ROADRUNNER TRANSPORTATION SYSTEMS Second Quarter 2018 Management Call YOUR GOODS. OUR BEST. YOUR GOODS. OUR BEST.

SAFE HARBOR STATEMENT This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which relate to future events or performance. Forward-looking statements include, among others, statements regarding the opportunity for Roadrunner to replace aging tractors and trailers and add capacity to its fleet over the next 12 months; Roadrunner’s expectation that the structural changes in dry van and intermodal services will begin to contribute to its results in the second half of 2018, with larger benefits from the full year impact in 2019; Roadrunner’s expectation that the changes in the LTL segment, coupled with increased freight density in key lanes, will result in improved operating trends in the second half of 2018 compared to the first half; Roadrunner’s expectation that its investments in people and IT and the integration work within the Ascent Global Logistics segment will continue to fuel growth and improved profitability in future periods; Roadrunner’s expectation that it will continue to invest in IT enhancements coupled with new capabilities across all three of its segments; the improvements in operational and corporate structure, which are designed to support future growth and allow Roadrunner to expand operating margins; Roadrunner’s expectation for revenue and Adjusted EBITDA by the end of 2020; Roadrunner’s belief that the structural changes being implemented will over time result in profitability that is more resilient and better positions Roadrunner for success throughout natural industry cycles. These statements are often, but not always, made through the use of words or phrases such as “may,” “will,” “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “predict,” “potential,” “opportunity,” and similar words or phrases or the negatives of these words or phrases. These forward-looking statements are based on Roadrunner’s current assumptions, expectations and beliefs and are subject to substantial risks, estimates, assumptions, uncertainties and changes in circumstances that may cause Roadrunner’s actual results, performance or achievements to differ materially from those expressed or implied in any forward-looking statement. Such factors include, among others, risks related to the restatement of Roadrunner’s previously issued financial statements, the remediation of Roadrunner’s identified material weaknesses in its internal control over financial reporting, the litigation resulting from the restatement of Roadrunner’s previously issued financial statements and the other risk factors contained in Roadrunner’s SEC filings, including Roadrunner’s Annual Report on Form 10-K for the year ended December 31, 2017. Because the risks, estimates, assumptions and uncertainties referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date hereof, and, except as required by law, Roadrunner assumes no obligation and does not intend to update any forward-looking statement to reflect events or circumstances after the date hereof. YOUR GOODS. OUR BEST. 2

INFORMATION ABOUT ADJUSTED EBITDA EBITDA represents earnings before interest, taxes, depreciation and amortization. We calculate Adjusted EBITDA as EBITDA excluding impairment and other non-cash gains and losses, other long-term incentive compensation expenses, losses from debt extinguishments, operations restructuring costs, corporate restructuring and restatement costs associated with legal matters (including our internal investigation, SEC compliance, and debt restructuring costs), and adjustments to contingent purchase obligations. We use Adjusted EBITDA as a supplemental measure in evaluating our operating performance and when determining executive incentive compensation. We believe Adjusted EBITDA is useful to investors in evaluating our performance compared to other companies in our industry because it assists in analyzing and benchmarking the performance and value of a business. The calculation of Adjusted EBITDA eliminates the effects of financing, income taxes, and the accounting effects of capital spending. These items may vary for different companies for reasons unrelated to the overall operating performance of a company’s business. Adjusted EBITDA is not a financial measure presented in accordance with GAAP. Although our management uses Adjusted EBITDA as a financial measure to assess the performance of our business compared to that of others in our industry, Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • Adjusted EBITDA does not reflect our cash expenditures, future requirements for capital expenditures, or contractual commitments; • Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; • Adjusted EBITDA does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on our debt or dividend payments on our preferred stock; • Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and Adjusted EBITDA does not reflect any cash requirements for such replacements; and • Other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, Adjusted EBITDA should not be considered a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our results of operations under GAAP. YOUR GOODS. OUR BEST. 3

AGENDA 1. Opening Comments 2. 2018 First Quarter & First Half Financial Results 3. Business Trends 4. Strategy Update & Outlook 5. Question & Answer Session YOUR GOODS. OUR BEST. 4

