17/B, Mahal Industrial Estate, Mahakali Caves Road, Andheri (East), Mumbai 400 093 India Tel.: (91-22) 6645 5645 Fax.: (91-22) 6645 5685 | |

December 17, 2009

Dear Fellow Taro Shareholder:

In the normal course of events, there really wouldn’t be a need for me to write to you, especially at this time of the year. However, it is the time of year that Taro Pharmaceutical Industries Ltd. holds its Annual General Meeting (“AGM”), this year, on December 31, 2009. In addition to sending the customary proxy statement with Board recommendations on the proposed resolutions, Dr Barrie Levitt, Chairman of the Board of Directors of Taro has made special efforts in spreading lies and misrepresentations about Sun Pharma with, of course, the overt support of the rest of the Taro Board.

In our view, the sole purpose of Dr Levitt’s letters is obvious: To take your attention away from the “all encompassing” protection being proposed to be given to “independent directors” as part of a payback for their complicity in illegally perpetuating control by the Levitt/Moros family over Taro in violation of contracts signed by the family.

As you are well aware, Taro shareholders do not have reliable and valid financial data for now almost 7 years, starting 2003. This failure is a result of the performance of these supposedly independent directors, as members of the Board, in discharging their fiduciary duties towards shareholders. Instead of working to correct the situation, they now want all Taro shareholders to pay for any damage claims made against them for this failure. I am hopeful that this can be prevented. We urge you to vote at the AGM and reject all such moves of the Levitt/Moros family. While I have little doubt that you will see through this web of distortions, I am writing this letter to set the record straight. Let me attempt to state or clarify our position on some of the more relevant issues.

Denial of vote to shareholders

LEVITTS AGREED TO SELL THEIR STAKE TO SUN, EITHER WAY

As you know, Sun entered into a merger agreement with Taro in May 2007 following a Board approved competitive auction process. At the time, Taro admitted to facing a dire financial crisis and Dr Levitt stated in a letter to shareholders that unless additional cash was raised or its debt restructured, it “may be forced to seek relief under applicable liquidation statutes.” In good faith, Sun agreed to provide Taro a lifeline of almost US$60 million cash, at Dr. Levitt’s request, in the form of an equity investment. This was in exchange for the option to purchase the Taro shares held by the Levitt/Moros family at $7.75 per share if the merger were not consummated. It was a simple deal, in our view.

From the moment Taro received Sun’s money, the Levitt/Moros family, with the cooperation of the rest of the Board, has tried to avoid its contractual obligations. Despite the tale woven by Dr. Levitt, the fact is that Taro’s shareholders never rejected Sun’s merger. They were never given the opportunity to vote. To accept or reject requires a vote and Taro’s Board gave one excuse after another to indefinitely delay holding the shareholders meeting required to vote on the merger. No such shareholder meeting was held. Sun’s well meaning attempts at dialogue

Registered Office : SPARC, Tandalja, Vadodara – 390 020. India

Corporate Office : Acme Plaza, Andheri – Kurla Road, Andheri (East), Mumbai – 400 059. India

with Taro, including a discussion on price, were rebuffed. Ultimately, Taro purported to terminate the merger agreement.

Shareholder wealth

A STUDY IN CONTRAST

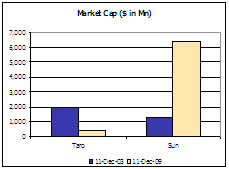

| Dr Levitt tries to paint a grim picture of Sun’s performance vis-a-vis shareholder returns. Here are some facts for a more balanced perspective. Six years ago, Taro was 1.5 times more valuable than Sun. Today, Sun is 17 times more valuable than Taro. In these past 6 years, Taro’s share price has decreased 86%, resulting in the loss of $1.6 billion of shareholder value. This represents a direct loss of $1.4 billion to shareholders outside the Levitt/Moros family, whose interests are purportedly being protected by Taro’s Board. |

By way of contrast, over that same time, Sun’s share price increased 406%, leading to a $5.1 billion increase in value for Sun shareholders.

