Roadrunner Transportation Systems Reports Second Quarter and First Half 2019 Results • Revenue and Adjusted EBITDA declined in 2019 second quarter primarily due to low market demand in air and ground expedited logistics at the Active On-Demand segment • Ascent Global Logistics (Ascent) segment earned lower revenue and marginally lower Adjusted EBITDA in 2019 second quarter due to declines in truckload volumes and rate mix which offset revenue improvements in international freight forwarding and retail consolidation • LTL segment continued to improve freight quality and operating metrics despite a slight decline in second quarter revenue and Adjusted EBITDA • Truckload segment Adjusted EBITDA declined due to lower revenue and higher costs at certain operating units • Narrowing strategic focus to logistics and asset-light LTL segments Downers Grove, IL (BUSINESS WIRE) - August 7, 2019 -- Roadrunner Transportation Systems, Inc. (“Roadrunner” or the “company”) (NYSE: RRTS), a leading asset-right transportation and asset-light logistics service provider, today announced results for the second quarter ended June 30, 2019. The company changed its segment reporting effective April 1, 2019, when the company began assessing the performance of the Active On-Demand air and ground expedited logistics business separately from its truckload businesses. Segment information for prior periods has been adjusted to align with the new segment structure. Second Quarter Financial Results Revenues for the second quarter ended June 30, 2019 were $480.7 million, compared to revenues of $558.0 million for the second quarter ended June 30, 2018. Lower revenues were primarily due to declines of $63.3 million in air and ground expedited logistics at Active On-Demand as well as reduced truckload shipment volumes and rate mix at Ascent and lower volumes at certain Truckload operating units. Operating loss was $137.8 million in the second quarter of 2019, compared to $11.4 million in the second quarter of 2018. Included in the 2019 operating loss was $108.3 million of goodwill, intangible asset, software and asset impairment charges. Excluding impairment charges, the higher consolidated operating loss in the second quarter of 2019 was attributable to a decrease of over $10 million in operating results at Active On-Demand as well as declines in LTL and Ascent. These declines were partially offset by improved operating results in Truckload. 1

Net loss was $141.9 million in the second quarter of 2019, compared to $42.0 million in the second quarter of 2018. In addition to the consolidated operating loss explanations above, the consolidated net loss in the second quarter of 2019 was impacted by a decrease in interest expense of $29.6 million (due to the absence of interest on the company’s preferred stock which was fully redeemed after completion of the company’s rights offering in February 2019) and a lower benefit from income taxes. The company’s effective income tax rate was 0.4% and 8.0% during the second quarter of 2019 and 2018, respectively. Diluted loss per share available to common stockholders was $3.77 for the second quarter of 2019, compared to diluted loss per share of $27.24 for the second quarter of 2018. On April 5, 2019, the company executed a 1-for-25 reverse stock split. All share and per common share data has been retroactively adjusted for all periods presented. After reflecting the impact of the reverse stock split, the weighted average common stock outstanding used in the calculation of diluted loss per share was significantly higher in the second quarter of 2019 due to the company’s issuance of 36 million shares of common stock in the rights offering which was completed in February 2019. (In thousands) Revenue Comparison of Second Quarter 2019 to 2018 Active On- Corporate/ Ascent Demand LTL TL Eliminations Total Q2 2019 Revenues $ 130,160 $ 101,492 $ 117,076 $ 141,472 $ (9,512) $ 480,688 Q2 2018 Revenues 144,630 164,770 117,164 145,761 (14,299) 558,026 Difference $ (14,470) $ (63,278) $ (88) $ (4,289) $ 4,787 $ (77,338) Adjusted EBITDA for the quarters ended June 30, 2019 and 2018 was calculated as follows: (In thousands) Three Months Ended June 30, 2019 Active On- Corporate/ Ascent Demand LTL TL Eliminations Total Net (loss) income $ 5,777 $ (2,614) $ (4,494 ) $ (104,278 ) $ (36,340 ) $ (141,949 ) Plus: Total interest expense 95 — 54 772 3,711 4,632 Plus: Provision (benefit) for income taxes 8 — — — (532 ) (524 ) Plus: Depreciation and amortization 1,616 2,125 1,085 7,030 2,932 14,788 Plus: Impairment charges — — — 95,336 12,995 108,331 Plus: Long-term incentive compensation 0 expenses — — — — 4,594 4,594 Plus: Settlement of contingent purchase obligation — — — — 360 360 Plus: Corporate restructuring and restatement costs — — — — 3,242 3,242 Adjusted EBITDA $ 7,496 $ (489) $ (3,355 ) $ (1,140 ) $ (9,038 ) $ (6,526 ) Adjusted EBITDA as a % of revenue 5.8 % (0.5)% (2.9) % (0.8)% (1.4) % 2

