UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22211

IVA FIDUCIARY TRUST

| |

| (Exact name of registrant as specified in charter) |

| | 717 Fifth Avenue, 10th Floor, New York, NY 10022 |

| | |

| (Address of principal executive offices) (zip code) |

Michael W. Malafronte

International Value Advisers, LLC

717 Fifth Avenue

10th Floor

New York, NY 10022

(Name and address of agent for service)

Copy to:

Michael S. Caccese, Esq.

K&L Gates LLP

State Street Financial Center

One Lincoln Street

Boston, Massachusetts 02111-2950

Brian F. Link, Esq.

State Street Bank and Trust Company

Mail Code: SUM0703

100 Summer Street, 7th Floor

Boston, MA 02111

Registrant’s telephone number, including area code: (212) 584-3570

Date of fiscal year end: September 30

Date of reporting period: March 31, 2017

Item 1. Report to Shareholders.

| | | |

| | | |

| | |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | |

IVA Worldwide Fund |

| | | IVA International Fund |

| | | |

| | | |

| | | |

| | | Semi-Annual Report |

| | | March 31, 2017 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Advised by International Value Advisers, LLC

| | An investment in the Funds is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

| | 2 | | An Owner’s Manual |

| | 3 | | Letter from the President |

| | 4 | | Letter from the Portfolio Managers |

| | 6 | | Management’s Discussion of Fund

Performance |

| | | | IVA Worldwide Fund |

| | 8 | | Performance |

| | 9 | | Portfolio Composition |

| | 10 | | Schedule of Investments |

| | | | IVA International Fund |

| | 20 | | Performance |

| | 21 | | Portfolio Composition |

| | 22 | | Schedule of Investments |

| | 31 | | Statements of Assets and Liabilities |

| | 32 | | Statements of Operations |

| | 33 | | Statements of Changes in Net Assets |

| | 34 | | Financial Highlights |

| | 40 | | Notes to Financial Statements |

| | 48 | | Additional Information |

| | 49 | | Fund Expenses |

| An Owner’s Manual | | IVA Funds |

| | | An Atypical Investment Strategy |

| | | |

| | | We manage both the IVA Worldwide and IVA International Funds with a dual attempt that is unusual in the mutual fund world: in the short-term (12-18 months), our attempt is to try to preserve capital, while in the longer-term (5-10 years, i.e., over a full economic cycle), we seek to perform better than the MSCI All Country World Index, in the case of your IVA Worldwide Fund, and the MSCI All Country World (ex-U.S.) Index, in the case of your IVA International Fund. |

| | | |

| | | The Worldwide Fund is typically used by investors who are looking for an “all weather fund” where we are given the latitude to decide how much we should have in the U.S. versus outside the U.S. The International Fund is typically used by investors who practice asset allocation and want to decide for themselves how much should be allocated to a domestic manager and how much should be allocated to a pure “international” (i.e., non-U.S.) manager, yet at the same time are looking for a lower risk – and lower volatility – exposure to international markets than may be obtained from a more traditional international fund. |

| | | |

| | | We believe our investment approach is very different from the traditional approach of most mutual funds. We are trying to deliver returns that are as absolute as possible, i.e., returns that try to be as resilient as possible in down markets, while many of our competitors try to deliver good relative performance, i.e., try to beat an index, and thus would be fine with being down 15% if their benchmark is down 20%. |

| | | |

| | | Why do we have such an unusual strategy (which, incidentally, is not easy to carry out)? Because we believe this strategy makes sense for many investors. We are fond of the quote by Mark Twain: “There are two times in a man’s life when he should not speculate: the first time is when he cannot afford to; the second time is when he can.” We realize that many investors cannot tolerate high volatility and appreciate that “life’s bills do not always come at market tops.” This strategy also appeals to us at International Value Advisers since we “eat our own cooking” for a significant part of our savings (invested in IVA products) and we have an extreme aversion to losing money. |

| | | |

| | | An Eclectic Investment Approach |

| | | |

| | | Here is how we try to implement our strategy: |

| | | |

| | | | | We don’t hug benchmarks. In practical terms, this means we are willing to make big “negative bets,” i.e., having nothing or little in what has become big in the benchmark. Conversely, we will generally seek to avoid overly large positive bets. |

| | | | | |

| | | | | We prefer having diversified portfolios (100 to 150 names). Because we invest on a global basis, we believe that diversification helps protect against weak corporate governance or insufficient disclosure, or simply against “unknown unknowns.” We like the flexibility to invest in small, medium and large companies, depending on where we see value. |

| | | | | |

| | | | | We attempt to capture equity-type returns through fixed income securities but predominantly when credit markets (or sub-sets of them) are depressed and offer this potential. |

| | | | | |

| | | | | We hold some gold, either in bullion form or via gold mining securities, as we believe gold provides a good hedge in either an inflationary or deflationary period, and it can help mitigate currency debasement over time. |

| | | | | |

| | | | | We are willing to hold cash when we cannot find enough cheap securities that we like or when we find some, yet the broader market (Mr. Market) seems fully priced. We will seek to use that cash as ammunition for future bargains. |

| | | | | |

| | | | | At the individual security level, we ask a lot of questions about “what can go wrong?” and will establish not only a “base case intrinsic value” but also a “worst case scenario” (What could prove us wrong? If we were wrong, are we likely to lose 25%, 30%, or even more of the money invested?). As a result, we will miss some opportunities, yet hopefully, we will also avoid instances where we experience a permanent impairment of value. |

| Letter from the President | IVA Funds |

| | Dear Shareholder:

This report covers the six month period ended March 31, 2017. The IVA Worldwide Fund and IVA International Fund (the “Funds”) are now in their ninth year and the Funds’ investment adviser, International Value Advisers, LLC, remains pleased with the Funds’ performance since their inception on October 1, 2008.

The investing environment and the factors influencing our investment decisions have not changed significantly over the last six months. Nor has our investment approach, which emphasizes capital preservation over the short-term while still providing the capacity to outperform equity indices over the long-term. Since inception, we have been, and will continue to be, absolute return oriented investors. We are willing to have a high “active share” and deviate significantly from our benchmarks. We believe that our investment approach represents one of the best ways to invest one’s money, in fact, almost everyone employed by IVA is a shareholder.

Looking back over letters I have written in the past, I wanted to emphasize some points after what has been a relatively quiet six month period: |

| | 1. | | Our investment strategy does not give us any room for excuses. The Funds are fortunate to be managed by Charles de Vaulx and Chuck de Lardemelle. |

| | | | |

| | 2. | | We do not pay attention to benchmark performance over a month, a quarter or a year and we are willing to endure short-term underperformance and let cash build when we cannot find enough attractive investment opportunities. |

| | | | |

| | 3. | | The responsibility we have to our clients spans many different departments at IVA. The investment team and the marketing and client service group are the most visible to our shareholders. IVA is also supported by excellent people in operations and accounting. It is extremely rewarding for me to observe the continued development, commitment, and strong work ethic of all my colleagues. |

| | | | |

| | 4. | | We manage our firm and our clients’ assets with a simple philosophy that establishes an order of priority for everything that we do. Our work begins with the client, proceeds to the firm, then to our colleagues, and finally, to the partners. This is and always will be the progression. If our clients are taken care of, the rest falls into place. At IVA, every working component is structured to benefit the client. |

| | | | I want to offer my thanks to all my colleagues and to our shareholders for their continued support. |

| | | | |

| | | |  |

| | | | |

| | | | Michael W. Malafronte, President |

| | | | |

| | | | Effective February 22, 2011, the IVA Worldwide Fund and IVA International Fund are closed to new investors. |

| Letter from the Portfolio Managers | IVA Funds |

| | May 1, 2017

Dear Fellow Shareholders,

During the period under review, October 1, 2016 to March 31, 2017, markets continued their upward journey. While equities owned by both Funds outperformed their indices of reference, the large cash position detracted from performance. The absolute performance over the period was satisfactory, in our opinion.

We believe that the sizeable cash position in both Funds is warranted given elevated valuations in all asset classes in the United States, substantial and unsustainable credit growth in China, political risks in relation to the eurozone, and rising short-term interest rates in the United States. These issues would be surmountable as investors if valuations were commensurate with these risks. We do not believe this is the case today.

We are however stock pickers at heart, and with the help of our analysts, we’ve been able to unearth a number of attractive investments over the period, in particular in Europe during the last quarter of 2016, and in Korea and emerging markets in the first quarter of 2017.

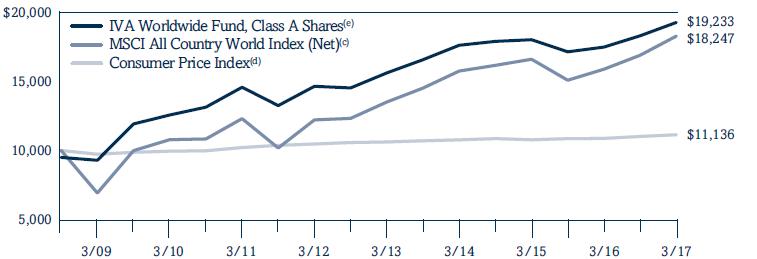

For the International Fund in particular, we were able to put a sizeable chunk of cash to work over the period, with cash moving from 34.1% to 28.1% over the period while the International Fund equity allocation moved from 53.9% to 61.3%. This is not a function of some macro views on economies outside the United States; rather this is the result of finding what we believe are a few undervalued businesses around the world, which led to sizeable investments in Airbus, Bureau Veritas, Kangwon Land and Korea Tobacco & Ginseng for both Funds, as well as a few South American names in Mexico, Chile, and Brazil for the International Fund.

