©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited- Exhibit 99.1

SEC SAFE HARBOR ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

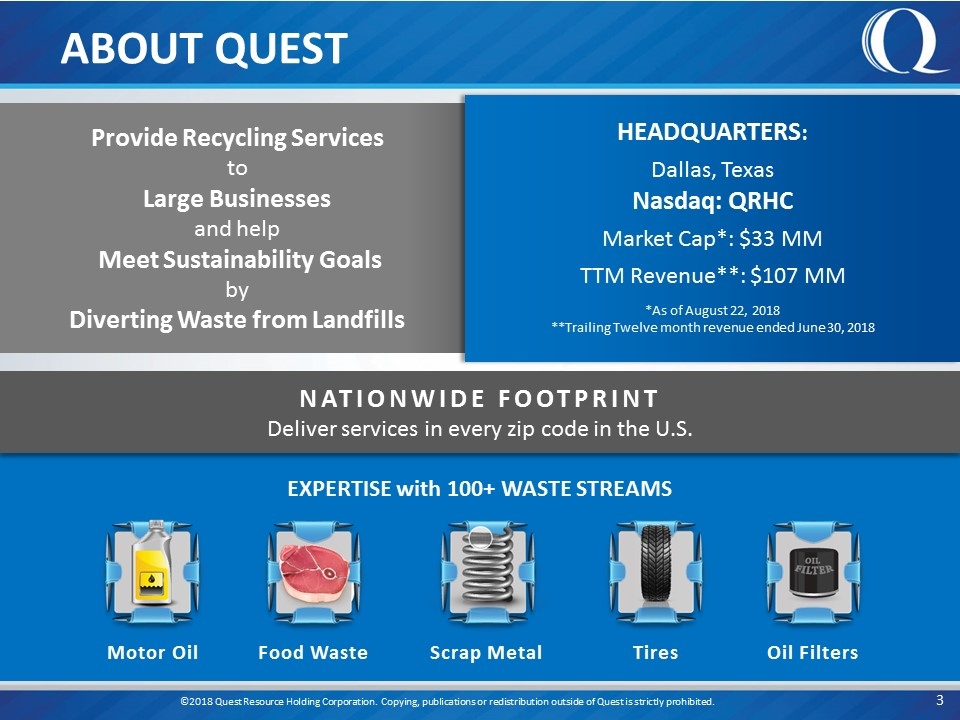

©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. EXPERTISE with 100+ WASTE STREAMS NATIONWIDE FOOTPRINT Deliver services in every zip code in the U.S. Motor Oil Scrap Metal Food Waste Tires Oil Filters ABOUT QUEST Provide Recycling Services to Large Businesses and help Meet Sustainability Goals by Diverting Waste from Landfills *As of August 22, 2018 **Trailing Twelve month revenue ended June 30, 2018 HEADQUARTERS: Dallas, Texas Nasdaq: QRHC Market Cap*: $33 MM TTM Revenue**: $107 MM

