- ZWS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Zurn Elkay Water Solutions (ZWS) DEF 14ADefinitive proxy

Filed: 22 Mar 24, 4:05pm

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material under Rule 14a-12 | |||

ZURN ELKAY WATER SOLUTIONS CORPORATION | ||||

(Name of registrant as specified in its charter) | ||||

(Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

on May 2, 2024

To the Stockholders of Zurn Elkay Water Solutions Corporation:

Zurn Elkay Water Solutions Corporation will hold its annual meeting of stockholders at its corporate offices at 511 W. Freshwater Way, Milwaukee, Wisconsin 53204, on May 2, 2024, at 9:00 a.m. Central Time for the following purposes:

| 1. | To elect three directors to serve for three-year terms expiring at the annual meeting to be held in 2027; |

| 2. | To hold an advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in “Compensation Discussion and Analysis” and “Executive Compensation” in the proxy statement; |

| 3. | To hold an advisory vote related to the frequency of future advisory votes to approve the compensation of the Company’s named executive officers; |

| 4. | To approve the Zurn Elkay Water Solutions Corporation Employee Stock Purchase Plan; |

| 5. | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024; and |

| 6. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Zurn Elkay Water Solutions Corporation’s stockholders of record at the close of business on March 4, 2024, will be entitled to vote at the meeting or any adjournment of the meeting. On or about March 22, 2024, we expect to mail stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and Annual Report, as well as vote, online. We encourage stockholders to vote in advance of the meeting.

We call your attention to the proxy statement accompanying this notice, which contains important information about the matters to be acted upon at the meeting.

By order of the Board of Directors |

|

Jeffrey J. LaValle |

Vice President, General Counsel and Secretary |

Milwaukee, Wisconsin

March 22, 2024

You may vote in person or by using a proxy as follows:

• By internet:

| Go to www.voteproxy.com. Have the notice we sent to you in hand when you access the website because you will need the control number from the notice to vote. | |

• By telephone:

| Call 1-800-PROXIES (1-800-776-9437) in the United States or 1-201-299-4446 from other countries on a touch-tone telephone. Have the notice we sent you in hand when you call because you will need the control number from the notice to vote. | |

• By mail:

| Please request written materials as provided on page 1 of the proxy statement. Complete, sign and date the proxy card, and return it to the address indicated on the proxy card. | |

If you later find that you will be present at the meeting or for any other reason desire to revoke your proxy, you may do so at any time before it is voted.

511 W. Freshwater Way

Milwaukee, Wisconsin 53204

PROXY STATEMENT

TABLE OF CONTENTS

ANNUAL MEETING OF STOCKHOLDERS

MAY 2, 2024

COMMONLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Q: WHEN IS THE ANNUAL MEETING?

A: Zurn Elkay Water Solutions Corporation (“Zurn Elkay,” “we,” “us,” “our” or the “Company”) will hold its annual meeting of stockholders at its corporate offices at 511 W. Freshwater Way, Milwaukee, Wisconsin 53204, on Thursday, May 2, 2024, at 9:00 a.m. Central Time.

Q: WHEN IS THE PROXY MATERIAL FIRST BEING MADE AVAILABLE TO STOCKHOLDERS?

A: On or about March 22, 2024, Zurn Elkay expects to mail stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy material over the internet.

Q: WHY DID I RECEIVE A NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A PRINTED COPY OF THE PROXY MATERIAL?

A: Securities and Exchange Commission (“SEC”) rules permit us to provide access to our proxy material over the internet instead of mailing a printed copy of the proxy material to each stockholder. As a result, we are mailing stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy material, including our proxy statement and Annual Report, and vote via the internet. Stockholders will not receive printed copies of the proxy material unless requested by following the instructions included on the Notice of Internet Availability of Proxy Materials or as provided below.

Important Notice Regarding the Availability of Proxy Materials for

the Stockholder Meeting to Be Held on May 2, 2024

The proxy statement and Annual Report to security holders are available at

http://www.astproxyportal.com/ast/17558

Q: HOW CAN STOCKHOLDERS REQUEST PAPER COPIES OF THE PROXY MATERIAL?

A: Stockholders may request that paper copies of the proxy material, including the Annual Report, proxy statement and proxy card, be sent to them without charge as follows:

• By internet:

| https://us.astfinancial.com/OnlineProxyVoting/ProxyVoting/RequestMaterials | |

• By e-mail:

| help@equiniti.com | |

• By telephone:

| 888-Proxy-NA (888-776-9962) in the United States or 201-299-6210 (for international callers) | |

When you make your request, please have available your personal control number contained in the notice we mailed to you. To assure timely delivery of the proxy material before the annual meeting, please make your request no later than April 22, 2024.

1

Q: WHAT AM I VOTING ON?

A: At the annual meeting you will be voting on the following proposals:

| 1. | The election of three directors to serve for three-year terms expiring at the annual meeting to be held in 2027. This year’s board nominees are: |

| • Todd A. Adams

• George C. Moore

• Rosemary Schooler |

| 2. | An advisory proposal to approve the compensation of the Company’s named executive officers, as disclosed in “Compensation Discussion and Analysis” and “Executive Compensation” herein. |

| 3. | An advisory proposal to approve the frequency of future advisory votes to approve the compensation of the Company’s named executive officers. |

| 4. | The approval of the Zurn Elkay Water Solutions Corporation Employee Stock Purchase Plan. |

| 5. | A proposal to ratify the selection of Ernst & Young LLP (“EY”) as the Company’s independent registered public accounting firm for the year ending December 31, 2024. |

Q: WHAT ARE THE BOARD’S VOTING RECOMMENDATIONS?

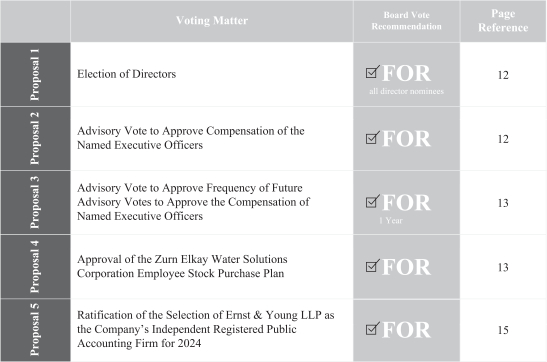

A: The board of directors is soliciting this proxy and recommends the following votes:

| 1. | FOR each of the board’s nominees for election as director. |

| 2. | FOR approval of the compensation of the Company’s named executive officers. |

| 3. | FOR approval of maintaining “1 YEAR” as the frequency of future advisory votes to approve the compensation of the Company’s named executive officers. |

| 4. | FOR approval of the Zurn Elkay Water Solutions Corporation Employee Stock Purchase Plan. |

| 5. | FOR the ratification of the selection of EY as the Company’s independent registered public accounting firm for 2024. |

Q: WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL?

A: To conduct the annual meeting, a majority of the shares entitled to vote must be present in person or by duly authorized proxy. This is referred to as a “quorum.” Abstentions and shares that are the subject of broker non-votes will be counted for the purpose of determining whether a quorum exists. Shares represented at a meeting for any purpose are counted in the quorum for all matters to be considered at the meeting. All of the voting requirements below assume that a quorum is present.

Directors are elected by a plurality of the votes cast in person or by proxy at the meeting, and entitled to vote on the election of directors. “Plurality” means that the individuals who receive the highest number of votes are elected as directors, up to the number of directors to be chosen at the meeting. Any votes attempted to be cast “against” a candidate are not given legal effect and are not counted as votes cast in the election of directors. Therefore, any shares that are not voted, whether by withheld authority, broker non-vote or otherwise, have no effect in the election of directors except to the extent that the failure to vote for any individual results in another individual receiving a relatively larger number of votes. Our bylaws provide that if any nominee does not receive, in an uncontested election, a majority of the votes cast for his or her election as a director, such individual must submit, promptly following such vote, an irrevocable resignation from the board that is contingent upon acceptance of such resignation by the board.