The rally in European equities in the first quarter of 2017 cut our European buying spree short. The names available in emerging markets tend to be small, constraining the size of the positions we establish there. Valuations in emerging markets are at substantial discounts to the United States; likewise, European markets have underperformed the U.S. market massively over the last few years, albeit for a good reason: European markets are heavily weighted towards financials, with the underlying issue of the sustainability of the euro, and therefore suspicious balance sheets; while U.S. indices are loaded with expensive, yet fast growing internet related names, such as Facebook or Amazon. Striking how absent these types of investments are from European or Japanese indices. |

| | For the Worldwide Fund, sizeable European investments over the period were offset by sales in the U.S. of substantially all of our mortgage real estate investment trust (REIT) preferred shares as well as selling out of a few U.S. equity names. |

| | |

| | We continue to carry a sizeable gold bullion position in both Funds. We view gold bullion as a currency that central bankers cannot debase, and as a useful hedge in both portfolios against extreme outcomes. While gold bullion historically has gone up in price during most bear markets in the United States, obviously past performance is no guarantee of future performance... In particular, if the next bear market in the U.S. is triggered by higher real interest rates, rather than by a recession, it is possible that gold may not perform as we anticipate. It is interesting to note however that in both Venezuela, where hyperinflation wiped out investors, as well as in Greece, where deflation led to financial ruin for most, gold protected wealth well. |

| Letter from the Portfolio Managers | IVA Funds |

| | We remain concerned by the large and growing amounts of worldwide debt outstanding as a percentage of global GDP, by the derelict global monetary system, as well as the furious credit growth in China and the volatile political situation in Europe, which eventually could result in a breakup of the eurozone (We believe Italy might be the weakest link there). Rising short-term interest rates in the U.S., in the context of one of the longest bull markets in history, coupled with an advanced economic cycle in the U.S. and very high valuations by historical standards, warrant a conservative and prudent capital allocation in our opinion, and explain why an allocation to gold bullion is warranted in your Funds, and why the cash (invested in commercial paper of our choosing) remains at high levels. | |

| | | |

| | We continue to work hard to find suitable investments, to avoid speculations, and to compound your hard-earned savings at a reasonable rate, while doing our utmost to preserve capital. We appreciate your continued confidence and thank you for your support. | |

| | | |

| |  | |

| | Charles de Vaulx, Chief Investment Officer and Portfolio Manager | |

| |  | |

| | Chuck de Lardemelle, Portfolio Manager | |

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

| | The election of Donald Trump as President of the United States stunned the world and was by far the defining event of the period under review. The news, for the most part, was calmly digested by markets. Immediately following the election, bonds were struck with the reality that inflation and higher interest rates may become a byproduct of any fiscal stimulus package initiated by President Trump and a Republican-controlled Congress. Equities fared better, especially in the U.S., as markets embraced an optimistic view of a “pro-business” Trump administration that would cut taxes, engage in deficit spending and roll back regulations. The global equity markets continued their “Trump-Trade” driven rally into the New Year and through most of the first quarter of 2017. There was an interruption in this rally following President Trump’s setback in healthcare reform at the end of March, as investors began to question his ability to accomplish his other goals such as corporate tax cuts, infrastructure spending and deregulation. However, these doubts seem to have been fleeting, as the market rebounded after only a few days of volatility. Helping to buoy markets at the end of the period, the U.S. Federal Reserve signaled in March that although they intend to gradually increase rates, they still want to proceed cautiously. | |

| | | |

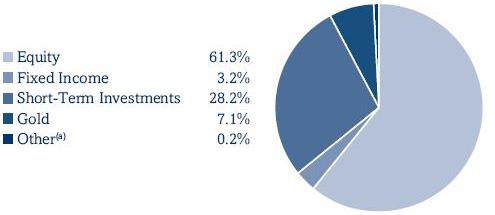

| | Over the period, our equity exposure decreased from 52.1% to 50.8% in the Worldwide Fund and increased from 53.9% to 61.3% in the International Fund. Cash increased from 37.3% to 40.7% in the Worldwide Fund and decreased from 34.1% to 28.2% in the International Fund. We found new equity opportunities over the period. In both Funds, we initiated a new position in BMW AG (Germany, consumer discretionary), Airbus Group SE (Netherlands, industrials) and KT&G Corp. (South Korea, consumer staples). We also added to our position in Bureau Veritas SA (France, industrials), which is now a top 10 name in both Funds. In the International Fund only, we added multiple new names, including TOTVS SA (Brazil, technology), Doshisha Co., Ltd. (Japan, consumer discretionary) and DONGKOOK Pharmaceutical Co., Ltd. (South Korea, health care). In the Worldwide Fund only, we added Ralph Lauren Corp. (U.S., consumer discretionary). | |

| | | |

| | While we were able to find new names, some of our existing names approached our intrinsic value estimates and in those cases we trimmed and even eliminated positions entirely. Yokogawa Electric Corp. (Japan, technology) was sold by both Funds. In the Worldwide Fund only, names that we eliminated included Raymond James Financial Inc. (U.S., financials) and Hewlett Packard Enterprise Co. (U.S., technology). | |

| | | |

| | Fixed income exposure decreased in both Funds as we trimmed corporate bond positions and reduced our exposure to short-dated bonds denominated in Singapore dollars over the period. In the Worldwide Fund, fixed income decreased from 3.3% to 2.5% and in the International Fund, it decreased from 4.1% to 3.2%. | |

| | | |

| | Our gold exposure through gold bullion decreased from 6.4% to 5.8% in the Worldwide Fund and from 7.6% to 7.1% in the International Fund. | |

| | | |

| | IVA Worldwide Fund | |

| | | |

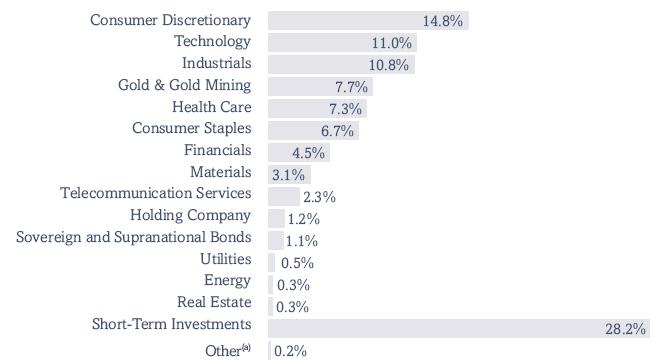

| | The IVA Worldwide Fund Class A, at net asset value, returned 5.26% over the six-month period ended March 31, 2017 compared to the MSCI All Country World Index (Net) (the “Index”) return of 8.18% over the same period. | |

| | | |

| | The IVA Worldwide Fund lagged the Index for the period, mostly due to the dilutive effect of our elevated cash position. Our equities outperformed, up 11.1%, compared to those in the Index* which were up 8.3%. Our U.S. names contributed 3.1%, led by a rally in financials and strong performance by some of our top 10 names, including DeVry Education Group Inc. (consumer discretionary) and Berkshire Hathaway Inc., Class ‘A’ and ‘B’ (holding company). Continental Europe contributed 0.9% and the United Kingdom added 0.7%, led by Antofagasta Plc (materials), which benefited from a rise in copper prices over the period. With markets robust around the globe, the only countries that detracted from return this period were Japan (taking away -0.3%) and Thailand (taking away -0.01%). In Japan, performance was hurt by Astellas Pharma Inc. (health care). | |

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

| | The top five individual contributors to return this period were: DeVry Education Group Inc. (U.S., consumer discretionary), Berkshire Hathaway Inc. Class ‘A’ and ‘B’ (U.S., holding company), Bank of America Corp. (U.S., financials), Samsung Electronics Co., Ltd. (South Korea, technology), Antofagasta Plc (U.K., materials). The top five individual detractors were: Astellas Pharma Inc. (Japan, health care), Hyundai Mobis Co., Ltd (South Korea, consumer discretionary), News Corp. Class ‘A’ and ‘B’ (U.S., consumer discretionary), CVS Health Corp. (U.S., consumer staples), Nestlé S.A. (Switzerland, consumer staples). | |

| | | |

| | Collectively, fixed income contributed 0.3%. Gold was down -5.3% and detracted -0.4%. | |

| | | |

| | In an effort to neutralize part of our foreign exchange risk, we were partially hedged against several currencies over the period – the euro, Japanese yen, South Korean won and Australian dollar. Our currency hedges added 0.3%, helped the most by our hedge on the Japanese yen as it depreciated against the U.S. dollar over the period. At the end of the period, our currency hedges were: 39% Australian dollar, 9% euro, 25% Japanese yen, and 30% South Korean won. | |

| | | |

| | IVA International Fund | |

| | | |

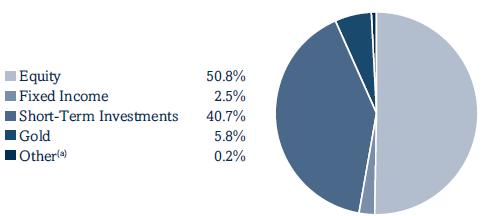

| | The IVA International Fund Class A, at net asset value, returned 4.25% over the six-month period ended March 31, 2017 compared to the MSCI All Country World Index (ex-U.S.)(Net)(the “Index”) return of 6.51% over the same period. | |

| | | |

| | The IVA International Fund lagged the Index for the period, mostly due to the dilutive effect of our elevated cash position. Our equities outperformed, up 7.4%, compared to those in the Index* which were up 6.6%. Our names in Continental Europe contributed the most to return, adding 1.5%. The United Kingdom added 1.0%, led by Antofagasta Plc (materials), which benefited from a rise in copper prices over the period. South Korea added 0.9%, led by Samsung Electronics Co., Ltd (technology). News Corp. Class ‘A’ and ‘B’ (U.S., consumer discretionary) detracted -0.2%. We hold News Corp. in our International portfolio due to its meaningful Australian exposure. With markets robust around the globe this period, the only countries that detracted from return were Hong Kong and Thailand, taking away a total of -0.03%. | |

| | | |

| | The top five individual equity contributors to return this period were: Samsung Electronics Co., Ltd. (South Korea, technology), Antofagasta Plc (U.K., materials), Jardine Strategic Holdings Ltd. (Bermuda, holding company), Clear Media Ltd. (China, consumer discretionary), Hongkong & Shanghai Hotels Ltd. (Hong Kong, consumer discretionary). The top five individual detractors were: Astellas Pharma Inc. (Japan, health care), News Corp. Class ‘A’ and ‘B’ (U.S., consumer discretionary), Hyundai Mobis Co., Ltd (South Korea, consumer discretionary), APT Satellite Holdings Ltd. (Hong Kong, telecommunications services), Toho Co., Ltd. (Japan, consumer discretionary). | |

| | | |

| | Collectively, fixed income contributed 0.2%. Gold was down -5.3% and detracted -0.5%. | |

| | | |

| | In an effort to neutralize part of our foreign exchange risk, we were partially hedged against several currencies over the period – the euro, Japanese yen, South Korean won and Australian dollar. Our currency hedges added 0.7%, helped the most by our hedge on the Japanese yen as it depreciated against the U.S. dollar over the period. At the end of the period, our currency hedges were: 39% Australian dollar, 9% euro, 36% Japanese yen, and 30% South Korean won. | |

| | | |

| | Investment Risks: There are risks associated with investing in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value. | |