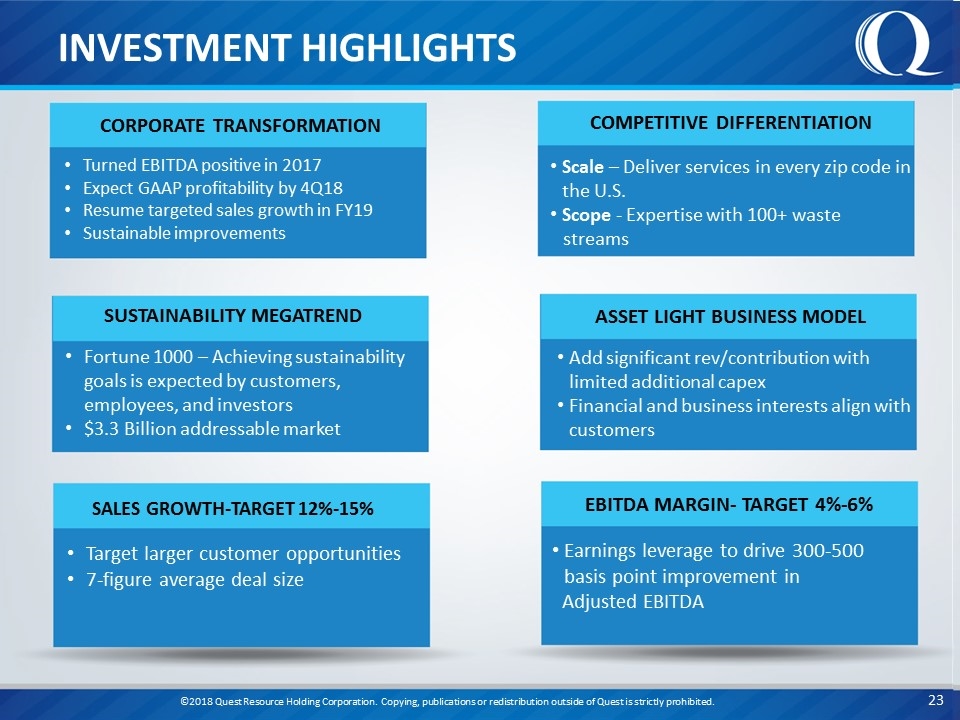

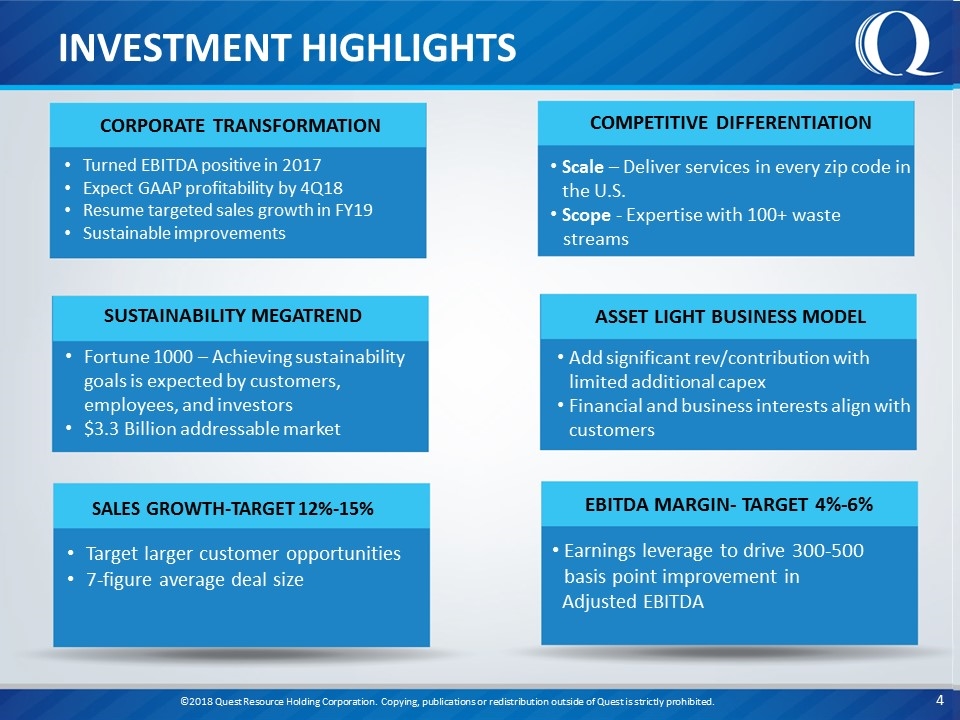

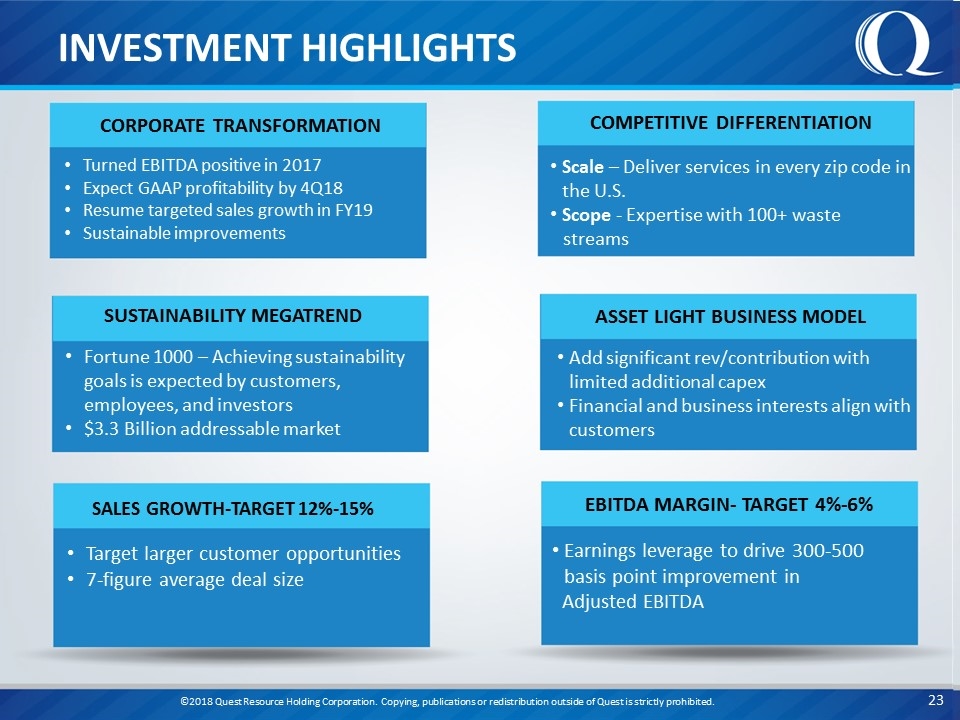

INVESTMENT HIGHLIGHTS ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Turned EBITDA positive in 2017 Expect GAAP profitability by 4Q18 Resume targeted sales growth in FY19 Sustainable improvements CORPORATE TRANSFORMATION Fortune 1000 – Achieving sustainability goals is expected by customers, employees, and investors $3.3 Billion addressable market SUSTAINABILITY MEGATREND Target larger customer opportunities 7-figure average deal size Earnings leverage to drive 300-500 basis point improvement in Adjusted EBITDA EBITDA MARGIN- TARGET 4%-6% Add significant rev/contribution with limited additional capex Financial and business interests align with customers ASSET LIGHT BUSINESS MODEL Scale – Deliver services in every zip code in the U.S. Scope - Expertise with 100+ waste streams COMPETITIVE DIFFERENTIATION SALES GROWTH-TARGET 12%-15%

SUSTAINABILITY MEGA TREND ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Today, the United States spends over $218 billion on sustainability 1.3% of GDP – growing, processing, transporting, and disposing of food that is never eaten* Sustainability is one of the most significant trends in financial markets as it creates competitive advantage, improves operating performance, and positively affects business valuation LEED® Certification is becoming prevalent Local and state regulations are increasing recycling requirement mandates, and adding penalties and fines * www.refed.com/downloads/ReFED_Report_2016.pdf

A VAST MARKET ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Total market opportunity is $60B Quest’s primary target: the top 50-100 companies in each vertical, is $3.3B Quest captured a 4.2% market share in 2017

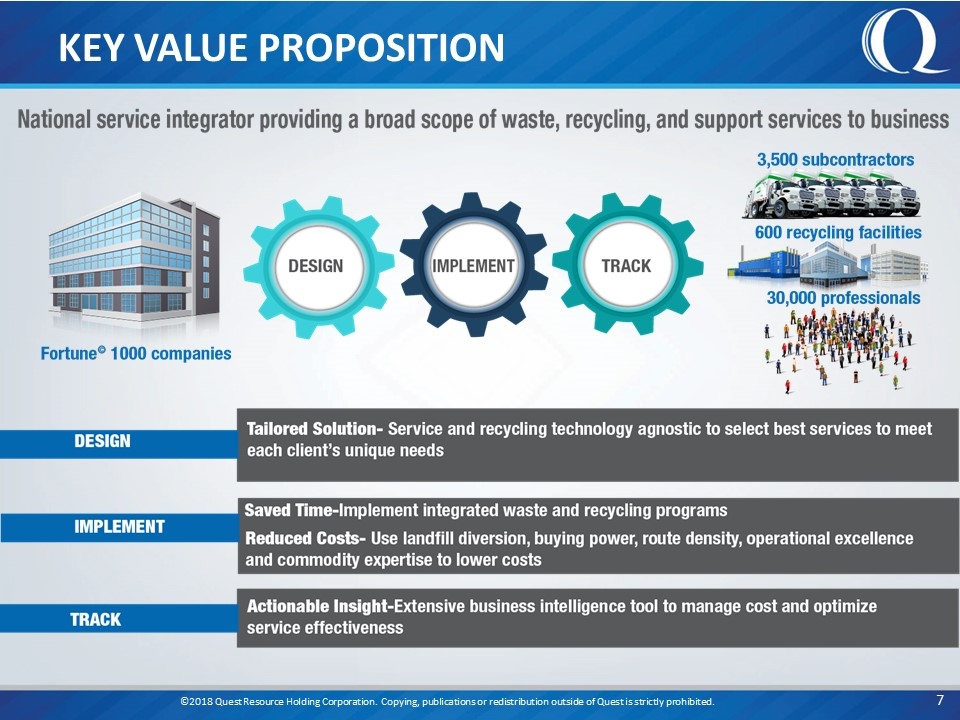

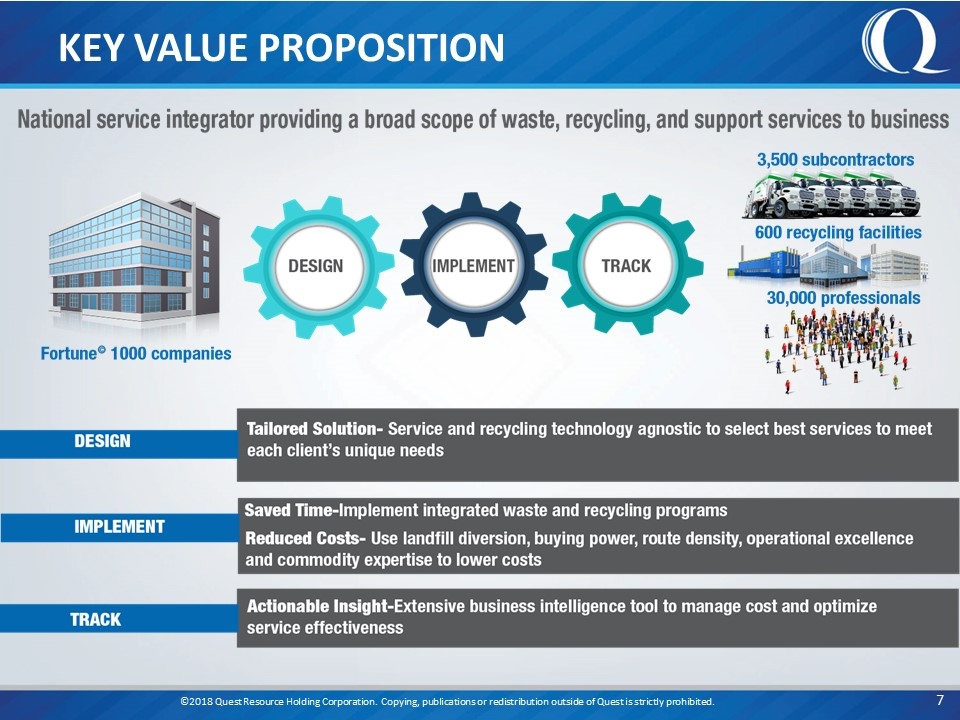

KEY VALUE PROPOSITION ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. FOCUS ON LARGE CLIENTS WITH COMPLEX WASTE STREAMS Clients span multiple industries including grocery, retail, automotive, property management, hospitality, industrial, and construction Trusted by Fortune© 1000 clients with national footprints and complex waste streams Proven ability to surround clients with valuable services

