CLICK TO ADD MAIN TITLE HERE CLICK TO ADD SUBTITLE HERE NATIONAL PROVIDER OF WASTE & RECYCLING SOLUTIONS Quest Resource Holding Corporation (NASDAQ: QRHC) March 2021 INVESTOR PRESENTATION © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. 1 Exhibit 99.1

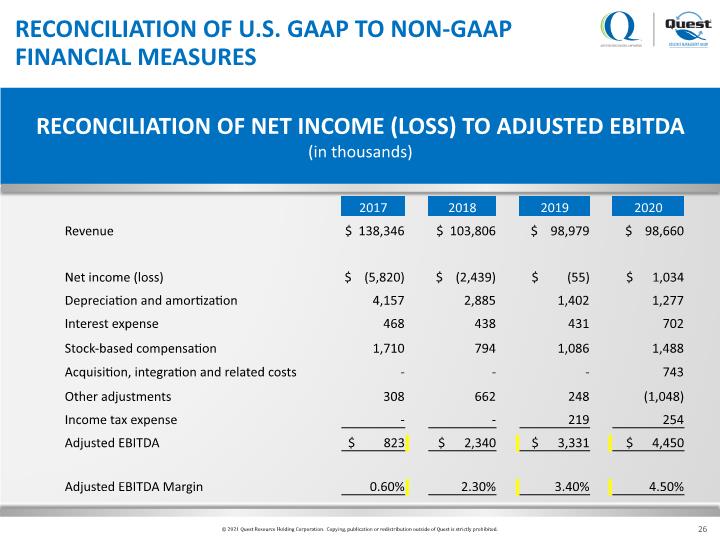

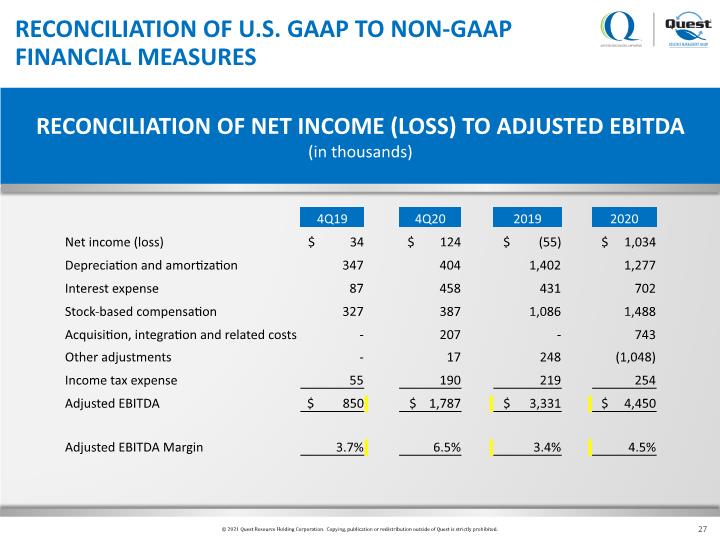

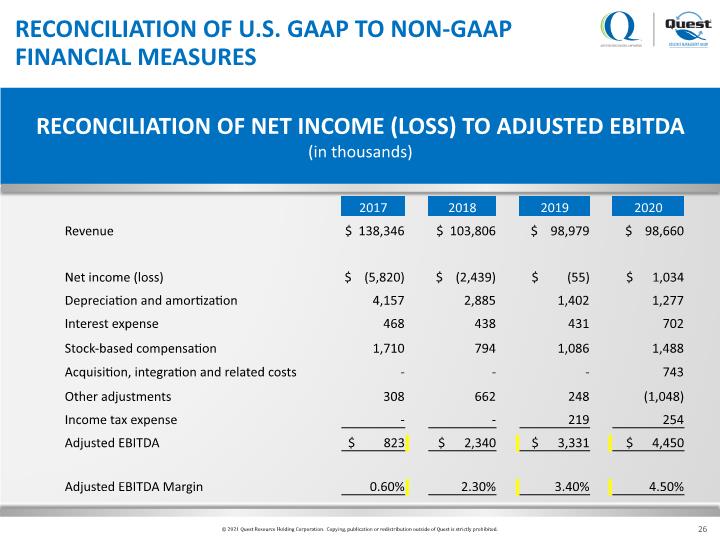

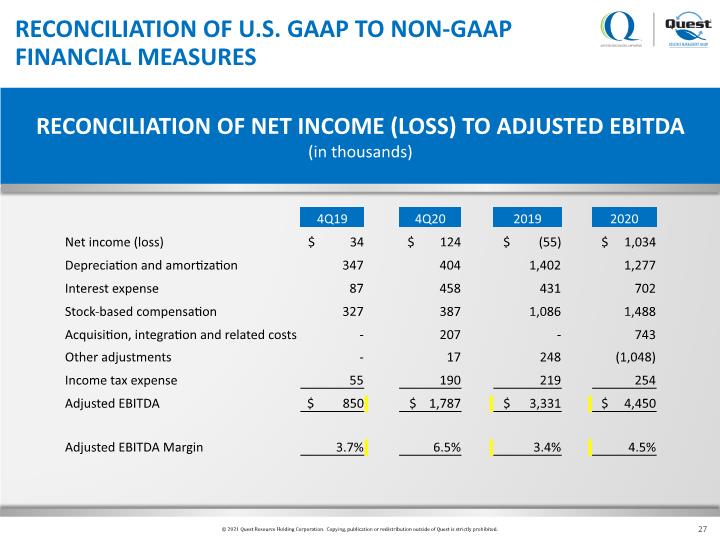

2 The statements contained in this Investor Presentation that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this Investor Presentation, including statements regarding our future operating results, future financial position, business strategy, objectives, goals, plans, prospects, and markets, and plans and objectives for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as "anticipates," "believes," "estimates," "expects," "intends," " targets," "contemplates," "projects," "predicts," "may," "might," "plan," "will," "would," "should," "could, "can," "potential,” “continue," "objective," or the negative of those terms, or similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. Specific forward-looking statements in this Investor Presentation include our belief that we turn our Clients' sustainability strategies into financial gains and competitive strength; our belief that we are poised to achieve significant margin improvement; and our growth strategy. All forward-looking statements included herein are based on information available to us as of the date hereof and speak only as of such date. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. The forward-looking statements contained in this Investor Presentation reflect our views as of the date of this Investor Presentation about future events and are subject to risks, uncertainties, assumptions, and changes in circumstances that may cause our actual results, performance, or achievements to differ significantly from those expressed or implied in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, performance, or achievements. A number of factors could cause actual results to differ materially from those indicated by the forward-looking statements, including competition in the environmental services industry, the impact of the current economic environment, and other factors detailed from time to time in our reports to the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2020. Certain information contained in this material is made available to Quest Resource Holding Corporation by third parties. Quest Resource Holding Corporation is not responsible for the content of any information made available to it by any third party. Quest Resource Holding Corporation disclaims any liability to any person for any delays, inaccuracies, errors, omissions, or defects in any such information or the transmission thereof, or for any actions taken by any person in reliance on such information or any damages arising from or relating to any use of such information. Information prepared by Quest Resource Holding Corporation that is included in this material speaks only as of the date that it was prepared. This information may be incomplete or may have become out of date. Quest Resource Holding Corporation makes no commitment and disclaims any duty, to update or revise such information. Reconciliation of U.S. GAAP to Non-GAAP Financial Measures In this Investor Presentation, a non-GAAP financial measure, "Adjusted EBITDA," is presented. From time-to-time, Quest considers and uses this supplemental measure of operating performance in order to provide an improved understanding of underlying performance trends. Quest believes it is useful to review, as applicable, both (1) GAAP measures that include (i) depreciation and amortization, (ii) interest expense, (iii) stock-based compensation expense, (iv) income tax expense, and (v) certain other adjustments, and (2) non-GAAP measures that exclude such information. Quest presents this non-GAAP measure because it considers it an important supplemental measure of Quest's performance. Quest's definition of this adjusted financial measure may differ from similarly named measures used by others. Quest believes this measure facilitates operating performance comparisons from period to period by eliminating potential differences caused by the existence and timing of certain expense items that would not otherwise be apparent on a GAAP basis. This non-GAAP measure has limitations as an analytical tool and should not be considered in isolation or as a substitute for the company's GAAP measures. (See attached table "Reconciliation of Net Loss to Adjusted EBITDA.") *Adjusted EBITDA is a Non-GAAP term. SEC SAFE HARBOR © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited.

