- MRC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

MRC Global (MRC) 8-KRegulation FD Disclosure

Filed: 4 Aug 17, 12:00am

Second Quarter 2017 Investor Presentation August 4, 2017 Andrew Lane President & CEO Jim Braun Executive Vice President & CFO Exhibit 99.1

Forward Looking Statements and Non-GAAP Disclaimer This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Words such as “will,” “expect,” “expected”, “looking forward”, “guidance” and similar expressions are intended to identify forward-looking statements. Statements about the company’s business, including its strategy, the impact of changes in oil prices and customer spending, its industry, the company’s future profitability, the company’s guidance on its sales, adjusted EBITDA, adjusted gross profit, tax rate, capital expenditures and cash flow, growth in the company’s various markets and the company’s expectations, beliefs, plans, strategies, objectives, prospects and assumptions are not guarantees of future performance. These statements are based on management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors, most of which are difficult to predict and many of which are beyond our control, including the factors described in the company’s SEC filings that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements. For a discussion of key risk factors, please see the risk factors disclosed in the company’s SEC filings, which are available on the SEC’s website at www.sec.gov and on the company’s website, www.mrcglobal.com. Our filings and other important information are also available on the Investor Relations page of our website at www.mrcglobal.com. Undue reliance should not be placed on the company’s forward-looking statements. Although forward-looking statements reflect the company’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause the company’s actual results, performance or achievements or future events to differ materially from anticipated future results, performance or achievements or future events expressed or implied by such forward-looking statements. The company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except to the extent required by law. Statement Regarding Use of Non-GAAP Measures: The Non-GAAP financial measures contained in this presentation (Adjusted EBITDA and Adjusted Gross Profit) are not measures of financial performance calculated in accordance with U.S. Generally Accepted Accounting Principles (GAAP) and should not be considered as alternatives to net income or gross profit. They should be viewed in addition to, and not as a substitute for, analysis of our results reported in accordance with GAAP. Management believes that these non-GAAP financial measures provide investors a view to measures similar to those used in evaluating our compliance with certain financial covenants under our credit facilities and provide meaningful comparisons between current and prior year period results. They are also used as a metric to determine certain components of performance-based compensation. They are not necessarily indicative of future results of operations that may be obtained by the Company.

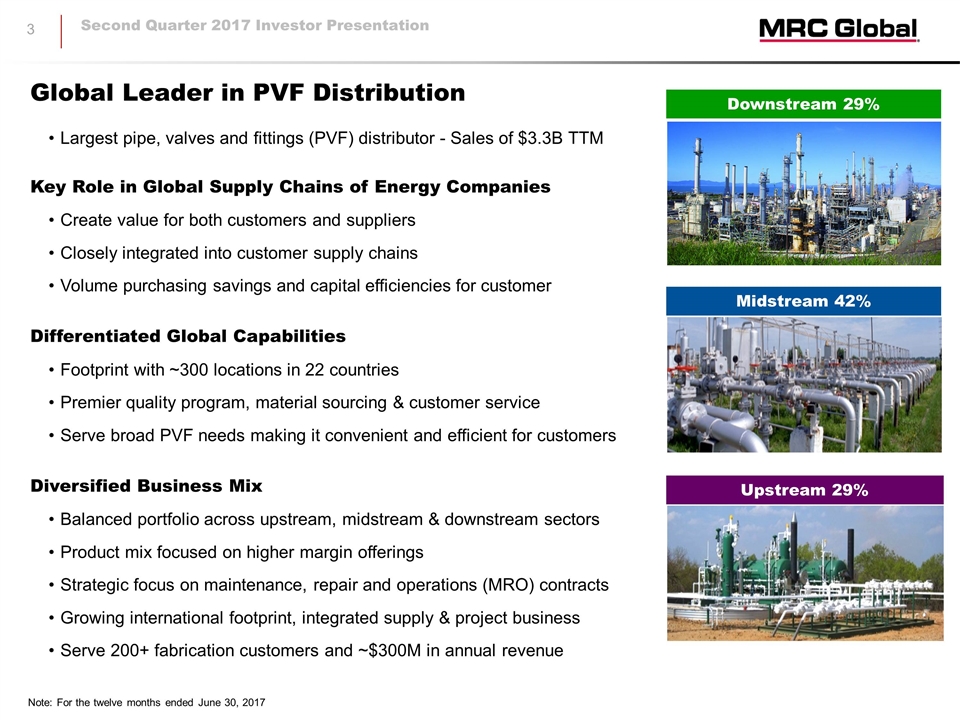

Projects 28% U.S. 75% Largest pipe, valves and fittings (PVF) distributor - Sales of $3.3B TTM Key Role in Global Supply Chains of Energy Companies Create value for both customers and suppliers Closely integrated into customer supply chains Volume purchasing savings and capital efficiencies for customer Differentiated Global Capabilities Footprint with ~300 locations in 22 countries Premier quality program, material sourcing & customer service Serve broad PVF needs making it convenient and efficient for customers Diversified Business Mix Balanced portfolio across upstream, midstream & downstream sectors Product mix focused on higher margin offerings Strategic focus on maintenance, repair and operations (MRO) contracts Growing international footprint, integrated supply & project business Serve 200+ fabrication customers and ~$300M in annual revenue Global Leader in PVF Distribution Downstream 29% Midstream 42% Upstream 29% Note: For the twelve months ended June 30, 2017

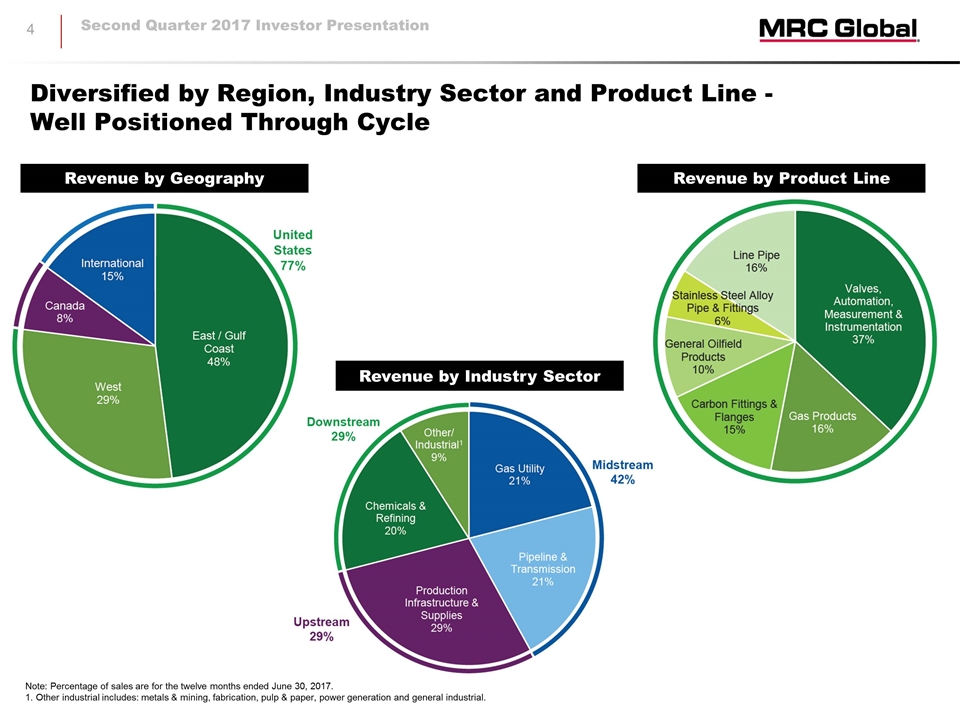

Diversified by Region, Industry Sector and Product Line - Well Positioned Through Cycle Note: Percentage of sales are for the twelve months ended June 30, 2017. 1. Other industrial includes: metals & mining, fabrication, pulp & paper, power generation and general industrial. Revenue by Product Line Revenue by Geography Revenue by Industry Sector

