- CLW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Clearwater Paper (CLW) DEF 14ADefinitive proxy

Filed: 6 Apr 21, 6:02am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

|

|

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ | Definitive Proxy Statement |

|

|

☐ | Definitive Additional Materials |

|

|

☐ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

CLEARWATER PAPER CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

|

| |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

|

| |

| (1) | Title of each class of securities to which transaction applies: |

|

|

|

| (2) | Aggregate number of securities to which transaction applies: |

|

|

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

| (4) | Proposed maximum aggregate value of transaction: |

|

|

|

| (5) | Total fee paid |

|

|

|

☐ | Fee paid previously with preliminary materials. | |

|

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

| |

| (1) | Amount Previously Paid: |

|

|

|

| (2) | Form, Schedule or Registration Statement No.: |

|

|

|

| (3) | Filing Party: |

|

|

|

| (4) | Date Filed: |

|

|

|

| Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | |

Clearwater Paper Corporation 2021

CLEARWATER PAPER CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

May 17, 2021

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

Clearwater Paper Corporation 2021

|

|

|

|

| Clearwater Paper Corporation 601 West Riverside, Suite 1100 Spokane, WA 99201

|

Dear Clearwater Paper stockholders and stakeholders:

As the COVID pandemic spread across our country, we at Clearwater Paper focused on two key priorities: keeping our people healthy and safe, and meeting the significant increase in demand for our essential products that were rapidly becoming in short supply. We managed to do both. I could not be prouder of our team of over 3,300 people across the country who made this happen – through their vigilance, commitment, and hard work. We took several steps to protect, support and thank our people during this time, including enhanced benefits, product distributions, and a discretionary bonus for more than 2,800 of our people.

While focusing on our people and customers, we delivered solid operational and financial results. We strengthened our balance sheet by reducing net debt by $200 million, re-financing our 2023 notes, and improving liquidity. You can read more about our 2020 accomplishments in the Business Highlights section.

2020 was certainly a challenging year, but we believe that we are well-positioned to benefit from key trends in the long run:

| • | Our products are inherently renewable. |

| o | The primary raw material we use is wood that we procure from sustainable sources. |

| o | As the world’s growing population places greater demands on scarce resources, the need to rely on renewable ones is growing. |

| • | As a leading provider of private-brand tissue products, we are positioned to benefit from consumers shift away from major brands. |

| • | Our expertise in tissue manufacturing, supply chain, and transportation is a key differentiator. |

| • | As a producer of high-quality paperboard, we are well-positioned to support the trend towards more sustainable packaging and foodservice products. |

| • | We operate well-invested paperboard assets, with a geographic footprint enabling us to efficiently service our customers. |

| • | We have a strong governance foundation, a gender-diverse leadership team, a diversity, equity and inclusion program, a wide array of employee benefits, and an ethics-based culture. |

| • | We are delivering strong business results that position us to continue to innovate and grow. |

We seek your voting support for the items described in this proxy statement and encourage you to participate in our annual meeting. I am truly honored and humbled to lead such a strong team and am grateful for your investment and trust in all of us.

Sincerely,

Arsen Kitch

Chief Executive Officer

Clearwater Paper Corporation 2021

i

PROXY STATEMENT TABLE OF CONTENTS

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS |

| 2 | |

|

|

| ||

| 4 | |||

|

|

|

|

|

|

|

|

|

|

2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS |

| 8 | |

|

|

| ||

Corporate Governance Guidelines; Code of Business Conduct and Ethics |

| 8 | ||

| 8 | |||

| 9 | |||

| 9 | |||

| 9 | |||

| 11 | |||

| 11 | |||

| 11 | |||

| 12 | |||

| 14 | |||

| 15 | |||

|

|

| ||

| 16 | |||

|

|

| ||

Nominees for Election at this Meeting for a Term Expiring in 2024 (Class I) |

| 16 | ||

| 17 | |||

| 18 | |||

|

|

| ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 20 | ||

|

|

|

|

|

|

|

| 22 | |

|

|

|

|

|

|

|

|

|

|

3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES |

| 25 | |

|

|

| ||

| 26 | |||

|

|

| ||

| 27 | |||

| 28 | |||

| 29 | |||

| 33 | |||

| 35 | |||

| 38 | |||

|

|

| ||

| 43 | |||

|

|

| ||

| 43 | |||

| 49 | |||

| 52 | |||

|

|

|

|

|

|

|

|

|

|

4 | AUDIT COMMITTEE REPORT |

| 59 | |

|

|

| ||

| 59 | |||

|

|

|

|

|

|

|

|

|

|

Clearwater Paper Corporation 2021

ii

|

|

|

|

|

5 | ANNUAL MEETING INFORMATION |

| 60 | |

|

|

| ||

| 61 | |||

|

|

| ||

| 61 | |||

|

|

|

|

|

|

|

|

|

|

6 | PROPOSALS |

| 67 | |

|

|

| ||

| 68 | |||

|

|

| ||

PROPOSAL 3—ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER |

| 69 | ||

|

|

| ||

|

|

|

|

|

Clearwater Paper Corporation 2021

iii

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Date: Monday, May 17, 2021

Time: 9:00 a.m. Pacific

Place: 601 West Riverside Avenue, Spokane, WA 99201 Via webcast: https://register.proxypush.com/CLW Record Date: March 18, 2021 |

| YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to vote and submit your proxy in order to ensure the presence of a quorum. Each attendee must present the proper form of documentation (as described in the section “Annual Meeting Information”) to be admitted. | ||||||

|

|

|

|

|

|

|

| |

| You may vote your shares in one of four ways: |

|

| |||||

| Return the proxy card by mail in the postage paid envelope |

| INTERNET go to www.proxyvote.com |

| TELEPHONE call the toll free number 1-800-690-6903 |

| IN PERSON Attend the annual meeting with your ID. | |

Meeting Agenda / Proposals | ||||||||

We are holding this meeting to:

| • | elect three directors to the Clearwater Paper Corporation Board of Directors; |

| • | ratify the appointment of our independent registered public accounting firm for 2021; |

| • | hold an advisory vote to approve the compensation of our named executive officers; and |

| • | transact any other business that properly comes before the meeting. |

Financial and other information concerning Clearwater Paper is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 2020. This proxy statement and our 2020 Annual Report to Stockholders are available on our website at www.clearwaterpaper.com by selecting “Investor Relations” and then “Financial Information & SEC Filings.” Additionally, and in accordance with SEC rules, you may access our proxy materials at www.proxyvote.com which does not have “cookies” that identify visitors to the site.

Notice Regarding the Availability of Proxy Materials | By Order of the Board of Directors, |

On or about April 6, 2021 we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to most of our stockholders containing instructions on how to access our 2021 Proxy Statement and 2020 Annual Report to Stockholders. Some of our stockholders, including stockholders that hold shares in one of our Clearwater Paper 401(k) Savings Plans, were not mailed the Notice and instead were mailed paper copies of our 2021 Proxy Statement and 2020 Annual Report on or about April 6, 2021. |

|

MICHAEL S. GADD | |

Senior Vice President, General Counsel and Corporate Secretary |

Clearwater Paper Corporation 2021

1

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. PROXY SUMMARY AND BUSINESS HIGHLIGHTS

CLEARWATER PAPER CORPORATION PROXY STATEMENT for the 2021 ANNUAL MEETING OF STOCKHOLDERS This proxy statement is being furnished to stockholders of Clearwater Paper Corporation in connection with the solicitation of proxies by our Board of Directors for use at our 2021 Annual Meeting of Stockholders, which is described below. References to “Clearwater Paper,” “the company,” “we,” “us” or “our” throughout this proxy statement mean Clearwater Paper Corporation.

|

This summary highlights important information you will find elsewhere in this Proxy Statement. It is only a summary and you should review the entire Proxy Statement before you vote.