| | | |

| | *The Index equity return excludes gold mining stocks. | |

| IVA Worldwide Fund | | IVA Funds |

| Performance (unaudited) | | As of March 31, 2017 |

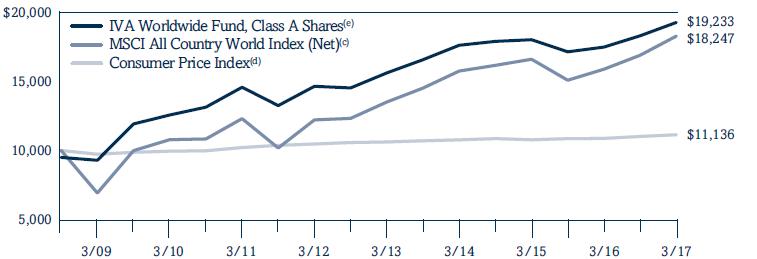

| Average Annual Total Returns as of March 31, 2017 | | | Six Months(a) | | One Year | | Five Year | | Since Inception(b) |

| | | | | | | | | | |

| Class A | | | 5.26 | % | | 10.17 | % | | 5.63 | % | | 8.65 | % |

| Class A (with a 5% maximum initial sales charge) | | | -0.01 | % | | 4.65 | % | | 4.55 | % | | 8.00 | % |

| Class C | | | 4.91 | % | | 9.40 | % | | 4.83 | % | | 7.84 | % |

| Class I | | | 5.43 | % | | 10.48 | % | | 5.88 | % | | 8.91 | % |

| MSCI All Country World Index (Net)(c) | | | 8.18 | % | | 15.04 | % | | 8.37 | % | | 7.33 | % |

| Consumer Price Index(d) | | | 1.14 | % | | 2.45 | % | | 1.28 | % | | 1.27 | % |

| Growth of a $10,000 Initial Investment | |

| | |

| |

| (a) | | Total returns for periods of less than one year are not annualized. |

| (b) | | The Fund commenced investment operations on October 1, 2008. |

| (c) | | The MSCI All Country World Index (Net) is an unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. |

| (d) | | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. |

| (e) | | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2017. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482.

The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. The expense ratios for the Fund are as follows: 1.25% (Class A shares); 2.00% (Class C shares); and 1.00% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2017. More recent expense ratios can be found in the Financial Highlights section of this Semi-Annual Report.

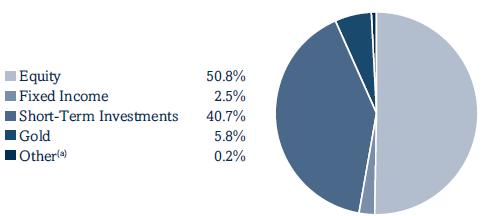

| IVA Worldwide Fund | | IVA Funds |

| Portfolio Composition (unaudited) | | As of March 31, 2017 |

| Asset Allocation (As a Percent of Total Net Assets) | |

| | |

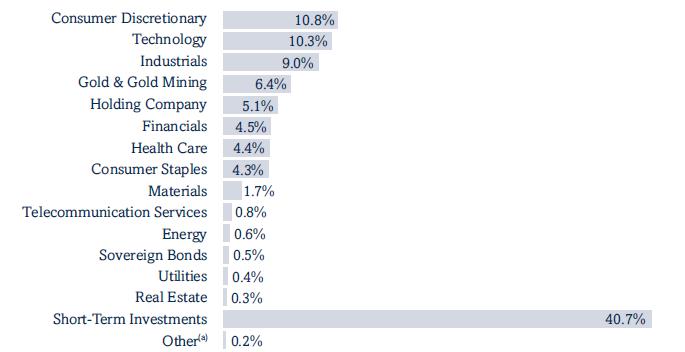

| Sector Allocation (As a Percent of Total Net Assets) | |

| | |

| Top 10 Positions (As a Percent of Total Net Assets)(b) | |

| | |

| Gold Bullion | | 5.8 | % |

| |

| Berkshire Hathaway Inc., Class ‘A’, Class ‘B’ | | 4.2 | % |

| |

| Astellas Pharma Inc. | | 3.7 | % |

| |

| Nestlé SA | | 2.2 | % |

| |

| Bureau Veritas SA | | 2.1 | % |

| |

| Oracle Corp. | | 1.8 | % |

| |

| Samsung Electronics Co., Ltd. | | 1.5 | % |

| |

| Mastercard Inc., Class ‘A’ | | 1.4 | % |

| |

| Antofagasta Plc | | 1.3 | % |

| |

| CVS Health Corp. | | 1.3 | % |

| |

| Top 10 positions represent 25.3% of total net assets. |

| (a) | | Other represents unrealized gains and losses on forward foreign currency contracts and other assets and liabilities. | | |

| (b) | | Short-Term Investments are not included. | | |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | |

| | COMMON STOCKS – 50.7% | | | | | | | |

| | |

| | Bermuda | 0.8% | | | | | | | |

| | | | 1,505,700 | | Jardine Strategic Holdings Ltd. | | $ | 63,239,400 |

| | |

| | | | | | | | | |

| | |

| | China | 0.6% | | | | | | | |

| | | | 129,324 | | Baidu Inc., ADR (a) | | | 22,310,977 |

| | |

| | | | 15,637,640 | | Clear Media Ltd. | | | 18,109,600 |

| | |

| | | | 68,320,000 | | Springland International Holdings Ltd. | | | 12,219,623 |

| | |

| | | | | | | | | 52,640,200 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | France | 6.8% | | | | | | | |

| | | | 903,607 | | Alten SA | | | 69,290,003 |

| | |

| | | | 3,705,607 | | Altran Technologies SA | | | 62,380,562 |

| | |

| | | | 24,549,756 | | Bolloré SA | | | 95,173,279 |

| | |

| | | | 177,361 | | Bolloré SA NV (a) | | | 673,583 |

| | |

| | | | 8,037,087 | | Bureau Veritas SA | | | 169,550,115 |

| | |

| | | | 2,258,966 | | Engie SA | | | 32,003,000 |

| | |

| | | | 37,482 | | Financière de l’Odet SA | | | 31,388,845 |

| | |

| | | | 94,455 | | Robertet SA | | | 35,267,601 |

| | |

| | | | 57,677 | | Séché Environnement SA | | | 1,699,454 |

| | |

| | | | 279,481 | | Sodexo SA | | | 32,871,068 |

| | |

| | | | 200,614 | | Thales SA | | | 19,402,598 |

| | |

| | | | 41,887 | | Wendel SA | | | 5,308,583 |

| | |

| | | | | | | | | 555,008,691 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Germany | 0.9% | | | | | | | |

| | | | 284,050 | | Bayerische Motoren Werke AG | | | 25,911,623 |

| | |

| | | | 332,556 | | Siemens AG | | | 45,552,555 |

| | |

| | | | | | | | | 71,464,178 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Hong Kong | 0.8% | | | | | | | |

| | | | 3,507,587 | | Henderson Land Development Co. Ltd. | | | 21,732,010 |

| | |

| | | | 37,372,159 | | Hongkong & Shanghai Hotels Ltd. | | | 43,953,102 |

| | |

| | | | | | | | | 65,685,112 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Japan | 7.7% | | | | | | | |

| | | | 23,041,200 | | Astellas Pharma Inc. | | | 303,407,879 |

| | |

| | | | 1,198,300 | | Azbil Corp. | | | 40,255,475 |

| | |

| | | | 537,500 | | Benesse Holdings Inc. | | | 16,801,401 |

| | |

| | | | 1,418,200 | | Cosel Co., Ltd. | | | 19,273,660 |

| | |

| | | | 588,100 | | F@N Communications, Inc. | | | 4,389,752 |

| | |

| | | | 289,700 | | FANUC Corp. | | | 59,381,604 |

| | |

| | | | 755,700 | | Icom Inc. (b) | | | 17,370,307 |

| | |

| | | | 211,200 | | Medikit Co., Ltd. | | | 8,840,313 |

| | |

| | | | 509,000 | | Miraca Holdings Inc. | | | 23,408,605 |

| | |

| 10 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | |

| | |

| | Japan | 7.7% (continued) | | | | | | | |

| | |

| | | | 178,500 | | Nitto Kohki Co., Ltd. | | $ | 4,086,917 |

| | |

| | | | 328,700 | | Okinawa Cellular Telephone Co. | | | 10,643,703 |

| | |

| | | | 1,064,000 | | Rohto Pharmaceutical Co., Ltd. | | | 19,936,262 |

| | |

| | | | 390,200 | | Seven & i Holdings Co., Ltd. | | | 15,288,354 |

| | |

| | | | 259,400 | | Techno Medica Co., Ltd. | | | 4,939,621 |

| | |

| | | | 932,900 | | Toho Co., Ltd. | | | 24,728,177 |

| | |

| | | | 11,298,800 | | Yahoo Japan Corp. | | | 52,165,483 |

| | |

| | | | | | | | | 624,917,513 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Malaysia | 0.8% | | | | | | | |

| | | | 52,837,200 | | Genting Malaysia Berhad | | | 65,068,973 |

| | |

| | | | | | | | | |

| | |

| | Netherlands | 1.1% | | | | | | | |

| | | | 1,177,040 | | Airbus Group SE | | | 89,566,659 |

| | |

| | | | | | | | | |

| | |

| | Norway | 0.0% | | | | | | | |

| | | | 77,511 | | Golden Close Maritime Corp. Ltd. (a)(c) | | | — |

| | |

| | | | | | | | | |

| | |

| | South Africa | 0.4% | | | | | | | |

| | | | 2,535,416 | | Net 1 U.E.P.S. Technologies Inc. (a) | | | 31,008,138 |

| | |

| | | | | | | | | |

| | |

| | South Korea | 4.8% | | | | | | | |

| | | | 398,539 | | Hyundai Mobis Co., Ltd. | | | 85,709,228 |

| | |

| | | | 474,241 | | Hyundai Motor Co. | | | 66,791,521 |

| | |

| | | | 1,994,452 | | Kangwon Land, Inc. | | | 68,128,468 |

| | |

| | | | 523,248 | | KT&G Corp. | | | 45,619,851 |

| | |

| | | | 68,381 | | Samsung Electronics Co., Ltd. | | | 125,963,391 |

| | |

| | | | | | | | | 392,212,459 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Switzerland | 3.4% | | | | | | | |

| | | | 473,828 | | Compagnie Financière Richemont SA | | | 37,465,360 |

| | |

| | | | 2,351,279 | | Nestlé SA | | | 180,398,134 |

| | |

| | | | 3,742,100 | | UBS Group AG | | | 59,887,049 |

| | |

| | | | | | | | | 277,750,543 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Thailand | 0.2% | | | | | | | |

