UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☒

Filed by party other than the registrant ☐

Check the appropriate box:

☒ | Preliminary Proxy Statement | ☐ | Confidential, for use of the Commission only |

|

|

| (as permitted by Rule 14a-6(e)(2)). |

☐ | Definitive Proxy Statement |

|

|

|

|

|

|

☐ | Definitive additional materials. |

|

|

|

|

|

|

☐ | Soliciting material under Rule 14a-12. |

|

|

GOLDEN MATRIX GROUP, INC. |

(Name of Registrant as Specified in Charter) |

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | No fee required. | |

|

| |

☒ | Fee paid previously with preliminary materials. | |

|

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

PRELIMINARY PROXY STATEMENT DATED JANUARY 24, 2024 — SUBJECT TO

COMPLETION

Golden Matrix Group, Inc.

3651 S. Lindell Road, Suite D131

Las Vegas, Nevada 89103

January [●], 2024

Dear Fellow Stockholder,

I am pleased to invite you to attend the special meeting of Stockholders of Golden Matrix Group, Inc., a Nevada corporation (“Golden Matrix”, “GMGI”, “we”, “us” or the “Company”) to be held (subject to any postponement(s) or adjournment(s) thereof (the “Special Meeting”)):

Date: |

| [________], [__________], 2024 |

Time: |

| 10:00 a.m. Pacific Time |

Virtual Meeting Site: |

| https://agm.issuerdirect.com/gmgi |

At the Special Meeting, you will be asked to approve (1) for the purposes of Nasdaq Listing Rules 5635(a) and (b), the terms of, and issuance of shares of common stock in connection with, that certain Amended and Restated Sale and Purchase Agreement of Share Capital dated June 27, 2023 (as amended by that certain First Amendment to Amended and Restated Sale and Purchase Agreement of Share Capital dated September 22, 2023, and entered into on September 27, 2023 and that certain Second Amendment to Amended and Restated Sale and Purchase Agreement of Share Capital dated and effective January 22, 2024, and as further amended from time to time, the “Purchase Agreement”) by and between the Company, as purchaser and Aleksandar Milovanović, Zoran Milošević and Snežana Božović, owners of the Meridian Companies (collectively, the “Sellers”), the shareholders of: Meridian Tech Društvo Sa Ograničenom Odgovornošću Beograd, a private limited company formed and registered in and under the laws of the Republic of Serbia, Društvo Sa Ograničenom Odgovornošću “Meridianbet” Društvo Za Proizvodnju, Promet Roba I Usluga, Export Import Podgorica, a private limited company formed and registered in and under the laws of Montenegro, Meridian Gaming Holdings Ltd., a company formed and registered in the Republic of Malta, and Meridian Gaming (Cy) Ltd, a company formed and registered in the Republic of Cyprus (collectively, the “Meridian Companies”), including the shares of Company common stock issuable upon conversion of certain shares of Series C Voting Preferred Stock issuable in connection therewith and any shares of common stock issuable in connection with the indemnification obligations set forth in the Purchase Agreement, pursuant to which the Company will acquire the Meridian Companies (the “Purchase Agreement Proposal”); (2) on a non-binding, advisory basis, the compensation that may be paid or become payable to certain of Golden Matrix’s named executive officers prior to, or after, the Purchase; (3) for the purposes of complying with the applicable listing rules of Nasdaq, to consider and vote upon a proposal to approve the issuance of more than 20% of the Company’s issued and outstanding common stock and voting stock in certain offerings after the date of the Special Meeting (the “Nasdaq Proposal”); (4) the adoption of a Certificate of Amendment to amend our Amended and Restated Articles of Incorporation to remove the provisions thereof providing for a three class, classified Board of Directors of the Company (the “Declassification Proposal”); (5) the adoption of a Certificate of Amendment to amend our Amended and Restated Articles of Incorporation to opt out of Nevada Revised Statutes Sections 78.378 to 78.3793 (the Nevada Control Share Act) (the “Control Share Act Opt Out Proposal”); (6) the adoption of a Certificate of Amendment to amend our Amended and Restated Articles of Incorporation to amend Article VI thereof to (a) remove the Board of Directors’ exclusive right to make, amend, alter, or repeal the bylaws of the Company; and (b) provide that nothing in the Amended and Restated Articles of Incorporation shall deny the concurrent power of the stockholders (together with the directors) to adopt, alter, amend, restate, or repeal the Bylaws of the Company (the “Stockholder Bylaws Amendment Proposal”); (7) the adoption of a Certificate of Amendment to our Amended and Restated Articles of Incorporation to amend Article III, Section 1, to increase the Company’s authorized number of shares of common stock from two hundred and fifty million (250,000,000) shares to three hundred million (300,000,000) shares (the “Authorized Shares Increase Proposal”); (8) the adoption of the Golden Matrix Group, Inc. 2023 Equity Incentive Plan; and (9) an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Purchase Agreement Proposal or Nasdaq Proposal (the “Adjournment Proposal”).

i |

As used herein, “Purchase” means the acquisitions and related transactions contemplated by the Purchase Agreement. The Board of Directors of Golden Matrix has unanimously approved the Purchase Agreement and the transactions contemplated thereby.

We are soliciting proxies for use at the Special Meeting of Golden Matrix’s stockholders to consider and vote upon the nine (9) proposals discussed above. Our Board of Directors unanimously recommends that you vote “FOR” each of the proposals discussed above.

A complete list of stockholders entitled to vote at the Special Meeting will be available at our principal executive offices, for any purpose germane to the Special Meeting, during ordinary business hours, for a period of ten days prior to the Special Meeting.

Your vote is very important. Whether or not you plan to attend the Special Meeting, please vote your shares by, telephone, fax, over the Internet or by signing and returning the enclosed proxy card, as soon as possible to make sure that your shares of common stock of Golden Matrix are represented at the Special Meeting.

You will not be able to attend the Special Meeting physically. The Special Meeting will be held via an audio teleconference. Stockholders may attend, vote and submit questions during the Special Meeting via the Internet by logging in at https://agm.issuerdirect.com/gmgi (please note this link is case sensitive), with your Control ID and Request ID, and thereafter following the instructions to join the virtual meeting. In addition to voting by submitting your proxy prior to the Special Meeting and/or voting online as discussed herein, you also will be able to vote your shares electronically during the Special Meeting with your Request ID. Details regarding the business to be conducted are more fully described in the accompanying Notice of Special Meeting and Proxy Statement.

As permitted by the rules of the Securities and Exchange Commission (the “SEC” or the “Commission”), we have provided access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, or E-proxy notice, on or about [●], 2024, to our stockholders of record as of the close of business on [●], 2024. The E-proxy notice contains instructions for your use of this process, including how to access our proxy statement and annual report and how to authorize your proxy to vote online. In addition, the E-proxy notice contains instructions on how you may receive a paper copy of the proxy statement and annual report or elect to receive your proxy statement and annual report over the Internet. We believe these rules allow us to provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of the Special Meeting.

ii |

The Notice of Special Meeting and Proxy Statement, is also available at https://www.iproxydirect.com/gmgi. Stockholders may also request a copy of the Proxy Statement by contacting our main office at (702) 318-7548.

The accompanying Proxy Statement provides you with detailed information about the proposed Purchase, the Special Meeting and the other business to be considered by Golden Matrix’s stockholders. We encourage you to read the entire Proxy Statement, the Purchase Agreement and the other Annexes attached to the Proxy Statement, carefully. You may also obtain more information about Golden Matrix from documents we have filed with the Commission, certain of which are incorporated by reference in the Proxy Statement as disclosed therein.

On behalf of the Board of Directors of Golden Matrix, we would like to thank you for being a stockholder and express our appreciation for your ongoing support and continued interest in Golden Matrix. We are excited about the opportunities the Purchase will bring to our stockholders.

Very truly yours,

Anthony Brian Goodman

Chief Executive Officer and Chairman

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this Proxy Statement. Any representation to the contrary is a criminal offense.

The accompanying Proxy Statement is dated January [●], 2024, and is first being made available to Golden Matrix stockholders on or about January [●], 2024.

Important Notice Regarding the Availability of Proxy Materials for the Virtual Special Meeting of Stockholders to Be Held on [__________], 2024.

Our Proxy Statement is available at the following cookies-free website that can be accessed anonymously: https://agm.issuerdirect.com/GMGI (please note this link is case sensitive). Stockholders may also vote prior to the meeting at www.iproxydirect.com/gmgi (please note this link is case sensitive).

iii |

Golden Matrix Group, Inc.

3651 S. Lindell Road, Suite D131

Las Vegas, Nevada 89103

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [●], 2024

NOTICE IS HEREBY GIVEN that the Special Meeting of Stockholders of Golden Matrix Group, Inc. (“Golden Matrix”, “we”, “us” or the “Company”), which will be held on [●], [●], 2024 at [●].M. [______] time (subject to postponement(s) or adjournment(s) thereof), which we refer to as the Special Meeting. The Special Meeting will be held virtually via live audio webcast at https://agm.issuerdirect.com/gmgi (please note this link is case sensitive). See also “Instructions For The Virtual Special Meeting”, below.

A Proxy Statement for the Special Meeting is below.

