- ZWS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Zurn Elkay Water Solutions (ZWS) DEF 14ADefinitive proxy

Filed: 27 Jul 12, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under Rule 14a-12 | |||

| REXNORD CORPORATION | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

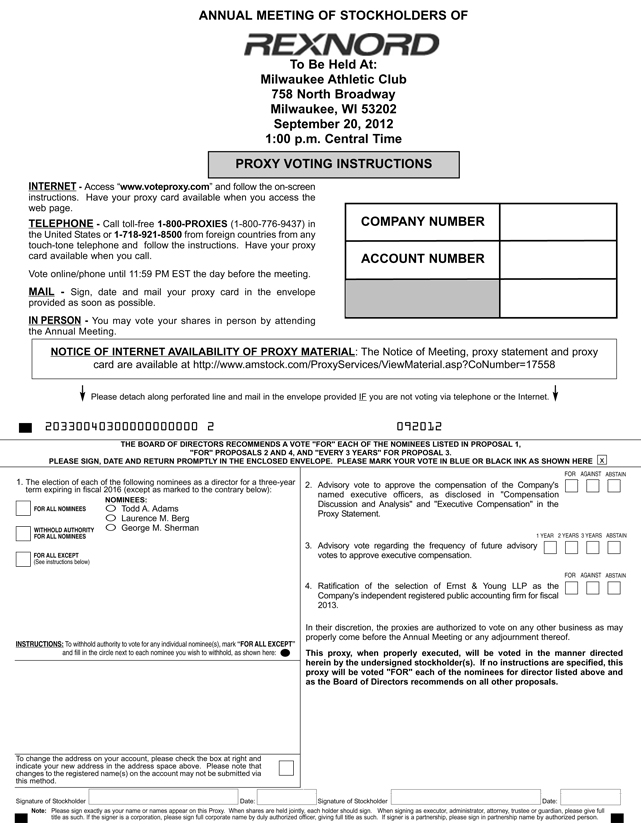

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

on September 20, 2012

To the Stockholders of Rexnord Corporation:

Rexnord Corporation will hold its annual meeting of stockholders at the Milwaukee Athletic Club, located at 758 North Broadway, Milwaukee, Wisconsin 53202 on Thursday, September 20, 2012, at 1:00 p.m. Central Time, for the following purposes:

| 1. | To elect three directors to serve for three-year terms expiring in fiscal 2016; |

| 2. | To hold an advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in “Compensation Discussion and Analysis” and “Executive Compensation” herein; |

| 3. | To hold an advisory vote regarding the frequency of future advisory votes to approve executive compensation; |

| 4. | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2013; and |

| 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Rexnord Corporation’s stockholders of record at the close of business on July 23, 2012, will be entitled to vote at the meeting or any adjournment of the meeting. If you are a stockholder and plan to attend the annual meeting in person, please refer to the section of this Proxy Statement titled “Commonly Asked Questions and Answers about the Annual Meeting.”

If you have questions, please direct them to Rexnord Corporation, Investor Relations, 4701 West Greenfield Avenue, Milwaukee, Wisconsin 53214. Please also contact Investor Relations if you would like directions to the annual meeting. We appreciate your interest in Rexnord and thank you for your continued support.

Your vote is important. To vote your shares, please mark, sign, date and return your proxy card or vote over the Internet or by telephone as soon as possible. Thank you for voting.

By order of the Board of Directors |

|

Patricia M. Whaley |

Vice President, General Counsel and Secretary |

Milwaukee, Wisconsin

July 27, 2012

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on September 20, 2012. The proxy statement and annual report to security holders are available at http://www.amstock.com/ProxyServices/ViewMaterial.asp?CoNumber=17558.

The board of directors recommends the following votes:

| 1. | FOR each of the board’s nominees for election. |

| 2. | FOR approval of the compensation of the Company’s named executive officers. |

| 3. | For the holding of future advisory votes to approve executive compensationEVERY THREE YEARS. |

| 4. | FOR the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2013. |

You may vote in person or by using a proxy as follows:

• By internet: | Go to www.voteproxy.com. Have your proxy card available when you access the website. You will need the control number from your proxy card to vote. | |

• By telephone: | Call 1-800-776-9437 (in the United States) or 1-718-921-8500 (from other countries) on a touch-tone telephone. Have your proxy card available when you access the website. You will need the control number from your proxy card to vote. | |

• By mail: | Complete, sign and date the proxy card, and return it in the postage paid envelope provided with the proxy material. | |

If you later find that you will be present at the meeting or for any other reason desire to revoke your proxy, you may do so at any time before it is voted.

4701 West Greenfield Avenue

Milwaukee, Wisconsin 53214

PROXY STATEMENT

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 48 | ||||

ANNUAL MEETING OF STOCKHOLDERS

SEPTEMBER 20, 2012

COMMONLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| Q: | WHEN WILL THIS PROXY STATEMENT FIRST BE MAILED TO STOCKHOLDERS? |

A: Rexnord Corporation (“Rexnord”, “we” or the “Company”) expects to begin mailing this Proxy Statement to stockholders on or about August 9, 2012. The proxy material is also being made available to stockholders by Internet posting on or about August 9, 2012.

| Q: | WHAT AM I VOTING ON? |

A: At the annual meeting you will be voting on four proposals:

| 1. | The election of three directors to serve for three-year terms expiring in fiscal 2016. This year’s board nominees are: |

| • | Todd A. Adams |

| • | Laurence M. Berg |

| • | George M. Sherman |

| 2. | An advisory proposal to approve the compensation of the Company’s named executive officers, as disclosed in “Compensation Discussion and Analysis” and “Executive Compensation” herein. |

| 3. | An advisory proposal to approve the frequency of future advisory votes to approve executive compensation. |

| 4. | A proposal to ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2013. |

| Q: | WHAT ARE THE BOARD’S VOTING RECOMMENDATIONS? |

A: The board of directors is soliciting this proxy and recommends the following votes:

| 1. | FOR each of the board’s nominees for election. |

| 2. | FOR approval of the compensation of the Company’s named executive officers. |

| 3. | For the holding of future advisory votes to approve executive compensationEVERY THREE YEARS. |

| 4. | FOR the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2013. |

| Q: | WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL? |

A: To conduct the annual meeting, a majority of the shares entitled to vote must be present in person or by duly authorized proxy. This is referred to as a “quorum.” Abstentions and shares that are the subject of broker non-votes will be counted for the purpose of determining whether a quorum exists; shares represented at a meeting for any purpose are counted in the quorum for all matters to be considered at the meeting. All of the voting requirements below assume that a quorum is present.

1

Directors are elected by a plurality of the votes cast in person or by proxy at the meeting, and entitled to vote on the election of directors. “Plurality” means that the individuals who receive the highest number of votes are elected as directors, up to the number of directors to be chosen at the meeting. Any votes attempted to be cast “against” a candidate are not given legal effect and are not counted as votes cast in the election of directors. Therefore, any shares that are not voted, whether by withheld authority, broker non-vote or otherwise, have no effect in the election of directors except to the extent that the failure to vote for any individual results in another individual receiving a relatively larger number of votes.

An affirmative vote of a majority of the shares present in person or represented by proxy at the annual meeting and entitled to vote thereon is required for advisory approval of the compensation of the Company’s named executive officers. Consequently, broker non-votes will have no effect on approval of the resolution; however, abstentions will act as a vote against approval of the resolution. Because your vote on this proposal is advisory, it will not be binding on the Compensation Committee, the board or the Company. However, the Compensation Committee and the board will review the voting results and take them into consideration when making future decisions regarding executive compensation.

