Exhibit 99.1

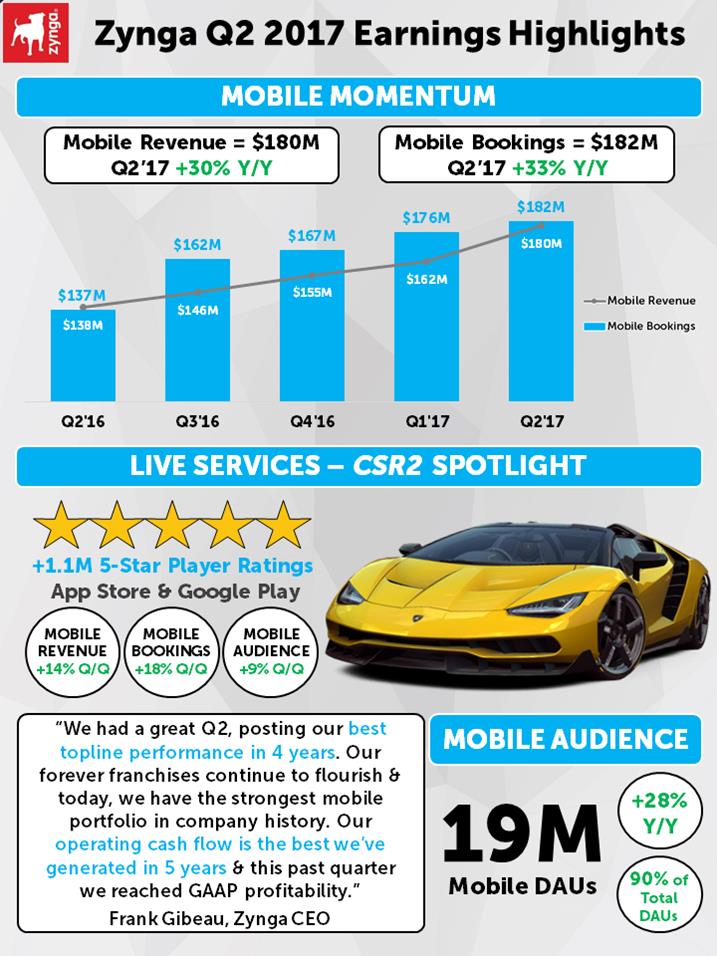

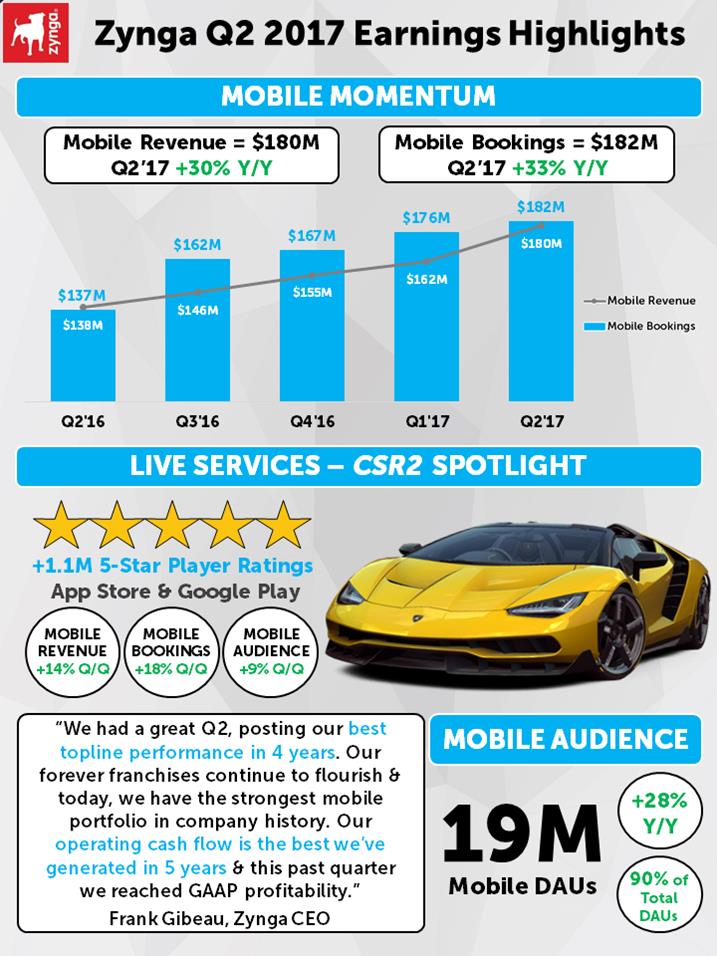

Zynga Q2 2017 Earnings Highlights MOBILE MOMENTUM Mobile Revenue = $180M Q2’17 +30% Y/Y Mobile Bookings = $182M Q2’17 +33% Y/Y $137M $138M Q2'16 $162M $146M Q3'16 $167M $155M Q4'16 $176M $162M Q1'17 $182M $180M Q2'17 LIVE SERVICES – CSR2 SPOTLIGHT +1.1M 5-Star Player Ratings App Store & Google Play MOBILE REVENUE +14% Q/Q MOBILE BOOKINGS +18% Q/Q MOBILE AUDIENCE+9% Q/Q “We had a great Q2, posting our best topline performance in 4 years. Our forever franchises continue to flourish & today, we have the strongest mobile portfolio in company history. Our operating cash flow is the best we’ve generated in 5 years & this past quarter we reached GAAP profitability.” Frank Gibeau, Zynga CEO MOBILE AUDIENCE 19M Mobile DAUs +28%Y/Y 90% of Total DAUs

ZYNGA – Q2 2017 QUARTERLY EARNINGS LETTER

August 2, 2017

Dear Shareholders,

We look forward to discussing our Q2 results during today’s earnings call at 2:30 p.m. PT. Below, you’ll find our quarterly earnings letter which details our performance over the last quarter and progress in our turnaround, as well as outlook for Q3 and key areas of focus for the second half of 2017 and beyond. Please note that we manage our business based on several topline measures, including revenue, which is comprised of deferred revenue and bookings. Revenue and deferred revenue are both directly affected by bookings results, and our management team utilizes bookings as a primary topline measure to help inform their decisions.

HIGHLIGHTS

We’re pleased with our performance in the first half of the year. As we progress through our turnaround, our strategy to innovate and grow our existing live services and sharpen our operating model continues to deliver encouraging results.

