EMBRACING OUR PAST, REIMAGINING OUR FUTURE December 21, 2020 Exhibit 99.2

Important Information for Investors and Stockholders Additional Information and Where to Find It This communication relates to the proposed transaction involving the sale by Agios Pharmaceuticals, Inc. (“Agios”) of its oncology business to Servier Pharmaceuticals, LLC. In connection with the proposed transaction, Agios will file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including Agios’ proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Agios may file with the SEC or send to its stockholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, STOCKHOLDERS OF AGIOS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s website, at http://www.sec.gov, and Agios’s website, at www.agios.com. In addition, the documents (when available) may be obtained free of charge by accessing Agios’s website at www.agios.com under the heading “Investors” or, alternatively, directing a request to Holly Manning by email at holly.manning@agios.com or by calling 617-649-8600. Participants in the Solicitation Agios and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Agios common stock in respect of the proposed transaction. Information about the directors and executive officers of Agios is set forth in the proxy statement for Agios’ 2020 annual meeting of stockholders, which was filed with the SEC on April 16, 2020, and in other documents filed by Agios with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

Forward Looking Statements Certain statements contained in this communication may constitute forward-looking statements within the meaning of within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based on our current plans and expectations and involve risks and uncertainties which are, in many instances, beyond our control, and which could cause actual results to differ materially from those included in or contemplated or implied by the forward-looking statements. Such risks and uncertainties include the following: (i) the occurrence of any event, change or other circumstance that could give rise to the termination of the purchase and sale agreement; (ii) the failure of Agios to obtain stockholder approval for the proposed transaction or the failure to satisfy any of the other conditions to the completion of the proposed transaction; (iii) the effect of the announcement of the proposed transaction on the ability of Agios to retain and hire key personnel and maintain relationships with its customers, suppliers, advertisers, partners and others with whom it does business, or on its operating results and businesses generally; (iv) risks associated with the disruption of management’s attention from ongoing business operations due to the proposed transaction; (v) the ability to meet expectations regarding the timing and completion of the proposed transaction, including with respect to receipt of required regulatory approvals; (vi) the failure of Agios to receive milestone or royalty payments under the purchase and sale agreement and the uncertainty of the timing of any receipt of any such payments; (vii) the uncertainty of the results and effectiveness of the use of proceeds from the proposed transaction; and (viii) other risks and uncertainties described in our reports and filings with the SEC, including the risks and uncertainties set forth in Item 1A under the heading Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2019, our Quarterly Report on Form 10-Q for the fiscal quarter ended on September 30, 2020 filed with the SEC on November 5, 2020 and other subsequent periodic reports we file with the SEC, which are available at www.sec.gov and Agios’ website at www.agios.com. While the list of factors presented here is considered representative, this list should not be considered to be a complete statement of all potential risks and uncertainties. Any forward-looking statements contained in this communication are made only as of the date hereof, and we undertake no obligation to update forward-looking statements to reflect developments or information obtained after the date hereof and disclaim any obligation to do so other than as may be required by law.

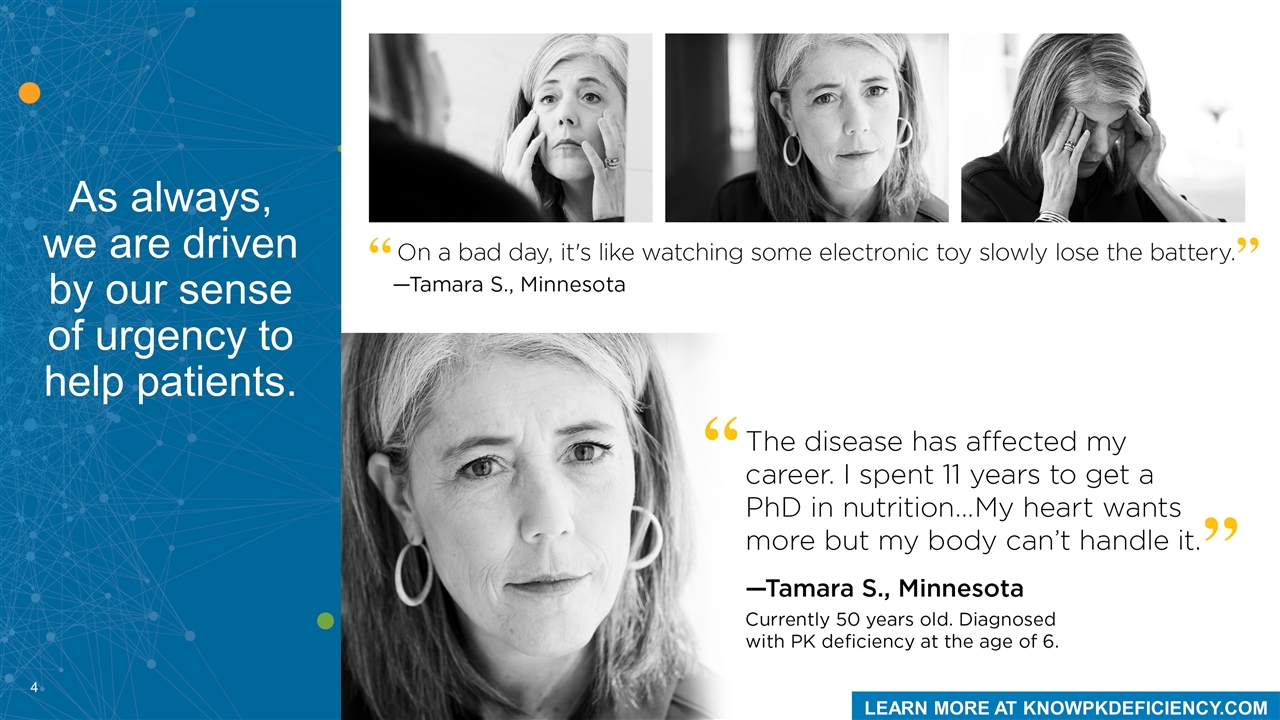

As always, we are driven by our sense of urgency to help patients. LEARN MORE AT KNOWPKDEFICIENCY.COM

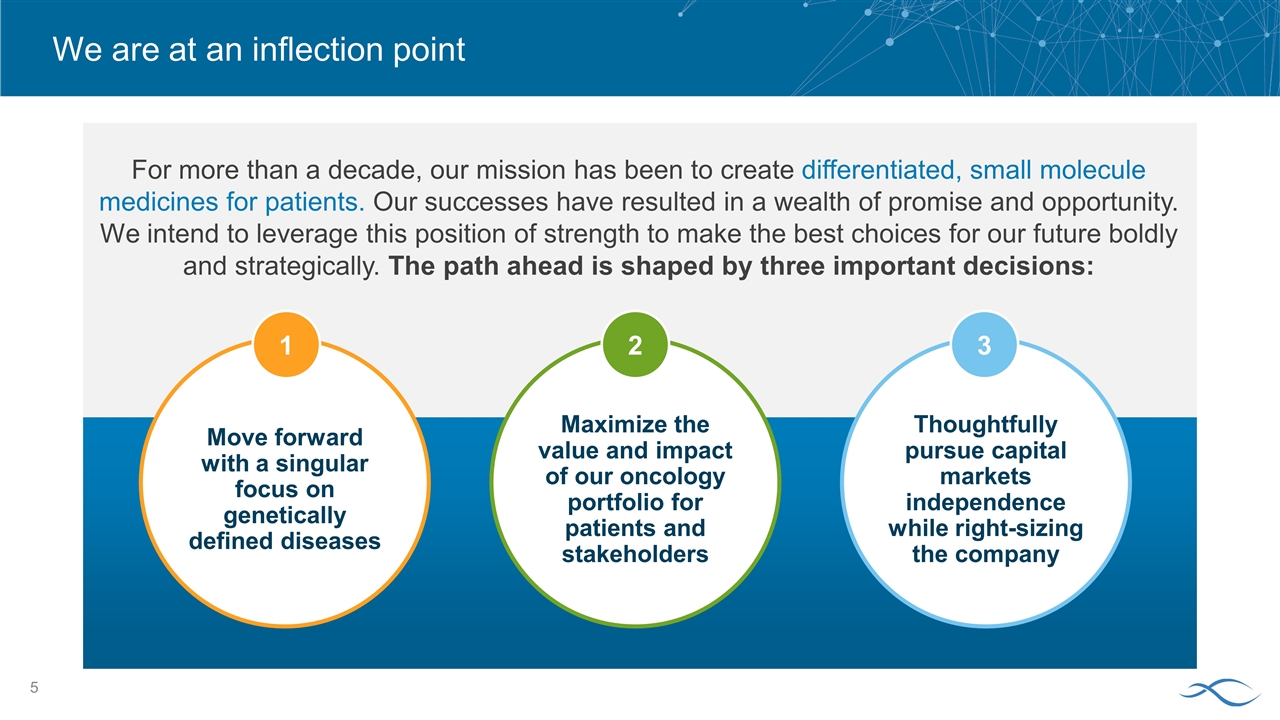

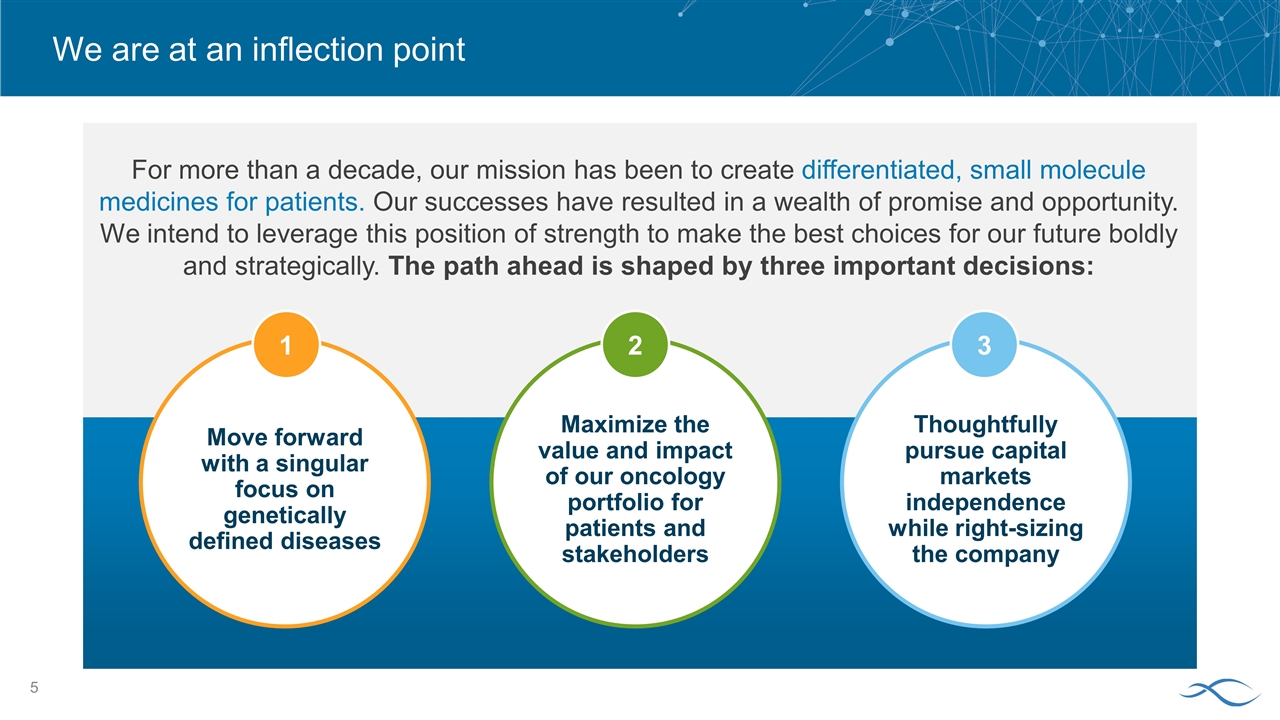

We are at an inflection point For more than a decade, our mission has been to create differentiated, small molecule medicines for patients. Our successes have resulted in a wealth of promise and opportunity. We intend to leverage this position of strength to make the best choices for our future boldly and strategically. The path ahead is shaped by three important decisions: Maximize the value and impact of our oncology portfolio for patients and stakeholders 2 Thoughtfully pursue capital markets independence while right-sizing the company 3 Move forward with a singular focus on genetically defined diseases 1