Meeting Information

Date and Time | Location | Record Date | Mailing Date | |

Monday, May 17, 2021 | 601 West Riverside Avenue, Spokane, WA 99201 | March 18, 2021 | On or about | |

Via webcast: https://register.proxypush.com/CLW | ||||

Meeting Agenda / Proposals | ||||

Proposal | Board of Directors’ Recommendation | |||

1. Elect three directors to the Clearwater Paper Corporation Board of Directors | FOR each nominee | |||

2. Ratify the appointment of our independent registered public accounting firm for 2021 | FOR | |||

3. Hold an advisory vote to approve the compensation of our named executive officers | FOR | |||

4. Transact any other business that properly comes before the meeting | ||||

| ||||

Information regarding our executive compensation program can be found under the “Executive Compensation Discussion and Analysis” section found later in this proxy. | ||||

Clearwater Paper Corporation 2021

2

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

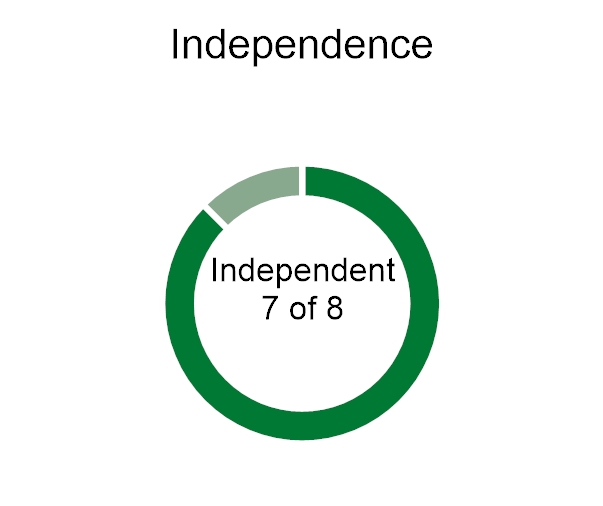

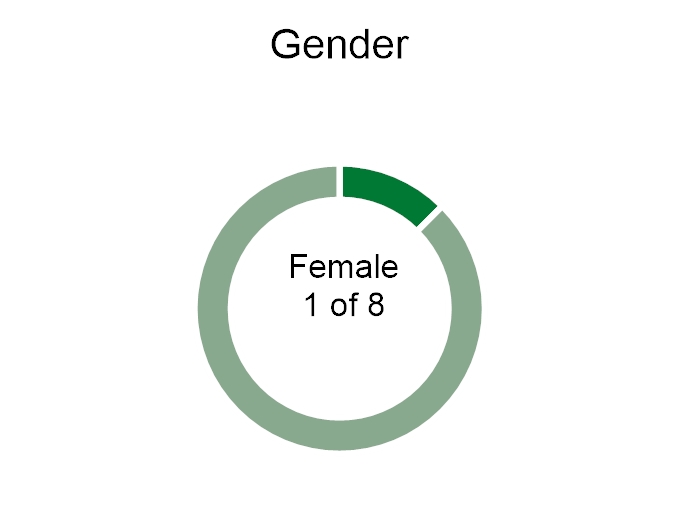

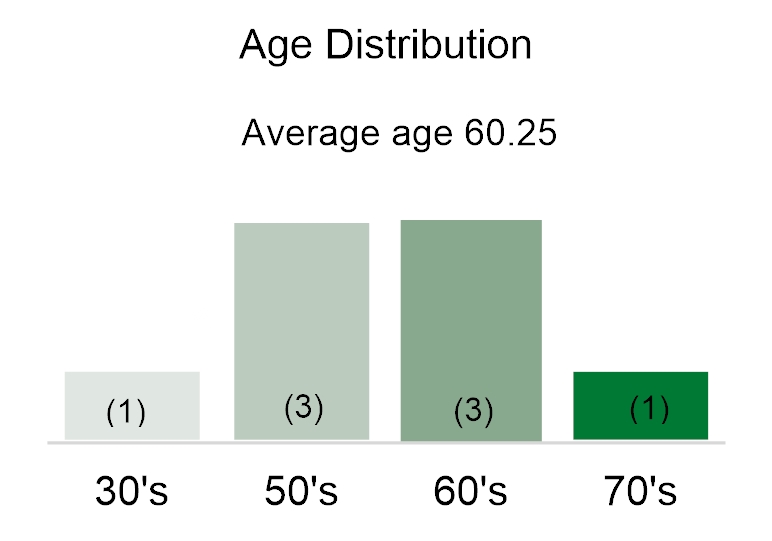

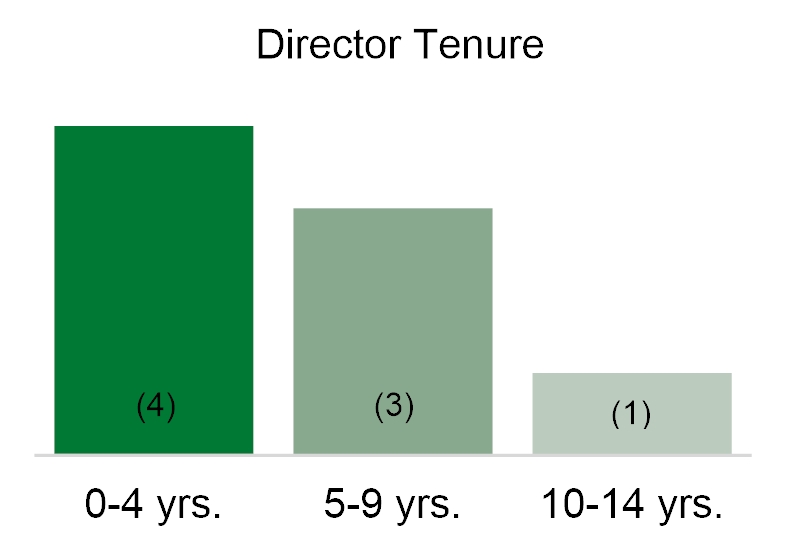

Board Composition and Diversity

Average tenure 5.2 years

| • | The above charts reflect information for all nominees and continuing directors. |

| • | Three independent directors have been added to the Board in the past two years. |

Director Nominees

This table provides a summary of information regarding our three director nominees. For more information regarding these nominees and our other directors see the “Board of Directors” section later in this Proxy Statement.

