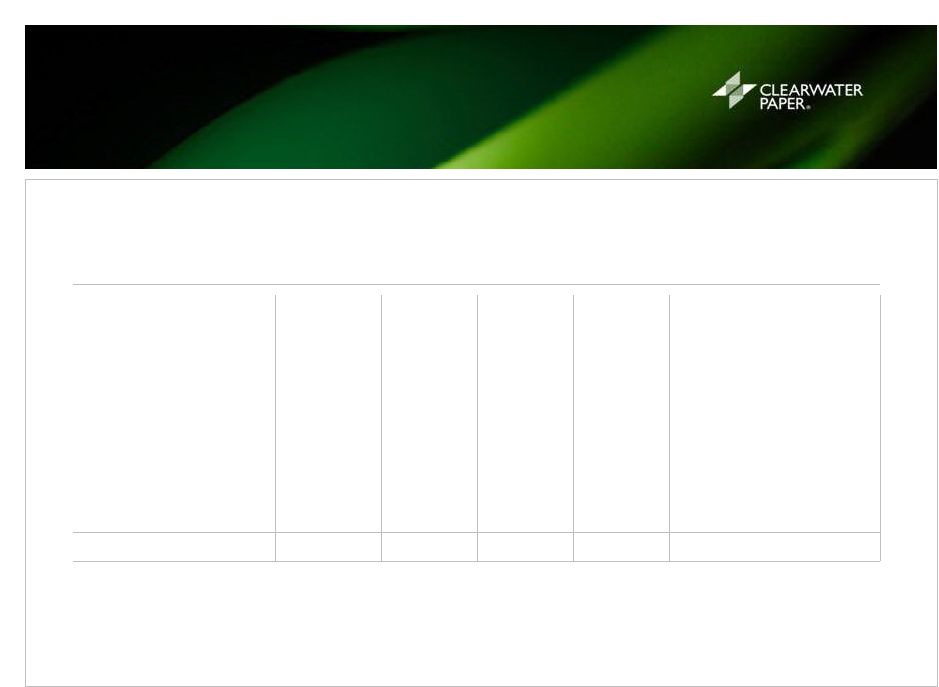

(Dollars in thousands) Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 2012 2013 2014 Earnings before interest, income taxes, and depreciation & amortization (EBITDA)¹ GAAP net (loss) earnings ($882) $ 11,658 $ 13,317 $ 82,862 $ 6,226 $ 12,453 $ 6,253 ($27,247) $ 64,131 $ 106,955 ($2,315) Interest expense, net² 28,040 11,094 10,708 11,252 10,734 10,688 33,990 8,158 33,796 61,094 63,570 Income tax (benefit) provision (14,675) 6,962 (5,183) (55,825) 3,558 9,942 3,735 1,321 47,460 (68,721) 18,556 Depreciation and amortization expense 22,151 23,253 22,180 22,688 22,231 22,015 22,293 23,606 79,333 90,272 90,145 EBITDA¹ $ 34,634 $ 52,967 $ 41,022 $ 60,977 $ 42,749 $ 55,098 $ 66,271 $ 5,838 $ 224,720 $ 189,600 $ 169,956 Loss on sale of foam assets - - - - - - - - 1,014 - - Costs associated with Metso litigation - - - - - - - - 2,019 - - Directors' equity-based compensation expense (benefit) 3,472 (1,141) 361 1,392 2,817 (36) (185) 2,010 1,369 4,084 4,606 Costs associated with Thomaston facility closure 183 1,013 1,717 3,064 750 374 42 91 - 5,977 1,257 Costs associated with Long Island facility closure - - - - 8,432 1,843 4,767 3,771 - - 18,813 Costs/loss associated with optimization and sale of the specialty mills - - - - - - 1,066 39,735 - - 40,801 Loss on impairment of Clearwater Fiber intangible asset - - - - - - - 3,078 - - 3,078 Adjusted EBITDA³ $ 38,289 $ 52,839 $ 43,100 $ 65,433 $ 54,748 $ 57,279 $ 71,961 $ 54,523 $ 229,122 $ 199,661 $ 238,511 Twelve Months Ended December 31, RECONCILIATION OF GAAP TO NON-GAAP: CLEARWATER PAPER EBITDA 1 AND ADJUSTED EBITDA 1 ¹ See Appendix for the definition of Adjusted EBITDA as well as the reconciliation to the most comparable GAAP measure. 2 Interest expense, net for 2009, 2013, and 2014 includes debt retirement costs of $6.2 , $17.1 and $24.4 million respectively. 31 |