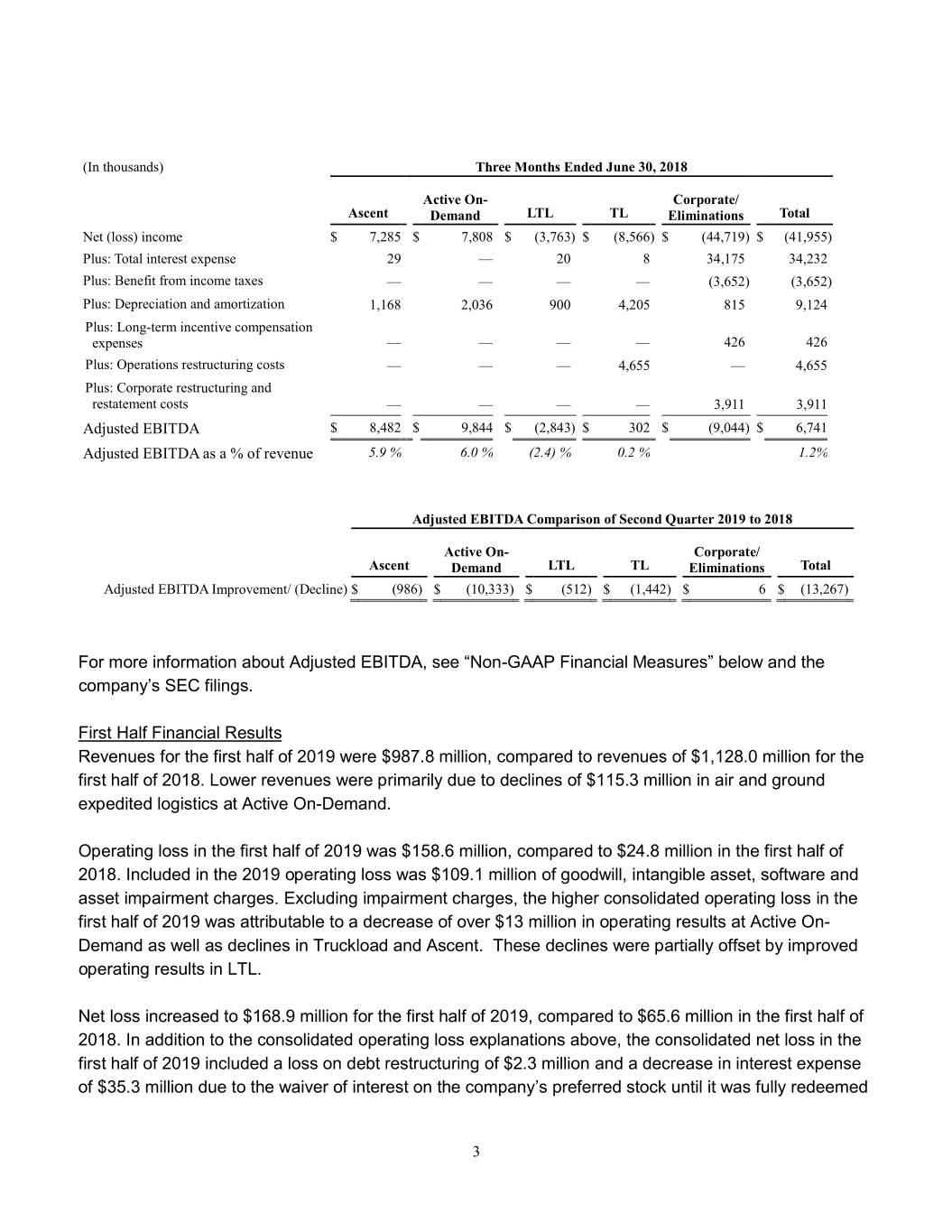

(In thousands) Three Months Ended June 30, 2018 Active On- Corporate/ Ascent Demand LTL TL Eliminations Total Net (loss) income $ 7,285 $ 7,808 $ (3,763) $ (8,566 ) $ (44,719 ) $ (41,955) Plus: Total interest expense 29 — 20 8 34,175 34,232 Plus: Benefit from income taxes — — — — (3,652 ) (3,652 ) Plus: Depreciation and amortization 1,168 2,036 900 4,205 815 9,124 Plus: Long-term incentive compensation expenses — — — — 426 426 Plus: Operations restructuring costs — — — 4,655 — 4,655 Plus: Corporate restructuring and restatement costs — — — — 3,911 3,911 Adjusted EBITDA $ 8,482 $ 9,844 $ (2,843) $ 302 $ (9,044 ) $ 6,741 Adjusted EBITDA as a % of revenue 5.9 % 6.0 % (2.4) % 0.2 % 1.2% Adjusted EBITDA Comparison of Second Quarter 2019 to 2018 Active On- Corporate/ Ascent Demand LTL TL Eliminations Total Adjusted EBITDA Improvement/ (Decline) $ (986) $ (10,333) $ (512) $ (1,442) $ 6 $ (13,267) (Decline) For more information about Adjusted EBITDA, see “Non-GAAP Financial Measures” below and the company’s SEC filings. First Half Financial Results Revenues for the first half of 2019 were $987.8 million, compared to revenues of $1,128.0 million for the first half of 2018. Lower revenues were primarily due to declines of $115.3 million in air and ground expedited logistics at Active On-Demand. Operating loss in the first half of 2019 was $158.6 million, compared to $24.8 million in the first half of 2018. Included in the 2019 operating loss was $109.1 million of goodwill, intangible asset, software and asset impairment charges. Excluding impairment charges, the higher consolidated operating loss in the first half of 2019 was attributable to a decrease of over $13 million in operating results at Active On- Demand as well as declines in Truckload and Ascent. These declines were partially offset by improved operating results in LTL. Net loss increased to $168.9 million for the first half of 2019, compared to $65.6 million in the first half of 2018. In addition to the consolidated operating loss explanations above, the consolidated net loss in the first half of 2019 included a loss on debt restructuring of $2.3 million and a decrease in interest expense of $35.3 million due to the waiver of interest on the company’s preferred stock until it was fully redeemed 3

