June 2014

Forward - Looking Statements 2 The information in this presentation has been prepared solely for informational purposes by Bluerock Residential Growth REIT, Inc . (“BRG”) and does not constitute an offer to sell or the solicitation of an offer to purchase any securities . Neither the U . S . Securities and Exchange Commission (“Commission”) nor any other regulatory body has approved or disapproved or passed upon the accuracy or adequacy of this presentation . Any representation to the contrary is a criminal offense . This presentation is not, and should not be assumed to be, complete . This presentation has been prepared to assist interested parties in making their own evaluation of BRG and does not purport to contain all of the information that may be relevant . In all cases, interested parties should conduct their own investigation and analysis of BRG and the data set forth in this presentation and other information provided by or on behalf of BRG . In addition, certain of the information contained herein may be derived from information provided by industry sources . BRG believes that such information is accurate and that the sources from which it has been obtained are reliable . BRG cannot guarantee the accuracy of such information, however, and has not independently verified such information . Statements in this presentation are made as of the date of this presentation unless stated otherwise . This presentation also contains statements that, to the extent they are not recitations of historical fact, constitute “forward - looking statements . ” Forward - looking statements are typically identified by the use of terms such as “may,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology . The forward - looking statements included herein are based upon BRG’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties . Assumptions relating to the foregoing involve judgments with respect to, among sother things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond BRG’s control . Although BRG believes that the expectations reflected in such forward - looking statements are based on reasonable assumptions, BRG’s actual results and performance and the value of its securities could differ materially from those set forth in the forward - looking statements due to the impact of many factors including, but not limited to, the uncertainties of real estate development, acquisition and disposition activity, the ability of our joint venture partners to satisfy their obligations, the costs and availability of financing, the effects of local economic and market conditions, the effects of acquisitions and dispositions, the impact of newly adopted accounting principles on BRG’s accounting policies and on period - to - period comparisons of financial results, regulatory changes and other risks and uncertainties detailed in the “Risk Factors” section of the prospectus dated March 28 , 2014 and filed by BRG with the Commission on April 1 , 2014 , and other discussions of risk factors as detailed in subsequent filings by BRG with the Commission, including periodic reports . BRG claims the safe harbor protection for forward looking statements contained in the Private Securities Litigation Reform Act of 1995 . BRG undertakes no obligation to update or revise any such information for any reason after the date of this presentation, unless required by law .

We Invest In 3 Institutional Multifamily In growth markets With Strategic Partners With a focus on Value Creation

