Exhibit (a)(5)(D)

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE

| | | | |

| IN RE MMODAL INC. | | ) | | CONSOLIDATED |

| SHAREHOLDER LITIGATION | | ) | | C.A. No. 7675-VCP |

PLAINTIFFS’ NOTICE OF FILING OF AMENDED

CONSOLIDATED VERIFIED CLASS ACTION COMPLAINT

| | | | |

| To: | | VIA E-FILING | | VIA E-FILING |

| | |

| | Anne C. Foster, Esquire | | Kevin G. Abrams, Esquire |

| | RICHARDS, LAYTON & FINGER, P.A. | | ABRAMS & BAYLISS LLP |

| | One Rodney Square | | 20 Montchanin Road, Suite 200 |

| | 920 North King Street | | Wilmington, DE 19807 |

| | Wilmington, DE 19801 | | |

PLEASE TAKE NOTICE that pursuant to Court of Chancery Rules 15(a) and 15(d), plaintiffs file herewith their Amended Consolidated Verified Class Action Complaint, which is attached hereto as Exhibit A.

In compliance with Court of Chancery Rule 15(aa), plaintiffs also file herewith a black- lined version, which is attached hereto as Exhibit B.

| | |

| | ROSENTHAL, MONHAIT & GODDESS, P.A. |

| |

| |

|

| | Jessica Zeldin (Del. Bar No. 3558) |

| | 919 North Market Street, Suite 1401 |

| | P.O. Box 1070 |

| | Wilmington, DE 19899-1070 |

| | (302) 656-4433 |

| |

| | Brian D. Long (Del. Bar No. 4347) |

OF COUNSEL: GARDY & NOTIS, LLP James S. Notis Kira German Jonathan Adler 501 Fifth Avenue New York, NY 10017 (212) 905-0509 | | RIGRODSKY & LONG, P.A. 919 North Market Street, Suite 980 Wilmington, DE 19801 (302) 295-5310 Co-Liaison Counsel for Plaintiffs |

| |

| |

| |

| |

| |

| |

| |

LEVI & KORSINSKY LLP

Donald J. Enright

Elizabeth K. Tripodi

1101 30th Street, NW, Suite 115

Washington, DC 20007

(202) 524-4290

WOLF POPPER LLP

Carl L. Stine

Joshua H. Saltzman

845 Third Avenue

New York, NY 10022

(212) 759-4600

Plaintiffs’ Co-Lead Counsel

July 24, 2012

2

EXHIBIT A

Amended Consolidated Verified Class Action Complaint

IN THE COURT OF CHANCERY FOR THE STATE OF DELAWARE

| | | | |

| IN RE MMODAL INC. | | ) | | CONSOLIDATED |

| SHAREHOLDER LITIGATION | | ) | | C.A. No.: 7675-VCP |

AMENDED CONSOLIDATED VERIFIED CLASS ACTION COMPLAINT

Plaintiffs Alan Kahn, Edward Forstein, and Scott Phillips (collectively, “Plaintiffs”), by their attorneys, allege upon information and belief, except for their own acts, which are alleged on knowledge, as follows:

NATURE OF THE ACTION

1. Plaintiffs bring this class action on behalf of themselves and all other public shareholders of MModal Inc. (“MModal” or the “Company”) against MModal’s Board of Directors (the “Individual Defendants” herein) and S.A.C. Private Capital Group LLC (“SAC”),1 the Company’s largest shareholder with 31% stake in the Company, and others for their breaches of fiduciary duties and for aiding and abetting such breaches arising out of their attempt to sell the Company to One Equity Partners V, L.P. (“OEP”), a private investment arm of JP Morgan Chase & Co.

2. Plaintiffs’ claims arise from an Agreement and Plan of Merger, dated as of July 2, 2012 (the “Merger Agreement”), between the Company and affiliates of OEP, Legend Parent, Inc. (“Parent”) and Legend Acquisition Sub, Inc. (“Merger Sub”), pursuant to which Parent will commence a tender offer (the “Tender Offer”) to acquire all outstanding shares of MModal for $14 cash per share (the “Buyout”), for a total equity value of approximately $1.1 billion. The Tender Offer was commenced on July 17, 2012, and is set to expire at 11:59 p.m. New York time, on Monday, August 13, 2012.

| 1 | SAC and its affiliates, including S.A.C. PEI CB Investment, L.P., S.A.C. PEI CB Investment II, International Equities (S.A.C. Asia) Limited and A.C. MultiQuant Fund, LLC are collectively referred to herein as “SAC.” |

3. The Buyout price undervalues the Company and is substantially below the $17 per share offer that the Individual Defendants received and rejected from a motivated strategic buyer, known as “Party A,” and likely the Company’s most significant competitor, Nuance Communications, Inc. (“Nuance”). The $14 per share Buyout price agreed to by the Individual Defendants represents a paltry premium of 8.4% over the closing price of MModal common stock on July 2, 2012, and far below the average premiums paid in recent comparable transactions. In fact, MModal’s stock traded as high as $13.15 per share on July 2, which implies an even lower premium of just 6.5%. Moreover, since the announcement of the Buyout, the Company’s common stock has traded above the Buyout price, and as high as $14.99 per share on July 17, 2012 – the day affiliates of OEP commenced the Tender Offer.

4. Indeed, the Individual Defendants’ decision to accept the Buyout is explained by SAC’s exit strategy that began with the Company’s initial public offering (the “IPO”) in February, 2011. Now, less than 18 months after the IPO, SAC seeks to dispose of its remaining stake in MModal through the Buyout and do so in a way that achieves closing certainty. A majority of the Individual Defendants are affiliated with SAC or are legacy directors from before the IPO, when SAC controlled the Company.

5. This goal was achieved by a heavily flawed sales process, run by and in the interests of, directors associated with or employed by SAC. These directors steered the process towards an all-cash deal with OEP, rejecting a higher offer from a strategic party in order to realize SAC’s goal of quickly liquidating its interest in the Company. These efforts were aided by management who realized that their chances of continued employment were far greater in a deal with a financial purchaser such as OEP than in one with a strategic party such as Nuance.

6. In addition, one of MModal’s financial advisors, RBC Capital Markets, LLC, (“RBCCM”), is providing committed financing to OEP through its affiliate Royal Bank of

2

Canada (“RBC”), whereas such financing was not needed in the higher offer from Nuance. Although the Individual Defendants also retained Macquarie Capital Inc. (“Macquarie”) as another financial advisor, Macquarie has provided significant financial services to OEP and served as OEP’s financial advisor as recently as March 2012, and both RBC and Macquarie have extensive ties to SAC.

7. While Macquarie provided a fairness opinion for the $14 per share Buyout price, that opinion is based on financial analyses that include unduly bearish assumptions of the Company’s financial performance that seem driven by the need to justify the low Buyout price rather than realistic expectations for the Company’s future. Even with these manipulations, the $14 per share Buyout Price is barely above the low end of the value range from a discounted cash flow (“DCF”) analysis that applied a whopping 40% discount rate for certain of the Company’s business lines and a (0.25%) negative perpetuity growth rate to other business lines.

8. In addition to the usual range of deal protection devices such as a 3.5% termination fee, no-solicitation clause, matching rights clause, and top-up option, the Defendants agreed to further lock up the Buyout and preclude a competing offer from Nuance (or anyone else) through a coercive support agreement (the “Support Agreement”) whereby SAC agreed to tender its 31% into the Tender Offer. The Support Agreement does not permit SAC to revoke the tender of the shares in the event of a change in recommendation by the board. Thus, even if a Nuance provides a superior proposal or commences a competing tender offer directly to MModal shareholders, SAC’s 31% stake will be tied up in support of the Buyout by OEP even if the board changes its recommendation. As a result of the Support Agreement, OEP can trigger the Merger Agreement’s top-up option with the tender of just 5.7 million more shares (roughly 16.6% of the remaining public shares) – a number far fewer than the 17 million shares that traded immediately following the announcement of the Merger Agreement.

3

9. Further compounding problems for shareholders, the tender offer documents filed by Defendants fail to provide the Company’s shareholders with material information and/or provides them with materially misleading information thereby rendering shareholders unable to make an informed decision on whether to tender their shares in the Tender Offer or seek statutory appraisal rights. For instance, on July 17, 2012, the Company filed a Schedule 14D-9 (“14D-9”) with the SEC that fails to disclose the unlevered free cash flows Macquarie used in the DCF analysis. With another bidder willing to pay $17 per share (over 21% higher than the Buyout price), such financial information concerning an important valuation analysis is material to shareholders and must be disclosed.

10. Plaintiffs seek equitable relief compelling the Individual Defendants to properly exercise its fiduciary duties to maximize shareholder value in connection with the Buyout or any alternate transaction and to provide shareholders with all material information.