OPENING COMMENTS Comparable 2018 revenue growth for the second quarter and first half of 2018 Positive business trends in all segments, including sequential quarterly improvements in the Less-than-Truckload segment as turnaround investments continue Strong top and bottom line comparable growth in Ascent Global Logistics segment Truckload & Express Services segment continues strong revenue growth in ground and air expedited business while making structural improvements in temperature controlled, scheduled dry van and intermodal services YOUR GOODS. OUR BEST. 5

Second Quarter 2018 Results YOUR GOODS. OUR BEST. 6

SUMMARY OF Q2 2018 RESULTS Financial Summary Revenues increased to $558.0 million from $530.6 million in 2017; up 10.0% excluding Unitrans • Increase due to higher revenues in the TES and Ascent segments (excluding Unitrans); LTL revenues improved sequentially from the first quarter • Unitrans revenues were $23.1 million in 2017 Net operating loss of $11.4 million vs. $7.5 million in 2017 • 2018 operating loss includes $8.6 million of operations and corporate restructuring and restatement costs • Operations and corporate restructuring costs of $4.7 million • Restatement/litigation costs of $3.9 million net of insurance recoveries • 2017 operating loss includes $9.1 million of corporate restructuring and restatement costs; Unitrans contributed $2.0 million of operating income in 2017 Net loss of $42.0 million vs. $37.9 million in 2017 • Increased net loss in 2018 due primarily to higher interest costs related to the outstanding preferred stock and a lower income tax benefit, partially offset by the absence of a loss from debt extinguishment of $9.8 million in 2017 Diluted loss per share available to common stockholders of $1.09, compared to $0.99 in 2017 Adjusted EBITDA (excluding Unitrans) was $6.7 million vs. $9.1 million in 2017 • Decrease due to corporate cost increases of $4.3 million, primarily IT costs and professional fees related to the audit of our 2017 financial statements Note: For a reconciliation of Adjusted EBITDA to Net Income, see our earnings release dated August 8, 2018 YOUR GOODS. OUR BEST. 7

SUMMARY OF Q2 2018 RESULTS Segment Results Changed reporting segments in Q1: Truckload & Express Services (TES), Less-than-Truckload (LTL) and Ascent Global Logistics (Ascent) TES revenues of $300.0 million increased 14.1% from $262.8 million in 2017. Operating loss of $0.8 million vs. operating income of $3.5 million in 2017. Adjusted EBITDA up 5.1% to $10.1 million from $9.7 million in 2017 • Higher revenues due to increased ground and air expedited freight and related brokerage coupled with a strong demand environment which drove higher volumes and rates; purchased transportation costs and yield were negatively impacted by capacity reductions in intermodal services and over-the-road operations, including dry van and temperature controlled • Operating income includes $4.7 million of operations restructuring costs related to fleet and facilities right-sizing and severance costs to complete the integration of temperature controlled • Increase in Adjusted EBITDA due to improved volume and rates, partially offset by increased purchased transportation, equipment lease, maintenance and IT costs LTL revenues of $117.2 million vs. $122.0 million in 2017. Operating loss of $3.7 million vs. $3.3 million in 2017. Adjusted EBITDA loss of $2.8 million vs $2.3 million in 2017 • Revenue decline due to decrease in shipping volumes, partially offset by higher fuel surcharges and rates; during the quarter, the company reduced selected service areas to eliminate unprofitable freight and focus on key lanes • Adjusted EBITDA loss was down year over year but improved by $5.0 million sequentially from the first quarter; decrease in Adjusted EBITDA resulted from lower shipping volumes and increased IT costs Ascent revenues of $144.6 million vs. $148.1 million in 2017. Operating income of $7.3 million vs. $7.2 million in 2017. Adjusted EBITDA (excluding Unitrans) increased 30.0% to $8.5 million vs. $6.5 million in 2017 • Revenues up 15.7% excluding Unitrans which had revenues of $23.1 million in 2017. Increase was due to higher revenue from domestic freight management (truckload and LTL brokerage) and retail consolidation (growth from existing and new customers) • 2017 operating income included $2.0 million from Unitrans • Increase in Adjusted EBITDA due to improved performance driven by growth in retail consolidation and domestic freight management, partly offset by declines in international freight forwarding and increases in other operating expenses, including IT costs YOUR GOODS. OUR BEST. 8

