Cane Clark llp | 3273 E. Warm Springs Las Vegas, NV 89120 |

| Kyleen E. Cane* | Bryan R. Clark^ | | | | Telephone: 702-312-6255 |

| Joe Laxague | Scott P. Doney | | Facsimile: 702-944-7100 |

| Christopher T. Clark | | | Email: sdoney@caneclark.com |

August 5, 2009

Via Facsimile

United States Securities and Exchange Commission

100 F Street, N.E. Mailstop

Washington D.C., 20549-7010

Attention: Pamela A. Long

| Re: | QE Brushes, Inc. Registration Statement on Form S-1 Filed March 16, 2009 File No. 333-157970 |

Dear Ms. Long:

We write on behalf of QE Brushes, Inc., (the “Company”) in response to Staff’s letter of May 13, 2009, by Edward M. Kelly, Senior Counsel of the United States Securities and Exchange Commission (the “Commission”) regarding the above-referenced Registration Statement on Form S-1/A, Amendment No. 1, filed May 1, 2009, (the Comment Letter”). On behalf of the Company, we are providing this response to the Comment Letter. The Company has filed with the Commission via the EDGAR system, an amended registration statement on Form S-1/A, Amendment No. 2 (the “Amended S-1”).

The factual information provided herein relating to the Company has been made available to us by the Company. Paragraph numbering used for each response corresponds to the numbering used in the Comment letter.

Form S-1

General

| 1. | We note your responses to prior comments 1 and 2 and your reference to Securities Act Release No. 6932. Please note, in the paragraph after the one from which you quote, the Commission also stated that it would scrutinize offerings “for attempts to create the appearance that he registrant is not a development stage company or has specific business plan, in an effort to avoid the application of Rule 419.” Based on our prior comments and the disclosure in your filing it appears that your operations are commensurate in scope with those ordinarily associated with a blank check company. We also note the following: |

*Licensed in California, Washington and Hawaii;

^Licensed in Colorado and District of Columbia Bars

| · | The substantial similarity between your filing and the registration statement on Form S-1 (File No. 333-157878) filed by Koko Ltd., including, but not limited to disclosure, management, shareholder base, and selling shareholders. |

| · | Various officers, directors, and shareholders of your company, including the Ruff/Bleiweis and Littler families, have been involved in repeated reverse merger activity at least as far back as 1999. |

| · | The registrant’s telephone number associated with Offer to sell Pink Sheet/OTCBB shells (http://thebullandbear.com/classified.html) |

Please revise your analysis as to why the prior and current activities of the Ruff/Bleiweis and Littler families and the proposed operations with respect to your company are not commensurate in scope with those ordinarily associated with a blank check company and why you do not need to comply with Rule 419 of Regulation C. In responding to this comment, please specifically address each of the bulleted items above. We may have further comment.

In response to this comment, the Company is not a blank check company. It has a specific business plan and purpose and has never indicated that it would merge with an unidentified company.

While the Company has a similar shareholder base to that of Koko, Ltd., the entities are separate and have distinct business plans and disclosures in their respective filings. Moreover, the Company and Koko, Ltd. are separate for valid business reasons. The business plans behind the steak timer product of Koko, Ltd. and the pet toothbrush product of the Company have separate and distinct needs with respect to product development, manufacturing, marketing and distribution. By placing each product and business plan into a separate company, conflicting operational strategies are eliminated, and each entity has a better overall chance at success. Shareholders will benefit from diversifying their stock into two separate start-up companies. These shareholders are able to spread the risk by investing smaller amounts of money into each company instead of one large amount into one company to protect their investment if one product fails to penetrate the market.

Management of the Company is separate and distinct from the “Ruff/Bleweis and Littler families” category described above. Other than Koko, Ltd. and QE Brushes, during the last ten years, Gregory Ruff has not been the officer or director of any public companies, shell companies, or blank check companies. Neither has Craig Littler been the officer or director of any public companies, shell companies, or blank check companies.