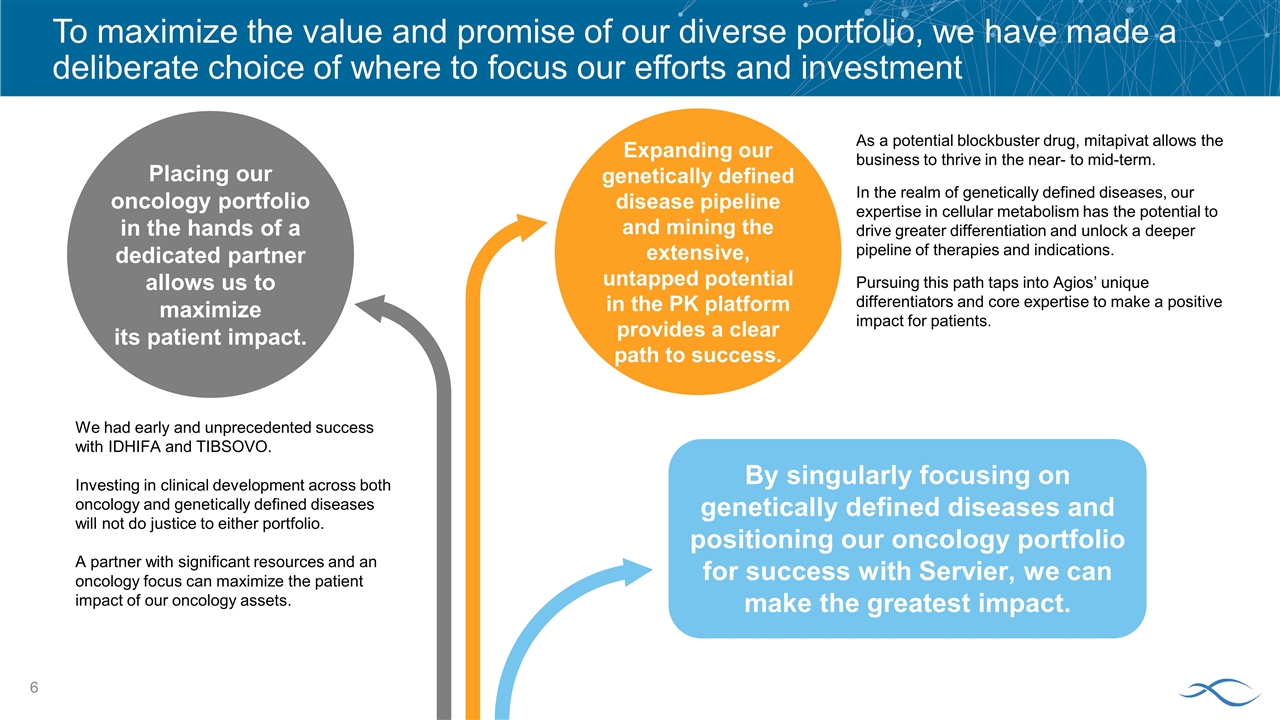

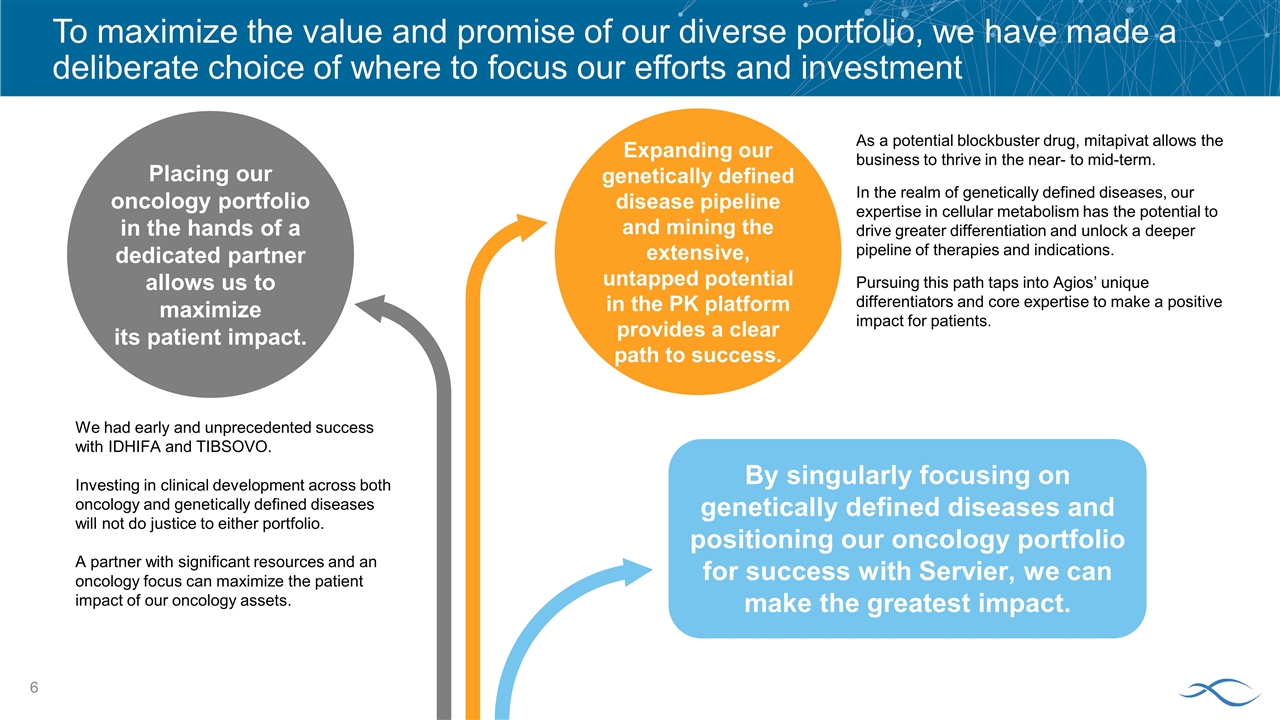

By singularly focusing on genetically defined diseases and positioning our oncology portfolio for success with Servier, we can make the greatest impact. To maximize the value and promise of our diverse portfolio, we have made a deliberate choice of where to focus our efforts and investment We had early and unprecedented success with IDHIFA and TIBSOVO. Investing in clinical development across both oncology and genetically defined diseases will not do justice to either portfolio. A partner with significant resources and an oncology focus can maximize the patient impact of our oncology assets. Placing our oncology portfolio in the hands of a dedicated partner allows us to maximize its patient impact. As a potential blockbuster drug, mitapivat allows the business to thrive in the near- to mid-term. In the realm of genetically defined diseases, our expertise in cellular metabolism has the potential to drive greater differentiation and unlock a deeper pipeline of therapies and indications. Pursuing this path taps into Agios’ unique differentiators and core expertise to make a positive impact for patients. Expanding our genetically defined disease pipeline and mining the extensive, untapped potential in the PK platform provides a clear path to success.