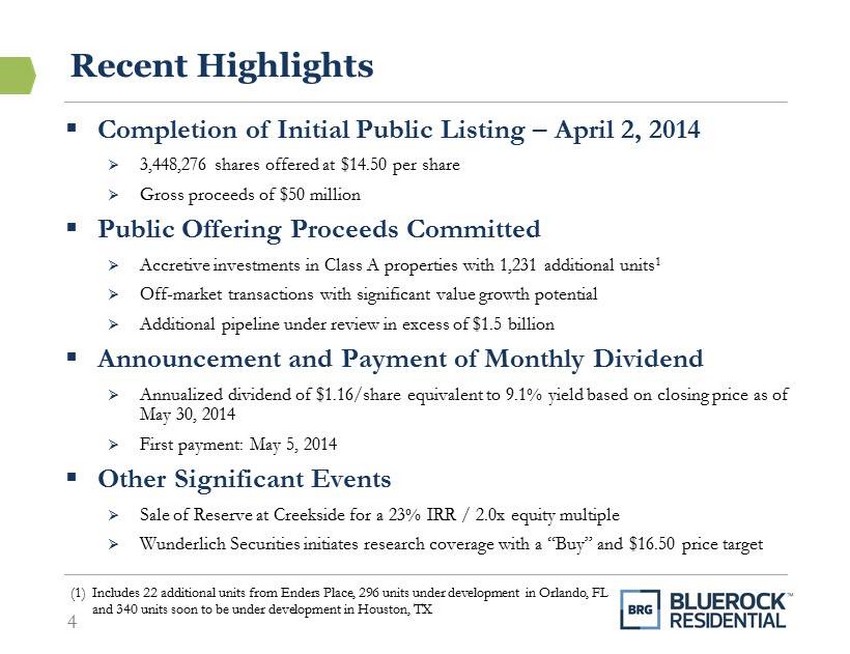

Recent Highlights 4 ▪ Completion of Initial Public Listing – April 2, 2014 » 3,448,276 shares offered at $14.50 per share » Gross proceeds of $50 million ▪ Public Offering Proceeds Committed » Accretive investments in C lass A properties with 1,231 additional units 1 » Off - market transactions with significant value growth potential » Additional pipeline under review in excess of $1.5 billion ▪ Announcement and Payment of Monthly Dividend » Annualized dividend of $1.16/share equivalent to 9 .1% yield based on closing price as of May 30, 2014 » First payment: May 5, 2014 ▪ Other Significant Events » Sale of Reserve at Creekside for a 23% IRR / 2.0x equity multiple » Wunderlich Securities initiates research coverage with a “Buy” and $16.50 price target (1) Includes 22 additional units from Enders Place, 296 units under development in Orlando, FL and 340 units soon to be under development in Houston, TX

Ramin Kamfar – Chairman, CEO and President of BRG » Co - Founder of Bluerock Real Estate – 2002 » Overseen acquisition of 8,000 apartment units and 2.5 million square feet of office space » 25 years in real estate, private equity, investment banking » Lehman Brothers Gary Kachadurian – Vice Chairman of BRGM » Board of Directors, Chair of Investment Committee » 33 years experience in real estate, former Chairman – NMHC » RREEF / Deutsche Bank – Head of National Acquisitions and Multifamily Value - Add & Development Groups; Member of Investment and Policy Committees » Lincoln Property Company – Partner; developed 3,000+ units James G. Babb, III – Chief Investment Officer of BRGM » 25 years experience in real estate » Starwood Capital – Founding Member; Co - Managed Starwood Multifamily and Office effort for 12 years » Involved in creation of Equity Residential; Starwood Hotels; iStar Financial Jordan Ruddy – President of BRGM » Co - Founder of Bluerock Real Estate – 2002 » 25 years experience in real estate, capital markets » Bank of America, JP Morgan Chase, Smith Barney 5 Experienced Management Team (*) “BRG” refers to Bluerock Residential Growth REIT, Inc. and “BRGM” refers to BRG Manager, LLC

6 Institutional Multifamily ▪ Institutional by Age » Typically built post - 2000 » One of the youngest portfolios in the publicly traded apartment REIT universe ▪ Institutional by Quality » Typically Class A with select value - added opportunity to reposition from Class B to Class A in select cases » Limited or no functional obsolescence ▪ Institutional by Market » Dynamic growth markets with institutional ownership presence