In response to the third bullet point above, Mr. Ruff has advised me that he was contacted by a few companies looking for a shell, but he never directed or put them in direct contact with any shell companies. Mr. Ruff did advise these few contacts that they should consider taking the company directly public with an IPO as an alternative to a reverse merger transaction, and planned to assist the company in the filing process but none of the companies engaged Mr. Ruff’s services for this endeavor. Mr. Ruff was not affiliated with any of these companies that responded to the ad you refer to in the Bull and Bear, and never put them in contact with any shell as mentioned above.

| 2. | We note the disclosure added on page 6 that you “have no intention of engaging in a reverse merger with any entity in an unrelated industry.” Please reconcile with the offer to sell PinkSheet/OTCBB shells found on the webpage noted above which references you company’s telephone number and which appears to be the home telephone number of Mr. Ruff. Additionally, please provide us the names of all shells Mr. Ruff has ever offered to sell. |

In response to this comment, please see the above response to comment 1. Additionally, Gregory Ruff has advised me that though the ad stated shells, he in fact neither owned nor controlled any shells. He also advised me that he has never matched any shells with targeted companies.

| 3. | Refer to prior comment 2. As requested previously, provide a discussion and analysis of a specific business plan for the next 12 months. We note disclosure on page 36 and elsewhere that QE Brushes has no revenues and insufficient cash to pursue its business plan in the next 12 months. |

In response to this comment, the Company set forth its specific business plan for the next 12 months in the Amended S-1 in the sections titled “Description of Business” and “Plan of Operations.” The Company updated these sections in the Amended S-1 with new information. These sections comport with the requirements of Items 101 and 303 of Regulation S-K.

| 4. | Since there is substantial doubt about QE Brushes’ ability to continue as a going concern, provide additional detail to show that QE Brushes will obtain sufficient working capital over the 12 months after the date of the financial statements in the registration statement. The additional detail should include: |

| · | Prominent disclosure of QE Brushes’ financial difficulties and viable plans to overcome those difficulties. See FRC 607.02. |

| · | Disclosure of any known demands, commitments, or uncertainties that will result in QE Brushes liquidity increasing or decreasing in any material way. |

| · | Detailed cash flow discussions for the 12 month period following the date of the latest balance sheet presented. |

| · | A reasonably detailed discussion of QE Brushes’ ability or inability to produce sufficient cash to support operations. |

| · | Management’s plans, including relevant prospective financial information. |

Alternatively, if QE Brushes does not have a viable plan to produce sufficient cash to support its operations during the 12 month period after the date of the financial statements in the registration statement, tell us why you believe that it is appropriate to continue presenting the financial statements on a going concern basis. Provide similar disclosures in the footnotes to both annual and interim financial statements.

In response to this comment, the Company revised its disclosure to explain that it believes cash reserves are sufficient for the next 12 months.

| 5. | Address in a discrete risk factor significant matters relating to QE Brushes’ liquidity problems and capital availability such as: |

| · | The rate at which QE Brushes burned cash in the fiscal year ended December 31, 2008 and the interim period ended March 31, 2009. |

| · | Known or anticipated costs of development of products and services, including the testing and refinement of QE Brushes’ prototype product. |

| · | Known or anticipated costs of marketing QE Brushes’ product under its license agreement with MR. Gregory P. Ruff. |

| · | Known or anticipated costs of research and development to accommodate the design of QE Brushes toothbrushes to accommodate the manufacturing process. |

| · | Known or anticipated costs of sales and distribution channels for QE Brushes’ toothbrush. |

| · | Known or anticipated costs of obtaining patent protection or QE Brushes’ toothbrush. |

| · | Other known or anticipated material costs relating to QE Brushes’ plan of operation. |

In response to this comment, the Company revised its disclosure to explain that it believes cash reserves are sufficient for the next 12 months. As such, no risk factor is necessary.

| 6. | Refer to prior comment3. It is unclear why you omit discussion of the involvement of Messrs. Gregory P. Ruff and Craig Littler with the registration statement on Form S-1 filed by KOKO, ltd. on Form S-1, file no. 333-157878. Please revise. |

In response to this comment, the Company included the disclosure about the registration statement filed by Koko, Ltd. in the section titled, “Directors, Executive Officers, Promoters and Control Persons.”