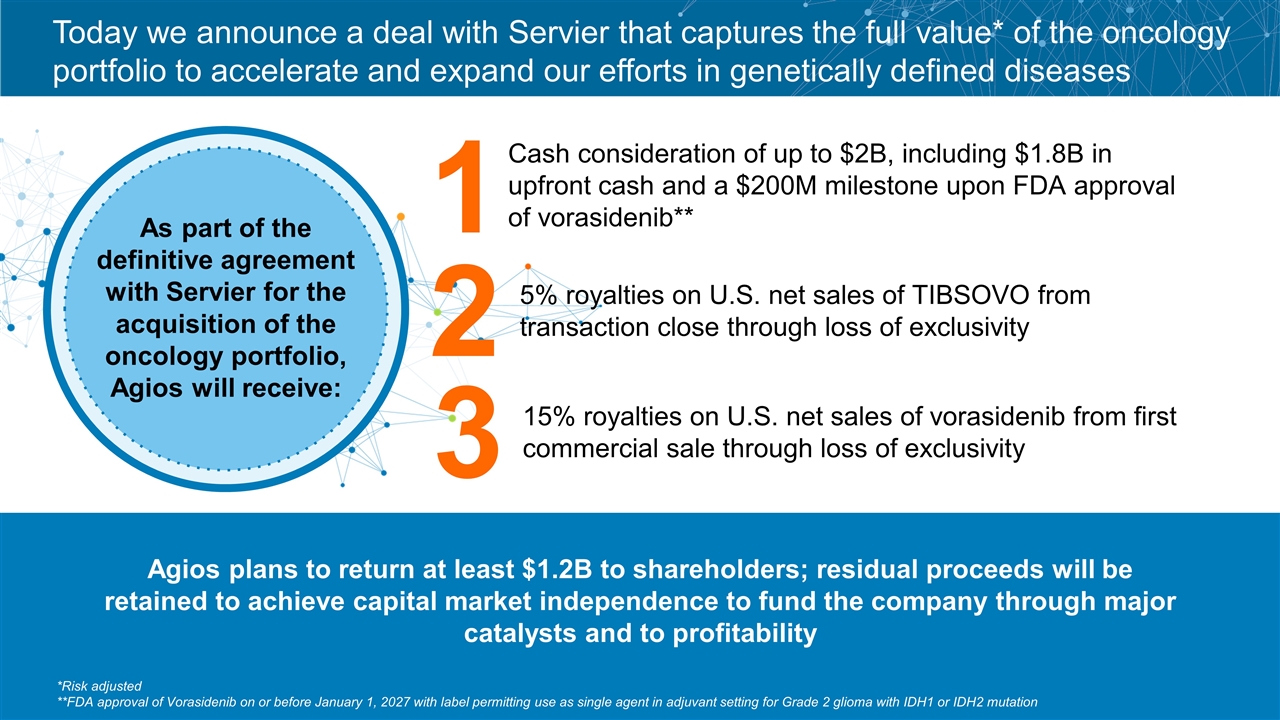

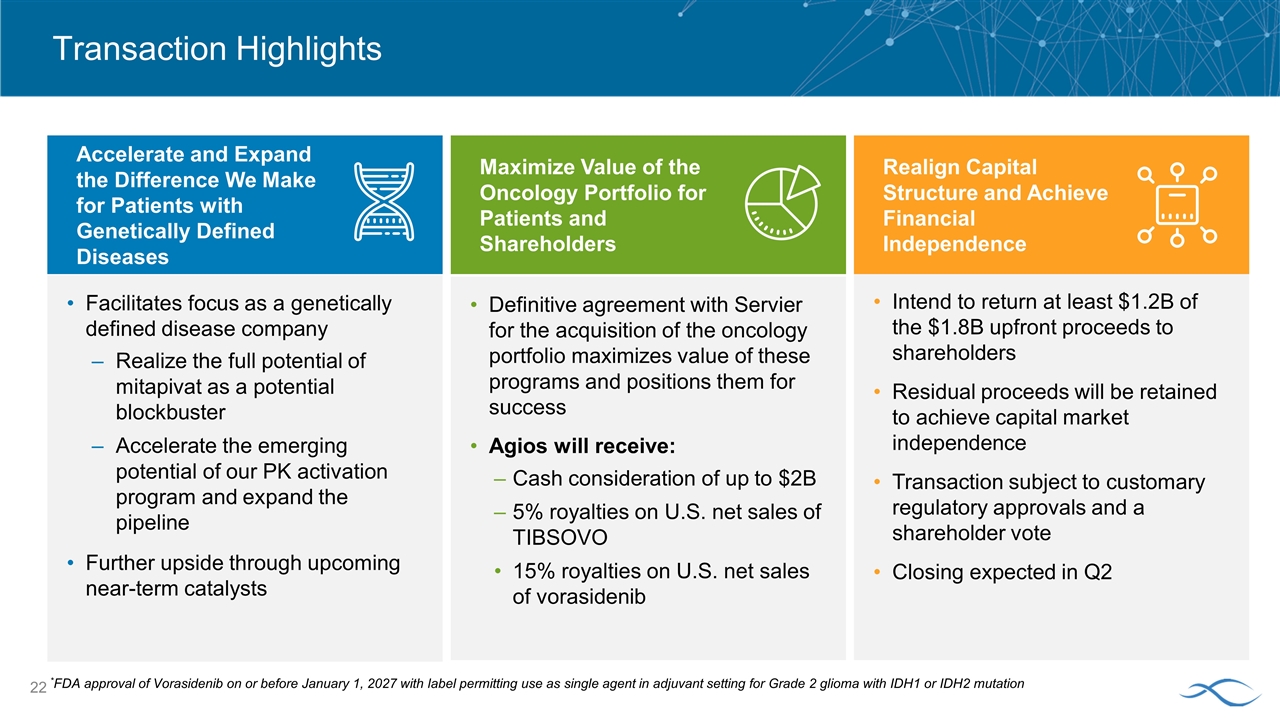

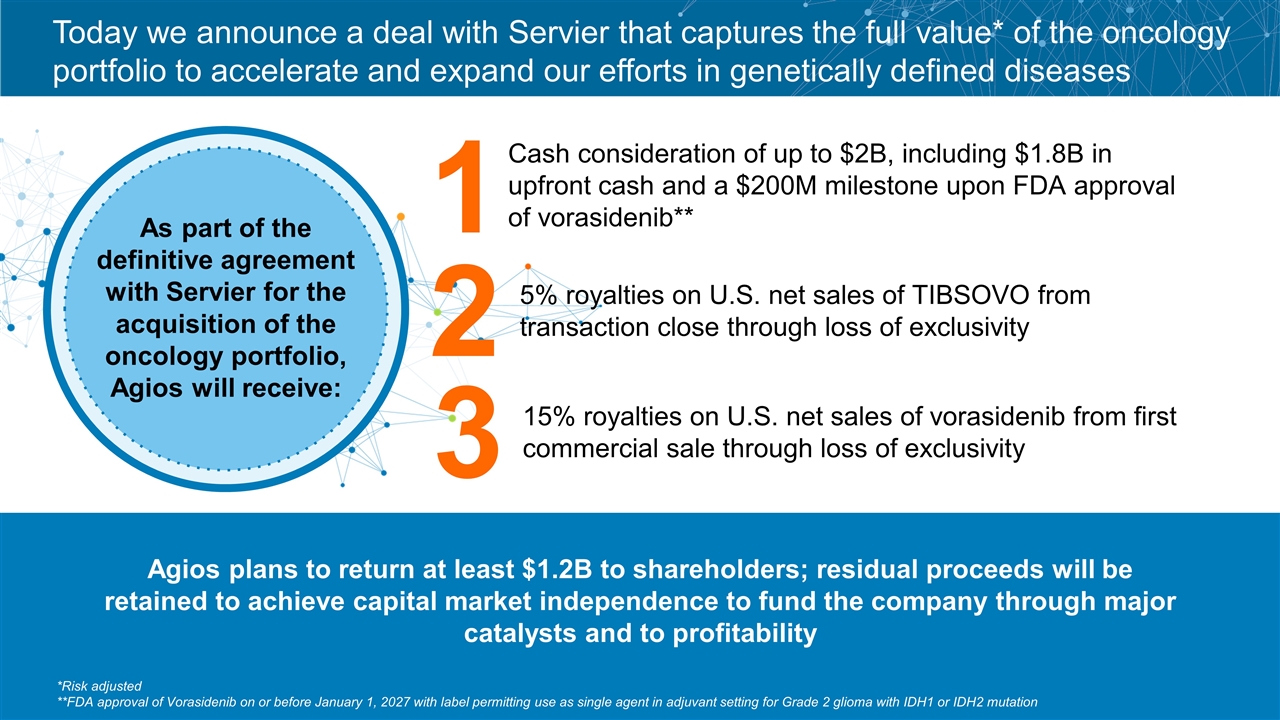

Today we announce a deal with Servier that captures the full value* of the oncology portfolio to accelerate and expand our efforts in genetically defined diseases As part of the definitive agreement with Servier for the acquisition of the oncology portfolio, Agios will receive: Cash consideration of up to $2B, including $1.8B in upfront cash and a $200M milestone upon FDA approval of vorasidenib** 1 2 3 5% royalties on U.S. net sales of TIBSOVO from transaction close through loss of exclusivity 15% royalties on U.S. net sales of vorasidenib from first commercial sale through loss of exclusivity *Risk adjusted **FDA approval of Vorasidenib on or before January 1, 2027 with label permitting use as single agent in adjuvant setting for Grade 2 glioma with IDH1 or IDH2 mutation Agios plans to return at least $1.2B to shareholders; residual proceeds will be retained to achieve capital market independence to fund the company through major catalysts and to profitability

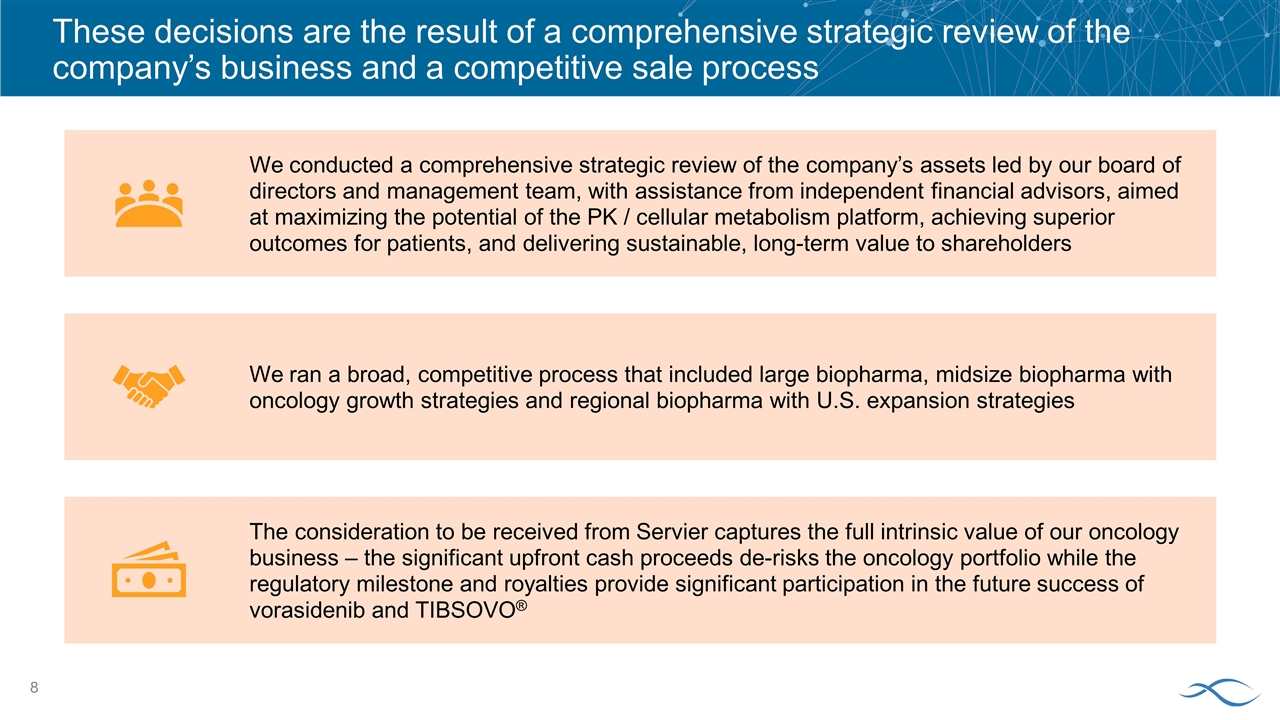

These decisions are the result of a comprehensive strategic review of the company’s business and a competitive sale process We conducted a comprehensive strategic review of the company’s assets led by our board of directors and management team, with assistance from independent financial advisors, aimed at maximizing the potential of the PK / cellular metabolism platform, achieving superior outcomes for patients, and delivering sustainable, long-term value to shareholders We ran a broad, competitive process that included large biopharma, midsize biopharma with oncology growth strategies and regional biopharma with U.S. expansion strategies The consideration to be received from Servier captures the full intrinsic value of our oncology business – the significant upfront cash proceeds de-risks the oncology portfolio while the regulatory milestone and royalties provide significant participation in the future success of vorasidenib and TIBSOVO ®

