Exhibit 99.1

Clearwater Paper Corporation

September 2013

Forward-Looking Statements

This presentation contains, in addition to historical information, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding tissue market dynamics and our ability to capitalize on such, future growth and market opportunities, including in the Midwestern and Eastern U.S. regions and non-grocery channels, absorption of tissue capacity increases, U.S. tissue and paperboard market demand, paperboard pricing, strategies to grow our tissue business and optimize profitability of our pulp & paperboard business, our DRIVE strategy, our estimated annual and quarterly Adjusted EBITDA run-rates, shipments from our new tissue machine and converting lines in Shelby, North Carolina, expected future savings from cost synergies relating to our Cellu Tissue acquisition, efficiency and cost savings projects and reductions to our cost structure, our future generation of discretionary free cash flow, uses of our cash, our outlook for Q3 2013 including production, shipment volumes, product pricing and mix, pulp costs, wood fiber costs and supply, chemical costs, transportation costs, energy costs, cost and timing of major maintenance and repairs and corporate expenses. Words such as “anticipate,” “expect,” “intend,” “will,” “plan,” “goals,” “objectives,” “target,” “project,” “believe,” “schedule,” “estimate,” “may,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on management’s current expectations, estimates, assumptions and projections that are subject to change. Our actual results of operations may differ materially from those expressed or implied by the forward-looking statements contained in this presentation. Important factors that could cause or contribute to such differences include the risk factors described in Item 1A of Part I of our Form

10-K for the year ended December 31, 2012, as well as the following:

customer acceptance and timing of purchases of our new through-air-dried (TAD) products and capacity;

competitive pricing pressures for our products, including as a result of increased capacity as additional manufacturing facilities are operated by our competitors; difficulties with the optimization and realization of the benefits expected from our new TAD paper machine and converting lines in Shelby, North Carolina; increased dependence on wood pulp; changes in the cost and availability of wood fiber and wood pulp; changes in transportation costs and disruptions in transportation services; manufacturing or operating disruptions, including equipment malfunction and damage to our manufacturing facilities; changes in costs for and availability of packaging supplies, chemicals, energy and maintenance and repairs; changes in customer product preferences and competitors’ product offerings; changes in the U.S. and international economies and in general economic conditions in the regions and industries in which we operate; increased supply and pricing pressures resulting from increasing Asian paper production capabilities; cyclical industry conditions; reliance on a limited number of third-party suppliers for raw materials; labor disruptions our ability to generate cash; and inability to successfully implement our expansion strategies.

Forward-looking statements contained in this presentation present management’s views only as of the date of this presentation. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise.

1

Overview of Clearwater Paper

Introduction to Clearwater Paper

We are a company formed in late 2008 with more than 60 years of operating history

Operate two business segments of similar size

– Pulp and Paperboard: 38% of June 2013 YTD net sales

– Consumer Products: 62% of June 2013 YTD net sales

Financial overview as of June 2013

– LTM Net Sales: $1.9 billion

– LTM Adjusted EBITDA1: $208 million

– 2008 to LTM Adjusted EBITDA1 CAGR: 23%

Approximately 3,960 employees

¹ See Appendix for the definition of Adjusted EBITDA as well as the reconciliation to the most comparable GAAP measure.

3

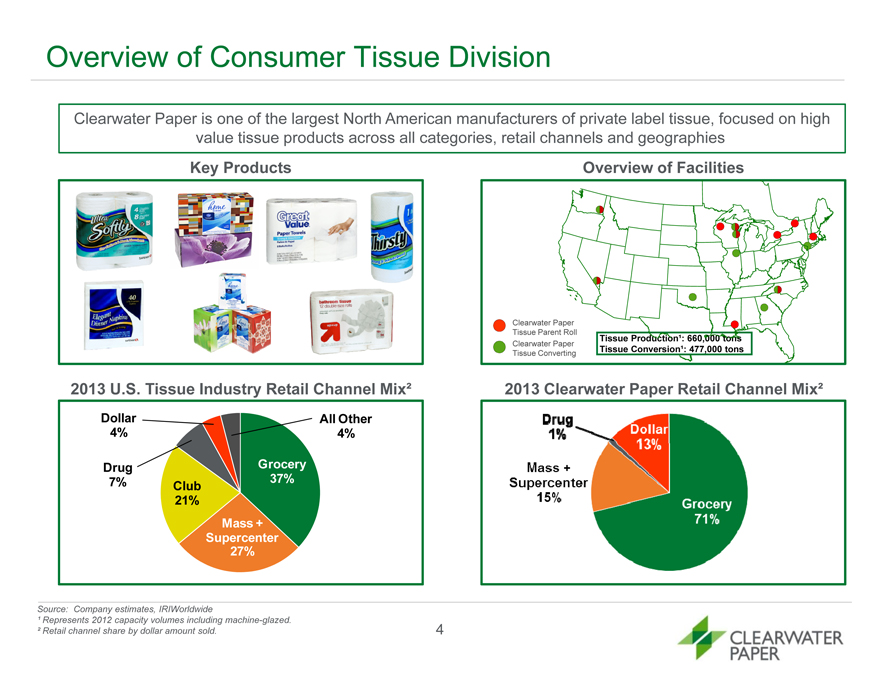

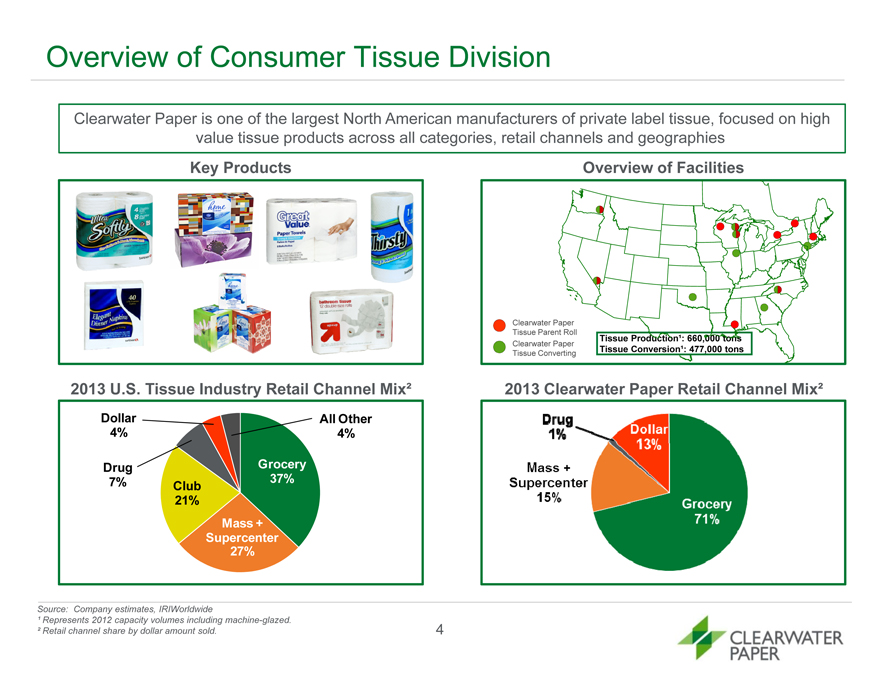

Overview of Consumer Tissue Division

Clearwater Paper is one of the largest North American manufacturers of private label tissue, focused on high

value tissue products across all categories, retail channels and geographies

Key Products Overview of Facilities

Clearwater Paper

Tissue Parent Roll

Tissue Production¹: 660,000 tons

Clearwater Paper Tissue Conversion¹: 477,000 tons

Tissue Converting

2013 U.S. Tissue Industry Retail Channel Mix² 2013 Clearwater Paper Retail Channel Mix²

Dollar All Other

4% 4%

Drug Grocery

7% Club 37%

21%

Mass +

Supercenter

27%

Source: Company estimates, IRIWorldwide

¹ Represents 2012 capacity volumes including machine-glazed.

