Sun Pharmaceutical Industries Limited Tandalja, Vadodara - 390 020, INDIA. Tel. : 91 - 265 - 6615500 / 6615600 / 6615700 Fax : 91 - 265 - 2354897 | |

January 2, 2009.

To:

Mr Myron Strober

Taro Pharmaceutical Industries Limited.

14 Hakitor Street

P.O. Box 10347

Haifa Bay 26110, Israel

Fax: 972-4-872-7165

Taro Pharmaceutical Industries Limited.

Euro Park (Italy Building), Yakum Business Park

Yakum 60972, Israel

Fax: 972-9-955-7443

Taro Pharmaceutical Industries Limited.

Three Skyline Drive, Hawthorne

New York 10532, USA

Fax: 1-914-345-8728

Dear Mr Strober

Re: Serious performance concerns

I thank you for your prompt response to my letters to the Board of Directors of Taro and also for the quick disclosure of financials by Taro in the standard tabular form. As the largest equity stakeholder of Taro, by virtue of Taro shares owned by Sun’s subsidiaries, we only wish these disclosures are regular and contain audited financial information. Nevertheless, a review of the information disclosed, however tentative by Taro’s own admission, reveals the real reasons to keep such disclosures to the bare minimum and away from the eyes of the non-Levitt shareholders.

Your repetitive claims of an “impressive turnaround” are now confirmed as being hollow. Our views on Taro’s performance based on unaudited financials:

| · | The so-called performance is largely on account of drastic cuts in critical R&D investments, a sure recipe for disaster for a generic pharma company. |

Let me illustrate. Counting from Jan 2007 to Sep 2008, based on the unaudited financials, Taro made an estimated net profit of USD 54 million and net cash from operations of USD 45 million, with deep cuts in R&D spending. Average R&D spend by Taro in R&D for 2003, 2004 and 2005 has been 15% of net sales while for 2007 and 2008 this is much lower at 10%. If Taro had

Corporate Office : ACME PLAZA, Andheri Kurla Road, Andheri(E), Mumbai - 400 059 INDIA.

Tel. : (91 - 22) 28230102 / 28211260 / 28212143, Fax (91 – 22) 28212010, Website : www.sunpharma.com

Sun Pharmaceutical Industries Limited Tandalja, Vadodara - 390 020, INDIA. Tel. : 91 - 265 - 6615500 / 6615600 / 6615700 Fax : 91 - 265 - 2354897 | |

continued to invest in R&D at 15% of net sales in 2007 and 2008, then the net profit would have been significantly lower at USD 25 million and the net cash from operations at USD 16 million. Thus, Taro cut R&D by USD 29 million, and showed higher profits as well as net cash from operations by over 100%!

I understand that you have been associated with a pharma company like Taro for a long time, earlier as a consultant and later as its Audit Committee Chairman. This long association ought to have given you a fair insight into the importance of continued R&D investments for the pharma industry in general and for Taro in particular. Reducing R&D spend to purely claim superlative performance in the short term will prove ominous over the long term.

| · | In the first 9 months of 2008, over USD 6 million has been the gain on account of foreign exchange fluctuations, which by any standard cannot be considered as recurring. Excluding this gain and counting R&D at 15% of net sales, the estimated net profit for these nine months of 2008 would have been much lower at USD 15.9 million. Source as well as the risk associated with this non-recurring gain has not been disclosed. |

| · | Since May 2007, Sun’s subsidiary has given Taro USD 59 million while the cash in hand with Taro on 30 Sep 2008 was USD 66 million. A back of the envelope calculation, using the same unaudited financials, shows that effectively the only cash generated from operations since May 2007 till Sep 2008 has been USD 22 million, almost exclusively contributed by the reduction in R&D spend. Looked at it differently, almost all of the cash Taro flaunts on its balance sheet is cash that Sun gave it. |

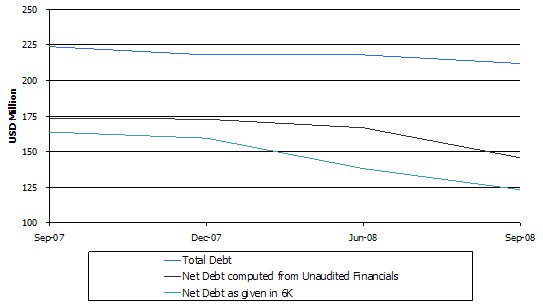

| · | Based on the numbers disclosed, net debt at end of Sep 2008 ought to be USD 146 million, and not USD 123 million as shown in the impressive-looking graph at the beginning of your 6-K; there is no accompanying explanation about the risk related to “hedging instruments” of USD 23 million, which probably make up this gap, in these extremely volatile credit and currency markets. Such disclosures are all the more important for shareholders in view of the recent trend wherein companies holding such instruments have been prone to sudden announcements of bankruptcy. |

| · | I refer you to the graph that appears below and you will see how misleading is the net debt graph in the recently filed 6-K. There has been virtually no reduction in the total debt levels. With the insignificant cash coming from operations as illustrated above, we fail to understand how this large debt will be serviced and repaid. |

Corporate Office : ACME PLAZA, Andheri Kurla Road, Andheri(E), Mumbai - 400 059 INDIA.

Tel. : (91 - 22) 28230102 / 28211260 / 28212143, Fax (91 – 22) 28212010, Website : www.sunpharma.com

Sun Pharmaceutical Industries Limited Tandalja, Vadodara - 390 020, INDIA. Tel. : 91 - 265 - 6615500 / 6615600 / 6615700 Fax : 91 - 265 - 2354897 | |

| · | The net debt graph in the 6-K includes data till Nov 08, for which no financial statements have been provided and hence is difficult for us as a shareholder to accept this claim of improvement. |

We await your clarifications on these.

On a very different note, you seem to be quite offended by my letter. In fact my objective was to provide strength to the Audit Committee and the Taro Board. Armed with a letter of this nature coming from the largest equity stakeholder, you should have got Taro management to commit to a schedule of disclosure for audited financial information. You also don’t seem to be happy about any questions raised about the quality of numbers and the remark that selective numbers are being disclosed to suit the purpose of Levitts. Mr. Strober, you have been the Audit Committee Chairman for a very long time. You are well aware that 2002, 2003 and 2004 audited numbers have been restated once and Taro in its recent filings has claimed that these numbers will be restated once again. When such is the quality of audited numbers that these have to be restated twice, it would be appropriate for Taro shareholders to understand the source of your sense of confidence in the unaudited, unreviewed numbers being released by Taro, solely at management’s convenience.

Look forward to hearing from you soon.

Sincerely yours,

For Sun Pharmaceutical Industries Ltd.

/s/ Dilip Shanghvi

Dilip Shanghvi

Chairman & Managing Director

Corporate Office : ACME PLAZA, Andheri Kurla Road, Andheri(E), Mumbai - 400 059 INDIA.

Tel. : (91 - 22) 28230102 / 28211260 / 28212143, Fax (91 – 22) 28212010, Website : www.sunpharma.com