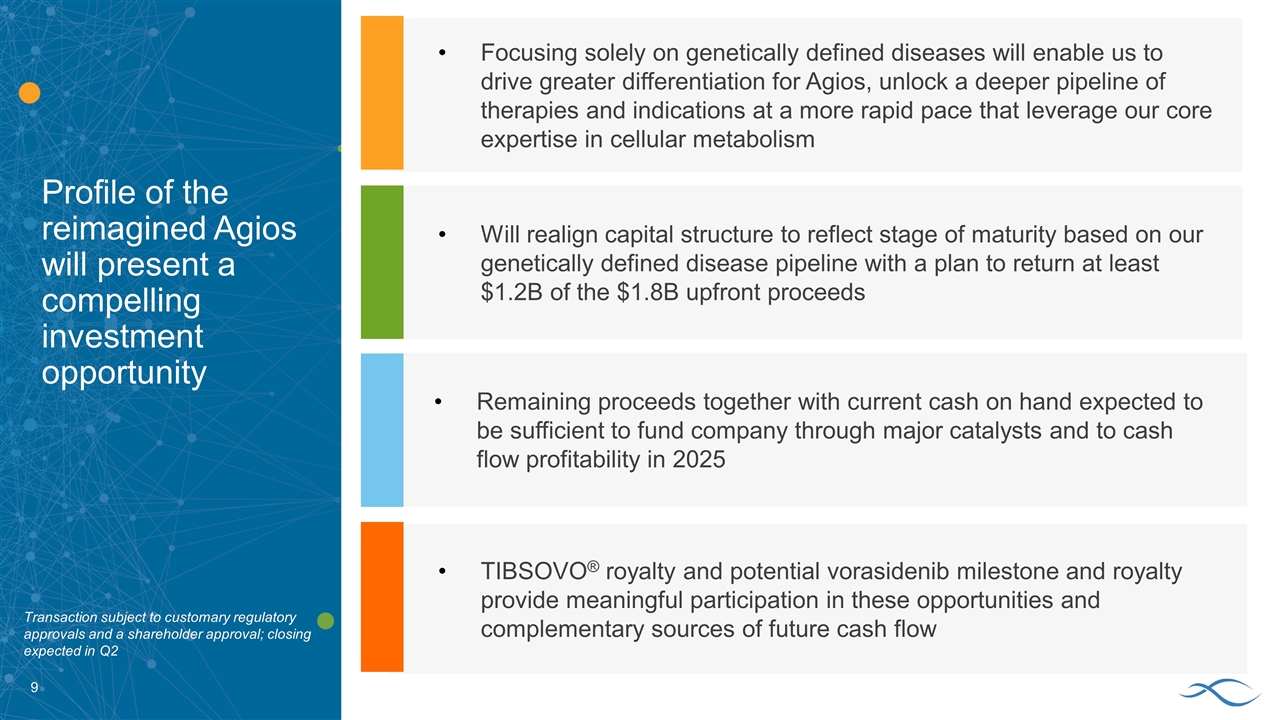

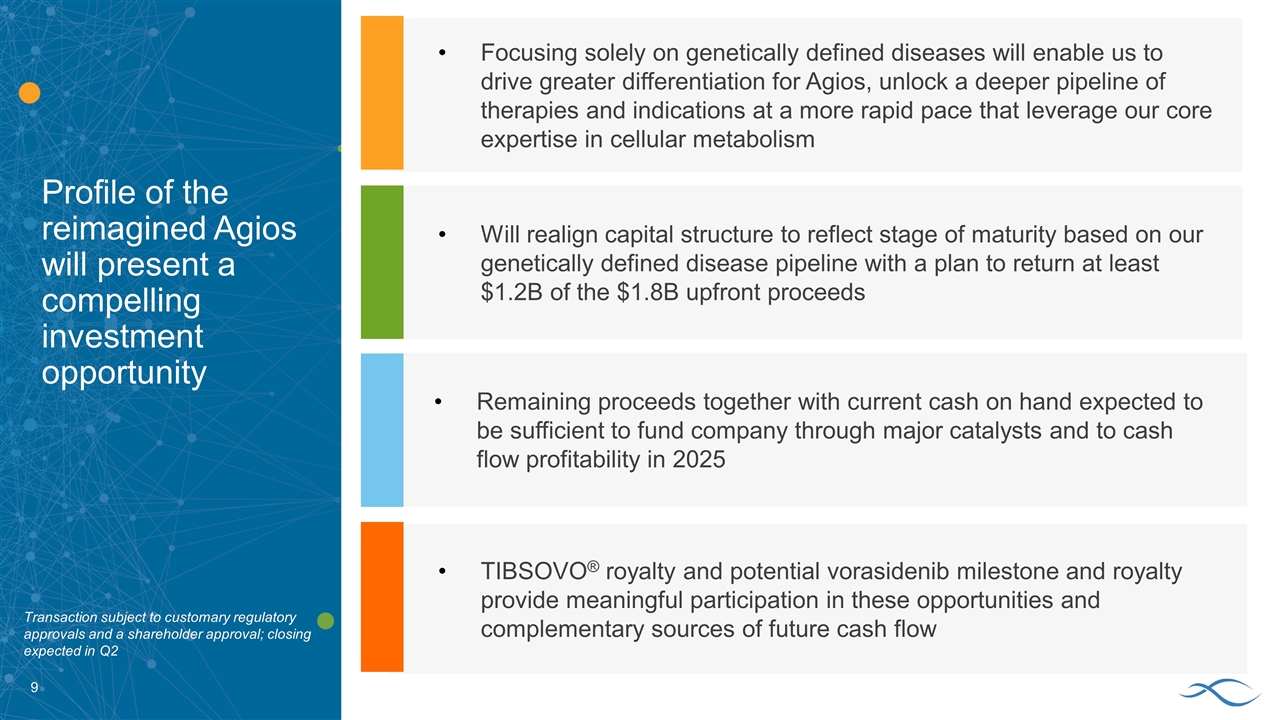

Profile of the reimagined Agios will present a compelling investment opportunity Will realign capital structure to reflect stage of maturity based on our genetically defined disease pipeline with a plan to return at least $1.2B of the $1.8B upfront proceeds Remaining proceeds together with current cash on hand expected to be sufficient to fund company through major catalysts and to cash flow profitability in 2025 Focusing solely on genetically defined diseases will enable us to drive greater differentiation for Agios, unlock a deeper pipeline of therapies and indications at a more rapid pace that leverage our core expertise in cellular metabolism TIBSOVO® royalty and potential vorasidenib milestone and royalty provide meaningful participation in these opportunities and complementary sources of future cash flow Transaction subject to customary regulatory approvals and a shareholder approval; closing expected in Q2

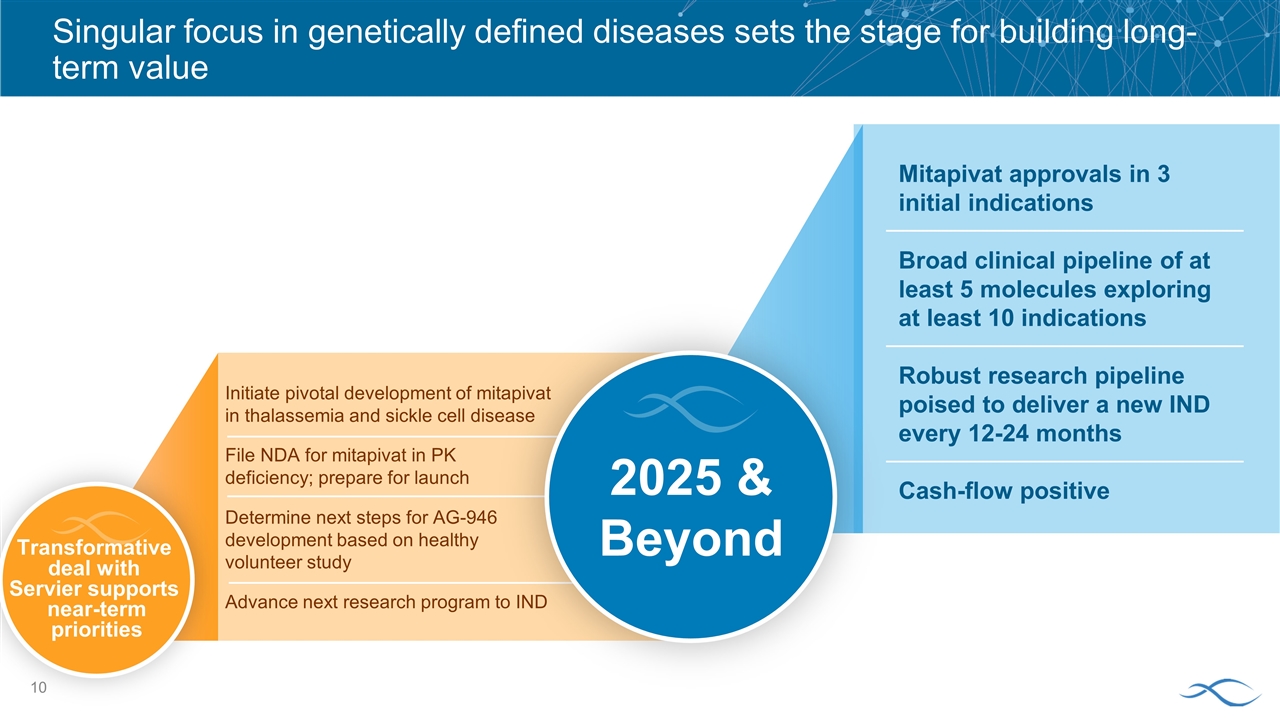

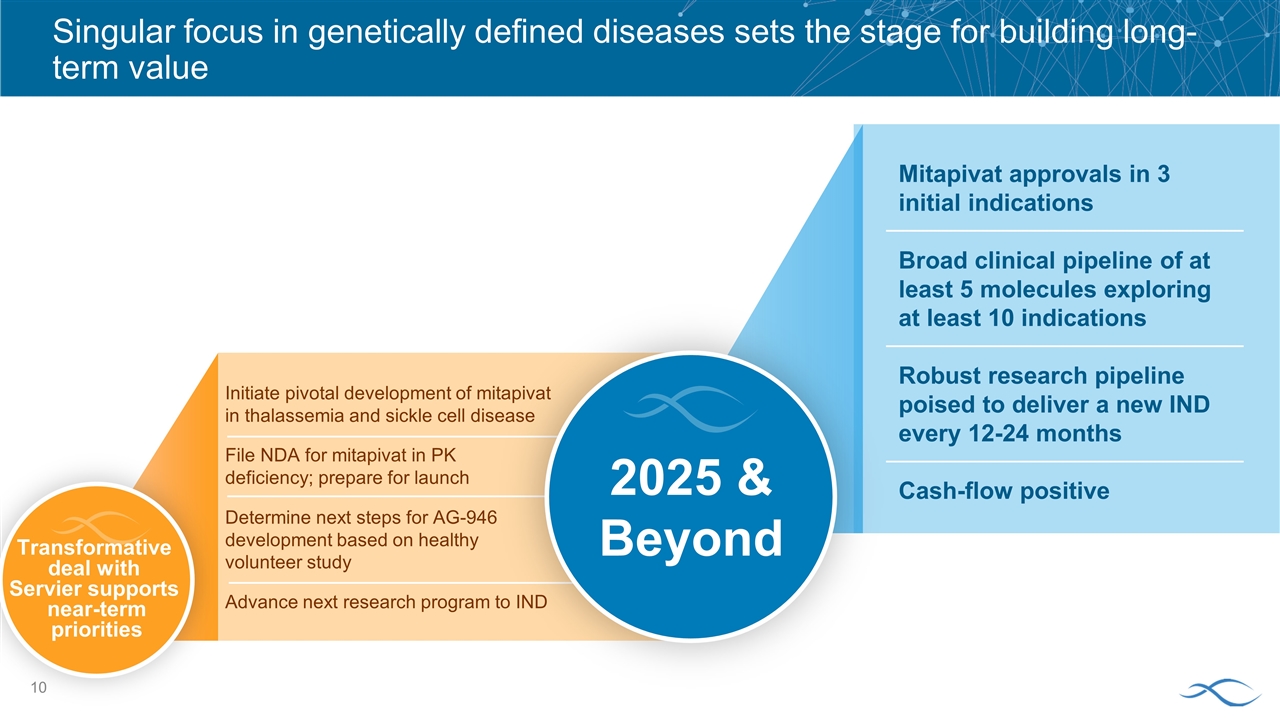

Mitapivat approvals in 3 initial indications Broad clinical pipeline of at least 5 molecules exploring at least 10 indications Robust research pipeline poised to deliver a new IND every 12-24 months Cash-flow positive Singular focus in genetically defined diseases sets the stage for building long-term value Transformative deal with Servier supports near-term priorities Initiate pivotal development of mitapivat in thalassemia and sickle cell disease File NDA for mitapivat in PK deficiency; prepare for launch Determine next steps for AG-946 development based on healthy volunteer study Advance next research program to IND 2025 & Beyond