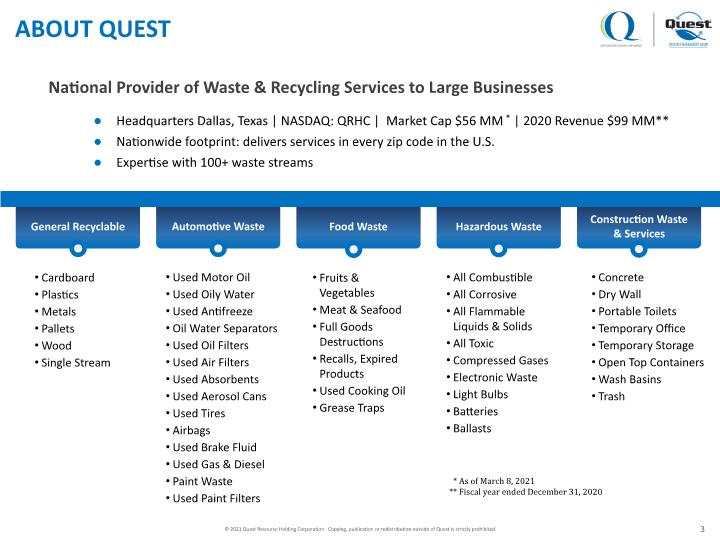

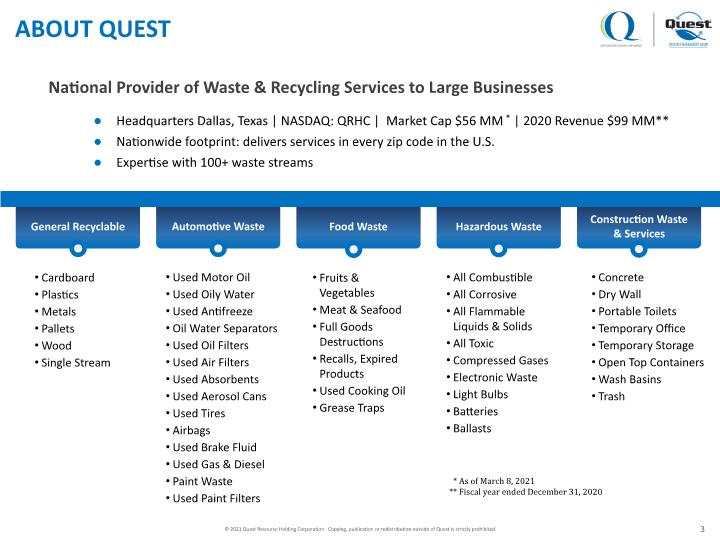

ABOUT QUEST 3 Hazardous Waste All Combustible All Corrosive All Flammable Liquids & Solids All Toxic Compressed Gases Electronic Waste Light Bulbs Batteries Ballasts Automotive Waste Used Motor Oil Used Oily Water Used Antifreeze Oil Water Separators Used Oil Filters Used Air Filters Used Absorbents Used Aerosol Cans Used Tires Airbags Used Brake Fluid Used Gas & Diesel Paint Waste Used Paint Filters Cardboard Plastics Metals Pallets Wood Single Stream General Recyclable Food Waste Fruits & Vegetables Meat & Seafood Full Goods Destructions Recalls, Expired Products Used Cooking Oil Grease Traps Construction Waste & Services Concrete Dry Wall Portable Toilets Temporary Office Temporary Storage Open Top Containers Wash Basins Trash National Provider of Waste & Recycling Services to Large Businesses Headquarters Dallas, Texas | NASDAQ: QRHC | Market Cap $56 MM * | 2020 Revenue $99 MM** Nationwide footprint: delivers services in every zip code in the U.S. Expertise with 100+ waste streams * As of March 8, 2021 ** Fiscal year ended December 31, 2020 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited.

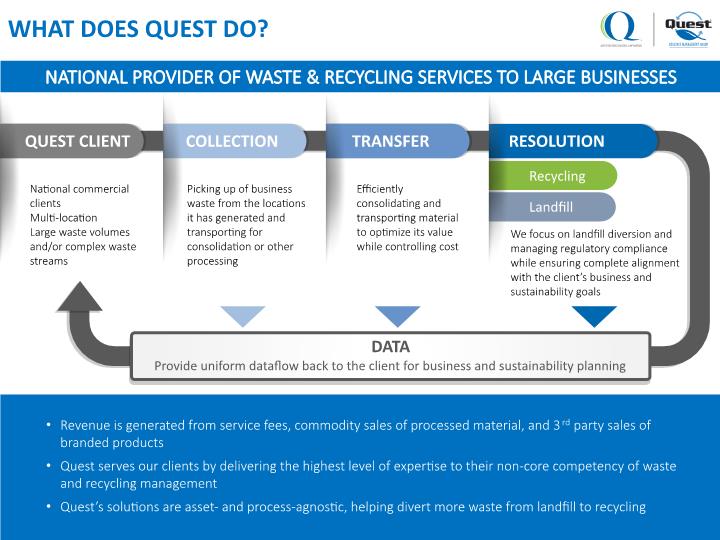

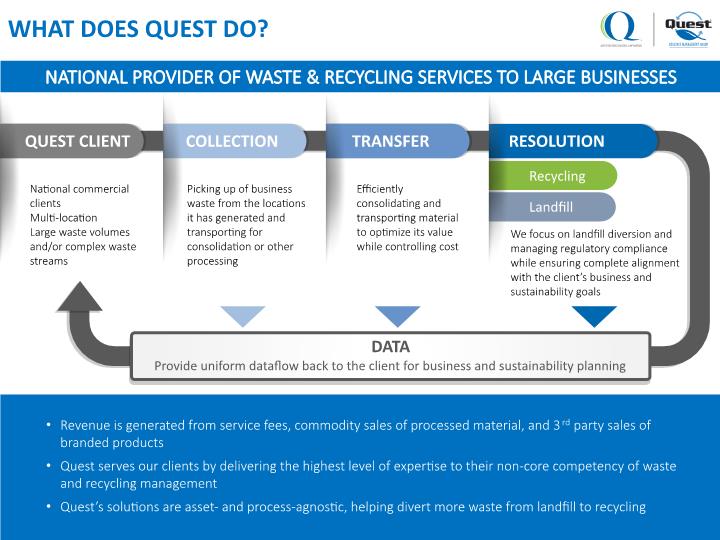

RESOLUTION Recycling Landfill WHAT DOES QUEST DO? We focus on landfill diversion and managing regulatory compliance while ensuring complete alignment with the client’s business and sustainability goals DATA Provide uniform dataflow back to the client for business and sustainability planning TRANSFER Efficiently consolidating and transporting material to optimize its value while controlling cost COLLECTION QUEST CLIENT National commercial clients Multi-location Large waste volumes and/or complex waste streams Picking up of business waste from the locations it has generated and transporting for consolidation or other processing Revenue is generated from service fees, commodity sales of processed material, and 3rd party sales of branded products Quest serves our clients by delivering the highest level of expertise to their non-core competency of waste and recycling management Quest’s solutions are asset- and process-agnostic, helping divert more waste from landfill to recycling NATIONAL PROVIDER OF WASTE & RECYCLING SERVICES TO LARGE BUSINESSES

