Washington, D.C. 20549

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

No shares of common stock were held by non-affiliates as of June 30, 2009. As of March 22, 2010, there were approximately 670,113 common shares of beneficial interest of United Development Funding IV outstanding.

The registrant incorporates by reference portions of its Definitive Proxy Statement for the 2010 annual meeting of shareholders, which is expected to be filed no later than April 30, 2009, into Part III of this Form 10-K to the extent stated herein.

This annual report contains forward-looking statements, including discussion and analysis of United Development Funding IV (which may be referred to as the “Trust,” “we,” “us,” “our,” or “UDF IV”) and our subsidiaries, our financial condition, our investment objectives, amounts of anticipated cash distributions to our common shareholders in the future and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on their knowledge and understanding of the business and industry. Words such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,� 221; “could,” “should” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guaranties of the future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false. We caution you not to place undue reliance on forward-looking statements, which reflect our management’s view only as of the date of this Form 10-K. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. The forward-looking statements should be read in light of the risk factors identified in the “Risk Factors” section of this Annual Report on Form 10-K.

Item 1. Business.

United Development Funding IV was organized on May 28, 2008 (“Inception”) as a Maryland real estate investment trust that intends to qualify as a real estate investment trust (a “REIT”) under federal income tax laws. The Trust is the sole general partner of and owns a 99.999% partnership interest in United Development Funding IV Operating Partnership, L.P. (“UDF IV OP”), a Delaware limited partnership. UMTH Land Development, L.P. (“UMTH LD”), a Delaware limited partnership and the affiliated asset manager of the Trust, is the sole limited partner and owner of 0.001% (minority interest) of the partnership interests in UDF IV OP.

The Trust intends to originate, purchase, participate in and hold for investment secured loans made directly by the Trust or indirectly through its affiliates to persons and entities for the acquisition and development of parcels of real property as single-family residential lots, and the construction of model and new single-family homes, including development of mixed-use master planned residential communities. The Trust also intends to make direct investments in land for development into single-family lots, new and model homes and portfolios of finished lots and homes; provide credit enhancements to real estate developers, home builders, land bankers and other real estate investors; and purchase participations in, or finance for other real estate investors the purchase of, securitized real estate loan pools and discounted cash flows secured by state, county, municipal or other similar assessments levied on real property. The Trust also may enter into joint ventures with unaffiliated real estate developers, home builders, land bankers and other real estate investors, or with other United Development Funding-sponsored programs, to originate or acquire, as the case may be, the same kind of secured loans or real estate investments the Trust may originate or acquire directly.

UMTH General Services, L.P., a Delaware limited partnership (“UMTH GS” or the “Advisor”), is the Trust’s advisor and is responsible for managing the Trust’s affairs on a day-to-day basis. UMTH GS has engaged UMTH LD as the Trust’s asset manager. The asset manager will oversee the investing and financing activities of the affiliated programs managed and advised by the Advisor and UMTH LD as well as oversee and provide the Trust’s board of trustees recommendations regarding investments and finance transactions, management, policies and guidelines and will review investment transaction structure and terms, investment underwriting, investment collateral, investment performance, investment risk management, and the Trust’s capital structure at both the entity and as set level.

On November 12, 2009, the Trust’s Registration Statement on Form S-11, covering an initial public offering (the “Offering”) of up to 25,000,000 common shares of beneficial interest at a price of $20 per share, was declared effective under the Securities Act of 1933, as amended. The Offering also covers up to 10,000,000 common shares of beneficial interest to be issued pursuant to our distribution reinvestment plan (the “DRIP”) for $20 per share. We reserve the right to reallocate the common shares of beneficial interest registered in the Offering between the primary offering and the DRIP. The shares are being offered to investors on a reasonable best efforts basis, which means the dealer manager will use its reasonable best efforts to sell the shares offered, but is not re quired to sell any specific number or dollar amount of shares and does not have a firm commitment or obligation to purchase any of the offered shares. Until we received and accepted subscriptions for at least $1 million, subscription proceeds were placed in an escrow account. On December 18, 2009, the Trust satisfied this minimum offering amount. As a result, the Trust’s initial public subscribers were accepted as shareholders and the subscription proceeds from such initial public subscribers were released to the Trust from escrow, provided that residents of New York, Nebraska and Pennsylvania will not be admitted until the Trust has received and accepted subscriptions aggregating at least $2,500,000, $5,000,000 and $35,000,000, respectively. As of December 31, 2009, we had issued 119,729 common shares of beneficial interest in exchange for gross proceeds of approximately $2.4 million.

We will offer our shares until the earlier of November 12, 2011 or the date we sell all $500 million worth of shares in our primary offering; provided, however, the amount of shares registered pursuant to the Offering is the amount which we reasonably expect to be offered and sold within two years from November 12, 2009, and we may extend the Offering for an additional year or as otherwise permitted by applicable law; provided, further, that notwithstanding the foregoing, our board of trustees may terminate the Offering at any time. Our board of trustees also may elect to extend the offering period for the shares sold pursuant to DRIP, in which case participants in the plan will be notified.

The outstanding aggregate principal amount of mortgage notes originated by us as of December 31, 2009 are secured by properties located in the Austin, Texas area. Security for such loans takes the form of either a direct security interest represented by a first or second lien on the respective property and/or an indirect security interest represented by a pledge of the ownership interests of the entity which holds title to the property. The participation agreements outstanding as of December 31, 2009 are made to developer entities which hold ownership interests in projects in addition to the project funded by us, are secured by multiple single-family residential communities and are secured by a personal guarantee of the developer in addition to a lien on the real property or the equity interests in the entity tha t holds the real property.

The average interest rate payable with respect to the outstanding loans as of December 31, 2009 is 13%, and the average term of the loans is approximately 12 months.

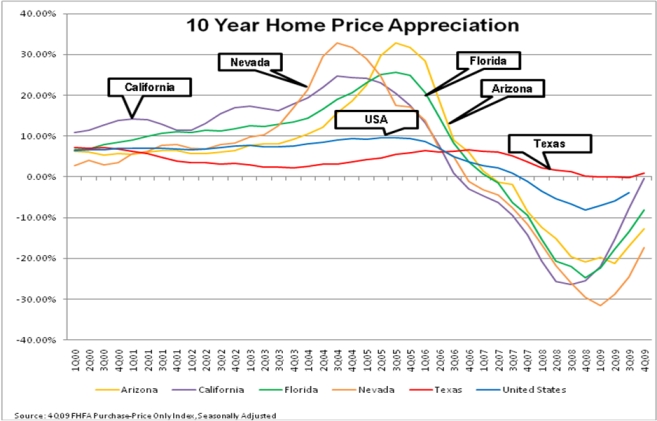

The U.S. housing market has suffered declines over the past four years, particularly in geographic areas that had previously experienced rapid growth, steep increases in property values and speculation. In 2009, the homebuilding industry was focused on further reducing supply and inventory overhang of new single-family homes. To that end, publicly traded national homebuilders continued to reduce the number of homes constructed in 2009 from the number constructed in 2008. We believe that while demand for new homes has been affected across the country by the general decline of the housing industry, the housing markets in the geographic areas in which we intend to invest have not been impacted as greatly. Further, we believe that, as a result of the inventory reductions and corresponding lack of development over the past few years, the supply of new homes and finished lots have generally aligned with market demand in most real estate markets; more homes will be started in 2010 than in 2009; and we will likely see continued demand for our products in 2010.