You are cordially invited to attend the Special Meeting, which will be held for the following purposes:

1. The Purchase Agreement Proposal – to consider and vote upon a proposal to approve, for the purposes of Nasdaq Listing Rules 5635(a) and (b), the terms of, and the issuance of shares of common stock in connection with, that certain Amended and Restated Sale and Purchase Agreement of Share Capital dated June 27, 2023 (as amended by that certain First Amendment to Amended and Restated Sale and Purchase Agreement of Share Capital dated September 22, 2023 and that certain Second Amendment to Amended and Restated Sale and Purchase Agreement of Share Capital dated and effective January 22, 2024, and entered into on September 27, 2023, and as further amended from time to time, the “Purchase Agreement”) by and between the Company, as purchaser and Aleksandar Milovanović, Zoran Milošević and Snežana Božović, owners of the Meridian Companies (collectively, the “Sellers”), the shareholders of: Meridian Tech Društvo Sa Ograničenom Odgovornošću Beograd, a private limited company formed and registered in and under the laws of the Republic of Serbia, Društvo Sa Ograničenom Odgovornošću “Meridianbet” Društvo Za Proizvodnju, Promet Roba I Usluga, Export Import Podgorica, a private limited company formed and registered in and under the laws of Montenegro, Meridian Gaming Holdings Ltd., a company formed and registered in the Republic of Malta, and Meridian Gaming (Cy) Ltd, a company formed and registered in the Republic of Cyprus (collectively, the “Meridian Companies”), including the shares of Company common stock issuable upon conversion of certain shares of Series C Voting Preferred Stock issued in connection therewith and any shares of common stock issuable in connection with the indemnification obligations set forth in the Purchase Agreement, pursuant to which the Company will acquire the Meridian Companies (Proposal No. 1);

2. The Compensation Proposal – to consider and vote upon, on a non-binding, advisory basis, the contingent compensation that may be paid or become payable to certain of Golden Matrix’s named executive officers after the Purchase (Proposal No. 2);

3. The Nasdaq Proposal – to consider and vote upon a proposal to approve, for the purposes of complying with the applicable listing rules of Nasdaq, the issuance of more than 20% of the Company’s issued and outstanding common stock and voting stock in certain offerings after the date of the Special Meeting (Proposal No. 3);

iv |

4. The Declassification Proposal – to consider and vote upon the adoption of a Certificate of Amendment to amend our Amended and Restated Articles of Incorporation to remove the provisions thereof providing for a three class, classified Board of Directors of the Company (the “Declassification of the Board”) (Proposal No. 4);

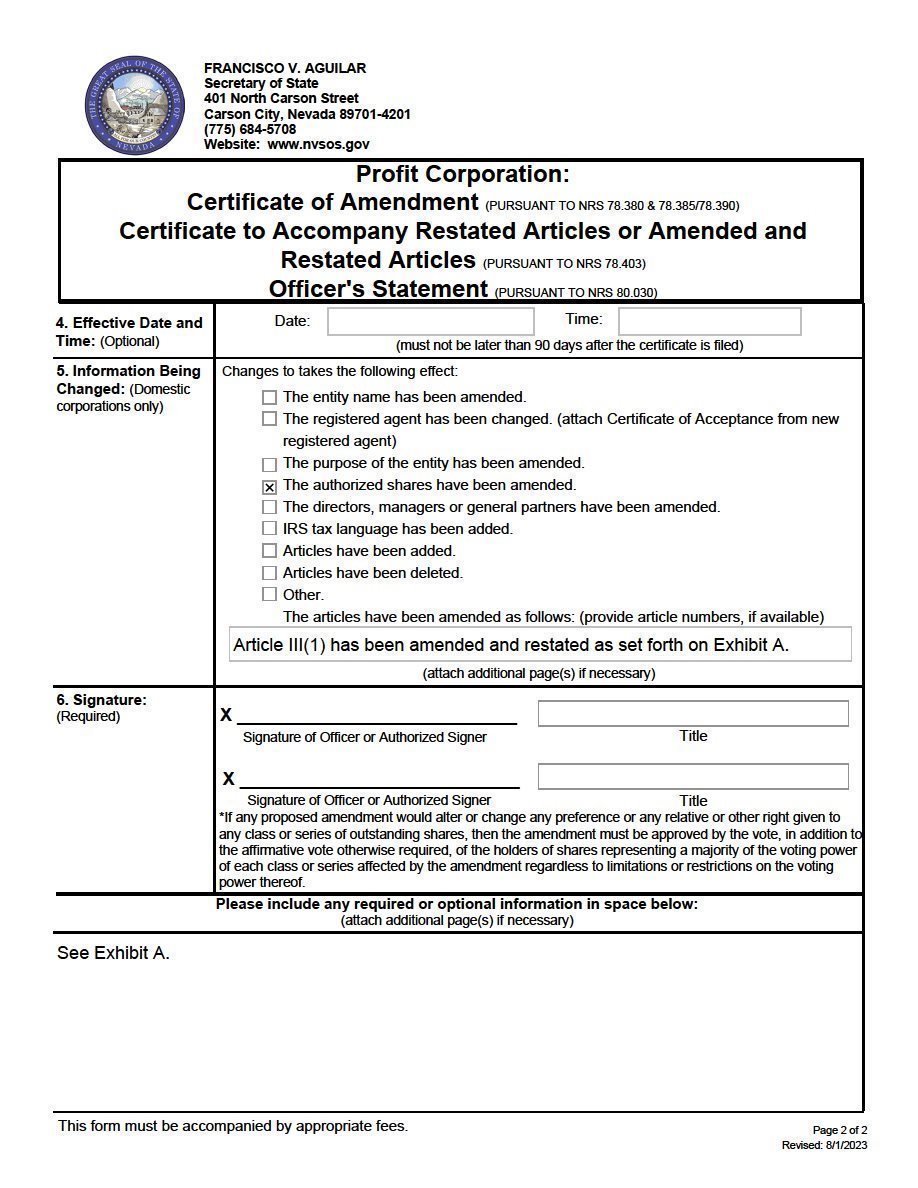

5. The Control Share Act Opt Out Proposal – to consider and vote upon the (the Nevada Control Share Act)(the “Control Share Act Opt Out”)(Proposal No. 5);

6. The Stockholder Bylaws Amendment Proposal – to consider and vote upon the adoption of a Certificate of Amendment to amend our Amended and Restated Articles of Incorporation to amend Article VI thereof to (a) remove the Board of Directors’ exclusive right to make, amend, alter, or repeal the bylaws of the Company; and (b) provide that nothing in the Amended and Restated Articles of Incorporation shall deny the concurrent power of the stockholders (together with the directors) to adopt, alter, amend, restate, or repeal the Bylaws of the Company (the “Stockholder Bylaws Amendment Right”) (Proposal No. 6);

