Registration No. 333-________

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GREENWOOD GOLD RESOURCES, INC.

(Name of small business issuer in its charter)

| Nevada | 1081 |

| (State or Other Jurisdiction of Organization) | (Primary Standard Industrial Classification Code) |

__________________________

| 4285 S.W. Martin Highway | | Val-U-Corp Services, Inc. |

| Palm City, Florida 34990 | | 1802 North Carson Street, Suite 212 |

| (772)288-2775 | | Carson City, Nevada 89701 |

| | | (775)887-8853 |

| (Address and telephone number of registrant's | | (Name, address and telephone |

| executive office) | | number of agent for service) |

__________________________

Copies to:

The Law Office of Conrad C. Lysiak, P.S.

601 West First Avenue, Suite 903

Spokane, Washington 99201

(509) 624-1475

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [ X ]

If this Form is filed to register additional common stock for an offering under Rule 462(b) of the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed under Rule 462(c) of the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed under Rule 462(d) of the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer"and "smaller reporting company"in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | [ | ] | Accelerated Filer | [ ] |

| Non-accelerated Filer | [ | ] | Smaller reporting company | [X] |

| (Do not check if a smaller reporting company) | | |

| CALCULATION OF REGISTRATION FEE |

| |

| | | Securities to be | Amount To Be | Offering Price Per | Aggregate Offering | | Registration Fee |

| | | Registered | Registered | Share | Price | | [1] |

| | | Common Stock by | | | | | | | |

| | | Selling Shareholders: | 3,327,750 | $ | 0.30 | $ | 998,325.00 | $ | 39.23 |

| |

| | | Total | 3,327,750 | $ | 0.30 | $ | 998,325.00 | $ | 39.23 |

| |

| [1 | ] | Estimated solely for purposes of calculating the registration fee under Rule 457. | | |

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON DATES AS THE COMMISSION, ACTING UNDER SAID SECTION 8(a), MAY DETERMINE.

- 2 -

Prospectus

GREENWOOD GOLD RESOURCES, INC.

We are registering for sale by selling shareholders 3,327,750 shares of common stock. We will not receive any proceeds from the shares sold by the selling shareholders.

The sales price to the public is fixed at $0.30 per share until such time as the shares of our common stock become traded on the Bulletin Board operated by the Financial Industry Regulatory Authority or another exchange. If our common stock becomes quoted on the Bulletin Board or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale.

Our shares of common stock are not traded anywhere.

Investing in our common stock involves risks. See "Risk Factors" starting at page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. It is illegal to tell you otherwise.

The date of this prospectus is ____________________.

- 3 -

| TABLE OF CONTENTS |

| |

| | Page No. |

| | |

| Summary of Prospectus | 5 |

| | |

| Risk Factors | 6 |

| | |

| Use of Proceeds | 10 |

| | |

| Determination of Offering Price | 10 |

| | |

| Dilution of the Price You Pay for Your Shares | 10 |

| | |

| Plan of Distribution; Terms of the Offering | 10 |

| | |

| Business | 14 |

| | |

| Management=s Discussion and Analysis of Financial Condition and Results of Operations | 24 |

| | |

| Management | 28 |

| | |

| Executive Compensation | 29 |

| | |

| Principal Shareholders | 31 |

| | |

| Description of Securities | 33 |

| | |

| Certain Transactions | 35 |

| | |

| Litigation | 35 |

| | |

| Experts | 35 |

| | |

| Legal Matters | 36 |

| | |

| Financial Statements | 36 |

- 4 -

SUMMARY OF OUR OFFERING

Our Business

We were incorporated on March 26, 2008. We are an exploration stage corporation. An exploration stage corporation is one engaged in the search for mineral deposits or reserves which are not in either the development or production stage. We intend to conduct exploration activities on one property located in the Province of Newfoundland, Canada. Record title to the property upon which we intend to conduct exploration activities is held in the name of Gary D. Alexander, our president. The property consists of 13 claim blocks totaling 325 hectares or approximately 803 acres. We intend to explore for gold on the property.

We have no revenues, have a loss since inception, have minimal operations, have been issued a going concern opinion.

Our administrative office is located at 4285 S.W. Martin Highway, Palm City, Florida 34990 and our telephone number is (772) 288-2775. Our registered statutory office is located at 1802 North Carson Street, Suite 212, Carson City, Nevada 89701. Our mailing address is the same as our administrative office, at 4285 S.W. Martin Highway, Palm City, Florida 34990.

Management or affiliates thereof, will not purchase shares in this offering in order to reach the minimum.

The offering

Following is a brief summary of this offering:

| Securities being offered by selling shareholders | | 3,327,750 shares of common stock |

| Offering price per share | | $0.30 |

| Net proceeds to us | | None |

| Number of shares outstanding before the offering | | 6,327,750 |

| Number of shares outstanding after the offering if all of the | | 6,327,750 |

| shares are sold | | |

Selected Financial Data

The following financial information summarizes the more complete historical financial information at the end of this prospectus.

| | | As of May 31, 2008 |

| | | (audited) |

| Balance Sheet | | |

| Total Assets | $ | 35,560 |

| Total Liabilities | $ | 5,780 |

| Stockholders=Equity | $ | 29,780 |

- 5 -

| | | March 26, 2008 |

| | | (Inception) to |

| | | May 31, 2008 |

| | | (audited) |

| Income Statement | | |

| Revenue | $ | 0 |

| Total Expenses | $ | 12,795 |

| Net Loss | $ | 12,795 |

RISK FACTORS

Please consider the following risk factors before deciding to invest in our common stock. We discuss all material risks in the risk factors.

Risks associated with Greenwood Gold Resources, Inc.

1.There is substantial doubt about our ability to continue as a going concern, there is substantial uncertainty we will continue activities in which case you could lose your investment.

Our financial statements have been prepared on a going concern basis, which implies we the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has not generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploitation of economically recoverable reserves in its resource properties, confirmation of the Company=s interests in the unde rlying properties, and the attainment of profitable operations. As at May 31, 2008, the Company has working capital of $ 29,780 and an accumulated deficit of $ 12,795. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. Accordingly, these factors raise substantial doubt regarding the Company=s ability to continue as a going concern.

2.Because the probability of an individual prospect ever having reserves is extremely remote, any funds spent on exploration will probably be lost.

The probability of an individual prospect ever having reserves is extremely remote. In all probability, the property does not contain any reserves. As such, any funds spent on exploration will probably be lost which result in a loss of your investment.

- 6 -

3.Our management has no technical training and experience in mineral activities and consequently our activities, earnings and ultimate financial success could be irreparably harmed.