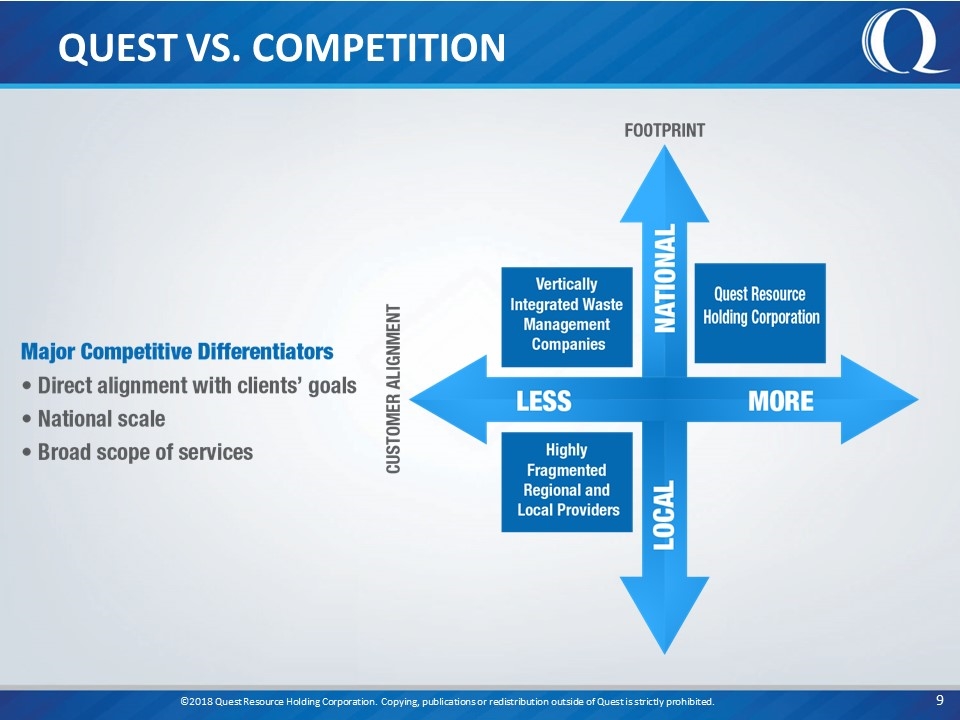

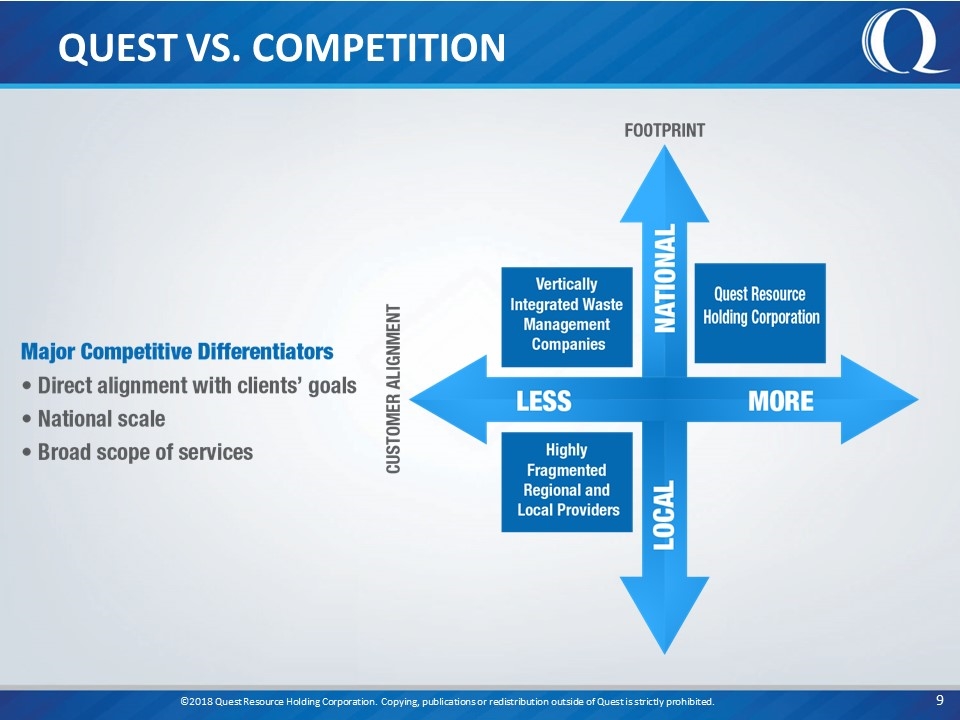

QUEST VS. COMPETITION ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

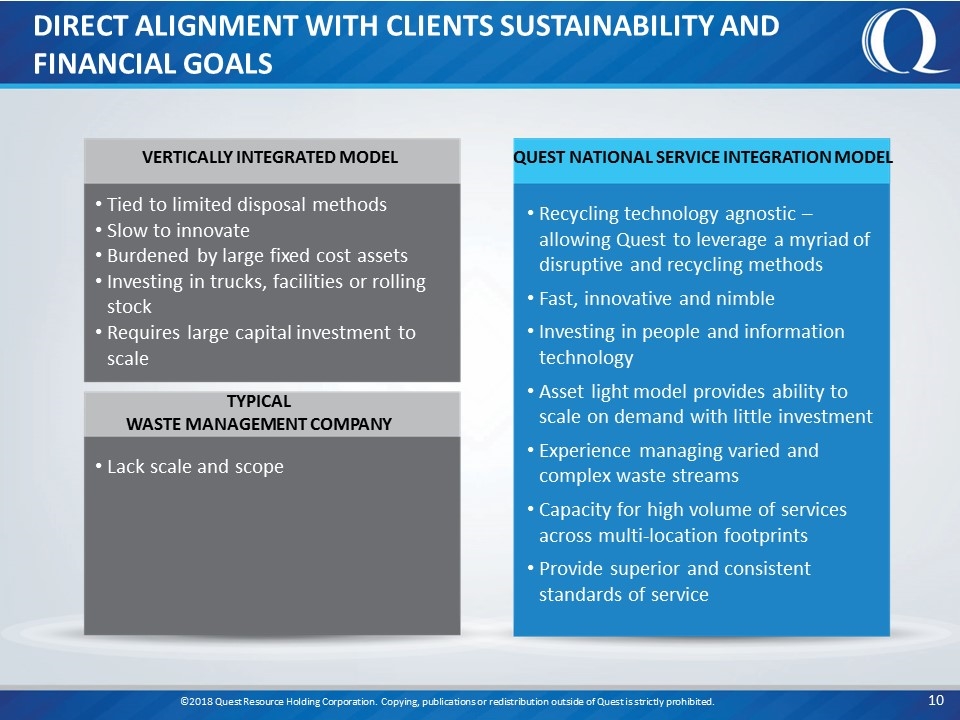

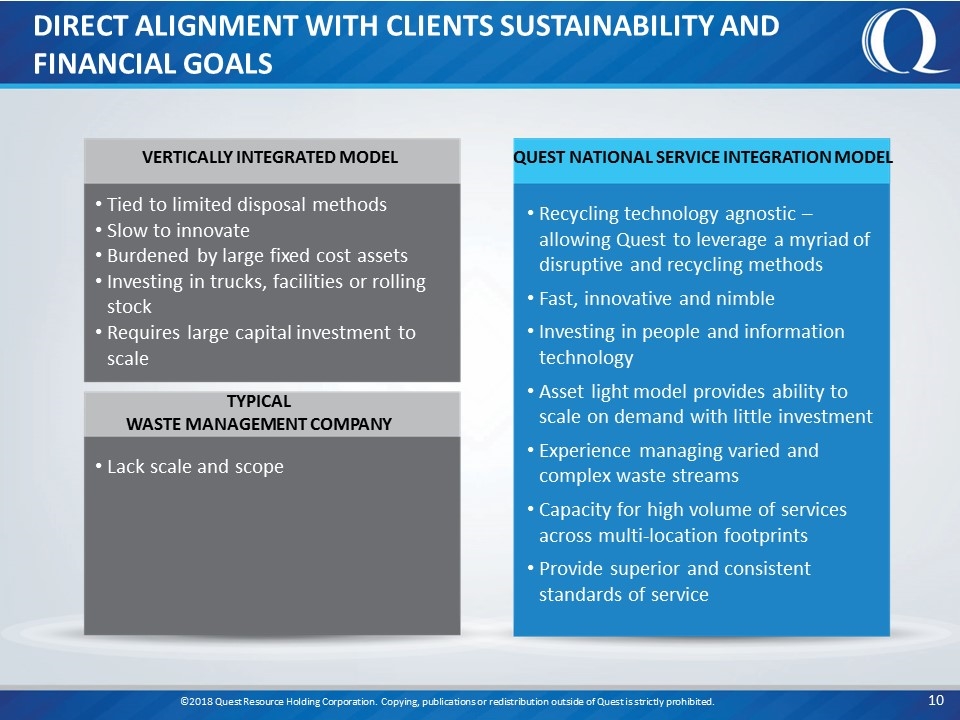

DIRECT ALIGNMENT WITH CLIENTS SUSTAINABILITY AND FINANCIAL GOALS ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Tied to limited disposal methods Slow to innovate Burdened by large fixed cost assets Investing in trucks, facilities or rolling stock Requires large capital investment to scale VERTICALLY INTEGRATED MODEL TYPICAL WASTE MANAGEMENT COMPANY Lack scale and scope QUEST NATIONAL SERVICE INTEGRATION MODEL Recycling technology agnostic –allowing Quest to leverage a myriad of disruptive and recycling methods Fast, innovative and nimble Investing in people and information technology Asset light model provides ability to scale on demand with little investment Experience managing varied and complex waste streams Capacity for high volume of services across multi-location footprints Provide superior and consistent standards of service