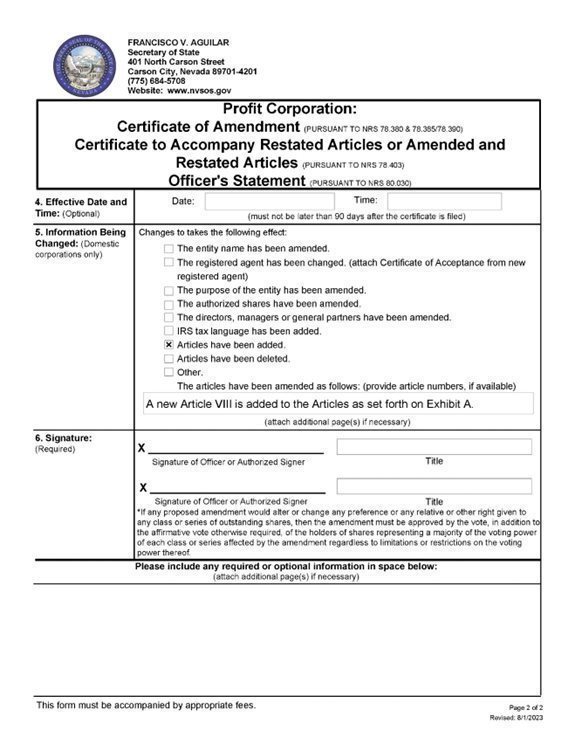

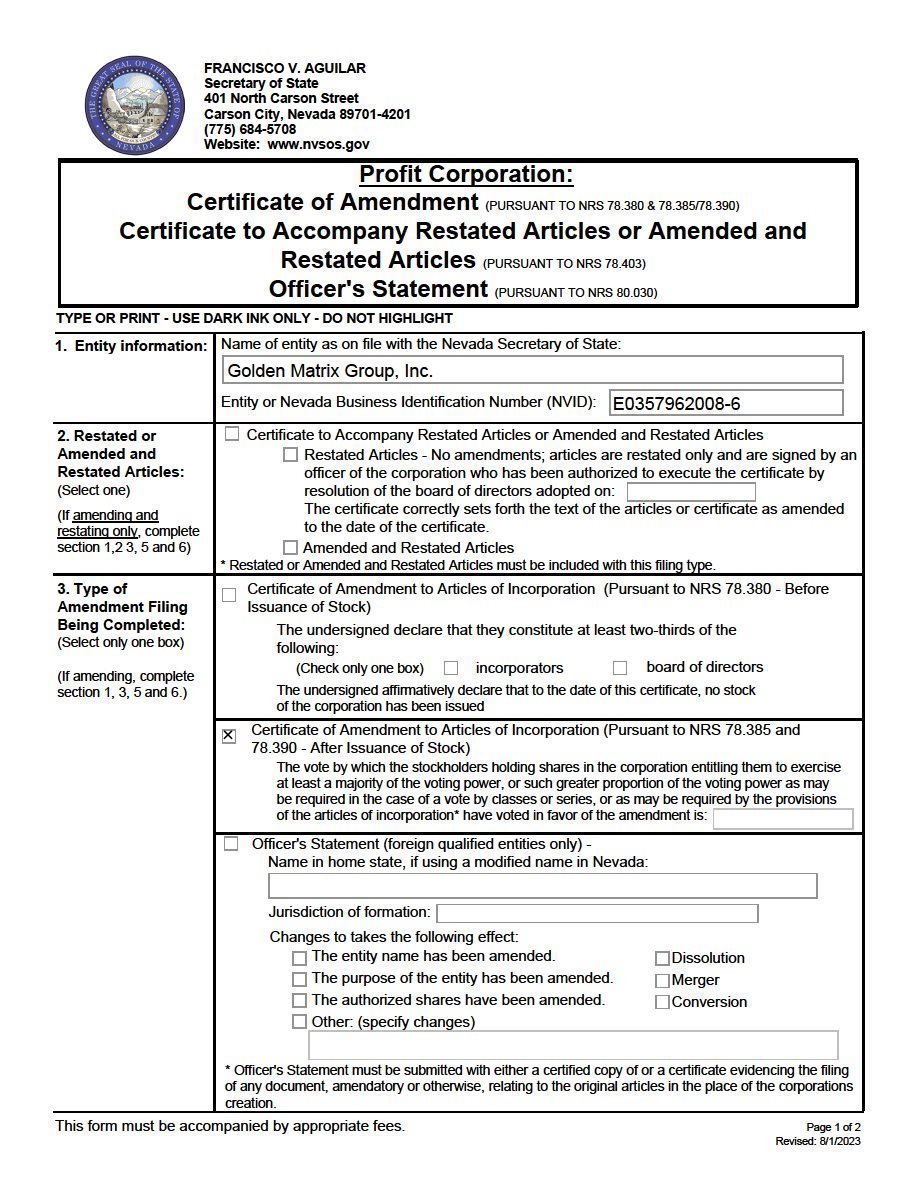

7. The Authorized Shares Increase Proposal – to consider and vote upon the adoption of a Certificate of Amendment to our Amended and Restated Articles of Incorporation to amend Article III, Section 1, to increase the Company’s authorized number of shares of common stock from two hundred and fifty million (250,000,000) shares to three hundred million (300,000,000) shares (Proposal No. 7);

8. The Equity Plan Proposal – to consider and vote upon the adoption of the Golden Matrix Group, Inc. 2023 Equity Incentive Plan (Proposal No. 8); and

9. The Adjournment Proposal – to consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if there are insufficient votes for, or otherwise in connection with, the approval of the Purchase Agreement Proposal or Nasdaq Proposal. This proposal will only be presented at the Special Meeting if there are not sufficient votes to approve the Purchase Agreement Proposal or Nasdaq Proposal (Proposal No. 9).

After careful consideration, the Board of Directors of Golden Matrix unanimously determined that the Purchase Agreement and the transactions contemplated thereby, are in the best interests of Golden Matrix and its stockholders, approved the Purchase Agreement and the transactions contemplated thereby, including, but not limited to the issuance of shares of common stock in connection therewith, and recommends that you vote “FOR” the approval, for the purposes of Nasdaq Listing Rules 5635(a) and (b), of the issuance of shares of common stock in connection of the Purchase Agreement and the transactions contemplated therein, subject to the conditions set forth in the Purchase Agreement; that you vote “FOR” the approval, on a non-binding, advisory basis, of the compensation that may be paid or become payable to certain of Golden Matrix’s named executive officers prior to, or after, consummation of the Purchase Agreement; and that you vote “FOR” the approval of the Nasdaq Proposal, Declassification Proposal, Control Share Act Opt Out Proposal, Stockholder Bylaws Amendment Proposal, Equity Plan Proposal, and Authorized Shares Increase Proposal and “FOR” an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Purchase Agreement Proposal or Nasdaq Proposal.

The Board of Directors’ approval of the Purchase Agreement is not conditioned on the approval of any of the other proposals above. Nevertheless, the Sellers’ obligation to complete the Purchase Agreement and consummate the Purchase is conditioned, among other conditions precedent, on the approval at this Special Meeting, or a subsequent meeting of stockholders held after Closing, of several of the proposals discussed above (e.g., Proposals No. 1, 4, 5, and 6).

More information about Golden Matrix, the Sellers, the Meridian Companies and the proposed transactions contemplated in the Purchase Agreement and related agreements, as well as the other proposals set forth above, are contained in the accompanying Proxy Statement. Golden Matrix urges you to read the accompanying Proxy Statement carefully and in its entirety. IN PARTICULAR, YOU SHOULD CAREFULLY CONSIDER THE MATTERS DISCUSSED UNDER “RISK FACTORS” BEGINNING ON PAGE 47.

v |

We do not expect to transact any other business at the Special Meeting, except as described herein. Only holders of record of shares of Golden Matrix’s common stock and Series B Voting Preferred Stock at the close of business on [●], 2024, are entitled to notice of, and to vote at, the Special Meeting and any postponements or adjournments thereof. At the close of business on the record date, 36,615,932 shares of our common stock were outstanding, which each vote one voting share and 1,000 shares of Series B Voting Preferred Stock were outstanding, which each vote 7,500 voting shares, and as such, a total of 44,115,932 voting shares are eligible to be voted at the Special Meeting. Other than our common stock and our Series B Voting Preferred Stock, we have no other voting securities currently outstanding. Everyone attending the Special Meeting will be required to present valid picture identification, such as a driver’s license or passport, as more fully described elsewhere in the accompanying Proxy Statement.

Your vote is very important. Pursuant to Nasdaq Listing Rule 5635(a), stockholder approval is required prior to the issuance of securities in connection with the acquisition of the stock or assets of another company if: (1) where, due to the present or potential issuance of common stock, including shares issued pursuant to an earn-out provision or similar type of provision, or securities convertible into or exercisable for common stock, other than a public offering for cash: (A) the common stock has or will have upon issuance voting power equal to or in excess of 20% of the voting power outstanding before the issuance of stock or securities convertible into or exercisable for common stock; or (B) the number of shares of common stock to be issued is or will be equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of the stock or securities; and pursuant to Nasdaq Listing Rule 5625(b), stockholder approval is required prior to the issuance of securities when the issuance or potential issuance will result in a change of control of the Company. Although The Nasdaq Stock Market has not adopted any rule on what constitutes a “change of control” for purposes of Rule 5635(b), The Nasdaq Stock Market has previously indicated that the acquisition of, or right to acquire, by a single investor or affiliated investor group, as little as 20% of the common stock (or securities convertible into or exercisable for common stock) or voting power of an issuer could constitute a change of control. As part of the Purchase, Golden Matrix will be issuing up to 87,141,857 shares of common stock, 1,000 shares of Series C Voting Preferred Stock (which vote an aggregate of 7,500,000 voting shares and are convertible into 1,000 shares of common stock) to the Sellers (assuming all post-closing shares are issued) and certain additional shares of common stock which may be issuable to satisfy indemnification obligations in the future, as discussed below under “The Purchase—Indemnification of Parties to the Purchase Agreement” and “The Purchase—Agreements Related to the Purchase—The Purchase Agreement—Indemnification”), representing 70.4% of the total number of outstanding shares of Golden Matrix’s common stock following the closing of the Purchase Agreement (based on the total current outstanding shares of common stock and including the 1,000 shares of common stock issuable upon conversion of the Series C Voting Preferred Stock shares), approximately 241.0% of Golden Matrix’s current shares of outstanding common stock, and 68.2% of Golden Matrix’s post-transaction voting shares, in each case without taking into account any potential dilution caused by Potential Offerings, as discussed in greater detail under, “Proposal No. 3: Approval of the Issuance of More Than 20% of the Company’s Issued and Outstanding Common Stock in Connection with Certain Offerings”. As the number of shares of common stock issuable to the Sellers pursuant to the terms of the Purchase Agreement will exceed 20% of the Company’s outstanding voting shares, 20% of the Company’s outstanding common stock shares and will be deemed a change of control of the Company, we are required to obtain stockholder approval for the Purchase Agreement and the transactions contemplated therein, pursuant to applicable Nasdaq rules and requirements (“Stockholder Approval”). We are therefore seeking the approval of the Purchase Agreement, and the issuance of shares of common stock pursuant to the terms of the Purchase Agreement and the transactions contemplated therein, including the issuance of shares of common stock upon conversion of the Series C Voting Preferred Stock to be issued by Golden Matrix to the Sellers, by adopting a resolution as described in the accompanying Proxy Statement under “Proposal No. 1: The Purchase Agreement Proposal—Stockholder Approval of the Purchase Agreement”.

vi |

Proposal Nos. 1, 2, 3, 8 and 9 each require the affirmative vote of a majority of the votes cast on such proposals, by the holders of shares of Golden Matrix’s voting stock present in person (i.e., virtually at the Special Meeting) or by proxy and entitled to vote on the matter at the Special Meeting, provided that a quorum exists at such Special Meeting. Proposals 4, 5, 6, and 7 require the affirmative vote of stockholders holding a majority of our outstanding voting shares eligible to be voted at the Special Meeting except for Proposal 4, which requires both the affirmative vote of both (a) a majority of the voting shares eligible to be voted at the Special Meeting; and (b) the holders of at least sixty-six and two-thirds percent (66⅔%) of the issued and outstanding shares of stock of the Company entitled to vote in the election of directors (excluding stock entitled to vote only upon the happening of a fact or event unless such fact or event shall have occurred). No individual proposal is contingent on any other proposal set forth above, except that (i) if the Purchase Proposal is not approved, the Declassification Proposal will have no effect, and the Board will not move forward with the filing of the amendment to the Articles of Incorporation to affect the Declassification of the Board with the Secretary of State of Nevada, even if approved by our stockholders; and (ii) the Sellers’ obligation to complete the Purchase Agreement and consummate the Purchase is conditioned, among other conditions precedent, on the approval at this Special Meeting of the Purchase, and either at this Special Meeting, or a subsequent stockholders meeting, of the Declassification Proposal, Control Share Act Opt Out Proposal, and Stockholder Bylaws Amendment Proposal.