Our management has no technical training and experience with exploring for, starting, and operating a mineral exploration program. With no direct training or experience in these areas, management may not be fully aware of many of the specific requirements related to working within the industry. Management=s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our activities, earnings and ultimate financial success could suffer irreparable harm due to management=s lack of experience in the industry.

4.We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease activities.

We were incorporated in March 2008, and we have started our proposed business activities, but not realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our net loss since inception is $ 12,795. The loss was a result of the payment of fees for staking our claims, incorporation, legal and accounting. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

| | * | our ability to locate a profitable mineral property |

| * | our ability to generate revenues |

| * | our ability to reduce exploration costs. |

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. As a result, we may not generate revenues in the future. Failure to generate revenues will cause us to suspend or cease activities.

5.Because we will have to spend additional funds to determine if we have a reserve, if we can=t raise the money we will have to cease operations and you could lose your investment.

Even if we complete our current exploration program and are successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit, a reserve.

6.Because our management only has limited technical training or experience in exploring for, starting, and operating an exploration program, management=s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. As a result, we may have to suspend or cease activities which will result in the loss of your investment.

- 7 -

Our management has limited experience with exploring for, starting, and operating an exploration program. Further, our management has no direct training or experience in these areas and as a result may not be fully aware of many of the specific requirements related to working within the industry. Management=s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently our activities, earnings and ultimate financial success could suffer irreparable harm due to management=s lack of experience in this industry. As a result we may have to susp end or cease activities which will result in the loss of your investment.

7.Because we are small and do no have much capital, we may have to limit our exploration activity which may result in a loss of your investment.

Because we are small and do not have much capital, we must limit our exploration activity. As such we may not be able to complete an exploration program that is as thorough as we would like. In that event, an existing reserve may go undiscovered. Without a reserve, we cannot generate revenues and you will lose your investment.

8.We may not have access to all of the supplies and materials we need to begin exploration which could cause us to delay or suspend activities.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as dynamite, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after this offering is complete. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

9.Because Gary D. Alexander has other outside business activities and will only be devoting 10% of his time or approximately four hours per week to our activities, our activities may be sporadic which may result in periodic interruptions or suspensions of exploration.

Because Mr. Alexander, our sole officer and director, has other outside business activities, he will be devoting only 10% of his time or four hours each week to our activities. Our activities may be sporadic and occur at times which are convenient to Mr. Alexander. As a result, exploration of the property may be periodically interrupted or suspended.

- 8 -

Risks associated with this offering:

10.Because our assets are located outside the United States of America, it may be difficult for an investor to enforce within the United States any judgments obtained against us.

All or a substantial portion of our assets are located outside the United States. As a result, it may be difficult for an investor to affect service of process or enforce within the United States any judgments obtained against us or our sole officer and director, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. In addition, there is uncertainty as to whether the courts of Canada and other jurisdictions would recognize or enforce judgments of United States courts obtained against us or our sole officer and director predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in Canada or other jurisdictions against us or our sole officer and director predicated upon the securities laws of the United States or any state thereof .

11Because we have only one officer and director who is responsible for our managerial and organizational structure, in the future, there may not be effective disclosure and accounting controls to comply with applicable laws and regulations which could result in fines, penalties and assessments against us.

We have only one officer and director. He is responsible for our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes Oxley Act of 2002. When these controls are implemented, he will be responsible for the administration of the controls. Should he not have sufficient experience, he may be incapable of creating and implementing the controls which may cause us to be subject to sanctions and fines by the Securities Exchange Committee which ultimately could cause us to lose money.

12Because there is no public trading market for our common stock, you may not be able to resell your stock.

There is currently no public trading market for our common stock. Therefore there is no central place, such as stock exchange or electronic trading system to resell your shares. If you do want to resell your shares, you will have to locate a buyer and negotiate your own sale.

13Because we may issue additional shares of common stock, your investment could be subject to substantial dilution.

We anticipate that any additional funding will be in the form of equity financing from the sale of our common stock. In the future, if we do sell more common stock, your investment could be subject to dilution. Dilution is the difference between what you pay for your stock and the net tangible book value per share immediately after the additional shares are sold by us.

- 9 -

14Because our securities are subject to penny stock rules, you may have difficulty reselling your shares.

Our shares as penny stocks are covered by section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice requirements on broker-dealers who sell the Company=s securities including the delivery of a standardized disclosure document; disclosure and confirmation of quotation prices; disclosure of compensation the broker-dealer receives; and, furnishing monthly account statements. For sales of our securities, the broker-dealer must make a special suitability determination and receive from its customer a written agreement prior to making a sale. The imposition of the foregoing additional sales practices could adversely affect a shareholder's ability to dispose of his stock.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the shares of common stock in this offering.

All proceeds from the sale of the shares of common stock will be received by the selling shareholders.

DETERMINATION OF OFFERING PRICE

The price of the shares has been determined by our board of directors. We selected the $0.30 price for the sale of our shares of common stock. Currently there is no market for the shares and we wanted to give our shareholders the ability to sell their shares for the price equal to the last price paid by outside investors. If our shares are listed for trading on the Bulletin Board, the price of the shares will be established by the market.

DILUTION

Since all of the shares of common stock being registered are already issued and outstanding, no dilution will result from this offering.

PLAN OF DISTRIBUTION; TERMS OF THE OFFERING

There are thirty-three selling shareholders. They may be deemed underwriters. They may sell some or all of their common stock in one or more transactions, including block transactions:

| | 1. | On such public markets or exchanges as the common stock may from time-to-time be trading; |

| 2. | In privately negotiated transactions; |

| 3. | Through the writing of options on the common stock; |

| 4. | In short sales; or |

| 5. | In any combination of these methods of distribution. |

- 10 -

The sales price to the public is fixed at $0.30 per share until such time as the shares of our common stock become traded on the Bulletin Board operated by the Financial Industry Regulatory Authority or another exchange. If our common stock becomes quoted on the Bulletin Board or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

| | 1. | The market price of our common stock prevailing at the time of sale; |

| 2. | A price related to such prevailing market price of our common stock; or |

| 3. | Such other price as the selling shareholders determine from time to time. |

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144. The selling shareholders may also sell their shares directly to market makers acting as principals or brokers or dealers, who may act as agent or acquire the common stock as a principal. Any broker or dealer participating in such transactions as agent may receive a commission from the selling shareholders, or, if they act as agent for the purchaser of such common stock, from such purchaser. The selling shareholders will likely pay the usual and customary brokerage fees for such services. Brokers or dealers may agree with the selling shareholders to sell a specified number of shares at a stipulated price per share and, to the extent such broker or dealer is unable to do so acting as agent for the selling shareholders, to purchase, as principal, any unsold shares at the price required to fulfill the respective br oker's or dealer's commitment to the selling shareholders. Brokers or dealers who acquire shares as principals may thereafter resell such shares from time to time in transactions in a market or on an exchange, in negotiated transactions or otherwise, at market prices prevailing at the time of sale or at negotiated prices, and in connection with such re-sales may pay or receive commissions to or from the purchasers of such shares. These transactions may involve cross and block transactions that may involve sales to and through other brokers or dealers.