² Retail channel share by dollar amount sold. 4

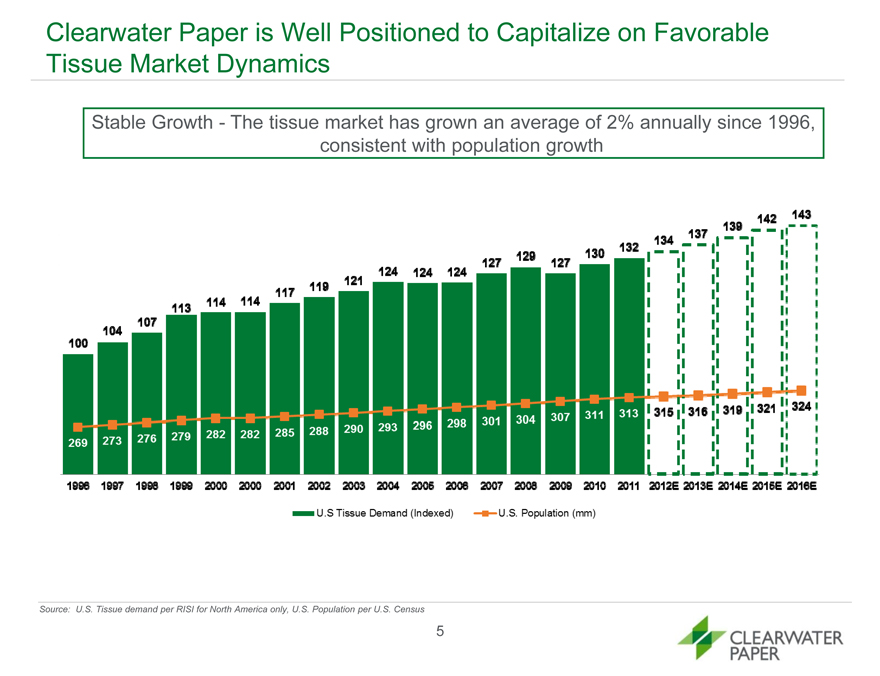

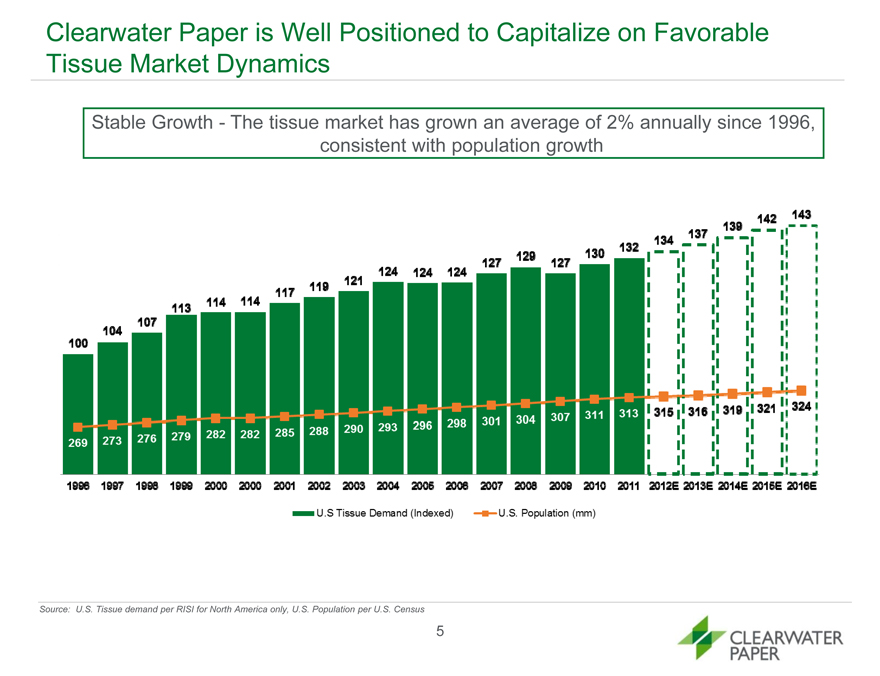

Clearwater Paper is Well Positioned to Capitalize on Favorable

Tissue Market Dynamics

Stable Growth—The tissue market has grown an average of 2% annually since 1996,

consistent with population growth

Source: U.S. Tissue demand per RISI for North America only, U.S. Population per U.S. Census

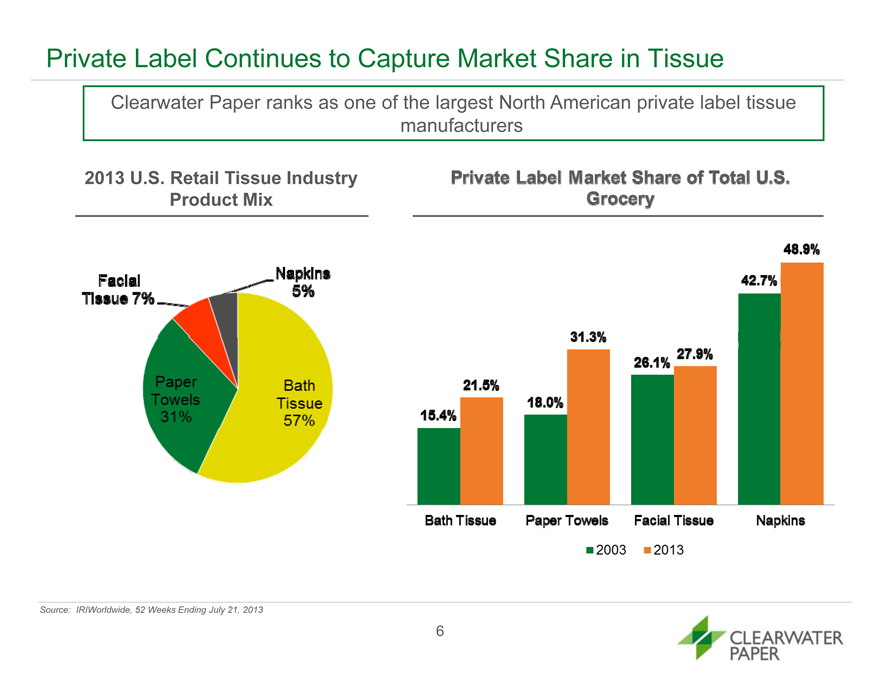

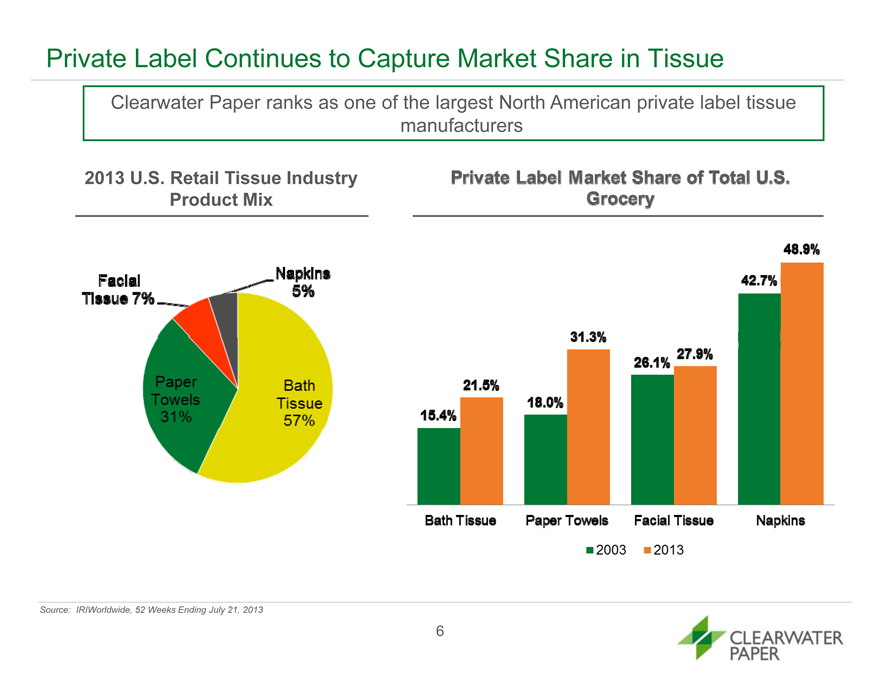

Private Label Continues to Capture Market Share in Tissue

Clearwater Paper ranks as one of the largest North American private label tissue

manufacturers

2013 U.S. Retail Tissue Industry

Product Mix

Source: IRIWorldwide, 52 Weeks Ending July 21, 2013

Significant Opportunity Still Exists for Clearwater Paper To Expand

Across the U.S. Private Label Market

2013 Multi-Outlet 1

West Midwest East Total

Equalized Case Volumes (mm) 86 181 233 500

% of U.S. Population 23% 34% 43% 100%

% Private Label (PL) 32% 25% 25% 26%

% Clearwater Paper of PL 70% 40% 24% 35%

Clearwater Paper led the development of private label tissue in the Western U.S.

Clearwater Paper is focused on growing the private label category and market share in the

Eastern U.S.

If Clearwater Paper could replicate its West model across the U.S.:

– 22% share in Midwest would be an incremental 25 million cases

– 22% share in East would be an incremental 37 million cases

Source: IRIWorldwide, 52 Weeks Ending July 21, 2013

1 Multi-Outlet includes Grocery, Drug, Mass, Dollar and Military.

7

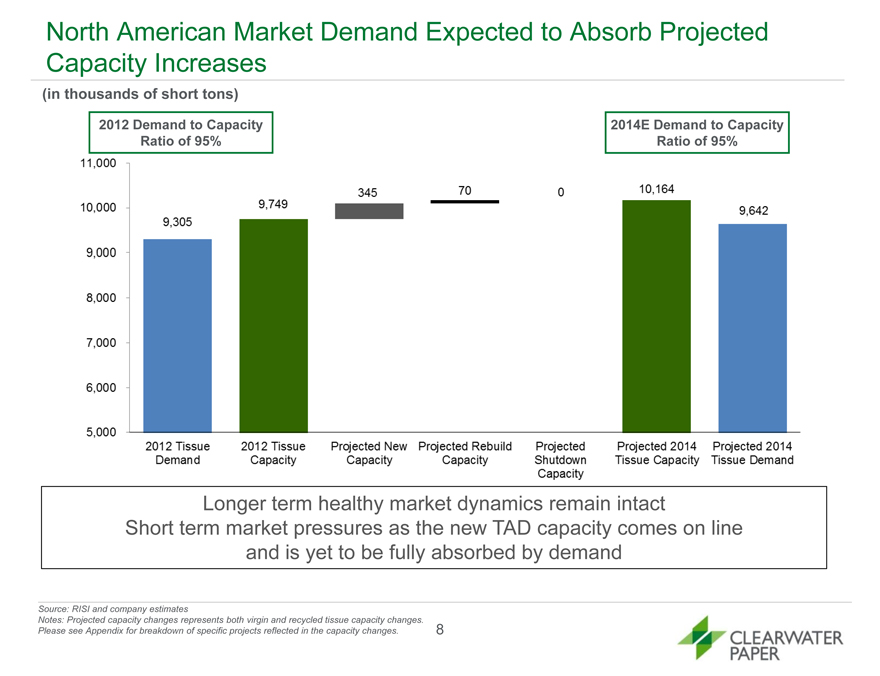

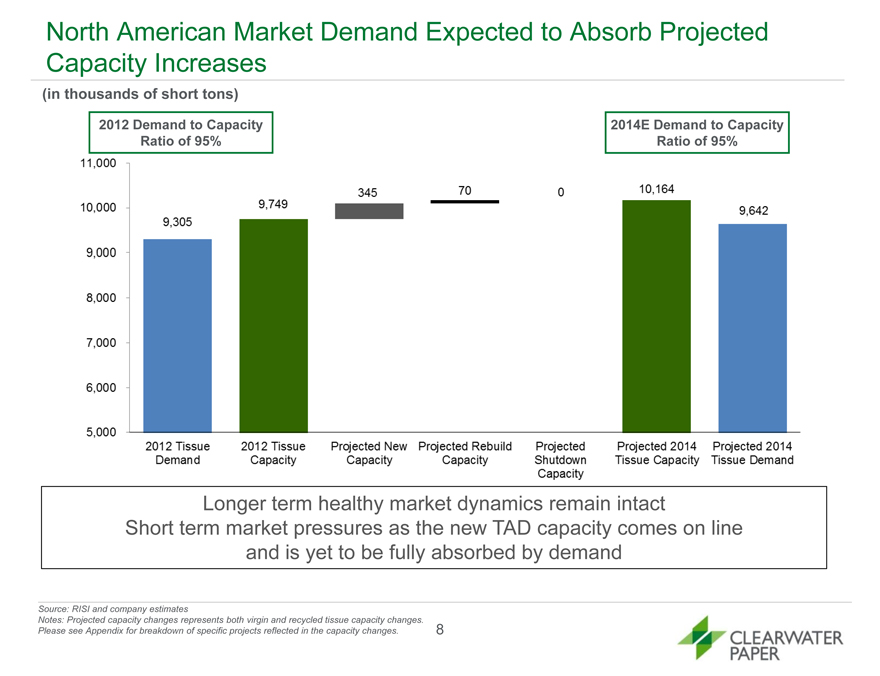

North American Market Demand Expected to Absorb Projected

Capacity Increases

(in thousands of short tons)

2012 Demand to Capacity 2014E Demand to Capacity

Ratio of 95% Ratio of 95%

Longer term healthy market dynamics remain intact

Short term market pressures as the new TAD capacity comes on line

and is yet to be fully absorbed by demand

Source: RISI and company estimates

Notes: Projected capacity changes represents both virgin and recycled tissue capacity changes.

