U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

| x | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31, 2011

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission File Number 001-34409

RECON TECHNOLOGY, LTD

(Exact name of registrant as specified in its charter)

| | |

| Cayman Islands | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification number) |

Room 1902, Building C, King Long International Mansion

No. 9 Fulin Road, Beijing, 100107

People’s Republic of China

(Address of principal executive offices and zip code)

0086-010-84945799

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. The Company is authorized to issue 25,000,000 ordinary shares. As of the date of this report, the Company has issued and outstanding 3,951,811 Shares.

RECON TECHNOLOGY, LTD

FORM 10-Q

INDEX

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limited to projected growth, trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond the control of the Company. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including but not limited to the following:

| | • | | the timing of the development of future products; |

| | • | | projections of revenue, earnings, capital structure and other financial items; |

| | • | | statements of our plans and objectives; |

| | • | | statements regarding the capabilities of our business operations; |

| | • | | statements of expected future economic performance; |

| | • | | statements regarding competition in our market; and |

| | • | | assumptions underlying statements regarding us or our business. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update this forward-looking information. Nonetheless, the Company reserves the right to make such updates from time to time by press release, periodic report or other method of public disclosure without the need for specific reference to this Report. No such update shall be deemed to indicate that other statements not addressed by such update remain correct or create an obligation to provide any other updates.

ii

PART I FINANCIAL INFORMATION

| Item 1. | Financial Statements. |

See the financial statements following the signature page of this report, which are incorporated herein by reference.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our company’s financial condition and results of operations should be read in conjunction with our unaudited consolidated financial statements and the related notes included elsewhere in this report. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors.

Overview

We are a company with limited liability incorporated in 2007 under the laws of the Cayman Islands. Headquartered in Beijing, we provide products and services to oil and gas companies and their affiliates through our contractually controlled affiliates, Beijing BHD Petroleum Technology Co. Ltd (“BHD”), Nanjing Recon Technology Co., Ltd. (“Nanjing Recon”), and Jining ENI Energy Technology Co., Ltd. (“ENI” and, together with BHD and Nanjing Recon, the “Domestic Companies”). We are the center of strategic management, financial control and human resources allocation for the Domestic Companies.

Through our contractual relationships with the Domestic Companies, we provide equipment, tools and other hardware related to oilfield production and management and develop and sell our own specialized industrial automation control and information solutions. However, we do not engage in the production of petroleum or petroleum products.

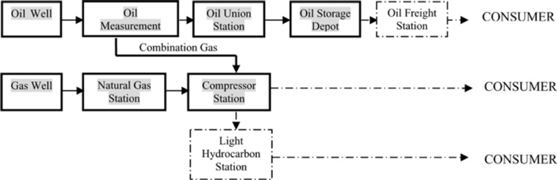

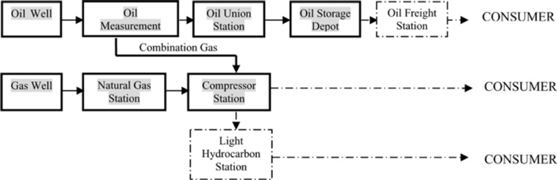

Our business is mainly focused on the upstream sectors of the oil and gas industry as shown by the solid framed boxes on the chart below:

We derive our revenues from (1) the sale of hardware products, (2) the sale of software products, and (3) engineering project services. Our products and services involve most of the key procedures of extraction and production of oil and gas, which include automation systems, equipment, tools and on-site technical services. We do not, however, engage in the production of petroleum or petroleum products.

1

Service and Products

Our products and services include:

Equipment for Oil and Gas Production and Transportation

High-Efficiency Heating Furnace. Crude petroleum contains certain impurities that must be removed before the petroleum can be sold, including water and natural gas. To remove the impurities and to prevent solidification and blockage in transport pipes, companies employ heating furnaces. BHD researched, developed and implemented a new oilfield furnace that is advanced, highly automated, reliable, easily operable, and comparatively safe and highly heat efficient (90% efficiency).

Burner. We serve as an agent for the Unigas Burner which is designed and manufactured by UNIGAS, a European burning equipment production company. The burner we provide has the following characteristics: high degree of automation; energy conservation; high turn down ratio; high security and is environmentally safe.

Separator. The test separator is the key measurement device for gas and oil in metering plants. Oil and gas mixture sprays on the oil block cap after entering into the separator through the oil pipeline. The diffused oil falls along the pipe wall to the separator bottom and through the draw-off pipe. The gas rises due to its low density and changes the flow direction after concentrating by the separator umbrella. In the process, the small oil droplets in the gas adhere to the umbrella wall and fall along the wall of the pipe. The de-oiled gas enters the pipeline through the freeing pipe at the top of the separator for measurement.

Oil and Gas Development Tools and Equipment

Oil and Gas Production Increasing Techniques:

Packers of Fracturing. This utility model is used concertedly with the security joint, hydraulic anchor, and slide brushing of sand spray in the well. It is used for easy seat sealing and sand-up prevention. The utility model reduces desilting volume and prevents sand-up which makes the deblocking processes easier to realize. The back flushing is sand-stick proof.

Production Packer. At varying withdrawal points, the production packer separates different oil layers, and protects the oil pipe from sand and permeation, promoting the recovery ratio.

Water Injection Packer. The water injection packer injects water into different layers rather than injecting on a large scale; this can reduce cost and promote effectiveness.

Fissure Shaper. This is our proprietary product that is used along with a perforating gun to effectively increase perforation depth by between 46% and 80%, shape stratum fissures, improve stratum diversion capability and, as a result, improve our ability to locate oilfields and increase the output of oil wells.

Sand Prevention in Oil and Water Well. This technique processes additives that are resistant to elevated temperatures into “resin sand” which is transported to the bottom of the well via carrying fluid. The “resin sand” goes through the borehole, pilling up and compacting at the borehole and oil vacancy layer. An artificial borehole wall is then formed, functioning as a means of sand prevention. This sand prevention technique has been adapted to more than 100 wells, including heavy oil wells, light oil wells, water wells and gas wells, with a 100% success rate and a 98% effective rate.

Water Locating and Plugging Technique. High water cut affects the normal production of oilfields. Previously, there was no sophisticated method for water locating and tubular column plugging in China. The mechanical water locating and tubular column plugging technique we have developed resolves the problem of high water cut wells. This technique conducts a self-sealing-test during multi-stage usage and is reliable to separate different production sets effectively. The water location switch forms a complete set by which the water locating and plugging can be finished in one trip. The tubular column is adaptable to several oil drilling methods and is available for water locating and plugging in second and third class layers.

2

Fracture Acidizing. We inject acid to layers under pressure which can form or expand fissures. The treatment process of the acid is defined as fracture acidizing. The technique is mainly adapted to oil and gas wells that are blocked up relatively deeply, or the ones in the zones of low permeability.

Electronic Break-down Service. This service resolves block-up and freezing problems by generating heat from the electric resistivity of the drive pipe and utilizing a loop tank composed of an oil pipe and a drive pipe. This technique saves energy and is environment friendly. It can increase the production of oilfields that are in the middle and later periods.

Automation System and Service:

Pumping Unit Controller. Functions as a monitor to the pumping unit, and also collects data for load, pressure, voltage, startup and shutdown control.

RTU Monitor. Collects gas well pressure data.

Wireless Dynamometer and Wireless Pressure Gauge. These products replace wired technology with cordless displacement sensor technology. They are easy to install and significantly reduce the work load associated with cable laying.

Electric Multi-way Valve for Oilfield Metering Station Flow Control. This multi-way valve is used before the test separator to replace the existing three valve manifolds. It facilitates the electronic control of the connection of the oil lead pipeline with the separator.

