Richard T. Prins, Esq.

PNMAC Mortgage Opportunity Fund, LLC

Semi-Annual Report

As of and for the period ended June 30, 2016

PNMAC Mortgage Opportunity Fund, LLC

Table of Contents

| | Page |

| Financial Statements | |

| Statement of Assets and Liabilities | 2 |

| Statement of Operations | 3 |

| Statements of Changes in Net Assets | 4 |

| Statement of Cash Flows | 5 |

| Financial Highlights | 6 |

| Notes to Financial Statements | 7 |

| Additional Information | 16 |

| | |

| Contained herein: | |

Unaudited consolidated financial statements of PNMAC Mortgage Opportunity Fund, LP (“Master Fund”) |

The accompanying notes and the attached financial statements of the Master Fund are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LLC

Statement of Assets and Liabilities

June 30, 2016 (Unaudited)

| Assets: | | | |

| Investment in PNMAC Mortgage Opportunity Fund, LP, at fair value | | $ | 59,263,876 | |

| Short-Term Investment in BlackRock Liquidity Funds: Tempfund Institutional Shares ^ | | | | |

| at fair value (cost $130,705) | | | 130,705 | |

| Tax withholdings refund receivable | | | 12,968,836 | |

| Other assets | | | 579 | |

| | | | 72,363,996 | |

| Liabilities: | | | | |

| Tax withholdings refund payable to common shareholders | | | 12,968,836 | |

| Payable to Investment Manager | | | 76,738 | |

| Distributions payable to Series A preferred shares | | | 11,400 | |

| Accrued expenses | | | 128,220 | |

| | | | 13,185,194 | |

| Net Assets | | $ | 59,178,802 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Series A preferred shares | | $ | - | |

| Common shares | | | 536 | |

| Additional paid-in capital | | | 51,719,864 | |

| Net unrealized appreciation on investments | | | 7,458,402 | |

| | | $ | 59,178,802 | |

| | | | | |

| Net Asset Value per Share | | | | |

| Series A preferred shares | | | | |

| Net assets applicable to preferred shares at a liquidation preference of $500 per share | | $ | 114,000 | |

| Shares outstanding ($0.001 par value, 5,000 shares authorized) | | | 228 | |

| Net asset value, offering and redemption price per Series A preferred share | | $ | 500.00 | |

| | | | | |

| Common shares | | | | |

| Net assets applicable to common shares | | $ | 59,064,802 | |

| Shares outstanding ($0.001 par value, unlimited shares authorized) | | | 535,688 | |

| Net asset value per common share | | $ | 110.26 | |

| | | | | |

| | | | | |

| ^ Investment represents securities issued by related party | | | | |

The accompanying notes and the attached financial statements of the Master Fund are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LLC

Statement of Operations

For the Six Months ended June 30, 2016 (Unaudited)

| Investment income allocated from Master Fund: | | | |

| Interest from mortgage loans | | $ | 11,683,472 | |

| Dividends from related party- | | | | |

| BlackRock Liquidity Funds: Tempfund Institutional Shares | | | 43,732 | |

| Home Affordable Modification Program incentives | | | 208,466 | |

| Other | | | 15,944 | |

| | | | 11,951,614 | |

| Expenses allocated from Master Fund: | | | | |

| Collection and liquidation expenses | | | 2,496,189 | |

| Interest on asset-backed financing | | | 1,646,243 | |

| Mortgage loan servicing fees to PennyMac Loan Services, LLC | | | 1,092,934 | |

| Investment advisory fees to PennyMac Capital Management, LLC | | | 381,618 | |

| Professional fees | | | 177,238 | |

| Other mortgage loan servicing expenses | | | 170,355 | |

| Directors' fees and expenses | | | 141,102 | |

| Administration fees | | | 112,906 | |

| Insurance | | | 85,231 | |

| Custodian fees | | | 27,407 | |

| Taxes | | | 22,132 | |

| Trustee fees | | | 21,672 | |

| Collateral valuation | | | 17,606 | |

| Investment software licensing | | | 13,970 | |

| Mortgage loan accounting fees | | | 11,217 | |

| Registration fees | | | 7,720 | |

| Total expenses before mortgage loan servicing fee rebate | | | 6,425,540 | |

| Mortgage loan servicing fee rebate from PennyMac Loan Services, LLC | | | (148,179 | ) |

| | | | 6,277,361 | |

| Net investment income allocated from Master Fund | | | 5,674,253 | |

| | | | | |

| Investment income: | | | | |

| Dividends from related party- | | | | |

| BlackRock Liquidity Funds: Tempfund Institutional Shares | | | 2,106 | |

| | | | 2,106 | |

| Expenses: | | | | |

| Shareholder services fee to PennyMac Capital Management, LLC | | | 161,928 | |

| Professional and other fees | | | 69,744 | |

| Administration fees | | | 70,745 | |

| Insurance | | | 3,266 | |

| Taxes | | | 800 | |

| | | | 306,483 | |

| Net investment income | | | 5,369,876 | |

| | | | | |

| Distributions to Series A preferred shareholders | | | 5,700 | |

| | | | | |

| Net realized and unrealized (loss) gain on investments and | | | | |

| asset-backed financing and carried interest allocated from Master Fund: | | | | |

| Net realized loss on investments | | | (6,661,493 | ) |

| Net change in unrealized gain on investments | | | 4,757,701 | |

| Net change in unrealized loss on asset-backed financing | | | (774,941 | ) |

| Net change in carried interest allocated from Master Fund | | | (537,089 | ) |

| | | | (3,215,822 | ) |

| Net increase in net assets resulting from operations | | $ | 2,148,354 | |

| | | | | |

The accompanying notes and the attached financial statements of the Master Fund are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LLC

Statement of Cash Flows

For the Six Months ended June 30, 2016 (Unaudited)

| | | Period Ended June 30, 2016 | | | Year Ended December 31, 2015 | |

| Increase in net assets resulting from operations: | | | | | | |

| Net investment income | | $ | 5,369,876 | | | $ | 8,372,575 | |

| Distributions to Series A preferred shareholders | | | (5,700 | ) | | | (11,400 | ) |

| Net change in unrealized (loss) gain on investments | | | 4,757,701 | | | | (7,472,362 | ) |

| Net change in unrealized (loss) gain on asset-backed financing | | | (774,941 | ) | | | 760,744 | |

| Net realized (loss) gain on investments | | | (6,661,493 | ) | | | 3,962,650 | |

| Net change in carried interest allocated from Master Fund | | | (537,089 | ) | | | (1,122,441 | ) |

| Net increase in net assets resulting from operations | | | 2,148,354 | | | | 4,489,766 | |

| | | | | | | | | |

| | | | | | | | | |

| Decrease in net assets resulting from capital transactions: | | | | | | | | |

| Distributions to common shareholders | | | (27,100,000 | ) | | | (148,200,000 | ) |

| | | | | | | | | |

| Net decrease in net assets | | | (24,951,646 | ) | | | (143,710,234 | ) |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of period | | | 84,130,448 | | | | 227,840,682 | |

| End of period | | $ | 59,178,802 | | | $ | 84,130,448 | |

The accompanying notes and the attached financial statements of the Master Fund are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LLC

Statement of Cash Flows

For the Six Months ended June 30, 2016 (Unaudited)

| Cash flows from operating activities: | | | |

| | | | |

| Net increase in net assets resulting from operations | | $ | 2,148,354 | |

| | | | | |

| Adjustments to reconcile net increase in net assets resulting from operations to net | | | | |

| cash provided by operating activities: | | | | |

| | | | | |

| Distributions from Master Fund | | | 27,350,000 | |

| Net investment income allocated from Master Fund | | | (5,674,253 | ) |

| Net change in unrealized gain on investments allocated from Master Fund | | | (4,757,701 | ) |

| Net change in unrealized loss on asset-backed financing allocated from Master Fund | | | 774,941 | |

| Net realized loss on investments allocated from Master Fund | | | 6,661,493 | |

| Net change in carried interest allocated from the Master Fund | | | 537,089 | |

| Change in assets and liabilities: | | | | |

| Increase in short-term investment | | | (6,976 | ) |

| Decrease in tax withholdings refund receivable | | | 7,727,046 | |

| Decrease in other assets | | | 103,254 | |

| Decrease in tax withholdings refund payable to common shareholders | | | (7,727,046 | ) |

| Decrease in payable to Investment Manager | | | (29,023 | ) |

| Decrease in distributions payable-Series A preferred shares | | | 5,700 | |

| Decrease in accrued expenses | | | (12,878 | ) |

| Net cash provided by operating activities | | | 27,100,000 | |

| | | | | |

| Cash flows from financing activities: | | | | |

| Distributions to common shareholders | | | (27,100,000 | ) |

| Net cash used in financing activities | | | (27,100,000 | ) |

| | | | | |

| Change in cash | | | - | |

| | | | | |

| Cash at beginning of period | | | - | |

| Cash at end of period | | $ | - | |

| | | | | |

The accompanying notes and the attached financial statements of the Master Fund are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LLC