We have no employees; however, our advisor and affiliates of our advisor have a staff of employees who perform a range of services for us, including originations, acquisitions, asset management, accounting, legal and investor relations.

Our current business consists only of originating, acquiring, servicing and managing mortgage loans on real property and issuing or acquiring an interest in credit enhancements to borrowers. We internally evaluate our activities as one industry segment, and, accordingly, we do not report segment information.

Item 1A. Risk Factors.

The factors described below represent our principal risks. Other factors may exist that we do not consider to be significant based on information that is currently available or that we are not currently able to anticipate.

There is no public trading market for our shares; therefore, it will be difficult for shareholders to sell their shares. If a shareholder is able to sell their shares, the shareholder may have to sell them at a substantial discount from the public offering price. In addition, we do not have a fixed liquidation date, and the shareholder may have to hold their shares indefinitely.

Shareholders will not have the opportunity to evaluate our investments before they are made.

For these and other reasons, we cannot assure our shareholders that we will be profitable or that we will realize growth in the amount of income we receive from our investments.

We expect to borrow money to make loans or purchase some of our real estate assets. If we fail to obtain or renew sufficient funding on favorable terms or at all, we will be limited in our ability to make loans or purchase assets, which will harm our results of operations. Furthermore, if we borrow money, our shareholders’ risks will increase if defaults occur.

We may incur substantial debt. We intend, when appropriate, to incur debt at the asset level. Asset level leverage will be determined by the anticipated term of the investment and the cash flow expected by the investment. Asset level leverage is expected to range from 0% to 90% of the asset value. In addition, we intend to incur debt at the fund level. Our board of trustees has adopted a policy to generally limit our fund level borrowings to 50% of the aggregate fair market value of our real estate properties or secured loans once we have invested a majority of the net proceeds of the Offering and subsequent offerings, if any. However, we are permitted by our declaration of trust to borrow up to 300% of our net assets, and may borrow in excess of such amount if such excess borrowing is approved by a majority of our independent trustee s and disclosed in our next quarterly report to shareholders, along with justification for such excess. Loans we obtain will likely be secured with recourse to all of our assets, which will put those assets at risk of forfeiture if we are unable to pay our debts.

Our ability to achieve our investment objectives depends, in part, on our ability to borrow money in sufficient amounts and on favorable terms. We expect to depend on a few lenders to provide the primary credit facilities for our investments, although we currently do not have any established financing sources. In addition, our existing indebtedness may limit our ability to make additional borrowings. If our lenders do not allow us to renew our borrowings or we cannot replace maturing borrowings on favorable terms or at all, we might have to sell our investment assets under adverse market conditions, which would harm our results of operations and may result in permanent losses. In addition, loans we obtain may be secured by all of our assets, which will put those assets at risk of forfeiture if we are unable to pay our debts.

Dislocations in the credit markets and real estate markets could have a material adverse effect on our results of operations, financial condition and ability to pay distributions to our shareholders.

Domestic and international financial markets currently are experiencing significant dislocations which have been brought about in large part by failures in the U.S. banking system. These dislocations have severely impacted the availability of credit and have contributed to rising costs associated with obtaining credit. If debt financing is not available on terms and conditions we find acceptable, we may not be able to obtain financing for investments. If this dislocation in the credit markets persists, our ability to borrow monies to finance investments in real estate assets will be negatively impacted. If we are unable to borrow monies on terms and conditions that we find acceptable, we likely will have to reduce the number of real estate investments we ca n make, and the return on the investments we do make likely will be lower. All of these events could have an adverse effect on our results of operations, financial condition and ability to pay distributions.

Our operating results may be negatively affected by potential development and construction delays and resultant increased costs and risks.

We may provide financing for borrowers that will develop and construct improvements to land at a fixed contract price. We will be subject to risks relating to uncertainties associated with re-zoning for development and environmental concerns of governmental entities and/or community groups and our developer’s ability to control land development costs or to build infrastructure in conformity with plans, specifications and timetables deemed necessary by builders. The developer’s failure to perform may necessitate legal action by us to compel performance. Performance may also be affected or delayed by conditions beyond the developer’s control. Delays in completion of construction could also give builders the right to terminate preconstruction lot purchase contracts. These and other such factors can result in increased c osts to the borrower that may make it difficult for the borrower to make payments to us. Furthermore, we must rely upon projections of lot take downs, expenses and estimates of the fair market value of property when evaluating whether to make loans. If our projections are inaccurate, and we are forced to foreclose on a property, our return on our investment could suffer.

The costs of compliance with environmental laws and other governmental laws and regulations may adversely affect our income and the cash available for any distributions.

All real property and the operations conducted on real property are subject to federal, state and local laws, ordinances and regulations relating to environmental protection and human health and safety. These laws and regulations generally govern wastewater discharges, air emissions, the operation and removal of underground and above-ground storage tanks, the use, storage, treatment, transportation and disposal of solid and hazardous materials, and the remediation of contamination associated with disposals. Under limited circumstances, a secured lender, in addition to the owner of real estate, may be liable for clean-up costs or have the obligation to take remedial actions under environmental laws, including, but not limited to, the Federal Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, or CE RCLA. Some of these laws and regulations may impose joint and several liability for the costs of investigation or remediation of contaminated properties, regardless of fault or the legality of the original disposal. In addition, the presence of these substances, or the failure to properly remediate these substances, may adversely affect our ability to sell such property or to use the property as collateral for future borrowing.

If we foreclose on a defaulted loan to recover our investment, we may become subject to environmental liabilities associated with that property if we participate in the management of that property or do not divest ourselves of the property at the earliest practicable time on commercially reasonable terms. Environmental laws may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require substantial expenditures. It is possible that property on which we foreclose may contain hazardous substances, wastes, contaminants or pollutants that we may be required to remove or remediate in order to clean up the property. If we foreclose on a contaminated property, we may also incur liability to tenants or other users of neighboring properties. We cannot assure our shareholders that we will not incur full recourse liability for the entire cost of removal and cleanup, that the cost of such removal and cleanup will not exceed the value of the property, or that we will recover any of these costs from any other party. It may be difficult or impossible to sell a property following discovery of hazardous substances or wastes on the property. The cost of defending against claims of liability, of compliance with environmental regulatory requirements, of remediating any contaminated property, or of paying personal injury claims could materially adversely affect our business, assets or results of operations and, consequently, amounts available for distribution to our shareholders.

Terrorist attacks or other acts of violence or war may affect the industry in which we operate, our operations and our profitability.

Terrorist attacks may harm our results of operations and our shareholders’ investments. We cannot assure our shareholders that there will not be further terrorist attacks against the United States or U.S. businesses. These attacks or armed conflicts may directly or indirectly impact the value of the property we own or the property underlying our loans. Losses resulting from these types of events are generally uninsurable. Moreover, any of these events could cause consumer confidence and spending to decrease or result in increased volatility in the United States and worldwide financial markets. They could also result in economic uncertainty in the United States or abroad. Adverse economic conditions resulting from terrorist activities could negatively impact borrowers’ ability to repay loans we make to them or harm the value of the property underlying our investments, both of which would impair the value of our investments and decrease our ability to make distributions to our shareholders.