Natural Gas Flow Computer System. The flow computer system isused in natural gas stations and gas distribution stations to measure flow.

Recon SCADA Oilfield Monitor and Data Acquisition System. Recon SCADA is a system which applies to the oil well, measurement station, and the union station for supervision and data collection.

EPC Service of Pipeline SCADA System. A service technique for pipeline monitoring and data acquisition after crude oil transmission.

EPC Service of Oil and Gas Wells SCADA System. A service technique for monitoring and data acquisition of oil wells and natural gas wells.

EPC Service of Oilfield Video Surveillance and Control System. A video surveillance technique for controlling the oil and gas wellhead area and the measurement station area.

Technique Service for “Digital oilfield” Transformation. Includes engineering technique services such as oil and gas SCADA system, video surveillance and control system and communication systems.

Recent Business Developments

Beginning in 2010, the big Chinese oil companies began implementing significant adjustments to their operating strategies. The following strategic initiatives implemented by the large Chinese oil companies have had a significant impact on our business and operations:

| • | | Development of strategic suppliers, and enhancement of direct operation with well-known domestic and international companies; |

| • | | Enhanced cooperation with qualified domestic manufacturers of equipment and suppliers of technology and services; and |

3

| • | | Increased focus on exploration and exploitation, and increased introductions of products and techniques through outsourcing with professional private enterprises in the remaining sectors of the industry chain, especially the development and production sectors. |

These polices aim to establish long-term and stable supply channels and obtain better prices and higher quality services. They also help to speed up the nationalization of major equipment and critical materials and implementation of new products and services.

Accordingly, our businesses were affected in the following ways:

| • | | Previously, approximately one-third of our revenue came from our trading business with Sinopec by acting as an agent. This business was primarily conducted by our contractually controlled affiliate, ENI. We received orders mainly by tendering. Then we would need to use our own funds to purchase specified equipment and we get paid after the contract period (usually 1 year). With a previously high threshold for access in this market, we could make considerable profits. However, this aspect of our business has suffered as a result of the large oil companies’ policy adjustments. Especially for Sinopec, for the year 2010, its strategic procurement rate rose rapidly to 60%, and this ratio is expected to be over 80% by then end of China’s 12th five year plan period. We do not manufacture such equipment ourselves and cannot meet the standards for being a strategic supplier to the large oil companies. As a result of such adjustments, our trading business, operated by ENI, has difficulty participating in larger projects with higher gross profits. We still have the ability to win smaller contracts with lower margin, however, occupying capital in such business is often inefficient. Thus, the contribution to revenue and net income from our trading business, operated by ENI, declined dramatically this quarter. |

| • | | We now have the opportunity to focus more on our own branded equipment and automation system products and services, which we believe are technologically advanced and provide a price advantage. |

| • | | We also have the capability of independent project construction. With fast improvement of our integrated design capabilities and rich experience of project construction, our management believes our advantage will be fully reflected and can benefit the company shortly in conjunction with proceeds from the capital market to undertake new engineering contracts. |

In an effort to remediate the adverse effects of these market changes, our management is also actively adjusting our operating structure to strip non-essential businesses and keep our core business healthy. We are also accelerating extensive application of our own developed technologies and products and expanding our sales network to offset the declines to our trading business.

Factors Affecting Our Business

Business Outlook

The oilfield engineering and technical service industry is generally divided into five sections: (1) exploration, (2) drilling and completion, (3) testing and logging, (4) production, and (5) oilfield construction. Thus far our businesses have only been involved in production. Our management believes it’s time to expand our core business, move into new markets, and develop new businesses. There are great opportunities both in new markets and our existing markets. We believe that many existing wells and oilfields need to improve or renew their equipment and service to maintain production and our techniques and services will be needed as new oil and gas fields are developed. In the next three years, we will focus on:

Measuring Equipment and Service. Our priority is the development of our well, pipeline and oilfield SCADA(Supervisory Control And Data Acquisition) engineering project contracting service, oilfield video surveillance and control system, and reforming technical support service. According to conservative estimates, the potential market for our wireless indicator and remote monitoring system (SCADA) is approximately RMB 5 billion.

4

Gathering and Transferring Equipment. (1) Furnace. We estimate demands for our furnace at about 2,000 units per year, of which, 500 are expected to come from new wells and 1,500 are expected to come from reconstruction of old wells. The potential market is estimated at RMB 800 million (approximately $122 million) based on an average price of RMB 400,000 (approximately $60,882) per furnace. (2) Oil/water separator. We estimate demand at about 800 units per year, of which, 300 are expected to come from new wells and 500 are expected to come from reconstruction of old wells. The potential market is about RMB 400 million (approximately $61 million) based on an average price of RMB 500,000 (approximately $76,102); (3) Burner. We estimate demand at about 5,000 units per year, of which, 1,000 are expected to come from new wells and 4,000 are expected to come from reconstruction of old wells. The potential market is about RMB 300 million (approximately $46 million) based on an average price of RMB 60,000 (approximately $9,132).

New business. Along with the opening of the oilfield service market to private companies, we plan to establish our own service team equipped with work-over rigs (specialized equipment used during the operation of well repairing) and coiled tubing machines. We expect this service team to begin operating in the first half of the 2012 fiscal year. Only a few companies can provide this business in China at present.

Growth Strategy

As a small local company, it is our basic strategy to focus on developing our onshore oilfield business, i.e. the upstream of the industry. Due to the remote location and difficult environment of China’s oil and gas fields, foreign competitors rarely enter those fields.

Large domestic oil companies prefer to focus on their exploration and development businesses to earn high margins and keep their competitive advantage. With regard to private oilfield service companies, 90% specialize in the manufacture of drilling and production equipment. Thus, the market for technical support and project service is still in its early stage. Our management insists on providing high quality products and service in the oilfield where we have a geographical advantage. This allows us to avoid conflicts of interest with bigger suppliers of drilling equipment and keep our leading position within the market segment. Our mission is to increase the automation and safety levels of industrial petroleum production in China, and improve the under-developed working process and management mode by using advanced technologies. At the same time, we are always looking to improve our business and to increase our earning capability.

Industry and Recent Developments

Oilfield drilling and production equipment and engineering technique services are applied in the process of oil and gas extraction, thus the exploration and exploitation activities of petroleum companies directly influences demand for oilfield technique service and corresponding equipment. At present, China is short of oil and gas. The discrepancy between production and demand is growing, sustaining high oil prices to a certain extent. This discrepancy significantly improves the business environment for petroleum equipment and service companies and is leading to rapid expansion of the market as oil companies increase capital expenditures on development.

With rapid growth of big petroleum companies’ overseas business, our management has expressed confidence with respect to the potential of our products and services in the international market based on the following factors:

| • | | After experiencing 2009 lows, international oil and gas exploration expenditures surged. Increases in oil prices have continued for the last six months, and expenditures, which usually lag at around six months to one year, are expected to increase significantly throughout 2011 and 2012. |

| • | | The three big Chinese petroleum companies made large-scale overseas acquisitions of oil and gas fields since the global economic crisis, and are expected to enter into a three to five year period of further exploitation and development. Companies such as ours, which have established good relationships with the big three Chinese petroleum companies should be presented with significant opportunities. |

| • | | We believe we have a technique and cost advantage and are capable of growing at a faster rate by implementing more active sales strategies. |

5

Factors Affecting Our Results of Operations — Generally

Our operating results in any period are subject to general conditions typically affecting the Chinese oilfield service industry including:

| | • | | the amount of spending by our customers, primarily those in the oil and gas industry; |

| | • | | growing demand from large corporations for improved management and software designed to achieve such corporate performance; |

| | • | | the procurement processes of our customers, especially those in the oil and gas industry; |

| | • | | competition and related pricing pressure from other oilfield service solution providers, especially those targeting the Chinese oil and gas industry; |

| | • | | the ongoing development of the oilfield service market in China; and |

| | • | | inflation and other factors. |

Unfavorable changes in any of these general conditions could negatively affect the number and size of the projects we undertake, the number of products we sell, the amount of services we provide, the price of our products and services and otherwise affect our results of operations.