The frequency of future advisory votes to approve executive compensation that receives the greatest number of votes cast in favor of such frequency, whether every year, every two years or every three years, will be the frequency that stockholders are deemed to have approved. Abstentions and broker non-votes do not constitute a vote for any particular frequency and will have no effect on the outcome of this vote. Because your vote on this proposal is advisory, it will not be binding on the board or the Company. However, the board will review the voting results and take them into consideration when making future decisions regarding the frequency of the advisory vote to approve executive compensation.

An affirmative vote of a majority of the shares represented at the meeting and entitled to vote thereon is required for the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2013. Consequently, abstentions will act as a vote against this proposal.

| Q: | WHAT IF I DO NOT VOTE? |

A: The effect of not voting will depend on how your share ownership is registered. If you own shares as a registered holder and you do not vote, then your unvoted shares will not be represented at the meeting and will not count toward the quorum requirement. If a quorum is obtained, then your unvoted shares will not affect whether a proposal is approved or rejected.

If you are a stockholder whose shares are not registered in your name and you do not vote, then your bank, broker or other holder of record may still represent your shares at the meeting for purposes of obtaining a quorum. In the absence of your voting instructions, your bank, broker or other holder of record may not be able to vote your shares in its discretion depending on the proposal before the meeting. Your broker may not vote your shares in its discretion in the election of directors; therefore, you must vote your shares if you want them to be counted in the election of directors. In addition, your broker is not permitted to vote your shares in its discretion regarding matters related to executive compensation, including the advisory vote to approve executive compensation and the advisory vote on the future frequency of such advisory votes. However, your broker may vote your shares in its discretion on routine matters such as the ratification of the Company’s independent registered public accounting firm.

| Q: | WHO MAY VOTE? |

A: You may vote at the annual meeting if you were a stockholder of record as of the close of business on July 23, 2012, which is the “Record Date.” Each outstanding share of common stock is entitled to one vote on each matter presented. As of the Record Date, Rexnord had 95,319,265 shares of common stock outstanding. Any stockholder entitled to vote may vote either in person or by duly authorized proxy.

2

| Q: | HOW DO I VOTE? |

A: We offer four methods for you to vote your shares at the annual meeting.While we offer four methods, we encourage you to vote through the Internet or by telephone as they are the most cost-effective methods. We also recommend that you vote as soon as possible, even if you are planning to attend the annual meeting, so that the vote count will not be delayed. Both the Internet and the telephone provide convenient, cost-effective alternatives to returning your proxy card by mail. There is no charge to vote your shares via the Internet, though you may incur costs associated with electronic access, such as usage charges from Internet access providers. If you choose to vote your shares through the Internet or by telephone, there is no need for you to mail your proxy card.

You may (i) vote in person at the annual meeting or (ii) authorize the persons named as proxies on the enclosed proxy card, Todd A. Adams, Mark W. Peterson and Patricia M. Whaley, to vote your shares by returning the enclosed proxy card by mail, through the Internet or by telephone.

• By internet: | Go to www.voteproxy.com. Have your proxy card available when you access the website. You will need the control number from your proxy card to vote. | |

• By telephone: | Call 1-800-776-9437 toll-free (in the United States) or 1-718-921-8500 (from other countries), on a touch-tone telephone. Have your proxy card available when you call. You will need the control number from your proxy card to vote. | |

• By mail: | Complete, sign and date the proxy card, and return it in the postage paid envelope provided with the proxy material. | |

If your shares are not registered in your name, then you vote by giving instructions to the firm that holds your shares rather than using any of these four methods. Please check the voting form from the firm that holds your shares to see if it offers Internet or telephone voting procedures.

| Q: | WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD? |

A: It means your shares are held in more than one account. You should vote the shares on all of your proxy cards. You may help us reduce costs by consolidating your accounts so that you receive only one set of proxy materials in the future. To consolidate your accounts, please contact our transfer agent, American Stock Transfer & Trust Company LLC (“AST”), toll-free at 1-800-937-5449 or as otherwise provided in our annual report.

| Q: | WHO WILL COUNT THE VOTE? |

A: AST, our transfer agent, will use an automated system to tabulate the votes. Its representative(s) will also serve as the inspector(s) of election.

| Q: | WHO MAY ATTEND THE ANNUAL MEETING? |

A: All stockholders of record as of the close of business on July 23, 2012, may attend the annual meeting. However, seating is limited and will be on a first arrival basis.

To attend the annual meeting, please follow these instructions:

| • | Bring proof of ownership of Rexnord common stock and a form of identification; or |

| • | If a broker or other nominee holds your shares, bring proof of ownership of Rexnord common stock through such broker or nominee and a form of identification. |

3

| Q: | CAN I CHANGE MY VOTE AFTER I RETURN OR SUBMIT MY PROXY? |

A: Yes. Even after you have submitted your proxy, you can revoke your proxy or change your vote at any time before the proxy is exercised by appointing a new proxy or by providing written notice to the Corporate Secretary or acting secretary of the meeting and by voting in person at the meeting. Presence at the annual meeting of a stockholder who has appointed a proxy does not in itself revoke a proxy.

| Q: | MAY I VOTE AT THE ANNUAL MEETING? |

A: If you complete a proxy card, or vote through the Internet or by telephone, then you may still vote in person at the annual meeting. To vote at the meeting, please give written notice that you would like to revoke your original proxy to the Corporate Secretary or acting secretary of the meeting.

If a broker, bank or other nominee holds your shares and you wish to vote in person at the annual meeting you must obtain a proxy issued in your name from the broker, bank or other nominee; otherwise you will not be permitted to vote in person at the annual meeting.

| Q: | WHO IS MAKING THIS SOLICITATION? |

A: This solicitation is being made on behalf of Rexnord by its board of directors. Rexnord will pay the expenses in connection with the solicitation of proxies. Upon request, Rexnord will reimburse brokers, dealers, banks and voting trustees, or their nominees, for reasonable expenses incurred in forwarding copies of the proxy material and annual report to the beneficial owners of shares which such persons hold of record. Rexnord will solicit proxies by mailing the proxy materials to stockholders. Proxies may be solicited in person, or by telephone, e-mail or fax, by officers and regular employees of Rexnord who will not be separately compensated for those services.

Q: WHEN ARE STOCKHOLDER PROPOSALS AND STOCKHOLDER NOMINATIONS DUE FOR THE FISCAL 2014 ANNUAL MEETING?

A: We expect to hold our fiscal 2014 annual meeting of stockholders on August 1, 2013. Under Rule 14a-8 under the Securities Exchange Act of 1934, the Corporate Secretary must receive a stockholder proposal no later than February 13, 2013, in order for the proposal to be considered for inclusion in our proxy materials for the fiscal 2014 annual meeting. To otherwise bring a proposal or nomination before the fiscal 2014 annual meeting, you must comply with our bylaws. Currently, our bylaws require written notice to the Corporate Secretary between March 4, 2013, and April 3, 2013. The purpose of this requirement is to assure adequate notice of, and information regarding, any such matter as to which stockholder action may be sought. If we receive your notice before March 4, 2013 or after April 3, 2013, then your proposal or nomination will be untimely. In addition, your proposal or nomination must comply with the procedural provisions of our bylaws. If you do not comply with these procedural provisions, your proposal or nomination can be excluded. Should the board nevertheless choose to present your proposal, the named proxies will be able to vote on the proposal using their best judgment.

| Q: | WHAT IS THE ADDRESS OF THE CORPORATE SECRETARY? |

A: The address of the Corporate Secretary is:

Rexnord Corporation

Attn: Patricia M. Whaley

4701 West Greenfield Avenue

Milwaukee, Wisconsin 53214

4

| Q: | WILL THERE BE OTHER MATTERS TO VOTE ON AT THIS ANNUAL MEETING? |

A: We are not aware of any other matters that you will be asked to vote on at the annual meeting. Other matters may be voted on if they are properly brought before the annual meeting in accordance with our bylaws. If other matters are properly brought before the annual meeting, then the named proxies will vote the proxies they hold in their discretion on such matters.

