Filed Pursuant to Rule 424(b)(3)

Registration No. 333-152302

PROSPECTUS

LOCAL INSIGHT REGATTA HOLDINGS, INC.

Offer to Exchange All Outstanding

11.00% Series A Senior Subordinated Notes due 2017 ($210,500,000 aggregate principal amount outstanding) for 11.00% Series B Senior Subordinated Notes due 2017, which have been registered under the Securities Act

We hereby offer to exchange, on the terms and subject to the conditions detailed in this prospectus and in the accompanying letter of transmittal, our 11.00% Series B Senior Subordinated Notes due 2017, or the “exchange notes,” for our currently outstanding 11.00% Series A Senior Subordinated Notes due 2017 that were issued in November 2007, or the “outstanding notes.”

The Exchange Offer

| | • | | We will exchange all outstanding notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer for an equal principal amount of exchange notes. |

| | • | | You may withdraw tendered outstanding notes at any time prior to the expiration of the exchange offer. |

| | • | | The exchange offer expires at 5:00 p.m., New York City time, on November 13, 2008, unless extended. |

| | • | | The exchange of outstanding notes for exchange notes pursuant to the exchange offer will not be a taxable event for U.S. federal income tax purposes. |

| | • | | We will not receive any proceeds from the exchange offer. |

The Exchange Notes

| | • | | The exchange notes will represent the same debt as the outstanding notes, and we will issue the exchange notes under the same indenture. |

| | • | | The exchange notes are substantially identical to the outstanding notes, except that: (i) the exchange notes have been registered under the federal securities laws and will not bear any legend restricting their transfer; (ii) the exchange notes will bear a Series B designation and a different CUSIP number than the outstanding notes; (iii) the exchange notes will not be entitled to certain registration rights that are applicable to the outstanding notes; and (iv) certain interest rate provisions applicable to the outstanding notes will no longer be applicable. |

| | • | | The exchange notes will be general unsecured senior subordinated obligations and will rank junior in right of payment to our existing and future senior debt. The exchange notes will rank equally with all future senior subordinated debt and senior to all future junior subordinated debt. |

| | • | | Each of our domestic subsidiaries initially, jointly and severally, irrevocably and unconditionally guarantees, on an unsecured senior subordinated basis, the performance and full and punctual payment, when due, whether at maturity, by acceleration or otherwise, of all of our obligations under the outstanding notes, the exchange notes and the indenture governing the notes. |

| | • | | We do not intend to apply for listing of the exchange notes on any securities exchange or automated quotation system. |

Any broker-dealer who holds notes acquired for its own account as a result of market-making activities or other trading activities, and who receives exchange notes pursuant to the exchange offer, may be an “underwriter” within the meaning of the Securities Act. If you are a broker-dealer and you receive exchange notes for your own account, you must acknowledge that you will deliver a prospectus in connection with any resale of such exchange notes. By making such acknowledgment, you will not be deemed to admit that you are an “underwriter” under the Securities Act. Broker-dealers may use this prospectus in connection with any resale of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by the broker-dealer as a result of market-making activities or trading activities. We have agreed that, for a period of one year after the expiration of the exchange offer or until any broker-dealer has sold all registered notes held by it, we will make this prospectus available to such broker-dealer for use in connection with any such resale. A broker-dealer may not participate in the exchange offer with respect to outstanding notes acquired other than as a result of market-making activities or trading activities. See “Plan of Distribution.”

If you are an affiliate of us, or are engaged in, or intend to engage in, or have an agreement or understanding to participate in, a distribution of the exchange notes, you cannot rely on the applicable interpretations of the Securities and Exchange Commission and you must comply with the registration requirements of the Securities Act in connection with any resale transaction.

Investing in the exchange notes involves risks.

See “Risk Factors” beginning on page 12 of this prospectus before participating in the exchange offer.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURES IN THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is October 15, 2008.

REFERENCES TO ADDITIONAL INFORMATION

This prospectus incorporates or refers to important business and financial information about us that is not included in or delivered with this prospectus. You may obtain documents that are filed by us with the Securities and Exchange Commission as exhibits to the registration statement of which this prospectus forms a part without charge upon your written or oral request. We will also provide you with copies of this information, without charge, if you request them in writing or by telephone from:

Local Insight Regatta Holdings, Inc.

188 Inverness Drive West, Suite 800

Englewood, Colorado 80112

Attention: General Counsel

Telephone: 303-867-1600

If you would like to request copies of these documents, please do so by November 5, 2008 in order to receive them before the expiration of the exchange offer. For additional information, see “Where You Can Find More Information.” You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

TABLE OF CONTENTS

i

We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained in this prospectus. You must not rely upon any information or representation not contained in this prospectus as if we had authorized it. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which it relates, nor does this prospectus constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

ii

EXPLANATORY NOTE

As permitted by Rule 409 under the Securities Act, we have omitted from the section of the prospectus entitled “Selected Historical Financial Data” statement of operations and cash flow data for our predecessor company’s fiscal year ended December 31, 2003, and balance sheet data for our predecessor company at December 31, 2003, and have omitted from the section of the prospectus entitled “Ratio of Earnings to Fixed Charges” calculations of our predecessor company’s ratio of earnings to fixed charges for the year ended December 31, 2003. Information necessary for us to provide this disclosure is in the possession of Windstream, which, following our split-off from Windstream on November 30, 2007, is no longer an affiliate of ours. We have requested information from Windstream that would enable us to provide the omitted statement of operations data, cash flow data, balance sheet data and ratio of earnings to fixed charges. Windstream has responded that such information does not exist in a format required by generally accepted accounting principles and that it is not under any contractual obligation to create such information. Therefore, the omitted information is not available to us without unreasonable effort or expense. Management believes that the omission of this information would not have a material impact on a reader’s understanding of our financial results and condition and related trends.

iii

CERTAIN DEFINITIONS

Unless the context requires otherwise, in this prospectus:

| | • | | “Berry ILOB” refers to the Independent Line of Business division of L.M. Berry, substantially all the assets and certain liabilities of which were acquired by The Berry Company from L.M. Berry on April 23, 2008. |

| | • | | “exchange notes” refers to the 11.00% Series B Senior Subordinated Notes due 2017 offered pursuant to this prospectus. |

| | • | | “LECs” refers to local exchange carriers. |

| | • | | “LILM” refers to Local Insight Listing Management, Inc., a wholly owned subsidiary of LIYP. |

| | • | | “LIYP” refers to Local Insight Yellow Pages, a wholly-owned subsidiary of Regatta Holdings. |

| | • | | “L.M. Berry” refers to L.M. Berry and Company, a subsidiary of AT&T Inc. |

| | • | | “Local Insight Media” refers to Local Insight Media, L.P., an affiliate of ours. |

| | • | | “Local Insight Media Holdings” refers to Local Insight Media Holdings, Inc., which is the indirect parent of Regatta Holdings and Local Insight Media. |

| | • | | “our company,” “we,” “our” or “us” refers collectively to Regatta Holdings and its consolidated subsidiaries and their predecessors. |

| | • | | “outstanding notes” refers to the 11.00% Series A Senior Subordinated Notes due 2017 issued on November 30, 2007. |