All stockholders of Golden Matrix are cordially invited to attend the Special Meeting in person, virtually. However, even if you plan to attend the Special Meeting in person, virtually, we request that you complete, date, sign and return the enclosed proxy card in the postage-paid envelope or vote your shares by telephone, fax or through the Internet as set forth on the Proxy Card or the Notice of Internet Availability of Proxy Materials, as promptly as possible prior to the Special Meeting to ensure that your shares of Golden Matrix’s common stock and/or preferred stock will be represented at the Special Meeting if you are unable to attend. If you sign, date and mail your proxy card without indicating how you wish to vote, all of your shares will be voted “FOR” Proposals Nos. 1 through 9. If you fail to return your proxy card as instructed on the enclosed proxy card or fail to submit your proxy by telephone, fax or through the Internet and do not vote at the Special Meeting, your shares will not be counted for purposes of determining whether a quorum is present at the Special Meeting and will have no effect with respect to the vote on Nos. 1, 2, 3, 8 and 9 (the Purchase Agreement Proposal, Compensation Proposal, Nasdaq Proposal, Equity Plan Proposal, and Adjournment Proposal), except to the extent that such non-vote prohibits the Company from obtaining a quorum for the Special Meeting, and will have the effect of a vote against Proposals 4, 5, 6 and 7 (the Declassification Proposal, Control Share Act Opt Out Proposal, Stockholder Bylaws Amendment Proposal and the Authorized Shares Increase Proposal), which require the affirmative vote of stockholders holding a majority of our outstanding voting shares eligible to be voted at the Special Meeting except for Proposal 4, which requires the affirmative vote of both (a) a majority of the voting shares eligible to be voted at the Special Meeting; and (b) the holders of at least sixty-six and two-thirds percent (66⅔%) of the issued and outstanding shares of stock of the Company entitled to vote in the election of directors (excluding stock entitled to vote only upon the happening of a fact or event unless such fact or event shall have occurred). If you do attend the Special Meeting and wish to vote, you may withdraw your proxy and vote via the Special Meeting web interface.

The Company is pleased to continue utilizing the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders on the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, or E-proxy notice, on or about January [●], 2024 to our stockholders of record as of the close of business on January [●], 2024. The E-proxy notice contains instructions for your use of this process, including how to access our proxy statement and annual report and how to authorize your proxy to vote online. In addition, the E-proxy notice contains instructions on how you may receive a paper copy of the proxy statement or elect to receive your proxy statement over the Internet. The Company believes these rules allow it to provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of the Special Meeting.

vii |

The enclosed Proxy Statement which is first being made available to stockholders on or about [●], 2024, is also available at https://www.iproxydirect.com/gmgi (please note this link is case sensitive). The accompanying Proxy Statement provides you with detailed information about the Purchase Agreement and the transactions contemplated therein and the other proposals and business to be considered by you at the Special Meeting. We encourage you to read the accompanying Proxy Statement and its annexes (which are incorporated by reference therein) carefully and in their entirety. If you have any questions concerning the Purchase, any of the other proposals described herein, the Special Meeting or the accompanying Proxy Statement, would like additional copies of the accompanying Proxy Statement or additional proxy cards, please contact:

Anthony Brian Goodman, Chief Executive Officer

3651 S. Lindell Road, Suite D131

Las Vegas, Nevada 89103

Telephone: (702) 318-7548

Email: brian@goldenmatrix.com

By Order of the Board of Directors,

Anthony Brian Goodman

Director

[●], 2024

IMPORTANT: If you hold shares of common stock of Golden Matrix through an account with a broker, dealer, bank or other nominee please follow the instructions you receive from them to vote your shares.

viii |

Golden Matrix Group, Inc.

3651 S. Lindell Road, Suite D131

Las Vegas, Nevada 89103

PROXY STATEMENT FOR

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [●], 2024

Golden Matrix Group, Inc. (“Golden Matrix”, “we”, “us” or the “Company”) has made these materials available to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail, on or about January [●], 2024, in connection with the solicitation of proxies by the Board of Directors of Golden Matrix (the “Board of Directors” or the “Board”) for the special meeting of Golden Matrix’s stockholders and any adjournment or postponement thereof (the “Special Meeting”) for the purposes set forth in the accompanying Notice of Special Meeting. The Special Meeting will be held on [●], [●], 2024 at [●].M. [______] time (subject to any postponement(s) or adjournment(s) thereof), virtually via live audio webcast at https://agm.issuerdirect.com/gmgi (please note this link is case sensitive). See also “Instructions For The Virtual Special Meeting”, below.

The Board of Directors encourages you to read this Proxy Statement and its annexes (which are incorporated by reference herein) carefully and, in their entirety, and to take the opportunity to submit a proxy to vote your shares on the matters to be decided at the Special Meeting.

Only holders of record of shares of Golden Matrix’s common stock and Series B Voting Preferred Stock at the close of business on January [●], 2024, are entitled to notice of, and to vote at, the Special Meeting and any postponements or adjournments thereof. At the close of business on the record date, 36,615,932 shares of our common stock were outstanding, which each vote one voting share, and 1,000 shares of our Series B Voting Preferred Stock were outstanding, each voting 7,500 voting shares on all stockholder matters, and as such, a total of 44,115,932 voting shares are eligible to be voted at the Special Meeting. Other than our common stock and our Series B Voting Preferred Stock, we have no other voting securities currently outstanding.

If you have any questions concerning the Special Meeting or this Proxy Statement, or would like additional copies of the Proxy Statement or additional proxy cards, please contact:

Anthony Brian Goodman, Chief Executive Officer

3651 S. Lindell Road, Suite D131

Las Vegas, Nevada 89103

Telephone: (702) 318-7548

Email: brian@goldenmatrix.com

The date of this Proxy Statement is January [●], 2024.

ix |

ABOUT THIS PROXY STATEMENT

This Proxy Statement constitutes a Proxy Statement under Section 14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

You should rely only on the information contained in this Proxy Statement. No one has been authorized to provide you with information that is different from the information contained in, or incorporated by reference into, this Proxy Statement. This Proxy Statement is dated January [●], 2024. You should not assume that the information contained in, or incorporated by reference into, this Proxy Statement is accurate as of any date other than that date (or, in the case of incorporated documents, their respective dates). Our mailing of this Proxy Statement and/or the notice of internet availability of this Proxy Statement to the Golden Matrix stockholders will not create any implication to the contrary.

x |

xi |

| Table of Contents |

30 | |

30 | |

30 | |

30 | |

|

|

QUESTIONS AND ANSWERS ABOUT THE PURCHASE AND THE SPECIAL MEETING | 30 |

|

|

39 | |

39 | |

|

|

44 | |

|

|

45 | |

|

|

45 | |

46 | |

|

|

47 | |

|

|

49 | |

Risk Factors Related to the Meridian Companies and the Combined Company | 63 |

86 | |

|

|

86 | |

|

|

86 | |

87 | |

87 | |

|

|

88 | |

|

|

88 | |

88 | |

89 | |

|

|

89 | |

|

|

89 | |

91 | |

92 | |

|

|

92 | |

|

|

92 | |

93 | |

Effective Time and Implementation of the Declassification Amendment | 93 |

93 | |

|

|

94 | |

|

|

94 | |

94 | |

Effective Time and Implementation of the Control Share Act Opt Out Amendment | 95 |

95 | |

|

|

96 |

xii |

| Table of Contents |

96 | |

96 | |

Effective Time and Implementation of the Stockholder Bylaws Amendment | 97 |

97 | |

|

|

97 | |

|

|

97 | |

98 | |

Effective Time and Implementation of the Authorized Shares Increase Amendment | 99 |

99 | |

|

|

PROPOSAL NO. 8: ADOPTION OF THE GOLDEN MATRIX GROUP, INC. 2023 EQUITY INCENTIVE PLAN | 99 |

|

|

99 | |

99 | |

99 | |

100 | |

100 | |

101 | |

101 | |

101 | |

103 | |

103 | |

103 | |

103 | |

104 | |

104 | |

104 | |

105 | |

105 | |

Repricing; Cancellation and Re-Grant of Stock Options or Stock Appreciation Rights | 105 |