We will be subject to risks related to the geographic concentration of the properties securing the loans and equity investments we make.

Although we may purchase loans and make investments throughout the contiguous United States, initially we expect the majority of investments will be in the Southeastern and Southwestern United States, with a near term concentration of substantially all of our investing and lending (90% or more) in the major Texas submarkets. However, if the residential real estate market or general economic conditions in these geographic areas decline to an extent greater than we forecast, or recover to a lesser extent than we forecast, our and our borrowers’ ability to sell homes, lots and land located in these areas may be impaired, we may experience a greater rate of default on the loans or other investments we make with respect to real estate in these areas, and the value of the homes and parcels in which we invest and that are underlying ou r investments in these areas could decline. Any of these events could materially adversely affect our business, financial condition or results of operations.

We will be subject to a number of legal and regulatory requirements, including regulations regarding interest rates, mortgage laws, securities laws and the taxation of REITs or business trusts, which may adversely affect our operations.

Federal and state lending laws and regulations generally regulate interest rates and many other aspects of real estate loans and contracts. Violations of those laws and regulations could materially adversely affect our business, financial condition and results of operations. We cannot predict the extent to which any law or regulation that may be enacted or enforced in the future may affect our operations. In addition, the costs to comply with these laws and regulations may adversely affect our profitability. Future changes to the laws and regulations affecting us, including changes to mortgage laws and securities laws and changes to the Internal Revenue Code applicable to the taxation of REITs or business trusts, could make it more difficult or expensive for us to comply with such laws or otherwise harm our business.

Failure to qualify as a REIT would adversely affect our operations and our ability to make distributions.

We have not yet elected to be taxed as a REIT. In order for us to qualify as a REIT, we must satisfy certain requirements set forth in the Internal Revenue Code and treasury regulations promulgated thereunder and various factual matters and circumstances that are not entirely within our control. We intend to structure our activities in a manner designed to satisfy all of these requirements. However, if certain of our operations were to be recharacterized by the Internal Revenue Service, such recharacterization could jeopardize our ability to satisfy all of the requirements for qualification as a REIT.

If we fail to qualify as a REIT for any taxable year, we will be subject to federal income tax on our taxable income at corporate rates. In addition, we may be disqualified from treatment as a REIT for the four taxable years following the year of losing our REIT status. Losing our REIT status would reduce our net earnings available for investment or distribution to shareholders because of the additional tax liability. In addition, distributions to shareholders would no longer qualify for the distributions paid deduction, and we would no longer be required to make distributions. If this occurs, we might be required to borrow funds or liquidate some investments in order to pay the applicable tax.

Qualification as a REIT is subject to the satisfaction of tax requirements and various factual matters and circumstances that are not entirely within our control. New legislation, regulations, administrative interpretations or court decisions could change the tax laws with respect to qualification as a REIT or the federal income tax consequences of being a REIT. Our failure to qualify as a REIT would adversely affect our shareholders’ returns on their investments.

Our investment strategy may cause us to incur penalty taxes, lose our REIT status, or own and sell properties through taxable REIT subsidiaries, each of which would diminish the return to our shareholders.

In light of our investment strategy, it is possible that one or more sales of our properties may be “prohibited transactions” under provisions of the Internal Revenue Code. If we are deemed to have engaged in a “prohibited transaction” (i.e., we sell a property held by us primarily for sale in the ordinary course of our trade or business), all income that we derive from such sale would be subject to a 100% tax. The Internal Revenue Code sets forth a safe harbor for REITs that wish to sell property without risking the imposition of the 100% tax. A principal requirement of the safe harbor is that the REIT must hold the applicable property for not less than two years prior to its sale. Given our investment strategy, it is entirely possible, if not likely, that the sale of one or more of our properties will not fall within the prohibited transaction safe harbor.

If we desire to sell a property pursuant to a transaction that does not fall within the safe harbor, we may be able to avoid the 100% penalty tax if we acquired the property through a taxable REIT subsidiary (“TRS”) or acquired the property and transferred it to a TRS for a non-tax business purpose prior to the sale (i.e , for a reason other than the avoidance of taxes). However, there may be circumstances that prevent us from using a TRS in a transaction that does not qualify for the safe harbor. Additionally, even if it is possible to effect a property disposition through a TRS, we may decide to forego the use of a TRS in a transaction that does not meet the safe harbor based on our own internal analysis, the opinion of counsel or the opinion of other tax advisors that the disposition will not be subject to the 100% penalty tax. In cases where a property disposition is not effected through a TRS, the Internal Revenue Service could successfully assert that the disposition constitutes a prohibited transaction, in which event all of the net income from the sale of such property will be payable as a tax and none of the proceeds from such sale will be distributable by us to our shareholders or available for investment by us.

If we acquire a property that we anticipate will not fall within the safe harbor from the 100% penalty tax upon disposition, then we may acquire such property through a TRS in order to avoid the possibility that the sale of such property will be a prohibited transaction and subject to the 100% penalty tax. If we already own such a property directly or indirectly through an entity other than a TRS, we may contribute the property to a TRS if there is another, non-tax related business purpose for the contribution of such property to the TRS. Following the transfer of the property to a TRS, the TRS will operate the property and may sell such property and distribute the net proceeds from such sale to us, and we may distribute the net proceeds distributed to us by the TRS to our shareholders. Though a sale of the property by a TRS may elimi nate the danger of the application of the 100% penalty tax, the TRS itself would be subject to a tax at the federal level, and potentially at the state and local levels, on the gain realized by it from the sale of the property as well as on the income earned while the property is operated by the TRS. This tax obligation would diminish the amount of the proceeds from the sale of such property that would be distributable to our shareholders. As a result, the amount available for distribution to our shareholders would be substantially less than if the REIT had not operated and sold such property through the TRS and such transaction was not successfully characterized as a prohibited transaction. The maximum federal corporate income tax rate currently is 35%. Federal, state and local corporate income tax rates may be increased in the future, and any such increase would reduce the amount of the net proceeds available for distribution by us to our shareholders from the sale of property through a TRS after the effec tive date of any increase in such tax rates.

