CLEARWATER PAPER CORPORATION FOURTH QUARTER EARNINGS RELEASE MATERIALS FEBRUARY 15, 2022 ARSEN S. KITCH President, Chief Executive Officer And Director MICHAEL J. MURPHY Senior Vice President And Chief Financial Officer

Cautionary Statement Regarding Forward Looking Statements This presentation of supplemental information contains, in addition to historical information, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the impact of COVID-19 on consumer behavior and our business and operations; order patterns; consumer demand and industry trends, including in response to COVID-19, and other factors; production targets; backlogs and inventory overhang; impact of announced price increases; assumptions for Q1 2022 and full year 2022 and 2023, including maintenance outage impacts, operational factors, interest, capital, inflation, depreciation and amortization and income tax; our capital allocation objectives; our strategy, including achieving target level ratio, debt reduction, and prioritizing free cash flow; the closure of the Neenah facility and related costs and benefits; expectations regarding the paperboard markets and tissue markets; focus on sustainable coating and fiber alternative initiatives; contract renewal uncertainty; and future sales chain opportunities. These forward-looking statements are based on management’s current expectations, estimates, assumptions and projections that are subject to change. Our actual results of operations may differ materially from those expressed or implied by the forward-looking statements contained in this presentation. Important factors that could cause or contribute to such differences include the risks and uncertainties described from time to time in the company's public filings with the Securities and Exchange Commission, including but not limited to the following: impact of COVID-19 on our operations and our supplier’s operations and on customer demand; competitive pricing pressures for our products, including as a result of increased capacity as additional manufacturing facilities are operated by our competitors and the impact of foreign currency fluctuations on the pricing of products globally; the loss of, changes in prices in regard to, or reduction in, orders from a significant customer; changes in the cost and availability of wood fiber and wood pulp; changes in transportation costs and disruptions in transportation services; changes in customer product preferences and competitors' product offerings; larger competitors having operational and other advantages; customer acceptance and timing and quantity of purchases of our tissue products, including the existence of sufficient demand for and the quality of tissue produced by our expanded Shelby, North Carolina operations; consolidation and vertical integration of converting operations in the paperboard industry; our ability to successfully implement our operational efficiencies and cost savings strategies, along with related capital projects and restructuring activities, and achieve the expected operational or financial results of those projects; changes in the U.S. and international economies and in general economic conditions in the regions and industries in which we operate; manufacturing or operating disruptions, including IT system and IT system implementation failures, equipment malfunctions and damage to our manufacturing facilities; cyber-security risks; changes in costs for and availability of packaging supplies, chemicals, energy and maintenance and repairs; labor disruptions; cyclical industry conditions; changes in expenses, required contributions and potential withdrawal costs associated with our pension plans; environmental liabilities or expenditures; reliance on a limited number of third-party suppliers for raw materials; our ability to attract, motivate, train and retain qualified and key personnel; our substantial indebtedness and ability to service our debt obligations; restrictions on our business from debt covenants and terms; negative changes in our credit agency ratings; and changes in laws, regulations or industry standards affecting our business. Forward-looking statements contained in this presentation present management’s views only as of the date of this presentation. We undertake no obligation to publicly update forward-looking statements, to retract future revisions of management's views based on events or circumstances occurring after the date of this presentation. Non-GAAP Financial Measures This presentation include certain financial measures that are not calculated in accordance with GAAP, including Adjusted EBITDA, Adjusted Income, Adjusted income per share, free cash flow and net debt. The Company’s management believes that the presentation of these financial measures provides useful information to investors because these measures are regularly used by management in assessing the Company’s performance. These financial measures should be considered in addition to results prepared in accordance with GAAP but should not be considered substitutes for or superior to GAAP results. In addition, these non-GAAP financial measures may not be comparable to similarly-titled measures utilized by other companies, since such other companies may not calculate such measure in the same manner as we do. A reconciliation of these measures (Adjusted EBITDA, Adjusted Income, Adjusted income per share, free cash flow and net debt) to the most relevant GAAP measure is available in the appendix of this presentation. FORWARD LOOKING STATEMENTS © Clearwater Paper Corporation 2022 2

Overall • Net income $9 million for Q4, net loss of $28 million for 2021 • Adjusted net income $14 million for Q4, $17 million for 2021 • Adjusted EBITDA $56 million for Q4, $175 million for 2021 • Net proceeds on asset sales of $13 million Pulp and Paperboard • Continued strong customer demand • SBS prices increased in Q4 and throughout 2021 Consumer Products • Inflation pressures, partially offset by price increases • Demand stabilized in Q4, after volatile year due to COVID impact Capital Structure • Liquidity remained strong at $265 million • Reduced net debt by $37 million in Q4, $69 million for the year Q4 AND FULL YEAR 2021 BUSINESS HIGHLIGHTS © Clearwater Paper Corporation 2022 3

Industry • Order backlogs remain strong • Fastmarkets RISI reported market price increases of $250/ton in 2021 • Folding carton: Q1’21 $20/ton, Q2’21 $100/ton, Q3’21 $80/ton and Q4’21 $50/ton • Cup stock and food service: Q2’21 $100/ton, Q3’21 $100/ton and Q4’21 $50/ton • Fastmarkets RISI reported an additional market price increase of $50/ton in January 2022 • Positive mix shift during COVID, which is likely to revert to historical levels • Folding carton has benefited from shift to at home consumption • Shift back to food service is expected as economy recovers Clearwater Paper • Demand and order backlogs remain strong • Continued expected benefit of previously announced price increases, which can take up to two quarters to implement BUSINESS UPDATE – PULP AND PAPERBOARD PRICING DRIVING OVERALL STRONG RESULTS © Clearwater Paper Corporation 2022 4

• Sustainable forest certifications for fiber supply in place for over a decade • Recent launch of products with recycled fiber content • ReMagine with up to 30% recycled content for folding carton applications • NuVo with up to 35% recycled content for cup applications • Focus on developing more sustainable coating applications with Jan 2022 launch of BioPBS • Compostable coating relative to current application • Focus on cup and food service applications • Future initiatives are focused on more sustainable coating and fiber alternatives PULP AND PAPERBOARD – SUSTAINABLE PRODUCTS © Clearwater Paper Corporation 2022 5 PRODUCT INNOVATION WITH FOCUS ON SUSTAINABILITY 2008 2012 2016 2020 2022 FSC COC Certification NuVo 35% PCR Cupstock ReMagine 30% PCR Folding Carton SFI COC Certification NuVo With BioPBS Develop products for a sustainable, circular economy that meet our converter operator and customer needs

Industry • COVID has led to demand and inventory distortions in 2020 and 2021 • Per RISI in 2020, US demand ~10.6 million tons • ~1 to 2% annual growth, slightly greater than population growth • ~70% at home (pre-COVID ~2/3 at home) • At home: ~ 7.6 million ton demand with ~2/3 branded and ~1/3 private branded • Private branded demand is ~2.5 million, growing faster than branded • Private branded capacity additions outpacing historical demand growth • Club and mass merch share of tissue sales has grown at expense of grocery Clearwater Paper • Q4 2021 shipments were 12.4 million cases compared to 13.9 million in Q4 2020, 12.3 million in Q3 2021 • Inflation persists, previously announced price increases are being implemented • Production increased relative to Q3 2021 but still below capacity and Q4 2020 levels • Monitoring channel and customer trends to determine altered consumer buying patterns • We are more concentrated in grocery and less in club/mass-merch versus industry BUSINESS UPDATE – CONSUMER PRODUCTS RETAIL TISSUE SHIPMENTS STABILIZED IN Q4 2021 © Clearwater Paper Corporation 2022 6 1. Based upon RISI Outlook for World Tissue Business April 2021