We can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders. We are bearing all costs relating to the registration of the common stock, estimated to be $22,500. The selling shareholders, however, will pay commissions or other fees payable to brokers or dealers in connection with any sale of the common stock. The selling shareholders must comply with the requirements of the Securities Act of 1933 and the Securities Exchange Act of 1934 in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

1. Not engage in any stabilization activities in connection with our common stock;

2. Furnish each broker or dealer through which common stock may be offered, such as copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and

3. Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Securities Exchange Act of 1934.

- 11 -

There is no assurance that any of the selling shareholders will sell any or all of the shares offered by them. Under the securities laws of certain states, the shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in certain states the shares may not be sold unless they have been registered or qualified for sale in that state or an exemption from registration or qualification is available and is met.

Of the 6,327,750 shares of common stock outstanding as of May 31, 2008, 3,000,000 are owned by Gary D. Alexander, our sole officer and director and may only be resold pursuant to this registration statement or in compliance with Rule 144 of the Securities Act of 1933. Mr. Alexander=s shares are not being registered in this registration statement.

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

Section 15(g) of the Exchange Act

Our shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rules 15g-1 through 15g-6 and Rule 15g-9 promulgated thereunder. They impose additional sales practice requirements on broker-dealers who sell our securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). While Section 15(g) and Rules 15g-1 through 15g-6 apply to brokers-dealers, they do not apply to us.

Rule 15g-1 exempts a number of specific transactions from the scope of the penny stock rules. Rule 15g-2 declares unlawful broker-dealer transactions in penny stocks unless the broker-dealer has first provided to the customer a standardized disclosure document.

Rule 15g-3 provides that it is unlawful for a broker-dealer to engage in a penny stock transaction unless the broker-dealer first discloses and subsequently confirms to the customer current quotation prices or similar market information concerning the penny stock in question.

Rule 15g-4 prohibits broker-dealers from completing penny stock transactions for a customer unless the broker-dealer first discloses to the customer the amount of compensation or other remuneration received as a result of the penny stock transaction.

Rule 15g-5 requires that a broker-dealer executing a penny stock transaction, other than one exempt under Rule 15g-1, disclose to its customer, at the time of or prior to the transaction, information about the sales persons compensation.

Rule 15g-6 requires broker-dealers selling penny stocks to provide their customers with monthly account statements.

- 12 -

Rule 15g-9 requires broker-dealers to approved the transaction for the customer's account; obtain a written agreement from the customer setting forth the identity and quantity of the stock being purchased; obtain from the customer information regarding his investment experience; make a determination that the investment is suitable for the investor; deliver to the customer a written statement for the basis for the suitability determination; notify the customer of his rights and remedies in cases of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker-dealers and their associated persons. The application of the penny stock rules may affect your ability to resell your shares.

- 13 -

BUSINESS

General

We were incorporated in the State of Nevada on March 26, 2008. We are an exploration stage corporation. An exploration stage corporation is one engaged in the search for mineral deposits or reserves which are not in either the development or production stage. We intend to conduct exploration activities on one property. We maintain our statutory registered agent's office at Val-U-Corp. of Nevada, Suite 212 - 1802 North Carson Street, Carson City, Nevada 89701. Our executive offices are located at 4285 S.W. Martin Highway, Palm City, Florida 34990 and our telephone number is (772) 288-2775. This is our mailing address as well. From inception through May 31, 2008, our executive offices were located in Gary D. Alexander=s business office. Mr. Alexander is our sole officer and director. He allowed us to use this space on a rent-free basis. Commencing June 1, 2008, we lease our offices for $150.00 per month from an unrelated third party.

There is no assurance that a commercially viable mineral deposit exists on the property and further exploration will be required before a final evaluation as to the economic feasibility is determined.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause our plans to change.

Background

On April 7, 2008, Mr. Alexander acquired one mineral property containing 13 Online Claims Staking cells in Newfoundland, Canada. Newfoundland allows a mineral explorer to claim a portion of available Crown lands as its exclusive area for exploration by registering the claim area on the Newfoundland and Labrador Department of Natural Resources Online Claims Staking system. The Online Claims Staking system is the Internet-based Newfoundland system used to register, maintain and manage the claims. A cell is an area which appears electronically on the Newfoundland Internet Minerals Titles Online Grid and was formerly called a claim. A claim is a grant from the Crown of the available land within the cells to the holder to remove and sell minerals. The online grid is the geographical basis for the cell. Previously, the claim was established by sticking stakes in the ground to define the area and then recording th e staking information. The staking system is now antiquated in Newfoundland and has been replaced with the online grid. The property was registered by Richard A. Jeanne, a non-affiliated third party. Mr. Jeanne is a self-employed professional geologist residing in Reno, Nevada.

We have no revenues, have a loss since inception, have minimal operations, have been issued a going concern opinion and rely upon the sale of our securities and loans from our officers and directors to fund operations.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause us to change our plans.

- 14 -

Canadian jurisdictions allow a mineral explorer to claim a portion of available Crown lands as its exclusive area for exploration by registering the same on the Online Claims Staking system. Mr. Alexander paid Mr. Jeanne $ 780 to register the claims on the Online Claims Staking system. The cells were recorded in Mr. Alexander's name to avoid incurring additional costs at this time. The additional fees would be for incorporation of a Newfoundland corporation and legal and accounting fees related to the incorporation.

In April 2008, Mr. Alexander executed a declaration of trust acknowledging that he holds the property in trust for us and he will not deal with the property in any way, except to transfer the property to us. In the event that Mr. Alexander transfers title to a third party, the declaration of trust will be used as evidence that he breached his fiduciary duty to us. Mr. Alexander has not provided us with a signed or executed bill of sale in our favor.

Mr. Alexander will issue a bill of sale to a subsidiary corporation to be formed by us should mineralized material be discovered on the property. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal.

Under Newfoundland law title to Newfoundland mining claims can only be held by Newfoundland residents. In the case of corporations, title must be held by a Newfoundland corporation. In order to comply with the law we would have to incorporate a Newfoundland wholly owned subsidiary corporation and obtain audited financial statements. We believe those costs would be a waste of our money at this time.