| | • | | “notes” refers collectively to the outstanding notes and the exchange notes. |

| | • | | “Regatta Holdings” refers to Local Insight Regatta Holdings, Inc., the issuer of the notes. |

| | • | | “The Berry Company” refers to The Berry Company LLC, a wholly-owned subsidiary of Regatta Holdings. |

| | • | | “Valor Directories” refers to the directories published by Valor Communications Group Inc. prior to its merger with Alltel Corporation’s wireline telecommunications business in the transaction that formed Windstream. |

| | • | | “WCAS” refers to Welsh, Carson, Anderson & Stowe. |

| | • | | “Welsh Holdings Group�� refers collectively to the Welsh Regatta Group and the Welsh LIM Group. |

| | • | | “Welsh LIM Group” refers to certain funds affiliated with WCAS which prior to June 20, 2008 indirectly owned approximately 70.5% of Local Insight Media. |

| | • | | “Welsh Regatta Group” refers to certain funds and individuals affiliated with WCAS which prior to June 20, 2008 indirectly owned 100% of Regatta Holdings. |

| | • | | “Windstream” refers to Windstream Corporation. |

| | • | | “Windstream Service Areas” refers to Windstream’s local wireline markets as they existed on December 12, 2006. |

iv

MARKET, INDUSTRY AND OTHER DATA

In this prospectus, we rely on and refer to information and statistics regarding the directory publishing industry as well as the general advertising industry and, unless otherwise specified, our market share is based on our revenue rank among public and private directory companies based on public filings with the SEC, industry presentations and industry research reports. Where possible, we obtained this information and these statistics from third-party sources, such as independent industry publications, government publications or reports by market research firms, including company research, trade interviews and public filings with the SEC. Additionally, we have supplemented third-party information where necessary with management estimates based on our review of internal surveys, information from our customers and vendors, trade and business organizations and other contacts in markets in which we operate, and our management’s knowledge and experience. However, these estimates are subject to change and are uncertain due to limits on the availability and reliability of primary sources of information and the voluntary nature of the data gathering process. As a result, you should be aware that industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. We make no representation as to the accuracy or completeness of such information.

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

v

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. These statements may be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “should” or “will” or the negative thereof or other variations thereon or comparable terminology. In particular, statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance contained in this prospectus under the headings “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in this prospectus under the headings “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include:

| | • | | the loss of any of our key customer agreements or our inability to enforce or fully realize our rights under those agreements; |

| | • | | our inability to enforce the full scope of our rights under non-competition agreements with third parties, including Windstream; |

| | • | | declines in our directory revenue; |

| | • | | increased competition from incumbent and independent Yellow Pages directory publishers, Internet-based advertisers and search engines as well as other types of media; |

| | • | | rapid technological developments and changing preferences in the Yellow Pages publishing and advertising industries; |

| | • | | a declining usage of printed Yellow Pages directories or a decrease in the number of businesses that advertise with us; |

| | • | | the effect of competition in local telephone service on the incumbent LECs’ current leading positions in the markets we serve; |

| | • | | our dependence on and ability to maintain satisfactory relationships with third party service providers; |

| | • | | difficulties integrating the Berry ILOB; |

| | • | | fluctuations in the price or availability of paper; |

| | • | | the effect of extending credit to small and medium-sized businesses; |

| | • | | a decline in the performance of third party certified marketing representatives, which coordinate sales of advertising to national accounts or a decision by these representatives to reduce or end their business with us; |

| | • | | the loss or impairment of our intellectual property rights; |

| | • | | changes in, or the failure to comply with, government regulations, including franchising laws, accounting standards, zoning laws, environmental laws and taxation requirements; |

| | • | | future changes in directory publishing obligations, and additional regulation regarding use of the Internet, data and data security; |

| | • | | our failure to identify and monitor or to capitalize on changing market conditions; |

vi

| | • | | the loss of key personnel or turnover among our sales representatives; |

| | • | | a prolonged economic downturn and the effects of war, terrorism or catastrophic events; |

| | • | | national or local economic or business conditions that affect advertising expenditures by businesses and individuals or consumer trends in the usage of our products; |

| | • | | risks related to our substantial indebtedness and to the notes; and |

| | • | | other risks and uncertainties, including those listed under the caption “Risk Factors.” |

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this prospectus are made only as of the date hereof. We do not undertake and specifically disclaim any obligation to update any such statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments.

vii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. We encourage you to read this entire prospectus and consider, among other things, the matters set forth under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus.

Company Overview

We are a leading publisher of print and Internet Yellow Pages directories and the largest provider of outsourced directory sales, marketing and related services in the United States. We have two principal operating subsidiaries. Local Insight Yellow Pages, Inc., or LIYP, is the seventh largest Yellow Pages directory publisher in the United States as measured by revenue. LIYP is the exclusive official publisher of Windstream-branded print and Internet directories in the Windstream Service Areas and publishes print directories on behalf of 79 other LECs. The Berry Company, which acquired the Berry ILOB in April 2008, provides an integrated array of outsourced directory sales, marketing, production and other services to third parties. The Berry Company publishes print directories on behalf of 78 customers (including 75 LECs), 34 of which (including 31 LECs) rely on The Berry Company for the publication of their Internet Yellow Pages, or IYP, directories.

Local Insight Yellow Pages. LIYP is a leading publisher of print and online directories in rural and certain suburban markets in 36 states located primarily in the eastern, midwestern and southern United States. LIYP serves as the exclusive official publisher of Windstream-branded print and Internet directories in the Windstream Service Areas. LIYP also publishes print directories for 78 other incumbent LECs and one competitive LEC. In addition, LIYP offers IYP services through theWindstreamYellowPages.com website.

Prior to November 30, 2007, we were wholly-owned by Windstream, a leading provider of telecommunications services in rural communities in the United States. Based on the number of telephone lines it has in service, Windstream is the fifth largest local telephone company in the country. On November 30, 2007, we were split off from Windstream to the Welsh Regatta Group in a tax-free transaction, which we refer to as the Split-Off. In connection with the Split-Off, LIYP entered into several commercial agreements with Windstream, including a 50-year Publishing Agreement that granted LIYP an exclusive, royalty-free license to publish Windstream-branded directories in the Windstream Service Areas. See the section entitled “Business—Agreements Between LIYP and Windstream” below for more information about these agreements.

During the year ended December 31, 2007, LIYP published, directly or under contract, 406 directories. Substantially all of these directories were published for incumbent LECs. In 2007, LIYP distributed approximately 5.3 million copies of directories for Windstream and approximately 2.1 million copies of directories for other LECs. We believe that small and medium-sized enterprises, or SMEs, constitute a substantial majority of LIYP’s customer advertising accounts.

In addition to print revenue, LIYP generates revenue from additional services provided to LECs and fees derived from other sources. Revenue from these other sources, including directory enhancements that are billed back to LECs, the commissions earned from LIYP’s certified marketing representative, or CMR, line of business and revenue fromWindstreamYellowPages.com, represented approximately 13.7% of our directory revenue for the 11 months ended November 30, 2007 and approximately 3.1% of our directory revenue for the one month ended December 31, 2007. In the last year, LIYP has implemented enhancements toWindstreamYellowPages.com that enable users to search the content of Yellow Pages advertisements in all of the Windstream Service Areas. We believe thatWindstreamYellowPages.com, along with several other contemplated new product launches, will help drive revenue growth over the next several years.