| 7. | Update the financial statements. See Item 16 of Form S-1 and Article 8-08 of Regulation S-X. As appropriate, revise disclosures throughout the registration statement to reflect the updated financial statements. For example, refer to the risk factors, business, and plan of operations sections. |

In response to this comment, the Company updated the financials in the Amended S-1.

| 8. | Refer to prior comment 8. As requested previously, delete the statements “The risks and uncertainties described below are not the only ones that impact on our operations and business. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, may also impair our business or operations. |

In response to this comment, the Company deleted the statements.

| 9. | Refer to prior comment 9. Revise the risk factor “If we are unable to gauge trends…, our business may fail” on page 9 to remove the There are no assurances” language” |

In response to this comment, the Company removed the “assurances” language from that risk factor.

| 10. | Refer to prior comment 12. As requested previously, discussing greater detail what you mean by “our current operating policies and our strategies” and what impact those would have on QE Brushes and its securityholders. Note that the word “certain” implies that you may not have disclosed all material operating policies and strategies of QE Brushes that its board of directors has the authority to waive or modify. Please revise. |

In response to this comment, the Company believes that investors are able to understand concepts like “polices” and “strategies” but included definitions so the words are less vague.

| 11. | Refer to prior comment 13. Identify here rather than by cross reference any present ventures organized by QE Brushes’ directors, officers, or their affiliates. |

In response to this comment, the Company revised the risk factor to include Mr. Gregory Ruff’s competing ventures.

| | Determination of Offering price, page 19 |

| 12. | Refer to prior comment 14. Conform the disclosure here to that under “Registration rights” on page 34 added in response to prior comment 35. As noted previously, QE Brushes will become a reporting company under the Exchange Act upon effectiveness of the registration statement filed March 16, 2009. |

In response to this comment, the Company revised the disclosure in “Determination of Offering Price to conform to “Registration Rights.”

| | Selling Shareholders, page 19 |

| 13. | We note the responses to prior comments 16 and 17. Disclose that none of the selling shareholders is a broker-dealer or an affiliate of a broker-dealer. |

In response to this comment, the Company included the requested disclosures in the Amended S-1.

| 14. | We note the response to prior comment 22. Disclose that QE Brushes may only substitute a new selling shareholder for an original selling shareholder by means of a prospectus supplement if: |

| · | The change is not material. |

| · | The number of shares or dollar amount registered does not change. |

| · | The new selling shareholder’s shares can be traced to those covered by the original registration statement. |

In response to this comment, the Company included the requested disclosure in the Amended S-1.

| 15. | Refer to prior comment 27. As requested previously, disclose the schedule for completion of each component of the testing process described in this subsection. Specify the known or anticipated schedule for completion of the entire development process for the product before QE Brushes is able to begin the manufacturing process. We note the disclosure on page 29 that the manufacturing process will take 12 months. |

In response to this comment, the Company finished its design prototypes in May 2009. The mechanical drawings of these toothbrushes were finished in early June 2009 and have bent sent to a toothbrush manufacturer in China, MERI China, LLC, for a bid. A bid was received from MERI China, LLC for the manufacturing of 15,000 pet toothbrushes for $24,000 US dollars. A down payment of $12,000 has been paid with the balance owing upon receipt of the toothbrushes. This includes packaging and shipping costs.

By having the toothbrush manufactured in China, the Company was able to negotiate a contract that cut the cost of the manufacturing cost by more than 2/3 compared to the tentative bid $60,000 US dollars the Company received from Boucherie USA. The Company’s Chinese bid included packaging and shipping costs which also wasn’t included in the Boucherie USA bid which therefore has put the Company in a much stronger financial position.

