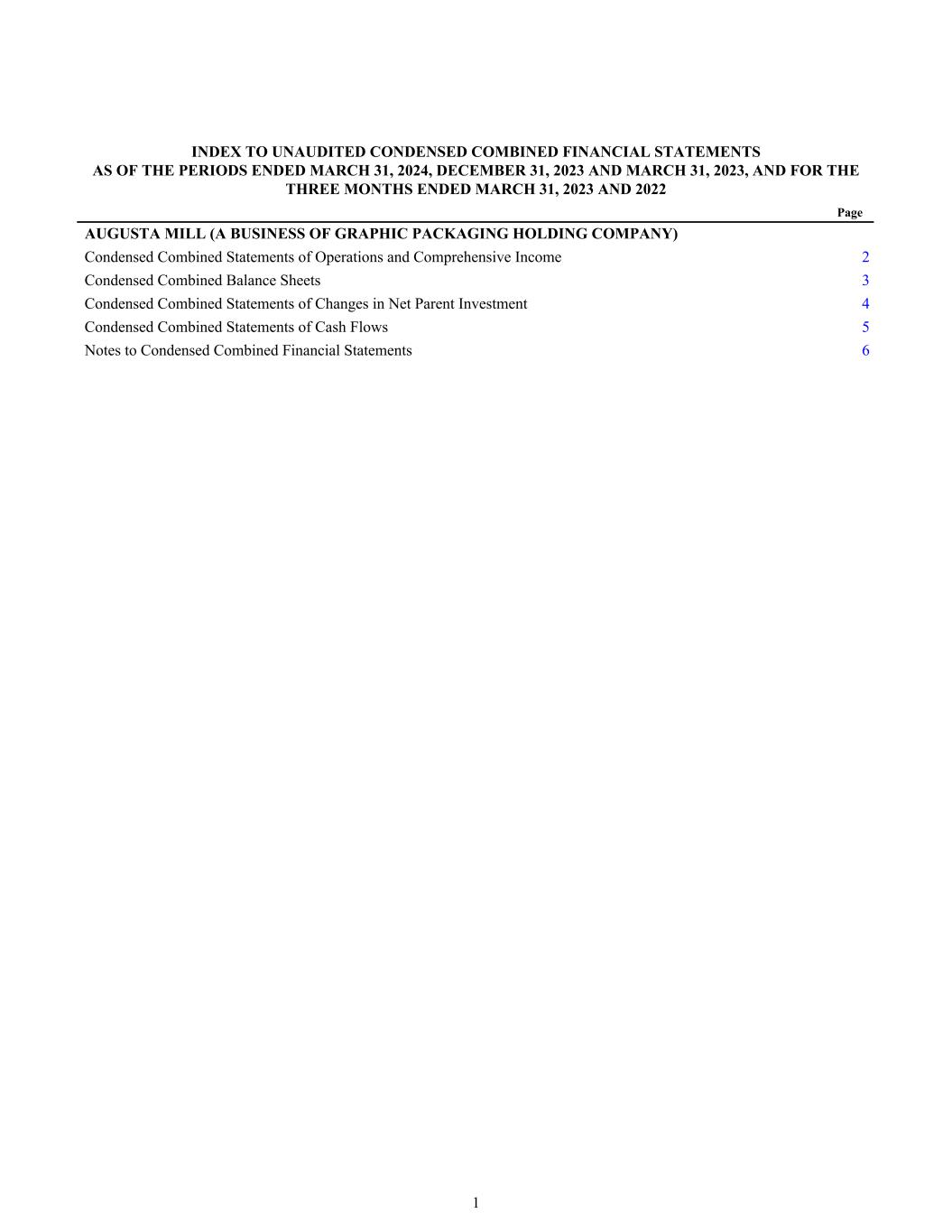

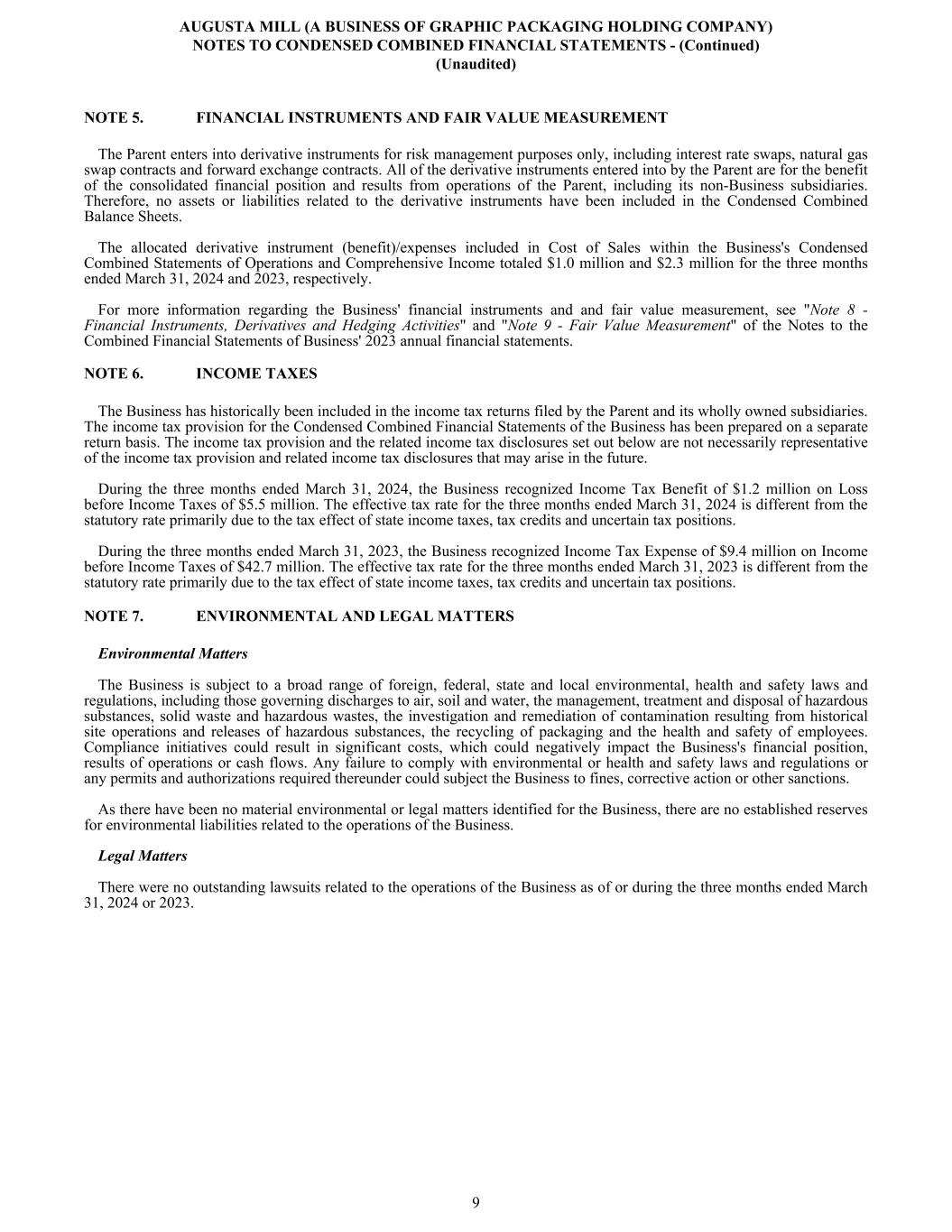

INDEX TO UNAUDITED CONDENSED COMBINED FINANCIAL STATEMENTS AS OF THE PERIODS ENDED MARCH 31, 2024, DECEMBER 31, 2023 AND MARCH 31, 2023, AND FOR THE THREE MONTHS ENDED MARCH 31, 2023 AND 2022 Page AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) Condensed Combined Statements of Operations and Comprehensive Income 2 Condensed Combined Balance Sheets 3 Condensed Combined Statements of Changes in Net Parent Investment 4 Condensed Combined Statements of Cash Flows 5 Notes to Condensed Combined Financial Statements 6 1