Name | Age | Director Since | Current Principal Occupation | Independent | Current Committee Memberships | Other Public Boards | ||

Audit | Compensation | Nominating and Corporate Governance |

| |||||

John J. Corkrean | 55 | 2019 | CFO of H.B. Fuller | Yes | * | * |

| 0 |

Arsen S. Kitch | 39 | 2020 | President & CEO of Clearwater Paper Corporation | No |

|

|

| 0 |

Alexander Toeldte | 61 | 2016 | Retired CEO | Yes |

| * | * | 0 |

Clearwater Paper Corporation 2021

3

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business highlights and sustainability

Corporate Governance Highlights

Independence |

•Our Board currently has 8 members, 7 of whom are independent. •There are three standing committees made up entirely of independent directors. •Independent directors regularly meet without management present. |

Board Practices |

•Our Board and its standing committees perform self-evaluations on an annual basis. •Each standing committee operates under a committee charter. •Our Board oversees risk management practices, including sound and effective ESG and human capital management practices. •Our Board regularly received information concerning, and provides input on, succession planning. •Our Board has adopted an insider trading policy, a related person policy, corporate governance guidelines, a code of business conduct and ethics, and a code of ethics for senior officers. •Our Board is committed to diversity and the pursuit of board refreshment and balanced tenure. •Our Board and its committee met 28 times in 2020. |

Leadership Structure |

• The Chair of our Board and the CEO are separate. |

Majority Vote |

• There is majority voting in uncontested director elections and M&A transactions. |

Stock Ownership Requirements |

•We have a comprehensive insider trading policy that covers directors, officers and other employees. •We have an anti-hedging and anti-pledging policy for our stock. •Directors and executive officers are all required to satisfy minimum stock ownership requirements. |

Stockholder Protection |

• There is only one vote for each share. • We do not have a “poison pill” in place. |

Clearwater Paper Corporation 2021

4

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We are a premier private brand tissue manufacturer and producer of high-quality paperboard products. Our products can provide more sustainable alternatives to products made from non-renewable resources.

Company |

•Implemented risk mitigation plan to protect employees and continue serving customers during the COVID-19 pandemic •Enhanced benefits to support employees through COVID-19 •Awarded bonuses to approximately 2,800 front-line workers •Appointed President & Chief Executive Officer - Arsen Kitch, Senior Vice President & Chief Financial Officer - Mike Murphy and Senior Vice President and Consumer Products General Manager - Joanne Shufelt •Ratified Lewiston contracts with United Steelworkers & International Brotherhood of Electrical Workers •Reduced net debt by $200 million •Repaid $160.8 million of term loan and refinanced 2023 notes with 2028 notes •Established the Diversity, Equity, and Inclusion steering committee |

Consumer Products Division |

•Met or exceeded customer expectations in spite of unprecedented volatility in consumer buying patterns •Adjusted business operations to support unprecedented tissue demand •Achieved Shelby, North Carolina paper machine ramp-up, new paper machine reached full production run rate •Expanded retailers’ capacity to grow their private brands through innovation of quality products •Received awards for outstanding support, execution, partnership, and distribution from major customers |

Pulp and Paperboard Division |

•Maintained strong and stable performance during COVID-19 pandemic •Introduced ReMagine™ premium folding carton paperboard with 30% recycled content •Received industry awards for paperboard packaging innovation and sustainability |

Clearwater Paper Corporation 2021

5

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sustainability and Human Capital Management

•We believe in careful utilization of our limited natural resources and understand our role in conserving and protecting the planet’s air, water, and land, and in managing climate change risk: oThe primary raw material in both our tissue and paperboard products is wood, which is 100% renewable and a commonly recycled resource. o100% of our wood comes from sustainably managed forests either controlled or certified by fiber sourcing standards, including Forest Stewardship Council (FSC®) Chain of Custody, Sustainable Forestry Initiative (SFI®), and Programme for the Endorsement of Forest Certification (PEFCTM). oOur paperboard products enable our customers to use renewable packaging rather than plastics. |

•Since 2012, we have reduced our costs and our environmental impact by designing out waste and pollution: oReduced our greenhouse gas emissions intensity by 3%. oReduced purchased energy intensity by 6%. oImproved water usage intensity by 11%. oIntroduced two new products with recycled content. NuVo®, cupstock with up to 35% post-consumer recycled fiber, and ReMagine™, a folding carton board with up to 30% post-consumer recycled fiber. oSignificantly reduced our waste-to-landfill intensity by 68%. |

•We support the principles of a circular economy and apply a management systems approach in each of our focus areas to support priorities and goals. |

•We utilize Global Reporting Initiative (GRI) Reporting Principles as the framework for our reporting and are committed to sharing our Environmental, Social and Governance (ESG) performance results and encourage open dialogue and feedback that helps make us better. |

•Our ESG reporting is both Sustainability Accounting Standards Board (SASB) and Task Force on Climate Related Financial Disclosure (TCFD) aligned. Our Environmental disclosures include: oWood Source Type, oWood Source Location, oTotal Energy and Energy Intensity, oEnergy Use by Source, oElectricity Use and Electricity Intensity, oPercentage Renewable Energy, oTotal CO2 Emissions and Emissions Intensity, and oWater Use and Water Intensity. |

Clearwater Paper Corporation 2021

6

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•We were recognized in 2020 for our safety and innovation efforts. |

oPulp & Paper Safety Association - Safety Innovator Award ▪Awarded for the development and implementation of an enclosed process that allows employees to safely sample chemical lines. oRISI - Packaging Innovation Award ▪Awarded for our NuVo® Cup Stock which has increased levels of post-consumer recycled fiber content while providing a hot cup print surface that allows for high-definition graphic design with less ink usage. |

•We believe that a sustained commitment to diversity, equity, and inclusion makes us a stronger organization. We are dedicated to fostering and sustaining an environment where our teammates, who stand beside us and work with us, are valued for their unique backgrounds, knowledge, skills, and experiences. |

•We maintain a human capital policy that supports a diverse and energized workforce with career advancement, role mobility opportunities, and strong health, safety, and wellness initiatives. Our values guide us beyond producing financial returns to serving our communities and developing our people. |

•We offer competitive benefits, including market-competitive compensation, healthcare, paid time off, parental leave, retirement benefits, tuition assistance, employee skills development, and leadership development, to attract and retain the best available talent. |

•We aspire to achieve zero workplace injuries and provide a safe, open, and accountable work environment for our employees. We provide several channels for all employees to speak up, ask for guidance, and report concerns related to ethics or safety violations. We address employee concerns and take appropriate actions that uphold our Clearwater Paper values, which include: oCommitment oCollaboration oCommunication oCourage oCharacter |

Clearwater Paper Corporation 2021

7

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Corporate Governance Guidelines; Code of Business Conduct and Ethics

We have established a corporate governance program to help guide our company and our employees, officers and directors in carrying out their responsibilities and duties as well as to set standards for their professional conduct. Our Board has adopted Corporate Governance Guidelines, or Governance Guidelines, which provide standards and practices of corporate governance that we have designed to help contribute to our success and to assure public confidence in our company. Our Governance Guidelines may be found on our website at www.clearwaterpaper.com under “Investors,” then “Governance.” In addition, all standing committees of the Board operate under charters that describe the responsibilities and practices of each committee.

We have adopted a Code of Business Conduct and Ethics, or Ethics Code, which provides ethical standards and corporate policies that apply to all our directors, officers and employees. Our Ethics Code requires, among other things, that our directors, officers and employees act with integrity and the highest ethical standards, comply with laws and other legal requirements, engage in fair competition, avoid conflicts of interest, and otherwise act in our best interests. We have also adopted a Code of Ethics for Senior Officers that applies to senior management and provides for accurate, full, fair and timely financial reporting and the reporting of information related to significant deficiencies in internal controls, fraud and legal compliance.