1

At October 10, 2008, LIYP employed approximately 384 employees, including a local sales force of 135 sales representatives. LIYP has one national account manager and three account representatives who interact with approximately 141 third party CMRs, which coordinate sales of advertising to national accounts.

The Berry Company. On April 23, 2008, our wholly-owned subsidiary, The Berry Company, acquired substantially all the assets and certain liabilities of the Berry ILOB from L.M. Berry, a subsidiary of AT&T Inc. Prior to its acquisition of the Berry ILOB, The Berry Company had no operations. The Berry Company provides outsourced directory sales, marketing, production and other services to third parties. The Berry Company publishes print directories on behalf of 78 customers (including 75 LECs). During the year ended December 31, 2007, the Berry ILOB published 490 print directories in 26 states and distributed approximately 18.5 million copies of these directories to or on behalf of its customers. The Berry Company also publishes IYP directories on behalf of 34 of its print directory customers (including 31 LECs). With the outsourced directory sales, marketing and publication services The Berry Company and LIYP both provide to incumbent LECs, we are now the largest provider of these outsourced services in the United States.

The Berry Company offers an integrated array of services relating to print Yellow Pages directories, including local and national sales, marketing, advertising design and production, composition, pagination, printing and distribution, advertising inventory control, customer acknowledgement preparation and mailing, quality review, production scheduling and billing and collection. The Berry Company also offers a full range of services relating to the publication of IYP directories, including sales, website production and maintenance, search engine placement services and distribution of Internet-based advertising content to third party IYP networks (includingYellowPages.com).

At October 10, 2008, The Berry Company employed approximately 892 employees, including approximately 343 sales representatives. The Berry Company’s sales force is locally based throughout its markets and, like the LIYP local sales force, utilizes a consultative sales approach to partner with customers to develop an effective advertising plan. For national sales, The Berry Company has three account managers who have relationships with approximately 180 CMRs.

In connection with our acquisition of the Berry ILOB, The Berry Company entered into a number of agreements with L.M. Berry and its affiliates, including an Intellectual Property Agreement and License Agreement and a YellowPages.com Local Advertising Reseller Agreement. See the section entitled “Business— The Berry Company—Agreements Entered into in Connection with the Berry ILOB Acquisition” below for more information about these agreements.

Our History

Formation of Windstream Yellow Pages. On July 17, 2006, Alltel Corporation, or Alltel, the parent of Alltel Publishing Corporation, or Alltel Publishing, completed the spin-off of its wireline telecommunications business (including Alltel Publishing) and the merger of that business with Valor Communications Group Inc., or Valor, in the transaction that formed Windstream. Prior to the merger, Alltel Publishing had published Yellow Pages directories for over 20 years, having increased its presence in the industry following its 1993 acquisition of the publishing business of GTE Directories Service Corporation. In addition, prior to the merger, Valor had outsourced the publishing of its directories, or the Valor Directories, to L.M. Berry. Following the merger of Alltel’s wireline telecommunications business with Valor in the transaction that formed Windstream, Windstream’s directory publishing business was operated by its wholly-owned subsidiary, Windstream Yellow Pages, Inc., or Windstream Yellow Pages.

The Split-Off. On December 13, 2006, Windstream announced that it would split off Windstream Yellow Pages in a tax-free transaction to the Welsh Regatta Group. Regatta Holdings was formed to hold Windstream

2

Yellow Pages prior to the Split-Off. The Split-Off was consummated on November 30, 2007. The following transactions occurred in connection with the Split-Off:

| | • | | Windstream contributed all the shares of capital stock of Windstream Yellow Pages to Regatta Holdings. |

| | • | | Regatta Holdings entered into senior secured credit facilities consisting of (i) a $20.0 million senior secured revolving credit facility and (ii) a $66.0 million senior secured term loan facility. |

| | • | | In exchange for the transfer to it of all the shares of capital stock of Windstream Yellow Pages, Regatta Holdings: (i) distributed to Windstream a special cash dividend of $40.0 million; (ii) issued additional shares of Regatta Holdings common stock to Windstream (which, together with the existing shares of Regatta Holdings’ common stock held by Windstream, are referred to as the Regatta Shares); and (iii) distributed the outstanding notes to Windstream. |

| | • | | Following the completion of the transactions described above, Windstream exchanged all the Regatta Shares for an aggregate of 19,574,422 shares of Windstream common stock then held by the Welsh Regatta Group, which were then retired. |

| | • | | Windstream then exchanged the outstanding notes for outstanding Windstream debt held by certain selling security holders. These security holders resold the outstanding notes to qualified institutional buyers pursuant to Rule 144A under the Securities Act and to non-U.S. persons under Regulation S under the Securities Act. |

Upon the consummation of the above-described transactions:

| | • | | The Welsh Regatta Group indirectly owned 100% of Regatta Holdings; |

| | • | | Windstream Regatta Holdings, Inc.’s name was changed to Local Insight Regatta Holdings, Inc.; and |

| | • | | Windstream Yellow Pages’ name was changed to Local Insight Yellow Pages, Inc. |

In connection with the Split-Off, LIYP entered into several commercial agreements with Windstream to define its relationship with Windstream with respect to a number of services. In particular, LIYP entered into a 50-year Publishing Agreement pursuant to which Windstream granted LIYP an exclusive, royalty-free license to publish Windstream-branded directories in the Windstream Service Areas. LIYP also entered into a Billing and Collection Agreement, a Foreign Billing and Collection Agreement and a Tax Sharing Agreement in connection with the Split-Off. See the section entitled “Business—Agreements Between LIYP and Windstream” below for more information about these agreements.

Acquisition of the Berry ILOB.On April 23, 2008, The Berry Company acquired substantially all the assets and certain liabilities of the Berry ILOB from L.M. Berry, a subsidiary of AT&T Inc., for a total purchase price of $235 million in cash (subject to adjustments relating to working capital). See the section entitled “Business—The Berry Company” for more information about this acquisition and The Berry Company.

Combination of Regatta Holdings and Local Insight Media. Prior to June 20, 2008, the Welsh Regatta Group indirectly owned 100% of Regatta Holdings and the Welsh LIM Group (which is comprised of certain funds affiliated with WCAS that are not part of the Welsh Regatta Group) owned approximately 70.5% of Local Insight Media. Local Insight Media’s operating subsidiaries are CBD Media Finance LLC, or CBD Media, the leading publisher of print and online directories in the greater Cincinnati metropolitan area; ACS Media Finance LLC, or ACS Media, the largest publisher of print and Internet advertising directories in the State of Alaska; and HYP Media Finance LLC, or HYP Media, the largest publisher of print and Internet advertising directories in the State of Hawaii.