In the event that we find mineralized material and the mineralized material can be economically extracted, we will form a wholly owned Newfoundland subsidiary corporation and Mr. Alexander will convey title to the property to the wholly owned subsidiary corporation. Should Mr. Alexander transfer title to another person and that deed is recorded before we record our documents, that other person will have superior title and we will have none. If that event occurs, we will have to cease or suspend operations. However, Mr. Alexander will be liable to us for monetary damages for breaching the terms of his agreement with us to transfer his title to a subsidiary corporation we create. To date, we have not performed any work on the property. All Canadian lands and minerals which have not been granted to private persons are owned by either the federal or provincial governments in the name of Her Majesty Elizabeth II . Ungranted minerals are commonly known as Crown minerals. Ownership rights to Crown minerals are vested by the Canadian Constitution in the province where the minerals are located. In the case of our property, that is the Province of Newfoundland.

In the 19thcentury the practice of reserving the minerals from fee simple Crown grants was established. Legislation now ensures that minerals are reserved from Crown land dispositions. The result is that the Crown is the largest mineral owner in Canada, both as the fee simple owner of Crown lands and through mineral reservations in Crown grants. Most privately held mineral titles are acquired directly from the Crown. The property is one such acquisition. Accordingly, fee simple title to the property resides with the Crown.

- 15 -

The property is comprised of mining leases issued pursuant to the Newfoundland Mineral Act. The lessee has exclusive rights to mine and recover all of the minerals contained within the surface boundaries of the lease vertically downward. The Crown does not have the right to reclaim provided the claims are maintained in good standing. The Crown could reclaim the property in an eminent domain proceeding, but would have to compensate the lessee for the value of the claim if it exercised the right of eminent domain. It is highly unlikely that the Crown will exercise the power of eminent domain. In general, where eminent domain has been exercised it has been in connection with incorporating the property into a provincial park.

The property is unencumbered and there are no competitive conditions which affect the property. Further, there is no insurance covering the property and we believe that no insurance is necessary since the property is unimproved and contains no buildings or improvements.

To date we have not performed any work on the property. We are presently in the exploration stage and we cannot guarantee that a commercially viable mineral deposit, a reserve, exists in the property until further exploration is done and a comprehensive evaluation concludes economic and legal feasibility.

There are no native land claims that affect title to the property. We have no plans to try to interest other companies in the property if mineralization is found. If mineralization is found, we will try to develop the property ourselves.

Claims

The following is a list of tenure numbers, claim, and expiration date of our claims:

| | | Number of | Date of |

| License No. | Claim Name | MTO Cells | Expiration |

| 014760M | Greenwood Pond Property | 13 | 04/07/2013 |

The minimum annual assessment work required to be done to maintain the claims will be approximately $ 2,600.00. If the minimum amount is not expended, we must pay a security deposit that when added to the amount of work done, will equal $2,600.00 .

Location and Access

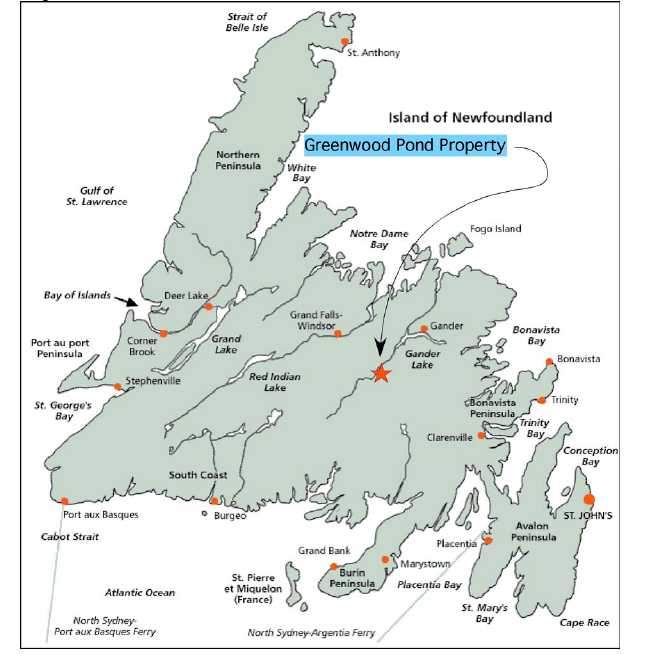

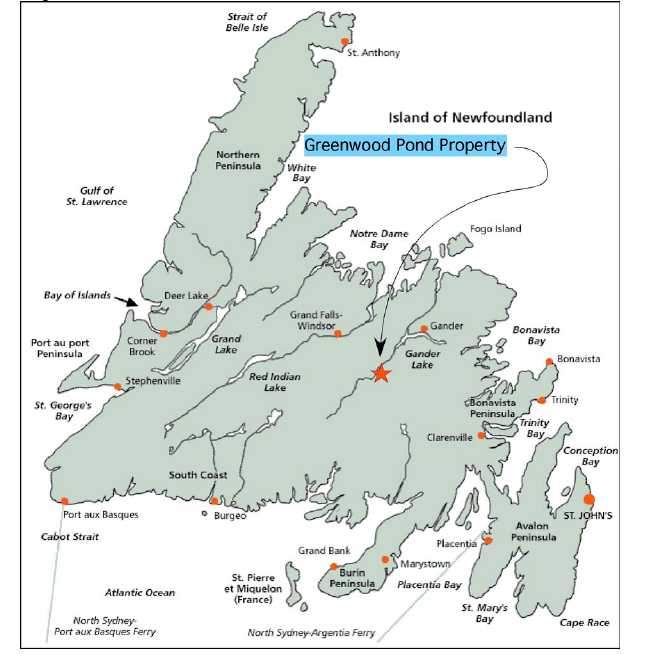

The Greenwood Pond property is located in central Newfoundland, Canada. It comprises 325 hectares or approximately 803 acres, approximately centered at latitude 48037=33" North, longitude 55013'50" West.

The property is located about 35 miles southwest of Gander between the Northwest and Southwest Gander Rivers. Access to the property can be gained via the Salmon Pond access road that leaves the Trans-Canada Highway at Glenwood and extends southwestward along the west side of the Northwest Gander River. At 31.5 km, a branch road to the left crosses the river over a steel bridge and continues southwest along the east side of the river. Approximately 10 miles from the bridge, a branch road to the left leads to Greenwood Pond.

- 16 -

Groceries and general supplies and services such as air transportation, car rentals, banking, restaurants and lodging are available in the town of Gander, about an hour and one-half drive from the property. Gander's population is about 10,000, but the town provides services to surrounding communities whose total population approaches 90,000. The town hosts an international airport that, historically, was a refueling stop for transatlantic flights.