THE PARTIES

11. Plaintiffs are, and have been at all relevant times, owners of shares of common stock of MModal. Plaintiff Alan Kahn owns 24,820 MModal shares, valued at $347,480 at the Buyout price; Plaintiff Edward Forstein owns 18,316 MModal shares, valued at $256,424 at the Buyout price; and Plaintiff Scott Phillips owns 3,150 MModal shares, valued at $44,100 at the Buyout price.

12. MModal is a Delaware corporation with a principal executive offices at 9009 Carothers Parkway, Franklin, Tennessee 37067. MModal provides medical document processing technology, including clinical transcription services, cloud-based speech understanding technology and unstructured data analytics. The Company’s common stock trades on the NASDAQ under the symbol “MODL.” MModal is named herein solely for the purpose of providing full and complete relief.

4

13. Defendant Roger L. Davenport (“Davenport”) has been the Chairman, Chief Executive Officer (“CEO”) and a director of the Company since 2011. Davenport’s appointment as CEO occurred on July 11, 2011, the same day that the Company, then Medquist Holdings Inc., announced the planned acquisition of Multimodal Technologies, Inc. for $130 million in cash and stock. That merger was completed on August 18, 2011.

14. Defendant V. Raman Kumar (“Kumar”) is a co-founder of the Company and has been a director and Vice Chairman since February 2007. Kumar served as the Company’s CEO from February 2007 to October 2010, and has held a variety of executive and director positions with various subsidiaries of the Company, including during periods prior to the IPO, when the Company was controlled by SAC. Kumar has also been an executive partner at Siris Capital Group, LLC, (“Siris”) since March 2011, when it was spun-off from SAC.

15. Defendant Frank Baker (“Baker”) has been a director of the Company since 2008. Baker was also a non-executive director of the Company’s wholly owned subsidiary, MModal MQ Inc. (formerly known as MedQuist), from August 2008 until April 2012. Baker was a co-founder of SAC and was a Managing Director of SAC from 2007 to March 2011. In March 2011, Baker co-founded Siris. From 1999 to 2006, Baker was at Ripplewood, a New York based private equity firm, and RHJ International, a financial services company incorporated under the laws of Belgium.

16. Defendant Peter Berger (“Berger”) has been a director of the Company since 2008. Berger is also a non-executive director of MModal MQ Inc., and a Managing Director and co-founder of Siris. Berger was a co-founder of SAC and was a Managing Director of SAC from 2007 to March 2011. Berger was also a founding member of Ripplewood and a special senior advisor to RHJ International.

5

17. Defendant Jeffrey Hendren (“Hendren”) has been a director of the Company since 2008. Hendren is a Managing Director and co-founder of Siris. He was also a co-founder of SAC and was a Managing Director of SAC from 2007 to March 2011. Hendren was also a Managing Director of Ripplewood and RHJ International.

18. Defendant Kenneth John McLachlan (“McLachlan”) has been a director of the Company since 2007, and is therefore a legacy director from a time prior to the IPO, when the Company was controlled by SAC.

19. Defendant James Patrick Nolan (“Nolan”) has been a director of the Company since 2009, and is therefore a legacy director from a time prior to the IPO, when the Company was controlled by SAC.

20. Defendant Colin J. O’Brien (“O’Brien”) has been a director of the Company since 2011, and was a member of the MModal MQ Inc. board of directors from September 2008 to March 201, and is therefore a legacy director from a time prior to the IPO, when the Company was controlled by SAC.

21. Defendant Andrew E. Vogel (“Vogel”) has been a director of the Company since 2011, and was a member of the MModal MQ Inc. board of directors from September 2008 to March 2011. Vogel was also an investment professional at Ripplewood Holdings.

22. Defendant Robert J. Greczyn, Jr. (“Greczyn”) has been a director of the Company since 2011.

23. Defendant Henry C. Wolf (“Wolf”) has been a director of the Company since February 2012.

24. Defendants Davenport, Kumar, Baker, Berger, Greczyn, McLachlan, Hendren, Nolan, O’Brien, Vogel and Wolf are collectively referred to herein as the “Individual Defendants.”

6

25. Defendant OEP is a Cayman Islands exempted limited partnership with its headquarters located at 320 Park Avenue, 18th Floor, New York, New York 10022. OEP manages $10 billion in investments and commitments for JPMorgan Chase & Co.

26. Defendant Parent is a Delaware corporation affiliated with OEP.

27. Defendant Merger Sub is a Delaware corporation wholly owned by Parent that was created to effectuate the Buyout.

28. Defendant SAC is a Delaware limited liability company and is MModal’s largest shareholder.

CLASS ACTION ALLEGATIONS

29. Plaintiffs bring this action pursuant to Court of Chancery Rule 23, individually and on behalf of the holders of the common stock of the Company as of the July 2, 2012 announcement of the Buyout, who have been and/or will be harmed as a result of the wrongful conduct alleged herein (the “Class”). The Class excludes Defendants herein, and any person, firm, trust, corporation or other entity related to, or affiliated with, any of the Defendants.

30. This action is properly maintainable as a class action.

31. The Class is so numerous that joinder of all members is impracticable. As of April 4, 2012, the Company had over 33 million shares outstanding that were not beneficially owned by the Defendants or their affiliates. Members of the Class are scattered geographically and are so numerous that it is impracticable to bring them all before this Court.

32. Questions of law and fact are common to the Class, including, inter alia, the following:

(a) Have the Individual Defendants breached their fiduciary duties of loyalty and/or due care with respect to Plaintiffs and the other members of the Class in connection with the Buyout;

7

(b) Have the Individual Defendants breached their fiduciary duty to secure and obtain the best price reasonable under the circumstances for the benefit of Plaintiffs and the other members of the Class in connection with the Buyout;

(c) Have the Individual Defendants misrepresented and omitted material facts in violation of their fiduciary duties owed by them to Plaintiffs and the other members of the Class;

(d) Whether Plaintiffs and the other members of the Class would be irreparably harmed were the transactions complained of herein consummated; and

(e) Have OEP, Parent, Merger Sub, and SAC aided and abetted the Individual Defendants’ breaches of fiduciary duty; and

33. Plaintiffs are committed to prosecuting this action and have retained competent counsel experienced in litigation of this nature. Plaintiffs’ claims are typical of the claims of the other members of the Class and Plaintiffs have the same interests as the other members of the Class. Accordingly, Plaintiffs are an adequate representative of the Class and will fairly and adequately protect the interests of the Class.

34. The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications with respect to individual members of the Class, which would establish incompatible standards of conduct for Defendants, or adjudications with respect to individual members of the Class which would, as a practical matter, be dispositive of the interests of the other members not parties to the adjudications or substantially impair or impede their ability to protect their interests.

35. Preliminary and final injunctive relief on behalf of the Class as a whole is entirely appropriate because Defendants have acted, or refused to act, on grounds generally applicable and causing injury to the Class.

8

SUBSTANTIVE ALLEGATIONS

Background of the Company and Expectations for Strong Future Growth

36. MModal’s predecessor, CBay Systems Holdings Limited (“CBay”), was organized in 1998. In August 2008, SAC invested $124 million to acquire a majority interest in CBay, paying roughly $6.20 per share. SAC also entered into a series of agreements with CBay in connection with acquiring the majority stake, including a management agreement, consulting agreement, voting agreement, registration rights agreement, stockholders agreement, and redemption agreement.

37. CBay used the proceeds of the SAC investment to acquire a majority stake in its competitor, MedQuist Inc. (later MModal MQ Inc.) from Koninklijke Philips Electronics N.V. (the Netherlands-based conglomerate known as Philips Electronics) on August 6, 2008. In April 2010, CBay and MedQuist Inc. separately acquired certain assets of Spheris in a transaction conducted under Section 363 of the Bankruptcy Code. Spheris was the second-largest U.S. medical transcriptions service provider by revenue at the time.

38. On January 17, 2011, CBay changed its name to Medquist Holdings Inc (“Holdings”), and in February 2011, Medquist Holdings commenced both a private and public exchange offer to exchange shares of MedQuist Inc. common stock for shares of Holdings common stock. As a result, Holdings increased its ownership interest in MedQuist Inc. to approximately 97%. On October 18, 2011, Holdings completed a short-form merger with MedQuist Inc, resulting in MedQuist Inc. becoming an indirectly, wholly owned subsidiary of Holdings, and Holdings common stock no longer being publicly traded.

39. In February 2011, Holdings completed the IPO at $8 per share. SAC owned a 47.8% stake in Holdings prior to the IPO and approximately 34% after the IPO.

9

40. On August 18, 2011, Holdings completed its acquisition of Multimodal Technologies, Inc. for $130 million in cash and stock.

41. Effective January 23, 2012, Holdings changed its name to MModal Inc., and on January 25, 2012, the Company’s stock symbol became “MODL.” The name change was effectuated to reflect the unification of services, including coding, data analytics, and health information management professional services, particularly transcription.