For matters to be properly brought before the annual meeting, we must have received written notice, together with specified information, by May 24, 2012. We did not receive notice of any matters by the deadline for this year’s annual meeting.

| Q: | HOW DOES REXNORD’S RECENT INITIAL PUBLIC OFFERING AFFECT THIS PROXY STATEMENT? |

A: Rexnord completed its initial public offering (“IPO”) on April 3, 2012 and its common stock began trading on the New York Stock Exchange on March 29, 2012. As a result of the IPO, Rexnord is holding its first annual meeting of stockholders as a public company. This is therefore the first proxy statement that we are sending to our stockholders for an annual meeting. To the extent that this proxy statement describes actions or information prior to March 29, 2012, they occurred prior to our becoming a public company, and thus at a time when various SEC and New York Stock Exchange rules did not yet apply to us. Also, prior to the IPO, some actions that are now being taken by the Rexnord Corporation board of directors, or a committee thereof, were previously taken by the board, or a board committee, of one or more of our subsidiaries, principally RBS Global, Inc., our wholly-owned subsidiary (“RBS Global”). Since the consummation of our IPO, those decisions have been made, and will continue to be made, by the Rexnord Corporation board or a committee.

| Q: | WHO IS APOLLO AND WHY IS IT REFERENCED IN THIS PROXY STATEMENT? |

A: In this proxy statement, unless the context requires otherwise “Apollo” refers to investment funds affiliated with, or co-investment vehicles managed by, Apollo Management VI, L.P., an affiliate of Apollo Management, L.P. Apollo is our majority stockholder, holding approximately 65.6% of our outstanding common stock as of the Record Date. Apollo became our majority stockholder in 2006, in a transaction that we refer to in this proxy statement as the “Apollo acquisition.” See “Proposal 1: Election of Directors,” “Corporate Governance–Apollo Approval of Certain Matters and Rights to Nominate Certain Directors” and “Certain Relationships and Related Party Transactions” herein for more detail regarding our relationship with Apollo.

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table provides certain information regarding the beneficial ownership of our outstanding capital stock as of the July 23, 2012 Record Date for:

| • | each person or group known to us to be the beneficial owner of more than 5% of our capital stock; |

| • | each of our current executive officers and our other Named Executive Officers in the Summary Compensation Table; |

| • | each of our directors and director nominees; and |

| • | all of our current directors and executive officers as a group. |

Beneficial ownership of shares is determined under the rules of the Securities and Exchange Commission and generally includes any shares over which a person exercises sole or shared voting or investment power. Except as indicated by footnote, and subject to applicable community or marital property laws, each person identified in the table possesses sole voting and investment power with respect to all shares of common stock held by them. Shares of common stock subject to options currently exercisable or exercisable within 60 days of the Record Date and not subject to repurchase as of that date are deemed outstanding for the purpose of calculating the percentage of outstanding shares of the person holding these options, but are not deemed outstanding for the purpose of calculating the percentage of outstanding shares owned by any other person.

Name of Beneficial Owner | Shares Beneficially Owned | Percentage of Shares Outstanding | ||||||||||

Apollo Management, L.P. | (1 | ) | 62,554,045 | 65.6 | % | |||||||

George M. Sherman | (2 | ) | 6,337,833 | 6.4 | % | |||||||

Todd A. Adams | (3 | ) | 964,619 | 1.0 | % | |||||||

Mark W. Peterson | (4 | ) | 51,582 | * | ||||||||

Praveen R. Jeyarajah | (5 | ) | 789,570 | * | ||||||||

Mark S. Bartlett | 0 | * | ||||||||||

Laurence M. Berg | (6 | )(10) | 41,626 | * | ||||||||

Peter P. Copses | (7 | )(10) | 41,626 | * | ||||||||

Damian J. Giangiacomo | (8 | )(10) | 41,626 | * | ||||||||

Steven Martinez | (9 | )(10) | 41,626 | * | ||||||||

John S. Stroup | (11 | ) | 18,732 | * | ||||||||

Current directors and executive officers as a group (10 persons) | (12 | ) | 8,328,840 | 8.3 | % | |||||||

George C. Moore | (13 | ) | 536,563 | * | ||||||||

Michael H. Shapiro | (14 | ) | 0 | * | ||||||||

| * | Indicates less than one percent |

| (1) | Based on a Form 3 filed on March 28, 2012 by Apollo, represents 32,587,093 shares of our common stock owned by Rexnord Acquisition Holdings I, LLC (“Rexnord I”) and 29,966,952 shares of our common stock owned by Rexnord Acquisition Holdings II, LLC (“Rexnord II”). Apollo Management VI, L.P. (“Management VI”) is the manager of Rexnord I and Rexnord II. AIF VI Management, LLC (“AIF VI LLC”) is the general partner of Management VI, and Apollo Management, L.P. (“Apollo Management”) is the sole member and manager of AIF VI LLC. Apollo Management GP, LLC (“Management GP”) is the general partner of Apollo Management. Apollo Management Holdings, L.P. (“Management Holdings”) is the sole member and manager of Management GP, and Apollo Management Holdings GP, LLC (“Holdings GP”) is the general partner of Management Holdings. Apollo Investment Fund VI, L.P. (“AIF VI”) is the sole member of Rexnord I. Apollo Advisors VI, L.P. (“Advisors VI”) is the general partner of AIF VI, and |

6

| Apollo Capital Management VI, LLC (“ACM VI”) is the general partner of Advisors VI. Apollo Principal Holdings I, L.P. (“Principal I”) is the sole member and manager of ACM VI. Apollo Principal Holdings I GP, LLC (“Principal I GP”) is the general partner of Principal I. Leon Black, Joshua Harris and Marc Rowan serve as the managers of Holdings GP and Principal I GP, and as such effectively have the power to exercise voting and investment control with respect to the shares of our common stock held of record by Rexnord I and Rexnord II. The address of each of Rexnord I, Rexnord II, AIF VI, Advisors VI, ACM VI, Principal I and Principal I GP is One Manhattanville Road, Suite 201, Purchase, New York 10577. The address of each of Management VI, AIF VI LLC, Apollo Management, Management GP, Management Holdings and Holdings GP, and of Messrs. Black, Harris and Rowan, is c/o Apollo Management, L.P., 9 West 57th Street, 43rd Floor, New York, NY 10019. |

| (2) | Includes 548,964 shares held by Mr. Sherman and 2,329,068 shares held by Cypress Industrial Holdings, LLC, over which Mr. Sherman has sole voting and dispositive power. Includes options to purchase 2,539,795 and 920,006 shares held by Mr. Sherman and Cypress Industrial Holdings, LLC, respectively, over which Mr. Sherman has sole voting and dispositive power. |

| (3) | Includes options to purchase 922,619 shares held by Mr. Adams, but excludes 33,745 shares held in trusts for the benefit of Mr. Adams’ children, as to which Mr. Adams does not have voting or dispositive power and therefore disclaims beneficial ownership. |

| (4) | Includes options to purchase 48,582 shares held by Mr. Peterson. |

| (5) | Includes options to purchase 649,144 shares held by Mr. Jeyarajah. |

| (6) | Represents options to purchase 41,626 shares held by Mr. Berg. |

| (7) | Represents options to purchase 41,626 shares held by Mr. Copses. |

| (8) | Represents options to purchase 41,626 shares held by Mr. Giangiacomo. |

| (9) | Represents options to purchase 41,626 shares held by Mr. Martinez. |

| (10) | Each of Messrs. Berg, Copses, Giangiacomo and Martinez is affiliated with Apollo as a partner or senior partner of Apollo or one of its affiliates, and as such may be deemed a beneficial owner of the shares owned by Rexnord I and Rexnord II, although such shares are not included in the individuals’ reported ownership above. Each such person disclaims beneficial ownership of any such shares. The address of each such person and Apollo is c/o Apollo Management, L.P., 9 West 57th Street, New York, NY 10019. |

| (11) | Represents options to purchase 18,732 shares held by Mr. Stroup. |

| (12) | Includes an aggregate of options to purchase 5,265,382 shares held by all of our directors and executive officers as a group. |

| (13) | Includes 7,492 shares transferred by Mr. Moore to his children, over which Mr. Moore has sole voting power. Also includes options to purchase 217,488 shares held by Mr. Moore. Mr. Moore ceased being deemed an executive officer on November 7, 2011. |

| (14) | Mr. Shapiro was no longer employed by Rexnord effective as of November 7, 2011. |

7

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees for Election at this Meeting

Our bylaws provide that the number of directors shall be not less than eight nor more than 15, with the number to be set by the board from time to time. The board of directors currently has eight directors. The board sets its size so that the board will possess, in the aggregate, the strategic, managerial and financial skills and experience necessary to fulfill its duties and to achieve its objectives and to maintain a sufficient number of independent directors.

