equity 4

Transformative Recapitalization / RBL Increase – Pro Forma Capital Structure (Unaudited) ($MM) 12/31/18 PF Adj. PF 12/31/18 1 Series E Convertible Preferred Stock Cash & Cash Equivalents $ 21.1 $ - $ 21.1 • $60MM Face Value • 8.25% annual PIK dividends Debt $2.50/share Conversion Price Revolving Credit Facility $ 75.0 $ - $ 75.0 • Second Lien Term Loan (Principal + PIK) 111.6 (111.6) - • Optional redemption premium of 10% in year 1, 5% in year 2, and zero Total Debt $ 186.6 $ (111.6) $ 75.0 thereafter (+) Second Lien MW Premium 1 22.0 (22.0) - Total Debt (incl. 2L MW) $ 208.6 $ (133.6) $ 75.0 Equity 2 Series F Non-Conv. Preferred Stock Series C Preferred Stock $ 134.8 $ - $ 134.8 • $55MM Face Value Series D Preferred Stock 40.0 - 40.0 • 9.0% annual PIK dividends Series E Preferred Stock - 1 60.0 60.0 • Optional redemption premium of Series F Preferred Stock - 2 55.0 55.0 15% Common Stock 321.8 3 18.6 340.3 Other Stockholders' Equity (Deficit) (307.7) - (307.7) New Common Equity Total Equity $ 188.8 $ 133.6 $ 322.4 3 • Shares issued upon transaction Total Capitalization $ 375.5 $ 21.9 $ 397.4 closing at market price • 3/4/2019 price of $1.88 per share Liquidity results in issuance of 9.9 million nd Cash & Cash Equivalents $ 21.1 $ - $ 21.1 shares to cover balance of 2 Lien facility (+) RBL Facility Capacity 108.0 4 17.0 125.0 (-) RBL Facility Borrowings (75.0) - (75.0) 4 RBL Facility Increase Total Liquidity $ 54.1 $ 17.0 $ 71.1 • 2nd Lien paydown frees up $17MM in BB capacity 1) 2nd Lien make whole includes accrued interest through 3/4/19 5

