UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a- 6(e)(2) ) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

CTPartners Executive Search Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

CTPartners Executive Search Inc.

1166 Avenue of the Americas

New York, New York 10036

To Our Stockholders:

On behalf of the Board of Directors, I invite you to attend the 2012 Annual Meeting of Stockholders of CTPartners Executive Search Inc. to be held at the Company’s offices, 1166 Avenue of the Americas, 3rd Floor, New York, New York 10036, on Thursday, June 14, 2012, at 9:00 a.m., New York, New York time. The formal notice of the Annual Meeting appears on the following page.

The attached Notice of Annual Meeting and Proxy Statement describe the matters that we expect to be acted upon at the Annual Meeting. Management will be available to answer any questions you may have immediately after the Annual Meeting.

Whether or not you choose to attend the Annual Meeting, it is important that your shares be represented. Regardless of the number of shares you own, please vote your shares via telephone, over the Internet or sign and date a paper copy of the proxy card and promptly return it to us in the enclosed postage-paid envelope. If you sign and return your proxy card without specifying your choices, your shares will be voted in accordance with the recommendations of the Board of Directors contained in the Proxy Statement.

|

| Sincerely, |

|

| /s/ Brian M. Sullivan |

| Brian M. Sullivan |

| Chairman and Chief Executive Officer |

May 9, 2012

TABLE OF CONTENTS

2

CTPartners Executive Search Inc.

1166 Avenue of the Americas

New York, New York 10036

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS

June 14, 2012

The Annual Meeting of Stockholders of CTPartners Executive Search Inc., a Delaware corporation, will be held on Thursday, June 14, 2012, at 9:00 a.m. Eastern Standard Time, at 1166 Avenue of the Americas, 3rd Floor, New York, New York 10036 for the following purposes:

| | (1) | to elect five (5) Directors; |

| | (2) | to approve an amendment to the Company’s Certificate of Incorporation reducing the number of shares of Common Stock authorized for issuance thereunder from 30,000,000 to 15,000,000; |

| | (3) | to ratify the designation of McGladrey & Pullen, LLP as independent auditors for the fiscal year ending December 31, 2012; and |

| | (4) | to consider any other matters that may properly come before the meeting or any adjournment thereof. |

The Company’s Board of Directors has carefully reviewed and considered the foregoing proposals and has concluded that each proposal is in the best interests of the Company and its stockholders.Therefore, the Company’s Board of Directors has approved each proposal and recommends that you vote FOR all of the foregoing proposals.

It is very important that your shares be represented at the Annual Meeting, regardless of the size of your holdings. Accordingly, whether or not you expect to attend the Annual Meeting, the Company urges you to vote promptly by completing, dating, signing and returning the enclosed proxy card in the enclosed postage pre-paid envelope, or by voting via the telephone or the Internet as instructed in these materials. This will not limit your right to attend or vote at the Annual Meeting. You may revoke your proxy at any time before it has been voted at the meeting.

Stockholders of record at the close of business on Friday, May 4, 2012 are entitled to vote at the Annual Meeting.

|

| By Order of the Board of Directors |

|

| /s/ David C. Nocifora |

David C. Nocifora Secretary |

May 9, 2012

|

| Important notice regarding the availability of proxy materials for the stockholder meeting to be held on June 14, 2012. The Proxy Statement, proxy card and annual report on Form 10-K are available, free of charge, at “http://www.amstock.com/ProxyServices/ViewMaterial.asp?CoNumber=16782.” |

3

CTPartners Executive Search Inc.

1166 Avenue of the Americas

New York, New York 10036

PROXY

STATEMENT

GENERAL INFORMATION

This proxy statement is furnished in connection with the solicitation by the Board of Directors of CTPartners Executive Search Inc., a Delaware corporation (the “Company”), of proxies to be used at the annual meeting of stockholders of the Company to be held on June 14, 2012 (the “Annual Meeting”). This proxy statement and the related proxy card are being mailed or made available via the Internet to stockholders commencing on or about May 9, 2012.

As permitted by rules adopted by the Securities and Exchange Commission, the Company is making this proxy statement and its annual report available to its stockholders electronically via the Internet. Our annual report on Form 10-K and this proxy statement are available athttp://www.amstock.com/ProxyServices/ViewMaterials.asp?CoNumber=16782.

PROXIES AND VOTING

Stockholders of record of the Company at the close of business on Friday, May 4, 2012, will be entitled to vote at the Annual Meeting. On that date, 7,132,953 shares of common stock, par value $0.001 per share, of the Company (“Common Stock”) were outstanding and entitled to vote. Each share of Common Stock is entitled to one vote. At the Annual Meeting, inspectors of election shall determine the presence of a quorum and shall tabulate the results of the vote of the stockholders.

Voting

As a stockholder of record, you may vote in one of the following three ways (whether or not you plan to attend the Annual Meeting): (1) by completing, signing and dating the accompanying proxy card and returning it in the postage-prepaid envelope enclosed for that purpose, (2) by completing your proxy using the toll-free telephone number listed on the proxy card, or (3) by completing your proxy via the Internet at the website address listed on the proxy card. If you attend the Annual Meeting, you may vote in person at the meeting even if you have previously completed your proxy by mail, telephone or via the Internet.

If your shares are held on your behalf by a third party such as your broker and are registered in the name of that party or other nominee, then that party is the stockholder of record and you are the beneficial owner. In that case, we refer to your shares as being held in “street name”. As the beneficial owner of your “street name” shares, you are entitled to instruct your broker or other nominee as to how to vote your shares. Your broker will provide you with information as to the manner in which you are able to instruct it as to the voting of your “street name” shares. If your shares are held in “street name” and you wish to attend the Annual Meeting in person and vote at the Annual Meeting, you will need to obtain a legal proxy in your name from your broker (or other nominee).

If your shares are held in “street name”, your broker is required to vote those shares in accordance with your instructions. If you do not give instructions to your broker or other nominee, your broker or other nominee will only be entitled to vote the shares with respect to “discretionary” matters as described below but will not be permitted to vote the shares with respect to “non-discretionary” matters. A “broker non-vote” with respect to any particular matter occurs when your broker (or other nominee) submits a proxy for your shares (because the broker (or other nominee) (i) has received instructions from you on some but not all proposals, or (ii) has not

4

received instructions from you on any proposals but is entitled to vote in its discretion on one or more matters) but does not indicate a vote for a particular proposal because the broker (or other nominee) does not have discretionary authority to vote on that proposal and has not received voting instructions from you. If your shares are held in “street name” by your broker (or other nominee), please check the instruction card provided by your broker (or other nominee) or contact your broker (or other nominee) to determine whether you will be able to vote by telephone or via the Internet.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted at the Annual Meeting. Proxies may be revoked by (i) delivering to the Secretary of the Company, before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a later date than the proxy, (ii) duly completing a later-dated proxy relating to the same shares and presenting it to the Secretary of the Company before the taking of the vote at the Annual Meeting or (iii) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). Any written notice of revocation or subsequent proxy should be delivered to the Company’s Secretary at the Company’s principal executive offices, the address of which is noted on the Notice of Annual Meeting, or hand delivered to the Secretary of the Company, before the taking of the vote at the Annual Meeting.

Quorum

The holders of a majority of the issued and outstanding stock of the Company present either in person or by proxy at the Annual Meeting constitute a quorum for the transaction of business at the Annual Meeting. The inspectors of election appointed for the Annual Meeting will determine whether a quorum is present. Shares that abstain from voting on any proposal and “broker non-votes” will be counted as shares that are present and entitled to vote for purposes of determining whether a quorum exists at the Annual Meeting. For purposes of determining the outcome of any matter as to which a broker (or other nominee) has not received instructions, and for which it does not have discretionary voting authority, those shares will be treated as not present and not entitled to vote with respect to that matter (even though those shares are considered entitled to vote for purposes of determining whether a quorum exists and may be entitled to vote on other matters).

