As filed with the Securities and Exchange Commission on ___________ , 2008

Registration No. 333- ____________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SOGUA (BVI) LIMITED

(Exact name of Registrant as specified in its charter)

British Virgin Islands | | 7370 | | Not Applicable |

| | | | | |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code) | | (I.R.S. Employer Identification No.) |

Room 1410, Kaiyuan Building, Beihuan Road

Shenzhen, Guangdong 518034

China

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Vcorp Services, LLC

20 Robert Pitt Drive

Monsey, New York 10952

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code of Agent For Service)

Copies to:

Peter Campitiello, Esq.

Tarter Krinsky & Drogin LLP

1350 Broadway

New York, New York 10018

Tel: 212-216-8085

Fax: 212-216-8001

Approximate date of commencement of proposed sale to the public: As soon as practicable after effectiveness of this registration statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

Title of each class to be registered | | | Amount to be registered | | | Proposed maximum offering price per share(1) | | | Proposed maximum aggregate offering price | | | Amount of registration fee | |

| Common stock, no par value per share | | | 798,000 | | $ | 1.00 | | $ | 798,000 | | $ | 31.37 | |

Total | | | 798,000 | | $ | 1.00 | | $ | 798,000 | | $ | 31.37 | |

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST __, 2008

SOGUA (BVI) LIMITED

Resale of 798,000 shares of common stock.

The prospectus relates to the registration of the resale of 798,000 shares of our common stock by the Selling Stockholders listed on page 48. Shares offered by the Selling Stockholders may be sold by one or more of the following methods:

| | • | ordinary brokerage transactions in which a broker solicits purchases; and |

| | • | face to face transactions between the Selling Stockholders and purchasers without a broker. |

There is presently no public market for our shares. We will apply to list the shares on the Over-The-Counter Bulletin Board (“OTCBB”). Selling stockholders will sell shares of our Common Stock at the set price of $1.00 per share until such time as our shares are quoted on the OTCBB, and then thereafter, at prevailing market prices or privately negotiated prices. A current prospectus must be in effect at the time of the sale of the shares of common stock discussed above. We will not receive any proceeds from the resale of common stock by the Selling Stockholders. The Selling Stockholders will be responsible for any commissions or discounts due to brokers or dealers. We will pay all of the other offering expenses with the resale of shares of our Common Stock.

Each Selling Stockholder or dealer selling the common stock is required to deliver a current prospectus upon the sale. In addition, for the purposes of the Securities Act of 1933, as amended, Selling Stockholders may be deemed underwriters. Therefore, the Selling Stockholders may be subject to statutory liabilities if the registration statement, which includes this prospectus, is defective by virtue of it containing a material misstatement or failing to disclose a statement of material fact. We have not agreed to indemnify any of the Selling Stockholders regarding such liability.

This investment involves a high degree of risk. You should retain or acquire our stock only after considering the risks associated with us. We urge you to read the ”Risk Factors” section beginning on page 10 along with the rest of this prospectus before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August ___, 2008

TABLE OF CONTENTS

| INTRODUCTION AND USE OF CERTAIN TERMS | |

| FORWARD-LOOKING STATEMENTS | |

| GLOSSARY OF MINING TERMS | |

| PROSPECTUS SUMMARY | 1 |

| SUMMARY FINANCIAL DATA | 5 |

| RISK FACTORS | 6 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | |

| USE OF PROCEEDS | 31 |

| CAPITALIZATION | 31 |

| DILUTION | |

| DIVIDEND POLICY | |

| EXCHANGE RATE INFORMATION | |

| PROPOSED BUSINESS | |

| OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 34 |

| OUR CORPORATE STRUCTURE | |

| MANAGEMENT | |

| SELLING STOCKHOLDERS | 45 |

| CERTAIN TRANSACTIONS | |

| CHINESE GOVERNMENT REGULATIONS | |

| DESCRIPTION OF SECURITIES | |

| TAXATION | |

| EXPENSES RELATED TO THIS OFFERING | |

| LEGAL MATTERS | |

| EXPERTS | |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | 76 |

| INDEX TO FINANCIAL STATEMENTS | 77 |

| SIGNATURES | II-6 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

PROSPECTUS SUMMARY

This summary highlights key aspects of the information contained elsewhere in this prospectus. Because it is a summary, it does not contain all of the information that you should consider before investing in shares of the Company. You should read the entire prospectus carefully, including the “Risk Factors” section on page 6, and the consolidated financial statements and accompanying notes to those statements appearing elsewhere in this prospectus. The statistics relating to China’s online advertising market and economy included in this prospectus are derived from various government and institute research publications. We have not independently verified such information and you should not unduly rely upon these statistics.

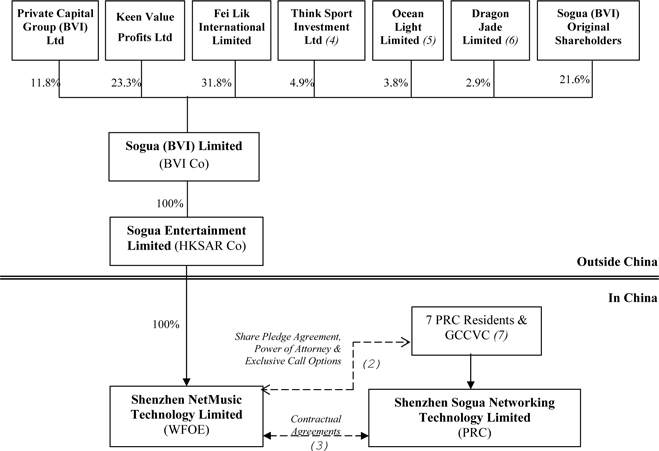

Unless we specify otherwise, when used in this prospectus the terms “Sogua,” the “Company,” “we,” “our” and “us” refer to Sogua (BVI) Ltd., and its wholly-owned subsidiary Sogua Entertainment Limited, a company incorporated on May 8, 2007 in the Hong Kong Special Administrative Region or “HKSAR.”, which has a wholly owned subsidiary Shenzhen NetMusic Technology Limited, incorporated in the People’s Republic of China (“NetMusic”). References to “Shenzhen Sogua” are to Shenzhen Sogua Networking Technology Limited, a company incorporated in the People’s Republic of China to which we will provide business consultancy, technical support, license of intellectual property, and Research and development services. Unless otherwise indicated, all references to “dollars” and “$” in this prospectus denote U.S. Dollars.

COMPANY SUMMARY

Overview

We are the leading Chinese language Internet music entertainment provider according to ChinaLabs.com, a leading market research and consulting firm specializing in China’s Internet industry (www.chinalabs.com). According to both ChinaLabs.com’s 2008 Q2 China Music Website Market Share Survey Report Summary and their 2008 June China Music Website Market Share Survey Report Summary, Sogua.com is the number 1 internet music website as ranked by market share. As measured by user traffic that reflects page views and reach, on August 1, 2008, our Sogua.com website on a 3 months average traffic ranking, was the 72nd largest website in China, according to www.chinarank.org.cn the official ranking website of the China Internet Network Information Centre (CNNIC) which is operated by the Chinese Academy of Sciences.

The main services that we offer to our internet users are our internet Music Portal and our downloadable music software applications. Our Music Portal currently consists of our three entertainment channels: (i) Community Channel (commonly referred to as “Social Networking”), (ii) our Entertainment Channel, and (iii) our Music Channel. Our music related software applications currently consist of two software applications: (i) our online music player “Xunting” and (ii) our online Karaoke and Music Video player “Sogua KK”. Our main revenues are currently generated through paid advertising, and mobile music downloads.