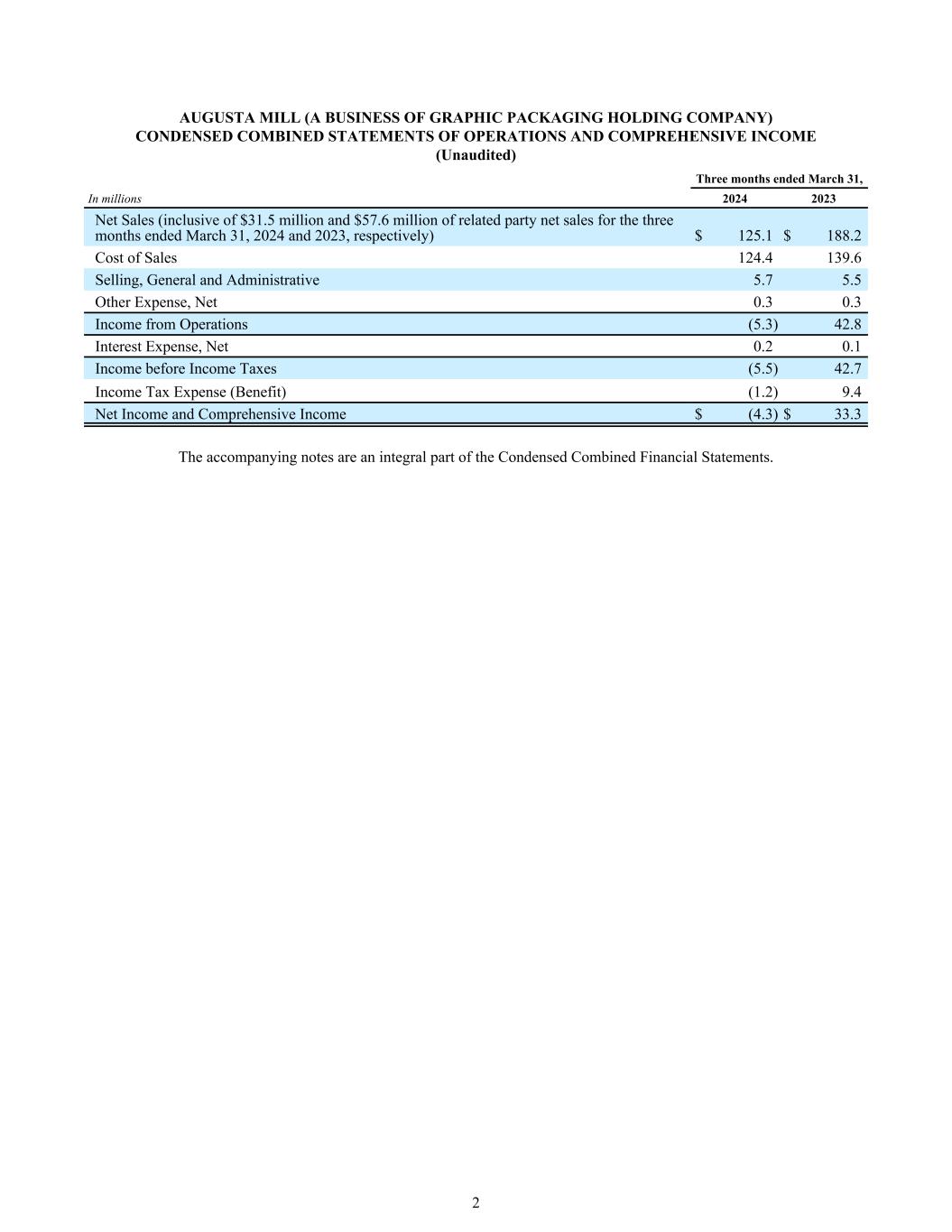

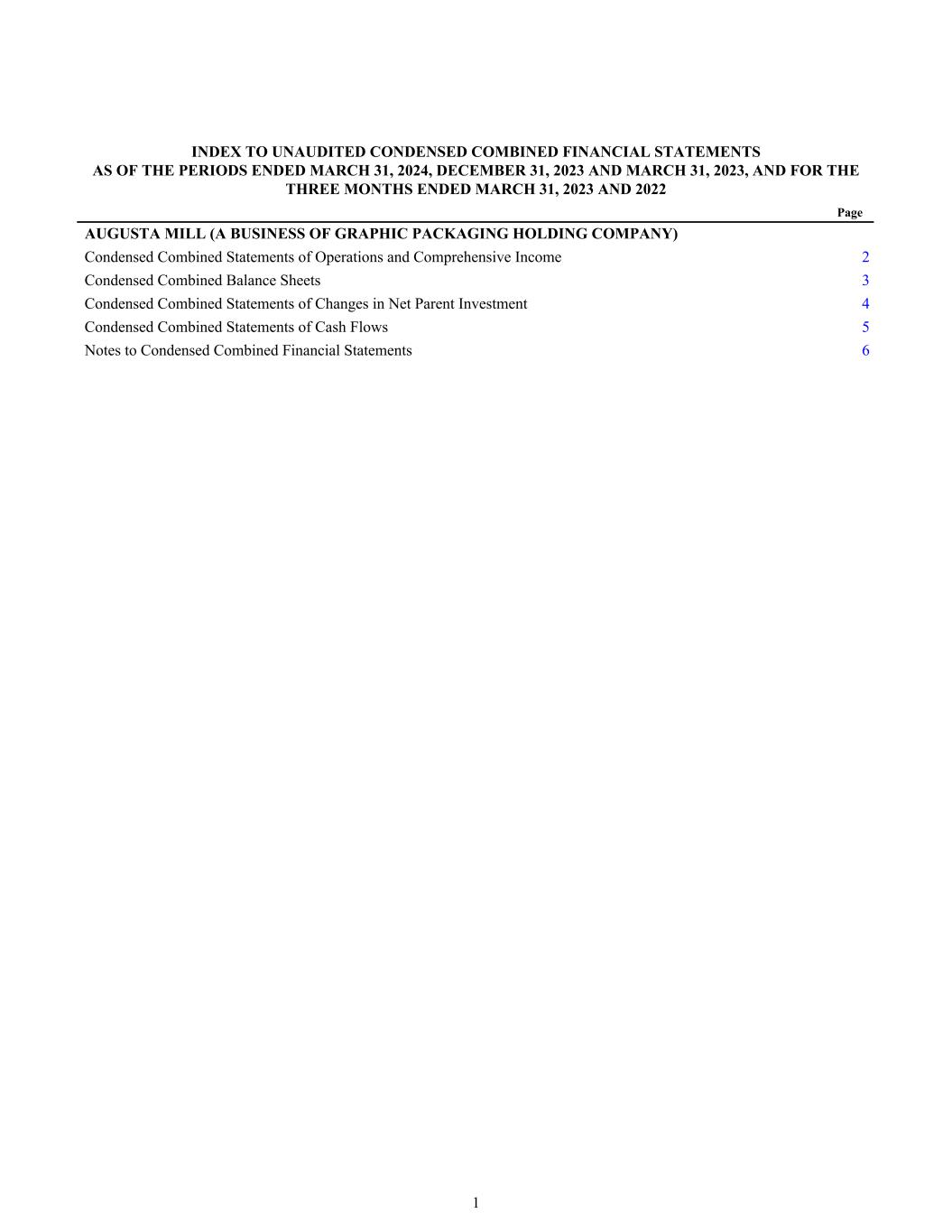

AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) CONDENSED COMBINED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Unaudited) Three months ended March 31, In millions 2024 2023 Net Sales (inclusive of $31.5 million and $57.6 million of related party net sales for the three months ended March 31, 2024 and 2023, respectively) $ 125.1 $ 188.2 Cost of Sales 124.4 139.6 Selling, General and Administrative 5.7 5.5 Other Expense, Net 0.3 0.3 Income from Operations (5.3) 42.8 Interest Expense, Net 0.2 0.1 Income before Income Taxes (5.5) 42.7 Income Tax Expense (Benefit) (1.2) 9.4 Net Income and Comprehensive Income $ (4.3) $ 33.3 The accompanying notes are an integral part of the Condensed Combined Financial Statements. 2