The nominees for Director receiving the greatest number of votes cast at the Annual Meeting in person or by proxy shall be elected. Consequently, any shares of Common Stock present in person or by proxy at the Annual Meeting, but not voted for any reason, have no impact in the election of Directors, except to the extent that the failure to vote for an individual may result in another individual receiving a larger number of votes. Stockholders have no right to cumulative voting as to any matter, including the election of Directors.

Required Votes

Regarding Proposal One, uncontested elections of directors are not considered to be “discretionary” matters for certain brokers and, as a result, those brokers are not authorized to vote “street name” shares in the absence of instructions from the beneficial owner. Thus, if you do not provide specific instructions to your broker on how to vote any of your “street name” shares with respect to the election of our directors, your broker may not be able to vote those shares in its discretion and, in such case, a “broker non-vote” would occur and no vote of your “street name” shares would be counted for purposes of the election of our directors. “Broker non-votes” willnot affect the outcome of our director election. With respect to shares held in “street name” by your broker (or other nominee), we strongly encourage you to provide instructions to such broker (or other nominee) as to how to vote on the election of directors by signing, dating and returning to the broker (or other nominee) the instruction card provided by that broker (or other nominee).THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTEFOR EACH OF THE DIRECTOR NOMINEES.

Regarding Proposal Two, approval of the amendment to our Certificate of Incorporation requires the affirmative vote of the holders of a majority of the outstanding shares of our Common Stock entitled to vote

5

thereon. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have the same effect as a vote against the proposal.THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE APPROVAL OF THE AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO EFFECT THE AUTHORIZED SHARE REDUCTION.

Regarding Proposal Three, an affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting is required for approval. Unlike the other proposals, Proposal Three involves a matter on which a broker (or other nominee)does have discretionary authority to vote and as a result, if you do not instruct your broker (or other nominee) as to how you want to vote your shares, your broker (or other nominee) is entitled to vote your shares in its discretion. With respect to Proposal Three, an abstention will have the same effect as a vote against the proposal.THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTEFOR PROPOSAL THREE.

6

PROPOSAL ONE:

ELECTION OF DIRECTORS

The Board of Directors currently consists of five (5) directors: Scott M. Birnbaum, Michael C. Feiner, Betsy L. Morgan, Brian M. Sullivan and Thomas R. Testwuide, Sr. All of our current directors are standing for re-election and the Board of Directors recommends that they be re-elected to hold office until the next annual meeting of shareholders and/or their successors are duly elected and qualified.

If any nominee becomes unavailable for any reason or should a vacancy occur before the election, which events are not anticipated, the proxies will be voted for the election of such other person as a Director as the Board of Directors may recommend. Information regarding the nominees for Director is set forth below.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED BELOW.

NOMINEES FOR DIRECTORS

The names of the nominees for the office of director, together with certain information concerning such nominee, is set forth below.

| | | | | | | | | | |

Name | | First Year as

Director | | | Age | | | Position |

Scott M. Birnbaum | | | 2010 | | | | 52 | | | Director and Chair of the Audit Committee |

Michael C. Feiner | | | 2010 | | | | 69 | | | Director and Chair of the Compensation Committee |

Betsy L. Morgan | | | 2010 | | | | 43 | | | Director |

Brian M. Sullivan | | | 2010 | | | | 59 | | | Director, Chairman of the Board and Chief Executive Officer |

Thomas R. Testwuide, Sr. | | | 2010 | | | | 66 | | | Director and Chair of the Nominating and Corporate Governance Committee |

Brian M. Sullivanhas served as our chief executive officer since joining us in September 2004, and as a director of the Company since December 2010. Prior to joining us, Mr. Sullivan served as Vice Chairman of Heidrick & Struggles International, which he joined upon its acquisition of Sullivan & Company, the financial services industry search firm founded by Mr. Sullivan in 1988. In 2008, Mr. Sullivan was named to BusinessWeek’s Top 50 List of the World’s Most Influential Headhunters. Mr. Sullivan received a B.S. degree from Lehigh University and an M.B.A. from Denver University. We believe Mr. Sullivan’s qualifications to serve on our board of directors include his years of leadership with the Company and extensive knowledge of the retained executive search industry.

Scott M. Birnbaumhas served as a director of the Company since December 2010. Since May 2010, Mr. Birnbaum has served as an Operating Partner for Kohlberg & Company, LLC, a leading U.S. private equity firm which specializes in acquiring middle market companies. Prior to joining Kohlberg & Company, LLC, Mr. Birnbaum was the founder, President and Senior Managing Director of Ameriquest Capital Group, a private equity firm focused on making investments in companies engaged in financial and business services. Prior to founding Ameriquest Capital Group in 2002, Mr. Birnbaum was Senior Partner and Practice Leader of Mercer Management Consulting (now known as Oliver Wyman), an international management consulting firm. We believe Mr. Birnbaum’s qualifications to serve on our board of directors include his extensive experience in the management consulting industry, broad knowledge of various financial and business models, and his knowledge of the capital markets.

7

Michael C. Feinerhas served as a director of the Company since December 2010. Mr. Feiner is the founder of Michael C. Feiner Consulting, Inc., a consulting firm specializing in advising companies on human capital strategies, organization development and leadership effectiveness. He has served as its President since the firm’s founding in 1996. Mr. Feiner also serves as Senior Advisor—Human Capital for Irving Place Capital, a private equity fund located in New York, New York. From 2003 to 2010, Mr. Feiner served as a professor and the Sanford C. Bernstein & Co. Ethics Fellow for Columbia Business School. Mr. Feiner worked for Pepsi-Cola Company from 1975 to 1995 where he served as Senior Vice President and Chief People Officer for Pepsi’s beverage operations worldwide from 1989 until his retirement in 1995. His book,The Feiner Points of Leadership: The 50 Basic Laws That Will Make People Want To Perform Better For You,was selected by the Toronto Globe and Mail as the Best Business Book of 2004. We believe Mr. Feiner’s qualifications to serve on our board of directors include his extensive experience related to human capital, organizational development and assessing management effectiveness.

Betsy L. Morganhas served as a director of the Company since December 2010. Since January, 2011 Ms. Morgan has served as the President ofThe Blaze,a digital news, information and opinion website. From October 2007 to June 2009, she was the chief executive officer of The Huffington Post, a leading news and opinion website. Prior to joining The Huffington Post, Ms. Morgan spent approximately 10 years in various positions at CBS, including service as Senior Vice President for CBS Interactive and General Manager of CBSNews.com, where she was in charge of the network’s broadband, on-demand news service. Prior to joining CBS, Ms. Morgan worked in the media and entertainment group of Schroders, a global asset management company. Ms. Morgan earned a MBA from Harvard Business School and a BA in Political Science and Economics from Colby College, where she currently serves on the Board of Trustees. She currently is a director of Vertical Acuity, an Atlanta-based technology company, and serves as Chairperson of the National Advisory Board of the Poynter Institute, a school for journalists and journalism teachers, based in St. Petersburg, Florida. We believe Ms. Morgan’s qualifications to serve on our board of directors include her knowledge and experience gained from service on the boards of various private companies and her leadership roles in various businesses, particularly service businesses.