| | |

| | | | 33,397,500 | | Thaicom PCL | | | 19,243,958 |

| | | | | | | | | |

| | |

| | United Kingdom | 2.4% | | | | | | | |

| | | | 10,128,763 | | Antofagasta Plc | | | 105,900,820 |

| | |

| | | | 4,773,700 | | HSBC Holdings Plc | | | 38,930,140 |

| | |

| | | | 8,984,991 | | Millennium & Copthorne Hotels Plc | | | 49,644,690 |

| | |

| | | | | | | | | 194,475,650 |

| | | | | | | | |

| See Notes to Financial Statements. | 11 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | SHARES | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | |

| | United States | 20.0% | | | | | | | | |

| | | | 14,434 | | | Alphabet Inc., Class ‘A’ (a) | | $ | 12,237,145 |

| | |

| | | | 45,665 | | | Alphabet Inc., Class ‘C’ (a) | | | 37,881,857 |

| | |

| | | | 940,901 | | | Amdocs Ltd. | | | 57,385,552 |

| | |

| | | | 741,612 | | | American Express Co. | | | 58,668,925 |

| | |

| | | | 349,766 | | | Aon Plc | | | 41,513,727 |

| | |

| | | | 4,294,892 | | | Bank of America Corp. | | | 101,316,502 |

| | |

| | | | 1,190 | | | Berkshire Hathaway Inc., Class ‘A’ (a) | | | 297,321,500 |

| | |

| | | | 285,555 | | | Berkshire Hathaway Inc., Class ‘B’ (a) | | | 47,596,307 |

| | |

| | | | 149,135 | | | Cimarex Energy Co. | | | 17,820,141 |

| | |

| | | | 1,384,235 | | | CVS Health Corp. | | | 108,662,448 |

| | |

| | | | 2,447,875 | | | DeVry Education Group Inc. | | | 86,777,169 |

| | |

| | | | 557,158 | | | Emerson Electric Co. | | | 33,351,478 |

| | |

| | | | 1,018,852 | | | Expeditors International of Washington, Inc. | | | 57,554,950 |

| | |

| | | | 468,024 | | | Flowserve Corp. | | | 22,661,722 |

| | |

| | | | 66,596 | | | Goldman Sachs Group, Inc. | | | 15,298,433 |

| | |

| | | | | | | Liberty Interactive Corp. QVC Group, | | | |

| | |

| | | | 2,524,713 | | | Series ‘A’ (a) | | | 50,544,754 |

| | |

| | | | 454,930 | | | Marsh & McLennan Cos., Inc. | | | 33,614,778 |

| | |

| | | | 1,006,921 | | | Mastercard Inc., Class ‘A’ | | | 113,248,405 |

| | |

| | | | 6,370,534 | | | News Corp., Class ‘A’ | | | 82,816,942 |

| | |

| | | | 1,285,193 | | | News Corp., Class ‘B’ | | | 17,350,106 |

| | |

| | | | 3,234,502 | | | Oracle Corp. | | | 144,291,134 |

| | |

| | | | 617,728 | | | Ralph Lauren Corp. | | | 50,418,959 |

| | |

| | | | 1,587,550 | | | Teradata Corp. (a) | | | 49,404,556 |

| | |

| | | | 428,963 | | | Tiffany & Co. | | | 40,880,174 |

| | |

| | | | 444,019 | | | United Technologies Corp. | | | 49,823,372 |

| | |

| | | | | | | | | | 1,628,441,036 |

| | | | | | | | | |

| | | | | | | TOTAL COMMON STOCKS | | | |

| | | | | | | (Cost — $2,906,449,224) | | | 4,130,722,510 |

| | |

| | PREFERRED STOCKS – 0.1% | | | | | | | | |

| | | | | | | | | | |

| | |

| | United States | 0.1% | | | | | | | | |

| | | | | | | CYS Investments Inc., Series ‘B’, | | | |

| | | | 297,755 | | | 7.5% due 4/30/2018 (d) | | | 6,997,243 |

| | |

| | | | | | | TOTAL PREFERRED STOCKS | | | |

| | | | | | | (Cost — $6,125,729) | | | 6,997,243 |

| | |

| | | | PRINCIPAL | | | | | | |

| | | | AMOUNT | | | | | | |

| | CORPORATE NOTES & BONDS – 2.0% | | | | | | | | |

| | | | | | | | | | |

| | |

| | Norway | 0.0% | | | | | | | | |

| | | | | | | Golden Close Maritime Corp. Ltd., | | | |

| | | | 154,101 | USD | | 8% due 3/29/2022 (c)(e)(f) | | | 154,101 |

| | |

| 12 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | PRINCIPAL | | | | | | |

| | | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | |

| | South Africa | 0.6% | | | | | | | | |

| | | | | | | Gold Fields Orogen Holding (BVI) Ltd., | | | |

| | | | 46,980,000 | USD | | 4.875% due 10/7/2020 (e) | | $ | 47,449,800 |

| | |

| | | | | | | | | | |

| | |

| | Switzerland | 0.1% | | | | | | | | |

| | | | 8,900,000 | EUR | | UBS AG, 7.152% due 12/21/2017 (g) | | | 9,962,266 |

| | |

| | | | | | | | | | |

| | |

| | United States | 1.3% | | | | | | | | |

| | | | | | | Brandywine Operating Partnership, LP, | | | |

| | | | 6,070,000 | USD | | 5.7% due 5/1/2017 | | | 6,088,356 |

| | |

| | | | 9,684,000 | USD | | Era Group Inc., 7.75% due 12/15/2022 | | | 9,272,430 |

| | |

| | | | | | | Intelsat Jackson Holdings Ltd.: | | | |

| | | | 8,702,000 | USD | | 7.5% due 4/1/2021 | | | 7,886,187 |

| | |

| | | | 29,476,000 | USD | | 5.5% due 8/1/2023 | | | 24,354,545 |

| | |

| | | | 34,108,000 | USD | | Joy Global Inc., 5.125% due 10/15/2021 | | | 36,640,314 |

| | |

| | | | | | | Rowan Cos., Inc.: | | | |

| | | | 17,524,000 | USD | | 4.875% due 6/1/2022 | | | 16,823,040 |

| | |

| | | | 3,786,000 | USD | | 4.75% due 1/15/2024 | | | 3,416,865 |

| | |

| | | | | | | | | | 104,481,737 |

| | | | | | | | | |

| | | | | | | TOTAL CORPORATE NOTES & BONDS | | | |

| | | | | | | (Cost — $138,309,743) | | | 162,047,904 |

| | |

| | | | | | | | | | |

| | CONVERTIBLE BONDS – 0.0% | | | | | | | | |

| | | | | | | | | | |

| | |

| | Norway | 0.0% | | | | | | | | |

| | | | | | | Golden Close Maritime Corp. Ltd., | | | |

| | | | 523,946 | USD | | 0% due 3/29/2022 (a)(c) | | | 104,789 |

| | |

| | | | | | | TOTAL CONVERTIBLE BONDS | | | |

| | | | | | | (Cost — $274,257) | | | 104,789 |

| | |

| | | | | | | | | | |

| | SOVEREIGN BONDS – 0.5% | | | | | | | | |

| | | | | | | | | | |

| | |

| | Singapore | 0.5% | | | | | | | | |

| | | | | | | Government of Singapore, | | | |

| | | | 48,812,000 | SGD | | 2.5% due 6/1/2019 | | | 35,791,512 |

| | |

| | | | | | | TOTAL SOVEREIGN BONDS | | | |

| | | | | | | (Cost — $36,924,723) | | | 35,791,512 |

| | |

| | | | OUNCES | | | | | | |

| | COMMODITIES – 5.8% | | | | | | | | |

| | | | 380,678 | | | Gold Bullion (a) | | | 474,887,580 |

| | |

| | | | | | | TOTAL COMMODITIES | | | |

| | | | | | | (Cost — $532,545,604) | | | 474,887,580 |

| | |

| See Notes to Financial Statements. | | 13 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | PRINCIPAL | | | | | | |

| | | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | SHORT-TERM INVESTMENTS – 40.7% | | | |

| | | | | | | | | | |

| | |

| | Commercial Paper | 40.6% | | | | |

| | | | | | | Apple Inc.: | | | |

| | | | 40,000,000 | USD | | 0.69% due 4/6/2017 (e) | | $ | 39,995,427 |

| | |

| | | | 25,000,000 | USD | | 0.72% due 4/13/2017 (e) | | | 24,993,744 |

| | |

| | | | 30,000,000 | USD | | 0.71% due 4/19/2017 (e) | | | 29,988,932 |

| | |

| | | | 30,000,000 | USD | | 0.75% due 5/4/2017 (e) | | | 29,979,770 |

| | |

| | | | 22,000,000 | USD | | 0.85% due 5/11/2017 (e) | | | 21,981,935 |

| | |

| | | | 33,000,000 | USD | | 0.72% due 5/12/2017 (e) | | | 32,972,203 |

| | |

| | | | 25,000,000 | USD | | 0.83% due 5/25/2017 (e) | | | 24,971,927 |

| | |

| | | | 32,000,000 | USD | | BASF SE, 0.85% due 4/24/2017 (e) | | | 31,981,291 |

| | |

| | | | | | | Cisco Systems Inc.: | | | |

| | | | 16,000,000 | USD | | 0.66% due 4/5/2017 (e) | | | 15,998,209 |

| | |

| | | | 80,000,000 | USD | | 0.7% due 4/12/2017 (e) | | | 79,978,107 |

| | |

| | | | 50,400,000 | USD | | 0.8% due 5/3/2017 (e) | | | 50,360,037 |

| | |

| | | | | | | Clorox Co.: | | | |

| | | | 15,000,000 | USD | | 1.13% due 5/8/2017 (e) | | | 14,980,161 |

| | |

| | | | 15,000,000 | USD | | 1.18% due 5/9/2017 (e) | | | 14,979,606 |

| | |

| | | | | | | Coca-Cola Co.: | | | |

| | | | 66,000,000 | USD | | 0.79% due 4/19/2017 (e) | | | 65,972,586 |

| | |

| | | | 50,000,000 | USD | | 0.85% due 5/22/2017 (e) | | | 49,938,828 |

| | |

| | | | 15,000,000 | USD | | 0.85% due 5/23/2017 (e) | | | 14,981,273 |

| | |

| | | | 30,000,000 | USD | | 0.85% due 5/25/2017 (e) | | | 29,960,950 |

| | |

| | | | | | | Colgate-Palmolive Co.: | | | |

| | | | 24,000,000 | USD | | 0.76% due 4/12/2017 (e) | | | 23,993,792 |

| | |

| | | | 30,000,000 | USD | | 0.8% due 4/20/2017 (e) | | | 29,986,867 |

| | |

| | | | | | | Danaher Corp.: | | | |

| | | | 35,000,000 | USD | | 0.75% due 4/7/2017 (e) | | | 34,994,283 |

| | |

| | | | 40,000,000 | USD | | 0.75% due 4/10/2017 (e) | | | 39,990,600 |

| | |

| | | | 48,100,000 | USD | | 0.85% due 4/13/2017 (e) | | | 48,085,184 |

| | |

| | | | 40,000,000 | USD | | 0.75% due 4/17/2017 (e) | | | 39,983,737 |

| | |

| | | | 66,900,000 | USD | | 0.9% due 4/18/2017 (e) | | | 66,871,133 |

| | |

| | | | 14,000,000 | USD | | Dover Corp., 1.15% due 4/6/2017 (e) | | | 13,998,045 |

