Exhibit (a)(5)(C)

| | | | |

| | EFiled: Jul 10 2012 4:16PM EDT Transaction ID 45242309 Case No. 7685- | |  |

IN THE COURT OF CHANCERY FOR THE STATE OF DELAWARE

| | | | |

SCOTT PHILLIPS, individually and on behalf of all others similarly situated, Plaintiff, v. ROGER L. DAVENPORT, V. RAMAN KUMAR, FRANK BAKER, JEFFREY HENDREN, JAMES PATRICK NOLAN, HENRY C. WOLF, ANDREW E. VOGEL, PETER BERGER, KENNETH JOHN MCLACHLAN, COLIN J. O’BRIEN, ROBERT J. GRECZYN, JR., ONE EQUITY PARTNERS LLC, LEGEND PARENT, INC., LEGEND ACQUISITION SUB, INC. and MMODAL INC., Defendants. | | ) | | |

| | ) | | |

| | ) | | |

| | ) | | Civil Action No. |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

| | ) | | |

VERIFIED CLASS ACTION COMPLAINT

FOR BREACH OF FIDUCIARY DUTY

Plaintiff, by his attorneys, alleges upon information and belief, except for his own acts, which are alleged on knowledge, as follows:

1. Plaintiff brings this class action on behalf of the public stockholders of MModal Inc. (“M*Modal” or the “Company”) against the members of M*Modal’s Board of Directors (the “Board” or the “Individual Defendants”) for their breaches of fiduciary duties arising out of their attempt to sell the Company to One Equity Partners LLC (“OEP”) by means of an unfair process and for an unfair price.

2. M*Modal is a leading provider of medical document processing technology, including clinical transcription services, clinical documentation workflow solutions, advanced cloud-based Speech Understanding™ technology, and advanced unstructured data analytics. M*Modal also offers voice to text solutions and delivers computer-assisted coding to support ICD-9 and the transition to ICD-10.

3. On July 2, 2012, OEP and the Company announced a definitive agreement under which OEP, through its affiliate Legend Parent, Inc. (“Parent”) and its wholly-owned subsidiary Legend Acquisition Sub, Inc. (“Merger Sub”), will commence a tender offer to acquire all of the outstanding shares of M*Modal for $14.00 per share in cash (the “Proposed Transaction”). The Proposed Transaction is valued at approximately $1.1 billion. The Board members have breached their fiduciary duties by agreeing to the Proposed Transaction for inadequate consideration. As described in more detail below, given M*ModaI’s recent strong performance as well as its future growth prospects, the consideration shareholders will receive undervalues the Company.

4. Defendants have exacerbated their breaches of fiduciary duty by agreeing to lock up the Proposed Transaction with deal protection devices that preclude other bidders from making successful competing offers for the Company. Specifically, pursuant to the merger agreement dated July 2, 2012 (the “Merger Agreement”), defendants agreed to: (i) a strict no-solicitation provision that prevents the Company from soliciting other potential acquirers or even continuing discussions and negotiations with potential acquirers; (ii) a provision that provides OEP with three business days to match any competing proposal in the event one is made; and (iii) a provision that requires the Company to pay OEP a termination fee of $28.7 million in order to enter into a transaction with a superior bidder. These provisions substantially and improperly limit the Board’s ability to act with respect to investigating and pursuing superior proposals and alternatives, including a sale of all or part of M*Modal.

2

5. The Individual Defendants have breached their fiduciary duties of loyalty, due care, independence, good faith and fair dealing, and M*Modal, OEP, Parent and Merger Sub have aided and abetted such breaches by M*Modal’s officers and directors. Plaintiff seeks to enjoin the Proposed Transaction unless and/or until defendants cure their breaches of fiduciary duty.

PARTIES

6. Plaintiff is, and has been at all relevant times, the owner of shares of common stock of M*Modal.

7. M*Modal is a corporation organized and existing under the laws of the State of Delaware. It maintains its principal executive offices at 9009 Carothers Parkway, Franklin, Tennessee 37067.

8. Defendant Roger L. Davenport (“Davenport”) has been the Chairman, Chief Executive Officer (“CEO”) and a director of the Company since 2011. Davenport’s appointment as CEO occurred on the same day that the Company, then Medquist Holdings, announced the planned acquisition of Multimodal Technologies for $130 million in cash and stock. That merger was completed on August 18, 2011.