AFFIRMING OUR LEGACY Embracing who we are and what we built

Our journey has delivered great successes and an expanded focus... 2008 Founded Agios to unlock a new field of discovery in cellular metabolism 2009 Published groundbreaking research in Nature, re: role of the IDH1 mutation in cancer genesis 2010 Entered into strategic collaboration with Celgene to discover and develop novel cellular metabolism-related therapies 2014 Initiated first clinical study of ivosidenib in patients with IDH1 mutant hematologic malignancies 2015 Initiated Phase 1 study of vorasidenib in patients with advanced solid tumors and IDH mutation Initiated a Phase 2 study of mitapivat in patients with pyruvate kinase (PK) deficiency 2019 Received FDA approval of TIBSOVO® in frontline AML Achieved proof-of- concept for mitapivat in thalassemia Published clinical data of mitipivat in PK deficiency in NEJM 2013 Initiated first clinical study of enasidenib in patients with IDH2 mutant hematologic malignancies Completed initial public offering on NASDAQ Expanded research focus beyond oncology into genetically defined diseases. CANCER METABOLISM CANCER METABOLISM RARE GENETIC DISEASES + + CANCER METABOLISM RARE GENETIC DISEASES + METABOLIC IMMUNO- ONCOLOGY + 2020 Achieved proof-of-concept for mitapivat in sickle cell disease Initiated first clinical study of next-generation PKR activator AG-946 Announced positive data from ACTIVATE Phase 3 trial of mitapivat in adults with PK deficiency who are not regularly transfused 2018 Received FDA approval of TIBSOVO® (ivosidenib tablets), which is wholly owned by Agios, in R/R AML

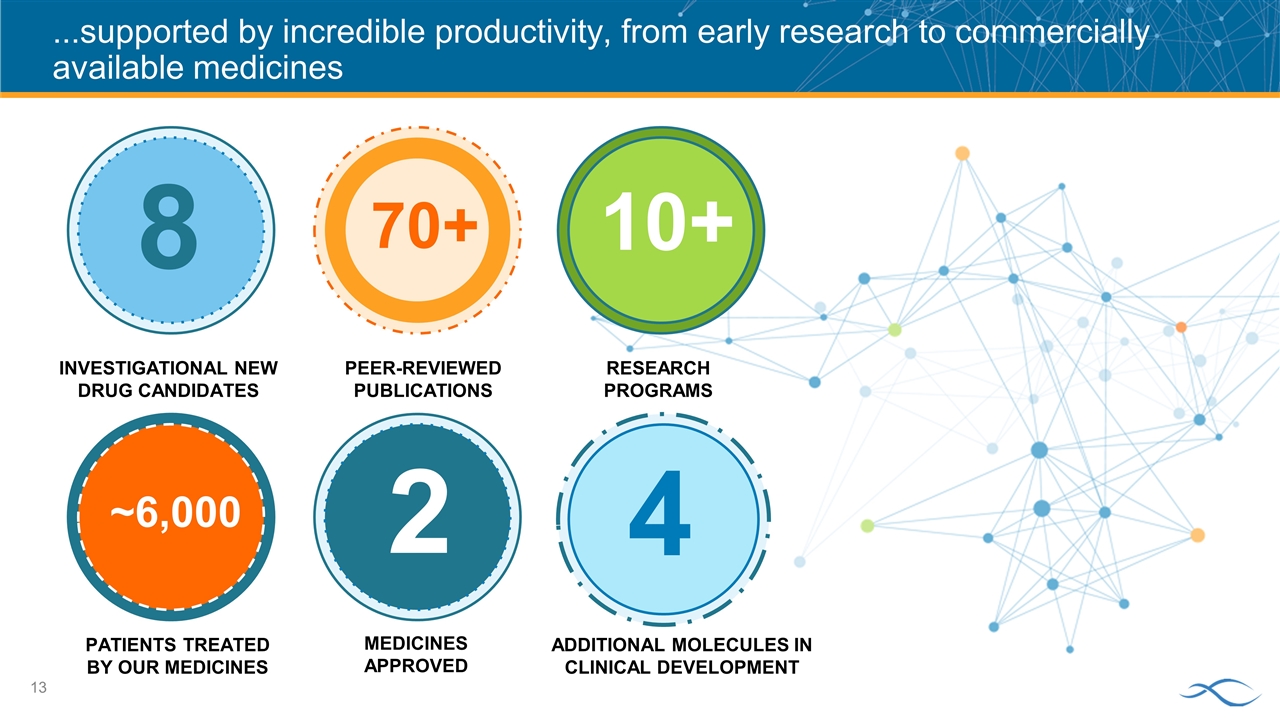

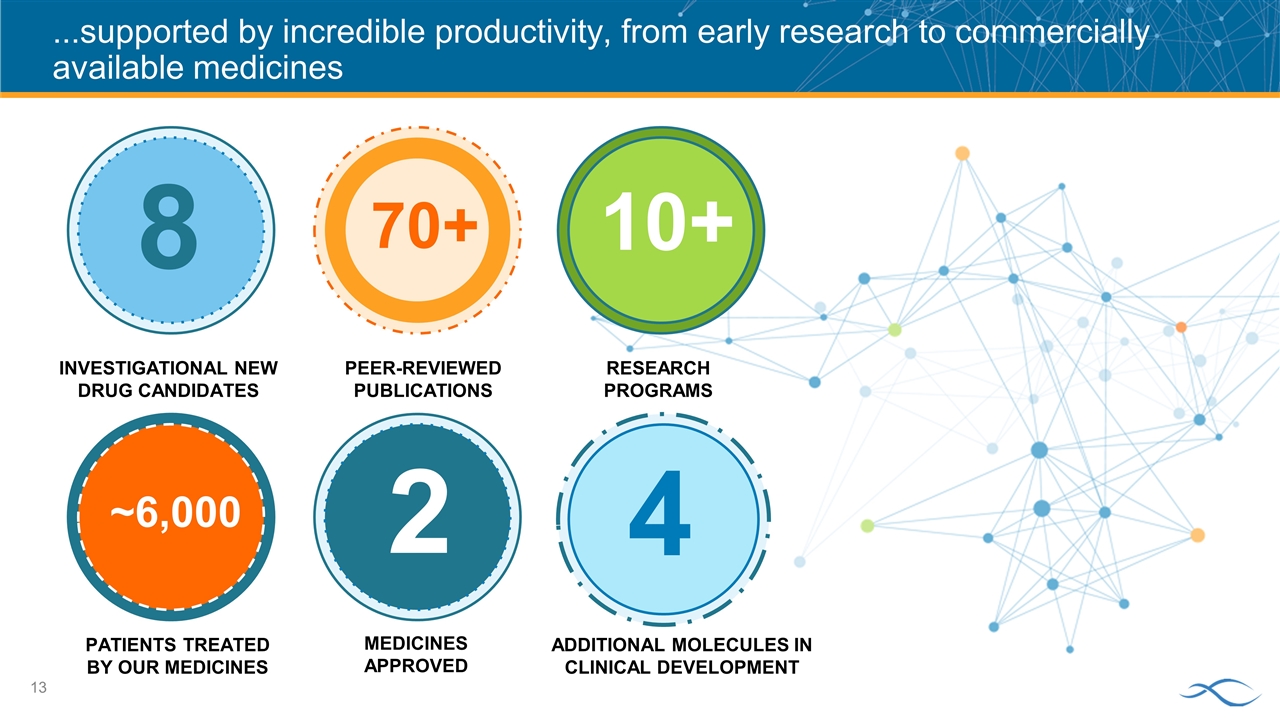

...supported by incredible productivity, from early research to commercially available medicines 8 70+ 10+ INVESTIGATIONAL NEW DRUG CANDIDATES PEER-REVIEWED PUBLICATIONS RESEARCH PROGRAMS MEDICINES APPROVED PATIENTS TREATED BY OUR MEDICINES ADDITIONAL MOLECULES IN CLINICAL DEVELOPMENT ~6,000 2 4