Assuming a quorum is present, the results of the advisory vote to approve the compensation of the Company’s named executive officers will be determined by a majority of shares voting on such matter. Abstentions and

2

broker non-votes will not affect this vote, except insofar as they reduce the number of shares that are voted. This is an advisory vote and is not binding on the Company. However, the Compensation Committee, the board and the Company review the voting results carefully and take them into consideration when evaluating and making future decisions regarding executive compensation.

To determine the results of the advisory vote related to the frequency of future advisory votes to approve named executive officer compensation, the frequency receiving the greatest number of votes, whether every year, every two years or every three years, will be considered the frequency approved by stockholders. Abstentions and broker non-votes do not constitute votes for any particular frequency and will have no effect on the outcome of this advisory vote. This is an advisory vote and is not binding on the Company. However, the Compensation Committee, the board and the Company review the voting results carefully and take them into consideration when evaluating and making future decisions regarding the frequency of future advisory votes to approve executive compensation.

An affirmative vote of a majority of the shares represented at the meeting and entitled to vote thereon is required for the approval of the Zurn Elkay Water Solutions Employee Stock Purchase Plan. Abstentions will act as votes against this proposal. Broker non-votes will not affect this vote, except insofar as they reduce the number of shares that are voted.

An affirmative vote of a majority of the shares represented at the meeting and entitled to vote thereon is required for the ratification of the selection of EY as the Company’s independent registered public accounting firm. Consequently, abstentions will act as votes against this proposal. Since brokers have discretionary authority to vote on this proposal, we do not anticipate any broker non-votes with regard to this matter.

Q: WHAT IF I DO NOT VOTE?

A: The effect of not voting will depend on how your share ownership is registered. If you own shares as a registered holder and you do not vote, then your unvoted shares will not be represented at the meeting and will not count toward the quorum requirement. If a quorum is obtained, then your unvoted shares will not affect whether a proposal is approved or rejected.

If you are a stockholder whose shares are not registered in your name and you do not vote, then your bank, broker or other holder of record may still represent your shares at the meeting for purposes of obtaining a quorum. In the absence of your voting instructions, your bank, broker or other holder of record may not be able to vote your shares in its discretion depending on the proposal before the meeting. Your broker may not vote your shares in its discretion in the election of directors; therefore, you must vote your shares if you want them to be counted in the election of directors. Your broker is also not permitted to vote your shares in its discretion on matters related to executive compensation, including the advisory vote to approve executive compensation. However, your broker may vote your shares in its discretion on routine matters such as the ratification of the Company’s independent registered public accounting firm.

Q: WHO MAY VOTE?

A: You may vote at the annual meeting if you were a stockholder of record as of the close of business on March 4, 2024, which is the “Record Date.” Each outstanding share of common stock is entitled to one vote on each matter presented. As of the Record Date, Zurn Elkay had 173,133,539 shares of common stock outstanding. Any stockholder entitled to vote may vote either by attending in person or by duly authorized proxy.

Q: HOW DO I VOTE?

A: You may vote either in person at the annual meeting or in advance of the meeting by authorizing–by internet, telephone or mail–the persons named as proxies on the proxy card, Todd A. Adams, Mark W. Peterson and Jeffrey J. LaValle, to vote your shares in accordance with your directions. We recommend that you vote as soon as possible, even if you are planning to attend the annual meeting, so that the vote count will not be delayed.

3

We encourage you to vote in advance of the meeting via the internet, as it is the most cost-effective method available. If you choose to vote your shares in advance of the meeting via the internet or by telephone, there is no need for you to request or mail back a proxy card.

• By internet:

| A stockholder of record may go to www.voteproxy.com. Have the notice we sent to you in hand when you access the website because you will need the control number from the notice to vote. | |

• By telephone:

| Call 1-800-PROXIES (1-800-776-9437) in the United States or 1-201-299-4446 from other countries on a touch-tone telephone. Have the notice we sent you in hand when you call because you will need the control number from the notice to vote. | |

• By mail:

| Please request written materials as provided on page 1 of the proxy statement. Complete, sign and date the proxy card, and return it to the address indicated on the proxy card. | |

If your shares are not registered in your name (for example, held through a broker or bank), then you vote by giving instructions to the firm that holds your shares rather than using any of the methods discussed above. Please check the voting form from the firm that holds your shares to see if it offers internet or telephone voting procedures.

Q: WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE REQUEST TO VOTE?

A: It means your shares are held in more than one account. You should vote the shares on all of your proxy cards. You may help us reduce costs by consolidating your accounts so that you receive only one set of proxy material in the future by contacting our transfer agent, Equiniti Trust Company LLC, toll-free at 1-800-937-5449.

Q: WHAT IF I OWN SHARES AS PART OF ZURN ELKAY’S 401(k) PLAN?

A: Stockholders who own shares as part of Zurn Elkay’s 401(k) Plan (the “401(k) Plan”) will receive a separate means for voting the shares held in each account. Shares held by the 401(k) Plan for which participant designations are received will be voted in accordance with those designations; those shares for which designations are not received will be voted proportionally based on the shares for which voting directions have been received from participants in the 401(k) Plan.

Q: WHO WILL COUNT THE VOTE?

A: Equiniti Trust Company LLC, our transfer agent, will use an automated system to tabulate the votes. Officers or employees of the Company will serve as the inspector(s) of election.

Q: WHO MAY ATTEND AND PARTICIPATE IN THE ANNUAL MEETING?

A: Only stockholders of record as of the close of business on the Record Date, or their proxy holders or the underlying beneficial owners, may attend the annual meeting. However, seating is limited and will be on a first-arrival basis.

To attend the annual meeting, please follow these instructions:

| • | Bring proof of ownership of Zurn Elkay common stock and a form of photo identification; or |

| • | If a broker or other nominee holds your shares, bring proof of ownership of Zurn Elkay common stock on or about the Record Date through such broker or nominee (or a proxy received from such holder) and a form of photo identification. |

4

Q: CAN I CHANGE MY VOTE AFTER I RETURN OR SUBMIT MY PROXY?

A: Yes. Even after you have submitted your proxy, you can revoke your proxy or change your vote at any time before the proxy is exercised by submitting a new proxy, or by providing written notice to the Corporate Secretary, or acting secretary of the meeting, and by voting in person at the meeting. Presence at the annual meeting of a stockholder who has appointed a proxy does not in itself revoke a proxy.

If a broker, bank or other nominee holds your shares and you wish to change your proxy prior to the voting thereof, please contact the broker, bank or other nominee to determine whether, and if so how, such proxy can be revoked.

Q: MAY I VOTE AT THE ANNUAL MEETING?

A: If you vote through the internet or by telephone, or complete a proxy card, then you may still vote at the annual meeting. To vote at the meeting, please give written notice that you would like to revoke your original proxy to the Corporate Secretary or acting secretary of the meeting.

If a broker, bank or other nominee holds your shares and you wish to vote in person at the annual meeting, you must obtain a legal proxy issued in your name from the broker, bank or other nominee; otherwise, you will not be permitted to vote in person at the annual meeting.

Q: WHO IS MAKING THIS SOLICITATION?

A: This solicitation is being made on behalf of Zurn Elkay by its board of directors. Zurn Elkay will pay the expenses in connection with the solicitation of proxies. Upon request, Zurn Elkay will reimburse brokers, dealers, banks and voting trustees, or their nominees, for reasonable expenses incurred in forwarding copies of the proxy material and Annual Report to the beneficial owners of shares which such persons hold of record. Zurn Elkay will solicit proxies by mailing a Notice of Internet Availability of Proxy Materials to all stockholders. Paper copies of the proxy material will be sent upon request as provided above as well as in the Notice of Internet Availability of Proxy Materials. Proxies may be solicited in person, or by telephone, e-mail or fax, by officers and regular employees of Zurn Elkay who will not be separately compensated for those services. Zurn Elkay has retained Morrow Sodali to assist in the solicitation of proxies and to provide informational support and analysis for up to $12,000 plus expenses.