105 | |

105 | |

107 | |

107 | |

|

|

107 | |

|

|

107 | |

107 | |

|

|

108 | |

|

|

108 | |

111 | |

112 | |

112 | |

113 | |

114 | |

115 | |

115 | |

116 | |

117 |

xiii |

| Table of Contents |

117 | |

117 | |

|

|

118 | |

|

|

118 | |

118 | |

119 | |

125 | |

|

|

125 | |

|

|

125 | |

126 | |

127 | |

127 | |

Recommendation of the Board of Directors and its Reasons for the Purchase | 138 |

142 | |

143 | |

Opinion of Rockport Valuation LLC—Financial Advisor to the Board | 146 |

155 | |

156 | |

156 | |

157 | |

157 | |

157 | |

158 | |

158 | |

158 | |

158 | |

159 | |

Limitations of Liability and Indemnification of the Golden Matrix Officers and Directors | 160 |

Material U.S. Federal Income Tax Consequences of the Purchase | 161 |

161 | |

161 | |

162 | |

162 | |

162 | |

163 | |

169 | |

169 | |

Stock Options; Restricted Stock Units and Change of Control Events Under our Equity Plans | 171 |

|

|

172 | |

|

|

172 | |

172 | |

172 | |

173 | |

174 | |

Directors and Officers of Golden Matrix Following the Closing | 175 |

176 | |

176 | |

181 | |

182 |

|

xiv |

| Table of Contents |

182 | |

186 | |

186 | |

187 | |

187 | |

187 | |

189 | |

189 | |

Proxy Statement, Stockholders Meeting and Requirement for Golden Matrix Stockholder Approval | 189 |

190 | |

190 | |

190 | |

192 | |

193 | |

193 | |

195 | |

197 | |

197 | |

197 | |

197 | |

198 | |

198 | |

198 | |

203 | |

204 | |

205 | |

206 | |

|

|

207 | |

|

|

Executive Officers and Directors of the Combined Company Following the Purchase | 207 |

208 | |

210 | |

211 | |

212 | |

212 | |

212 | |

212 | |

213 | |

214 | |

215 | |

215 | |

215 | |

216 | |

216 | |

|

|

217 | |

|

|

219 | |

219 | |

|

|

213 | |

|

|

222 | |

|

|

222 | |

Unaudited U.S. GAAP Pro Forma Consolidated Financial Statements | 222 |

xv |

| Table of Contents |

234 | |

|

|

234 | |

|

|

234 | |

234 | |

|

|

235 | |

|

|

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON | 235 |

|

|

235 | |

|

|

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION OF INFORMATION BY REFERENCE | 236 |

|

|

237 | |

|

|

F-1 |

xvi |

| Table of Contents |

Golden Matrix Group, Inc., which we refer to herein as the “Company,” “Golden Matrix,”, “GMGI”, “we,” “our,” or “us,” is providing these proxy materials in connection with the solicitation by our Board of Directors of proxies to be voted at our Special Meeting of stockholders to be held on [●], [●], 2024, at [●].M. [___________] time at [___________], subject to any postponement(s) or adjournment(s) thereof. This Proxy Statement and the enclosed proxy card is first being made available to Golden Matrix stockholders on or about January [●], 2024.

You should rely only on the information contained in or incorporated by reference into this Proxy Statement. No one has been authorized to provide you with information that is different from that contained in or incorporated by reference into this Proxy Statement. This Proxy Statement is dated January [●], 2024. You should not assume that the information contained in this Proxy Statement is accurate as of any other date, nor should you assume that the information incorporated by reference into this Proxy Statement is accurate as of any date other than the date of such incorporated document. The mailing of this Proxy Statement to our stockholders will not create any implication to the contrary.

This Proxy Statement does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction in which or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

Website links included in this Proxy Statement are for convenience only. The content in any website links included in this Proxy Statement is not incorporated herein and does not constitute a part of this Proxy Statement.

REFERENCES TO ADDITIONAL INFORMATION

You may request a copy of this Proxy Statement from Issuer Direct Corporation, the Company’s proxy agent, at the following address and telephone number:

Issuer Direct Corporation

One Glenwood Ave., Suite 1001, Raleigh, North Carolina, 27603

(919) 481-4000, or 1-866-752-VOTE (8683)

For additional details about where you can find information about Golden Matrix, please see the section titled “Where You Can Find More Information; Incorporation of Information by Reference” in this Proxy Statement.

SUMMARY OF TERMS OF THE PURCHASE

This summary highlights selected information from this Proxy Statement. It may not contain all of the information that is important to you with respect to the Purchase Agreement and the transactions contemplated therein, or any other proposal or matter described in this Proxy Statement. We urge you to carefully read this Proxy Statement, as well as the documents attached to this Proxy Statement, to fully understand the Purchase Agreement Proposal and the other proposals set forth therein. In particular, you should read the Purchase Agreement, the First Amendment and Second Amendment, the Form of Certificate of Designation of Golden Matrix Group, Inc. Establishing the Designation, Preferences, Limitations and Relative Rights of Its Series C Preferred Stock, the Form of Promissory Note, the Form of Voting Agreement and Form of Day-to-Day Management Agreement, which are described elsewhere in this Proxy Statement and which are attached hereto as Annexes A, B, C, D, E and F to this Proxy Statement, respectively.

| 1 |

| Table of Contents |

In this Proxy Statement, references to:

| (i) | “2023 Equity Plan” mean the Golden Matrix Group, Inc. 2023 Equity Incentive Plan in the form of Annex K hereto; | |

|

|

| |

| (ii) | “Adjournment Proposal” means the proposal to adjourn the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Purchase Agreement Proposal and/or Nasdaq Proposal, to approve such proposals; | |

|

|

| |

| (iii) | “Amended and Restated Articles of Incorporation” mean the Amended and Restated Articles of Incorporation of the Company, as amended from time to time; | |

|

|

| |

| (iv) | “Authorized Shares Increase Amendment” means the amendment to the Amended and Restated Articles of Incorporation to amend Article III, Section 1, to increase the Company’s authorized number of shares of common stock from two hundred and fifty million (250,000,000) shares to three hundred million (300,000,000) shares; | |

|

|

| |

| (v) | “Authorized Shares Increase Proposal” means the proposal to consider and vote upon the adoption of a Certificate of Amendment to our Amended and Restated Articles of Incorporation to amend Article III, Section 1, to increase the Company’s authorized number of shares of common stock from two hundred and fifty million (250,000,000) shares to three hundred million (300,000,000) shares; | |

|

|

| |

| (vi) | “Automatic Closing Date Extension” means the automatic extension of the then Required Closing Date by up to 45 days, in the event that the Sellers reject the Company’s proposed reallocation of up to $20 million of the Meridian Company’s cash on hand at Closing to satisfy, on a dollar-for-dollar basis, the amount of cash consideration due by the Company at Closing. In the event of an Automatic Closing Date Extension, the then Required Closing Date will be automatically adjusted up to the date which falls 45 days after the date the Company expected the Closing to occur, in the event the Sellers accepted the Company’s proposed reallocation of the Meridian Companies’ cash on hand, in the event such date falls after the then Required Closing Date; | |

|

|

| |

| (vii) | “Board” or the “Board of Directors” refer to the Board of Directors of Golden Matrix; | |

|

|

| |

| (viii) | “Break-Fee” means that, to the extent that any term sheet, letter of intent or other agreement or understanding relating to the Required Financing includes any break-fee, termination fee, or other expenses payable by the Company upon termination thereof, to the proposed lender, financier, investment bank or agent, despite the parties’ best efforts to avoid such a requirement, each of the Company and Sellers shall be responsible for 50% of any such Break-Fee, including any amounts required to be escrowed in connection therewith; | |

|

|

| |

| (ix) | “Classified Board” means the requirements set forth in the current Articles of Incorporation of Golden Matrix, as amended, which provides that our Board be divided into three classes, each Director to be appointed to serve for a three year term, and until their respective successors are duly elected and qualified; | |

|

|

| |

| (x) | “Closing” means the purchase by Golden Matrix of 100% of each of the Meridian Companies; | |

| 2 |

| Table of Contents |

| (xi) | “Closing Date” means the date that the Closing occurs; | |

|

|

| |

| (xii) | “Closing Shares” means 82,141,857 restricted shares of the Company’s common stock agreed to be issued to the Sellers at the Closing; | |

|

|

| |

| (xiii) | “Combined company” means Golden Matrix following the Closing and the acquisition of the Meridian Companies; | |

|

|

| |

| (xiv) | “Compensation Proposal” means the proposal to approve, on a non-binding, advisory basis, the compensation that may be paid or become payable to certain of Golden Matrix’s named executive officers prior to, or after, the Purchase; | |

|

|

| |

| (xv) | “Control Share Act Opt Out Amendment” means the Certificate of Amendment to be filed with the Secretary of State of Nevada assuming approval of the Control Share Act Opt out Proposal in the form of Annex H hereto; | |

|

|

| |

| (xvi) | “Control Share Act Opt Out Proposal” means the proposal to consider and vote upon the adoption of a Certificate of Amendment to amend our Amended and Restated Articles of Incorporation to opt out of Nevada Revised Statutes Sections 78.378 to 78.3793 (the Nevada Control Share Act); | |