ACCELERATING OUR IMPACT Adapting to preserve and expand the difference we make

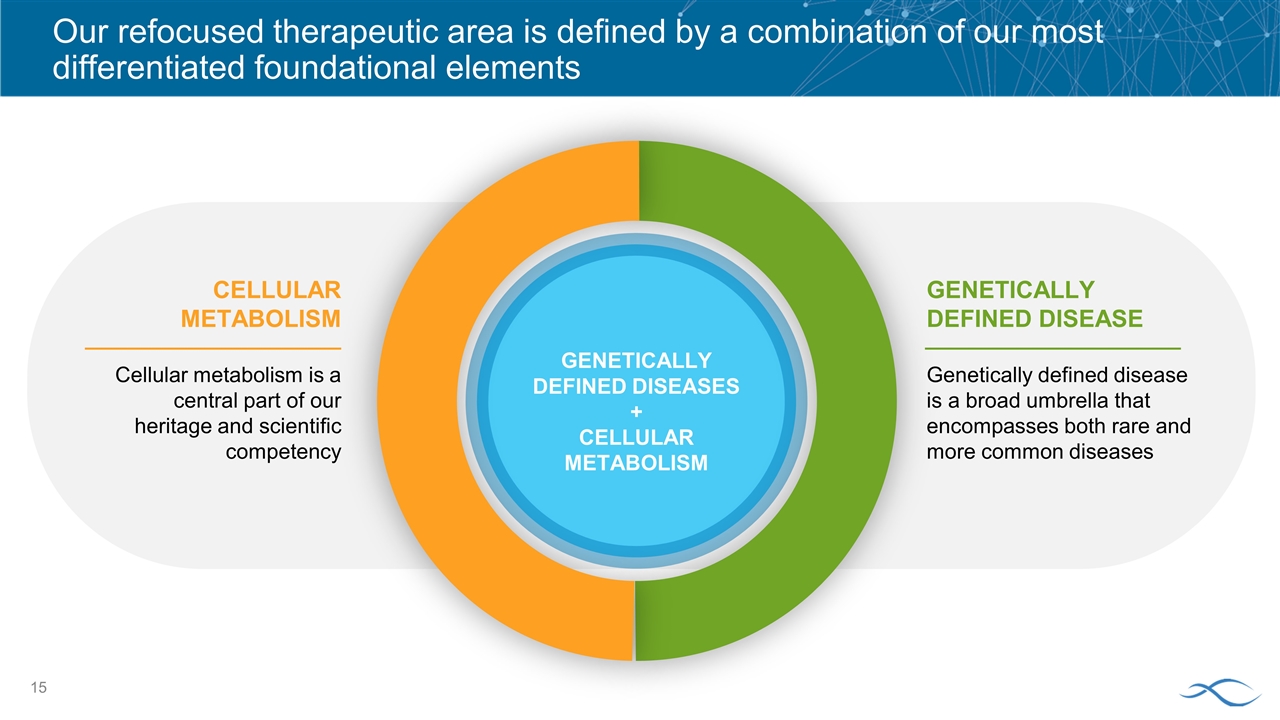

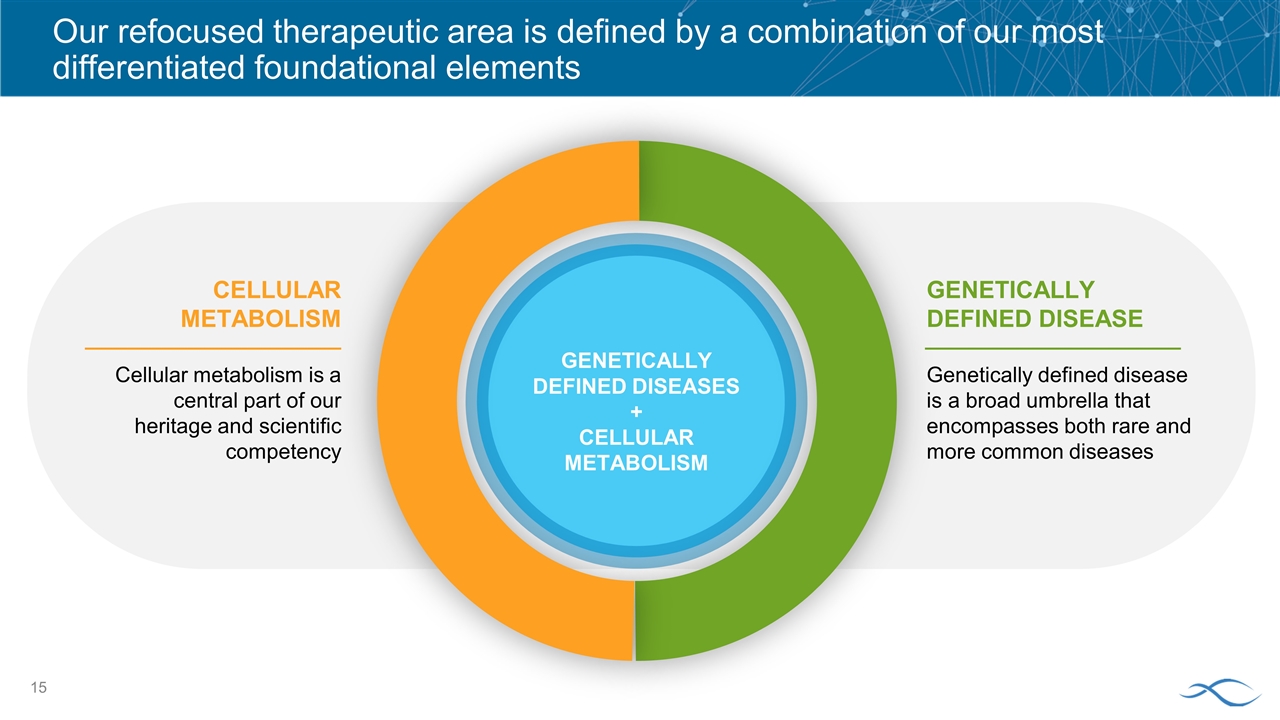

Our refocused therapeutic area is defined by a combination of our most differentiated foundational elements CELLULAR METABOLISM Cellular metabolism is a central part of our heritage and scientific competency GENETICALLY DEFINED DISEASE Genetically defined disease is a broad umbrella that encompasses both rare and more common diseases GENETICALLY DEFINED DISEASES + CELLULAR METABOLISM

We are the pioneering leaders in PKR activation STUDYING PKR ACTIVATION IN THE CLINIC A LOT OF FIRSTS: DISEASES WITH POC ACHIEVED + 6 YEARS 1st INTERNATIONAL PK DEFICIENCY ADVOCACY COUNCIL 1st HEMOLYTIC ANEMIA ADVOCACY COALITION BUILDING 1st GLOBAL PK DEFICIENCY REGISTRY ~190 17 JOURNAL ARTICLES PUBLISHED MEDICAL/SCIENTIFIC COLLABORATIONS PATIENTS TREATED CLINICAL TRIALS 15 17 3 1st POSITIVE PHASE 3 READOUT IN PK DEFICIENCY

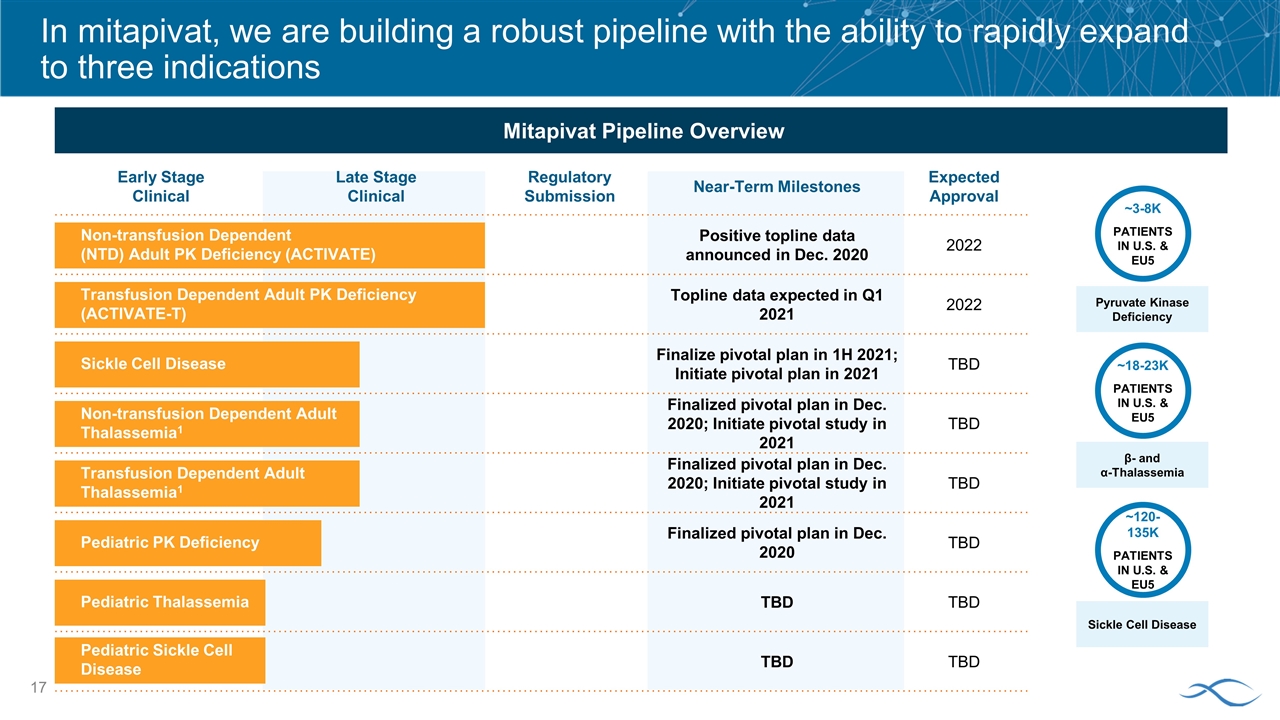

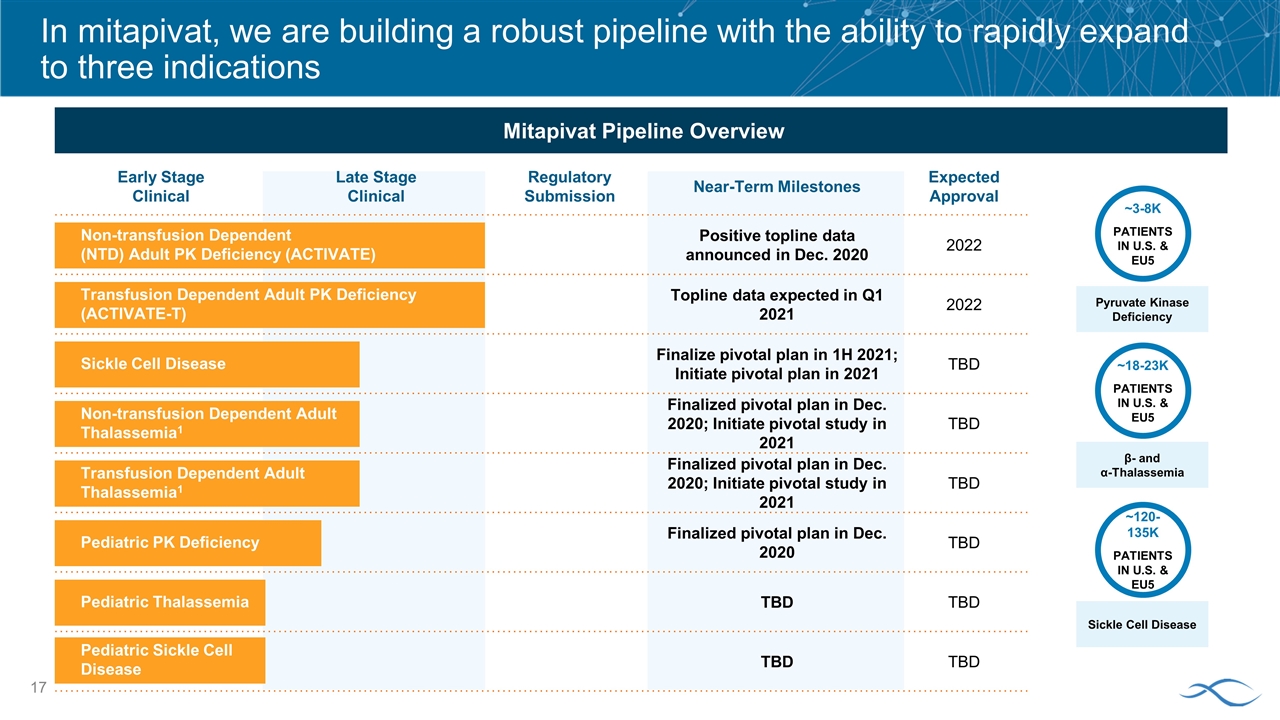

Early Stage Clinical Late Stage Clinical Regulatory Submission Near-Term Milestones Expected Approval Positive topline data announced in Dec. 2020 2022 Topline data expected in Q1 2021 2022 Finalize pivotal plan in 1H 2021; Initiate pivotal plan in 2021 TBD Finalized pivotal plan in Dec. 2020; Initiate pivotal study in 2021 TBD Finalized pivotal plan in Dec. 2020; Initiate pivotal study in 2021 TBD Finalized pivotal plan in Dec. 2020 TBD TBD TBD TBD TBD In mitapivat, we are building a robust pipeline with the ability to rapidly expand to three indications Mitapivat Pipeline Overview ~3-8K PATIENTS IN U.S. & EU5 Pyruvate Kinase Deficiency β- and α-Thalassemia Sickle Cell Disease ~18-23K PATIENTS IN U.S. & EU5 ~120-135K PATIENTS IN U.S. & EU5 Non-transfusion Dependent (NTD) Adult PK Deficiency (ACTIVATE) Transfusion Dependent Adult PK Deficiency (ACTIVATE-T) Sickle Cell Disease Non-transfusion Dependent Adult Thalassemia1 Pediatric PK Deficiency Pediatric Thalassemia Transfusion Dependent Adult Thalassemia1 Pediatric Sickle Cell Disease