Q: WILL THERE BE OTHER MATTERS TO VOTE ON AT THIS ANNUAL MEETING?

A: We are not aware of any other matters that you will be asked to vote on at the annual meeting. Other matters may be voted on if they are properly brought before the annual meeting in accordance with our bylaws. If other matters are properly brought before the annual meeting, then the named proxies will vote the proxies they hold in their discretion on such matters.

For matters to be properly brought before the annual meeting, we must have received written notice, together with specified information, by January 5, 2024. We did not receive notice of any matters proper for the consideration by our stockholders by the deadline for this year’s annual meeting.

5

STOCKHOLDER UPDATE AND HIGHLIGHTS

Message from the Chairman and Chief Executive Officer

| To our stockholders,

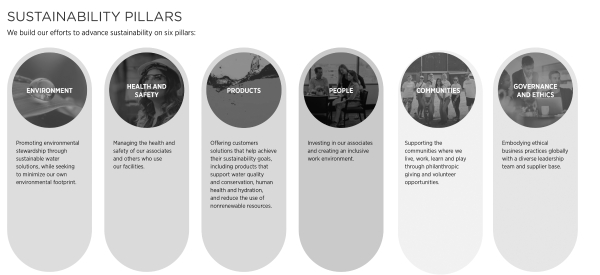

Thank you for your continued support and confidence in Zurn Elkay. Our long-term approach has always been — and will continue to be — building value in the collective best interest of all our stakeholders, including stockholders, associates, customers, suppliers, sales and distribution partners and, especially, our global environment.

In 2023 we continued to integrate and streamline into one distinctive clean water enterprise, unlocking the tremendous value for stockholders that the combination of two industry leaders – Zurn and Elkay – promised. During the year we delivered $233 million free cash flow, repurchased $125 million dollars of shares, increased our quarterly dividend by 14 percent, and ended with our lowest ever net debt leverage. |

One year into the Zurn Elkay combination, the benefits from the transaction are clear, as we realized the expected synergy savings as well as the significant growth opportunity in clean filtered drinking water. Our team is stronger than ever, unified and focused on a sole mission around the delivery of the most important natural resource in the world: cleaner, safer water.

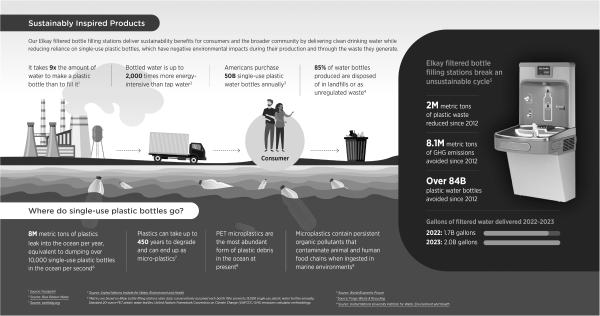

Our new product innovations are transformational. For example, in 2023, we launched a combined lead and PFOA/PFOS (PFAS) reducing filter for our bottle fillers and filtered faucets. As more is learned about the serious health effects of PFAS chemicals on people and as regulations evolve, we’re pleased to offer drinking water filtration solutions that are certified to reduce harmful contaminants in water consumed by students, patients and the overall public. We applaud activity we saw on the legislative side related to reducing lead in drinking water – with Michigan being the first state in the nation to pass Filter First legislation and Pennsylvania having introduced a similar bill. The Filter First legislation in Michigan requires all K-12 schools and childcare facilities in the state to install filtered bottle filling stations and filtered faucets for all water sources intended for human consumption.

The effective protection, conservation and management of the water we all depend on is central to how we are driving our business forward. As certain regions of the United States deal with water scarcity, it only amplifies how important water is to everyone’s daily life and the role our products can play in conservation and management of water. As a global leader in water management solutions, we are uniquely capable of solving complex water challenges on behalf of our global stakeholders as the world faces an array of climate- and water-related crises, including flooding and drought events exacerbated by climate change, water pollution and its impact on biodiversity and human health, and aging infrastructure that can contaminate water supplies.

More than just drinking water, our comprehensive portfolio of products help customers meet their sustainability goals – including pressure-reducing valves that conserve water, backflow preventers and grease interceptors that protect water sources, touchless faucets, flush valves and hand dryers that prevent the spread of germs, bottle fillers that reduce the use of single-use plastic bottles and digitally connected water management systems that minimize water waste while providing a return on investment for our customers. We also leverage our collective water expertise and resources to help improve lives in the communities where our associates live and work, expanding our giving and supporting them in the fight for worry-free water.

As validation of our guiding principle to always Do the Right Thing, these efforts earned us recognition from Newsweek and Statista as one of America’s Most Responsible Companies, for a fourth consecutive year, improving from No. 131 to No. 78.

Personally, I’m proud to be a part of the talented and dedicated associate team of Zurn Elkay. While we have accomplished many of our goals in 2023, we are even more energized and excited about the challenges and opportunities ahead. With your continued support, we are confident we can and will succeed in that regard.

Best Regards,

Todd A. Adams

Chairman of the Board and Chief Executive Officer

6

Recent Developments

Elkay Merger

| • | On July 1, 2022, we completed the combination with Elkay Manufacturing Company (“Elkay”) through the merger of Elkay with and into a newly created subsidiary of the Company, with Elkay surviving as a wholly owned subsidiary of Zurn Elkay (the “Merger” or “Elkay Transaction”). |

Spin-Off of PMC Segment

| • | On October 4, 2021, we completed the spin-off of our Process & Motion Control (“PMC”) business in a Reverse Morris Trust transaction (the “RMT Transaction”) with Regal Rexnord Corporation (formerly Regal Beloit Corporation). The PMC business previously represented approximately 55% of our revenue and approximately 5,550 employees were transferred in connection with the spin-off. Zurn Elkay is now a stand-alone pure-play water solutions company. |

Stockholder Outreach and Input

We value the opinions of our stockholders and regularly engage with them on various matters. After our 2023 annual meeting, our integrated outreach team, led by our Investor Relations group, General Counsel and Corporate Secretary’s office and Chief Human Resources Officer, conducted extensive stockholder outreach in December 2023 and January 2024 with the following objectives:

| • | Attaining stockholder feedback on our strategy around: corporate governance, executive compensation, sustainability and other important matters. |

| • | Understanding stockholder questions, concerns, and priorities. |

| • | Providing insight into corporate governance, executive compensation, sustainability and enhancing overall communication with our stockholders. |

As part of our outreach:

• We invited stockholders representing approximately 67% of our outstanding common stock to meet with our integrated outreach team to share feedback. |

| |

• We met with each stockholder who accepted our invitation. Overall, we met with holders of 61% of the outstanding common stock that we contacted as part of our outreach effort, representing approximately 41% of our outstanding common stock. |

|

We received constructive feedback and support on board skills and diversity, corporate governance, executive compensation, sustainability and other matters. The feedback was presented to our executive management team and the Board for their review and consideration. The executive management team and the Board have carefully considered feedback from the stockholder discussions, and determined that our current practices generally reflect the sentiment of our stockholders and do not require material changes at this time. We will continue to seriously consider feedback from these discussions as we move forward.

7

Below is a summary of the feedback we received.

| Stockholder Feedback | Background / Response | |

Board Diversity

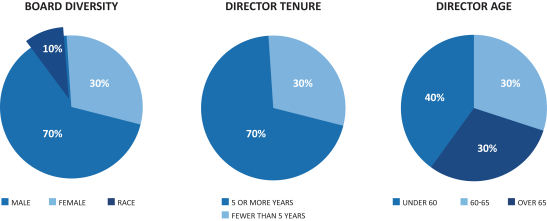

Stockholders expressed satisfaction with our continued focus on board diversity, including that we have 30% female representation on the Board and a female chair leading the Nominating and Governance Committee. |

• Our Board of Directors reflects a broad diversity of backgrounds, experience, perspectives and talents. Our Board is comprised of ten directors, nine of whom are independent and three are female.