3

On June 20, 2008, the businesses of Regatta Holdings and Local Insight Media were combined in a transaction pursuant to which:

| | • | | A new holding company, Local Insight Media Holdings, was established; |

| | • | | Regatta Holdings became a wholly-owned, indirect subsidiary of Local Insight Media Holdings; |

| | • | | Local Insight Media became a wholly-owned, indirect subsidiary of Local Insight Media Holdings; and |

| | • | | The Welsh Regatta Group and the Welsh LIM Group directly or indirectly owned approximately 69.3% and 21.7%, respectively, of Local Insight Media Holdings. |

As a result of this combination, we are controlled by the Welsh Holdings Group, which is comprised of certain funds and individuals affiliated with WCAS. The Welsh Holdings Group directly or indirectly owns 91.0% of Local Insight Media Holdings, our indirect parent. Since its founding in 1979, WCAS has organized 14 limited partnerships with total capital of $16 billion. Since its inception, WCAS has invested in 159 companies in its target industries and has funded over 650 follow-on acquisitions.

The Berry Company is party to directory publishing and services agreements with CBD Media, ACS Media and HYP Media, which are indirect subsidiaries of Local Insight Media. In addition, under the terms of a Consulting Agreement, our affiliate, Local Insight Media, Inc., or LIMI, provides significant strategic, operational and other support to us. See the section below entitled “Certain Relationships and Related Transactions” for a description of these agreements.

4

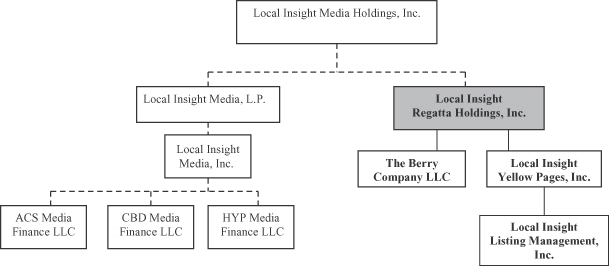

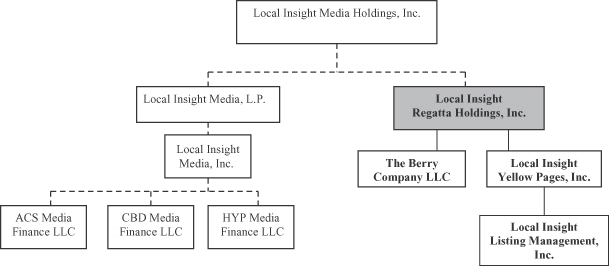

The following chart shows our basic organizational structure following the combination with Local Insight Media. Dashed lines indicate indirect holdings through one or more holding companies.

5

The Exchange Offer

On November 30, 2007, we completed an offering of $210.5 million in aggregate principal amount of the outstanding notes. The offering of the outstanding notes was exempt from registration under the Securities Act. This prospectus is part of a registration statement covering the exchange of the outstanding notes for the exchange notes. The following is a brief summary of terms of the exchange offer. For a more complete description of the exchange offer, see the section entitled “The Exchange Offer” below.

Securities Offered | $210.5 million in aggregate principal amount of 11.00% Series B Senior Subordinated Notes due 2017. |

Exchange Offer | The exchange notes are being offered in exchange for a like principal amount of outstanding notes. We will accept any and all outstanding notes validly tendered and not withdrawn prior to 5:00 p.m., New York City time, on November 13, 2008. Holders may tender some or all of their outstanding notes pursuant to the exchange offer. However, outstanding notes may only be exchanged in denominations of $2,000 and integral multiples of $1,000 in excess of $2,000. The form and terms of the exchange notes are the same as the form and terms of the outstanding notes except that: |

| | • | | the exchange notes have been registered under the federal securities laws and will not bear any legend restricting their transfer; |

| | • | | the exchange notes will bear a series B designation and a different CUSIP number than the outstanding notes; |

| | • | | the exchange notes will not be entitled to certain registration rights that are applicable to the outstanding notes under the registration rights agreement; and |

| | • | | certain special interest rate provisions applicable to the outstanding notes will no longer be applicable. |

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on November 13, 2008, unless we decide to extend the exchange offer, which we do not currently intend to do. A tender of outstanding notes pursuant to the exchange offer may be withdrawn at any time prior to the expiration date. Any outstanding notes not accepted for exchange for any reason will be returned without expense to the tendering holder promptly after the expiration or termination of the exchange offer. |

Conditions to the Exchange Offer | The exchange offer is subject to certain customary conditions, some of which we may waive. See “The Exchange Offer—Conditions to the Exchange Offer” below for more information regarding the conditions to the exchange offer. |

Procedures for Tendering Outstanding Notes | If you wish to accept the exchange offer, you must complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal, in accordance with the instructions contained in this prospectus and in the letter of transmittal. You must also then mail or otherwise deliver the letter of transmittal, or facsimile of the letter of transmittal, |

6

| | together with the outstanding notes to be exchanged and any other required documentation, to the exchange agent at the address set forth in this prospectus and in the letter of transmittal. If you hold outstanding notes through The Depository Trust Company, or DTC, and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC, by which you will agree to be bound by the letter of transmittal. |

By executing the letter of transmittal, you will represent to us that, among other things:

| | • | | any exchange notes to be received by you will be acquired in the ordinary course of business; |

| | • | | you are not participating in or intend to participate in, and have no arrangement or understanding with any person or entity to participate in a distribution (within the meaning of the Securities Act) of the exchange notes; |

| | • | | you are not an “affiliate” (within the meaning of Rule 405 under Securities Act) of Regatta Holdings, or if you are an affiliate, you will comply with any applicable registration and prospectus delivery requirements of the Securities Act; and |

| | • | | if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making or other trading activities, then you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

See the sections below entitled “The Exchange Offer—Purpose of the Exchange Offer,” “The Exchange Offer—Procedures for Tendering” and “Plan of Distribution.”

Effect of Not Tendering | Any outstanding notes that are not tendered or that are tendered but not accepted will remain subject to the restrictions on transfer provided for in the outstanding notes and in the indenture governing the notes. Since the outstanding notes have not been registered under the federal securities laws, they bear a legend restricting their transfer absent registration or the availability of a specific exemption from registration. Upon the completion of the exchange offer, we will have no further obligations, except under limited circumstances, to provide for registration of the outstanding notes under the federal securities laws. See “The Exchange Offer—Consequences of Failure to Exchange Outstanding Notes.” |

Interest on the Exchange Notes and the Outstanding Notes | The exchange notes will bear interest from the most recent interest payment date to which interest has been paid on the notes. Interest on the outstanding notes accepted for exchange will cease to accrue upon the issuance of the exchange notes. |

Withdrawal Rights | Tenders of outstanding notes may be withdrawn at any time prior to 5:00 p.m., New York City time, on the expiration date. |

7

United States Federal Tax Consequences | There will be no United States federal income tax consequences to you if you exchange your outstanding notes for exchange notes in the exchange offer. See “Material United States Federal Income Tax Consequences.” |

Use of Proceeds | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. |

Exchange Agent | Wells Fargo Bank, N.A., the trustee under the indentures, will serve as exchange agent in connection with the exchange offer. |

8

Terms of the Exchange Notes

The following is a brief summary of the terms of the exchange notes. The financial terms and covenants of the exchange notes are the same as the outstanding notes. For a more complete description of the terms of the exchange notes, see the section entitled “Description of Exchange Notes.”