We have established procedures for confidentially and anonymously reporting concerns and potential violations regarding accounting, internal controls and auditing matters, as well as concerns regarding, or potential violations of, our ethics codes and other matters.

The role of our Board is to oversee and provide policy guidance on our business and affairs. The Board believes that it will best serve our stockholders if the majority of its members are independent. As of April 6, 2021, our Board had eight members, seven of whom are outside (non-employee) directors. The Independent Executive Chair of our Board, Alexander Toeldte, is an outside director. With the exception of Linda K. Massman, who served as our President and Chief Executive Officer until April 1, 2020, and Arsen S. Kitch who began serving as President and Chief Executive Officer on April 1, 2020, the Board has determined that none of our directors or their immediate family members have a material relationship with the company (either directly or as a partner, stockholder or officer of an organization that has a relationship with us), and none of our directors or their immediate family members are employees of our independent registered public accounting firm, KPMG LLP. All our outside directors are independent within the meaning of the New York Stock Exchange, or NYSE, listing standards and our Director Independence Policy.

Our Board meets regularly in executive session without members of management present and as the Board or its individual members deem necessary. Mr. Toeldte, as the Independent Executive Chair, presides over these sessions. Each standing committee of the Board also meets in executive session regularly and as the committee or its individual members deem necessary. Our directors are also invited to attend the meetings of committees of which they are not members, and regularly do so.

Clearwater Paper Corporation 2021

8

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Board and its committees met a total of 28 times in 2020. All directors serving in 2020 attended all Board meetings and all Board committees meetings for which they were a committee member during 2020. The Board does not have a policy requiring director attendance at annual meetings of our stockholders. However, all our directors attended our 2020 annual stockholders meeting by webcast and we anticipate that all will attend our 2021 annual stockholders meeting by webcast as well.

Stockholders and interested parties may contact our directors to provide comments, to report concerns, or to ask a question, by mail at the following address:

Corporate Secretary

Clearwater Paper Corporation

601 West Riverside Ave., Suite 1100

Spokane, Washington 99201

Stockholders and interested parties may also communicate with our directors as a group by using the form on our website at www.clearwaterpaper.com, by selecting “Investors,” then “Governance” and “Contact the Board.” All communications received will be processed by our Corporate Secretary. We forward all communications, other than those that are unrelated to the duties and responsibilities of the Board, to the intended director(s).

Our Audit Committee has established procedures to address concerns and reports of potential irregularities or violations regarding accounting, internal controls and auditing matters. Reports may be made on a confidential and anonymous basis. All such reports are directed through an independent, third-party hotline provider and are routed directly to the Chair of the Audit Committee. The procedures and hotline number are available by going to our public website at www.clearwaterpaper.com, and selecting “Investors,” then “Governance,” and “Procedures for the Reporting of Questionable Accounting and Auditing Matters.” Reports may also be made via the hotline provider’s website that is accessed through our website or intranet site.

Our Nominating and Governance Committee, or Nominating Committee, is responsible for identifying, evaluating, recruiting and recommending qualified candidates to our Board for nomination or election. The Board nominates directors for election at each annual meeting of stockholders and elects new directors to fill vacancies if they occur.

Our Board strives to find directors who are experienced and dedicated individuals with diverse backgrounds, perspectives and skills. Our Governance Guidelines contain membership criteria that call for candidates to be selected for their character, judgment, diversity of experience, business acumen and ability to act on behalf of and in the best interest of all stockholders. While we do not have a formal policy or requirement with respect to director diversity, we value members who represent diverse backgrounds and viewpoints and strive towards a board composition that encompasses such diversity. We added a new female Director in 2020 and the Nominating Committee is focused in the near term on identifying and nominating additional qualified female director candidates for the Board. To the extent it is able to do so in a manner consistent with our bylaws and Governance Guidelines, the Board seeks to have at least two female members before year-end 2021. The Nominating Committee will continue to review all measurable objectives for achieving diversity on the Board and recommend them to the Board for consideration. In addition, we expect each director to be committed to enhancing stockholder value and to have sufficient time to effectively carry out his or her duties as a director. Our Nominating Committee also seeks to ensure that a majority of our directors are independent under NYSE rules as well as our policies, and that one or more of our directors is an “Audit Committee Financial Expert” under SEC rules.

Clearwater Paper Corporation 2021

9

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior to our annual meeting of stockholders, our Nominating Committee identifies director nominees by first evaluating the current directors whose terms will expire at the annual meeting and who are willing to continue in service. These candidates are evaluated based on the criteria described above, the candidate’s prior service as a director, and the needs of the Board for any particular talents and experience. If a director no longer wishes to continue in service, if the Nominating Committee decides not to re-nominate a director, or if a vacancy is created on the Board because of a resignation or an increase in the size of the Board or other event, then the committee considers whether to replace such director or to decrease the size of the Board. If the decision is to replace a director, then the Nominating Committee considers various candidates for Board membership, including those suggested by committee members, by other Board members, a director search firm engaged by the committee, or our stockholders. Prospective nominees are evaluated by the Nominating Committee based on the membership criteria described above and set forth in our Governance Guidelines.

A stockholder who wishes to recommend a prospective nominee to the Board for consideration by the Nominating Committee must notify our Corporate Secretary in writing at our principal executive office located at 601 West Riverside Avenue, Suite 1100, Spokane, WA 99201. Each notice must include the information about the prospective nominee as would be required under our Amended and Restated Bylaws, or bylaws. Such notice must be delivered to our offices by the deadline relating to stockholder proposals to be considered for inclusion in our proxy materials, as described under “General Information—Stockholder Proposals for 2022” in this proxy statement.

Each notice delivered by a stockholder who wishes to recommend a prospective nominee to the Board for consideration by the Nominating Committee generally must include the following information about the prospective nominee:

| ▪ | the name, age, business address and residence address of the person; |

| ▪ | the principal occupation of the person; |

| ▪ | the number of shares of Clearwater Paper common stock owned by the person; |

| ▪ | a statement whether the person, if elected, intends to tender an irrevocable resignation effective upon (i) such person’s failure to receive the required vote for re-election and (ii) acceptance of such resignation by the Board; |

| ▪ | a description of all compensation and other relationships during the past three years between the stockholder and the person; |

| ▪ | any other information relating to the person required to be disclosed pursuant to Section 14 of the Exchange Act, and |

| ▪ | the person’s written consent to serve as a director if elected. |

The Nominating Committee may require any prospective nominee recommended by a stockholder to furnish such other information as the Nominating Committee may reasonably require to determine the eligibility of such person to serve as an independent director or that could be material to a stockholder’s understanding of the independence, or lack thereof, of such person.

The foregoing is only a summary of the detailed requirements set forth in our bylaws regarding director nominations by stockholders that would apply when a stockholder wishes to recommend a prospective nominee to the Board for consideration by the Nominating Committee. A more detailed description of the information that must be provided as to a prospective nominee is set forth in Article 3 of our bylaws, which are available on our website at www.clearwaterpaper.com by selecting “Investors” and then “Governance.”

Clearwater Paper Corporation 2021

10

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Board currently has three standing committees, as described below. The current charters of each of these committees are available on our website at www.clearwaterpaper.com by selecting “Investors” and then “Governance.”