Financial Highlights

As of and for the Six Months ended June 30, 2016 and Years ended December 31, 2015, 2014, 2013, and 2012 (Unaudited)

| | | Period Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | June | | | December | | | December | | | December | | | December | |

| | | | 30, 2016 | | | | 31, 2015 | | | | 31, 2014 | | | | 31, 2013 | | | | 31, 2012 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | (amounts applicable to common shares) | |

| | | | | | | | | | | | | | | | | | | | | |

| BEGINNING NET ASSET VALUE | | $ | 156.84 | | | $ | 425.11 | | | $ | 567.03 | | | $ | 618.05 | | | $ | 696.92 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 10.02 | | | | 15.63 | | | | 50.34 | | | | 1.17 | | | | 42.80 | |

| Distributions to Series A preferred shares | | | (0.01 | ) | | | (0.02 | ) | | | (0.02 | ) | | | (0.02 | ) | | | (0.02 | ) |

| Net realized and unrealized (loss) gain | | | | | | | | | | | | | | | | | | | | |

| from investments | | | (6.00 | ) | | | (7.23 | ) | | | (27.41 | ) | | | 57.97 | | | | (3.11 | ) |

| Total income from investment operations | | | 4.01 | | | | 8.38 | | | | 22.91 | | | | 59.12 | | | | 39.67 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS (2) | | | | | | | | | | | | | | | | | | | | |

| Investment income | | | (10.02 | ) | | | - | | | | (61.20 | ) | | | (24.46 | ) | | | (9.84 | ) |

| Capital gains | | | - | | | | (15.70 | ) | | | (31.23 | ) | | | (32.49 | ) | | | (19.90 | ) |

| Return of capital | | | (40.57 | ) | | | (260.95 | ) | | | (72.40 | ) | | | (53.19 | ) | | | (88.80 | ) |

| Total distributions | | | (50.59 | ) | | | (276.65 | ) | | | (164.83 | ) | | | (110.14 | ) | | | (118.54 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| ENDING NET ASSET VALUE | | $ | 110.26 | | | $ | 156.84 | | | $ | 425.11 | | | $ | 567.03 | | | $ | 618.05 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (3)(4) | | | 3.52 | % | | | 3.59 | % | | | 4.24 | % | | | 11.49 | % | | | 6.16 | % |

| Internal rate of return (5) | | | 8.78 | % | | | 8.80 | % | | | 9.11 | % | | | 9.72 | % | | | 9.40 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Series A preferred shares: | | | | | | | | | | | | | | | | | | | | |

| Net assets at period end | | $ | 114,000 | | | $ | 114,000 | | | $ | 114,000 | | | $ | 114,000 | | | $ | 114,000 | |

| Total shares outstanding | | | 228 | | | | 228 | | | | 228 | | | | 228 | | | | 228 | |

| Asset coverage ratio | | | 51811 | % | | | 73,699 | % | | | 199,760 | % | | | 266,451 | % | | | 290,423 | % |

| Liquidation preference per share | | $ | 500 | | | $ | 500 | | | $ | 500 | | | $ | 500 | | | $ | 500 | |

| | | | | | | | | | | | | | | | | | | | | |

| Common Shares: | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate (4) | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| Ratio of net investment income to weighted | | | | | | | | | | | | | | | | | | | | |

| average net assets (1)(6)(7) | | | 17.84 | % | | | 6.64 | % | | | 9.90 | % | | | 0.22 | % | | | 6.35 | % |

| Ratio of expenses to weighted average net | | | | | | | | | | | | | | | | | | | | |

| assets (1)(6)(7) | | | 21.88 | % | | | 10.96 | % | | | 5.56 | % | | | 2.62 | % | | | 3.06 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at period end | | $ | 59,064,802 | | | $ | 84,016,448 | | | $ | 227,726,682 | | | $ | 303,753,744 | | | $ | 331,082,007 | |

| | | | | | | | | | | | | | | | | | | | | |

| (1) Includes proportionate share of income and expenses of the Master Fund. | | | | | | | | | | | | | |

| (2) Character of distributions is on the GAAP basis for the period from January 1, 2016 to June 30, 2016. | | | | | |

(3) Total return is calculated for the common share class taken as a whole. An investor’s return may vary from these returns based on the timing of capital transactions. | |

| (4) Not annualized. | | | | | | | | | | | | | | | | | | | | |

(5) Internal rate of return is calculated based on the actual dates of the cash inflows (capital contributions), outflows (distributions), with the exception of distributions declared but not paid, and shareholder capital accounts on a life-to-date basis. | |

| (6) Ratios exclude distributions to Series A preferred shareholders. | | | | | | | | | | | | | |

| (7) Annualized for the period from January 1, 2016 to June 30, 2016. | | | | | | | | | | | | | |

The accompanying notes and the attached financial statements of the Master Fund are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LLC

Notes to Financial Statements

As of and for the Six Months ended June 30, 2016 (Unaudited)

Note 1—Organization

PNMAC Mortgage Opportunity Fund, LLC (the “Fund”) is a limited liability company organized under the laws of the state of Delaware. The Fund is registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified management company. Shares of the Fund were issued solely in private placement transactions that did not involve any “public offering” within the meaning of Section 4(2) of the Securities Act of 1933, as amended (the “1933 Act”). Investments in the Fund may be made only by “accredited investors” within the meaning of Regulation D under the 1933 Act. The investment objective of the Fund is to achieve attractive total returns by capitalizing on dislocations in the mortgage market through opportunistic investments primarily in U.S. residential mortgages and related assets, instruments and entities.

The Fund is managed by PNMAC Capital Management, LLC (the “Investment Manager”). The Investment Manager is a registered investment adviser with the Securities and Exchange Commission (“the SEC”).

The Fund invests substantially all of its assets in a limited partnership interest of PNMAC Mortgage Opportunity Fund, LP (the “Master Fund”), a limited partnership formed under the laws of the state of Delaware. The general partner of the Master Fund is PNMAC Opportunity Fund Associates, LLC (the “General Partner”), a Delaware limited liability company, which along with the Investment Manager, is a wholly owned subsidiary of Private National Mortgage Acceptance Company, LLC (“PNMAC”), all of which are affiliates of the Fund.

The Master Fund operates as a master fund in a master-feeder fund structure. The Master Fund acts as the central investment mechanism for the Fund and the General Partner. The General Partner has the exclusive right to conduct the operations of the Master Fund. The Fund held a 47% interest in the Master Fund at June 30, 2016, net of the General Partner’s Carried Interest in the Master Fund. The General Partner’s investment in the Master Fund includes its capital account, which includes its proportional share of the Master Fund’s net investment income and its Carried Interest in the Master Fund. The Fund is the sole limited partner in the Master Fund.

The Master Fund has the same investment objective as the Fund and conducts its operations through its subsidiaries: PNMAC Mortgage Co. Funding, LLC, PNMAC Mortgage Co., LLC, and PNMAC Mortgage Co (FI), LLC (these companies are referred to collectively as the “Mortgage Investments”).

| · | PNMAC Mortgage Co. Funding, LLC is a wholly owned limited liability company that acquires, holds and works out distressed U.S. residential mortgage loans and holds mortgage-backed securities resulting from securitization of such mortgage loans. |

| · | PNMAC Mortgage Co. LLC is a wholly owned limited liability company that acquires, holds and works out distressed U.S. residential mortgage loans. |

| · | PNMAC Mortgage Co (FI), LLC is an investment company that was formed to pool investor capital and take an interest in the proceeds of FNBN I, LLC (“FNBN”). FNBN is a limited liability company formed to own a pool of residential mortgage loans in a transaction with the Federal Deposit Insurance Corporation (the “FDIC”). |

PNMAC Mortgage Co (FI), LLC is the sole member and manager of FNBN. Accordingly, PNMAC Mortgage Co (FI), LLC consolidates its investment in FNBN. The FDIC owns a substantial participation interest in the proceeds of the mortgage loans held by FNBN that depends on the amount of proceeds collected. The FDIC’s interest in FNBN is shown as a Non-controlling Interest in the Master Fund (the “Non-controlling Interest”). The FDIC’s Non-controlling Interest in FNBN is included in the Consolidated Statement of Assets and Liabilities of the Master Fund as a component of Partners’ Capital.

PNMAC Mortgage Opportunity Fund, LLC

Notes to Financial Statements

As of and for the Six Months ended June 30, 2016 (Unaudited)

The Master Fund owns a 100% interest in a series of PNMAC Mortgage Co (FI), LLC. The series holds its own assets and recognizes the revenues and expenses attributable to those assets.