Issuer | Local Insight Regatta Holdings, Inc. |

Exchange Notes Offered | $210.5 million of aggregate principal amount of 11.00% Series B Senior Subordinated Notes. |

Resale | Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are an “affiliate” of Regatta Holdings, within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that you are acquiring the exchange notes in the ordinary course of your business and that you are not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

Each participating broker-dealer that receives exchange notes for its own account pursuant to the exchange offer in exchange for outstanding notes that were acquired as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.”

Any holder of outstanding notes who:

| | • | | is an affiliate of Regatta Holdings; |

| | • | | does not acquire exchange notes in the ordinary course of business; or |

| | • | | tenders in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes; |

cannot rely on the position of the staff of the SEC enunciated inExxon Capital Holdings Corporation, Morgan Stanley & Co. Incorporated, Shearman & Sterling or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirement of the Securities Act in connection with the resale of the exchange notes. See “The Exchange Offer—Resale of Exchange Notes.”

Maturity Date | December 1, 2017. |

9

Guarantees | The exchange notes will be guaranteed, jointly and severally, irrevocably and unconditionally on a senior subordinated basis, by each of our existing and future domestic restricted subsidiaries that becomes a guarantor under our existing senior credit facilities or any successor credit facility. The guarantees will rank equally with all of the subsidiary guarantors’ other unsecured senior subordinated indebtedness, and will be subordinate in right of payment to any subsidiary guarantors’ senior indebtedness. |

Interest Payment Dates | We will pay interest on the exchange notes in cash every June 1 and December 1. |

Ranking | The exchange notes will be our unsecured senior subordinated obligations and will rank junior in right of payment to our existing and future senior debt. The exchange notes will rank equally with all future senior subordinated debt and senior to all future junior subordinated indebtedness. As of October 10, 2008, we had approximately $571.3 million of debt outstanding and $3.4 million of available borrowing capacity under our senior secured revolving credit facility. However, such available borrowing capacity represents the unfunded revolving loan commitment of Lehman Brothers Inc. under our senior secured revolving credit facility. Lehman Brothers Inc., whose parent has filed for bankruptcy protection, failed to fund this amount when we submitted a borrowing request following the bankruptcy. We therefore believe that this amount will be unavailable under our senior secured revolving credit facility. In addition, our existing credit facilities provide for an uncommitted incremental facility of up to $100.0 million. The indenture governing the exchange notes will allow us to incur additional debt, including senior secured debt, subject to certain restrictions. |

Optional Redemption | We may redeem some or all of the exchange notes at any time on or after December 1, 2012, at redemption prices described in this prospectus under the caption “Description of Exchange Notes—Optional Redemption.” Prior to December 1, 2012, we may not exercise our optional redemption rights. |

Change of Control Offer | Upon a change of control (as described below under “Description of Exchange Notes—Repurchase at the Option of Holders—Change of Control”), we must offer to repurchase the exchange notes at 101% of the principal amount of the exchange notes, plus accrued and unpaid interest to the date of repurchase. |

Certain Indenture Covenants | The indenture governing the exchange notes contains certain covenants limiting our ability and the ability of our restricted subsidiaries, under certain circumstances, to: |

| | • | | prepay subordinated indebtedness; |

10

| | • | | pay dividends or make other distributions on, redeem or repurchase, capital stock; |

| | • | | make investments or other restricted payments; |

| | • | | enter into transactions with affiliates; |

| | • | | engage in sale and leaseback transactions; |

| | • | | issue stock of restricted subsidiaries; |

| | • | | sell all, or substantially all, of our or its assets; |

| | • | | create liens on assets to secure debt; or |

| | • | | effect a consolidation or merger. |

These covenants are subject to important exceptions and qualifications as described in this prospectus under the caption “Description of Exchange Notes—Certain Covenants.”

No Public Market for the Exchange Notes | The exchange notes are new issues of securities and will not be listed on any securities exchange or included in any automated quotation system. The initial purchasers of the outstanding notes advised us at the time of the issuance of the notes that they then intend to make a market in the exchange notes. The initial purchasers are not obligated, however, to make a market in the exchange notes, and they may discontinue any market-making activities in their discretion at any time without notice. See the section below entitled “Plan of Distribution.” |

Risk Factors

You should carefully consider all the information in this prospectus prior to participating in the exchange offer. In particular, we urge you to consider carefully the factors set forth under “Risk Factors” beginning on page 12.

Corporate Information

Our principal executive offices are located at 188 Inverness Drive West, Suite 800, Englewood, Colorado 80112, and our telephone number at that location is 303-867-1600. LIYP’s website is located atwww.WindstreamYellowPages.com and The Berry Company’s website is located atwww.theberrycompany.com.The information contained on these websites is not a part of this prospectus and is not being incorporated by reference herein.

11

RISK FACTORS

An investment in the notes involves certain risks, including those set forth below. In addition to the risks set forth below, other risks and uncertainties not known to us or that we deem to be immaterial may also materially adversely affect our business operations. All of the following risks could materially and adversely affect our business, financial condition or results of operations. In such a case, you could lose all of or a part of your original investment. You should carefully consider the risks described below as well as other information and data included in this prospectus in considering whether to exchange any outstanding notes for exchange notes.

Risks Related to our Business

The loss of any of our key customer agreements could have a material adverse effect on our business.

In connection with the Split-Off, LIYP entered into several agreements with Windstream, including a Publishing Agreement that expires November 30, 2057. Under the Publishing Agreement, Windstream, among other things, appointed LIYP the exclusive official publisher of Windstream-branded print directories in the Windstream Service Areas. LIYP is also party to a directory publishing agreement with TDS Telecom, under which LIYP publishes 101 print directories on behalf of TDS Telecom.

In connection with the Berry ILOB acquisition, The Berry Company assumed L.M. Berry’s directory service contracts with its customers, including with CenturyTel Service Group, LLC, or CenturyTel, and with Frontier Directory Services Company, LLC and certain of its affiliates, which we collectively refer to as Frontier. Frontier currently may terminate its directory services agreement with The Berry Company by providing notice of the effective date of such termination (subject to certain wind-down procedures). If the directory service agreement with Frontier is terminated, The Berry Company would continue to receive commission payments for a period (up to 12 months following the effective date of the termination of the directory services agreement) based on the gross revenue billed or billable with respect to all directories published prior to the effective date of the termination of the directory services agreement. We are currently in negotiations with Frontier to extend the term of the existing agreement or enter into a new directory services agreement. These negotiations, which have been challenging from time to time, may not be successful, although the parties have recently agreed to attempt to seek a resolution of open points.

Each of these agreements may be terminated prior to its stated term under specified circumstances, some of which are beyond our reasonable control or could require extraordinary efforts or the incurrence of material excess costs on our part in order to avoid breach of such agreement. The termination or nonrenewal of any of these agreements in accordance with their stated terms or otherwise, or the failure by Windstream, TDS Telecom, CenturyTel or Frontier to satisfy their obligations under the agreements to which each is a party, could have a material adverse effect on our business, financial condition and results of operations.

Our inability to enforce the full scope of certain non-competition provisions may impair the value of our business.