If we own too many properties through one or more of our TRSs, then we may lose our status as a REIT. If we fail to qualify as a REIT for any taxable year, we will be subject to federal income tax on our taxable income at corporate rates. In addition, we may be disqualified from treatment as a REIT for the four taxable years following the year of losing our REIT status. Losing our REIT status would reduce our net earnings available for investment or distribution to shareholders because of the additional tax liability. In addition, distributions to shareholders would no longer qualify for the distributions paid deduction, and we would no longer be required to make distributions. If this occurs, we might be required to borrow funds or liquidate some investments in order to pay the applicable tax. As a REIT, the value of the securities w e hold in all of our TRSs may not exceed 25% of the value of all of our assets at the end of any calendar quarter. If the Internal Revenue Service were to determine that the value of our interests in all of our TRSs exceeded 25% of the value of total assets at the end of any calendar quarter, then we would fail to qualify as a REIT. If we determine it to be in our best interests to own a substantial number of our properties through one or more TRSs, then it is possible that the Internal Revenue Service may conclude that the value of our interests in our TRSs exceeds 25% of the value of our total assets at the end of any calendar quarter and therefore cause us to fail to qualify as a REIT. Additionally, as a REIT, no more than 25% of our gross income with respect to any year may be from sources other than real estate. Distributions paid to us from a TRS are considered to be non-real estate income. Therefore, we may fail to qualify as a REIT if distributions from all of our TRSs, when aggregated with all other non-real estate income with respect to any one year, are more than 25% of our gross income with respect to such year. We will use all reasonable efforts to structure our activities in a manner intended to satisfy the requirements for our continued qualification as a REIT. Our failure to qualify as a REIT would adversely affect our shareholders’ returns on their investments.

Certain fees paid to us may affect our REIT status.

Certain fees and income we receive could be characterized by the Internal Revenue Service as non-qualifying income for purposes of satisfying the “income tests” required for REIT qualification. If this fee income were, in fact, treated as non-qualifying, and if the aggregate of such fee income and any other non-qualifying income in any taxable year ever exceeded 5% of our gross revenues for such year, we could lose our REIT status for that taxable year and the four ensuing taxable years. We will use all reasonable efforts to structure our activities in a manner intended to satisfy the requirements for our continued qualification as a REIT. Our failure to qualify as a REIT would adversely affect our shareholders’ returns on their investments.

Shareholders may have tax liability on distributions they elect to reinvest in our common shares of beneficial interest, and they may have to use funds from other sources to pay such tax liability.

If shareholders elect to have their distributions reinvested in our common shares of beneficial interest pursuant to our distribution reinvestment plan, they will be deemed to have received, and for income tax purposes will be taxed on, the amount reinvested that does not represent a return of capital. As a result, unless a shareholder is a tax-exempt entity, a shareholder may have to use funds from other sources to pay their tax liability on the value of the shares received.

If our operating partnership fails to maintain its status as a partnership, its income may be subject to taxation, which would reduce our cash available for distribution to our shareholders.

We intend to maintain the status of the operating partnership as a partnership for federal income tax purposes. However, if the Internal Revenue Service were to successfully challenge the status of the operating partnership as a partnership, it would be taxable as a corporation. In such event, this would reduce the amount of distributions that the operating partnership could make to us. This would also result in our losing REIT status, and becoming subject to a corporate level tax on our own income. This would substantially reduce our cash available to make distributions and the return on our shareholders’ investments. In addition, if any of the partnerships or limited liability companies through which the operating partnership owns its properties, in whole or in part, loses its characterization as a partnership for federal inco me tax purposes, it would be subject to taxation as a corporation, thereby reducing distributions to the operating partnership. Such a recharacterization of an underlying property owner could also threaten our ability to maintain REIT status.

In certain circumstances, we may be subject to federal and state taxes on income as a REIT, which would reduce our cash available for distribution to our shareholders.

Even if we qualify and maintain our status as a REIT, we may become subject to federal income taxes and related state taxes. For example, if we have net income from a “prohibited transaction,” such income will be subject to a 100% tax. We may not be able to make sufficient distributions to avoid excise taxes applicable to REITs. We may also decide to retain income we earn from the interest on our secured loans or the sale or other disposition of our property and pay income tax directly on such income. In that event, our shareholders would be treated as if they earned that income and paid the tax on it directly. However, shareholders that are tax-exempt, such as charities or qualified pension plans, would have no benefit from their deemed payment of such tax liability. We may also be subject to state and local taxes on our income or property, either directly or at the level of the operating partnership or at the level of the other companies through which we indirectly make secured loans or own our assets. Any federal or state taxes paid by us will reduce our cash available for distribution to our shareholders.

Legislative or regulatory action could adversely affect the returns to our investors.

In recent years, numerous legislative, judicial and administrative changes have been made in the provisions of the federal income tax laws applicable to investments similar to an investment in our common shares of beneficial interest. Additional changes to the tax laws are likely to continue to occur, and we cannot assure investors that any such changes will not adversely affect the taxation of a shareholder. Any such changes could have an adverse effect on an investment in our shares or on the market value or the resale potential of our assets. Investors are urged to consult with their own tax advisor with respect to the impact of recent legislation on their investment in our shares and the status of legislative, regulatory or administrative developments and proposals and their potential effect on an investment in our shares.

Congress passed major federal tax legislation in 2003, with modifications to that legislation in 2005. One of the changes effected by that legislation generally reduced the tax rate on dividends paid by companies to individuals to a maximum of 15% prior to 2011. REIT distributions generally do not qualify for this reduced rate. The tax changes did not, however, reduce the corporate tax rates. Therefore, the maximum corporate tax rate of 35% has not been affected. However, as a REIT, we generally would not be subject to federal or state corporate income taxes on that portion of our ordinary income or capital gain that we distribute currently to our shareholders, and we thus expect to avoid the “double taxation” to which other companies are typically subject.

Although REITs continue to receive substantially better tax treatment than entities taxed as corporations, it is possible that future legislation would result in a REIT having fewer tax advantages, and it could become more advantageous for a company that invests in real estate to elect to be taxed for federal income tax purposes as a corporation. As a result, our declaration of trust provides our board of trustees with the power, under certain circumstances, to revoke or otherwise terminate our REIT election and cause us to be taxed as a corporation, without the vote of our shareholders. Our board of trustees has fiduciary duties to us and our shareholders and could only cause such changes in our tax treatment if it determines in good faith that such changes are in the best interest of our shareholders.

Equity participation in secured loans may result in taxable income and gains from these properties, which could adversely impact our REIT status.

If we participate under a secured loan in any appreciation of the properties securing the secured loan or its cash flow and the Internal Revenue Service characterizes this participation as “equity,” we might have to recognize income, gains and other items from the property. This could affect our ability to qualify as a REIT.

Distributions to tax-exempt investors may be classified as UBTI and tax-exempt investors would be required to pay tax on such income and to file income tax returns.

Neither ordinary nor capital gain distributions with respect to our common shares of beneficial interest nor gain from the sale of shares should generally constitute UBTI to a tax-exempt investor. However, there are certain exceptions to this rule, including:

| · | under certain circumstances, part of the income and gain recognized by certain qualified employee pension trusts with respect to our shares may be treated as UBTI if our shares are predominately held by qualified employee pension trusts, such that we are a “pension-held” REIT (which we do not expect to be the case); |

| · | part of the income and gain recognized by a tax-exempt investor with respect to our shares would constitute UBTI if such investor incurs debt in order to acquire the common shares of beneficial interest; and |

| · | part or all of the income or gain recognized with respect to our common shares of beneficial interest held by social clubs, voluntary employee benefit associations, supplemental unemployment benefit trusts and qualified group legal services plans which are exempt from U.S. federal income taxation under Sections 501(c)(7), (9), (17) or (20) of the Internal Revenue Code may be treated as UBTI. |

Distributions to foreign investors may be treated as ordinary income distributions to the extent that they are made out of current or accumulated earnings and profits.