We provide independent artists with an online platform to show their talents and our music loving users with convenient access to entertainment news, and the music and videos of their favorite artists. We have tens of thousands of amateur musicians, artists and singers that have uploaded their music, songs and dance videos to our internet site. Our services are designed to enable Internet users to find and share relevant music related information and media online, including Chinese language web pages, news, images and multimedia files, through links provided on our websites. We provide users of our Internet Website Portal with Web 2.0 features and our leading edge online entertainment and social networking software. Our users make friends online and have created communities through our website and software thus reinforcing Sogua’s status as one of China’s leading online music brands.

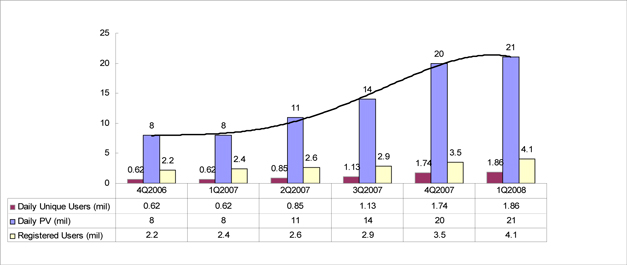

As of March 31, 2008, we had approximately 4.2 million registered users. Many of these registered users are independent amateur artists that create their own content consisting of Blogs, homepages, music lyrics, music audio tracks, music videos, and dance videos which they upload to our Sogua.com website for the enjoyment of Sogua.com’s users. In the month of March, 2008, we recorded over 681 Million page views. The Company generates the majority of its revenues from online advertising and Mobile Value Added Services (“MVAS”) offerings.

Corporate History

Sogua BVI Limited is a holding company of Sogua Entertainment Limited. The Sogua.com website was started by our Chief Technical Officer Alan Ding and two other beneficial shareholders Zhenyu Xie and Mengjie Wu in October 2001, as China’s first music search service. In August 2004, they received seed investment money from Shenzhen Chengfeng Management Consulting Co., Ltd, a limited liability company registered in the People’s Republic of China (“PRC”). The information on our website(s) is not incorporated by reference into this prospectus.

Shenzhen Sogua Networking Technology Limited was established in China on November 22, 2005 to acquire the Sogua.com brand website and its operations. In January 2006, we began developing our own content including the community and entertainment channels of the Sogua.com website. We began commercial operations by offering online advertising services on our website in January 2006. We have grown significantly since we commenced operations. Our total monthly Page Views increased from approximately 150 million in December 2005 to approximately 500 million in December 2007 and to 681 million in March 2008. In the same time period, the number of our registered users increased from 1.5 million in December 2005 to 3.5 million in December 2007 and to over 4.4 million in March 2008. We intend to continue to leverage our broad user and customer base, our brand recognition and our innovative team to further capture the opportunities presented by the rapid growth of Internet usage in China.

Pursuant to a Subscription and Shareholders’ Agreement entered on July 17, 2007, Private Capital Group (BVI) Limited (“Private Capital Group”) subscribed for 1,499 shares of Sogua Entertainment, Keen Value Profits Limited (“Keen Value”) subscribed for 2,975 shares of Sogua Entertainment and Fei Lik International Limited (“Fei Lik”) subscribed for 5,525 shares of Sogua Entertainment. Prior to the Subscription and Shareholders’ Agreement, Sogua Entertainment’s issued and outstanding share capital consisted of 1 share held by Private Capital Group. Upon completion of the agreement, Private Capital Group held 15% of the share capital of Sogua Entertainment, Keen Value held 29.75% of the share capital and Fei Lik held 55.25% of the share capital.

On August 22, 2007, the shareholders of Shenzhen Sogua Networking Technology Limited procured Shenzhen Sogua Networking Technology Limited to enter into a series of agreements comprised of exclusive business cooperation agreement, exclusive call option agreement, power of attorneys, and share pledge agreements with Shenzhen NetMusic Technology Limited (“NetMusic”), the wholly owned subsidiary of Sogua Entertainment Limited (“Sogua Entertainment”).

In anticipation of a public offering, Sogua (BVI) Limited was incorporated in the British Virgin Islands on October 15, 2007. On December 6, 2007, the shareholders of Sogua Entertainment exchanged 100% of their shares in consideration for 4,000,000 shares (the “Exchange”) of the Company’s common stock, no par value per share (the “Common Stock”). As a result of the Exchange, Sogua Entertainment became a wholly-owned subsidiary of the Company. Pursuant to the Exchange, Private Capital Group exchanged 1,500 shares of Sogua Entertainment for 600,000 shares of the Company, Keen Value exchanged 2,975 shares of Sogua Entertainment for 1,190,000 shares of the Company, and Fei Lik exchanged 5,525 shares of Sogua Entertainment for 2,210,000 shares of the Company, of which 250,619 were later transferred to Think Sport Investment Limited; 193,932 to Ocean Light Limited; and 145,200 to Dragon Jade Limited. .

SUMMARY OF THE OFFERING

Common Stock to be Offered | | 798,000 shares of common stock |

| | | |

Common Stock Outstanding | | 5,100,000 shares |

| | | |

Use of Proceeds | | We will not receive any proceeds from the sale of the shares offered by the Selling Stockholders. See "Use of Proceeds." |

| | | |

Offering Price: | | The offering price of the shares has been arbitrarily determined by us based on estimates of the price that purchasers of speculative securities, such as the shares, will be willing to pay considering the nature and capital structure of our Company, the experience of our officers and directors and the market conditions for the sale of equity securities in similar companies. The offering price of the shares bears no relationship to the assets, earnings or book value of us, or any other objective standard of value. We believe that no shares will be sold by any of the Selling Stockholders prior to our becoming a publicly traded company, at which time the Selling Stockholders will sell shares based on the market price of such shares. We are not selling any shares of our common stock, and are only registering the re-sale of shares of common stock previously sold by us. |

| | | |

No Market | | There has not been any market for our securities in the U.S. or any foreign markets in the past, and no market currently exists for our securities in the U.S. or in any foreign markets. No assurance is provided that a market will be created for our securities in the future, or at all. If in the future a market does exist for our securities, it is likely to be highly illiquid and sporadic. |

| | | |

Risk Factors | | The securities offered hereby involve a high degree of risk. See "Risk Factors," below. |

SUMMARY CONSOLIDATED FINANCIAL DATA

You should read the following summary financial data in conjunction with our consolidated financial statements and the related notes, "Selected Financial Data" and "Operating and Financial Review and Prospects" included elsewhere in this document. Our financial statements are reported in United States Dollars and presented in accordance with United States generally accepted accounting principles. The financial reports mentioned above have all been audited by Gruber & Company, LLC.

| | | For the year ended December 31, 2007 | | For the year ended December 31, 2006 (Pro Forma) | | For the period from November 22, 2005 (date of inception) through December 31, 2005 (Pro Forma) | |

| Revenue | | $ | 659,916 | | $ | 201,778 | | $ | — | |

| | | | | | | | | | | |

| Selling, General and Administrative | | $ | 810,032 | | $ | 366,591 | | $ | 47,337 | |

| | | | | | | | | | | |

| Operating Profit / (Loss) | | $ | (183,951 | ) | $ | (175,306 | ) | $ | (47,337 | ) |

| | | | | | | | | | | |

| Net Profit / (Loss) | | $ | (171,038 | ) | $ | (174,720 | ) | $ | (47,336 | ) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Profit / (Loss) Per Share | | $ | (0.03 | ) | $ | (0.03 | ) | $ | (0.01 | ) |

| | | | | | | | | | | |

| Weighted Average Common Shares Outstanding | | | 4,900,000 | | | 4,900,000 | | | 4,900,000 | |

RISK FACTORS

In addition to the other information presented in this Registration Statement, you should consider the following carefully in evaluating the Company and its business. This Registration Statement contains forward-looking statements that involve risks and uncertainties. The Company’s actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed below and elsewhere in this Registration Statement.