Our board of directors is divided into three classes. The members of each class serve staggered, three-year terms (other than with respect to the initial terms of the Class I and Class II directors). Upon the expiration of the term of a class of directors, directors in that class will be elected for three-year terms at the annual meeting of stockholders in the year in which their term expires. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. At each annual meeting, our stockholders will elect the successors to our directors. Our executive officers and key employees serve at the discretion of our board of directors. Directors may be removed for cause by the affirmative vote of the holders of a majority of our common stock.

This year’s board nominees for election for terms expiring at the fiscal 2016 annual meeting are Todd A. Adams, Laurence M. Berg and George M. Sherman.

Pursuant to our bylaws and a nominating agreement between the Company and Apollo, Apollo has the right, at any time until Apollo no longer beneficially owns at least 50.1% of our outstanding common stock, to require us to increase the size of our board of directors by such number that, when added to the number of then-serving directors designated by Apollo, would constitute a majority of our board of directors, and to fill those vacancies with directors nominated by Apollo. In addition, until such time as Apollo no longer beneficially owns at least 50.1% of our outstanding common stock, Apollo has the right to nominate four designees to our board of directors. After Apollo no longer beneficially owns at least 50.1% of our outstanding common stock, but until such time as Apollo no longer beneficially owns at least 33 1/3% of our outstanding common stock, Apollo will have the right to nominate three designees to our board of directors. See “Corporate Governance – Apollo Approval of Certain Matters and Rights to Nominate Certain Directors” and “Certain Relationships and Related Party Transactions – Nominating Agreement.” Mr. Berg was designated by Apollo as a nominee for election at the fiscal 2013 annual meeting; Peter P. Copses, Damian J. Giangiacomo and Steven Martinez, whose terms expire in future years, were also designated by Apollo pursuant to the nominating agreement.

It is our policy that the board of directors should reflect a broad variety of experience and talents. When the Nominating and Corporate Governance Committee of the board determines which directors to nominate for election at any meeting of stockholders, or appoints a new director between meetings, it reviews our director selection criteria and seeks to choose individuals who bring a variety of expertise to the board within these criteria. For further information about the criteria used to evaluate board membership, see “Selection Criteria for Directors” below.

In order to comply with New York Stock Exchange rules regarding the number of independent directors required to be on the audit committee within 90 days following the Company’s IPO, the Company sought a new board member earlier in fiscal 2013. Mark S. Bartlett was elected to the board, and was placed in the class of directors whose terms expire at the fiscal 2014 annual meeting, effective June 4, 2012. In conjunction with Mr. Bartlett joining the board, Praveen R. Jeyarajah resigned from the board so that the board size would not need to be increased and so that, in accordance with best corporate governance practices, there would be only one management director. The Company’s search for an independent director commenced prior to our IPO and the related establishment of the Nominating Committee. Mr. Bartlett was initially recommended for consideration by the Nominating Committee for service on the board by Mr. Sherman, our Chairman.

8

The following is information about the experience and attributes of the director nominees and Rexnord’s other directors. Together, the experience and attributes included below provide the reasons that these individuals were selected for board membership and/or nominated for re-election, as well as why they continue to serve on the board.

Nominees for Election for Terms Expiring at the Fiscal 2016 Annual Meeting

Todd A. Adams

Director since 2009

Mr. Adams, age 41, became our President and Chief Executive Officer in September 2009 and became a director in October 2009. Mr. Adams joined us in 2004 as Vice President, Treasurer and Controller; he has also served as Senior Vice President and Chief Financial Officer from April 2008 to September 2009 and as President of the Water Management platform in 2009. Prior to joining us, Mr. Adams held various positions at The Boeing Company, APW Ltd. and Applied Power Inc. (currently Actuant Corporation). Mr. Adams serves on our board of directors because he has significant experience in the manufacturing industry and an in-depth knowledge of Rexnord and our business and because he is our Chief Executive Officer.

Laurence M. Berg

Director since 2006

Mr. Berg, age 46, became a director in July 2006 upon consummation of the Apollo acquisition. Mr. Berg is a Senior Partner of Apollo Management, L.P., where he has worked since 1992. Prior to joining Apollo, Mr. Berg was a member of the Mergers and Acquisition Group at Drexel Burnham Lambert, an investment banking firm. Mr. Berg is also a director of Jacuzzi Brands Corp. and ABC Supply Co. Inc., and has previously served as a director of Connections Academy LLC, Bradco Supply Corp., Educate, Inc., GNC Corp., Goodman Global Holdings, Inc., Hayes Lemmerz International, Inc., Rent A Center, Inc. and Panolam Industries International, Inc. Mr. Berg serves on our board of directors because he has significant experience making and managing private equity investments on behalf of Apollo and has over 20 years of experience financing, analyzing and investing in public and private companies. In addition, Mr. Berg worked with the diligence team for Apollo at the time of the Apollo acquisition and has worked closely with our management since that time; therefore, Apollo initially appointed him to the board pursuant to a stockholders agreement. Mr. Berg was designated by Apollo as a nominee for election at the fiscal 2013 annual meeting pursuant to the nominating agreement with Apollo.

George M. Sherman

Director since 2002

Mr. Sherman, age 70, has been our Non-Executive Chairman and a director since 2002. Mr. Sherman is a principal of Cypress Group LLC. Mr. Sherman also currently serves as the non-executive Chairman of Jacuzzi Brands Corp. and has served as the Chairman of Campbell Soup Company from 2001 to 2004. Prior to his service with Campbell Soup, Mr. Sherman was the President and Chief Executive Officer at Danaher Corporation from 1990 to 2001. Prior to joining Danaher, he was Executive Vice President at Black & Decker Corporation. Mr. Sherman became our Non-Executive Chairman pursuant to a management consulting agreement; see “Certain Relationships and Related Party Transactions” below. Mr. Sherman serves on our board of directors because he has significant experience and expertise in the manufacturing industry (including as chief executive officer), mergers and acquisitions and strategy development and continues to serve because of his in-depth knowledge of Rexnord and our business.

The board recommends that you vote “FOR” each of the three nominees.

9

Shares represented by proxies will be voted according to instructions on the proxy card or delivered via the Internet or telephone. Only cards clearly indicating a vote “withheld” will be considered as a vote withheld from the nominees. Any votes attempted to be cast “against” a candidate are not given legal effect and are not counted as votes cast in the election of directors. In the unlikely event that the board learns prior to the annual meeting that a nominee is unable or unwilling to act as a director, which is not foreseen, the proxies will be voted with discretionary authority for a substitute nominee designated by the board of directors.