Upstream – Providing Completion Infrastructure to E&P Operators Walk-in counter sales at strategically located branches in active oil and gas production areas Located in all major basins Upstream revenue follows basin market activity levels Provide well hook-ups via on-site product trailers, above-ground infrastructure PVF products for flow lines & tank batteries Serve E&P operators including Shell, Chevron, Statoil and Canadian Natural Resources Primary drivers are customers’ capital budgets for well completions & production tank battery upgrades and expansions

Midstream – Serving Gas Utilities & Transmission & Gathering Customers Provide PVF and integrated supply services including smart meters Business drivers: integrity projects pipeline enhancement projects independent of commodity prices residential and commercial, new & upgrade installations Relatively stable, steady growth Provide PVF to midstream gathering customers (e.g. MLPs) Provide PVF bulks & shorts and logistical services to long-haul transmission customers Benefit from recent pipeline approvals & modernization projects replacing older pipelines Gas Utilities Transmission & Gathering

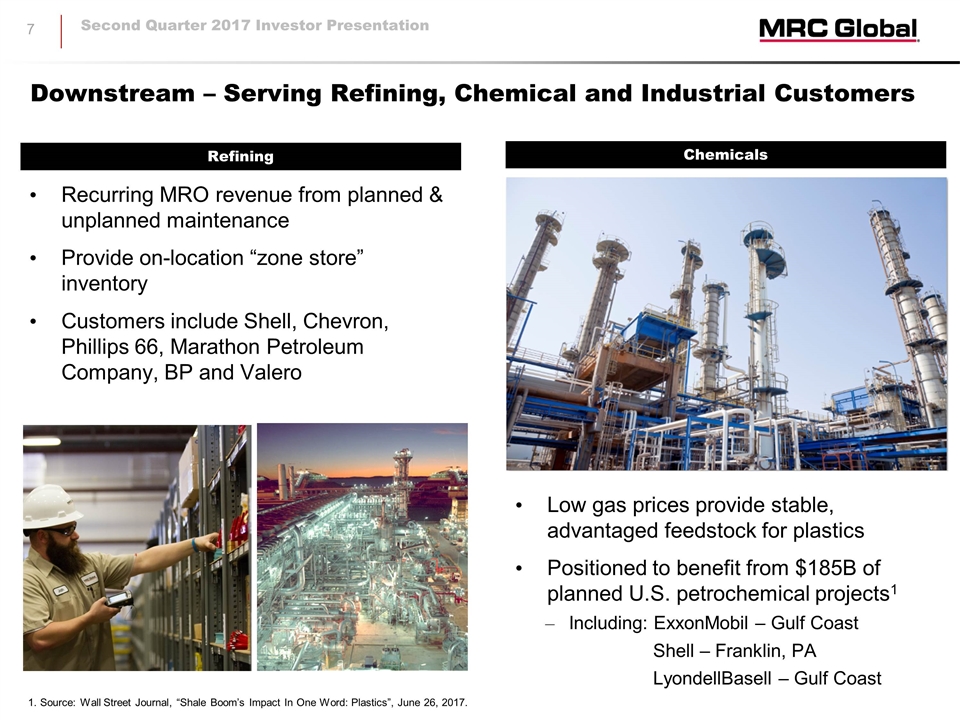

Downstream – Serving Refining, Chemical and Industrial Customers Recurring MRO revenue from planned & unplanned maintenance Provide on-location “zone store” inventory Customers include Shell, Chevron, Phillips 66, Marathon Petroleum Company, BP and Valero Low gas prices provide stable, advantaged feedstock for plastics Positioned to benefit from $185B of planned U.S. petrochemical projects1 Including: ExxonMobil – Gulf Coast Shell – Franklin, PA LyondellBasell – Gulf Coast Refining Chemicals 1. Source: Wall Street Journal, “Shale Boom’s Impact In One Word: Plastics”, June 26, 2017.

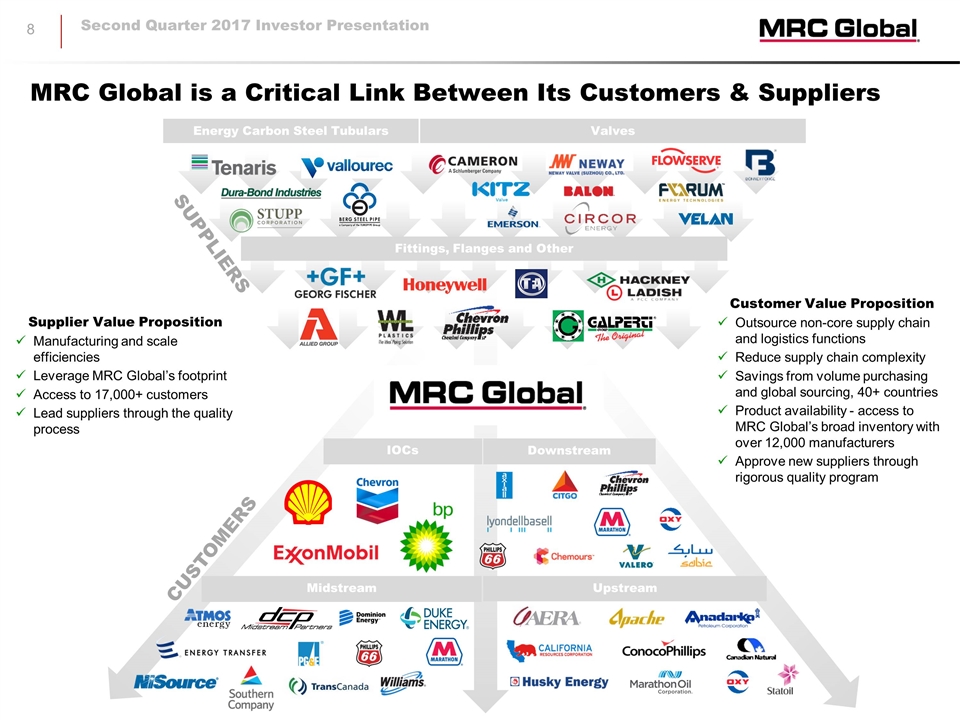

MRC Global is a Critical Link Between Its Customers & Suppliers CUSTOMERS SUPPLIERS Energy Carbon Steel Tubulars Valves Fittings, Flanges and Other IOCs Downstream Midstream Upstream Supplier Value Proposition Manufacturing and scale efficiencies Leverage MRC Global’s footprint Access to 17,000+ customers Lead suppliers through the quality process Customer Value Proposition Outsource non-core supply chain and logistics functions Reduce supply chain complexity Savings from volume purchasing and global sourcing, 40+ countries Product availability - access to MRC Global’s broad inventory with over 12,000 manufacturers Approve new suppliers through rigorous quality program