LIYP’s Publishing Agreement with Windstream contains a non-competition agreement pursuant to which Windstream has generally agreed, among other things, not to publish tangible or digital media directory products consisting principally of wireline listings and classified advertisements of subscribers in the Windstream Service Areas or any area in which it published directory products for other LECs as of November 30, 2007. In connection with the Berry ILOB acquisition, L.M. Berry, BellSouth Advertising and Publishing Corporation, or BAPCO, and AT&T Yellow Pages Holdings, LLC, or YPH, entered into a non-competition agreement with The Berry Company pursuant to which they agreed, for a period of five years, not to compete with us in the business of providing independent outsourced sales forces to LECs as their primary sales force for local sales of paid advertisements. The noncompetition provisions apply to any English language Yellow Pages print directory in the geographic areas served by The Berry Company or LIYP as of April 23, 2008.

12

Under applicable law, enforcement of a covenant not to compete may be limited if:

| | • | | it is not necessary to protect a legitimate business interest of the party seeking enforcement; |

| | • | | it unreasonably restrains the party against whom enforcement is sought; or |

| | • | | it is contrary to the public interest. |

If these non-competition agreements were ever challenged, their enforceability would be determined by a court based on all of the facts and circumstances of the specific case at the time enforcement is sought. For this reason, it is not possible to predict with certainty whether, or to what extent, a court would enforce these non-competition agreements in our favor or find that any of them are unenforceable. If a court were to determine that any of these non-competition agreements are unenforceable, Windstream, L.M. Berry, BAPCO or YPH, as the case may be, could compete directly against us in the previously restricted markets, which could harm our business, financial condition and results of operations.

Our rights under existing agreements could be impaired if bankruptcy proceedings were brought by or against any of the parties to these agreements or certain third parties.

As described above, we are party to a Publishing Agreement and other commercial contracts with Windstream, and directory publishing agreements with TDS Telecom, CenturyTel, Frontier, ACS Media, CBD Media, HYP Media and other LECs. If a bankruptcy case were to be commenced by or against any of these companies, it is possible that all or part of these agreements could be considered an executory contract and could therefore be subject to rejection by that party or by a trustee appointed in a bankruptcy case. In addition, protections for certain types of intellectual property licenses under the Bankruptcy Code are limited in scope and do not presently extend to trademarks. Accordingly, we could lose our rights to use the trademarks we license in connection with these agreements should we or the party from whom we license these rights become subject to a bankruptcy proceeding. If one or more of these agreements were rejected, the applicable agreement might not be specifically enforceable. The loss of any rights under any of these agreements could have a material adverse effect on our business, financial condition and results of operations.

In addition, ACS Media, CBD Media and HYP Media (which are affiliates of ours) are parties to publishing agreements with the LECs in the markets they serve (Alaska Communications Systems Group, Inc. in the case of ACS Media, Cincinnati Bell Telephone Company LLC in the case of CBD Media and Hawaiian Telcom, Inc. in the case of HYP Media). Substantially all the obligations of ACS Media, CBD Media and HYP Media under those publishing agreements are outsourced to The Berry Company. If a bankruptcy case were to be commenced by or against any of these LECs, it is possible that all or part of the publishing agreement with that LEC could be considered an executory contract and could therefore be subject to rejection by that LEC or a trustee appointed in a bankruptcy case. The loss by ACS Media, CBD Media or HYP Media of its rights under its publishing agreement with the relevant LEC could result in a decrease or cessation of payments to The Berry Company under its directory service agreements with that company, which could have a material adverse effect on our business, financial condition and results of operations. On September 16, 2008, Hawaiian Telcom Communications, Inc., or HTCI, the parent of Hawaiian Telcom, Inc., announced that it had engaged the services of Lazard Frères & Co. LLC as its financial advisor to assist in the evaluation of various balance sheet restructuring options, that it expected to review a range of options to best position HTCI to maximize value and to capitalize on the continuing opportunities that exist in the Hawaii communications market, and that it is taking steps to organize HTCI’s bondholders to facilitate discussions regarding a revised strategic plan. HTCI stated that it could provide no assurances about the outcome of this process.

Our directory revenue may decline.

For the 11 months ended November 30, 2007 and the one month ended December 31, 2007, LIYP generated directory revenue of $122.7 million and $10.2 million, respectively. Directory revenue for the year ended December 31, 2006 was $149.7 million. For the six months ended June 30, 2008, LIYP generated directory

13

revenue of $65.2 million, compared to directory revenue of $69.0 million for the six months ended June 30, 2007. These declines were primarily due to lower print revenue. LIYP’s print revenue may continue to decline. The Berry Company’s print revenue may also decline. These declines may not be offset by increases in revenue from our IYP and other non-print products, which could harm our business, financial condition and results of operations.

We face significant competition in directory advertising that may reduce our market share and harm our financial performance.

The directory advertising industry is highly competitive. Approximately 77% of total U.S. directory advertising sales are attributable to publishers that are either owned by incumbent LECs (such as AT&T Inc.), or have agreements to publish directories for incumbent LECs (such as Idearc Inc. and R.H. Donnelley Corporation), or incumbent publishers. Independent Yellow Pages directory publishers operating in the United States compete with these incumbent publishers and represent the remaining market share.

In all of our directory publishing markets, we compete with one or more Yellow Pages directory publishers, which are predominantly independent publishers. Given the mature state of the directory advertising industry, independent competitors are typically focused on aggressive pricing to gain market share. In some markets, we also compete with other incumbent publishers in overlapping and adjacent markets, which affects our ability to attract and retain advertisers and to increase advertising rates. We also compete for advertising sales with other traditional media, including newspapers, magazines, radio, direct mail, telemarketing, billboards and television. Many of these other publishers and traditional media competitors are larger and have greater financial resources than us. We may not be able to compete effectively with these companies for advertising sales or acquisitions in the future, which could have a material adverse effect on our business, financial condition and results of operations.

If we fail to anticipate or respond adequately to changes in technology and user preferences, our competitive position could be materially adversely affected.

The Internet has emerged as a significant medium for advertisers. Advances in technology have brought and likely will continue to bring new participants, new products and new channels to our industry, primarily as a result of user preferences for electronic delivery of traditional directory information and electronic search engines and services. We expect the use of the Internet and wireless devices by consumers as a means to transact commerce and obtain information about advertisers to continue to result in new technologies being developed and services being provided that will compete with our traditional products and services. National search companies such as Google, AT&T and Yahoo! are focusing and placing high priorities on local commercial search initiatives. Several other companies are developing technologies that allow advertisers to tailor their messages to consumers based on detailed and individualized consumer information and to track and report this individualized information to advertisers to allow them to further refine their advertising initiatives. Our growth and future financial performance depends on our ability to develop and market new products and services and create new distribution channels, while enhancing existing products, services and distribution channels, to incorporate the latest technological advances and accommodate changing user preferences. We may not be able to provide services over the Internet successfully or compete successfully with other IYP or wireless services. If we fail to anticipate or respond adequately to changes in technology and user preferences or are unable to finance the capital expenditures necessary to respond to such changes, our advertising revenue could decline significantly.

We face significant competition from other Internet-based advertisers and search engines that may have more resources than us devoted to developing new technologies to enhance advertising revenues.