Highlights from the quarter include:

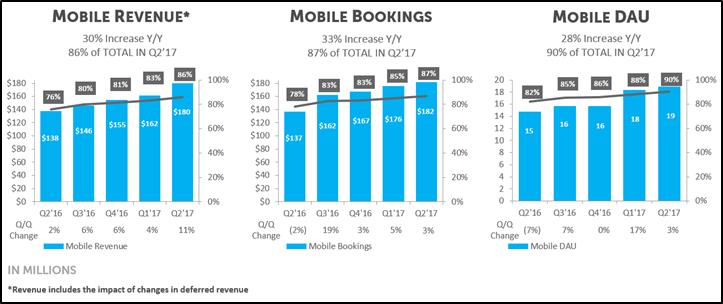

| • | We achieved record mobile revenue and bookings, with revenue up 30% year-over-year and bookings up 33% year-over-year. Mobile now represents 86% and 87% of our total revenue and total bookings, respectively. |

| • | Mobile online game – or user pay – revenue was up 39% year-over-year, and mobile user pay bookings were up 45% year-over-year. Both mobile user pay revenue and bookings were the best in Zynga’s history. |

| • | Mobile audience reached 19 million average daily active users (DAUs), up 28% year-over-year and the strongest year-over-year growth we’ve seen since Q4 2014. |

| • | GAAP operating expenses for the quarter were 67% of revenue – down from 73% of revenue in Q2 2016 – and non-GAAP operating expenses were 58% of bookings – down from 68% of bookings a year ago. |

| • | We delivered our first quarter of GAAP pre-tax profit since Q4 2012, due in part to progress in improving our operating leverage and our lowest quarter of stock-based compensation expense in more than three years. |

| • | We generated operating cash flow of $37.8 million, which was our best quarterly performance in five years. |

| • | CSR2 delivered strong results in the quarter, reflecting our commitment to invest in our forever franchises. In Q2, the game celebrated its 1-year anniversary and drove sequential growth of 14% in mobile revenue and 18% in mobile bookings. |

| • | Today we’re announcing that we’ve entered a 9-year lease term with Airbnb as an anchor tenant in our San Francisco headquarters which takes effect in Q1 2018. |

EXECUTIVE SUMMARY

(in millions) | Q2'17 Actuals | | | Q2'16 Actuals | | | Variance $ (Y/Y) | | | Variance % (Y/Y) | | | Q2'17 Guidance | | | Variance $ (Guidance) | | | Variance % (Guidance) | |

Revenue | $ | | 209.2 | | | $ | | 181.7 | | | $ | | 27.5 | | | | 15 | % | | $ | | 200.0 | | | $ | | 9.2 | | | | 5 | % |

Net income (loss) | $ | | 5.1 | | | $ | | (4.4 | ) | | $ | | 9.5 | | | NM | | | $ | | (6.0 | ) | | $ | | 11.1 | | | NM | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bookings | $ | | 209.2 | | | $ | | 174.7 | | | $ | | 34.5 | | | | 20 | % | | $ | | 205.0 | | | $ | | 4.2 | | | | 2 | % |

Adjusted EBITDA (1) | $ | | 29.9 | | | $ | | 18.6 | | | $ | | 11.3 | | | | 61 | % | | $ | | 19.0 | | | $ | | 10.9 | | | | 58 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Change in deferred revenue | $ | | (0.1 | ) | | $ | | (7.1 | ) | | $ | | 7.0 | | | NM | | | $ | | 5.0 | | | $ | | (5.1 | ) | | NM | |

(1) | Zynga's methodology for computing Adjusted EBITDA includes the impact of changes in deferred revenue. This methodology has also been applied for the second quarter of 2016, which was previously reported without the inclusion of deferred revenue before we applied the SEC Compliance and Disclosure Interpretations released on May 17, 2017. |

1

In Q2, revenue was $209.2 million, above our guidance by $9.2 million and up 15% year-over-year. We had net income of $5.1 million, better than our guidance by $11.1 million and an improvement of $9.5 million year-over-year. In terms of our bookings performance, our teams delivered $209.2 million, beating our guidance by $4.2 million and up 20% year-over-year. This quarter represented our strongest revenue and bookings performance in four years and our best year-over-year performance since Q2 2015. The over delivery in the quarter was driven by better than expected results from our portfolio of live services. We had a net release in deferred revenue of $0.1 million versus our guidance for a net increase in deferred revenue of $5 million. Our Adjusted EBITDA, which includes the impact of changes in deferred revenue, was $29.9 million, above our guidance by $10.9 million. We delivered operating cash flow of $37.8 million – our best quarterly performance in five years. Our Q2 performance was primarily due to our bookings beat, the net release in our deferred revenue and lower than expected operating expenses. While we’re progressing in our turnaround, we still have more work to do to unlock Zynga’s full potential.

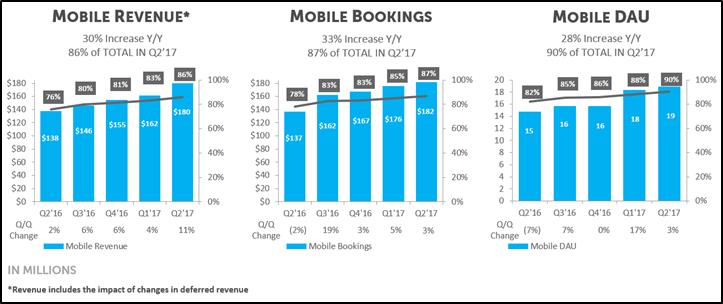

We’re particularly pleased with the trends we’re seeing in mobile. In Q2, we achieved record mobile revenue and bookings, with revenue up 30% year-over-year and bookings up 33% year-over-year. Mobile revenue now represents 86% of total revenue, up from 76% one year ago and mobile bookings represents 87% of our total bookings, up from 78% a year ago. Mobile user pay revenue was up 39% year-over-year, and mobile user pay bookings were up 45% year-over-year – both of which were the best in Zynga’s history. We also saw encouraging growth in audience where we reached 19 million average DAUs, up 28% year-over-year and the strongest year-over-year growth we’ve seen in more than two years.

Q2 was driven by the continued strength of our live services and momentum of our forever franchises, particularly in CSR2 and Social Slots. CSR2, which celebrated its 1-year anniversary at the end of June, delivered sequential growth of 14% in mobile revenue and 18% in mobile bookings. The game’s strong performance was due to a steady cadence of exclusive events and bold beats for players anchored by licensing deals with Universal Brand Development’s Fast & Furious and world-class partnerships with iconic auto manufacturers such as Lamborghini. We’re proud CSR2 has maintained its position as the #1 Top Grossing Racing game in the U.S. App Store since the day it launched. The game has more than 1.1 million 5-star player reviews in the App Store and Google Play combined – a testament to its high quality player experience. CSR2 also saw impressive gains in audience, with average mobile DAUs up 9% this quarter. We look forward to innovating for fans of this forever franchise and delivering new racing experiences for years to come.