• Female leadership role on the Board – Peggy Troy currently serves as Chair of the Nominating and Corporate Governance Committee and, as such, will serve a key role in future director searches. | |

Board Refreshment; Governance

Stockholders expressed their views regarding board refreshment efforts, including director tenure, evaluating director performance and recruiting directors with skills that meet the evolving needs of the Company. We also discussed with stockholders other corporate governance practices, including the history and rationale regarding the Company’s classified board structure. |

• We conduct rigorous director evaluations annually, including an evaluation of individual performance as well as overall board and committee performance.

• We regularly review director tenure and succession planning.

• We regularly review director skills and experiences to ensure that our Board members have the right mix of skills to meet the evolving needs of the Company in order to oversee and drive Company strategy.

• Since 2019, we added 5 new directors to the Board, bringing fresh perspectives, skills and experience. In addition, our Board is comprised of ten directors, nine of whom are independent and three are female.

• We regularly evaluate our corporate governance policies and practices to ensure they are market and in-line with stockholder expectations, and believe that our current structure and practices are in-line with similarly-situated companies. | |

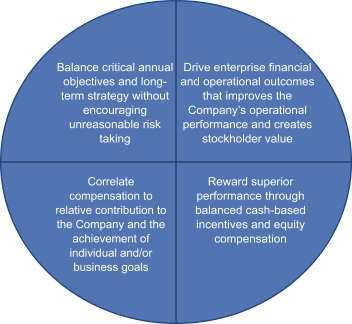

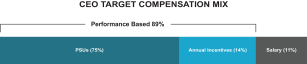

Executive Compensation Philosophy

Stockholders discussed executive compensation philosophy and policies, sought to further understand and clarify aspects of our policies and discussed other desired practices and market trends. |

• We continued our practice of granting the CEO equity exclusively in the form of performance-based stock awards. We also continue to increase the percentage of performance-based stock awards for other executives.

• We regularly evaluate our compensation policies and practices to ensure they are market and in-line with stockholder expectations. | |

Employee Stock Purchase Plan (ESPP)

Stockholders expressed support for the ESPP as a way to grow employees’ ownership of the company and to align employees’ interests with those of stockholders. |

• Our Board has adopted the ESPP and is seeking stockholder approval at the 2024 Annual Meeting. We believe that an ESSP helps our ability to maintain a competitive position in attracting, retaining and motivating talented personnel, that the ability to participate in the ESPP is an attractive feature for our employees and potential employees, and that an ESPP further aligns the interests of employees and stockholders.

| |

8

| Stockholder Feedback | Background / Response | |

Sustainability

Stockholders expressed a desire for continued enhancements in disclosure regarding Zurn Elkay’s environmental, social and governance and sustainability practices, including information about progress on previously committed sustainability goals. |

• We understand the importance of establishing and achieving sustainability goals and will continue to improve our sustainability strategy by regularly reviewing our goals and the key performance indicators that help us measure our progress.

• We will continue to evaluate the changing reporting frameworks and landscape to ensure we are providing the appropriate level of disclosure to stockholders. | |

The Board has considered, and will continue to seriously consider, feedback from these discussions as we review and evaluate our corporate governance, executive compensation and sustainability programs, and the evolution of our business.

9

PROXY STATEMENT HIGHLIGHTS

This section highlights selected information in this proxy statement. Please review the entire document before voting.

Voting Recommendations from the Zurn Elkay Board

Proposal 1: Zurn Elkay has a long-standing focus on building a diverse, highly-engaged, independent board that possesses the necessary skills, experiences, and qualifications to effectively oversee the business and the short- and long-term interests of our stockholders. Biographies for each of the nominees standing for election begin on page 21 and include descriptions of their occupation, experience, qualifications and skills. Upon the recommendation of our Nominating and Corporate Governance Committee, our Board has nominated the three individuals to serve as directors for a three-year term ending in 2027.

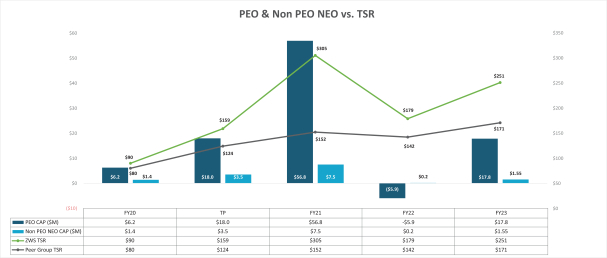

Proposal 2: The second proposal is an advisory vote to approve the compensation of the named executive officers. The compensation program elements are set on the principles of performance-based pay. The mix of cash and equity incentives are strongly tied to the financial performance of the Company, which align with the short- and long-term interests of our stockholders. The compensation program is reviewed by the Compensation Committee and includes considerations of competitive benchmarking and general input by our independent compensation consultant, Willis Towers Watson (“WTW”). In 2022 and again in 2023, we confirmed our focus on stockholder input by engaging in an outreach program to further understand specific questions, concerns and priorities. Details on the outreach campaign and stockholder feedback are discussed beginning on page 7.

Proposal 3: The third proposal is an advisory vote to approve the frequency of future advisory votes to approve the compensation of the Company’s named executive officers. The Company’s executive compensation programs are designed to drive long-term stockholder value. We believe that advisory votes to approve the compensation of the NEOs should be held every year so that our stockholders may annually express their views on our programs. The Company considers this input as it assesses whether these programs are appropriately motivating employees and driving stockholder value.

10

Proposal 4: The fourth proposal is a vote to approve the Zurn Elkay Water Solutions Corporation Employee Stock Purchase Plan (“ESPP”). The Employee Stock Purchase Plan would allow eligible employees to purchase shares of our common stock at eighty five percent (85%) of the fair market value. The number of common shares available for purchase under the ESPP will be 2,000,000 shares, subject to adjustment in the event of a change in capitalization. We believe that an ESSP helps our ability to maintain a competitive position in attracting, retaining and motivating talented personnel, that the ability to participate in the ESPP is an attractive feature for our employees and potential employees, and that an ESPP further aligns the interests of employees and stockholders.

Proposal 5: Finally, the fifth proposal is ratification of the selection of EY as our independent registered public accounting firm for 2024. The Audit Committee is involved in the annual review and engagement of EY and believes their continued retention is in the best interests of the Company and its stockholders.

THE BOARD RECOMMENDS STOCKHOLDERS VOTE “FOR” 1, 2, 4, and 5 AND “FOR” 1 YEAR ON PROPOSAL 3.

11

PROPOSAL 1: ELECTION OF DIRECTORS

Upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has considered and nominated the following slate of nominees to stand for re-election for a three-year term expiring at the 2027 annual meeting of stockholders or until his or her successor is duly elected:

| • | Todd A. Adams |

| • | George C. Moore |

| • | Rosemary Schooler |

The biographies and qualifications of the three director nominees are set forth below under the heading “Nominees for Election for Terms Expiring at the 2027 Annual Meeting” starting on page 21.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE.

PROPOSAL 2: ADVISORY VOTE TO APPROVE THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS

SEC rules require publicly-traded companies like Zurn Elkay to hold an advisory vote of their stockholders at least once every three years to approve the compensation of the named executive officers, as disclosed in the company’s proxy statement pursuant to Item 402 of the SEC’s Regulation S-K; Zurn Elkay discloses this information in “Compensation Discussion and Analysis” and “Executive Compensation” herein. Zurn Elkay currently holds these votes annually and, in accordance with SEC rules, is holding an advisory vote this year related to the frequency of such votes in the future; see “Proposal 3: Advisory Vote Related to the Frequency of Future Advisory Votes to Approve the Compensation of the Company’s Named Executive Officers” below.