Directory publishers, including us, have increasingly bundled online advertising with their traditional print offerings in order to enhance total usage and advertiser value. LIYP operates an IYP site,WindstreamYellowPages.com. In addition, The Berry Company is an authorized reseller ofYellowPages.com, an IYP directory, and publishes IYP sites for 34 customers (including 31 LECs). These IYP sites compete with the IYP directories of incumbent publishers (such asSuperpages.com andDexknows.com) and of independent

14

directory publishers (such asYellowbook.com), and with other Internet sites, including those available through wireless applications, that provide classified directory information, such asSwitchboard.com (which is owned by Idearc Inc.),Business.com (which is owned by R.H. Donnelley Corporation),Citysearch.com andZagat.com, and with search engines and portals, such as Yahoo!, Google, MSN and others, some of which have entered into affiliate agreements with other major directory publishers. We may not be able to compete effectively with these other companies, some of which may have greater resources than we do, including financial and technical resources needed to develop technological advances necessary to attract and enhance advertising revenue in the future, which could have a material adverse effect on our business, financial condition and results of operations.

Increased competition in local telephone markets could reduce the benefits of using the Windstream and other incumbent LEC brand names.

The market position of Windstream, as well as other incumbent LECs with which we have publishing contracts, may be adversely impacted by the Telecommunications Act of 1996, which effectively opened local telephone markets to increased competition. In addition, Federal Communication Commission rules regarding local number portability, advances in communications technology (such as wireless devices and voice over Internet protocol) and demographic factors (such as potential shifts by younger generations away from wireline telephone communications towards wireless or other communications technologies) may further erode the market position of Windstream and other incumbent LECs. As a result, it is possible that some or all of these incumbent LECs will not remain the primary local telephone services providers in their local service areas. In that event, our right to be the exclusive publisher in that market and to use an incumbent LEC’s brand name on its directories in that market may not be as valuable as we presently anticipate, and we may not realize some of the existing benefits under our other commercial arrangements with such incumbent LECs.

Declining usage of printed Yellow Pages directories could adversely affect our business.

Overall references to print Yellow Pages directories in the United States have declined according to the most recent available data. We believe this decline was attributable to a number of factors, including increased usage of IYP directory products (particularly in business-to-business and retail categories), the proliferation of very large retail stores for which consumers and businesses may not reference the Yellow Pages, and demographic shifts among consumers, particularly the increase of households in which English was not the primary language spoken. We believe that over the next several years, references to print Yellow Pages directories are likely to gradually decline as users may increasingly turn to digital and interactive media delivery devices for local commercial search information.

Usage of our print directories may continue to decline. Any decline in usage could:

| | • | | impair our ability to maintain or increase our advertising prices; |

| | • | | reduce advertising sales in our Yellow Pages directories; and |

| | • | | discourage new businesses from purchasing advertising in our Yellow Pages directories. |

Any decline in the usage of our printed directories may not be offset in whole or in part by an increase in usage of our IYP directories. Any of the factors that may contribute to a decline in usage of our print directories, or a combination of them, could impair our revenues and have a material adverse effect on our business, financial condition and results of operations.

We may experience difficulties integrating the Berry ILOB.

On April 23, 2008, The Berry Company, our wholly-owned subsidiary, consummated its acquisition of substantially all the assets and certain liabilities of the Berry ILOB. Combining our operations, technologies and personnel with the Berry ILOB, coordinating and integrating sales organizations and distribution channels, and implementing appropriate standards, internal controls, processes, procedures, policies and information systems is and will be time-consuming and expensive. Disruption of, or loss of momentum in, our business or loss of key personnel caused by the acquisition and integration process, diversion of management’s attention from daily

15

operations and any delays or difficulties encountered in connection with these acquisition and integration efforts could have an adverse effect on our business, financial condition and results of operations. In addition, achieving the expected synergies and other benefits from our acquisition of the Berry ILOB will depend in large part on successful integration efforts.

A prolonged economic downturn would adversely affect our business.

We derive substantially all of our revenue from the sale of advertising in directories. Expenditures by advertising customers are sensitive to economic conditions and tend to decline in a recession or other period of uncertainty. We have experienced some decline in directory revenue as a result of recent economic conditions. A continuation or worsening of these economic conditions, a prolonged national or regional economic recession or other events that could produce major changes in shopping and spending patterns, such as the housing market crisis, the credit crisis or a terrorist attack, would have a material adverse effect on our business. In such an event, we would experience lower revenues.

Our dependence on third-party providers of printing, distribution and billing and collection services could materially affect us.

We rely on the information and other systems of our third-party service providers, their ability to perform key operations on our behalf in a timely manner and in accordance with agreed levels of service and their ability to attract and retain sufficient qualified personnel to perform these essential services for us. We depend on third parties to print and distribute our directories and for certain billing and collection services. In particular, we and our affiliates are party to multi-year printing agreements with Quebecor World (USA) Inc., or Quebecor, Des Plaines Printing, LLC, or Des Plains, RR Donnelley & Sons Company, or Donnelley, and Stevens Graphics, Inc., or Stevens Graphics, pursuant to which these third parties print and bind all of our directories (except for the directories published by The Berry Company for Frontier, which contracts directly with a third party for the printing of their directories).

In addition, Windstream performs billing and collection services with respect to amounts owed by advertisers in LIYP’s Windstream-branded directories. LIYP also has contracts with Market Distribution Specialists and Directory Distributing Associates for the distribution of its directories. Generally, The Berry Company’s LEC customers perform billing and collection services with respect to amounts owed by advertisers for whom such LEC is the provider of local telephone service. The Berry Company also has contracts with Directory Distributing Associates and Specialty Directory Distribution Services Inc. for the distribution of its directories.

Because of the large print volume and specialized binding of directories, there are only a limited number of companies capable of servicing our printing and distribution needs and for certain billing and collection services. If we were unable to maintain our current relationships with the third parties who provide our printing and distribution services to us under long-term contracts or any other third-party service providers, we would be required either to hire sufficient staff to perform the provider’s services in-house or to find an alternative service provider. In some cases, including the printing of our directories, it would be impracticable for us to perform the function internally. If we were required to perform any of the services that we currently outsource, it is unlikely that we would be able to perform them on a cost-effective basis. Accordingly, the inability or unwillingness of our third-party vendors to perform their obligations under agreements with us could have a material adverse effect on our business, results of operations and financial condition.

In January 2008, Quebecor filed for creditor protection under the Companies’ Creditors Arrangement Act in Canada and for bankruptcy protection under Chapter 11 of the United States Bankruptcy Code. In June 2008, Local Insight Media Holdings entered into an agreement with Quebecor that covers directories published by LIYP and The Berry Company. If Quebecor were to fail to successfully exit creditor protection, we would be required to find an alternative provider of printing services. In addition, under The Berry Company’s printing agreement with Stevens Graphics, Stevens Graphics subcontracts certain of its publishing obligations to Quebecor. Under Chapter 11, it is possible that all or part of Stevens Graphics’ agreement with Quebecor could

16

be considered an executory contract and could therefore be subject to rejection by Quebecor or by a trustee appointed in the bankruptcy case. To date, Stevens Graphics’ agreement with Quebecor has not been rejected. However, if that agreement were rejected, it might not be specifically enforceable. The loss of any direct or indirect rights under our agreements with Quebecor could have a material adverse effect on our business, financial condition and results of operations.

