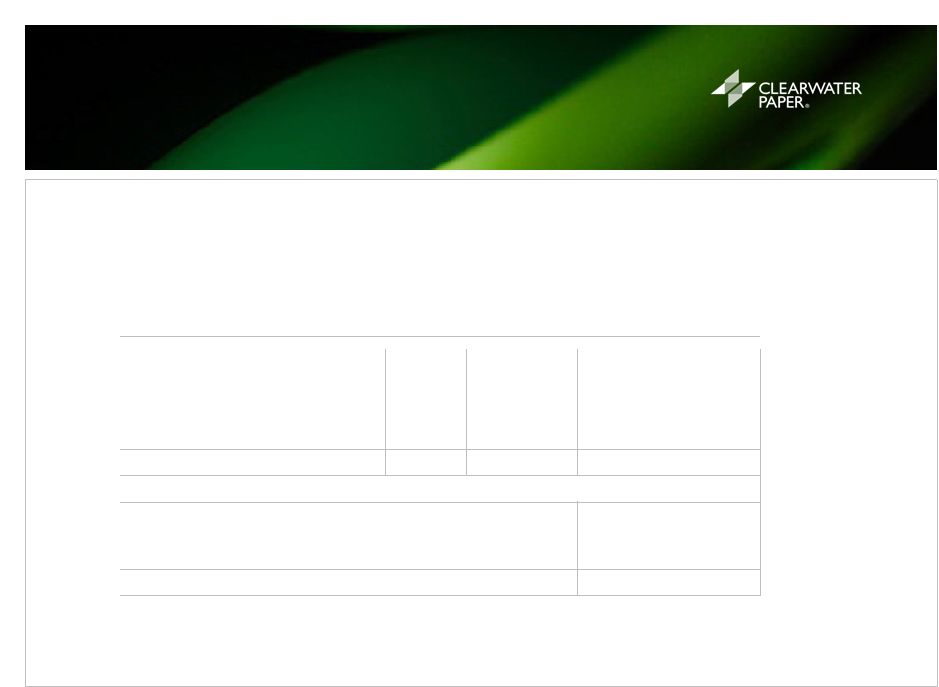

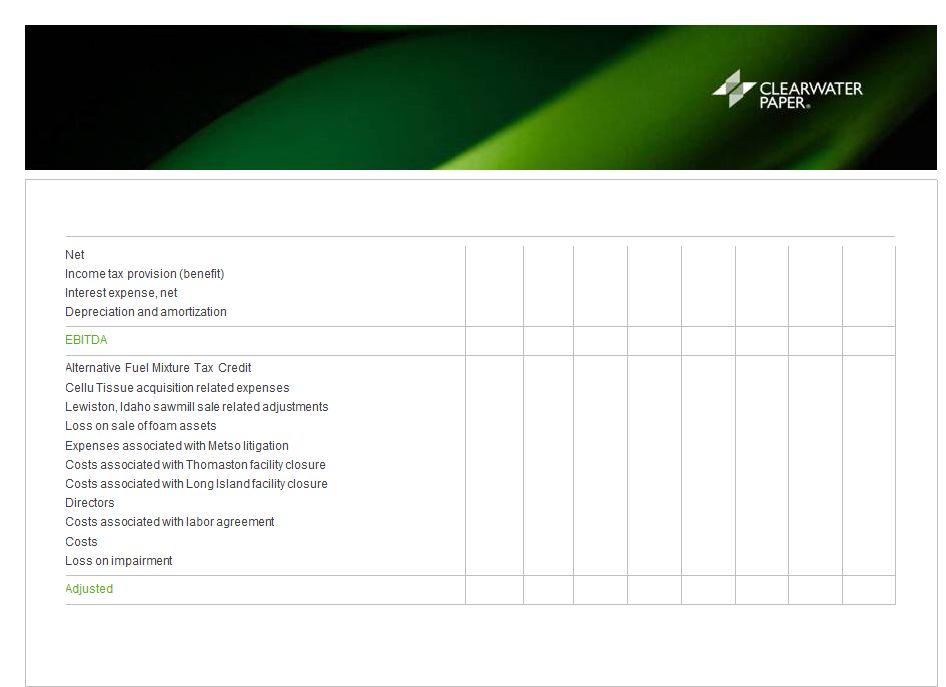

SEGMENT EBITDA & ADJUSTED EBITDA RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (UNAUDITED) 32 1 Segment EBITDA is a non-GAAP measure that management uses as a supplemental performance measure. The most directly comparable GAAP measure is segment operating income (loss). Segment EBITDA is segment operating income (loss) adjusted for depreciation and amortization. It should not be considered as an alternative to segment operating income (loss) computed under GAAP. 2 Segment Adjusted EBITDA excludes the impact of the items listed that we do not believe are indicative of our core operating performance. (Dollars in thousands) Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Consumer Products Operating (loss) income ($523) $ 12,705 $ 12,535 (30,745) $ $ 12,395 $ 17,032 Depreciation and amortization expense 15,490 15,071 15,484 15,459 12,977 13,438 Segment EBITDA 1 $ 14,967 $ 27,776 $ 28,019 ($15,286) $ 25,372 $ 30,470 Costs associated with Thomaston facility closure 750 374 42 91 - - Costs associated with Long Island facility closure 8,432 1,843 4,767 3,771 554 735 Costs/loss associated with optimization and sale of the specialty mills - - 579 40,222 (131) (1,331) Costs associated with labor agreement - - - - 814 - Segment Adjusted EBITDA 2 $ 24,149 $ 29,993 $ 33,407 $ 28,798 $ 26,609 $ 29,874 Pulp and Paperboard Operating income $ 36,776 $ 33,635 $ 45,602 $ 28,158 $ 16,194 $ 27,754 Depreciation and amortization expense 6,270 6,019 5,939 7,224 7,311 6,737 Segment EBITDA 1 $ 43,046 $ 39,654 $ 51,541 $ 35,382 $ 23,505 $ 34,491 Loss on impairment of Clearwater Fiber intangible asset - - - 3,078 - - Costs associated with labor agreement - - - - 916 - Segment Adjusted EBITDA 2 $ 43,046 $ 39,654 $ 51,541 $ 38,460 $ 24,421 $ 34,491 Corporate Operating loss ($15,735) ($13,257) ($14,159) ($15,181) ($13,352) ($12,713) Depreciation and amortization expense 471 925 870 923 720 457 Corporate EBITDA 1 ($15,264) ($12,332) ($13,289) ($14,258) ($12,632) ($12,256) Directors' equity-based compensation expense (benefit) 2,817 (36) (185) 2,010 (470) (1,457) Costs/loss associated with optimization and sale of the specialty mills - - 487 (487) - - Corporate Adjusted EBITDA 2 ($12,447) ($12,368) ($12,987) ($12,735) ($13,102) ($13,713) |