9. Defendant V. Raman Kumar (“Kumar”) has been a director of the Company since 2007.

10. Defendant Frank Baker (“Baker”) has been a director of the Company since 2008.

3

11. Defendant Peter Berger (“Berger”) has been a director of the Company since 2008.

12. Defendant Robert J. Greczyn, Jr. (“Greczyn”) has been a director of the company since 2011.

13. Defendant Jeffrey Hendren (“Hendren”) has been a director of the Company since 2008.

14. Defendant Kenneth John McLachlan (“McLachlan”) has been a director of the Company since 2007.

15. Defendant James Patrick Nolan (“Nolan”) has been a director of the Company since 2009.

16. Defendant Colin J. O’Brien (“O’Brien”) has been a director of the Company since 2011.

17. Defendant Andrew E. Vogel (“Vogel”) has been a director of the Company since 2011.

18. Defendant Henry C. Wolf (“Wolf) has been a director of the Company since February 2012.

19. Defendants referenced in ¶¶ 8 through 18 are collectively referred to as Individual Defendants and/or the Board.

20. Defendant OEP is a Delaware limited liability company with its headquarters located at 320 Park Avenue, 18th Floor, New York, New York 10022. OEP manages $10 billion in investments and commitments for JPMorgan Chase & Co.

21. Defendant Parent is a Delaware corporation affiliated with OEP.

4

22. Defendant Merger Sub is a Delaware corporation, wholly-owned by Parent that was created to effectuate the Proposed Transaction.

INDIVIDUAL DEFENDANTS’ FIDUCIARY DUTIES

23. By reason of the Individual Defendants’ positions with the Company as officers and/or directors, they are in a fiduciary relationship with plaintiff and the other public shareholders of M*Modal and owe them, as well as the Company, a duty of care, loyalty, good faith, candor, and independence.

24. Under Delaware law, where the directors of a publicly traded corporation undertake a transaction that will result in either a change in corporate control or a break up of the corporation’s assets, the directors have an affirmative fiduciary obligation to obtain the highest value reasonably available for the corporation’s shareholders and, if such transaction will result in a change of corporate control, the shareholders are entitled to receive a significant premium. To diligently comply with their fiduciary duties, the Individual Defendants may not take any action that:

(a) adversely affects the value provided to the Company’s shareholders;

(b) favors themselves or will discourage or inhibit alternative offers to purchase control of the Company or its assets;

(c) adversely affects their duty to search and secure the best value reasonably available under the circumstances for the Company’s shareholders; and/or

(d) will provide the Individual Defendants with preferential treatment at the expense of, or separate from, the public shareholders.

5

25. In accordance with their duties of loyalty and good faith, the Individual Defendants are obligated to refrain from:

(a) participating in any transaction where the Individual Defendants’ loyalties are divided;

(b) participating in any transaction where the Individual Defendants receive, or are entitled to receive, a personal financial benefit not equally shared by the public shareholders of the Company; and/or

(c) unjustly enriching themselves at the expense or to the detriment of the public shareholders.

26. Plaintiff alleges herein that the Individual Defendants, separately and together, in connection with the Proposed Transaction, are knowingly or recklessly violating their fiduciary duties, including their duties of care, loyalty, good faith, candor, and independence owed to plaintiff and other public shareholders of M*Modal.

CLASS ACTION ALLEGATIONS

27. Plaintiff brings this action on its own behalf and as a class action on behalf of all owners of M*Modal common stock and their successors in interest, except defendants and their affiliates (the “Class”).

28. This action is properly maintainable as a class action for the following reasons:

(a) The Class is so numerous that joinder of all members is impracticable. As of May 3, 2012, M*Modal has approximately 56.9 million shares outstanding.

6

(b) Questions of law and fact are common to the Class, including,inter alia, the following:

(i) Have the Individual Defendants breached their fiduciary duties of undivided loyalty, independence, or due care with respect to plaintiff and the other members of the Class in connection with the Proposed Transaction;

(ii) Have the Individual Defendants breached their fiduciary duty to secure and obtain the best price reasonable under the circumstances for the benefit of plaintiff and the other members of the Class in connection with the Proposed Transaction;

(iii) Have the Individual Defendants breached any of their other fiduciary duties to plaintiff and the other members of the Class in connection with the Proposed Transaction, including the duties of good faith, diligence, honesty and fair dealing;

(iv) Have the Individual Defendants, in bad faith and for improper motives, impeded or erected barriers to discourage other strategic alternatives including offers from interested parties for the Company or its assets;

(v) Whether plaintiff and the other members of the Class would be irreparably harmed were the transactions complained of herein consummated;

(vi) Have M*Modal, OEP, Parent and Merger Sub aided and abetted the Individual Defendants’ breaches of fiduciary duty; and

(vii) Is the Class entitled to injunctive relief or damages as a result of defendants’ wrongful conduct.