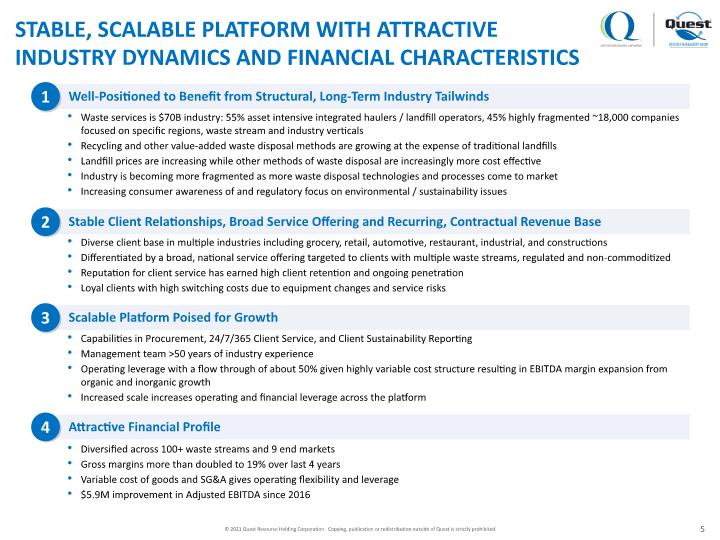

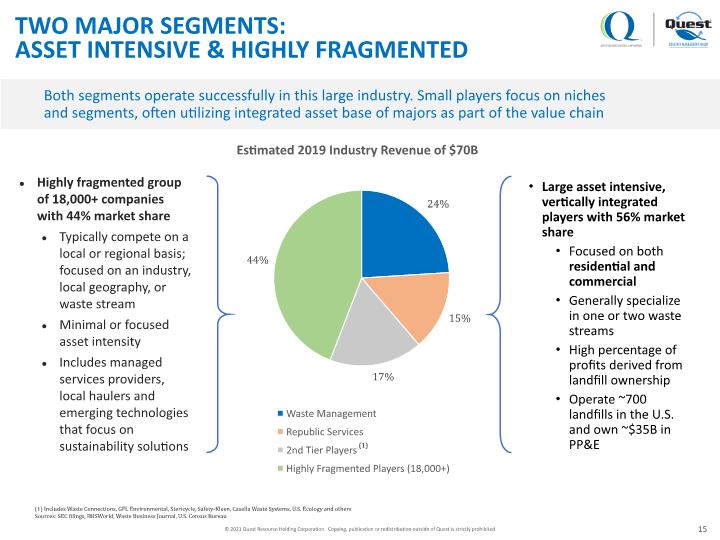

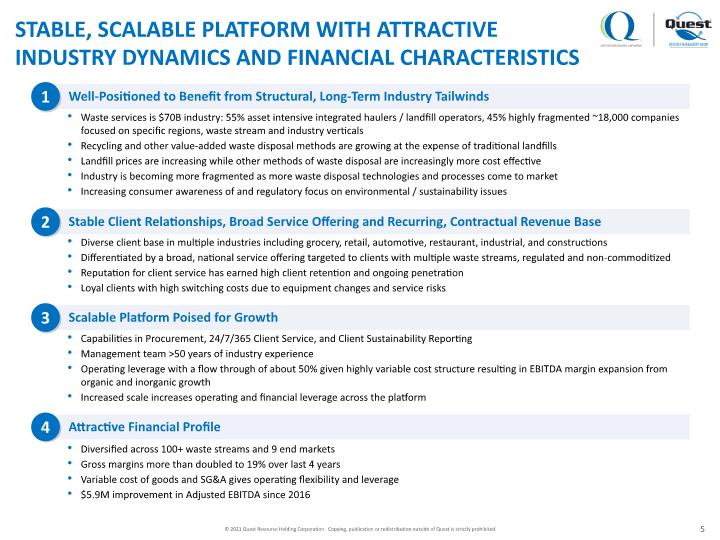

Stable Client Relationships, Broad Service Offering and Recurring, Contractual Revenue Base Attractive Financial Profile Scalable Platform Poised for Growth Well-Positioned to Benefit from Structural, Long-Term Industry Tailwinds 2 Diverse client base in multiple industries including grocery, retail, automotive, restaurant, industrial, and constructions Differentiated by a broad, national service offering targeted to clients with multiple waste streams, regulated and non-commoditized Reputation for client service has earned high client retention and ongoing penetration Loyal clients with high switching costs due to equipment changes and service risks 4 Diversified across 100+ waste streams and 9 end markets Gross margins more than doubled to 19% over last 4 years Variable cost of goods and SG&A gives operating flexibility and leverage $5.9M improvement in Adjusted EBITDA since 2016 3 Capabilities in Procurement, 24/7/365 Client Service, and Client Sustainability Reporting Management team >50 years of industry experience Operating leverage with a flow through of about 50% given highly variable cost structure resulting in EBITDA margin expansion from organic and inorganic growth Increased scale increases operating and financial leverage across the platform 1 Waste services is $70B industry: 55% asset intensive integrated haulers / landfill operators, 45% highly fragmented ~18,000 companies focused on specific regions, waste stream and industry verticals Recycling and other value-added waste disposal methods are growing at the expense of traditional landfills Landfill prices are increasing while other methods of waste disposal are increasingly more cost effective Industry is becoming more fragmented as more waste disposal technologies and processes come to market Increasing consumer awareness of and regulatory focus on environmental / sustainability issues 5 STABLE, SCALABLE PLATFORM WITH ATTRACTIVE INDUSTRY DYNAMICS AND FINANCIAL CHARACTERISTICS © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited.

Clients span multiple industries including grocery, retail, automotive, restaurant, industrial, and construction Trusted by Fortune© 1000 Businesses with national footprints and complex waste streams 7-figure average deal size FOCUS ON LARGE CLIENTS WITH COMPLEX WASTE STREAMS 6 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited.

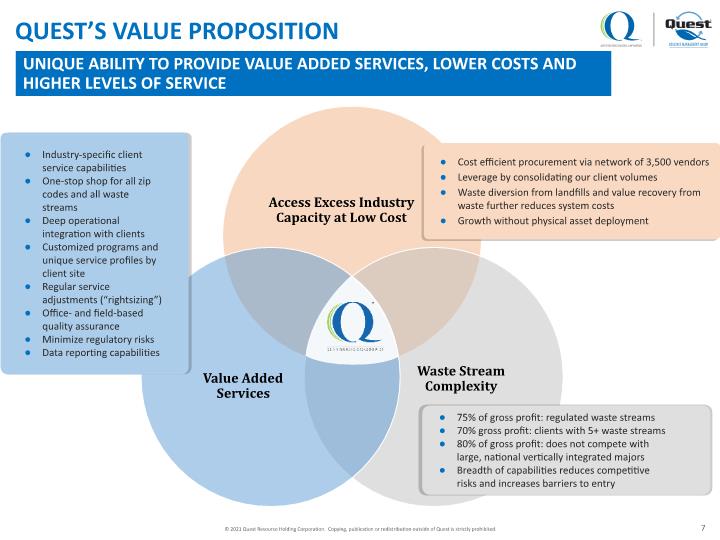

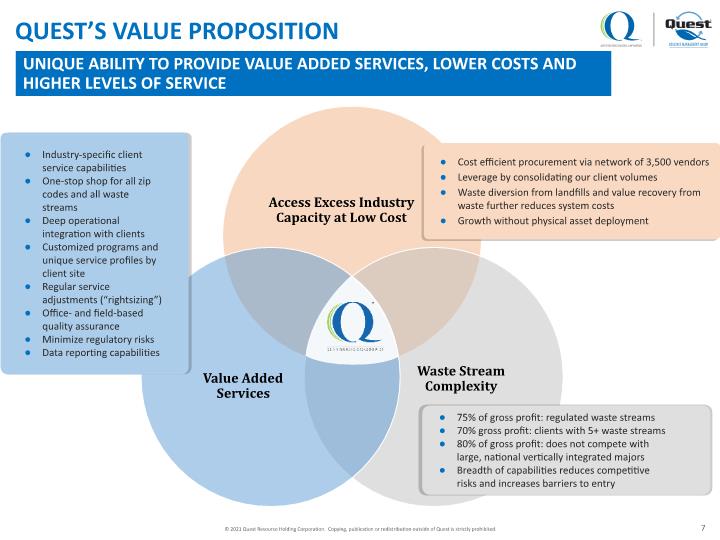

7 UNIQUE ABILITY TO PROVIDE VALUE ADDED SERVICES, LOWER COSTS AND HIGHER LEVELS OF SERVICE QUEST’S VALUE PROPOSITION © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. Cost efficient procurement via network of 3,500 vendors Leverage by consolidating our client volumes Waste diversion from landfills and value recovery from waste further reduces system costs Growth without physical asset deployment 75% of gross profit: regulated waste streams 70% gross profit: clients with 5+ waste streams 80% of gross profit: does not compete with large, national vertically integrated majors Breadth of capabilities reduces competitive risks and increases barriers to entry Industry-specific client service capabilities One-stop shop for all zip codes and all waste streams Deep operational integration with clients Customized programs and unique service profiles by client site Regular service adjustments (“rightsizing”) Office- and field-based quality assurance Minimize regulatory risks Data reporting capabilities