PNMAC Mortgage Co (FI), LLC’s operating agreement with the FDIC governing its investment in FNBN limits PNMAC Mortgage Co (FI), LLC’s ability to transfer any of its rights or interests in FNBN. PNMAC Mortgage Co (FI), LLC may only transfer all or any part of its interest or rights if (i) the transferee is a qualified transferee as defined in the operating agreement and (ii) it first obtains prior written consent of the FDIC. The contract specifies that the consent shall not be unreasonably withheld, delayed or conditioned, if the transferee is a qualified transferee.

As market conditions permit, PNMAC Mortgage Co., LLC may transfer the mortgage loans it owns to the Master Fund to be securitized for financing purposes or sale. The Master Fund may hold interests in pools of such securitized mortgage loans and invest directly in other mortgage-related investment securities.

The financial statements of the Master Fund are included elsewhere in this report and should be read with the Fund’s financial statements.

The Fund began operations on August 11, 2008 and will continue in existence through December 31, 2016, subject to three one-year extensions by the Investment Manager at its discretion, in accordance with the terms of the Limited Liability Company Agreement governing the Fund.

Note 2—Significant Accounting Policies

Basis of Presentation

The Fund prepares its financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”) as codified by the Financial Accounting Standards Board (“FASB”) in its Accounting Standards Codification (the “Codification”). The Fund is classified as an investment company and reports its investments in accordance with the Financial Services – Investment Companies topic of the Codification.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires the Investment Manager to make estimates and judgments that affect the reported amount of assets and liabilities, recognition of income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results will likely differ from those estimates.

Fair Value

The Fund carries its investments at fair values with changes in fair value recognized in current period results of operations. The Fund groups its assets and liabilities at fair value in three levels, based on the markets in which the assets and liabilities are traded and the observability of the inputs used to determine fair value. The three levels are described below:

Level 1 – Quoted prices in active markets for identical assets or liabilities.

PNMAC Mortgage Opportunity Fund, LLC

Notes to Financial Statements

As of and for the Six Months ended June 30, 2016 (Unaudited)

Level 2 – Prices determined using other significant observable inputs. Observable inputs are inputs that other market participants would use in pricing an asset or liability and are developed based on market data obtained from sources independent of the Fund. These may include quoted prices for similar assets and liabilities, interest rates, prepayment speeds, credit risk and others.

Level 3 – Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an asset or liability at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Investment Manager’s own judgments about the factors that market participants use in pricing an asset or liability, and are based on the best information available in the circumstances.

As a result of the difficulty in observing certain significant valuation inputs affecting “Level 3” financial statement items, the Investment Manager is required to make judgments regarding these items’ fair values. Different persons in possession of the same facts may reasonably arrive at different conclusions as to the inputs to be applied in estimating the fair value of these financial statement items and their fair values. Likewise, due to the general illiquidity of some of these financial statement items, subsequent transactions may be at values significantly different from those reported.

Investment in Master Fund

The Fund receives a proportionate limited partnership interest in the Master Fund equal to its relative contribution of capital to the Master Fund before allocation of Carried Interest to the General Partner of the Master Fund. The net increase or decrease in net assets resulting from operations includes the Fund’s proportionate share of the Master Fund’s income and losses (including net investment income and net realized and unrealized gains and losses on investments) arising from its investment in the Master Fund.

The Fund carries its investment in the Master Fund based on the Master Fund’s fair value and recognizes its proportional share of changes in the Master Fund’s fair value in current period operations. The fair value estimates of investments held by the Master Fund are based on the discounted cash flow projections of its investments.

Because the fair value of most of the Master Fund’s assets has been estimated by the Investment Manager in the absence of readily determinable fair values, the Master Fund categorizes these investments as “Level 3” fair value financial statement items.

Short-term Investment

The short-term investment, the BlackRock Liquidity Funds: TempFund Institutional Shares is carried at fair value with changes in fair value recognized in current period operations. Fair value is based on the fair value per share published by the manager of the money market fund on the valuation date. The Fund’s short-term investment is classified as a “Level 1” fair value financial statement item.

Dividends on short-term investment are accrued based on the interest earned by the money market fund reduced by its operating expenses as reported by the money market fund for the reporting period.

Expenses

The Fund is charged for those expenses that are directly attributable to it, such as, but not limited to, administration and custody fees. Expenses that are not directly attributable to the Fund are generally allocated among the Fund and other entities managed by the Investment Manager in proportion to their assets. All expenses are recognized on the accrual basis of accounting.

PNMAC Mortgage Opportunity Fund, LLC

Notes to Financial Statements

As of and for the Six Months ended June 30, 2016 (Unaudited)

Income Taxes

The Fund is treated as a separate taxable entity for Federal income tax purposes. The Fund’s policy is to comply with the provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute to shareholders all of its distributable net investment income and net realized gain on investments. Accordingly, no provision for Federal income or excise tax is necessary.

The Investment Manager’s assessment of the requirement to provide for income taxes also includes an assessment of the liability arising from uncertain income tax positions. The Investment Manager has concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions that will be taken on the tax return for the fiscal year ended December 31, 2015.

The Investment Manager is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. In developing its conclusion, the Investment Manager has analyzed all tax years that are open for examination by the relevant income taxing authority. As of June 30, 2016, open Federal and state income tax years include the tax years ended December 31, 2012 through 2015 and December 31, 2011 through 2015, respectively. The Fund has no such examinations in progress.

If applicable, the Fund will recognize interest charges related to unrecognized tax benefits in “interest expense” and penalties in “other expenses” on the statement of operations.

Distributions to Shareholders

Distributions to shareholders are recorded on the ex-dividend date. The Fund will distribute substantially all of its net investment income and all of its capital gains to shareholders at least annually. The character of distributions made during the year from net investment income or capital gains might differ from their ultimate characterization for federal income tax purposes due to differences in the recognition of income and expense items for financial statement and tax purposes.

Indemnifications

Under the Fund’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnification to other parties. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred, and may not occur. However, the Fund has not had prior claims or losses pursuant to these contracts, has not recorded any amounts as of June 30, 2016, and expects the risk of loss to be remote.

Note 3—Fair Value of Investments

Following is a summary of financial statement items that are measured at fair value on a recurring basis for the six months ended June 30, 2016:

| | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | |

| Investment in Master Fund | | $ | - | | | $ | - | | | $ | 59,263,876 | | | $ | 59,263,876 | |

| Short-term investment | | | 130,705 | | | | - | | | | - | | | | 130,705 | |

| | | $ | 130,705 | | | $ | - | | | $ | 59,263,876 | | | $ | 59,394,581 | |

PNMAC Mortgage Opportunity Fund, LLC

Notes to Financial Statements

As of and for the Six Months ended June 30, 2016 (Unaudited)

There were no transfers between fair value hierarchy levels during the six months ended June 30, 2016.

Following is a roll forward of the Fund’s Investment in Master Fund for the six months ended June 30, 2016:

| PNMAC Mortgage Opportunity Fund, LP | | | |

| | | | |

| Balance at January 1, 2016 | | $ | 84,155,445 | |

| Distributions | | | (27,350,000 | ) |

| Net investment income | | | 5,674,253 | |

| Net change in unrealized gain on investments | | | 4,757,701 | |

| Net change in unrealized loss on asset-backed financing | | | (774,941 | ) |

| Net realized loss on investments | | | (6,661,493 | ) |

| Net change in Carried Interest allocated from the | | | | |

| Master Fund to General Partner | | | (537,089 | ) |

| Balance at June 30, 2016 | | $ | 59,263,876 | |

Valuation Techniques and Assumptions

Most of the Fund’s assets are carried at fair value with changes in fair value recognized in current period operations. A substantial portion of those assets are “Level 3” financial statement items which require the use of significant unobservable inputs in the estimation of the assets’ fair values. Unobservable inputs reflect the Investment Manager’s own judgments about the factors that market participants use in pricing an asset, and are based on the best information available under the circumstances.

Because the fair value of “Level 3” financial statement items is difficult to estimate, the Investment Manager’s process includes performance of these items’ valuation by a specialized staff and significant executive management oversight. The Investment Manager has assigned the responsibility for estimating the fair values of “Level 3” financial statement items to its Financial Analysis and Valuation group (the “FAV group”), which is responsible for estimating the fair value of and monitoring the Fund’s investment portfolios and maintenance of its valuation policies and procedures.

The Investment Manager’s FAV group submits the results of its valuations to the Investment Manager’s valuation committee, which oversees and approves the valuations. The Investment Manager’s valuation committee includes the chief executive, financial, operating, risk, business development, and asset/liability management officers of PNMAC.

The FAV group monitors the models used for valuation of the Fund’s “Level 3” financial statement items, including the models’ performance versus actual results and reports those results to the valuation committee. The results developed in the FAV group’s monitoring activities are used to calibrate subsequent projections used to estimate fair value.

The FAV group is responsible for reporting to the Investment Manager’s valuation committee on a monthly basis on the changes in the valuation of the portfolio, including major factors affecting the valuation and any changes in model methods and inputs. To assess the reasonableness of its valuations, the FAV group presents an analysis of the effect on the valuation of each of the changes to the significant inputs to the models.