Our operating results in any period are more directly affected by company-specific factors including:

| | • | | the proportion of our business dedicated to large companies; |

| | • | | our ability to successfully develop, introduce and market new solutions and services; |

| | • | | our ability to increase our revenues to businesses, both old customers and new in the Chinese oil and gas industry; |

| | • | | our ability to effectively manage our operating costs and expenses; and |

| | • | | our ability to effectively implement any targeted acquisitions and/or strategic alliances so as to provide efficient access to markets and industries in the Chinese oil and gas industry. |

Critical Accounting Policies and Estimates

Estimates and Assumptions. We prepare our consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP), which requires us to make judgments, estimates and assumptions. We continually evaluate these estimates and assumptions based on the most recently available information, our own historical experience and various other assumptions that we believe to be reasonable under the circumstances. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from those estimates. An accounting policy is considered critical if it requires an accounting estimate to be made based on assumptions about matters that are highly uncertain at the time such estimate is made, and if different accounting estimates that reasonably could have been used, or changes in the accounting estimates that are reasonably likely to occur periodically, could materially impact the consolidated financial statements. We believe that the following policies involve a higher degree of judgment and complexity in their application and require us to make significant accounting estimates. The following descriptions of critical accounting policies, judgments and estimates should be read in conjunction with our consolidated financial statements and other disclosures included in this quarterly report. Significant accounting estimates reflected in our Company’s consolidated financial statements include revenue recognition, allowance for doubtful accounts, and useful lives of property and equipment.

Revenue Recognition. We recognize revenue when the following four criteria are met: (1) persuasive evidence of an arrangement exists, (2) delivery has occurred or services have been provided, (3) the sales price is fixed or determinable, and (4) collectability is reasonably assured. Delivery does not occur until products have been shipped or services have been provided to the client and the client has signed a completion and acceptance report, risk of loss has transferred to the client, client acceptance provisions have lapsed, or the Company has objective evidence that the criteria specified in client acceptance provisions have been satisfied. The sales price is not considered to be fixed or determinable until all contingencies related to the sale have been resolved.

6

Hardware:

Revenue from hardware sales is generally recognized when the product is shipped to the customer and when there are no unfulfilled company obligations that affect the customer’s final acceptance of the arrangement.

Software:

The Company sells self-developed software. For software sales, the Company recognizes revenues in accordance with ASC 985-605, “Software Revenue Recognition,” and related interpretations. Revenue from software is recognized according to project contracts. Contract costs are accumulated during the periods of installation and testing or commissioning. Usually this is short term. Revenue is not recognized until completion of the contracts and receipt of acceptance statements.

Services:

The Company provides services to improve software functions and system requirements on separated fixed-price contracts. Revenue is recognized on the completed contract method when acceptance is determined by a completion report signed by the customer.

Deferred income represents unearned amounts billed to customers related to sales contracts.

Cost of Revenues. When the criteria for revenue recognition have been met, costs incurred are recognized as cost of revenue. Cost of revenues includes wages, materials, handling charges, the cost of purchased equipment and pipes, and other expenses associated with manufactured products and services provided to customers. We expect cost of revenues to grow as our revenues grow. It is possible that we could incur development costs with little revenue recognition, but based upon our past history, we expect our revenues to grow.

Fair Values of Financial Instruments. The carrying amounts reported in the consolidated balance sheets for trade accounts receivable, other receivables, advances to suppliers, trade accounts payable, accrued liabilities, advances from customers and notes payable approximate fair value because of the immediate or short-term maturity of these financial instruments.

Allowance for Doubtful Accounts. Trade receivables and other receivable accounts are recognized initially at fair value and subsequently measured at amortized cost using the effective interest method, less a provision made for impairment of these receivables. Provisions are applied to trade and other receivables where events or changes in circumstances indicate that the balance may not be collectible. The identification of doubtful debts requires the use of judgment and estimates of management. Our management must make estimates of the collectability of our accounts receivable. Management specifically analyzes accounts receivable, historical bad debts, customer creditworthiness, current economic trends and changes in our customer payment terms when evaluating the adequacy of the allowance for doubtful accounts. Our allowance for trade accounts receivable was ¥1,089,331 and ¥2,196,723 ($334,351) on June 30, 2010 and March 31, 2011 respectively. Allowance for other receivables was ¥154,057 and ¥6,984,535 ($1,063,079) on June 30, 2010 and March 31, 2011 respectively

Property and Equipment. We record property and equipment at cost. We depreciate property and equipment on a straight-line basis over their estimated useful lives using the following annual rates:

| | | | |

Items | | Useful life | |

| |

Motor Vehicles | | | 10 years | |

| |

Office Equipment | | | 2-5 years | |

| |

Leasehold Improvements | | | 5 years | |

We expense maintenance and repair expenditures as they do not improve or extend an asset’s productive life. These estimates are reasonably likely to change in the future since they are based upon matters that are highly uncertain such as general economic conditions, potential changes in technology and estimated cash flows from the use of these assets.

7

Software Development Costs. We charge all of our development costs to research and development until we have established technological feasibility. We acknowledge technological feasibility of our software when a detailed program design has been completed, or upon the completion of a working model. Upon reaching technological feasibility, we capitalize additional software costs until the software is available for general release to customers. Although we have not established a budget or time table for software development, we anticipate the need to continue the development of our software products in the future and the cost could be significant. We believe that, as in the past, the costs of development will result in new products that will increase revenue and therefore justify costs. There is, however, a reasonable possibility that we may be unable to realize the carrying value of our software, and the amount not so realized may adversely affect our financial position, results of operation or liquidity in the future.

Valuation of Long-Lived Assets.We review the carrying values of our long-lived assets for impairment whenever events or changes in circumstances indicate that they may not be recoverable. When such an event occurs, we project undiscounted cash flows to be generated from the use of the asset and its eventual disposition over the remaining life of the asset. If projections indicate that the carrying value of the long-lived asset will not be recovered, we reduce the carrying value of the long-lived asset by the estimated excess of the carrying value over the projected discounted cash flows. In the past, we have not had to make significant adjustments to the carrying values of our long-lived assets, and we do not anticipate a need to do so in the future. However, circumstances could cause us to have to reduce the value of our capitalized software more rapidly than we have in the past if our revenues were to significantly decline. Estimated cash flows from the use of the long-lived assets are highly uncertain and therefore the estimation of the need to impair these assets is reasonably likely to change in the future. Should the economy or acceptance of our software change in the future, it is likely that our estimate of the future cash flows from the use of these assets will change by a material amount.

8

Results of Operations

The following consolidated results of operations include the results of operations of the Company, all the contractual subsidiaries, which are BHD, Nanjing Recon and ENI of the Company. The results of operations are primarily those of the contractual subsidiaries.

Three Months Ended March 31, 2011 Compared to Three Months Ended March 31, 2010

Our historical reporting results are not necessarily indicative of the results to be expected for any future period.