Continuing Directors Not Standing for Election at this Meeting

Directors Continuing to Serve Until the Fiscal 2014 Annual Meeting

Mark S. Bartlett

Director since 2012

Mr. Bartlett, age 61, became a director on June 4, 2012. Mr. Bartlett is a retired Ernst & Young LLP (“E&Y”) partner. Mr. Bartlett joined E&Y in 1972 and worked there until his retirement in 2012, including having served as Managing Partner of E&Y’s Baltimore office and as Senior Client Service Partner for the Mid-Atlantic Region. Mr. Bartlett is a certified public accountant and has extensive experience serving global manufacturers, as well as companies in other industries. Mr. Bartlett also has experience in mergers and acquisitions, SEC rules and regulations, public offerings and financing alternatives. The board appointed Mr. Bartlett as a director due to his significant accounting experience, as well as his expertise in the manufacturing industry, and in mergers and acquisitions and securities regulation.

Damian J. Giangiacomo

Director since 2006

Mr. Giangiacomo, age 35, became a director in October 2006. Mr. Giangiacomo is a principal of Apollo Management, L.P., where he has been employed since July 2000. Prior to joining Apollo, Mr. Giangiacomo was an investment banker at Morgan Stanley & Co. Mr. Giangiacomo is also a director of Jacuzzi Brands Corp. and Connections Academy LLC, and has previously served as director of Linens N’ Things, Inc. Mr. Giangiacomo serves on our board of directors because he has significant experience making and managing private equity investments on behalf of Apollo and has over 10 years of experience financing, analyzing and investing in public and private companies. In addition, Mr. Giangiacomo worked with the diligence team for Apollo at the time of the Apollo acquisition and has worked closely with our management since that time; therefore, Apollo initially appointed him to the board pursuant to a stockholders agreement. Mr. Giangiacomo is a director designated by Apollo pursuant to the nominating agreement.

Steven Martinez

Director since 2006

Mr. Martinez, age 43, became a director in July 2006 upon the consummation of the Apollo acquisition. Mr. Martinez is a Senior Partner of Apollo Management, L.P. Prior to joining Apollo in 2000, Mr. Martinez worked for Goldman, Sachs & Co. and Bain & Company, Inc. Mr. Martinez also serves as a director of Prestige Cruise Holdings, Inc., NCL Corporation Ltd., Hughes Telematics, Inc., Principal Maritime and Veritable Maritime Holdings, LLC, and has previously served as a director of Jacuzzi Brands Corp., Allied Waste Industries, Inc. and Goodman Global Holdings, Inc. Mr. Martinez serves on our board of directors because he has significant experience making and managing private equity investments on behalf of Apollo and has over 15 years of experience financing, analyzing and investing in public and private companies. In addition, Mr. Martinez worked with the diligence team for Apollo at the time of the Apollo acquisition and has worked closely with our management since that time; therefore, Apollo initially appointed him to the board pursuant to a stockholders agreement. Mr. Martinez is a director designated by Apollo pursuant to the nominating agreement.

10

Directors Continuing to Serve Until the Fiscal 2015 Annual Meeting

Peter P. Copses

Director since 2006

Mr. Copses, age 54, became director in July 2006 upon consummation of the Apollo acquisition. Mr. Copses is a Senior Partner of Apollo Management, L.P., where he has worked since 1990. Prior to joining Apollo, Mr. Copses was an investment banker at Drexel Burnham Lambert, and subsequently at Donaldson, Lufkin & Jenrette Securities, primarily concentrating on the structuring, financing and negotiation of mergers and acquisitions. Mr. Copses is also Chairman of the Board of Claire’s Stores, Inc. and CKE Restaurants, Inc. and has previously served as a director of Linens N’ Things, Inc., GNC Corp., Rent A Center, Inc., Zale Corporation and Smart & Final, Inc. Mr. Copses serves on our board of directors because he has significant experience making and managing private equity investments on behalf of Apollo and has over 25 years of experience financing, analyzing and investing in public and private companies; therefore, Apollo initially appointed him to the board pursuant to a stockholders agreement. Mr. Copses is a director designated by Apollo pursuant to the nominating agreement.

John S. Stroup

Director since 2008

Mr. Stroup, age 46, became a director in October 2008. Mr. Stroup is currently president and chief executive officer and a member of the board of directors of Belden Inc., a company listed on the New York Stock Exchange, that designs, manufactures, and markets cable, connectivity, and networking products in markets including industrial automation, enterprise, transportation, infrastructure, and consumer electronics. Prior to joining Belden Inc. in 2005, Mr. Stroup was employed by Danaher Corporation, a manufacturer of process/environmental controls and tools and components. At Danaher, Mr. Stroup initially served as Vice President, Business Development. He was promoted to President of a division of Danaher’s Motion Group and later to Group Executive of the Motion Group. Prior to that, he was Vice President of Marketing and General Manager with Scientific Technologies Inc. Mr. Stroup serves on our board of directors because he has significant experience in strategic planning and general management of business units of public companies (including as chief executive officer).

Selection Criteria for Directors

The Company believes it is important for its board to be comprised of individuals with diverse backgrounds, skills and experiences. All board members are expected to meet Rexnord’s board member selection criteria, which are listed below:

| • | Personal and professional integrity, ethics and values. |

| • | Experience in corporate or financial management, such as serving as an officer or former officer of a publicly held company. |

| • | Experience in the Company’s industry and with relevant social policy concerns. |

| • | Experience as a board member of another publicly held company. |

| • | Academic expertise in an area of the Company’s operations or financial or other areas relevant to the Company. |

| • | Practical and mature business judgment. |

| • | Such other criteria as the board or the nominating and corporate governance committee may from time to time determine. |

11

In addition to the board member selection criteria identified above, the board and the Nominating and Corporate Governance Committee review the board’s composition annually to ensure the right mix of skills, experience and background needed for the foreseeable future and will change the membership mix of the board as required to meet such needs. Important skills and experiences currently identified are as follows:

| • | Significant chief executive officer and/or chief operating officer experience in a publicly traded company, or a major division of a publicly traded company. |

| • | International experience, with an understanding of conducting business on a global basis. |

| • | Financial and accounting skills and experience in a public accounting firm or a public company, preferably with controller and/or chief financial officer experience, and who would fulfill the SEC requirements of an audit committee “financial expert.” |

| • | Relevant manufacturing management background from a well respected manufacturing-based company. |

| • | Considerable human resources management experience involving the design of both short and long-term compensation programs, who understands benefit plans and has managed succession planning and leadership development for a successful company. |

| • | Experience in one or more of the industries that are served by the Company. |

In addition, the Company’s Corporate Governance Guidelines provide that, if a director experiences a significant change in employment status from the status when that director was most recently elected to the board, the director must inform the chairperson of the change and offer a letter of resignation. The Nominating and Corporate Governance Committee will evaluate the director’s change in status and the board will then decide whether to accept or decline the director’s resignation. The Corporate Governance Guidelines also provide that, as a general policy, executive officers of the Company who are directors will resign from the board upon the termination of their employment with the Company. Further, the Corporate Governance Guidelines require directors to advise the chairperson of the board and the chairperson of the Nominating and Corporate Governance Committee in advance of accepting an invitation to serve on another board. A non-executive director of the board may serve as a director of another public company only to the extent such position does not conflict or interfere with such person’s service as a director of the Company; an executive director may not serve as a director of another public company without the board’s consent.

See “Corporate Governance – Apollo Approval of Certain Matters and Rights to Nominate Certain Directors” and “Certain Relationships and Related Party Transactions – Nominating Agreement” for certain rights of Apollo to nominate directors.

The Company’s Corporate Governance Guidelines and Nominating and Corporate Governance Committee Charter state that the Nominating and Corporate Governance Committee will identify candidates without regard to any candidate’s race, color, disability, gender, national origin, religion or creed. The board believes that the use of the Nominating and Corporate Governance Committee’s general criteria, along with non-discriminatory policies, will best promote a board that shows diversity in many respects.