42. On March 8, 2012, the Company issued a press release announcing financial results for fourth quarter and fiscal year ended December 31, 2011. For the quarter, the Company reported net revenues of $116.1 million as compared to net revenues of $110.5 million for fourth quarter 2010, and adjusted net income of $0.38 per diluted share as compared to $0.28 for fourth quarter 2010. Net revenues and earnings per share for the quarter were higher than analyst estimates of $114.22 million and $0.29 per diluted share, respectively. For the year, the Company reported net revenues of $443.8 million as compared to $417.3 million for 2010, and adjusted net income of $1.34 per diluted share as compared to $1.01 for 2010. In the press release, Chairman and CEO Davenport stated: “[w]e have continued to improve our execution, and I am pleased with the tremendous efforts of our team. Additionally, we have made progress on our goals of unifying the Company and solutions under one brand, signing significant strategic partnerships and competing much more effectively in the market.”

43. On May 9, 2012, the Company issued a press release announcing financial results for first quarter of 2012, ended March 31, 2012. The Company reported net revenues of $117.4 million as compared to $111.2 million for first quarter of 2011, and adjusted net income of $0.30 per diluted share. Net revenues and earnings per share for the quarter were higher than analyst estimates of $116.08 million and $0.25 per diluted share, respectively. “We demonstrated the benefit of having our new leadership team assembled and management system in place this

10

quarter with revenue growth and continued execution on leveraging an enhanced value proposition across our customer base,” stated Davenport in the press release. “The significant win we announced this quarter with Duke University Health System highlights the value of consolidating documentation services across multiple clinical environments and the ability to enable physician adoption of EHRs with our MModal Fluency Direct™ solution.”

44. Davenport also told investors:

We are off to a strong start in 2012 and well underway with our most important objectives of significantly expanding the direct sales force for technology solutions and transcription outsource services, building out an indirect sales channel with an ecosystem of partners and commercializing our technologies . . . . The promise of our technology is to solve some of the most pressing problems of our industry, and this is being validated by our success in the marketplace. We will continue to focus on the execution required to translate this ‘promise’ into meaningful financial and operating momentum in the second half of the year.

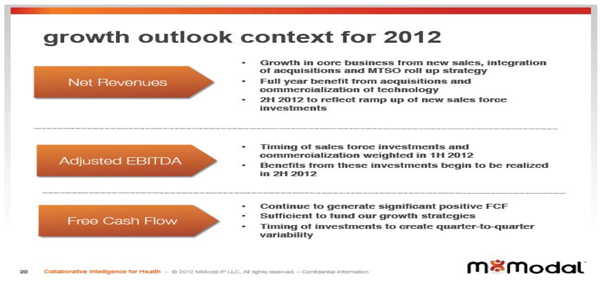

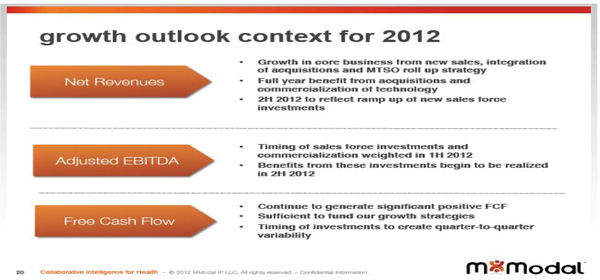

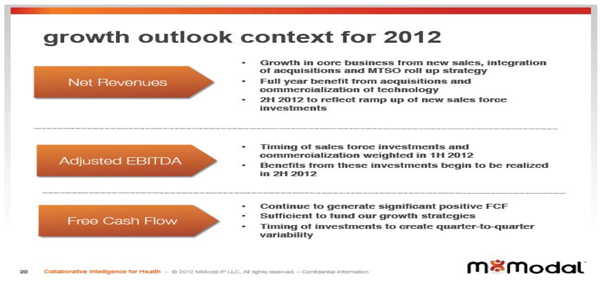

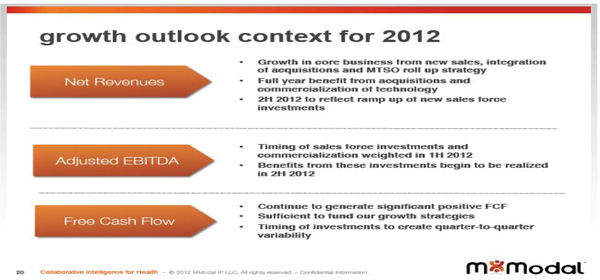

45. On June 6, 2012, the Company presented at the Jeffries 2012 Global Healthcare Conference. The presentation highlighted the Company’s future growth prospects, as demonstrated in the following slide:

11

46. Also in June 2012, the Company introduced a new line of products called Catalyst, which helps clinicians extract unstructured data, such as dictated notes from patient exams, and combine it with structured information, such as lab values and vital signs.

47. According to Stephen Willis, chief information officer at Canopy Partners,

“MModal Catalyst allows us an unparalleled level of visibility. It actually bridges the gap between structured data and language and lets us mine the data hidden within the language. . . . We’re able to turn a static, text document into an actual living document so we can measure against the quality measures that our best practice operating committee has determined are most meaningful.”

48. Likewise, Bloomberg reported the comments of another analyst on the positive impact of the Supreme Court’s recent decision to uphold healthcare reform:

MModal’s speech recognition and document processing technologies will be in demand as hospitals race to become more efficient after the U.S. Supreme Court upheld the health-care overhaul. . . Altogether, it’s an attractive asset. . . . This allows physicians to be productive, while still capturing the data they need.

49. MModal’s share price reflects market enthusiasm about the Company’s financial strength and optimism about its prospects. Since closing at $6.52 on October 4, 2011 – the stock’s lowest price since its February 2011 IPO – the Company’s stock has climbed steadily, closing as high as $13.25 on June 19, 2012, just two weeks before the announcement of the Buyout. On July 3, 2012, the day the Buyout was announced, MModal closed $0.02 above the $14 per share Buyout price, and traded as high as $0.99 above the Buyout price.

The SAC-Affiliated Directors Controlled the Sales Process

50. A majority of Individual Defendants are either affiliated with SAC or its Siris spin-off or are legacy directors of the Company from before the IPO, when SAC owned 48% of the Company (the next largest shareholder, a Lehman Brothers affiliate, owned 12%) and controlled the Company through various management and consulting agreements. SAC currently owns over 17.5 million shares, representing a 31% equity stake. SAC’s 17.5 million shares are rendered effectively illiquid by the Company’s average daily trading volume of just

12

762,915 shares. Absent an extraordinary transaction, SAC has no prospect of liquidity. Now, following the private equity playbook of cycling the Company between private and public ownership, SAC seeks to dispose of its remaining stake in MModal through the Buyout.

51. Not surprisingly, SAC-affiliated directors, including most notably Hendren, Baker, and Berger, played key roles throughout the sales process, meeting with representatives of potential acquirers, and engaging in discussions with RBCCM and Macquarie, and largely controlling the principal-to-principal discussions with Nuance. On March 6, 2011, Berger and Baker were also appointed to the Transaction Committee, a committee designed to “effectively manage the logistics of the process and periodically report to the Board regarding the status of the process.”

Defendants’ Flawed Sales Process

52. At various times during 2010 and 2011, representatives of the Company had discussions with Party A – a potential strategic acquirer who, from clues provided in the 14D-9, appears to be the company’s most significant competitor, Nuance – and with OEP, respectively, regarding potential a potential acquisition of the Company. These discussions did not advance beyond a preliminary stage.

53. In October 2011, Hendren and Baker, both of whom were appointed to the board by SAC, entered into more substantial negotiations with OEP and entered into a confidentiality agreement, although the negotiations did not lead to a proposal and the parties ceased further discussions, when OEP informed Hendren and Baker that it would likely require SAC to roll over its equity stake in the Company.

54. During December 2011 and early 2012, representatives of the Company took various steps to explore a possible sale to a financial buyer, including holding discussions with several financial sponsors and meeting with potential financial advisors. In February 2012, the Company engaged RBCCM and Macquarie Capital as its financial advisors.

13

55. Later in February 2012, representatives of Party A contacted Baker and expressed interest in acquiring the Company. On March 5, 2012, Davenport received a written proposal from Party A to purchase all of the outstanding shares of the Company at a price of $14 per share, payable 50% in cash and 50% in Party A common stock. The proposal included a commitment by Party A to divest certain assets of the Company to obtain antitrust approval for the Buyout, and a $75 million antitrust termination fee payable by Party A to the Company if antitrust approval was not obtained for the transaction within 15 months, and required the Company to negotiate exclusively with Party A for a period of 30 days.

56. Due to concerns including “the significant delay” and “the potential loss of employees,” the board determined on March 6, 2012, that negotiating exclusively with Party A would not be in the Company’s best interests. In addition, certain board members (the 14D-9 does not say who) expressed the view at a March 6, 2012 board meeting that Party A was really just using MModal “as a stalking horse bidder to put pressure on” another acquisition target that Party A was pursuing at the time. Such characterizations by certain of the Individual Defendants to malign Party A were proven false. Party A announced that other acquisition, which appears to be Nuance’s acquisition of Transcend Services, Inc., on March 7, 2012.