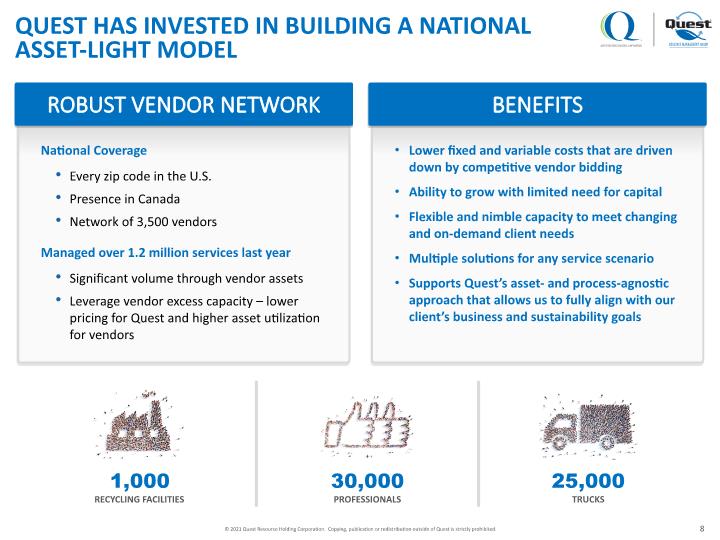

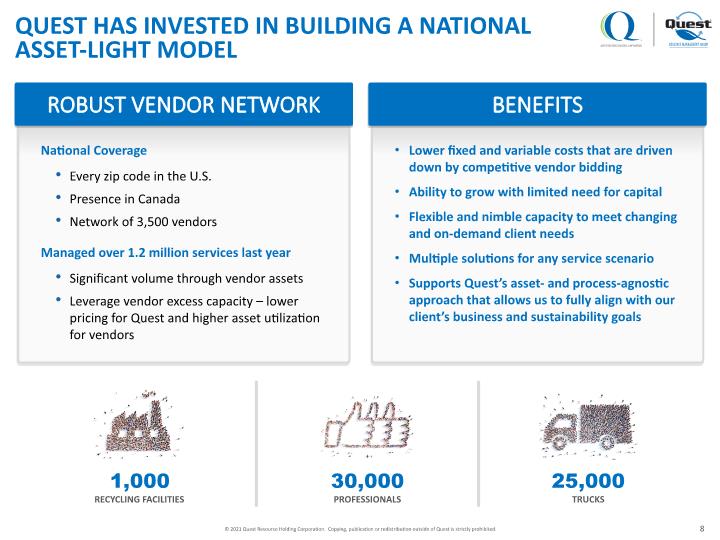

National Coverage Every zip code in the U.S. Presence in Canada Network of 3,500 vendors Managed over 1.2 million services last year Significant volume through vendor assets Leverage vendor excess capacity – lower pricing for Quest and higher asset utilization for vendors 8 QUEST HAS INVESTED IN BUILDING A NATIONAL ASSET-LIGHT MODEL ROBUST VENDOR NETWORK Lower fixed and variable costs that are driven down by competitive vendor bidding Ability to grow with limited need for capital Flexible and nimble capacity to meet changing and on-demand client needs Multiple solutions for any service scenario Supports Quest’s asset- and process-agnostic approach that allows us to fully align with our client’s business and sustainability goals BENEFITS © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited.

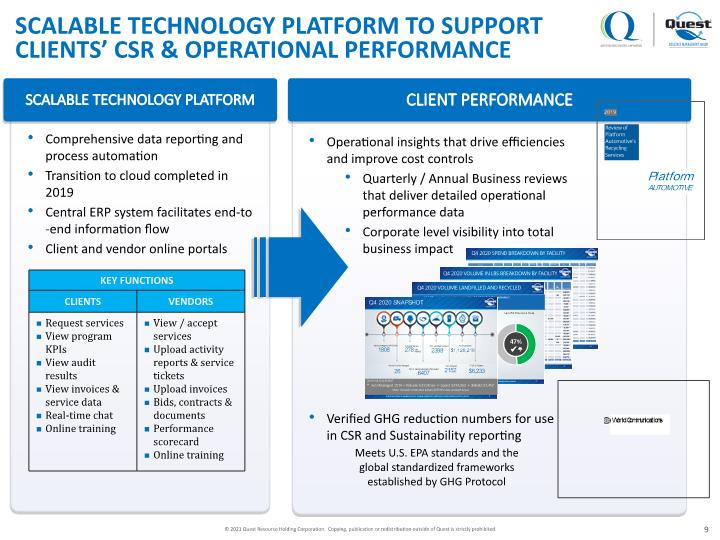

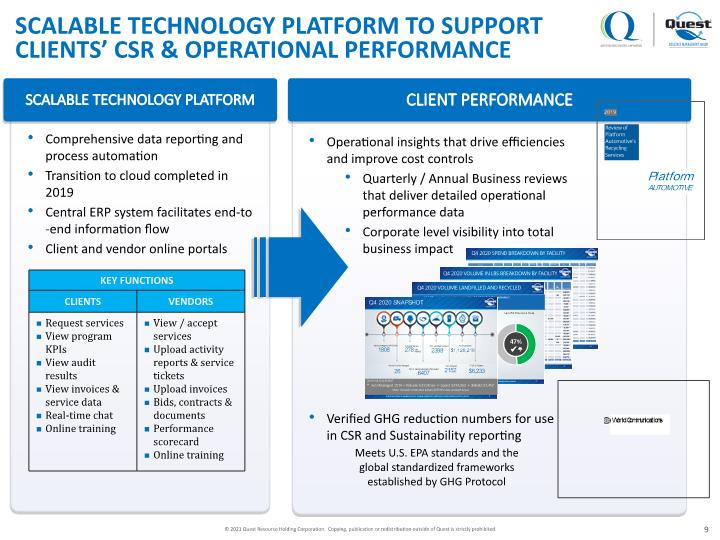

9 Comprehensive data reporting and process automation Transition to cloud completed in 2019 Central ERP system facilitates end-to-end information flow Client and vendor online portals SCALABLE TECHNOLOGY PLATFORM TO SUPPORT CLIENTS’ CSR & OPERATIONAL PERFORMANCE Meets U.S. EPA standards and the global standardized frameworks established by GHG Protocol Operational insights that drive efficiencies and improve cost controls Quarterly / Annual Business reviews that deliver detailed operational performance data Corporate level visibility into total business impact Verified GHG reduction numbers for use in CSR and Sustainability reporting © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. SCALABLE TECHNOLOGY PLATFORM CLIENT PERFORMANCE

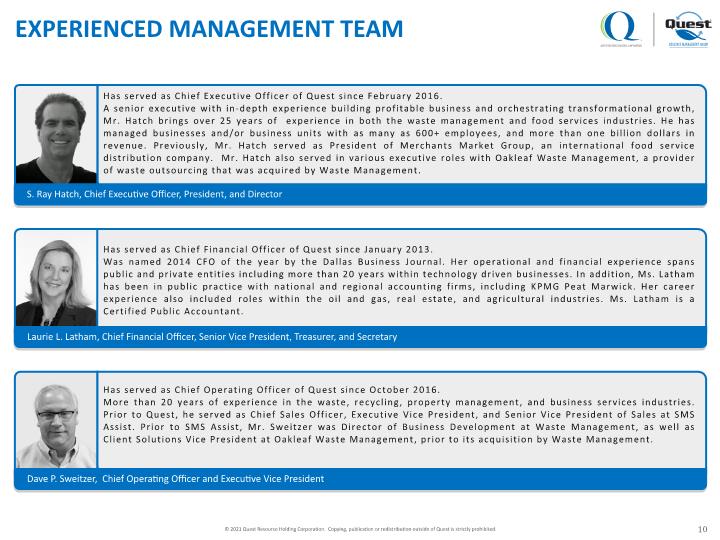

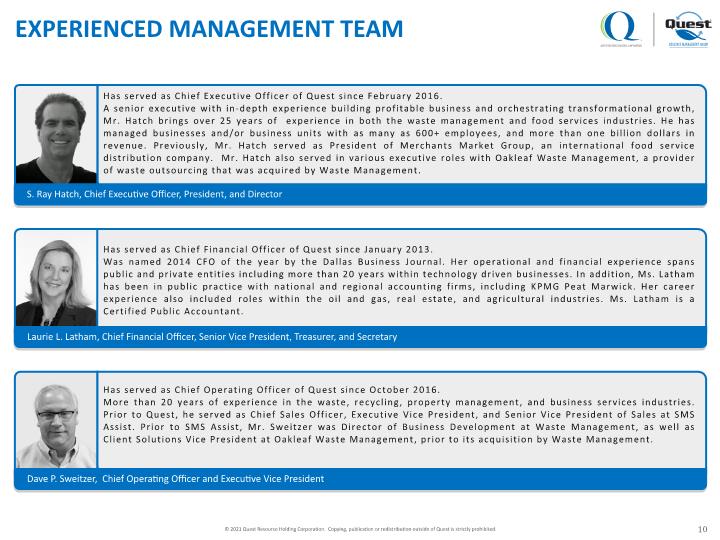

EXPERIENCED MANAGEMENT TEAM 10 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited.