Investment in Master Fund

The Fund’s investment in the Master Fund is a “Level 3” financial statement item and the Fund’s estimate of the fair value of its investment in the Master Fund is based on the fair value of the assets of the Master Fund’s investments, most of which are mortgage loans and real estate acquired in settlement of loans.

PNMAC Mortgage Opportunity Fund, LLC

Notes to Financial Statements

As of and for the Six Months ended June 30, 2016 (Unaudited)

Note 4—Investment Transactions

During the six months ended June 30, 2016, the Fund received distributions from the Master Fund in the amount of $27,350,000 and did not purchase any limited partnership interests in the Master Fund.

Note 5—Shareholder Services Fee, Administration Fees and Custodian Fees

The Fund has a shareholder services agreement with the Investment Manager. Under the terms of the agreement, the Investment Manager provides certain shareholder (but not investment management) services to the Fund.

Shareholder services include responding to inquiries by shareholders of the Fund regarding the Fund and their investment therein, preparation, review and distribution of a comprehensive monthly economic report relating to the Fund and its investments; reviewing and supervising the preparation of reports to and other communications with shareholders as the Fund may reasonably request.

For shareholder services provided by the Investment Manager, the Fund pays the Investment Manager a fee equal to an annual rate of 0.5% of the Fund’s net asset value so long as the fee does not exceed 0.5% of the aggregate capital contributions to the Fund.

The shareholder services fee is calculated and accrued monthly based on the lesser of the partners’ capital commitments or capital balances and is paid to the Investment Manager quarterly after the end of the quarter. The shareholder services fee for the six months ended June 30, 2016 was $161,928.

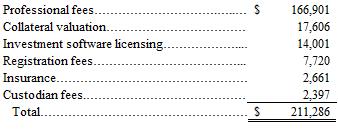

The Fund has engaged U.S. Bancorp Fund Services, LLC, an indirect wholly-owned subsidiary of U.S. Bancorp, to serve as the Fund's administrator, fund accountant, transfer agent, and dividend paying agent. The Fund pays the administrator a monthly fee computed at an annual rate of 0.02% of the first $1,000,000,000 of the Fund's total monthly net assets, 0.015% on the next $1,000,000,000 of the Fund's total monthly net assets and 0.01% on the balance of the Fund's total monthly net assets subject to an annual minimum fee of $120,000. The administration fees for the six months ended June 30, 2016 totaled $70,745.

U.S. Bank, N.A. serves as the Fund's custodian. The Master Fund pays the custodian a monthly fee computed at an annual rate of 0.01% on the Fund's average daily market value subject to an annual minimum fee of $28,800 across all funds managed by the Investment Manager. The custodian fees incurred by the Master Fund and allocated to the Fund for the six months ended June 30, 2016 totaled $27,407.

Note 6—Directors and Officers

The Fund and Master Fund share the same board of directors. The Master Fund’s board of directors has overall responsibility for monitoring and overseeing the investment program of the Master Fund and its management and operations. All directors’ fees and expenses are paid by the Master Fund. Independent directors receive an annual retainer of $64,800 and a fee per meeting of the board of directors or committees of $2,000, subject to a cap of $15,000 per year for all non-regularly-scheduled meetings. The audit committee chairperson receives an annual retainer of $10,000 in addition to the amounts above. Directors are reimbursed by the Master Fund for their travel expenses related to board meetings. The total directors’ fees and expenses incurred at the Master Fund and allocated to the Fund for the six months ended June 30, 2016 were $141,102.

PNMAC Mortgage Opportunity Fund, LLC

Notes to Financial Statements

As of and for the Six Months ended June 30, 2016 (Unaudited)

One of the directors of the Fund is an officer of the Investment Manager and the Master Fund and receives no compensation from the Master Fund for serving as a director. Certain officers of the Master Fund are affiliated with the Investment Manager. Such officers receive no compensation from the Master Fund for serving in their respective roles.

Note 7—Common Shareholders

The Fund is authorized to issue an unlimited number of common shares. The common shares have no preferential, preemptive, conversion, appraisal, exchange or redemption rights and there are no sinking fund provisions applicable to the shares. The Fund issues common shares at the net asset value per share as calculated within 48 hours before receipt of capital called. Shareholders are not able to withdraw from the Fund other than through distributions made upon a realization of the Fund’s investments.

Common shares of the Fund were offered in private placements pursuant to Section 4(2) of the U.S. Securities Act of 1933, as amended on August 11, 2008 (the “Initial Closing”). The Fund raised $393,283,020 in aggregate capital commitments. No additional closings were held after the Initial Closing to accept new or additional capital commitments.

Common shares are distributed among three separate series based on the timing of capital contributions, which has affected the underlying calculation of carried interest for each series.

Following is a summary of distributions made by the Fund determined on a GAAP basis during the six months ended June 30, 2016:

Investment income | | $ | 5,369,876 | |

Realized gains | | | - | |

Return of capital | | | 21,730124 | |

Total distributions | | $ | 27,100,000 | |

These distributions are not subject to recall.

Note 8—Preferred Shares

Series A preferred shares of the Fund were created by the board of directors on August 11, 2008. The preferred shares have a 10% cumulative dividend preference and a liquidation preference totaling $114,000 plus accumulated and unpaid dividends. In the event of a liquidation of the Fund, the accumulated preferred dividends and the remaining face amount of the preferred shares will be distributed before any distributions are made to common shareholders. The Fund is authorized to issue up to 5,000 Series A preferred shares at $500 per share. As of June 30, 2016 the Fund has issued 228 Series A preferred shares.

Series A preferred shareholders are not entitled to vote on any matter except matters submitted to a vote of the common shares that also affect the Series A preferred shares. The Fund shall not issue or sell any preferred shares or pay any dividend or distribution to the common shares unless the preferred shares have an asset coverage of at least 200% immediately following the given action.

During the six months ended June 30, 2016, no dividends to preferred shareholders have been paid; accrued but unpaid dividends of $11,400 remained at June 30, 2016.

PNMAC Mortgage Opportunity Fund, LLC

Notes to Financial Statements

As of and for the Six Months ended June 30, 2016 (Unaudited)

Note 9—Transactions with Affiliates

PNMAC Mortgage Opportunity (Offshore) Fund, Ltd. owns 29% of the Fund’s common shares.

The Fund paid $82,682 to PNMAC for reimbursable expenses paid on the Fund’s behalf during the six months ended June 30, 2016. Of this amount, $82,374 was for professional fees and $308 was for registration fees.

PLS acts as the primary mortgage servicer for all mortgage loans owned by the Master Fund. The servicing agreement between PLS and Master Fund generally provides for servicing fees of 50 to 100 basis points of unpaid principal balance per year, depending on the type and quality of mortgage loans being serviced, plus other specified fees and charges. The servicing agreement also requires that PLS will rebate to the Master Fund an amount equal to the cumulative profit, if any, of the servicing operations attributable to the loans owned by the Master Fund, and conversely, charge the Master Fund if a loss has been incurred in order to effect overall “at cost” pricing with respect to loan servicing activities for such assets. Under a separate agreement between the Master Fund and the Investment Manager, the Investment Manager will cause PLS to rebate to the Master Fund an amount equal to 13% of servicing-related fees charged to the Master Fund to approximate overall “at cost” pricing with respect to mortgage loan servicing activities for such assets, and the Investment Manager will represent on an annual basis to the Master Fund’s board of directors whether servicing fees paid net of the rebate have in fact not exceeded the actual cash costs incurred in servicing the mortgage loans owned by the Master Fund.

Total mortgage loan servicing fees charged by PLS allocated to the Fund before the rebate for the six months ended June 30, 2016 totaled $1,092,934, of which PLS reduced by providing a rebate allocated to the Fund of $148,179.

The Fund’s short-term investment, the BlackRock Liquidity Funds: TempFund Institutional Shares, is managed by BlackRock Institutional Management Corporation which a wholly owned subsidiary of Blackrock, Inc. BlackRock Inc. is an affiliate of the Fund.

Note 10—Risk Factors

Because of the limitation on rights of redemption and the fact that the shares will not be traded on any securities exchange or other market and will be subject to substantial restrictions on transfer, and because the Investment Manager invests the Fund's assets in illiquid assets, an investment in the Fund is highly illiquid and involves a substantial degree of risk.

Due to the nature of the “master/feeder” structure, the Fund is materially affected by the actions of the Master Fund and other investors. Investment risks such as market and credit risks of the Master Fund’s investments are discussed in the notes to the Master Fund’s financial statements included herein.

Note 11—Subsequent Events

The Investment Manager has evaluated all events or transactions through the date of issuance of these financial statements. During this period the Fund paid a dividend of $11,400 to the Series A preferred shareholders.