Risks Related to Our Business

OUR LIMITED OPERATING HISTORY MAKES IT DIFFICULT TO EVALUATE OUR FUTURE PROSPECTS AND RESULTS OF OPERATIONS.

We have a limited operating history. We commenced operations in 2005 and have not yet achieved profitability in a full financial year. Accordingly, you should consider our future prospects in light of the risks and uncertainties experienced by early stage companies in evolving industries such as the Internet industry in China. Some of these risks and uncertainties relate to our ability to:

| • | maintain our position in the Internet music community and entertainment market in China; |

| • | offer new and innovative products and services to attract and retain a larger user base; |

| • | attract additional customers and increase spending per customer; |

| • | increase awareness of our brand and continue to develop user and customer loyalty; |

| • | respond to competitive market conditions; |

| • | respond to changes in our regulatory environment; |

| • | manage risks associated with intellectual property rights; |

| • | maintain effective control of our costs and expenses; |

| • | raise sufficient capital to sustain and expand our business; |

| • | attract, retain and motivate qualified personnel; and |

| • | upgrade our technology to support increased traffic and expanded services. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected and the value of our securities may decline in value, if any.

WE SUSTAINED LOSSES IN THE PAST AND OUR HISTORICAL FINANCIAL INFORMATION MAY NOT BE REPRESENTATIVE OF OUR FUTURE RESULTS OF OPERATIONS.

We have not yet achieved profitability in a full financial year. As of December 31, 2007, we had accumulated losses of approximately US$171,038. We have experienced growth in recent periods in part due to the growth in China’s online marketing industry, which may not be representative of future growth or be sustainable. We cannot assure you that our historical financial information is indicative of our future operating results or financial performance, or that profitability will be achieved.

If we are unable to generate sales revenues sufficient to meet these capital needs we may have to seek to raise additional funds through capital or debt financing, to fund the Company’s operations. We can give no assurances that we will be able to obtain additional capital or that any additional capital that we are able to obtain will be on favorable terms or sufficient to meet our needs.

IF THE INTERNET AND, IN PARTICULAR, ONLINE MUSIC ENTERTAINMENT ARE NOT BROADLY ADOPTED IN CHINA, OUR ABILITY TO INCREASE REVENUE AND ACHIEVE PROFITABILITY WILL BE MATERIALLY AND ADVERSELY AFFECTED.

The use of the Internet as a marketing and entertainment channel is at an early stage in China. Internet and broadband penetration rates in China are both relatively low compared to those in most developed countries. Many of our current and potential customers have limited experience with the Internet as a marketing and entertainment channel, and have not historically devoted a significant portion of their marketing budgets to online marketing and promotion. As a result, they may not consider the Internet effective in promoting their products and services as compared to traditional print and broadcast media. Our ability to generate significant revenues may be negatively impacted by a number of factors, many of which are beyond our control, including:

| • | difficulties associated with developing a larger user base with demographic characteristics attractive to customers; |

| • | increased competition and potential downward pressure on online marketing prices; |

| • | higher customer acquisition costs due in part to Chinese business’ limited experience with the Internet as a marketing channel; |

| • | failure to develop an independent and reliable means of verifying online traffic; |

| • | ineffectiveness of our online marketing delivery, tracking and reporting systems; and |

| • | lack of increase in Internet usage in China. |

WE FACE SIGNIFICANT COMPETITION AND MAY SUFFER FROM A LOSS OF USERS AND CUSTOMERS AS A RESULT.

We face significant competition in almost every aspect of our business, particularly from companies that seek to provide Internet music search services and online music entertainment to users and that provide online marketing services to customers. Our main competitors include U.S.-based Internet music search providers such as Google, Yahoo! and Microsoft, as well as Chinese Internet companies. These Chinese competitors include Internet portals and application providers such as Tencent, Netease, Sina, Sohu, and TomOnline; Internet search service providers such as Baidu, and Zhongzou; and online entertainment providers such as A8.com, 56.com, 6.cn, Tudou.com and 9Sky.com. We compete with these entities for both users and customers on the basis of marketing to advertisers, user traffic, quality (relevance) and quantity (index size) of the search results, availability and ease of use of products and services, the number of customers, distribution channels and the number of associated third-party websites. In addition, we may face greater competition from our U.S. competitors as a result of, among other things, a relaxation on the foreign ownership restrictions of PRC Internet content and advertising companies, improvements in online payment systems and Internet infrastructure in China and our U.S. competitors’ increased business activities in China.

Many of these competitors have significantly greater financial resources than we do. Many also have longer operating histories and more experience in attracting and retaining users and managing customers than we do. They may use their experience and resources to compete with us in a variety of ways, including by competing more heavily for users, customers, distributors and networks of third-party websites, investing more heavily in research and development and making acquisitions. If any of our competitors provides comparable or better online entertainment experience or Chinese language music search experience, our user traffic could decline significantly. Any such decline in traffic could weaken our brand, result in loss of customers and users and have a material adverse effect on our results of operations.

We also face competition from traditional advertising media, such as newspapers, magazines, yellow pages, billboards and other forms of outdoor media, television and radio. Most large companies in China allocate, and will likely continue to allocate, most of their marketing budgets to traditional advertising media and only a small portion of their budgets to online marketing. If these companies do not devote a larger portion of their marketing budgets to online marketing services provided by us, or if our existing customers reduce the amount they spend on online marketing, our results of operations and future growth prospects could be adversely affected.

OUR BUSINESS DEPENDS ON A STRONG BRAND, AND IF WE ARE NOT ABLE TO MAINTAIN AND ENHANCE OUR BRAND, OUR BUSINESS AND OPERATING RESULTS MAY BE HARMED.

We believe that recognition of our brand “Sogua” has contributed significantly to the success of our business. We also believe that maintaining and enhancing the “Sogua” brand is critical to expanding our base of customers, online users and our Sogua members. As our market becomes increasingly competitive, maintaining and enhancing our brand will depend largely on our ability to remain as an Internet search leader and online entertainment provider in China, which may be increasingly difficult and expensive.

We have developed our user base primarily by word-of-mouth and incurred limited brand promotion expenses. We have recently initiated brand promotion efforts, but we cannot assure you that our new marketing efforts will be successful in further promoting our brand. If we fail to promote and maintain the “Sogua” brand, or if we incur excessive expenses in this effort, our business and results of operations could be materially and adversely affected and the value of our securities, if any, could become devalued or worthless.

IF WE FAIL TO CONTINUE TO INNOVATE AND PROVIDE RELEVANT PRODUCTS AND SERVICES, WE MAY NOT BE ABLE TO GENERATE SUFFICIENT USER TRAFFIC LEVELS TO REMAIN COMPETITIVE.