Please see Appendix for breakdown of specific projects reflected in the capacity changes. 8

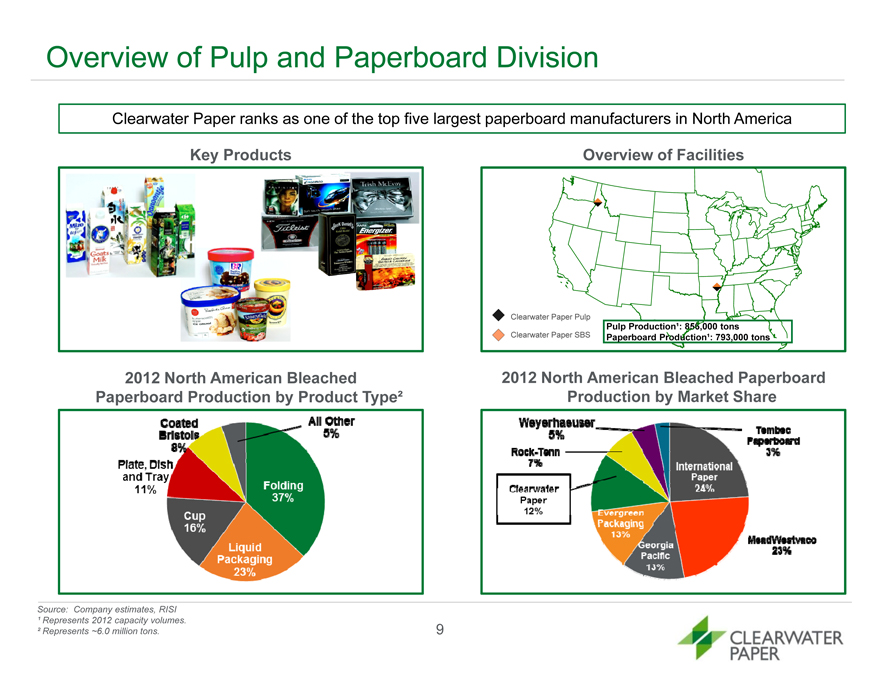

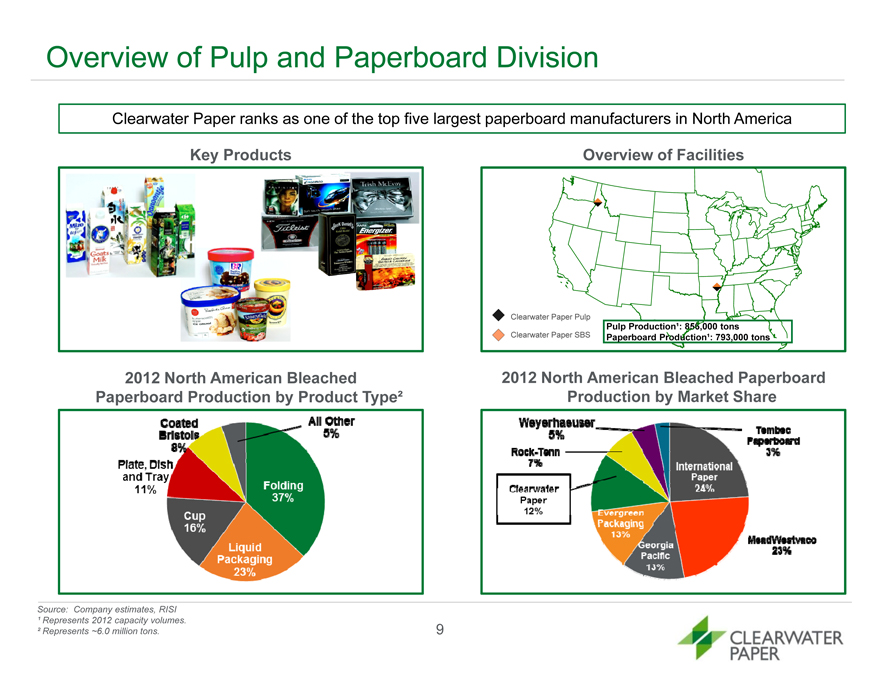

Overview of Pulp and Paperboard Division

Clearwater Paper ranks as one of the top five largest paperboard manufacturers in North America

Key Products Overview of Facilities

Clearwater Paper Pulp

Pulp Production¹: 856,000 tons

Clearwater Paper SBS Paperboard Production¹: 793,000 tons

2012 North American Bleached 2012 North American Bleached Paperboard

Paperboard Production by Product Type² Production by Market Share

Source: Company estimates, RISI

¹ Represents 2012 capacity volumes.

² Represents ~6.0 million tons. 9

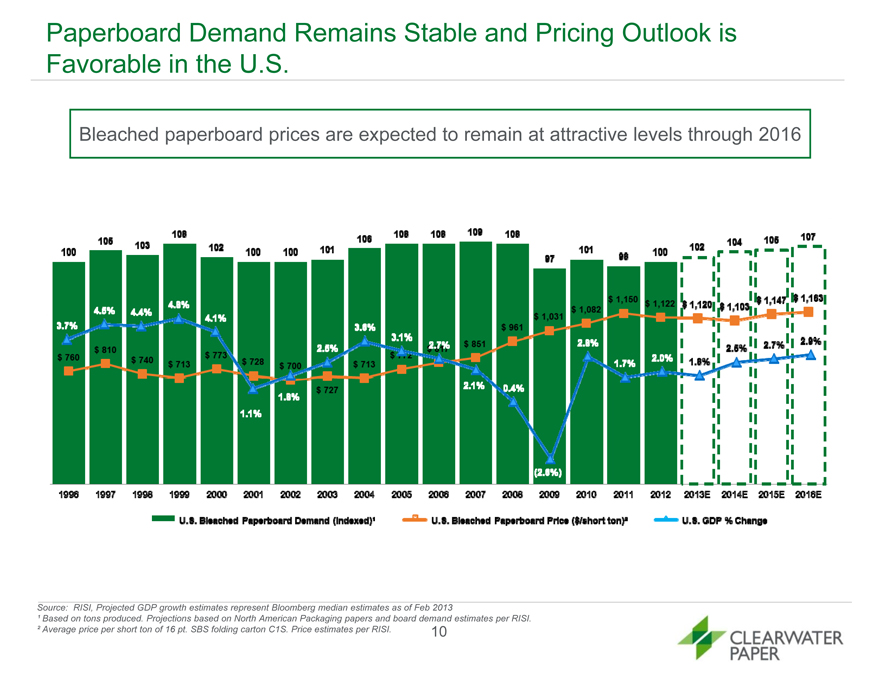

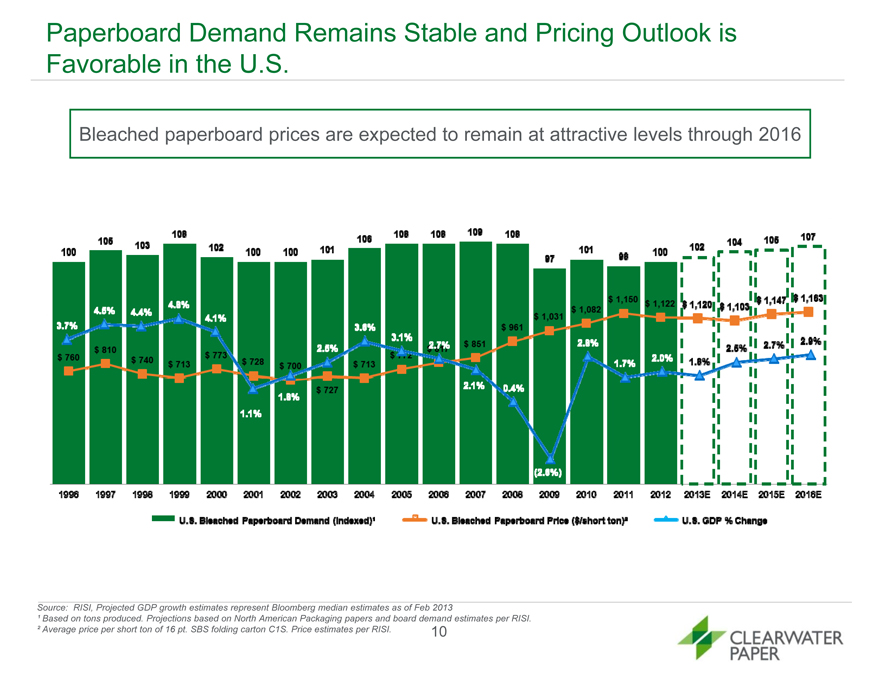

Paperboard Demand Remains Stable and Pricing Outlook is

Favorable in the U.S.

Bleached paperboard prices are expected to remain at attractive levels through 2016

Source: RISI, Projected GDP growth estimates represent Bloomberg median estimates as of Feb 2013

¹ Based on tons produced. Projections based on North American Packaging papers and board demand estimates per RISI.