ADJUSTED EBITDA Second Quarter 2018 vs. 2017 (In thousands) Three Months Ended June 30, 2018 Corporate/ TES LTL Ascent Eliminations Total Net (loss) income $ (758 ) $ (3,763 ) $ 7,285 $ (44,719 ) $ (41,955 ) Plus: Total interest expense 8 20 29 34,175 34,232 Plus: Benefit from income taxes — — — (3,652 ) (3,652) Plus: Depreciation and amortization 6,241 900 1,168 815 9,124 Plus: Long-term incentive compensation expenses — — — 426 426 Plus: Operations restructuring costs 4,655 — — — 4,655 Plus: Corporate restructuring and restatement costs — — — 3,911 3,911 Adjusted EBITDA $ 10,146 $ (2,843 ) $ 8,482 $ (9,044 ) $ 6,741 (In thousands) Three Months Ended June 30, 2017 Corporate/ Less: Total w/o TES LTL Ascent Eliminations Total Unitrans Unitrans Net (loss) income $ 3,475 $ (3,312 ) $ 7,181 $ (45,207 ) $ (37,863 ) $ 2,026 $ (39,889 ) Plus: Total interest expense (19 ) 48 36 28,290 28,355 — 28,355 Plus: Benefit from income taxes — — — (7,812 ) (7,812 ) — (7,812 ) Plus: Depreciation and amortization 6,197 953 1,631 429 9,210 295 8,915 Plus: Long-term incentive compensation expenses — — — 659 659 — 659 Plus: Loss on debt extinguishments — — — 9,827 9,827 — 9,827 Plus: Corporate restructuring and restatement costs — — — 9,052 9,052 — 9,052 Adjusted EBITDA $ 9,653 $ (2,311 ) $ 8,848 $ (4,762 ) $ 11,428 $ 2,321 $ 9,107 Note: Adjusted EBITDA for the Ascent segment in the second quarter of 2017, excluding Unitrans, was $6.5 million. YOUR GOODS. OUR BEST. 9

First Half 2018 Results YOUR GOODS. OUR BEST. 10

SUMMARY OF FIRST HALF 2018 RESULTS Financial Summary Revenues increased to $1,128.0 million from $1,009.5 million in 2017; up 17.4% excluding Unitrans • Unitrans revenues were $48.3 million in 2017 Net operating loss of $24.8 million vs. $25.4 million in 2017 • 2018 operating loss includes $15.5 million of operations and corporate restructuring and restatement costs • 2017 operating loss includes $16.8 million of corporate restructuring and restatement costs; Unitrans contributed $4.5 million of operating income in 2017 Net loss of $65.6 million vs. $57.8 million in 2017 • Increased net loss in 2018 due primarily to higher interest costs related to the outstanding preferred stock, partially offset by the absence of a loss from debt extinguishment of $9.8 million in 2017 Diluted loss per share available to common stockholders of $1.70, compared to diluted loss per share of $1.51 in 2017 Adjusted EBITDA (excluding Unitrans) was $9.9 million vs. $6.1 million in 2017 YOUR GOODS. OUR BEST. 11

SUMMARY OF FIRST HALF 2018 RESULTS Segment Results TES revenues of $626.1 million increased 27.7% from $490.3 million in 2017. Operating income of $3.7 million vs. $1.7 million in 2017. Adjusted EBITDA up 46.7% to $20.8 million from $14.2 million in 2017 • Higher revenues due to increased ground and air expedited freight and related brokerage coupled with a strong demand environment which drove higher volumes and rates; purchased transportation costs and yield were negatively impacted by capacity reductions in intermodal services and over-the-road operations, including dry van and temperature controlled • Operating income included $4.7 million of operations restructuring costs related to fleet and facilities right-sizing and severance costs to complete the integration of temperature controlled • Increase in Adjusted EBITDA due to improved volume and rates, partially offset by increased purchased transportation costs, equipment lease and maintenance expense, and IT costs LTL revenues of $230.3 million vs. $230.7 million in 2017. Operating loss of $12.4 million vs. $6.0 million in 2017. Adjusted EBITDA loss of $10.6 million vs. $4.1 million in 2017 • Revenue decline of 0.2% due to a decrease in shipping volumes, partially offset by higher fuel surcharges and rates • Decrease in Adjusted EBITDA due to lower shipping volumes, higher purchased transportation costs driven by market conditions resulting in rate increases from purchase power providers and higher spot prices paid to brokers, which negatively impacted linehaul expense; and higher other operating expenses, including equipment lease, facility-related and bad debt expenses Ascent revenues of $279.6 million vs. $293.6 million in 2017. Operating income of $14.0 million vs. $14.9 million in 2017. Adjusted EBITDA (excluding Unitrans) increased 25.0% to $16.4 million vs. $13.1 million in 2017 • Revenues increased 14.0% excluding Unitrans, which contributed $48.3 million of revenue in 2017; revenue increase due to retail consolidation (growth from existing and new customers) and domestic freight management (higher truckload and LTL brokerage) • 2017 operating income included $4.5 million from Unitrans • Increase in Adjusted EBITDA resulted from improved performance driven by growth in retail consolidation and domestic freight management, partially offset by decreases in international freight forwarding and increases in other operating expenses, including IT costs YOUR GOODS. OUR BEST. 12