In general, foreign investors will be subject to regular U.S. federal income tax with respect to their investment in our shares if the income derived therefrom is “effectively connected” with the foreign investor’s conduct of a trade or business in the United States. A distribution to a foreign investor that is not attributable to gain realized by us from the sale or exchange of a “U.S. real property interest” within the meaning of the Foreign Investment in Real Property Tax Act of 1980, as amended, or FIRPTA, and that we do not designate as a capital gain dividend, will be treated as an ordinary income distribution to the extent that it is made out of current or accumulated earnings and profits (as determined for U.S. federal income tax purposes). Generally, any ordinary income distributio n will be subject to a U.S. federal income tax equal to 30% of the gross amount of the distribution, unless this tax is reduced by the provisions of an applicable treaty.

Foreign investors may be subject to FIRPTA tax upon the sale of their shares.

A foreign investor disposing of a U.S. real property interest, including shares of a U.S. entity whose assets consist principally of U.S. real property interests, is generally subject to FIRPTA tax on the gain recognized on the disposition. Such FIRPTA tax does not apply, however, to the disposition of shares in a REIT if the REIT is “domestically controlled.” A REIT is “domestically controlled” if less than 50% of the REIT’s shares, by value, have been owned directly or indirectly by persons who are not qualifying U.S. persons during a continuous five-year period ending on the date of disposition or, if shorter, during the entire period of the REIT’s existence. While we intend to qualify as “domestically controlled,” we cannot assure shareholders that we will. If we were to fail to so qualify, gain realized by foreign investors on a sale of our shares would be subject to FIRPTA tax, unless the shares were traded on an established securities market and the foreign investor did not at any time during a specified testing period directly or indirectly own more than 5% of the value of our outstanding common shares of beneficial interest.

Foreign investors may be subject to FIRPTA tax upon the payment of a capital gain distribution.

A foreign investor also may be subject to FIRPTA tax upon the payment of any capital gain distribution by us, which distribution is attributable to gain from sales or exchanges of U.S. real property interests. Additionally, capital gain distributions paid to foreign investors, if attributable to gain from sales or exchanges of U.S. real property interests, would not be exempt from FIRPTA and would be subject to FIRPTA tax.

We encourage investors to consult their own tax advisor to determine the tax consequences applicable to them if they are a foreign investor.

Risks Related to Investments by Tax-Exempt Entities and Benefit Plans Subject to ERISA

If our shareholders fail to meet the fiduciary and other standards under ERISA or the Internal Revenue Code as a result of an investment in our common shares of beneficial interest, they could be subject to criminal and civil penalties.

There are special considerations that apply to tax-qualified pension, stock bonus or profit-sharing plans, employee benefit plans described in Section 3(3) of ERISA and other retirement plans or accounts subject to Section 4975 of the Internal Revenue Code (such as IRAs or annuities described in Sections 408 or 408A of the Internal Revenue Code, annuities described in Sections 403(a) or (b) of the Internal Revenue Code, Archer MSAs described in Section 220(d) of the Internal Revenue Code, health savings accounts described in Section 223(d) of the Internal Revenue Code, or Coverdell education savings accounts described in Section 530 of the Internal Revenue Code) that are investing in our shares. If investors are investing the assets of a plan or IRA in our common shares of beneficial interest, t hey should satisfy themselves that, among other things:

| · | their investment is consistent with their fiduciary obligations under ERISA and the Internal Revenue Code applicable to their plan or IRA; |

| · | their investment is made in accordance with the documents and instruments governing their plan or IRA (including their plan’s investment policy, if applicable); |

| · | their investment satisfies the prudence and diversification requirements of Sections 404(a)(1)(B) and 404(a)(1)(C) of ERISA and other applicable provisions of ERISA and the Internal Revenue Code that may apply to their plan or IRA; |

| · | their investment will not impair the liquidity of the plan or IRA; |

| · | their investment will not produce UBTI for the plan or IRA; |

| · | they will be able to value the assets of the plan or IRA annually or more frequently in accordance with ERISA and Internal Revenue Code requirements and any applicable provisions of the plan or IRA; and |

| · | their investment will not constitute a prohibited transaction under Section 406 of ERISA or Section 4975 of the Internal Revenue Code. |

Failure to satisfy the fiduciary standards of conduct and other applicable requirements of ERISA and the Internal Revenue Code may result in the imposition of civil or criminal penalties and could subject the responsible fiduciaries to liability and equitable remedies. In addition, if an investment in our shares constitutes a prohibited transaction under ERISA or the Internal Revenue Code, the “party-in-interest” or “disqualified person” who engaged in the prohibited transaction may be subject to the imposition of excise taxes with respect to the amount involved.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We do not maintain any physical properties.

Item 3. Legal Proceedings.

None.

Item 4. (Removed and Reserved).

Part II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

Market Information

Unless and until our shares are listed on a national securities exchange, we do not expect that a public market for our shares will develop. This illiquidity creates a risk that a shareholder may not be able to sell shares at a time or price acceptable to the shareholder. Until eighteen months after the termination of the Offering or the termination of any subsequent offering of our shares, we intend to use the offering price of shares in our most recent offering as the per share value (unless we have made a special distribution to shareholders of net proceeds from our investments prior to the date of determination of the per share value, in which case we will use the offering price less the per share amount of the special distribution). Beginning eighteen months after the last offering of our shares, our board of trustees will determine the value of our properties and other assets based on such information as our board determines appropriate, which may include independent valuations of our investments or of our enterprise as a whole.

There can be no assurance, however, with respect to any estimate of value that we prepare, that:

| · | the estimated value per share would actually be realized by our shareholders upon liquidation, because these estimates do not necessarily indicate that all loans will be paid in full or the price at which properties can be sold; |

| · | our shareholders would be able to realize estimated net asset values if they were to attempt to sell their shares, because no public market for our shares exists or is likely to develop; |

| · | the estimated value per share would be related to any individual or aggregated value estimates or appraisals of our assets; or |

| · | that the value, or method used to establish value, would comply with ERISA or Internal Revenue Code requirements. |

We have adopted a share redemption program that enables our shareholders to sell their shares back to us in limited circumstances. This program permits our shareholders to sell their shares back to us after they have held them for at least one year, subject to the significant conditions and limitations described below.

Our shareholders who have held their shares for at least one year may receive the benefit of limited liquidity by presenting for redemption all or portion of their shares to us at any time in accordance with the procedures outlined herein. At that time, we may, subject to the conditions and limitations described below, redeem the shares presented for redemption for cash to the extent that we have sufficient funds from operations available to us to fund such redemption.