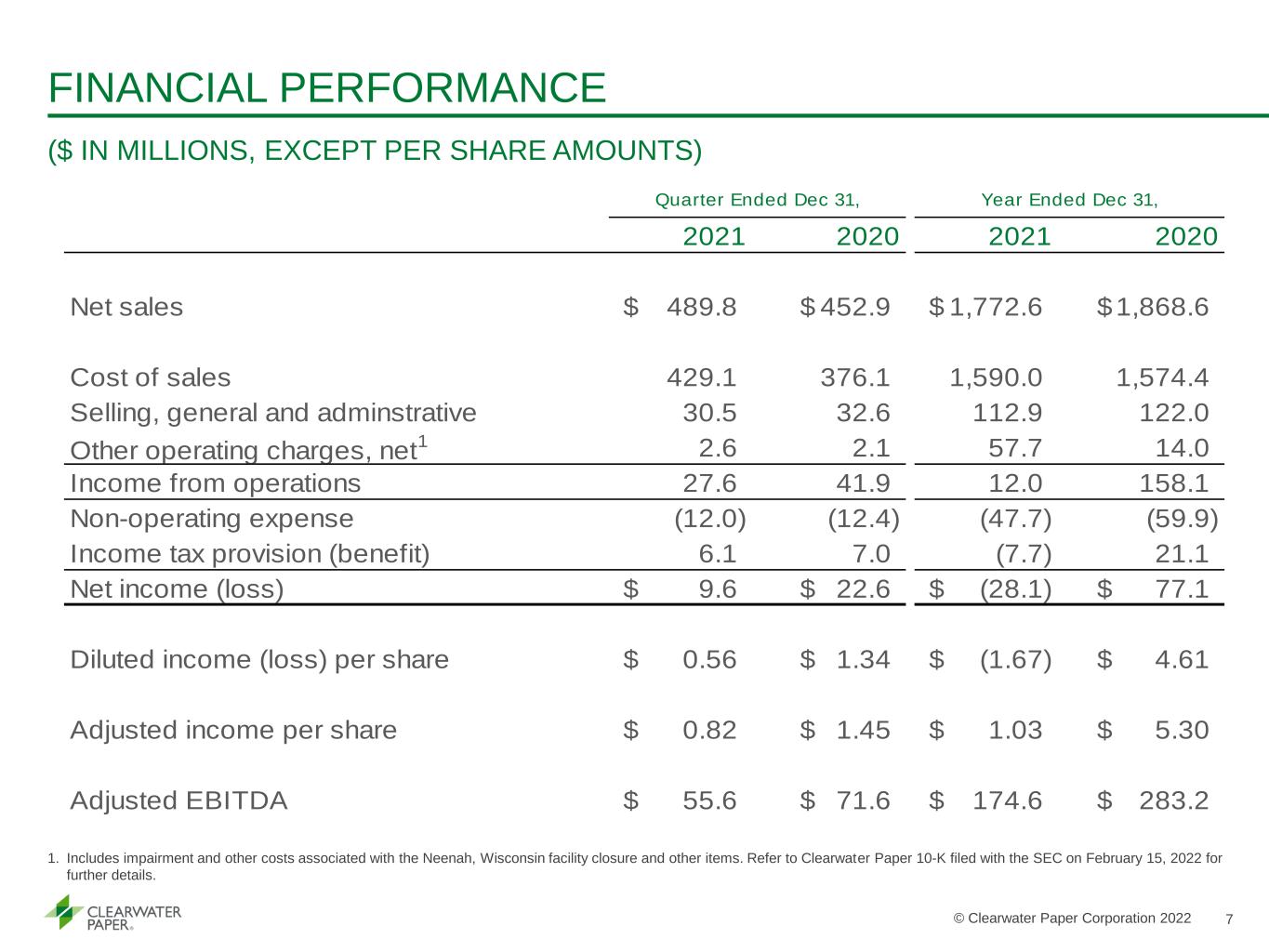

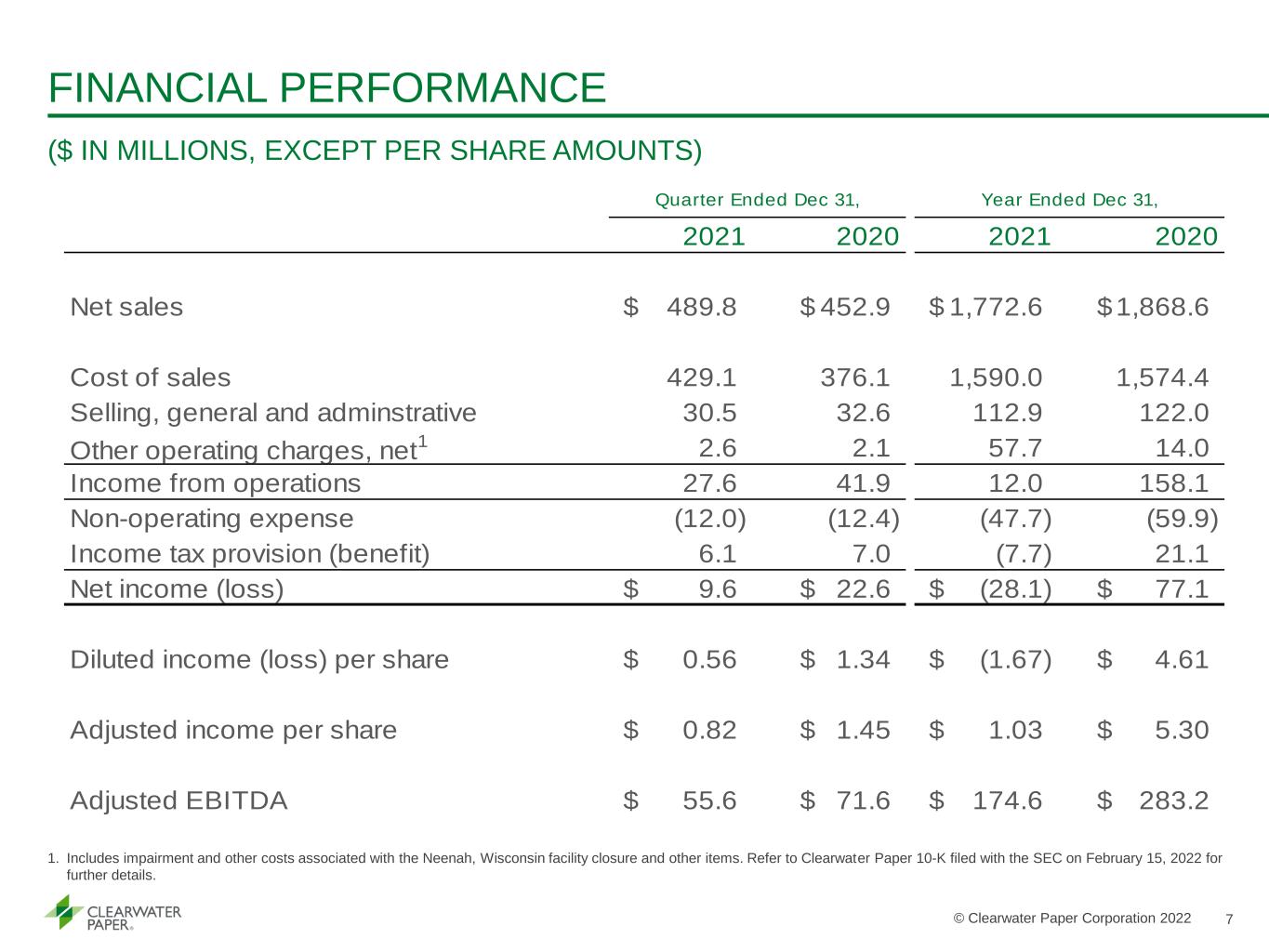

© Clearwater Paper Corporation 2022 FINANCIAL PERFORMANCE ($ IN MILLIONS, EXCEPT PER SHARE AMOUNTS) 1. Includes impairment and other costs associated with the Neenah, Wisconsin facility closure and other items. Refer to Clearwater Paper 10-K filed with the SEC on February 15, 2022 for further details. 2021 2020 2021 2020 Net sales 489.8$ 452.9$ 1,772.6$ 1,868.6$ Cost of sales 429.1 376.1 1,590.0 1,574.4 Selling, general and adminstrative 30.5 32.6 112.9 122.0 Other operating charges, net 1 2.6 2.1 57.7 14.0 Income from operations 27.6 41.9 12.0 158.1 Non-operating expense (12.0) (12.4) (47.7) (59.9) Income tax provision (benefit) 6.1 7.0 (7.7) 21.1 Net income (loss) 9.6$ 22.6$ (28.1)$ 77.1$ Diluted income (loss) per share 0.56$ 1.34$ (1.67)$ 4.61$ Adjusted income per share 0.82$ 1.45$ 1.03$ 5.30$ Adjusted EBITDA 55.6$ 71.6$ 174.6$ 283.2$ Quarter Ended Dec 31, Year Ended Dec 31, 7

© Clearwater Paper Corporation 2022 SEGMENT PROFIT AND LOSS AND ADJUSTED EBITDA ($ IN MILLIONS) 1. Includes impairment and other costs associated with Neenah, Wisconsin and other items. Refer to Clearwater Paper 10-K filed with the SEC on February 15, 2022, for further details. 2021 2020 2021 2020 Net Sales Pulp and Paperboard 261.3$ 220.4$ 946.0$ 877.1$ Consumer Products 231.8 238.9 835.0 1,018.5 Eliminations (3.3) (6.4) (8.4) (27.0) 489.8$ 452.9$ 1,772.6$ 1,868.6$ Operating Income Pulp and Paperboard 53.1$ 33.7$ 125.7$ 124.5$ Consumer Products (7.5) 27.6 4.0 110.6 Corporate and other (15.3) (17.3) (60.1) (63.0) Other operating charges, net 1 (2.6) (2.1) (57.7) (14.0) 27.6$ 41.9$ 12.0$ 158.1$ Adjusted EBITDA Pulp and Paperboard 61.9$ 42.8$ 161.4$ 161.3$ Consumer Products 8.0 44.7 69.0 179.1 Corporate and other (14.3) (16.0) (55.7) (57.2) 55.6$ 71.6$ 174.6$ 283.2$ Quarter Ended Dec 31, Year Ended Dec 31, 8

PULP AND PAPERBOARD RESULTS Q4 2021 VS. Q4 2020 SEGMENT ADJUSTED EBITDA ($ IN MILLIONS) Higher pricing with favorable mix Higher input costs including energy, chemicals and transportation © Clearwater Paper Corporation 2022 9