| | |

| | | | | | | Dow Chemical Co.: | | | |

| | | | 15,000,000 | USD | | 1.03% due 4/4/2017 | | | 14,998,157 |

| | |

| | | | 9,000,000 | USD | | 1.0% due 4/18/2017 | | | 8,994,744 |

| | |

| | | | | | | Engie SA: | | | |

| | | | 35,000,000 | USD | | 0.9% due 4/25/2017 (e) | | | 34,978,635 |

| | |

| | | | 26,000,000 | USD | | 0.74% due 5/11/2017 (e) | | | 25,973,113 |

| | |

| | | | 25,000,000 | USD | | 0.9% due 5/17/2017 (e) | | | 24,970,037 |

| | |

| 14 | | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | PRINCIPAL | | | | | | |

| | | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | |

| | Commercial Paper | 40.6% (continued) | | | | |

| | |

| | | | | | | Essilor International: | | | |

| | | | 25,000,000 | USD | | 0.95% due 5/24/2017 (e) | | $ | 24,965,125 |

| | |

| | | | 25,000,000 | USD | | 0.95% due 5/25/2017 (e) | | | 24,964,403 |

| | |

| | | | | | | Estée Lauder Companies Inc., | | | |

| | | | 21,400,000 | USD | | 0.73% due 4/7/2017 (e) | | | 21,396,505 |

| | |

| | | | | | | Florida Power & Light Co.: | | | |

| | | | 24,000,000 | USD | | 1.0% due 4/6/2017 | | | 23,995,648 |

| | |

| | | | 40,000,000 | USD | | 0.87% due 4/7/2017 | | | 39,991,522 |

| | |

| | | | 25,000,000 | USD | | 0.92% due 4/17/2017 | | | 24,986,884 |

| | |

| | | | 25,000,000 | USD | | 0.91% due 4/19/2017 | | | 24,985,275 |

| | |

| | | | 15,000,000 | USD | | 1.07% due 5/12/2017 | | | 14,979,700 |

| | |

| | | | 10,000,000 | USD | | 1.12% due 5/12/2017 | | | 9,986,467 |

| | |

| | | | 10,000,000 | USD | | 1.12% due 5/15/2017 | | | 9,985,437 |

| | |

| | | | 31,100,000 | USD | | 1.15% due 5/18/2017 | | | 31,051,484 |

| | |

| | | | | | | Henkel Corp.: | | | |

| | | | 63,000,000 | USD | | 0.74% due 4/3/2017 (e) | | | 62,995,637 |

| | |

| | | | 44,500,000 | USD | | 0.74% due 4/5/2017 (e) | | | 44,494,833 |

| | |

| | | | 23,900,000 | USD | | 0.75% due 4/10/2017 (e) | | | 23,894,383 |

| | |

| | | | 25,000,000 | USD | | 0.98% due 6/1/2017 (e) | | | 24,959,312 |

| | |

| | | | | | | Johnson & Johnson: | | | |

| | | | 45,900,000 | USD | | 0.73% due 4/6/2017 (e) | | | 45,894,117 |

| | |

| | | | 7,000,000 | USD | | 0.77% due 4/18/2017 (e) | | | 6,997,253 |

| | |

| | | | 18,000,000 | USD | | 0.77% due 4/20/2017 (e) | | | 17,992,120 |

| | |

| | | | 20,200,000 | USD | | 0.77% due 4/28/2017 (e) | | | 20,187,337 |

| | |

| | | | 39,000,000 | USD | | 0.8% due 5/5/2017 (e) | | | 38,968,984 |

| | |

| | | | 50,500,000 | USD | | 0.8% due 5/9/2017 (e) | | | 50,454,866 |

| | |

| | | | | | | Kraft Heinz Foods Co., | | | |

| | | | 20,000,000 | USD | | 1.1% due 4/17/2017 (e) | | | 19,986,674 |

| | |

| | | | | | | L’Oréal USA Inc.: | | | |

| | | | 10,000,000 | USD | | 0.83% due 4/18/2017 (e) | | | 9,995,835 |

| | |

| | | | 46,000,000 | USD | | 0.79% due 4/21/2017 (e) | | | 45,977,460 |

| | |

| | | | 30,000,000 | USD | | 0.83% due 4/27/2017 (e) | | | 29,980,807 |

| | |

| | | | | | | Merck & Co. Inc.: | | | |

| | | | 32,700,000 | USD | | 0.81% due 4/28/2017 (e) | | | 32,679,501 |

| | |

| | | | 19,000,000 | USD | | 0.83% due 5/1/2017 (e) | | | 18,986,715 |

| | |

| | | | 13,000,000 | USD | | 0.84% due 5/10/2017 (e) | | | 12,988,054 |

| | |

| | | | | | | Microsoft Corp.: | | | |

| | | | 30,000,000 | USD | | 0.64% due 4/12/2017 (e) | | | 29,991,940 |

| | |

| | | | 30,000,000 | USD | | 0.75% due 5/10/2017 (e) | | | 29,971,433 |

| | |

| | | | 20,000,000 | USD | | 0.77% due 5/16/2017 (e) | | | 19,977,843 |

| | |

| | | | 26,000,000 | USD | | 0.82% due 5/18/2017 (e) | | | 25,969,840 |

| | |

| | | | 25,000,000 | USD | | 0.85% due 5/23/2017 (e) | | | 24,967,685 |

| | |

| See Notes to Financial Statements. | | 15 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | PRINCIPAL | | | | | | |

| | | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | |

| | Commercial Paper | 40.6% (continued) | | | | |

| | | | | | | Nestlé Capital Corp., 0.7% | | | |

| | | | 35,000,000 | USD | | due 5/10/2017 (e) | | $ | 34,967,800 |

| | |

| | | | | | | Nestlé Finance International Ltd., | | | |

| | | | 30,000,000 | USD | | 0.77% due 5/8/2017 (e) | | | 29,973,970 |

| | |

| | | | | | | Novartis Finance Corp.: | | | |

| | | | 25,000,000 | USD | | 0.83% due 4/7/2017 (e) | | | 24,996,062 |

| | |

| | | | 30,000,000 | USD | | 0.72% due 4/10/2017 (e) | | | 29,993,200 |

| | |

| | | | 15,000,000 | USD | | 0.72% due 4/13/2017 (e) | | | 14,995,542 |

| | |

| | | | 25,000,000 | USD | | 0.73% due 4/18/2017 (e) | | | 24,989,587 |

| | |

| | | | 50,000,000 | USD | | 0.73% due 4/21/2017 (e) | | | 49,975,500 |

| | |

| | | | 22,000,000 | USD | | 0.85% due 4/26/2017 (e) | | | 21,986,479 |

| | |

| | | | 20,000,000 | USD | | 0.85% due 5/1/2017 (e) | | | 19,985,154 |

| | |

| | | | 38,900,000 | USD | | 0.85% due 5/4/2017 (e) | | | 38,868,148 |

| | |

| | | | 20,000,000 | USD | | 0.85% due 5/9/2017 (e) | | | 19,981,042 |

| | |

| | | | 1,400,000 | USD | | 0.87% due 5/22/2017 (e) | | | 1,398,186 |

| | |

| | | | | | | Procter & Gamble Co.: | | | |

| | | | 55,200,000 | USD | | 0.69% due 4/4/2017 (e) | | | 55,195,302 |

| | |

| | | | 25,000,000 | USD | | 0.7% due 4/5/2017 (e) | | | 24,997,337 |

| | |

| | | | 35,000,000 | USD | | 0.8% due 4/17/2017 (e) | | | 34,987,059 |

| | |

| | | | 22,000,000 | USD | | 0.8% due 4/24/2017 (e) | | | 21,988,311 |

| | |

| | | | 35,000,000 | USD | | 0.82% due 4/25/2017 (e) | | | 34,980,580 |

| | |

| | | | 20,000,000 | USD | | 0.81% due 4/27/2017 (e) | | | 19,987,955 |

| | |

| | | | | | | Roche Holdings, Inc.: | | | |

| | | | 17,000,000 | USD | | 0.66% due 4/4/2017 (e) | | | 16,998,481 |

| | |

| | | | 38,900,000 | USD | | 0.66% due 4/10/2017 (e) | | | 38,891,183 |

| | |

| | | | 15,000,000 | USD | | 0.62% due 4/11/2017 (e) | | | 14,996,246 |

| | |

| | | | 30,000,000 | USD | | 0.66% due 4/12/2017 (e) | | | 29,991,790 |

| | |

| | | | 20,000,000 | USD | | 0.62% due 4/13/2017 (e) | | | 19,994,056 |

| | |

| | | | 20,000,000 | USD | | 0.66% due 4/17/2017 (e) | | | 19,992,152 |

| | |

| | | | 10,000,000 | USD | | 0.67% due 4/19/2017 (e) | | | 9,995,588 |

| | |

| | | | 20,000,000 | USD | | 0.68% due 4/24/2017 (e) | | | 19,988,707 |

| | |

| | | | 42,400,000 | USD | | 0.67% due 4/25/2017 (e) | | | 42,375,002 |

| | |

| | | | 50,000,000 | USD | | 0.8% due 4/26/2017 (e) | | | 49,969,269 |

| | |

| | | | | | | Schlumberger Holdings Corp., | | | |

| | | | 19,000,000 | USD | | 0.95% due 4/3/2017 (e) | | | 18,998,288 |

| | |

| | | | | | | Siemens Capital Co., LLC, | | | |

| | | | 11,000,000 | USD | | 0.88% due 5/1/2017 (e) | | | 10,991,835 |

| | |

| | | | | | | Unilever Capital Corp.: | | | |

| | | | 20,000,000 | USD | | 0.75% due 4/3/2017 (e) | | | 19,998,675 |

| | |

| | | | 25,000,000 | USD | | 0.72% due 4/11/2017 (e) | | | 24,993,851 |

| | |

| | | | 17,200,000 | USD | | 0.84% due 5/1/2017 (e) | | | 17,187,529 |

| | |

| | | | 25,000,000 | USD | | 0.85% due 5/8/2017 (e) | | | 24,977,490 |

| | |

| 16 | | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | PRINCIPAL | | | | | | |

| | | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | |

| | Commercial Paper | 40.6% (continued) | | | | |

| | | | | | | United Healthcare Co.: | | | |

| | | | 25,000,000 | USD | | 1.1% due 4/20/2017 (e) | | $ | 24,984,472 |

| | |

| | | | 44,500,000 | USD | | 1.2% due 5/26/2017 (e) | | | 44,418,110 |

| | |

| | | | 30,000,000 | USD | | 1.2% due 6/5/2017 (e) | | | 29,933,780 |

| | | | | | | United Parcel Service, Inc.: | | | |

| | | | 30,000,000 | USD | | 0.78% due 4/20/2017 (e) | | | 29,986,367 |

| | |

| | | | 23,000,000 | USD | | 0.76% due 4/24/2017 (e) | | | 22,987,319 |

| | |

| | | | 35,000,000 | USD | | 0.8% due 4/24/2017 (e) | | | 34,980,703 |

| | |

| | | | 25,000,000 | USD | | 0.8% due 4/27/2017 (e) | | | 24,984,381 |

| | |

| | | | 25,000,000 | USD | | 0.82% due 5/15/2017 (e) | | | 24,972,969 |

| | |

| | | | 25,000,000 | USD | | 0.82% due 5/17/2017 (e) | | | 24,971,669 |

| | |

| | | | 38,000,000 | USD | | 0.82% due 5/26/2017 (e) | | | 37,947,805 |

| | |

| | | | | | | United Technologies Corp., | | | |

| | | | 5,000,000 | USD | | 1.22% due 4/27/2017 (e) | | | 4,995,425 |

| | |

| | | | | | | Wal-Mart Stores, Inc.: | | | |

| | | | 40,000,000 | USD | | 0.79% due 4/3/2017 (e) | | | 39,997,450 |

| | |

| | | | 35,000,000 | USD | | 0.66% due 4/4/2017 (e) | | | 34,997,021 |

| | |

| | | | 11,000,000 | USD | | 0.68% due 4/4/2017 (e) | | | 10,999,064 |

| | |

| | | | 25,000,000 | USD | | 0.78% due 4/5/2017 (e) | | | 24,997,337 |

| | |

| | | | 20,000,000 | USD | | 0.75% due 4/10/2017 (e) | | | 19,995,700 |

| | |

| | | | 40,000,000 | USD | | 0.66% due 4/11/2017 (e) | | | 39,990,528 |

| | |

| | | | 40,100,000 | USD | | 0.8% due 4/11/2017 (e) | | | 40,090,504 |

| | |

| | | | | | | Walt Disney Co., | | | |

| | | | 40,000,000 | USD | | 0.84% due 5/19/2017 (e) | | | 39,952,524 |

| | |

| | | | | | | | | | 3,312,204,876 |

| | | | | | | | | |

| | |

| | Treasury Bills | 0.1% | | | | | | | | |

| | | | 5,000,000 | USD | | U.S. Treasury Bill, due 6/8/2017 (h) | | | 4,993,535 |

| | |

| | | | | | | TOTAL SHORT-TERM INVESTMENTS | | | |

| | | | | | | (Cost — $3,317,356,284) | | | 3,317,198,411 |

| | |

| | | | | | | TOTAL INVESTMENTS — 99.8% | | | |

| | | | | | | (Cost — $6,937,985,564) | | | 8,127,749,949 |

| | |

| | | | | | | Other Assets In Excess of | | | |

| | | | | | | Liabilities — 0.2% | | | 17,917,440 |

| | |

| | | | | | | TOTAL NET ASSETS — 100.0% | | $ | 8,145,667,389 |

| | | | | | | | | |

| See Notes to Financial Statements. | | 17 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | The IVA Worldwide Fund had the following open forward foreign currency contracts at March 31, 2017: |

| | | | | | | | | | | | | | USD | | NET |

| | | | | | | SETTLEMENT | | LOCAL | | | | | VALUE AT | | UNREALIZED |

| FOREIGN | | | | | | DATES | | CURRENCY | | | USD | | MARCH 31, | | APPRECIATION/ |

| CURRENCY | | | COUNTERPARTY | | | THROUGH | | AMOUNT | | | EQUIVALENT | | 2017 | | (DEPRECIATION) |

| |

| Contracts to Sell: |

| | | | State Street | | | | | | | | | | | | | | | | |

| Australian | | | Bank & | | | | | | | | | | | | | | | | |

dollar | | | Trust Co. | | | 06/07/2017 | | AUD 50,786,000 | | $ | 38,797,013 | | $ | 38,755,831 | | | $ | 41,182 | |

| |

| | | | State Street | | | | | | | | | | | | | | | | |

| | | | Bank & | | | | | | | | | | | | | | | | |

| euro | | | Trust Co. | | | 06/07/2017 | | EUR 63,705,000 | | | 67,396,705 | | | 68,160,717 | | | | (764,012 | ) |

| |

| | | | State Street | | | | | | | | | | | | | | | | |

| Japanese | | | Bank & | | | | | | | | | | | | | | | | |

yen | | | Trust Co. | | | 06/07/2017 | | JPY 17,686,200,000 | | | 155,618,837 | | | 159,237,781 | | | | (3,618,944 | ) |

| |

| South | | | State Street | | | | | | | | | | | | | | | | |

Korean | | | Bank & | | | | | | | | | | | | | | | | |

won | | | Trust Co. | | | 05/08/2017 | | KRW 131,760,000,000 | | | 116,639,940 | | | 117,942,979 | | | | (1,303,039 | ) |

| |

| Net Unrealized Depreciation on Open Forward Foreign Currency Contracts | | | | | | | $ | (5,644,813 | ) |

| |

| Abbreviations used in this schedule: |

| | | |

| ADR | — | American Depositary Receipt |

| AUD | — | Australian dollar |

| EUR | — | euro |

| JPY | — | Japanese yen |

| KRW | — | South Korean won |

| NV | — | Non-voting |

| SGD | — | Singapore dollar |

| USD | — | United States dollar |

| 18 | | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | (a) | | Non-income producing investment. |

| | (b) | | Issuer of the security is an affiliate of the IVA Worldwide Fund as defined by the Investment Company Act of 1940. An affiliate is deemed as a company in which the IVA Worldwide Fund indirectly or directly has ownership of at least 5% of the company’s outstanding voting securities. See Schedule of Affiliates below for additional information. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | Schedule of Affiliates | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | SHARES | | | | | | | | | | SHARES | | | | | | | | | | | |

| | | | HELD AT | | | | | | | | | | HELD AT | | FAIR VALUE AT | | | | | | | |

| | | | SEPTEMBER 30, | | SHARE | | SHARE | | MARCH 31, | | MARCH 31, | | REALIZED | | DIVIDEND |

| | SECURITY | | 2016 | | ADDITIONS | | REDUCTIONS | | 2017 | | 2017 | | GAIN/(LOSS) | | INCOME* |

| | |

| | DeVry | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Education | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Group | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Inc.** | | | 6,567,795 | | | | — | | | | 4,119,920 | | | | 2,447,875 | | | | — | | | $ | (16,481,162 | ) | | $ | 803,819 |

| | |

| | Icom Inc. | | | 758,200 | | | | — | | | | 2,500 | | | | 755,700 | | | $ | 17,370,307 | | | | (88 | ) | | | 68,060 |

| | |

| | Net 1 U.E.P.S. | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Technologies | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Inc.** | | | 2,835,280 | | | | — | | | | 299,864 | | | | 2,535,416 | | | | — | | | | 552,279 | | | | — |

| | |

| | Total | | | | | | | | | | | | | | | | | | $ | 17,370,307 | | | $ | (15,928,971 | ) | | $ | 871,879 |

| | |

| | * | | Dividend income is gross of withholding taxes. |

| | ** | | Non-affiliated at March 31, 2017. |

| | | | |

| | (c) | | Security is deemed illiquid. As of March 31, 2017, the value of these illiquid securities amounted to 0.0% of total net assets. |

| | (d) | | Cumulative redeemable preferred stock. The date shown represents the first optional call date. |

| | (e) | | Security is exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933 (the “1933 Act”). Any resale of these securities must generally be effected through a sale that is registered under the 1933 Act or otherwise exempted from such registration requirements. |

| | (f) | | Payment-in-kind security for which the issuer may pay interest with additional debt securities or cash. |

| | (g) | | Fixed-to-float perpetual bond. The security has no maturity date. The date shown represents the next call date. |

| | (h) | | This security is held at the custodian as collateral for forward foreign currency contracts sold. As of March 31, 2017, portfolio securities valued at $4,993,535 were segregated to cover collateral requirements. |

| IVA International Fund | IVA Funds |

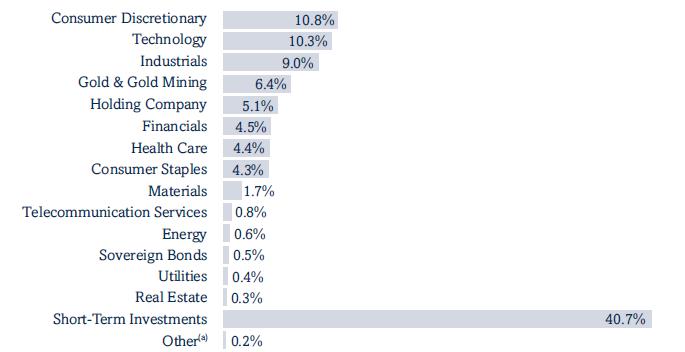

| Performance (unaudited) | As of March 31, 2017 |

| Average Annual Total Returns as of March 31, 2017 | | Six Months(a) | | One Year | | Five Year | | Since Inception(b) |

| | | | | | | | | |

| Class A | | | 4.25 | % | | | 8.31 | % | | | 6.01 | % | | | 8.39 | % |

| Class A (with a 5% maximum initial sales charge) | | | -0.98 | % | | | 2.93 | % | | | 4.92 | % | | | 7.74 | % |

| Class C | | | 3.86 | % | | | 7.55 | % | | | 5.23 | % | | | 7.58 | % |

| Class I | | | 4.38 | % | | | 8.57 | % | | | 6.28 | % | | | 8.66 | % |

| MSCI All Country World (ex-U.S.) Index (Net)(c) | | | 6.51 | % | | | 13.13 | % | | | 4.36 | % | | | 4.47 | % |

| Consumer Price Index(d) | | | 1.14 | % | | | 2.45 | % | | | 1.28 | % | | | 1.27 | % |

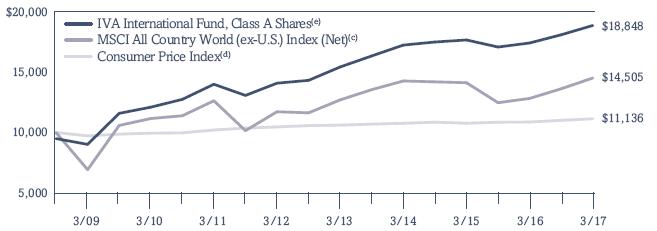

| Growth of a $10,000 Initial Investment | |

| | |

| |

| (a) | | Total returns for periods of less than one year are not annualized. |

| (b) | | The Fund commenced investment operations on October 1, 2008. |

| (c) | | The MSCI All Country World (ex-U.S.) Index (Net) is an unmanaged, free float-adjusted, market capitalization weighted index composed of stocks of companies located in countries throughout the world, excluding the United States. It is designed to measure equity market performance in global developed and emerging markets outside the United States. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. |

| (d) | | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. |

| (e) | | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2017. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482.