The Company has since filed for its trademark “Poochy Smooch” with the US Trademark office. It is hired an art work packaging consultant for its packaging artwork for $700. The final 2 and 3 dimensional drawings with the logo placements on the brush handle will be completed by the end of July, 2009 by JB Engineering and sent to MERI China, LLC so they can commence manufacturing operations in August 2009. The injection molds are being completed now. Since only one injection mold is being made, the maximum amount toothbrushes that can be made each day tops out between 1,200 to 1,500 units. Therefore, it is estimated the toothbrushes will take 14 days to manufacturer. It will take 3 weeks to insert the bristles into their bristle heads and have one of the arms sonically welded back together onto the brush handle. Once the toothbrush is manufactured and packaged, it is estimated it will take almost 30 days to receive them in Spokane WA once they are shipped.

| 16. | Disclosure that QE Brushes faces “some” competition in the pet toothbrush industry is inconsistent with disclosure in the risk factors section on page 10 that QE Brushes faces “substantial” competition in the industry. Please reconcile the disclosures. |

| | In response to this comment, the Company reconciled the disclosures as requested. |

Intellectual Property, page 30; Certain Relationships and Related Transactions, page 42; Exhibit 10.1

| 17. | Refer to prior comment 30. As requested previously, state in the registration statement the expiration date of QE Brushes’ license agreement with Mr. Gregory Ruff. Given that the license agreement was executed on March 2, 2008, it would appear that the license agreement’s expiration date is March 2, 2011. |

In response to this comment, the Company included the expiration date of the license agreement as requested.

| 18. | Refer to prior comment 34. As requested previously, explain what Form 10 type information encompasses. |

In response to this comment, the Company included a description of the type of information contained in Form 10.

| | Directors, Executive Officers, Promotes and Control Persons, page 37 |

| 19. | FINRA is successor to NASD. Please revise the disclosure in Mr. Gregory Ruff’s biographical paragraph to reflect that fact. |

| | In response to this comment, the Company revised the disclosure as requested. |

| 20. | Refer to prior comment 46. As requested previously, describe briefly Mr. Paul Charbonneau’s business experience during the past five years. See Item 401(e)(1) of Regulation S-K. |

In response to this comment, the Company revised the disclosure to indicate Mr. Charbonneau’s business experience in the past five years.

| | Certain Relationships and Related Transactions, page 42 |

| 21. | As requested previously, disclose the information given to us in response to prior comment 52: |

| · | QE Brushes’ articles of incorporation expressly opt out of the prohibitions against combinations with interested stockholders contained in NRS 78.411 to 78.444. |

| · | QE Brushes may engage in a combination with an interested stockholder. |

| | In response to this comment, the Company disclosed the requested information. |

| | Recent Sales of Unregistered Securities, page 45 |

| 22. | Refer to prior comment 59. As requested previously, state the value of the 130,000 shares of common stock issued to a consultant for services. See Item 701(c) of Regulation S-K. |

| | In response to this comment, the Company revised the disclosure as requested. |

| 23. | Refer to prior comment 60. The Rule 430B undertakings under (i) and (ii) of 4(a) are inapplicable to this offering because QE Brushes is Form S-3 ineligible. The undertaking under (5) is inapplicable to this offering because this is a secondary offering of securities by the selling shareholders. As requested previously, please remove these undertakings. |

| | In response to this comment, the Company removed the undertakings as requested. |

| 24. | Refer to prior comment 61. The requirement of Item 16(a) of Form S-1 to furnish the exhibits as required by Item 601(b)(10) of Regulation S-K is a discrete requirement and is not synonymous with the requirement of Rule 102(d) of Regulation S-T to include an exhibit index immediately before the exhibits. As requested previously, include an exhibit index immediately before the exhibits as required by Rule 102(d) of Regulation S-T. |

In response to this comment, the Company included an exhibit index immediately before the exhibits.

| 25. | Refer to prior comments, 11, 28 and 59. Where a registrant is party to an oral contract that would be required to be filed as an exhibit under Item 601(b)(10) of Regulation S-K if it were written, the registrant should provide a written description of the contract similar to that required for oral contracts or arrangements under Item 601(b)(10)(iii) of Regulation S-K. See Question 146.04 under Regulation S-K in our “Compliance and Disclosure Interpretations” that are available on the Commission’s website at http://www.sec.gov. Please file as exhibits written descriptions of the contracts. |

In response to this comment, the Company included a written description of its oral arrangements with Robert Slack and Jeff Bendio as exhibits.