INDUSTRY OVERVIEW

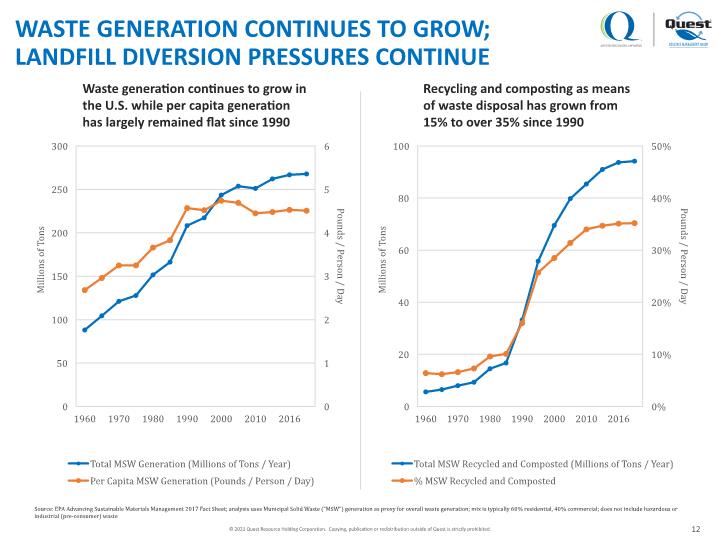

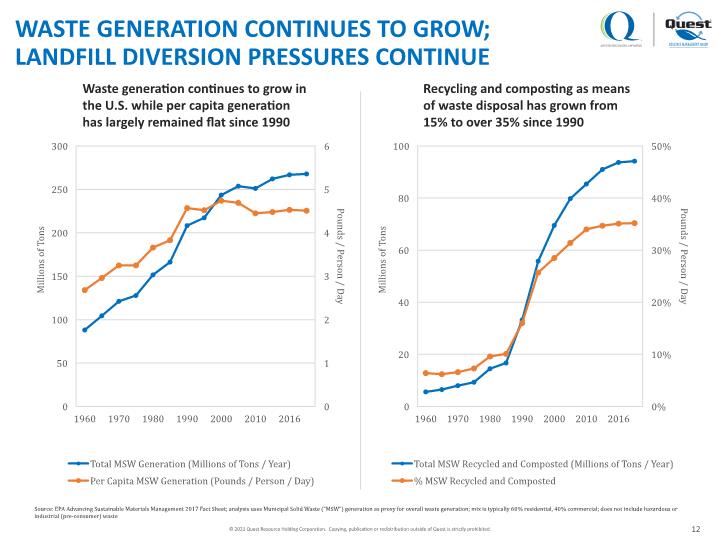

Recycling and composting as means of waste disposal has grown from 15% to over 35% since 1990 WASTE GENERATION CONTINUES TO GROW; LANDFILL DIVERSION PRESSURES CONTINUE © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. 12 Waste generation continues to grow in the U.S. while per capita generation has largely remained flat since 1990 Source: EPA Advancing Sustainable Materials Management 2017 Fact Sheet; analysis uses Municipal Solid Waste (“MSW”) generation as proxy for overall waste generation; mix is typically 60% residential, 40% commercial; does not include hazardous or industrial (pre-consumer) waste

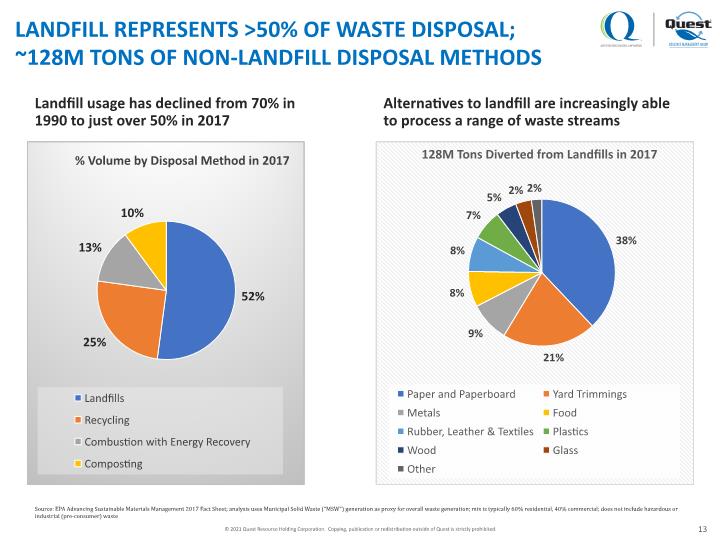

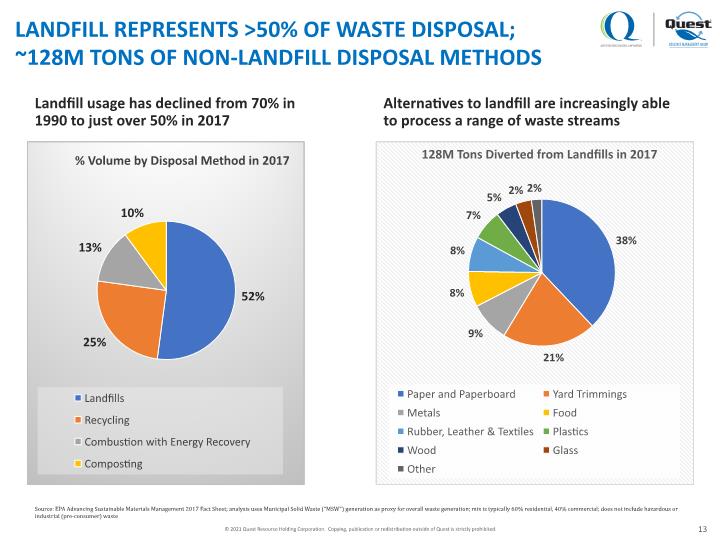

LANDFILL REPRESENTS >50% OF WASTE DISPOSAL; ~128M TONS OF NON-LANDFILL DISPOSAL METHODS 13 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. Landfill usage has declined from 70% in 1990 to just over 50% in 2017 Alternatives to landfill are increasingly able to process a range of waste streams Source: EPA Advancing Sustainable Materials Management 2017 Fact Sheet; analysis uses Municipal Solid Waste (“MSW”) generation as proxy for overall waste generation; mix is typically 60% residential, 40% commercial; does not include hazardous or industrial (pre-consumer) waste

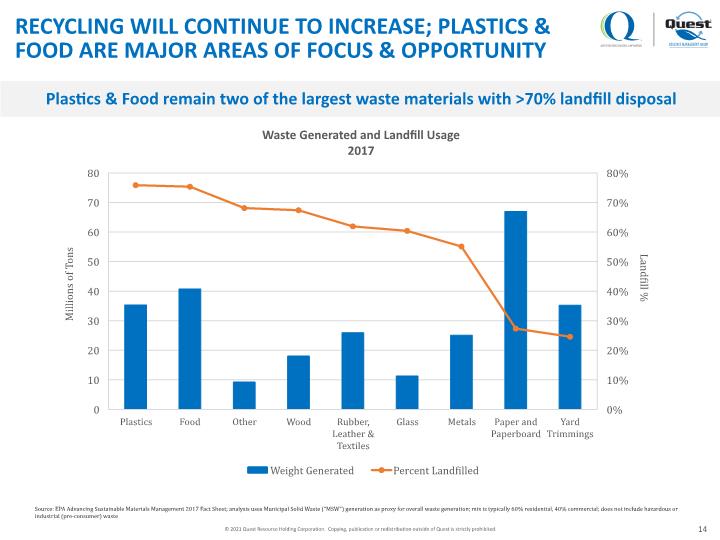

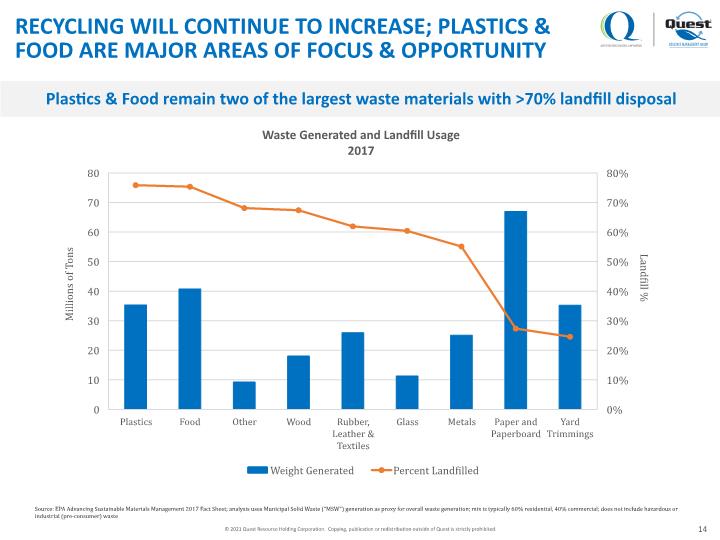

RECYCLING WILL CONTINUE TO INCREASE; PLASTICS & FOOD ARE MAJOR AREAS OF FOCUS & OPPORTUNITY 14 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. Plastics & Food remain two of the largest waste materials with >70% landfill disposal Source: EPA Advancing Sustainable Materials Management 2017 Fact Sheet; analysis uses Municipal Solid Waste (“MSW”) generation as proxy for overall waste generation; mix is typically 60% residential, 40% commercial; does not include hazardous or industrial (pre-consumer) waste