The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. The expense ratios for the Fund are as follows: 1.24% (Class A shares); 1.99% (Class C shares); and 0.99% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2017. More recent expense ratios can be found in the Financial Highlights section of this Semi-Annual Report.

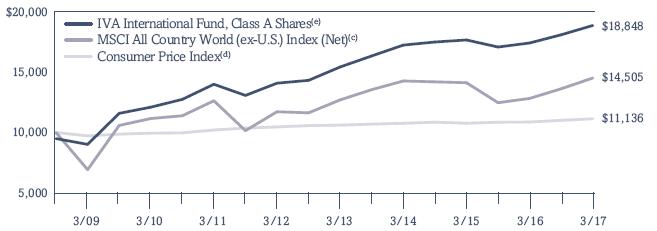

| IVA International Fund | IVA Funds |

| Portfolio Composition (unaudited) | As of March 31, 2017 |

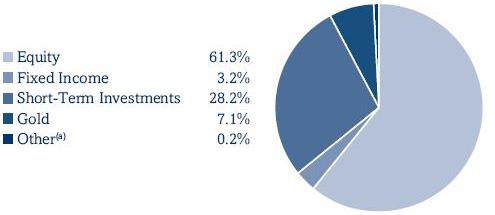

| Asset Allocation (As a Percent of Total Net Assets) | |

| | |

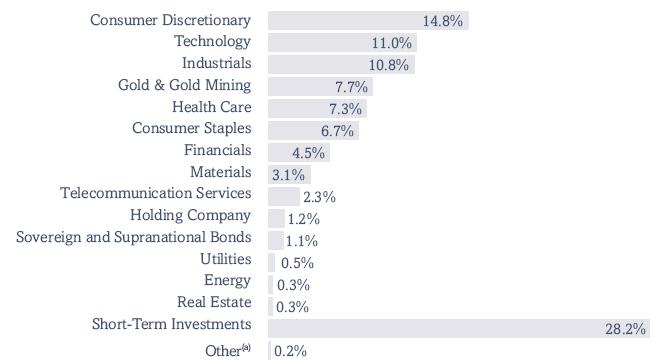

| Sector Allocation (As a Percent of Total Net Assets) | |

| | |

| Top 10 Positions (As a Percent of Total Net Assets)(b) | |

| | |

| Gold Bullion | | 7.1 | % |

| |

| Astellas Pharma Inc. | | 4.0 | % |

| |

| Bureau Veritas SA | | 3.1 | % |

| |

| Nestlé SA | | 2.5 | % |

| |

| Alten SA | | 2.3 | % |

| |

| Samsung Electronics Co., Ltd. | | 2.3 | % |

| |

| Antofagasta Plc | | 1.8 | % |

| |

| Airbus Group SE | | 1.6 | % |

| |

| First Resources Ltd. | | 1.5 | % |

| |

| Hyundai Mobis Co., Ltd. | | 1.5 | % |

| |

| Top 10 positions represent 27.7% of total net assets. |

| (a) | | Other represents unrealized gains and losses on forward foreign currency contracts and other assets and liabilities. |

| (b) | | Short-Term Investments are not included. |

| IVA International Fund | | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| | COMMON STOCKS – 61.3% | | | | | | | |

| | |

| | Argentina | 0.0% | | | | | | | |

| | | | 876 | | Nortel Inversora SA, Series ‘B’, ADR | | $ | 22,776 |

| | |

| | | | | | | | | |

| | |

| | Australia | 0.0% | | | | | | | |

| | | | 1,351,864 | | Programmed Maintenance Services Ltd. | | | 1,936,544 |

| | |

| | | | | | | | | |

| | |

| | Bermuda | 1.1% | | | | | | | |

| | | | 976,326 | | Jardine Strategic Holdings Ltd. | | | 41,005,692 |

| | |

| | | | | | | | | |

| | |

| | Brazil | 0.3% | | | | | | | |

| | | | 1,515,600 | | TOTVS SA | | | 13,434,453 |

| | |

| | | | | | | | | |

| | |

| | Canada | 0.3% | | | | | | | |

| | | | 3,307,348 | | Uranium Participation Corp. (a) | | | 10,097,254 |

| | |

| | | | | | | | | |

| | |

| | Chile | 0.4% | | | | | | | |

| | | | 551,948 | | Compañía Cervecerías Unidas SA, ADR | | | 13,947,726 |

| | |

| | | | | | | | | |

| | |

| | China | 2.7% | | | | | | | |

| | | | 96,761 | | Baidu Inc., ADR (a) | | | 16,693,208 |

| | |

| | | | 40,065,030 | | Clear Media Ltd. (b) | | | 46,398,414 |

| | |

| | | | 3,441,970 | | Phoenix New Media Ltd., ADR (a) | | | 12,012,475 |

| | |

| | | | 59,788,000 | | Phoenix Satellite Television Holdings Ltd. | | | 11,155,195 |

| | |

| | | | 108,509,000 | | Springland International Holdings Ltd. | | | 19,407,773 |

| | |

| | | | | | | | | 105,667,065 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | France | 11.6% | | | | | | | |

| | | | 1,186,888 | | Alten SA | | | 91,012,435 |

| | |

| | | | 2,076,828 | | Altran Technologies SA | | | 34,961,532 |

| | |

| | | | 12,736,006 | | Bolloré SA | | | 49,374,317 |

| | |

| | | | 84,610 | | Bolloré SA NV (a) | | | 321,333 |

| | |

| | | | 5,779,454 | | Bureau Veritas SA | | | 121,923,166 |

| | |

| | | | 188,235 | | DOM Security SA (b) | | | 11,446,117 |

| | |

| | | | 1,463,806 | | Engie SA | | | 20,737,888 |

| | |

| | | | 184,201 | | Euler Hermes Group | | | 16,926,992 |

| | |

| | | | 30,023 | | Financière de l’Odet SA | | | 25,142,396 |

| | |

| | | | 79,189 | | Robertet SA | | | 29,567,583 |

| | |

| | | | 5,900 | | Robertet SA-CI (c) | | | 1,724,589 |

| | |

| | | | 300,428 | | Séché Environnement SA | | | 8,852,114 |

| | |

| | | | 167,314 | | Sodexo SA | | | 19,678,582 |

| | |

| | | | 155,834 | | Thales SA | | | 15,071,652 |

| | |

| | | | 29,983 | | Wendel SA | | | 3,799,920 |

| | |

| | | | | | | | | 450,540,616 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Germany | 1.3% | | | | | | | |

| | | | 228,887 | | Bayerische Motoren Werke AG | | | 20,879,542 |

| | |

| | | | 225,710 | | Siemens AG | | | 30,917,100 |

| | |

| | | | | | | | | 51,796,642 |

| | | | | | | | |

| 22 | | See Notes to Financial Statements. |

| IVA International Fund | | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | |

| | |

| | Hong Kong | 2.7% | | | | | | | |

| | | | 40,491,000 | | APT Satellite Holdings Ltd. | | $ | 21,622,293 |

| | |

| | | | | | Asia Satellite Telecommunications | | | |

| | |

| | | | 15,821,000 | | Holdings Ltd. (a) | | | 19,543,409 |

| | |

| | | | 1,900,386 | | Henderson Land Development Co. Ltd. | | | 11,774,250 |

| | |

| | | | 44,448,917 | | Hongkong & Shanghai Hotels Ltd. | | | 52,276,021 |

| | |

| | | | | | | | | 105,215,973 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | India | 0.8% | | | | | | | |

| | | | 425,750 | | Bajaj Holdings and Investment Ltd. | | | 14,227,728 |

| | |

| | | | 47,141,230 | | South Indian Bank Ltd. | | | 15,535,879 |

| | |

| | | | | | | | | 29,763,607 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Indonesia | 0.3% | | | | | | | |