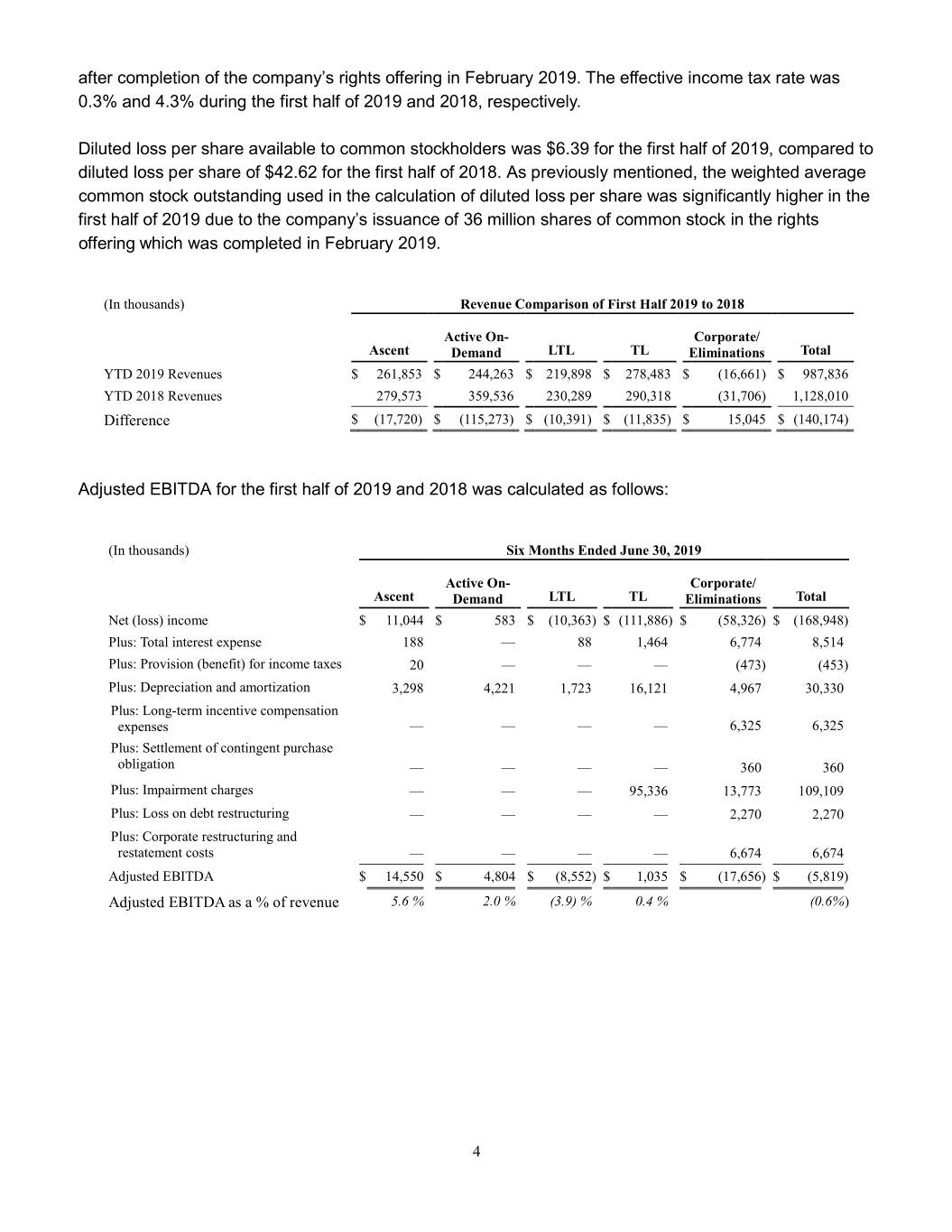

after completion of the company’s rights offering in February 2019. The effective income tax rate was 0.3% and 4.3% during the first half of 2019 and 2018, respectively. Diluted loss per share available to common stockholders was $6.39 for the first half of 2019, compared to diluted loss per share of $42.62 for the first half of 2018. As previously mentioned, the weighted average common stock outstanding used in the calculation of diluted loss per share was significantly higher in the first half of 2019 due to the company’s issuance of 36 million shares of common stock in the rights offering which was completed in February 2019. (In thousands) Revenue Comparison of First Half 2019 to 2018 Active On- Corporate/ Ascent Demand LTL TL Eliminations Total YTD 2019 Revenues $ 261,853 $ 244,263 $ 219,898 $ 278,483 $ (16,661) $ 987,836 YTD 2018 Revenues 279,573 359,536 230,289 290,318 (31,706) 1,128,010 Difference $ (17,720) $ (115,273) $ (10,391) $ (11,835) $ 15,045 $ (140,174) Adjusted EBITDA for the first half of 2019 and 2018 was calculated as follows: (In thousands) Six Months Ended June 30, 2019 Active On- Corporate/ Ascent Demand LTL TL Eliminations Total Net (loss) income $ 11,044 $ 583 $ (10,363 ) $ (111,886 ) $ (58,326 ) $ (168,948 ) Plus: Total interest expense 188 — 88 1,464 6,774 8,514 Plus: Provision (benefit) for income taxes 20 — — — (473) (453 ) Plus: Depreciation and amortization 3,298 4,221 1,723 16,121 4,967 30,330 Plus: Long-term incentive compensation expenses — — — — 6,325 6,325 Plus: Settlement of contingent purchase 0 obligation — — — — 360 360 Plus: Impairment charges — — — 95,336 13,773 109,109 Plus: Loss on debt restructuring — — — — 2,270 2,270 Plus: Corporate restructuring and restatement costs — — — — 6,674 6,674 Adjusted EBITDA $ 14,550 $ 4,804 $ (8,552 ) $ 1,035 $ (17,656 ) $ (5,819 ) Adjusted EBITDA as a % of revenue 5.6 % 2.0 % (3.9) % 0.4 % (0.6% ) 4