57. The Individual Defendants on March 6, 2012 also established the Transaction Committee, consisting of Davenport, Berger, Baker, Wolf and Nolan. Davenport, Berger and Baker were all company insiders due to their executive position with the Company and/or their affiliation with SAC. Nevertheless, these conflicted insiders negotiated with prospective acquirers, while Wolf and Nolan apparently had no contact with any acquirers. The board directed the Transaction Committee to meet to discuss how the Company should respond to Party A’s proposal.

14

58. They also decided to cut Party A out of negotiations entirely for the time being. Citing reasons including the speed at which the process could move, the Transaction Committee decided to only invite financial acquirers to participate in the process until a later date.

59. During the week of March 12, 2012, the Company and its financial advisors prepared a list of 19 financial sponsors, including OEP, and invited them to participate in the sales process. From March 16 to 26, 2012, five additional financial sponsors contacted the Company indicating an interest in participating in the process. On April 26, 2012, the Company received initial indications of interest from several of these parties, including OEP.

60. OEP’s initial indication of interest included a price range of $13.00 to $13.50 per share. Despite the fact that this indication was $0.50 to $1.00 less than the price indicated by Party A, which the Company readily dismissed along with Party A entirely, the Company determined to continue to pursue negotiations with OEP.

61. On May 2 and 3, 2012, the board authorized Macquarie to invite five potential strategic purchasers that it believed “were most likely to be interested and capable of consummating a transaction.” These parties were essentially forced to play catch-up to the financial parties who had the benefit of a nearly two-month head start. Despite already knowing Party A’s interest in a transaction however, the board determined not to include Party A, citing worries over antitrust risks and concerns regarding providing competitively sensitive information to them. None of the strategic parties solicited ultimately submitted an offer to acquire the Company.

62. On June 8, 2012, a representative of Party A’s financial advisor contacted Baker regarding Party A’s continued interest in a potential transaction. Baker referred the Party A

15

representative to contact Macquarie. On June 15, 2012, Baker received a call from Party A’s CEO regarding Party A’s continued interest in a potential transaction, and Baker referred the CEO to contact Macquarie.

63. In addition, on June 12, 2012, the Baker and Berger confirmed, on behalf of SAC, that SAC would be willing to deliver a support agreement to OEP. The Transaction Committee directed its counsel, Simpson Thacher & Bartlett LLP (“Simpson Thacher”) to provide SAC’s counsel, Willkie Farr & Gallagher LLP (“Willkie Farr”) a draft support agreement.

64. On June 19, 2012, OEP submitted a proposal to acquire the Company at $13.00 per share. In the alternative, OEP indicated that it would be willing to purchase only SAC’s 31% interest in the Company. OEP’s proposal constituted a take-under to MModal’s June 19, 2012 closing price of $13.04 per share. Not surprisingly, Baker and Berger rejected OEP’s suggestion to purchase only OEP’s shares, ostensibly because SAC would not receive a takeover premium without all shareholders tendering their shares. Nevertheless, despite OEP’s low-ball offer, the Transaction Committee continued to negotiate with OEP.

65. On June 22, 2012, Simpson Thacher reached out to Party A’s counsel to indicate that Party A’s proposal would need to include a “hell or high water” antitrust covenant for Party A, that would require Party A to take any and all actions to obtain antitrust approval for the proposed transaction. That same day, Party A communicated to Baker an informal offer of $16.00 per share, 70% in cash and 30% in Party A common stock. While Party A was not willing to agree to a “hell or high water” antitrust covenant, Party A told Baker that it was willing to consider alternative proposals regarding allocation of risk between the Company and Party A. Baker proceeded to inform Party A’s CEO that “he did not believe that $16.00 per share would be sufficient given the alternatives available to the Company” in spite of the fact that the only other offer the Company was entertaining was OEP’s significantly lower, no premium $13.00 per share offer. Baker also stated that this was in part due to the “significant risks and delay inherent in a transaction between Party A and the Company.”

16

66. Throughout the remainder of June, and up until the day the Merger Agreement was signed, Party A made serious efforts to negotiate a deal with the Company. On June 24, 2012 the Transaction Committee met to discuss the status of OEP and Party A’s respective proposals. The Transaction Committee concluded that the Company could proceed with Party A in the absence of a “hell or high water” antitrust covenant, so long as Party A agreed to a significant antitrust reverse termination fee. The Transaction Committee directed Simpson Thatcher to prepare to send to Party A’s outside counsel a draft antitrust covenant that was short of a “hell or high water” provision. That day, Party A submitted a written proposal to Simpson Thacher that included a $16.50 per share purchase price (composed of 70% in cash and 30% in Party A common stock) and a reverse termination fee that would increase by $7.5 million each month after the six-month anniversary of signing (for a total potential antitrust reverse termination fee of $120 million).

67. On June 25, 2012, the Transaction Committee directed Simpson Thatcher to send a counterproposal to Party A of $18 per share (composed of 77.8% in cash and 22.2% in Party A common stock) and a $125 million reverse termination fee, which would increase by $4.2 million each month after the six-month anniversary of signing up to a cap of $150 million.

68. That day, Party A submitted a counter proposal of $17 per share (composed of 70% in cash and 30% in Party A stock) and a $120 million reverse termination fee with no increases contemplated after six months.

69. On July 1, 2012, Party A reaffirmed its $17 per share offer, but raised its reverse termination fee to $140 million. That evening, the Transaction Committee provided Party A with two counterproposals. Either $17 per share and $180 million reverse termination fee or $18

17

per share a $160 million reverse termination fee (which was an increase from the $18 per share and up to $150 million reverse termination fee the Transaction Committee had countered on June 25). On July 2, 2012, Party A provided Simpson Thacher an updated proposal of $17 per share and a reverse termination fee of $150 million.

70. Despite Party A’s persistent efforts, the board, led by the Transaction Committee with its SAC representatives, rebuffed Party A’s higher bid. The Company demanded extremely favorable terms from Party A, and then settled for an inferior $14 per share offer from OEP, which amount is roughly $171.2 million less than Party A’s 17 per share offer. In fact, on July 2, 2012, the Transaction Committee recommended “approval of the OEP offer and not the Party A offer” an hour prior to even receiving Party A’s final offer. Indeed, despite citing the risk of antitrust approval of a transaction with Party A in the 14D-9 as the basis for the Individual Defendants’ rejection of Party A’s offer, Party A made significant efforts to accede to the board’s demand and alleviate its antitrust concerns by upping its reverse termination fee from $75 million on March 5, 2012 to $150 million (just $30 million shy of the Board’s counter-proposal) on July 2012. Thus, the Board rejected Part A’s $17 offer, which provided additional $171.2 million in value to MModal shareholders above OEP’s $14 offer, ostensibly based on a $30 million difference in a reverse termination fee.

71. On July 2, 2012, the full board followed the conflicted Transaction Committee’s advice, and approved and authorized the execution of the Merger Agreement with OEP, citing, among other things, the lengthy amount of time a transaction with Party A would take due to antitrust issues. This timeframe, discussed as being troublesome on several occasions by the board, is estimated in the 14D-9 as taking anywhere from 6 to 12 months, with Party A’s outside counsel opining that approval could take as long as 6 to 9 months and MModal’s counsel opining that approval may take 9 to 12 months. This time frame, however, would be inconvenient for

18

SAC’s goal of disposing of its remaining stake in MModal with closing certainty and no delay. The cash and stock consideration proposed by Party A also did not provide SAC with immediate liquidity. The quick and all-cash Buyout by a financial buyer like OEP, however, did.

72. The Company unfairly favored OEP over Party A in the sales process, regardless of the Transaction Committee’s repeated concerns about the “status of OEP’s proposal,” and the ultimate low price that proposal offered, and despite Party A’s higher offer and continued earnest efforts at negotiating a viable deal.

73. In addition to the 3.5% termination fee and matching rights and last look for OEP in the Merger Agreement, Defendants sought to obtain further deal protection lock-ups though the Support Agreement between SAC and OEP. Having achieved a price it was willing to sell at and on its preferred terms that favored deal certainty, SAC entered in to the Support Agreement whereby SAC agreed to irrevocably tender its 31% equity stake in favor of the Buyout. Notably, the Support Agreement does not provide for any termination rights in the event that board issues a change in recommendation. In addition to effectively precluding the ability of Party A from succeeding with a competing tender offer, SAC’s agreement to tender the 31% stake means that OEP can trigger the Merger Agreement’s top-up option with the tender of just 5.7 million more shares (roughly 16.6% of the remaining public shares).

74. This unfair process, while largely driven by Baker, Hendren and Berger’s desire to realize SAC’s goal of quickly liquidating its stake in the Company, was also supported by management’s desire to procure post-transaction employment.