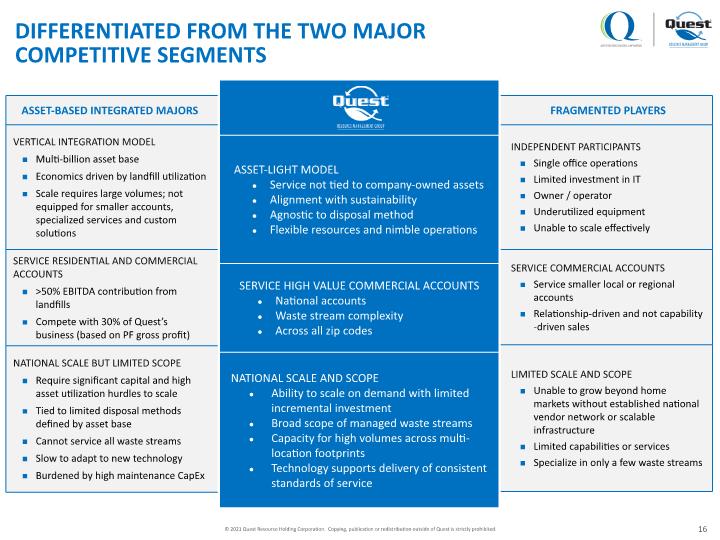

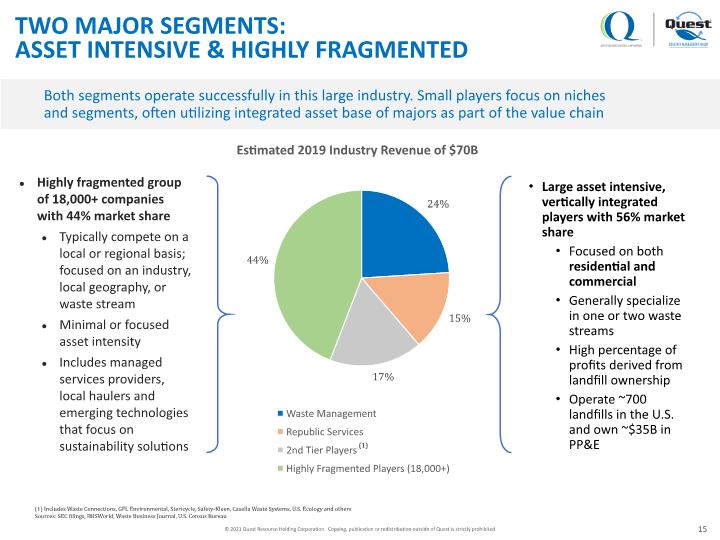

TWO MAJOR SEGMENTS: ASSET INTENSIVE & HIGHLY FRAGMENTED Large asset intensive, vertically integrated players with 56% market share Focused on both residential and commercial Generally specialize in one or two waste streams High percentage of profits derived from landfill ownership Operate ~700 landfills in the U.S. and own ~$35B in PP&E 15 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. (1) Includes Waste Connections, GFL Environmental, Stericycle, Safety-Kleen, Casella Waste Systems, U.S. Ecology and others Sources: SEC filings, IBISWorld, Waste Business Journal, U.S. Census Bureau Both segments operate successfully in this large industry. Small players focus on niches and segments, often utilizing integrated asset base of majors as part of the value chain Highly fragmented group of 18,000+ companies with 44% market share Typically compete on a local or regional basis; focused on an industry, local geography, or waste stream Minimal or focused asset intensity Includes managed services providers, local haulers and emerging technologies that focus on sustainability solutions

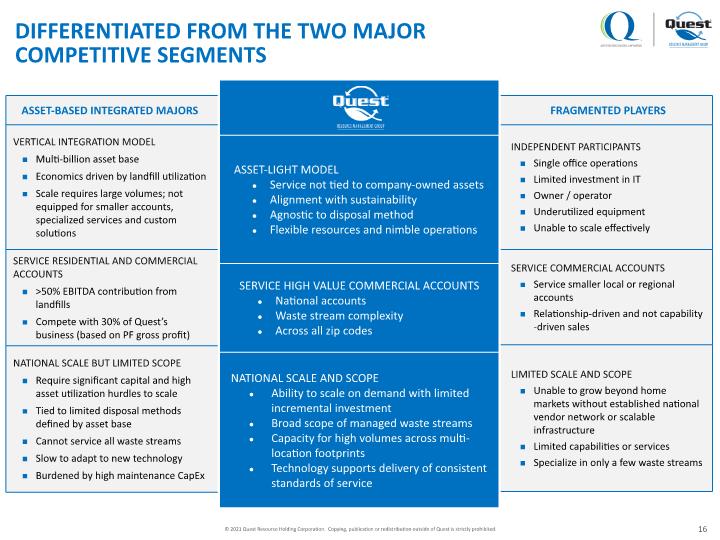

DIFFERENTIATED FROM THE TWO MAJOR COMPETITIVE SEGMENTS 16 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited.

QUEST BUSINESS, PERFORMANCE & STRATEGY

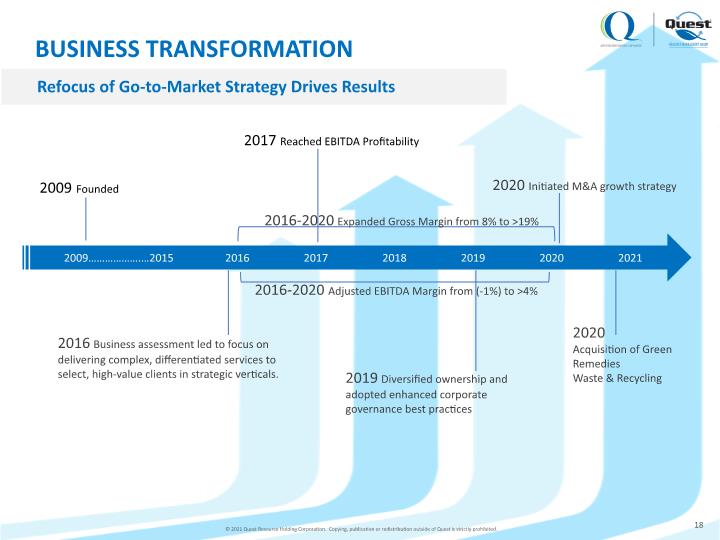

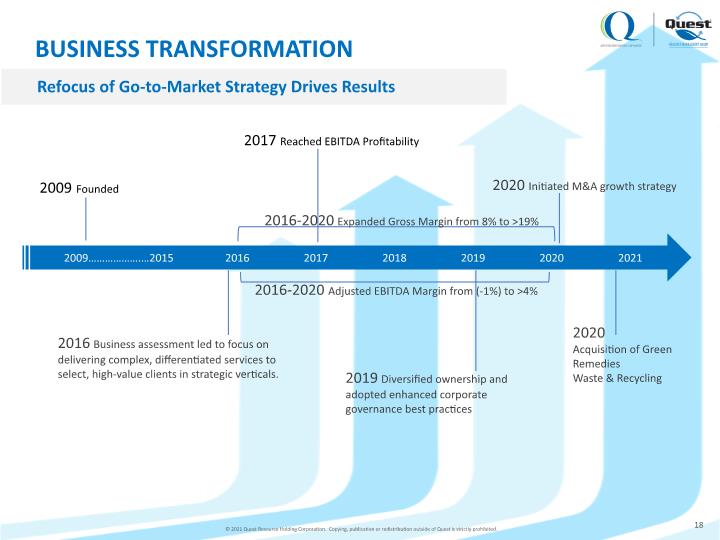

18 2020 Initiated M&A growth strategy © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. BUSINESS TRANSFORMATION 2009 Founded 2009……………….…2015 2016 2017 2018 2019 2020 2021 2016 Business assessment led to focus on delivering complex, differentiated services to select, high-value clients in strategic verticals. 2017 Reached EBITDA Profitability 2019 Diversified ownership and adopted enhanced corporate governance best practices 2020 Acquisition of Green Remedies Waste & Recycling 2016-2020 Expanded Gross Margin from 8% to >19% 2016-2020 Adjusted EBITDA Margin from (-1%) to >4% Refocus of Go-to-Market Strategy Drives Results