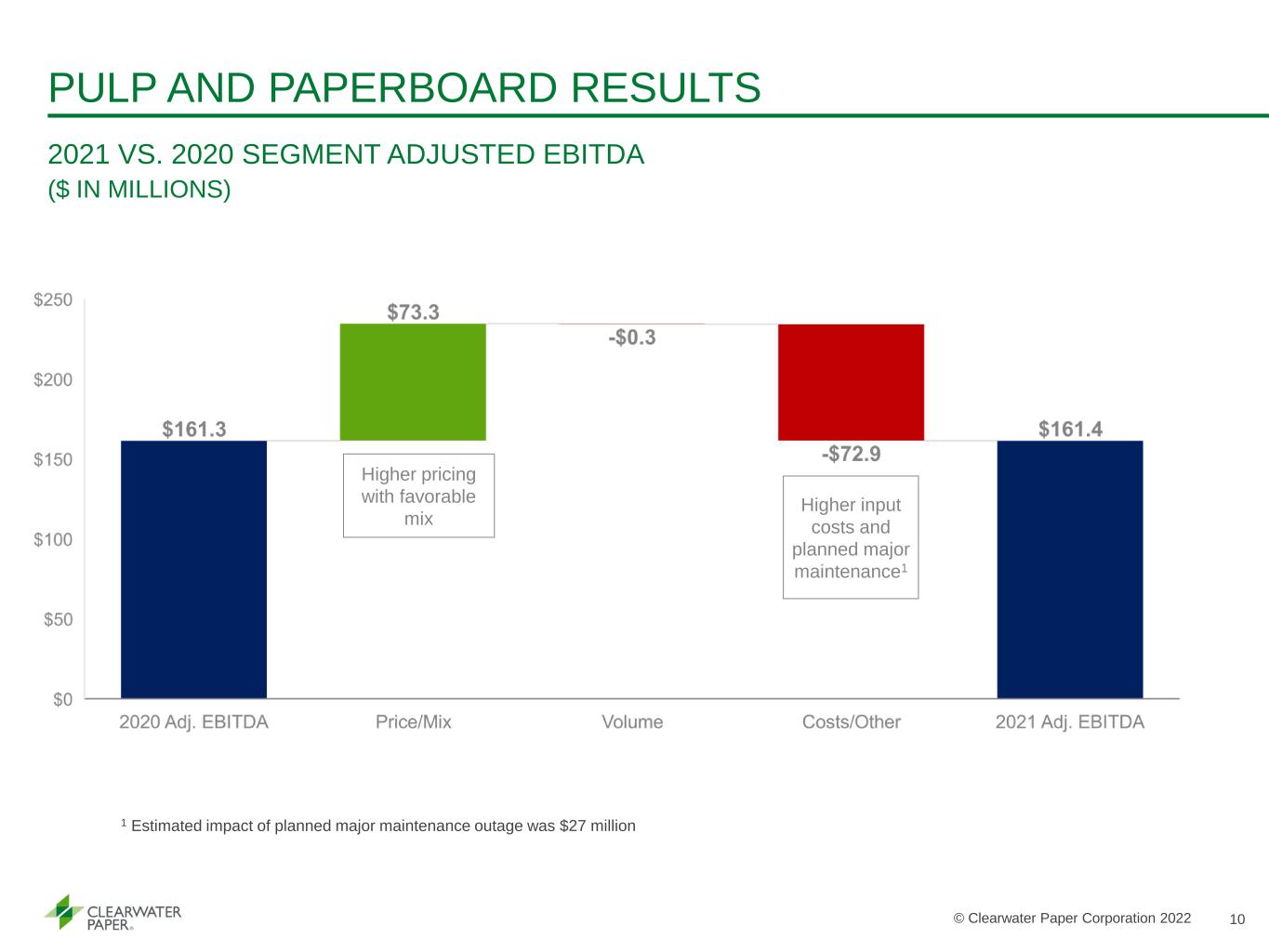

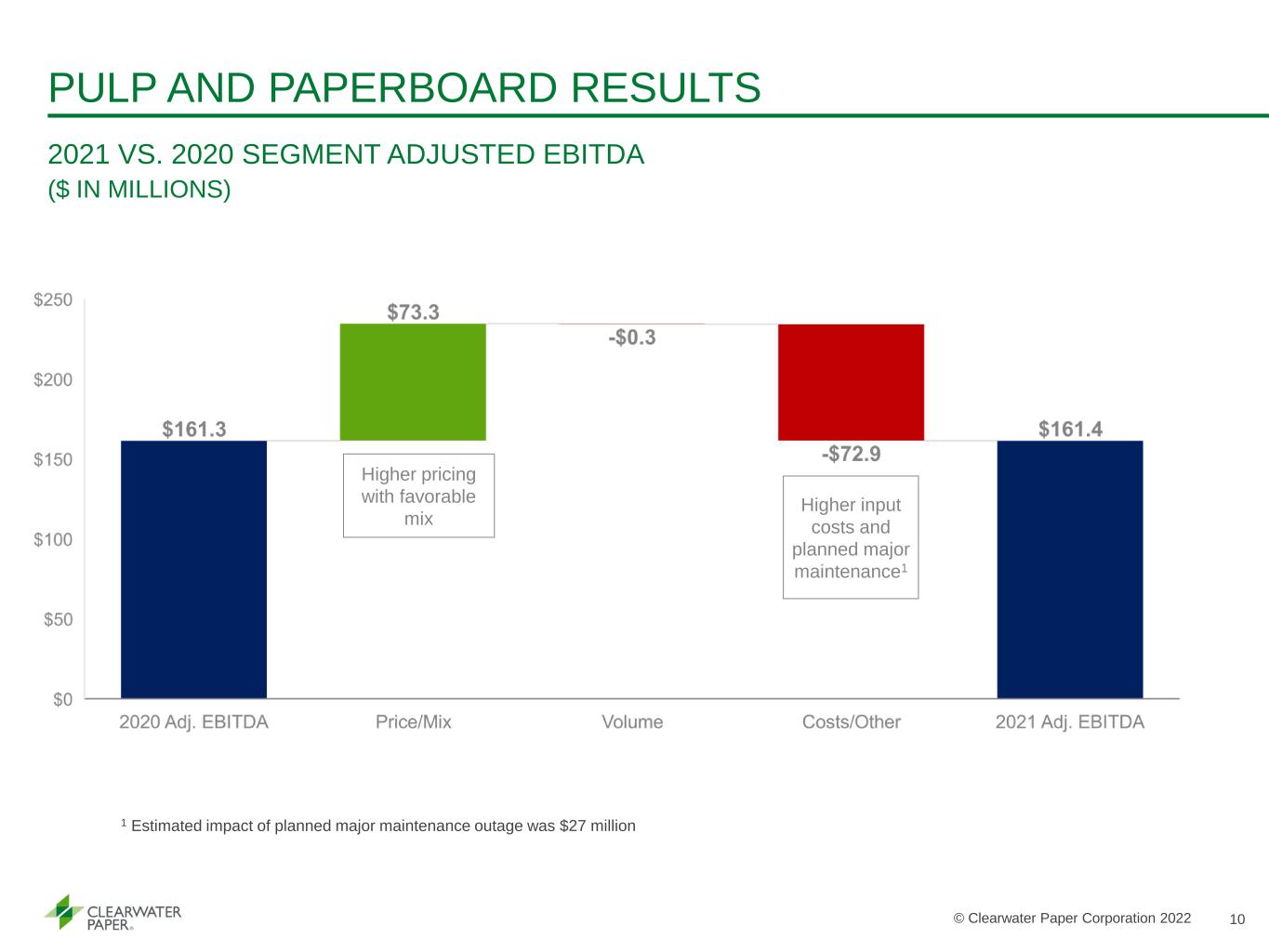

PULP AND PAPERBOARD RESULTS 2021 VS. 2020 SEGMENT ADJUSTED EBITDA ($ IN MILLIONS) Higher pricing with favorable mix Higher input costs and planned major maintenance1 © Clearwater Paper Corporation 2022 10 1 Estimated impact of planned major maintenance outage was $27 million

CONSUMER PRODUCTS RESULTS Q4 2021 VS. Q4 2020 SEGMENT ADJUSTED EBITDA ($ IN MILLIONS) Lower sales and production volumes Higher input costs partially offset by benefits from Neenah consolidation © Clearwater Paper Corporation 2022 11 Favorable mix with targeted price increases

CONSUMER PRODUCTS RESULTS 2021 VS. 2020 SEGMENT ADJUSTED EBITDA ($ IN MILLIONS) Lower sales and production volumes Higher input costs partially offset by benefits from Neenah closure © Clearwater Paper Corporation 2022 12 Favorable mix