Our success depends on providing products and services that people use for a high-quality Internet experience. Our competitors are constantly developing innovations in Internet search and online entertainment and online marketing as well as enhancing users’ online experience. As a result, we must continue to invest significant resources in research and development to enhance our Internet search technology and our existing products and services and introduce additional high quality products and services to attract and retain users. If we are unable to anticipate user preferences or industry changes, or if we are unable to modify our products and services on a timely basis, we may lose users and customers. Our operating results would also suffer if our innovations do not respond to the needs of our users and customers, are not appropriately timed with market opportunities or are not effectively brought to market. As internet technology continues to develop, our competitors may be able to offer Internet experiences that are, or that are perceived to be, substantially similar to or better than those generated by our services. This may force us to expend significant resources in order to remain competitive, of which there can be no assurance.

IF WE FAIL TO KEEP UP WITH RAPID TECHNOLOGICAL CHANGES, OUR FUTURE SUCCESS MAY BE ADVERSELY AFFECTED.

The online marketing and media industry is subject to rapid technological changes. Our future success will depend on our ability to respond to rapidly changing technologies, adapt our services to evolving industry standards and improve the performance and reliability of our services. Our failure to adapt to such changes could harm our business. New marketing media could also adversely affect us. For example, the number of people accessing the Internet through devices other than personal computers, including mobile telephones and hand-held devices, has increased in recent years. If we are slow to develop products and technologies that are more compatible with non-PC communications devices, we may not be successful in capturing a significant share of this increasingly important market for media and other services. In addition, the widespread adoption of new Internet, networking or telecommunications technologies or other technological changes could require substantial expenditures to modify or adapt our products, services or infrastructure. If we fail to keep up with rapid technological changes to remain competitive in our rapidly evolving industry, our future success, if any, may be adversely affected. As a result, the value of our securities may decline in value and/or become worthless.

WE MAY FACE INTELLECTUAL PROPERTY INFRINGEMENT CLAIMS AND OTHER RELATED CLAIMS THAT COULD BE TIME-CONSUMING AND COSTLY TO DEFEND AND MAY RESULT IN OUR INABILITY TO CONTINUE PROVIDING CERTAIN OF OUR EXISTING SERVICES.

Internet, technology and media companies are frequently involved in litigation based on allegations of infringement of intellectual property rights, unfair competition, invasion of privacy, defamation and other violations of third-party rights. The validity, enforceability and scope of protection of intellectual property in Internet-related industries, particularly in China, are uncertain and still evolving. In addition, many parties are actively developing and seeking protection for Internet-related technologies, including seeking patent protection. There may be patents issued or pending that are held by others that cover significant aspects of our technologies, products, business methods or services. As we face increasing competition and as litigation becomes more common in China in resolving commercial disputes, we face a higher risk of being the subject of intellectual property infringement claims.

Our products and services link to materials in which third parties may claim ownership of trademarks, copyrights or other rights. From time to time, we may be subject to trademark or copyright infringement or related claims, in China and/or internationally. For example, we provide search engine facilities capable of finding and accessing links to downloadable MP3 music, movies, images and other multimedia files and/or other items hosted on third-party websites, which may be protected by copyright, including search facilities enabling our users to search for MP3 music files in various ways such as by artist, title, or via lists of most-searched-for titles and artists. In the United States, the legal standards for determining indirect liability for copyright infringement have been strengthened by the United States Supreme Court in the decision Metro-Goldwyn-Mayer Studios Inc. v. Grokster, Ltd., No. 04-480, 2005 WL 1499402 (June 27, 2005), ( “Grokster”). The implications of the Grokster decision for search engine services such as our MP3 search service are uncertain and may increase the risk of legal liability. While we conduct our business operations outside the United States, we cannot assure you that we would not be subject to U.S. copyright laws, including the legal standards established by Grokster. Moreover, we cannot assure you that Grokster will not influence the legal standards for determining indirect copyright infringement in other jurisdictions, including China. In light of Grokster and the associated publicity, copyright owners may monitor their copyrighted materials more closely worldwide and may seek to enforce their rights under theories of indirect liability or otherwise. As a result, we face increased risks of being subject to copyright infringement claims relating to our MP3 search service. Furthermore, this same consideration may also lead to decreased availability of third-party MP3 websites. A significant portion of our traffic is generated by users of our MP3 search service. Should we face (as a result of the foregoing considerations or otherwise) a need or decision to substantially modify, limit, or terminate our MP3 search service, our business, financial condition or results of operations would be materially and adversely affected, which would cause the value of our securities to become devalued or worthless.

In addition we host certain song lyrics on our websites which may be protected by copyright. As a result, we may be subject to copyright infringement claims. Moreover, we may be subject to administrative actions brought by the PRC State Copyright Bureau for alleged copyright infringement, and as a result may be subject to fines and/or other penalties and be required to discontinue infringing activities. In addition, we provide links to images of celebrities and other persons, and may face claims for misappropriation of publicity rights. Finally, since a substantial portion of our search results links to MP3 files and other materials in which third parties may claim to own trademarks, copyrights or publicity rights and since we host certain song lyrics on our websites which may be protected by copyright, we may be required to change our business model and service offerings to minimize this risk, which would adversely affect our business prospects. See “PRC Government Regulations and Regulation on Intellectual Property Rights.”

Intellectual property litigation is expensive and time consuming and could divert resources and management attention from the operations of our business. If there is a successful claim of infringement, we may be required to pay substantial fines and damages or enter into royalty or license agreements that may not be available on commercially acceptable terms, if at all. Our failure to obtain a license of the rights on a timely basis could harm our business. Any intellectual property litigation could have a material adverse effect on our business, financial condition or results of operations, cause us to curtail or abandon our operations, and as a result, could cause the value of our securities to decline in value or become worthless.

WE MAY NOT BE ABLE TO PREVENT OTHERS FROM UNAUTHORIZED USE OF OUR INTELLECTUAL PROPERTY, WHICH COULD HARM OUR BUSINESS AND COMPETITIVE POSITION.

We rely on a combination of copyright, trademark and trade secret laws, as well as nondisclosure agreements and other methods to protect our intellectual property rights. The protection of intellectual property rights in China may not be as effective as those in the United States or other countries. The steps we have taken may be inadequate to prevent the misappropriation of our technology. Reverse engineering, unauthorized copying or other misappropriation of our technologies could enable third parties to benefit from our technologies without paying us. Moreover, unauthorized use of our technology could enable our competitors to offer Chinese language search, online karaoke functions or online advertising services that are comparable to or better than ours, which could harm our business and competitive position. From time to time, we may have to enforce our intellectual property rights through litigation. Such litigation may result in substantial costs and diversion of resources and management attention.

IF WE FAIL TO RETAIN EXISTING CUSTOMERS OR ATTRACT NEW CUSTOMERS FOR OUR ONLINE MARKETING SERVICES, OUR BUSINESS AND GROWTH PROSPECTS COULD BE SERIOUSLY HARMED.

Our online marketing customers will not continue to do business with us if their investment does not generate sales leads and ultimately consumers, or if we do not deliver their web pages in an appropriate and effective manner. Our customers may discontinue their business with us at any time and for any reason as most of them are not subject to fixed-term contracts. Failure to retain our existing online marketing customers or attract new customers for our online marketing services could seriously harm our business and growth prospects.