As described in the “Compensation Discussion and Analysis” below, our executive compensation program is designed to focus our executives on critical business goals that translate into long-term value creation. As a result, we believe that a meaningful portion of our executives’ compensation should be variable and based, as appropriate, on the financial performance of the Company or one of its specific businesses, segments or departments and we have increased the emphasis on performance-based compensation in recent years through our MICP, a sub-plan of the Performance Incentive Plan, and through the awarding of PSUs and other equity awards. We believe the Company’s compensation program as a whole is well suited to promote the Company’s objectives in both the short and long term.

Accordingly, the following resolution will be submitted to our stockholders for approval at the annual meeting:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby approved.”

As an advisory vote, this proposal is not binding on the Company. However, the Compensation Committee, which is responsible for designing and administering the Company’s executive compensation programs, values the opinions expressed by our stockholders, and will consider the outcome of the vote when making future compensation decisions on the Company’s executive compensation programs. Additionally, please see page 7 for a discussion of the stockholder outreach that was conducted following our 2023 annual meeting of stockholders.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS AS DESCRIBED IN THIS PROXY STATEMENT.

12

PROPOSAL 3: ADVISORY VOTE RELATED TO THE FREQUENCY OF FUTURE ADVISORY VOTES TO APPROVE THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

SEC rules also require publicly-traded companies to hold advisory votes at least every six years related to the frequency of future advisory votes to approve the compensation of the named executive officers. Advisory votes to approve the compensation of the named executive officers may be held every one, two or three years. At the 2018 annual meeting, stockholders voted in favor of advisory votes every one year, and, for the reasons discussed below, the board is recommending that the Company continue to hold such votes annually.

The Company’s executive compensation programs are designed to drive long-term stockholder value. We believe that advisory votes to approve the compensation of the named executive officers should be held every year so that our stockholders may annually express their views on our programs. The Company considers this input as it assesses whether these programs are appropriately motivating employees and driving stockholder value.

Similar to the advisory vote to approve the compensation of the named executive officers, this proposal is also an advisory vote and is not binding on the Company. However, as noted above, the Company values the opinions expressed by its stockholders, and will consider the outcome of the advisory votes to approve the compensation of the named executive officers itself and on the frequency of future advisory votes when making decisions on the frequency of future votes.

THE BOARD RECOMMENDS THAT YOU VOTE FOR “1 YEAR” AS THE FREQUENCY OF FUTURE ADVISORY VOTES TO APPROVE THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS.

PROPOSAL 4: APPROVAL OF THE ZURN ELKAY WATER SOLUTIONS CORPORATION EMPLOYEE STOCK PURCHASE PLAN

The Company’s stockholders are asked to approve a proposal to create the Zurn Elkay Water Solutions Corporation Employee Stock Purchase Plan (“ESPP”). The following summary of the material terms of the ESPP is qualified in its entirety by the full text of the ESPP, a copy of which is attached to this Proxy Statement as Appendix A.

Summary of the Plan

Our Board has approved, subject to the approval of the stockholders, the adoption of the ESPP. We believe that an ESSP helps our ability to maintain a competitive position in attracting, retaining and motivating talented personnel, that the ability to participate in the ESPP is an attractive feature for our employees and potential employees, and that an ESPP further aligns the interests of employees and stockholders. The ESPP is a broad-based plan that allows eligible employees to purchase shares of our common stock at an amount equal to eighty five percent (85%) of the fair market value of a share of common stock as of the first trading day or the last trading day of the offering period, whichever is less. No shares will be purchased under the ESPP at less than the par value of the shares. The number of common shares initially available for purchase under the ESPP will be 2,000,000 shares, subject to adjustment in the event of a change in capitalization. The stock allocated to the participants in the ESPP may be authorized but unissued shares or treasury shares, including shares bought on the open market or otherwise for purposes of the ESPP.

All United States based regular full-time employees of the Company and designated subsidiaries whose customary employment is 30 or more hours per week and who have been continuously employed for at least 90 days are eligible to participate in the component of the ESPP that is compliant with Section 423 of the U.S. Internal Revenue Code (the “423 Component”). Company employees in other countries may be eligible to the extent determined by the Compensation Committee or by an officer or officers to the extent authorized by the Compensation Committee and under the Non-423 Component (as defined in the ESPP plan). Notwithstanding the

13

foregoing, the Compensation Committee may exclude certain highly compensated and other employees, including citizens or residents of foreign jurisdictions where participation would be prohibited under the laws of such jurisdiction or would cause the ESPP to violate Section 423, from participation in the ESPP or the 423 Component. In addition, no employee is eligible to participate in the ESPP if, immediately after participating, the employee would own, directly or indirectly, five (5) percent or more of our common stock outstanding.

All eligible employees may participate in the ESPP by completing an enrollment agreement and electing to have payroll deductions made during a three-month offering period. Assuming the ESPP is approved by the stockholders, the first offering period under the ESPP will commence July 1, 2024 and end September 30, 2024. Subsequent offering periods are expected to commence on or around October 1, January 1, April 1, and July 1, of each year. During the course of an offering period, a participant may not increase or decrease the amount of his or her payroll deductions under the ESPP. Upon termination from employment, any payroll deductions that were not used to purchase stock will be returned to the individual. For any calendar year, a participant may not purchase more than $25,000 of Company stock (determined at the fair market value of the shares as of the beginning of each offering period). The Company annually may determine, in its sole discretion, to establish a minimum or maximum dollar amount or percentage of compensation that an eligible employee is entitled to authorize for payroll deductions during a calendar year, which restrictions shall apply to all eligible employees and fall within the parameters of Section 423 of the U.S. Internal Revenue Code for the 423 Component of the plan. A participant has the right to direct the vote of his or her shares held in the ESPP.

Shares purchased under the ESPP will be credited to an account with a transfer agent or a securities brokerage firm, as determined by the Company, in the name of the participant. Participants will not incur any brokerage commissions or service charges for purchases of common stock under the ESPP. However, if a participant desires to sell some or all of their shares, they may do so through the transfer agent or securities brokerage firm subject to any applicable fee or through any means as the Company may permit.

The ESPP will continue in effect until February 1, 2034, subject to the Company’s right to amend or terminate the ESPP at any time. In the event of termination, any uninvested cash will be refunded to participants.

U.S. Federal Income Tax Consequences

The following discussion summarizes the material U.S. federal income tax consequences of the ESPP. Pursuant to Section 423 of the Internal Revenue Code, participating employees in the 423 Component of the ESPP are able to enjoy favorable tax treatment with regard to the shares purchased including the deferral of tax liability until the shares are sold and the taxing of any gain at capital gains rates. The required holding period to receive capital gains for favorable income tax treatment upon disposition of common stock acquired under the ESPP is two years after the deemed “option” is granted (the first day of the offering period). When the common stock is disposed of prior to the expiration of the required holding period, the participant recognizes ordinary income to the extent of the difference between the price actually paid for the common stock and the fair market value of the common stock on the date the option was exercised (the purchase date), regardless of the price at which the common stock was sold.

New Plan Benefits

Participation in the ESPP is entirely within the discretion of the eligible employees of the Company. As a result, the Company cannot forecast the extent of future participation. Therefore, the Company has omitted the tabular disclosure of the benefits or amounts allocated under the ESPP.

Registration With the SEC

If the ESPP is approved by our shareholders, we intend to file a registration statement on Form S-8 registering the shares reserved for issuance under the ESPP.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE ZURN ELKAY WATER SOLUTIONS CORPORATION EMPLOYEE STOCK PURCHASE PLAN.