75. Davenport and Company management recognized the heightened prospects of retaining their positions if the Company were to enter into a deal with a financial party as opposed to a strategic one. From the first consideration of Party A’s March 5, 2012 proposal, the board considered “the potential loss of employees.” Later, on June 10, 2012 after months of

19

steadily steering the process towards financial bidders, and away from strategic parties such as Party A, Davenport announced that he would be resigning from the Transaction Committee due to “the likelihood that the bidders would include two financial sponsors with which management would likely have an ongoing employment role, and possibly an equity interest or other incentive different from other stockholders.”

76. Although the 14D-9 makes no mention of management procuring such employment, nor of any negotiations in which such employment was a topic of discussion, it was revealed in the MModal Employee Q&A filed on July 3, 2012 that “[t]he current expectation is for the existing management team to remain in place following the close of the transaction.” Davenport, who joined the Company less than a year earlier, will receive over $7 million for unvested restricted stock options and/or restricted stock units of the Company as a result of the Buyout. The Individual Defendants (with Davenport excluded) when they approved the Merger Agreement also awarded $4 million in “transaction close and retention bonuses” to management, with Davenport collecting another $1 million.

77. Furthermore, while it is stated that on June 11, 2012, it was decided that as a result of employment possibilities Davenport had a conflict of interest with regards to being a party to continued discussions and deliberations regarding a possible transaction, Davenport continued to be a party to meetings with OEP on June 11, 2012 and June 18, 2012. He did not participate in any further meetings with Party A. However, on June 28, 2012, the board requested Davenport to give his point of view regarding a potential transaction with Party A. Unsurprisingly, Davenport noted concerns, including the potential loss of employees.

The Board Was Represented By Conflicted Financial Advisors

78. The board decided to embark on this unfair process aided by a conflicted financial advisor. Although the board “noted the importance of retaining a financial advisor that would be

20

free of potential conflicts of interest . . . and that could be asked to deliver a fairness opinion in connection with the transaction,” on March 6, 2012, the board selected RBCCM for the role of potential financer and Macquarie as its lead financial advisor, ignoring the fact that Macquarie was currently providing services to OEP. In fact, Macquarie served as OEP’s financial advisor in its acquisition of Sonneborn in March 2012; the very same month the Company reached out to OEP to participate in the sales process. In addition, Macquarie may have undisclosed ties to SAC, as the 14D9 states that Macquarie “has made a $15 million investment in a fund whose principals are directors of the Company.” And further, RBCCM has an interest in both sides of the Buyout, as it is providing committed financing to OEP for the Buyout through its affiliate Royal Bank of Canada (“RBC”).

The Board Agreed to Inadequate Consideration

79. The $14 per share in cash agreed to by the Individual Defendants does not represent fair value for MModal, in that it does not reflect the long-term value of the Company.

80. The Buyout provides a premium of just 8.3% based on the closing price of $12.93 per share on July 2, 2012. Indeed, the Company’s stock traded as high as $13.15 per share on July 2, 2012, implying an even lower premium of just 6.5%.

81. Moreover, several analysts and investors raised pointed questions to management regarding the low valuation of the Buyout price. In a July 3, 2012 MModal investor call held to discuss the Buyout, analyst Frank Morgan from RBCCM noted the valuation and stated, “[Y]ou know, we’ve already started getting called about it – how do you think about the valuation here versus some of the takeout comps that have happened in the past?” Michael Needleman from Preservation Asset Management commented that:

Going back to the premium if you go back to when you announced the deal for MModal on July [2] I think the price was – of the stock was approximately $13.20. And having kind of gone through a year of, you know, putting together a plan that premium, in my opinion, is not justified on the overall potential from the standpoint of the market.

21

If in fact the business outlook is so robust, and so big why are you selling at this time? I just don’t get it? And for this price?

82. The financial press has likewise questioned the Buyout price, as the $14 per share price is at just 8.46x EBITDA, compared with an average 21.3x among ten comparable deals, according toBloomberg.

83. A July 4, 2012, article inThe Tennessean, entitled “MModal seeks growth, so why the low price?” included the following statement:

“The question everybody’s asking is what’s there that we’re missing?” said analyst Leo Carpio of Caris & Co. “Why are they selling themselves at so low a price?”

Carpio believes MModal is worth at least $18 a share.

Carpio is puzzled that MModal, one of only two players with proprietary speech-recognition software in the health-care information technology sector, sold for relatively less than a smaller, solely medical transcription services company went for roughly three months ago.

84. Macquarie’s financial analysis confirms that the Buyout price is low, even accepting Macquarie’s unusual (and unwarranted) negative view of the Company’s prospects. Most striking is Macquarie’s DCF analysis, which appears contorted to fit the Buyout price into a fairness range. Macquarie performed a sum-of-the-parts DCF analysis by splitting the Company’s operations into a base business segment and a high growth business segment. For the base business segment, Macquarie used (i) five-year projections of unlevered free cash flow (which figures are undisclosed in the 14D-9), (ii) assumed perpetuity growth rates to year-five cash flow from a low of (0.25%) growth to a high of just 0.25% growth (thus assuming a midpoint of zero growth), and (iii) a discount rate range of 10.4% to 11.4%, which implies a midpoint matching Macquarie’s calculation of a weighted average cost of capital (“WACC”) for the base business segment of 10.9%. For the high growth business segment, Macquarie used (i)

22

five-year projections of unlevered free cash flow (which figures are undisclosed in the 14D-9), (ii) terminal multiples to year five adjusted EBITDA of 6.0x to 8.0x, and (iii) a discount rate range of 30.0% to 40.0%. Macquarie’s use of a 30.0% to 40.0% discount range is not typical, not supported by Macqurie’s own WACC analysis for the high growth business segment, but was necessary to drive the low end of the DCF value range to under $14 per share. For instance, while, as is typical, the WACC was used as the midpoint (10.9%) midpoint for the discount rate range (10.4% to 11.4%) for the base business segment, the WACC for the high growth business segment (32.4%) was near the low end of the 30.0% to 40.0% discount range used. The higher the discount rate, the lower the values derived in the DCF analysis. By manipulating the discount rate range to a whopping 40%, Macquarie was able to lower the low end of the DCF to $13.84 per share. Put another way, had Macquarie not made those adjustments and kept the WACC closer to the midpoint of the discount rate range, the $14 Buyout price would be below the lowest values in the DCF analysis. And, that is in addition to the fact that choosing such sky-high discount rates effectively makes the present value negligible for any cash flows past year two or three, when management was projecting substantial growth.

85. MModal’s officers and directors ignored these compelling factors, however, along with shareholders’ best interest; the officers focused on procuring post-transaction employment for themselves with a financial acquirer, and the directors focused on realizing SAC’s goal of shedding its interest in the Company as quickly as possible.

The Materially Incomplete and Misleading 14D-9

86. On July 17, 2012, the Company filed the 14D-9 with the SEC in connection with the Buyout. The 14D-9 fails to provide the Company’s shareholders with material information and/or provides them with materially misleading information thereby rendering the shareholders unable to make an informed decision on whether to tender their shares.

23

87. The 14D-9 fails to disclose material information surrounding the sales process. In particular the 14D-9 fails to disclose the timing and content of all discussions and negotiations with OEP relating to the post-transaction employment of management, as well as whether or not any such discussions took place with other potential acquirers, and if so, the timing and content of any such discussions. While the Company has acknowledged in an July 2, 2012 MModal Employee Q&A that “[t]he current expectation is for the existing management team to remain in place following the close of the transaction,” the 14D-9 fails to make that disclosure to shareholders. Information regarding the retention of senior management by OEP, particularly in the face of a far higher but rejected price from a strategic buyer that would likely end employment for senior management, is material to shareholders and must be disclosed.

88. With respect to Macquarie’s valuation work, the 14D-9 fails to disclose the unlevered free cash flows Macquarie used in the DCF analysis. This is material for several reasons. The 14D-9 discloses as part of management’s projections a line item for “unlevered pre-tax free cash flow,” but those free cash flow projections appear to be different from the unlevered free cash flows used by Macquarie in the DCF analysis. Macquarie acknowledges that the unlevered free cash flows used by Macquarie are from management – not Macquarie – but then fails to disclose the unlevered free cash flows figures themselves. Furthermore, those undisclosed unlevered free cash flow projections, even after being run through a analysis skewed to unreasonably high discount rates of up to 40% and perpetuity growth rates that unreasonably assumed negative growth still yielded a price of $13.83 per share on the low end, barely capturing the $14 per share Buyout price. Disclosure of the unlevered free cash flows where the Buyout price barely reached the low end of the DCF value range is material to shareholders in a cashout merger with statutory appraisal rights and must be disclosed. The fact that Party A’s rejected bid was over 21% higher than the Buyout price likewise militates in favor of disclosure.