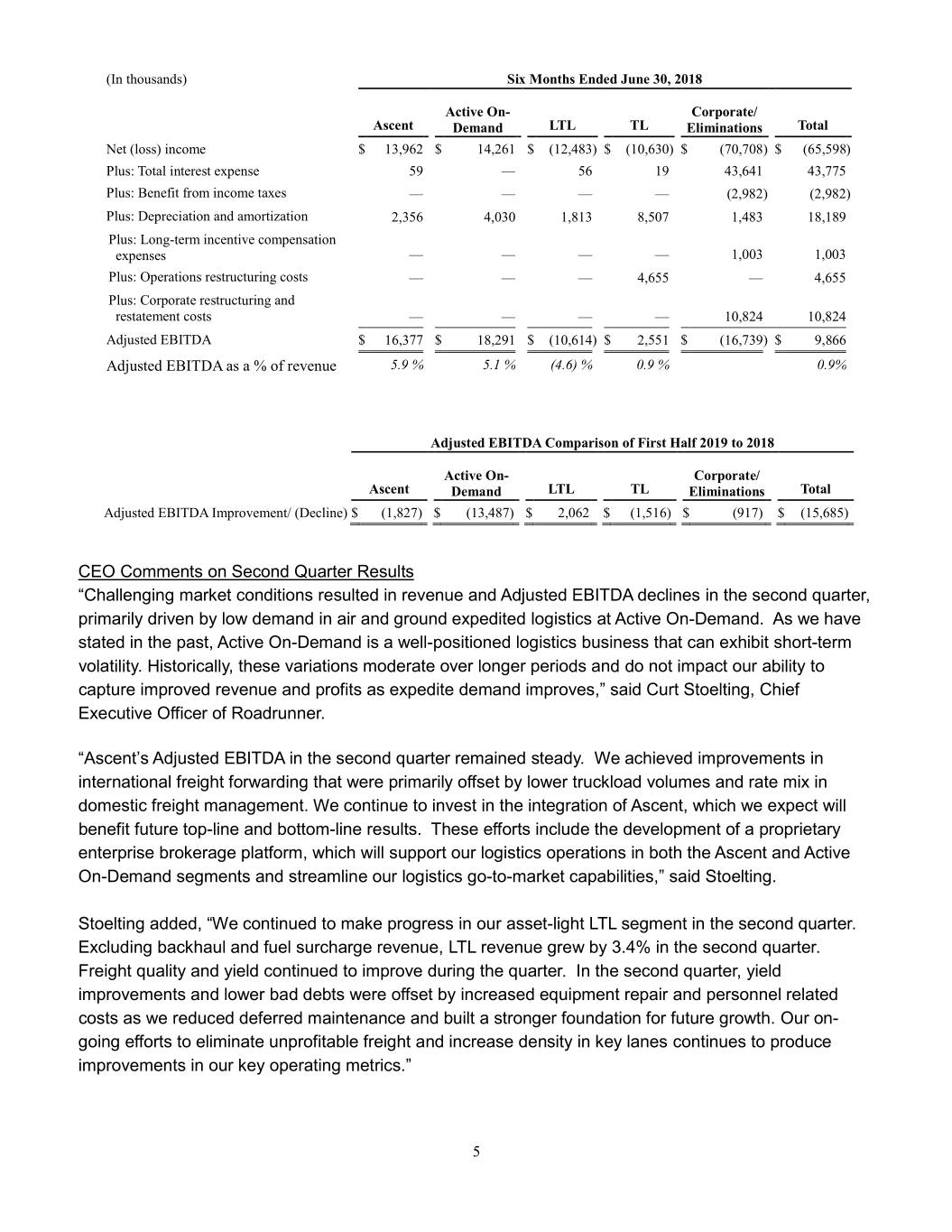

(In thousands) Six Months Ended June 30, 2018 Active On- Corporate/ Ascent Demand LTL TL Eliminations Total Net (loss) income $ 13,962 $ 14,261 $ (12,483 ) $ (10,630 ) $ (70,708 ) $ (65,598) Plus: Total interest expense 59 — 56 19 43,641 43,775 Plus: Benefit from income taxes — — — — (2,982 ) (2,982 ) Plus: Depreciation and amortization 2,356 4,030 1,813 8,507 1,483 18,189 Plus: Long-term incentive compensation expenses — — — — 1,003 1,003 Plus: Operations restructuring costs — — — 4,655 — 4,655 Plus: Corporate restructuring and restatement costs — — — — 10,824 10,824 Adjusted EBITDA $ 16,377 $ 18,291 $ (10,614 ) $ 2,551 $ (16,739 ) $ 9,866 Adjusted EBITDA as a % of revenue 5.9 % 5.1 % (4.6) % 0.9 % 0.9% Adjusted EBITDA Comparison of First Half 2019 to 2018 Active On- Corporate/ Ascent Demand LTL TL Eliminations Total Adjusted EBITDA Improvement/ (Decline) $ (1,827) $ (13,487) $ 2,062 $ (1,516) $ (917) $ (15,685) (Decline) CEO Comments on Second Quarter Results “Challenging market conditions resulted in revenue and Adjusted EBITDA declines in the second quarter, primarily driven by low demand in air and ground expedited logistics at Active On-Demand. As we have stated in the past, Active On-Demand is a well-positioned logistics business that can exhibit short-term volatility. Historically, these variations moderate over longer periods and do not impact our ability to capture improved revenue and profits as expedite demand improves,” said Curt Stoelting, Chief Executive Officer of Roadrunner. “Ascent’s Adjusted EBITDA in the second quarter remained steady. We achieved improvements in international freight forwarding that were primarily offset by lower truckload volumes and rate mix in domestic freight management. We continue to invest in the integration of Ascent, which we expect will benefit future top-line and bottom-line results. These efforts include the development of a proprietary enterprise brokerage platform, which will support our logistics operations in both the Ascent and Active On-Demand segments and streamline our logistics go-to-market capabilities,” said Stoelting. Stoelting added, “We continued to make progress in our asset-light LTL segment in the second quarter. Excluding backhaul and fuel surcharge revenue, LTL revenue grew by 3.4% in the second quarter. Freight quality and yield continued to improve during the quarter. In the second quarter, yield improvements and lower bad debts were offset by increased equipment repair and personnel related costs as we reduced deferred maintenance and built a stronger foundation for future growth. Our on- going efforts to eliminate unprofitable freight and increase density in key lanes continues to produce improvements in our key operating metrics.” 5