14

PROPOSAL 5: RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2024

The board of directors proposes that the stockholders ratify the selection by the Audit Committee of EY to serve as the Company’s independent registered public accounting firm for 2024. In making its decision to reappoint EY for 2024, the Audit Committee considered the qualifications, performance and independence of EY and the audit engagement team, the quality of its discussions with EY and the fees charged for the services provided. EY has served as Zurn Elkay’s, or its predecessor companies’, independent registered public accounting firm since 2002. Pursuant to the Sarbanes-Oxley Act and regulations promulgated by the SEC thereunder, the Audit Committee is directly responsible for the appointment of the independent registered public accounting firm. Although stockholder ratification of the Audit Committee’s selection of the independent registered public accounting firm is not required by our bylaws or otherwise, we are submitting the selection of EY to our stockholders for ratification to permit stockholders to participate in this important decision. If the stockholders fail to ratify the Audit Committee’s selection of EY as the Company’s independent registered public accounting firm for 2024 at the annual meeting, the Audit Committee will reconsider the selection, although the Audit Committee will not be required to select a different independent registered public accounting firm. Representatives of EY will be at the annual meeting to answer your questions and to make a statement if they so desire.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE AUDIT COMMITTEE’S SELECTION OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2024.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the board of directors, which was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act, oversees and monitors the participation of Zurn Elkay’s management and independent auditors throughout the financial reporting process and approves the hiring, retention and fees paid to the independent auditors. The board of directors has adopted a written charter for the Audit Committee, which includes among other things, the duties and responsibilities of the Audit Committee; the current version of the charter is available on Zurn Elkay’s website. Management has the primary responsibility for the financial statements and the reporting process, including internal control over financial reporting. The independent registered public accounting firm is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles and an opinion on the effectiveness of the Company’s internal control over financial reporting.

During 2023, the Audit Committee discussed with management its evaluation of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2023, and discussed with the independent auditors their evaluation of the effectiveness of the Company’s internal control over financial reporting. The Audit Committee also discussed with the Company’s internal auditors and the independent auditors the overall scope and plans for their respective audits. The Audit Committee met with the Company’s internal auditors and the independent auditors, with and without management present, to discuss the results of their examinations and their evaluations of the Company’s internal controls.

The Audit Committee also generally reviews other transactions between the Company and interested parties which may involve a potential conflict of interest. Each of Messrs. Bartlett, Butler and Moore is independent as independence is defined in Rule 10A-3 of the Securities Exchange Act and under listing standards of the New York Stock Exchange (the “NYSE”).

In connection with its function to oversee and monitor the financial reporting process of Zurn Elkay and in addition to its quarterly review of interim unaudited financial statements, the Audit Committee has done the following:

| • | reviewed and discussed the audited financial statements for the year ended December 31, 2023, with Zurn Elkay management; |

15

| • | discussed with EY, Zurn Elkay’s independent auditors, those matters which are required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC; and |

| • | received the written disclosure and the letter from EY required by the applicable standards of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with EY its independence. |

Based on the foregoing, the Audit Committee recommended to the board of directors that the audited financial statements be included in Zurn Elkay’s Annual Report on Form 10-K for the year ended December 31, 2023. The Audit Committee further confirmed the independence of EY.

Members of the Audit Committee at the time of the filing of the Annual Report on Form 10-K and who approved this report:

George C. Moore (Chair)

Mark S. Bartlett

Don Butler

16

AUDITORS

Fees and Services

Fees paid to EY for services for 2023 and 2022 were as follows:

| 2023 | 2022 | |||||||

Audit fees: | $ | 1,753,750 | $1,467,000 | |||||

Audit-related fees: | 0 | 86,000 | ||||||

Tax fees: | 202,680 | 236,490 | ||||||

All other fees: | 0 | 0 | ||||||

The above amounts relate to services provided for the indicated periods, irrespective of when they were billed. Audit fees included services and expenses related to 2023 and 2022 financial statement audits, including quarterly reviews and certain statutory audits of foreign subsidiaries. Audit-related fees principally include due diligence, accounting consultations and audits in connection with the Elkay Merger. Tax services consisted of tax return preparation, tax audit assistance and various other tax-related consulting projects. The Audit Committee considered the compatibility of the audit and non-audit services provided by EY with the maintenance of that firm’s independence.

Audit Committee Pre-Approval Policies and Procedures

All of the services described above were approved by the Audit Committee in advance of the services being rendered.

The Audit Committee is responsible for the appointment, compensation, oversight and evaluation of the work performed by the independent registered public accounting firm. The Audit Committee must pre-approve all audit (including audit-related) services and permitted non-audit services provided by the independent registered public accounting firm in accordance with the pre-approval policies and procedures established by the Audit Committee.

The Audit Committee annually approves the scope and fee estimates for the quarterly reviews, year-end audit, statutory audits, acquisition due diligence and tax work to be performed by the Company’s independent registered public accounting firm for the next fiscal year. With respect to other permitted services, management defines and presents specific projects and categories of service for which the advance approval of the Audit Committee is requested. The Audit Committee pre-approves specific engagements, projects and categories of services on a fiscal year basis, subject to individual project thresholds and annual thresholds. In assessing requests for services by the independent registered public accounting firm, the Audit Committee considers whether such services are consistent with the auditor’s independence, whether the independent registered public accounting firm is likely to provide the most effective and efficient service based upon its familiarity with the Company, and whether the service could enhance the Company’s ability to manage or control risk or improve audit quality. In making its recommendation to ratify the appointment of EY as our auditor for 2024, the Audit Committee has considered whether the non-audit services provided by them are compatible with maintaining their independence. The Chief Financial Officer regularly reports to the Audit Committee regarding the aggregate fees for which the independent registered public accounting firm has been engaged for such engagements, projects and categories of services compared to the approved amounts.

17

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

We remain committed to robust corporate governance practices that provide meaningful rights to our stockholders and ensure Board and management accountability, ultimately supporting long-term value creation for our stockholders.

Corporate Governance Highlights

| Effective Board Leadership and Independent Oversight |

| Stockholder Rights | ||||||

✓ CEO is the only non-independent director ✓ Focus on refreshment: 5 new directors added since 2019 who expand the Board’s diversity, perspectives, and skills ✓ Lead independent director with specified duties and responsibilities ✓ Director retirement policy at age 75 ✓ Board benefits from diverse experiences and backgrounds ✓ 30% female representation on the Board ✓ Director and committee evaluations performed annually ✓ 100% independence on key committees of the Board |

✓ Directors who do not receive a majority of votes cast in uncontested elections must offer their resignation ✓ One share, one vote (no dual-class stock) ✓ Majority standard for approval of mergers and bylaw and charter amendments ✓ Annual say-on-pay voting ✓ Annual shareholder outreach conducted to solicit feedback from investors ✓ Nominating and Corporate Governance Committee regularly reassesses adequacy of Company’s overall corporate governance framework | |||||||

Engaged Board with the Right Skills and Expertise to Oversee Value Creation

The following charts highlight Board composition and key skills of our director nominees and continuing directors on the Board. Additional information about each director’s experience and qualifications is set forth in their profiles, starting on page 21.

| ZURN ELKAY’S BOARD OF DIRECTORS | ||||||||||

| Director | Independent | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Sustainability Committee | |||||

Todd A. Adams ($) | CEO | |||||||||

Mark S. Bartlett ($) | X | X | ||||||||

Don Butler ($) | X | X | X | |||||||

Thomas D. Christopoul ($) | X | Chair | ||||||||

Timothy J. Jahnke ($) | X | |||||||||

David C. Longren | X | X | Chair | |||||||

Emma M. McTague | X | X | X | |||||||

George C. Moore ($) | X | Chair | X | |||||||

Rosemary Schooler | X | X | ||||||||

Peggy N. Troy | X | Chair | X | |||||||

$ – Financial expertise

18

DIRECTOR SKILL AND DIVERSITY MATRIX

Our Board is comprised of committed, qualified individuals with a diverse and complementary blend of skills, business and personal experiences, backgrounds and expertise, including the following:

| Adams | Bartlett | Butler | Christopoul | Jahnke | Longren | McTague | Moore | Schooler | Troy | |||||||||||

| Qualifications and Experience | ||||||||||||||||||||

Public Company CEO/COO | X | X | X | X | ||||||||||||||||

Financial & Accounting | X | X | X | X | X | X | ||||||||||||||

Global Operations | X | X | X | X | X | X | X | X | X | |||||||||||

Industry Experience | X | X | X | X | X | X | X | |||||||||||||

Public Company Director | X | X | X | X | X | |||||||||||||||

Manufacturing | X | X | X | X | X | X | ||||||||||||||

HR & Compensation | X | X | X | X | X | X | ||||||||||||||

Corporate Governance | X | X | X | X | X | X | X | |||||||||||||

Cybersecurity | X | X | X | |||||||||||||||||

Sustainability | X | X | X | X | X | X | ||||||||||||||

| Demographics and Board Tenure | ||||||||||||||||||||

Diversity (Gender) | • | • | • | |||||||||||||||||

Diversity (Race) | • | |||||||||||||||||||

Age (at Annual Meeting) | 53 | 73 | 60 | 59 | 64 | 65 | 50 | 68 | 56 | 72 | ||||||||||