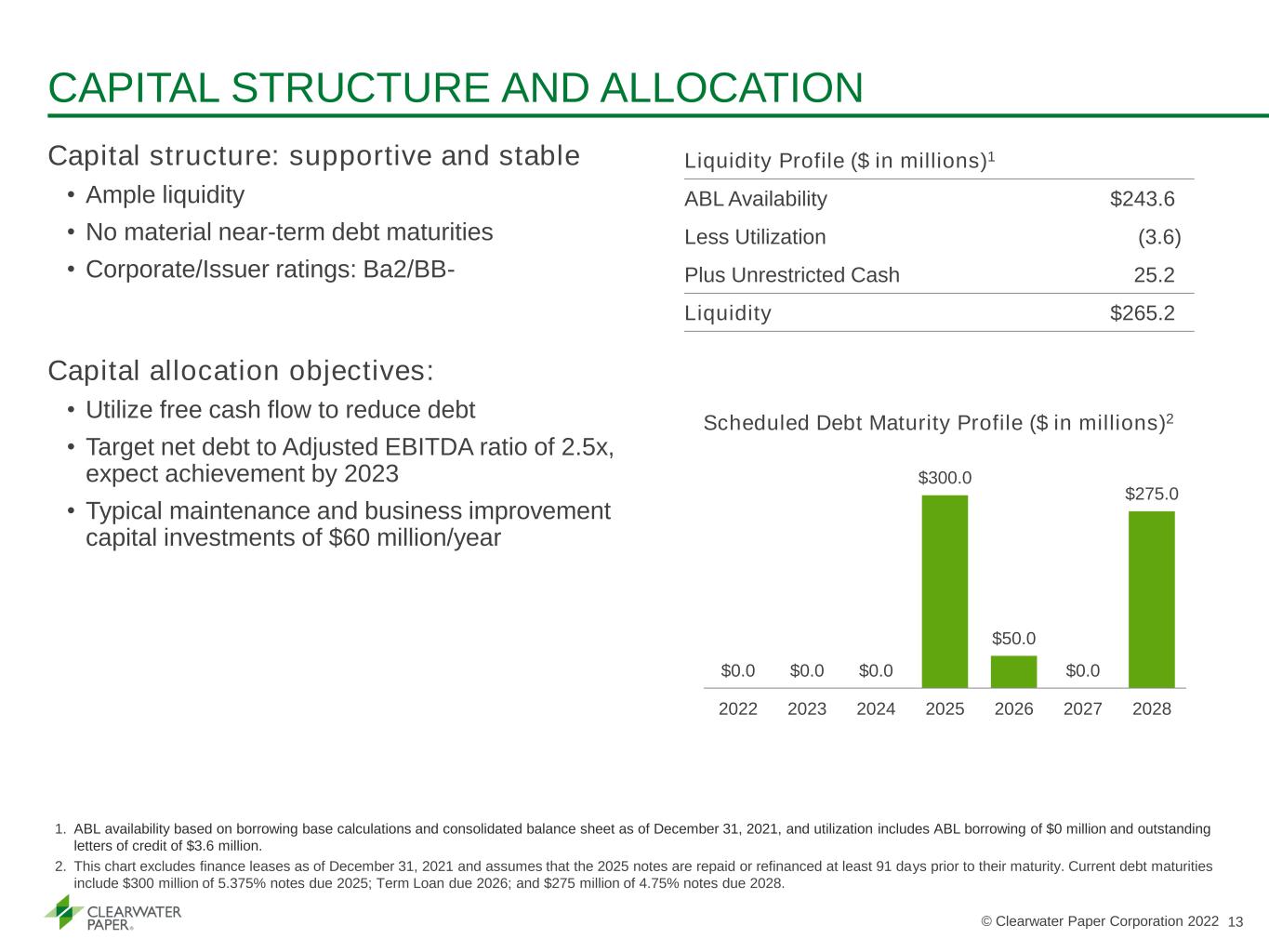

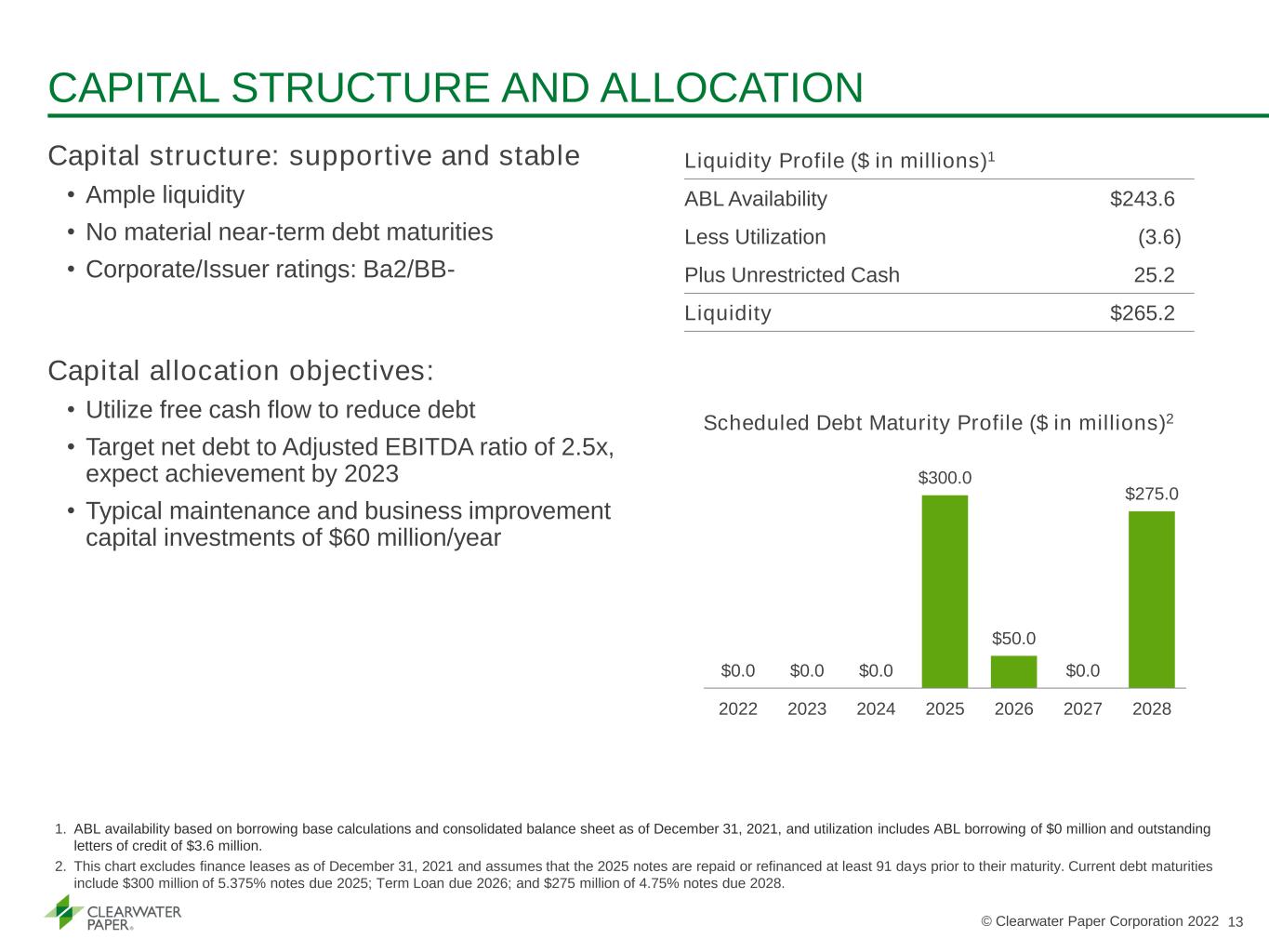

© Clearwater Paper Corporation 2022 CAPITAL STRUCTURE AND ALLOCATION Capital structure: supportive and stable • Ample liquidity • No material near-term debt maturities • Corporate/Issuer ratings: Ba2/BB- Capital allocation objectives: • Utilize free cash flow to reduce debt • Target net debt to Adjusted EBITDA ratio of 2.5x, expect achievement by 2023 • Typical maintenance and business improvement capital investments of $60 million/year $0.0 $0.0 $0.0 $300.0 $50.0 $0.0 $275.0 2022 2023 2024 2025 2026 2027 2028 Scheduled Debt Maturity Profile ($ in millions)2 Liquidity Profile ($ in millions)1 ABL Availability $243.6 Less Utilization (3.6) Plus Unrestricted Cash 25.2 Liquidity $265.2 1. ABL availability based on borrowing base calculations and consolidated balance sheet as of December 31, 2021, and utilization includes ABL borrowing of $0 million and outstanding letters of credit of $3.6 million. 2. This chart excludes finance leases as of December 31, 2021 and assumes that the 2025 notes are repaid or refinanced at least 91 days prior to their maturity. Current debt maturities include $300 million of 5.375% notes due 2025; Term Loan due 2026; and $275 million of 4.75% notes due 2028. 13

OUTLOOK FOR Q1 AND 2022 OVERALL ASSUMPTIONS © Clearwater Paper Corporation 2022 Q1 2022: $48 to $56 million of Adjusted EBITDA • Positive impact of previously announced price increases in paperboard and tissue • Raw material inflation impacting Adjusted EBITDA by $5 to $7 million relative to Q4 2021 • Lewiston headbox outage and other maintenance, expected to impact Adjusted EBITDA by $3 to $4 million 2022 Operational Assumptions vs. 2021 • Price/mix - $120 to $140 million impact from previously announce price increases • Volume – stability in paperboard, recovery in tissue, with some uncertainty due to contract renewals and new sales opportunities • Inflation – raw material, freight and energy inflation expected impact of $90 to $100 million 2022 Other • Interest expense: $33 to $35 million • Depreciation and amortization expense: $101 to $104 million • CAPEX: $60 to $70 million • Taxes: Effective rate 22 to 23% 14