|

|

| |

| (xvii) | “Declassification Amendment” means the Certificate of Amendment to be filed with the Secretary of State of Nevada assuming approval of the Declassification Proposal (and subject to approval of the Purchase Proposal), in the form of Annex G hereto; | |

| (xviii) | “Declassification Proposal” means the proposal to consider and vote upon the adoption of a Certificate of Amendment to amend our Amended and Restated Articles of Incorporation to remove the provisions thereof providing for a three class, classified Board of Directors of the Company; | |

|

|

| |

| (xix) | “Effective Time” means 12:01 a.m., Las Vegas, Nevada time on the first day of the month in which Closing occurs; | |

|

|

| |

| (xx) | “Equity Plan Proposal” means the proposal to adopt the 2023 Equity Plan; | |

|

|

| |

| (xxi) | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; | |

|

|

| |

| (xxii) | “IFRS” means International Financial Reporting Standards; | |

|

|

| |

| (xxiii) | “First Amendment” means that certain First Amendment to Amended and Restated Sale and Purchase Agreement of Share Capital dated September 22, 2023, and entered into on September 27, 2023, by and between Golden Matrix and the Sellers; | |

|

|

| |

| (xxiv) | “GAAP” or “US GAAP” means United States generally accepted accounting principles; | |

|

|

| |

| (xxv) | “Golden Matrix,” the “Company,” “we,” “our,” or “us” refer to Golden Matrix Group, Inc. and its subsidiaries (unless the context requires otherwise); | |

|

|

| |

| (xxvi) | “Management Agreement” means that certain Day-to-Day Management Agreement between Zoran Milošević and Golden Matrix, as may be amended or revised from time to time, a form of which is attached hereto as Annex F; | |

| 3 |

| Table of Contents |

| (xxvii) | “Meridian Companies” means Meridian Tech Društvo Sa Ograničenom Odgovornošću Beograd, a private limited company formed and registered in and under the laws of the Republic of Serbia, Društvo Sa Ograničenom Odgovornošću “Meridianbet” Društvo Za Proizvodnju, Promet Roba I Usluga, Export Import Podgorica, a private limited company formed and registered in and under the laws of Montenegro, Meridian Gaming Holdings Ltd., a company formed and registered in the Republic of Malta, and Meridian Gaming (Cy) Ltd, a company formed and registered in the Republic of Cyprus, each to be acquired by Golden Matrix pursuant to the Purchase; | |

|

|

| |

| (xxviii) | “Meridian Cyprus” means, Meridian Gaming (Cy) Ltd, a company formed and registered in the Republic of Cyprus. | |

|

|

| |

| (xxix) | “Meridian Malta” means, Meridian Gaming Holdings Ltd., a company formed and registered in the Republic of Malta. | |

|

|

| |

| (xxx) | “Meridian Montenegro” means, Društvo Sa Ograničenom Odgovornošću “Meridianbet” Društvo Za Proizvodnju, Promet Roba I Usluga, Export Import Podgorica, a private limited company formed and registered in and under the laws of Montenegro. | |

|

|

| |

| (xxxi) | “Meridian Serbia” means Meridian Tech Društvo Sa Ograničenom Odgovornošću Beograd, a private limited company formed and registered in and under the laws of the Republic of Serbia; | |

|

|

| |

| (xxxii) | “Nasdaq” means the Nasdaq Capital Market; | |

|

|

| |

| (xxxiii) | “Nasdaq Proposal” means the proposal to consider and approve of, for the purposes of complying with the applicable listing rules of Nasdaq, the issuance of more than 20% of the Company’s issued and outstanding common stock and voting stock in certain offerings after the date of the Special Meeting; | |

|

|

| |

| (xxxiv) | “Offering Securities” means a maximum of $30,000,000 in equity, convertible equity (including preferred stock (including dividends thereon)), or debt, sold by the Company, with or without warrant coverage, in one or more transactions, resulting in the potential issuance of up to 20,000,000 shares of common stock (and/or other securities convertible into or exercisable for up to 20,000,000 shares of common stock), to be sold at an initial purchase price, or effective purchase price per share of underlying common stock, equal to no more than a 20% effective discount to the closing price of the Company’s common stock on the Nasdaq Capital Market, at the time the binding agreement relating thereto is entered into, subject to a potential variable or default provision which may result in the adjustment of the conversion rate/price thereof, provided that such adjustment will not result in a decrease of the conversion price/rate of such Offering Securities in an amount equal to more than a 85% discount from the closing price of the Company’s common stock at the time the binding agreement relating thereto is entered into, to be completed, if at all, within three months following the Special Meeting; | |

| 4 |

| Table of Contents |

| (xxxv) | “Offering Shares” means the potential issuance of up to a maximum of 20,000,000 shares of common stock (or other securities convertible into or exercisable for up to 20,000,000 shares of common stock) of the Company, including convertible equity (including preferred stock (including dividends thereon)), or debt, sold by the Company, in one or more transactions, with or without warrant coverage; |

|

|

|

| (xxxvi) | “Post-Closing Contingent Consideration” means $5,000,000 in cash and the Post-Closing Contingent Shares; |

|

|

|

| (xxxvii) | “Post-Closing Contingent Shares” means 5,000,000 restricted shares of Company common stock required to be issued to the Sellers, within five business days following the six month anniversary of the Closing if (and only if) the Company has determined that: the Sellers and their affiliates are not then in default in any of their material obligations, covenants or representations under the Purchase Agreement, or any of the other transaction documents entered into in connection therewith; |

|

|

|

| (xxxviii) | “Post-Closing Equity Awards” means $3 million in restricted stock units which Golden Matrix has agreed to issue to employees of the Meridian Companies (and their subsidiaries) within 30 days following the Closing in order to incentive such employees to continue to provide services to such entities following the Closing; |

|

|

|

| (xxxix) | “Post-Closing Non-Contingent Consideration” means $10,000,000 in cash payable 12 months after the date of the Closing and $10,000,000 in cash payable 18 months after the date of the Closing; |

|

|

|

| (xl) | “Potential Offerings” means one or more private or registered direct offerings of gross proceeds of up to a maximum of $30,000,000 of Offering Securities; |

|

|

|

| (xli) | “Preferred Conversion Shares” means the 1,000 shares of common stock of Golden Matrix issuable upon conversion of the Series C Preferred Stock; |

|

|

|

| (xlii) | “Promissory Notes” mean those certain three Promissory Notes, issuable to the Sellers at the Closing, evidencing $15,000,000 of the amount owed by Golden Matrix to the Sellers pursuant to the Purchase Agreement, in the form of Annex D; |

|

|

|

| (xliii) | “Purchase” or “Purchase Transactions” mean the acquisition of the Meridian Companies contemplated by the Purchase Agreement and the other terms of the Purchase Agreement; |

|

|

|

| (xliv) | “Purchase Agreement” means that certain Amended and Restated Sale and Purchase Agreement of Share Capital dated June 27, 2023, between Golden Matrix and the Sellers, as amended by the First Amendment, and as further amended from time to time; |

|

|

|

| (xlv) | “Purchase Agreement Proposal” means the proposal to approve the Purchase Agreement and the terms thereof and exhibits thereto, including the shares of Company common stock issuable in connection therewith, pursuant to which the Company will acquire the Meridian Companies; |

|

|

|

| (xlvi) | “Purchase Price” means an agreed upon value of $331,428,571, which is made up of the Closing Cash Consideration, Closing Shares, the Promissory Notes, the Series C Preferred Stock, the Contingent Post-Closing Consideration, and the Non-Contingent Post-Closing Consideration; |

|

|

|

| (xlvii) | “Required Amendments to the Articles” means the Declassification Amendment, Control Share Act Opt Out Amendment and the Stockholder Bylaws Amendment; |

|

|

|

| (xlviii) | “Required Closing Date” means June 30, 2024, unless such date is extended with the mutual consent of Golden Matrix and the Sellers and subject to an Automatic Closing Date Extension; |

| 5 |

| Table of Contents |

| (xlix) | “Required Financing” means up to $30,000,000 in funding raised by, or attempted to be raised by, Golden Matrix, in order to fund the cash purchase price payable to the Sellers in connection with the Purchase; |

|

|

|

| (l) | “Rockport” means Rockport Valuation LLC; |

|

|

|

| (li) | “SEC” or the “Commission” refers to the Securities and Exchange Commission; |

|

|

|

| (lii) | “Second Amendment” means that certain Second Amendment to Amended and Restated Sale and Purchase Agreement of Share Capital dated and effective January 22, 2024, by and between Golden Matrix and the Sellers; |

|

|

|

| (liii) | “Securities Act” refers to the Securities Act of 1933, as amended; |

|

|

|

| (liv) | “Sellers” means collectively, Aleksandar Milovanović, Zoran Milošević and Snežana Božović, owners of the Meridian Companies; |

|

|

|

| (lv) | “Series C Designation” means the Certificate of Designation of Golden Matrix Group, Inc. Establishing the Designation, Preferences, Limitations and Relative Rights of Its Series C Preferred Stock in substantially the form of Annex C; |

|

|

|

| (lvi) | “Series C Preferred Stock” means the 1,000 shares of Series C Voting Preferred Stock of Golden Matrix, with such rights, preferences and privileges as are set forth in the Series C Designation, which are required to be issued to the Sellers at the Closing; |