| | | | 288,943,800 | | PT Bank Bukopin Tbk | | | 13,552,203 |

| | |

| | | | | | | | | |

| | |

| | Japan | 14.4% | | | | | | | |

| | | | 1,325,570 | | Arcland Sakamoto Co., Ltd. | | | 15,931,130 |

| | |

| | | | 285,100 | | As One Corp. | | | 12,343,322 |

| | |

| | | | 11,760,600 | | Astellas Pharma Inc. | | | 154,864,274 |

| | |

| | | | 1,135,200 | | Azbil Corp. | | | 38,135,705 |

| | |

| | | | 73,800 | | The Bank of Okinawa Ltd. | | | 2,823,929 |

| | |

| | | | 379,200 | | Benesse Holdings Inc. | | | 11,853,193 |

| | |

| | | | 1,010,100 | | Cosel Co., Ltd. | | | 13,727,488 |

| | |

| | | | 371,100 | | Daiseki Co., Ltd. | | | 7,566,667 |

| | |

| | | | 605,800 | | Doshisha Co., Ltd. | | | 11,214,891 |

| | |

| | | | 214,500 | | Earth Chemical Co., Ltd. | | | 11,502,425 |

| | |

| | | | 4,096,300 | | F@N Communications, Inc. (b) | | | 30,575,993 |

| | |

| | | | 175,400 | | FANUC Corp. | | | 35,952,825 |

| | |

| | | | 819,800 | | Hi-Lex Corp. | | | 21,744,987 |

| | |

| | | | 662,700 | | Icom Inc. | | | 15,232,635 |

| | |

| | | | 105,900 | | Medikit Co., Ltd. | | | 4,432,713 |

| | |

| | | | 413,600 | | Miraca Holdings Inc. | | | 19,021,216 |

| | |

| | | | 780,000 | | Nitto Kohki Co., Ltd. | | | 17,858,798 |

| | |

| | | | 268,900 | | Okinawa Cellular Telephone Co. | | | 8,707,307 |

| | |

| | | | 1,011,000 | | Rohto Pharmaceutical Co., Ltd. | | | 18,943,196 |

| | |

| | | | 171,300 | | San-A Co., Ltd. | | | 7,785,664 |

| | |

| | | | 290,400 | | Sankyo Co., Ltd. | | | 9,703,476 |

| | |

| | | | 10,600 | | Secom Joshinetsu Co., Ltd. | | | 326,579 |

| | |

| | | | 276,000 | | Seven & i Holdings Co., Ltd. | | | 10,813,905 |

| | |

| | | | 495,575 | | Shingakukai Co., Ltd. | | | 2,599,621 |

| | |

| | | | 300,650 | | Shofu Inc. | | | 3,572,801 |

| | |

| | | | 4,500 | | SK Kaken Co., Ltd. | | | 440,582 |

| | |

| | | | 556,900 | | Techno Medica Co., Ltd. (b) | | | 10,604,761 |

| | |

| | | | 637,600 | | Toho Co., Ltd. | | | 16,900,724 |

| | |

| | | | 255,200 | | Transcosmos Inc. | | | 5,996,615 |

| | |

| | | | 8,366,000 | | Yahoo Japan Corp. | | | 38,625,025 |

| | |

| | | | | | | | | 559,802,447 |

| | | | | | | | |

| See Notes to Financial Statements. | 23 |

| IVA International Fund | | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | |

| | |

| | Malaysia | 1.3% | | | | | | | |

| | | | 40,205,300 | | Genting Malaysia Berhad | | $ | 49,512,797 |

| | |

| | | | | | | | | |

| | |

| | Mexico | 0.9% | | | | | | | |

| | | | 1,133,839 | | Corporativo Fragua, SAB de CV | | | 12,778,683 |

| | |

| | | | 11,084,097 | | Grupo Comercial Chedraui SAB de CV | | | 23,888,331 |

| | | | | | | | | 36,667,014 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Netherlands | 1.6% | | | | | | | |

| | | | 834,110 | | Airbus Group SE | | | 63,471,459 |

| | |

| | | | | | | | | |

| | |

| | Norway | 0.0% | | | | | | | |

| | | | 37,272 | | Golden Close Maritime Corp. Ltd. (a)(c) | | | — |

| | |

| | | | | | | | | |

| | |

| | Singapore | 2.8% | | | | | | | |

| | | | 42,447,700 | | First Resources Ltd. | | | 58,868,741 |

| | |

| | | | 7,043,020 | | Haw Par Corp. Ltd. | | | 50,449,341 |

| | |

| | | | | | | | | 109,318,082 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | South Africa | 0.8% | | | | | | | |

| | | | 2,444,574 | | Net 1 U.E.P.S. Technologies Inc. (a) | | | 29,897,140 |

| | |

| | | | | | | | | |

| | |

| | South Korea | 7.3% | | | | | | | |

| | | | 75,334 | | DONGKOOK Pharmaceutical Co., Ltd. | | | 4,338,290 |

| | |

| | | | 80,618 | | Fursys Inc. | | | 2,296,059 |

| | |

| | | | 268,785 | | Hyundai Mobis Co., Ltd. | | | 57,804,518 |

| | |

| | | | 252,562 | | Hyundai Motor Co. | | | 35,570,522 |

| | |

| | | | 1,536,843 | | Kangwon Land, Inc. | | | 52,497,007 |

| | |

| | | | 408,731 | | KT&G Corp. | | | 35,635,583 |

| | |

| | | | 48,803 | | Samsung Electronics Co., Ltd. | | | 89,899,115 |

| | |

| | | | 298,218 | | WHANIN Pharmaceutical Co., Ltd. | | | 4,200,066 |

| | |

| | | | | | | | | 282,241,160 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Switzerland | 4.4% | | | | | | | |

| | | | 347,236 | | Compagnie Financière Richemont SA | | | 27,455,789 |

| | |

| | | | 1,271,232 | | Nestlé SA | | | 97,533,249 |

| | |

| | | | 2,755,821 | | UBS Group AG | | | 44,103,041 |

| | |

| | | | | | | | | 169,092,079 |

| | | | | | | | |

| | | | | | | | | |

| | |

| | Thailand | 0.5% | | | | | | | |

| | | | 30,705,300 | | Thaicom PCL | | | 17,692,687 |

| | |

| | | | | | | | | |

| | |

| | United Kingdom | 4.3% | | | | | | | |

| | | | 6,545,486 | | Antofagasta Plc | | | 68,436,030 |

| | |

| | | | 3,999,945 | | HSBC Holdings Plc | | | 32,620,068 |

| | |

| | | | 1,208,449 | | Jardine Lloyd Thompson Group Plc | | | 17,139,230 |

| | |

| | | | 6,594,416 | | Millennium & Copthorne Hotels Plc | | | 36,436,068 |

| | |

| | | | 5,019,571 | | Mitie Group Plc | | | 13,955,342 |

| | |

| | | | | | | | | 168,586,738 |

| | | | | | | | |

| 24 | See Notes to Financial Statements. |

| IVA International Fund | | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | SHARES | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | |

| | United States | 1.5% | | | | | | | | |

| | | | 3,096,223 | | | News Corp., Class ‘A’ | | $ | 40,250,899 |

| | |

| | | | 1,216,344 | | | News Corp., Class ‘B’ | | | 16,420,644 |

| | |

| | | | | | | | | | 56,671,543 |

| | | | | | | | | |

| | | | | | | TOTAL COMMON STOCKS | | | |

| | |

| | | | | | | (Cost — $2,014,512,650) | | | 2,379,933,697 |

| | | | PRINCIPAL | | | | | | |

| | | | AMOUNT | | | | | | |

| | CORPORATE NOTES & BONDS – 2.1% | | | |

| | | | | | | | | | |

| | |

| | Norway | 0.3% | | | | | | | | |

| | | | | | | Golden Close Maritime Corp. Ltd., | | | |

| | | | 74,103 | USD | | 8% due 3/29/2022 (c)(d)(e) | | | 74,103 |

| | |

| | | | | | | Stolt-Nielsen Ltd., | | | |

| | | | 77,500,000 | NOK | | 5.69% due 3/19/2018 (c)(f) | | | 9,271,189 |

| | |

| | | | | | | | | | 9,345,292 |

| | | | | | | | | |

| | | | | | | | | | |

| | |

| | Singapore | 0.3% | | | | | | | | |

| | | | | | | DBS Capital Funding II Corp., | | | |

| | | | 7,750,000 | SGD | | 5.75% due 6/15/2018 (g) | | | 5,773,344 |

| | |

| | | | | | | United Overseas Bank Ltd., | | | |

| | | | 8,250,000 | SGD | | 4.9% due 7/23/2018 (g) | | | 6,081,061 |

| | |

| | | | | | | | | | 11,854,405 |

| | | | | | | | | |

| | | | | | | | | | |

| | |

| | South Africa | 0.6% | | | | | | | | |

| | | | | | | Gold Fields Orogen Holding (BVI) Ltd., | | | |

| | | | 23,118,000 | USD | | 4.875% due 10/7/2020 (d) | | | 23,349,180 |

| | |

| | Switzerland | 0.1% | | | | | | | | |

| | | | 4,500,000 | EUR | | UBS AG, 7.152% due 12/21/2017 (g) | | | 5,037,101 |

| | |

| | United Kingdom | 0.2% | | | | | | | | |

| | | | | | | Avanti Communications Group Plc: | | | |

| | | | 5,188,226 | USD | | 10% due 10/1/2021 (c)(d)(e) | | | 4,747,227 |

| | |

| | | | 8,523,925 | USD | | 12% due 10/1/2023 (c)(d)(e) | | | 3,494,809 |

| | |

| | | | | | | | | | 8,242,036 |

| | | | | | | | | |

| | | | | | | | | | |

| | |

| | United States | 0.6% | | | | | | | | |

| | | | | | | Intelsat Jackson Holdings Ltd.: | | | |

| | | | 4,096,000 | USD | | 7.5% due 4/1/2021 | | | 3,712,000 |

| | |

| | | | 13,873,000 | USD | | 5.5% due 8/1/2023 | | | 11,462,566 |

| | |

| | | | | | | Rowan Cos., Inc.: | | | |

| | | | 8,168,000 | USD | | 4.875% due 6/1/2022 | | | 7,841,280 |

| | |

| | | | 1,586,000 | USD | | 4.75% due 1/15/2024 | | | 1,431,365 |

| | |

| | | | | | | | | | 24,447,211 |

| | | | | | | | | |

| | | | | | | TOTAL CORPORATE NOTES & BONDS | | | |

| | | | | | | (Cost — $86,345,045) | | | 82,275,225 |

| | |

| See Notes to Financial Statements. | 25 |

| IVA International Fund | | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2017 |

| |

| | | | PRINCIPAL | | | | | | |

| | | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | CONVERTIBLE BONDS – 0.0% | | | |

| | | | | | | | | | |

| | |

| | Norway | 0.0% | | | | | | | | |

| | | | | | | Golden Close Maritime Corp. Ltd., | | | |

| | | | 251,952 | USD | | 0% due 3/29/2022 (c)(d) | | $ | 50,390 |

| | |

| | | | | | | TOTAL CONVERTIBLE BONDS | | | |

| | | | | | | (Cost — $131,883) | | | 50,390 |

| | |

| | SOVEREIGN AND SUPRANATIONAL BONDS – 1.1% | | | |

| | | | | | | | | | |

| | |

| | Luxembourg | 0.1% | | | | | | | | |

| | | | | | | European Investment Bank, | | | |

| | | | 37,500,000 | NOK | | 1.125% due 5/15/2020 | | | 4,385,869 |

| | |

| | | | | | | | | | |

| | |

| | Singapore | 1.0% | | | | | | | | |

| | | | | | | Government of Singapore: | | | |

| | | | 6,786,000 | SGD | | 2.375% due 4/1/2017 | | | 4,852,098 |

| | |

| | | | 21,142,000 | SGD | | 0.5% due 4/1/2018 | | | 15,032,229 |

| | |

| | | | 26,781,000 | SGD | | 2.5% due 6/1/2019 | | | 19,637,230 |

| | |

| | | | | | | | | | 39,521,557 |

| | | | | | | | | |

| | | | | | | TOTAL SOVEREIGN AND SUPRANATIONAL BONDS | | | |