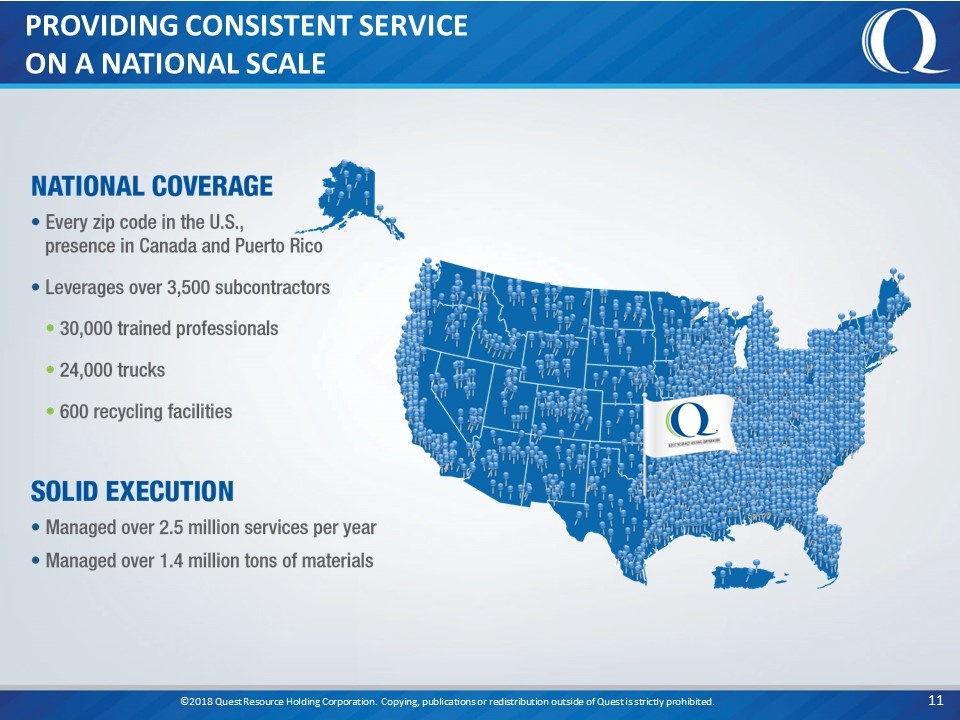

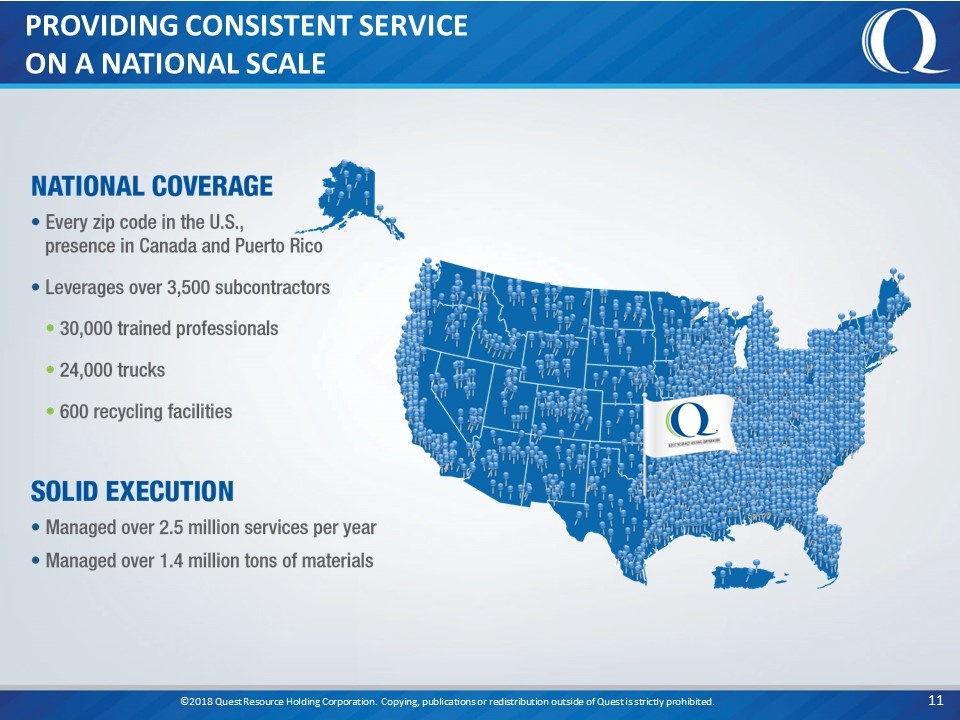

PROVIDING CONSISTENT SERVICE ON A NATIONAL SCALE ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

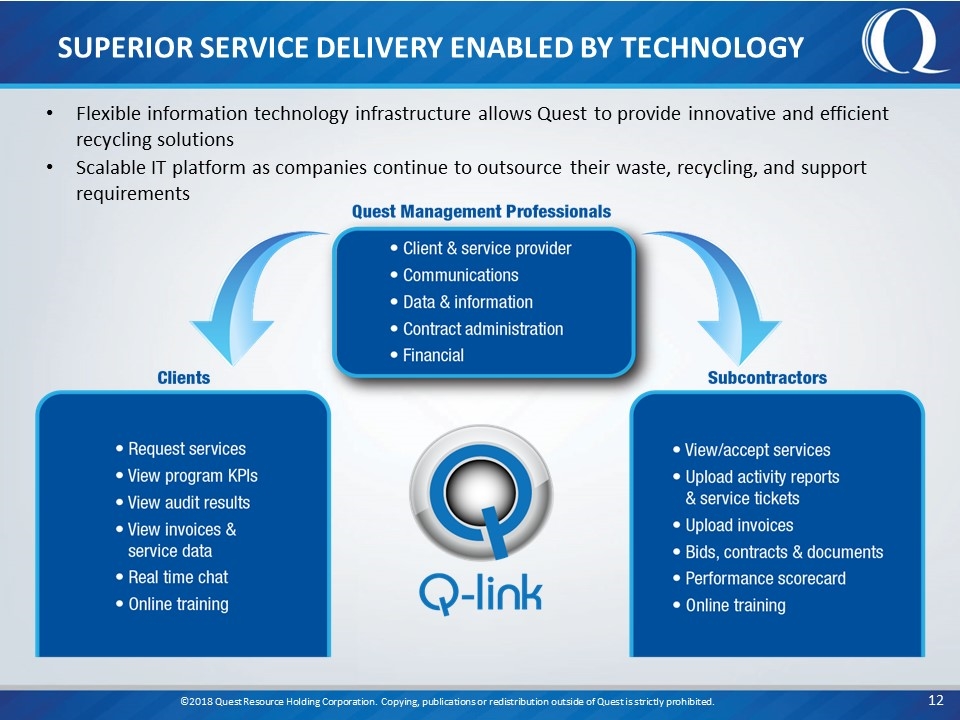

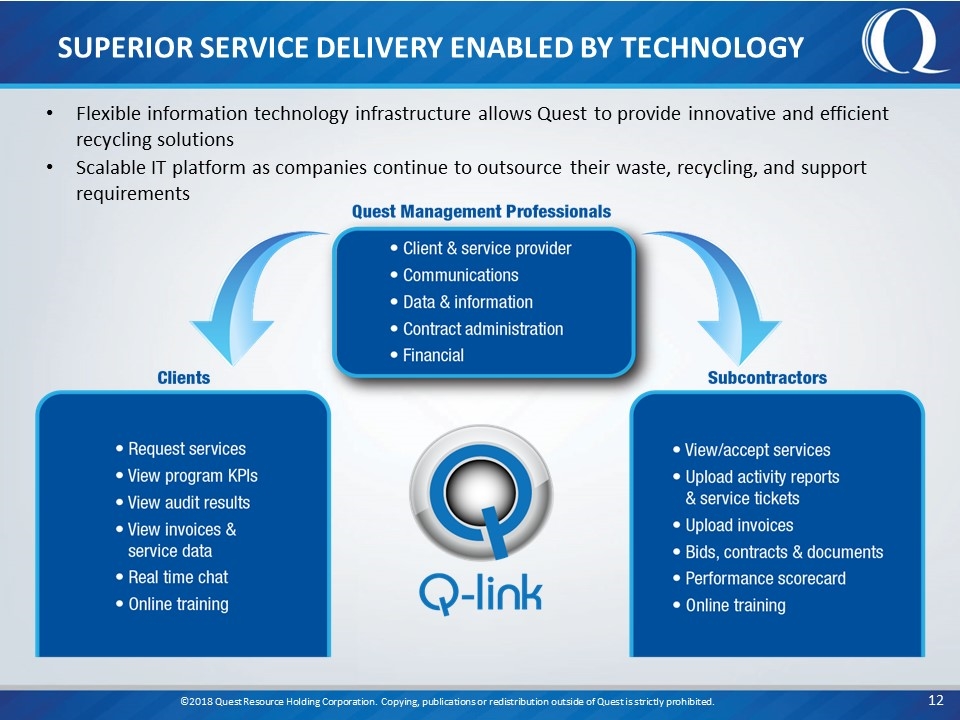

SUPERIOR SERVICE DELIVERY ENABLED BY TECHNOLOGY ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Flexible information technology infrastructure allows Quest to provide innovative and efficient recycling solutions Scalable IT platform as companies continue to outsource their waste, recycling, and support requirements