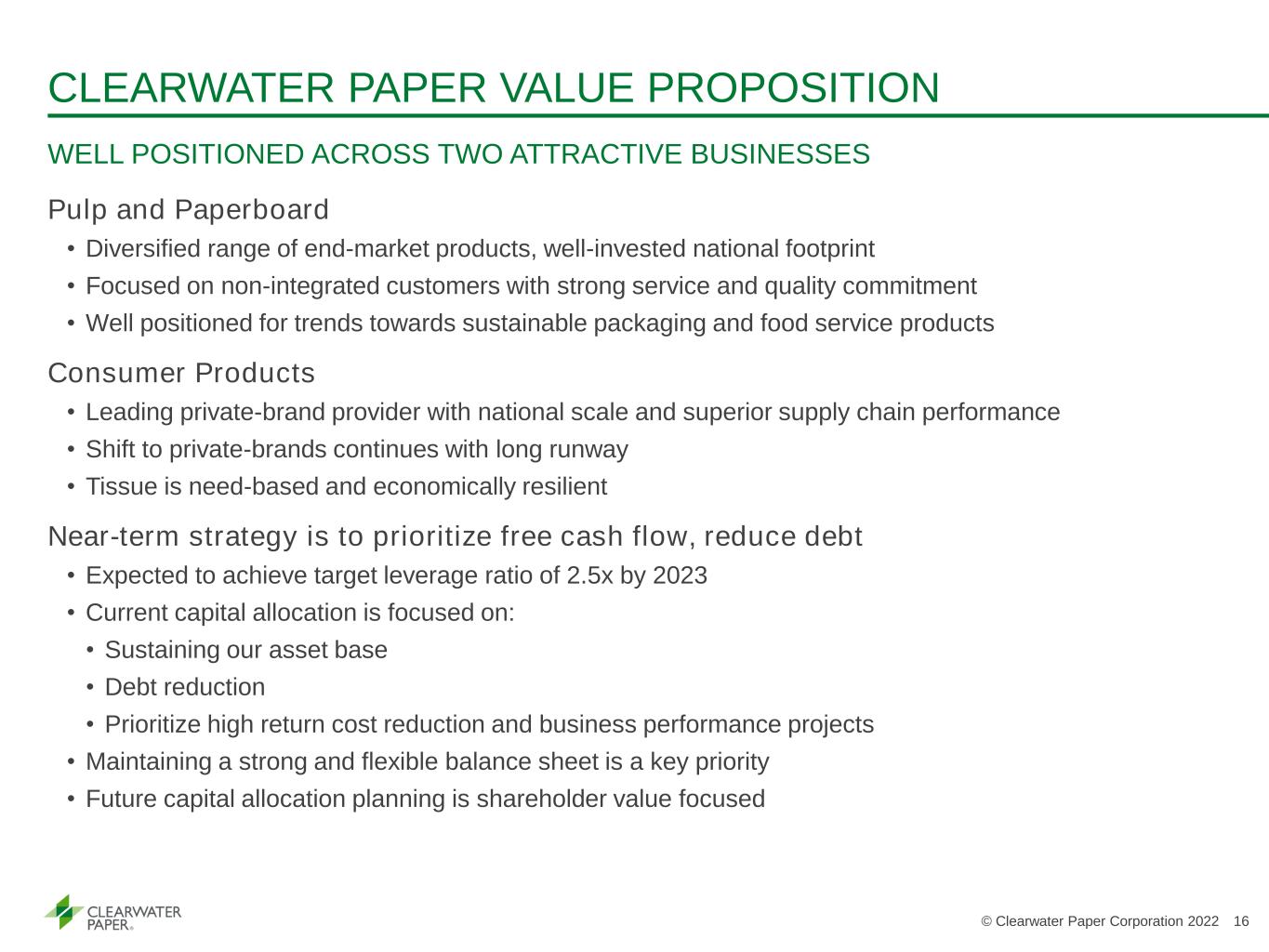

Pulp and Paperboard • Diversified range of end-market products, well-invested national footprint • Focused on non-integrated customers with strong service and quality commitment • Well positioned for trends towards sustainable packaging and food service products Consumer Products • Leading private-brand provider with national scale and superior supply chain performance • Shift to private-brands continues with long runway • Tissue is need-based and economically resilient Near-term strategy is to prioritize free cash flow, reduce debt • Expected to achieve target leverage ratio of 2.5x by 2023 • Current capital allocation is focused on: • Sustaining our asset base • Debt reduction • Prioritize high return cost reduction and business performance projects • Maintaining a strong and flexible balance sheet is a key priority • Future capital allocation planning is shareholder value focused CLEARWATER PAPER VALUE PROPOSITION WELL POSITIONED ACROSS TWO ATTRACTIVE BUSINESSES © Clearwater Paper Corporation 2022 16