Revenue

| | | | | | | | | | | | | | | | |

| | | For the Three Months Ended March 31, | |

| | | 2011 | | | 2010 | | | Decrease | | | Percentage

Change | |

Hardware | | ¥ | 11,108,566 | | | ¥ | 24,578,963 | | | ¥ | (13,470,397 | ) | | | (54.80 | %) |

| | | | |

Service | | ¥ | — | | | ¥ | 1,709,402 | | | ¥ | (1,709,402 | ) | | | (100 | %) |

| | | | | | | | | | | | | | | | |

Total Revenue | | ¥ | 11,108,566 | | | ¥ | 26,288,365 | | | ¥ | (15,179,799 | ) | | | (57.74 | %) |

| | | | | | | | | | | | | | | | |

Revenues. Our total revenues were ¥11,108,566 ($1,690,776), a decrease of 57.74% or ¥15,179,799 from ¥26,288,365 for the three months ended March 31, 2010. During this three months period, sales of transportation equipment increased by 20.42%, while our automation business decreased by 61.82% and our accessory sales business decreased over 80.30%. The decrease in our revenues for the three months ended March 31, 2011 compared to the three months ended March 31, 2010 was due to the following operating challenges: (1) as described above, some of our large clients, especially Sinopec, adjusted their procurement policies, to increase direct purchases from strategic manufacturers rather than purchase from agency companies. Additionally, our former Chief Marketing Officer, Mr. Li Hongqi, resigned effective January 31, 2011. When Mr. Li resigned, we lost our established relationship with Sinopec and other companies. Without such relationships, it was very difficult for us to compete with the large strategic suppliers adopted by the large oil companies under their new procurement policies, thus decreasing our revenues as an agent for hardware sales; and (2) our equipment and service terminals can only be assembled and operated after completion of field infrastructure. Currently, our major on-going projects are all located in Ji dong oilfield and Weston Sichuan gas field, which are both newly developed oil and gas fields, with relatively long construction periods. Since some of our clients have not finished their oilfield construction, which in turn caused delays in our projects, we could not provide equipment to our clients and recognize the corresponding revenue as scheduled, this is also the reason for our increase of inventories for this period.

As discussed above, the changes to our clients’ procurement policies may have long-term adverse effects on our operation and our management believes we need to adjust our business structure to place a greater emphasis on our high efficiency equipment and service business. Short-term priorities for our management are:

| | • | | Reevaluate the agency trading department operated by ENI and find the most appropriate way to proceed with this business. Our management intends to evaluate the remaining relationships with clients and suppliers in the agency trading business to determine the best course of action for the Company to minimize the impact of the declining agency trading business; and |

| | • | | Expansion of our sales network and establishment of relationships with new clients to receive larger overall packages. |

Our management intends to pursue these goals in an effort to maximize shareholder value, overcome recent declines, and progress with the Company’s long-term goals and strategies.

9

Cost and Margin

| | | | | | | | | | | | | | | | |

| | | For the Three Months Ended March 31, | |

| | | 2011 | | | 2010 | | | Increase

(Decrease) | | | Percentage

Change | |

Total Revenue | | ¥ | 11,108,566 | | | ¥ | 26,288,365 | | | ¥ | (15,179,799 | ) | | | (57.74 | %) |

Cost of Revenue | | ¥ | 9,123,575 | | | ¥ | 14,538,530 | | | ¥ | (5,414,955 | ) | | | (37.25 | %) |

| | | | | | | | | | | | | | | | |

Gross Margin | | ¥ | 1,984,991 | | | ¥ | 11,749,835 | | | ¥ | (9,764,844 | ) | | | (83.11 | %) |

Margin % | | | 17.87 | % | | | 44.70 | % | | | (26.83 | %) | | | | |

Cost of Revenues. Our cost of revenues includes raw materials and costs related to design, implementation, delivery and maintenance of products and services. We are a light-asset company, and all materials and components we need can be purchased or manufactured under contract. Usually the price of electronic components doesn’t fluctuate violently due to competitive forces, and it will not affect our cost significantly. Specialized equipment and incentive chemical products can be influenced directly if the price for metal and oil changes. Additionally, the price for some imported accessories appointed by our clients can also impact our cost.

Our cost of revenues decreased from ¥14,538,530 in the three months ended March 31, 2010 to ¥9,123,575 ($1,388,651) for the same period of 2011, a decrease of ¥5,414,955 or 37.25%. As a percentage of revenues, our cost of revenues increased from 55.30% in the three months ended March 31, 2010 to 82.13% in the three months ended March 31, 2011. During this period, the decrease in cost of revenues was mainly caused by the decrease in our agency business and project delays. As our agency business is high margin, when that business declined, our cost of revenue as a percentage of revenue increased.

Gross Profit. For the three months ended March 31, 2011, our gross profit decreased to ¥1,984,991 ($302,125) from ¥11,749,835 for the same period in 2010, a decrease of ¥9,764,844, or approximately 83.11%. For the three months ended March 31, 2011, our gross profit as a percentage of revenue decreased to 17.87%, from 44.70% for the same period in 2010. As a result of a decrease in our revenue and increased cost as a percentage of our revenue, our gross profit decreased and gross margin dropped. Our management believes that a higher margin level is very important to secure our business. Additionally, as more and more domestic peer companies go public in Chinese capital markets, the oilfield service industry is becoming more and more competitive. To maintain our position and profitability in our segmented market, our management plans to focus its efforts on research and development of our products and expansion of our service business. We also plan to actively finance our development.

Expenses

Operating Expenses

| | | | | | | | | | | | | | | | |

| | | For the Three Months Ended March 31, | |

| | | 2011 | | | 2010 | | | Increase

(Decrease) | | | Percentage

Change | |

Selling and Distribution Expenses | | ¥ | 1,449,192 | | | ¥ | 1,534,090 | | | ¥ | (84,898 | ) | | | (5.53 | %) |

Percentage of Revenue | | | 13.05 | % | | | 5.84 | % | | | 7.21 | % | | | | |

General and Administrative expenses | | ¥ | 8,183,056 | | | ¥ | 3,337,591 | | | ¥ | 4,845,465 | | | | 145.18 | % |

Percentage of Revenue | | | 73.66 | % | | | 12.70 | % | | | 60.96 | % | | | | |

| | | | | | | | | | | | | | | | |

Operating Expenses | | ¥ | 9,632,248 | | | ¥ | 4,871,681 | | | ¥ | 4,760,567 | | | | 97.72 | % |

| | | | | | | | | | | | | | | | |

Selling and Distribution Expenses. Selling and distribution expenses consist primarily of salaries and related expenditures of our sales and marketing department, sales commissions, costs of our marketing programs, including

10

public relations, advertising and trade shows; and an allocation of our facilities and depreciation expenses. Selling expenses decreased by 5.53%, from ¥1,534,090 for the three months ended March 31, 2010 to ¥1,449,192 ($220,574) for the same period of 2011. Selling and distribution expenses were 5.84% of total revenues in the three months ended March 31, 2010 and 13.05% of total revenues in the same period in 2011. The overall decrease is mainly attributable to decreased expenses for our trading department, while selling and distribution expenses increased as a percentage of revenues due to more active sales activities in our two departments. Selling expenses for the automation department increased the most as the cost of developing business with new clients in a new area is high. Our management expects this will bring direct benefits within six months.

General and Administrative Expenses. General and administrative expenses consist primarily of costs from our human resources organization, facilities costs, provision of bad debt, depreciation expenses, professional advisor fees, audit fees and other expenses incurred in connection with general operations. General and administrative expenses increased 145.18%, or ¥4,845,465, from ¥3,337,591 in the three months ended March 31, 2010 to ¥8,183,056 ($1,245,499) for the same period of 2011. General and administrative expenses were 12.70% of total revenues in the three months ended March 31, 2010 and 73.66% of total revenues in the same period in 2011. This percentage increase was primarily attributable to the decline of our trading business, the change of operating structure and our management’s decision to make some allowance for purchase advances related to certain projects. Specifically, we made advanced orders and purchases in anticipation of the continued flow of business through ENI. With the decline of ENI’s business, we are now left with little option as to how to dispose of the advances purchases. As such, our management made very cautious estimates about the possible loss of these advanced payments and recognized it as expenses in this period.