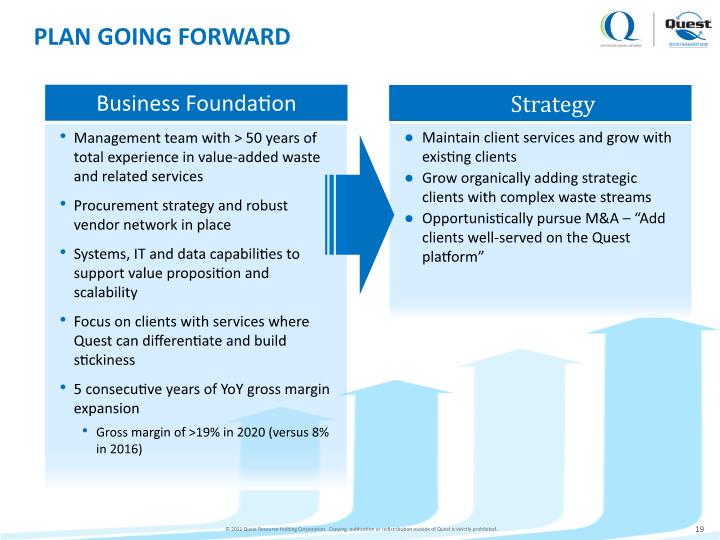

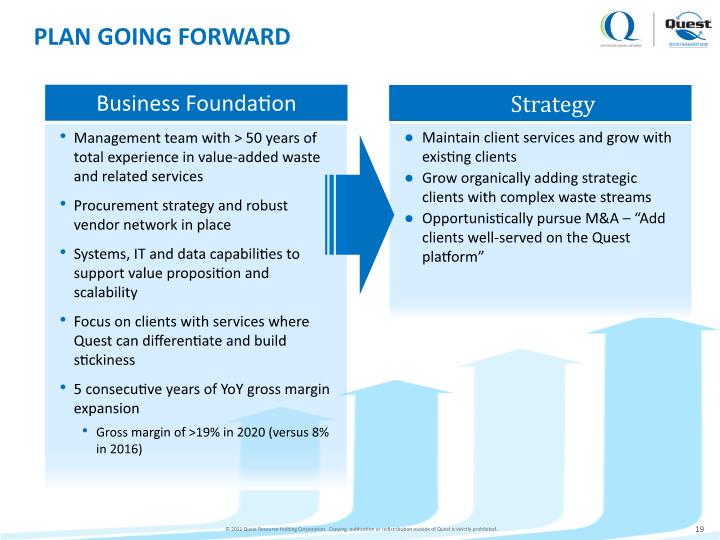

19 Business Foundation Strategy © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. PLAN GOING FORWARD Management team with > 50 years of total experience in value-added waste and related services Procurement strategy and robust vendor network in place Systems, IT and data capabilities to support value proposition and scalability Focus on clients with services where Quest can differentiate and build stickiness 5 consecutive years of YoY gross margin expansion Gross margin of >19% in 2020 (versus 8% in 2016) Maintain client services and grow with existing clients Grow organically adding strategic clients with complex waste streams Opportunistically pursue M&A – “Add clients well-served on the Quest platform”

FOCUSED M&A STRATEGY: ACQUIRE COMPANIES WITH STRONG CLIENTS & FOCUS ON SERVICE 20 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. Acquisition Candidate Enables Growth at National Scale Reduces Capital Risk Adds Capabilities Client Maintain or Improve Service Access to National Footprint Reporting Capabilities Quest Gain Greater Efficiencies of Scale and Scope Operating Leverage & Improved Returns Ideal Acquisition Candidate Successful business built by entrepreneur who wants to reduce capital at risk and add capabilities Longstanding client relationships and track record of excellent service Favorable/long-term client contracts Support expansion to adjacent regions leveraging Quest’s vendor network Opportunity 18,000+ companies with 44% market share of $70 billion market Many regional / local players have longstanding client relationships but are reluctant or unable to grow due to lack of infrastructure Clients are sticky and tend to stay with the acquirer as long as service levels are maintained Execution Reduce risk through simple integration process; same as onboarding new clients Cost synergies from functional overlaps Support expansion to adjacent regions leveraging Quest’s vendor network Repeatable across acquisitions QUEST’S NATIONAL PLATFORM Comprehensive Services & Capabilities “ADD CLIENTS TO THE QUEST PLATFORM THAT WE CAN SERVE AS WELL OR BETTER”

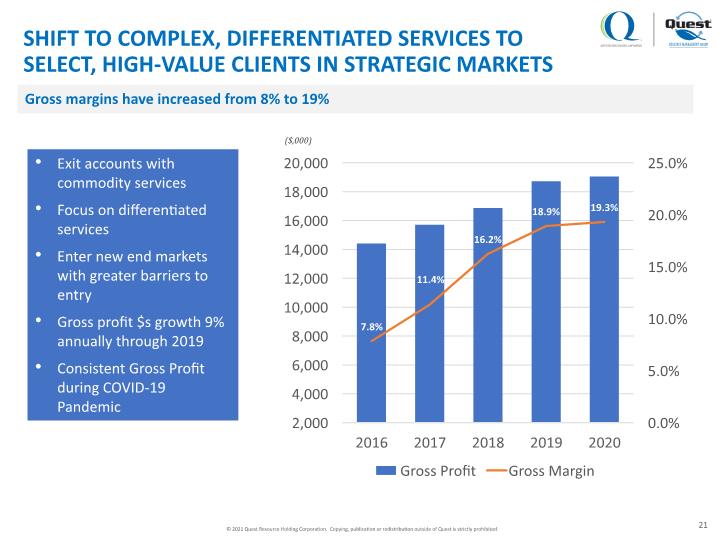

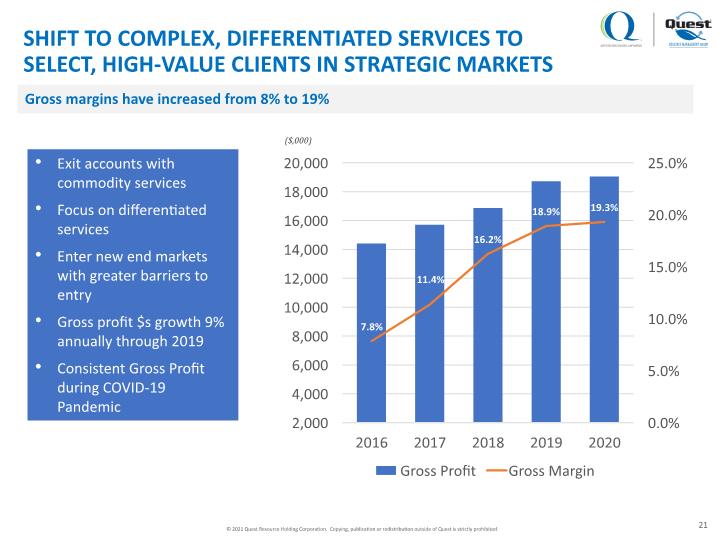

21 Exit accounts with commodity services Focus on differentiated services Enter new end markets with greater barriers to entry Gross profit $s growth 9% annually through 2019 Consistent Gross Profit during COVID-19 Pandemic Gross margins have increased from 8% to 19% © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. SHIFT TO COMPLEX, DIFFERENTIATED SERVICES TO SELECT, HIGH-VALUE CLIENTS IN STRATEGIC MARKETS ($,000)

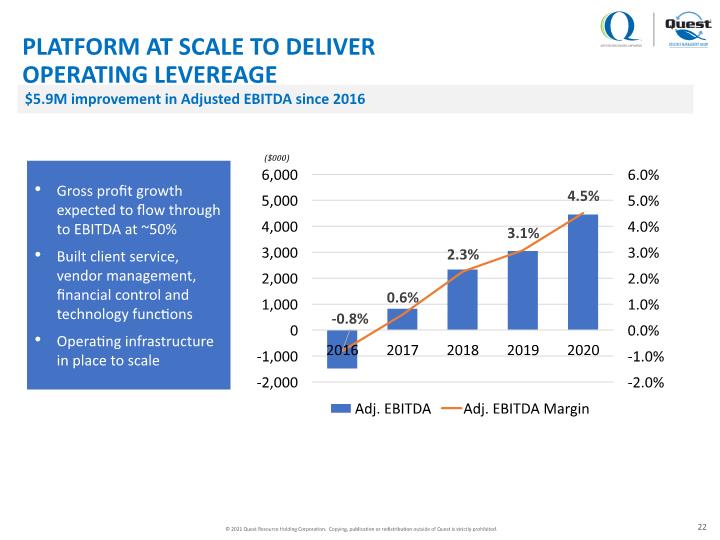

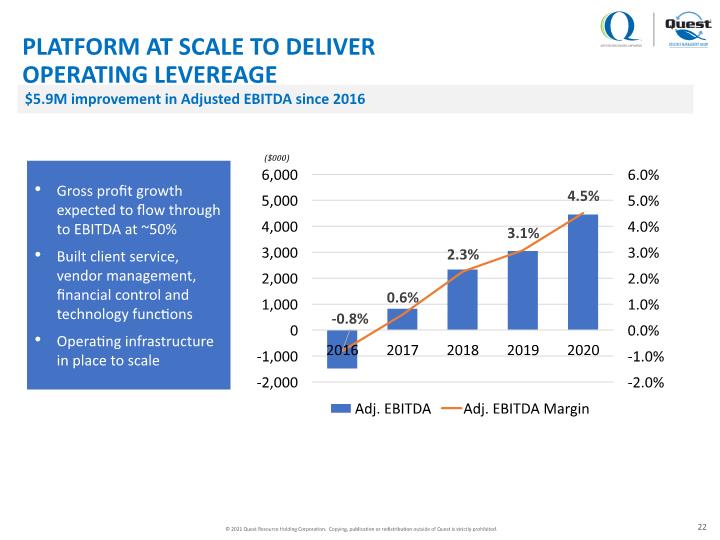

22 Gross profit growth expected to flow through to EBITDA at ~50% Built client service, vendor management, financial control and technology functions Operating infrastructure in place to scale $5.9M improvement in Adjusted EBITDA since 2016 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. PLATFORM AT SCALE TO DELIVER OPERATING LEVEREAGE ($000)