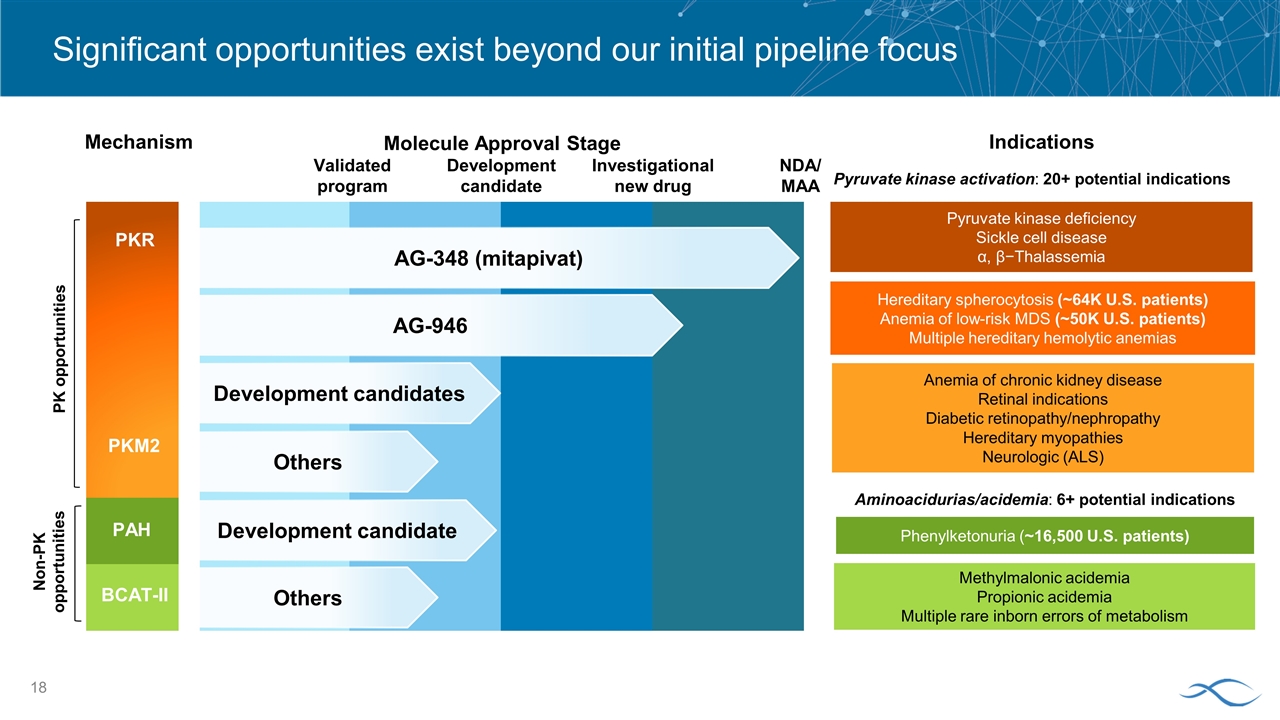

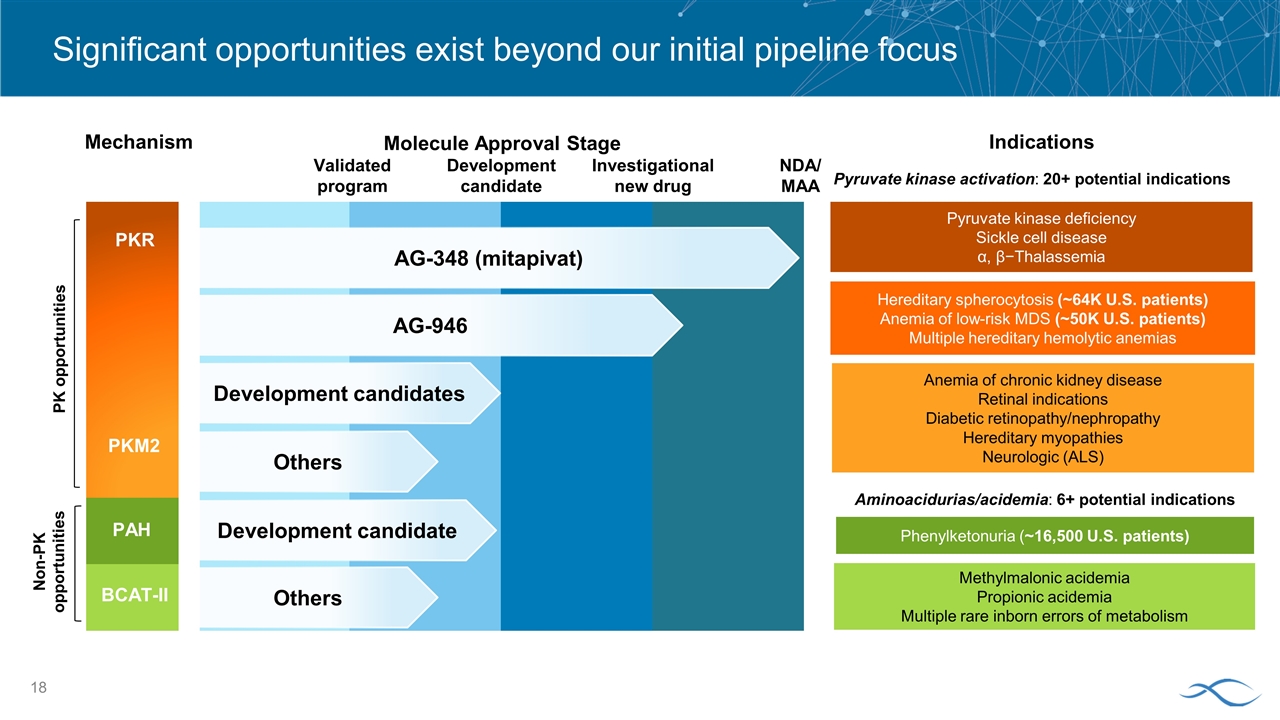

Significant opportunities exist beyond our initial pipeline focus Mechanism Molecule Approval Stage Pyruvate kinase activation: 20+ potential indications Indications Aminoacidurias/acidemia: 6+ potential indications AG-348 (mitapivat) AG-946 Development candidates Others PKR PKM2 Development candidate Others PAH BCAT-II Methylmalonic acidemia Propionic acidemia Multiple rare inborn errors of metabolism Pyruvate kinase deficiency Sickle cell disease α, β−Thalassemia Hereditary spherocytosis (~64K U.S. patients) Anemia of low-risk MDS (~50K U.S. patients) Multiple hereditary hemolytic anemias Phenylketonuria (~16,500 U.S. patients) Anemia of chronic kidney disease Retinal indications Diabetic retinopathy/nephropathy Hereditary myopathies Neurologic (ALS) PK opportunities Non-PK opportunities Validated program Investigational new drug Development candidate NDA/ MAA

ACHIEVING OUR POTENTIAL Taking action to realize our goals and opportunity

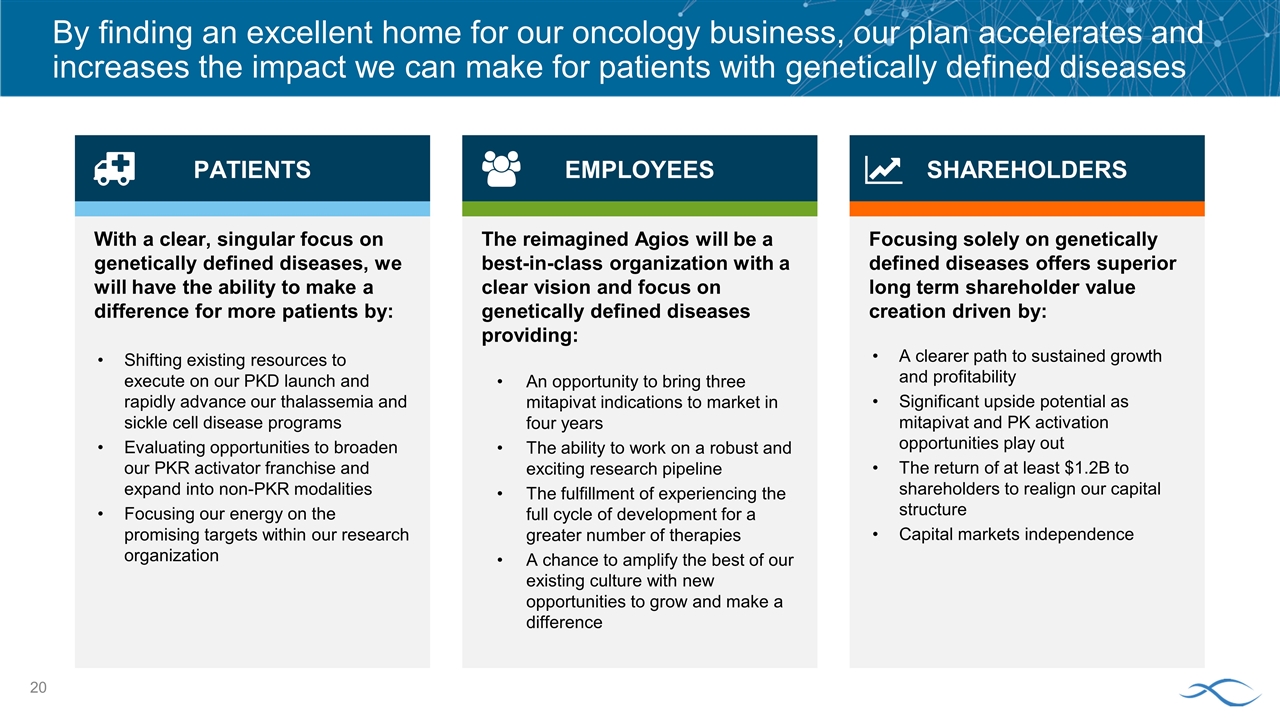

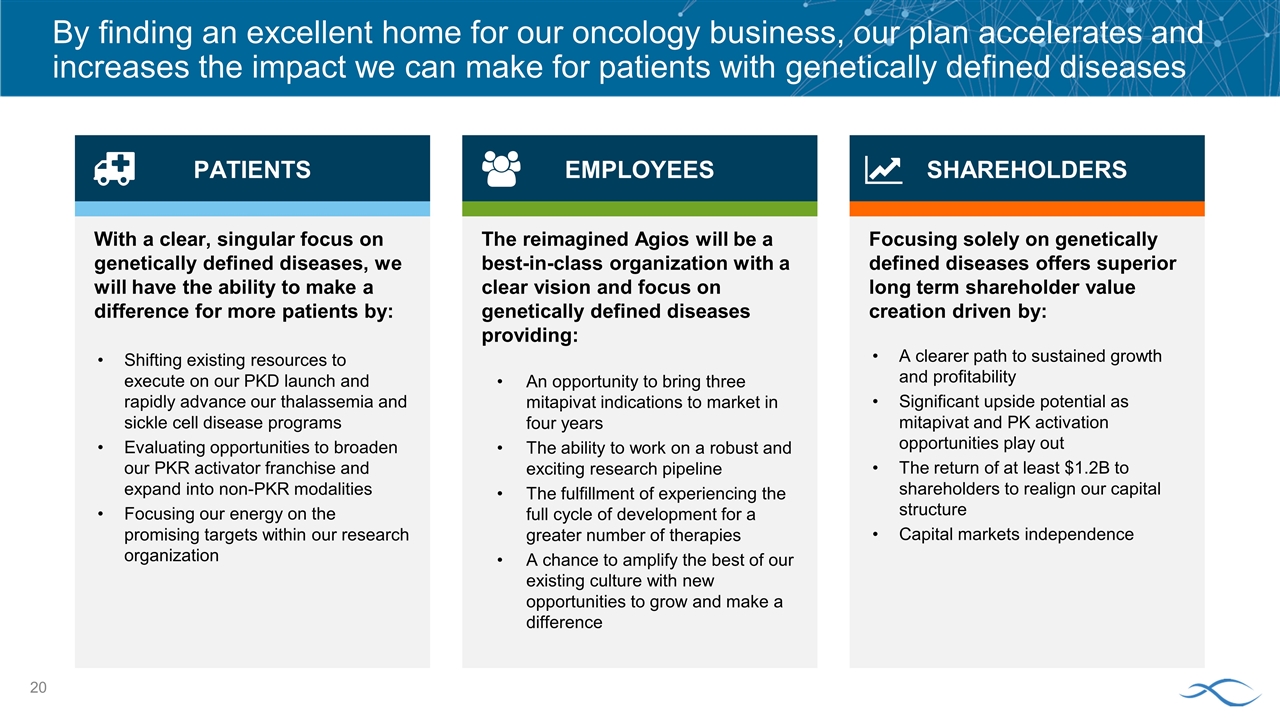

By finding an excellent home for our oncology business, our plan accelerates and increases the impact we can make for patients with genetically defined diseases With a clear, singular focus on genetically defined diseases, we will have the ability to make a difference for more patients by: Shifting existing resources to execute on our PKD launch and rapidly advance our thalassemia and sickle cell disease programs Evaluating opportunities to broaden our PKR activator franchise and expand into non-PKR modalities Focusing our energy on the promising targets within our research organization Focusing solely on genetically defined diseases offers superior long term shareholder value creation driven by: A clearer path to sustained growth and profitability Significant upside potential as mitapivat and PK activation opportunities play out The return of at least $1.2B to shareholders to realign our capital structure Capital markets independence The reimagined Agios will be a best-in-class organization with a clear vision and focus on genetically defined diseases providing: An opportunity to bring three mitapivat indications to market in four years The ability to work on a robust and exciting research pipeline The fulfillment of experiencing the full cycle of development for a greater number of therapies A chance to amplify the best of our existing culture with new opportunities to grow and make a difference SHAREHOLDERS EMPLOYEES PATIENTS