ADJUSTED EBITDA First Half 2018 vs. 2017 YOUR GOODS. OUR BEST. 13

LIQUIDITY & EQUIPMENT PURCHASE UPDATE Currently have approximately $40 million of available funds for working capital and operating purposes from existing borrowing capacity under ABL facility and standby commitment from preferred stock investor In compliance with ABL and preferred stock investment agreements Recently received approvals for equipment purchase financing from a number of captive OEM contract manufacturers and other lenders; opportunities to replace aging tractors and trailers and add capacity over the next 12 months YOUR GOODS. OUR BEST. 14

Business Trends YOUR GOODS. OUR BEST. 15

BUSINESS TRENDS Truckload & Express Services Operating Commentary Strategy • Integration to improve our scale and right size capacity to address both scheduled and unscheduled freight needs Q2 2018 vs 2017 (%) H1 2018 vs 2017 (%) • During Q2 we completed the integration of multiple temperature controlled Over-the-Road businesses into one business, including right sizing fleets, facilities and support Fleet Revenue $106,244 1.3% $212,700 1.9% functions. We incurred nonrecurring operations restructuring charges of $4.7m in Brokerage Revenue $97,649 26.1% $230,035 61.1% Q2 related to these activities Intermodal Revenue $33,894 7.1% $66,512 3.6% Over the Road ~ 65% of Segment Revenue Air • Includes our dry van, temperature controlled and flatbed fleets and related brokerage Fleet Revenue $30,964 78.5% $58,436 118.9% • Revenue growth driven primarily by expedited ground brokerage which is primarily Brokerage Revenue $33,373 0.3% $65,634 31.9% management fee based and generates lower relative margins • Modest increases in fleet revenues vs. prior year representing improvements in rates offset Local, Warehouse & Other Revenue $8,452 8.0% $16,667 5.2% by reductions in fleet size, primarily in temperature control Intrasegment Eliminations ($10,540) (10.3%) ($23,881) (35.3%) Intermodal Services ~ 10% of Segment Revenue • Revenue growth driven by improvement in rates partially offset by reductions in load counts from scaling back operations at unprofitable terminals and customers and higher than Total Revenue $300,037 14.2% $626,104 27.7% normal weather disruptions in January Adjusted EBITDA $10,146 5.1% $20,842 46.7% Air ~ 20% of Segment Revenue • Air revenues up strongly with good performance in owned and leased fleet. A tight market continues to favorably impact demand and rates YOUR GOODS. OUR BEST. 16 16