In our Social Slots franchise, our goal has been to increase engagement and player monetization across our portfolio. This focus is starting to deliver meaningful results. In Q2, Social Slots drove the highest monetization levels in franchise history, based primarily on the performance of Wizard of Oz Slots. Overall, the team delivered a strong quarter with mobile revenue up 6% and mobile bookings up 4% sequentially. Going forward, the team is blending best in class content with data science to bring players a more customized experience and strengthen long-term engagement. Over the coming quarters, we expect to create a more connected network across our Social Slots products where we can reward and retain our players over time.

Turning to our operating model, we continue to make strides in improving our operating efficiency. In Q2, we began winding down NaturalMotion’s third party licensing and middleware businesses, which we determined weren’t core to our future growth. We continue to invest in our India studio with new leadership and a broader live services portfolio. In Q2, we completed the transition of operations for FarmVille 2: Country Escape to our studio in India, and later this quarter we’ll begin to transition FarmVille: Tropic Escape to the studio. This team has been effectively managing our FarmVille games on the web for years, and we’re confident in this talented team’s ability to entertain our mobile players.

We’re being deliberate about our new IP development by pursuing the categories and emerging platforms where we believe we can win over the long-term. To that end, we recently decided to cease development of Mafia Wars, an MMO game we were testing in soft launch. We have a high bar for our new releases, and didn’t believe the game had the potential to be a successful forever franchise for us given the soft launch metrics and projected investment needed to compete in this genre. We see better opportunities to expand our leadership position within each of the categories in which we compete by building new IP and innovating within our existing franchises through bold beats and pursuing our mass market, social vision for gaming.

We also remain focused on unlocking value from the assets on our balance sheet. Today, we’re announcing that we’ve entered a 9-year lease term with Airbnb as an anchor tenant in our San Francisco headquarters. Starting in March 2018, Airbnb will begin a multi-phased plan to lease approximately 287,000 square feet in our building’s east tower. Going forward, we’ll continue to optimize our footprint within the building and pursue additional leasing opportunities.

Overall, we’ve seen a marked improvement year-over-year in profitability, cash flow, revenue and bookings, as we continue to make progress in our turnaround. We’re pacing well against our strategy of growing our existing live services as a top priority and continuing to drive efficiencies across our business. In Q2, GAAP operating expenses for the quarter were 67% of revenue – down from 73% of revenue in Q2 2016 – and non-GAAP operating expenses were 58% of bookings – down from 68% of bookings a year ago. We delivered our first quarter of GAAP pre-tax profit since Q4 2012,

2

due in part to progress in improving our operating leverage and our lowest level of stock-based compensation expense in more than three years.

As we enter the second half of the year, growing our live services continues to be a top priority. Today, we have the strongest mobile portfolio in company history, delivering new highs in revenue and bookings. Across all our forever franchises, we’re taking a longer-term view of our business and focusing on delivering quality and innovation for our players. We believe there’s more opportunity to unlock value with our mobile franchises and are investing in bold beat roadmaps for 2017 and 2018. In addition to live services, new title development will continue to play an important role at Zynga. Looking forward to 2018 and beyond, we’re actively developing new games in categories such as Action Strategy, Casual and Invest Express.

As we move through our turnaround, there’s more work to do to achieve our topline and bottom line goals and we continue to prioritize the long-term health of our business. We’re actively managing our teams towards improving predictability, stability and consistency across our live services. The operational rigor we’ve been implementing, and the changes we’ve been making over the last year are driving some of the best company results we’ve seen in years. We expect to end 2017 with a stronger foundation for the future and more competitive live services. We remain focused on delivering our improved margin goals by the end of 2018 and achieving margins more in line with our peers over the long term.

Q2 PERFORMANCE OVERVIEW

Q2 Financial Highlights

| • | Revenue of $209.2 million; above our guidance; up 15% year-over-year |

| • | GAAP operating expenses of $139.4 million; below our expectations and up 5% year-over-year |

| • | Net income of $5.1 million; above our guidance with an improvement of $9.5 million year-over-year. This is primarily driven by our revenue beat and lower than expected operating expenses. |

| • | Deferred revenue decreased by $0.1 million; below our guidance of a net increase in deferred revenue of $5.0 million |

| • | Bookings of $209.2 million; above our guidance; up 20% year-over-year |

| • | Non-GAAP operating expenses of $121.5 million; below our expectations and up 3% year-over-year |

| • | Adjusted EBITDA, which includes the impact of changes in deferred revenue, of $29.9 million; above our guidance by $10.9 million; up 61% year-over-year. This is primarily due to our bookings beat, the net release in our deferred revenue and lower than expected operating expenses |

| • | Operating cash flow of $37.8 million; up $23.3 million year-over-year |

Q2 Mobile Highlights

| • | Mobile revenue of $179.9 million; up 30% year-over-year; 86% of total revenue as compared to 76% one year ago |

| • | Mobile bookings of $181.6 million; up 33% year-over-year; 87% of total bookings as compared to 78% one year ago |

| • | Average mobile DAUs of 19 million; up 28% year-over-year |

| • | Mobile user pay revenue was up 39% year-over-year, and mobile user pay bookings were up 45% year-over-year – both of which were the best in Zynga’s history |

| • | Apple and Google continue to be our two largest platform partners for user pay revenue and bookings |

3

MOBILE REVENUE* 30% Increase Y/Y 86% of TOTAL IN Q2’ 17 $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 76% 80% 81% 83% 86% $138 $146 $155 $162 $180 Q2’16 Q3’16 Q4’16 Q1’17 Q2’17 Q/Q Change 2% 6% 6% 4% 11% Mobile Revenue MOBILE BOOKINGS 33% Increase Y/Y 87% of TOTAL IN Q2’17 $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 78% 83% 83% 85% 85& $137 $162 $167 $176 $182 Q2’16 Q3’16 Q4’16 Q1’17 Q2’17 Q/Q Change (2%) 19% 3% 5% 3% Mobile Bookings MOBILE DAU 28% Increase Y/Y 90% of TOTAL IN Q2’17 20 18 16 14 12 10 8 6 4 2 0 82% 85% 86% 88% 90% 15 16 16 18 19 Q2’16 Q3’16 Q4’16 Q1’17 Q2’17 100% 80% 60% 40% 20% 0% Q/Q Change (7%) 7% 0% 17% 3% Mobile DAU IN MILLIONS *Revenue includes the impact of changes in deferred revenue