Fluctuations in the price or availability of paper could materially affect our costs and, as a result, our profitability.

The principal raw material that we use is paper. We do not obtain paper directly from paper mills. Rather, Quebecor, Des Plains and Stevens Graphics purchase the paper on our behalf at market prices that are then charged to us under our contracts with these providers. Changes in the supply of, or demand for, paper could affect delivery times and cause prices to fluctuate. Our third-party print service providers may not be able to continue to purchase paper at reasonable prices and any increases in the cost of paper could impact the profitability of our print directories and harm our overall operating results and financial condition.

Our business may be adversely affected by our reliance on, and our extension of credit to, SMEs.

We believe SMEs constitute a substantial majority of our customer accounts. In the ordinary course of business, we extend credit to these advertisers by allowing the SMEs to pay for their advertising purchases in installments. SMEs, however, tend to have fewer financial resources and higher failure rates than large businesses. In addition, full or partial collection of delinquent accounts can take an extended period of time. In part because of our reliance on SME’s, LIYP recorded $1.3 million in bad debt expense in 2007. The proliferation of very large retail stores may continue to harm SMEs. We believe this trend is a significant contributing factor to advertisers in any given year choosing not to renew their advertising in the following year. Consequently, our business, operating results and financial condition could be adversely affected by our dependence on and our extension of credit to SMEs.

Sales of advertising to national accounts are coordinated by third parties that we do not control.

For the 11 months ended November 30, 2007 and the one month ended December 31, 2007, the sale of advertising to national or large regional chains that purchase advertising in several of the directories that LIYP publishes (such as rental car companies, insurance companies, and pizza delivery businesses) accounted for approximately 10.9% and 2.0% of LIYP’s directory revenue, respectively. During the period from April 23, 2008 to June 30, 2008, the sale of advertising to national accounts accounted for approximately 11.8% of The Berry Company’s directory revenues. Substantially all the revenue derived from national accounts is serviced through CMRs, which are independent third parties that act as agents for national companies and design their advertisements, arrange for the placement of those advertisements in directories and provide billing services. As a result, our relationships with national advertisers depend significantly on the performance of these third party CMRs, which we do not control. If some or all of these CMRs were unable or unwilling to do business with us or if their performance declines, it could materially impair our ability to generate revenue from our national accounts and our overall financial condition and results of operations. In addition, we face credit risks with CMRs and may be required to write down amounts owed to us if a CMR is unable to pay.

The loss of important intellectual property rights could adversely affect us.

We rely on a combination of copyright and trademark laws as well as contractual arrangements to establish and protect our intellectual property rights. In connection with the Split-Off, we received an exclusive, royalty-free 50-year license to use the Windstream trademark in connection with our publication, marketing and distribution of directory products and related marketing materials in Windstream’s service areas. We also received an exclusive, royalty-free 50-year license to use theWindstreamYellowPages.com domain name. In addition, The Berry Company holds a 10-year, non-exclusive license to use theYellowPages.com trademark in connection with its activities under a Local Advertising Reseller Agreement with YellowPages.com LLC. We also own The Berry Company trademark. Our ability to continue to use licensed marks is subject to our

17

compliance with the terms and conditions of the respective licenses. These intellectual property rights are important to our business as our advertising sales depend to a large extent on our ability to develop and maintain strong brand recognition in the markets we serve, in particular the Windstream brand and theWindstreamYellowPages.com andYellowPages.com domain names. Consequently, the loss or significant limitation of our rights to use, or injury to the goodwill associated with, the trademarks we license or own could diminish our brand and impair our ability to generate advertising revenue in affected markets.

We license other key trademarks we currently use from the applicable LEC. These licenses generally interact with the other contractual arrangements with the applicable LEC, including with respect to the term of the license. Because we license, and do not own, these trademarks, we do not control their prosecution, maintenance or enforcement. Although provisions in the license agreements limit the actions the LECs may take with regard to the trademarks, our inability to control the prosecution, maintenance or defense of the trademarks could result in decisions adverse to us with regard to these trademarks, including the elimination of our rights to use a trademark. In addition, not all of the trademarks that we license from LECs are subject to state or federal trademark protection. This lack of protection may make it more difficult for the relevant LEC to defend against potential infringers and thus could decrease the value of the licensed trademarks to us.

Certain trademarks that we use contain generic terms or may be considered merely descriptive, and therefore may be less valuable to us.

Trademarks that we use may be less valuable to us to the extent a trademark is considered generic or merely descriptive. For example, the phrases “White Pages” and “Yellow Pages” are considered generic by the United States Patent and Trademark Office, or the USPTO, and the three-fingered “Walking Fingers” logo is in the public domain, meaning that third parties are free to use such phrases or logos in their own trademarks and designs. Moreover, elements of some of our licensed trademarks may be considered merely descriptive of the particular good or its source. Descriptive trademarks are initially only allowed registration on the Supplemental Register of the USPTO, if at all, which does not provide the same benefits as registration on the Principal Register. The trademarks currently registered on the Supplemental Register may not become registerable on the Principal Register and therefore afford less protection against use by third parties.

Legal actions involving the trademarks that we own or license could have a material adverse effect on our business.

We may be required from time to time to bring lawsuits against third parties to protect our rights in trademarks that we own or license. Similarly, from time to time, we may be party to proceedings whereby third parties challenge our rights in these trademarks. Any such lawsuits or other actions that we bring may not be successful and we may be found to have infringed or be infringing upon the intellectual property rights of third parties. Although we are not aware of any material infringements of any trademark rights, or loss of important intellectual property rights, that are significant to our business, any lawsuits, regardless of the outcome, or threatened litigation could result in substantial costs and diversion of resources, including costs associated with obtaining additional licenses to continue to use such intellectual property rights, and could have a material adverse effect on our business, financial condition and results of operations.

Litigation related to defamation and other claims could have a material adverse effect on our business.

Various lawsuits and other claims typical for a business of our size and nature are pending against us or may be threatened against us from time to time. We are exposed to defamation, breach of privacy claims and other litigation matters relating to our business, as well as methods of collection, processing and use of personal data. The subjects of our data and users of data collected and processed by us could also have claims against us if our data were found to be inaccurate, or if personal data stored by us were improperly accessed and disseminated by unauthorized persons. The defense of these claims and an adverse outcome of any such lawsuit could be costly, could harm our reputation with our customers and otherwise divert the attention of our management.

18

In addition, from time to time we receive communications from government or regulatory agencies concerning investigations or allegations of noncompliance with laws or regulations in jurisdictions in which we operate. We do not expect that the ultimate resolution of pending regulatory and legal matters in future periods will have a material effect on our financial condition. Any potential judgments, fines or penalties relating to these matters, however, may have a material effect on our results of operations in the period in which they are recognized.

Legislative initiatives directed at limiting or restricting the distribution of our print directory products or shifting the costs and responsibilities of waste management related to our print products could adversely affect our business.