Four of the most senior executives in Taro are family members. While ordinary shareholders of Taro have never received a dividend in Taro’s long history, over the years, members of the Levitt/Moros family have been paid many millions of dollars in salary and bonuses for a performance that brought Taro to the brink of bankruptcy.

No compulsion on minority shareholders to sell

THEY MAY PREFER SUN

Dr. Levitt’s recent letters to shareholders are riddled with misrepresentations, false statements and omissions, including that the upcoming Annual Meeting involves a vote about Sun’s tender offer and that we at Sun are trying to coerce shareholders to tender their shares. This is simply not true.

Dr. Levitt claims that Sun is trying to take over Taro “by every conceivable means.” What Dr. Levitt tries to obscure is that he signed the option agreement to sell his shares to Sun at $7.75 per share. He conveniently forgets to mention that the purpose of our tender offer is to comply with the terms of that option agreement. To avoid a situation where the exercise of the option agreement allowed the Levitt/Moros family to receive a premium while the public shareholders received nothing, the option agreement expressly provides that Sun must make a tender offer at the option price of $7.75 before purchasing shares from the Levitt/Moros family. Let me clarify: Contrary to the impression being created by Barrie Levitt, there is no compulsion on minority shareholders to tender their shares into the offer. While Sun stands committed to accepting all shares tendered in the offer, even if zero shares are tendered, it is members of the Levitt/Moros family that will be obligated to transfer their Taro shares to Sun upon the closing of the offer as per the agreement they signed. Hence, it is in the interest of the Levitt/Moros family to prolong the close of the tender offer.

What are these directors hiding?

SEEKING PROTECTION AGAINST FAILURE TO PERFORM DUTY

| UNRELIABLE DATA | | While Dr. Levitt asks shareholders to re-elect the existing directors of Taro on the basis of Taro’s financial turnaround and exceptional growth since 2007, in the next breath he notes that the financial information he relies on for that assertion is unaudited, unreviewed and subject to change. A sampler to highlight the unreliability of the numbers: Taro has reported cash as of December 31, 2008 differently three times so far this year. The latest correction witnessed a drop of approximately $5 million from $78.093 million on August 10 to $73.161 million on December 2. |

As Reported on | Cash as on 31-Dec-08 (in 000 | Difference (in 000 USD) |

| 2-Feb-09 | 78,052 | |

| 8-Oct-09 | 78,093 | 41 |

| 2-Dec-09 | 73,161 | (4,891) |

In fact, you are well aware that Taro has not produced audited financial statements for fiscal years 2006, 2007 or 2008 and, by its own admission, the previously issued audited financial statements for the years 2003, 2004 and 2005 “can no longer be relied upon”. The current Board has missed its own deadlines time after time, and year after year. At the extraordinary shareholders meeting held on September 14, 2009, specifically called to discuss the status of the audit, not only did Taro’s auditors decline to be present, but Taro was still unable to predict when audited financials would be available.

There are only two explanations for the failure to produce reliable audited financials year after year – the current directors are totally incompetent or they are hiding something. Either way, these directors should be held accountable for their inability to satisfy one of the most fundamental responsibilities of a Board. If these restatements and failure to publish audited financials are not enough to cause concern, the proposal to exempt certain directors from any legal responsibility for, among other things, their failure to produce reliable audited financial statements should sound the alarm.

Are these directors promoting your interests?

USING YOUR MONEY TO HELP THE LEVITT/MOROS FAMILY

Rather than working in good faith and in the interests of all shareholders, the actions of the independent directors have been to aid the Levitt/Moros family in trying to renege on its contractual obligations. The Levitt/Moros family is the sole beneficiary of the Israeli litigation brought by Taro and its independent directors to seek a declaratory ruling that Sun’s tender offer must comply with the “special tender offer” rules under the Israeli Companies Law, and effectively delay the closing of the option agreement. While the case is still pending appeal, the disparity between Sun’s “good faith” investment in Taro that saved Taro from insolvency and the “lack of good faith” displayed by Taro’s directors in their attempt to block the tender offer, was declared unequivocally by the District Court of Tel-Aviv in its ruling in favor of Sun:

“The shareholders cannot, on the one hand, benefit from Sun’s investment and Taro’s prosperity, and on the other hand argue that they fear a breach of the provisions of the Companies Law…It can be said that the applicants are silenced or prohibited from bringing up these claims today, and this can be seen as a lack of good faith.”