12

Directors are expected to attend each regular and special meeting of the board of directors and of each board committee of which the director is a member. The board of directors held four meetings during fiscal 2012. All of the then-current directors attended at least 75% of the total meetings of the board and the committees of the board on which they served during fiscal 2012. Since becoming a public company, the board has determined that it will have regular meetings at least four times per year, including in future years a meeting substantially concurrently with the annual stockholders meeting. It is the Company’s policy that the board will hold an executive session at each regularly scheduled meeting without members of the Company’s management present, and upon the request of any independent director (and in any event, not less than annually), the board will hold an executive session without any director who is not an independent director. Directors are also expected to attend the annual meeting of stockholders. Because Rexnord was not a public company until April 2012, no annual meeting of stockholders was held in fiscal 2012.

Apollo Approval of Certain Matters and Rights to Nominate Certain Directors

The approval of a majority of a quorum of the members of our board of directors, which must include the approval of a majority of the directors nominated by Apollo voting on the matter, is required by our bylaws under certain circumstances. These consist of, as to us and, to the extent applicable, each of our subsidiaries:

| • | amendment, modification or repeal of any provision of our certificate of incorporation, bylaws or similar organizational documents in a manner that adversely affects Apollo; |

| • | the issuance of additional shares of any class of our capital stock (other than any award under any stockholder approved equity compensation plan); |

| • | a consolidation or merger of us with or into any other entity, or transfer (by lease, assignment, sale or otherwise) of all or substantially all of our and our subsidiaries’ assets, taken as a whole, to another entity, or a “Change of Control” as defined in our or our subsidiaries’ principal senior secured credit facilities or senior note indentures; |

| • | a disposition, in a single transaction or a series of related transactions, of any of our or our subsidiaries’ assets with a value in excess of $150 million in the aggregate, other than the sale of inventory or products in the ordinary course of business; |

| • | consummation of any acquisition of the stock or assets of any other entity (other than any of our subsidiaries), in a single transaction or a series of related transactions, involving consideration in excess of $150 million in the aggregate; |

| • | the incurrence of indebtedness, in a single transaction or a series of related transactions, by us or any of our subsidiaries aggregating more than $25 million, except for borrowings under a revolving credit facility that has previously been approved or is in existence (with no increase in maximum availability) on the date of closing our IPO (i.e., April 3, 2012) or that is otherwise approved by Apollo; |

| • | a termination of the chief executive officer or designation of a new chief executive officer; and |

| • | a change in size of the board of directors. |

These approval rights will terminate at such time as Apollo no longer beneficially owns at least 33 1/3% of our outstanding common stock.

See also “Proposal 1: Election of Directors” and “Certain Relationships and Related Party Transactions – Nominating Agreement” for rights of Apollo to nominate a certain number of directors.

13

We have availed ourselves of the “controlled company” exception under the New York Stock Exchange rules, which eliminates the requirements that we have a majority of independent directors on our board of directors and that we have compensation and nominating/corporate governance committees composed entirely of independent directors. However, we are required to have a fully-independent audit committee within one year from the date of effectiveness of the registration statement in connection with our IPO (i.e., by March 29, 2013).

If at any time we cease to be a “controlled company” under the New York Stock Exchange rules, the board of directors will take all action necessary to comply with the applicable New York Stock Exchange rules, including appointing a majority of independent directors to the board of directors and establishing certain committees composed entirely of independent directors, subject to a permitted “phase-in” period.

Notwithstanding that we are a “controlled company,” the board of directors has affirmatively determined that each of Messrs. Bartlett and Stroup are independent on the basis that they had no relationships with the Company that would be prohibited under the independence standards of the New York Stock Exchange. In making its determination, the board considered that Mr. Bartlett was, until 2012, a partner at E&Y and that E&Y has served as Rexnord’s independent registered public accounting firm since 2006; however, because Mr. Bartlett did not personally work on E&Y’s audit of Rexnord or provide any other services to the Company, the board determined that such former relationship would not impair Mr. Bartlett’s independent judgment in carrying out his responsibilities as a member of the board. See “Certain Relationships and Related Party Transactions” for information about Rexnord’s policies and practices regarding transactions with members of the board.

The Company has no formal policy regarding the separation or combination of the position of Chairperson and CEO; however, it believes that in the Company’s current circumstances it is advantageous to separate those positions.

Mr. Sherman has the right to serve as our Non-Executive Chairman of the Board pursuant to an amended and restated management consulting agreement with the Company. Mr. Sherman has served in that role since 2002. The Company believes that having Mr. Sherman serve as Chairman is appropriate at the current time because he has significant experience and expertise in the manufacturing industry (including as chief executive officer), mergers and acquisitions and strategy development and has in-depth knowledge of Rexnord and its business, all of which make him well qualified to serve as our Chairman. See “Certain Relationships and Related Party Transactions” for information about the management consulting agreement with Mr. Sherman.

Board’s Role in Risk Oversight

It is management’s responsibility to manage the Company’s enterprise risks on a day-to-day basis. Through regular updates and the strategic planning process, the board of directors oversees management’s efforts to ensure that they effectively identify, prioritize, manage and monitor all material business risks to Rexnord’s strategy. In addition, the board delegates certain risk management oversight responsibilities to its committees. The Audit Committee reviews and discusses the Company’s material financial and other risk exposures and the steps management has taken to identify, monitor and control such risks. The Compensation Committee is responsible for overseeing the Company’s compensation programs, including related risks.

14

The board of directors has four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the Executive Committee. The committees on which our directors currently serve, and the chairs of those committees, are identified in the following table:

| Director | Audit | Compensation | Nominating and Corporate Governance | Executive | ||||

Todd A. Adams | X | |||||||

Mark S. Bartlett | Chair | |||||||

Laurence M. Berg | X | Chair | X | |||||

Peter P. Copses | X | |||||||

Damian J. Giangiacomo | X | Chair | X | |||||

Steven Martinez | ||||||||

George M. Sherman | X | X | Chair | |||||

John S. Stroup | X | X |

Audit Committee

The Audit Committee of Rexnord Corporation held one meeting during fiscal 2012; the audit committee of RBS Global held three meetings during fiscal 2012. The current members of the Rexnord Corporation Audit Committee are Messrs. Bartlett (Chair), Giangiacomo and Stroup; Mr. Martinez served on and chaired the Audit Committee during fiscal 2012 and through June 4, 2012. Our board of directors has determined that each of Messrs. Bartlett and Stroup qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K and that each of Messrs. Bartlett and Stroup is independent as independence is defined in Rule 10A-3 of the Exchange Act and under the New York Stock Exchange listing standards. The principal duties and responsibilities of our Audit Committee are as follows:

| • | to prepare the annual Audit Committee report to be included in our annual proxy statement; |

| • | to oversee and monitor our financial reporting process; |

| • | to oversee and monitor the integrity of our financial statements and internal control system; |

| • | to oversee and monitor the independence, retention, performance and compensation of our independent auditor; |

| • | to oversee and monitor the performance, appointment and retention of our senior internal audit staff person; |

| • | to discuss, oversee and monitor policies with respect to risk assessment and risk management; |

| • | to oversee and monitor our compliance with legal and regulatory matters; and |

| • | to provide regular reports to the board. |

The Audit Committee also has the authority to retain counsel and advisors to fulfill its responsibilities and duties and to form and delegate authority to subcommittees.