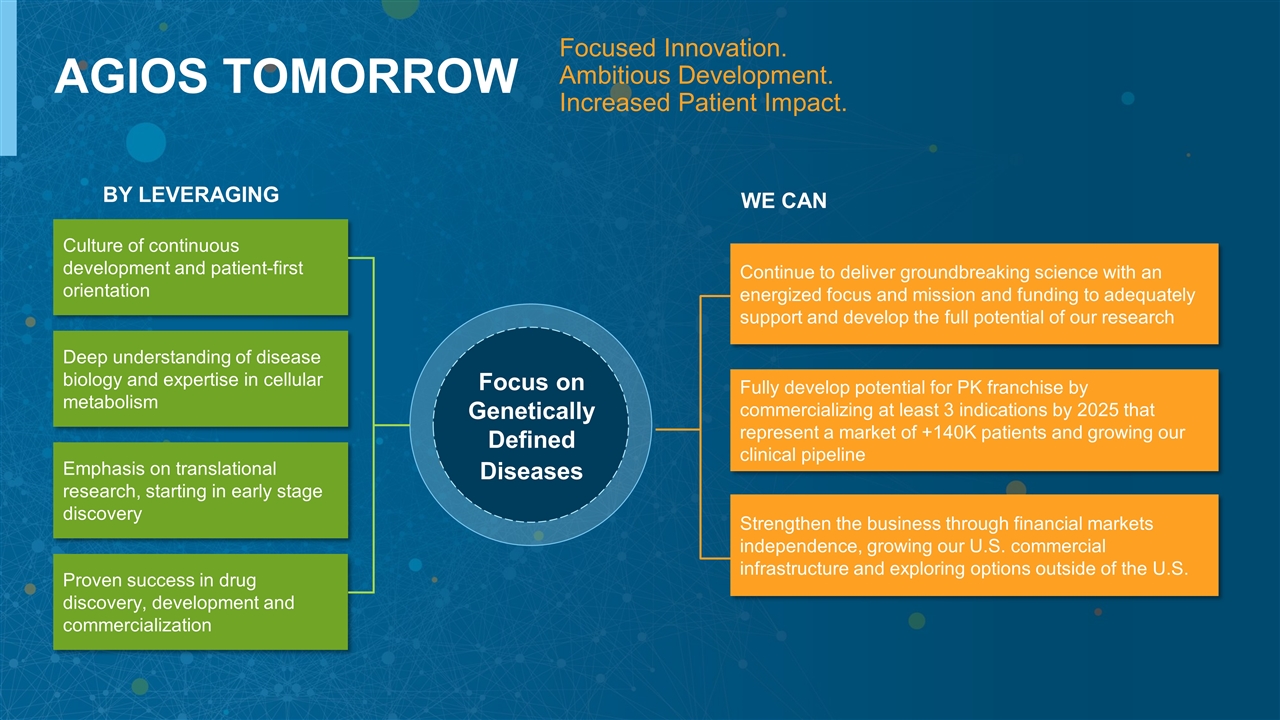

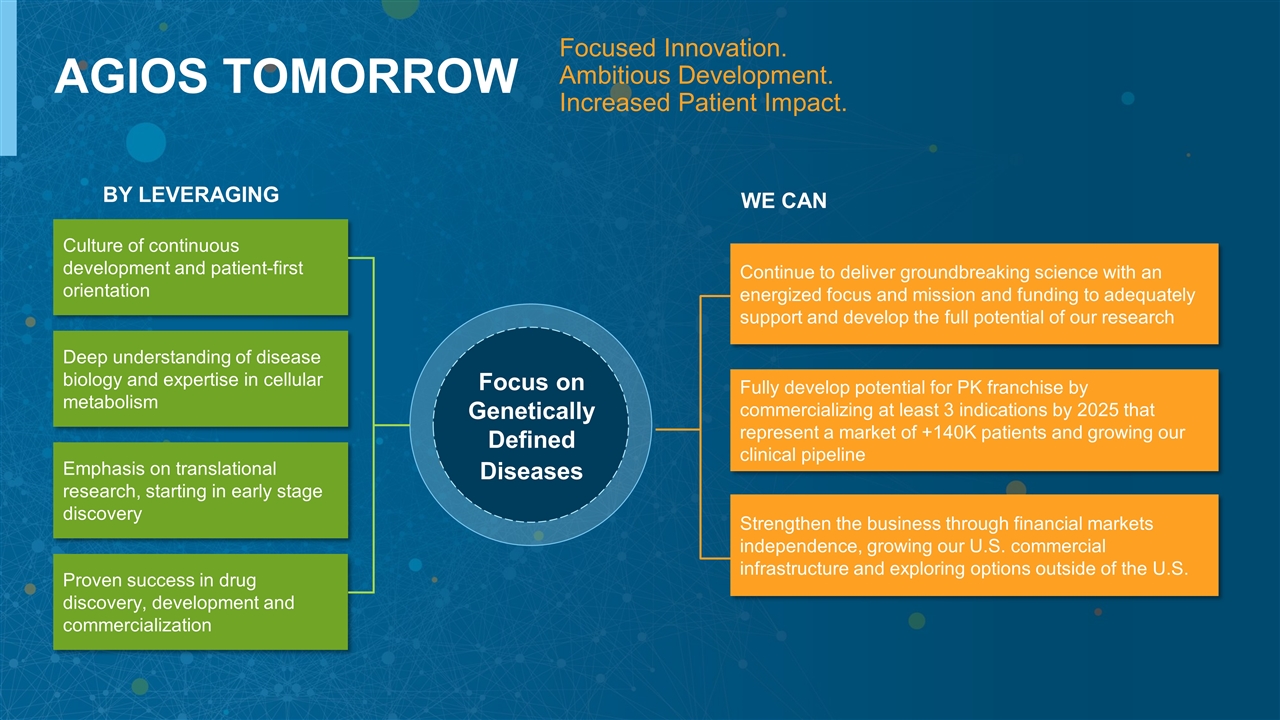

AGIOS TOMORROW BY LEVERAGING Culture of continuous development and patient-first orientation Deep understanding of disease biology and expertise in cellular metabolism Emphasis on translational research, starting in early stage discovery Proven success in drug discovery, development and commercialization Focus on Genetically Defined Diseases WE CAN Fully develop potential for PK franchise by commercializing at least 3 indications by 2025 that represent a market of +140K patients and growing our clinical pipeline Continue to deliver groundbreaking science with an energized focus and mission and funding to adequately support and develop the full potential of our research Strengthen the business through financial markets independence, growing our U.S. commercial infrastructure and exploring options outside of the U.S. Focused Innovation. Ambitious Development. Increased Patient Impact.

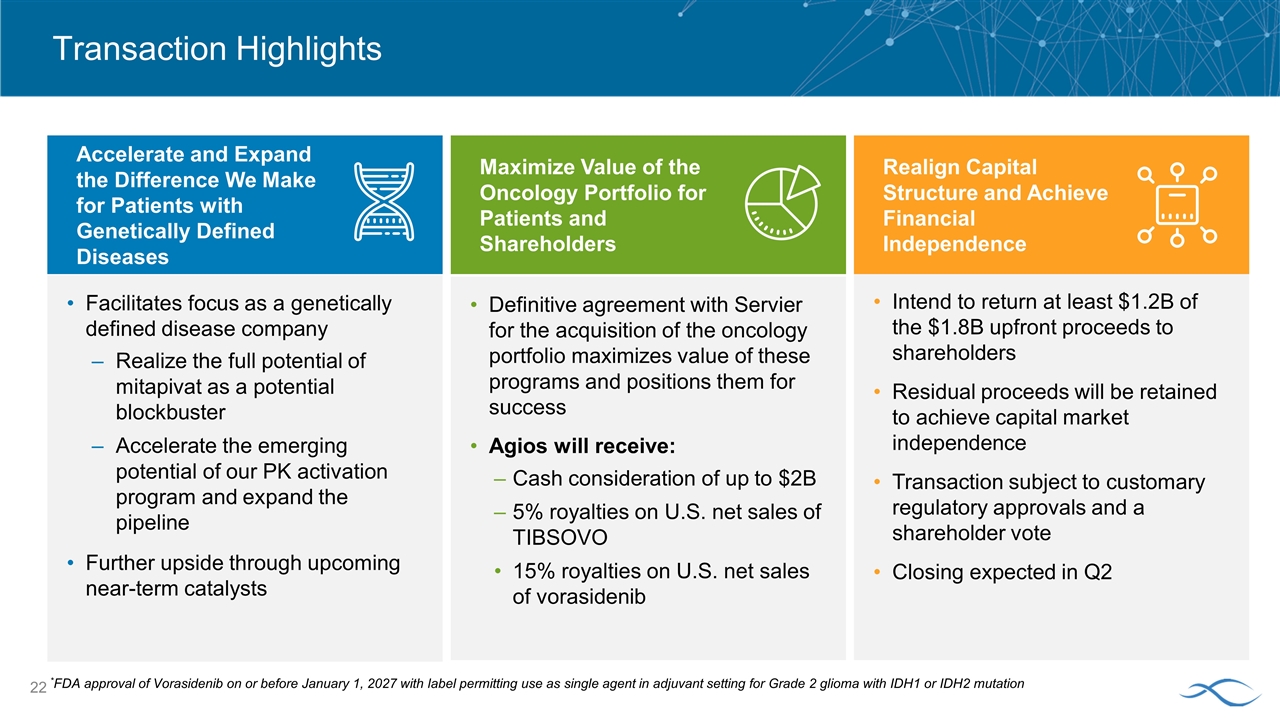

Transaction Highlights Definitive agreement with Servier for the acquisition of the oncology portfolio maximizes value of these programs and positions them for success Agios will receive: Cash consideration of up to $2B 5% royalties on U.S. net sales of TIBSOVO 15% royalties on U.S. net sales of vorasidenib Facilitates focus as a genetically defined disease company Realize the full potential of mitapivat as a potential blockbuster Accelerate the emerging potential of our PK activation program and expand the pipeline Further upside through upcoming near-term catalysts Intend to return at least $1.2B of the $1.8B upfront proceeds to shareholders Residual proceeds will be retained to achieve capital market independence Transaction subject to customary regulatory approvals and a shareholder vote Closing expected in Q2 Maximize Value of the Oncology Portfolio for Patients and Shareholders Accelerate and Expand the Difference We Make for Patients with Genetically Defined Diseases Realign Capital Structure and Achieve Financial Independence *FDA approval of Vorasidenib on or before January 1, 2027 with label permitting use as single agent in adjuvant setting for Grade 2 glioma with IDH1 or IDH2 mutation

THANK YOU