7

(c) Plaintiff is committed to prosecuting this action, is an adequate representative of the Class, and has retained competent counsel experienced in litigation of this nature.

(d) Plaintiff’s claims are typical of those of the other members of the Class.

(e) Plaintiff has no interests that are adverse to the Class.

(f) The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications for individual members of the Class and of establishing incompatible standards of conduct for the party opposing the Class.

(g) Conflicting adjudications for individual members of the Class might, as a practical matter, be dispositive of the interests of the other members not parties to the adjudications, or substantially impair or impede their ability to protect their interests.

(h) Defendants have acted, or refused to act, on grounds generally applicable, and are causing injury to the Class and, therefore, final injunctive relief on behalf of the Class as a whole is appropriate.

FURTHER SUBSTANTIVE ALLEGATIONS

29. M*Modal is a leading provider of medical document processing technology, including clinical transcription services, clinical documentation workflow solutions, advanced cloud-based Speech UnderstandingTM technology, and advanced unstructured data analytics. M*Modal also offers voice to text solutions and delivers computer-assisted coding to support ICD-9 and the transition to ICD-10.

8

30. On March 8, 2012, the Company issued a press release announcing financial results for fourth quarter and fiscal year ended December 31, 2011. For the quarter, the Company reported net revenues of $116.1 million as compared to net revenues of $110.5 million for fourth quarter 2010, and adjusted net income of $0.38 per diluted share as compared to $0.28 for fourth quarter 2010. Net revenues and earnings per share for the quarter were higher than analyst estimates of $114.22 million and $0.29 per diluted share, respectively. For the year, the Company reported net revenues of $443.8 million as compared to $417.3 million for 2010, and adjusted net income of $1.34 per diluted share as compared to $1.01 for 2010. In the press release, defendant Davenport stated: “[w]e have continued to improve our execution, and I am pleased with the tremendous efforts of our team. Additionally, we have made progress on our goals of unifying the Company and solutions under one brand, signing significant strategic partnerships and competing much more effectively in the market.”

31. On May 9, 2012, the Company issued a press release announcing financial results for first quarter of 2012, which ended on March 31, 2012. The Company reported net revenues of $117.4 million as compared to $111.2 million for first quarter of 2011, and adjusted net income of $0.30 per diluted share. Net revenues and earnings per share for the quarter were higher than analyst estimates of $116.08 million and $0.25 per diluted share, respectively. “We demonstrated the benefit of having our new leadership team assembled and management system in place this quarter with revenue growth and

9

continued execution on leveraging an enhanced value proposition across our customer base,” stated defendant Davenport in the press release. “The significant win we announced this quarter with Duke University Health System highlights the value of consolidating documentation services across multiple clinical environments and the ability to enable physician adoption of EHRs with our M*Modal Fluency Direct™ solution.”

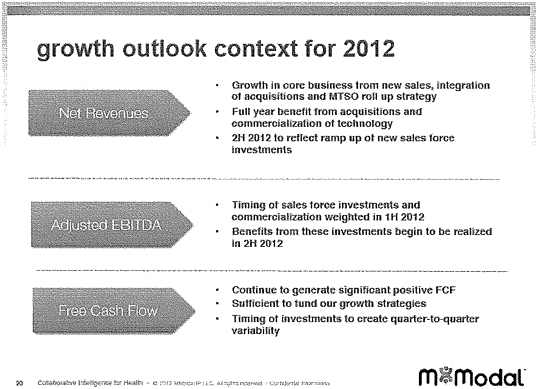

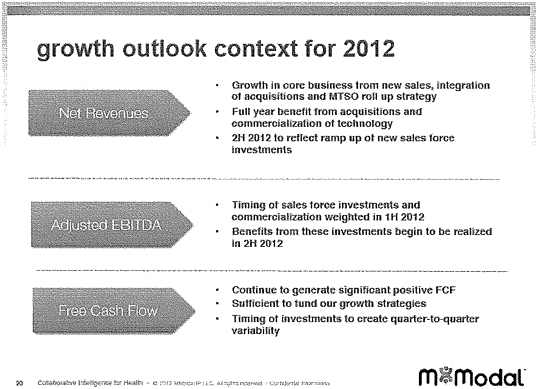

32. On June 6, 2012, the Company presented at the Jefferies 2012 Global Healthcare Conference. The presentation highlighted the Company’s future growth prospects, as demonstrated in the following slide:

? Timing of sales force investments and commercialization weighted in 1H 2012

• Benefits from these investments begin to be realized in 2H 2012

• Continue to generate significant positive FCF ? Sufficient to fund our growth strategies

« Timing of investments to create quarter-to-quarter

variability

m*Modal

•Growth in core business from new sales, integration of acquisitions and MTSO roll up strategy

? Full year benefit from acquisitions and commercialization of technology

•2H 2012 to reflect ramp up of new sales force investments

10

33. In a press release dated July 2, 2012, the Company announced that it had entered into the Merger Agreement with OEP pursuant to which OEP, through Parent and Merger Sub, would commence a tender offer to acquire all of the outstanding shares of the Company for $14.00 per share.

34. The Proposed Transaction provides a premium of just 8.3% based on the closing price of $12.93 on July 2, 2012. The price offered to shareholders in the Proposed Transaction actually represents a discount of 1.4% from M*Modal’s 52-week high of $14.20 on July 12, 2011.

35. Further, according to Yahoo! Finance, at least one Wall Street analyst had a price target of $15.00 per share before the Proposed Transaction was announced.

36. A July 4, 2012, article in THE TENNESSEAN, entitled “M*Modal seeks growth, so why the low price?” included the following statement:

“The question everybody’s asking is what’s there that we’re missing?” said analyst Leo Carpio of Caris & Co. “Why are they selling themselves at so low a price?”

Carpio believes M*Modal is worth at least $18 a share.

Carpio is puzzled that M*Modal, one of only two players with a proprietary speech-recognition software in the health-care information technology sector, sold for relatively less than a smaller, solely medical transcription services company went for roughly three months ago.

37. OEP is seeking to acquire the Company at the most opportune time, at a time when the Company is performing very well and is positioned for tremendous growth.

11

38. Moreover, the Company’s executive officers and directors have material conflicts of interest and are acting to better their own personal interests through the Proposed Transaction at the expense of M*Modal’s public shareholders.

39. Members of M*Modal’s management team will be employed by the combined company after the Proposed Transaction is completed. As stated in the M*Modal Employee Q&A filed on July 3, 2012, with the Form 8-K announcing the Proposed Transaction: “[t]he current expectation is for the existing management team to remain in place following the close of the transaction.”

40. In addition, certain of the Company’s officers and directors currently hold unvested stock options and/or restricted stock units of the Company. Pursuant to the terms of the Merger Agreement, stock options to acquire M*Modal common stock will be cancelled and converted into the right to receive the excess of the merger consideration over the per share exercise price of the option. Restricted shares will be cancelled and converted into the right to tender and receive the per share merger consideration.

41. In addition, as part of the Merger Agreement, defendants agreed to certain onerous and preclusive deal protection devices that operate conjunctively to make the Proposed Transaction afait accompli and ensure that no competing offers will emerge for the Company.

42. Section 5.6(a) of the Merger Agreement includes a “no solicitation” provision barring the Company from soliciting interest from other potential acquirers in order to procure a price in excess of the amount offered by OEP. Section 5.6(a) demands that the Company terminate any and all prior or on-going discussions with other potential acquirers, and includes a provision whereby M*Modal will not waive an existing standstill agreement.

12

43. Pursuant to Section 5.6(f) of the Merger Agreement, should an unsolicited bidder submit a competing proposal, the Company must notify OEP of the bidder’s identity and the terms of the bidder’s offer. Thereafter, Section 5.6(a) demands that should the Board determine to enter into a superior competing proposal, it must grant OEP three business days in which the Company must negotiate in good faith with OEP (if OEP so desires) and allow OEP to amend the terms of the Merger Agreement to make a counter-offer so that the Company will not enter into an agreement with the competitor or change its recommendation in favor of OEP. In other words, the Merger Agreement gives OEP access to any rival bidder’s information and allows OEP a free right to top any superior offer simply by matching it. Accordingly, no rival bidder is likely to emerge and act as a stalking horse, because the Merger Agreement unfairly assures that any “auction” will favor OEP and piggy-back upon the due diligence of the foreclosed second bidder.

44. The Merger Agreement also provides that a termination fee of $ 28.7 million must be paid to OEP by M*Modal if the Company decides to pursue the competing offer, thereby essentially requiring that the competing bidder agree to pay a naked premium for the right to provide the shareholders with a superior offer.

45. Pursuant to the Merger Agreement, if OEP receives 90% of the shares outstanding through its tender offer, it can effect a short-form merger. In the event OEP fails to acquire the 90% required, the Merger Agreement also contains a “Top-Up” provision that grants OEP an option to purchase additional shares from the Company in order to reach the 90% threshold required to effectuate a short-form merger.