Thomas R. Testwuide, Sr.has served as a director of the Company since December 2010. Since March 2010, Mr. Testwuide has served as the Chairman of the Board and Chief Executive Officer of Skana Aluminum Company, an aluminum products manufacturer in Manitowoc, Wisconsin. From February 2005 to May 2010, Mr. Testwuide served as Chairman of the Board and Chief Executive Officer of Plymouth Foam Incorporated, a leading manufacturer of rigid and soft foam products for building insulation and protective packaging applications. Since December 2001, he has served as Chairman of the Board of Torginol, Inc., a manufacturer of specialty coating products for seamless flooring systems and epoxy resin paints. Mr. Testwuide previously served as Chairman of the Board, Chief Executive Officer and President of Schreier Malt Company, a malt production company with operations in the United States, Canada and China, and which was awarded the Wisconsin Manufacturer of the Year Grand Award in 1994. We believe Mr. Testwuide’s qualifications to serve on our board of directors include his knowledge and experience gained from service on the boards of various private companies, and his leadership roles in managing several global businesses.

The Board of Directors unanimously recommends that stockholders vote FOR the election of all nominees.

8

PROPOSAL TWO:

APPROVAL OF AMENDMENT TO THE COMPANY’S CERTIFICATE OF

INCORPORATION TO DECREASE THE NUMBER OF AUTHORIZED SHARES OF

COMMON STOCK FROM 30,000,000 TO 15,000,000

General

The Board of Directors has approved an amendment to the Company’s Certificate of Incorporation, subject to stockholder approval, reducing the number of authorized shares of common stock of the Company from 30,000,000 to 15,000,000. The amendment, if approved by the stockholders, would result in state franchise tax savings while continuing to provide the Company with sufficient flexibility to meet future needs for issuances of common stock. The proposed amendment would amend and restate the first sentence of Paragraph A of Article IV of the Company’s Certificate of Incorporation as follows:

| | A. | Classes of Stock. The total number of shares of all classes of capital stock that the corporation shall have authority to issue is Sixteen Million (16,000,000), of which Fifteen Million (15,000,000) shares shall be Common Stock, $0.001 par value per share (the “Common Stock”), and One Million (1,000,000) shares shall be Preferred Stock, $0.001 par value per share (the “Preferred Stock”). |

Reasons for Amendment

Under Delaware law, the Company is required to pay an annual franchise tax to the State of Delaware based on the total number of its authorized shares. The principal purpose of the proposed amendment is to reduce the number of authorized shares and thereby reduce the Company’s annual franchise tax liability in Delaware. Based on a reduction of 15,000,000 shares, the Company estimates that it will save approximately $40,000 annually in Delaware franchise taxes. The adoption of this proposed amendment to the Certificate of Incorporation would not adversely affect the rights of the holders of the Company’s currently outstanding shares of Common Stock.

If this amendment is approved and the number of authorized shares of Common Stock is reduced to 15,000,000 shares, the Company would have available approximately 6,678,094 shares (including Treasury shares) of Common Stock for future issuances, excluding shares presently reserved for issuances under the Company’s 2010 Equity Incentive Plan. The Board of Directors believes that this number of available shares of Common Stock is adequate for the Company’s currently anticipated requirements.

If the stockholders approve this amendment to the Company’s Certificate of Incorporation, the Company intends to file the amendment with the Secretary of State of Delaware as soon as practicable following the Annual Meeting. The amendment will become effective on the date the amendment is filed, or such later date as is specified in the filing.

While the Company anticipates franchise tax savings, it cannot assure you that the amendment will result in tax savings in Delaware, as Delaware may change the methods it uses to calculate franchise tax, or the Company’s assets or issued shares of stock may change in a way that eliminates any tax savings.

Any subsequent increase in the number of authorized shares of Common Stock, whether for capital raising, acquisitions, anti-takeover measures or any other reason, would require approval by the Company’s stockholders of another amendment to the Company’s Certificate of Incorporation.

Required Vote

The affirmative vote of a majority of the outstanding shares of the Company’s capital stock is required to approve this amendment to the Company’s Certificate of Incorporation. Abstentions and broker non-votes will count as votes against this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL NUMBER 2 TO AMEND THE COMPANY’S CERTIFICATE OF INCORPORATION.

9

PROPOSAL THREE:

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has appointed McGladrey & Pullen, LLP (“McGladrey & Pullen”) as the independent auditors of the Company to examine the financial statements of the Company and its subsidiaries for the fiscal year ending December 31, 2012. The Board of Directors recommends ratification of the appointment of McGladrey & Pullen.

Although stockholder ratification of this appointment is not required by law or binding on the Audit Committee, the Audit Committee believes that stockholders should be given the opportunity to express their views. If the stockholders do not ratify the appointment of McGladrey & Pullen as the Company’s independent auditors, the Audit Committee will consider this vote in determining whether or not to continue the engagement of McGladrey & Pullen.

Principal Accounting Fees and Services

Audit Fees. The aggregate amount billed by McGladrey & Pullen for audit services performed for the fiscal years ending December 31, 2011 and 2010 was $316,000 and $1,244,000, respectively. Audit services include the auditing of financial statements and quarterly reviews.

Audit-Related Fees. No fees were paid to McGladrey & Pullen for audit-related services for either of the fiscal years ended December 31, 2011 and 2010.

Tax Fees. No fees were paid to McGladrey & Pullen associated with tax compliance and tax consultation for either of the fiscal years ended December 31, 2011 and 2010.

All Other Fees. The Company paid McGladrey & Pullen fees of $139,000 and $30,000, for the fiscal years ending December 31, 2011 and December 31, 2010, respectively, in connection with their examination of certain assertions made by the Company relating to certain business performance metrics. In addition, for the fiscal year ended December 31, 2011, McGladrey & Pullen performed a comprehensive review of the Company’s transfer pricing practices.

Audit Committee Pre-Approval Policies and Procedures. The Audit Committee pre-approves the audit and non-audit services performed by McGladrey & Pullen and any of its affiliates in order to assure that the provision of such services does not impair McGladrey & Pullen’s independence. Unless a type of service to be provided by McGladrey & Pullen or one of its affiliates has received general pre-approval, it will require specific pre-approval by the Audit Committee. The Audit Committee does not delegate its responsibilities to pre-approve services performed by the independent auditor to management.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE RATIFICATION OF MCGLADREY & PULLEN AS THE INDEPENDENT AUDITORS OF THE COMPANY’S FINANCIAL STATEMENTS FOR THE YEAR ENDING DECEMBER 31, 2012.

10

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Director Independence

The Board reviews the independence of each Director at least annually. During these reviews, the Board will consider transactions and relationships between each Director (and his or her immediate family and affiliates) and the Company and our management to determine whether any such transactions or relationships are inconsistent with a determination that the Director was independent. The Board has conducted its annual review of Director independence to determine if any transactions or relationships exist that would disqualify any of the individuals who serve as a Director under the applicable listing standards of the NYSE Amex stock exchange or require disclosure under SEC rules. Based upon the foregoing review, the Board has determined that none of its directors, other than Brian M. Sullivan, its Chief Executive Officer, has a material relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of such directors. Mr. Sullivan is not considered independent under the independence rules of the NYSE Amex stock exchange.

Board Meetings

The Board of Directors held five meetings during fiscal year 2011. All of the Directors attended every meeting held by the Board and by all committees on which he or she served during fiscal year 2011. The Board held one executive session of non-employee directors during fiscal year 2011.

Attendance at Annual Meeting

Although the Company does not have a policy with respect to attendance by members of the Board of Directors at its annual meeting of stockholders, Directors are encouraged to attend. All members of our Board of Directors attended last year’s annual meeting of stockholders.