EXPERIENCED MANAGEMENT TEAM ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

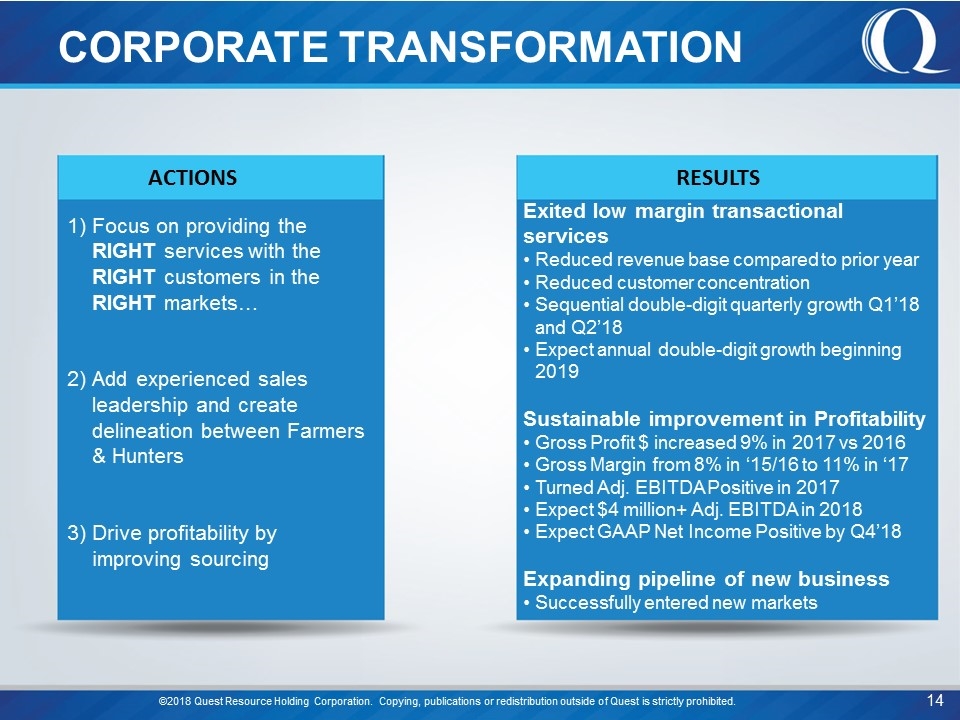

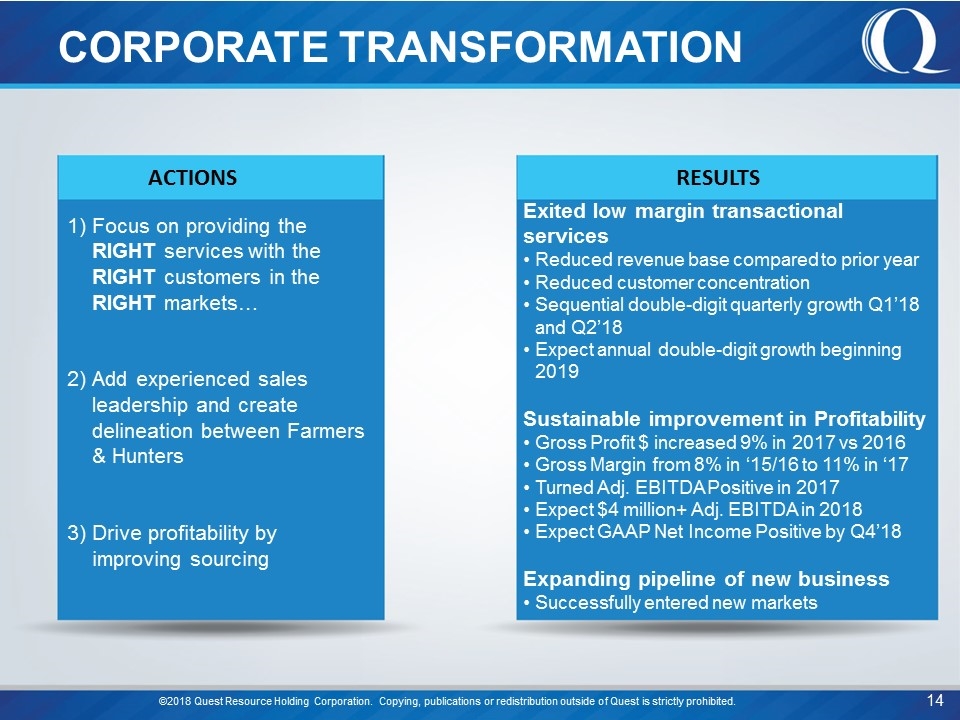

CORPORATE TRANSFORMATION ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Focus on providing the RIGHT services with the RIGHT customers in the RIGHT markets… Add experienced sales leadership and create delineation between Farmers & Hunters Drive profitability by improving sourcing Exited low margin transactional services Reduced revenue base compared to prior year Reduced customer concentration Sequential double-digit quarterly growth Q1’18 and Q2’18 Expect annual double-digit growth beginning 2019 Sustainable improvement in Profitability Gross Profit $ increased 9% in 2017 vs 2016 Gross Margin from 8% in ‘15/16 to 11% in ‘17 Turned Adj. EBITDA Positive in 2017 Expect $4 million+ Adj. EBITDA in 2018 Expect GAAP Net Income Positive by Q4’18 Expanding pipeline of new business Successfully entered new markets ACTIONS RESULTS

TARGET THE RIGHT BUSINESS ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Providing the RIGHT Services.. to the RIGHT Clients… in the RIGHT Markets Greater focus on services that highlight our value add less focus on commoditized services Continue to target large clients with national footprint Target markets that have more complex waste streams with an opportunity to demonstrate strategic value of relationship Sunset business that does not match our strategic direction Expected Results… Create long-term strategic relationships with clients Although near-term revenue temporarily contracts, gross profit dollars increase Resume revenue growth after adjustment in existing revenue base

GO TO MARKET CHANGES ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Sales Force Repositioning Change the culture of our sales team. Sell based on value, not price… consultative sale not a price point solution Sales structure provides clear delineation between farmers and hunters. Farmer team focused on penetrating existing customer base Hunter team focused on adding new customer relationships New Leadership and more experienced talent…each with 15 to 20 years of broad based experience and existing relationships in specific verticals. Expected Results Significant increase in the size of our pipeline Enhanced ability to provide consultative sales representation Broader market and vertical coverage

OPTIMIZING SOURCING ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Treat subcontractors as essential partners Help subcontractors maximize efficiencies Right sizing- changing the size of the containers and the service frequency to be the most efficient Load optimization- ensure the optimum volume per service to maximize transportation efficiency Route density- add more stops within subcontractors’ service routes to maximize asset utilization. Resulting service efficiency is translated into competitive rates Expected results Create a sustainable win-win-win for Quest, clients, and subcontractors by sharing benefits among all parties