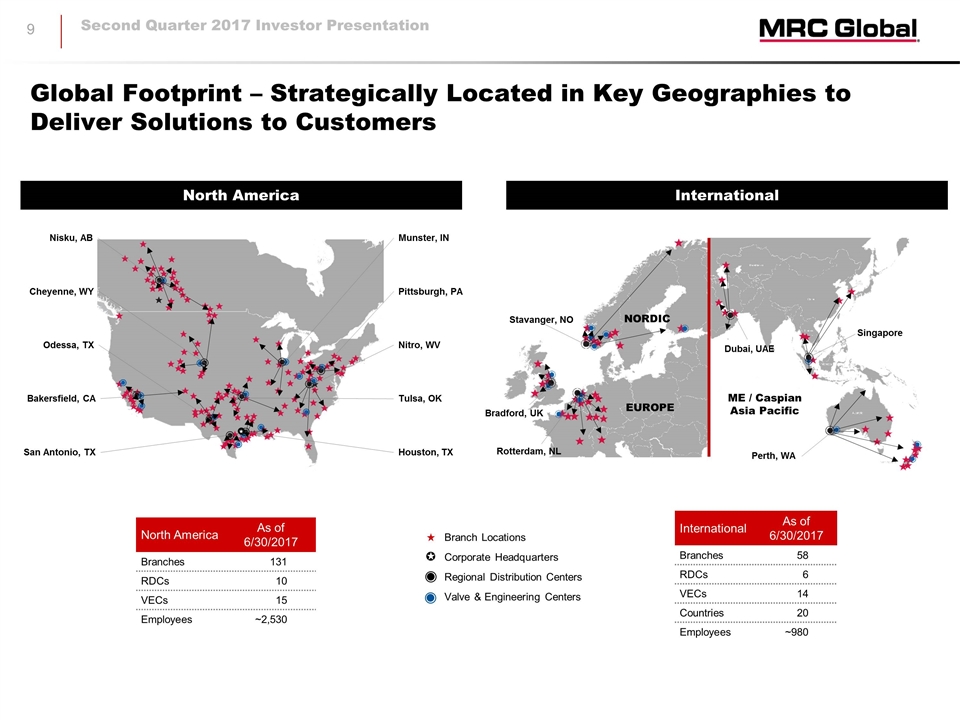

Global Footprint – Strategically Located in Key Geographies to Deliver Solutions to Customers North America As of 6/30/2017 Branches 131 RDCs 10 VECs 15 Employees ~2,530 Corporate Headquarters Regional Distribution Centers Valve & Engineering Centers Branch Locations International As of 6/30/2017 Branches 58 RDCs 6 VECs 14 Countries 20 Employees ~980 International North America Nisku, AB Cheyenne, WY Odessa, TX Bakersfield, CA San Antonio, TX Munster, IN Nitro, WV Tulsa, OK Pittsburgh, PA Houston, TX ME / Caspian Asia Pacific Dubai, UAE Singapore Perth, WA NORDIC EUROPE Stavanger, NO Bradford, UK Rotterdam, NL

MRC Global’s Differentiated Value Proposition Organic Growth Operational Optimization Strategic Capital Decisions Global M&A Platform Strong record of winning new customers and expanding existing relationships resulting in growth Driving enhanced profitability and return on capital through operational efficiencies, disciplined cost management and products & services portfolio optimization Active balance sheet management and robust cash flow create financial flexibility and capital allocation opportunities Solid history of strategic acquisitions in advantageous geographies, sectors and product lines

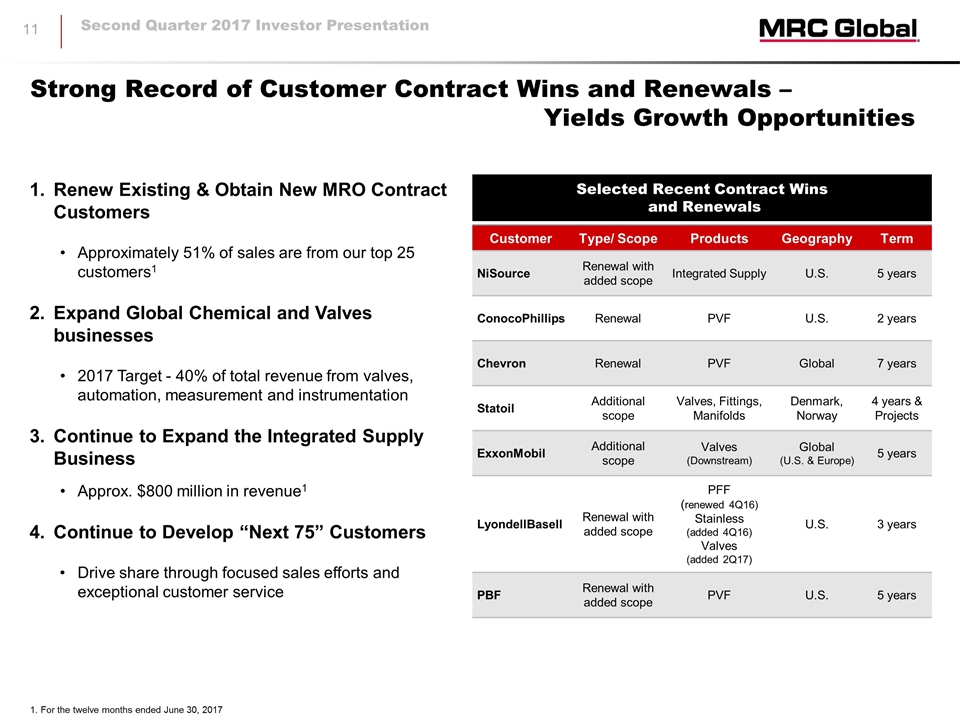

Strong Record of Customer Contract Wins and Renewals – Yields Growth Opportunities Renew Existing & Obtain New MRO Contract Customers Approximately 51% of sales are from our top 25 customers1 Expand Global Chemical and Valves businesses 2017 Target - 40% of total revenue from valves, automation, measurement and instrumentation Continue to Expand the Integrated Supply Business Approx. $800 million in revenue1 Continue to Develop “Next 75” Customers Drive share through focused sales efforts and exceptional customer service Customer Type/ Scope Products Geography Term NiSource Renewal with added scope Integrated Supply U.S. 5 years ConocoPhillips Renewal PVF U.S. 2 years Chevron Renewal PVF Global 7 years Statoil Additional scope Valves, Fittings, Manifolds Denmark, Norway 4 years & Projects ExxonMobil Additional scope Valves (Downstream) Global (U.S. & Europe) 5 years LyondellBasell Renewal with added scope PFF (renewed 4Q16) Stainless (added 4Q16) Valves (added 2Q17) U.S. 3 years PBF Renewal with added scope PVF U.S. 5 years Selected Recent Contract Wins and Renewals 1. For the twelve months ended June 30, 2017

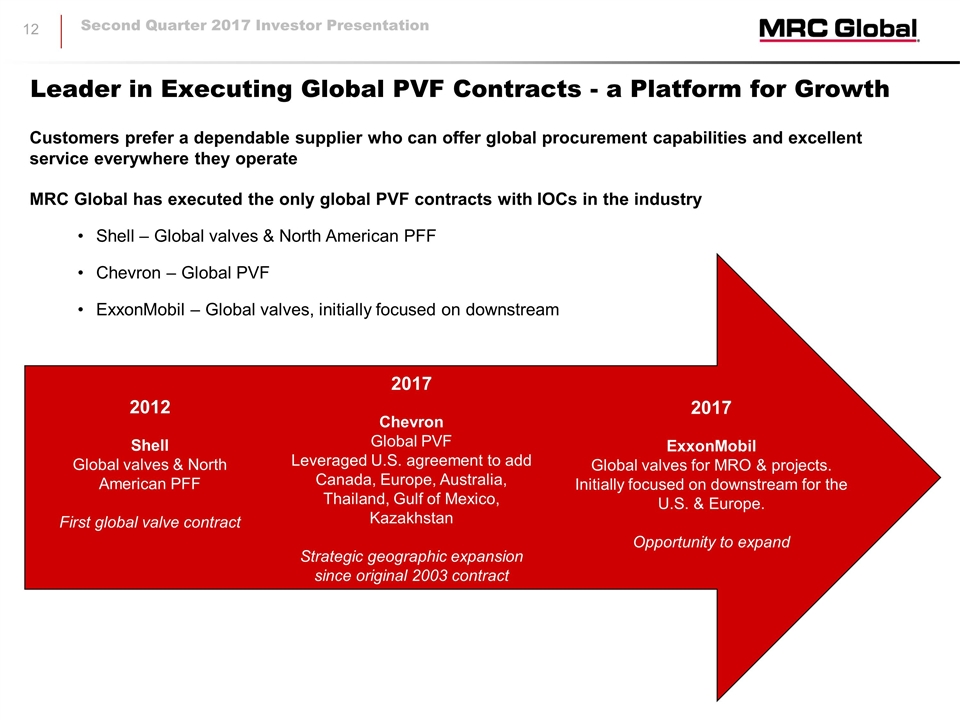

Leader in Executing Global PVF Contracts - a Platform for Growth Customers prefer a dependable supplier who can offer global procurement capabilities and excellent service everywhere they operate MRC Global has executed the only global PVF contracts with IOCs in the industry Shell – Global valves & North American PFF Chevron – Global PVF ExxonMobil – Global valves, initially focused on downstream 2012 Shell Global valves & North American PFF First global valve contract 2017 Chevron Global PVF Leveraged U.S. agreement to add Canada, Europe, Australia, Thailand, Gulf of Mexico, Kazakhstan Strategic geographic expansion since original 2003 contract 2017 ExxonMobil Global valves for MRO & projects. Initially focused on downstream for the U.S. & Europe. Opportunity to expand