Income (Loss) from Operations. Due to the decline of our agency trading business, the uncertainty associated with the recovery of advance payments we made, and our efforts to expand our sales channels, our revenue during the period decreased while our administrative expenses increased, causing our income from operations for the period to decrease by ¥211.18%, or ¥14,525,410, to loss of ¥7,647,257 ($ 1,163,948) for the three months ended March 31, 2011, compared to ¥6,878,153 for the same period of 2010.

Subsidy Income. We received grants of ¥20,000 and ¥341,025 ($51,906) from the local government for the three months ended March 31, 2010 and 2011, respectively. These grants were given by the government as return of income tax to support local companies to develop high technology and improve their products.

Income Tax Expense. Income taxes are provided based upon the liability method of accounting pursuant to ASC No. 740, “Accounting for Income Taxes.” Under this approach, deferred income taxes are recorded to reflect the tax consequences on future years of differences between the tax basis of assets and liabilities and their financial reporting amounts. A valuation allowance is recorded against deferred tax assets if it is not likely that the asset will be realized. We have not been subject to any income taxes in the United States or the Cayman Islands. Enterprises doing business in PRC are generally subject to federal (state) enterprise income tax at a rate of 25%; however, Nanjing Recon and BHD were granted certifications of High Technology Enterprise and are taxed at a rate of 15% for taxable income generated. The applicable tax rate for each of our subsidiaries changed in the past few years because of their qualifications and different local policies. From calendar year 2010 and 2011, Nanjing Recon and BHD are taxed at a rate of 15% and ENI is still taxed at 25%. Our effective EIT burden will vary, depending on which of our domestic companies generate greater revenue.

Income tax expense for three months ended March 31, 2010 and 2011 was ¥2,082,801 and ¥174,898 ($26,620), respectively. This decrease was mainly due to a decrease in taxable operating income.

Net Income (Loss) Attributable to Ordinary Shareholders. As a result of the factors described above, net loss attributable to ordinary shareholders was ¥7,384,290 ($1,123,924) for the three months ended March 31, 2011, a decrease of 263.21%, or ¥11,908,641 over net income of ¥4,524,351 for the same period of 2010.

11

ADJUSTED EBITDA

| | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended March 31, | |

| | 2011 | | | 2010 | | | Increase | | | Percentage | | | 2011 | |

| | RMB | | | RMB | | | (Decrease) | | | Change | | | U.S. Dollars | |

| | (Unaudited) | | | (Unaudited) | | | | | | | | | (Unaudited) | |

Reconciliation of Adjusted EBITDA from Net Income (Loss): | | | | | | | | | | | | | | | | | | | | |

Net income (loss) from continuing operations | | ¥ | (7,295,092 | ) | | ¥ | 5,172,178 | | | ¥ | (12,467,270 | ) | | | (241.04 | %) | | $ | (1,110,347 | ) |

Income tax expense | | | 174,898 | | | | 2,082,801 | | | | (1,907,903 | ) | | | (91.60 | %) | | | 26,620 | |

Interest expense | | | 99,543 | | | | 32,841 | | | | 66,702 | | | | 203.11 | % | | | 15,151 | |

Stock compensation expense | | | 268,180 | | | | 442,013 | | | | (173,833 | ) | | | (39.33 | %) | | | 40,818 | |

Depreciation, amortization and accretion | | | 100,526 | | | | 92,172 | | | | 8,354 | | | | 9.06 | % | | | 15,301 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | ¥ | (6,651,945 | ) | | ¥ | 7,822,005 | | | ¥ | (14,473,950 | ) | | | (185.04 | %) | | $ | (1,012,457 | ) |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA. We define Adjusted EBITDA as income from continuing operations before income tax expense, interest expense, non-cash stock compensation expense, and depreciation, amortization and accretion expense. We think it is useful to an equity investor in evaluating our operating performance because: (1) it is widely used by investors in our industry to measure a company’s operating performance without regard to items such as interest expense, depreciation and amortization, which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and the method by which the assets were acquired; and (2) it helps investors more meaningfully evaluate and compare the results of our operations from period to period by removing the impact of our capital structure and asset base from our operating results.

Adjusted EBITDA decreased ¥14,473,950 or 185.04% to negative EBITDA of ¥6,651,945 for the three months ended March 31, 2011 compared to the same period in 2010. This was due to the decline of our agency trading department and the large expense allowance for purchase advance payment. These factors caused revenues during the period to decrease while our administrative expenses increased. Compared to the 263.21% decrease in net income attributable to ordinary shareholders, we believe EBITDA more accurately reflects our operations.

12

Nine Months Ended March 31, 2011 Compared to Nine Months Ended March 31, 2010

Our historical reporting results are not necessarily indicative of the results to be expected for any future period.

Revenue

| | | | | | | | | | | | | | | | |

| | | For the Nine Months Ended March 31, | |

| | | 2011 | | | 2010 | | | Increase

(Decrease) | | | Percentage

Change | |

Hardware | | ¥ | 77,754,951 | | | ¥ | 90,932,348 | | | ¥ | (13,177,397 | ) | | | (14.49 | %) |

Service | | ¥ | 2,111,111 | | | ¥ | 7,675,214 | | | ¥ | (5,564,103 | ) | | | (72.49 | %) |

Software | | ¥ | — | | | ¥ | 226,496 | | | ¥ | (226,496 | ) | | | (100.00 | %) |

| | | | | | | | | | | | | | | | |

Total Revenue | | ¥ | 79,866,062 | | | ¥ | 98,834,057 | | | ¥ | (18,967,996 | ) | | | (19.19 | %) |

| | | | | | | | | | | | | | | | |

Revenues. Our total revenues for the nine months ended March 31, 2011 were ¥79,866,062 ($12,155,989), a decrease of 19.19% from ¥98,834,057 for the nine months ended March 31, 2010. During this nine months period, our automation business decreased approximately 17.99%, our accessory sales business decreased by 28.67% and sales of transportation equipment decreased by 6.78%. This was mainly caused by: (1) our shrinking accessory agency business; and (2) delays in some of our projects caused by our clients’ field construction, all as described in more detail in the three months discussion.

Cost and Margin

| | | | | | | | | | | | | | | | |

| | | For the Nine Months Ended March 31, | |

| | | 2011 | | | 2010 | | | Increase

(Decrease) | | | Percentage

Change | |

| | | | |

Total Revenue | | ¥ | 79,866,062 | | | ¥ | 98,834,057 | | | ¥ | (18,967,995 | ) | | | (19.19 | %) |

Cost of revenue | | ¥ | 50,332,089 | | | ¥ | 56,007,688 | | | ¥ | (5,675,599 | ) | | | (10.13 | %) |

| | | | | | | | | | | | | | | | |

Gross margin | | ¥ | 29,533,973 | | | ¥ | 42,826,369 | | | ¥ | (13,292,396 | ) | | | (31.04 | %) |

margin % | | | 36.98 | % | | | 43.33 | % | | | (6.35 | %) | | | | |

Cost of Revenues. Our cost of revenues decreased 10.13% from ¥56,007,688 in the nine months ended March 31, 2010 to ¥50,332,089 ($7,660,780) for the same period of 2011. As a percentage of revenues, our cost of revenues increased from 56.67% in the nine months ended March 31, 2010 to 63.02% in the same period of 2011. This increase was a result of (1) the decline of our agency trading business which resulted in the loss of our high margin orders, leaving us with only smaller orders with smaller margins; and (2) unfinished service projects, that have higher margins.