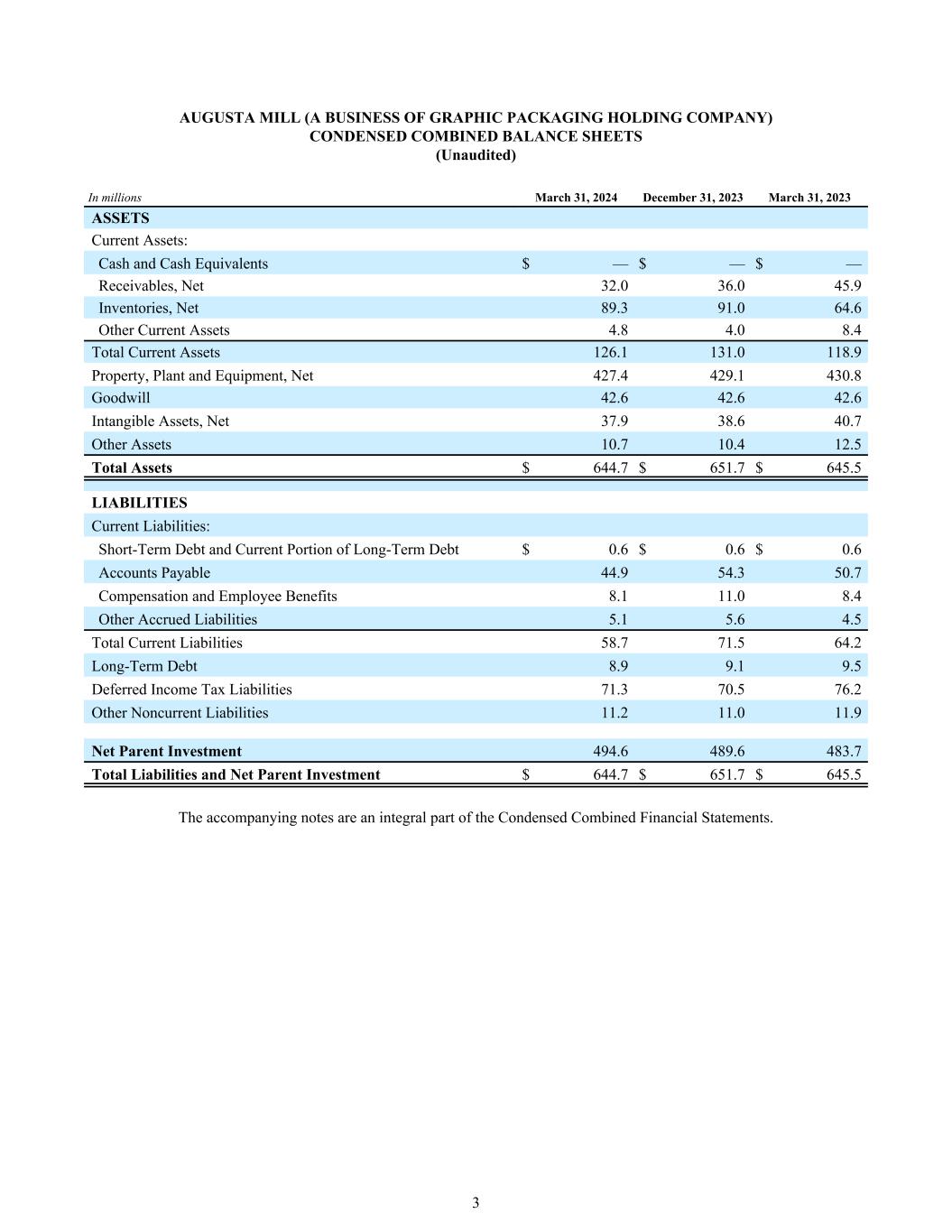

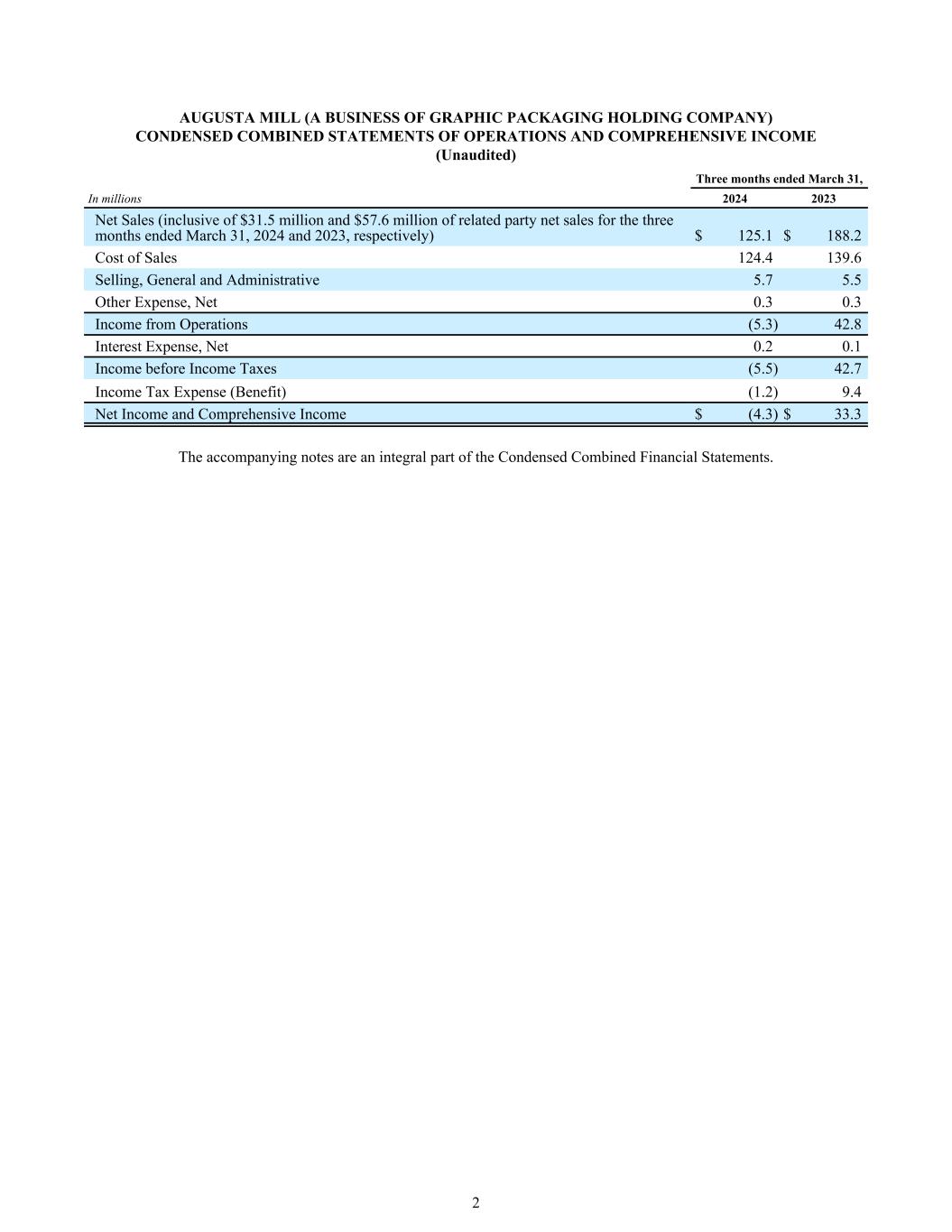

AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) CONDENSED COMBINED BALANCE SHEETS (Unaudited) In millions March 31, 2024 December 31, 2023 March 31, 2023 ASSETS Current Assets: Cash and Cash Equivalents $ — $ — $ — Receivables, Net 32.0 36.0 45.9 Inventories, Net 89.3 91.0 64.6 Other Current Assets 4.8 4.0 8.4 Total Current Assets 126.1 131.0 118.9 Property, Plant and Equipment, Net 427.4 429.1 430.8 Goodwill 42.6 42.6 42.6 Intangible Assets, Net 37.9 38.6 40.7 Other Assets 10.7 10.4 12.5 Total Assets $ 644.7 $ 651.7 $ 645.5 LIABILITIES Current Liabilities: Short-Term Debt and Current Portion of Long-Term Debt $ 0.6 $ 0.6 $ 0.6 Accounts Payable 44.9 54.3 50.7 Compensation and Employee Benefits 8.1 11.0 8.4 Other Accrued Liabilities 5.1 5.6 4.5 Total Current Liabilities 58.7 71.5 64.2 Long-Term Debt 8.9 9.1 9.5 Deferred Income Tax Liabilities 71.3 70.5 76.2 Other Noncurrent Liabilities 11.2 11.0 11.9 Net Parent Investment 494.6 489.6 483.7 Total Liabilities and Net Parent Investment $ 644.7 $ 651.7 $ 645.5 The accompanying notes are an integral part of the Condensed Combined Financial Statements. 3