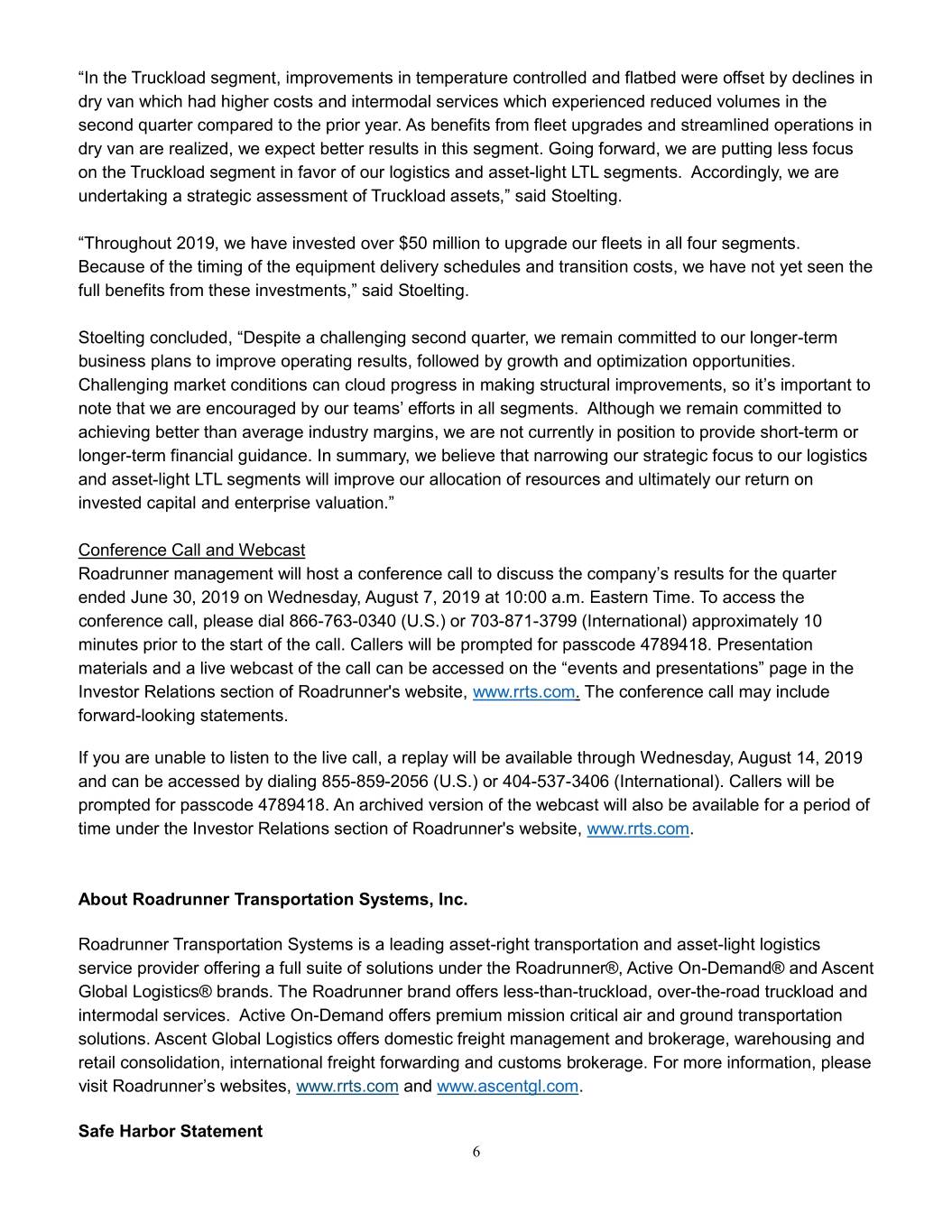

“In the Truckload segment, improvements in temperature controlled and flatbed were offset by declines in dry van which had higher costs and intermodal services which experienced reduced volumes in the second quarter compared to the prior year. As benefits from fleet upgrades and streamlined operations in dry van are realized, we expect better results in this segment. Going forward, we are putting less focus on the Truckload segment in favor of our logistics and asset-light LTL segments. Accordingly, we are undertaking a strategic assessment of Truckload assets,” said Stoelting. “Throughout 2019, we have invested over $50 million to upgrade our fleets in all four segments. Because of the timing of the equipment delivery schedules and transition costs, we have not yet seen the full benefits from these investments,” said Stoelting. Stoelting concluded, “Despite a challenging second quarter, we remain committed to our longer-term business plans to improve operating results, followed by growth and optimization opportunities. Challenging market conditions can cloud progress in making structural improvements, so it’s important to note that we are encouraged by our teams’ efforts in all segments. Although we remain committed to achieving better than average industry margins, we are not currently in position to provide short-term or longer-term financial guidance. In summary, we believe that narrowing our strategic focus to our logistics and asset-light LTL segments will improve our allocation of resources and ultimately our return on invested capital and enterprise valuation.” Conference Call and Webcast Roadrunner management will host a conference call to discuss the company’s results for the quarter ended June 30, 2019 on Wednesday, August 7, 2019 at 10:00 a.m. Eastern Time. To access the conference call, please dial 866-763-0340 (U.S.) or 703-871-3799 (International) approximately 10 minutes prior to the start of the call. Callers will be prompted for passcode 4789418. Presentation materials and a live webcast of the call can be accessed on the “events and presentations” page in the Investor Relations section of Roadrunner's website, www.rrts.com. The conference call may include forward-looking statements. If you are unable to listen to the live call, a replay will be available through Wednesday, August 14, 2019 and can be accessed by dialing 855-859-2056 (U.S.) or 404-537-3406 (International). Callers will be prompted for passcode 4789418. An archived version of the webcast will also be available for a period of time under the Investor Relations section of Roadrunner's website, www.rrts.com. About Roadrunner Transportation Systems, Inc. Roadrunner Transportation Systems is a leading asset-right transportation and asset-light logistics service provider offering a full suite of solutions under the Roadrunner®, Active On-Demand® and Ascent Global Logistics® brands. The Roadrunner brand offers less-than-truckload, over-the-road truckload and intermodal services. Active On-Demand offers premium mission critical air and ground transportation solutions. Ascent Global Logistics offers domestic freight management and brokerage, warehousing and retail consolidation, international freight forwarding and customs brokerage. For more information, please visit Roadrunner’s websites, www.rrts.com and www.ascentgl.com. Safe Harbor Statement 6