Gross Profit. For the nine months ended March 31, 2011, our gross profit decreased to ¥29,533,973 ($4,495,209) from ¥42,826,369 for the same period in 2010, a decrease of ¥13,292,396, or approximately 31.04%. For the nine months ended March 31, 2011, our gross profit as a percentage of revenue decreased to 36.98%, from 43.33% for the same period in 2010. Our management believes it is necessary to adjust our business structure to maintain a higher margin ratio. We plan to accomplish this by focusing more on our automation business and self-developed products and services, while shifting our focus away from agency sales, which provide now a lower margin.

The capital and technology intensive nature of our industry, abundant capital strength and spending of oil companies and a higher threshold for access make it possible for suppliers to earn high yields. As to sales of

13

equipment and accessories, our gross margin remains at approximately 29% (a basic level), margin of automation products is approximately 29% and that of oilfield service and project engineering service can be higher than 44%. It’s our strategy to improve our operating results by participating in more projects and increasing the services we provide.

Expenses

Operating expenses

| | | | | | | | | | | | | | | | |

| | | For the Nine Months Ended March 31, | |

| | | 2011 | | | 2010 | | | Increase

(Decrease) | | | Percentage

Change | |

Selling and Distribution Expenses | | ¥ | 6,545,509 | | | ¥ | 7,557,188 | | | ¥ | (1,011,679 | ) | | | (13.39 | %) |

Percentage of Revenue | | | 8.20 | % | | | 7.65 | % | | | 0.55 | % | | | | |

General and Administrative Expenses | | ¥ | 19,908,120 | | | ¥ | 9,803,491 | | | ¥ | 10,104,629 | | | | 103.07 | % |

Percentage of Revenue | | | 24.93 | % | | | 9.92 | % | | | 15.01 | % | | | | |

| | | | | | | | | | | | | | | | |

Operating Expenses | | ¥ | 26,453,629 | | | ¥ | 17,360,679 | | | ¥ | 9,092,950 | | | | 52.38 | % |

| | | | | | | | | | | | | | | | |

Selling and Distribution Expenses. Selling expenses decreased by 13.39%, from ¥7,557,188 for nine months ended March 31, 2010 to ¥6,545,509 ($996,257) for the same period of 2011. This decrease is mainly attributed to the shrinking of our trading department and its selling activities.

General and Administrative Expenses. General and administrative expenses increased 103.07%, or ¥10,104,629, from ¥9,803,491 in nine months ended March 31, 2010 to ¥19,908,120 ($3,030,109) for the same period of 2011. General and administrative expenses were 9.92% of total revenues for the nine months ended March 31, 2010 and 24.93% of total revenues in the same period in 2011. This percentage increase was primarily attributable to (1) the increased allowance of advance payment related to the trading business in the event we cannot sell related goods as we have planned ; (2) increased expenses related to our planned secondary offering, which was withdrawn due to unfavorable market conditions; and

Income from Operations. Income from operations was ¥3,080,344 ($468,843) for the nine months ended March 31, 2011, compared to ¥25,465,690 for the same period of 2010. As a result of lower revenue and higher administrative expenses, income from operations decreased during this period.

Subsidy Income. We received grants of ¥1,178,034 and ¥792,545 ($120,629) from the local government for the nine months ended March 31, 2010 and 2011, respectively. These grants were given by the government as return of income tax to support local companies to develop advanced technology and improve their products.

Income Tax Expense. Income tax expense for nine months ended March 31, 2010 and 2011 was ¥7,189,566 and ¥1,561,897 ($237,728), respectively. This decrease was mainly due to a decrease in taxable operating income.

Net Income Attributable to Ordinary Shareholders. As a result of the factors described above, net income attributable to ordinary shareholders was ¥1,284,907 ($195,568) for the nine months ended March 31, 2011, a decrease of 92.66% over ¥16,218,016 for the same period of 2010.

14

ADJUSTED EBITDA

| | | | | | | | | | | | | | | | | | | | |

| | | For the Nine Months Ended March 31, | |

| | | 2011 | | | 2010 | | | Increase | | | Percentage | | | 2011 | |

| | | RMB | | | RMB | | | (Decrease) | | | Change | | | U.S. Dollars | |

| | | (Unaudited) | | | (Unaudited) | | | | | | | | | (Unaudited) | |

Reconciliation of Adjusted EBITDA from Net Income: | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | ¥ | 2,180,232 | | | ¥ | 19,821,690 | | | ¥ | (17,641,458 | ) | | | (89.00 | %) | | $ | 331,842 | |

Income tax expense | | | 1,561,897 | | | | 7,189,566 | | | | (5,627,669 | ) | | | (78.28 | %) | | | 237,728 | |

Interest expense | | | 426,339 | | | | 110,075 | | | | 316,264 | | | | 287.32 | % | | | 64,891 | |

Stock compensation expense | | | 1,138,264 | | | | 1,178,701 | | | | (40,437 | ) | | | (3.43 | %) | | | 173,249 | |

Depreciation, amortization and accretion | | | 303,804 | | | | 263,036 | | | | 40,768 | | | | 15.50 | % | | | 46,240 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | ¥ | 5,610,536 | | | ¥ | 28,563,068 | | | ¥ | (22,952,532 | ) | | | (80.36 | %) | | $ | 853,950 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA. We define Adjusted EBITDA as income from continuing operations before income tax expense, interest expense, non-cash stock compensation expense, and depreciation, amortization and accretion expense. We think it is useful to an equity investor in evaluating our operating performance because: (1) it is widely used by investors in our industry to measure a company’s operating performance without regard to items such as interest expense, depreciation and amortization, which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and the method by which the assets were acquired; and (2) it helps investors more meaningfully evaluate and compare the results of our operations from period to period by removing the impact of our capital structure and asset base from our operating results.

Adjusted EBITDA decreased ¥22,952,532 or 80.36% to ¥5,610,536 ($853,950) for the nine months ended March 31, 2011 compared to the same period in 2010. This was due to the construction delays experienced by some of our customers, and of the decline of our agency trading business and related issues caused by payment advance for goods. These factors caused revenues during the period to decrease while our administrative expenses increased. Compared to the 80.36% decrease in net income attributable to ordinary shareholders, we believe EBITDA more accurately reflects our operations.

Liquidity and Capital Resources.

General

Cash and Cash Equivalents. Cash and cash equivalents are comprised of cash on hand, demand deposits and highly liquid short-term debt investments with stated maturities of no more than six months. As of March 31, 2011, we had cash and cash equivalents in the amount of ¥16,620,761 ($2,529,758).

Indebtedness. As of March 31, 2011, except for ¥7,188,425 ($1,094,112) of short-term borrowings and a ¥5,000,000 ($761,023) commercial loan from a local bank, we did not have any finance leases or purchase commitments, guarantees or other material contingent liabilities.

Holding Company Structure. We are a holding company with no operations of our own. All of our operations are conducted through the Domestic Companies. As a result, our ability to pay dividends and to finance any debt that we may incur is dependent upon the receipt of dividends and other distributions from the Domestic Companies. In addition, Chinese legal restrictions permit payment of dividends to us by our Domestic Companies only out of its accumulated net profit, if any, determined in accordance with Chinese accounting standards and regulations. Under Chinese law, the Domestic Companies are required to set aside a portion (at least 10%) of their after-tax net income (after discharging all cumulated loss), if any, each year for compulsory statutory reserve until the amount of the reserve reaches 50% of the Domestic Companies’ registered capital. These funds may be distributed to shareholders

15

at the time of wind up. When we were incorporated in the Cayman Islands in August 2007, 5,000,000 ordinary shares were authorized, and 50,000 ordinary shares were issued to Mr. Yin Shenping, Mr. Chen Guangqiang and Mr. Li Hongqi, at a par value of $0.01 each. On December 10, 2007, our company sold 2,632 ordinary shares to an investor at an aggregate consideration of $200,000. On June 8, 2009, in connection with our initial public offering, the Board of Directors approved a 42.7840667-to-1 split of ordinary shares and redeemable ordinary shares to shareholders of record as of such date. After giving effect to the share split of our ordinary shares and the completion of our initial public offering, we had 3,951,811 ordinary shares outstanding.