Board Tenure | 15 | 12 | 3 | 11 | 2 | 8 | 1 | 9 | 5 | 5 |

Selection Criteria for Directors

The Company believes it is important for its board to be comprised of individuals with diverse backgrounds, skills and experiences. Zurn Elkay’s board member selection criteria include:

| • | Personal and professional integrity, ethics and values. |

| • | Experience in corporate or financial management, such as serving as an officer or former officer of a publicly held company. |

| • | Experience in the Company’s industry and with relevant social policy concerns. |

| • | Experience as a board member of another publicly held company. |

| • | Academic expertise in an area of the Company’s operations or financial or other areas relevant to the Company. |

19

| • | Practical and mature business judgment. |

| • | Such other criteria as the board or the nominating and corporate governance committee may from time to time determine. |

In addition to the board member selection criteria identified above, the board and the Nominating and Corporate Governance Committee review the board’s composition annually to ensure the right mix of skills, experience and backgrounds needed for the foreseeable future, and will change the membership mix of the board as required to meet such needs. Important skills and experiences currently identified are as follows:

| • | Significant chief executive officer and/or chief operating officer experience in a publicly traded company, or a major division of a publicly traded company. |

| • | International experience, with an understanding of conducting business on a global basis. |

| • | Financial and accounting skills and experience in a public accounting firm or a public company, preferably with controller and/or chief financial officer experience, in order to fulfill the SEC requirements of an audit committee “financial expert.” |

| • | Relevant manufacturing management background from a well-respected manufacturing-based company. |

| • | Considerable human resources management experience involving the design of both short- and long-term compensation programs, an understanding of benefit plans and experience managing succession planning and leadership development for a successful company. |

| • | Experience in one or more of the industries that are served by the Company. |

The Company’s Corporate Governance Guidelines provide that, if a director experiences a significant change in employment status from the status when that director was most recently elected to the board, the director must inform the chairperson of the change and offer a letter of resignation. The Nominating and Corporate Governance Committee will evaluate the director’s change in status and the board will then decide whether to accept or decline the director’s resignation. The Corporate Governance Guidelines also provide that, as a general policy, executive officers of the Company who are directors will resign from the board upon the termination of their employment with the Company. In addition, the Company’s Corporate Governance Guidelines provide that the board generally will not nominate individuals for election or re-election as directors after they have attained age 75, although a director who reaches age 75 during a term may continue to serve for the remainder of the director’s term. Further, the Corporate Governance Guidelines require directors to advise the chairperson of the board and the chairperson of the Nominating and Corporate Governance Committee in advance of accepting an invitation to serve on another board. A non-executive director of the board may serve as a director of another public company only to the extent such position does not conflict or interfere with such person’s service as a director of the Company; an executive director may not serve as a director of another public company without the board’s consent.

The Company’s Corporate Governance Guidelines and Nominating and Corporate Governance Committee Charter state that the Nominating and Corporate Governance Committee will identify candidates without regard to any candidate’s race, color, disability, gender, national origin, religion or creed. The board believes that the use of the Nominating and Corporate Governance Committee’s general criteria, along with non-discriminatory policies, will best promote a board that shows diversity in many respects.

Nominees for Election at this Meeting

Our bylaws provide that the number of directors shall be not less than eight or more than 15, with the number to be set by the board from time to time. Currently, the size of the Board is 10 members. The board sets its size so that the board will possess, in the aggregate, the strategic, managerial and financial skills and experience necessary to fulfill its duties and to achieve its objectives as well as to maintain a sufficient number of independent directors.

20

Our board of directors is divided into three classes. The members of each class serve staggered, three-year terms. Upon the expiration of the term of a class of directors, directors in that class are elected for three-year terms at the annual meeting of stockholders in the year in which their term expires. Any additional directorships resulting from an increase in the number of directors are distributed among the three classes so that, as nearly as possible, each class consists of one-third of our directors. From time to time, a director is elected to a class with a shorter term, or moved into a different class, to rebalance the classes. Our executive officers and key employees serve at the discretion of our board of directors. Directors may be removed for cause by the affirmative vote of the holders of a majority of our common stock.

Directors are elected by a plurality of votes cast in person or by proxy at the meeting and entitled to vote on the election of directors. Our bylaws provide that if any nominee does not receive, in an uncontested election, a majority of the votes cast for his or her election as a director, such individual must submit, promptly following such vote, an irrevocable resignation from the board that is contingent upon acceptance of such resignation by the board.

Stockholders are being asked to elect three directors to serve for three-year terms expiring at the annual meeting to be held in 2027. This year’s board nominees for election for terms expiring at the 2027 annual meeting of stockholders are Todd A. Adams, George C. Moore and Rosemary Schooler.

It is our policy that the board of directors should reflect a broad diversity of backgrounds, experience, perspectives and talents. When the Nominating and Corporate Governance Committee of the board determines which directors to nominate for election at any meeting of stockholders, or appoints a new director between meetings, it reviews our director selection criteria and seeks to choose individuals who bring a variety of expertise to the board within these criteria. For further information about the criteria used to evaluate board membership, see “Selection Criteria for Directors” above.

The following is information about the experience and attributes of the director nominees and Zurn Elkay’s other directors. Together, the experience and attributes included below provide the reasons that these individuals were selected for board membership and/or nominated for election, as well as why they continue to serve on the board.

Nominees for Election for Terms Expiring at the 2027 Annual Meeting

| Todd A. Adams Chairman of the Board and CEO, Zurn Elkay Age: 53 Director Since: 2009 Chairman Since: 2020 |

Professional Experience: Mr. Adams currently serves as Chairman of the Board and Chief Executive Officer of Zurn Elkay. Mr. Adams joined us in 2004 and has served in various roles, including President and Chief Financial Officer. Mr. Adams is also a director and member of the audit and compliance committee of Badger Meter, Inc.

Qualifications: Mr. Adams serves on our board of directors because he has significant experience in the manufacturing industry and an in-depth knowledge of Zurn Elkay and our business as well as because he is our Chief Executive Officer.

21

| George C. Moore Executive Chairman, IPS Corporation Age: 68 Director Since: 2015 |

Professional Experience: Mr. Moore has served as a director of: IPS Corporation, a provider of solvent cements and adhesives for residential, commercial and industrial use, as well as plumbing and roofing products, since 2017, and Executive Chairman since 2021; Cypress Performance Group LLC, the parent holding company of Encapsys, LLC and IPS Corporation, since 2017; and CP Atlas Parent Holdings, L.P. (aka American Bath Group), a bathware manufacturer, since 2021. Mr. Moore served as a director of Encapsys, LLC, a provider of custom microencapsulation services for use in the building and construction, paper, bedding, and personal and household care industries, from 2015 until 2021; Culligan International Company, a provider of residential, office, commercial and industrial water treatment products and services, from 2018 until 2021; Industrial Container Services, LLC, a provider of reusable container solutions, from 2017 until 2018; Wastequip, Inc., a leading manufacturer of waste handling and recycling equipment in North America, from 2012 until 2018; and Pro Mach, Inc., a provider of integrated packaging and processing products and solutions, from 2015 until 2018. Mr. Moore previously served in various capacities with Zurn from 2006 to 2012. Prior thereto, Mr. Moore served as the Executive Vice President and Chief Financial Officer of Maytag Corporation, a manufacturer of major appliances and household products, and as group chief financial officer and group vice president of finance at Danaher Corporation, a manufacturer of process/environmental controls and tools and components. Mr. Moore began his career at Arthur Andersen & Co., a former accounting firm.