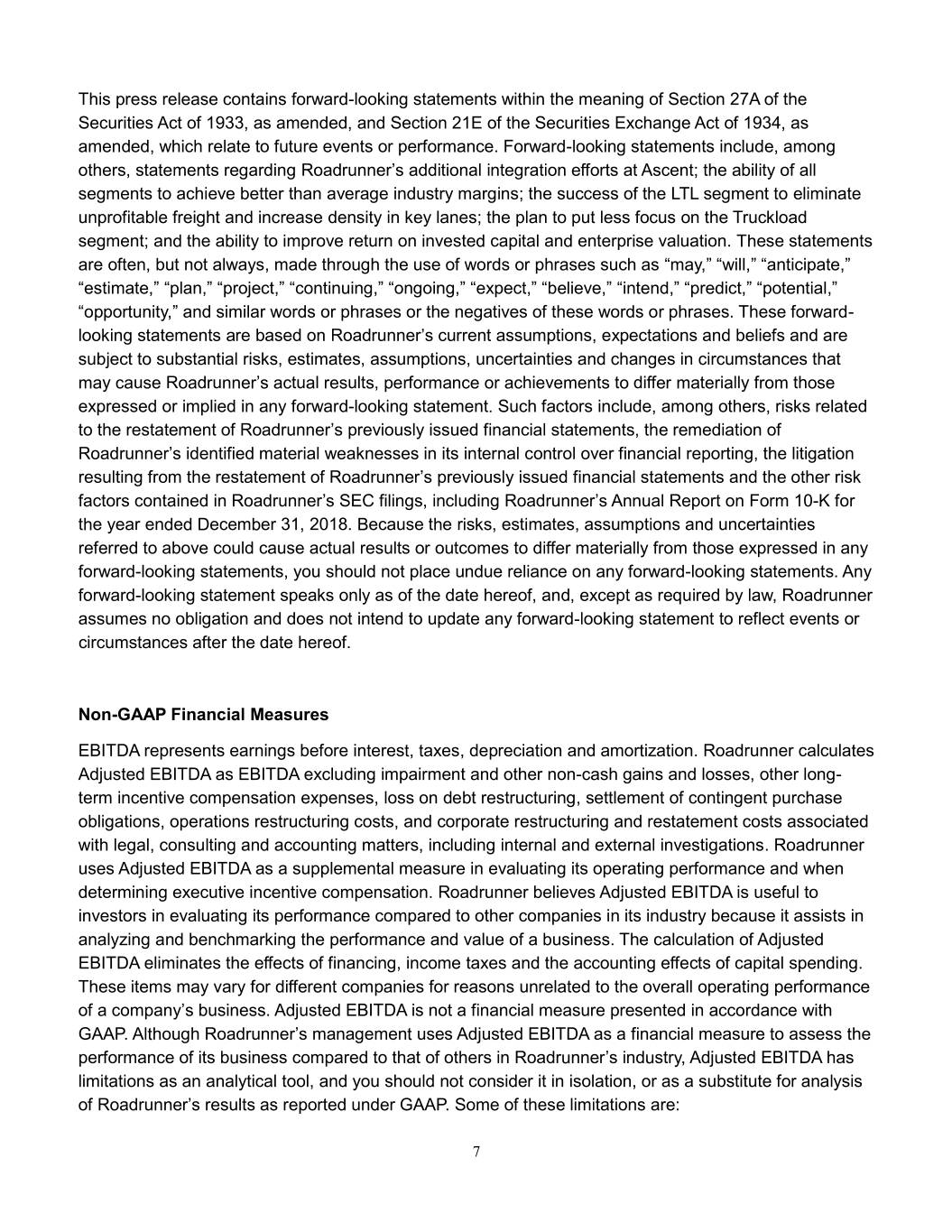

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which relate to future events or performance. Forward-looking statements include, among others, statements regarding Roadrunner’s additional integration efforts at Ascent; the ability of all segments to achieve better than average industry margins; the success of the LTL segment to eliminate unprofitable freight and increase density in key lanes; the plan to put less focus on the Truckload segment; and the ability to improve return on invested capital and enterprise valuation. These statements are often, but not always, made through the use of words or phrases such as “may,” “will,” “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “predict,” “potential,” “opportunity,” and similar words or phrases or the negatives of these words or phrases. These forward- looking statements are based on Roadrunner’s current assumptions, expectations and beliefs and are subject to substantial risks, estimates, assumptions, uncertainties and changes in circumstances that may cause Roadrunner’s actual results, performance or achievements to differ materially from those expressed or implied in any forward-looking statement. Such factors include, among others, risks related to the restatement of Roadrunner’s previously issued financial statements, the remediation of Roadrunner’s identified material weaknesses in its internal control over financial reporting, the litigation resulting from the restatement of Roadrunner’s previously issued financial statements and the other risk factors contained in Roadrunner’s SEC filings, including Roadrunner’s Annual Report on Form 10-K for the year ended December 31, 2018. Because the risks, estimates, assumptions and uncertainties referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date hereof, and, except as required by law, Roadrunner assumes no obligation and does not intend to update any forward-looking statement to reflect events or circumstances after the date hereof. Non-GAAP Financial Measures EBITDA represents earnings before interest, taxes, depreciation and amortization. Roadrunner calculates Adjusted EBITDA as EBITDA excluding impairment and other non-cash gains and losses, other long- term incentive compensation expenses, loss on debt restructuring, settlement of contingent purchase obligations, operations restructuring costs, and corporate restructuring and restatement costs associated with legal, consulting and accounting matters, including internal and external investigations. Roadrunner uses Adjusted EBITDA as a supplemental measure in evaluating its operating performance and when determining executive incentive compensation. Roadrunner believes Adjusted EBITDA is useful to investors in evaluating its performance compared to other companies in its industry because it assists in analyzing and benchmarking the performance and value of a business. The calculation of Adjusted EBITDA eliminates the effects of financing, income taxes and the accounting effects of capital spending. These items may vary for different companies for reasons unrelated to the overall operating performance of a company’s business. Adjusted EBITDA is not a financial measure presented in accordance with GAAP. Although Roadrunner’s management uses Adjusted EBITDA as a financial measure to assess the performance of its business compared to that of others in Roadrunner’s industry, Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of Roadrunner’s results as reported under GAAP. Some of these limitations are: 7

• Adjusted EBITDA does not reflect Roadrunner’s cash expenditures, future requirements for capital expenditures or contractual commitments; • Adjusted EBITDA does not reflect changes in, or cash requirements for, Roadrunner’s working capital needs; • Adjusted EBITDA does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on Roadrunner’s debt or dividend payments on Roadrunner’s preferred stock; • Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and Adjusted EBITDA does not reflect any cash requirements for such replacements; and • Other companies in Roadrunner’s industry may calculate Adjusted EBITDA differently than Roadrunner does, limiting its usefulness as a comparative measure. Because of these limitations, Adjusted EBITDA should not be considered a measure of discretionary cash available to Roadrunner to invest in the growth of the company’s business. Roadrunner compensates for these limitations by relying primarily on Roadrunner’s results of operations under GAAP. ### Contact: Reputation Partners Marilyn Vollrath 414-376-8834 ir@rrts.com 8