APPENDIX © Clearwater Paper Corporation 2022 16

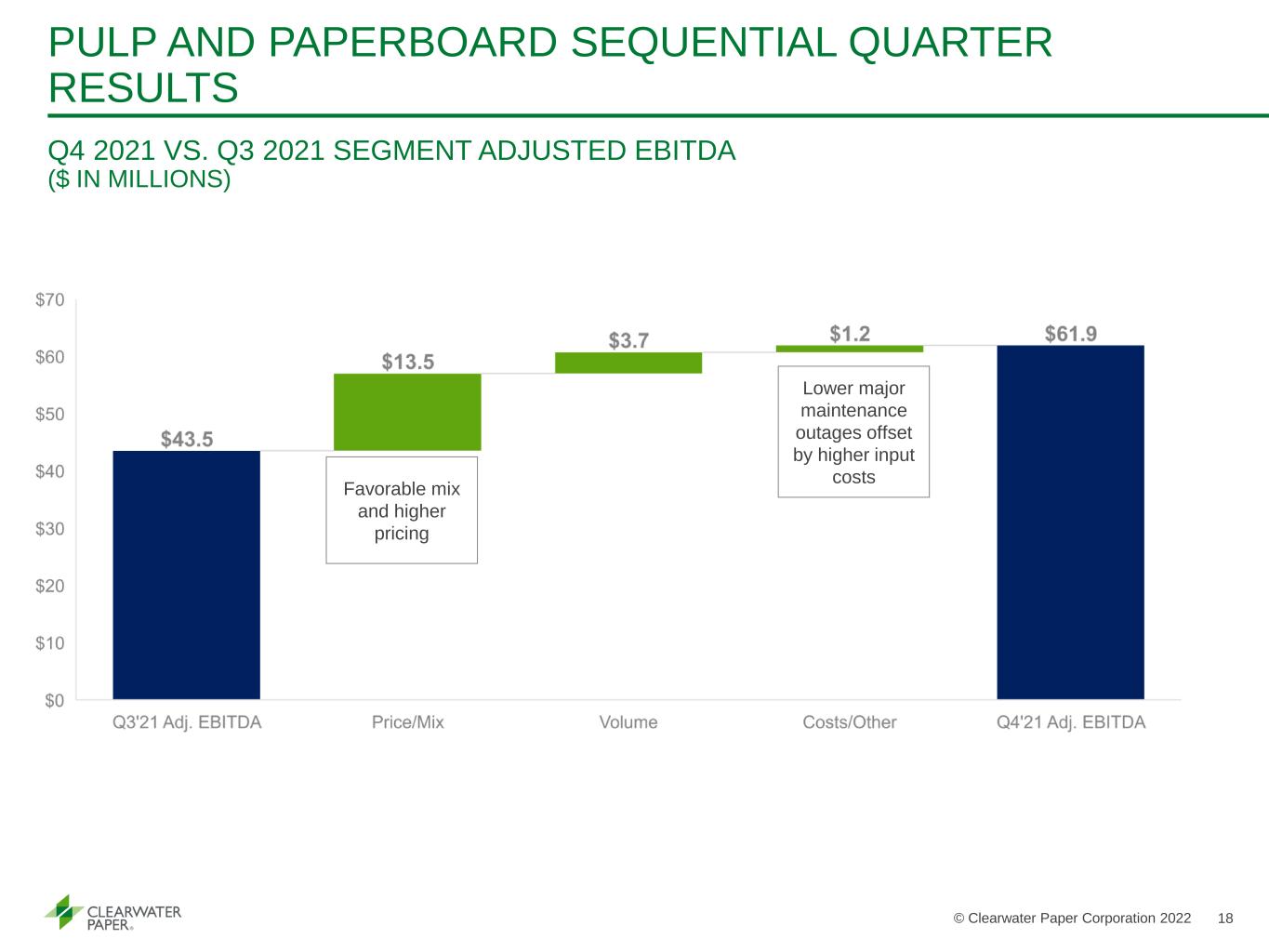

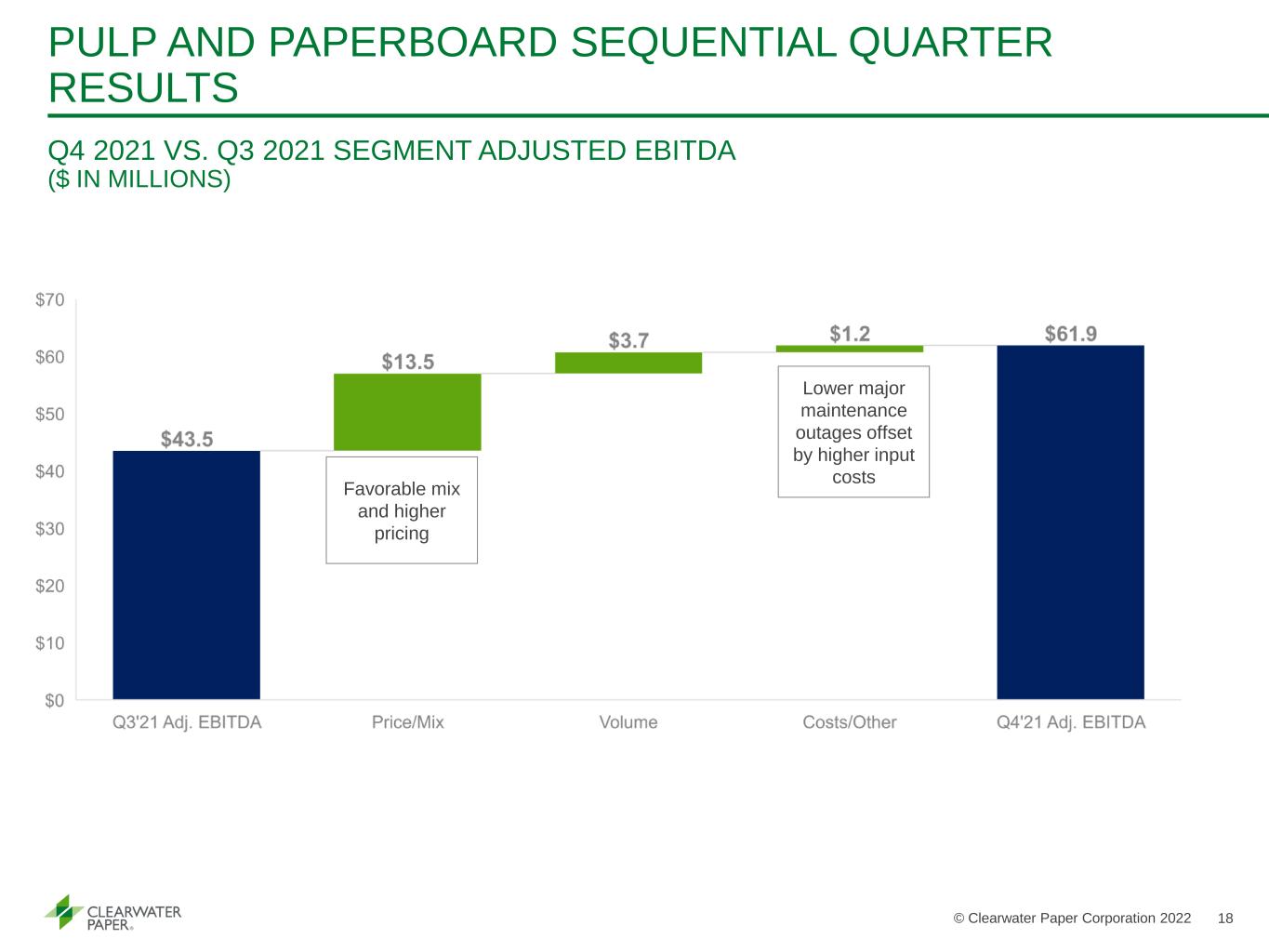

PULP AND PAPERBOARD SEQUENTIAL QUARTER RESULTS Q4 2021 VS. Q3 2021 SEGMENT ADJUSTED EBITDA ($ IN MILLIONS) Lower major maintenance outages offset by higher input costs Favorable mix and higher pricing © Clearwater Paper Corporation 2022 18

CONSUMER PRODUCTS SEQUENTIAL QUARTER RESULTS Q4 2021 VS. Q3 2021 SEGMENT ADJUSTED EBITDA ($ IN MILLIONS) Improved production and demand Higher input costs in pulp, transportation and energy © Clearwater Paper Corporation 2022 19 Favorable mix with targeted price increases