² Average price per short ton of 16 pt. SBS folding carton C1S. Price estimates per RISI. 10

Clearwater Paper’s Strategic Plan

11

Our Macro Strategy to Create Shareholder Value

• Lead private label quality

Grow our Tissue • Expand geographically

Business

• Expand retail channel penetration

Optimize Profitability • Improve sales mix

of Paperboard • Reduce costs

Business • Continue to improve quality

12

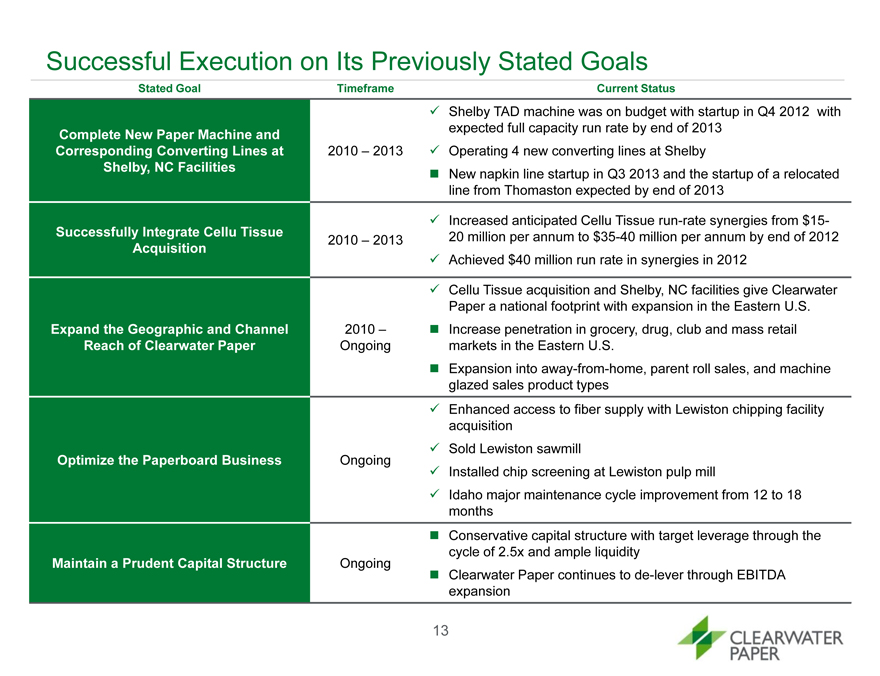

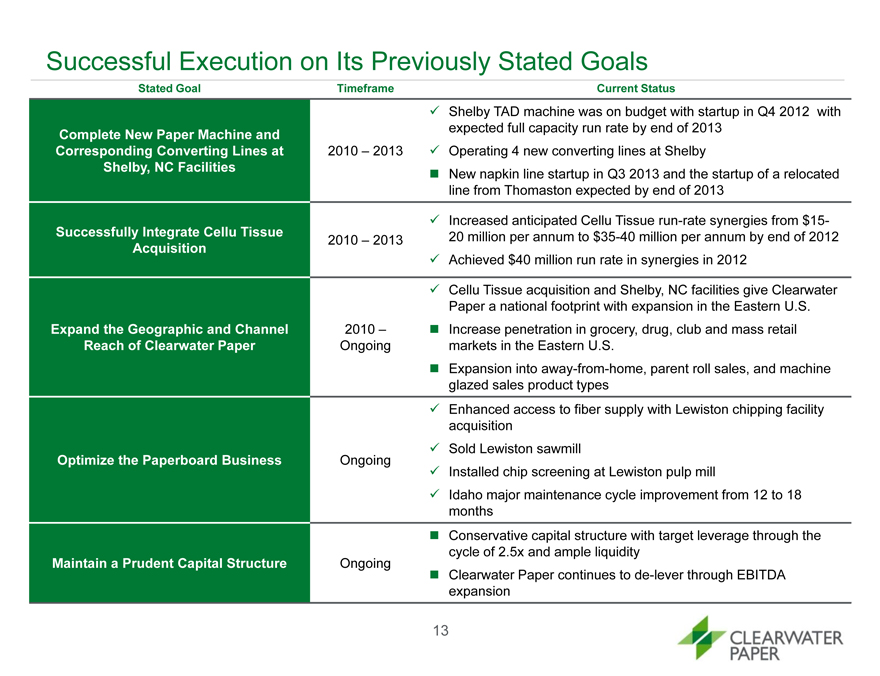

Successful Execution on Its Previously Stated Goals

Stated Goal Timeframe Current Status

Shelby TAD machine was on budget with startup in Q4 2012 with

Complete New Paper Machine and expected full capacity run rate by end of 2013

Corresponding Converting Lines at 2010 – 2013 Operating 4 new converting lines at Shelby

Shelby, NC Facilities ? New napkin line startup in Q3 2013 and the startup of a relocated

line from Thomaston expected by end of 2013

Increased anticipated Cellu Tissue run-rate synergies from $15-

Successfully Integrate Cellu Tissue 2010 – 2013 20 million per annum to $35-40 million per annum by end of 2012

Acquisition

Achieved $40 million run rate in synergies in 2012

Cellu Tissue acquisition and Shelby, NC facilities give Clearwater

Paper a national footprint with expansion in the Eastern U.S.

Expand the Geographic and Channel 2010 – ? Increase penetration in grocery, drug, club and mass retail

Reach of Clearwater Paper Ongoing markets in the Eastern U.S.

Expansion into away-from-home, parent roll sales, and machine

glazed sales product types

Enhanced access to fiber supply with Lewiston chipping facility

acquisition

Sold Lewiston sawmill

Optimize the Paperboard Business Ongoing

Installed chip screening at Lewiston pulp mill

Idaho major maintenance cycle improvement from 12 to 18

months

Conservative capital structure with target leverage through the

cycle of 2.5x and ample liquidity

Maintain a Prudent Capital Structure Ongoing

Clearwater Paper continues to de-lever through EBITDA

expansion

13

Continued momentum into 2013

Refinanced debt to secure long-term capital flexibility

Initiated a $100 million stock buyback

Commenced chipping facility operations

Announced asset rationalization with the phased closure of Thomaston converting facility

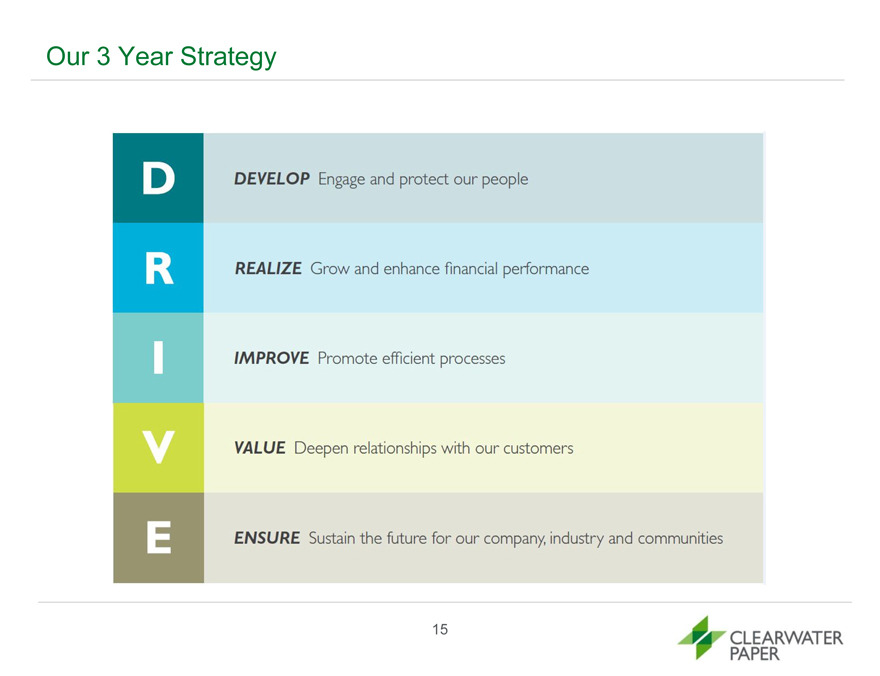

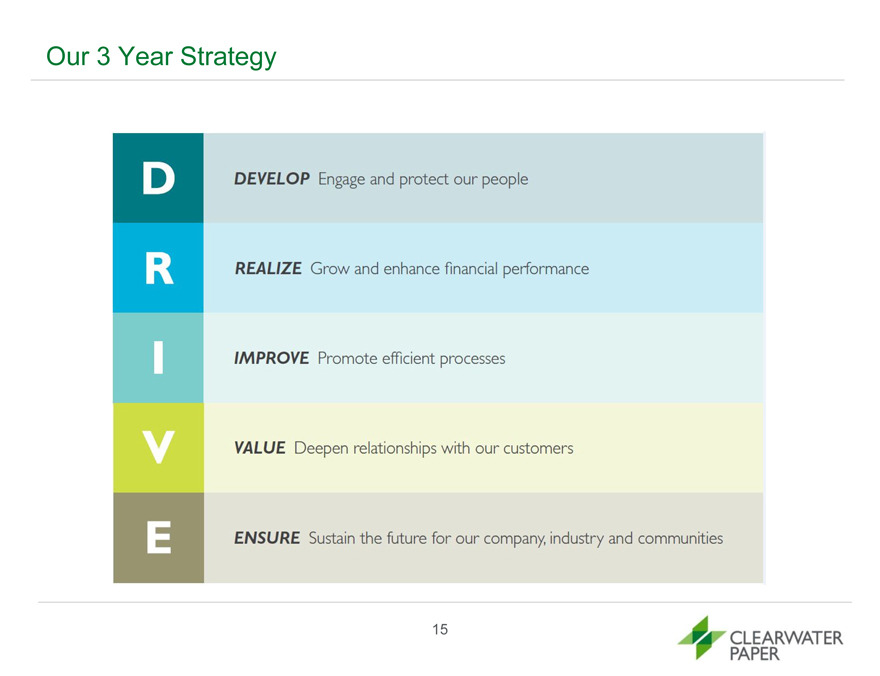

Launched a new mission, vision and strategy companywide called DRIVE

14

Our 3 Year Strategy

15

Clearwater Paper’s Value Proposition

16

Key Initiatives Expected to Significantly Improve Earnings Power

($ in millions) Expected Free Cash

Flow (FCF)

Realization of Full Cost

Shelby Cellu Tissue Savings Adj. EBITDA1 $300

Ramp-up Synergies Programs Less:

Cash Taxes ($55)