24

89. Finally, the 14D-9 fails to disclose the dates and nature of all services Macquarie has provided to OEP and SAC during the last two years, as well as which directors of the Company are principals in a fund in which Macquarie has made a $15 million investment.

90. Accordingly, Plaintiffs seek injunctive and other equitable relief to prevent the irreparable injury that Company shareholders will continue to suffer absent judicial intervention.

COUNT I

Breach of Fiduciary Duties

(Against the Individual Defendants)

91. Plaintiffs repeat all previous allegations as if set forth in full herein.

92. The Individual Defendants have in bad faith violated their fiduciary duties of care and loyalty owed to the public shareholders of MModal.

93. The Individual Defendants’ recommendation of the Buyout will result in change of control of the Company which imposes heightened fiduciary responsibilities to maximize MModal’s value for the benefit of the stockholders and requires enhanced scrutiny by the Court.

94. The Individual Defendants have breached their fiduciary duties of care and loyalty owed to the shareholders of MModal because, among other reasons:

(a) they failed to take steps to maximize the value of MModal to its public shareholders, including rejecting a materially higher bid that did not serve the personal interests of certain Board members and taking steps to avoid competitive bidding;

(b) they failed to properly value MModal; and

(c) they ignored or did not protect against the numerous conflicts of interest resulting from the directors’ own interrelationships or connections with the Buyout.

95. As a result of the Individual Defendants’ breaches of their fiduciary duties, Plaintiffs and the Class will suffer irreparable injury in that they have not and will not receive their fair portion of the value of MModal’s assets and will be prevented from benefiting from a value-maximizing transaction.

25

96. Unless enjoined by this Court, the Individual Defendants will continue to breach their fiduciary duties owed to Plaintiffs and the Class, and may consummate the Buyout, to the irreparable harm of the Class.

97. Plaintiffs and the Class have no adequate remedy at law.

COUNT II

Breach of Fiduciary Duty – Disclosure

(Against Individual Defendants)

98. Plaintiffs repeat all previous allegations as if set forth in full herein.

99. The fiduciary duties of the Individual Defendants in the circumstances of the Buyout require them to disclose to Plaintiffs and the Class all information material to the decisions confronting MModal’s shareholders.

100. As set forth above, the Individual Defendants have breached their fiduciary duty through materially inadequate disclosures and material disclosure omissions.

101. Plaintiffs and the members of the Class have no adequate remedy at law. Only through the exercise of the Court’s equitable powers can Plaintiffs and the Class be fully protected from the immediate and irreparable injury which Defendants’ actions threaten to inflict.

COUNT III

Aiding and Abetting

(Against OEP, Parent, Merger Sub, and SAC)

102. Plaintiffs repeat all previous allegations as if set forth in full herein.

103. SAC, Parent, Merger Sub and OEP have acted and are acting with knowledge of, or with reckless disregard to, the fact that the Individual Defendants are in breach of their fiduciary duties to MModal’s public shareholders, and has participated in such breaches of fiduciary duties.

26

104. SAC, Parent, Merger Sub and OEP have knowingly aided and abetted the Individual Defendants’ wrongdoing alleged herein, including Parent, Merger Sub and OEP’s knowing use of MModal’s financial advisor to provide committed financing to OEP and the Support Agreement whereby SAC has agreed to irrevocably tender its 31% equity stake in favor of the Buyout. In so doing, SAC, Parent, Merger Sub and OEP rendered substantial assistance in order to effectuate the Individual Defendants’ plan to consummate the Merger in breach of their fiduciary duties.

105. Plaintiffs have no adequate remedy at law.

WHEREFORE, Plaintiffs demand judgment against Defendants jointly and severally, as follows:

A. Declaring this action to be a class action and certifying Plaintiffs as the Class representatives and their counsel as Class counsel;

B. Enjoining, preliminarily and permanently, the Buyout;

C. Directing that Defendants account to Plaintiffs and the other members of the Class for profits and any special benefits obtained as a result of their breaches of their fiduciary duties;

D. Ordering the Defendants to disclose to MModal’s public shareholders the omitted material information alleged herein in an amendment to the 14D-9, and if necessary, extending the close of the Tender Offer in order for this information to be fully disseminated to shareholders;

E. Awarding Plaintiffs the costs of this action, including a reasonable allowance for the fees and expenses of Plaintiffs’ attorneys and experts; and

27

F. Granting Plaintiffs and the other members of the Class such further relief as the Court deems just and proper.

| | |

| | | ROSENTHAL, MONHAIT & GODDESS, P.A. |

| |

| | |

|

| | Jessica Zeldin (Del. Bar No. 3558) |

| | 919 N. Market Street, Suite 1401 |

| | P.O. Box 1070 Wilmington, DE 19899-1070 |

| | (302) 656-4433 |

| OF COUNSEL: | | |

| | RIGRODSKY & LONG, P.A. |

| LEVI & KORSINSKY, LLP | | Brian D. Long (Del. Bar No. 3147) |

| Donald J. Enright | | 919 N. Market Street, Suite 980 |

| Elizabeth K. Tripodi | | Wilmington, DE 19801 |

| 1101 30th Street, N.W., Suite 115 | | (302) 295-5310 |

| Washington, DC 20007 | | |

| (202) 524-4290 | | Plaintiffs ’ Liaison Counsel |

| |

| WOLF POPPER LLP | | |

| Carl L. Stine | | |

| Joshua H. Saltzman | | |

| 845 Third Avenue | | |

| New York, NY 10022 | | |

| (212) 759-4600 | | |

| |

| GARDY & NOTIS, LLP | | |

| James S. Notis | | |

| Kira German | | |

| 560 Sylvan Avenue, Suite 3085 | | |

| Englewood Cliffs, NJ 07632 | | |

| (201) 567-7377 | | |

| |

| Plaintiffs ’ Co-Lead Counsel | | |

| |

| HAROLD B. OBSTFELD, P.C. | | |

| Harold B. Obstfeld | | |

| 100 Park Avenue, 20th Floor | | |

| New York, NY 10017 | | |

| (212) 696-1212 | | |

| |

| July 24, 2012 | | |

28

EXHIBIT B

Blackline comparison between operative

Complaint and Verified Consolidated Amended

Class Action Complaint

IN THE COURT OF CHANCERYOFFOR THE STATE OF DELAWARE

| | | | | | |

| IN RE MMODAL INC. | | | | ) | | CONSOLIDATED |

| SHAREHOLDER LITIGATION | | | | ) | | C.A. No.: 7675-VCP |

AMENDED CONSOLIDATED VERIFIED CLASS ACTION COMPLAINT

PlaintiffPlaintiffs Alan Kahn (“Plaintiff, Edward Forstein, and Scott Phillips (collectively, “Plaintiffs”), byhistheirattorneys,alleges the followingallege upon information and belief, exceptas to those allegations pertaining to Plaintifffor their own acts, which are allegedupon personalon knowledge, as follows:

NATURE OF THE ACTION

1.This is a shareholderPlaintiffs bring thisclass actionbrought by Plaintiffon behalf ofhimselfthemselves and all othersimilarly situatedpublic shareholders of MModal, Inc. (“MModal” or the “Company”) againsttheCompany’sMModal’sBoard of Directors (the “Individual Defendants”)” herein) and S.A.C. Private Capital Group LLC (“SAC”),1 the Company’s largest shareholder with 31% stake in the Company, and others fortheirbreaches of fiduciary duties, and against and for aiding and abetting such breaches arising out of their attempt to sell the Company to One Equity PartnersLLCV, L.P. (“OEP”), a private investment arm of JP Morgan Chase & Co.(“JPMorgan”), and its

1.2. Plaintiffs’ claims arise from an Agreement and Plan of Merger, dated as of July 2, 2012 (the “Merger Agreement”), between the Company and affiliates of OEP, Legend Parent, Inc. (“Parent”) and Legend Acquisition Sub, Inc. (“Merger Sub”),for aiding such breaches of fiduciary duties. Plaintiff’s claims arise from the Agreement and Plan of Merger between the Company, Parent and Merger Sub dated as of July 2, 2012 (the “Merger Agreement”) pursuant

| 1 | SAC and its affiliates, including S.A.C. PEI CB Investment, L.P., S.A.C. PEI CB Investment II, International Equities (S.A.C. Asia) Limited and A.C. MultiQuant Fund, LLC are collectively referred to herein as “SAC.” |

to which Parent will commence a tender offer (the “Tender Offer”) to acquire all outstanding shares of MModal for $14 cash per share (the “Buyout”).”), for a total equity value of approximately $1.1 billion. The Tender Offer was commenced on July 17, 2012, and is set to expire at 11:59 p.m. New York time, on Monday, August 13, 2012.