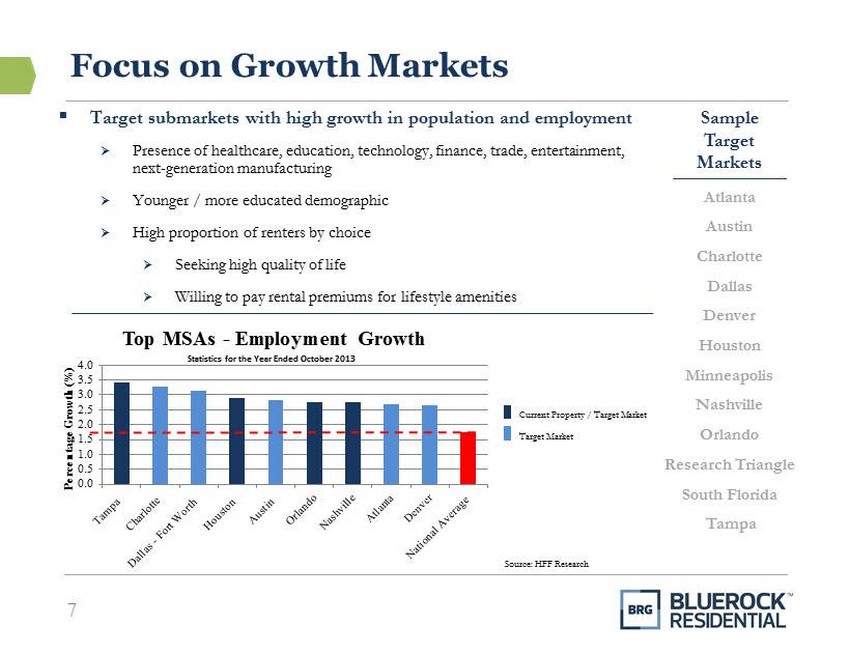

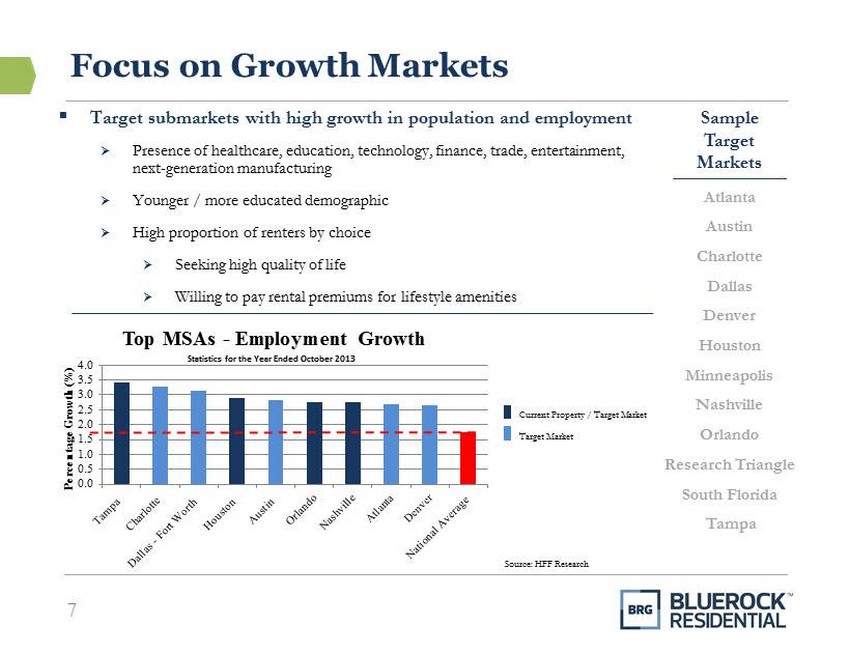

0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 Percentage Growth (%) Top MSAs - Employment Growth 7 Current Property / Target Market Target Market ▪ Target submarkets with high growth in population and employment » Presence of healthcare , e ducation, technology, f inance , trade , entertainment , next - generation manufacturing » Younger / more educated demographic » H igh proportion of renters by choice » Seeking high quality of life » Willing to pay rental premiums for lifestyle amenities Sample Target Markets Atlanta Austin Charlotte Dallas Denver Houston Minneapolis Nashville Orlando Research Triangle South Florida Tampa Source: HFF Research Focus on Growth Markets Statistics for the Year Ended October 2013