Expected benefit Incremental Expected benefit Cash Interest ($45)

from full ramp-up savings from lean

of TAD paper expected from manufacturing and CAPEX ($75)

machine, 5 Cellu Tissue cost optimization Free Cash Flow $125

converting lines acquisition initiatives FCF per Share $5.60

and Las Vegas Weighted Avg. Shares

paper machine Outstanding—22.3 million

upgrade

Realized To Date

Sale of Wood Products $ 4

Realized To Date Idaho chipping facility 4

Energy projects 5

$40+ Chip screening 2

Expected EBITDA Ramp Paper machine dry stack 2

Per Quarter $17

Q2-2013 $ 2 Anticipated

Q3-2013 3-4 • Thomaston closure $12

Q4-2013 7 • Extend maintenance cadence 5

Q1-2014 9 • Coating operating change 5

• Arkansas recovery upgrade 2

Expected Full Ramp •Other opportunities 4+

($12-$15 in Q3-2014) EXPECTED COST SAVINGS $45+

Note: Assumes no change in prices or input costs from 2011

¹ See Appendix for the definition of Adjusted EBITDA as well as the reconciliation to

the most comparable GAAP measure. 17

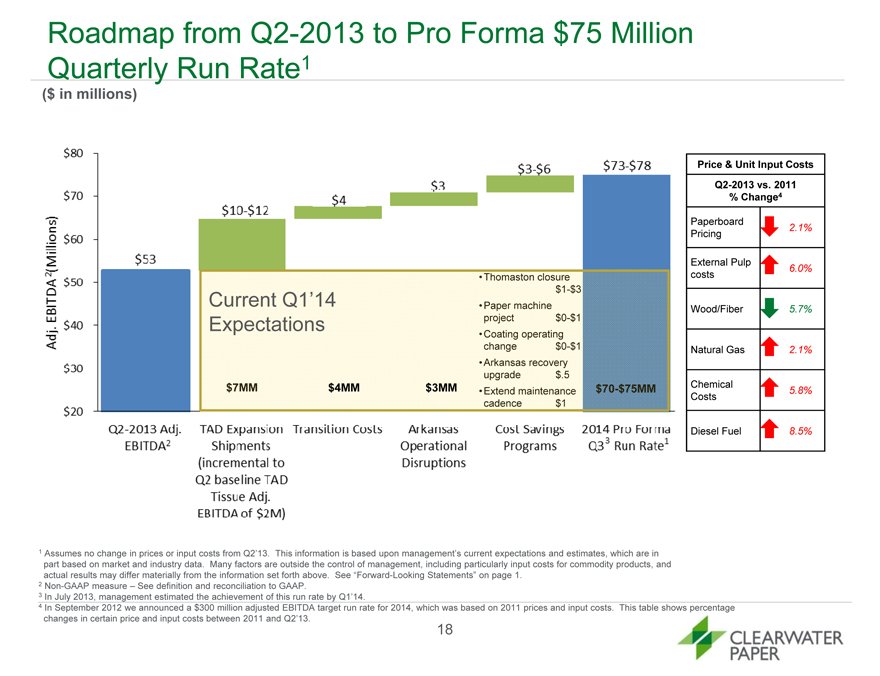

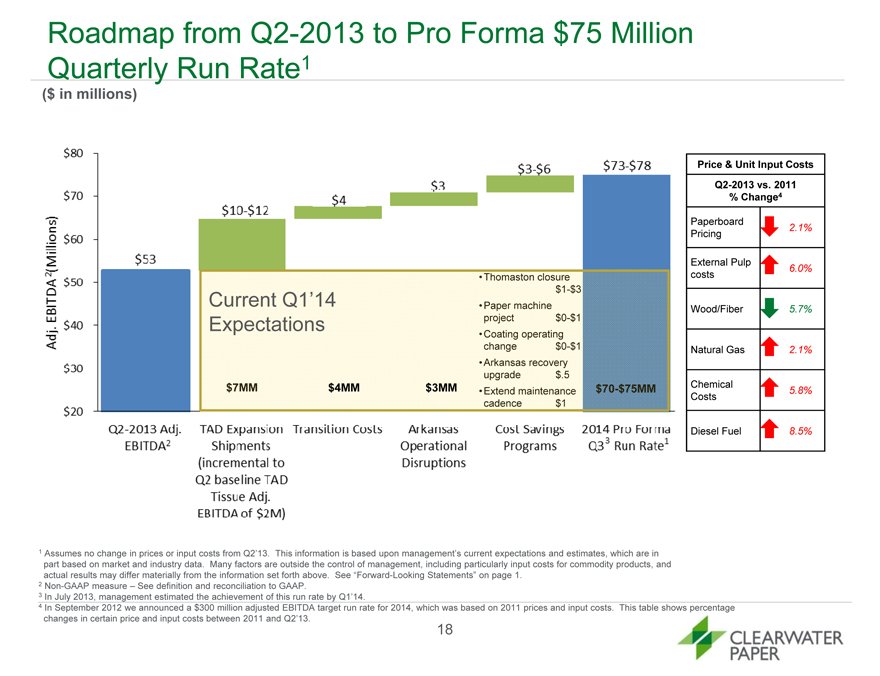

Roadmap from Q2-2013 to Pro Forma $75 Million

Quarterly Run Rate1

($ in millions)

Price & Unit Input Costs

Q2-2013 vs. 2011

% Change4

Paperboard 2.1%

Pricing

External Pulp 6.0%

•Thomaston closure costs

$1-$ 3

Current Q1’14 •Paper machine Wood/Fiber 5.7%

Expectations project $0-$ 1

•Coating operating

change $0-$ 1 Natural Gas 2.1%

•Arkansas recovery

upgrade $.5

$7MM $4MM $3MM •Extend maintenance $ 70-$75MM Chemical 5.8%

cadence $1 Costs

Diesel Fuel 8.5%

1 Assumes no change in prices or input costs from Q2’13. This information is based upon management’s current expectations and estimates, which are in

part based on market and industry data. Many factors are outside the control of management, including particularly input costs for commodity products, and

actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 1.

2 Non-GAAP measure – See definition and reconciliation to GAAP.

3 In July 2013, management estimated the achievement of this run rate by Q1’14.

4 In September 2012 we announced a $300 million adjusted EBITDA target run rate for 2014, which was based on 2011 prices and input costs. This table shows percentage

changes in certain price and input costs between 2011 and Q2’13.

18

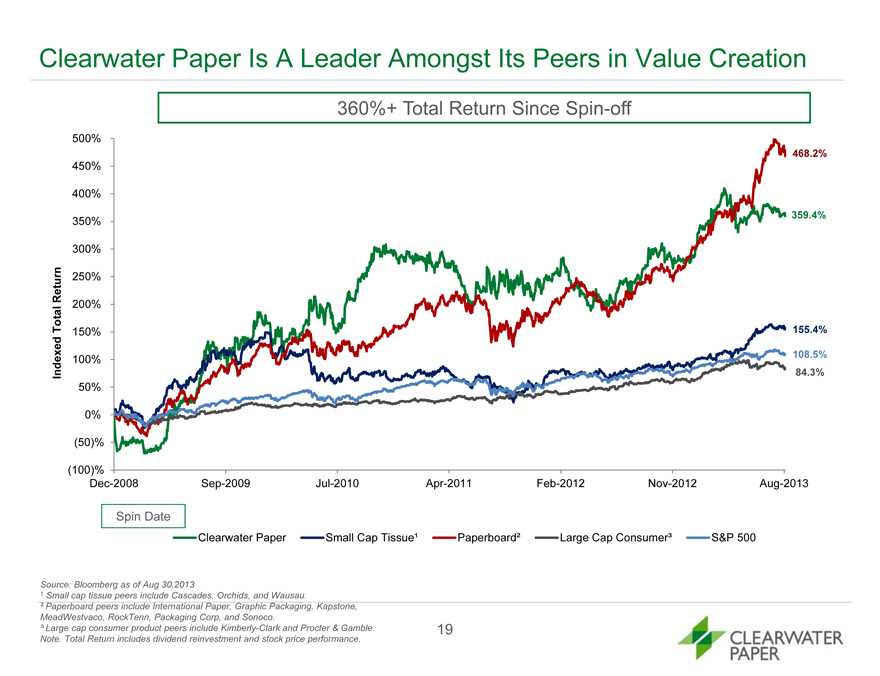

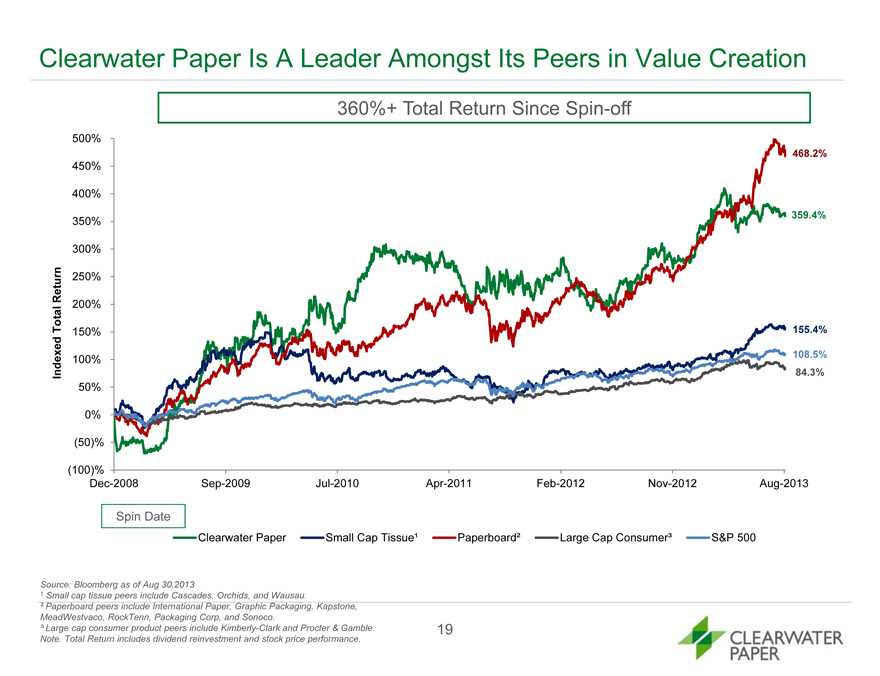

Clearwater Paper Is A Leader Amongst Its Peers in Value Creation

360%+ Total Return Since Spin-off

500%

468.2%

450%

400%

350% 359.4%

300%

Return 250%

Total 200%

150% 155.4%

100% 108.5%

Indexed 84.3%

50%

0%

(50)%

(100)%

Dec-2008 Sep-2009 Jul-2010 Apr-2011 Feb-2012 Nov-2012 Aug-2013

Spin Date

Clearwater Paper Small Cap Tissue¹ Paperboard² Large Cap Consumer³ S&P 500

Source: Bloomberg as of Aug 30,2013

1 Small cap tissue peers include Cascades, Orchids, and Wausau.

² Paperboard peers include International Paper, Graphic Packaging, Kapstone,

MeadWestvaco, RockTenn, Packaging Corp, and Sonoco.