Except as described below for redemptions upon the death of a shareholder (in which case we may waive the minimum holding periods), the purchase price for the redeemed shares, for the period beginning after a shareholder has held the shares for a period of one year, will be (1) 92% of the purchase price actually paid for any shares held less than two years, (2) 94% of the purchase price actually paid for any shares held for at least two years but less than three years, (3) 96% of the purchase price actually paid for any shares held at least three years but less than four years, (4) 98% of the purchase price actually paid for any shares held at least four years but less than five years and (5) for any shares held at least five years, the lesser of the purchase price actually paid or the then-current fair market value of the shareholder’s shares as determined by the most recent annual valuation of our shares. However, at any time we are engaged in an offering of our shares, the per share price for shares purchased under our redemption program will always be equal to or less than the applicable per share offering price. The price we will pay for redeemed shares will be offset by any net proceeds from capital transactions previously distributed to the redeeming shareholder in respect of such shares as a return of capital. In no event will the total amount paid for redeemed shares, including any net proceeds from capital transactions previously distributed to the redeeming shareholder in respect of the redeemed shares as a return of capital, exceed the then-current offering price. Distributions of cash available for distribution from our operations will not effect the price we will pay in respect of our redeemed shares. Although we do not intend to make distributions in excess of available cash, we are not precl uded from doing so. Any such distributions would be a return of capital to shareholders and would offset the price we will pay for redeemed shares.

We reserve the right in our sole discretion at any time and from time to time to (1) waive the one-year holding period in the event of the death or bankruptcy of a shareholder or other exigent circumstances, (2) reject any request for redemption, (3) change the purchase price for redemptions, or (4) terminate, suspend and/or reestablish our share redemption program. In the event that we change the purchase price for redemption or terminate or suspend the program, we will send our shareholders written notice of such changes, termination or suspension at least 30 days prior to the date the change, termination or suspension will become effective.

In addition, and subject to the conditions and limitations described below, we will redeem shares, upon the death of a shareholder, including shares held by such shareholder through an IRA or other retirement or profit-sharing plan, after receiving written notice from the estate of the shareholder or the recipient of the shares through bequest or inheritance. We must receive such written notice within 180 days after the death of the shareholder. If spouses are joint registered holders of shares, the request to redeem the shares may be made if either of the registered holders dies. If the shareholder is not a natural person, such as a trust, partnership, corporation or other similar entity, the right of redemption upon death does not apply.

The purchase price for shares redeemed upon the death of a shareholder will be the lesser of (1) the purchase price the shareholder actually paid for the shares or (2) $20.00 per share. The price we will pay for shares redeemed upon the death of a shareholder will be offset by any net proceeds from capital transactions previously distributed to the deceased shareholder, or his or her estate, in respect of such shares as a return of capital contributions. In no event will the total amount paid for redeemed shares, including any net proceeds from capital transactions previously distributed to the deceased shareholder, or his or her estate, in respect of the redeemed shares as a return of capital, exceed the then-current offering price. Distributions of cash available for distribution from our operations will not affect the pri ce we will pay in respect of our redeemed shares. Although we do not intend to make distributions in excess of available cash, we are not precluded from doing so. Any such distributions would be a return of capital to shareholders and would offset the price we will pay for redeemed shares.

We will redeem shares upon the death or bankruptcy of a shareholder only to the extent that we decide to waive any applicable holding period requirements and have sufficient funds available to us to fund such redemption.

Our share redemption program, including the redemption upon the death of a shareholder, is available only for shareholders who purchase their shares directly from us (including shares purchased through the dealer manager and soliciting dealers) or certain transferees, and is not intended to provide liquidity to any shareholder who acquired his or her shares by purchase from another shareholder. In connection with a request for redemption, the shareholder or his or her estate, heir or beneficiary will be required to certify to us that the shareholder either (1) acquired the shares to be repurchased directly from us (including shares purchased through the dealer manager and soliciting dealers) or (2) acquired such shares from the original subscriber by way of a bona fide gift not for value to, or for the benefit of, a member o f the subscriber’s immediate or extended family (including the subscriber’s spouse, parents, siblings, children or grandchildren and including relatives by marriage) or through a transfer to a custodian, trustee or other fiduciary for the account of the subscriber or members of the subscriber’s immediate or extended family in connection with an estate planning transaction, including by bequest or inheritance upon death or operation of law.

We intend to redeem shares monthly under the program. In respect of shares redeemed upon the death of a shareholder, we will not redeem in excess of 1% of the weighted average number of shares outstanding during the prior twelve-month period immediately prior to the date of redemption, and the total number of shares we may redeem at any time will not exceed 5% of the weighted average number of shares outstanding during the trailing twelve-month period prior to the redemption date. Our board of trustees will determine from time to time whether we have sufficient excess cash from operations to repurchase shares. Generally, the cash available for redemption will be limited to 1% of the operating cash flow from the previous fiscal year, plus any net proceeds from our distribution reinvestment plan.

We cannot guarantee that the funds set aside for the share redemption program will be sufficient to accommodate all requests made in any year. If we do not have such funds available at the time when redemption is requested, the shareholder or his or her estate, heir or beneficiary can (1) withdraw the request for redemption, (2) ask that we redeem their shares for an amount equal to the then-current net asset value of the shares, as determined by our board of trustees in its sole discretion, if the then-current net asset value of the shares is less than the repurchase price that otherwise would be paid for the shares under the redemption program, or (3) ask that we honor the original request at such time, if any, when sufficient funds become available. Such pending requests will be honored among all requesting sharehold ers in any given redemption period, as follows: first, pro rata as to redemptions upon the death of a shareholder; next, pro rata to shareholders who have requested redemption of their shares at the then-current net asset value as determined by our board of trustees in its sole discretion; next, pro rata to shareholders who demonstrate to our satisfaction another involuntary exigent circumstance, such as bankruptcy; and, finally, pro rata as to other redemption requests in the order, by month, in which such requests are received by us. With respect to this last category of pending requests, each pending request will be sorted according to the month in which such request was received by us. Future funds available for redemptions will then be allocated pro rata among the redemption requests received by us in the earliest month for which redemption requests have not been fulfilled, until all redemption requests received by us for such month have been fulfilled.

A shareholder or his or her estate, heir or beneficiary may present to us fewer than all of its shares then-owned for redemption, provided, however, that the minimum number of shares that must be presented for redemption shall be at least 25% of the holder’s shares. In the event a shareholder tenders all of his or her shares for redemption, our board of trustees, in its sole discretion, may waive the one-year holding period for shares purchased pursuant to our distribution reinvestment plan. A shareholder who wishes to have shares redeemed must mail or deliver to us a written request on a form provided by us and executed by the shareholder, its trustee or authorized agent. An estate, heir or beneficiary that wishes to have shares redeemed following the death of a shareholder must mail or deliver to us a written request on a form provided by us, including evidence acceptable to us of the death of the shareholder, and executed by the executor or executrix of the estate, the heir or beneficiary, or their trustee or authorized agent. If the shares are to be redeemed under the conditions outlined herein, we will forward the documents necessary to affect the redemption, including any signature guaranty we may require. Shareholders may withdraw a redemption request at any time prior to the date for redemption.

Through the fifth year following the termination of our primary offering, we intend to reinvest the principal repayments we receive on loans to create or invest in new loans. Following the fifth anniversary of the termination of our primary offering, we will not reinvest such proceeds in order to provide our shareholders with increased distributions and provide increased cash flow from which we may repurchase shares from shareholders wishing to sell their shares (subject to all applicable regulatory requirements and restrictions). We currently intend to redeem shares at that time for a purchase price equal to or less than the then-current net asset value of our shares as determined by our board of trustees in its sole discretion.