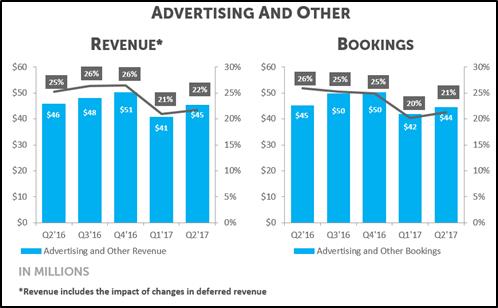

Q2 Advertising Highlights

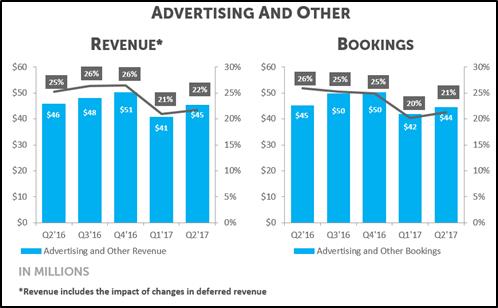

| • | Advertising and other revenue of $45.5 million; down 1% year-over-year. This represented 22% of total revenue compared to 25% one year ago |

| • | Advertising and other bookings of $44.5 million; down 2% year-over-year. This represented 21% of total bookings compared to 26% one year ago |

| • | Given our performance to date and our assessment for the remainder of the year, we expect full year 2017 advertising to decline slightly year-over-year driven by web declines, as well as softness in the mobile gaming advertising market |

| • | Today, we’re announcing a partnership with Unity, a global development platform, to leverage its tools and technology for our rewarded advertising, including our watch-to-earn videos, across our portfolio of mobile games |

ADVERTISING AND OTHER REVENUE* $60 $50 $40 $30 $20 $10 $0 25% 26% 26% 21% 22% $46 $48 $51 $41 $45 Q2’16 Q3’16 Q4’16 Q1’17 Q2’17 30% 25% 20% 15% 10% 5% 0% Advertising and Other Revenue BOOKINGS $60 $50 $40 $30 $20 $10 $0 26% 25% 25% 20% 21% $45 $50 $50 $42 $44 30% 25% 20% 15% 10% 5% 0% Q2’16 Q3’16 Q4’16 Q1’17 Q2’17 Advertising and Other Bookings IN MILLIONS *Revenue includes the impact of changes in deferred revenue

4

Player Metrics (users and payers in millions)

| | Three Months Ended | | | | | | | | | |

| | June 30, | | | March 31, | | | June 30, | | | Q2'17 | | | Q2'17 | |

| | 2017 | | | 2017 | | | 2016 | | | Q/Q | | | Y/Y | |

Average daily active users (DAUs) (1) | | | 21 | | | | 21 | | | | 18 | | | | 1 | % | | | 17 | % |

Average mobile DAUs (1) | | | 19 | | | | 18 | | | | 15 | | | | 3 | % | | | 28 | % |

Average web DAUs (1) | | | 2 | | | | 3 | | | | 3 | | | | (12 | )% | | | (32 | )% |

| | | | | | | | | | | | | | | | | | | | |

Average monthly active user (MAUs) (1) | | | 80 | | | | 72 | | | | 61 | | | | 11 | % | | | 32 | % |

Average mobile MAUs (1) | | | 71 | | | | 63 | | | | 49 | | | | 13 | % | | | 45 | % |

Average web MAUs (1) | | | 9 | | | | 9 | | | | 12 | | | | (5 | )% | | | (23 | )% |

| | | | | | | | | | | | | | | | | | | | |

Average daily bookings per average DAU (ABPU) | | $ | 0.109 | | | $ | 0.107 | | | $ | 0.107 | | | | 2 | % | | | 2 | % |

Average monthly unique users (MUUs) (2) | | | 52 | | | | 56 | | | | 50 | | | | (7 | )% | | | 4 | % |

Average monthly unique payers (MUPs) (2) | | | 1.2 | | | | 1.3 | | | | 0.9 | | | | (6 | )% | | | 33 | % |

Payer conversion (2) | | | 2.3 | % | | | 2.3 | % | | | 1.8 | % | | | 2 | % | | | 28 | % |

(1) | For the first quarter of 2017, Daily Celebrity Crossword, our Solitaire games and our Facebook Messenger games are included incrementally in DAU and MAU because we do not have the third party network login data to link an individual who has played under multiple user accounts. As such, actual DAU and MAU may be lower than reported due to the potential duplication of these individuals. |

(2) | For the first and second quarters of 2017, MUUs and MUPs exclude Daily Celebrity Crossword, our Solitaire games and our Facebook Messenger games. For the second quarter of 2016, MUPs exclude Black Diamond Casino, Vegas Diamond Slots, Yummy Gummy and Crazy Kitchen. |

FINANCIAL GUIDANCE

Q3 Guidance

| • | Net income of $7 million |

| • | Net release of deferred revenue of $5 million |

| • | Bookings of $205 million |

| • | Adjusted EBITDA, which includes the impact of changes in deferred revenue, of $30 million |

There are several factors to consider in our Q3 guidance as we continue to progress through our turnaround. On a year-over-year basis, we expect our growth to be driven by our live service franchises. We believe this growth will be offset by declines in our web and older games, as well as continued softness in advertising. We also considered seasonality as Q3 has historically seen a dip in player activity on live services. We expect gross margins in Q3 to be in-line with our performance in Q2 and we expect our operating expenses to be down year-over-year in absolute and percentage terms.

OUR PRODUCTS

Social Casino

Zynga Poker – Over the last year, our team reinvested in Zynga Poker’s bold beat roadmap and that work has paid off throughout the first half of the year. The game continues to post promising year-over-year trends with mobile revenue up 61% year-over-year and mobile bookings up 58% year-over-year. Zynga Poker’s audience across mobile DAUs held flat quarter-over-quarter and was up 73% year-over-year. The year-over-year performance of this forever franchise is a testament to the team’s focus on live services and delivering engaging content to our players. This past quarter, we launched a new bold beat for competitive league players – Weekly Playoff Tournaments. This unique, multi-table tournament enables millions of our Zynga Poker players to compete for chips, trophies and status, increasing overall engagement.

Looking ahead, our Zynga Poker team is executing against an ambitious roadmap of innovative events and bold beats, including a 10-year anniversary celebration, designed to build on the momentum we delivered in the first half of the year. We’re also finding new ways to connect fans with the game, including partnering with Amazon and Poker Central on a new TV show with MSNBC called “Monday Night Poker,” which debuted last week. The show puts the brand front and center in real-world poker tournaments and includes a series of Zynga Poker TV commercials that air during the show.

5

Social Slots – Over the last few quarters, our Social Slots team has successfully executed against a more focused portfolio strategy centered on their four anchor products – Wizard of Oz Slots, Hit It Rich! Slots, Willy Wonka and the Chocolate Factory Slots and Black Diamond Casino. Our goal has been to increase engagement and player monetization across our Social Slots portfolio, and the work our team did in the first half of the year is starting to deliver meaningful results. Due to this narrowed focus, in Q2 our Social Slots portfolio drove the highest monetization levels in franchise history. These strong results were based primarily on the performance of Wizard of Oz Slots, which launched a new, social bold beat in Q2 called Tournaments, as well as Hit It Rich! Slots, which introduced an improved VIP experience for players. This past quarter, Social Slots grew sequentially with mobile revenue up 6% and mobile bookings up 4%.