Online marketing is at an early stage of development in China and is not as widely accepted by or available to businesses in China as in the United States. As a result, we rely heavily on a nationwide advertising/media agency network for our sales to, and collection of payment from, our advertising customers. If our agents do not provide quality services to our advertising customers or otherwise breach their contracts with our advertising customers, we may lose customers and our results of operations may be materially and adversely affected. We do not have long-term agreements with any of our agents, except our key agent, and cannot assure you that we will continue to maintain favorable relationships with them. Our agency arrangements, except for those with our key agent, are non-exclusive. Furthermore, some of our agents also contract with our competitors or potential competitors and may not renew their agency agreements with us. In addition, as new methods for accessing the Internet, including the use of wireless devices, become available, we may need to expand our advertising network. If we fail to retain our key agent or attract additional advertisers on terms that are commercially reasonable, our business and results of operations could be materially and adversely affected. As a result, our securities could become devalued or worthless.

OUR STRATEGY OF ACQUIRING COMPLEMENTARY BUSINESSES, ASSETS AND TECHNOLOGIES MAY FAIL.

As part of our business strategy, we intend to pursue selective strategic acquisitions of businesses, assets and technologies located within China that complement our existing business. We may make acquisitions in the future if suitable opportunities arise. Acquisitions involve uncertainties and risks, including:

| • | potential ongoing financial obligations and unforeseen or hidden liabilities; |

| • | failure to achieve the intended objectives, benefits or revenue-enhancing opportunities; |

| • | costs and difficulties of integrating acquired businesses and managing a larger business; and |

| • | diversion of resources and management attention. |

Our failure to address these risks successfully may have a material adverse effect on our financial condition and results of operations. Any such acquisition may require a significant amount of capital investment, which would decrease the amount of cash available for working capital or capital expenditures. In addition, if we use our equity securities to pay for acquisitions, we may dilute the value of your shares. If we borrow funds to finance acquisitions, such debt instruments may contain restrictive covenants that could, among other things, restrict us from distributing dividends. Such acquisitions may also generate significant amortization expenses related to intangible assets.

WE MAY NOT BE ABLE TO MANAGE OUR EXPANDING OPERATIONS EFFECTIVELY.

Our website commenced operations in November 2005, and since then, our operations have expanded rapidly. We anticipate significant continued expansion of our business as we address growth in our user and customer base and market opportunities, of which there can be no assurance. To manage the potential growth of our operations and personnel, we will be required to improve operational and financial systems, procedures and controls, and expand, train and manage our growing employee base. Furthermore, our management will be required to maintain and expand our relationships with advertising agencies, other websites, Internet companies and other third parties. We cannot assure you that our current and planned personnel, systems, procedures and controls will be adequate to support our future operations in the future, or that our results of operations will not be adversely affected in the event that our controls are not adequate.

OUR OPERATING RESULTS MAY FLUCTUATE, WHICH MAKES OUR RESULTS DIFFICULT TO PREDICT AND COULD CAUSE OUR RESULTS TO FALL SHORT OF EXPECTATIONS.

Our operating results may fluctuate as a result of a number of factors, many of which are beyond our control. For these reasons, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly and annual revenues and costs and expenses as a percentage of our revenues may be significantly different from our historical or projected rates. Our operating results in future quarters may fall below expectations. Any of these events could cause the price of our shares to fall. Any of the risk factors listed in this “Risk Factors” section, and in particular, the following risk factors, could cause our operating results to fluctuate from quarter to quarter:

| • | general economic conditions in China and economic conditions specific to the Internet, Internet search, social networking and online marketing including potential disruption to the electrical infrastructure or the internet infrastructure; |

| • | our ability to continue to attract users to our website; |

| • | our ability to continue to attract and retained talented employees to our company; |

| • | our ability to attract additional customers and increase spending per customer; |

| • | the announcement or introduction of new or enhanced products and services by us or our competitors; |

| • | the amount and timing of operating costs and capital expenditures related to the maintenance and expansion of our businesses, operations and infrastructure; |

| • | the results of our acquisitions of, or investments in, other businesses or assets; |

| • | PRC regulations or actions pertaining to activities on the Internet, including video sharing, music sharing, blogging, online games and other forms of entertainment; and |

| • | geopolitical events or natural disasters such as war, threat of war, trade war, terrorism, earthquake, flood, drought, global warming, Avian Influenza, Severe Acute Respiratory Syndrome, Ebola, or other potential epidemics. |

Because of our limited operating history and our rapidly growing business, our historical operating results may not be useful to you in predicting our future operating results. Our user traffic tends to be seasonal. For example, we generally experience less user traffic during public education examination periods which typically last for up to two weeks during January and June in China. In addition, advertising spending in China has historically been cyclical, reflecting overall economic conditions as well as budgeting and buying patterns. As we continue to grow, we expect that the cyclicality in our business may cause our operating results to fluctuate.

OUR BUSINESS MAY BE ADVERSELY AFFECTED BY THIRD-PARTY SOFTWARE APPLICATIONS THAT INTERFERE WITH OUR RECEIPT OF INFORMATION FROM, AND PROVISION OF INFORMATION TO, OUR USERS, WHICH MAY IMPAIR OUR USERS’ EXPERIENCE.

Our business may be adversely affected by third-party malicious or unintentional software applications that make changes to our users’ computers and interfere with our products and services. These software applications may change our users’ Internet experience by hijacking access to our websites, altering or replacing our search results, or otherwise interfering with our ability to connect with our users. The interference often occurs without disclosure to or consent from users, resulting in a negative experience that users may associate with Sogua.com. These software applications may be difficult or impossible to remove or disable, may reinstall themselves and may circumvent other applications’ efforts to block or remove them. The ability to provide a superior user experience is critical to our success. If our efforts to combat these software applications are unsuccessful, our reputation may be harmed. This could result in a decline in user traffic and, consequently, our revenues, which in turn, could cause the value of our securities, if any, to decline in value or become worthless.

THE SUCCESSFUL OPERATION OF OUR BUSINESS DEPENDS UPON THE PERFORMANCE AND RELIABILITY OF THE INTERNET INFRASTRUCTURE AND FIXED TELECOMMUNICATIONS NETWORKS IN CHINA.

Our business depends on the performance and reliability of the Internet infrastructure in China. Almost all access to the Internet is maintained through state-owned telecommunication operators under the administrative control and regulatory supervision of the Ministry of Information Industry of China. In addition, the national networks in China are connected to the Internet through international gateways controlled by the PRC government. These international gateways are the only channels through which a domestic user can connect to the Internet. We cannot assure you that a more sophisticated Internet infrastructure will be developed in China. We may not have access to alternative networks in the event of disruptions, failures or other problems with China’s Internet infrastructure. In addition, the Internet infrastructure in China may not support the demands associated with continued growth in Internet usage.

We also rely on China Telecommunications Corporation (“China Telecom”), and China Netcom Corporation Ltd. (“China Netcom”), to provide us with data communications capacity primarily through local telecommunications lines and Internet data centers to host our servers. We do not have access to alternative services in the event of disruptions, failures or other problems with the fixed telecommunications networks of China Telecom and China Netcom, or if China Telecom or China Netcom otherwise fail to provide such services. Any unscheduled service interruption could damage our reputation and result in a decrease in our revenues. Furthermore, we have no control over the costs of the services provided by China Telecom and China Netcom. If the prices that we pay for telecommunications and Internet services rise significantly, our gross margins could be adversely affected. In addition, if Internet access fees or other charges to Internet users increase, our user traffic may decrease, which in turn would likely reduce our revenues.