Traditionally, the Board has elected to appoint one of its independent members to serve as Chair. In that role, Alexander Toeldte, acts as the lead independent director and, among other responsibilities, provides an independent contact to allow the other directors to communicate their views and concerns to management as well as presides over non-management executive sessions of Board meetings. Beginning on March 1, 2020, the Board appointed Mr. Toeldte to serve as the Independent Executive Chair on an interim basis to perform additional services to help facilitate the leadership change in our CEO position. Additionally, in that role Mr. Toeldte mentors and advises our new CEO, Arsen S. Kitch, and other senior management and assists with major stockholder engagement and management in their role in strategic planning when requested by the CEO. Our Board believes that an independent Chair with prior corporate governance experience combined with a President and CEO who manages the day-to-day operations of our company while also serving as a director, provides our Board with an optimal balance in terms of leadership structure at this point in time.

In the future, the Board may elect to have the role of Board Chair and CEO performed by the same person, as other companies in our industry do. If we were to adopt that structure, the Board would appoint one of its independent members to serve as Vice Chair, who would act as the lead independent director and, among other responsibilities, provide an independent contact to allow the other directors to communicate their views, and concerns to management as well as preside over non-management executive sessions of Board meetings.

One of the responsibilities of our Board is to provide oversight of our risk management practices in order to ensure appropriate risk management systems are employed throughout the company. Management, which is responsible for the day-to-day assessment and mitigation of our risks, utilizes an enterprise risk management, or ERM, program, which is an enterprise-wide program designed to enable effective and efficient identification and management of critical enterprise risks and to facilitate the incorporation of risk considerations into decision making. To assist and strengthen management’s risk assessment and mitigation efforts, we have a Risk Management Committee whose management members represent a company-wide perspective and provide subject matter expertise as part of our ERM process. Through the ERM process, management identifies, monitors and mitigates risks and regularly reports to the Board or a committee of the Board as to the assessment and management of those risks.

The Board’s standing committees support the Board by regularly addressing various issues within their respective areas of oversight. The Audit Committee’s responsibilities include reviewing and overseeing major financial risk exposures and the steps management has taken to monitor and control these exposures. Management, on a regular basis, provides the committee with its assessment and mitigation efforts in regard to particular risks facing the company that have been identified through the ERM process or other processes. Our Audit Committee also reviews with our independent auditors the adequacy and effectiveness of our internal controls over financial reporting. Additionally, our Vice President, Internal Audit provides the Audit Committee with regular updates on our systems of internal controls over financial reporting, and our General Counsel reviews with the committee significant litigation, claims and regulatory and legal compliance matters.

Clearwater Paper Corporation 2021

11

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Compensation Committee assists the Board in fulfilling its risk management oversight responsibilities associated with risks arising from our compensation policies and programs. Each year management and the Compensation Committee review whether risks arising from our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on the company. The Nominating Committee assists the Board in fulfilling its risk management oversight responsibilities associated with risks related to corporate governance structures and processes. Each of the committee chairs, as appropriate, reports to the full Board at regular meetings concerning the activities of the committee, any significant issues it has discussed, and the actions taken by the committee.

The Board’s role in risk oversight is consistent with its leadership structure. We believe that our Board’s leadership structure facilitates its oversight of our risk management practices by combining the day-to-day knowledge of our business possessed by our President and CEO as a member of the Board, with the independence provided by our Independent Executive Chair and independent Board committees.

The following table shows the membership of each committee as of April 6, 2021:

|

|

|

|

|

| Nominating |

|

| Audit |

| Compensation |

| and Governance |

Name |

| Committee |

| Committee |

| Committee |

John J. Corkrean |

| X (Chair) |

| X |

|

|

Kevin J. Hunt |

| X |

| X (Chair) |

|

|

Arsen S. Kitch |

|

|

|

|

|

|

William D. Larsson |

| X |

|

|

| X |

Joe W. Laymon |

|

|

| X |

| X |

Ann C. Nelson |

| X |

|

|

| X |

John P. O'Donnell |

| X |

|

|

| X (Chair) |

Alexander Toeldte (Independent Executive Chair of the Board) |

|

|

| X |

| X |

Meetings in Fiscal 2020 |

| 8 |

| 6 |

| 5 |

Clearwater Paper Corporation 2021

12

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Members: John J. Corkrean* (Chair) (since May 2019 and Chair since September 2019) |

* Audit Committee financial expert as defined by NYSE and SEC rules. |

Each member has been determined by the Board to be independent within the meaning of the NYSE listing standards and our Director Independence Policy. |

Description and Key Responsibilities: |

• Assists the Board in its oversight of our accounting, financial reporting and internal accounting control matters. • Reviews the quarterly and audited annual financial statements (as more fully described in its charter.) • Exercises sole authority to select, compensate and terminate our independent registered public accounting firm as well as the committee’s own consultants and advisors. • Oversees the appointment, compensation and replacement of our Vice President, Internal Audit. • Reviews our Related Person Transactions Policy and considers any related person transactions. See “Transactions with Related Persons”. • Pre-approves the independent registered public accounting firm’s audit fees and non-audit services and fees in accordance with criteria adopted by the committee. |

|

Current Members: Kevin J. Hunt (Chair) (since January 2013 and Chair since May 2016) |

Each member has been determined by the Board to be independent within the meaning of the NYSE listing standards and our Director Independence Policy. |

Description and Key Responsibilities: |

• Oversees our executive compensation and benefits programs, including establishing the performance measurements and targets for executive officers’ incentive pay. • Annually reviews and approves executive compensation. • Coordinates with our Board Chair the annual performance review of our Chief Executive Officer. • Reviews the “Executive Compensation Discussion and Analysis” contained in this proxy statement and recommends its inclusion to the full Board for approval. • Exercises sole authority to select, compensate and terminate its own compensation consultants or other advisors. |

Clearwater Paper Corporation 2021

13

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Members: John P. O’Donnell (Chair) (since May 2018 and Chair since May 2020) |

Each member has been determined by the Board to be independent within the meaning of the NYSE listing standards and our Director Independence Policy. |

Description and Key Responsibilities: |

• Identifies, evaluates, recruits and recommends to the Board nominees for election as directors. • Develops and recommends to the Board corporate governance principles. • Oversees the evaluation of the Board and assists in the evaluation of management. • Director succession planning is also a focus of the Nominating Committee with striking a balance between Board refreshment and the need for new or additional skill sets with maintaining the institutional knowledge about our business and operating history. • Exercises sole authority to select, compensate and terminate its own consultants and advisors. |

Compensation Committee Interlocks and Insider Participation

John J. Corkrean, Kevin J. Hunt, Joe W. Laymon, John P. O’Donnell, and Alexander Toeldte each served as a member of our Compensation Committee during 2020. All are outside directors, and none of our named executive officers served as a director or as a member of a Compensation Committee of any business entity employing any of our directors during 2020.

Transactions with Related Persons

Securities laws require us to disclose certain business transactions that are considered related person transactions. In order to comply with these requirements, our Board has adopted a Related Person Transactions Policy that applies to our directors and executive officers, any beneficial owner of more than 5% of our voting stock, any immediate family member of any of the foregoing persons, and any entity that employs any of the foregoing persons, or in which any of the foregoing persons is a general partner, principal or 10% or greater beneficial owner. Transactions covered by this policy are those in which (a) we or any of our subsidiaries participate, (b) the amount involved exceeds $120,000, and (c) any related person had, has or will have a direct or indirect material interest, as defined in the policy.