2.3.TheBuyout price undervalues the Company and is substantially below the $17 per share offer that theIndividual Defendantsagreed to the Buyout at an inadequate price for MModal shareholders.received and rejected from a motivated strategic buyer, known as “Party A,” and likely the Company’s most significant competitor, Nuance Communications, Inc. (“Nuance”). The $14 per share Buyout priceis at just 8.46x EBITDA, compared with an average 21.3x among ten comparable deals, according toBloomberg. The Buyout price also agreed to by the Individual Defendantsrepresents apaltrypremium ofjustjust prior to the announcement, which is alsoand far below the average premiums paid in recent, comparable transactions. Indeed, the Company’s In fact, MModal’s stock traded as high as $13.15 per share on July 2, which implies an even lower premium of just 6.5%. Moreover, since the announcement of the Buyout, the Company’s common stock has traded above the Buyout price, and as high as $14.99 per share on July 17, 2012 – the day affiliates of OEP commenced the Tender Offer.

1. The Company has performed well for its investors in the past and is expected to do in the future. Its annual revenue increased from $171.41 million in 2008 to $443.80 million in 2011 and its net loss of $113.67 million in 2008 turned into a net income of $62.80 million in 2011. Analyst estimates for MMondal range from $14 to $16 per share, such that the Buyout price matches only the most bearish of analyst views of the Company. Taking into account a going-private premium, the price should be even higher. One analyst commented after theIndeed, the Individual Defendants’ decision to accept theBuyoutannouncements that MModal “should have been sold for between $17 and $18 a share.”

2

2. MModal is effectively controlled by its largest shareholder, S.A.C. Private Capital Group LLC and its affiliates (collectively, “SAC”), which owns 31% of the Company’s outstanding common shares. Several members of the Board are employed by or affiliated with SAC.

4.SAC first acquired a majority stake in the Company in 2008. The Buyout is anis explained by SAC’sexit strategyfor SACthat beganwhen SAC divested of approximately 16.8% of its stake in the Company through a February 2011with the Company’s initial public offering (the “IPO”). Now, following the private equity playbook of cycling the Company between private ownership to public ownership”) in February, 2011. Now, less than 18 months after the IPO, SAC seeks to dispose of its remaining stake in MModal through the Buyout.Although the agreements have not been made public, SAC appears to have entered into support agreements with OEP to tender its 31%and do so in a way that achieves closing certainty. A majority of the Individual Defendants are affiliated with SAC or are legacy directors from before the IPO, when SAC controlled the Company.

5. This goal was achieved by a heavily flawed sales process, run by and in the interests of, directors associated with or employed by SAC. These directors steered the process towards an all-cash deal with OEP, rejecting a higher offer from a strategic party in order to realize SAC’s goal of quickly liquidating its interest in the Company. These efforts were aided by management who realized that their chances of continued employment were far greater in a deal with a financial purchaser such as OEP than in one with a strategic party such as Nuance.

6. In addition, one of MModal’s financial advisors, RBC Capital Markets, LLC, (“RBCCM”), is providing committed financing to OEP through its affiliate Royal Bank of

3

Canada (“RBC”), whereas such financing was not needed in the higher offer from Nuance. Although the Individual Defendants also retained Macquarie Capital Inc. (“Macquarie”) as another financial advisor, Macquarie has provided significant financial services to OEP and served as OEP’s financial advisor as recently as March 2012, and both RBC and Macquarie have extensive ties to SAC.

7. While Macquarie provided a fairness opinion for the $14 per share Buyout price, that opinion is based on financial analyses that include unduly bearish assumptions of the Company’s financial performance that seem driven by the need to justify the low Buyout price rather than realistic expectations for the Company’s future. Even with these manipulations, the $14 per share Buyout Price is barely above the low end of the value range from a discounted cash flow (“DCF”) analysis that applied a whopping 40% discount rate for certain of the Company’s business lines and a (0.25%) negative perpetuity growth rate to other business lines.

3.8. In addition to the usual range of deal protection devices such as a 3.5% termination fee, no-solicitation clause, matching rights clause, and top-up option, the Defendants agreed to further lock up the Buyout and preclude a competing offer from Nuance (or anyone else) through a coercive support agreement (the “Support Agreement”) whereby SAC agreed to tender its 31% into the Tender Offer. The Support Agreement does not permit SAC to revoke the tender of the shares in the event of a change in recommendation by the board. Thus, even if a Nuance provides a superior proposal or commences a competing tender offer directly to MModal shareholders, SAC’s 31%stakeandwill be tied up insupportthe Buyout. In addition to effectively precluding the emergence of any competing bidder for the Company, the agreement to tender the 31% stake means thatof the Buyout by OEP even if the board changes its recommendation. As a result of the Support Agreement, OEP can trigger the Merger Agreement’s top-up option with the tender of just 5.7 million more shares (roughly 16.6% of the

4

remaining public shares), which is) – a number far fewer than the 17 million shares that traded immediately following the announcement of theBuyout and now presumably rest in the hands of arbitrageurs who favor the BuyoutMerger Agreement.

3. The inadequate price was further produced through a flawed process in which MModal’s financial advisor, RBC Capital Markets, LLC (“RBC”), switched sides and is now providing committed financing to OEP to complete the Buyout. The Individual Defendants declined to just say no to RBC’s efforts to play both sides (and presumably profit from both sides), instead installing Macquarie Capital (USA) Inc. (“Macquarie”) as another financial advisor to bless the Buyout.

9.The Individual Defendants have breached their fiduciary duties by agreeing to the Buyout based on a defective sales process that resulted in inadequate consideration. Plaintiff seeksFurther compounding problems for shareholders, the tender offer documents filed by Defendants fail to provide the Company’s shareholders with material information and/or provides them with materially misleading information thereby rendering shareholders unable to make an informed decision on whether to tender their shares in the Tender Offer or seek statutory appraisal rights. For instance, on July 17, 2012, the Company filed a Schedule 14D-9 (“14D-9”) with the SEC that fails to disclose the unlevered free cash flows Macquarie used in the DCF analysis. With another bidder willing to pay $17 per share (over 21% higher than the Buyout price), such financial information concerning an important valuation analysis is material to shareholders and must be disclosed.

4.10. Plaintiffs seek equitable relief, compelling theBoardIndividual Defendants to properly exercise its fiduciary duties to maximize shareholder value in connection with the Buyout or any alternate transaction and to provide shareholders with all material information.

5

THE PARTIES

5.11.Plaintiff isPlaintiffs are, andhave beenat alltimesrelevanthereto was a shareholdertimes, owners of shares of common stock of MModal. PlaintiffAlan Kahnowns 24,820 MModal shares, valued at $347,480 at the Buyout price; Plaintiff Edward Forstein owns 18,316 MModal shares, valued at $256,424 at the Buyout price; and Plaintiff Scott Phillips owns 3,150 MModal shares, valued at $44,100 at the Buyout price.

6.12.MModal is a Delaware corporation withaprincipal executive officeslocatedat 9009 Carothers Parkway, Franklin, Tennessee 37067. MModalis a provider ofprovides medical document processing technology, including clinical transcription services, cloud-based speech understanding technology and unstructured data analytics.MModalThe Company’s common stock trades on the NASDAQ under the symbol “MODL.” MModal is named herein solely for the purpose of providing full and complete relief.

7.13.Defendant Roger L. Davenport (“Davenport”) has been theCompany’sChairman,Chief Executive Officer (“CEO”) andCEO sincea director of the Company since 2011.Davenport’s appointment as CEO occurred on July 11, 2011, the same day that the Company, then Medquist Holdings Inc., announced the planned acquisition of Multimodal Technologies, Inc. for $130 million in cash and stock. That merger was completed on August 18,2011.

8.14.Defendant V. Raman Kumar (“Kumar”)is a co-founder of the Company andhas beenthe Company’ sa director and Vice Chairman since February 2007.FromKumar served as the Company’s CEO from February 2007 to October 2010,Kumar wasthe Company’s CEO.been an executive partner at Siris Capital Group, LLC, (“Siris”) since March 2011, when it was spun-off from SAC.

6

9.15.Defendant Frank Baker (“Baker”) has been a director of the Company sinceAugust2008. Baker was also a non-executive director of the Company’s wholly owned subsidiary, MModal MQ Inc. (formerly known as MedQuist Inc.),), from August 2008 until April 2012. Baker was a co-founder of SAC and was a Managing Director of SAC from 2007 to March 2011. In March 2011, Baker co-founded Siris Capital Group, LLC (“Siris”) as a successor entity to SAC.. From 1999 to 2006, Baker was at Ripplewood, a New York based private equity firm, and RHJ International, a financial services company incorporated under the laws of Belgium.

10.16.Defendant Peter Berger (“Berger”) has been a director of the Company sinceAugust2008. Berger is also a non-executive director of MModal MQ Inc.., andas Chairman of its Audit Committee and Nominating Committee until April 2012. Berger isa Managing Director and co-founder of Siris Capital Group, LLC, which was established in March 2011.Berger was a co-founder of SAC and was a Managing Director of SAC from 2007 to March 2011. Berger was also a founding member of Ripplewood and a special senior advisor to RHJ International.