Our share redemption program is only intended to provide limited interim liquidity for our shareholders until our liquidation, since there is no public trading market for our shares and we do not expect that any public market for our shares will ever develop. Our board of trustees, in its sole discretion, may choose to terminate or suspend our share redemption program at any time it determines that such termination or suspension is in our best interest, or to reduce the number of shares purchased under the share redemption program if it determines the funds otherwise available to fund our share redemption program are needed for other purposes. These limitations apply to all redemptions, including redemptions upon the death of a shareholder. We will terminate our share redemption program during the distribution of our common shares of beneficial interest in the event that our shares become listed on a national securities exchange or in the event that a secondary market for our shares develops. Shares owned by our sponsor or its affiliates will not be redeemed pursuant to our share redemption program. Neither our advisor nor any of its affiliates will receive any fee on the repurchase of shares by us pursuant to the share redemption program.

We will cancel the shares we purchase under the share redemption program and will not reissue the shares unless they are first registered with the SEC under the Securities Act and under appropriate state securities laws or otherwise issued in compliance with such laws and our declaration of trust.

The foregoing provisions regarding the share redemption program in no way limit our ability to repurchase shares from shareholders by any other legally available means for any reason that our board of trustees, in its discretion, deem to be in our best interest.

As of December 31, 2009, no shares of beneficial interest have been redeemed.

As of March 22, 2010, we had approximately 670,113 common shares of beneficial interest outstanding that were held by a total number of approximately 479 shareholders.

Distribution Reinvestment Plan

Our DRIP will allow our shareholders, and, subject to certain conditions set forth in the plan, any shareholder or partner of any other publicly offered limited partnership, real estate investment trust or other United Development Funding-sponsored real estate program, to elect to purchase our common shares with our distributions or distributions from such other programs. We are offering 10,000,000 shares for sale pursuant to our DRIP at $20 per share until the earliest to occur of: (1) the issuance of all shares authorized and reserved for issuance pursuant to the DRIP; (2) the termination of the Offering (which is anticipated to be November 12, 2011, unless extended for an additional year by our board of trustees or as otherwise permitted b y applicable law; provided, however, that our board of trustees may elect to extend the offering period for the shares sold pursuant to our DRIP, in which case participants in the plan will be notified) and any subsequent offering of DRIP shares pursuant to an effective registration statement; or (3) the determination by our board of trustees that the number of our shares traded in a secondary market is more than a de minimis amount. If shares authorized and reserved for issuance pursuant to the DRIP remain available for issuance, shares are being offered to the public pursuant to the Offering or a subsequent offering, and our shares are being traded in a secondary market and the amount of such shares traded is more than a de minimis amount, we will invest distributions in shares at a price equal to the most recent per share price at which our shares were traded in the secondary market prior to the close of business on the last business day prior to the date of the distribution.

Distributions will be authorized at the discretion of our board of trustees, which will be directed, in substantial part, by its obligation to cause us to comply with the REIT requirements of the Internal Revenue Code. The funds we receive from operations that are available for distribution may be affected by a number of factors, including the following:

| · | the amount of time required for us to invest the funds received in the Offering; |

| · | our operating and interest expenses; |

| · | the ability of borrowers to meet their obligations under the loans; |

| · | the amount of distributions or dividends received by us from our indirect real estate investments; |

| · | the ability of our clients to sell finished lots to homebuilders and the ability of homebuilders to sell new homes to home buyers; |

| · | capital expenditures and reserves for such expenditures; |

| · | the issuance of additional shares; and |

| · | financings and refinancings. |

We must distribute to our shareholders at least 90% of our taxable income each year in order to meet the requirements for being treated as a REIT under the Internal Revenue Code.

Our board of trustees authorized a distribution to our shareholders of record beginning as of the close of business on each day of the period commencing on December 18, 2009 and ending on March 31, 2010. The distributions will be calculated based on the number of days each shareholder has been a shareholder of record based on 365 days in the calendar year, and will be equal to $0.0043836 per common share of beneficial interest, which is equal to an annualized distribution rate of 8.0%, assuming a purchase price of $20.00 per share. These distributions will be aggregated and paid in cash monthly in arrears. Therefore, the distributions declared for each record date in the December 2009, January 2010, February 2010 and March 2010 periods will be paid in January� 60;2010, February 2010, March 2010 and April 2010, respectively. Distributions will be paid on or about the 25th day of the respective month or, if the 25th day of the month falls on a weekend or bank holiday, on the next business day following the 25th day of the month. Distributions for shareholders participating in our DRIP will be reinvested into our shares on the payment date of each distribution.

As of December 31, 2009, no distributions to shareholders had been made, but total distributions payable of approximately $4,000 had been declared and were paid on January 25, 2010.

Recent Sales of Unregistered Securities

None.

Use of Proceeds from Registered Securities

On November 12, 2009, the Trust’s Registration Statement (Registration No. 333-152760), covering the Offering of up to 25,000,000 common shares of beneficial interest to be offered at a price of $20 per share, was declared effective under the Securities Act of 1933, as amended. The Offering also covers up to 10,000,000 common shares of beneficial interest to be issued pursuant to our DRIP for $20 per share. We reserve the right to reallocate the common shares of beneficial interest registered in the Offering between the primary offering and the DRIP, provided that the aggregate amount of the Offering may not exceed $700,000,000.

The shares are being offered by our dealer manager, Realty Capital Securities, LLC, and select members of the Financial Industry Regulatory Authority (“FINRA”) on a “best efforts” basis, which means the dealer manager and soliciting dealers will only be required to use their best efforts to sell the shares and have no firm commitment or obligation to purchase any of the shares.

On December 18, 2009, we satisfied the minimum offering of 50,000 common shares of beneficial interest for gross offering proceeds of $1.0 million in connection with the Offering. As a result, our initial public subscribers were accepted as shareholders and the subscription proceeds from such initial public subscribers were released to us from escrow, provided that residents of New York and Nebraska were not admitted until we received and accepted subscriptions aggregating at least $2,500,000 and $5,000,000, respectively (the New York minimum offering amount was satisfied on January 8, 2010 and the Nebraska minimum offering amount was satisfied on January 27, 2010), and provided further, that residents of Pennsylvania will not be admitted until we receive and accept subscriptions aggregating at least $35,000,000. ; Since such time, we have admitted and intend to continue to admit, new investors at least monthly. As of December 31, 2009, we had issued an aggregate of 119,729 shares of beneficial interest in the Offering, in exchange for gross proceeds of approximately $2.4 million (approximately $2.1 million, net of approximately $285,000 in costs associated with the Offering). Of the Offering costs paid as of December 31, 2009, approximately $66,000 was paid to our Advisor or affiliates of our Advisor for organizational and offering expense and approximately $219,000 was paid to our dealer manager.

As of December 31, 2009, we had funded/participated in two participation agreements. These participation agreements totaled approximately $1.4 million and are included in loan participation interest – related party on our balance sheets. We paid our asset manager, an affiliate of our Advisor, approximately $40,000 for acquisition and origination fee expenses associated with such loan.

Item 6. Selected Financial Data.