Any proposed related person transaction is reviewed by our Audit Committee at its next regularly scheduled meeting, unless our General Counsel and Corporate Secretary determines that it is not practicable or desirable to wait until the next scheduled meeting for a particular transaction, in which case the Chair of the Audit Committee has the authority to review and consider the proposed transaction. Only those transactions determined to be fair and in our best interests are approved, after taking into account all factors deemed relevant by the Audit Committee, or its Chair, as the case may be. If the Chair

Clearwater Paper Corporation 2021

14

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

approves any related person transaction, then that approval is reported to the Audit Committee at its next regularly scheduled meeting.

We did not conduct any transactions with related persons in 2020 that would require disclosure in this proxy statement or that required approval by the Audit Committee pursuant to the policy described above.

Clearwater Paper Corporation 2021

15

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Board of Directors is divided into three classes serving staggered three-year terms. The average tenure of our directors is 5.2 years. At the Annual Meeting, our stockholders will be asked to elect three individuals to serve as directors until the 2024 Annual Meeting. See “Proposal No. 1—Election of Directors.” Our bylaws require our directors to be elected by a majority vote of the shares of common stock present or represented by proxy and entitled to vote at the Annual Meeting.

Below are the names and ages of our eight directors as of the date of this proxy statement, the year each became a director, each director’s principal occupation or employment for at least the past five years, and other public company directorships held by each director during the past five years. Unless authority is withheld, the persons named as proxies in the voting materials made available to you or in the accompanying proxy will vote for the election of the nominees listed below. We have no reason to believe that any of these nominees will be unable to serve as a director. If any of the nominees becomes unavailable to serve, however, the persons named as proxies will have discretionary authority to vote for a substitute nominee.

Nominees for Election at this Meeting for a Term Expiring in 2024 (Class I)

Biography: Mr. Corkrean (age 55) has been a director since May 2019. Mr. Corkrean currently serves as executive vice president and chief financial officer for H.B. Fuller Company (NYSE:FUL), a global adhesive, sealants and chemical products manufacturer, a position he has held since 2016. Prior to that he was employed by Ecolab for 17 years in a series of financial leadership roles concluding from 2014-2016 as senior vice president, finance for the global energy service division.

Qualifications: Our Nominating Committee believes Mr. Corkrean’s financial and public company expertise and leadership background make him an asset to our Board.

Arsen S. Kitch

Biography: Mr. Kitch (age 39) has been a director since April 1, 2020. He has served as the company’s president and CEO since April 1, 2020. He served as the company’s senior vice president, general manager, consumer products division from May 2018 to April 2020 and served as vice president, general manager, consumer products division from January 2018 to May 2018. He served as the company’s vice president, finance and vice president financial planning and analysis from January 2015 through December 2017, and served as senior director, strategy and planning from August 2013 through December 2014.

Qualifications: Our Nominating Committee believes as the CEO, Mr. Kitch’s knowledge of our day-to-day operations and effectiveness of our business strategies provides a valuable perspective to the Board. Additionally, Mr. Kitch’s experience, knowledge, skills and expertise acquired having served as CEO, senior vice president of a major division and vice president in the financial and strategical planning aspects of the company, add significant value to the Board.

Clearwater Paper Corporation 2021

16

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alexander Toeldte

Biography: Mr. Toeldte (age 61) has been a director since April 2016. Mr. Toeldte has served as the chairman of Jitasa, Inc., a privately held provider of accounting and financial management services for non-profit organizations, since 2014 and is a member of its compensation committee. He served as a director of Xerium Technologies, Inc. (NYSE:XRM), a global provider of industrial consumable products and services from 2016 until the company’s sale in 2018 and was a member of its compensation committee and governance committee. He served as an operating director at Paine & Partners, LLC, a private equity firm from 2015 to 2016. Mr. Toeldte served as president, CEO and a director of Boise Inc., a paper manufacturer, from February 2008 to 2013 and at Boise Cascade and as its executive vice president, paper, packaging and newsprint segments from October 2005 to 2008. Mr. Toeldte’s previous experience includes serving as executive vice President of Fonterra Co-operative Group from 2001 to 2003, a New Zealand based global dairy company, and CEO of Fonterra Enterprises. Mr. Toeldte served in various capacities with Fletcher Challenge Limited Group from 1999 to 2001, a New Zealand based group with holdings in paper, forestry, building materials, and energy, including as CEO of Fletcher Challenge Building from 2000 to 2001 and Fletcher Challenge Paper from 1999 to 2000, as well as Group CFO in 1999. He also served as chair of the board of Fletcher Challenge Canada. Mr. Toeldte served in 2012 as chairman and is currently a member of the board of the American Forest & Paper Association.

Qualifications: Our Nominating Committee believes Mr. Toeldte’s experience in the consumer products and paper industries, financial expertise, and leadership and board experience make him an asset to our Board

Directors Continuing in Office until 2022 (Class II)

Biography: Mr. Hunt (age 69) has been a director since January 2013. From January 2013 to January 2014, he served as a consultant to ConAgra Foods, Inc., which acquired Ralcorp Holdings Inc. in January 2013. Mr. Hunt served as president, CEO and a director of Ralcorp Holdings Inc., a producer of private-brand foods and food service products from January 2012 to January 2013. He served as co-CEO and president of Ralcorp from 2003 until 2012 and as a director from 2004 until the company’s acquisition in 2013. Prior to that period, Mr. Hunt was corporate vice president and president of Bremner Food Group. Mr. Hunt served as an advisory director of Berkshire Partners LLC, a private equity firm, from 2013 to 2015. He served as a director of Vi Jon, a manufacturer of private label personal care products owned by Berkshire Partners, from 2012 to 2017. Since August 2018, he has served as a senior advisor for C.H. Guenther and Son, Inc., a leading producer of branded and private-label food products.

Current Public Directorships: Mr. Hunt has served as a director of Energizer Holdings, Inc. (NYSE: ENR), a manufacturer of primary batteries and portable lighting products since its spin-off from Edgewell Personal Care Company (NYSE: EPC) in July 2015. He is a member of Energizer’s human capital committee and serves as chairman of its finance and oversight committee.

Qualifications: Our Nominating Committee believes his experience with private label consumer product companies, financial expertise, strategic planning and both management and board experience make him an asset to our Board.

Clearwater Paper Corporation 2021

17

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

William D. Larsson

Biography: Mr. Larsson (age 75) has been a director since December 2008. Mr. Larsson served as senior vice president and CFO of Precision Castparts Corp., an industrial manufacturing company, from August 2000 until his retirement in December 2008.

Current Public Directorships: Mr. Larsson has served as a director and chair of the nominating and corporate governance committee and is a member of the audit committee of Schnitzer Steel Industries, Inc. (NASDAQ: SCHN), a manufacturer of recycled metal products. Mr. Larsson served as lead director of Schnitzer Steel from 2008 to 2014.

Qualifications: Our Nominating Committee believes his experience as a founding director, as a financial expert, and experience as a lead independent director of another public company make him an asset to our Board.

Ann C. Nelson

Biography: Ms. Nelson (age 61) has been a director since May 2020. Ms. Nelson served as a lead audit partner of KPMG, LLP., an audit services firm, from August 1982 until her retirement in September 2019. Prior to that she served in various positions with KPMG including lead client partner.

Current Public Directorships: Ms. Nelson has served as a director and chair of the audit committee and is a member of the nominating and corporate governance committee of Rayonier, Inc. (NYSE: RYN), a timber REIT since 2020.