|

|

|

| (lvii) | “Stockholder Bylaws Amendment” means the Certificate of Amendment to be filed with the Secretary of State of Nevada assuming approval of the Stockholder Bylaws Amendment Proposal in the form of Annex H hereto; |

|

|

|

| (lviii) | “Stockholder Bylaws Amendment Proposal” means the proposal to consider and vote upon the adoption of a Certificate of Amendment to amend to our Amended and Restated Articles of Incorporation to amend Article VI thereof to (a) remove the Board of Directors’ exclusive right to make, amend, alter, or repeal the bylaws of the Company; and (b) provide that nothing in the Amended and Restated Articles of Incorporation shall deny the concurrent power of the stockholders (together with the directors) to adopt, alter, amend, restate, or repeal the Bylaws of the Company; |

|

|

|

| (lvix) | “Transaction Documents” means the Purchase Agreement, the transfer instruments entered into at Closing, the Promissory Notes, the Voting Agreement, the Management Agreement, the Required Amendments to the Articles, certain confirmations and certifications, and other certificates, instruments, or agreements contemplated by the Purchase Agreement to which Golden Matrix or the Sellers are a party; and |

|

|

|

| (lvx) | “Voting Agreement” means that certain Nominating and Voting Agreement between Golden Matrix, Anthony Brian Goodman, Luxor Capital LLC, and each of the Sellers, as may be amended or revised from time to time, a form of which is attached hereto as Annex E. |

| 6 |

| Table of Contents |

On January 11, 2023, we entered into a Sale and Purchase Agreement of Share Capital (the “Original Purchase Agreement”) with Aleksandar Milovanović, Zoran Milošević (“Milošević”) and Snežana Božović (collectively, the “Sellers”), the owners of Meridian Tech Društvo Sa Ograničenom Odgovornošću Beograd, a private limited company formed and registered in and under the laws of the Republic of Serbia (“Meridian Serbia”); Društvo Sa Ograničenom Odgovornošću “Meridianbet” Društvo Za Proizvodnju, Promet Roba I Usluga, Export Import Podgorica, a private limited company formed and registered in and under the laws of Montenegro; Meridian Gaming Holdings Ltd., a company formed and registered in the Republic of Malta; and Meridian Gaming (Cy) Ltd, a company formed and registered in the republic of Cyprus (collectively, the “Meridian Companies”).

Subsequent to the parties’ entry into the Original Purchase Agreement, the parties continued to discuss the consideration payable by the Company to the Sellers, the breakdown between cash and equity of such consideration, the timing for the payment of such consideration, and the number of closings, and after such discussions, the parties determined to amend and restate the Original Purchase Agreement, to adjust such consideration breakdown, the timing of payments in connection therewith, the number of closings, to extend certain required deadlines set forth in the Original Purchase Agreement, and make various other changes to the Original Agreement.

In connection therewith, on June 28, 2023, we entered into an Amended and Restated Sale and Purchase Agreement of Share Capital dated June 27, 2023 with the Sellers, and on September 27, 2023, we entered into a First Amendment to Amended and Restated Sale and Purchase Agreement of Share Capital dated September 22, 2023, with the Sellers (the “First Amendment”, and the Amended and Restated Sale and Purchase Agreement of Share Capital, as amended from time to time, including by the First Amendment, the “Purchase Agreement”), the terms of which are discussed herein.

On January 22, 2024, the Company and the Sellers entered into a Second Amendment to Amended and Restated Sale and Purchase Agreement of Share Capital which extended the required closing date to June 30, 2024, or such other later date as may be approved by the mutual consent of the parties (subject to an Automatic Closing Date Extension).

The Meridian Companies operate online sports betting, online casino, and gaming operations and are currently licensed and operating in more than 15 jurisdictions across Europe, Africa and Central and South America.

Pursuant to the Purchase Agreement, the Sellers agreed to sell us 100% of the outstanding capital stock of each of the Meridian Companies in consideration for (a) a cash payment of $30 million, due at the closing of the acquisition, of which up to $20 million of such amount may be paid after Closing, from cash on hand of the Meridian Companies at Closing, including from the available cash the Meridian Companies are required to have at the Closing under the Purchase Agreement (Aggregate Required Closing Cash), as long as after the payment thereof to Sellers, the Meridian Companies will not be insolvent or left with inadequate cash to pay their debts, bills, and other liabilities as they become due, in the ordinary course of business, subject to the approval, in their sole discretion, of the Sellers; (b) 82,141,857 restricted shares of the Company’s common stock (the “Closing Shares”), with an agreed upon value of $3.00 per share, due at the closing of the acquisition; (c) 1,000 shares of a to be designated series of Series C preferred stock of the Company, discussed in greater detail below (the “Series C Voting Preferred Stock”), due at the closing of the acquisition; (d) $5,000,000 in cash and 5,000,000 restricted shares of Company common stock (the “Post-Closing Contingent Shares”), due within five business days following the six month anniversary of the Closing if (and only if) the Company has determined that: the Sellers and their affiliates are not then in default in any of their material obligations, covenants or representations under the Purchase Agreement, or any of the other transaction documents entered into in connection therewith (the “Contingent Post-Closing Consideration”); (e) $20,000,000 in cash, of which $10,000,000 is due 12 months after the date of the Closing and $10,000,000 is due 18 months after the date of the Closing (the “Non-Contingent Post-Closing Consideration”); and (f) promissory notes in the amount of $15,000,000 (the “Promissory Notes”), due 24 months after the Closing. The Closing Shares, Series C Voting Preferred Stock, and Post-Closing Contingent Shares, are collectively defined herein as the “Purchase Shares”.

| 7 |

| Table of Contents |

The Closing is required to occur prior to prior to June 30, 2024, or such other later date as may be approved by the mutual consent of the parties, subject to an Automatic Closing Date Extension, as discussed below under “The Purchase—Potential Reallocation of the Meridian Companies’ Cash on Hand at Closing to Pay a Portion of the Purchase Price”.

The Purchase Agreement does not include a price-based termination right, so there will be no adjustment to the total number of shares of Golden Matrix common stock or Series C Voting Preferred Stock that the Sellers will be entitled to receive for changes in the market price of Golden Matrix common stock. Accordingly, the market value of the shares of Golden Matrix common stock issued pursuant to the Purchase Agreement will depend on the market value of the shares of Golden Matrix common stock at the time the Purchase Agreement closes, and could vary significantly from the market value on the date the Purchase Agreement was entered into and/or the date of this Proxy Statement.

To the extent that any term sheet, letter of intent or other agreement or understanding relating to up to $30,000,000 in financing raised by, or attempted to be raised by, Golden Matrix, for the purpose of paying the cash payable to the Sellers at the Closing (the “Required Financing”) includes any break-fee, termination fee, or other expenses payable by the Company upon termination thereof, to the proposed lender, financier, investment bank or agent (each a “Break-Fee”), despite the parties’ best efforts to avoid such a requirement, each of the Company and Sellers shall be responsible for 50% of any such Break-Fee, including any amounts required to be escrowed in connection therewith, as discussed in greater detail below under “Agreements Related to the Purchase—The Purchase Agreement—Termination of the Purchase Agreement”.

The Closing contemplated by the Purchase Agreement is expected to occur in the second calendar quarter of 2024, subject to satisfaction of customary closing conditions, including approval of the transactions contemplated by the Purchase Agreement, and the issuance of the shares of common stock issuable pursuant to the terms of the Purchase Agreement, by the stockholders of the Company at the Special Meeting.

The conditions to the closing of the Purchase Agreement may not be met, and such Closing may not ultimately occur on the terms set forth in the Purchase Agreement, if at all.

Upon closing of the transactions, the Sellers will collectively own approximately 70.4% of the Company’s then outstanding shares of common stock, and 68.2% of the Company’s then outstanding voting shares, in each case without taking into account any potential dilution caused by Potential Offerings, as discussed in greater detail under, “Proposal No. 3: Approval of the Issuance of More Than 20% of the Company’s Issued and Outstanding Common Stock in Connection with Certain Offerings”, and will effectively control the Company, and as such, the Purchase will result in a change of control of the Company.

The Purchase Agreement requires that the Company designate shares of Series C Voting Preferred Stock prior to the Closing, which shares of Series C Voting Preferred Stock will have the rights, preferences, and privileges set forth in the Certificate of Designation of Golden Matrix Group, Inc. Establishing the Designation, Preferences, Limitations and Relative Rights of Its Series C Voting Preferred Stock, attached hereto as Annex C (the “Series C Designation”).