Transformative Recapitalization / RBL Increase – Pro Forma Fully Diluted Share Count (1) Common Stock Issuance LLEX Diluted Share Count 1 • 7.8MM shares eliminate Series C&D conversion and voting rights Pro Forma 2L Conversion and 9.9MM shares for 2L claim value Extinguishment of Series C&D • Conversion Features • Represents 24% common dilution Outstanding 2L Conversion Pro Forma • Värde PF common ownership increases from 8.1% to 25.8%, 3/4/19 3/4/19 3/4/19 (2) improving economic alignment Total Common Shares Outstanding 73,682,816 1 17,641,638 91,324,454 between Värde and other shareholders Dilutive Equity (incl. PIK & MW) 2nd Lien Note 17,003,163 2 (17,003,163) - 2 2L, Series C&D Dilutive Elimination Series C Preferred Equity 27,858,631 (27,858,631) - • Elimination of 2L and Series C&D Series D Preferred Equity 8,667,020 (8,667,020) - conversion features removes Series E Preferred Equity - 3 24,000,000 24,000,000 53.5MM dilutive shares Total Dilutives 53,528,814 (29,528,814) 24,000,000 • Total dilutives decrease by 29.5MM net shares or 55% Current Fully Diluted Shares 127,211,630 4 (11,887,176) 115,324,454 3 Series E Preferred Stock Issuance (1) Note: Based on 3/4/19 closing price of $1.88 per share for the issue price of new common stock • $60MM Series E Stated Value / $2.50 per share conversion price • Simplifies dilutive impact to one class of preferred shares 4 Net Change in Fully Diluted Shares • Fully diluted share count decreases 9.3% or 11.9MM shares 6

Appendix: Preferred Stock and RBL Summary Terms 7

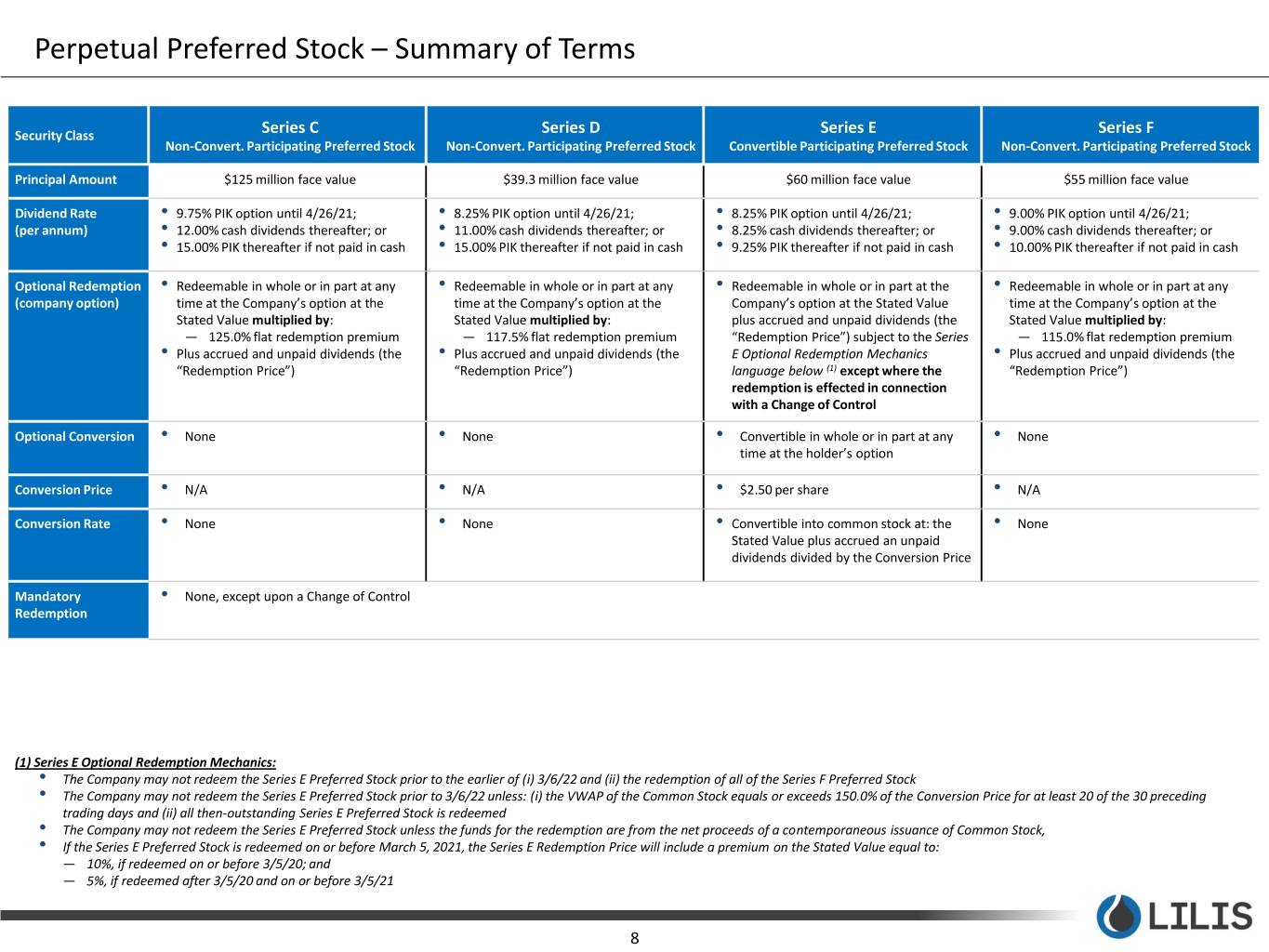

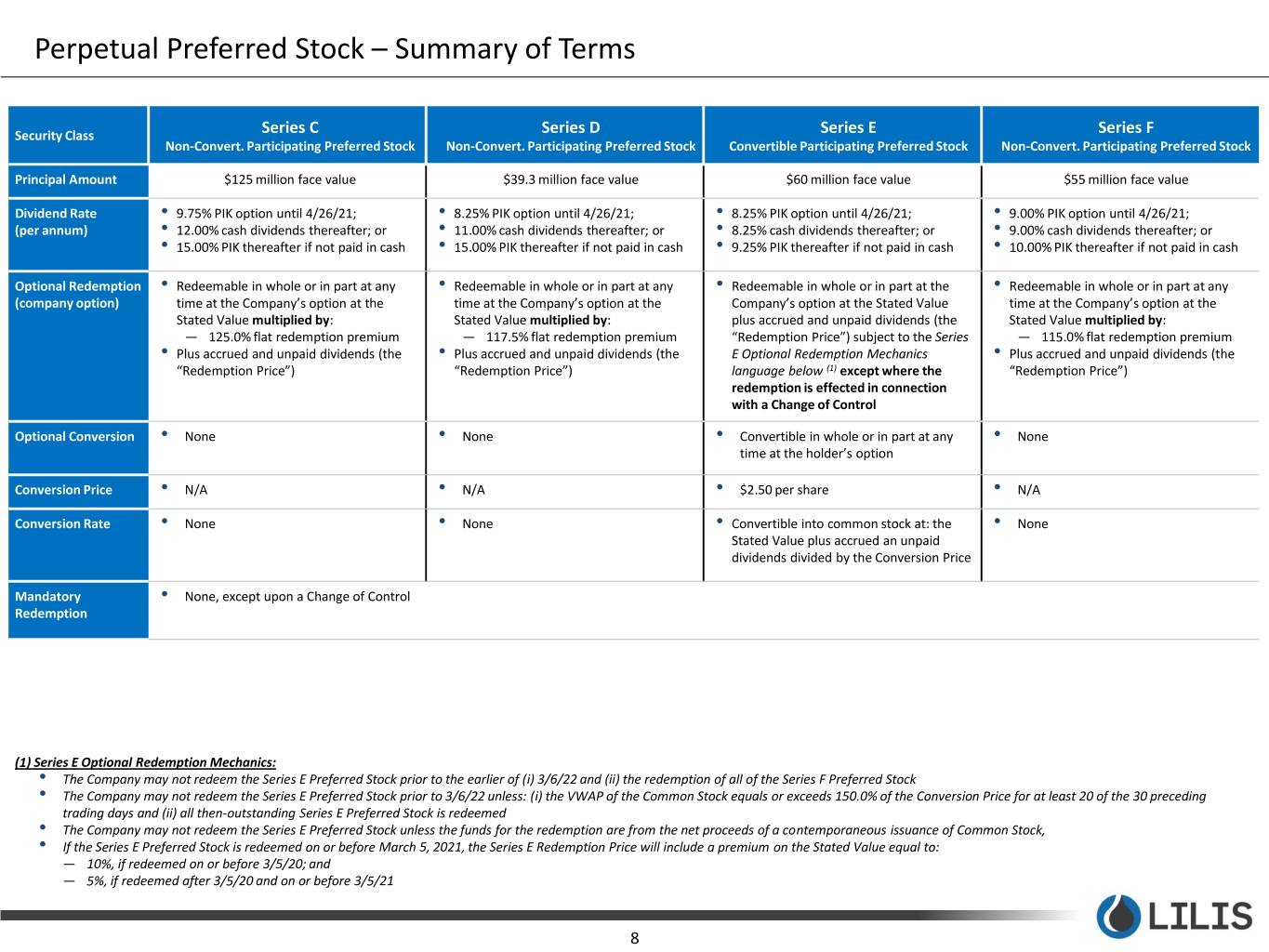

Perpetual Preferred Stock – Summary of Terms Security Class Series C Series D Series E Series F Non-Convert. Participating Preferred Stock Non-Convert. Participating Preferred Stock Convertible Participating Preferred Stock Non-Convert. Participating Preferred Stock Principal Amount $125 million face value $39.3 million face value $60 million face value $55 million face value Dividend Rate • 9.75% PIK option until 4/26/21; • 8.25% PIK option until 4/26/21; • 8.25% PIK option until 4/26/21; • 9.00% PIK option until 4/26/21; (per annum) • 12.00% cash dividends thereafter; or • 11.00% cash dividends thereafter; or • 8.25% cash dividends thereafter; or • 9.00% cash dividends thereafter; or • 15.00% PIK thereafter if not paid in cash • 15.00% PIK thereafter if not paid in cash • 9.25% PIK thereafter if not paid in cash • 10.00% PIK thereafter if not paid in cash Optional Redemption • Redeemable in whole or in part at