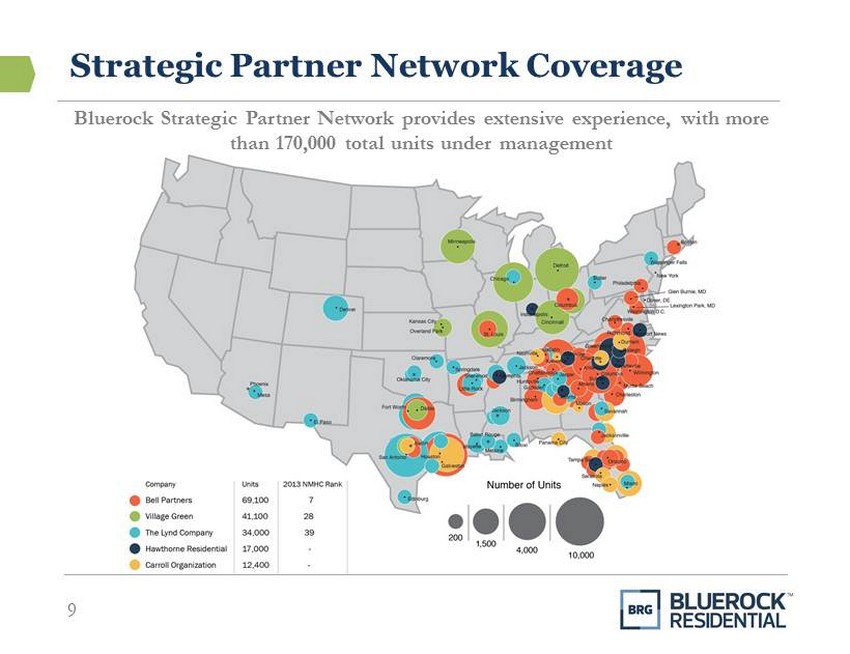

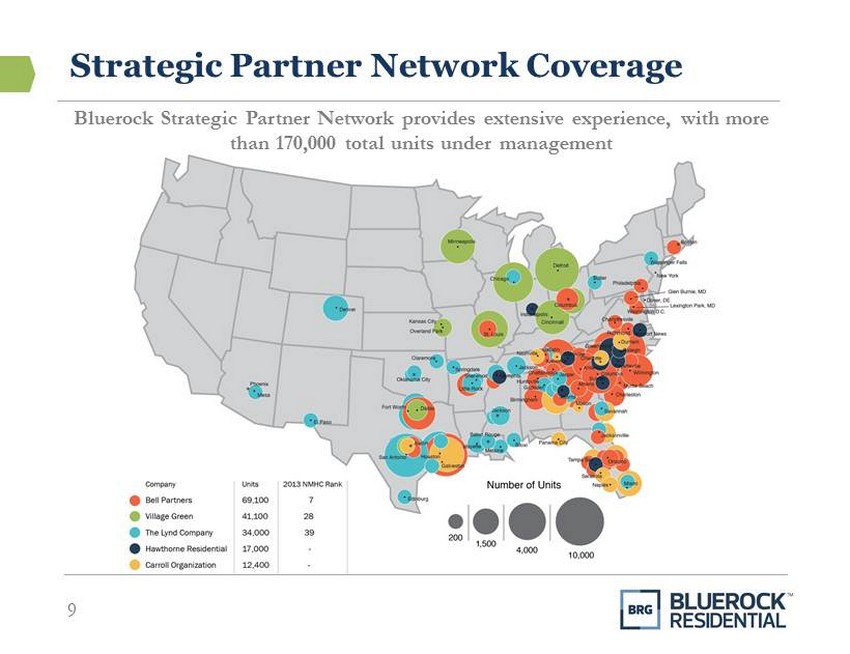

8 Strategic Partner Network ▪ Strategic Partner Network based on longstanding management relationships » Bluerock is a preferred capital partner due to hands - on multifamily / real estate expertise and industry relationships ▪ Intellectual capital from leading owner/operators in the nation » Archstone , Bell Partners, Carroll Organization, Hawthorne Residential, The Lynd Company , Stonehenge, Village Green » Partnerships are typically non - promoted structures ▪ Strategic Partner Network leverages Bluerock’s abilities » Substantial, often proprietary, relationship - based deal flow » 2013 S trategic P artner transaction activity exceeding $ 3 billion / 30 , 000 units » Disciplined ‘broad and deep ’ underwriting by both Bluerock and Strategic Partners enhances ability to execute attractive transactions ▪ Efficiently source / execute across markets without incremental cost or logistical burdens Network acts as ‘Force Multiplier’ in sourcing and execution

Bluerock Strategic P artner N etwork provides extensive experience, with more than 170,000 total units under management Strategic Partner Network Coverage 9 RK