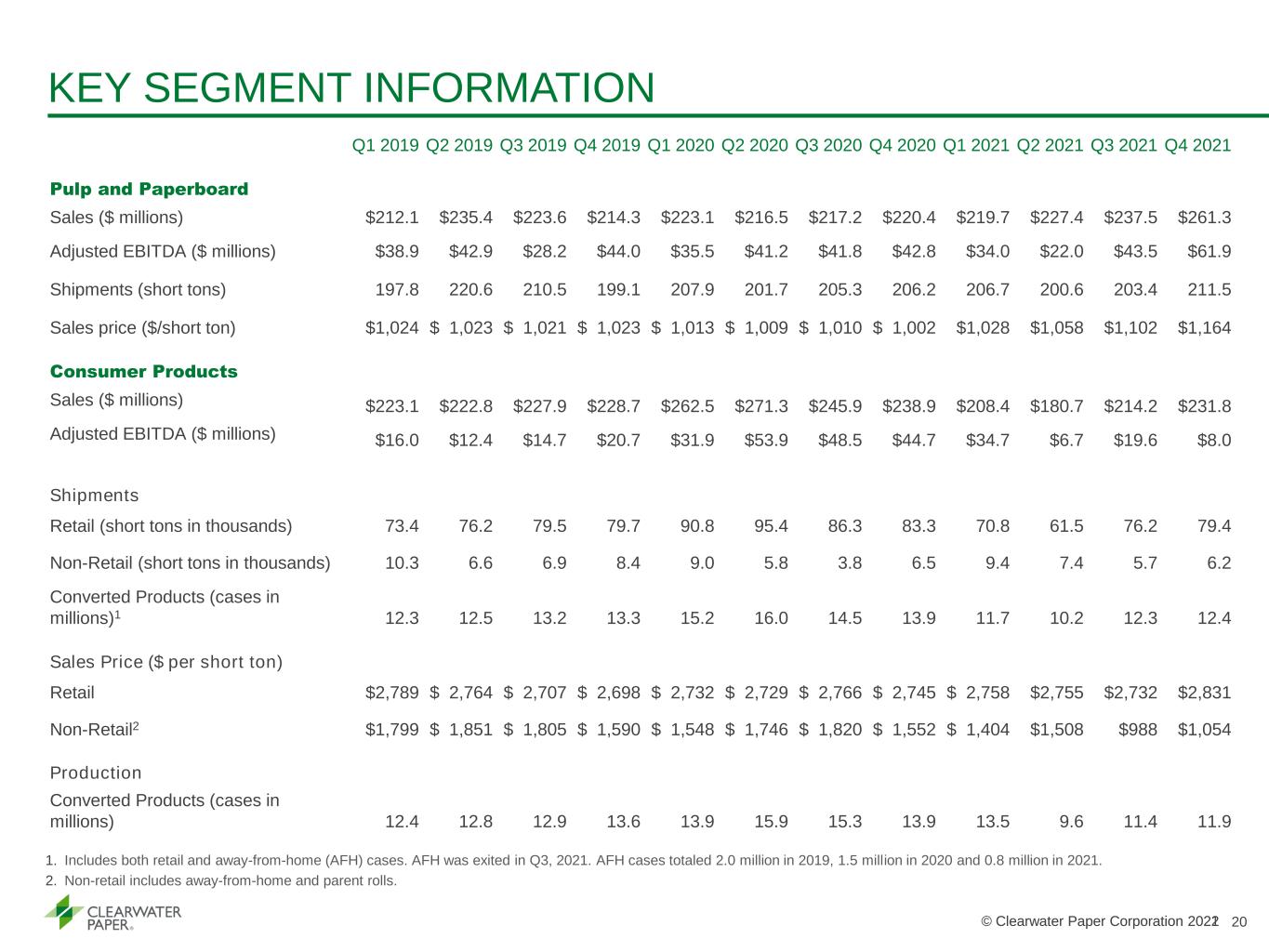

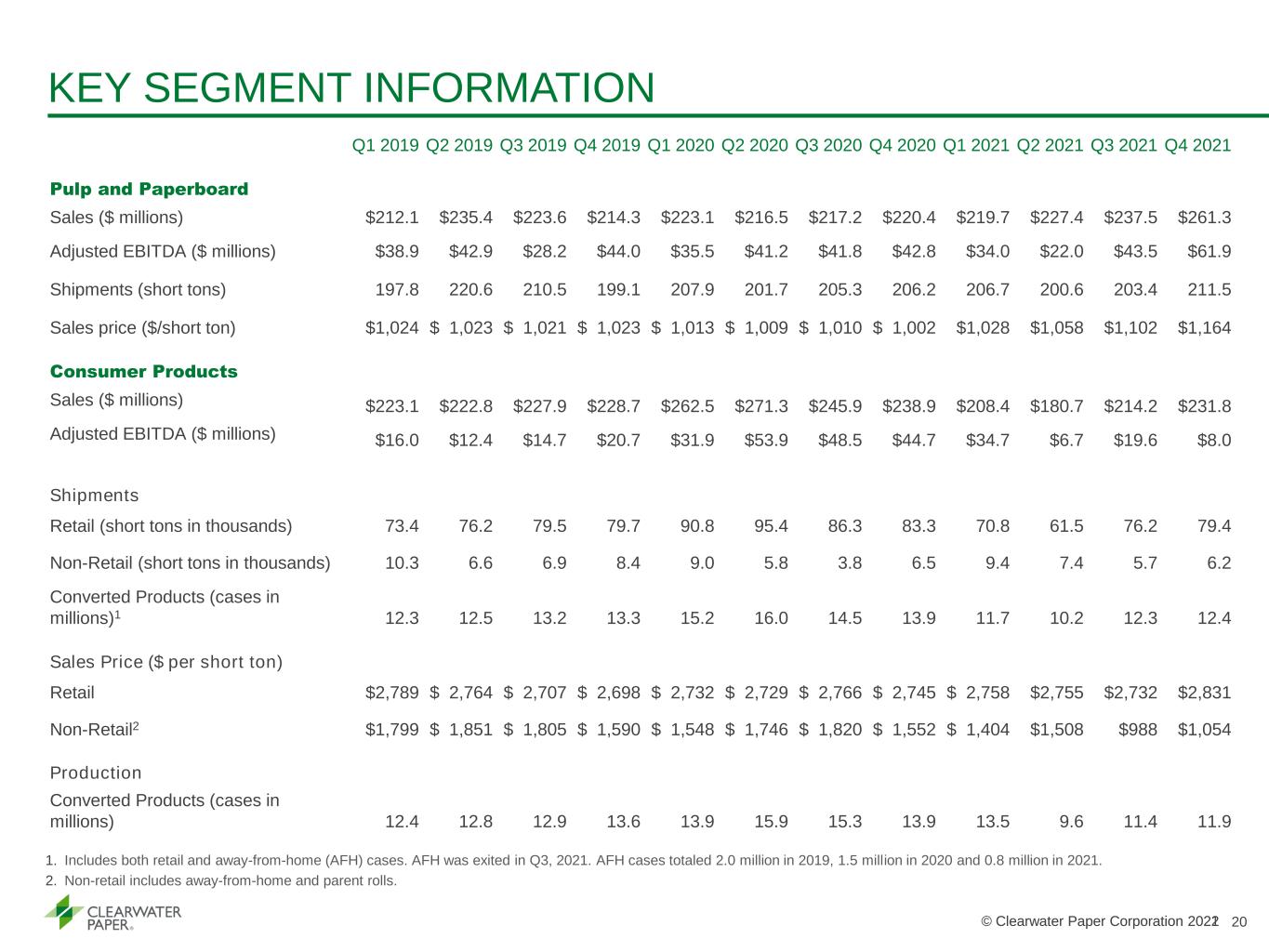

KEY SEGMENT INFORMATION 1. Includes both retail and away-from-home (AFH) cases. AFH was exited in Q3, 2021. AFH cases totaled 2.0 million in 2019, 1.5 million in 2020 and 0.8 million in 2021. 2. Non-retail includes away-from-home and parent rolls. Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Pulp and Paperboard Sales ($ millions) $212.1 $235.4 $223.6 $214.3 $223.1 $216.5 $217.2 $220.4 $219.7 $227.4 $237.5 $261.3 Adjusted EBITDA ($ millions) $38.9 $42.9 $28.2 $44.0 $35.5 $41.2 $41.8 $42.8 $34.0 $22.0 $43.5 $61.9 Shipments (short tons) 197.8 220.6 210.5 199.1 207.9 201.7 205.3 206.2 206.7 200.6 203.4 211.5 Sales price ($/short ton) $1,024 $ 1,023 $ 1,021 $ 1,023 $ 1,013 $ 1,009 $ 1,010 $ 1,002 $1,028 $1,058 $1,102 $1,164 Consumer Products Sales ($ millions) $223.1 $222.8 $227.9 $228.7 $262.5 $271.3 $245.9 $238.9 $208.4 $180.7 $214.2 $231.8 Adjusted EBITDA ($ millions) $16.0 $12.4 $14.7 $20.7 $31.9 $53.9 $48.5 $44.7 $34.7 $6.7 $19.6 $8.0 Shipments Retail (short tons in thousands) 73.4 76.2 79.5 79.7 90.8 95.4 86.3 83.3 70.8 61.5 76.2 79.4 Non-Retail (short tons in thousands) 10.3 6.6 6.9 8.4 9.0 5.8 3.8 6.5 9.4 7.4 5.7 6.2 Converted Products (cases in millions)1 12.3 12.5 13.2 13.3 15.2 16.0 14.5 13.9 11.7 10.2 12.3 12.4 Sales Price ($ per short ton) Retail $2,789 $ 2,764 $ 2,707 $ 2,698 $ 2,732 $ 2,729 $ 2,766 $ 2,745 $ 2,758 $2,755 $2,732 $2,831 Non-Retail2 $1,799 $ 1,851 $ 1,805 $ 1,590 $ 1,548 $ 1,746 $ 1,820 $ 1,552 $ 1,404 $1,508 $988 $1,054 Production Converted Products (cases in millions) 12.4 12.8 12.9 13.6 13.9 15.9 15.3 13.9 13.5 9.6 11.4 11.9 © Clearwater Paper Corporation 20212 20

RECONCILIATION OF ADJUSTED EBITDA ($ IN MILLIONS) Sept 30, 2021 2020 2021 2021 2020 Net income (loss) $ 9.6 $ 22.6 $ 1.9 $ (28.1) $ 77.1 Income tax provision (benefit) 6.1 7.0 (0.3) (7.7) 21.1 Interest expense, net 8.9 9.5 8.9 36.4 46.5 Depreciation and amortization expense 25.4 27.5 25.9 105.0 111.0 Other operating charges, net 2.6 2.1 10.2 57.7 14.0 Other non-operating expense 2.6 1.9 2.8 10.4 7.6 Debt retirement costs 0.5 1.1 0.5 1.0 5.9 Adjusted EBITDA $ 55.6 $ 71.6 $ 49.9 $ 174.6 $ 283.2 Pulp and Paperboard segment income $ 53.1 $ 33.7 $ 34.6 $ 125.7 $ 124.5 Depreciation and amortization 8.8 9.0 8.9 35.7 36.7 Adjusted EBITDA Paperboard segment $ 61.9 $ 42.8 $ 43.5 $ 161.4 $ 161.3 Consumer Products segment income $ (7.5) $ 27.6 $ 3.7 $ 4.0 $ 110.6 Depreciation and amortization 15.5 17.1 15.9 64.9 68.5 Adjusted EBITDA Consumer Products segment $ 8.0 $ 44.7 $ 19.6 $ 69.0 $ 179.1 Corporate and other expense $ (15.3) $ (17.3) $ (14.3) $ (60.1) $ (63.0) Depreciation and amortization 1.1 1.4 1.1 4.4 5.8 Adjusted EBITDA Corporate and other $ (14.3) $ (16.0) $ (13.1) $ (55.7) $ (57.2) Pulp and Paperboard segment $ 61.9 $ 42.8 $ 43.5 $ 161.4 $ 161.3 Consumer Products segment 8.0 44.7 19.6 69.0 179.1 Corporate and other (14.3) (16.0) (13.1) (55.7) (57.2) Adjusted EBITDA $ 55.6 $ 71.6 $ 49.9 $ 174.6 $ 283.2 Dec 31, Dec 31, Quarter Ended Year Ended © Clearwater Paper Corporation 2022 21

© Clearwater Paper Corporation 2022 RECONCILIATION OF ADJUSTED INCOME ($ IN MILLIONS, EXCEPT PER SHARE AMOUNTS) 2021 2020 2021 2020 Net income (loss) 9.6$ 22.6$ (28.1)$ 77.1$ Add back: Income tax provision (benefit) 6.1 7.0 (7.7) 21.1 Income (loss) before income taxes 15.6 29.5 (35.7) 98.2 Add back: Debt retirement costs 0.5 1.1 1.0 5.9 Other operating charges, net 2.6 2.1 57.7 14.0 Adjusted income before tax 18.7 32.7 23.0 118.1 Normalized income tax provision (benefit) 4.7 8.2 5.7 29.5 Adjusted income 14.1$ 24.6$ 17.2$ 88.6$ Weighted average diluted shares (thousands) 17,149 16,891 16,767 16,724 Adjusted income per diluted share 0.82$ 1.45$ 1.03$ 5.30$ Year Ended Dec 31,Quarter Ended Dec 31, 22