Expanding Higher Margin Product Offerings Increases Growth Opportunities and Profitability Organic growth through expansion of higher margin products: Valves Entered into Global Enterprise Distributor Program (EDP) with Cameron Access to several valve lines previously sold directly to customers Across upstream, midstream & downstream Measurement & Instrumentation (M&I) Exclusive EDP with Cameron for M&I products in North America Previously sold directly to customers Includes 1,300 new SKUs Opportunity to expand to midstream and downstream customers Expect 2017 annual revenue $125-$150 million from expanded Cameron agreements MRC Global is the largest distributor of Cameron products

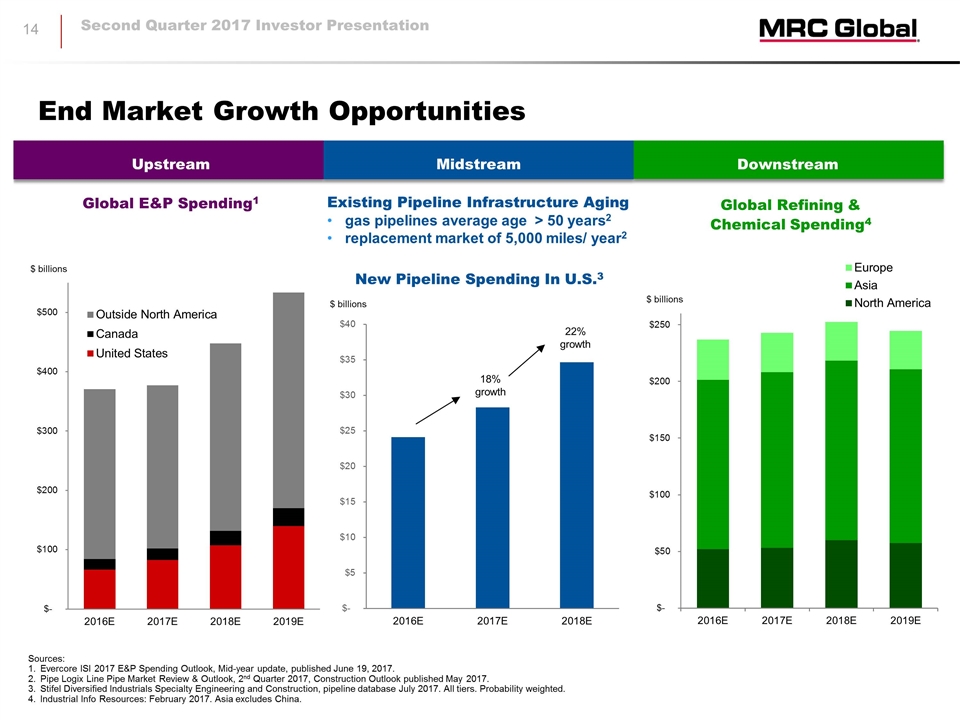

End Market Growth Opportunities Global E&P Spending1 Sources: Evercore ISI 2017 E&P Spending Outlook, Mid-year update, published June 19, 2017. Pipe Logix Line Pipe Market Review & Outlook, 2nd Quarter 2017, Construction Outlook published May 2017. Stifel Diversified Industrials Specialty Engineering and Construction, pipeline database July 2017. All tiers. Probability weighted. Industrial Info Resources: February 2017. Asia excludes China. Global Refining & Chemical Spending4 $ billions $ billions Upstream Midstream Downstream Existing Pipeline Infrastructure Aging gas pipelines average age > 50 years2 replacement market of 5,000 miles/ year2 $ billions New Pipeline Spending In U.S.3

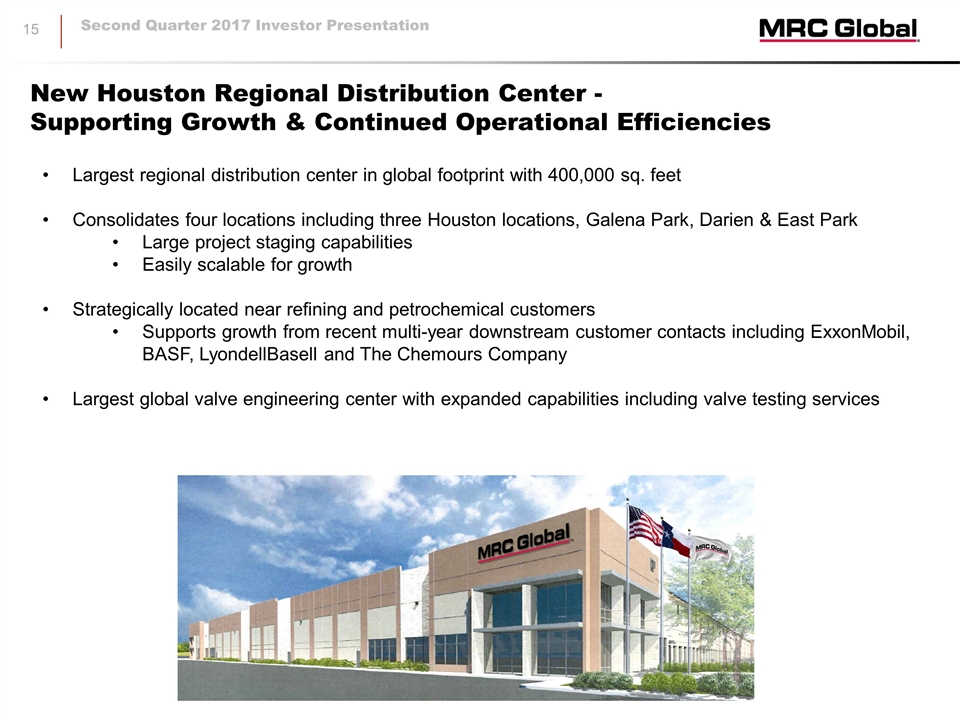

New Houston Regional Distribution Center - Supporting Growth & Continued Operational Efficiencies Largest regional distribution center in global footprint with 400,000 sq. feet Consolidates four locations including three Houston locations, Galena Park, Darien & East Park Large project staging capabilities Easily scalable for growth Strategically located near refining and petrochemical customers Supports growth from recent multi-year downstream customer contacts including ExxonMobil, BASF, LyondellBasell and The Chemours Company Largest global valve engineering center with expanded capabilities including valve testing services

Investing in Technology for Long-Term Growth & Efficiency Benefits of implementing SAP ERP system: Makes interaction with customers streamlined and efficient Provides global view of inventory, global procurement and strategic inventory management Standardization of processes resulting in lower costs Timing International complete in 2017 Canada implementation in 2018 MRCGO online catalog increased functionality added B-2-B for contract customers allows for easy and efficient ordering Customized for each customer’s contract terms, part numbers, commonly ordered items Real-time inventory, pricing and order status $100 million of TTM revenue generated through MRCGO 35% of the top 25 U.S. customers’ 2016 revenue was transacted through e-commerce (e.g. catalog, EDI)