Going forward, the team will continue to focus on live service innovation, specifically by creating a better experience for players by blending best-in-class content with data science to deliver a more customized experience. For the remainder of 2017, our team will be launching a series of new bold beats across our portfolio, including the introduction of an exclusive Hit It Rich! Slots Max Voltage lobby featuring beloved slots brands and content from Ainsworth Gaming Technology, a leader in real-world slots.

Casual

Words With Friends – As we approach the 8-year anniversary of Words With Friends, the team behind this forever franchise is focused on delivering fresh ways for players to engage with the game. This past quarter, mobile revenue was up 3% sequentially and down 15% year-over-year, while mobile bookings were up 2% sequentially and down 16% year-over-year. In Q2, the team continued to test features like Hindsight, Radar and Tile Swap, enlisting player feedback as they add more depth and strategy to the game.

We’re continuing to explore new, mainstream entertainment mediums to connect Words With Friends to audiences around the world. Last month, we announced a partnership with MGM TV to develop a primetime TV show based on Words With Friends and our collection of With Friends games. While it’s early days in the concept and greenlight process, we look forward to how this fun take on the game play might come to life with celebrities and fans. We’re excited about the remainder of the year as we prepare to roll out a bold beat roadmap that delivers our players a greater sense of social competition, progression and achievement.

Crosswords With Friends – We launched Crosswords With Friends in May in partnership with Time Inc.’s People Magazine. The game received strong partner support from Apple and Google, and was also prominently featured on the TODAY Show three times since launch, a testament to the game’s appeal to mass market audiences with a pop culture take on the puzzle genre. Our team is currently focused on adding new social features and events to the game to improve its engagement and increase organic installs.

Wizard of Oz: Magic Match – In our pursuit to create high quality, social games in mass market categories, we’ve been proving out our approach to the Match-3 genre with Wizard of Oz: Magic Match. Over the last year, the team has honed their live service capabilities, launched new innovative features and deepened the player engagement in one of the most competitive mobile gaming genres. Since launching in May 2016, Wizard of Oz: Magic Match has steadily grown in mobile audience and monetization over the past four quarters. Going forward, we see an opportunity in Match-3 to create fun, lightweight experiences that align with the mass market approach we’re taking with the rest of our Casual portfolio.

Emerging Platforms – In Q2, our teams continued to experiment with new platforms, launching GIFs Against Friends in the App Store for iMessage, as well as Words With Friends for Instant Games in May. In the second half of the year, we look forward to bringing additional new experiences to players within messaging platforms. We believe these emerging platforms have the potential to reshape the accessibility and social nature of mobile gaming. Our teams will continue to experiment within these emerging platforms, particularly in terms of audience engagement and – over the longer term – monetization.

6

Action Strategy

CSR2 – We’re particularly pleased with the CSR2 team’s dedication to innovating for players in a live service environment. This past quarter, CSR2 celebrated its 1-year anniversary at the end of Q2 and delivered sequential growth with mobile revenue up 14% and mobile bookings up 18%. The game’s performance in Q2 was driven by a steady cadence of events and bold beats for players, anchored by pop culture licensing deals with Universal Brand Development’s Fast & Furious and world-class partnerships with iconic auto manufacturers such as Lamborghini. This content has helped the game maintain its position as the #1 Top Grossing Racing Game in the U.S App Store. We’re pleased to have three games in the U.S. App Store Top Grossing Racing charts with the #7 and #14 Top Grossing Racing games with CSR and CSR Classics, respectively. CSR2 also has 1.1 million 5-star player reviews in the App Store and Google Play combined – a testament to its high quality, engaging player experience. CSR2 also saw impressive audience gains in Q2, with average mobile DAUs up 9% this quarter.

In the second half of the year, the team will continue to focus on content and social events that amplify the racing experience and car culture for players, including the recently introduced The Fate of the Furious’ Dodge Demon release and a series of special Ferrari events celebrating the auto manufacturer’s 70th anniversary.

Dawn of Titans – In Q2, our team developed features designed to deepen the social and event strategy for our elder players. As we continue to focus on the live services of the game, in the back half of the year the team will introduce a series of bold beats including Alliance vs. Alliance, that will enable players to compete with their friends in new ways, upgrade their Titans and add more depth to their experience.

Invest Express

FarmVille 2: Country Escape and FarmVille: Tropic Escape – In Q2, we completed the transition of FarmVille 2: Country Escape to our studio in India, and later this quarter we’ll begin the transition of FarmVille: Tropic Escape to the same studio. Our talented team in India has been effectively managing our FarmVille games on the web for years, and we’re confident in this talented team’s ability to innovate for our players on mobile. Both FarmVille 2: Country Escape and FarmVille: Tropic Escape delivered strong Q2 performances. The results were driven by the introduction of the Show Pigs bold beat along with new crafting and leaderboard events in FarmVille 2: Country Escape, as well as a Spring Event in FarmVille: Tropic Escape that resulted in prominent partner featuring from Apple and Google.

CLOSING

In summary, we’re pleased with our performance in the first half of the year. Our focus on innovating and growing our existing live services and sharpening our operating model continues to deliver encouraging results. This past quarter, we delivered all-time highs in mobile revenue and bookings and drove the strongest year-over-year mobile audience growth we’ve seen in more than two years. We generated operating cash flow of $37.8 million – our best quarterly performance in five years and we’re making strides to steadily improve our operating margins. While there’s more work to do to reach our topline and bottom line goals, we remain focused on delivering our improved margin goals by the end of 2018 and achieving margins more in line with our peers over the long term.

Sincerely,

| |

|

|

Frank Gibeau | Ger Griffin |

Chief Executive Officer | Chief Financial Officer |

7

CONTACTS

Rebecca Lau

Manager, Investor Relations & Corporate Finance

relau@zynga.com

Dani Dudeck

Chief Communications Officer

dani@zynga.com

FORWARD LOOKING STATEMENTS

This letter contains forward-looking statements, including those statements relating to our outlook for the third quarter of 2017 under the heading "FINANCIAL GUIDANCE" and statements relating to, among other things: progress in our turnaround; our strategy with respect to our live services; our ability to grown our live services; our ability to sharpen our operating model; our ability to expand our leadership position within each of the categories in which we compete; our ability to optimize our footprint within our building and pursue additional leasing opportunities; our commitment to deliver improved margins; our ability to deliver margins in line with our peers; our ability to execute against a roadmap of innovative events and bold beats in Zynga Poker; our ability to explore new ways to connect Words with Friends to audiences around the world; our ability to add new social features and events to Crosswords With Friends to improve its engagement and increase organic installs; our belief that emerging platforms have the potential to reshape the accessibility and social nature of mobile gaming; that we will continue experiment within emerging platforms; that we will continue to focus on live service innovation in our Social Slots portfolio; our ability to launch a series of new bold beats across our Social Slots portfolio; that we will continue to focus on content and social events that amplify the racing experience and car culture for players in CSR 2; our ability to introduce a series of bold beats in Dawn of Titans; our ability to transition FarmVille: Tropic Escape to our India studio in Q3 2017; our expectations regarding the advertising market; our expectations regarding current and future products, features and platforms; and our ability to deliver product, financial and operating performance.