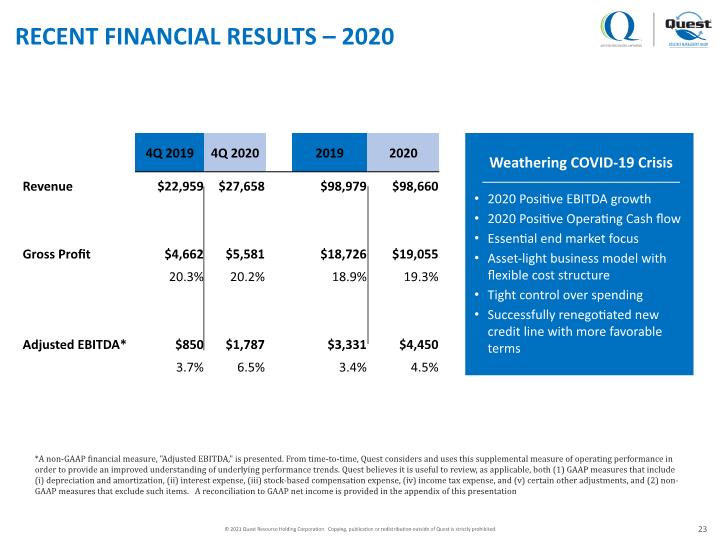

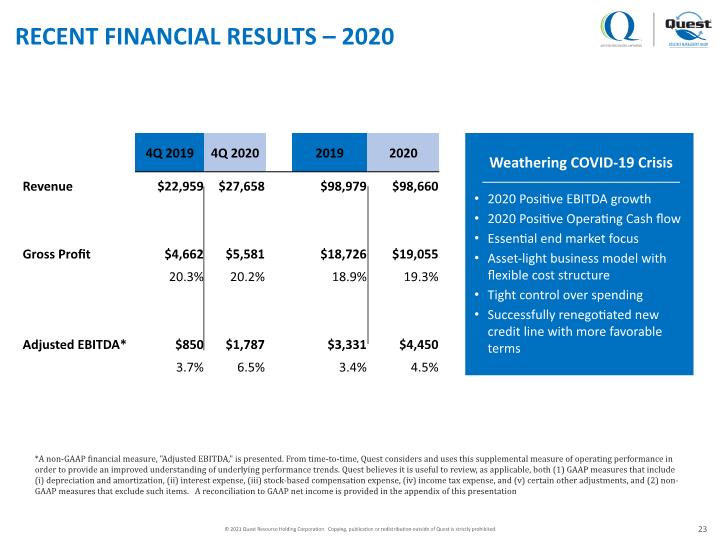

RECENT FINANCIAL RESULTS – 2020 23 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. *A non-GAAP financial measure, "Adjusted EBITDA," is presented. From time-to-time, Quest considers and uses this supplemental measure of operating performance in order to provide an improved understanding of underlying performance trends. Quest believes it is useful to review, as applicable, both (1) GAAP measures that include (i) depreciation and amortization, (ii) interest expense, (iii) stock-based compensation expense, (iv) income tax expense, and (v) certain other adjustments, and (2) non-GAAP measures that exclude such items. A reconciliation to GAAP net income is provided in the appendix of this presentation Weathering COVID-19 Crisis 2020 Positive EBITDA growth 2020 Positive Operating Cash flow Essential end market focus Asset-light business model with flexible cost structure Tight control over spending Successfully renegotiated new credit line with more favorable terms

Stable Client Relationships, Broad Service Offering and Recurring, Contractual Revenue Base Attractive Financial Profile Scalable Platform Poised for Growth Well-Positioned to Benefit from Structural, Long-Term Industry Tailwinds 2 4 3 1 24 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. STABLE, SCALABLE PLATFORM WITH ATTRACTIVE INDUSTRY DYNAMICS AND FINANCIAL CHARACTERISTICS

APPENDIX

RECONCILIATION OF U.S. GAAP TO NON-GAAP FINANCIAL MEASURES 26 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA (in thousands)

RECONCILIATION OF U.S. GAAP TO NON-GAAP FINANCIAL MEASURES 27 © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited. RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA (in thousands)

DAVE SWEITZER Chief Operations Officer 3481 Plano Pkwy. The Colony, TX 75056 877.321.1811 www.questrmg.com RAY HATCH Chief Executive Officer LAURIE LATHAM Chief Financial Officer © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited.

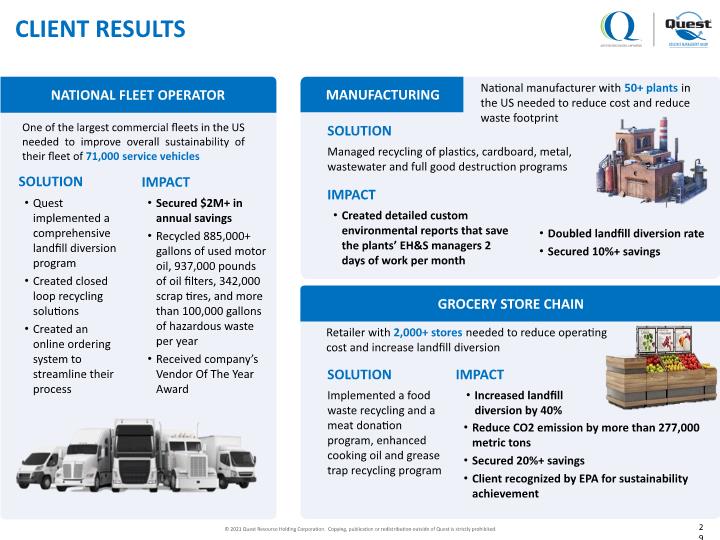

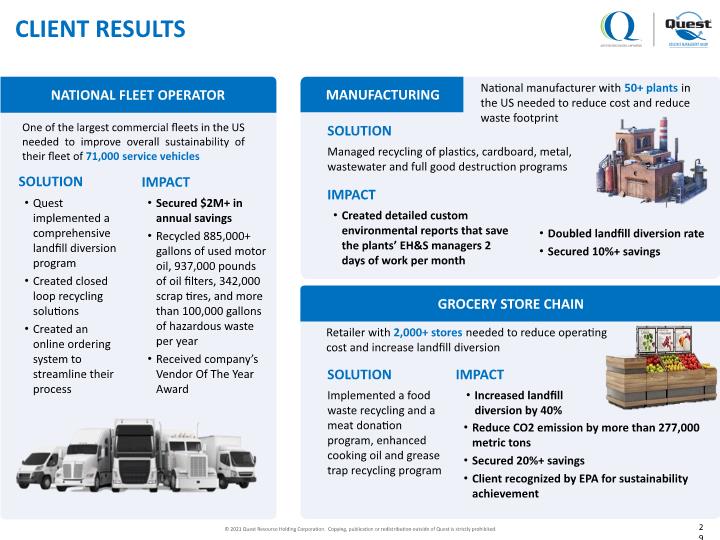

GROCERY STORE CHAIN NATIONAL FLEET OPERATOR MANUFACTURING Quest implemented a comprehensive landfill diversion program Created closed loop recycling solutions Created an online ordering system to streamline their process SOLUTION IMPACT Secured $2M+ in annual savings Recycled 885,000+ gallons of used motor oil, 937,000 pounds of oil filters, 342,000 scrap tires, and more than 100,000 gallons of hazardous waste per year Received company’s Vendor Of The Year Award One of the largest commercial fleets in the US needed to improve overall sustainability of their fleet of 71,000 service vehicles Implemented a food waste recycling and a meat donation program, enhanced cooking oil and grease trap recycling program SOLUTION IMPACT Increased landfill diversion by 40% Reduce CO2 emission by more than 277,000 metric tons Secured 20%+ savings Client recognized by EPA for sustainability achievement Retailer with 2,000+ stores needed to reduce operating cost and increase landfill diversion Managed recycling of plastics, cardboard, metal, wastewater and full good destruction programs SOLUTION IMPACT Created detailed custom environmental reports that save the plants’ EH&S managers 2 days of work per month Doubled landfill diversion rate Secured 10%+ savings National manufacturer with 50+ plants in the US needed to reduce cost and reduce waste footprint 29 CLIENT RESULTS Increased landfill diversion by 40% Reduce CO2 emission by more than 277,000 metric tons Secured 20%+ savings Client recognized by EPA for sustainability achievement © 2021 Quest Resource Holding Corporation. Copying, publication or redistribution outside of Quest is strictly prohibited.