Qualifications: Mr. Moore serves as a director due to his extensive financial and accounting experience, including as chief financial officer, at multinational companies.

| Rosemary Schooler Retired Corporate Vice President, Global Data Center Sales, Intel Corporation Age: 56 Director Since: 2019 |

Professional Experience: Ms. Schooler retired in 2022 as Corporate Vice President, Global Data Center Sales for Intel Corporation (“Intel”), a designer and manufacturer of computing, networking, data storage and communications solutions, a position held since 2018. Since joining Intel in 1989, Ms. Schooler held various leadership positions, including serving as Intel’s Corporate Vice President, Global Internet of Things (“IoT”) Sales and Marketing from 2016 to 2018, Vice President of the IoT Strategy and Technology Office from 2015 to 2016, and as Vice President and General Manager of Intel’s Communications and Storage Infrastructure Group prior thereto. Ms. Schooler currently serves as director and member of the compensation and audit committees of ARM Holdings. She is also a board member of privately owned Densify. Ms. Schooler previously served as a director and member of the nominating and governance committee of Cloudera, Inc. (before it went private in 2021).

Qualifications: Ms. Schooler serves as a director due to her extensive information technology experience, including service as a senior executive at a prominent technology company.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE.

22

Shares represented by proxies will be voted according to instructions provided. A vote marked “withheld” will be considered as a vote withheld from the nominees; any votes attempted to be cast “against” a candidate are not given legal effect and are not counted as votes cast in the election of directors. In the unlikely event that the board learns prior to the annual meeting that a nominee is unable or unwilling to act as a director, which is not foreseen, the proxies will be voted with discretionary authority for a substitute nominee designated by the board of directors.

Continuing Directors Not Standing for Election at this Meeting

Directors Continuing to Serve Until the 2025 Annual Meeting

| Mark S. Bartlett Retired Partner, Ernst & Young LLP Age: 73 Director Since: 2012 Lead Director Since: 2020 |

Professional Experience: Mr. Bartlett has served as the lead director of Zurn Elkay’s Board since July 2020. Mr. Bartlett joined Ernst & Young LLP (“EY”) in 1972 and worked there until his retirement in 2012, including having served as Managing Partner of EY’s Baltimore office and as Senior Client Service Partner for the Mid-Atlantic Region. Mr. Bartlett is a certified public accountant and has extensive experience serving global manufacturers, as well as companies in other industries. Mr. Bartlett also has experience in mergers and acquisitions, SEC rules and regulations, public offerings and financing alternatives. Mr. Bartlett currently serves as a director, chairman of the audit committee and member of the executive compensation and management development committee of T. Rowe Price Group, Inc., as a director, chairman of the audit committee and member of the compensation committee of WillScot Mobile Mini Holdings Corporation (formerly known as WillScot Corporation), and as a director and member of the audit committee of FTI Consulting, Inc.

Qualifications: Mr. Bartlett serves as a director due to his significant accounting experience, as well as his expertise in the manufacturing industry, and in mergers and acquisitions and securities regulation. The board has considered Mr. Bartlett’s commitments to serve on the other audit committees and has affirmatively determined that such simultaneous service does not impair his ability to effectively serve on Zurn Elkay’s Audit Committee.

23

| Don Butler Retired Executive Director, Connected Vehicle Ford Motor Company Age: 60 Director Since: 2021 |

Professional Experience: Mr. Butler is the retired Executive Director, Connected Vehicles of Ford Motor Company (“Ford”) a designer, manufacturer and servicer of vehicles. He held such position from 2014 until his retirement in 2020. Prior to joining Ford, Mr. Butler held various leadership positions with increasing responsibility at General Motors Company, a designer and manufacturer of vehicles, including Vice President, Marketing and Global Strategy, Cadillac, Chairman and Managing Director, General Motors Egypt and Vice President, OnStar, from 1981 to 2013. Mr. Butler previously served on the boards of the 5G Automotive Association and SmartDeviceLink Consortium (chairman). He currently serves on the board of a private company, INRIX, a mobility data services and software company.

Qualifications: Mr. Butler serves as a director due to his extensive engineering, marketing, product development and information technology experience, including connected products, and leadership experience at large organizations.

| Timothy J. Jahnke Retired Chairman, Elkay Manufacturing Company Age: 64 Director Since: 2022 |

Professional Experience: Mr. Jahnke is the retired Chairman of the Board of Directors of Elkay Manufacturing Company. Mr. Jahnke joined Elkay in 2007 as President and CEO, positions he held until his retirement in 2019. Following his retirement, he continued to serve as Chairman of Elkay through the time of Elkay’s merger with the Company in 2022. During the pendency of the merger with the Company, he also served as interim President and CEO for a brief period in 2022. Mr. Jahnke was also a director of Elkay from 2008 to 2022. Prior to joining Elkay, Mr. Jahnke served in various roles of increasing responsibility with Newell Brands, a marketer and manufacturer of branded consumer products, including President, Anchor Hocking Specialty Glass, Chief Human Resources Officer, Newell Rubbermaid and Group President, Home & Family Products Group, from 1986 to 2007. Mr. Jahnke serves an advisor to the board of directors of Wahl Clipper Company, a manufacturer of professional and home grooming equipment, and a board member of Elkay Interior Systems, Inc., and Your 6, both of which are privately owned businesses.

Qualifications: Mr. Jahnke serves as a director due to his extensive knowledge of the Elkay business and varied business experience.

24

| David C. Longren Retired Senior Vice President, Polaris Industries, Inc. Age: 65 Director Since: 2016 |

Professional Experience: Mr. Longren is a retired Senior Vice President of Polaris Industries, Inc. ,a designer, engineer and manufacturer of off-road vehicles, snowmobiles, motorcycles and small vehicles. He held such position from 2015 until his retirement in 2016. Mr. Longren joined Polaris in 2003 and served in various capacities with increasing responsibility, including President, Off-Road Vehicles, Vice President, Chief Technical Officer, and Director of Engineering for the ATV Division. Prior thereto, Mr. Longren was a Vice President in the Weapons Systems Division of Alliant Techsystems and Senior Vice President, Engineering and Marketing at Blount Sporting Equipment Group. He currently serves on the board of three private companies, Horton Worldwide, a provider of premium engine-cooling solutions for OEM applications and the aftermarket, Northern Tool, a supplier and manufacturer of tools and equipment, and United Tactical Systems, an ordnance and accessories manufacturer.

Qualifications: Mr. Longren serves as a director due to his extensive product development, innovation and marketing experience.

Directors Continuing to Serve Until the 2026 Annual Meeting

| Thomas D. Christopoul Co-founder and Managing Partner, Iviron Capital Partners Age: 59 Director Since: 2013 |

Professional Experience: Mr. Christopoul is Founder and Managing Partner of Iviron Capital Partners, a real estate private equity investment firm and was a founding principal of both 54 Madison Partners and Athos Real Estate Partners, both precedent investment funds of Iviron since 2015. He previously served as a Senior Partner and Head of Real Estate Investment, at Cain Hoy Enterprises, LLC, an investment firm launched by Guggenheim Partners. Prior to that time, Mr. Christopoul was a Senior Managing Director in the Real Estate Group at Guggenheim Partners. Previously, he was a senior advisor at Falconhead Capital, LLC, a boutique private equity firm in New York City, and served as executive chairman of two of Falconhead’s portfolio companies—GPSi Holdings, LLC and Rita’s Water Ice Franchise Company. Mr. Christopoul is also an active venture capital investor through Somerset Shore Associates, Inc., a private investment company.

Qualifications: Mr. Christopoul serves as a director due to his significant and varied business experience.

25

| Emma M. McTague Senior Vice President and Chief Human Resources Officer, Oshkosh Corporation Age: 50 Director Since: 2023 |