Forward-looking statements often include words such as "outlook," "projected," "intends," "will," "anticipate," "believe," "target," "expect," and statements in the future tense are generally forward-looking. The achievement or success of the matters covered by such forward-looking statements involves significant risks, uncertainties, and assumptions. Our actual results could differ materially from those predicted or implied and reported results should not be considered as an indication of our future performance. Undue reliance should not be placed on such forward-looking statements, which are based on information available to us on the date hereof. We assume no obligation to update such statements. More information about factors that could affect our operating results are described in greater detail in our public filings with the Securities and Exchange Commission (the “SEC”), copies of which may be obtained by visiting our Investor Relations web site at http://investor.zynga.com or the SEC's web site at www.sec.gov.

In addition, the preliminary financial results set forth in this letter are estimates based on information currently available to us. While we believe these estimates are meaningful, they could differ from the actual amounts that we ultimately report in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017. We assume no obligation and do not intend to update these estimates prior to filing our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017.

NON-GAAP FINANCIAL MEASURES

We have provided in this letter certain non-GAAP financial measures to supplement our consolidated financial statements prepared in accordance with GAAP (our “GAAP financial statements”). Management uses non-GAAP financial measures internally in analyzing our financial results to assess operational performance and liquidity. Our non-GAAP financial measures may be different from non-GAAP financial measures used by other companies.

The presentation of our non-GAAP financial measures is not intended to be considered in isolation or as a substitute for our GAAP financial statements. We believe that both management and investors benefit from referring to our non-GAAP financial measures in assessing our performance and when planning, forecasting and analyzing future periods. We believe our non-GAAP financial measures are useful to investors because they allow for greater transparency with respect to key financial metrics we use in making operating decisions and because our investors and analysts use them to help assess the health of our business.

We have provided reconciliations of our non-GAAP financial measures used in this letter to the most directly comparable GAAP financial measures in the following tables. Because of the following limitations of our non-GAAP financial measures, you should consider the non-GAAP financial measures presented in this letter with our GAAP financial statements.

8

Key limitations of our non-GAAP financial measures include:

| • | Adjusted EBITDA does not include the impact of stock-based expense, acquisition-related transaction expenses, contingent consideration fair value adjustments and restructuring expense; |

| • | Bookings does not reflect that we defer and recognize online game revenue and revenue from certain advertising transactions over the estimated average life of durable virtual goods or as virtual goods are consumed; |

| • | Adjusted EBITDA does not reflect income tax expense and does not include other income (expense) net, which includes foreign exchange gains and losses and interest income; |

| • | Adjusted EBITDA excludes depreciation and amortization of intangible assets. Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future; and |

| • | Free cash flow is derived from net cash provided by operating activities less cash spent on capital expenditures. |

9

ZYNGA INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, unaudited)

| | June 30, | | | December 31, | |

| | 2017 | | | 2016 | |

Assets | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 738,975 | | | $ | 852,467 | |

Accounts receivable | | | 85,228 | | | | 77,260 | |

Income tax receivable | | | 249 | | | | 296 | |

Restricted cash | | | 11,182 | | | | 6,199 | |

Prepaid expenses and other current assets | | | 28,078 | | | | 29,254 | |

Total current assets | | | 863,712 | | | | 965,476 | |

| | | | | | | | |

Goodwill | | | 642,681 | | | | 613,335 | |

Other intangible assets, net | | | 43,896 | | | | 25,430 | |

Property and equipment, net | | | 267,453 | | | | 269,439 | |

Restricted cash | | | 250 | | | | 3,050 | |

Prepaid expenses and other long-term assets | | | 39,401 | | | | 29,119 | |

Total assets | | $ | 1,857,393 | | | $ | 1,905,849 | |

| | | | | | | | |

Liabilities and stockholders’ equity | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 14,264 | | | $ | 23,999 | |

Income tax payable | | | 4,638 | | | | 1,889 | |

Other current liabilities | | | 76,935 | | | | 75,754 | |

Deferred revenue | | | 155,085 | | | | 141,998 | |

Total current liabilities | | | 250,922 | | | | 243,640 | |

Deferred revenue | | | 92 | | | | 158 | |

Deferred tax liabilities | | | 6,259 | | | | 5,791 | |

Other non-current liabilities | | | 23,213 | | | | 75,596 | |

Total liabilities | | | 280,486 | | | | 325,185 | |

| | | | | | | | |

Stockholders’ equity: | | | | | | | | |

Common stock and additional paid in capital | | | 3,390,996 | | | | 3,349,714 | |

Accumulated other comprehensive income (loss) | | | (111,686 | ) | | | (128,694 | ) |

Accumulated deficit | | | (1,702,403 | ) | | | (1,640,356 | ) |

Total stockholders’ equity | | | 1,576,907 | | | | 1,580,664 | |

Total liabilities and stockholders’ equity | | $ | 1,857,393 | | | $ | 1,905,849 | |

10

ZYNGA INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data, unaudited)

| | Three Months Ended | | | Six Months Ended | |

| | June 30, 2017 | | | March 31, 2017 | | | June 30, 2016 | | | June 30, 2017 | | | June 30, 2016 | |

Revenue: | | | | | | | | | | | | | | | | | | | | |

Online game | | $ | 163,745 | | | $ | 153,481 | | | $ | 135,823 | | | $ | 317,226 | | | $ | 272,880 | |

Advertising and other | | | 45,486 | | | | 40,803 | | | | 45,912 | | | | 86,289 | | | | 95,576 | |

Total revenue | | | 209,231 | | | | 194,284 | | | | 181,735 | | | | 403,515 | | | | 368,456 | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | | |

Cost of revenue | | | 64,172 | | | | 64,877 | | | | 56,103 | | | | 129,049 | | | | 113,242 | |

Research and development | | | 64,615 | | | | 69,202 | | | | 66,233 | | | | 133,817 | | | | 153,970 | |

Sales and marketing | | | 51,201 | | | | 46,620 | | | | 40,631 | | | | 97,821 | | | | 86,975 | |

General and administrative | | | 23,551 | | | | 22,565 | | | | 25,374 | | | | 46,116 | | | | 47,758 | |

Total costs and expenses | | | 203,539 | | | | 203,264 | | | | 188,341 | | | | 406,803 | | | | 401,945 | |