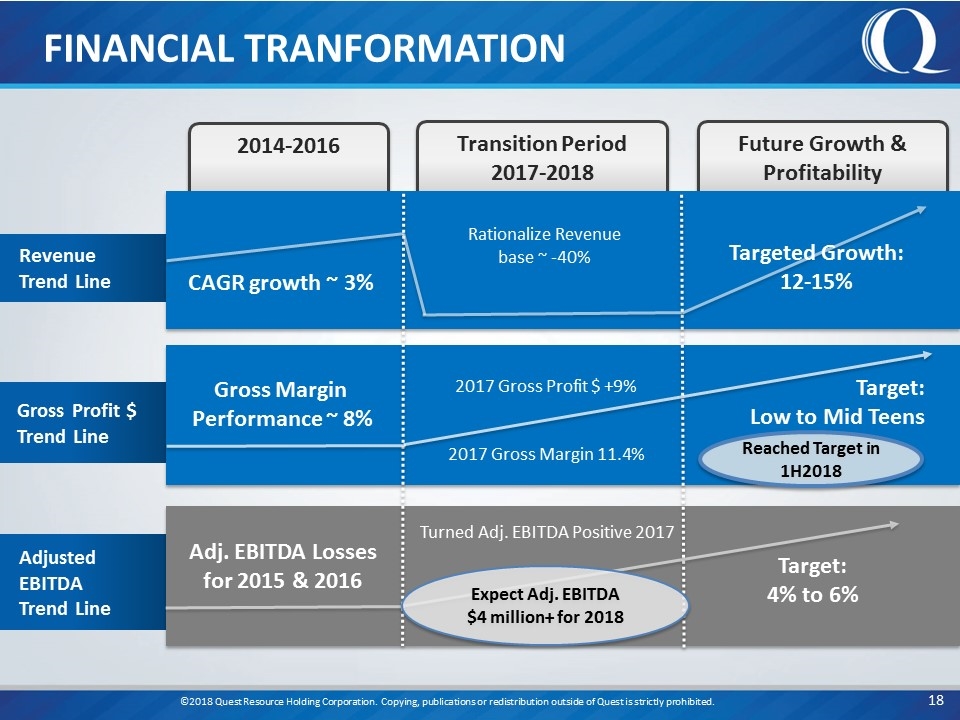

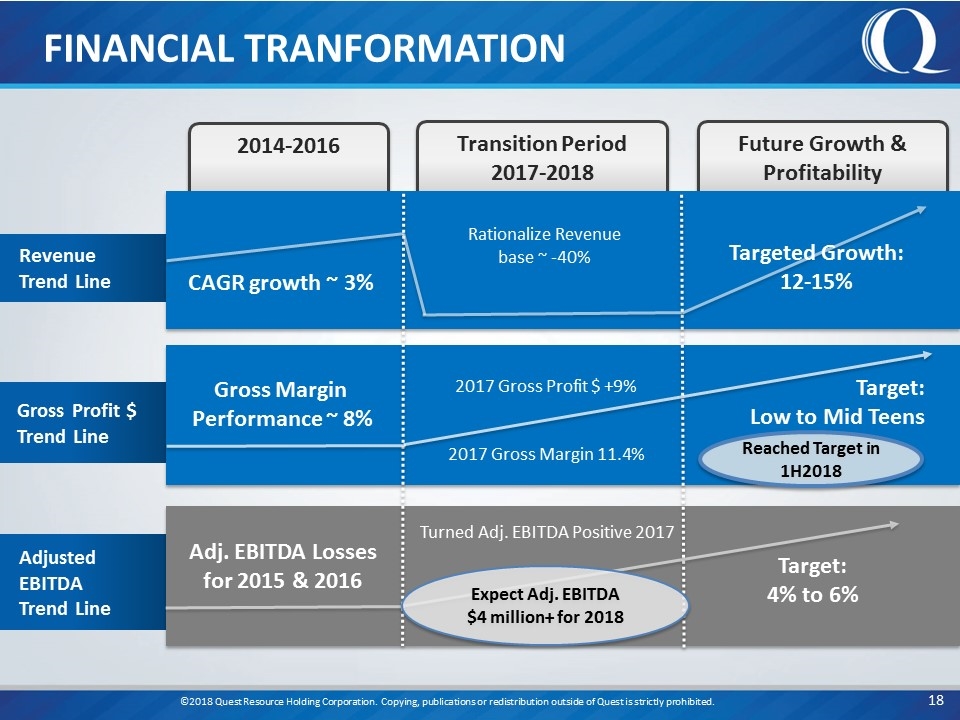

©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Revenue Trend Line Gross Profit $ Trend Line Adjusted EBITDA Trend Line Transition Period 2017-2018 Future Growth & Profitability 2014-2016 CAGR growth ~ 3% Rationalize Revenue base ~ -40% Targeted Growth: 12-15% Gross Margin Performance ~ 8% 2017 Gross Profit $ +9% 2017 Gross Margin 11.4% Target: Low to Mid Teens Adj. EBITDA Losses for 2015 & 2016 Turned Adj. EBITDA Positive 2017 Target: 4% to 6% Reached Target in 1H2018 Expect Adj. EBITDA $4 million+ for 2018 FINANCIAL TRANFORMATION

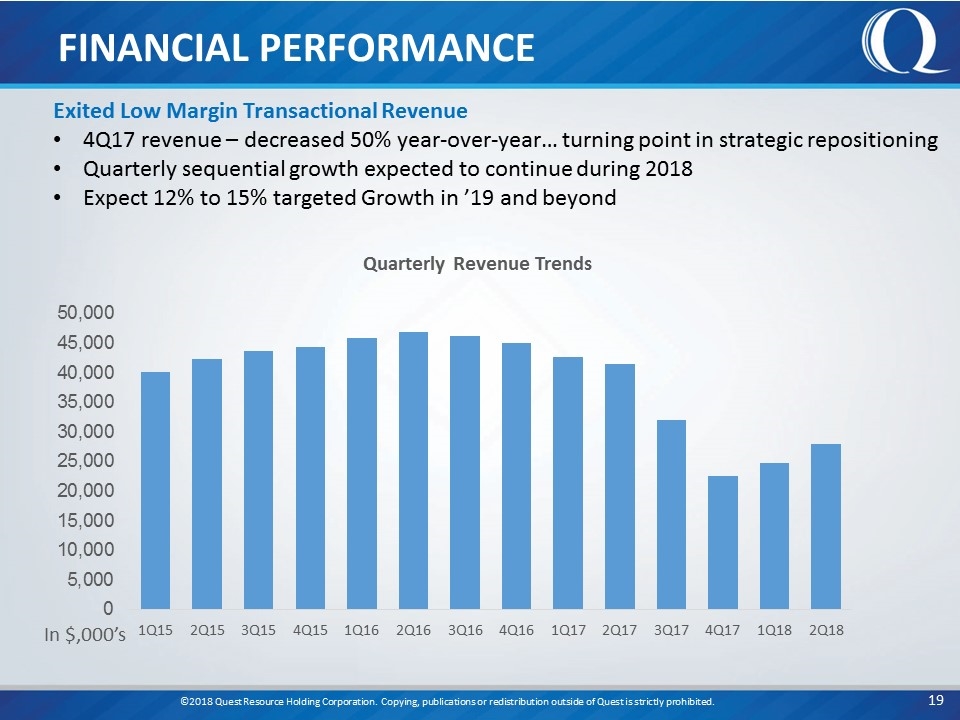

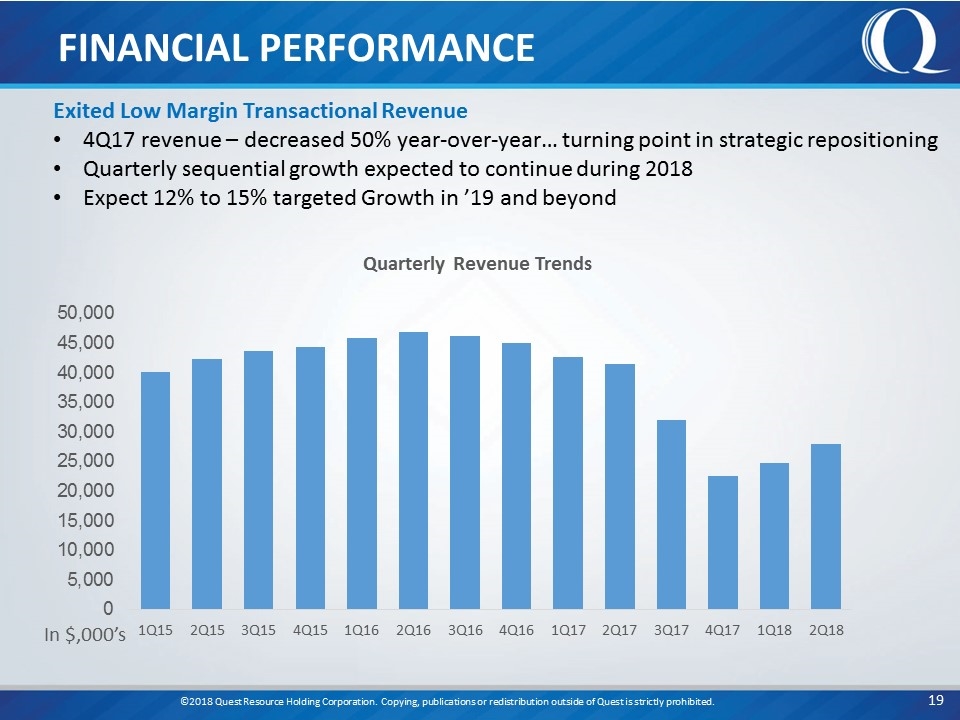

©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. FINANCIAL PERFORMANCE Exited Low Margin Transactional Revenue 4Q17 revenue – decreased 50% year-over-year… turning point in strategic repositioning Quarterly sequential growth expected to continue during 2018 Expect 12% to 15% targeted Growth in ’19 and beyond In $,000’s Quarterly Revenue Trends