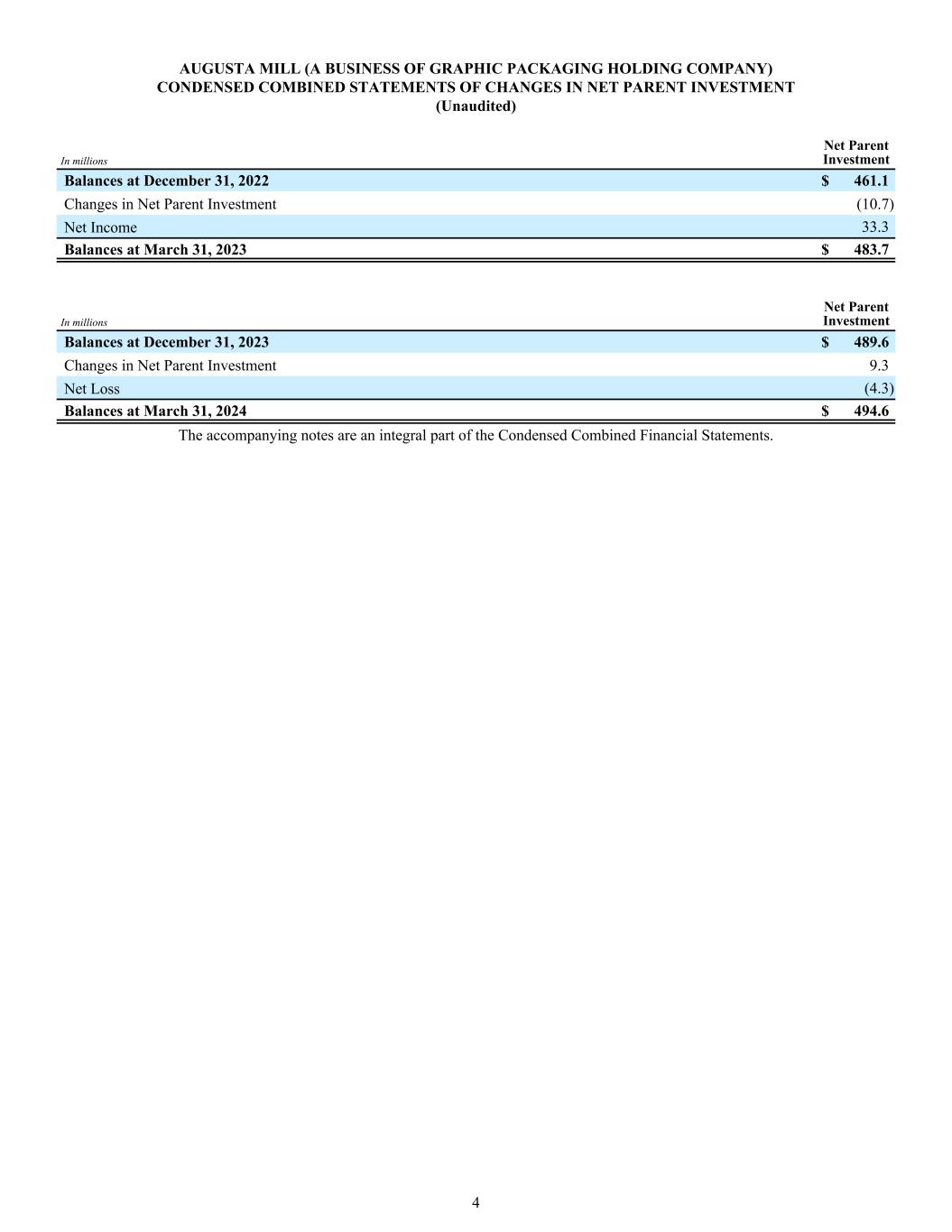

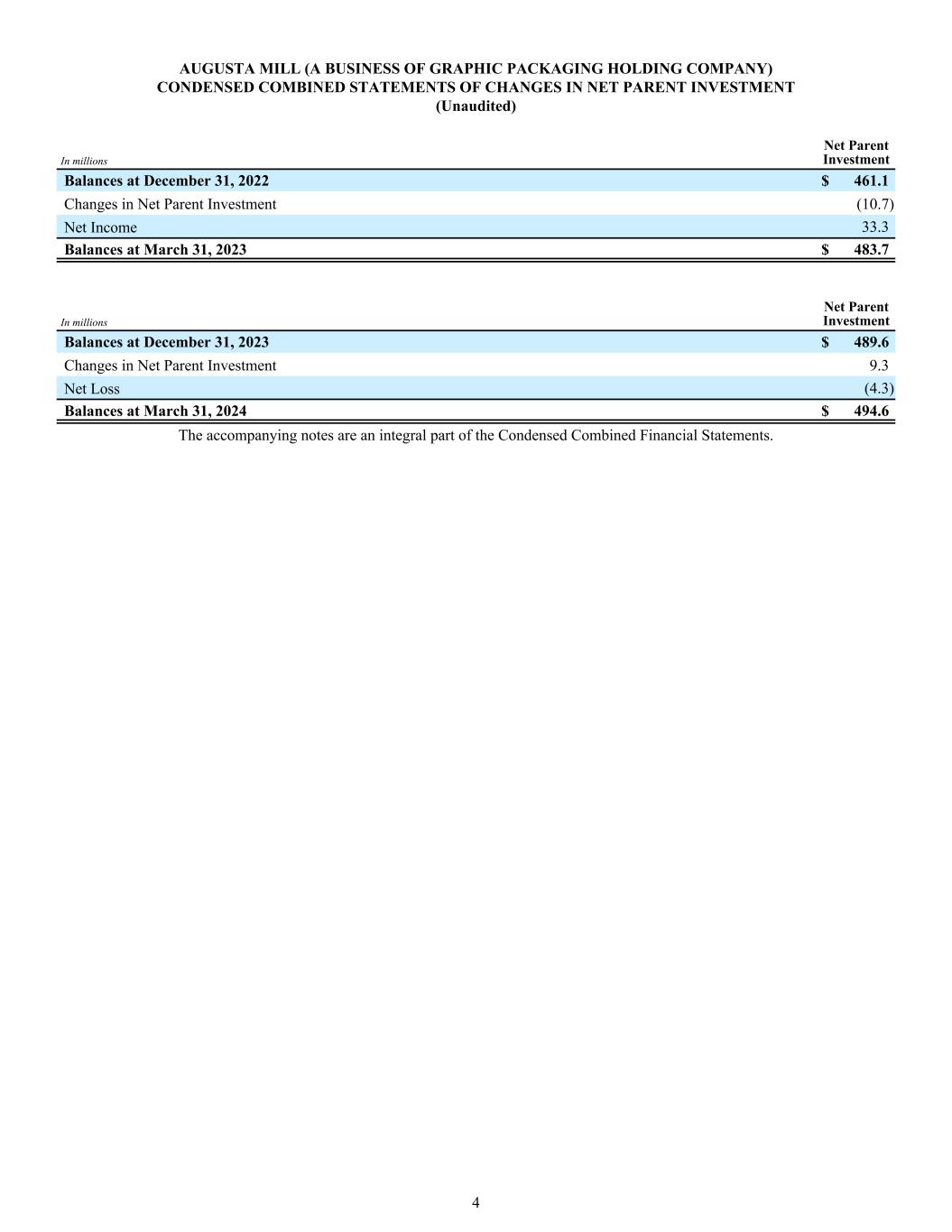

AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) CONDENSED COMBINED STATEMENTS OF CHANGES IN NET PARENT INVESTMENT (Unaudited) Net Parent Investment In millions Balances at December 31, 2022 $ 461.1 Changes in Net Parent Investment (10.7) Net Income 33.3 Balances at March 31, 2023 $ 483.7 Net Parent Investment In millions Balances at December 31, 2023 $ 489.6 Changes in Net Parent Investment 9.3 Net Loss (4.3) Balances at March 31, 2024 $ 494.6 The accompanying notes are an integral part of the Condensed Combined Financial Statements. 4