ADDITIONAL RECONCILIATIONS Net Debt Mar 31, 2020 June 30, 2020 Sept 30, 2020 Dec 31, 2020 Mar 31, 2021 June 30, 2021 Sept 30, 2021 Dec 31, 2021 Cash $ 60.8 $ 48.2 $ 47.5 $ 35.9 $ 57.1 $ 60.9 $ 27.8 $ 25.2 Current debt 58.1 1.6 1.7 1.7 1.7 1.7 1.6 1.6 Long term debt 883.9 827.9 785.5 716.4 716.3 716.2 676.5 637.6 add: Deferred debt costs 7.7 6.4 8.2 6.9 6.6 6.4 5.6 4.8 less: Financing leases (22.0) (21.6) (21.2) (20.8) (20.4) (20.0) (19.5) (19.1) Subtotal 927.7 814.3 774.2 704.2 704.2 704.3 664.2 624.9 Net debt $ 866.9 $ 766.1 $ 726.7 $ 668.4 $ 647.1 $ 643.3 $ 636.4 $ 599.8 Free Cash Flow Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Cash from operations $ 11.7 $ 109.0 $ 55.7 $ 70.8 $ 33.8 $ 14.8 $ 16.3 $ 32.1 Additions to property, plant and equipment, net of proceeds from sales (10.5) (7.3) (9.7) (12.2) (11.1) (10.5) (8.9) 4.8 Free cash flow $ 1.2 $ 101.7 $ 46.0 $ 58.6 $ 22.7 $ 4.3 $ 7.4 $ 36.9 ($ IN MILLIONS) © Clearwater Paper Corporation 2022 23

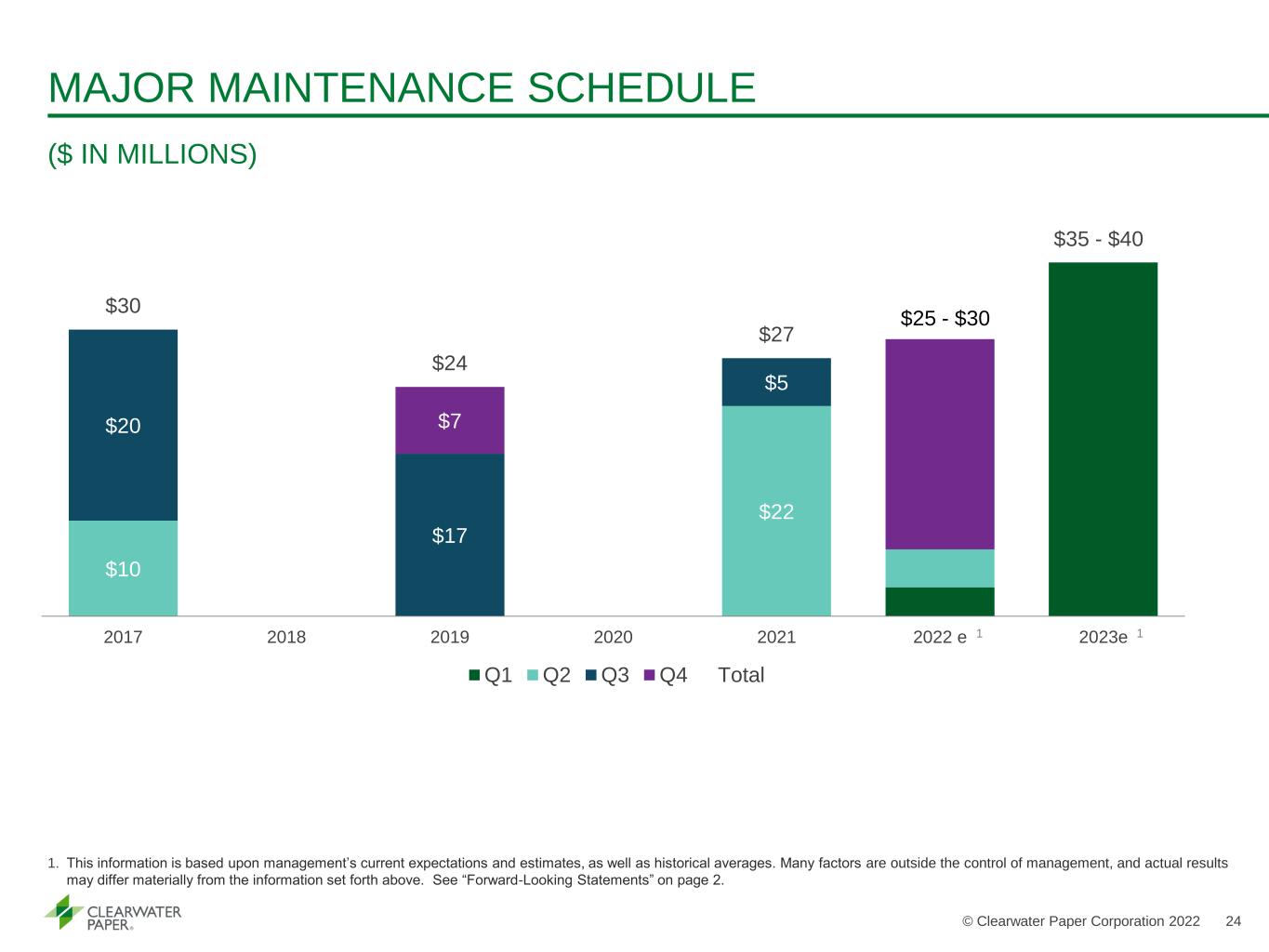

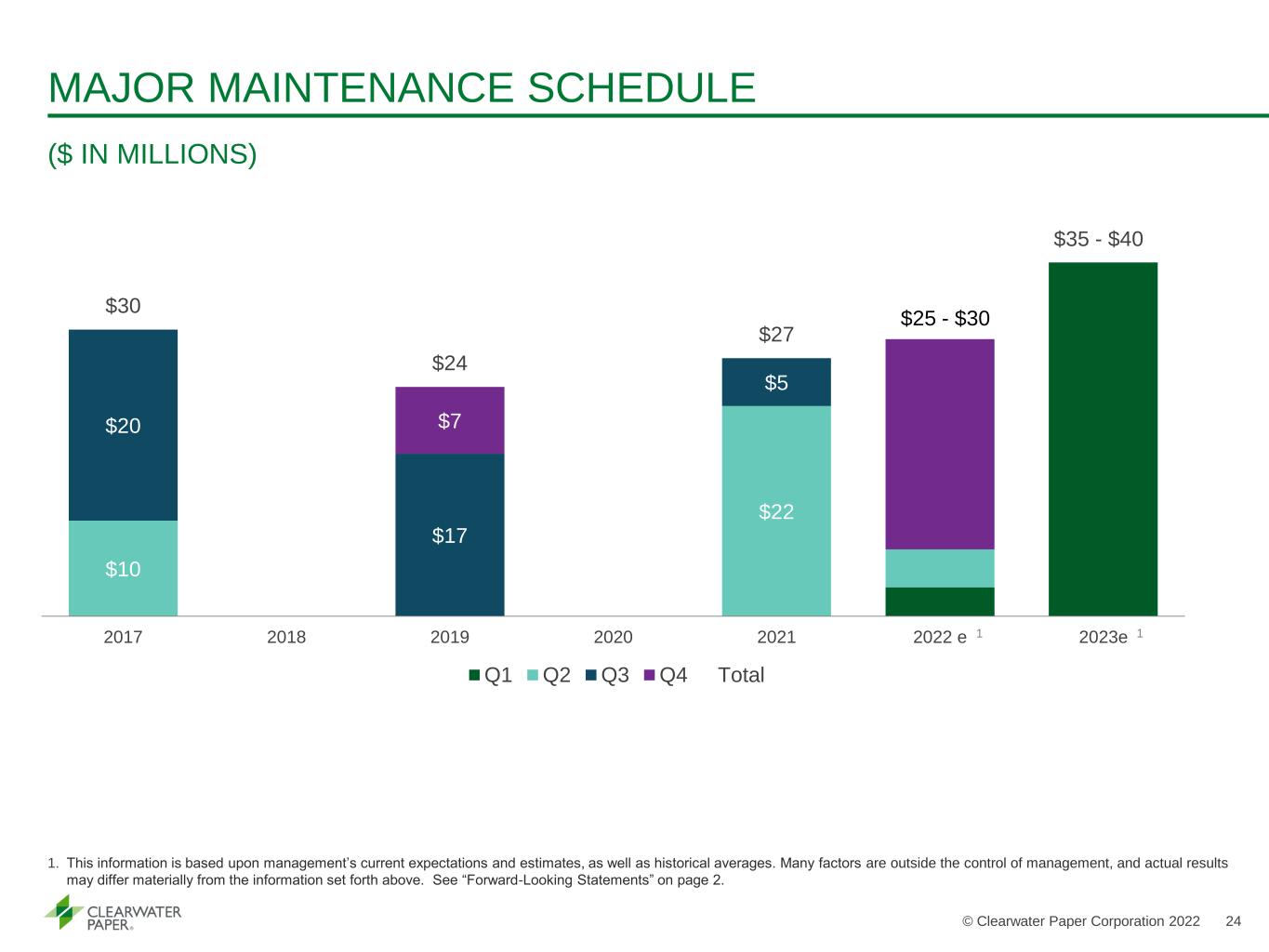

MAJOR MAINTENANCE SCHEDULE ($ IN MILLIONS) 1. This information is based upon management’s current expectations and estimates, as well as historical averages. Many factors are outside the control of management, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 2. Idaho $10 $22 $20 $17 $5 $7 $30 $24 $27 $35 - $40 2017 2018 2019 2020 2021 2022 e 2023e Q1 Q2 Q3 Q4 Total $25 - $30 1 © Clearwater Paper Corporation 2022 24 1