Committees

General. The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each committee is comprised solely of independent directors as defined in the NYSE Amex stock exchange listing standards. The Board of Directors has adopted a written charter for each of the committees. These charters, as well as our Code of Business Conduct and Ethics, are posted and available on the Investor Relations page of our website at www.ctnet.com. Stockholders may request copies of these corporate governance documents, free of charge, by writing to CTPartners Executive Search Inc., 1166 Avenue of the Americas, New York, New York 10036, Attention: Corporate Secretary.

Audit Committee. The Audit Committee is responsible for overseeing the accounting and financial reporting processes of the Company and the audits of the Company’s financial statements. The Audit Committee is also directly responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent auditors, including the resolution of disagreements between Company’s management and the auditors regarding financial reporting. Additionally, the Audit Committee approves all related-party transactions that are required to be disclosed pursuant to Item 404 of SEC Regulation S-K. Each member of the Audit Committee is an independent director as defined in Section 803 of the NYSE Amex Company Guide and SEC Rule 10A-3. Each member of the Audit Committee also is financially literate. The current members of the Audit Committee are Scott M. Birnbaum (Chair), Michael C. Feiner, Betsy L. Morgan and Thomas R. Testwuide, Sr. The Board of Directors has determined that it has at least one “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K, serving on the Audit Committee, Mr. Birnbaum, and that Mr. Birnbaum is an “independent director” as defined in the NYSE Amex stock exchange listing standards. The Audit Committee held four meetings during fiscal year 2011.

11

Compensation Committee. The Compensation Committee is responsible for, among other things, annually reviewing and approving the salary and other compensation (including equity-based incentives) of our chief executive officer, reviewing the compensation programs of our non-employee Directors, overseeing and administering the Company’s equity incentive plans, engaging and determining the fees of compensation consultants, and overseeing regulatory compliance with respect to compensation matters. The Company’s executive compensation philosophy is to position base pay and incentive compensation in a manner so that we are able to attract and retain high performing executives. From time to time, the Compensation Committee invites certain members of management to attend meetings to discuss the performance of the Company and other matters affecting the compensation of each of the named executive officers. The Compensation Committee is appointed by the Board, and consists entirely of independent directors, as defined in Section 803 of the NYSE Amex Company Guide. The current members of this committee are Michael C. Feiner (Chair), Scott M. Birnbaum, Betsy L. Morgan and Thomas R. Testwuide, Sr. The Compensation Committee held one meeting during fiscal year 2011.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for, among other things, evaluating and recommending to the Board of Directors qualified nominees for election as Directors and qualified Directors for committee membership. The current members of the Nominating and Corporate Governance Committee are Thomas R. Testwuide, Sr. (Chair), Scott M. Birnbaum, Michael C. Feiner and Betsy L. Morgan. The members of this committee are all independent directors as defined in Section 803 of the NYSE Amex Company Guide. The Nominating and Corporate Governance Committee held two meetings during fiscal year 2011.

In recommending candidates, the Nominating and Corporate Governance Committee considers such factors as it deems appropriate, consistent with criteria approved by the Board of Directors. These factors may include judgment, skill, diversity, integrity, experience with businesses and organizations of comparable size, experience in corporate governance, experience in business and human resource management, and the interplay of the candidate’s experience with the experience of other members of the Board of Directors. Except as may be required by rules promulgated by the SEC or NYSE Amex stock exchange, there are currently no specific, minimum qualifications that must be met by each candidate for the Board of Directors. The Nominating and Corporate Governance Committee also is responsible for evaluating the “independence” of Directors and Director nominees under the applicable rules and regulations of the SEC and NYSE Amex stock exchange.

The Nominating and Corporate Governance Committee does not currently use an independent search firm in identifying candidates for service on the Board.

The Nominating and Corporate Governance Committee will give appropriate consideration to qualified persons recommended by stockholders for nomination as our Directors, provided that the stockholder delivers written notice to the Secretary of the Company, which contains the following information:

| | • | | the name and address of the stockholder and each Director nominee; |

| | • | | a representation that the stockholder is entitled to vote and intends to appear in person or by proxy at the meeting in which such Director nominee will be considered for election; |

| | • | | a description of any and all arrangements or understandings between the stockholder and each Director nominee; |

| | • | | such other information regarding the Director nominee that would have been required to be included by the SEC in a proxy statement had the Director nominee been named in a proxy statement; |

| | • | | a brief description of the Director nominee’s qualifications to be a Director; and |

| | • | | the written consent of the Director nominee to serve as a Director if so elected. |

Subject to meeting the above requirements, the Nominating and Corporate Governance Committee evaluates Director nominees proposed by stockholders using the same criteria as for other candidates not nominated by stockholders.

12

Board Leadership Structure

We operate in a dynamic industry. Therefore, the Board of Directors believes that our Chief Executive Officer is the most appropriate person to serve as our Chairman of the Board because he possesses in-depth knowledge of the issues, opportunities and challenges facing our business. Because of this knowledge and insight, we believe that he is in the best position to effectively identify strategic opportunities and priorities and to lead the discussion for the execution of the Company’s strategies and achievement of its objectives. As Chairman, our Chief Executive Officer is able to:

| | • | | focus the Board of Directors on the most significant strategic goals and risks of our businesses; |

| | • | | utilize the individual qualifications, skills and experience of the other members of the Board in order to maximize their contributions to the Board of Directors; |

| | • | | ensure that each other member of the Board of Directors has sufficient knowledge and understanding of our business to enable him or her to make informed judgments; and |

| | • | | facilitate the flow of information between the Board of Directors and management of the Company. |

The Board of Directors believes that by combining the roles of Chairman and Chief Executive Officer in one person, it promotes the strategic development and execution of our business strategies, which is essential to effective governance. The Board has chosen not to appoint a “lead director,” but instead uses executive sessions of the independent Directors, as necessary. In addition, the committees of the Board are comprised solely of independent Directors. We believe that shared leadership responsibility among the independent Directors, as opposed to a single lead director, results in increased engagement of the Board of Directors as a whole, and that having a strong, independent group of Directors fully engaged is important for good governance.

The Board’s Role in Risk Oversight

The Board of Directors oversees the risk management of the Company. The full Board of Directors, as supplemented by the appropriate board committee in the case of risks that are overseen by a particular committee, reviews information provided by management in order for the Board of Directors to oversee risk identification, risk management and risk mitigation strategies. Our board committees assist the full Board of Directors’ oversight of our material risks by focusing on risks related to the particular area of concentration of the relevant committee. For example, our Compensation Committee oversees risks related to our executive compensation plans and arrangements, our Audit Committee oversees the financial reporting and control risks, and our Nominating and Corporate Governance Committee oversees risks associated with the independence of the Board of Directors and potential conflicts of interest. Each committee reports on these discussions of the applicable relevant risks to the full Board of Directors during the committee reports portion of the Board of Directors meeting, as appropriate. The full Board of Directors incorporates the insight provided by these reports into its overall risk management analysis.

Certain Relationships and Related Person Transactions

We give careful attention to related person transactions because they may present the potential for conflicts of interest. We refer to “related person transactions” as those transactions, arrangements, or relationships in which:

| | • | | we were, are or are to be a participant; |

| | • | | the amount involved exceeds $120,000; and |

| | • | | any of our Directors, Director nominees, executive officers or greater-than five percent stockholders (or any of their immediate family members) had or will have a direct or indirect material interest. |

13

To identify related person transactions in advance, we rely on information supplied by our executive officers, Directors and certain significant stockholders. We have adopted a comprehensive written policy for the review, approval or ratification of related person transactions, and our Audit Committee reviews all related person transactions identified by us. The Audit Committee approves or ratifies only those related person transactions that are determined by it to be, under all of the circumstances, in the best interest of the Company and its stockholders. No related person transactions occurred in fiscal 2011 that required a review by the Audit Committee.