Income (loss) from operations | | | 5,692 | | | | (8,980 | ) | | | (6,606 | ) | | | (3,288 | ) | | | (33,489 | ) |

Interest income | | | 1,109 | | | | 937 | | | | 761 | | | | 2,046 | | | | 1,466 | |

Other income (expense), net | | | 1,614 | | | | 1,436 | | | | 1,905 | | | | 3,050 | | | | 4,005 | |

Income (loss) before income taxes | | | 8,415 | | | | (6,607 | ) | | | (3,940 | ) | | | 1,808 | | | | (28,018 | ) |

Provision for (benefit from) income taxes | | | 3,322 | | | | 2,867 | | | | 506 | | | | 6,189 | | | | 2,986 | |

Net income (loss) | | $ | 5,093 | | | $ | (9,474 | ) | | $ | (4,446 | ) | | $ | (4,381 | ) | | $ | (31,004 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) per share attributable to common stockholders: | | | | | | | | | | | | | | | | | | | | |

Basic and diluted | | $ | 0.01 | | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.04 | ) |

Diluted | | $ | 0.01 | | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.04 | ) |

| | | | | | | | | | | | | | | | | | | | |

Weighted average common shares used to compute net income (loss) per share attributable to common stockholders: | | | | | | | | | | | | | | | | | | | | |

Basic and diluted | | | 863,125 | | | | 875,712 | | | | 873,393 | | | | 869,025 | | | | 872,243 | |

Diluted | | | 887,991 | | | | 875,712 | | | | 873,393 | | | | 869,025 | | | | 872,243 | |

| | | | | | | | | | | | | | | | | | | | |

Stock-based compensation expense included in the above line items: | | | | | | | | | | | | | | | | | | | | |

Cost of revenue | | $ | 371 | | | $ | 619 | | | $ | 1,127 | | | $ | 990 | | | $ | 1,776 | |

Research and development | | | 10,483 | | | | 11,713 | | | | 20,213 | | | | 22,196 | | | | 44,416 | |

Sales and marketing | | | 1,751 | | | | 1,787 | | | | 2,206 | | | | 3,538 | | | | 4,197 | |

General and administrative | | | 3,627 | | | | 3,407 | | | | 3,353 | | | | 7,034 | | | | 6,118 | |

Total stock-based compensation expense | | $ | 16,232 | | | $ | 17,526 | | | $ | 26,899 | | | $ | 33,758 | | | $ | 56,507 | |

11

ZYNGA INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands, unaudited)

| | Three Months Ended | | | Six Months Ended | |

| | June 30, 2017 | | | March 31, 2017 | | | June 30, 2016 | | | June 30, 2017 | | | June 30, 2016 | |

Operating activities: | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 5,093 | | | $ | (9,474 | ) | | $ | (4,446 | ) | | $ | (4,381 | ) | | $ | (31,004 | ) |

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 7,398 | | | | 8,881 | | | | 10,835 | | | | 16,279 | | | | 21,647 | |

Stock-based compensation expense | | | 16,232 | | | | 17,526 | | | | 26,899 | | | | 33,758 | | | | 56,507 | |

(Gain) loss from sales of investments, assets and other, net | | | (222 | ) | | | 38 | | | | 231 | | | | (184 | ) | | | 242 | |

Accretion and amortization on marketable securities | | | — | | | | — | | | | 52 | | | | — | | | | 311 | |

Change in deferred income taxes and other | | | 1,193 | | | | 1,075 | | | | 148 | | | | 2,268 | | | | 1,570 | |

Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | | | | | |

Accounts receivable, net | | | 996 | | | | (8,964 | ) | | | 7,319 | | | | (7,968 | ) | | | 14,536 | |

Income tax receivable | | | 27 | | | | 20 | | | | 177 | | | | 47 | | | | 772 | |

Other assets | | | 3,282 | | | | (5,923 | ) | | | (2,630 | ) | | | (2,641 | ) | | | (4,442 | ) |

Accounts payable | | | 461 | | | | (8,802 | ) | | | (1,498 | ) | | | (8,341 | ) | | | (14,316 | ) |

Deferred revenue | | | (53 | ) | | | 13,074 | | | | (7,082 | ) | | | 13,021 | | | | (12,178 | ) |

Income tax payable | | | 1,497 | | | | 1,252 | | | | — | | | | 2,749 | | | | — | |

Other liabilities | | | 1,926 | | | | (13,422 | ) | | | (15,459 | ) | | | (11,496 | ) | | | (22,404 | ) |

Net cash provided by (used in) operating activities | | | 37,830 | | | | (4,719 | ) | | | 14,546 | | | | 33,111 | | | | 11,241 | |

| | | | | | | | | | | | | | | | | | | | |

Investing activities: | | | | | | | | | | | | | | | | | | | | |

Sales and maturities of marketable securities | | | — | | | | — | | | | 85,902 | | | | — | | | | 204,802 | |

Acquisition of property and equipment | | | (1,856 | ) | | | (2,285 | ) | | | (1,293 | ) | | | (4,141 | ) | | | (3,947 | ) |

Business acquisitions, net of cash acquired | | | — | | | | (35,081 | ) | | | (1,720 | ) | | | (35,081 | ) | | | (14,220 | ) |

Proceeds from sale of property and equipment | | | 133 | | | | 15 | | | | 1,179 | | | | 148 | | | | 1,577 | |

Other investing activities, net | | | 165 | | | | (7,390 | ) | | | — | | | | (7,225 | ) | | | — | |

Net cash provided by (used in) investing activities | | | (1,558 | ) | | | (44,741 | ) | | | 84,068 | | | | (46,299 | ) | | | 188,212 | |

| | | | | | | | | | | | | | | | | | | | |

Financing activities: | | | | | | | | | | | | | | | | | | | | |

Taxes paid related to net share settlement of equity awards | | | (9,008 | ) | | | (415 | ) | | | (746 | ) | | | (9,423 | ) | | | (1,665 | ) |

Repurchases of common stock | | | (10,760 | ) | | | (86,164 | ) | | | — | | | | (96,924 | ) | | | (112,392 | ) |

Proceeds from issuance of common stock | | | 865 | | | | 3,152 | | | | 409 | | | | 4,017 | | | | 2,885 | |

Net cash provided by (used in) financing activities | | | (18,903 | ) | | | (83,427 | ) | | | (337 | ) | | | (102,330 | ) | | | (111,172 | ) |

| | | | | | | | | | | | | | | | | | | | |

Effect of exchange rate changes on cash and cash equivalents | | | 1,169 | | | | 857 | | | | (1,340 | ) | | | 2,026 | | | | (2,110 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | 18,538 | | | | (132,030 | ) | | | 96,937 | | | | (113,492 | ) | | | 86,171 | |

Cash and cash equivalents, beginning of period | | | 720,437 | | | | 852,467 | | | | 731,451 | | | | 852,467 | | | | 742,217 | |

Cash and cash equivalents, end of period | | $ | 738,975 | | | $ | 720,437 | | | $ | 828,388 | | | $ | 738,975 | | | $ | 828,388 | |

12

ZYNGA INC.