BUSINESS TRENDS Less-than-Truckload Operating Commentary Strategy • Focus on core competency as a metro to metro long haul provider • Reducing pickup and delivery footprint to remove unprofitable areas and redeploy Supplemental Operating KPI's Q2 2018 vs 2017 (%) H1 2018 vs 2017 (%) assets to more profitable lanes, while improving freight profile • Sales and pricing discipline to drive volume in strategic lanes Revenue (Incl. Fuel) ( a ) $114,100 (6.5%) $227,302 (1.5%) • Drive shipment reliability and visibility through investments in technology, centralization and Revenue (Ex. Fuel) $98,397 (9.1%) $196,735 (3.6%) process standardization Revenue per Hundredweight (Incl. Fuel) $21.03 6.6% $21.00 7.4% Trends Revenue per Hundredweight (Ex. Fuel) $18.13 3.7% $18.17 5.1% • Adjusted EBITDA improved by $4.9m from Q1 to Q2, which reflects the team’s efforts Revenue per Shipment (Incl. Fuel) $240.77 13.1% $236.54 11.8% regarding yield, freight profile and improving direct costs Revenue per Shipment (Ex. Fuel) $207.63 10.0% $204.73 9.4% Pounds per Shipment 1,145 6.1% 1,127 4.2% Revenue & Yield Shipments per Day 7,405 (17.3%) 7,507 (11.9%) • Q2 revenue down 4% due to reductions in shipments associated with reduced pickup and delivery footprint and addressing unprofitable customers, partially offset by improved pricing and freight profile Backhaul Revenue ( b ) $3,133 N/A $3,133 N/A • Revenue per shipment up 10% excluding fuel and 13% including fuel Intrasegment Eliminations ( c ) ($69) (6.6%) ($146) (25.0%) • Yield up 4% excluding fuel and 7% including fuel • Continued success increasing revenue in our Tier 1 lanes (Major Metro) – 60% in 18Q2 vs. Total Revenue (a+b+c) $117,164 (3.9%) $230,289 (0.2%) 58% in 18Q1 and 53% in 17Q2 Adjusted EBITDA ($2,843) (23.0%) ($10,614) (160.7%) Cost • Improved pickup and delivery costs due to reduced footprint and improved freight profile • While linehaul costs continue to be a headwind versus last year, we had a second sequential quarter of improvement • Driving mode optimization by reducing use of purchased power and increasing direct rail and IC’s usage YOUR GOODS. OUR BEST. 17 17