****

PNMAC Mortgage Opportunity Fund, LLC

Directors and Officers (Unaudited)

Form N-Q

The Fund files its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Fund’s Form N-Q is available without charge by visiting the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities owned by the Fund and information regarding how the Fund voted proxies relating to portfolio securities are available to stockholders (i) without charge, upon request, by calling the Fund collect at +1(818) 224-7442; and (ii) on the SEC’s website at http://www.sec.gov.

Board of Directors

The Fund’s Form N-2 includes additional information about the Fund’s directors and is available upon request without charge by calling the Fund collect at (818) 224-7442 or by visiting the SEC’s website at www.sec.gov.

Forward-Looking Statements

This report contains "forward-looking statements,'' which are based on current management expectations. Actual future results, however, may prove to be different from expectations. You can identify forward-looking statements by words such as "may'', "will'', "believe'', "attempt'', "seem'', "think'', "ought'', "try'' and other similar terms. The Fund’s past investment performance and returns are not predictive of its future investment performance and returns. The Fund cannot promise future investment performance or returns. Management’s opinions are a reflection of its best judgment at the time this report is compiled, and it disclaims any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Approval of Investment Management Agreement

On June 16, 2016, the Board of Directors of the Master Fund and the Fund (collectively, the “Funds”), including the “non-interested” Directors (the “Independent Directors”), met in person and voted to approve the continuance of the Investment Management Agreements (including the portions of the Master Fund’s partnership agreement referred to therein) with the Investment Manager for an additional year.

In considering whether to recommend approval of the Investment Management Agreements, the Independent Directors reviewed materials provided by the Investment Manager and counsel to the Independent Directors. The Independent Directors also met with senior personnel of the Investment Manager and discussed a number of topics affecting their determination, including the following:

(i) The nature, extent, and quality of services expected to be provided by the Investment Manager. The Independent Directors reviewed the services that the Investment Manager provided to the Funds since inception in August 2008 and are expected to continue to provide to the Funds. In addition, the Independent Directors considered the size, education, background, and experience of the Investment Manager’s staff, including the mortgage finance and capital markets experience of the Investment Manager’s senior management team. Lastly, the Independent Directors reviewed the Investment Manager’s ability to attract and retain quality and experienced personnel. The Independent Directors concluded that the scope of services provided since inception and expected to be provided by the Investment Manager to the Funds, and the experience and expertise of the personnel performing such services, was consistent with the nature, extent, and quality expected of an investment adviser of investment vehicles such as the Funds.

(ii) The investment performance of the Funds and the Investment Manager. The Independent Directors received information about the performance of the Funds and the Investment Manager in managing the Fund. The Directors also received performance information regarding the Funds compared to certain indexes, benchmarks, and/or registered and non-registered funds managed by other investment advisers that had somewhat comparable investment programs.

PNMAC Mortgage Opportunity Fund, LLC

Directors and Officers (Unaudited)

(iii) Cost of the services to be provided and profits to be realized by the Investment Manager and its affiliates from the relationship with the Funds. The Independent Directors considered the estimated cost of the services provided by the Investment Manager. As part of their analysis, the Independent Directors gave substantial consideration to the compensation payable to the Investment Manager. The Independent Directors noted that the compensation terms would remain the same. In reviewing the management compensation, the Independent Directors considered the management fees and operating expense ratios of other registered and non-registered funds managed by other investment advisers that had somewhat comparable investment programs. The Independent Directors also reviewed and took into account other relationships between the Funds and the Investment Manager and its related persons, including the shareholder servicing agreement between the Investment Manager and the Fund, the mortgage servicing agreements between the Master Fund and an affiliate of the Investment Manager, and an agreement with BlackRock, which has an investment in the Investment Manager’s parent company, for a portfolio valuation analytic model. The Independent Directors also considered the compensation charged by the Investment Manager to its other clients. Finally, the Independent Directors took those other service agreements into account in the context of evaluating the profitability of the Investment Manager in respect of the overall relationship of the Investment Manager and its related persons to the Funds.

(iv) Economies of Scale. The Independent Directors also considered that possible economies of scale from future growth of the Funds were not relevant inasmuch as the Funds were closed to any new investment and had limited terms.

The Independent Directors had an opportunity to have Executive Session with counsel to the Independent Directors. During the course of their deliberations at the meeting on June 16, 2016, the Independent Directors thoroughly reviewed and evaluated the factors to be considered for approval of the Investment Management Agreements including, but not limited to: the expenses incurred in performance of services by the Investment Manager; the compensation to be received by the Investment Manager under the Investment Management Agreements; the fees charged by the Investment Manager’s peers; the past performance of the Investment Manager; and the range and quality of services provided by the Investment Manager.

The Independent Directors expressed satisfaction with the information provided at the meeting on June 16, 2016 and prior meetings, and acknowledged that they had received sufficient information to consider and approve the continuance of the Investment Management Agreements. No single factor was determinative to the decision of the Independent Directors. Rather, after weighing all of the reasons discussed above, the Independent Directors unanimously approved the continuance of the Investment Management Agreements.

The Independent Directors concluded that the compensation that the Investment Manager would receive under the Investment Management Agreements was reasonable.

PNMAC Mortgage Opportunity Fund, LP

and Subsidiaries

Semi-Annual Report

As of and for the six months ended June 30, 2016

| | |

| Financial Statements | Page |

| Consolidated Statement of Assets and Liabilities | 2 |

| Consolidated Summary Schedule of Investments | 3 |

| Consolidated Statement of Operations | 5 |

| Consolidated Statements of Changes in Partners’ Capital | 6 |

| Consolidated Statement of Cash Flows | 7 |

| Consolidated Financial Highlights | 8 |

| Notes to Consolidated Financial Statements | 11 |

| Additional Information | 26 |

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Consolidated Statement of Assets and Liabilities

June 30, 2016 (Unaudited)

| Assets: | | | |

| Investments at fair value (cost $156,773,827) | | $ | 183,193,040 | |

| Receivable from PennyMac Loan Services, LLC | | | 15,069,356 | |

| Other assets | | | 3,322,224 | |

| Total assets | | | 201,584,620 | |

| | | | | |

| Liabilities: | | | | |

| Asset-backed financing at fair value (proceeds $74,658,100) | | | 74,672,306 | |

| Payable to PennyMac Loan Services, LLC | | | 632,960 | |

| Accrued expenses | | | 397,765 | |

| Payable to Investment Manager | | | 230,215 | |

| Other liabilities | | | 227,078 | |

| Total liabilities | | | 76,160,324 | |

| | | | | |

| Partners' capital | | $ | 125,424,296 | |

| | | | | |

| Partners' capital consists of: | | | | |

| Non-controlling Interest | | $ | 23,727,735 | |

| General Partner | | | 42,432,685 | |

| Limited Partner | | | 59,263,876 | |

| Total partners' capital | | $ | 125,424,296 | |

| | | | | |

The accompanying notes are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Consolidated Summary Schedule of Investments

June 30, 2016 (Unaudited)

| INVESTMENTS - 146%* | | | | | | | |

| INVESTMENTS IN NONAFFILIATES - 133%* | | | | | | | |

| | | | | | | | | | | | |

| Description | | | | Maturity date | State | | | | | | |

| Mortgage loans | | | | | | | | | | | |

| Mortgage Loan ID#1000043954** | | | 5.25 | % | 5/1/2037 | FL | | $ | 2,230,825 | | | $ | 1,814,734 | |

| Mortgage Loan ID#1000043569** | | | 3.13 | % | 9/1/2036 | CA | | | 1,506,793 | | | | 1,335,097 | |

| Mortgage Loan ID#1000015063** | | | 7.38 | % | 9/1/2036 | FL | | | 1,350,000 | | | | 1,221,972 | |

| Mortgage Loan ID#1000028984** | | | 3.00 | % | 6/1/2056 | CA | | | 1,348,206 | | | | 1,003,727 | |

| Mortgage Loan ID#1000043880** | | | 3.00 | % | 2/1/2035 | OR | | | 1,387,425 | | | | 931,799 | |

| Mortgage Loan ID#1000002193 | | | 6.88 | % | 5/1/2037 | DC | | | 990,000 | | | | 908,634 | |

| Mortgage Loan ID#1000015179** | | | 4.25 | % | 10/1/2043 | CT | | | 873,780 | | | | 731,823 | |

| Mortgage Loan ID#1000035099** | | | 6.00 | % | 7/1/2037 | NY | | | 999,000 | | | | 697,943 | |

| Mortgage Loan ID#1000016663** | | | 6.88 | % | 5/1/2037 | OR | | | 799,863 | | | | 693,208 | |

| Mortgage Loan ID#1000002189 | | | 5.13 | % | 8/1/2055 | NY | | | 1,019,114 | | | | 660,827 | |

| Mortgage Loan ID#1000016006** | | | 7.15 | % | 2/1/2037 | NY | | | 641,150 | | | | 642,515 | |

| Mortgage Loan ID#1000029387** | | | 8.25 | % | 6/1/2037 | NY | | | 600,000 | | | | 630,000 | |