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

(In thousands, except per share data, unaudited)

| | Three Months Ended | | | Six Months Ended | |

| | June 30, 2017 | | | March 31, 2017 | | | June 30, 2016 | | | June 30, 2017 | | | June 30, 2016 | |

Reconciliation of Revenue to Bookings | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 209,231 | | | $ | 194,284 | | | $ | 181,735 | | | $ | 403,515 | | | $ | 368,456 | |

Change in deferred revenue | | | (53 | ) | | | 13,074 | | | | (7,082 | ) | | | 13,021 | | | | (12,178 | ) |

Bookings | | $ | 209,178 | | | $ | 207,358 | | | $ | 174,653 | | | $ | 416,536 | | | $ | 356,278 | |

| | | | | | | | | | | | | | | | | | | | |

Reconciliation of Revenue to Bookings: Mobile | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 179,868 | | | $ | 161,613 | | | $ | 138,125 | | | $ | 341,481 | | | $ | 273,791 | |

Change in deferred revenue | | | 1,755 | | | | 14,508 | | | | (1,492 | ) | | | 16,263 | | | | 1,604 | |

Bookings: Mobile | | $ | 181,623 | | | $ | 176,121 | | | $ | 136,633 | | | $ | 357,744 | | | $ | 275,395 | |

| | | | | | | | | | | | | | | | | | | | |

Reconciliation of Revenue to Bookings: Advertising and Other; Advertising | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 45,485 | | | $ | 40,802 | | | $ | 45,912 | | | $ | 86,287 | | | $ | 95,576 | |

Change in deferred revenue | | | (1,015 | ) | | | 1,082 | | | | (695 | ) | | | 67 | | | | (3,750 | ) |

Bookings: Advertising and Other | | $ | 44,470 | | | $ | 41,884 | | | $ | 45,217 | | | $ | 86,354 | | | $ | 91,826 | |

Bookings: Other | | | (1,046 | ) | | | (777 | ) | | | (1,990 | ) | | | (1,823 | ) | | | (3,223 | ) |

Bookings: Advertising | | $ | 43,424 | | | $ | 41,107 | | | $ | 43,227 | | | $ | 84,531 | | | $ | 88,603 | |

| | | | | | | | | | | | | | | | | | | | |

Reconciliation of Net income (loss) to Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 5,093 | | | $ | (9,474 | ) | | $ | (4,446 | ) | | $ | (4,381 | ) | | $ | (31,004 | ) |

Provision for (benefit from) income taxes | | | 3,322 | | | | 2,867 | | | | 506 | | | | 6,189 | | | | 2,986 | |

Other income (expense), net | | | (1,614 | ) | | | (1,436 | ) | | | (1,905 | ) | | | (3,050 | ) | | | (4,005 | ) |

Interest income | | | (1,109 | ) | | | (937 | ) | | | (761 | ) | | | (2,046 | ) | | | (1,466 | ) |

Restructuring expense, net | | | 1,422 | | | | (845 | ) | | | 1,710 | | | | 577 | | | | 2,178 | |

Depreciation and amortization | | | 7,398 | | | | 8,881 | | | | 10,835 | | | | 16,279 | | | | 21,647 | |

Acquisition-related transaction expenses | | | — | | | | 187 | | | | 199 | | | | 187 | | | | 199 | |

Contingent consideration fair value adjustment | | | (807 | ) | | | (94 | ) | | | (14,390 | ) | | | (901 | ) | | | (12,360 | ) |

Stock-based compensation expense | | | 16,232 | | | | 17,526 | | | | 26,899 | | | | 33,758 | | | | 56,507 | |

Adjusted EBITDA | | $ | 29,937 | | | $ | 16,675 | | | $ | 18,647 | | | $ | 46,612 | | | $ | 34,682 | |

| | | | | | | | | | | | | | | | | | | | |

Reconciliation of GAAP operating expense to Non-GAAP operating expense | | | | | | | | | | | | | | | | | | | | |

GAAP operating expense | | $ | 139,367 | | | $ | 138,387 | | | $ | 132,238 | | | $ | 277,754 | | | $ | 288,703 | |

Restructuring expense, net | | | (1,422 | ) | | | 845 | | | | (1,710 | ) | | | (577 | ) | | | (2,178 | ) |

Amortization of intangible assets from acquisition | | | (1,397 | ) | | | (1,053 | ) | | | (743 | ) | | | (2,450 | ) | | | (1,480 | ) |

Acquisition-related transaction expenses | | | — | | | | (187 | ) | | | (199 | ) | | | (187 | ) | | | (199 | ) |

Contingent consideration fair value adjustment | | | 807 | | | | 94 | | | | 14,390 | | | | 901 | | | | 12,360 | |

Stock-based compensation expense | | | (15,861 | ) | | | (16,907 | ) | | | (25,772 | ) | | | (32,768 | ) | | | (54,731 | ) |

Non-GAAP operating expense | | $ | 121,494 | | | $ | 121,179 | | | $ | 118,204 | | | $ | 242,673 | | | $ | 242,475 | |

| | | | | | | | | | | | | | | | | | | | |

Reconciliation of Cash provided by operating activities to free cash flow | | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | | 37,830 | | | | (4,719 | ) | | | 14,546 | | | | 33,111 | | | | 11,241 | |

Acquisition of property and equipment | | | (1,856 | ) | | | (2,285 | ) | | | (1,293 | ) | | | (4,141 | ) | | | (3,947 | ) |

Free cash flow | | $ | 35,974 | | | $ | (7,004 | ) | | $ | 13,253 | | | $ | 28,970 | | | $ | 7,294 | |

13

ZYNGA INC.

RECONCILIATION OF GAAP TO NON-GAAP THIRD QUARTER 2017 GUIDANCE

(In thousands, except per share data, unaudited)

| | Third Quarter 2017 | |

Reconciliation of Revenue to Bookings | | | | |

Revenue | $ | 210,000 | |

Change in deferred revenue | | (5,000) | |

Bookings | $ | 205,000 | |

| | | | |

Reconciliation of Net income (loss) to Adjusted EBITDA | | | | |

Net income (loss) | $ | 7,000 | |

Provision for (benefit from) income taxes | | 4,000 | |

Other income (expense), net | | (2,000) | |

Interest income | | (1.000) | |

Depreciation and amortization | | 7,000 | |

Stock-based compensation expense | | 15,000 | |

Adjusted EBITDA | $ | 30,000 | |

| | | | |

GAAP diluted shares | | 894,000 | |

Net income (loss) per share | $ | | 0.01 | |

14