³ Large cap consumer product peers include Kimberly-Clark and Procter & Gamble. 19

Note. Total Return includes dividend reinvestment and stock price performance.

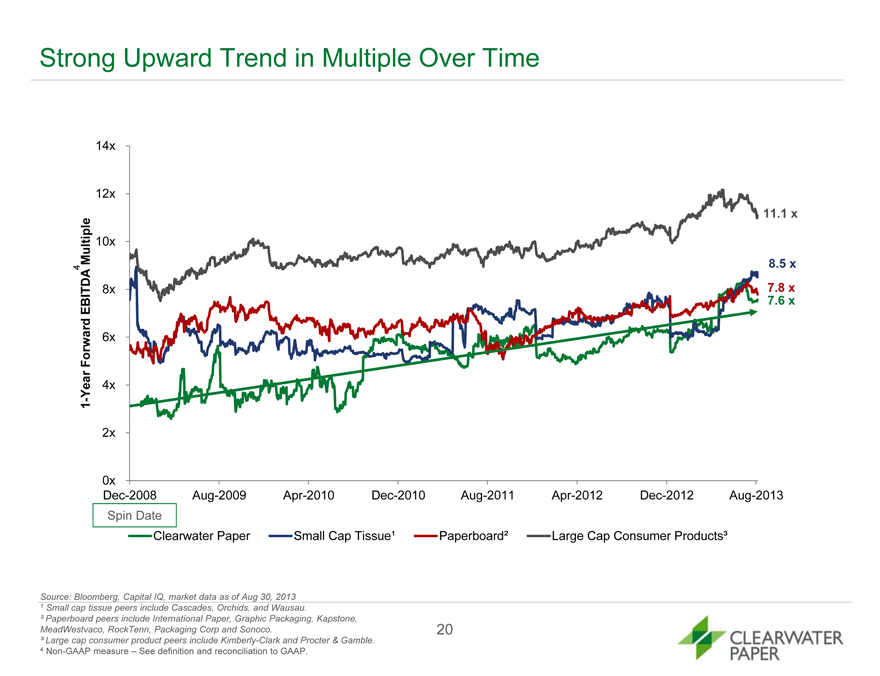

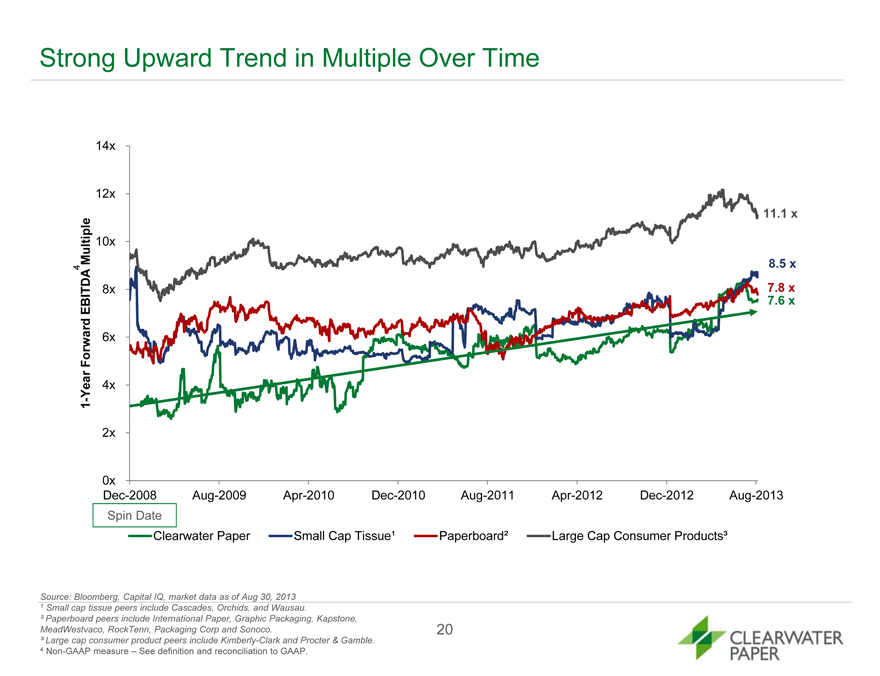

Strong Upward Trend in Multiple Over Time

14x

12x

11.1 x

ultiple 10x

4 M 8.5 x

8x 7.8 x

EBITDA 7.6 x

ard 6x

Forw

Year 4x

-

1

2x

0x

Dec-2008 Aug-2009 Apr-2010 Dec-2010 Aug-2011 Apr-2012 Dec-2012 Aug-2013

Spin Date

Clearwater Paper Small Cap Tissue¹ Paperboard² Large Cap Consumer Products³

Source: Bloomberg, Capital IQ, market data as of Aug 30, 2013

1 Small cap tissue peers include Cascades, Orchids, and Wausau.

² Paperboard peers include International Paper, Graphic Packaging, Kapstone,

MeadWestvaco, RockTenn, Packaging Corp and Sonoco. 20

³ Large cap consumer product peers include Kimberly-Clark and Procter & Gamble.

4 Non-GAAP measure – See definition and reconciliation to GAAP.

Clearwater Paper’s Outlook

21

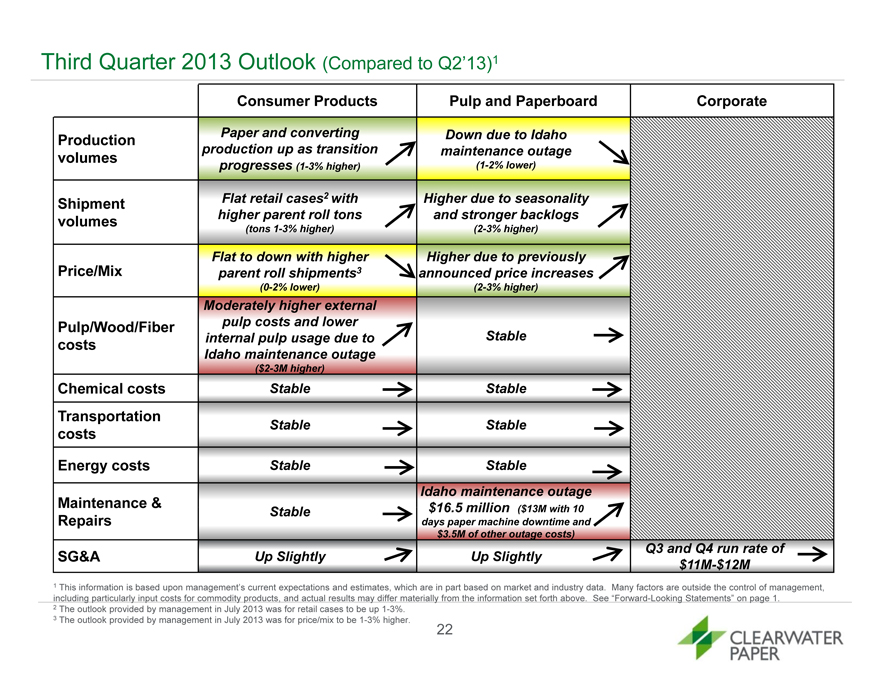

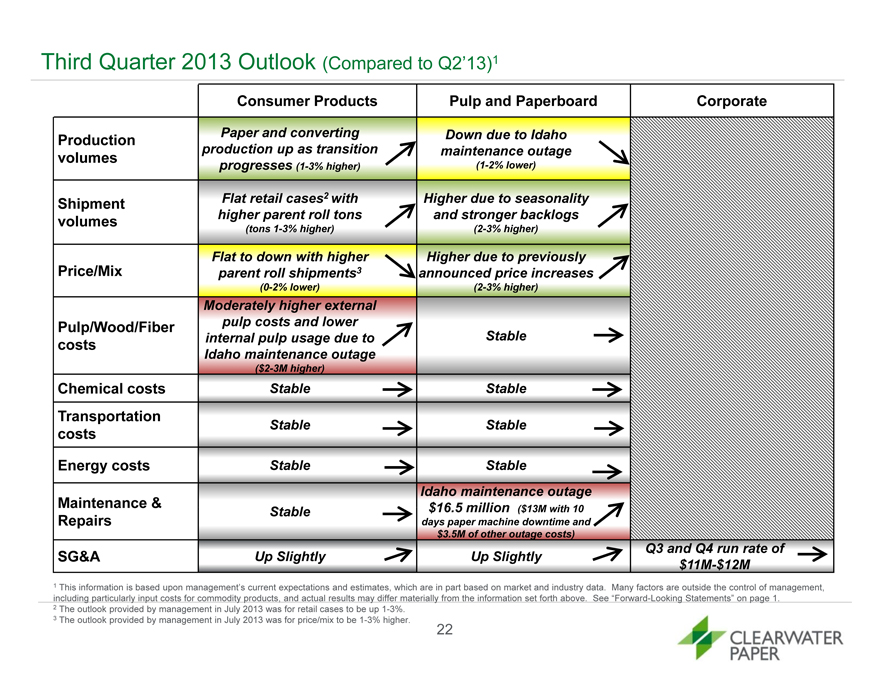

Third Quarter 2013 Outlook (Compared to Q2’13)1

Consumer Products Pulp and Paperboard Corporate

Production Paper and converting Down due to Idaho

volumes production up as transition maintenance outage

progresses (1-3% higher) (1-2% lower)

Shipment Flat retail cases2 with Higher due to seasonality

volumes higher parent roll tons and stronger backlogs

(tons 1-3% higher) (2-3% higher)

Flat to down with higher Higher due to previously

Price/Mix parent roll shipments3 announced price increases

(0-2% lower) (2-3% higher)

Moderately higher external

Pulp/Wood/Fiber pulp costs and lower

costs internal pulp usage due to Stable

Idaho maintenance outage

($2-3M higher)

Chemical costs Stable Stable

Transportation

costs Stable Stable

Energy costs Stable Stable

Idaho maintenance outage

Maintenance & Stable $16.5 million ($13M with 10

Repairs days paper machine downtime and

$3.5M of other outage costs)

SG&A Up Slightly Up Slightly Q3 and Q4 run rate of

$11M-$12M

1 This information is based upon management’s current expectations and estimates, which are in part based on market and industry data. Many factors are outside the control of management,

including particularly input costs for commodity products, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 1.