| Mortgage Loan ID#1000035343** | | | 6.50 | % | 12/1/2043 | CA | | | 890,860 | | | | 616,006 | |

| Mortgage Loan ID#1000043694** | | | 3.38 | % | 3/1/2056 | CT | | | 771,808 | | | | 611,182 | |

| Mortgage Loan ID#1000043772** | | | 5.88 | % | 7/1/2037 | FL | | | 920,218 | | | | 609,883 | |

| Mortgage Loan ID#1000015520** | | | 8.00 | % | 11/1/2037 | GA | | | 1,000,000 | | | | 606,217 | |

| Mortgage Loan ID#1000043744** | | | 3.50 | % | 8/1/2055 | CA | | | 887,676 | | | | 578,143 | |

| Mortgage Loan ID#1000034768** | | | 3.25 | % | 4/1/2036 | NY | | | 644,039 | | | | 576,158 | |

| Mortgage Loan ID#1000016833** | | | 6.50 | % | 10/1/2037 | NY | | | 645,282 | | | | 554,990 | |

| Mortgage Loan ID#1000002384 | | | 3.13 | % | 11/1/2045 | DC | | | 738,636 | | | | 549,363 | |

| Mortgage Loan ID#1000001411 | | | 3.00 | % | 7/1/2047 | CA | | | 832,829 | | | | 546,394 | |

| Mortgage Loan ID#1000026020** | | | 4.00 | % | 6/1/2037 | CA | | | 550,425 | | | | 546,311 | |

| Mortgage Loan ID#1000029315** | | | 4.00 | % | 4/1/2037 | CA | | | 618,984 | | | | 518,905 | |

| Mortgage Loan ID#1000026032** | | | 4.00 | % | 12/1/2036 | HI | | | 420,101 | | | | 509,686 | |

| Mortgage Loan ID#1000026795** | | | 3.00 | % | 1/1/2049 | CA | | | 563,607 | | | | 501,326 | |

| Mortgage Loan ID#1000000557** | | | 6.90 | % | 3/1/2037 | NJ | | | 990,473 | | | | 489,599 | |

| Mortgage Loan ID#1000026305** | | | 5.88 | % | 10/1/2036 | CA | | | 594,045 | | | | 487,151 | |

| Mortgage Loan ID#1000001651 | | | 3.00 | % | 5/1/2055 | FL | | | 1,439,522 | | | | 477,797 | |

| Mortgage Loan ID#1000034934** | | | 2.00 | % | 6/1/2054 | NY | | | 732,839 | | | | 475,919 | |

| Mortgage Loan ID#1000026350** | | | 6.50 | % | 4/1/2037 | NY | | | 719,176 | | | | 475,591 | |

| Mortgage Loan ID#1000002404 | | | 3.44 | % | 9/1/2036 | NY | | | 755,396 | | | | 474,784 | |

| Mortgage Loan ID#1000043559** | | | 2.88 | % | 8/1/2045 | VA | | | 622,790 | | | | 465,586 | |

| Mortgage Loan ID#1000043885** | | | 5.50 | % | 12/1/2055 | MA | | | 519,033 | | | | 454,464 | |

| Mortgage Loan ID#1000035850** | | | 2.00 | % | 4/1/2055 | NY | | | 688,854 | | | | 454,427 | |

| Mortgage Loan ID#1000038435** | | | 5.38 | % | 2/1/2056 | CA | | | 526,418 | | | | 454,133 | |

| Mortgage Loan ID#1000025998** | | | 3.00 | % | 12/1/2053 | CA | | | 574,591 | | | | 453,759 | |

| Mortgage Loan ID#1000002184 | | | 2.00 | % | 5/1/2054 | NY | | | 763,182 | | | | 452,040 | |

| Mortgage Loan ID#1000002180 | | | 2.00 | % | 8/1/2055 | NY | | | 768,935 | | | | 450,783 | |

| Mortgage Loan ID#1000000560** | | | 6.80 | % | 1/1/2037 | NY | | | 613,522 | | | | 449,690 | |

| Mortgage Loan ID#1000027234** | | | 2.00 | % | 1/1/2050 | NY | | | 666,598 | | | | 440,944 | |

| Other** | | | 206,520,195 | | | | 118,955,842 | |

| | | | | | | | | | 240,726,190 | | | | 144,509,352 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(Continued)

The accompanying notes are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Consolidated Summary Schedule of Investments

June 30, 2016 (Unaudited)

| | | | Principal | | | Fair | |

| Description | State | | amount | | | value | |

| Real estate acquired in settlement of loans | | | | | | | |

| Property ID#1000043536** | MN | | $ | 860,000 | | | $ | 845,000 | |

| Property ID#1000027733** | IL | | | 573,920 | | | | 640,000 | |

| Property ID#1000027525 | NJ | | | 554,549 | | | | 620,000 | |

| Property ID#1000001643** | FL | | | 621,672 | | | | 610,000 | |

| Property ID#1000027182** | NV | | | 649,095 | | | | 598,000 | |

| Property ID#1000026843 | CA | | | 536,000 | | | | 560,000 | |

| Property ID#1002229087** | GA | | | 545,063 | | | | 475,000 | |

| Property ID#1000043755 | MN | | | 478,088 | | | | 475,000 | |

| Property ID#1000001655** | NY | | | 648,000 | | | | 455,000 | |

| Property ID#1000016184 | NJ | | | 440,000 | | | | 450,000 | |

| Other** | | | 21,684,550 | | | | 17,011,776 | |

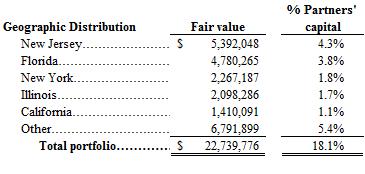

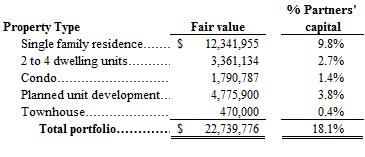

| | | | | 27,590,937 | | | | 22,739,776 | |

| | | | | | | | | | |

| TOTAL INVESTMENTS IN NONAFFILIATES (Cost $140,829,915) | | | 268,317,127 | | | | 167,249,128 | |

| | | | | | | | | | |

| INVESTMENTS IN AFFILIATES - 13%* | | | | | | | | |

Name of Issuer | | Shares | | | Fair value | |

| Short-Term Investment | | | | | | |

| BlackRock Liquidity Funds: TempFund Institutional Shares ^ | | $ | 15,943,912 | | | $ | 15,943,912 | |

| | | | | | | | | |

| TOTAL INVESTMENTS IN AFFILIATES (Cost $15,943,912) | | | 15,943,912 | | | | 15,943,912 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $156,773,827) | | | $ | 183,193,912 | |

| LIABILITIES - 60%* | | | | | | | | | | |

| Description | | | | | | Principal amount | | | Fair value | |

| Asset-backed financing | | | | | | | | | | |

| PNMAC 2015-NPL1 A-1-144A ^ | | | 4.00 | % | 3/25/2055 | | $ | 74,765,763 | | | $ | 74,672,306 | |

| | | | | | | | | | | | | | |

| TOTAL LIABILITIES (Proceeds $74,658,100) | | | 74,765,763 | | | | 74,672,306 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other assets in excess of other liabilities - 13%* | | | | 16,903,562 | |

| | | | | | | | | | | | | | |

| TOTAL PARTNERS' CAPITAL - 100%* | | | $ | 125,424,296 | |

| | | | | | | | | | | | | | |

| * Percentages are stated as a percent of partners’ capital | | | | | | |

| ** Pledged as collateral for asset-backed financing, including $81,807,484 of $118,955,842 other mortgage loans and $13,174,890 of $17,011,776 other real estate acquired in settlement of loans (See Note 5) |

| ^ Investment represents securities held or issued by related parties | | | | | | |

| All investments are in the United States of America. | | | | | | | |

(Concluded)

The accompanying notes are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Consolidated Statement of Operations