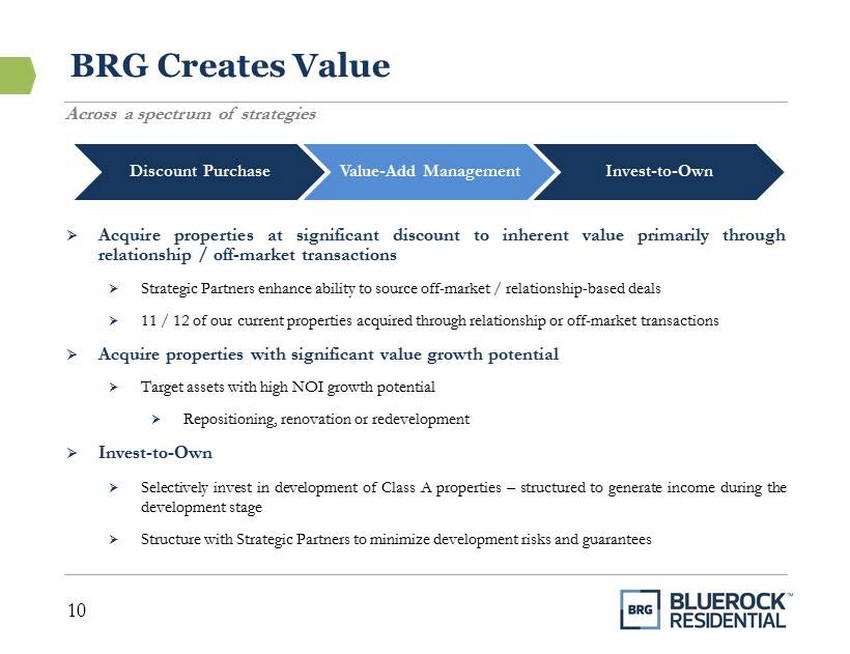

10 » Acquire properties at significant discount to inherent value primarily through relationship / off - market transactions » Strategic Partners enhance ability to source off - market / relationship - based deals » 11 / 12 of our current properties acquired through relationship or off - market transactions » Acquire properties with significant value growth potential » Target assets with high NOI growth potential » Repositioning, renovation or redevelopment » Invest - to - Own » Selectively invest in development of Class A properties – structured to generate income during the development stage » Structure with Strategic Partners to minimize development risks and guarantees Discount Purchase Value - Add Management Invest - to - Own A cross a spectrum of strategies BRG Creates Value