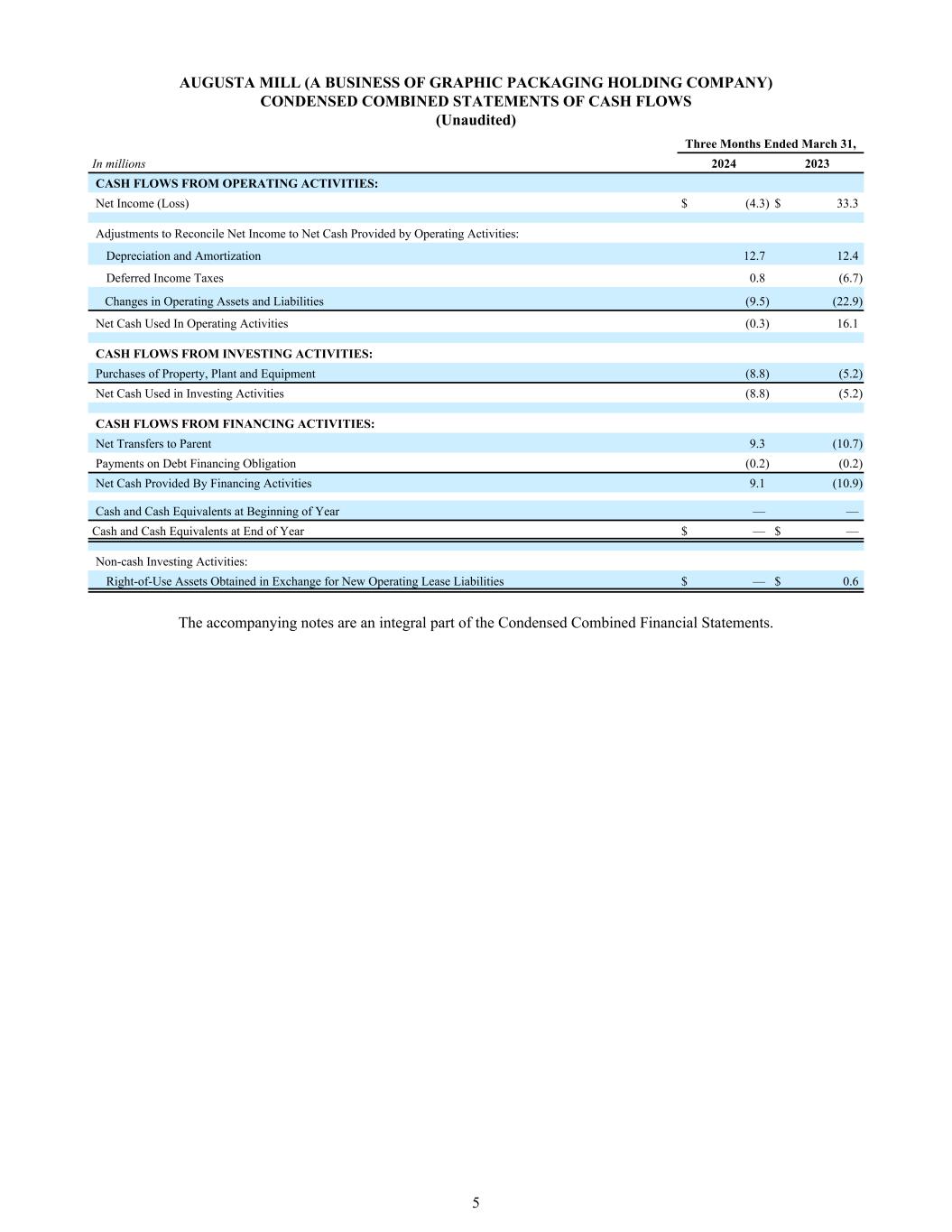

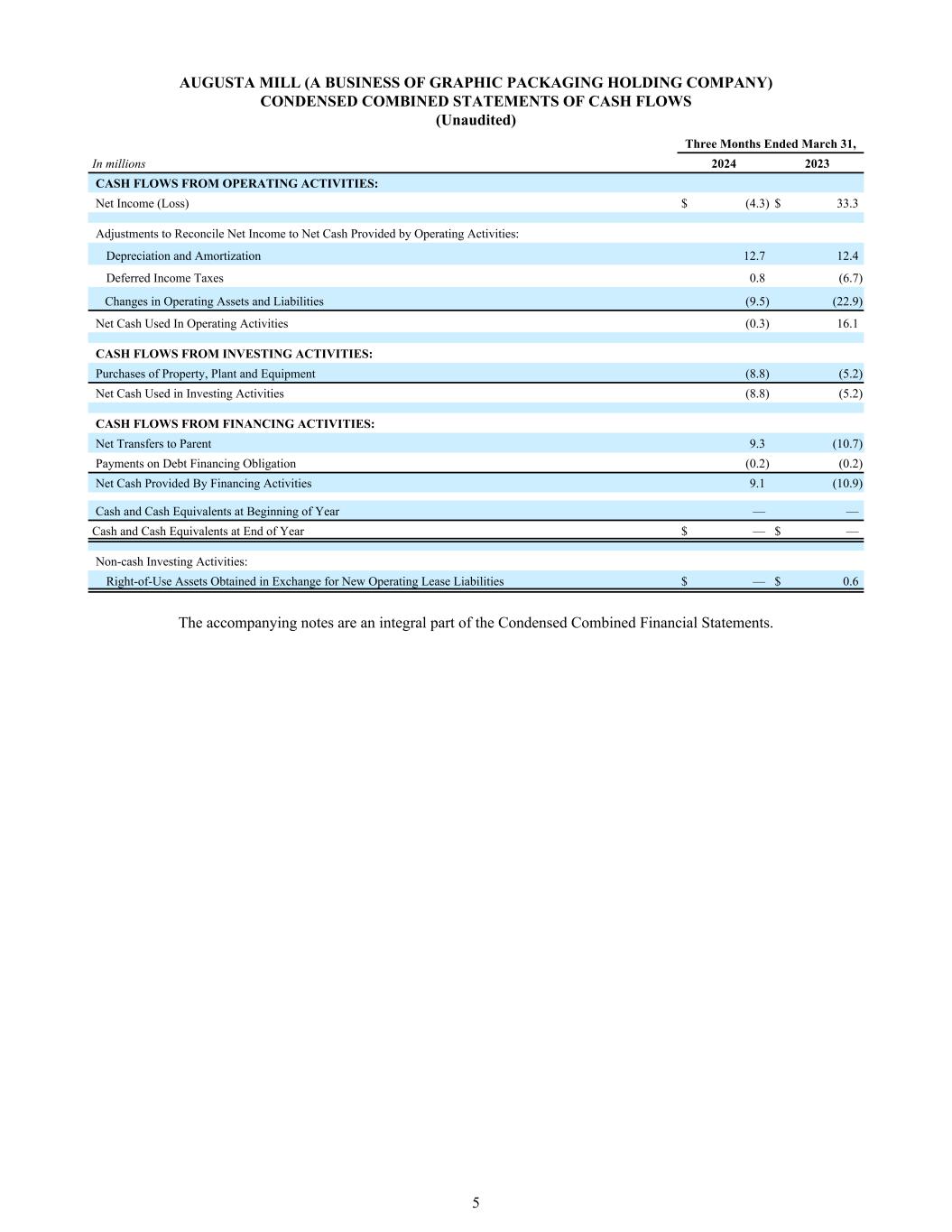

AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) CONDENSED COMBINED STATEMENTS OF CASH FLOWS (Unaudited) Three Months Ended March 31, In millions 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES: Net Income (Loss) $ (4.3) $ 33.3 Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Depreciation and Amortization 12.7 12.4 Deferred Income Taxes 0.8 (6.7) Changes in Operating Assets and Liabilities (9.5) (22.9) Net Cash Used In Operating Activities (0.3) 16.1 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of Property, Plant and Equipment (8.8) (5.2) Net Cash Used in Investing Activities (8.8) (5.2) CASH FLOWS FROM FINANCING ACTIVITIES: Net Transfers to Parent 9.3 (10.7) Payments on Debt Financing Obligation (0.2) (0.2) Net Cash Provided By Financing Activities 9.1 (10.9) Cash and Cash Equivalents at Beginning of Year — — Cash and Cash Equivalents at End of Year $ — $ — Non-cash Investing Activities: Right-of-Use Assets Obtained in Exchange for New Operating Lease Liabilities $ — $ 0.6 The accompanying notes are an integral part of the Condensed Combined Financial Statements. 5

AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) NOTES TO CONDENSED COMBINED FINANCIAL STATEMENTS (Unaudited) NOTE 1. GENERAL INFORMATION Nature of Business The Augusta, Georgia bleached paperboard manufacturing facility (the “Augusta Mill” or the “Business”) is a wholly- owned component of Graphic Packaging Holding Company (“GPHC” or the "Parent"). On February 20, 2024, the Parent, through its subsidiary Graphic Packaging International, LLC, entered into a purchase agreement (the “Purchase Agreement”) with Clearwater Paper Corporation to sell the Augusta Mill in exchange for (i) $700 million in cash consideration (subject to normal adjustments as set forth in the Purchase Agreement, the “Purchase Price”) and (ii) the assumption of certain liabilities of the Business as specified in the Purchase Agreement (such transaction, the “Transaction”). The transaction is expected to close in the second quarter of 2024, subject to regulatory approvals and other customary closing conditions. Basis of Presentation The accompanying Condensed Combined Financial Statements have been prepared on a standalone basis and are derived from the Parent’s Consolidated Financial Statements and accounting records. The Condensed Combined Financial Statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and reflect historical results of operations, financial position and cash flows of the Business, as included in the Consolidated Financial Statements of Parent and using Parent’s historical accounting policies. These Condensed Combined Financial Statements do not purport to reflect what the Business’s results of operations, financial position or cash flows would have been had the Business operated as a stand-alone company during the periods presented, nor are they necessarily indicative of the Business’s future results of operations, financial position, or cash flows. In the Company’s opinion, the accompanying Condensed Combined Financial Statements contain all normal recurring adjustments necessary to state fairly the financial position, results of operations and cash flows for the interim periods. The Company’s year-end Condensed Combined Balance Sheet data was derived from audited financial statements. The accompanying unaudited Condensed Combined Financial Statements have been prepared in accordance with Rule 10-01 of Regulation S-X and do not include all the information required by accounting principles generally accepted in the United States of America (“U.S. GAAP”) for complete financial statements. These Condensed Combined Financial Statements should be read in conjunction with the financial statements and notes included in our audited Combined Financial Statements for the year ended December 31, 2023. In addition, the preparation of the Condensed Combined Financial Statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Condensed Combined Financial Statements and the reported amounts of revenues and expenses during the reporting period. Actual amounts could differ from those estimates and changes in these estimates are recorded when known. As the Business's operations were not historically held by a single legal entity or separate legal entities, net parent investment is shown in lieu of stockholders’ equity in the Condensed Combined Financial Statements. Net parent investment represents the cumulative investment by Parent in the Business through the dates presented, inclusive of operating results. All transactions between the Business and the Parent are considered to be effectively settled in the Condensed Combined Financial Statements at the time the transaction is recorded. The effects of the settlement of these transactions between the Business and the Parent are reflected in the Condensed Combined Statements of Cash Flows as “Net transfers to parent” within financing activities and in the Condensed Combined Balance Sheets and Condensed Combined Statements of Changes in Net Parent Investment as “Net parent Investment”. All intercompany transactions and accounts within the Business have been eliminated. Historically, the Business was dependent upon Parent for all of its working capital and financing requirements, as Parent uses a centralized approach to cash management and financing its operations. There were no cash amounts specifically attributable to the Business for the historical periods presented; therefore, cash and cash equivalents have not been included in the Condensed Combined Financial Statements. Financing transactions related to the Parent are accounted for as a component of Net Parent Investment in the Condensed Combined Balance Sheets and as a financing activity on the accompanying Condensed Combined Statements of Cash Flows. The Condensed Combined Financial Statements of the Business include the assets, liabilities, and expenses of the Parent that management has determined are specifically identifiable to the Business, such as those related to direct internal and external costs as well as leases and fixed assets specifically identifiable to the Business. The Condensed Combined Financial Statements of the Business also include an allocation of costs that are not directly attributable to the operations of the Business, including the costs of general and administrative support functions that are provided by the Parent, such as senior management, information technology, legal, accounting and finance, human resources, facility, and other corporate services. 6