For the Six Months ended June 30, 2016 (Unaudited)

| Investment income | |

| Interest from mortgage loans | | $ | 14,000,858 | |

| Home Affordable Modification Program incentives | | | 268,584 | |

| Dividends from related party- | | | | |

| BlackRock Liquidity Funds: Tempfund Institutional Shares | | | 43,733 | |

| Other | | | 20,704 | |

| Total investment income | | | 14,333,879 | |

| | | | | |

| Expenses: | |

| Collection and liquidation expenses | | | 2,668,210 | |

| Interest on asset-backed financing | | | 1,646,281 | |

| Mortgage loan servicing fees to PennyMac Loan Services, LLC | | | 1,092,960 | |

| Investment advisory fees to PennyMac Capital Management, LLC | | | 485,783 | |

| Other mortgage loan servicing expenses | | | 284,906 | |

| Professional fees | | | 177,242 | |

| Directors' fees and expenses | | | 141,105 | |

| Administration fees | | | 112,908 | |

| Insurance | | | 85,233 | |

| Custodian fees | | | 30,919 | |

| Taxes | | | 22,133 | |

| Trustee fees | | | 21,672 | |

| Collateral valuation | | | 17,606 | |

| Investment software licensing | | | 13,970 | |

| Mortgage loan accounting fees | | | 11,218 | |

| Registration fees | | | 7,720 | |

| Total expenses before mortgage loan servicing fee rebate | | | 6,819,866 | |

| Mortgage loan servicing fee rebate from PennyMac Loan Services, LLC | | | (148,183 | ) |

| Net expenses | | | 6,671,683 | |

| Net investment income | | | 7,662,196 | |

Net realized loss and change in unrealized (loss) gain on investments and asset-backed financing: | |

| Net realized loss on investments | | | (7,203,011 | ) |

| Net change in unrealized gain on investments | | | 3,549,134 | |

| Net change in unrealized loss on asset-backed financing | | | (774,959 | ) |

| Net realized loss and change in unrealized (loss) gain on investments | | | | |

| and asset-backed financing | | | (4,428,836 | ) |

| Net increase in partners' capital resulting from operations | | | 3,233,360 | |

| Less: increase in partners' capital resulting from operations attributable to | | | | |

| Non-controlling Interest | | | 237,764 | |

| Net increase in partners' capital resulting from operations attributable to | | | | |

| General and Limited Partners | | $ | 2,995,596 | |

The accompanying notes are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Consolidated Statements of Changes in Partners’ Capital

For the Six Months ended June 30, 2016 and Year ended December 31, 2015 (Unaudited)

| | | Non-controlling | | | General | | | Limited | | | | |

| | | Interest | | | Partner | | | Partner | | | Total | |

| | | | | | | | | | | | | |

| Partners' capital, January 1, 2015 | | $ | 26,764,463 | | | $ | 40,772,973 | | | $ | 228,041,135 | | | $ | 295,578,571 | |

| Distributions | | | (4,478,266 | ) | | | - | | | | (149,470,693 | ) | | | (153,948,959 | ) |

| Increase in partners' capital from operations: | | | | | | | | | | | | | | | | |

| Net investment income | | | 5,490,685 | | | | 140 | | | | 9,456,412 | | | | 14,947,237 | |

| Net realized (loss) gain on investments | | | (1,779,226 | ) | | | 49 | | | | 3,962,650 | | | | 2,183,473 | |

| Net change in unrealized gain on investments | | | (1,077,359 | ) | | | (92 | ) | | | (7,472,362 | ) | | | (8,549,813 | ) |

| Net change in unrealized gain on asset-backed financing | | | - | | | | 9 | | | | 760,744 | | | | 760,753 | |

| Net change in Carried Interest | | | - | | | | 1,122,441 | | | | (1,122,441 | ) | | | - | |

| Net increase in partners' capital from operations | | | 2,634,100 | | | | 1,122,547 | | | | 5,585,003 | | | | 9,341,650 | |

| | | | | | | | | | | | | | | | | |

| Partners' capital, December 31, 2015 | | | 24,920,297 | | | | 41,895,520 | | | | 84,155,445 | | | | 150,971,262 | |

| Distributions | | | (1,430,326 | ) | | | - | | | | (27,350,000 | ) | | | (28,780,326 | ) |

| Increase in partners' capital from operations: | | | | | | | | | | | | | | | | |

| Net investment income | | | 1,987,806 | | | | 137 | | | | 5,674,253 | | | | 7,662,196 | |

| Net realized loss on investments | | | (541,368 | ) | | | (151 | ) | | | (6,661,492 | ) | | | (7,203,011 | ) |

| Net change in unrealized (loss) gain on investments | | | (1,208,674 | ) | | | 108 | | | | 4,757,700 | | | | 3,549,134 | |

| Net change in unrealized loss on asset-backed financing | | | - | | | | (18 | ) | | | (774,941 | ) | | | (774,959 | ) |

| Net change in Carried Interest | | | - | | | | 537,089 | | | | (537,089 | ) | | | - | |

| Net increase in partners' capital from operations | | | 237,764 | | | | 537,165 | | | | 2,458,431 | | | | 3,233,360 | |

| | | | | | | | | | | | | | | | | |

| Partners' capital, June 30, 2016 | | $ | 23,727,735 | | | $ | 42,432,685 | | | $ | 59,263,876 | | | $ | 125,424,296 | |

The accompanying notes are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Consolidated Statement of Cash Flows

For the Six Months ended June 30, 2016 (Unaudited)

| Cash flows from operating activities: | | | |

| | | | |

| Net increase in partners' capital resulting from operations | | $ | 3,233,360 | |

| | | | | |

| Adjustments to reconcile net increase in partners' capital resulting | | | | |

| from operations to net cash provided by operating activities: | | | | |

| | | | | |

| Accrual of unearned discount on mortgage loans | | | (8,827,072 | ) |

| Capitalization of interest on mortgage loans | | | (3,564,595 | ) |

| Net realized loss on investments | | | 7,203,011 | |

| Net change in unrealized gain on investments | | | (3,549,134 | ) |

| Net change in unrealized loss on asset-backed financing | | | 774,959 | |

| Principal repayments on mortgage loans | | | 5,171,519 | |

| Sales of real estate acquired in settlement of loans | | | 14,306,698 | |

| Net change in short-term investment | | | 27,287,262 | |

| Changes in other assets and liabilities: | | | | |

| Increase in receivable from PennyMac Loan Services, LLC | | | (547,042 | ) |

| Decrease in other assets | | | 220,414 | |

| Decrease in payable to PennyMac Loan Services, LLC | | | (93,793 | ) |

| Decrease in accrued expenses | | | (17,374 | ) |

| Decrease in payable to Investment Manager | | | (87,069 | ) |

| Increase in other liabilities | | | 1,233 | |

| Net cash provided by operating activities | | | 41,512,377 | |

| | | | | |

| Cash flows from financing activities: | | | | |

| Repayment of asset-backed financing | | | (12,732,051 | ) |

| Distributions to Non-controlling Interest | | | (1,430,326 | ) |

| Distributions to Limited Partner | | | (27,350,000 | ) |

| Net cash used in financing activities | | | (41,512,377 | ) |

| | | | | |

| Net change in cash | | | - | |

| | | | | |

| Cash at beginning of period | | | - | |

| Cash at end of period | | $ | - | |

| | | | | |

| | | | | |

| Supplemental cash flow information: | | | | |

| Cash paid for interest on asset-backed financing | | $ | 1,645,047 | |

The accompanying notes are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Financial Highlights

As of and for the Six Months ended June 30, 2016 and Years ended December 31, 2015, 2014, 2013, and 2012 (Unaudited)

| For the six months ended June 30, 2016 | | | | | | | | | |

| | | | | | | | | Total | |

Total Return (2)(3) | | | | | | | | | |

| Before Carried Interest | | | 3.49 | % | | | 5.04 | % | | | 5.04 | % |

Carried Interest (4) | | | 1.31 | % | | | -0.92 | % | | | - | |

| After Carried Interest | | | 4.80 | % | | | 4.12 | % | | | 5.04 | % |

| | | | | | | | | | | | | |

Internal rate of return (5) | | | 285.92 | % | | | 9.81 | % | | | 11.27 | % |

| | | | | | | | | | | | | |

Ratio of net investment income to weighted average partners capital (6) | | | 12.37 | % | | | 18.82 | % | | | 18.82 | % |

| | | | | | | | | | | | | |

Ratio of expenses to weighted average partners' capital (1)(6) | | | 12.05 | % | | | 20.81 | % | | | 20.81 | % |

| Carried Interest | | | -24,143.40 | % | | | 0.89 | % | | | - | |

| Ratio of expenses and carried interest to weighted average partners' capital | | | -24,131.35 | % | | | 21.70 | % | | | 20.81 | % |

| | | | | | | | | | | | | |

| Partners' capital, end of period | | $ | 42,432,685 | | | $ | 59,263,876 | | | $ | 101,696,561 | |

Portfolio turnover rate (3) | | | | | | | | | | | 0.00 | % |

| | | | | | | | | | | | | |

| For the year ended December 31, 2015 | | | | | | | | | | | | |

| | | | | | | | | Total | |

Total Return (2) | | | | | | | | | | | | |

| Before Carried Interest | | | 5.09 | % | | | 5.43 | % | | | 5.43 | % |

Carried Interest (4) | | | 2.70 | % | | | -0.89 | % | | | - | |

| After Carried Interest | | | 7.79 | % | | | 4.54 | % | | | 5.43 | % |

| | | | | | | | | | | | | |

Internal rate of return (5) | | | 322.00 | % | | | 9.83 | % | | | 11.36 | % |

| | | | | | | | | | | | | |

| Ratio of net investment income to weighted average | | | | | | | | | | | | |

| partners capital | | | 6.55 | % | | | 7.49 | % | | | 7.49 | % |

| | | | | | | | | | | | | |

Ratio of expenses to weighted average partners' capital (1) | | | 6.29 | % | | | 10.09 | % | | | 10.09 | % |

| Carried Interest | | | -52,330.73 | % | | | 0.89 | % | | | - | |

| Ratio of expenses and carried interest to weighted average partners' capital | | | -52,324.44 | % | | | 10.98 | % | | | 10.09 | % |

| | | | | | | | | | | | | |

| Partners' capital, end of year | | $ | 41,895,520 | | | $ | 84,155,445 | | | $ | 126,050,965 | |

| Portfolio turnover rate | | | | | | | | | | | 0.00 | % |

(Continued)