Other

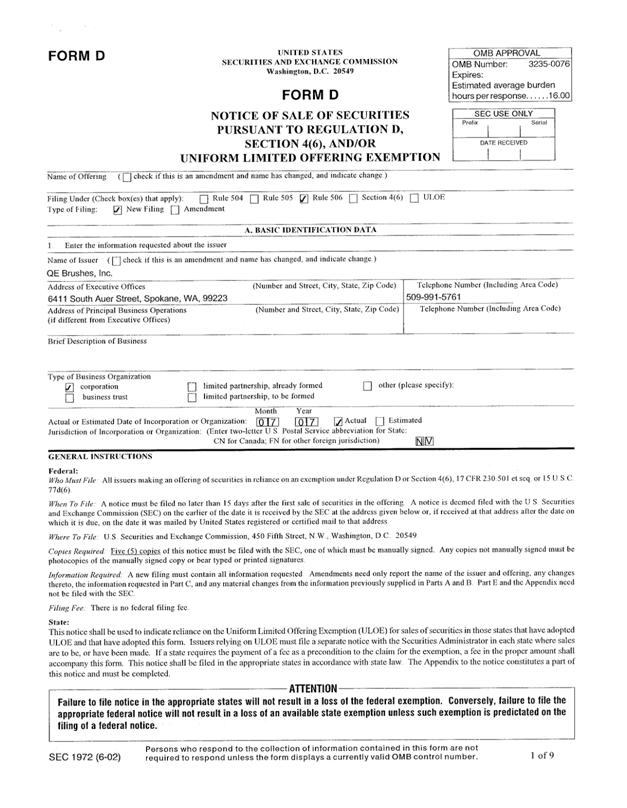

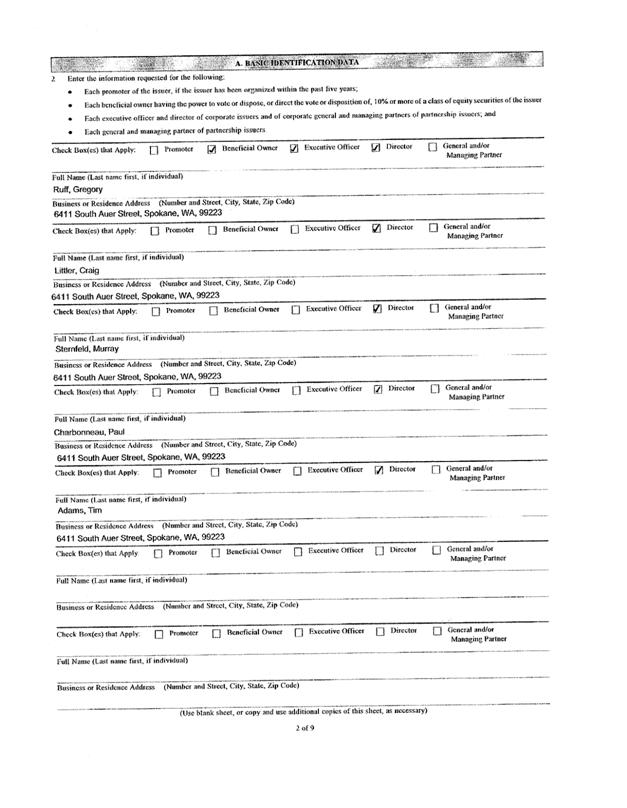

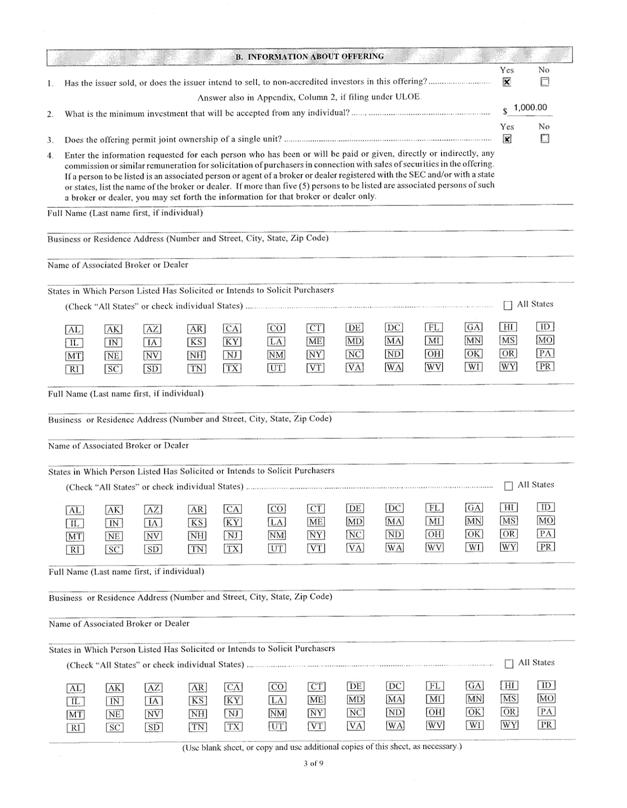

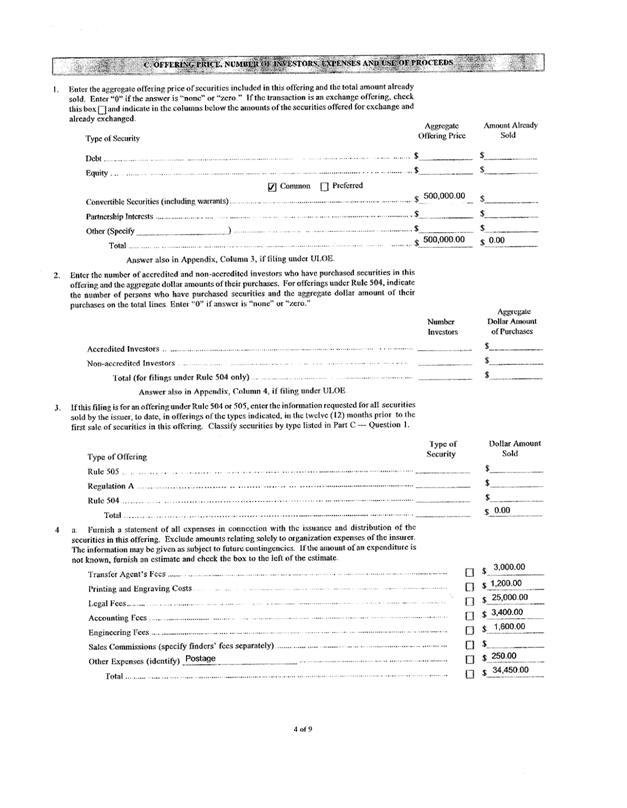