Communications with Directors

Stockholders may communicate their concerns directly to the entire Board of Directors or specifically to non-management Directors. Such communication can be confidential or anonymous, if so designated, and may be submitted in writing to the following address:

Board of Directors

CTPartners Executive Search Inc.

c/o David C. Nocifora, Corporate Secretary

1166 Avenue of the Americas, 3rd Floor

New York, NY 10036

Compensation Committee Interlocks and Insider Participation

In 2011, none of our executive officers or Directors was a member of the board of directors of any other company where the relationship would be construed to constitute an interlocking relationship (as described in Item 407(e)(iii) of SEC Regulation S-K).

Code of Business Conduct and Ethics

The Company’s Code of Business Conduct and Ethics applies to all of its employees, including its Chief Executive Officer and its Chief Financial Officer. The Code of Business Conduct and Ethics and all Committee charters are posted in the investor relations portion of the Company’s website at www.ctnet.com.

14

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is composed of four Directors, all of whom are independent, as required by the applicable listing standards of the NYSE Amex stock exchange and by applicable laws and rules of the SEC. The Audit Committee operates under a written charter adopted and approved by the Board of Directors. The charter imposes on the Audit Committee the duties and responsibilities imposed upon audit committees generally by applicable legal requirements and regulations, particularly those contained in the Sarbanes-Oxley Act of 2002 (“SOX”) and the SEC rules promulgated pursuant to SOX. The written charter of the Audit Committee is posted and available on the Investor Relations page of our website at www.ctnet.com.

Management is responsible for the Company’s internal controls and financial reporting process. McGladrey & Pullen, the Company’s independent auditor, is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee’s responsibility is to provide oversight to these processes.

In fulfilling its oversight responsibility, the Audit Committee relies on the accuracy of financial and other information, opinions, reports, and statements provided to the Audit Committee. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management follows appropriate accounting and financial reporting principles or maintains appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Nor does the Audit Committee’s oversight assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or the audited financial statements are presented in accordance with generally accepted accounting principles.

The Audit Committee has reviewed and discussed with the Company’s management and McGladrey & Pullen the audited consolidated financial statements of the Company for the year ended December 31, 2011. The Audit Committee also has discussed with McGladrey & Pullen the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees,” as amended, as adopted by the Public Company Accounting Oversight Board. The Audit Committee has also received and reviewed the written disclosures and the letter from McGladrey & Pullen required by applicable requirements of the Public Company Accounting Oversight Board regarding McGladrey & Pullen’s communications with the Audit Committee concerning independence, and has discussed with McGladrey & Pullen their independence. The Audit Committee also has considered whether McGladrey & Pullen’s provision of services to the Company beyond those rendered in connection with their audit and review of the Company’s financial statements is compatible with maintaining their independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011 for filing with the Securities and Exchange Commission.

Submitted by the Audit Committee

Scott M. Birnbaum, Chair

Michael C. Feiner

Betsy L. Morgan

Thomas R. Testwuide, Sr.

15

EXECUTIVE OFFICERS

The following table summarizes information regarding the current executive officers of the Company.

| | | | | | |

Name | | Age | | | Position |

Brian M. Sullivan | | | 59 | | | Chief Executive Officer and Chairman of the Board of Directors |

David C. Nocifora | | | 52 | | | Chief Operating Officer, Chief Financial Officer and Secretary |

Brian M. Sullivanhas served as our Chief Executive Officer since joining us in September 2004. Prior to joining us, Mr. Sullivan served as Vice Chairman of Heidrick & Struggles International, which he joined upon its acquisition of Sullivan & Company, the financial services industry search firm he founded in 1988. In 2008, Mr. Sullivan was named Business Week’s Top 50 List of the World’s Most Influential Headhunters. Mr. Sullivan received a B.S. degree from Lehigh University and an M.B.A. from Denver University.

David C. Nociforahas served as our Chief Financial Officer since June 1994 and as our Chief Operating Officer since 2003. Previously, Mr. Nocifora served as Division Controller for Jaite Packaging, a division of Sealright Co., Inc., and Accounting Manager for Tremco, a division of Goodrich Corporation. Mr. Nocifora is a certified public accountant in the State of Ohio. He received his B.S. degree in Accounting from Ohio Northern University and an M.B.A. from Lake Erie College.

Executive Compensation

Summary Compensation Table

The following table summarizes compensation information for the Company’s Chief Executive Officer and Chief Operating and Financial Officer who are the only named executive officers for the fiscal years ended December 31, 2011 and 2010:

| | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position | | Year | | | Salary

($) | | | Bonus

($) | | | NonEquity

Incentive Plan

Compensation

($) | | | Total

($) | |

Brian M. Sullivan, | | | 2011 | | | | 750,000 | | | | 562,500 | (1) | | | — | | | | 1,312,500 | |

Chief Executive Officer | | | 2010 | | | | 400,000 | | | | 1,250,000 | | | | 207,679 | | | | 1,857,679 | |

| | | | | |

David C. Nocifora, | | | 2011 | | | | 500,000 | | | | 250,000 | (2) | | | — | | | | 750,000 | |

Chief Operating and Financial | | | 2010 | | | | 450,000 | | | | 375,000 | | | | 197,602 | | | | 1,022,602 | |

Officer and Secretary | | | | | | | | | | | | | | | | | | | | |

| (1) | Under his employment agreement, Mr. Sullivan was eligible to receive a bonus in an amount between 75% and 150% of his then-current annual base salary. The Compensation Committee awarded Mr. Sullivan a bonus of $562,500 for fiscal year 2011, representing 75% of his fiscal year 2011 base salary. |

| (2) | Under his employment agreement, Mr. Nocifora was eligible to receive a bonus in an amount between 50% and 100% of his then-current annual base salary. The Compensation Committee awarded Mr. Nocifora a bonus of $250,000 for fiscal year 2011, representing 50% of his fiscal year 2011 base salary. |

16

Shareholder Communications with the Board of Directors

The Company’s Board of Directors has always been, and will remain, open to communications from the Company’s shareholders. The following process for communication between shareholders and the Board was established by the Board in December 2010.

If any Company shareholder desires to send a communication to the Board, such shareholder may mail any such communication, on an anonymous or named basis, to any Director or to the Company’s Corporate Secretary (David C. Nocifora) at the Company’s offices at 1166 Avenue of the Americas, New York, New York 10036. The Corporate Secretary will review the communication and forward it to such Director or Directors as is appropriate. While the Board certainly makes efforts to respond to communications from the Company’s shareholders, this process will not result in, nor should it be viewed to create, an obligation of a response to any communication. Shareholder proposals must be communicated in accordance with the procedures prescribed by the applicable securities laws and otherwise pursuant to the process described in the section of this Proxy Statement captioned “Submission of Stockholders’ Proposals and Additional Information” below.

Severance Arrangements

See the disclosure under “Potential Payments Upon Termination or Change in Control” for more information about severance arrangements with our named executive officers. We provide such severance arrangements to attract and retain qualified personnel.

Employment Agreements

We believe that entering into employment agreements with each of our named executive officers was necessary for us to attract and retain these talented and experienced individuals for our senior level positions. The contracts term for each of these employment agreements is September 1, 2010 to August 30, 2013. In addition to base salary, each employment agreement provides the executive officer with the opportunity to earn cash and equity-based bonus compensation. In this way, the employment agreements help us meet the initial objective of our compensation program. For more details of our employment agreements and arrangements, see the disclosure under “Executive Compensation — Summary Compensation Table.”