2 The outlook provided by management in July 2013 was for retail cases to be up 1-3%.

3 The outlook provided by management in July 2013 was for price/mix to be 1-3% higher.

22

Appendix

23

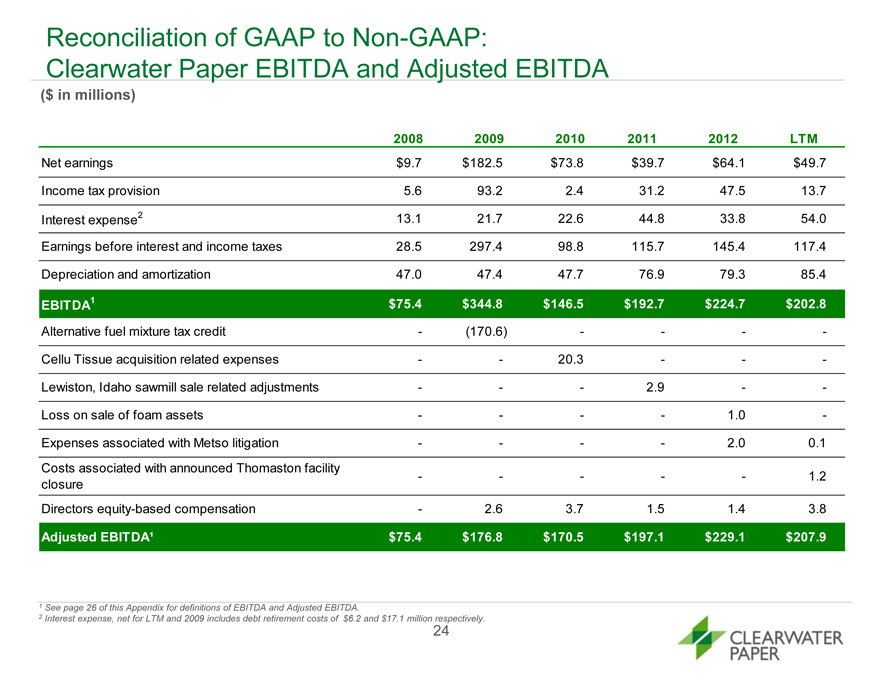

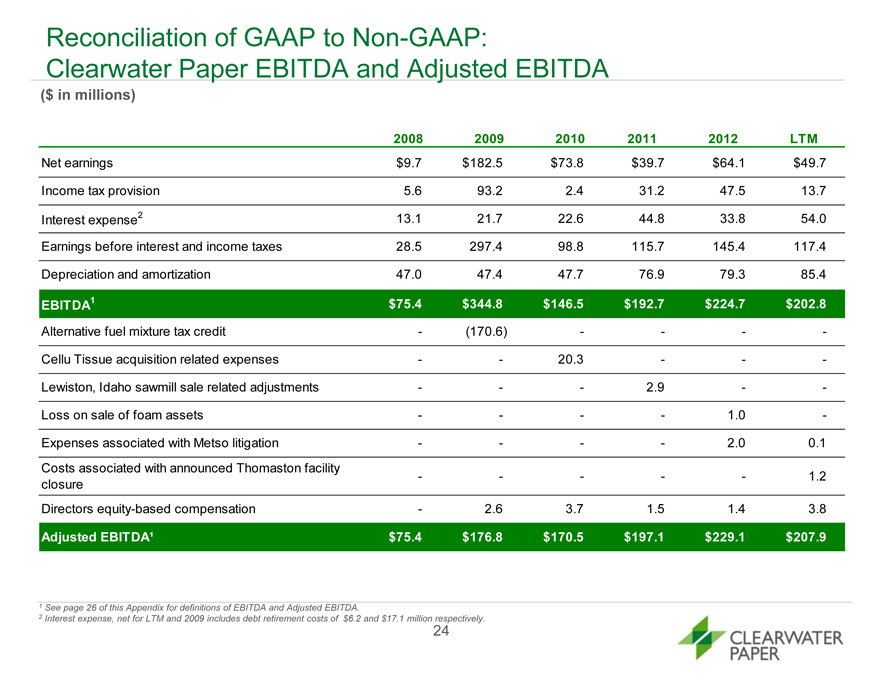

Reconciliation of GAAP to Non-GAAP:

Clearwater Paper EBITDA and Adjusted EBITDA

($ in millions)

2008 2009 2010 2011 2012 LTM

Net earnings $9.7 $182.5 $73.8 $39.7 $64.1 $49.7

Income tax provision 5.6 93.2 2.4 31.2 47.5 13.7

Interest expense2 13.1 21.7 22.6 44.8 33.8 54.0

Earnings before interest and income taxes 28.5 297.4 98.8 115.7 145.4 117.4

Depreciation and amortization 47.0 47.4 47.7 76.9 79.3 85.4

EBITDA1 $75.4 $344.8 $146.5 $192.7 $224.7 $202.8

Alternative fuel mixture tax credit — (170.6) ——— -

Cellu Tissue acquisition related expenses —— 20.3 —— -

Lewiston, Idaho sawmill sale related adjustments ——— 2.9 — -

Loss on sale of foam assets 1.0

Expenses associated with Metso litigation 2.0 0.1

Costs associated with announced Thomaston facility 1.2

closure

Directors equity-based compensation — 2.6 3.7 1.5 1.4 3.8

Adjusted EBITDA¹ $75.4 $176.8 $170.5 $197.1 $229.1 $207.9

1 See page 26 of this Appendix for definitions of EBITDA and Adjusted EBITDA.

2 Interest expense, net for LTM and 2009 includes debt retirement costs of $6.2 and $17.1 million respectively.

24

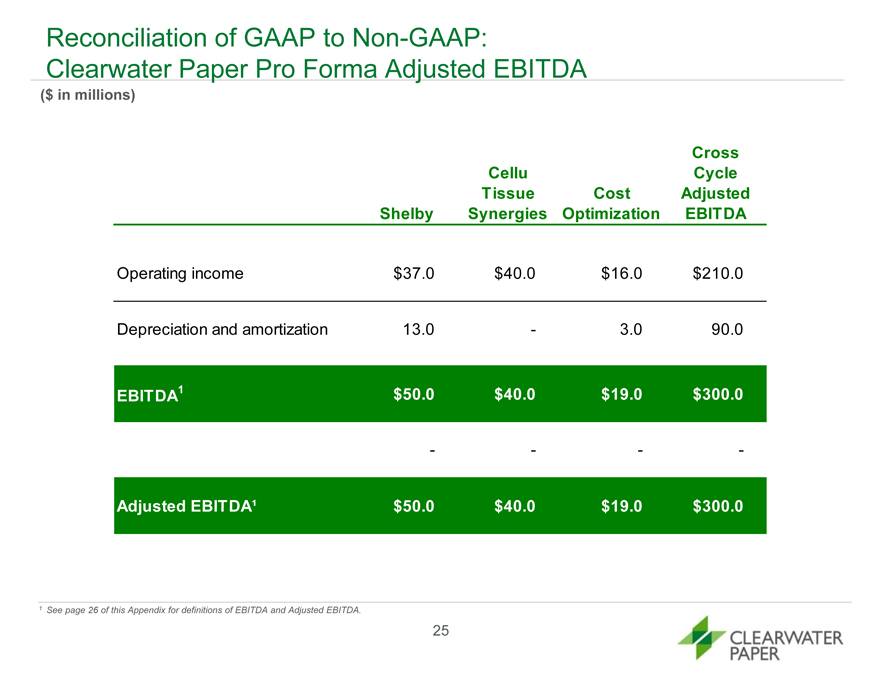

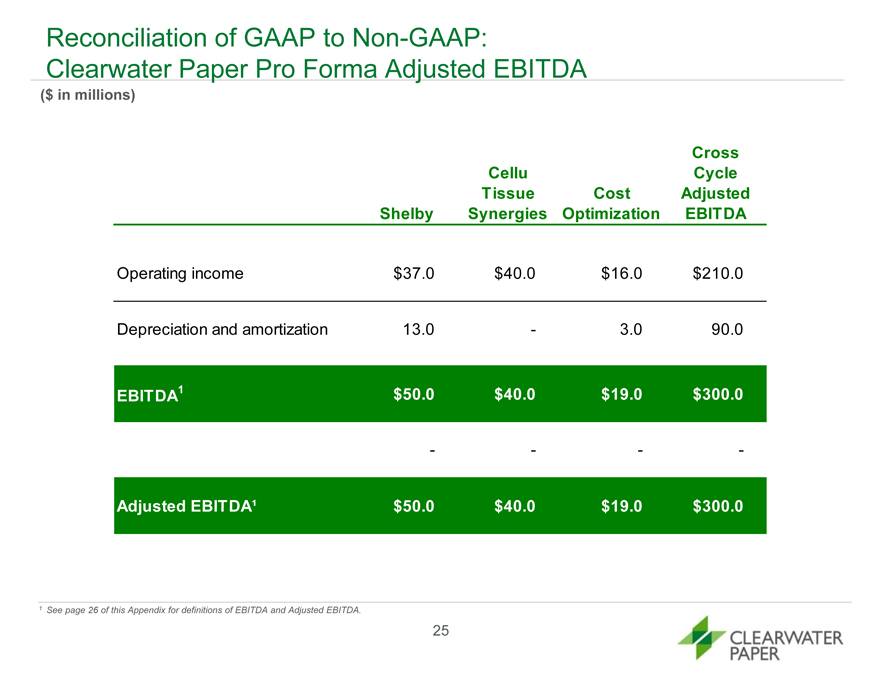

Reconciliation of GAAP to Non-GAAP:

Clearwater Paper Pro Forma Adjusted EBITDA

($ in millions)