Compensation Committee

Prior to Rexnord’s becoming a public company, the Compensation Committee met as part of board meetings or informally, and took relevant actions by unanimous consent. The current members of the Compensation Committee are Messrs. Giangiacomo (Chair), Berg, Sherman and Stroup. The principal duties and responsibilities of the Compensation Committee are as follows:

| • | to review, evaluate and make recommendations to the full board of directors regarding our compensation policies and programs; |

15

| • | to review and approve the compensation of our chief executive officer, other officers and key employees, including all material benefits, option or stock award grants and perquisites and all material employment agreements, confidentiality and non-competition agreements; |

| • | to review and recommend to the board of directors a succession plan for the chief executive officer and development plans for other key corporate positions as shall be deemed necessary from time to time; |

| • | to review and make recommendations to the board of directors with respect to our incentive compensation plans and equity-based compensation plans; |

| • | to administer incentive compensation and equity-related plans; |

| • | to review and make recommendations to the board of directors with respect to the financial and other performance targets that must be met; |

| • | to set and review the compensation of members of the board of directors; and |

| • | to prepare an annual compensation committee report and take such other actions as are necessary and consistent with the governing law and our organizational documents. |

We have availed ourselves of the “controlled company” exception under the New York Stock Exchange rules which exempts us from the requirement that we have a compensation committee composed entirely of independent directors. However, none of the members of our Compensation Committee during fiscal 2012 was, and none of the current members of our Compensation Committee is, a current or former employee of the Company.

Nominating and Corporate Governance Committee

We did not have a Nominating and Corporate Governance Committee prior to becoming a public company in April 2012. The current members of the Nominating and Corporate Governance Committee are Messrs. Berg (Chair), Copses and Sherman. The principal duties and responsibilities of the Nominating and Corporate Governance Committee are as follows:

| • | to identify candidates qualified to become directors of the Company, consistent with criteria approved by our board of directors; |

| • | to recommend to our board of directors nominees for election as directors at the next annual meeting of stockholders or a special meeting of stockholders at which directors are to be elected, as well as to recommend directors to serve on the other committees of the board; |

| • | to recommend to our board of directors candidates to fill vacancies and newly created directorships on the board of directors; |

| • | to identify best practices and recommend corporate governance principles, including giving proper attention and making effective responses to stockholder concerns regarding corporate governance; |

| • | to develop and recommend to our board of directors guidelines setting forth corporate governance principles applicable to the Company; and |

| • | to oversee the evaluation of our board of directors and senior management. |

We have availed ourselves of the “controlled company” exception under the New York Stock Exchange rules which exempts us from the requirement that we have a Nominating and Corporate Governance Committee composed entirely of independent directors.

The Nomination Process

At an appropriate time prior to each annual meeting of stockholders at which directors are to be elected, the Nominating and Corporate Governance Committee recommends to the board for nomination by the board such

16

candidates as the Nominating and Corporate Governance Committee, in the exercise of its judgment, has found to be well qualified and willing and available to serve. In addition, the Nominating and Corporate Governance Committee recommends candidates to serve on the board at other times during the year, as needed. For example, in order to comply with New York Stock Exchange and SEC rules, the Company was required, within 90 days of the effectiveness of the registration statement for the IPO, to add an independent director to its board to serve on the Audit Committee. Consequently, the Nominating and Corporate Governance Committee recommended that Mr. Bartlett be added to the board. Further, to comply with New York Stock Exchange and SEC rules, the Company will need to have another independent member on its board and Audit Committee by March 29, 2013.

The Nominating and Corporate Governance Committee will identify and consider candidates suggested by outside directors, management and/or stockholders and evaluate them in accordance with its established criteria. In addition, Apollo has certain rights to nominate directors and the Nominating and Corporate Governance Committee must follow those requirements as long as the Company is subject to those requirements. See “Proposal 1: Election of Directors” above. Any recommendations for consideration by the Nominating and Corporate Governance Committee should be sent to the Corporate Secretary in writing, together with appropriate biographical information concerning each proposed nominee, at least 120 days but not more than 150 days prior to the first anniversary of the date of the preceding year’s annual meeting; provided that, in the case of the fiscal 2014 annual meeting of stockholders, such information must be received by the Company by the dates provided elsewhere in this proxy statement. Our bylaws also set forth certain requirements for stockholders wishing to nominate director candidates directly for consideration by stockholders; provided however, that certain of those requirements do not apply to nominees designated by Apollo pursuant to the bylaws and the nominating agreement.

Executive Committee

Prior to the Company’s becoming a public company, the Executive Committee met informally, and took relevant actions by unanimous consent. The current members of the Executive Committee are Messrs. Sherman (Chair), Adams, Berg and Giangiacomo. The primary duty and responsibility of the Executive Committee is to act on behalf of the board of directors in between meetings of the full board, as necessary or appropriate.

Any communications to the board of directors should be sent to Rexnord’s headquarters office, 4701 West Greenfield Avenue, Milwaukee, Wisconsin 53214, in care of Rexnord’s Corporate Secretary. Any communication sent to the board in care of the Corporate Secretary or any other corporate officer is forwarded to the board. There is no screening process, and any communication will be delivered directly to the director or directors to whom it is addressed. Any other procedures which may be developed, and any changes in those procedures, will be posted as part of our Corporate Governance Guidelines on Rexnord’s website at www.rexnord.com/investors.

Availability of Code of Business Conduct and Ethics, Committee Charters and Other Corporate Governance Documents

We have a Code of Business Conduct and Ethics that applies to all of our officers, directors and employees, including our principal executive officer, principal financial officer and principal accounting officer, or persons performing similar functions. These standards are designed to deter wrongdoing and to promote honest and ethical conduct. The Code of Business Conduct and Ethics is posted on our website at www.rexnord.com/investors. Any substantive amendment to, or waiver from, any provision of the Code of Business Conduct and Ethics with respect to any senior executive or financial officer will also be posted on our website. The information contained on or accessible from our website is not part of this proxy statement.

17

In addition, the board has adopted Corporate Governance Guidelines and a written charter for each of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Executive Committee. The Corporate Governance Guidelines and the charters are available on the Company’s website at www.rexnord.com.

The table below summarizes the compensation we paid to persons who were non-employee directors of the Company for the fiscal year ended March 31, 2012. Subsequently, on June 4, 2012, Mr. Bartlett was appointed to the board of directors. Mr. Bartlett receives a standard compensation package for independent directors and, upon his appointment, received a grant of options; information related to Mr. Bartlett is not in the table below since he was not a director during fiscal 2012.

Name | Fees earned or Paid in Cash ($) | Stock Awards ($) | Option Awards (1) ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

George M. Sherman | $ | 298,000 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 298,000 | ||||||||||||||

Laurence M. Berg | 48,000 | — | — | — | — | — | 48,000 | |||||||||||||||||||||

Peter P. Copses | 44,000 | — | — | — | — | — | 44,000 | |||||||||||||||||||||

Damian J. Giangiacomo | 48,000 | — | — | — | — | — | 48,000 | |||||||||||||||||||||

Steven Martinez | 46,000 | — | — | — | — | — | 46,000 | |||||||||||||||||||||

John S. Stroup | 49,000 | — | — | — | — | — | 49,000 | |||||||||||||||||||||

| (1) | No options were granted to non-employee directors in fiscal 2012. The following table presents the aggregate number of outstanding unexercised options (including, in the case of Mr. Stroup, options that have not yet vested) held by each of our non-employee directors as of March 31, 2012. |

Director | Number of Options Outstanding | |||

George M. Sherman(*) | 3,459,801 | |||

Laurence M. Berg | 41,626 | |||

Peter P. Copses | 41,626 | |||

Damian J. Giangiacomo | 41,626 | |||

Steven Martinez | 41,626 | |||

John S. Stroup | 18,732 | |||

| (*) | These include options granted to Mr. Sherman, Cypress Group, LLC and Cypress Industrial Holdings, LLC, entities over which Mr. Sherman has sole voting and dispositive power. |

Narrative to Directors’ Compensation Table

In fiscal 2012, we paid certain fees to our non-employee directors. In addition, directors were eligible in fiscal 2012 to receive equity-based awards from time to time on a discretionary basis; however, under the new director compensation program discussed below, independent directors will receive annual equity grants. All directors also receive reimbursement for all reasonable out-of-pocket expenses incurred in connection with their duties as a director. Directors who are also employees of the Company receive no additional compensation for their service as directors. See the executive compensation disclosures above for information related to Mr. Adams’ and Mr. Jeyarajah’s (who served as a director during fiscal 2012 and through June 2012) compensation in fiscal 2012.