General Tax Deductibility of Executive Compensation

We structure our compensation program to comply with Internal Revenue Code Section 162(m). Under Section 162(m), there is a limitation on tax deductions of any publicly-held corporation for individual compensation to certain executives of such corporation exceeding $1.0 million in any taxable year, unless the compensation is performance-based. The Compensation Committee manages our incentive programs to qualify for the performance-based exemption; however, it also reserves the right to provide compensation that does not meet the exemption criteria if, in its sole discretion, it determines that doing so advances our business objectives.

Equity Compensation Plans

In 2010, we adopted the 2010 Equity Incentive Plan, which authorizes the Board of Directors, or a committee thereof, to provide equity-based compensation in the form of stock options, restricted stock, restricted stock units and other stock-based awards, which are used to attract and retain qualified employees, Directors and consultants. Total awards under this plan are limited to 1,000,000 shares of Common Stock.

Outstanding Equity Awards at December 31, 2011

There were no outstanding equity or stock awards held by our named executive officers at December 31, 2011.

17

Potential Payments Upon Termination or Change in Control

Under their employment agreements, the named executive officers may be entitled to certain potential payments upon termination. In the event that an executive officer is terminated without cause or terminates employment for good reason, as defined in their employment agreements, we would, in general, be obligated to pay severance equal to the executive’s base salary for 18 months plus an amount equal to a pro rata portion of the executive’s target cash bonus for the year in which such termination occurs, plus any unpaid bonus from prior years, and any other unpaid amounts and benefits to which the executive is entitled as of the termination under any of our compensation plans and programs. In the event that a named executive officer is terminated upon a change in control, such officer is entitled to receive, among other things, severance in an amount equal to his base salary for 18 months plus an amount equal to a pro rata portion of his target cash bonus amount for the year in which such termination occurs.

In general, the employment agreements define “cause” to mean (i) the executive’s breach, non-performance or non-observance of any of the provisions of his agreement which has a material adverse affect on the Company, (ii) the executive’s breach of any of his fiduciary duties to the Company which has a material adverse affect on the Company, or (iii) the executive’s conviction of a felony involving theft, embezzlement, fraud or moral turpitude, or a felony in connection with his employment by the Company. The employment agreements define “good reason” to mean (i) an assignment to the executive of any duties inconsistent in any material respect with the duties of the position he currently occupies or a material change in his position, authority or responsibilities without his consent, (ii) a material reduction in his base salary other than as part of an across-the-board reduction applicable to the executive officers of the Company, and (iii) the Company’s breach of any material provision of the employment agreement. A “change in control” occurs when (i) a person who is not a stockholder of the Company becomes the direct or indirect beneficial owner of 30% or more of our voting securities, (ii) there is a reorganization, merger, consolidation or sale of substantially all of the assets of the Company which would result in our then-current stockholders owning less than 50% of our voting securities, (iii) there is a change in the Board of Directors such that the individuals who then served on the Board cease to constitute at least a majority of the Board, or (iv) the Company liquidates, dissolves or sells substantially all of its assets.

In the event that an executive officer is terminated for cause or as a result of death or disability, we would be obligated to pay his full base salary and other benefits, including any unpaid expense reimbursements, through the date of termination.

Director Compensation

Under our current director compensation program, each director of the Company (other than a director who is employed by the Company) receives an annual retainer of $40,000 payable as follows: (i) $20,000 ($5,000 per quarter) in cash and (ii) $20,000 in restricted stock units granted under the Company’s 2010 Equity Incentive Plan. (For fiscal year 2011, the Company increased the compensation payable to its non-employee directors in consideration of their uncompensated board and committee service prior to last year’s annual stockholders meeting, the Company’s first annual meeting after its initial public offering.) The restricted stock units are granted immediately after the director’s election at the annual meeting and vest on the day immediately prior to the following annual meeting. In addition, the chairman of each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee receive an annual cash retainer of $10,000, $7,500 and $7,500, respectively, payable at the end of each quarter. Members of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee each receive $2,500, $1,000 and $1,000 annually, respectively. The Company believes that its director compensation program is competitive with similarly-situated companies.

The following table sets forth information regarding fiscal year 2011 compensation for each Director other than Mr. Sullivan, whose compensation is set forth above under the heading “Executive Compensation”.

18

| | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash ($) | | | Stock Awards ($)1 | | | Total

Compensation ($) | |

Scott M. Birnbaum | | | 32,000 | | | | 30,000 | | | | 62,000 | |

Michael C. Feiner | | | 31,000 | | | | 30,000 | | | | 61,000 | |

Betsy L. Morgan | | | 24,500 | | | | 30,000 | | | | 54,500 | |

Thomas R. Testwuide, Sr. | | | 31,000 | | | | 30,000 | | | | 61,000 | |

| 1 | Each Director was awarded 2,396 restricted shares of the Company’s common stock immediately after the 2011 annual meeting of stockholders. Fair value is based on (i) the number of restricted shares granted in fiscal year 2011 multiplied by (ii) the closing market price of the Company’s Common Shares on the NYSE Amex stock exchange on the date of grant, which was $12.52. |

BENEFICIAL OWNERSHIP OF OUR COMMON STOCK

The following table sets forth certain information known to us regarding the beneficial ownership of our Common Stock as of April 12, 2012 by:

| | • | | each person known by us to beneficially own more than 5% of our Common Stock; |

| | • | | each director and nominee for Director; |

| | • | | each named executive officer; and |

| | • | | all of our directors, nominees for director and executive officers as a group. |

On April 12, 2012, there were 7,132,953 shares of Common Stock outstanding.

We have determined beneficial ownership in accordance with SEC rules. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, restricted stock units and shares of Common Stock that could be issued upon the exercise of outstanding options and warrants held by that person that are exercisable within 60 days of April 12, 2012 are considered outstanding. These shares, however, are not considered outstanding when computing the percentage ownership of each other person.

Except as indicated in the footnotes to this table and pursuant to state community property laws, to our knowledge, each stockholder named in the table has sole voting and investment power for the shares shown as beneficially owned by them.

| | | | | | | | |

| | | Shares of Common

Stock Beneficially

Owned | |

Name of Beneficial Owner (1) | | Number(2) | | | Percent | |

Greater Than 5% Stockholders | | | | | | | | |

Adam Kohn | | | 626,698 | | | | 8.8 | % |

Newland Capital Management, LLC (3) | | | 421,242 | | | | 5.9 | % |

Burke St. John (4) | | | 398,456 | | | | 5.6 | % |

Royce & Associates, LLC (5) | | | 381,890 | | | | 5.4 | % |

| | |

Directors, Nominee for Director and Executive Officers | | | | | | | | |

Brian M. Sullivan (6) | | | 1,180,204 | | | | 16.6 | % |

David C. Nocifora | | | 236,049 | | | | 3.3 | % |

Scott M. Birnbaum | | | 2,396 | | | | * | |

Michael C. Feiner | | | 2,396 | | | | * | |

Betsy L. Morgan | | | 2,396 | | | | * | |

Thomas R. Testwuide, Sr. | | | 3,396 | | | | * | |

All directors, nominees for director and executive officers as a group (6 persons) | | | 1,426,837 | | | | 20.0 | % |