Cross

Cellu Cycle

Tissue Cost Adjusted

Shelby Synergies Optimization EBITDA

Operating income $ 37.0 $ 40.0 $ 16.0 $ 210.0

Depreciation and amortization 13.0 — 3.0 90.0

EBITDA1 $ 50.0 $ 40.0 $ 19.0 $ 300.0

Adjusted EBITDA¹ $ 50.0 $ 40.0 $19.0 $ 300.0

1 See page 26 of this Appendix for definitions of EBITDA and Adjusted EBITDA.

25

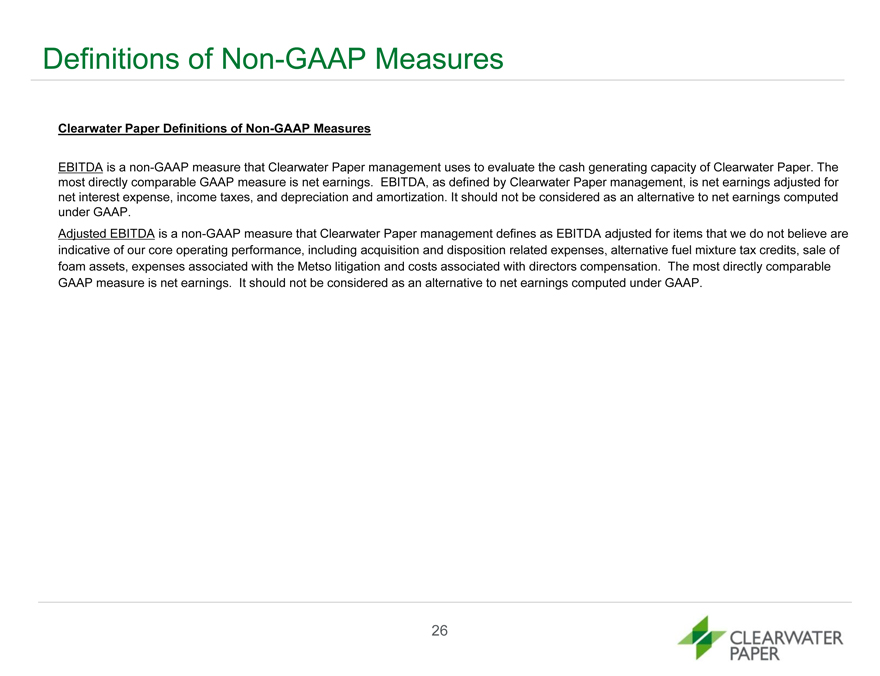

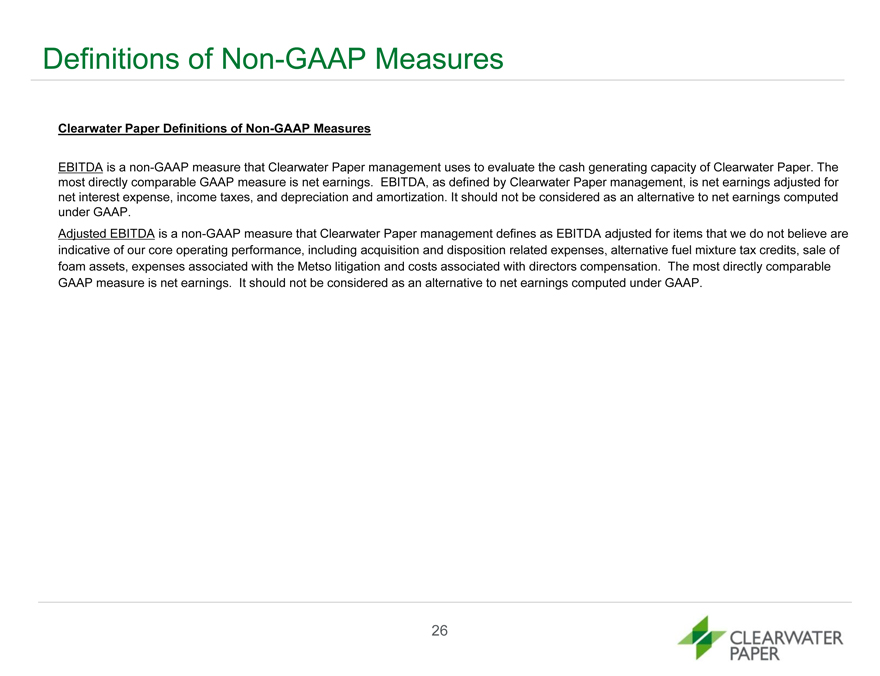

Definitions of Non-GAAP Measures

Clearwater Paper Definitions of Non-GAAP Measures

EBITDA is a non-GAAP measure that Clearwater Paper management uses to evaluate the cash generating capacity of Clearwater Paper. The most directly comparable GAAP measure is net earnings. EBITDA, as defined by Clearwater Paper management, is net earnings adjusted for net interest expense, income taxes, and depreciation and amortization. It should not be considered as an alternative to net earnings computed under GAAP.

Adjusted EBITDA is a non-GAAP measure that Clearwater Paper management defines as EBITDA adjusted for items that we do not believe are indicative of our core operating performance, including acquisition and disposition related expenses, alternative fuel mixture tax credits, sale of foam assets, expenses associated with the Metso litigation and costs associated with directors compensation. The most directly comparable GAAP measure is net earnings. It should not be considered as an alternative to net earnings computed under GAAP.

26

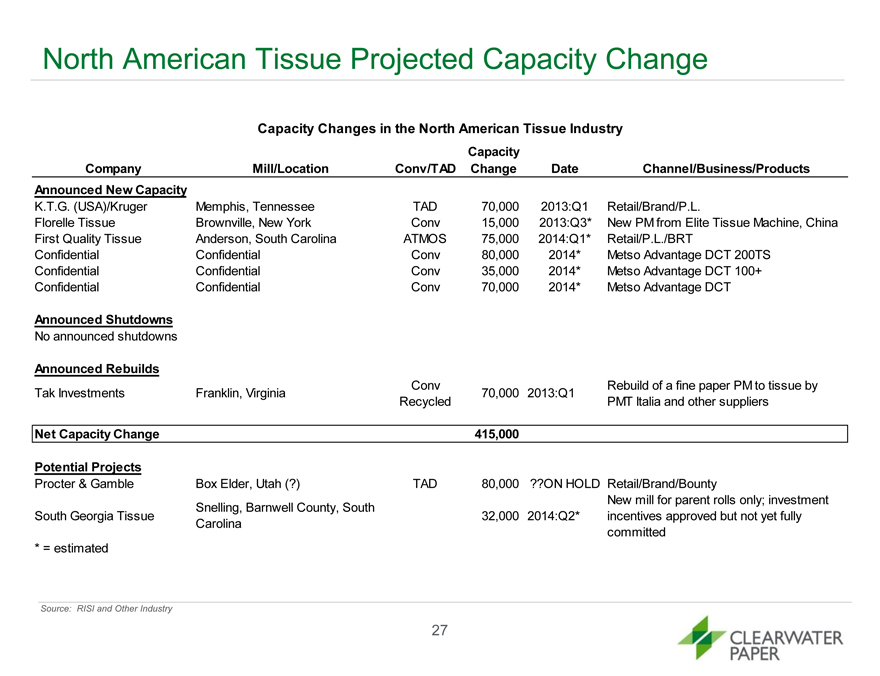

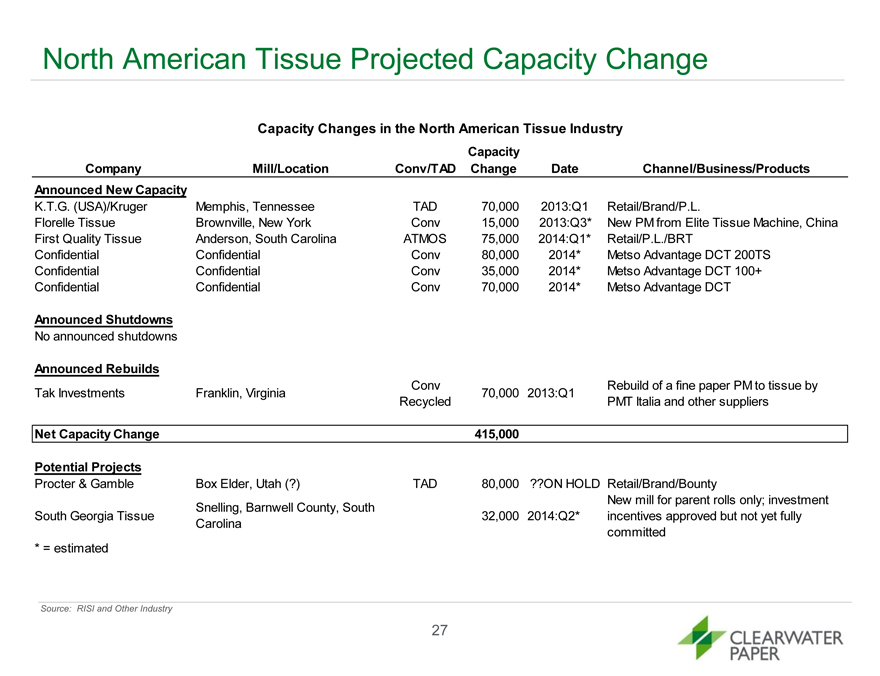

North American Tissue Projected Capacity Change

Capacity Changes in the North American Tissue Industry

Capacity

Company Mill/Location Conv/TAD Change Date Channel/Business/Products

Announced New Capacity

K.T.G. (USA)/Kruger Memphis, Tennessee TAD 70,000 2013:Q1 Retail/Brand/P.L.

Florelle Tissue Brownville, New York Conv 15,000 2013:Q3* New PM from Elite Tissue Machine, China

First Quality Tissue Anderson, South Carolina ATMOS 75,000 2014:Q1* Retail/P.L./BRT

Confidential Confidential Conv 80,000 2014* Metso Advantage DCT 200TS

Confidential Confidential Conv 35,000 2014* Metso Advantage DCT 100+

Confidential Confidential Conv 70,000 2014* Metso Advantage DCT

Announced Shutdowns

No announced shutdowns

Announced Rebuilds

Conv Rebuild of a fine paper PM to tissue by

Tak Investments Franklin, Virginia 70,000 2013:Q1

Recycled PMT Italia and other suppliers

Net Capacity Change 415,000

Potential Projects

Procter & Gamble Box Elder, Utah (?) TAD 80,000 ??ON HOLD Retail/Brand/Bounty

Snelling, Barnwell County, South New mill for parent rolls only; investment

South Georgia Tissue 32,000 2014:Q2* incentives approved but not yet fully

Carolina committed

* = estimated

Source: RISI and Other Industry

27