We present below selected financial information. We encourage you to read the financial statements and the notes accompanying the financial statements included in this Annual Report. This information is not intended to be a replacement for the financial statements.

| | Year Ended December 31, 2009 | | Period from May 28, 2008 (Inception) through December 31, 2008 |

| OPERATING DATA | | | |

| Revenues | $ 4,247 | | $ 619 |

| Expenses | 25,959 | | 240 |

| Net Income (loss) | $ (21,712) | | $ 379 |

| Net income (loss) per share | $ (1.63) | | $ 0.04 |

| | December 31, |

| | 2009 | | 2008 |

| BALANCE SHEET DATA | | | |

| Loan participation interest – related party | $ 1,380,757 | | $ - |

| Deferred offering costs | 5,684,106 | | 1,455,788 |

| Other assets | 1,243,893 | | 23,629 |

| Total assets | $ 8,308,756 | | $ 1,479,417 |

| | | | |

| Accrued liabilities – related party | $ 5,516,613 | | $ 1,279,038 |

| Other liabilities | 708,171 | | - |

| Total liabilities | 6,224,784 | | 1,279,038 |

| Shareholders’ equity | 2,083,972 | | 200,379 |

| Total liabilities and shareholders’ equity | $ 8,308,756 | | $ 1,479,417 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with our accompanying financial statements and the notes thereto:

Overview

On November 12, 2009, the Trust’s Registration Statement on Form S-11, covering the Offering of up to 25,000,000 common shares of beneficial interest to be offered at a price of $20 per share, was declared effective under the Securities Act of 1933, as amended. The Offering also covers up to 10,000,000 common shares of beneficial interest to be issued pursuant to our DRIP for $20 per share. We reserve the right to reallocate the common shares of beneficial interest registered in the Offering between the primary offering and the DRIP. On December 18, 2009, we satisfied the minimum offering of 50,000 common shares of beneficial interest for gross offering proceeds of $1.0 million in connection with the Offering. As a result, our initial public subscribers were accepted as sharehold ers and the subscription proceeds from such initial public subscribers were released to us from escrow, provided that residents of New York and Nebraska were not admitted until we received and accepted subscriptions aggregating at least $2,500,000 and $5,000,000, respectively (the New York minimum offering amount was satisfied on January 8, 2010 and the Nebraska minimum offering amount was satisfied on January 27, 2010), and provided further, that residents of Pennsylvania will not be admitted until we receive and accept subscriptions aggregating at least $35,000,000.

We will experience a relative increase in liquidity as additional subscriptions for common shares are received and a relative decrease in liquidity as offering proceeds are expended in connection with the origination, purchase or participation in secured loans or other investments, as well as the payment or reimbursement of selling commissions and other organizational and offering expenses.

The Trust intends to use substantially all of the net proceeds from the Offering to originate, purchase, participate in and hold for investment secured loans made directly by the Trust or indirectly through its affiliates to persons and entities for the acquisition and development of parcels of real property as single-family residential lots, and the construction of model and new single-family homes, including development of mixed-use master planned residential communities. The Trust also intends to make direct investments in land for development into single-family lots, new and model homes and portfolios of finished lots and homes; provide credit enhancements to real estate developers, home builders, land bankers and other real estate investors; and purchase participations in, or finance for other real estate investors the purchase o f, securitized real estate loan pools and discounted cash flows secured by state, county, municipal or other similar assessments levied on real property. The Trust also may enter into joint ventures with unaffiliated real estate developers, home builders, land bankers and other real estate investors, or with other United Development Funding-sponsored programs, to originate or acquire, as the case may be, the same kind of secured loans or real estate investments the Trust may originate or acquire directly.

Until required in connection with the funding of loans or other investments, substantially all of the net proceeds of the Offering and, thereafter, our working capital reserves, may be invested in short-term, highly-liquid investments including, but not limited to, government obligations, bank certificates of deposit, short-term debt obligations and interest-bearing accounts.

We intend to make an election under Section 856(c) of the Internal Revenue Code to be taxed as a REIT, beginning with the taxable year ending December 31, 2010, which will be the first year in which we have material operations. If we qualify as a REIT for federal income tax purposes, we generally will not be subject to federal income tax on income that we distribute to our shareholders. If we make an election to be taxed as a REIT and later fail to qualify as a REIT in any taxable year, we will be subject to federal income tax on our taxable income at regular corporate rates and may not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year in which our qualification is denied unless we are entitled to relief under certain statutory provisions. Such an event could ma terially and adversely affect our net income. However, we believe that we are organized and will operate in a manner that will enable us to qualify for treatment as a REIT for federal income tax purposes during the year ended December 31, 2010, the first year in which we will have material operations, and we intend to continue to operate so as to remain qualified as a REIT for federal income tax purposes.

Critical Accounting Policies and Estimates

Our accounting policies have been established to conform with generally accepted accounting principles (“GAAP”) in the United States. The preparation of financial statements in conformity with GAAP requires management to use judgment in the application of accounting policies, including making estimates and assumptions. These judgments affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. If management’s judgment or interpretation of the facts and circumstances relating to various transactions had been different, it is po ssible that different accounting policies would have been applied, thus resulting in a different presentation of the financial statements. Additionally, other companies may utilize different estimates that may impact comparability of our results of operations to those of companies in similar businesses.

Management’s discussion and analysis of financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with GAAP. GAAP consists of a set of standards issued by the Financial Accounting Standards Board (“FASB”) and other authoritative bodies in the form of FASB Statements, Interpretations, FASB Staff Positions, EITF consensuses and AICPA Statements of Position, among others. The FASB recognized the complexity of its standard-setting process and embarked on a revised process in 2004 that culminated in the release on July 1, 2009 of the Accounting Standards Codification (“ASC”). The ASC does not change how the Trust accounts for its transactions or the nature of related disclosures made. Rather, the ASC results in change s to how the Trust references accounting standards within its reports. This change was made effective by the FASB for periods ending on or after September 15, 2009. The Trust has updated references to GAAP in this Annual Report on Form 10-K to reflect the guidance in the ASC. The preparation of these financial statements requires our management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On a regular basis, we evaluate these estimates, including investment impairment. These estimates are based on management’s historical industry experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates.

Revenue Recognition

Interest income on loan participation interest – related party is recognized over the life of the participation agreement and recorded on the accrual basis. Income recognition is suspended for participation agreements at either the date at which payments become 90 days past due or when, in the opinion of management, a full recovery of income and principal becomes doubtful. Income recognition is resumed when the loan becomes contractually current and performance is demonstrated to be resumed. As of December 31, 2009, we were accruing interest on the loan participation interest – related party.

Loan Participation Interest – Related Party

Loan participation interest – related party represents two participation agreements with UMT Home Finance, L.P., a Delaware limited partnership (“UMTHF”), to participate in certain of UMTHF’s interim construction loan facilities (the “Construction Loans”). Pursuant to the participation agreements, UDF IV will participate in the Construction Loans up to a maximum amount of $3.5 million by funding the lending obligations of UMT; UMT owns 100% of the interests in UMTHF and its advisor also serves as the Trust’s Advisor.

Cash Flow Distributions