19

| (1) | The mailing address for each director, director nominee, executive officer and Mr. St. John is 1166 Avenue of the Americas, 3rd Floor, New York, New York 10036. The mailing address for Mr. Kohn is 28601 Chagrin Blvd., 6th Floor, Cleveland, Ohio 44122. |

| (2) | Amount includes 2,396 restricted shares held by the following directors: Mr. Birnbaum, Mr. Feiner, Ms. Morgan and Mr. Testwuide, Sr. |

| (3) | Number is based on information contained in Schedule 13G/A filed with the Securities and Exchange Commission on February 10, 2012. The mailing address for Newland Capital Management is 350 Madison Avenue, 8th Floor, New York, New York 10017. |

| (4) | Includes 358,461 shares held by LBS Group Inc., which is wholly owned by Mr. St. John. |

| (5) | Number is based on information contained in Schedule 13G filed with the Securities and Exchange Commission on January 11, 2012. The mailing address for Royce & Associates is 745 Fifth Avenue, New York, New York 10151. |

| (6) | All of these shares are held by Revenant, Inc., which is wholly owned by Mr. Sullivan. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”) requires the Company’s executive officers, directors and greater than 10% shareholder’s to file with the SEC and the Company reports regarding their ownership of and transactions in the Company’s securities. Based solely on a review of reports that were furnished to the Company during or with respect to fiscal year 2011 by persons who were, at any time during fiscal year 2011, Directors or officers of the Company or beneficial owners of more than 10% of the outstanding shares of Common Stock, all filings were made on a timely basis.

NO INCORPORATION BY REFERENCE

The Audit Committee Report (including reference to the independence of the Audit Committee members) is not deemed filed with the SEC or subject to the liabilities of Section 18 of the Exchange Act, and shall not be deemed incorporated by reference into any prior or future filings made by us under the Securities Act or the Exchange Act, except to the extent that we specifically incorporate such information by reference.

SUBMISSION OF PROPOSALS FOR NEXT ANNUAL MEETING

A stockholder who intends to present a proposal at the 2013 annual meeting of the stockholders of the Company (the “2013 Annual Meeting”) and who wishes to have the proposal included in the Company’s Proxy Statement and Form of Proxy for that meeting, must deliver the proposal to the Company no later than January 15, 2013. Stockholder proposals should be directed to the Company via certified mail, Attention: Corporate Secretary, 1166 Avenue of the Americas, 3rd Floor, New York, New York 10036. Any stockholder proposal submitted other than for inclusion in the Company’s proxy materials for the 2013 Annual Meeting must be delivered to the Company no later than March 15, 2013 or such proposal will be considered untimely. If a stockholder proposal is received after March 15, 2013, the Company may vote ALL proxies, in its discretion as to the proposal.

ANNUAL REPORTS

The Company will furnish without charge to each person from whom a proxy is being solicited, upon written request of any such person, a copy of the Annual Report on Form 10-K of the Company for the fiscal year ended December 31, 2011, as filed with the SEC, including the financial statements and schedules thereto. Requests for copies of such Annual Report on Form 10-K should be directed to: CTPartners Executive Search Inc., 1166 Avenue of the Americas, New York, New York 10036, Attention: Corporate Secretary.

20

SOLICITATION OF PROXIES

The Company will bear the costs of soliciting proxies from its stockholders. In addition to the use of the mails, proxies may be solicited by the Directors, officers and employees of the Company by personal interview or telephone. Such Directors, officers and employees will not be additionally compensated for such solicitation but may be reimbursed for out-of-pocket expenses incurred in connection with such solicitation. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation materials to the beneficial owners of Common Stock held of record by such persons, and the Company will reimburse such brokerage houses, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred in connection with such solicitation.

OTHER MATTERS

The Board of Directors knows of no other matters that are likely to be brought before the Annual Meeting. The Company did not receive notice of any other matter intended to be raised by a stockholder at the Annual Meeting. Therefore, the enclosed proxy card grants to the persons named in the proxy card the authority to vote in their best judgment regarding all other matters properly raised at the Annual Meeting.

|

| By Order of the Board of Directors |

|

| /s/ DAVID C. NOCIFORA |

| David C. Nocifora |

| Secretary |

May 9, 2012

IT IS IMPORTANT THAT THE PROXIES BE RETURNED PROMPTLY. EVEN IF YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE PROMPTLY COMPLETE, SIGN, DATE AND MAIL THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

21

14475 CTPARTNERS EXECUTIVE SEARCH INC. ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 14, 2012 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS The undersigned hereby appoints Brian M. Sullivan and David C. Nocifora as proxies, each with full power of substitution, to represent and vote as designated on the reverse side, all the shares of Common Stock of CTPartners Executive Search Inc. held of record by the undersigned on May 4, 2012, at the Annual Meeting of Stockholders to be held at 1166 Avenue of the Americas, 3rd Floor, New York, New York on Thursday, June 14, 2012 at 9:00 a.m., or any adjournment or postponement thereof. (Continued and to be signed on the reverse side)