13

46. Ultimately, these deal protection provisions unreasonably restrain the Company’s ability to solicit or engage in negotiations with any third party regarding a proposal to acquire all or a significant interest in the Company. The circumstances under which the Board may respond to an unsolicited written bona fide proposal for an alternative acquisition that constitutes or would reasonably be expected to constitute a superior proposal are too narrowly circumscribed to provide an effective “fiduciary out” under the circumstances.

47. Moreover, in connection with the Proposed Transaction, the Company’s largest stockholder, who owns approximately 31% of the Company’s outstanding stock entered into a support agreement to tender all its shares. M*Modal’s officers and directors own approximately 9.1% of the Company’s outstanding stock. Accordingly, approximately 40% of M*Modal’s common stock is already “locked up” in favor of the Proposed Transaction.

48. Accordingly, plaintiff seeks injunctive and other equitable relief to prevent the irreparable injury that Company shareholders will continue to suffer absent judicial intervention.

CLAIMS FOR RELIEF

COUNT I

Breach of Fiduciary Duties

(Against All Individual Defendants)

49. Plaintiff repeats all previous allegations as if set forth in full herein.

14

50. The Individual Defendants have knowingly and recklessly and in bad faith violated their fiduciary duties of care, loyalty, good faith, and independence owed to the public shareholders of M*Modal.

51. The Individual Defendants’ recommendation of the Proposed Transaction will result in a change of control of the Company which imposes heightened fiduciary responsibilities to maximize M*Modal’s value for the benefit of the stockholders and requires enhanced scrutiny by the Court.

52. The Individual Defendants have breached their fiduciary duties of loyalty, good faith, and independence owed to the shareholders of M*Modal because, among other reasons:

(a) they failed to take steps to maximize the value of M*ModaI to its public shareholders and took steps to avoid competitive bidding;

(b) they failed to properly value M*Modal; and

(c) they ignored or did not protect against the numerous conflicts of interest resulting from the directors’ own interrelationships or connection with the Proposed Transaction.

53. As a result of the Individual Defendants’ breaches of their fiduciary duties, plaintiff and the Class will suffer irreparable injury in that they have not and will not receive their fair portion of the value of M*Modal’s assets and will be prevented from benefiting from a value-maximizing transaction.

15

54. Unless enjoined by this Court, the Individual Defendants will continue to breach their fiduciary duties owed to plaintiff and the Class, and may consummate the Proposed Transaction, to the irreparable harm of the Class.

55. Plaintiff and the Class have no adequate remedy at law.

COUNT II

Aiding and Abetting

(Against M*Modal, OEP, Parent and Merger Sub)

56. Plaintiff repeats all previous allegations as if set forth in full herein.

57. As alleged in more detail above, defendants M*Modal, OEP, Parent and Merger Sub have aided and abetted the Individual Defendants’ breaches of fiduciary duties.

58. As a result, plaintiff and the Class members are being harmed.

59. Plaintiff and the Class have no adequate remedy at law.

WHEREFORE, plaintiff demands judgment against defendants jointly and severally, as follows:

(A) declaring this action to be a class action and certifying plaintiff as the Class representative and his counsel as Class counsel;

(B) enjoining, preliminarily and permanently, the Proposed Transaction;

(C) directing that defendants account to plaintiff and the other members of the Class for profits and any special benefits obtained as a result of their breaches of their fiduciary duties;

16

(D) awarding plaintiff the costs of this action, including a reasonable allowance for the fees and expenses of plaintiff’s attorneys and experts; and

(E) granting plaintiff and the other members of the Class such further relief as the Court deems just and proper.

| | | | | | |

| Dated: July 10, 2012 | | | | RIGRODSKY & LONG, P.A. |

| | | |

| | | | By: | | /s/ Brian D. Long |

| | | | | | Seth D. Rigrodsky (#3147) |

| | | | | | Brian D. Long (#4347) |

| | | | | | Gina M. Serra (#5387) |

| | | | | | 919 North Market Street, Suite 980 |

| | | | | | Wilmington, DE 19801 |

| OF COUNSEL: | | | | | | (302) 295-5310 |

LEVI & KORSINSKY LLP | | | | | | Attorneys for Plaintiff |

Donald J. Enright Elizabeth K. Tripodi 1101 30th Street, NW, Suite 115 Washington, DC 20007 (202) 524-4290 | | | | | | |

17