These costs have been allocated to the Business for the purposes of preparing the Condensed Combined Financial Statements based on proportional cost allocation methods using sales, headcount, or other allocation methods that are considered to be a reasonable reflection of the utilization of services provided or benefit received by the Business during the periods presented. Management considers that such allocations have been made on a reasonable basis; however, these allocations may not necessarily be indicative of the costs that would have been incurred if the Business had operated on a standalone basis for the periods presented and, therefore, may not reflect the Business’s results of operations, financial position, and cash flows had the Business operated as a standalone entity during the periods presented. See “Note 8 - Related Party Transactions”, for additional information regarding related-party transactions with the Parent. Revenue Recognition The Business's primary activity is the manufacturing of paperboard for conversion by its customers into consumer packaging made from renewable resources. Revenue is recognized on the Business's annual and multi-year supply contracts when the Business satisfies the performance obligation by transferring control over the product or service to a customer, which is generally based on shipping terms and passage of title under the point-in-time method of recognition. For the three months ended March 31, 2024 and 2023, the Business recognized $125.1 million and $188.2 million, respectively, of revenue from contracts with customers. The transaction price allocated to each performance obligation consists of the stand-alone selling price, estimates of rebates and other sales or contract renewal incentives, and cash discounts and sales returns ("Variable Consideration") and excludes sales tax. Estimates are made for Variable Consideration based on contract terms and historical experience of actual results and are applied to the performance obligations as they are satisfied. Purchases by the Business's principal customers are manufactured and shipped with minimal lead time, therefore performance obligations are generally satisfied shortly after manufacturing and shipment. With the exception of sales to related parties, which are settled through intercompany processes, the Business uses standard payment terms that are consistent with industry practice. The Business did not have any contract asset balances as of March 31, 2024, December 31, 2023, and March 31, 2023. The Business's contract liabilities consist principally of rebates, and as of March 31, 2024, December 31, 2023 and March 31, 2023 were $1.7 million, $3.0 million and $0.9 million, respectively. Accounts Receivable and Allowances Accounts receivable are stated at the amount owed by the customer, net of an allowance for estimated uncollectible accounts, returns and allowances, and cash discounts. The allowance for doubtful accounts is estimated based on historical experience, current economic conditions and the creditworthiness of customers. Receivables are charged to the allowance when determined to be no longer collectible. The Parent has entered into agreements to sell, on a revolving basis, certain trade accounts receivable to third party financial institutions, including trade accounts receivables attributable to the Business. Transfers under these agreements meet the requirements to be accounted for as sales in accordance with the Transfers and Servicing topic of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification (the "Codification"). The loss on sale is included in Other Expense (Income), Net on the Condensed Combined Statements of Operations and Comprehensive Income. Concentration of Credit Risk The Business's accounts receivable are potentially subject to concentration of credit risk. Accounts receivable are derived from revenue earned from customers located in the U.S. and internationally and generally do not require collateral. The Business believes that concentration of credit risk with respect to accounts receivable is limited because of the creditworthiness of its major customers. For the three months ended March 31, 2024 and 2023, the Business's top two customers accounted for 38% and 26% of net revenues, respectively. Of these customers, one customer accounted for more than 10% of the Business's revenues during both the three months ended March 31, 2024 and 2023, and the other customer accounted for more than 10% of the Business's revenues in during the three months ended March 31, 2023. Additionally, sales to related entities controlled by the Parent which are not included within the Business accounted for 25% and 31% of net revenues for the three months ended March 31, 2024 and 2023, respectively. AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) NOTES TO CONDENSED COMBINED FINANCIAL STATEMENTS - (Continued) (Unaudited) 7