Map 1

- 17 -

Map 2

- 18 -

Physiography

The topography is relatively flat over much of the property, but slopes steeply toward the Northwest Gander River along its western edge. Forest cover is dominated by black spruce with lesser amounts of balsam fir, white birch, aspen and locally common white pine. Boggy areas are common and during the spring and early summer can impede vehicular travel. Elevations range between 260 feet and 525 feet above sea level.

The region receives abundant snowfall during the winter months, making geological exploration and other related activities impractical during this time. The climate during the remainder of the year is moderate.

History

There is evidence of previous exploration activity on the property.

Regional Geology

The Greenwood Pond property lies within the Dunnage tectonostratigraphic zone which encompasses much of central Newfoundland. The Dunnage zone consists of telescoped, early to middle Paleozoic oceanic terrane remnants comprised of volcaniclastic to epiclastic sedimentary rocks and ophiolitic and arc-to back-arc-volcanic rocks.

Property Geology

The eastern portion of the property is underlain by sandstone, greywacke, shale and conglomerate interbedded with laminated gray-green siltstone. The western portion of the property is underlain by red and green siltstone, sandstone, minor interbedded greywacke, locally graphitic shale, and minor cobble conglomerate. Both of these units have been intruded by gabbroic rocks.

Supplies

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as dynamite, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after this offering is complete. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Other Property

Other than our interest in the property, we own no plants or other property. With respect to the property, our right to conduct exploration activity is based upon our oral agreement with Mr. Alexander. Under this oral agreement, he has allowed us to conduct exploration activity on the property. Mr. Alexander holds the property in trust for us pursuant to a declaration of trust.

- 19 -

Our Proposed Exploration Program

Our exploration target is to find an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant if the property contains reserves. We have not selected a consultant as of the date of this prospectus and will not do so until our offering is successfully completed, if that occurs, of which there is no assurance. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don't find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease operations and you will lose your investment.

In addition, we may not have enough money to complete our exploration of the property. If it turns out that we have not raised enough money to complete our exploration program, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we will be able to raise additional money in the future. If we need additional money and can=t raise it, we will have to suspend or cease operations.

We must conduct exploration to determine what amount of minerals, if any, exist on our properties and if any minerals which are found can be economically extracted and profitably processed.

The property is undeveloped raw land. Exploration and surveying has not been initiated and will not be initiated until we raise money in this offering. That is because we do not have money to start exploration. Once the offering is concluded, we intend to start exploration operations. To our knowledge, the property has never been mined. The only event that has occurred is the staking of the property by Mr. Jeanne. The cost of recording the cells was included in the $ 780 paid to Mr. Jeanne. Before minerals retrieval can begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material. We can't predict what that will be until we find mineralized material.

We do not know if we will find mineralized material. We believe that activities occurring on adjoining properties are not material to our activities. The reason is that what ever is located under adjoining property may or may not be located under the property.

We do not claim to have any minerals or reserves whatsoever at this time on any of the property.

Before minerals retrieval can begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material. We can't predict what that will be until we find mineralized material.

- 20 -

We cannot provide you with a more detailed discussion of how our exploration program will work and what we expect will be our likelihood of success. That is because we have a piece of raw land and we intend to look for a gold ore body. We may or may not find an ore body. We have the right to prospect, explore, test, develop, work and mine the property. We hope we do, but it is impossible to predict the likelihood of such an event. In addition, the nature and direction of the exploration may change depending upon initial results.

We do not have any plan to take our company to revenue generation. That is because we have not found economic mineralization yet and it is impossible to project revenue generation from nothing.

If we are unable to complete exploration because we don=t have enough money, we will cease operations until we raise more money. If we cannot or do not raise more money, we will cease operations. If we cease operations, we don't know what we will do and we don=t have any plans to do anything else.

Our exploration program will not result in the generation of revenue. It is designed only to determine if mineralized material is located on the property. Revenue will only be generated if we discover mineralized material and extract the minerals and sell them. Because we have not found mineralized material yet, it is impossible to project revenue generation.

Our Proposed Exploration Program

We are intending to initiate a mapping and sampling program and will begin to compile a geologic profile of the property. Gold is associated with structurally controlled hydrothermal veins, so emphasis should be placed on documenting their locations and characteristics. Sampling should accompany this phase to verify the published data and begin the delineation of mineralized zones. Prospective locations that exhibit alteration and structural features indicative of mineralization should be mapped in detail and thoroughly sampled. Where these features project into covered areas, trenching may be necessary to expose bedrock for follow-up mapping and sampling, pending the results of analyses of the initial sampling program.

In Gander, contact should be made with local heavy equipment contractors to determine their availability for light excavation work. During the second phase of exploration, trenching will likely be undertaken to expose potentially mineralized bedrock and provide access to additional sample material.

We are proposing to undertake a two phase mineral exploration program consisting of onsite surface reconnaissance, mapping, sampling and trench site identification followed by geochemical analyses. If encouraging results come from the initial investigation, we would then commence Phase 2.

A budget for the proposed work program is as follows (in US$):

- 21 -

| Phase I | | | |

| 1. Preparation for field, travel & lodging arrangements, base map preparation | $ | | 600 |

| (1 day office @ $600/day) | | | |

| 2. On site surface reconnaissance, mapping, sampling and trench site identi- | $ | 4,200 |

| fication (5 days field, 2 days travel @ $600/day) | | | |

| 3. Geochemical analyses (H20 samples) | $ | | 360 |

| (Sample prep + Au & Ag fire assay AA finish @ $18/ sample) | | | |

| 4. Expenses: | | | |

| Round trip air fare Reno, NV- Gander, NL | $ | 1,200 |

| Vehicle rental, 6 days | $ | | 400 |

| Lodging, 6 nights @ $85/night | $ | | 510 |

| Meals, 6 days @ $30/day | $ | | 180 |

| Total Phase I: | $ | 7,450 |

| |

| Phase II | | | |

| 1. On site trenching, mapping and sampling | $ | 8,000 |

| (8 days field, 2 days travel geologist @ $600/day ) | | | |

| (Equipment rental 4 days @ $500/day) | | | |

| 2. Geochemical analyses (H100 samples) | $ | 1,800 |

| (Sample prep + Au & Ag fire assay AA finish @ $18/ sample) | | | |

| 3. Data compilation and report preparation | $ | 2,400 |

| (4 days office @ $600/day) | | | |

| 4. Expenses: | | | |

| Round trip air fare Reno, NV- Gander, NL | $ | 1,200 |

| Vehicle rental, 6 days | $ | | 400 |

| Lodging, 6 nights @ $85/night | $ | | 510 |

| Meals, 6 days @ $30/day | $ | | 180 |

| Total Phase II: | $ | 14,490 |

| Grand Total Exploration: US$ 21,940 |

The proposed work program was devised by company management in consultation with our geologist, Richard Jeanne.