Qualifications: Our Nominating Committee believes Ms. Nelson’s leadership capabilities, knowledge of the paper industry as well as experience as a financial expert, and experience as a chair of the audit committee of another public company make her an asset to our Board.

Directors Continuing in Office until 2023 (Class III)

Joe W. Laymon

Biography: Mr. Laymon (age 68) has been a director since May 2019. Mr. Laymon served as vice president, human resources and corporate services at Chevron Corporation (NYSE:CVX), a leading global integrated energy company from 2008 until his retirement in 2017.

Current Public Directorships: Mr. Laymon has served on the board of directors for Peabody Energy (NYSE:BTU), a global coal company, since 2017 and serves as the chair of the compensation committee as well as is a member of the health, safety, security & environmental committee.

Qualifications: Our Nominating Committee believes Mr. Laymon’s leadership and executive compensation and human resources experience and experience as a chair of the compensation committee of another public company make him an asset to our Board.

John P. O’Donnell

Biography: Mr. O’Donnell (age 60) has been a director since April 2016. Mr. O’Donnell served as president and CEO of Neenah, Inc. (NYSE: NP), a global specialty materials company, from May 2011 and as a director from November 2010 until his retirement in July 2020. He served as Neenah

Clearwater Paper Corporation 2021

18

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inc.’s COO from June 2010 to May 2011 and as president, Fine Paper from 2007 to June 2010. Mr. O'Donnell was employed by Georgia-Pacific Corporation from 1985 until 2007 and held increasingly senior management positions in the consumer products division where he served as president of the north american retail business from 2004 through 2007, and as president of the north american commercial tissue business from 2002 through 2004.

Qualifications: Our Nominating Committee believes Mr. O’Donnell’s leadership, strategic planning and consumer product paper industry experience make him an asset to our Board.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF THE THREE NOMINEES FOR DIRECTOR.

Clearwater Paper Corporation 2021

19

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

This table shows the number of shares of common stock beneficially owned, by each owner of more than 5% of our common stock, each of our directors, each executive officer for whom compensation is reported in this proxy statement, and all directors and executive officers as a group. Except for our 5% holders, the table shows beneficial ownership as of March 18, 2021. The number of shares reported is based on data provided to us by the beneficial owners of the shares. The percentage ownership data is based on 16,678,422 shares of common stock outstanding as of March 18, 2021. Under SEC rules, beneficial ownership includes shares over which the person or entity exercises voting or investment power and also any shares that the person or entity has the right to acquire within 60 days of March 18, 2021. Except as noted, and subject to applicable community property laws, each owner has sole voting and investment power over the shares shown in this table.

|

| Amount and Nature of Common Stock Beneficially Owned |

|

|

| ||

|

| Number of Shares Beneficially Owned |

| Percent of Class |

| Common Stock Units (1) |

|

Stockholders Owning More Than 5% |

|

|

|

|

|

|

|

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 |

| 2,551,890 | (2) | 15.30% |

|

|

|

T. Rowe Price Associates, Inc. 100 E. Pratt Street Baltimore, MD 21202 |

| 1,776,885 | (3) | 10.65% |

|

|

|

Dimensional Fund Advisors LP 6300 Bee Cave Road, Building One Austin, TX 78746 |

| 1,354,725 | (4) | 8.12% |

|

|

|

The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 |

| 1,080,073 | (5) | 6.48% |

|

|

|

Directors and Named Executive Officers |

|

|

|

|

|

|

|

John J. Corkrean |

| - |

| * |

| 9,278 |

|

Kevin J. Hunt |

| - |

| * |

| 22,585 |

|

Arsen S. Kitch |

| 34,129 | (6) |

|

|

|

|

William D. Larsson |

| 1,000 |

| * |

| 65,892 |

|

Joe W. Laymon |

| - |

|

|

| 9,278 |

|

Linda K. Massman |

| 25,500 | (7) | * |

|

|

|

Ann C. Nelson |

| 3,000 | (8) |

|

| 4,053 |

|

John P. O'Donnell |

| - |

| * |

| 17,034 |

|

Alexander Toeldte |

| - |

| * |

| 17,034 |

|

Steve M. Bowden |

| 3,269 |

| * |

|

|

|

Michael S. Gadd |

| 91,624 | (9) | * |

|

|

|

Robert G. Hrivnak |

| 1,098 | (10) |

|

|

|

|

Kari G. Moyes |

| 38,516 | (11) | * |

|

|

|

Michael J. Murphy |

| 2,376 | (12) | * |

|

|

|

Directors and Executive Officers as a Group |

|

|

|

|

|

|

|

(13 persons) |

| 340,559 |

| 2.01% |

| 259,217 |

|

* | Less than 1% |

Clearwater Paper Corporation 2021

20

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) | Represents vested common stock units as of March 18, 2021, as well as 4,053 common stock units for each director that will vest within 60 days of March 18, 2021. These stock units are not actual shares of common stock and have no voting power. In the case of our non-employee directors, these stock units are credited, along with any accrued dividend equivalents, on a one-for-one basis with common stock pursuant to our Deferred Compensation Plan for Directors (see “Compensation of Directors”). The annual deferred awards to non-employee directors are converted to cash and paid upon separation from service as a director. |

(2) | Based on the stockholders’ Schedule 13G filed on January 25, 2021 with the SEC, the stockholder serves as a parent holding company registered under the Investment Advisors Act, with sole dispositive power over all of these shares and sole voting power over 2,520,592 of these shares of common stock as of December 31, 2020. The Schedule indicates that sole dispositive power over all these shares is held as of December 31, 2020, by the following subsidiaries of Blackrock, Inc.: BlackRock Advisors, LLC; BlackRock Investment Management (UK) Limited; BlackRock Asset Management Canada Limited; BlackRock Investment Management (Australia) Limited; BlackRock (Netherlands) B.V.; BlackRock Fund Advisors; BlackRock Asset Management Ireland Limited; BlackRock Institutional Trust Company, National Association; BlackRock Financial Management, Inc.; BlackRock Asset Management Schweiz AG, and BlackRock Investment Management, LLC. BlackRock Fund Advisors beneficially owns 5% or more of the total shares owned by BlackRock, Inc. More than 5% of the total outstanding shares are held in the interest of iShares Core S&P Small-Cap ETF. |

(3) | Based on the stockholders’ Schedule 13G/A filed jointly on February 16, 2021 with the SEC. T. Rowe Price Associates, Inc. serves as an investment advisor with sole voting power over 636,817 and sole dispositive power of 1,776,885 of these shares as of December 31, 2020, and T. Rowe Price Small-Cap Value Fund, Inc. serves as an investment company registered under the Investment Advisors Act, with sole voting power over 1,074,479 of these shares and sole dispositive power over none of these shares as of December 31, 2020. The schedule indicates that these shares are held as of December 31, 2020, by various individual and institutional clients. For the purpose of the reporting requirements of the Securities Exchange Act of 1934, T. Rowe Price Associates, Inc. and T. Rowe Small-Cap Value Fund, Inc. are deemed to be beneficial owners of such securities; however, each expressly disclaims that it is, in fact, the beneficial owner of such securities. |