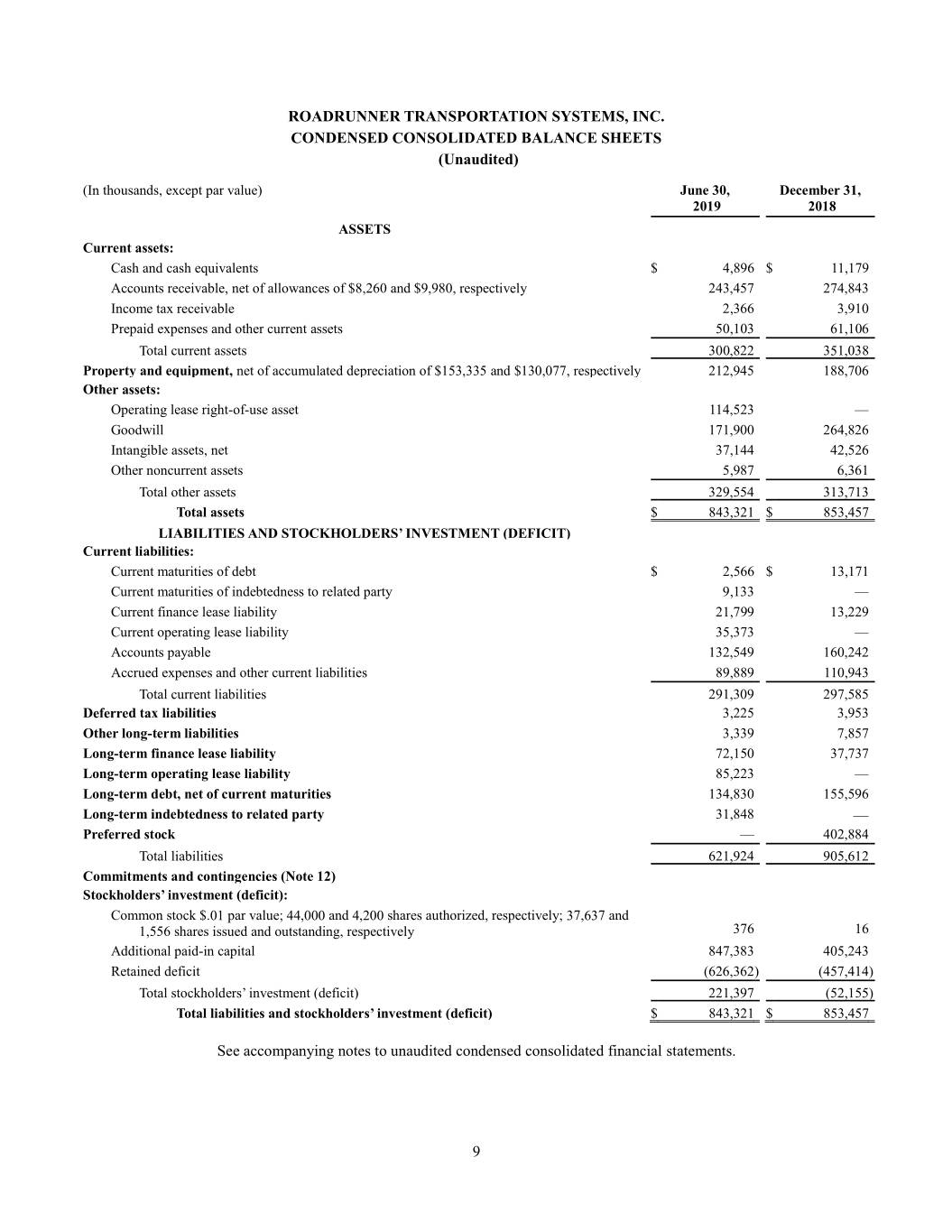

ROADRUNNER TRANSPORTATION SYSTEMS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (In thousands, except par value) June 30, December 31, 2019 2018 ASSETS Current assets: Cash and cash equivalents $ 4,896 $ 11,179 Accounts receivable, net of allowances of $8,260 and $9,980, respectively 243,457 274,843 Income tax receivable 2,366 3,910 Prepaid expenses and other current assets 50,103 61,106 Total current assets 300,822 351,038 Property and equipment, net of accumulated depreciation of $153,335 and $130,077, respectively 212,945 188,706 Other assets: Operating lease right-of-use asset 114,523 — Goodwill 171,900 264,826 Intangible assets, net 37,144 42,526 Other noncurrent assets 5,987 6,361 Total other assets 329,554 313,713 Total assets $ 843,321 $ 853,457 LIABILITIES AND STOCKHOLDERS’ INVESTMENT (DEFICIT) Current liabilities: Current maturities of debt $ 2,566 $ 13,171 Current maturities of indebtedness to related party 9,133 — Current finance lease liability 21,799 13,229 Current operating lease liability 35,373 — Accounts payable 132,549 160,242 Accrued expenses and other current liabilities 89,889 110,943 Total current liabilities 291,309 297,585 Deferred tax liabilities 3,225 3,953 Other long-term liabilities 3,339 7,857 Long-term finance lease liability 72,150 37,737 Long-term operating lease liability 85,223 — Long-term debt, net of current maturities 134,830 155,596 Long-term indebtedness to related party 31,848 — Preferred stock — 402,884 Total liabilities 621,924 905,612 Commitments and contingencies (Note 12) Stockholders’ investment (deficit): Common stock $.01 par value; 44,000 and 4,200 shares authorized, respectively; 37,637 and 1,556 shares issued and outstanding, respectively 376 16 Additional paid-in capital 847,383 405,243 Retained deficit (626,362 ) (457,414 ) Total stockholders’ investment (deficit) 221,397 (52,155 ) Total liabilities and stockholders’ investment (deficit) $ 843,321 $ 853,457 See accompanying notes to unaudited condensed consolidated financial statements. 9

ROADRUNNER TRANSPORTATION SYSTEMS, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (In thousands, except per share amounts) Three Months Ended Six Months Ended June 30, June 30, 2019 2018 2019 2018 Revenues $ 480,688 $ 558,026 $ 987,836 $ 1,128,010 Operating expenses: Purchased transportation costs 317,785 380,072 660,560 781,035 Personnel and related benefits 81,686 75,838 160,901 151,725 Other operating expenses 95,939 99,712 185,553 197,211 Depreciation and amortization 14,788 9,124 30,330 18,189 Operations restructuring costs — 4,655 — 4,655 Impairment charges 108,331 — 109,109 — Total operating expenses 618,529 569,401 1,146,453 1,152,815 Operating loss (137,841 ) (11,375 ) (158,617 ) (24,805 ) Interest expense: Interest expense - preferred stock — 31,609 — 38,724 Interest expense - debt 4,632 2,623 8,514 5,051 Total interest expense 4,632 34,232 8,514 43,775 Loss on debt restructuring — — 2,270 — Loss before income taxes (142,473 ) (45,607 ) (169,401 ) (68,580 ) Benefit from income taxes (524 ) (3,652 ) (453 ) (2,982 ) Net loss $ (141,949 ) $ (41,955 ) $ (168,948 ) $ (65,598 ) Loss per share: Basic $ (3.77 ) $ (27.24 ) $ (6.39 ) $ (42.62 ) Diluted $ (3.77 ) $ (27.24 ) $ (6.39 ) $ (42.62 ) Weighted average common stock outstanding: Basic 37,603 1,540 26,442 1,539 Diluted 37,603 1,540 26,442 1,539 See accompanying notes to unaudited condensed consolidated financial statements. 10