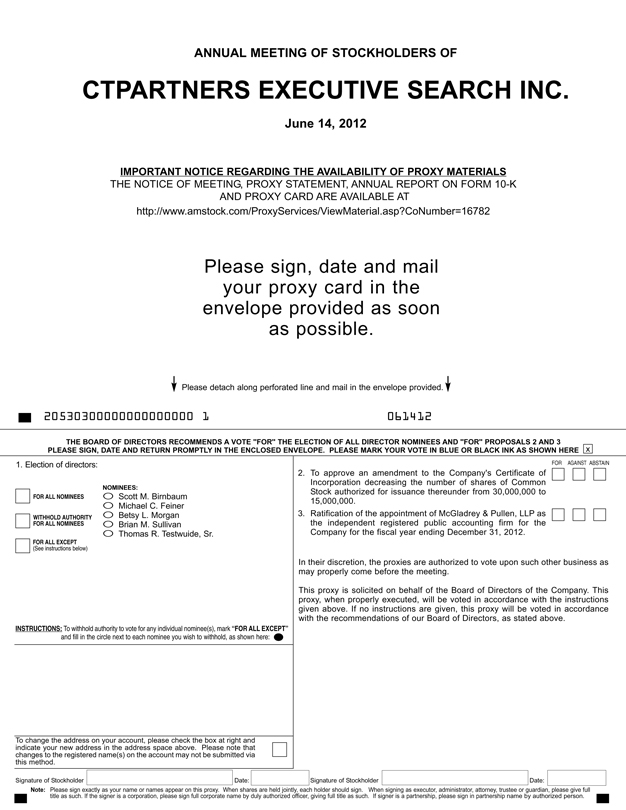

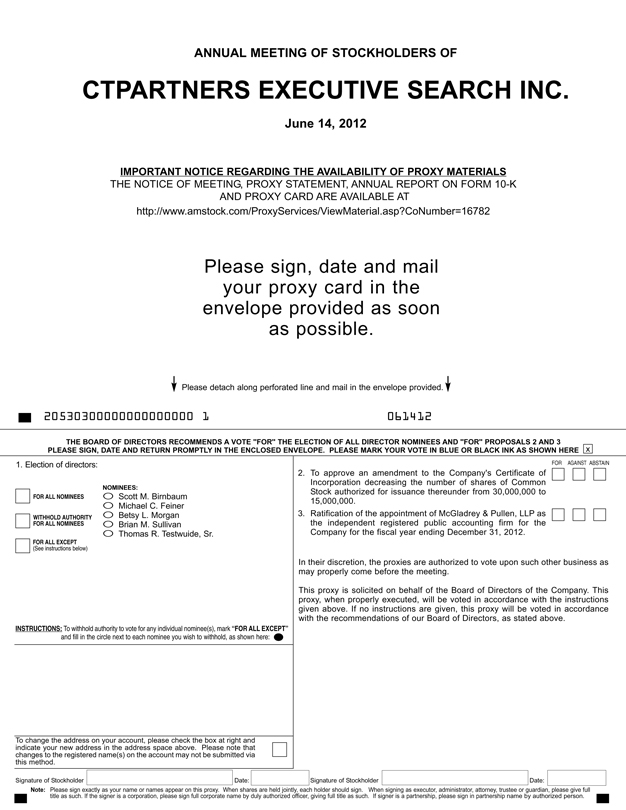

ANNUAL MEETING OF STOCKHOLDERS OF CTPARTNERS EXECUTIVE SEARCH INC. June 14, 2012 IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS THE NOTICE OF MEETING, PROXY STATEMENT, ANNUAL REPORT ON FORM 10-K AND PROXY CARD ARE AVAILABLE AT http://www.amstock.com/ProxyServices/ViewMaterial.asp?CoNumber=16782 Please sign, date and mail your proxy card in the envelope provided as soon as possible. Signature of Stockholder Date: Signature of Stockholder Date: Note: Please sign exactly as your name or names appear on this proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. 1. Election of directors: Scott M. Birnbaum Michael C. Feiner Betsy L. Morgan Brian M. Sullivan Thomas R. Testwuide, Sr. 2. To approve an amendment to the Company’s Certificate of Incorporation decreasing the number of shares of Common Stock authorized for issuance thereunder from 30,000,000 to 15,000,000. 3. Ratification of the appointment of McGladrey & Pullen, LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2012. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. This proxy is solicited on behalf of the Board of Directors of the Company. This proxy, when properly executed, will be voted in accordance with the instructions given above. If no instructions are given, this proxy will be voted in accordance with the recommendations of our Board of Directors, as stated above. FOR AGAINST ABSTAIN FOR ALL NOMINEES WITHHOLD AUTHORITY FOR ALL NOMINEES FOR ALL EXCEPT (See instructions below) INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: NOMINEES: THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL DIRECTOR NOMINEES AND “FOR” PROPOSALS 2 AND 3 PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x Please detach along perforated line and mail in the envelope provided. 20530300000000000000 1 061412

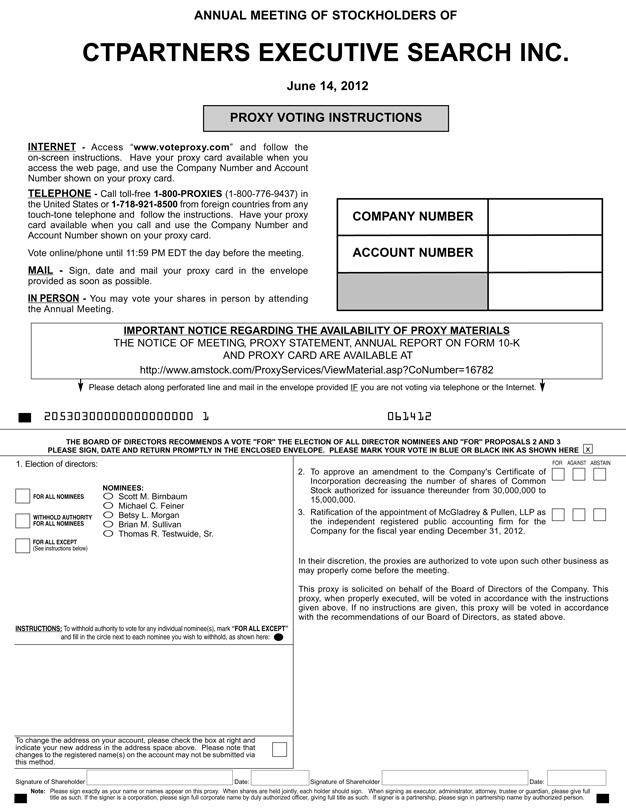

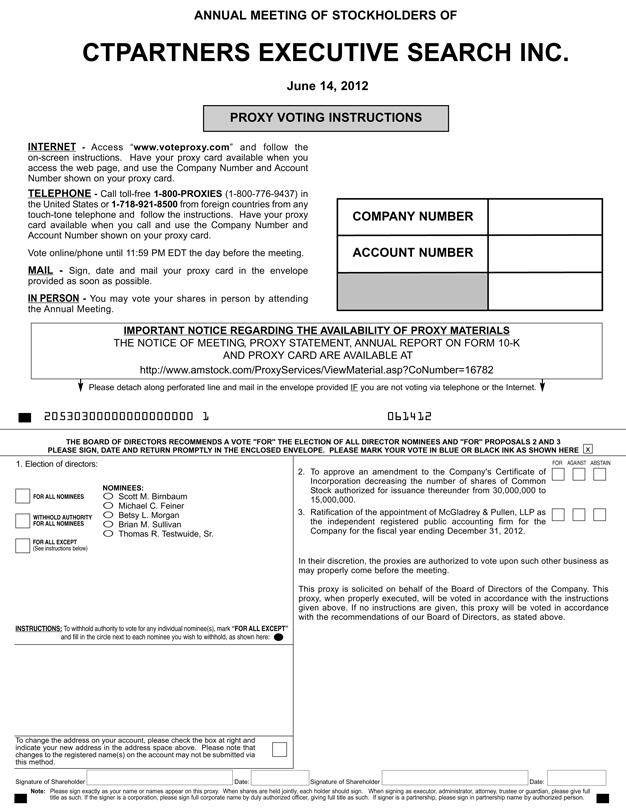

Signature of Shareholder Date: Signature of Shareholder Date: Note: Please sign exactly as your name or names appear on this proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. 1. Election of directors: Scott M. Birnbaum Michael C. Feiner Betsy L. Morgan Brian M. Sullivan Thomas R. Testwuide, Sr. 2. To approve an amendment to the Company’s Certificate of Incorporation decreasing the number of shares of Common Stock authorized for issuance thereunder from 30,000,000 to 15,000,000. 3. Ratification of the appointment of McGladrey & Pullen, LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2012. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. This proxy is solicited on behalf of the Board of Directors of the Company. This proxy, when properly executed, will be voted in accordance with the instructions given above. If no instructions are given, this proxy will be voted in accordance with the recommendations of our Board of Directors, as stated above. FOR AGAINST ABSTAIN FOR ALL NOMINEES WITHHOLD AUTHORITY FOR ALL NOMINEES FOR ALL EXCEPT (See instructions below) INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: NOMINEES: ANNUAL MEETING OF STOCKHOLDERS OF CTPARTNERS EXECUTIVE SEARCH INC. June 14, 2012 INTERNET - Access “www.voteproxy.com” and follow the on-screen instructions. Have your proxy card available when you access the web page, and use the Company Number and Account Number shown on your proxy card. TELEPHONE - Call toll-free 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. Have your proxy card available when you call and use the Company Number and Account Number shown on your proxy card. Vote online/phone until 11:59 PM EDT the day before the meeting. MAIL - Sign, date and mail your proxy card in the envelope provided as soon as possible. IN PERSON - You may vote your shares in person by attending the Annual Meeting. PROXY VOTING INSTRUCTIONS Please detach along perforated line and mail in the envelope provided IF you are not voting via telephone or the Internet. THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL DIRECTOR NOMINEES AND “FOR” PROPOSALS 2 AND 3 PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x 20530300000000000000 1 061412 COMPANY NUMBER ACCOUNT NUMBER IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS THE NOTICE OF MEETING, PROXY STATEMENT, ANNUAL REPORT ON FORM 10-K AND PROXY CARD ARE AVAILABLE AT http://www.amstock.com/ProxyServices/ViewMaterial.asp?CoNumber=16782