OUR SUCCESS DEPENDS ON THE CONTINUING EFFORTS OF OUR SENIOR MANAGEMENT TEAM AND OTHER KEY PERSONNEL AND OUR BUSINESS MAY BE HARMED IF WE LOSE THEIR SERVICES.

Our future success depends heavily upon the continuing services of the members of our senior management team, in particular our Chief Executive Officer, Ben Li, our Chief Operating Officer, Kevin Xiong, our Chief Technology Officer, Alan Ding, and our financial Controller Lillian Jung. If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all, and our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. Competition for senior management and key personnel is intense, the pool of qualified candidates is very limited, and we may not be able to retain the services of our senior executives or key personnel, or attract and retain high-quality senior executives or key personnel in the future.

In addition, if any member of our senior management team or any of our other key personnel joins a competitor or forms a competing company, we may lose customers, distributors, know-how and key professionals and staff members. Each of our executive officers and key employees has entered into an employment agreement with us, which contains confidentiality and non-competition provisions. If any disputes arise between any of our senior executives or key personnel and us, we cannot assure you the extent to which any of these agreements may be enforced.

If any member of our senior management team or other key personnel leaves our company, our ability to successfully operate our business and execute our business strategy could be impaired. We may also have to incur significant costs in identifying, hiring, training and retaining replacements for departing employees. As a result, the value of our securities, if any, could decline in value and/or become worthless.

WE RELY ON HIGHLY SKILLED PERSONNEL AND, IF WE ARE UNABLE TO RETAIN OR MOTIVATE KEY PERSONNEL OR HIRE QUALIFIED PERSONNEL, WE MAY NOT BE ABLE TO GROW EFFECTIVELY.

Our performance and future success depends on the talents and efforts of highly skilled individuals. We will need to continue to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization. Competition in our industry for qualified employees is intense. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees.

As competition in our industry intensifies, it may be more difficult for us to hire, motivate and retain highly skilled personnel. If we do not succeed in attracting additional highly skilled personnel or retaining or motivating our existing personnel, we may be unable to grow effectively.

IF WE ARE UNABLE TO ADAPT OR EXPAND OUR EXISTING TECHNOLOGY INFRASTRUCTURE TO ACCOMMODATE GREATER TRAFFIC OR ADDITIONAL CUSTOMER REQUIREMENTS, OUR BUSINESS MAY BE HARMED.

Our Sogua.com website regularly serves a large numbers of users and customers and delivers a large number of monthly page views. Our technology infrastructure is highly complex and may not provide satisfactory service in the future, especially as the number of customers using our entertainment and community software products and services increases. We may be required to upgrade our technology infrastructure to keep up with the increasing traffic on our websites, such as increasing the capacity of our hardware servers and the sophistication of our software. If we fail to adapt our technology infrastructure to accommodate greater traffic or customer requirements, our users and customers may become dissatisfied with our services and switch to our competitors’ websites, which could harm our business.

INTERRUPTION OR FAILURE OF OUR INFORMATION TECHNOLOGY AND COMMUNICATIONS SYSTEMS COULD IMPAIR OUR ABILITY TO EFFECTIVELY PROVIDE OUR PRODUCTS AND SERVICES, WHICH COULD DAMAGE OUR REPUTATION AND HARM OUR OPERATING RESULTS.

Our ability to provide our products and services depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could interrupt our service. Service interruptions could reduce our revenues and profits, and damage our brand if our system is perceived to be unreliable. Our systems are vulnerable to damage or interruption as a result of terrorist attacks, war, earthquakes, floods, fires, power loss, telecommunications failures, computer viruses, interruptions in access to our websites through the use of “denial of service” or similar attacks, hacking or other attempts to harm our systems, and similar events. Our servers, which are hosted at third-party Internet data centers, are also vulnerable to break-ins, sabotage and vandalism. Some of our systems are not fully redundant, and our disaster recovery planning does not account for all possible scenarios. The occurrence of a natural disaster or a closure of an Internet data center by a third-party provider without adequate notice could result in lengthy service interruptions.

If we experience frequent or persistent system failures on our website, our reputation and brand could be permanently harmed. The steps we plan to take to increase the reliability and redundancy of our systems are expensive, reduce our operating margin and may not be successful in reducing the frequency or duration of service interruptions.

OUR BUSINESS COULD BE ADVERSELY AFFECTED IF OUR SOFTWARE CONTAINS BUGS.

Our online systems, including our websites, our music and multimedia search software and other software applications and products, could contain undetected errors or “bugs” that could adversely affect their performance. We regularly update and enhance our website and our other online systems and introduce new versions of our software products and applications. The occurrence of errors in any of these may cause us to lose market share, damage our reputation and brand name, and materially and adversely affect our business. As a result, the value of our securities, if any, could become devalued or worthless.

CONCERNS ABOUT THE SECURITY OF ELECTRONIC COMMERCE TRANSACTIONS AND CONFIDENTIALITY OF INFORMATION ON THE INTERNET MAY REDUCE USE OF OUR NETWORK AND IMPEDE OUR GROWTH.

A significant barrier to electronic commerce and communications over the Internet in general has been a public concern over security and privacy, including the transmission of confidential information. If these concerns are not adequately addressed, they may inhibit the growth of the Internet and other online services generally, especially as a means of conducting commercial transactions. If a well-publicized Internet breach of security were to occur, general Internet usage could decline, which could reduce traffic to our destination websites and impede our growth, as well as decrease our results of operations.

WE HAVE LIMITED BUSINESS INSURANCE COVERAGE.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products. We do not have any business liability or disruption insurance coverage for our operations in China. Any business disruption, litigation or natural disaster may result in our incurring substantial costs and the diversion of our resources.

Risks Related to Our Corporate Structure

PRC LAWS AND REGULATIONS GOVERNING OUR BUSINESSES AND THE VALIDITY OF CERTAIN OF OUR CONTRACTUAL ARRANGEMENTS ARE UNCERTAIN. IF WE ARE FOUND TO BE IN VIOLATION, WE COULD BE SUBJECT TO SANCTIONS. IN ADDITION, CHANGES IN SUCH PRC LAWS AND REGULATIONS MAY MATERIALLY AND ADVERSELY AFFECT OUR BUSINESS.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including, but not limited to, the laws and regulations governing our business, or the enforcement and performance of our contractual arrangements with our affiliated Chinese entity, Shenzhen Sogua Networking Technology Limited, and its shareholders. We, Sogua Entertainment Limited, and Shenzhen NetMusic Technology Limited are considered foreign persons or foreign invested enterprises under PRC law. As a result, we, Sogua Entertainment Limited, and Shenzhen NetMusic Technology Limited are subject to PRC law limitations on foreign ownership of Internet and advertising companies. These laws and regulations are relatively new and may be subject to change, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

PRC laws currently provide limited guidance as to whether an Internet search provider that provides search result links to domestic news websites is required to obtain an approval from the State Council News Office. PRC laws also do not provide clear guidance as to whether an Internet search provider that provides links to online audio/video products is required to obtain an Internet culture permit from the Ministry of Culture or a license for broadcasting audio/video programs from the State Administration of Radio, Film and Television, which we currently do not have. If the interpretation of existing laws and regulations changes or new regulations come into effect requiring us to obtain any such licenses, permits or approvals, we cannot assure you that we may successfully obtain them, and we may need to remove links to news and audio/video products until we obtain the requisite licenses, permits and approvals, which there can be no assurance that we will be able to obtain.