We have not commenced any exploration work but intend to proceed with Phase 1 in July 2008, weather permitting and subject to our geologist, Mr. Jeanne’s availability to proceed with our proposed work program. Upon our review of the results we will assess whether the results are sufficiently positive to warrant proceeding with Phase 2 of the exploration program. We will make this decision to proceed with further programs based upon our consulting geologist’s review of the results and recommendation. In order to proceed with any additional phases, if recommended, we will need to raise additional capital. If needed, we will raise additional capital from existing investors or by offering equity securities to new investors. We have no immediate plans to raise any additional funds until we assess the results of our initial exploration program.

- 22 -

Competitive Factors

The gold mining industry is fragmented, that is there are many, many gold prospectors and producers, small and large. We do not compete with anyone. That is because there is no competition for the exploration or removal of minerals from the property. We will either find gold on the property or not. If we do not, we will cease or suspend operations. We are one of the smallest exploration companies in existence. We are an infinitely small participant in the gold mining market. Readily available gold markets exist in Canada and around the world for the sale of gold. Therefore, we will be able to sell any gold that we are able to recover.

Regulations

Our mineral exploration program is subject to the Canadian Mineral Tenure Act Regulation. This act sets forth rules for

| * | locating claims |

| * | posting claims |

| * | working claims |

| * | reporting work performed |

We are also subject to the Newfoundland Mineral Exploration Code which tells us how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our operations.

Environmental Law

We are also subject to the Health, Safety and Reclamation Code for Mines in Newfoundland. This code deals with environmental matters relating to the exploration and development of mining properties. Its goals are to protect the environment through a series of regulations affecting:

| 1. | Health and Safety |

| 2. | Archaeological Sites |

| 3. | Exploration Access |

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

We will secure all necessary permits for exploration and, if development is warranted on the property, will file final plans of operation before we start any mining operations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint.

- 23 -

We are in compliance with the act and will continue to comply with the act in the future. We believe that compliance with the act will not adversely affect our business operations in the future.

Exploration stage companies have no need to discuss environmental matters, except as they relate to exploration activities. The only "cost and effect"of compliance with environmental regulations in Newfoundland is returning the surface to its previous condition upon abandonment of the property. We believe the cost of reclaiming the property will be $750 if we drill 8 holes and $2,250 if we drill 20 holes. We have not allocated any funds for the reclamation of the property and the proceeds for the cost of reclamation will not be paid from the proceeds of the offering. Mr. Alexander has agreed to pay the cost of reclaiming the property should mineralized material not be discovered.

Employees

We intend to use the services of subcontractors for manual labor exploration work on our properties.

Employees and Employment Agreements

At present, we have no full-time employees. Our sole officer and director is a part-time employee and will devote about 10% of his time or four hours per week to our operation. Mr. Alexander, our sole officer and director does not have an employment agreement with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officers and directors. Mr. Alexander will handle our administrative duties. We intend to subcontract all work out to third parties. As of today, we have not looked for or talked to any geologists or engineers who will perform work for us in the future. We do not intend to do so until we complete this offering.

MANAGEMENT=S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

This section of the prospectus includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements subject to certain risks and uncertainties could cause actual results to differ materially from historical results or our predictions.

Plan of Operation

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business operations.

- 24 -

Our auditor has issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated until we begin removing and selling minerals. There is no assurance we will ever reach this point.

We will be conducting research in the form of exploration of the property. Our exploration program is explained in as much detail as possible in the business section of this prospectus. We are not going to buy or sell any plant or significant equipment during the next twelve months.

The property is located about 35 miles southwest of Gander between the Northwest and Southwest Gander Rivers. Access to the property can be gained via the Salmon Pond access road that leaves the Trans-Canada Highway at Glenwood and extends southwestward along the west side of the Northwest Gander River. At 31.5 km, a branch road to the left crosses the river over a steel bridge and continues southwest along the east side of the river. Approximately 10 miles from the bridge, a branch road to the left leads to Greenwood Pond.

Our exploration target is to find an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant if the property contains reserves. We have not selected a consultant as of the date of this prospectus and will not do so until our offering is successfully completed, if that occurs, of which there is no assurance. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don't find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease operations and you will lose your investment.

In addition, we may not have enough money to complete our exploration of the property. If it turns out that we have not raised enough money to complete our exploration program, we will try to raise additional funds from a public offering, another private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. In we need additional money and can=t raise it, we will have to suspend or cease operations.

We must conduct exploration to determine what amount of minerals, if any, exist on our properties and if any minerals which are found can be economically extracted and profitably processed.

The property is undeveloped raw land. Exploration and surveying has not been initiated. To our knowledge, the property has never been mined.

The only event that has occurred is the recording of the property by Mr. Jeanne and the preparation of the proposed work program. The registration of the cells was included in the $ 780.00 paid to Mr. Jeanne. We also paid Mr. Jeanne $3,000.00 for consulting services. The claims were recorded in Mr. Alexander=s name to avoid incurring additional costs at this time. The additional costs would be for incorporation of a Newfoundland corporation and legal and accounting fees related to the incorporation.

- 25 -

In April 2008, Mr. Alexander executed a declaration of trust acknowledging that he holds the property in trust for us and he will not deal with the property in any way, except to transfer the property to us. In the event that Mr. Alexander transfers title to a third party, the declaration of trust will be used as evidence that he breached his fiduciary duty to us. Mr. Alexander has not provided us with a signed or executed bill of sale in our favor. Mr. Alexander will issue a bill of sale to a subsidiary corporation to be formed by us should mineralized material be discovered on the property.

Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. Before mineral retrieval can begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material.

We can=t predict what that will be until we find mineralized material. Mr. Alexander does not have a right to sell the property to anyone. He may only transfer the property to us. He may not demand payment for the claims when he transfers them to us. Further, Mr. Alexander does not have the right to sell the claims at a profit to us if mineralized material is discovered on the property. Mr. Alexander must transfer title to us, without payment of any kind, upon our demand whether mineralized material is found on the claims or not.

We do not know if we will find mineralized material. We believe that activities occurring on adjoining properties are not material to our activities. The reason is that what ever is located under adjoining property may or may not be located under our property.

We do not claim to have any minerals or reserves whatsoever at this time on any of our property.

We don=t intend to hire additional employees at this time. All of the work on the property will be conduct by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Milestones

The following are our milestones:

1. July 2008 to September 2008 – commence Phase 1 of our recommended work program –estimated cost of $7,450.00. Time of retention 0-90 days.