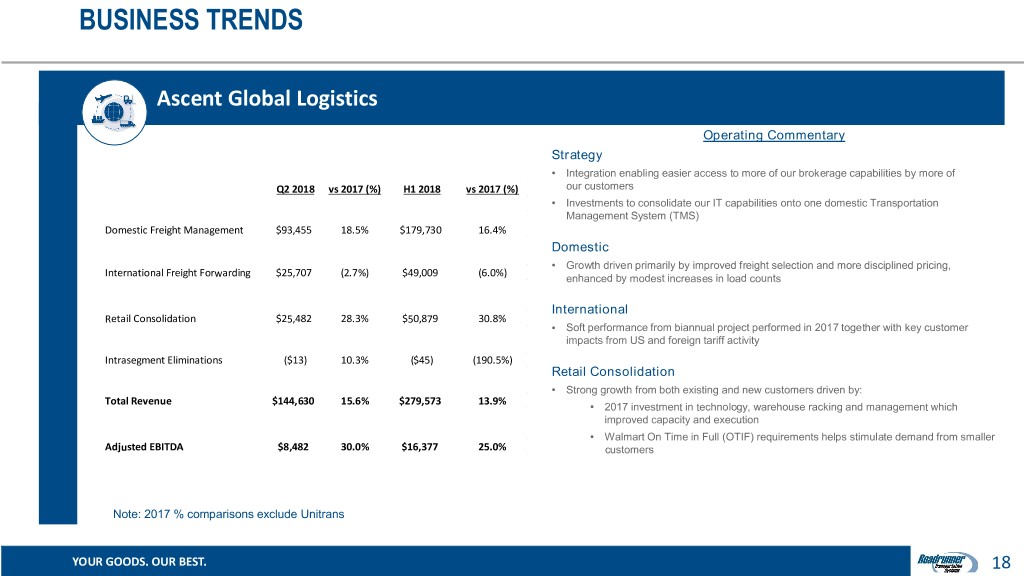

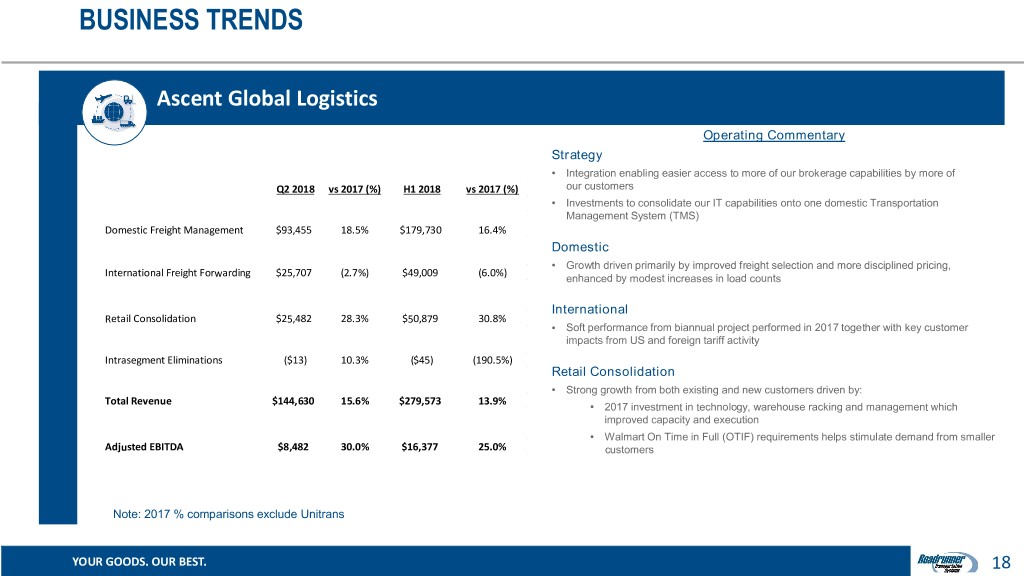

BUSINESS TRENDS Ascent Global Logistics Operating Commentary Strategy • Integration enabling easier access to more of our brokerage capabilities by more of Q2 2018 vs 2017 (%) H1 2018 vs 2017 (%) our customers • Investments to consolidate our IT capabilities onto one domestic Transportation Management System (TMS) Domestic Freight Management $93,455 18.5% $179,730 16.4% Domestic • Growth driven primarily by improved freight selection and more disciplined pricing, International Freight Forwarding $25,707 (2.7%) $49,009 (6.0%) enhanced by modest increases in load counts International Retail Consolidation $25,482 28.3% $50,879 30.8% • Soft performance from biannual project performed in 2017 together with key customer impacts from US and foreign tariff activity Intrasegment Eliminations ($13) 10.3% ($45) (190.5%) Retail Consolidation • Strong growth from both existing and new customers driven by: Total Revenue $144,630 15.6% $279,573 13.9% • 2017 investment in technology, warehouse racking and management which improved capacity and execution • Walmart On Time in Full (OTIF) requirements helps stimulate demand from smaller Adjusted EBITDA $8,482 30.0% $16,377 25.0% customers Note: 2017 % comparisons exclude Unitrans YOUR GOODS. OUR BEST. 18 18

Strategy Update & Outlook YOUR GOODS. OUR BEST. 19

BUSINESS IMPROVEMENT GUIDEPOSTS 5 Key Phases – Tracking & Reporting Our Progress 5. OPTIMIZATION YOUR GOODS. OUR BEST. 20

2018 SIMPLIFICATION & INTEGRATION Key Initiatives Segment strategies • Improve operational structure and performance in Truckload & Express segment • Integrate and expand Ascent Global Logistics segment • Invest in longer-term recovery of LTL segment Invest in our fleets and drivers • New equipment and better control – recent commitments for equipment purchase financing • Increased driver/contractor pay and retention – improving trends and stability IT investments • Improved system integration and customer-facing technology in each segment • IT upgrades that will support integration, strengthen internal controls and enable future growth Financial goals • Implement key operating and ROIC metrics across all business units • Move operating margins closer to industry norms YOUR GOODS. OUR BEST. 21

POSITIVE OUTLOOK Expect benefits from first half integrations and investments will begin to contribute to results in the second half of 2018 with larger benefits from the full year impact in 2019 • Truckload & Express Services and Ascent positive business trends expected to continue • Expect improvement in LTL operating trends in the second half of 2018 Expansion of operating margins expected in future periods • Expect to achieve revenue of over $2.2 billion and Adjusted EBITDA of over $100 million by end of 2020 • Represents a 2020 target of Adjusted EBITDA margin similar to the company’s 2015 revenue of $2.0 billion and Adjusted EBITDA of $93.6 million Working with Barclays to identify the optimal capital structure to support our long-term business plans YOUR GOODS. OUR BEST. 22

Q & A Discussion YOUR GOODS. OUR BEST. 23