The PRC government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by higher regulatory bodies. We cannot predict the effect of the interpretation of existing or new PRC laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation of any current or future PRC laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide certain services. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations. As a result the value of our securities, if any, could decline in value or become worthless.

WE MAY BE ADVERSELY AFFECTED BY COMPLEXITY, UNCERTAINTIES AND CHANGES IN PRC REGULATION OF INTERNET BUSINESS AND COMPANIES, INCLUDING LIMITATIONS ON OUR ABILITY TO OWN KEY ASSETS SUCH AS OUR WEBSITE.

The PRC government extensively regulates the Internet industry including foreign ownership of, and the licensing and permit requirements pertaining to, companies in the Internet industry. These Internet-related laws and regulations are relatively new and evolving, and their interpretation and enforcement involve significant uncertainty. As a result, in certain circumstances it may be difficult to determine what actions or omissions may be deemed to be a violation of applicable laws and regulations. Issues, risks and uncertainties relating to PRC government regulation of the Internet industry include the following:

| • | We only have contractual control over our websites. We do not own the websites due to the restriction of foreign investment in businesses providing value-added telecommunication services in China, including online information services. |

| • | There are uncertainties relating to the regulation of the Internet business in China, including evolving licensing practices, means that permits, licenses or operations at some of our companies may be subject to challenge. This may disrupt our business, or subject us to sanctions, requirements to increase capital or other conditions or enforcement, or compromise enforceability of related contractual arrangements, or have other harmful effects on us. |

| • | Certain PRC government authorities have stated publicly that they are in the process of promulgating new laws and regulations that will regulate Internet activities. The areas of regulation may include online advertising, online news displaying, online audio-video program broadcasting and the provision of culture-related information over the Internet. Other aspects of our online operations may be regulated in the future. If our operations do not comply with these new regulations at the time they become effective, we could be subject to penalties, and/or stricter penalties, of which there can be no assurance. |

THE INTERPRETATION AND APPLICATION OF EXISTING PRC LAWS, REGULATIONS AND POLICIES AND POSSIBLE NEW LAWS, REGULATIONS OR POLICIES HAVE CREATED SUBSTANTIAL UNCERTAINTIES REGARDING THE LEGALITY OF EXISTING AND FUTURE FOREIGN INVESTMENTS IN, AND THE BUSINESSES AND ACTIVITIES OF, INTERNET BUSINESSES IN CHINA, INCLUDING OUR BUSINESS.

The PRC government restricts foreign investment in Internet and advertising businesses. Accordingly, we operate our websites and our online advertising business in China through Shenzhen Sogua, a company wholly owned by Ben Li our Chief Executive Officer, Kevin Xiong our Chief Operating Officer, Alan Ding our Chief Technical Officer, Baoyu Ding our non executive director and shareholder, among others, all of whom are PRC citizens and Shenzhen Chengfeng Management Consulting Co., Ltd, which is a limited liability company registered in the PRC. Shenzhen Sogua holds the licenses and approvals necessary to operate our website and our online advertising business in China. We have contractual arrangements with Shenzhen Sogua and its shareholders that allow us to substantially control Shenzhen Sogua. We cannot assure you, however, that we will be able to enforce these contracts.

Although we believe we comply with current PRC regulations, we cannot assure you that the PRC government would agree that these operating arrangements comply with PRC licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future. If the PRC government determines that we do not comply with applicable law, it could revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, block our website, require us to restructure our operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business and results of operations, and/or which could cause the value of our securities, if any, to decline in value or become worthless.

OUR CONTRACTUAL ARRANGEMENTS WITH SHENZHEN SOGUA AND ITS SHAREHOLDERS MAY NOT BE AS EFFECTIVE IN PROVIDING CONTROL OVER THESE ENTITIES AS DIRECT OWNERSHIP.

Since PRC law limits foreign equity ownership in Internet and advertising companies in China, we operate our Internet Content Provider (“ICP”) license and advertising businesses through Shenzhen Sogua. We have no equity ownership interest in Shenzhen Sogua and rely on contractual arrangements to control and operate such businesses. These contractual arrangements may not be as effective in providing control over Shenzhen Sogua as direct ownership. For example, Shenzhen Sogua could fail to take actions required for our business or fail to maintain our website despite its contractual obligation to do so. If Shenzhen Sogua fails to perform under their agreements with us, we may have to rely on legal remedies under PRC law, which may not be effective. In addition, we cannot assure you that Shenzhen Sogua’s shareholders will always act in our best interests.

OUR CONTRACTUAL ARRANGEMENTS WITH SHENZHEN SOGUA MAY RESULT IN ADVERSE TAX CONSEQUENCES TO US.

As a result of our corporate structure and contractual arrangements between NetMusic and Shenzhen Sogua, we are effectively subject to the 5% PRC business tax on both revenues generated by Shenzhen Sogua’s operations in China and revenues derived from NetMusic’s contractual arrangements with Shenzhen Sogua. Moreover, we would be subject to adverse tax consequences if the PRC tax authorities were to determine that the contracts between NetMusic and Shenzhen Sogua were not on an arm’s length basis and therefore constitute a favorable transfer pricing. As a result, the PRC tax authorities could request that Shenzhen Sogua adjust its taxable income upward for PRC tax purposes. Such a pricing adjustment could adversely affect us by:

| • | increasing Shenzhen Sogua’s tax expenses without reducing NetMusic’s tax expenses, which could subject Shenzhen Sogua to late payment fees and other penalties for under-payment of taxes; and/or |

| • | resulting in Shenzhen Sogua’s loss of its preferential tax treatment, and the loss of NetMusic’s entitlement to apply for preferential tax treatment. |

THE PRINCIPAL SHAREHOLDERS OF SHENZHEN SOGUA HAVE POTENTIAL CONFLICTS OF INTEREST WITH US, WHICH MAY ADVERSELY AFFECT OUR BUSINESS.

Ben Li, our Chief Executive Officer, Kevin Xiong, our Chief Operating Officer, Alan Ding, our Chief Technical Officer, Baoyu Ding, our non executive director and shareholder, Heyuan Xu, our beneficial shareholder, Mengjie Wu, our beneficial shareholder, and Zhenyu Xie, our beneficial shareholder, all of whom are PRC citizens, and Shenzhen Chengfeng Management Consulting Co., Ltd ,our shareholder which is a limited liability company registered in the PRC, are also the principal shareholders of Shenzhen Sogua. Conflicts of interests between their duties to our company and Shenzhen Sogua may arise. As Mr. Li, and Mr. Xiong are directors and executive officers of our company, they have a duty of loyalty and care to us under British Virgin Islands law when there are any potential conflicts of interests between our Company and Shenzhen Sogua.

Additionally, all the shareholders of Shenzhen Sogua have executed irrevocable power of attorneys to appoint the individuals designated by NetMusic to be their attorneys-in-fact to vote on their behalf on all Shenzhen Sogua matters requiring shareholder approval. We cannot assure you, however, that when conflicts of interest arise, any or all of the shareholders of Shenzhen Sogua will act completely in our interests or that conflicts of interests will be resolved in our favor. In addition, Mr. Li, Mr. Xiong or Mr. Alan Ding could violate their employment agreements with us or their legal duties by diverting business opportunities from us to others. If we cannot resolve any conflicts of interest between us and Mr. Li, Mr. Xiong or Mr. Alan Ding, we would have to rely on legal proceedings, which could result in the disruption of our business.