Off-Balance Sheet Arrangements. We have not entered into any financial guarantees or other commitments to guarantee the payment obligations of any third parties. In addition, we have not entered into any derivative contracts that are indexed to our own shares and classified as shareholders’ equity, or that are not reflected in our financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. Moreover, we do not have any variable interest in an unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

Capital Resources. To date we have financed our operations primarily through cash flows from operations. As of March 31, 2011 we had total assets of ¥176,635,836 ($26,884,801), which includes cash amounting to ¥16,620,761 ($2,529,758), and net accounts receivable amounting to ¥83,080,495 ($12,645,241). Working capital amounted to ¥121,018,093 ($18,419,521) and shareholders’ equity amounted to ¥122,344,619 ($18,621,424).

Cash from Operating Activities. Net cash provided by operating activities was ¥4,787,066 ($728,614) for the nine months ended March 31, 2011. This was an increase of ¥46,293,943 compared to cash of ¥41,506,877 used in operating activities for the nine months ended March 31, 2010. The change is mainly attributed to the favorable collection of accounts receivable and less payment for purchase of goods.

Cash from Investing Activities. Net cash used in investing activities was ¥147,449 ($22,442) for the nine months ended March 31, 2011, relatively stable compared to the same period in 2010.

Cash from Financing Activities. Cash flows used in financing activities amounted to ¥179,913 ($27,384) for the nine months ended March 31, 2011 and cash flows provided by financing activities amounted to ¥61,471,426 for the nine months ended March 31, 2010. The decrease was because we received our IPO funds in the same period of 2010. During the nine months ended March 31, 2011, we borrowed ¥5,000,000 ($761,023) from a domestic commercial bank to supplement working capital. While at the same time, we paid back some due-on-demand loans to Wu Jin, the manager and a minority shareholder of ENI, and the wife of our former CMO, Hongqi Lo. Specifically, for the nine months ended March 31, 2011, we paid back ¥4,300,000 ($654,480) to Wu Jin.

Working Capital. Total current assets as of March 31, 2011 amounted to ¥175,309,310 ($26,682,898), an increase of ¥144,905 ($22,055) compared to ¥175,164,405 at June 30, 2010. This was relatively stable across periods.

Current liabilities amounted to ¥54,291,217 ($8,263,377) at March 31, 2011, in comparison to ¥57,563,362 at June 30, 2010. This decrease has been attributed to the decrease in trade accounts payable and deferred income caused by less business and contracts.

The current ratio increased from 3.04 at June 30, 2010 to 3.23 in March 31, 2011. The change in our current ratio was primarily due to the decrease of current liabilities.

Recently Enacted Accounting Standards

In the quarter ended March 31, 2011, The Financial Accounting Standards Board (“FASB”) has issued ASU No. 2011-01 through ASU 2011-3, which is not expected to have a material impact on the consolidated financial statements upon adoption.

16

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk. |

Not applicable.

| Item 4/4T. | Controls and Procedures |

Disclosure Controls and Procedures

As of March 31, 2011, our company carried out an evaluation, under the supervision of and with the participation of management, including our company’s chief executive officer and chief financial officer, of the effectiveness of the design and operation of our company’s disclosure controls and procedures. Based on the foregoing, the chief executive officer and chief financial officer concluded that our company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934) were effective.

Changes in Internal Control over Financial Reporting

There were no changes in our company’s internal control over financial reporting (as defined in Rule 13a-15(f) of the Securities Exchange Act of 1934) during the quarter ended March 31, 2011 that have materially affected, or are reasonably likely to materially affect, our company’s internal control over financial reporting.

17

PART II OTHER INFORMATION

None.

Not applicable.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

| | (b) | The section entitled “Use of Proceeds” from our registration statement filed on August 12, 2008, as amended (the “Registration Statement”) is incorporated herein by reference. The effective date of the Registration Statement is July 22, 2009, and the Commission file number assigned to the Registration Statement is 333-152964. The Registration Statement registers the offering of up to 1,700,000 ordinary shares (subject to amendment in accordance with the Securities Act of 1933 and the rules and regulations promulgated thereunder) (the Offering”). As of March 31, 2011, the Company has spent proceeds from the Offering in accordance with the following chart: |

| | | | | | | | |

Description of Use | | Proposed

Expenditure

Amount | | | Actual Expenditures

through

March 31, 2011 | |

| | |

Product Research and development | | $ | 1,273,024 | | | $ | 0 | |

| | |

Acquisition and business development in oil-field industry in China and globally | | | 4,073,675 | | | | 5,000,000 | |

| | |

Sarbanes-Oxley compliance | | | 424,341 | | | | 0 | |

| | |

Fixed asset purchases | | | 442,341 | | | | 0 | |

| | |

Employee training | | | 169,736 | | | | 6,639 | |

| | |

General working capital | | | 2,121,706 | | | | 1,350,261 | |

| | |

Total | | $ | 8,486,824 | | | $ | 6,356,900 | |

| Item 3. | Defaults upon Senior Securities |

None.

| Item 4. | (Removed and Reserved) |

None.

18

The following exhibits are filed herewith:

| | |

Exhibit Number | | Document |

| |

| 3.1 | | Amended and Restated Articles of Association of the Registrant (1) |

| |

| 3.2 | | Amended and Restated Memorandum of Association of the Registrant (1) |

| |

| 4.1 | | Specimen Share Certificate (1) |

| |

| 10.1 | | Translation of Exclusive Technical Consulting Service Agreement between Recon Technology (Jining) Co., Ltd. and Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.2 | | Translation of Power of Attorney for rights of Chen Guangqiang in Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.3 | | Translation of Power of Attorney for rights of Yin Shenping in Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.4 | | Translation of Power of Attorney for rights of Li Hongqi in Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.5 | | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Chen Guangqiang and Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.6 | | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Yin Shenping and Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.7 | | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Li Hongqi and Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.8 | | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Chen Guangqiang and Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.9 | | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Yin Shenping and Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.10 | | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Li Hongqi and Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.11 | | Translation of Exclusive Technical Consulting Service Agreement between Recon Technology (Jining) Co., Ltd. and Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.12 | | Translation of Power of Attorney for rights of Chen Guangqiang in Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.13 | | Translation of Power of Attorney for rights of Yin Shenping in Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.14 | | Translation of Power of Attorney for rights of Li Hongqi in Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.15 | | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Chen Guangqiang and Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.16 | | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Yin Shenping and Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.17 | | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Li Hongqi and Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.18 | | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Chen Guangqiang and Jining ENI Energy Technology Co., Ltd. (1) |