In the first nine months of 2009 alone, Taro is estimated to have incurred approximately $14.5 million in professional, consulting and other fees related to the unending audit and the various litigation proceedings. The use of shareholders’ funds by the current directors to aid the

Levitt/Moros family, that owns only an 11% economic interest in Taro, needs to be brought to an end.

This second attempt to seek approval of an undertaking by Taro to exempt from liability, and to widely expand indemnification for, current and certain former directors is a payoff for supporting the Levitt/Moros family.

What are the facts?

DEBUNKING LIES ABOUT CARACO

In his desperate attempt to retain his position, Dr. Levitt has irresponsibly spread lies about Sun’s majority-owned subsidiary, Caraco Pharmaceutical Laboratories, Ltd. These are the facts. In 1997, when Sun purchased its majority stake in Caraco, shares of Caraco traded below $1 per share and the company’s aggregate market capitalization was less than $10 million. As of December 11, 2009, Caraco’s shares have traded at nearly $6 per share and, despite the FDA’s actions, its market capitalization was over $230 million, representing a CAGR of 27% since Sun acquired control. Unlike Taro, Caraco has been current on its financials.

It is a fact that Caraco has had serious problems on account of which Caraco faced a seizure of material at its Michigan facilities in June 2009 by the FDA. Since then, the facility remains closed. However, the Board took swift actions. There is a new team of senior management executives, including a new CEO, spearheading Caraco’s revival effort. The new management team has acted aggressively in response to the FDA’s actions, entering a consent decree with the FDA, and implementing the agreed remediation plan in order to get Caraco’s Detroit plant up and running. So while the FDA related developments are a negative, these haven’t been taken lightly by the Board of Directors of Caraco. Contrast that with the situation at Taro. No reliable numbers for 7 years. Driven almost to bankruptcy. Still the same management team and same directors continue. As if this is not enough, company money and resources are being blatantly used to protect the interests of the same management team who also happen to be a mere 11% owner. Taro’s shareholders should look at the facts rather than the rhetoric.

Dr Levitt has cited a former independent Director of Caraco to support claims of “serious corporate governance controversies” facing Sun as a result of its stewardship of Caraco. Not only do we at Sun feel, but even the former independent Director himself feels, that he is being quoted out of context and he has written to Caraco to set the record straight. In his own words: “As you know, I resigned from the Board of Directors of Caraco because of my “disagreement with respect to issues of corporate governance and the fiduciary role of independent directors” arising from the FDA seizure of inventory and products at Caraco's Detroit facility. I want to make clear that despite these specific disagreements, I had no material disagreement on any other issues. I continue to be proud of our efforts on behalf of Caraco and its shareholders reflected in the increase in revenues reported by Caraco over the five years I served as an independent director on the Board of Directors from $60 million to $337 million.”

We urge you to vote AGAINST the election and re-election of directors

and AGAINST the indemnification proposal

Dr. Levitt and his family have demonstrated time and again that their interests lie in self-protection rather than the best interests of all of Taro’s shareholders. That has come at the cost of shareholder value. As Taro’s largest shareholder, it is difficult to accept abuse of shareholders’ money and being left in the dark about the true state of Taro’s financial affairs.

Now is the time to vote AGAINST the election and re-election of the proposed directors and AGAINST the indemnification proposal.

Sun urges its fellow shareholders to sign, date and return their proxy cards# immediately.

| | Sincerely yours,

For Sun Pharmaceutical Industries Ltd.

/s/ Dilip Shanghvi

Dilip Shanghvi

Chairman & Managing Director |

# Please contact our proxy solicitors, MacKenzie Partners, Inc., with any questions or should you need assistance voting or changing your vote for your shares. MacKenzie Partners can be contacted within the U.S. and Canada at 1-800-322-2885 (toll-free) or 1-212-929-5500 (call collect), within Israel at +1-809-494-159 (toll-free) or via email at proxy@mackenziepartners.com.