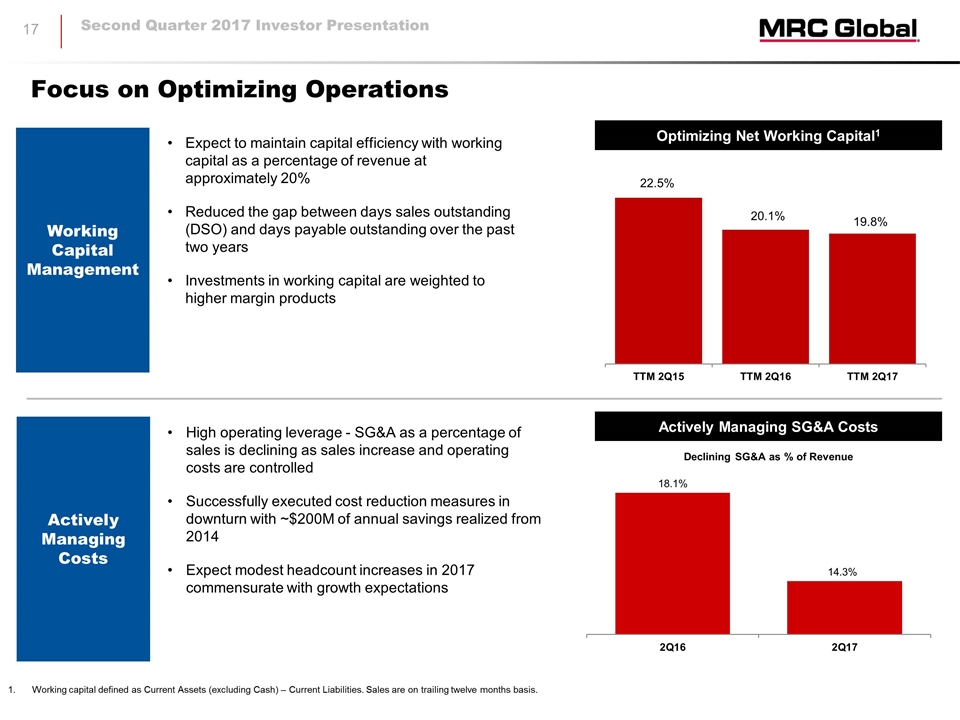

Working Capital Management Focus on Optimizing Operations Expect to maintain capital efficiency with working capital as a percentage of revenue at approximately 20% Reduced the gap between days sales outstanding (DSO) and days payable outstanding over the past two years Investments in working capital are weighted to higher margin products Optimizing Net Working Capital1 Working capital defined as Current Assets (excluding Cash) – Current Liabilities. Sales are on trailing twelve months basis. Actively Managing Costs High operating leverage - SG&A as a percentage of sales is declining as sales increase and operating costs are controlled Successfully executed cost reduction measures in downturn with ~$200M of annual savings realized from 2014 Expect modest headcount increases in 2017 commensurate with growth expectations Actively Managing SG&A Costs Declining SG&A as % of Revenue

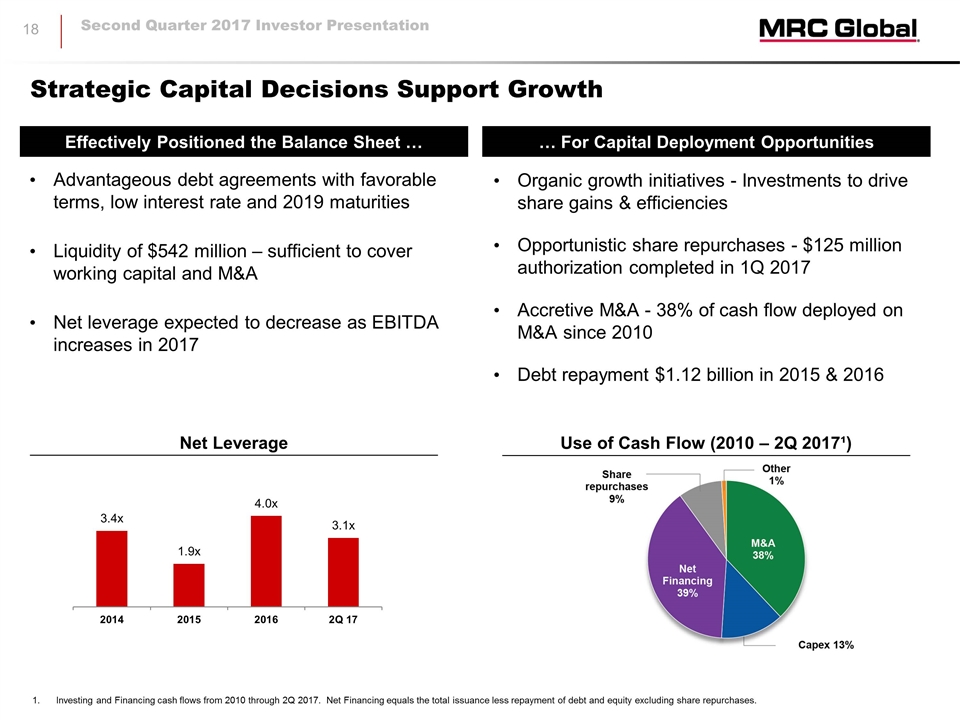

Strategic Capital Decisions Support Growth Investing and Financing cash flows from 2010 through 2Q 2017. Net Financing equals the total issuance less repayment of debt and equity excluding share repurchases. Effectively Positioned the Balance Sheet … Advantageous debt agreements with favorable terms, low interest rate and 2019 maturities Liquidity of $542 million – sufficient to cover working capital and M&A Net leverage expected to decrease as EBITDA increases in 2017 … For Capital Deployment Opportunities Organic growth initiatives - Investments to drive share gains & efficiencies Opportunistic share repurchases - $125 million authorization completed in 1Q 2017 Accretive M&A - 38% of cash flow deployed on M&A since 2010 Debt repayment $1.12 billion in 2015 & 2016 Use of Cash Flow (2010 – 2Q 2017¹) Net Leverage

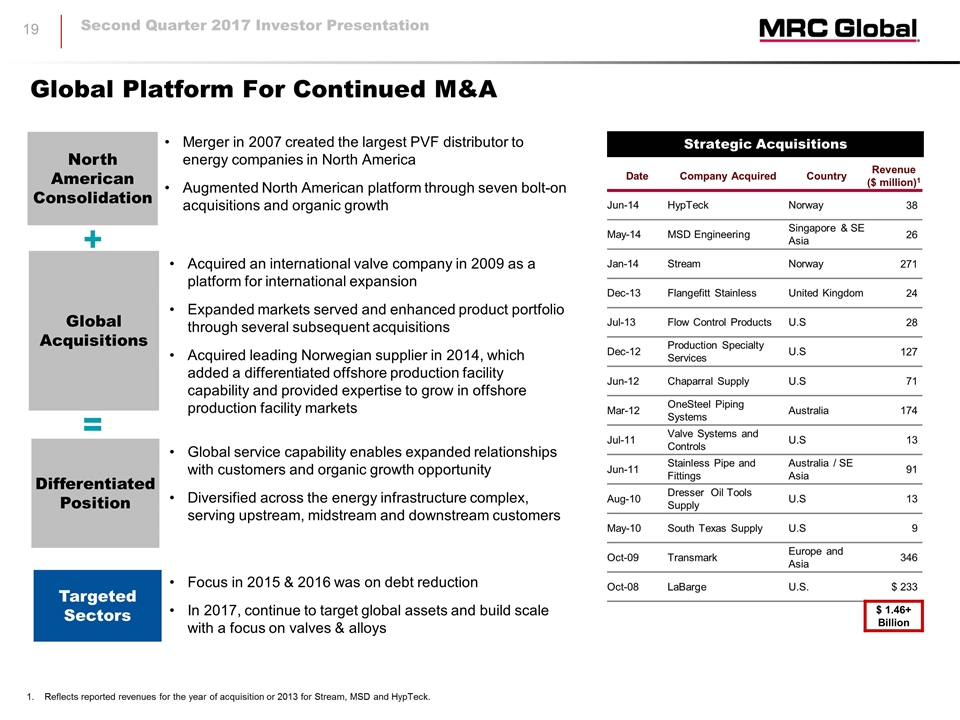

Date Company Acquired Country Revenue ($ million)1 Jun-14 HypTeck Norway 38 May-14 MSD Engineering Singapore & SE Asia 26 Jan-14 Stream Norway 271 Dec-13 Flangefitt Stainless United Kingdom 24 Jul-13 Flow Control Products U.S 28 Dec-12 Production Specialty Services U.S 127 Jun-12 Chaparral Supply U.S 71 Mar-12 OneSteel Piping Systems Australia 174 Jul-11 Valve Systems and Controls U.S 13 Jun-11 Stainless Pipe and Fittings Australia / SE Asia 91 Aug-10 Dresser Oil Tools Supply U.S 13 May-10 South Texas Supply U.S 9 Oct-09 Transmark Europe and Asia 346 Oct-08 LaBarge U.S. $ 233 $ 1.46+ Billion Reflects reported revenues for the year of acquisition or 2013 for Stream, MSD and HypTeck. Strategic Acquisitions Global Platform For Continued M&A North American Consolidation Global Acquisitions Differentiated Position Merger in 2007 created the largest PVF distributor to energy companies in North America Augmented North American platform through seven bolt-on acquisitions and organic growth Acquired an international valve company in 2009 as a platform for international expansion Expanded markets served and enhanced product portfolio through several subsequent acquisitions Acquired leading Norwegian supplier in 2014, which added a differentiated offshore production facility capability and provided expertise to grow in offshore production facility markets Global service capability enables expanded relationships with customers and organic growth opportunity Diversified across the energy infrastructure complex, serving upstream, midstream and downstream customers Targeted Sectors Focus in 2015 & 2016 was on debt reduction In 2017, continue to target global assets and build scale with a focus on valves & alloys