19

| | |

| |

| 10.19 | | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Yin Shenping and Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.20 | | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Li Hongqi and Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.21 | | Translation of Exclusive Technical Consulting Service Agreement between Recon Technology (Jining) Co., Ltd. and Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.22 | | Translation of Power of Attorney for rights of Chen Guangqiang in Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.23 | | Translation of Power of Attorney for rights of Yin Shenping in Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.24 | | Translation of Power of Attorney for rights of Li Hongqi in Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.25 | | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Chen Guangqiang and Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.26 | | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Yin Shenping and Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.27 | | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Li Hongqi and Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.28 | | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Chen Guangqiang and Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.29 | | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Yin Shenping and Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.30 | | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Li Hongqi and Nanjing Recon Technology Co., Ltd. (1) |

| |

| 10.33 | | Employment Agreement between Recon Technology (Jining) Co., Ltd. and Mr. Yin Shenping (1) |

| |

| 10.34 | | Employment Agreement between Recon Technology (Jining) Co., Ltd. and Mr. Chen Guangqiang (1) |

| |

| 10.35 | | Employment Agreement between Recon Technology (Jining) Co., Ltd. and Mr. Li Hongqi (1) |

| |

| 10.36 | | Summary Translation of Technical Service Contract by and between Natural Gas Development Company of Qinghai Oilfield and Beijing BHD Petroleum Technology Co., Ltd. (1) |

| |

| 10.37 | | Summary Translation of Sales Contract, by and between the West Site Department of Bazhou, Zhongyuan Petroleum Exploration Bureau Project Construction Corporation and Jining ENI Energy Technology Co., Ltd. (1) |

| |

| 10.38 | | Ordinary Shares Subscription Agreement dated December 31, 2007 between the Registrant and Bloomsway Development Ltd (1) |

| |

| 10.39 | | Translation of Contract for the Sale of Industrial and Mineral Products between Nanjing Recon Technology Co., Ltd. and PetroChina Qinghai Oilfield Co., Ltd. (1) |

| |

| 10.40 | | Translation of Contract of Material Reserves and Sales between Beijing BHD Petroleum Technology Co., Ltd. and PetroChina Qinghai Oilfield Co., Ltd. (1) |

| |

| 10.41 | | Translation of Contract of Material Reserves and Sales between Beijing BHD Petroleum Technology Co., Ltd. and PetroChina Qinghai Oilfield Co., Ltd. (1) |

| |

| 10.42 | | Translation of Contract for Purchasing Vacuum-Heating-Furnace between Beijing BHD Petroleum Technology Co., Ltd. and PetroChina Huabei Oilfield Co., Ltd. (1) |

20

| | |

| |

| 10.43 | | Translation of Contract of the Sale of Goods between Beijing BHD Petroleum Technology Co., Ltd. and PetroChina Huabei Oilfield Co., Ltd. (1) |

| |

| 10.44 | | Summary Translation of Chuan East to Chuan West Transferring Gas Pipe Project Product Collective Contract between Jining ENI Energy Technology Co., Ltd. and Southwest Oil Gas Company of Sinopec. (1) |

| |

| 10.45 | | Summary Translation of Industrial Product Purchasing Agreement between Jining ENI Energy Technology Co., Ltd. and Southwest Oil Gas Company of Sinopec. (1) |

| |

| 10.46 | | Summary Translation of Purchase Agreement between Jining ENI Energy Technology Co., Ltd. and Southwest Oil Gas Company of Sinopec. (1) |

| |

| 10.47 | | Summary Translation of Chuan East to Chuan West Transferring Gas Pipe Project Product Collective Contract between Jining ENI Energy Technology Co., Ltd. and Southwest Oil Gas Company of Sinopec. (1) |

| |

| 10.48 | | Operating Agreement among Recon Technology (Jining) Co. Ltd., Nanjing Recon Technology Co., Ltd. and Mr. Yin Shenping, Mr. Chen Guangqiang and Mr. Li Hongqi (1) |

| |

| 10.49 | | Operating Agreement among Recon Technology (Jining) Co. Ltd., Jining ENI Energy Technology Co., Ltd., and Mr. Yin Shenping, Mr. Chen Guangqiang and Mr. Li Hongqi (1) |

| |

| 10.50 | | Operating Agreement among Recon Technology (Jining) Co. Ltd., Beijing BHD and Mr. Yin Shenping, Mr. Chen Guangqiang and Mr. Li Hongqi (1) |

| |

| 21.1 | | Subsidiaries of the Registrant (1) |

| |

| 99.1 | | Stock Option Plan (1) |

| |

| 99.2 | | Code of Business Conduct and Ethics (1) |

| |

| 31.1 | | Certifications pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. (2) |

| |

| 31.2 | | Certifications pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. (2) |

| |

| 32.1 | | Certifications pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. (2) |

| |

| 32.1 | | Certifications pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. (2) |

| (1) | Incorporated by reference to the Company’s Registration Statement on Form S-1, Registration No. 333-152964. |

21

SIGNATURES

In accordance with the requirements of the Exchange Act, the Company caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | RECON TECHNOLOGY, LTD |

| | |

| May 16, 2011 | | By: | | /s/ Liu Jia |

| | | | Liu Jia |

| | | | Chief Financial Officer |

| | | | (Principal Financial and Accounting Officer) |

22

RECON TECHNOLOGY, LTD

RECON TECHNOLOGY, LTD

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | |

| | | June 30,

2010 | | | March 31,

2011 | | | March 31,

2011 | |

| | | RMB | | | RMB | | | U.S. Dollars | |

| | | | | | (Unaudited) | | | (Unaudited) | |

ASSETS | | | | | | | | | | | | |

Current assets | | | | | | | | | | | | |

Cash and cash equivalents | | ¥ | 12,142,957 | | | ¥ | 16,620,761 | | | $ | 2,529,758 | |

Trade accounts receivable, net | | | 89,425,990 | | | | 83,080,495 | | | | 12,645,241 | |

Other receivables, net | | | 12,850,547 | | | | 17,794,691 | | | | 2,708,435 | |

Purchase advances | | | 46,551,402 | | | | 16,878,362 | | | | 2,568,966 | |

Prepaid expenses | | | 766,638 | | | | 1,228,887 | | | | 187,042 | |

Inventories | | | 13,150,911 | | | | 37,644,403 | | | | 5,729,654 | |

Deferred tax assets | | | 275,960 | | | | 2,061,711 | | | | 313,802 | |

| | | | | | | | | | | | |

Total current assets | | | 175,164,405 | | | | 175,309,310 | | | | 26,682,898 | |

| | | |

Property and equipment, net | | | 1,482,881 | | | | 1,326,526 | | | | 201,903 | |

| | | | | | | | | | | | |

Total Assets | | ¥ | 176,647,286 | | | ¥ | 176,635,836 | | | $ | 26,884,801 | |

| | | | | | | | | | | | |

| | | |

LIABILITIES AND EQUITY | | | | | | | | | | | | |

Current liabilities | | | | | | | | | | | | |

Trade accounts payable | | ¥ | 16,536,796 | | | ¥ | 14,859,767 | | | $ | 2,261,727 | |

Other payables | | | 3,096,309 | | | | 2,589,053 | | | | 394,066 | |

Deferred income | | | 4,267,711 | | | | 2,853,075 | | | | 434,251 | |

Advances from customers | | | 439,761 | | | | — | | | | — | |

Accrued payroll and employees’ welfare | | | 360,540 | | | | 117,562 | | | | 17,893 | |

Accrued expenses | | | 290,803 | | | | 313,747 | | | | 47,754 | |

Taxes payable | | | 20,203,104 | | | | 21,369,588 | | | | 3,252,551 | |

Short-term bank loan | | | — | | | | 5,000,000 | | | | 761,023 | |

Short-term borrowings | | | 5,024,881 | | | | 3,913,820 | | | | 595,702 | |

Short-term borrowings-related parties | | | 7,343,457 | | | | 3,274,605 | | | | 498,410 | |

| | | | | | | | | | | | |

Total current liabilities | | | 57,563,362 | | | | 54,291,217 | | | | 8,263,377 | |

| | | | | | | | | | | | |

Total Liabilities | | | 57,563,362 | | | | 54,291,217 | | | | 8,263,377 | |

| | | | | | | | | | | | |

| | | |

Commitments and Contingencies | | | | | | | | | | | | |

| | | |

Equity | | | | | | | | | | | | |