4. Defendant Robert J. Greczyn (“Greczyn”) has been a director of the Company since October 2011. Greczyn is a member of the Audit Committee and Compensation Committee.

11.17.Defendant Jeffrey Hendren (“Hendren”) has been a director of the Company since 2008. Hendren is a Managing Director and co-founder of Siris. He was also a co-founder of SAC and was a Managing Director of SAC from 2007 to March 2011. Hendren was also a Managing Director of Ripplewood and RHJ International.

12.18.Defendant KennethJ.John McLachlan (“McLachlan”) has been a director of the Company sinceMay 2007. McLachlan is Chairman of the Audit Committee2007, and isthereforeamember of the Compensation Committee.legacy director from a time prior to the IPO, when the Company was controlled by SAC.

7

13.19.Defendant JamesP.Patrick Nolan (“Nolan”) has been a director of the Company sinceJune 2009. Nolan is Chairman of2009, and is therefore a legacy director from a time prior to theCompensation Committee and as a member of the Nomination and Corporate Governance CommitteeIPO, when the Company was controlled by SAC.

14.20. DefendantColin J. O’Brien (“O’Brien”) has been a director of the Company sinceNovember 2011. O’Brien is a member of the Audit Committee and Nomination and Corporate Governance Committee. O’Brien2011, and was a member of the MModal MQ Inc. board of directors from September 2008 to March2011.201, and is therefore a legacy director from a time prior to the IPO, when the Company was controlled by SAC.

15.21.Defendant Andrew E. Vogel (“Vogel”) has been a director of the Company sinceOctober 2011. Vogel is Chairman of the Nomination and Corporate Governance Committee. Vogel2011, and was a member of the MModal MQ Inc. board of directors from September 2008 to March 2011. Vogel was also an investmentprofessionprofessional at Ripplewood Holdings.

22. Defendant Robert J. Greczyn, Jr. (“Greczyn”) has been a director of the Company since 2011.

16.23.Defendant Henry C. Wolf (“Wolf”) has been a director of the Company since February 2012. Wolf is a member of the Compensation Committee.

17.24.Defendants Davenport, Kumar, Baker, Berger, Greczyn, McLachlan, Hendren, Nolan, O’Brien, Vogel and Wolf are collectively referred to herein as the “Individual Defendants.”

18.25.Defendant OEP is aDelaware limited liability company and is the private investment arm of JPMorganCayman Islands exempted limited partnership with its headquarters

8

located at 320 Park Avenue, 18th Floor, New York, New York 10022. OEPwas established in 2001 andmanages $10 billionofin investments and commitmentsfromfor JPMorgan.Chase & Co.

19.26.Defendant Parent is a Delaware corporationand is an affiliate ofaffiliated with OEP.

20.27.Defendant Merger Sub is a Delawarecompany andcorporation wholly ownedsubsidiary ofby Parentformed solelythat was created to effectuate the Buyout. Collectively, Parent and Merger Sub are referred to as “Parent” herein.

5. The Individual Defendants, MModal, OEP and Parent, are collectively referred to herein as “Defendants.”

28. Defendant SAC is a Delaware limited liability company and is MModal’s largest shareholder.

CLASS ACTION ALLEGATIONS

21.29.Plaintiff bringsPlaintiffs bring this action pursuant to Court of Chancery Rule 23, individually and on behalf of the holders of the common stock of the Company as of the July 2, 2012 announcement of the Buyout, who have been and/or will be harmed as a result of the wrongful conduct alleged herein (the “Class”). The Class excludes Defendants herein, and any person, firm, trust, corporation or other entity related to, or affiliated with, any of the Defendants.

22.30.This action is properly maintainable as a class action.

23.31.The Class is so numerous that joinder of all members is impracticable. As of April 4, 2012, the Company had over 33 million shares outstanding that were not beneficially owned by the Defendants orSAC and itstheir affiliates. Members of the Class are scattered geographically and are so numerous that it is impracticable to bring them all before this Court.

9

24.32.Questions of law and factexist thatare common to the Class, including,among others:inter alia, the following:

(a) whetherHave the Individual Defendantshavebreached their fiduciary dutiesof loyalty and/or due care with respect to Plaintiffs and the other members of the Class in connection with the Buyout;

(b) Have the Individual Defendants breached their fiduciary duty to secure and obtain the best price reasonable under the circumstances for the benefit of Plaintiffs and the other members of the Class in connection with the Buyout;

(a)(c) Have the Individual Defendants misrepresented and omitted material facts in violation of their fiduciary dutiesowedby themtoPlaintiffPlaintiffs and the other members of the Class;

(d) whetherWhether Plaintiffs and the other members of the Class would be irreparably harmed were the transactions complained of herein consummated; and

(b)(e) Have OEP and, Parent have, Merger Sub, and SACaided and abettedsuchthe Individual Defendants’ breaches of fiduciary duty; and

(a) whether Plaintiff and the other members of the Class will be irreparably damaged if Defendantsnot enjoined from continuing the conduct described herein.

25.33.Plaintiff iscommitted to prosecuting this action andhashave retained competent counsel experienced in litigation of this nature.Plaintiff’sPlaintiffs’ claims are typical of the claims of the other members of the Class andPlaintiff hasPlaintiffs havethe same interests as the other members of the Class. Accordingly,Plaintiff isPlaintiffs are an adequate representative of the Class and will fairly and adequately protect the interests of the Class.

26.34.The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications with respect to individual members of the

10

Class, which would establish incompatible standards of conduct for Defendants, or adjudications with respect to individual members of the Class which would, as a practical matter, be dispositive of the interests of the other members not parties to the adjudications or substantially impair or impede their ability to protect their interests.

27.35.Preliminary and final injunctive relief on behalf of the Class as a whole is entirely appropriate because Defendants have acted, or refused to act, on grounds generally applicable and causing injury to the Class.

SUBSTANTIVE ALLEGATIONS

Background of the Company and Expectations for Strong Future Growth

36.The Company’sMModal’s predecessor,CBaySystemsCBay Systems Holdings Limited (“CBay”)”), was organized in 1998. In August 2008, SAC invested $124 million to acquire a majority interest in CBay., paying roughly $6.20 per share. SAC also entered into a series of agreements with CBay in connection with acquiring the majority stake, including a management agreement, consulting agreement, voting agreement, registration rights agreement, stockholders agreement, and redemption agreement.

28.37.CBay used the proceeds of the SAC investment to acquire a majority stake in its competitor,MedquistMedQuist Inc. (later MModal MQ Inc.) from Koninklijke Philips Electronics N.V.(the Netherlands-based conglomerate known as Philips Electronics)on August 6, 2008. In April 2010, CBay and MedQuist Inc. separately acquired certain assets of Spheris in a transaction conducted under Section 363 of the Bankruptcy Code. Spheris was the second-largestUSU.S. medicaltranscriptiontranscriptions service provider by revenue at the time.

6.On January2717, 2011, CBay changed its name toMedQuistMedquist Holdings Inc. (“MedQuist”),re-domiciled from the British Virgin Islands to Delaware, (“Holdings”), andauthorized an offering of 300 million shares of common stock par value at $0.10 per share and

11

25 million shares of preferred stock at $0.10 par value per share. In connection with the re-domiciliation, MedQuist adjusted the number of its shares outstanding through a reverse share split in which every 4.5 shares of its common stock outstanding prior to there-domiciliation was converted into one share of MedQuist common stock upon its re-domiciliation.

29.38.In February 2011,MedQuistMedquist Holdings commenced both a private and public exchange offer to exchange shares of MedQuistcommon stock for shares of MedQuist Inc. common stock for shares of Holdings common stock. As a result,MedQuistHoldings increased its ownership interest in MedQuist Inc. to approximately 97%. On October 18, 2011,MedQuistHoldingscompleted a short-form merger with MedQuist Inc., resulting in MedQuist Inc. becoming an indirectly, wholly owned subsidiary ofMedQuistHoldings, andMedQuistHoldings common stock no longer being publicly traded.

39.In February 2011,MedQuistHoldings completedits U.S. initial public offering of common stock, selling 3 million of its common shares (along with 1.5 million shares owned by selling shareholders) at an offer price of $8.00 per share. MedQuist’s common stock was initially listed on the NASDAQ under the symbol “MEDH.” Prior tothe IPO, at $8 per share. SAC owned a 47.8% stake inMedQuistHoldings prior to the IPO and approximately 34% after the IPO.

30.40. On August 18, 2011, Holdings completed its acquisition of Multimodal Technologies, Inc. for $130 million in cash and stock.

31.41.Effective January 23, 2012,MedQuistHoldings changed its name to MModal Inc., and on January 25, 2012, the Company’s stock symbolwas changed tobecame “MODL.” The name change was effectuated to reflect the unification ofthe company’sservices,which also includeincluding coding, data analytics, and health information management professional services, particularly transcription.

12