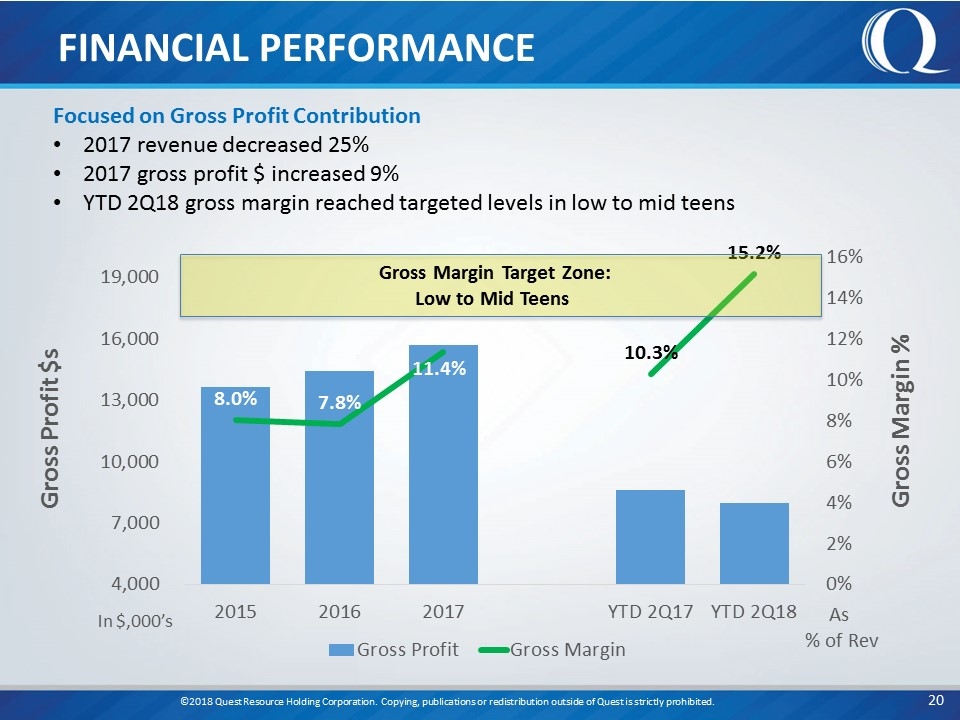

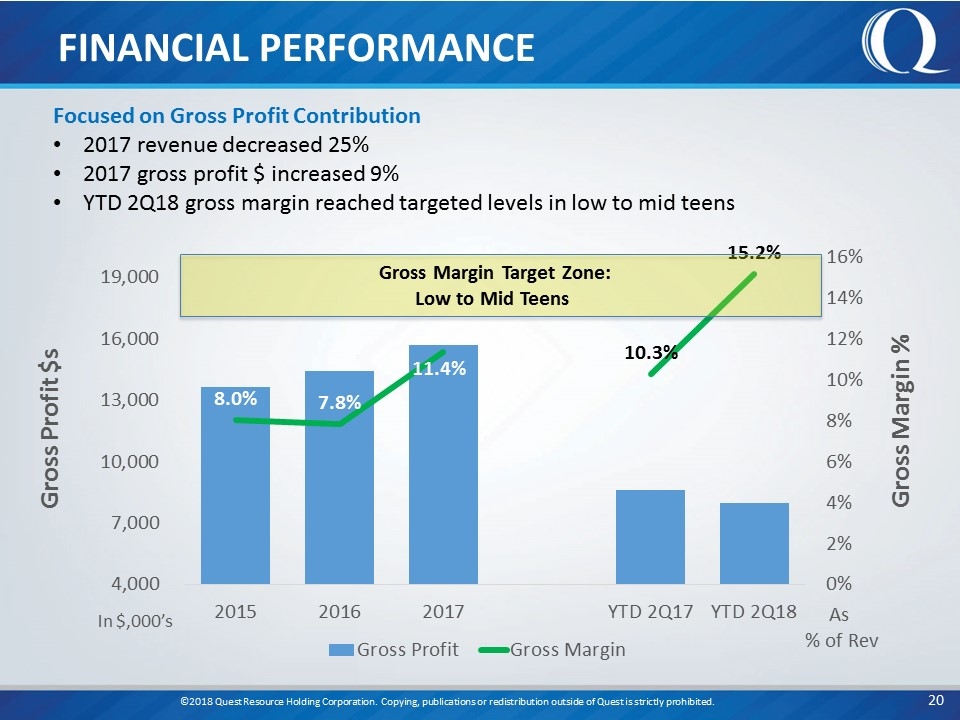

©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Focused on Gross Profit Contribution 2017 revenue decreased 25% 2017 gross profit $ increased 9% YTD 2Q18 gross margin reached targeted levels in low to mid teens FINANCIAL PERFORMANCE Gross Margin Target Zone: Low to Mid Teens In $,000’s As % of Rev Gross Profit $s Gross Margin %

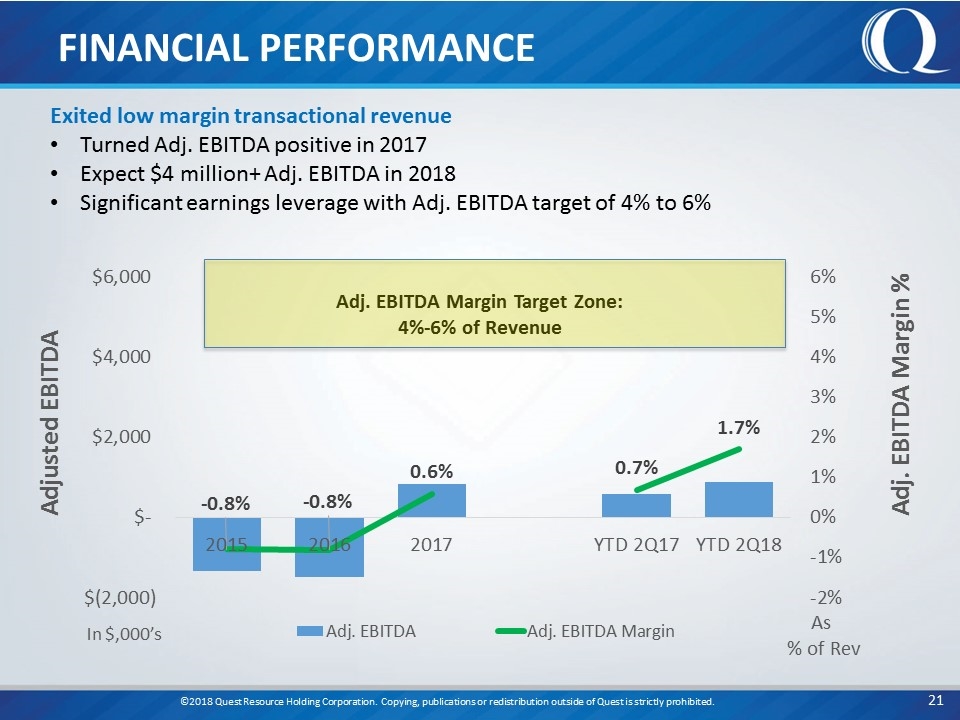

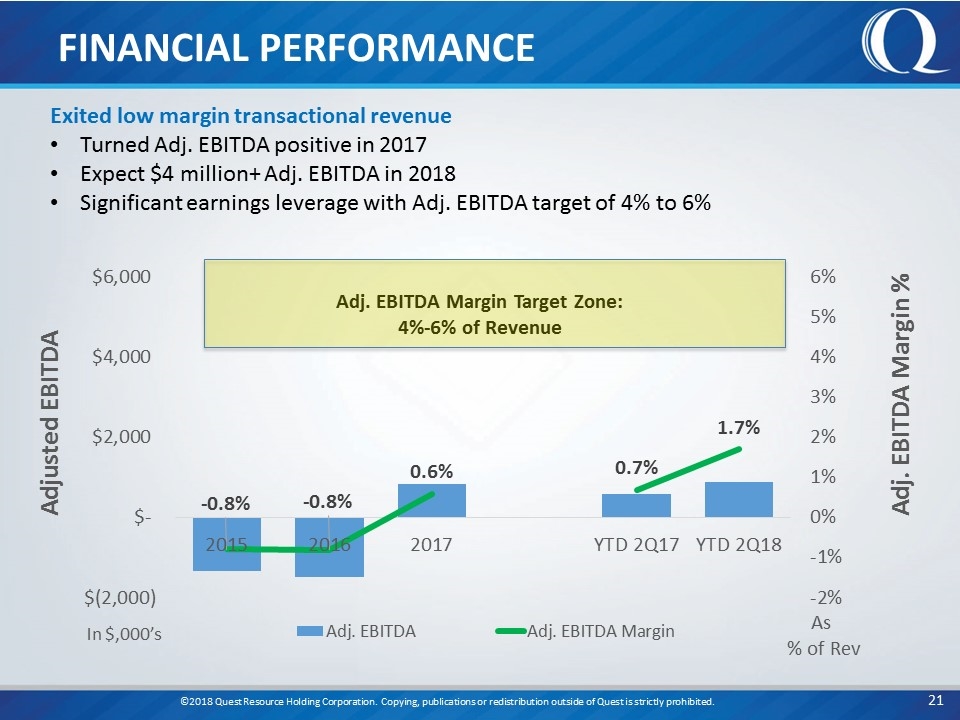

©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. FINANCIAL PERFORMANCE Adj. EBITDA Margin Target Zone: 4%-6% of Revenue Exited low margin transactional revenue Turned Adj. EBITDA positive in 2017 Expect $4 million+ Adj. EBITDA in 2018 Significant earnings leverage with Adj. EBITDA target of 4% to 6% As % of Rev Adjusted EBITDA Adj. EBITDA Margin % In $,000’s