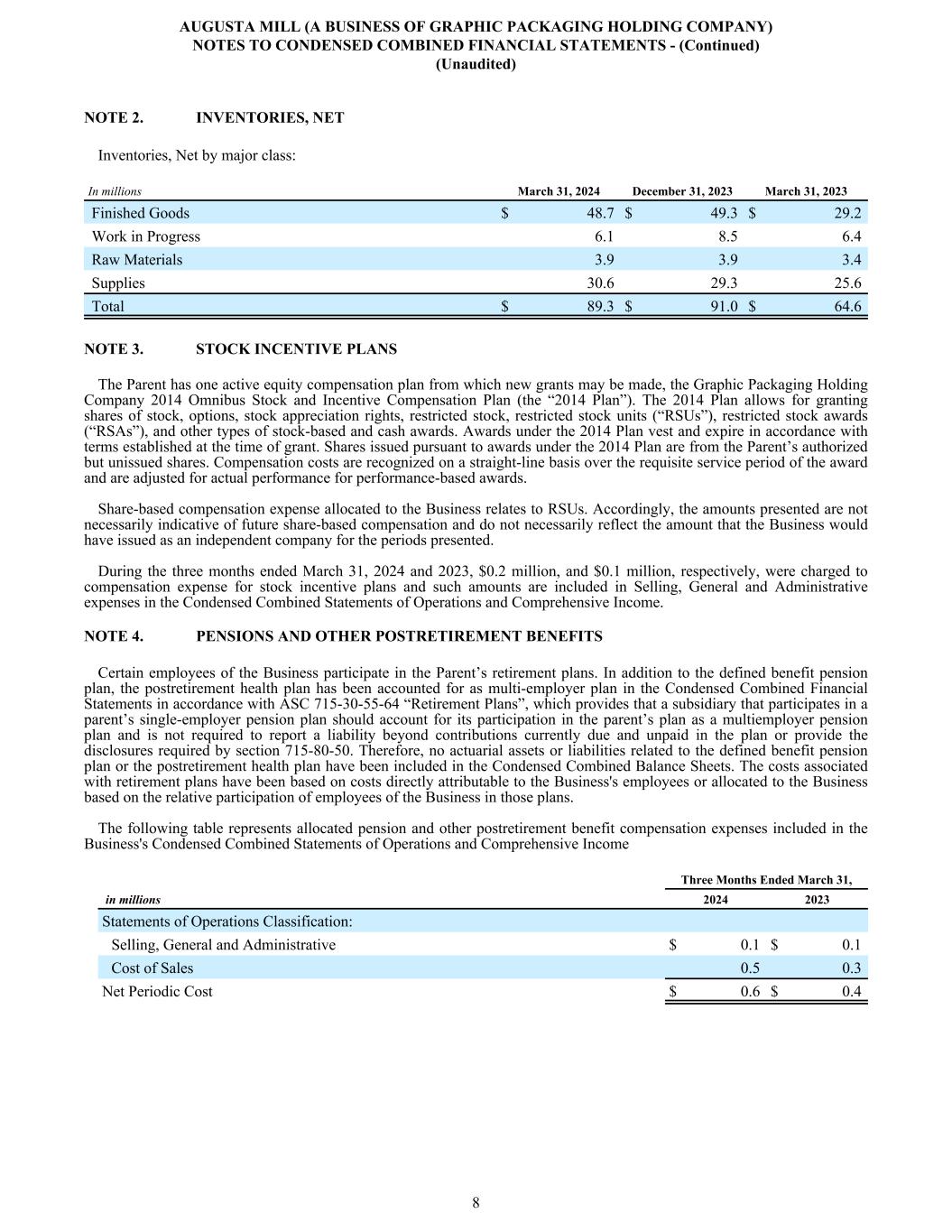

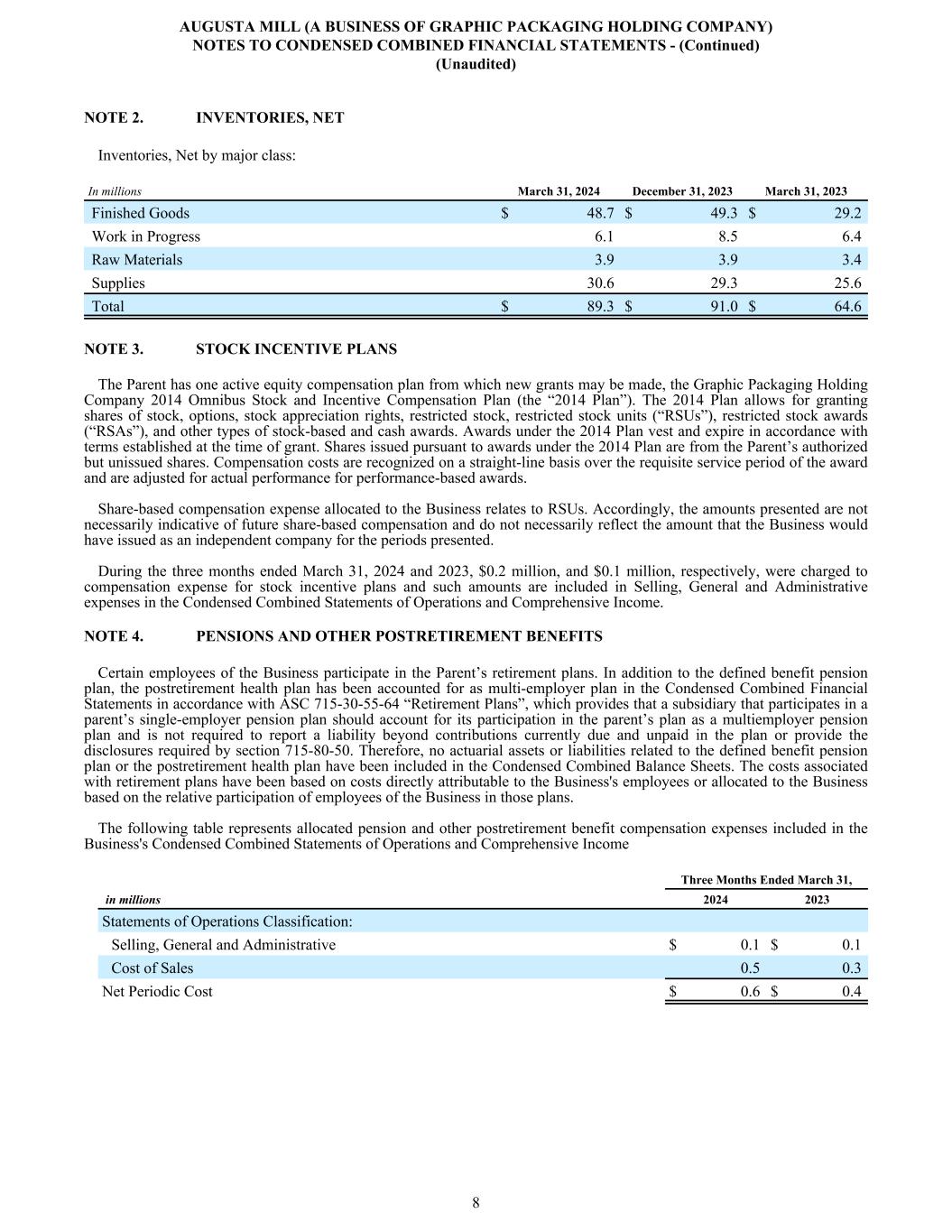

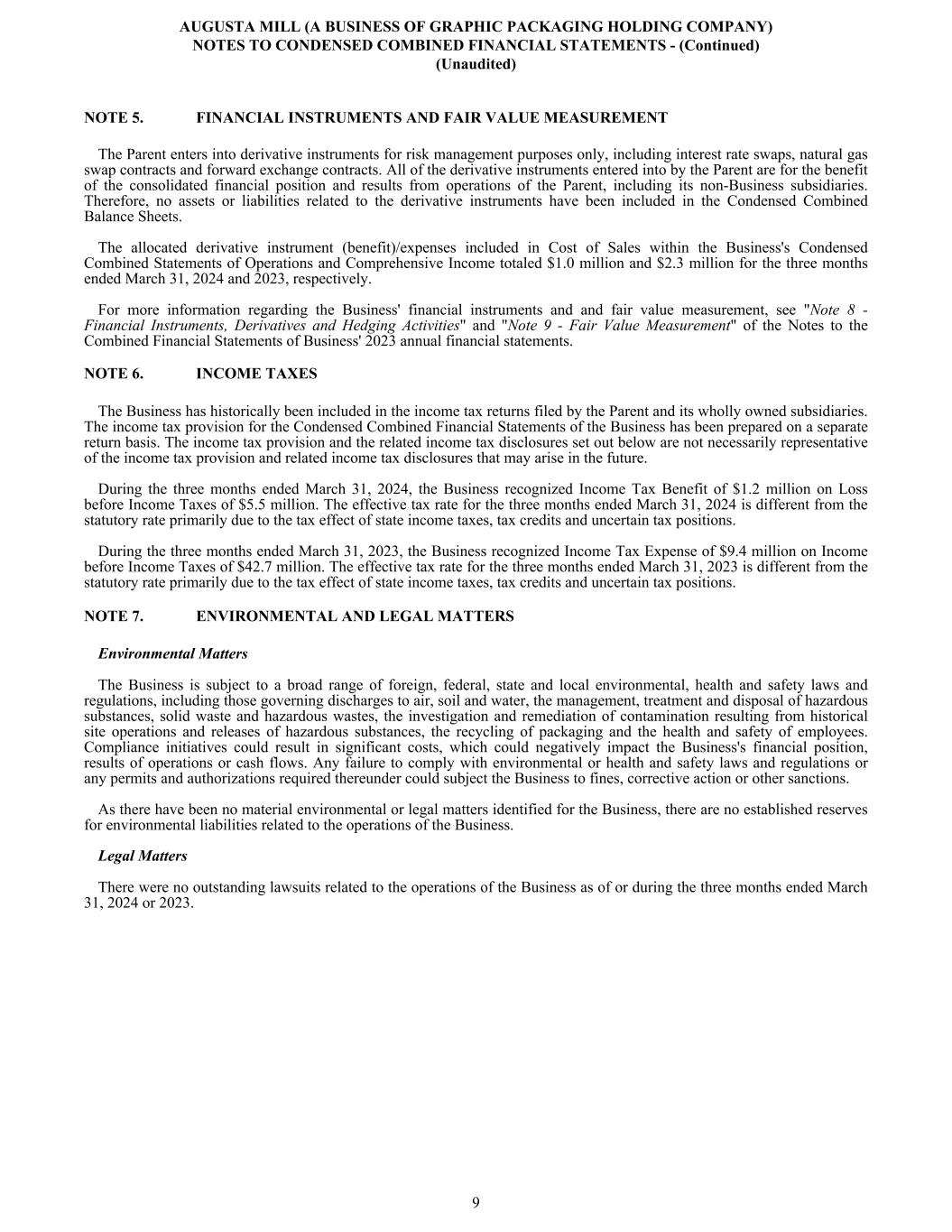

NOTE 2. INVENTORIES, NET Inventories, Net by major class: In millions March 31, 2024 December 31, 2023 March 31, 2023 Finished Goods $ 48.7 $ 49.3 $ 29.2 Work in Progress 6.1 8.5 6.4 Raw Materials 3.9 3.9 3.4 Supplies 30.6 29.3 25.6 Total $ 89.3 $ 91.0 $ 64.6 NOTE 3. STOCK INCENTIVE PLANS The Parent has one active equity compensation plan from which new grants may be made, the Graphic Packaging Holding Company 2014 Omnibus Stock and Incentive Compensation Plan (the “2014 Plan”). The 2014 Plan allows for granting shares of stock, options, stock appreciation rights, restricted stock, restricted stock units (“RSUs”), restricted stock awards (“RSAs”), and other types of stock-based and cash awards. Awards under the 2014 Plan vest and expire in accordance with terms established at the time of grant. Shares issued pursuant to awards under the 2014 Plan are from the Parent’s authorized but unissued shares. Compensation costs are recognized on a straight-line basis over the requisite service period of the award and are adjusted for actual performance for performance-based awards. Share-based compensation expense allocated to the Business relates to RSUs. Accordingly, the amounts presented are not necessarily indicative of future share-based compensation and do not necessarily reflect the amount that the Business would have issued as an independent company for the periods presented. During the three months ended March 31, 2024 and 2023, $0.2 million, and $0.1 million, respectively, were charged to compensation expense for stock incentive plans and such amounts are included in Selling, General and Administrative expenses in the Condensed Combined Statements of Operations and Comprehensive Income. NOTE 4. PENSIONS AND OTHER POSTRETIREMENT BENEFITS Certain employees of the Business participate in the Parent’s retirement plans. In addition to the defined benefit pension plan, the postretirement health plan has been accounted for as multi-employer plan in the Condensed Combined Financial Statements in accordance with ASC 715-30-55-64 “Retirement Plans”, which provides that a subsidiary that participates in a parent’s single-employer pension plan should account for its participation in the parent’s plan as a multiemployer pension plan and is not required to report a liability beyond contributions currently due and unpaid in the plan or provide the disclosures required by section 715-80-50. Therefore, no actuarial assets or liabilities related to the defined benefit pension plan or the postretirement health plan have been included in the Condensed Combined Balance Sheets. The costs associated with retirement plans have been based on costs directly attributable to the Business's employees or allocated to the Business based on the relative participation of employees of the Business in those plans. The following table represents allocated pension and other postretirement benefit compensation expenses included in the Business's Condensed Combined Statements of Operations and Comprehensive Income Three Months Ended March 31, in millions 2024 2023 Statements of Operations Classification: Selling, General and Administrative $ 0.1 $ 0.1 Cost of Sales 0.5 0.3 Net Periodic Cost $ 0.6 $ 0.4 AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) NOTES TO CONDENSED COMBINED FINANCIAL STATEMENTS - (Continued) (Unaudited) 8