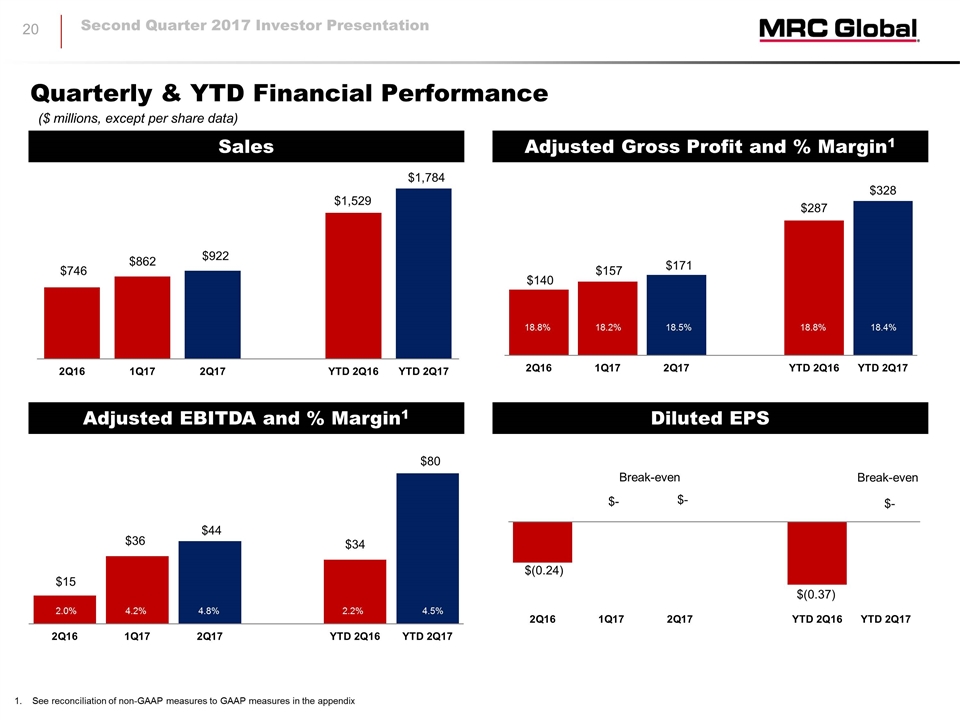

Sales Adjusted Gross Profit and % Margin1 Adjusted EBITDA and % Margin1 7.0% 8.5% ($ millions, except per share data) 2.0% 4.2% 4.8% 2.2% 4.5% Diluted EPS 18.8% 18.2% 18.5% 18.8% 18.4% Quarterly & YTD Financial Performance See reconciliation of non-GAAP measures to GAAP measures in the appendix

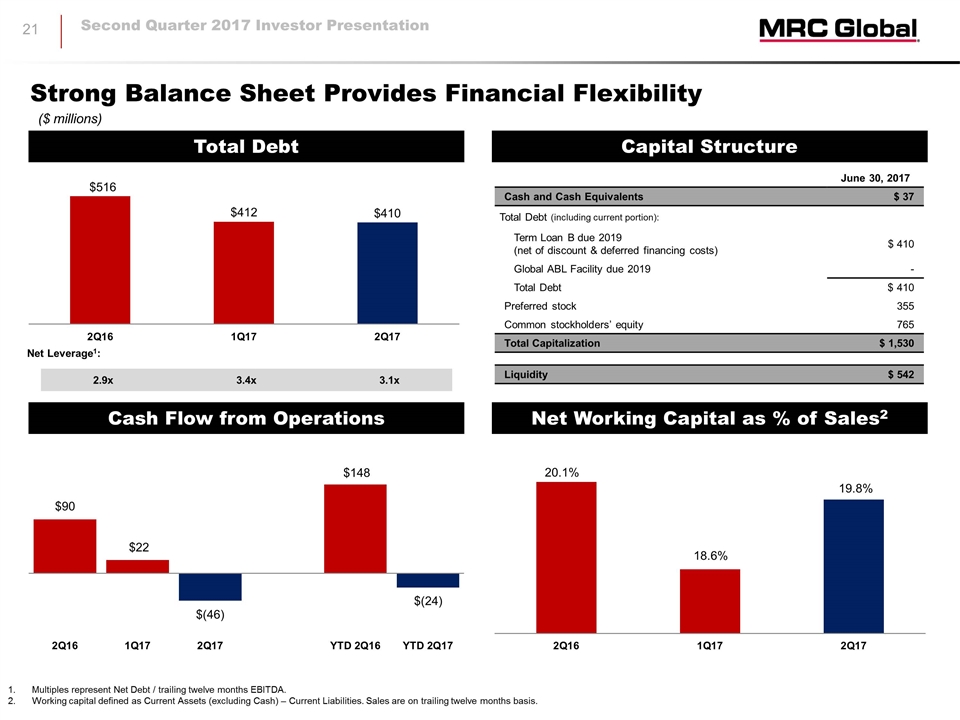

Total Debt Capital Structure Cash Flow from Operations Net Working Capital as % of Sales2 ($ millions) Strong Balance Sheet Provides Financial Flexibility Multiples represent Net Debt / trailing twelve months EBITDA. Working capital defined as Current Assets (excluding Cash) – Current Liabilities. Sales are on trailing twelve months basis. Y-o-Y Growth 30.8% 13.1% (9.0%) 39.7% (39.7%) 2.9x 3.4x 3.1x Net Leverage1: June 30, 2017 Cash and Cash Equivalents $ 37 Total Debt (including current portion): Term Loan B due 2019 (net of discount & deferred financing costs) $ 410 Global ABL Facility due 2019 - Total Debt $ 410 Preferred stock 355 Common stockholders’ equity 765 Total Capitalization $ 1,530 Liquidity $ 542

Market Leader in PVF Distribution, Serving Critical Function to the Energy Industry Diversified Across Sectors, Regions and Customers Differentiated Global Platform Creates Customer Value Counter-cyclical Cash Flow and Strong Balance Sheet Organic Growth Potential via Market Share Gains from Expanded Multi-year MRO Contracts and Supported by Long-term Secular Growth from Global Energy Demand Proven History of Driving Continuous Productivity Improvements Industry Consolidator with Proven Success in Acquiring and Integrating Businesses World-class Management Team with Significant Distribution and Energy Experience Compelling Long-Term Investment