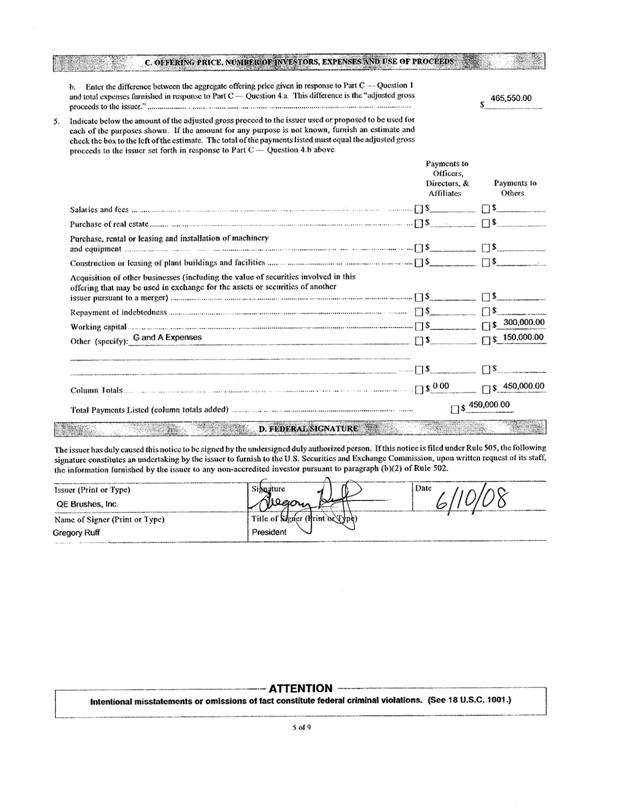

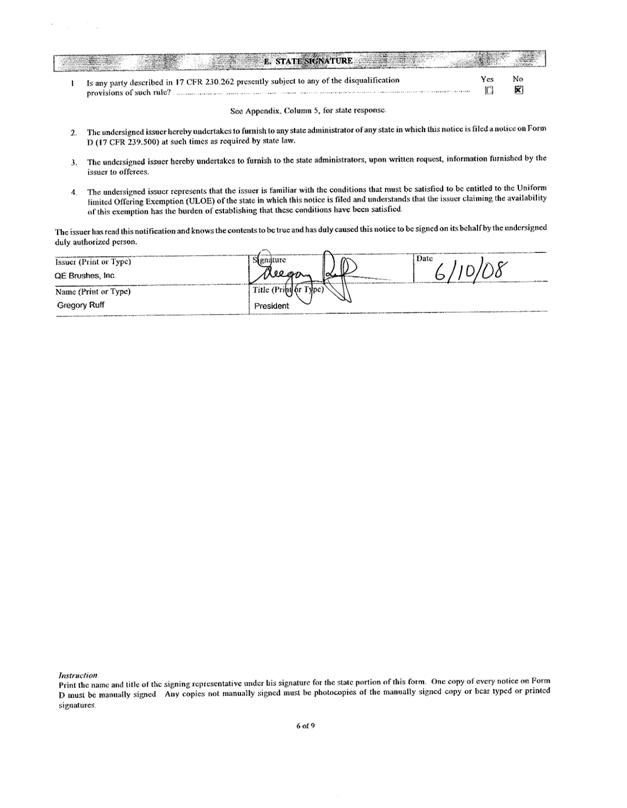

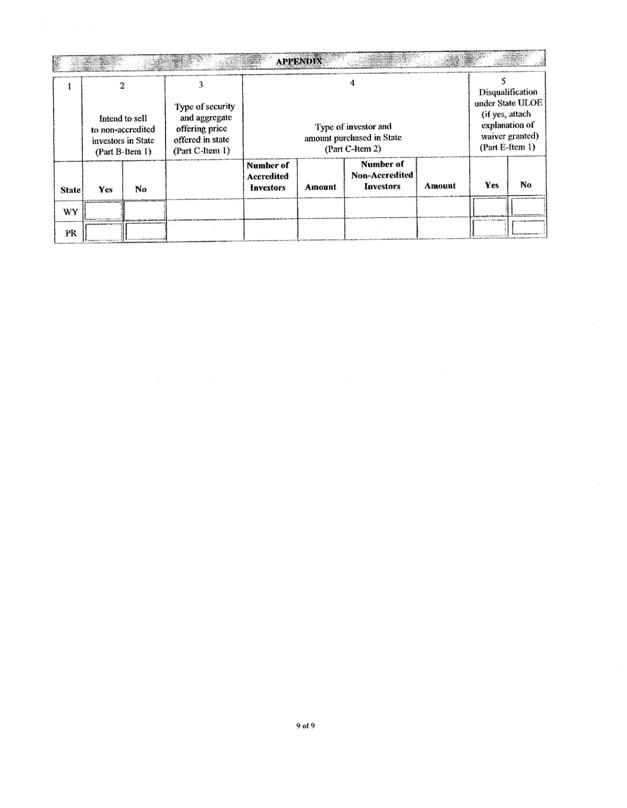

| 26. | Refer to prior comment 62. As requested previously, provide us a copy of the Form D filing made by QE Brushes on June 23, 2008. |

| | In response to this comment, the Company included a copy of its Form D. |

Sincerely,

Cane Clark LLP

/s/ Scott P. Doney

Scott P. Doney