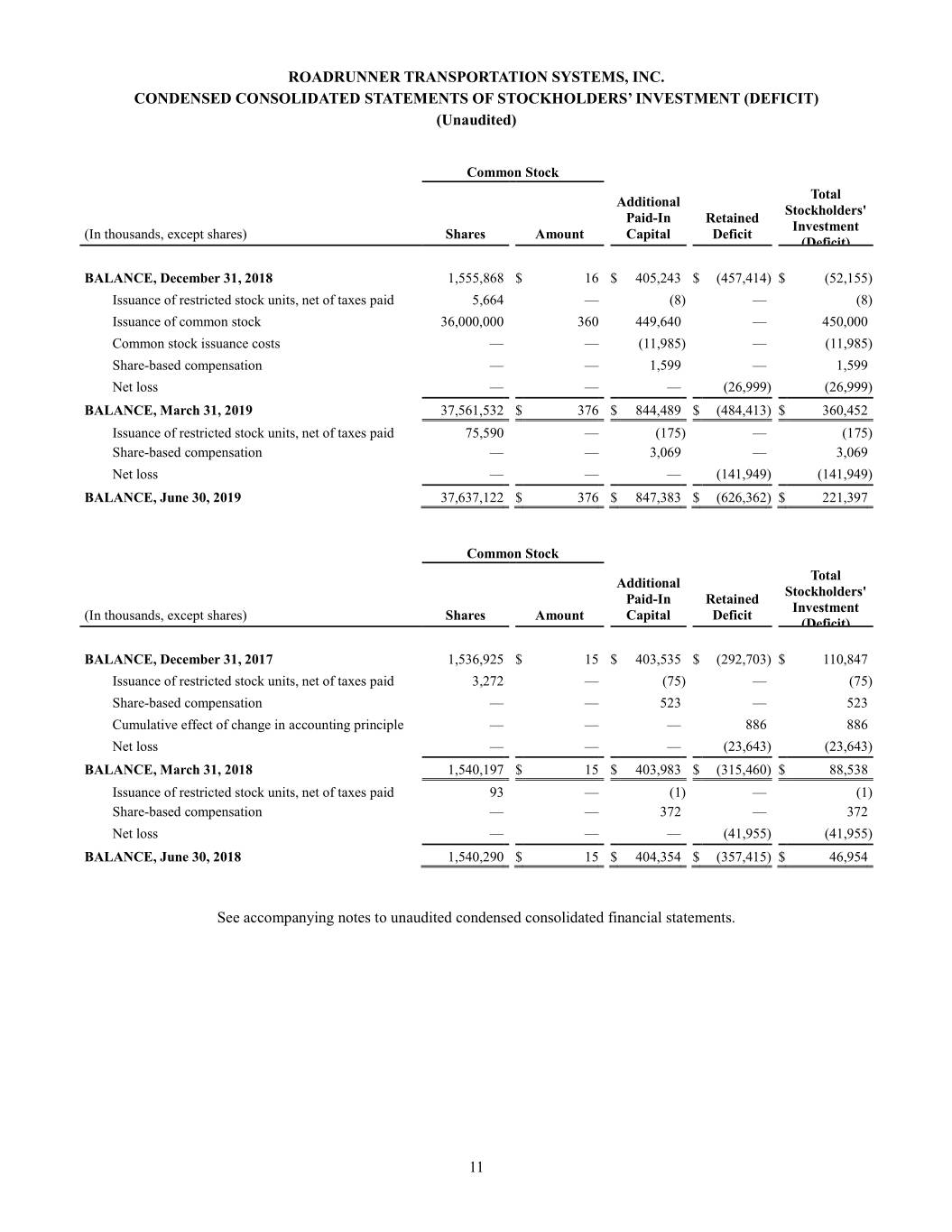

ROADRUNNER TRANSPORTATION SYSTEMS, INC. CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ INVESTMENT (DEFICIT) (Unaudited) Common Stock Total Additional Stockholders' Paid-In Retained Investment (In thousands, except shares) Shares Amount Capital Deficit (Deficit) BALANCE, December 31, 2018 1,555,868 $ 16 $ 405,243 $ (457,414 ) $ (52,155 ) Issuance of restricted stock units, net of taxes paid 5,664 — (8 ) — (8 ) Issuance of common stock 36,000,000 360 449,640 — 450,000 Common stock issuance costs — — (11,985 ) — (11,985 ) Share-based compensation — — 1,599 — 1,599 Net loss — — — (26,999 ) (26,999 ) BALANCE, March 31, 2019 37,561,532 $ 376 $ 844,489 $ (484,413 ) $ 360,452 Issuance of restricted stock units, net of taxes paid 75,590 — (175 ) — (175 ) Share-based compensation — — 3,069 — 3,069 Net loss — — — (141,949 ) (141,949 ) BALANCE, June 30, 2019 37,637,122 $ 376 $ 847,383 $ (626,362 ) $ 221,397 Common Stock Total Additional Stockholders' Paid-In Retained Investment (In thousands, except shares) Shares Amount Capital Deficit (Deficit) BALANCE, December 31, 2017 1,536,925 $ 15 $ 403,535 $ (292,703 ) $ 110,847 Issuance of restricted stock units, net of taxes paid 3,272 — (75 ) — (75 ) Share-based compensation — — 523 — 523 Cumulative effect of change in accounting principle — — — 886 886 Net loss — — — (23,643 ) (23,643 ) BALANCE, March 31, 2018 1,540,197 $ 15 $ 403,983 $ (315,460 ) $ 88,538 Issuance of restricted stock units, net of taxes paid 93 — (1 ) — (1 ) Share-based compensation — — 372 — 372 Net loss — — — (41,955 ) (41,955 ) BALANCE, June 30, 2018 1,540,290 $ 15 $ 404,354 $ (357,415 ) $ 46,954 See accompanying notes to unaudited condensed consolidated financial statements. 11

ROADRUNNER TRANSPORTATION SYSTEMS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (In thousands) Six Months Ended June 30, 2019 2018 Cash flows from operating activities: Net loss $ (168,948 ) $ (65,598 ) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 30,720 18,552 Change in fair value of preferred stock — 37,663 Amortization of preferred stock issuance costs — 1,061 Loss on disposal of property and equipment 355 1,972 Share-based compensation 4,668 895 Loss on debt restructuring 2,270 — Provision for bad debts 491 2,030 Deferred tax benefit (729 ) (3,544 ) Impairment charges 109,109 — Changes in: Accounts receivable 30,895 27,156 Income tax receivable 1,544 911 Prepaid expenses and other assets 30,676 6,900 Accounts payable (29,879 ) (23,852 ) Accrued expenses and other liabilities (30,718 ) (5,052 ) Net cash used in operating activities (19,546 ) (906 ) Cash flows from investing activities: Capital expenditures (13,043 ) (11,391 ) Proceeds from sale of property and equipment 1,882 927 Net cash used in investing activities (11,161 ) (10,464 ) Cash flows from financing activities: Borrowings under revolving credit facilities 523,478 — Payments under revolving credit facilities (526,643 ) — Term debt borrowings 52,592 557 Term debt payments (39,714 ) (11,846 ) Debt issuance costs (2,005 ) — Payments of debt extinguishment costs (693 ) — Proceeds from issuance of common stock 450,000 — Common stock issuance costs (10,514 ) — Proceeds from issuance of preferred stock — 34,999 Preferred stock issuance costs — (1,061 ) Preferred stock payments (402,884 ) — Issuance of restricted stock units, net of taxes paid (183 ) (76 ) Payments on insurance premium financing (9,957 ) — Payment of capital lease obligation (9,053 ) (1,267 ) Net cash provided by financing activities 24,424 21,306 Net (decrease) increase in cash and cash equivalents (6,283 ) 9,936 Cash and cash equivalents: Beginning of period 11,179 25,702 End of period $ 4,896 $ 35,638 12

ROADRUNNER TRANSPORTATION SYSTEMS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued) (Unaudited) Six Months Ended (In thousands) June 30, 2019 2018 Supplemental cash flow information: Cash paid for interest $ 8,125 $ 4,966 Cash (refunds from) paid for income taxes, net $ (787 ) $ 144 Non-cash finance leases and other obligations to acquire assets $ 52,456 $ 10,451 Capital expenditures, not yet paid $ 2,814 $ — See accompanying notes to unaudited condensed consolidated financial statements. 13