2. October 2008 to March 2009 (weather permitting) – commence Phase 2 of our recommended work program – estimated cost of $ 14,490.00.

All funds for the foregoing activities have been obtained from our private placement.

- 26 -

Limited Operating History; Need for Additional Capital

There is limited historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

To become profitable and competitive, we will need to conduct research and exploration of our property before we start production of any minerals we may find. We are seeking equity financing to provide for the capital required to implement our research and exploration phases. We believe that the funds we raised from our private placement will allow us to operate for one year.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Liquidity and Capital Resources

To meet our need for cash we raised money from our private placement. If we find mineralized material and it is economically feasible to remove the mineralized material, we will attempt to raise additional money through a subsequent private placement, public offering or through loans. The funds we have will allow us only to conduct limited exploration activity on the property.

At the present time, we have not made any arrangements to raise additional cash. If we need additional cash and can't raise it we will either have to suspend operations until we do raise the cash, or cease operations entirely. We believe that the funds we have will allow us to operate for twelve months. Other than as described in this paragraph, we have no other financing plans.

We have the right to explore one property containing thirteen cells and will begin our exploration shortly, weather permitting. As of the date of this prospectus we have yet to generate any revenues.

As of May 31, 2008, our total assets were $ 35,560 and our total liabilities were $ 5,780.

- 27 -

MANAGEMENT

Officers and Directors

Our sole director serves until his successor is elected and qualified. Our sole officer is elected by the board of directors to a term of one (1) year and serves until his successor is duly elected and qualified, or until he is removed from office. The board of directors has no nominating, auditing or compensation committees.

The name, age and position of our sole officer and director is set forth below:

| Name | Age | Position Held |

| Gary D. Alexander | 55 | president, principal executive officer, secretary, |

| 4285 SW Martin Highway | | treasurer, principal financial officer, principal |

| Palm City, FL 34990 | | accounting officer, and sole member of the board of |

| | | directors. |

Mr. Alexander will serve until our next annual meeting of the stockholders. The Board of Directors elects officers and their terms of office are at the discretion of the Board of Directors.

Background of our Officers and Directors

Gary D. Alexander has been our president, chief executive officer, treasurer, chief financial officer and our sole directors since inception on March 26, 2008. Since November 2007, Mr. Alexander has been an independent director of FirstPlus Financial Group, Inc. located in Irving, Texas. FirstPlus Financial is a diversified company that provides commercial loan, auto loan, consumer lending, real estate holding, residential and commercial restoration, facility (janitorial) care and construction management services. FirstPlus Financial files reports with the Securities and Exchange Commission pursuant to Section 13 of the Securities Exchange Act of 1934 and is traded on the Pink Sheets under the symbol FPFX. Since March 2004, Mr. Alexander has been president of Treasure Coast Private Equity, LLC, a private equity firm that specializes in providing debt and equity resources for privately owned business seeking expansion capital. Treasure Coast Private Equity is located in Palm City, Florida. From November 2006 to April 2007, Mr. Alexander was acting chief financial officer of Air Rutter International, LLC and Airspace LLC located in Long Beach California. Air Rutter and Airspace are engaged in the business jet charter aircraft management. From November 2005 to March 2006, Mr. Alexander was acting Chief Financial Officer for Jet First, Inc. located in West Palm Beach, Florida. Jet First is a jet charter company. From June 1987 to December 2006, Mr. Alexander was a principal at Alexander Company CPA=s located in Palm City, Florida.

During the past five years, Mr. Alexander has not been the subject of the following events:

1. Any bankruptcy petition filed by or against any business of which Mr. Alexander was a general partners or executive officers either at the time of the bankruptcy or within two years prior to that time.

2. Any conviction in a criminal proceeding or being subject to a pending criminal proceeding.

- 28 -

3. An order, judgment, or decree, not subsequently reversed, suspended or vacated, or any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting Mr. Alexander=s involvement in any type of business, securities or banking activities.

4. Found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Future Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Audit Committee Financial Expert

We do not have an audit committee financial expert. We do not have an audit committee financial expert because we believe the cost related to retaining a financial expert at this time is prohibitive. Further, because we are only beginning our commercial operations, at the present time, we believe the services of a financial expert are not warranted.

Conflicts of Interest

There are no conflicts of interest.

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid by us for the last three fiscal years ending December 31, 2007 for each or sole officer. This information includes the dollar value of base salaries, bonus awards and number of stock options granted, and certain other compensation, if any. The compensation discussed addresses all compensation awarded to, earned by, or paid to named executive officers.

| Executive Officer Compensation Table |

| | | | | | | Non- | Nonqualified | | |

| | | | | | | Equity | Deferred | All | |

| Name | | | | | | Incentive | Compensa- | Other | |

| and | | | | Stock | Option | Plan | tion | Compen- | |

| Principal | | Salary | Bonus | Awards | Awards | Compensation | Earnings | sation | Total |

| Position | Year | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) |

| |

| Gary D.Alexander | 2007 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| President | 2006 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| | 2005 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

We do not have employment agreements with our sole officer. We do not contemplate entering into any employment agreements until such time as we begin profitable operations.

The compensation discussed herein addresses all compensation awarded to, earned by, or paid to our named executive officer.

- 29 -

There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our sole officer and director other than as described herein.

Compensation of Directors

The sole member of our board of directors is not compensated for his services as a director. The board has not implemented a plan to award options to any director. There are no contractual arrangements with any member of the board of director. We have no director's service contracts.

| Director=s Compensation Table |

| | Fees | | | | | | |

| | Earned | | | | Nonqualified | | |

| | Or | | | Non-Equity | Deferred | | |

| | Paid in | Stock | Option | Incentive Plan | Compensation | All Other | |

| | Cash | Awards | Awards | Compensation | Earnings | Compensation | Total |

| Name | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) |

| |

| Gary D. Alexander | 2007 | 0 | 0 | 0 | 0 | 0 | 0 |

Long-Term Incentive Plan Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

Indemnification

Under our Articles of Incorporation and Bylaws of the corporation, we may indemnify an officer or director who is made a party to any proceeding, including a lawsuit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent that the officer or director is successful on the merits in a proceeding as to which he is to be indemnified, we must indemnify him against all expenses incurred, including attorney's fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding, and if the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors or officers under Nevada law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

- 30 -

PRINCIPAL AND SELLING SHAREHOLDERS

The following table sets forth, as of the date of this prospectus, the total number of shares owned beneficially by our directors, officers and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The table also reflects what their ownership will be assuming completion of the sale of all shares in this offering. The stockholders listed below have direct ownership of their shares and possesses sole voting and dispositive power with respect to the shares.

| | | | | | Number of Shares | Percentage of |

| | | | | Percentage of | After Offering | Ownership After the |

| | | Number of | Ownership Before | Assuming all of the | Offering Assuming |

| Name and Address | Shares Before | the Offering | Shares are Sold | all of the Shares are |

| Beneficial Owner [1] | the Offering | | | Sold |

| |

| Gary D. Alexander | 3,000,000 | 47.42% | 3,000,000 | 47.42% |

| 4285 SW Martin Highway | | | | |

| Palm City, FL 34990 | | | | |

| |

| [1 | ] | The person named above may be deemed to be a "parent" and "promoter" of our company, |

| | | within the meaning of such terms under the Securities Act of 1933, as amended, by virtue of |

| | | her/his/its direct and indirect stock holdings. Mr. Alexander is the only "promoter" of our |

| | | company. | | | | |

Securities authorized for issuance under equity compensation plans.