any • Redeemable in whole or in part at any • Redeemable in whole or in part at the • Redeemable in whole or in part at any (company option) time at the Company’s option at the time at the Company’s option at the Company’s option at the Stated Value time at the Company’s option at the Stated Value multiplied by: Stated Value multiplied by: plus accrued and unpaid dividends (the Stated Value multiplied by: — 125.0% flat redemption premium — 117.5% flat redemption premium “Redemption Price”) subject to the Series — 115.0% flat redemption premium • Plus accrued and unpaid dividends (the • Plus accrued and unpaid dividends (the E Optional Redemption Mechanics • Plus accrued and unpaid dividends (the “Redemption Price”) “Redemption Price”) language below (1) except where the “Redemption Price”) redemption is effected in connection with a Change of Control Optional Conversion • None • None • Convertible in whole or in part at any • None time at the holder’s option Conversion Price • N/A • N/A • $2.50 per share • N/A Conversion Rate • None • None • Convertible into common stock at: the • None Stated Value plus accrued an unpaid dividends divided by the Conversion Price Mandatory • None, except upon a Change of Control Redemption (1) Series E Optional Redemption Mechanics: • The Company may not redeem the Series E Preferred Stock prior to the earlier of (i) 3/6/22 and (ii) the redemption of all of the Series F Preferred Stock • The Company may not redeem the Series E Preferred Stock prior to 3/6/22 unless: (i) the VWAP of the Common Stock equals or exceeds 150.0% of the Conversion Price for at least 20 of the 30 preceding trading days and (ii) all then-outstanding Series E Preferred Stock is redeemed • The Company may not redeem the Series E Preferred Stock unless the funds for the redemption are from the net proceeds of a contemporaneous issuance of Common Stock, • If the Series E Preferred Stock is redeemed on or before March 5, 2021, the Series E Redemption Price will include a premium on the Stated Value equal to: — 10%, if redeemed on or before 3/5/20; and — 5%, if redeemed after 3/5/20 and on or before 3/5/21 8

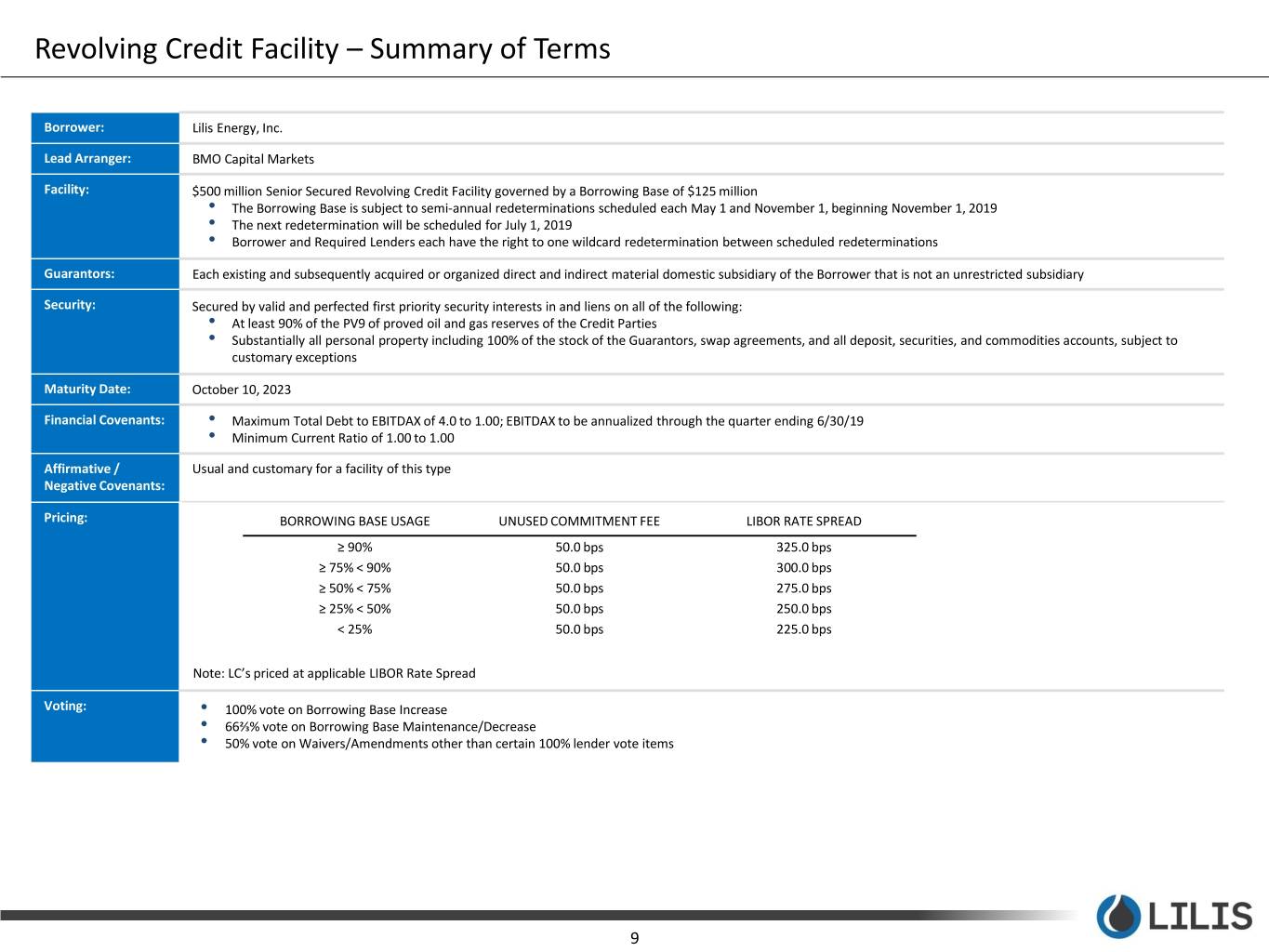

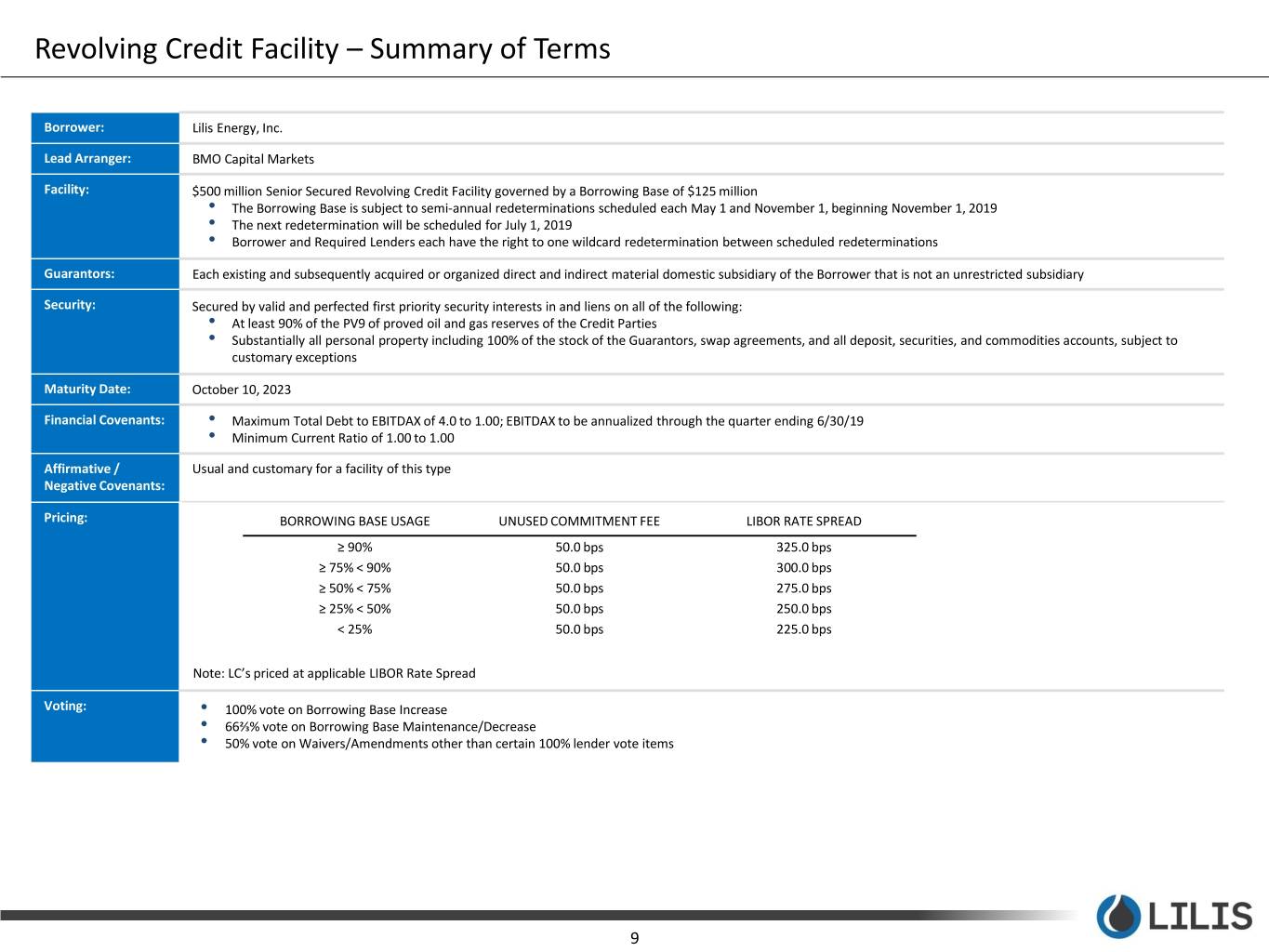

Revolving Credit Facility – Summary of Terms Borrower: Lilis Energy, Inc. Lead Arranger: BMO Capital Markets Facility: $500 million Senior Secured Revolving Credit Facility governed by a Borrowing Base of $125 million • The Borrowing Base is subject to semi-annual redeterminations scheduled each May 1 and November 1, beginning November 1, 2019 • The next redetermination will be scheduled for July 1, 2019 • Borrower and Required Lenders each have the right to one wildcard redetermination between scheduled redeterminations