Appendix

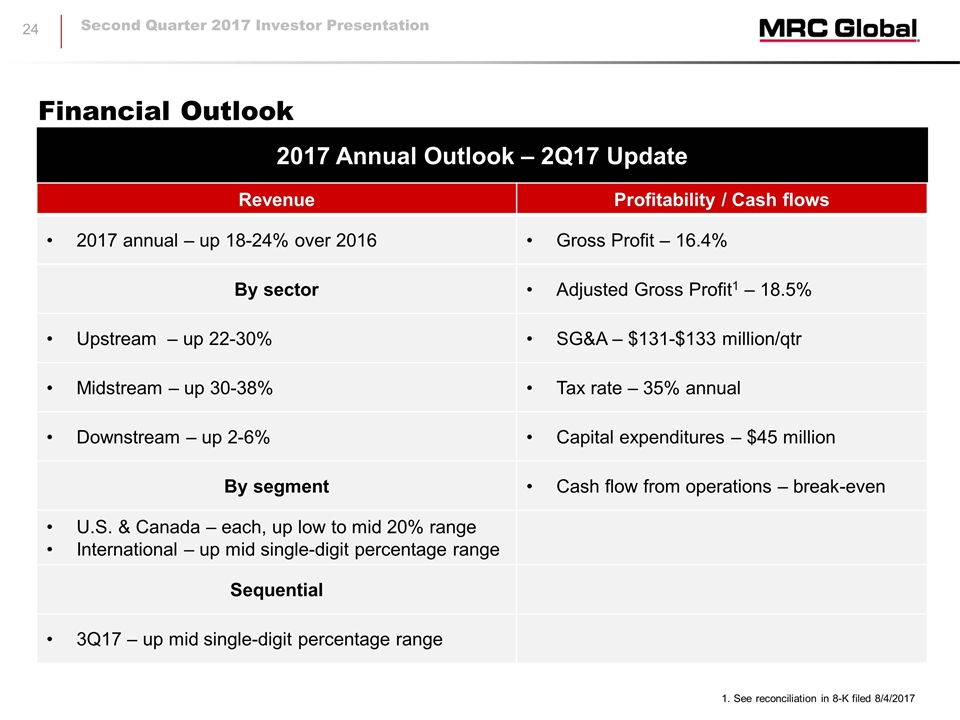

Financial Outlook 2017 Annual Outlook – 2Q17 Update Revenue Profitability / Cash flows 2017 annual – up 18-24% over 2016 Gross Profit – 16.4% By sector Adjusted Gross Profit1 – 18.5% Upstream – up 22-30% SG&A – $131-$133 million/qtr Midstream – up 30-38% Tax rate – 35% annual Downstream – up 2-6% Capital expenditures – $45 million By segment Cash flow from operations – break-even U.S. & Canada – each, up low to mid 20% range International – up mid single-digit percentage range Sequential 3Q17 – up mid single-digit percentage range 1. See reconciliation in 8-K filed 8/4/2017

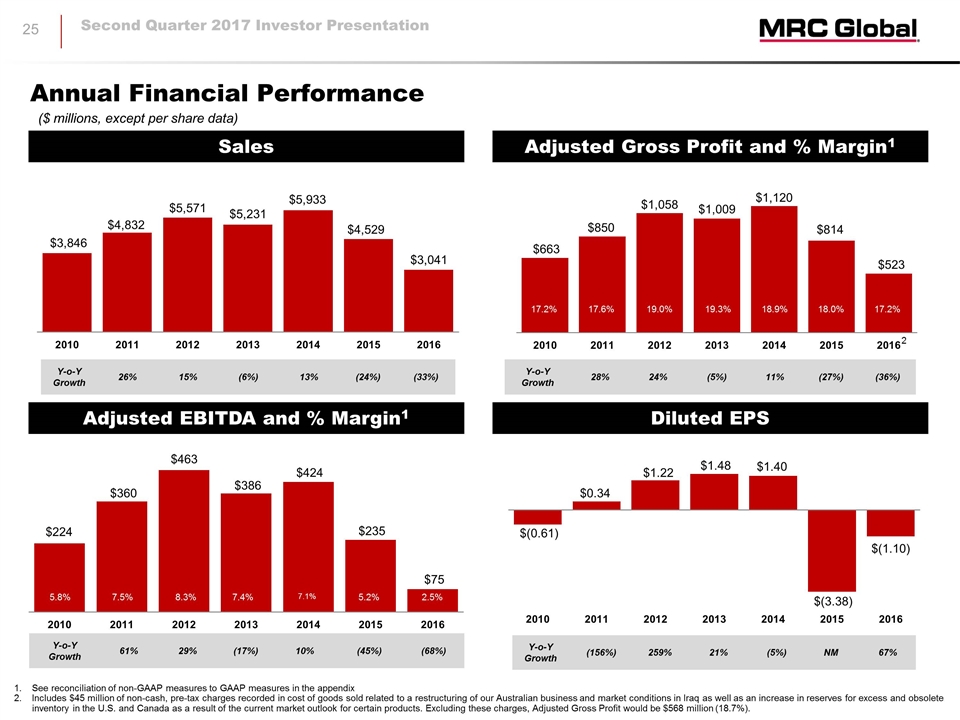

Y-o-Y Growth 61% 29% (17%) 10% (45%) (68%) Y-o-Y Growth 28% 24% (5%) 11% (27%) (36%) Sales Adjusted Gross Profit and % Margin1 Adjusted EBITDA and % Margin1 7.0% 8.5% ($ millions, except per share data) 5.8% 7.5% 8.3% 7.4% 7.1% 5.2% 2.5% Diluted EPS 17.2% 17.6% 19.0% 19.3% 18.9% 18.0% 17.2% Annual Financial Performance Y-o-Y Growth 26% 15% (6%) 13% (24%) (33%) Y-o-Y Growth (156%) 259% 21% (5%) NM 67% See reconciliation of non-GAAP measures to GAAP measures in the appendix Includes $45 million of non-cash, pre-tax charges recorded in cost of goods sold related to a restructuring of our Australian business and market conditions in Iraq as well as an increase in reserves for excess and obsolete inventory in the U.S. and Canada as a result of the current market outlook for certain products. Excluding these charges, Adjusted Gross Profit would be $568 million (18.7%). 2

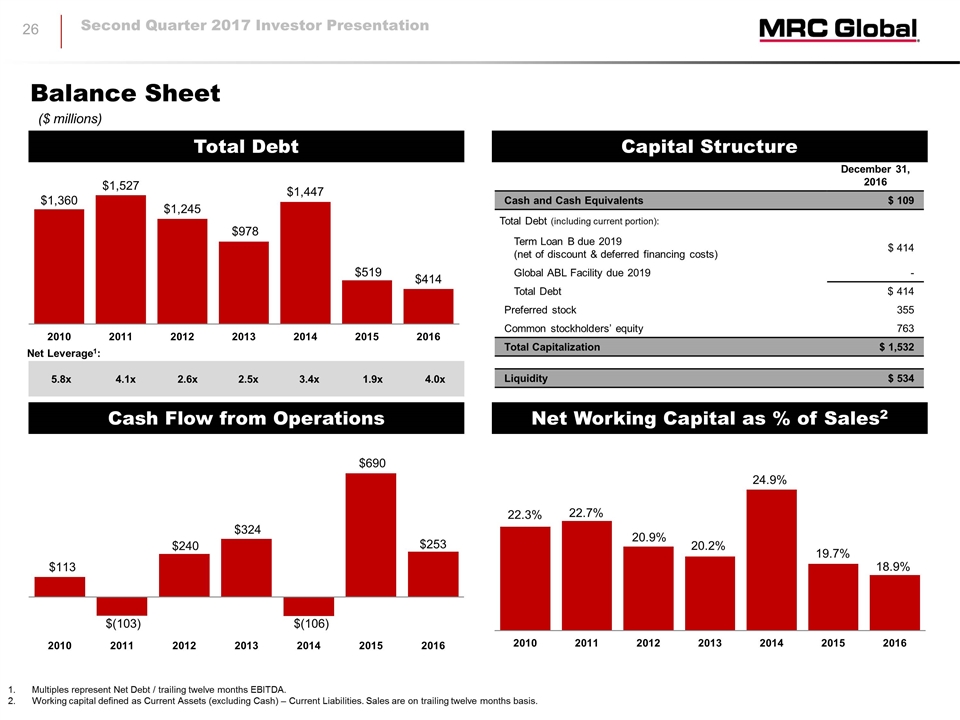

Total Debt Capital Structure Cash Flow from Operations Net Working Capital as % of Sales2 ($ millions) December 31, 2016 Cash and Cash Equivalents $ 109 Total Debt (including current portion): Term Loan B due 2019 (net of discount & deferred financing costs) $ 414 Global ABL Facility due 2019 - Total Debt $ 414 Preferred stock 355 Common stockholders’ equity 763 Total Capitalization $ 1,532 Liquidity $ 534 Balance Sheet Multiples represent Net Debt / trailing twelve months EBITDA. Working capital defined as Current Assets (excluding Cash) – Current Liabilities. Sales are on trailing twelve months basis. Y-o-Y Growth 30.8% 13.1% (9.0%) 39.7% (39.7%) 5.8x 4.1x 2.6x 2.5x 3.4x 1.9x 4.0x Net Leverage1:

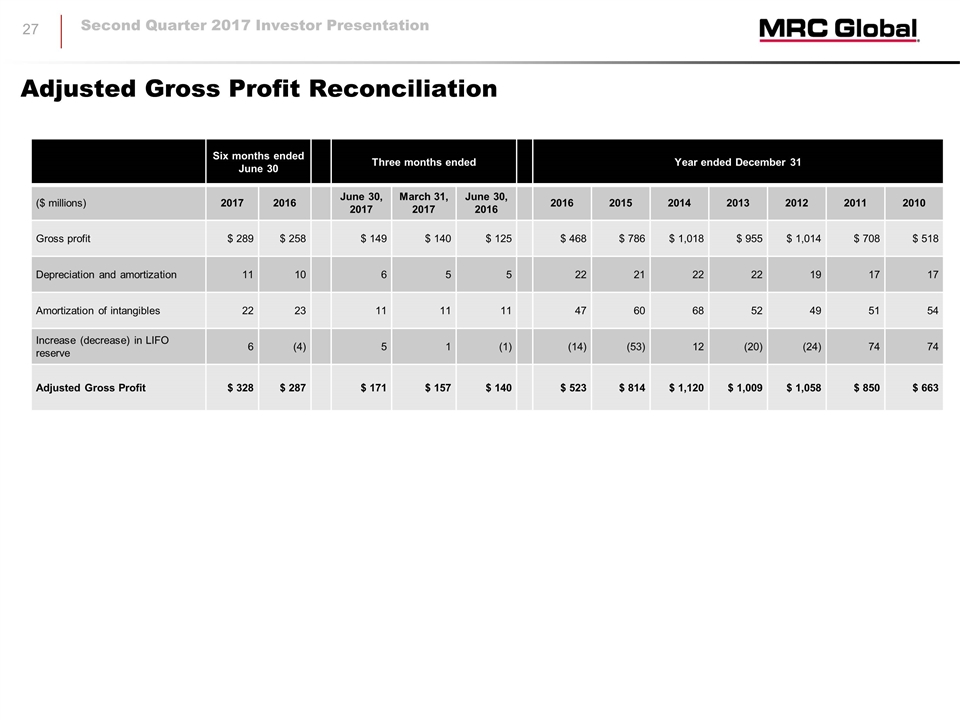

Adjusted Gross Profit Reconciliation Six months ended June 30 Three months ended Year ended December 31 ($ millions) 2017 2016 June 30, 2017 March 31, 2017 June 30, 2016 2016 2015 2014 2013 2012 2011 2010 Gross profit $ 289 $ 258 $ 149 $ 140 $ 125 $ 468 $ 786 $ 1,018 $ 955 $ 1,014 $ 708 $ 518 Depreciation and amortization 11 10 6 5 5 22 21 22 22 19 17 17 Amortization of intangibles 22 23 11 11 11 47 60 68 52 49 51 54 Increase (decrease) in LIFO reserve 6 (4) 5 1 (1) (14) (53) 12 (20) (24) 74 74 Adjusted Gross Profit $ 328 $ 287 $ 171 $ 157 $ 140 $ 523 $ 814 $ 1,120 $ 1,009 $ 1,058 $ 850 $ 663

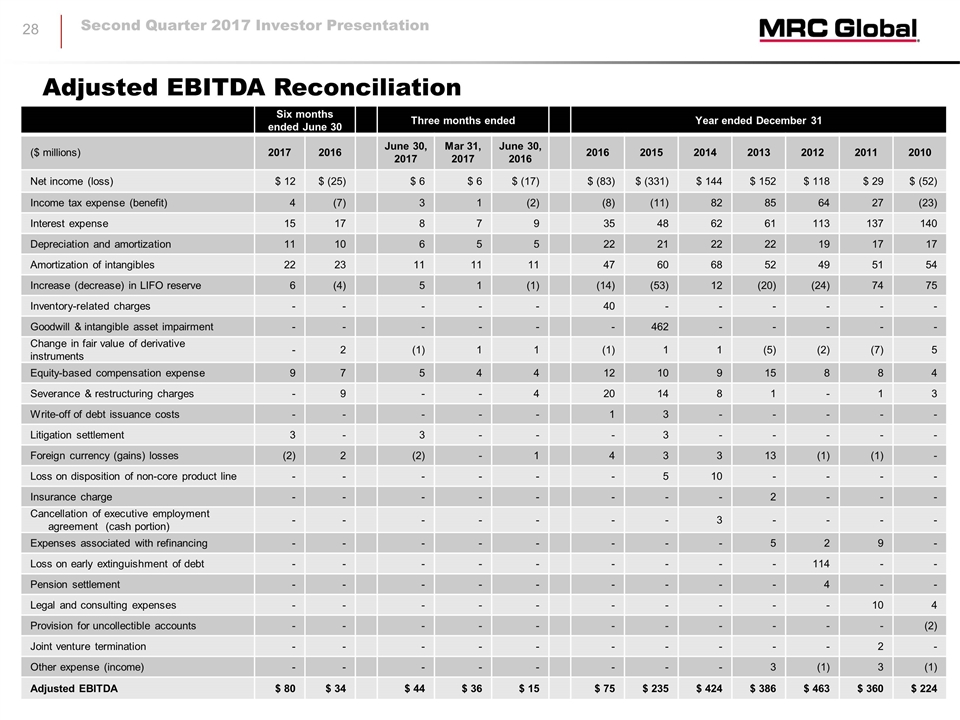

Adjusted EBITDA Reconciliation Six months ended June 30 Three months ended Year ended December 31 ($ millions) 2017 2016 June 30, 2017 Mar 31, 2017 June 30, 2016 2016 2015 2014 2013 2012 2011 2010 Net income (loss) $ 12 $ (25) $ 6 $ 6 $ (17) $ (83) $ (331) $ 144 $ 152 $ 118 $ 29 $ (52) Income tax expense (benefit) 4 (7) 3 1 (2) (8) (11) 82 85 64 27 (23) Interest expense 15 17 8 7 9 35 48 62 61 113 137 140 Depreciation and amortization 11 10 6 5 5 22 21 22 22 19 17 17 Amortization of intangibles 22 23 11 11 11 47 60 68 52 49 51 54 Increase (decrease) in LIFO reserve 6 (4) 5 1 (1) (14) (53) 12 (20) (24) 74 75 Inventory-related charges - - - - - 40 - - - - - - Goodwill & intangible asset impairment - - - - - - 462 - - - - - Change in fair value of derivative instruments - 2 (1) 1 1 (1) 1 1 (5) (2) (7) 5 Equity-based compensation expense 9 7 5 4 4 12 10 9 15 8 8 4 Severance & restructuring charges - 9 - - 4 20 14 8 1 - 1 3 Write-off of debt issuance costs - - - - - 1 3 - - - - - Litigation settlement 3 - 3 - - - 3 - - - - - Foreign currency (gains) losses (2) 2 (2) - 1 4 3 3 13 (1) (1) - Loss on disposition of non-core product line - - - - - - 5 10 - - - - Insurance charge - - - - - - - - 2 - - - Cancellation of executive employment agreement (cash portion) - - - - - - - 3 - - - - Expenses associated with refinancing - - - - - - - - 5 2 9 - Loss on early extinguishment of debt - - - - - - - - - 114 - - Pension settlement - - - - - - - - - 4 - - Legal and consulting expenses - - - - - - - - - - 10 4 Provision for uncollectible accounts - - - - - - - - - - - (2) Joint venture termination - - - - - - - - - - 2 - Other expense (income) - - - - - - - - 3 (1) 3 (1) Adjusted EBITDA $ 80 $ 34 $ 44 $ 36 $ 15 $ 75 $ 235 $ 424 $ 386 $ 463 $ 360 $ 224