We have no equity compensation plans.

Selling Shareholders

The following table sets forth the name of each selling shareholder, the total number of shares owned prior to the offering, the percentage of shares owned prior to the offering, the number of shares offered, and the percentage of shares owned after the offering, assuming the selling shareholder sells all of his shares and we sell the maximum number of shares.

- 31 -

| | | | | Percentage |

| | | | | of shares |

| | | | | owned after the |

| | Total number of | Percentage of | Number of | offering assuming |

| | shares owned | shares owned | shares being | all of the share are |

| Name | prior to offering | prior to offering | offered | sold in the offering |

| Almeida, David | 3,200 | 0.05% | 3,200 | 0.0% |

| Brown, Nathaniel | 2,200 | 0.04% | 2,200 | 0.0% |

| Camacho, Sandra | 225,000 | 3.56% | 225,000 | 0.0% |

| Crawford, Crystal | 1,500 | 0.02% | 1,500 | 0.0% |

| Douglas, Matthew | 3,400 | 0.05% | 3,400 | 0.0% |

| Garrison, Cherie | 7,800 | 0.12% | 7,800 | 0.0% |

| Hamden, William | 4,500 | 0.07% | 4,500 | 0.0% |

| Handley, Angela | 175,000 | 2.77% | 175,000 | 0.0% |

| Handley, William | 175,000 | 2.77% | 175,000 | 0.0% |

| Karolides, Paul | 225,000 | 3.56% | 225,000 | 0.0% |

| Keister, Michael | 5,600 | 0.09% | 5,600 | 0.0% |

| Kotovich, Leo | 8,500 | 0.13% | 8,500 | 0.0% |

| Lewis, Susan | 3,750 | 0.06% | 3,750 | 0.0% |

| Mahan, James | 150,000 | 2.37% | 150,000 | 0.0% |

| Maione, Steven | 225,000 | 3.56% | 225,000 | 0.0% |

| Maione, Tara | 225,000 | 3.56% | 225,000 | 0.0% |

| Moran, Douglas | 200,000 | 3.16% | 200,000 | 0.0% |

| Moran, Michael | 300,000 | 4.74% | 300,000 | 0.0% |

| Moran, Steven | 175,000 | 2.77% | 175,000 | 0.0% |

| Moran, Terri | 175,000 | 2.77% | 175,000 | 0.0% |

| Murphy, Alexander | 3,800 | 0.06% | 3,800 | 0.0% |

| Neely, Donald | 200,000 | 3.16% | 200,000 | 0.0% |

| Neely, Lauren | 200,000 | 3.16% | 200,000 | 0.0% |

| O=Kane, Denise | 2,600 | 0.04% | 2,600 | 0.0% |

| O=Kane, Kevin | 2,600 | 0.04% | 2,600 | 0.0% |

| Rizzotto, Daina | 225,000 | 3.56% | 225,000 | 0.0% |

| Rizzotto, John | 225,000 | 3.56% | 225,000 | 0.0% |

| Rowe, Sandra | 6,700 | 0.10% | 6,700 | 0.0% |

| Tompkins, Lela | 150,000 | 2.37% | 150,000 | 0.0% |

| Wouters, Bruno | 7,100 | 0.11% | 7,100 | 0.0% |

| Wouters, Dennis | 4,600 | 0.07% | 4,600 | 0.0% |

| Wouters, Gina | 3,300 | 0.05% | 3,300 | 0.0% |

| Wouters, Jenny | 6,600 | 0.10% | 6,600 | 0.0% |

| Total | 3,327,750 | 52.59% | 3,327,750 | 0.0% |

Other than investing money with us, the foregoing selling security holders have had no material relationship with us during the last three years.

All of persons named as selling security holders exercise voting and/or dispositive powers with respect to the securities to be offered for resale by our selling security holders.

No selling shareholder is an affiliate of a registered broker-dealer.

The following is a summary of the issuances of all shares:

- 32 -

In April 2008, we issued 3,000,000 restricted shares of common stock to Gary D. Alexander pursuant to Section 4(2) of the Securities Act of 1933. The shares were sold in a private transaction to Mr. Alexander. Mr. Alexander is a sophisticated investor. He is our sole officer and director; was furnished the same information that can be found in Part I of a Form S-1 registration statement; and, is capable of reading and understanding the information furnished to him. Further, no commissions were paid to anyone in connection with the sale of the shares and general solicitation was not made to anyone.

In May 2008 we completed a private placement of 3,327,750 shares of common stock to 33 investors in consideration of $39,575. The shares were issued as restricted securities pursuant to the exemption from registration contained in Regulation 504 of the Securities Act of 1933 in that a Form D was filed with the Securities and Exchange Commission; we raised less than $1,000,000 in the last twelve months; and, each purchaser was solicited by Mr. Alexander, our sole officer and director.

Future Sales of Shares

A total of 6,327,750 shares of common stock are issued and outstanding. Of the 6,327,750 shares outstanding, all are restricted securities as defined in Rule 144 of the Securities Act of 1933. 3,327,750 are being offered for resale by the selling shareholders described above.

Shares purchased in this offering will be immediately resalable without any restriction of any kind.

DESCRIPTION OF SECURITIES

Common Stock

Our authorized capital stock consists of 75,000,000 shares of common stock, par value $0.001 per share. The holders of our common stock:

| * | have equal ratable rights to dividends from funds legally available if and when declared by our board of directors; |

| * | are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs; |

| * | do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and |

| * | are entitled to one non-cumulative vote per share on all matters on which stockholders may vote. |

Non-cumulative Voting

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors.

- 33 -

Cash Dividends

As of the date of this prospectus, we have not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our board of directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Anti-Takeover Provisions