(4) | Based on the stockholder’s Schedule 13G/A filed on February 12, 2021 with the SEC, the stockholder serves as an investment advisor registered under the Investment Advisors Act, with sole dispositive power over all of these shares, and sole voting power over 1,301,558 of these shares as of December 31, 2020 (subject to the provisions of Note 1 of such 13G/A), however, Dimensional Fund Advisors LP disclaims beneficial owner of such securities. |

(5) | Based on the stockholders’ Schedule 13G/A filed on February 10, 2021 with the SEC, the stockholder serves as an investment advisor registered under the Investment Advisors Act, with sole dispositive power over 1,046,803 of these shares, shared dispositive power over 33,270 of these shares, and shared voting power over 18,314 of these shares as of December 31, 2020. The Schedule indicates that all these shares are held by various individuals and institutional investors including Vanguard Asset Management, Limited; Vanguard Fiduciary Trust Company; Vanguard Global Advisors, LLC; Vanguard Group (Ireland) Limited; Vanguard Investments Australia Ltd; Vanguard Investments Canada Inc.; Vanguard Investments Hong Kong Limited; and Vanguard Investments UK, Limited as of December 31, 2020. |

(6) | Mr. Kitch became President and CEO on April 1, 2020. Includes 19,932 shares of common stock exercisable under vested stock options and 6,490 restricted stock units that will vest on April 1, 2021. |

(7) | Ms. Massman served as President and CEO through May 31, 2020. |

(8) | Ms. Nelson joined the Board on May 13, 2020. |

(9) | Includes (i) 28 shares of common stock held in Mr. Gadd’s individual account under our 401(k) employee savings plan, and (ii) 42,630 shares of common stock exercisable under vested stock options. |

(10) | Mr. Hrivnak served as CFO through April 8, 2020. |

(11) | Ms. Moyes shares includes 29,169 shares of common stock exercisable under vested stock options. |

(12) | Mr. Murphy joined the Company as Senior Vice President, CFO on April 13, 2020. Includes 2,376 restricted stock units that will vest on April 13, 2021. |

Clearwater Paper Corporation 2021

21

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Nominating Committee reviews and makes recommendations to our Board concerning director compensation. Similar to our philosophy regarding executive compensation, our philosophy regarding director compensation is to provide our directors a fair compensation package that is tied to the services they perform as well as to the performance of the company, with the objective of recruiting and retaining an outstanding group of directors.

The Nominating Committee, pursuant to the authority granted under its charter, engaged Semler Brossy Consulting Group to advise it on director compensation matters for 2020. Semler Brossy’s assessment was taken into consideration in establishing our current director compensation, which is targeted to be at the median of compensation paid by comparable companies.

2020 Compensation of Non-Employee Directors

Name |

| Fees Earned or Paid in Cash ($)(1) |

|

| Stock Awards ($)(2) |

| All Other Compensation ($) |

| Total ($) |

John J. Corkrean |

| $108,750 |

|

| $114,714 |

| - |

| $223,464 |

Kevin J. Hunt |

| $110,500 |

|

| $114,714 |

| - |

| $225,214 |

William D. Larsson |

| $94,000 |

|

| $114,714 |

| - |

| $208,714 |

Joe L. Laymon |

| $83,500 |

|

| $114,714 |

|

|

| $198,214 |

Ann C. Nelson |

| $57,692 | (3) |

| $114,714 |

| - |

| $172,406 |

John P. O'Donnell |

| $92,250 |

|

| $114,714 |

| - |

| $206,964 |

Alexander Toeldte |

| $278,167 |

|

| $114,714 |

| - |

| $392,881 |

(1) | Represents annual retainers for 2020, as well as any amounts earned for service as Chair or committee Chair as well as committee membership retainers. |

(2) | This column shows the aggregate grant date fair value, computed in accordance with FASB ASC Topic 718, of stock units granted in 2020. In accordance with FASB ASC Topic 718, the grant date fair value reported for all stock units was computed by multiplying the number of stock units by the closing price of our stock on the grant date. The aggregate number of vested and unvested phantom common stock units credited for service and deferred fees as a director outstanding as of December 31, 2020 for each non-employee director was as follows: Mr. Corkrean— 9,278 units; Mr. Hunt—22,585 units; Mr. Larsson—65,892 units; Mr. Laymon— 9,278 units; Ms. Nelson— 4,053 units; Mr. O’Donnell—17,034 units and Mr. Toeldte—17,034 units. |

(3) | Ms. Nelson joined the company on May 1, 2020. |

During 2020, one of our directors, Arsen S. Kitch, also served as our CEO. As a result, he did not receive compensation for his services as a director during 2020. The compensation received by Mr. Kitch is shown in the “2020 Summary Compensation Table” provided elsewhere in this proxy statement.

Clearwater Paper Corporation 2021

22

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retainer and Fees

Our outside directors cash compensation in 2020 was at the following rates:

Annual retainer fee |

| $70,000 |

Annual retainer fee for Audit Committee membership |

| $15,000 |

Annual retainer fee for Compensation Committee membership |

| $7,500 |

Annual retainer fee for Nominating & Governance Committee membership |

| $6,000 |

Annual retainer fee for Chair (if not CEO) |

| $75,000 |

Annual Retainer Fee for Independent Executive Chair |

| $200,000 |

Annual retainer fee for Chair of the Audit Committee |

| $20,000 |

Annual retainer fee for Chair of the Compensation Committee |

| $15,000 |

Annual retainer fee for Chair of the Nominating and Governance Committee |

| $10,000 |

Attendance fee for each Board or Committee meeting in excess of 12 meetings, respectively |

| $1,500 |

We also reimburse directors for their reasonable out-of-pocket expenses for attending Board and committee meetings as well as educational seminars and conferences.

Directors may defer receiving all or any portion of their fees under the terms of our Deferred Compensation Plan for Directors, or Directors Plan. When a director elects to defer fees, he or she must elect a payment date or dates for the deferred amount and elect to have the deferred fees converted into phantom common stock units or, if not converted, then credited with annual interest at 120% of the long-term applicable federal rate published by the Internal Revenue Service, with quarterly compounding. The common stock units are credited with amounts in common stock units equal in value to any dividends that are paid on the same amount of common stock. Upon separation from service as a director, the common stock units credited to the director are converted to cash based upon the then market price of the common stock and paid to the director according to the plan the shares were deferred under.

Long-Term Incentive Awards. In May 2020, each of our outside directors received an annual equity award that vests in May 2021. These annual awards were granted in the form of phantom common stock units. The number of phantom common stock units actually awarded was determined by dividing $100,000 by the average closing price of a share of our common stock over a twenty-day period that ended on the date of the grant. The common stock units awarded are credited with additional common stock units equal in value to any dividends that are paid on the same amount of common stock. Upon separation from service as a director, the common stock units credited to the director are converted to cash based upon the then market price of the common stock and paid to the director according to the plan the shares were granted under.

Other Benefits. Directors and their spouses are also eligible to participate in our Matching Gifts to Education Program, which matches contributions of up to $1,500 per year to eligible educational institutions. In 2020 we made one matching donation for $1,500 on behalf of outside directors under this program.

Clearwater Paper Corporation 2021

23

1 | PROXY SUMMARY AND BUSINESS HIGHLIGHTS | 2 | CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 3 | EXECUTIVE COMPENSATION DISCUSSION AND TABLES | 4 | AUDIT COMMITTEE REPORT | 5 | ANNUAL MEETING INFORMATION | 6 | PROPOSALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|