Guarantors: Each existing and subsequently acquired or organized direct and indirect material domestic subsidiary of the Borrower that is not an unrestricted subsidiary Security: Secured by valid and perfected first priority security interests in and liens on all of the following: • At least 90% of the PV9 of proved oil and gas reserves of the Credit Parties • Substantially all personal property including 100% of the stock of the Guarantors, swap agreements, and all deposit, securities, and commodities accounts, subject to customary exceptions Maturity Date: October 10, 2023 Financial Covenants: • Maximum Total Debt to EBITDAX of 4.0 to 1.00; EBITDAX to be annualized through the quarter ending 6/30/19 • Minimum Current Ratio of 1.00 to 1.00 Affirmative / Usual and customary for a facility of this type Negative Covenants: Pricing: BORROWING BASE USAGE UNUSED COMMITMENT FEE LIBOR RATE SPREAD ≥ 90% 50.0 bps 325.0 bps ≥ 75% < 90% 50.0 bps 300.0 bps ≥ 50% < 75% 50.0 bps 275.0 bps ≥ 25% < 50% 50.0 bps 250.0 bps < 25% 50.0 bps 225.0 bps Note: LC’s priced at applicable LIBOR Rate Spread Voting: • 100% vote on Borrowing Base Increase • 66⅔% vote on Borrowing Base Maintenance/Decrease • 50% vote on Waivers/Amendments other than certain 100% lender vote items 9

Wobbe Ploegsma VP of Finance & Capital Markets ir@lilisenergy.com 210.999.5400 NYSE American | LLEX