18

In fiscal 2012, Messrs. Sherman, Berg, Copses, Giangiacomo and Martinez received an annual cash retainer of $40,000, paid quarterly after each fiscal quarter of service, and a fee of $2,000 for each board meeting attended in person. With respect to Messrs. Berg, Copses, Giangiacomo and Martinez (i.e., the directors appointed by Apollo), the amount of fees were set forth in the stockholders agreements executed at the time of the Apollo transaction. Those stockholders agreements have subsequently been terminated (except for certain registration rights). Fifty percent of the meeting fee is paid for board meetings attended by teleconference. Beginning in fiscal 2013, Mr. Sherman will no longer receive the $40,000 annual cash retainer or the meeting fees. The fees to be paid to Messrs. Berg, Copses, Giangiacomo and Martinez will remain the same in fiscal 2013. In addition, in fiscal 2012, Mr. Sherman received a fee of $250,000 for his service as Chairman of the Board, which he will again receive in fiscal 2013. In fiscal 2012, Mr. Stroup received annual cash compensation comprised of (i) a $35,000 annual fee, (ii) fees of $2,500 per board meeting attended and (iii) committee attendance fees of $1,000 per meeting.

In connection with the completion of the IPO, the Company revised its compensation program for independent directors. For fiscal 2013, each independent director will receive annual cash compensation of $60,000, but will not receive additional board or committee meeting attendance fees, and will receive an annual option grant in an amount equal to $90,000 as of the date of grant; such options will vest in equal installments over three years following the grant date (one-third each year). In addition, the chair of the Audit Committee will receive a $10,000 annual cash retainer and the chair of the Compensation Committee will receive a $6,000 annual cash retainer. Further, as described in “ – Ownership Guidelines for Directors” below, independent directors are required to own a certain amount of Rexnord common stock.

On July 22, 2006, we entered into the Cypress agreement, as described in “Certain Relationships and Related Party Transactions” herein and Part II, Item 8, Note 17 of the notes to consolidated financial statements in the Company’s Annual Report on Form 10-K. Under the terms of the agreement, options to purchase 165,244 shares of Rexnord Corporation common stock were granted to Mr. Sherman. As of the end of fiscal 2012, 100% of the outstanding options granted to Mr. Sherman under the Cypress agreement had vested. Under the agreement, Mr. Sherman is also entitled to reimbursement for all reasonable travel and other expenses incurred in connection with our business.

As part of the new compensation program for independent directors, on May 11, 2012, Mr. Stroup received an option to purchase 11,250 shares at an exercise price of $22.03 per share, which was the closing trading price on the New York Stock Exchange on the date of the grant, and on June 4, 2012, Mr. Bartlett received an option to purchase 11,250 shares at an exercise price of $19.20 per share, which was the closing trading price on the New York Stock Exchange on the date of the grant. The options granted to Messrs. Stroup and Bartlett vest equally on the first three anniversary dates following the grant date.

Stock Ownership Guidelines for Directors

The Company believes that it is important for independent directors to maintain an equity stake in Rexnord to further align their interests with those of our stockholders. Independent directors must comply with stock ownership guidelines as determined from time to time by our board. Effective April 1, 2012, the ownership guidelines for independent directors require that each independent director must own a minimum of $250,000 of Rexnord stock, which includes vested options, within five years of his or her initial election to the board. Currently, although neither of the independent directors has yet met the ownership guidelines, the Company believes that all such directors will have met their stock ownership guidelines within the specified five-year window.

19

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires Rexnord’s officers and directors, and persons who beneficially own more than 10% of Rexnord’s common stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. These “insiders” are required by SEC regulation to furnish Rexnord with copies of all forms they file under Section 16(a).

All publicly-held companies are required to disclose the names of any insiders who fail to make any such filing on a timely basis within the preceding fiscal year, and the number of delinquent filings and transactions, based solely on a review of the copies of the Section 16(a) forms furnished to Rexnord, or written representations that no such forms were required. On the basis of filings and representations received by Rexnord, Rexnord believes that during fiscal 2012 our insiders have complied with all Section 16(a) filing requirements that were applicable to them.

20

COMPENSATION DISCUSSION AND ANALYSIS

The following is a discussion of the material elements of compensation awarded to, earned by, or paid to our Named Executive Officers during our fiscal year ended March 31, 2012. Throughout this discussion, the individuals named in the Summary Compensation Table below are referred to as “Named Executive Officers” and the terms “Compensation Committee” or the “Committee” refer to the compensation committee of RBS Global or Rexnord Corporation, whichever is appropriate from the context.

The Committee, in consultation with the board of directors, oversees our executive compensation agreements, plans and policies and has the authority to approve all matters regarding executive compensation. The Committee seeks to ensure that the compensation and benefits provided to executives were reasonable, fair and competitive and aligned with the short- and long-term goals of the Company so as to foster a “pay for performance” culture that places an emphasis on value creation and makes a portion of each executive’s compensation subject to the performance of the Company. Based upon these criteria, the Committee sets the principles and strategies that guided the design of our executive compensation program.

We compensate our executives through various forms of cash and non-cash compensation. Our compensation program includes:

| • | Cash compensation: |

| • | base salaries, which are intended to attract and retain highly-qualified individuals (as base salary is frequently used as an initial metric for evaluating compensation) and provide a predictable stream of income for living expenses in an amount proportionate to the executive’s duties and responsibilities; |

| • | annual performance-based cash incentive awards, which are intended to award performance by tying additional cash compensation to specific Company and individual goals; and |

| • | discretionary bonuses, which can be used to recognize extraordinary performance or other unique contributions or circumstances that may not be quantifiable; for example, in fiscal 2012, our Chief Financial Officer (“CFO”) received a discretionary bonus for his contributions in connection with the refinancing of our credit facilities and the successful completion of our IPO; |

| • | Long-term equity incentive awards, which are intended to further align the financial interests of management with those of our stockholders and incent executive officers by providing economic rewards tied to increased value of the Company over an extended period of time; |

| • | Severance benefits and other post-employment commitments under a policy that applies to all domestic salaried employees, as well as initial implementation of practices applicable to the Chief Executive Officer (“CEO”) in the event of a change in control of the Company, all of which are intended to provide some degree of certainty when employment ends under certain circumstances; and |

| • | Retirement benefits, which are intended to reward long-term service to us and provide incentive to remain with us by building benefits for eventual retirement. |

During fiscal 2012, the Company appointed a new CFO, Mark W. Peterson. Mr. Peterson was an officer of the Company but not a Named Executive Officer prior to his appointment as CFO. Our former CFO, Michael H. Shapiro, was no longer employed by the Company effective as of November 7, 2011. Also, in November 2011, as a consequence of planned changes over time in his duties by which he transitioned into a part-time role, the responsibilities of George C. Moore, who had been Executive Vice President, were determined to no longer meet those of an “executive officer,” although Mr. Moore remains a Rexnord employee.

21

Prior to the consummation of our IPO on April 3, 2012, Apollo owned over 90% of our outstanding common stock, and Apollo continues to own a significant majority of our common stock. Our compensation structure prior to our IPO reflected policies, practices and metrics used by Apollo that were appropriate for a privately-held company. However, following the completion of the IPO and as discussed in more detail below, we have began to modify and intend to continue to modify our compensation programs to better reflect our becoming a public company and further strive for a “pay for performance” culture aimed at creating value for our stockholders.