The accompanying notes are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Financial Highlights

As of and for the Six Months ended June 30, 2016 and Years ended December 31, 2015, 2014, 2013, and 2012 (Unaudited)

| For the year ended December 31, 2014 | | | | | | | | | |

| | | General | | | Limited | | | | |

| | | Partner (1) | | | Partner | | | Total | |

Total Return (2) | | | | | | | | | |

| Before Carried Interest | | | 6.67 | % | | | 5.39 | % | | | 5.39 | % |

Carried Interest (4) | | | 1.47 | % | | | -0.36 | % | | | - | |

| After Carried Interest | | | 8.14 | % | | | 5.03 | % | | | 5.39 | % |

| | | | | | | | | | | | | |

Internal rate of return (5) | | | 426.38 | % | | | 10.15 | % | | | 11.85 | % |

| | | | | | | | | | | | | |

| Ratio of net investment income to weighted average | | | | | | | | | | | | |

| partners capital | | | 9.92 | % | | | 9.38 | % | | | 9.38 | % |

| | | | | | | | | | | | | |

Ratio of expenses to weighted average partners' capital (1) | | | 2.81 | % | | | 4.41 | % | | | 4.41 | % |

| Carried Interest | | | -151,179.28 | % | | | 1.00 | % | | | - | |

| Ratio of expenses and carried interest to weighted average | | | | | | | | | | | | |

| partners' capital | | | -151,176.47 | % | | | 5.41 | % | | | 4.41 | % |

| | | | | | | | | | | | | |

| Partners' capital, end of year | | $ | 40,772,973 | | | $ | 228,041,135 | | | $ | 268,814,108 | |

| Portfolio turnover rate | | | | | | | | | | | 0.00 | % |

| | | | | | | | | | | | | |

| For the year ended December 31, 2013 | | | | | | | | | | | | |

| | | General | | | Limited | | | | | |

| | | Partner (1) | | | Partner | | | Total | |

Total Return (2) | | | | | | | | | | | | |

| Before Carried Interest | | | 14.95 | % | | | 13.86 | % | | | 13.86 | % |

Carried Interest (4) | | | 11.63 | % | | | -1.40 | % | | | - | |

| After Carried Interest | | | 26.58 | % | | | 12.46 | % | | | 13.86 | % |

| | | | | | | | | | | | | |

Internal rate of return (5) | | | 605.95 | % | | | 10.79 | % | | | 12.72 | % |

| | | | | | | | | | | | | |

| Ratio of net investment income to weighted average | | | | | | | | | | | | |

| partners capital | | | 2.18 | % | | | 0.86 | % | | | 0.86 | % |

| | | | | | | | | | | | | |

Ratio of expenses to weighted average partners' capital (1) | | | 0.31 | % | | | 1.68 | % | | | 1.68 | % |

| Carried Interest | | | -430,447.69 | % | | | 2.44 | % | | | - | |

| Ratio of expenses and carried interest to weighted average | | | | | | | | | | | | |

| partners' capital | | | -430,447.38 | % | | | 4.12 | % | | | 1.68 | % |

| | | | | | | | | | | | | |

| Partners' capital, end of year | | $ | 37,704,608 | | | $ | 304,323,367 | | | $ | 342,027,975 | |

| Portfolio turnover rate | | | | | | | | | | | 0.00 | % |

(Continued)

The accompanying notes are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Financial Highlights

As of and for the Six Months ended June 30, 2016 and Years ended December 31, 2015, 2014, 2013, and 2012 (Unaudited)

| | | | | | | | | | | | | |

| For the year ended December 31, 2012 | | | | | | | | | | | | |

| | | General | | | Limited | | | | | |

| | | Partner (1) | | | Partner | | | Total | |

| Total Return (2) | | | | | | | | | | | | |

| Before Carried Interest | | | 9.13 | % | | | 7.70 | % | | | 7.70 | % |

| Carried Interest (3) | | | 12.58 | % | | | -0.97 | % | | | - | |

| After Carried Interest | | | 21.71 | % | | | 6.73 | % | | | 7.70 | % |

| | | | | | | | | | | | | |

| Internal rate of return (4) | | | 944.06 | % | | | 10.54 | % | | | 12.55 | % |

| | | | | | | | | | | | | |

| Ratio of net investment income to weighted average | | | | | | | | | | | | |

| partners capital | | | 8.44 | % | | | 6.57 | % | | | 6.57 | % |

| | | | | | | | | | | | | |

| Ratio of expenses to weighted average partners' capital (1) | | | 0.83 | % | | | 2.30 | % | | | 2.30 | % |

| Carried Interest | | | -327,857.36 | % | | | 1.39 | % | | | - | |

| Ratio of expenses and carried interest to weighted average | | | | | | | | | | | | |

| partners' capital | | | -327,856.53 | % | | | 3.69 | % | | | 2.30 | % |

| | | | | | | | | | | | | |

| Partners' capital, end of year | | $ | 29,786,420 | | | $ | 331,483,559 | | | $ | 361,269,979 | |

| Portfolio turnover rate | | | | | | | | | | | 15.00 | % |

(1) In accordance with the Limited Partnership Agreement of the Master Fund, not all expenses are allocated to the General Partner (see Note 8). (2) Total return is calculated for each partner class taken as a whole. An investor’s return may vary from these returns based on different fee arrangements (as applicable) and the timing of capital transactions. (3) The Carried Interest is allocated (and subsequently distributed) by the Master Fund to the General Partner as allocable shares of the Master Fund’s gains. (4) Internal rate of return is computed based on the actual dates of the cash inflows (capital contributions), outflows (distributions), with the exception of distributions declared but not paid, net of carried interest on a life-to date basis. (5) Annualized. (6) Not annualized. | |

| |

| |

| |

| |

| |

| |

| |

| |

(Concluded)

The accompanying notes are an integral part of these financial statements.

PNMAC Mortgage Opportunity Fund, LP and Subsidiaries

Notes to Consolidated Financial Statements

As of and for the Six Months ended June 30, 2016 (Unaudited)

Note 1—Organization

PNMAC Mortgage Opportunity Fund, LP (the “Master Fund”) is a limited liability partnership organized under the laws of the state of Delaware. The Master Fund is registered under the Investment Company Act of 1940, as amended. Interests in the Master Fund were issued solely in private placement transactions that do not involve any “public offering” within the meaning of Section 4(2) of the Securities Act of 1933, as amended. The investment objective of the Master Fund is to achieve attractive total returns by capitalizing on dislocations in the mortgage market through opportunistic investments primarily in U.S. residential mortgages and related assets, instruments, and entities.

The Master Fund is managed by PNMAC Capital Management, LLC (the “Investment Manager”). The Investment Manager is a registered investment adviser with the Securities and Exchange Commission (“the SEC”). The general partner of the Master Fund is PNMAC Opportunity Fund Associates, LLC (the “General Partner”), a Delaware limited liability company. Both the Investment Manager and General Partner are wholly-owned subsidiaries of Private National Mortgage Acceptance Company, LLC (“PNMAC”).

The Master Fund operates as a master fund in a master-feeder fund structure. The Master Fund acts as a central investment mechanism for (i) PNMAC Mortgage Opportunity Fund, LLC (the “Fund” or “Limited Partner”) and (ii) the General Partner. The Fund owned 47% of the Master Fund at June 30, 2016 and is the sole limited partner. The General Partner has the exclusive right to conduct the operations of the Master Fund.

The Master Fund conducts its operations through its subsidiaries: PNMAC Mortgage Co. Funding, LLC, PNMAC Mortgage Co., LLC, and PNMAC Mortgage Co (FI), LLC (these companies are referred to collectively as the “Mortgage Investments”).

| · | PNMAC Mortgage Co. Funding, LLC is a wholly owned limited liability company that acquires, holds and works out distressed U.S. residential mortgage loans and holds mortgage-backed securities resulting from securitization of such mortgage loans. |

| · | PNMAC Mortgage Co. LLC is a wholly owned limited liability company that acquires, holds and works out distressed U.S. residential mortgage loans. |

| · | PNMAC Mortgage Co (FI), LLC is an investment company that was formed to pool investor capital and take an interest in the proceeds of FNBN I, LLC (“FNBN”). FNBN is a limited liability company formed to own a pool of residential mortgage loans in a transaction with the Federal Deposit Insurance Corporation (the “FDIC”). |