©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. “CAPITAL LITE” MODEL Limited Capital Demands Capital Spending: Historically $500,000 to $1.5 million per year Ample Liquidity for Growth (As of June 30, 2018) Cash: $1.1M million Debt: $4.9 million Line of Credit: $12.1 million available under $20 million facility

INVESTMENT HIGHLIGHTS ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited. Turned EBITDA positive in 2017 Expect GAAP profitability by 4Q18 Resume targeted sales growth in FY19 Sustainable improvements CORPORATE TRANSFORMATION Fortune 1000 – Achieving sustainability goals is expected by customers, employees, and investors $3.3 Billion addressable market SUSTAINABILITY MEGATREND Target larger customer opportunities 7-figure average deal size Earnings leverage to drive 300-500 basis point improvement in Adjusted EBITDA EBITDA MARGIN- TARGET 4%-6% Add significant rev/contribution with limited additional capex Financial and business interests align with customers ASSET LIGHT BUSINESS MODEL Scale – Deliver services in every zip code in the U.S. Scope - Expertise with 100+ waste streams COMPETITIVE DIFFERENTIATION SALES GROWTH-TARGET 12%-15%

©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

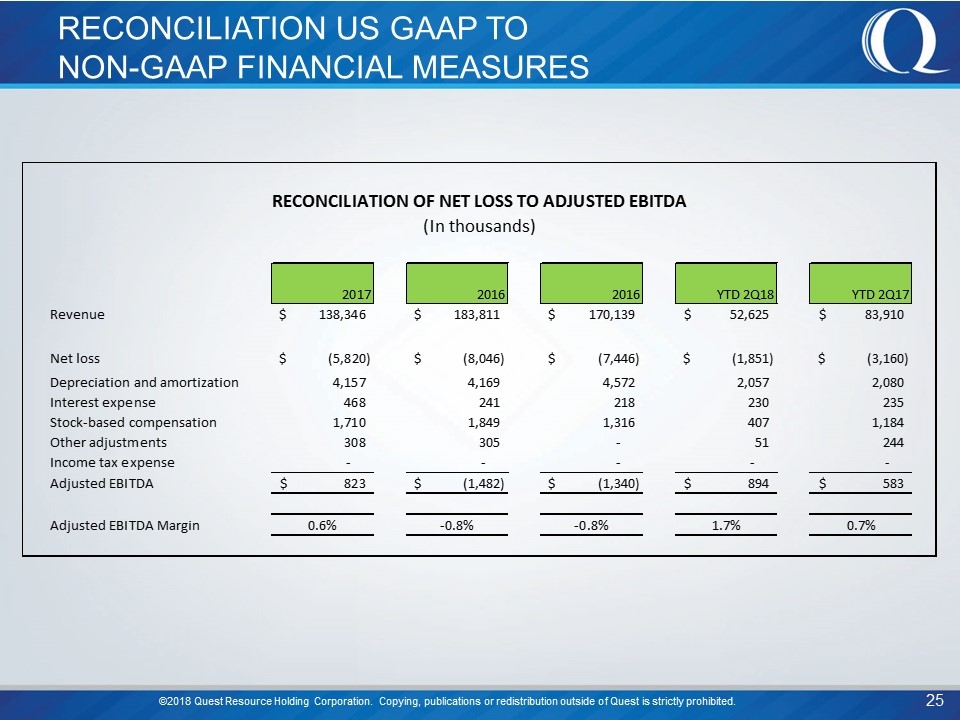

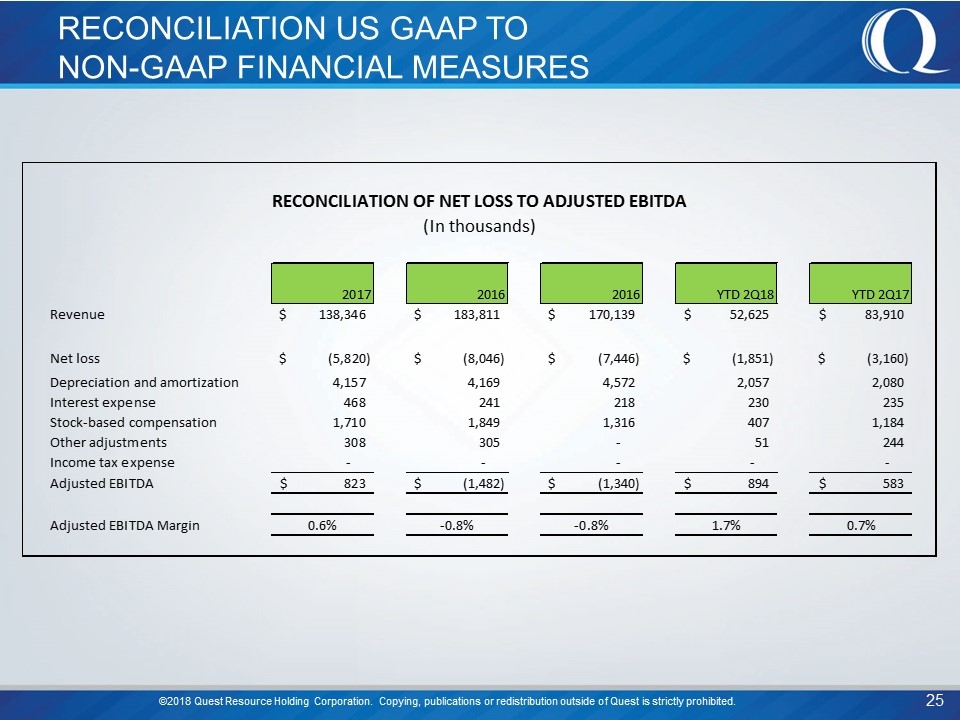

RECONCILIATION US GAAP TO NON-GAAP FINANCIAL MEASURES ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

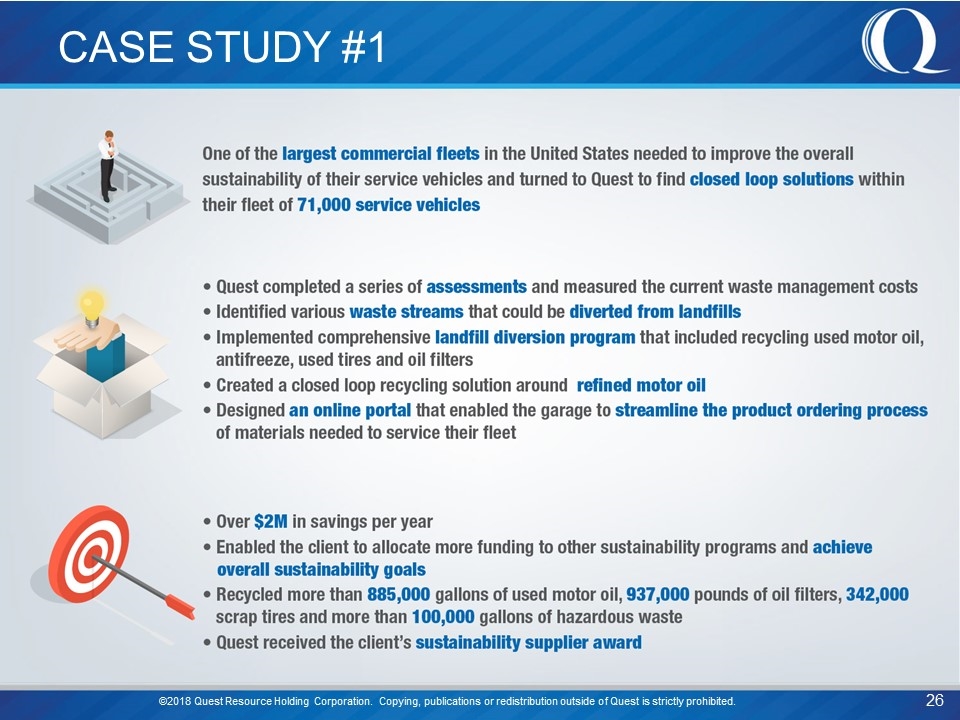

CASE STUDY #1 ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

CASE STUDY #2 ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

CASE STUDY #3 ©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited.

©2018 Quest Resource Holding Corporation. Copying, publications or redistribution outside of Quest is strictly prohibited- Quest Resource Holding Corporation 3481 Plano Parkway The Colony, Texas 75056 972.464.0004 www.qrhc.com www.qrmg.com Ray Hatch Chief Executive Officer Laurie Latham Chief Financial Officer Dave Sweitzer Chief Operating Officer