One of the rights of the holders of the Series C Voting Preferred Stock will be the right, for so long as (a) the Company’s Board of Directors has at least five members; and (b) the Sellers collectively beneficially own more than 40% of the Company’s outstanding common stock (without taking into account shares voted by, or convertible into pursuant to, the Series C Preferred Stock) and for so long as the Series C Voting Preferred Stock is outstanding, voting separately, to appoint two members to the Company’s Board of Directors. If (x) the Company’s Board of Directors has less than five members, or (y) the Sellers ever collectively beneficially own 40% or less of the Company’s outstanding common stock, the holders of the Series C Voting Preferred Stock, voting separately, will have the right to appoint one member to the Board of Directors. The holders of the Series C Voting Preferred Stock will also have the sole right to remove such persons solely appointed by the Series C Voting Preferred Stock and to fill vacancies in such appointees, see “Agreements Related to the Purchase—Series C Voting Preferred Stock— Voting Rights”.

| 8 |

| Table of Contents |

In connection with the Purchase Agreement, prior to the Closing, one independent member of our Board is expected to resign from the Board, which member of the Board is expected to be Philip Daniel Moyes (provided that Mr. Moyes has not formally resigned and/or provided notice of his resignation to date), and one person designated by the Sellers, William Scott, will be appointed to the Board, as an independent member of the Board, to fill such vacancy, who will thereafter be deemed an appointee of the Sellers under the terms of the Series C Designation (the “Seller Series C Appointee”), and who will also be appointed as Chairperson of the Board. The Sellers will have the right, at any time, to remove the Seller Series C Appointee pursuant to the terms of the Series C Designation. As a result, at Closing, we expect to continue to have a five member Board, including four of our current directors, including Mr. Anthony Brian Goodman, our current Chief Executive Officer and Chairman, and Weiting ‘Cathy’ Feng, the current Chief Operating Officer, as well as two continuing independent directors (Thomas E. McChesney and Murray G. Smith), and Mr. Scott, who will be a Seller Series C Appointee, but will also be independent under the rules of Nasdaq and the SEC.

We also plan to amend our Bylaws prior to Closing to provide that the maximum number of members of the Board of Directors will be five (5) members. In the event that the Sellers desire to appoint another member to the Board of Directors pursuant to the rights set forth in the Series C Designation (i.e., two in total), it is expected that a current member of the Board of Directors will resign, with an independent member of the Board expected to resign if the Sellers’ second Board appointee is independent and an executive Director resigning if the Sellers’ second Board appointee is not independent.

We do not expect any changes in our executive officers in connection with the Closing and instead Zoran Milošević, one of the Sellers, and the current Chief Executive Officer of the Meridian Companies is expected to continue in that role (and not as an executive officer of the Company) following the Closing, with control over the operations of the Meridian Companies pursuant to the Day-to-Day Management Agreement discussed below under “Agreements Related to the Purchase—Day-to-Day Management Agreement”, provided that Mr. Milošević has the right, for two years following the Closing, to require the Board of Directors to appoint him as Chief Operating Officer of the Company, at which time we are required to enter into an employment agreement with Mr. Milošević, with identical terms and conditions, including compensation, as our then Chief Executive Officer, and for two years after that, the Company is required to ensure that Mr. Milošević enjoys the same benefits and advantages as the Company’s then Chief Executive Officer (i.e., a most favored nation right), as discussed below under “The Purchase—Right of Milošević to Require Appointment as an Officer and Require Entry Into the Employment Agreement”.

Additionally, a required term and condition of the Closing is that the Company and each of the Sellers enter into a Nominating and Voting Agreement, which will provide among other things, that each Seller will vote their voting shares of Golden Matrix “For” appointment of those director nominees nominated to the Board by the independent Nominating and Corporate Governance Committee, which shall be composed of two members and not vote their shares to remove any directors nominated by the committee, subject to certain exceptions. See “Agreements Related to the Purchase—Nominating and Voting Agreement”. Another required term and condition of the Closing is that the Company and Mr. Milošević enter into a Day-to-Day Management Agreement, which will among other things, prohibit Golden Matrix or its executives from materially interfering in the operation of the business of, and day-to-day operations of, the Meridian Companies by its current leadership (i.e., Mr. Milošević, as Chief Executive Officer), while the Voting Agreement is in place. See “Agreements Related to the Purchase—Day-to-Day Management Agreement”.

| 9 |

| Table of Contents |

A copy of the Purchase Agreement is attached as Annex A, a copy of the First Amendment and Second Amendment is attached as Annex B, a copy of the Series C Designation is attached as Annex C, a copy of the form of Promissory Note is attached as Annex D, a copy of the Form of Voting Agreement is attached as Annex E, and a copy of the Form of Day-to-Day Management Agreement is attached as Annex F, to this Proxy Statement. Golden Matrix encourages you to read such Purchase Agreement, Series C Designation and form of Promissory Note in their entirety because they are the principal documents governing the Purchase. For more information on the Purchase Agreement, Series C Designation and Promissory Note, see the sections of this Proxy Statement titled “Agreements Related to the Purchase—Series C Voting Preferred Stock”, “Agreements Related to the Purchase—Promissory Notes”, “Agreements Related to the Purchase—Nominating and Voting Agreement”, and “Agreements Related to the Purchase—Day-to-Day Management Agreement”.

For more information about the Purchase itself and the Meridian Companies to be acquired pursuant to the Purchase, see “The Purchase” and “Information about the Meridian Companies”.

The Company was incorporated in the State of Nevada on June 4, 2008 and is based in Las Vegas, Nevada. Golden Matrix is an established business-to-business (B2B) and business-to-consumer (B2C) gaming technology company operating across multiple international markets. The B2B division of Golden Matrix develops and licenses proprietary gaming platforms for its extensive list of clients and also a B2C division, through its wholly-owned subsidiary, RKingsCompetitions Ltd, a private limited company formed under the laws of Northern Ireland (“RKings”), which operates a high-volume eCommerce site enabling end users to enter paid-for competitions on its proprietary platform in authorized markets. Golden Matrix’s sophisticated software automatically declines any gaming or redemption requests from within the United States, in strict compliance with current US law.

Golden Matrix’s principal executive offices are located at 3651 S. Lindell Road, Suite D131, Las Vegas, Nevada 89103, and its telephone number is (702) 318-7548. More information about Golden Matrix Group, Inc. can be found at https://goldenmatrix.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this Proxy Statement, and you should not consider information on our website to be part of this Proxy Statement. Golden Matrix’s common stock is listed on the Nasdaq Capital Market under the trading symbol “GMGI.”

The Meridian Companies are a well-established brand and operator in the sports betting and gaming industry, spanning across 15 markets in Europe, Central and South America, and Africa. The companies employ approximately 1,200 personnel, operating both online (mobile and web) and via around 700 Meridian Company-owned or franchised betting shops, with a primary focus (in those shops) on sports betting, online casino games, and virtual games. Of those 700 shops, approximately 250 are owned by the Meridian Companies (and their subsidiaries) and approximately 450 shops are owned by franchisees. This is complemented by a variety of slot machines and online casino, eSports, fixed odds games, and other entertainment options, contingent on the regulatory parameters of the specific jurisdictions. While sports betting is a primary focus, Meridian’s online casino revenue has grown significantly over the past couple of years.

The Meridian Companies’ principal executive offices are located at Bulevar Mihajla Pupina 10 b, Belgrade, Serbia, and their telephone number is +381 113015309. The Meridian Companies are private companies.

* * * * *

For more information see “The Purchase—Parties to the Purchase”.

| 10 |

| Table of Contents |

The Board of Directors considered a number of factors before deciding to enter into the Purchase Agreement, including, among other factors, the benefits to current Company stockholders, and the terms and conditions of the Purchase Agreement. For additional information, see the section titled “The Purchase—Recommendation of the Board of Directors and its Reasons for the Purchase”.

Activities of Golden Matrix Following the Purchase

Following the completion of the Purchase, we plan to focus on growing the combined company business and to seek further accretive acquisitions that we believe will bring additional revenues and profitability.

Following the completion of the Purchase, Golden Matrix will continue to be a public company. The Purchase will have no effect on the attributes of shares of Golden Matrix’s common stock or Series B Preferred Stock held by Golden Matrix’s stockholders, except for the increase in such outstanding shares of common stock in connection with the issuance of the shares of common stock and Series C Voting Preferred Stock issuable to the Sellers in connection therewith, as discussed in greater detail herein.

In the event the Purchase is not consummated, Golden Matrix plans to seek out alternative accretive business acquisitions that we believe will add revenues and profitability, and work to continue the growth of our core businesses.

Recommendation of the Board of Directors and its Reasons for the Purchase

The Board of Directors unanimously determined that the Purchase Agreement and the transactions contemplated thereby, including the Purchase, are in the best interests of Golden Matrix and its stockholders, approved the Purchase Agreement and the transactions contemplated thereby, including the Purchase, and recommends that you vote:

1. “FOR” approval of the terms of the Purchase Agreement, including the shares of Company common stock, Series C Voting Preferred Stock, Preferred Conversion Shares and the Indemnification Shares (discussed below under “The Purchase—Agreements Related to the Purchase—The Purchase Agreement—Indemnification”), issuable in connection therewith, pursuant to which the Company will acquire the Meridian Companies (Proposal No. 1);

2. “FOR” the compensation that may be paid or become payable to certain of Golden Matrix’s named executive officers prior to, or after, the Purchase, on a non-binding, advisory basis (Proposal No. 2);

3. “FOR” the approval, for purposes of complying with applicable Nasdaq listing rules of the issuance of more than 20% of the Company’s issued and outstanding common stock and voting stock in certain offerings after the date of the Special Meeting (Proposal No. 3);

4. “FOR” the approval of the adoption of a Certificate of Amendment to amend our Amended and Restated Articles of Incorporation to remove the provisions thereof providing for a three class, classified Board of Directors of the Company (Proposal No. 4);