OUR CORPORATE ACTIONS ARE SUBSTANTIALLY CONTROLLED BY OUR PRINCIPAL SHAREHOLDERS AND AFFILIATED ENTITIES.

Our principal shareholders and their affiliated entities own approximately 31% of our outstanding common stock. These shareholders, acting individually or as a group, could exert substantial influence over matters such as electing directors and approving mergers or other business combination transactions. This concentration of ownership may also discourage, delay or prevent a change in control of our company, which could deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price of our shares. These actions may be taken even if they are opposed by our other shareholders, including those who purchase shares in this offering.

BECAUSE WE ARE INCORPORATED UNDER THE LAWS OF THE BRITISH VIRGIN ISLANDS, YOU MAY FACE DIFFICULTIES IN PROTECTING YOUR INTERESTS, AND YOUR ABILITY TO PROTECT YOUR RIGHTS THROUGH THE U.S. FEDERAL COURTS MAY BE LIMITED.

We are a company incorporated under the laws of the British Virgin Islands, and substantially all of our assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States in a way that will permit a U.S. court to have jurisdiction over us.

Our corporate affairs are governed by our Amended and Restated Memorandum and Articles of Association, the Companies Law of the British Virgin Islands, as the same may be supplemented or amended from time to time, which we refer to herein as the Companies Law, and the common law of the British Virgin Islands. The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary responsibilities of our directors to us under British Virgin Islands law are to a large extent governed by the common law of the British Virgin Islands. The common law of the British Virgin Islands is derived in part from comparatively limited judicial precedent in the British Virgin Islands as well as from English common law, the decisions of whose courts are of persuasive authority, but are not binding on a court in the British Virgin Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under British Virgin Islands law are not as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the British Virgin Islands has a less developed body of securities laws as compared to the United States, and some states, such as Delaware, have more fully developed and judicially interpreted bodies of corporate law. In addition, shareholders of British Virgin Islands companies may not have standing to initiate a shareholder derivative action in a federal court of the United States.

The British Virgin Islands courts are also unlikely:

| | | to recognize or enforce against us judgments of courts of the United States based on certain civil liability provisions of U.S. securities laws; and |

| | | to impose liabilities against us, in original actions brought in the British Virgin Islands, based on certain civil liability provisions of U.S. securities laws that are penal in nature. |

There is no statutory recognition in the British Virgin Islands of judgments obtained in the United States, although the courts of the British Virgin Islands will in certain circumstances recognize and enforce a non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits.

BECAUSE NEARLY ALL OF OUR DIRECTORS AND OFFICERS RESIDE OUTSIDE OF THE UNITED STATES, IT MAY BE DIFFICULT FOR YOU TO ENFORCE YOUR RIGHTS AGAINST THEM OR ENFORCE U.S. COURT JUDGMENTS AGAINST THEM OUTSIDE THE UNITED STATES.

Since nearly all of our directors and officers reside outside of the United States and, after the consummation of our share exchange with Shenzhen Sogua Entertainment Limited, substantially all of our assets could be located outside of the United States. We believe that certain countries in Asia (such as China) do not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States. As a result, it may be necessary to comply with local law in order to obtain an enforceable judgment against certain directors and officers and certain assets. It may therefore be difficult for investors in the United States to enforce their legal rights, to effect service of process upon our directors or officers outside of the United States or to enforce judgments of U.S. courts predicated upon civil liabilities and criminal penalties of our directors and officers under U.S. federal securities laws. Further, it is unclear if extradition treaties now in effect between the United States and certain Asian countries (such as China) would permit effective enforcement of criminal penalties of the U.S. federal securities laws.

RISKS RELATED TO DOING BUSINESS IN CHINA

ADVERSE CHANGES IN ECONOMIC AND POLITICAL POLICIES OF THE PRC GOVERNMENT COULD HAVE A MATERIAL ADVERSE EFFECT ON THE OVERALL ECONOMIC GROWTH OF CHINA, WHICH COULD ADVERSELY AFFECT OUR BUSINESS.

Substantially all of our business operations are conducted in China. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in China. China’s economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth in the past 20 years, growth has been uneven across different regions and among various economic sectors of China. The PRC government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. Since early 2004, the PRC government has implemented certain measures to control the pace of economic growth. Such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition, which could have a material adverse effect on the value of our securities, if any.

REGULATION AND CENSORSHIP OF INFORMATION DISSEMINATED OVER THE INTERNET IN CHINA MAY ADVERSELY AFFECT OUR BUSINESS AND SUBJECT US TO LIABILITY FOR INFORMATION LINKED TO OUR WEBSITE.

The PRC government has adopted regulations governing Internet access and the distribution of news and other information over the Internet. Under these regulations, Internet content providers and Internet publishers are prohibited from posting or displaying over the Internet content that, among other things, violates PRC laws and regulations, impairs the national dignity of China, is opposed to national unity, or is reactionary, obscene, superstitious, fraudulent or defamatory. Failure to comply with these requirements may result in the revocation of licenses to provide Internet content and other licenses and the closure of the concerned websites. In the past, failure to comply with such requirements has resulted in the closure of certain websites. The website operator may also be held liable for such censored information displayed on or linked to the website.

In addition, the Ministry of Information Industry has published regulations that subject website operators to potential liability for content displayed on their websites and the actions of users and others using their systems, including liability for violations of PRC laws prohibiting the dissemination of content deemed to be socially destabilizing. The Ministry of Public Security has the authority to order any local Internet service provider to block any Internet website at its sole discretion. From time to time, the Ministry of Public Security has stopped the dissemination over the Internet of information which it believes to be socially destabilizing. The State Secrecy Bureau is also authorized to block any website it deems to be leaking State secrets or failing to meet the relevant regulations relating to the protection of State secrets in the dissemination of online information.

Although we attempt to monitor the content in our search results and on our websites and online community, we are not able to control or restrict the content of other Internet content providers linked to or accessible through our websites, or content generated or placed on our community message boards by our users. To the extent that PRC regulatory authorities find any content displayed on our websites objectionable, they may require us to limit or eliminate the dissemination of such information on our websites, which may reduce our user traffic and have an adverse effect on our business. In addition, we may be subject to penalties for violations of those regulations arising from information displayed on or linked to our websites, including a suspension or shutdown of our online operations. If this were to happen, we could be forced to curtail or abandon our business operations, which could cause the value of our securities, if any, to decline in value or become worthless.

NEWLY ENACTED PRC RULES THAT RESTRICT THE BROADCAST OF VIDEOS ON THE INTERNET MAY ADVERSELY AFFECT OUR BUSINESS

China's State Administration of Radio, Film and Television (“SARFT”) and Ministry of Information Industry (“MII”) have co-published new regulations for online audio and video services, which took effect on January 31, 2008. The regulations cover the production, editing, and aggregation of audio and video content and provision to the public through both Internet and mobile networks. The new regulation defines SARFT as the authority to administer, monitor, and regulate the industry's development, while the MII, with authority over the internet and mobile industry, will take related monitoring responsibilities and provide a set of service guidelines. Pursuant to the new regulation, all websites that provide video programming or allow users to upload video must obtain a government "Online Audio-Visual Broadcasting License". Further, the new regulations only allow companies that are state-owned or state-controlled to apply for the license. Applicants must also have a specific program in place for censoring content, as well as legal program resources, legal funding sources, and "standardized technology."