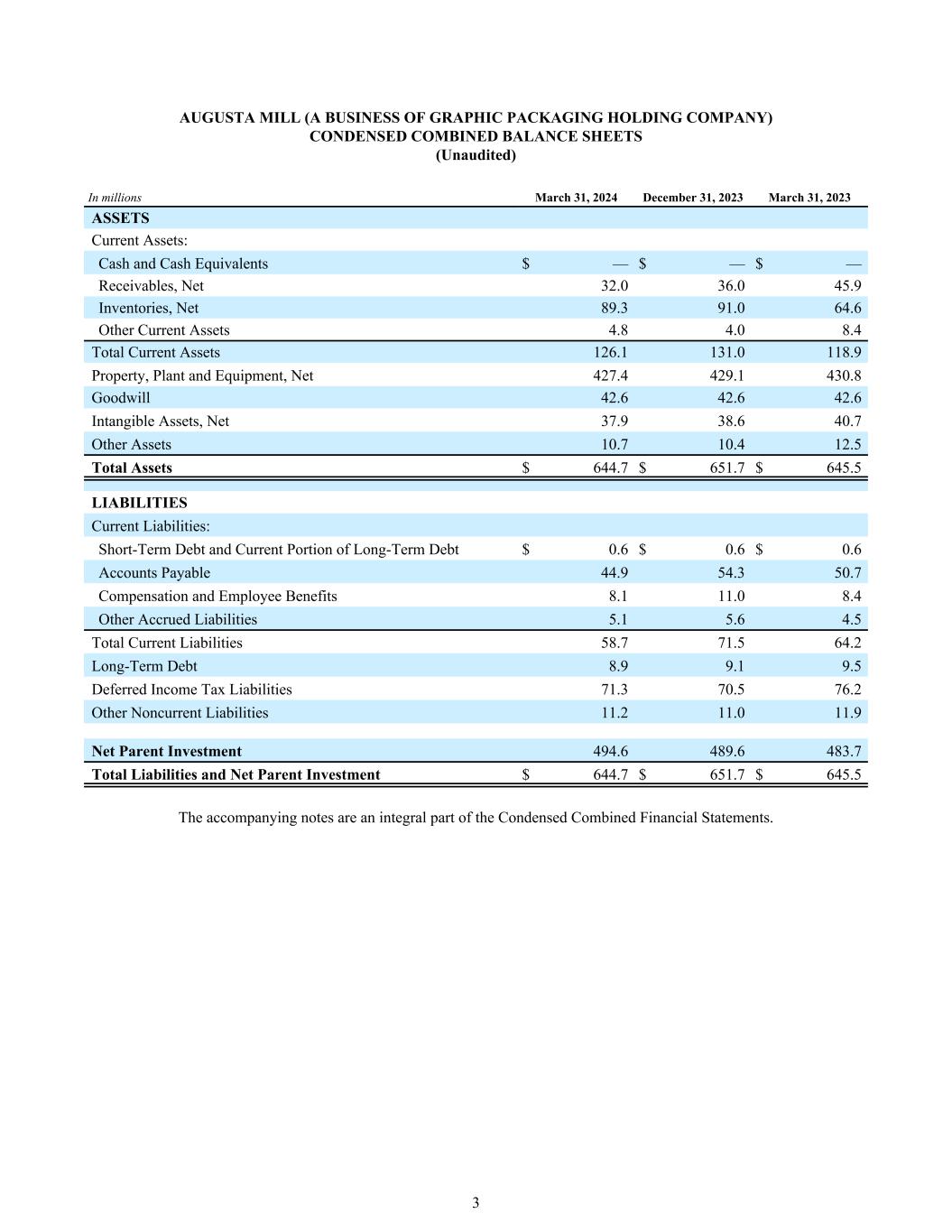

NOTE 5. FINANCIAL INSTRUMENTS AND FAIR VALUE MEASUREMENT The Parent enters into derivative instruments for risk management purposes only, including interest rate swaps, natural gas swap contracts and forward exchange contracts. All of the derivative instruments entered into by the Parent are for the benefit of the consolidated financial position and results from operations of the Parent, including its non-Business subsidiaries. Therefore, no assets or liabilities related to the derivative instruments have been included in the Condensed Combined Balance Sheets. The allocated derivative instrument (benefit)/expenses included in Cost of Sales within the Business's Condensed Combined Statements of Operations and Comprehensive Income totaled $1.0 million and $2.3 million for the three months ended March 31, 2024 and 2023, respectively. For more information regarding the Business' financial instruments and and fair value measurement, see "Note 8 - Financial Instruments, Derivatives and Hedging Activities" and "Note 9 - Fair Value Measurement" of the Notes to the Combined Financial Statements of Business' 2023 annual financial statements. NOTE 6. INCOME TAXES The Business has historically been included in the income tax returns filed by the Parent and its wholly owned subsidiaries. The income tax provision for the Condensed Combined Financial Statements of the Business has been prepared on a separate return basis. The income tax provision and the related income tax disclosures set out below are not necessarily representative of the income tax provision and related income tax disclosures that may arise in the future. During the three months ended March 31, 2024, the Business recognized Income Tax Benefit of $1.2 million on Loss before Income Taxes of $5.5 million. The effective tax rate for the three months ended March 31, 2024 is different from the statutory rate primarily due to the tax effect of state income taxes, tax credits and uncertain tax positions. During the three months ended March 31, 2023, the Business recognized Income Tax Expense of $9.4 million on Income before Income Taxes of $42.7 million. The effective tax rate for the three months ended March 31, 2023 is different from the statutory rate primarily due to the tax effect of state income taxes, tax credits and uncertain tax positions. NOTE 7. ENVIRONMENTAL AND LEGAL MATTERS Environmental Matters The Business is subject to a broad range of foreign, federal, state and local environmental, health and safety laws and regulations, including those governing discharges to air, soil and water, the management, treatment and disposal of hazardous substances, solid waste and hazardous wastes, the investigation and remediation of contamination resulting from historical site operations and releases of hazardous substances, the recycling of packaging and the health and safety of employees. Compliance initiatives could result in significant costs, which could negatively impact the Business's financial position, results of operations or cash flows. Any failure to comply with environmental or health and safety laws and regulations or any permits and authorizations required thereunder could subject the Business to fines, corrective action or other sanctions. As there have been no material environmental or legal matters identified for the Business, there are no established reserves for environmental liabilities related to the operations of the Business. Legal Matters There were no outstanding lawsuits related to the operations of the Business as of or during the three months ended March 31, 2024 or 2023. AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) NOTES TO CONDENSED COMBINED FINANCIAL STATEMENTS - (Continued) (Unaudited) 9

NOTE 8. RELATED PARTY TRANSACTIONS Related Party Purchases and Sales In addition to sales to external customers, the Business also sells its products to related entities controlled by the Parent which are not included within the Business. Such related party sales are included within the Net Sales within the Condensed Combined Statements of Operations and Comprehensive Income and were $31.5 million and $57.6 million for the three months ended March 31, 2024 and 2023, respectively. Allocated Centralized Costs Corporate expenses represent shared costs of Parent that have been allocated to the Business based on a systematic and rational methodology and are reflected as expenses in these Condensed Combined Financial Statements. These amounts include, but are not limited to, items such as general management and executive oversight, costs to support the Business's information technology infrastructure, facilities, compliance, human resources, legal and finance functions, risk management, and share-based compensation administration, all of which support the operations of the Business as a whole. Corporate expense allocations are generally allocated to the Business based on proportional cost allocation methods using sales, headcount, or other allocation methods that are considered to be a reasonable reflection of the utilization of services provided or benefit received by the Business during the periods presented. Total corporate expense allocations in general and administrative were $4.6 million and $4.6 million during the three months ended March 31, 2024 and 2023, respectively. Management considers the allocation methodologies used to be reasonable and appropriate reflections of the related expenses attributable to the Business for purposes of the Condensed Combined Financial Statements; however, the expenses reflected in these financial statements may not be indicative of the actual expenses that would have been incurred during the periods presented if the Business had operated as a standalone entity. In addition, the expenses reflected in the Condensed Combined Financial Statements may not be indicative of expenses that will be incurred in the future by the Business. Cash Management and Financing See "Note 1 - General Information" for details of the Business’s cash arrangements and additional information on the preparation and basis of presentation of these Condensed Combined Financial Statements. As of the date these Condensed Combined Financial Statements were available for issuance, there were no existing intercompany debt or other financing agreements in place with the Parent. NOTE 9. SUBSEQUENT EVENTS The Business has evaluated subsequent events through May 1, 2024, the date these Condensed Combined Financial Statements were available for issuance, and determined that there have been no events that have occurred that would require adjustments to our disclosures in the Condensed Combined Financial Statements. AUGUSTA MILL (A BUSINESS OF GRAPHIC PACKAGING HOLDING COMPANY) NOTES TO CONDENSED COMBINED FINANCIAL STATEMENTS - (Continued) (Unaudited) 10