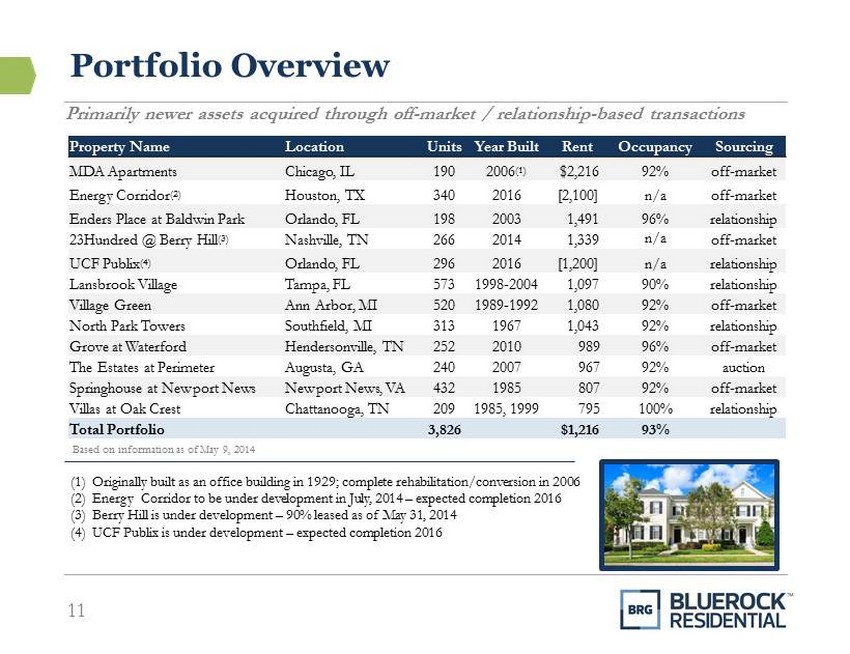

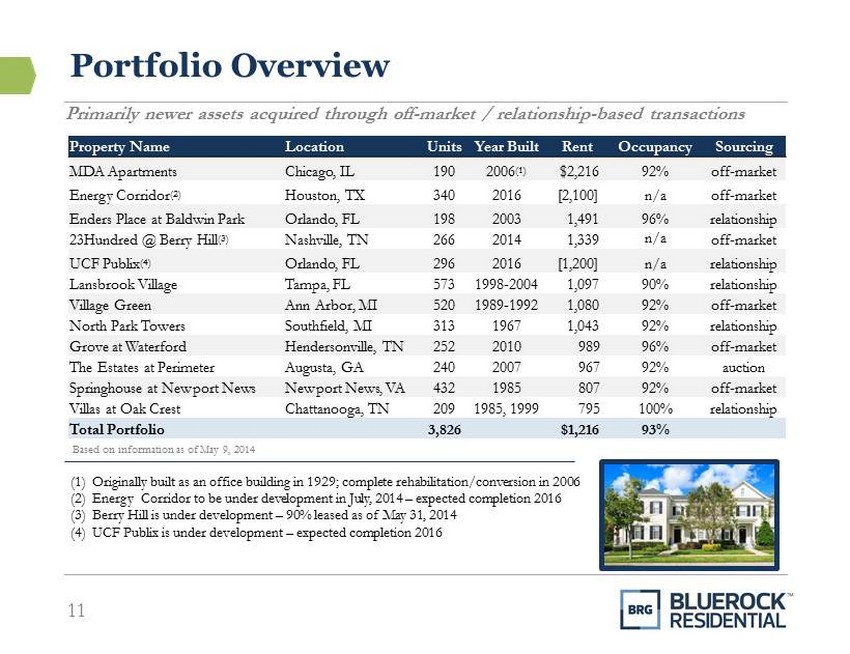

(1) Originally built as an office building in 1929; complete rehabilitation/conversion in 2006 (2) Energy Corridor to be under development in July, 2014 – expected completion 2016 (3) Berry Hill is under development – 90% leased as of May 31, 2014 (4) UCF Publix is under development – expected completion 2016 Portfolio Overview 11 Primarily newer assets acquired through off - market / relationship - based transactions Based on information as of May 9, 2014 Property Name Location Units Year Built Rent Occupancy Sourcing MDA Apartments Chicago, IL 190 2006 (1) $2,216 92% off - market Energy Corridor (2 ) Houston, TX 340 2016 [2,100] n/a off - market Enders Place at Baldwin Park Orlando, FL 198 2003 1,491 96% relationship 23Hundred @ Berry Hill (3) Nashville, TN 266 2014 1,339 n/a off - market UCF Publix (4) Orlando, FL 296 2016 [1,200] n/a relationship Lansbrook Village Tampa, FL 573 1998 - 2004 1,097 90% relationship Village Green Ann Arbor, MI 520 1989 - 1992 1,080 92% off - market North Park Towers Southfield, MI 313 1967 1,043 92% relationship Grove at Waterford Hendersonville, TN 252 2010 989 96% off - market The Estates at Perimeter Augusta, GA 240 2007 967 92% auction Springhouse at Newport News Newport News, VA 432 1985 807 92% off - market Villas at Oak Crest Chattanooga, TN 209 1985, 1999 795 100% relationship Total Portfolio 3,826 $1,216 93%

IPO Proceeds Committed to Accretive Investments 12 RK UCF Publix – Rendering Lansbrook Village Energy Corridor – Rendering (1) UCF Publix and Energy Corridor are development projects, year b uilt and units are estimates (2) Based on company estimates Enders Place Lansbrook Village UCF Publix (1) Energy Corridor (1) Enders Buyout Location Tampa Bay, FL Orlando, FL Houston, TX Orlando, FL Year Built 1998 - 2004 2016 2016 2003 Units 573 / 774 296 340 220 Investment Strategy Fractured Condo Invest-to-Own Invest-to-Own Fractured Condo Return on Cost (2) 6.65% / 7.40% 7.50% 7.25% 6.25% Market Cap Rate (2) 5.75% 5.25 - 5.50% 4.75 - 5.00% 5.25 - 5.50% Equity Multiple (2) 2.0x 1.9x 1.8x 1.9x

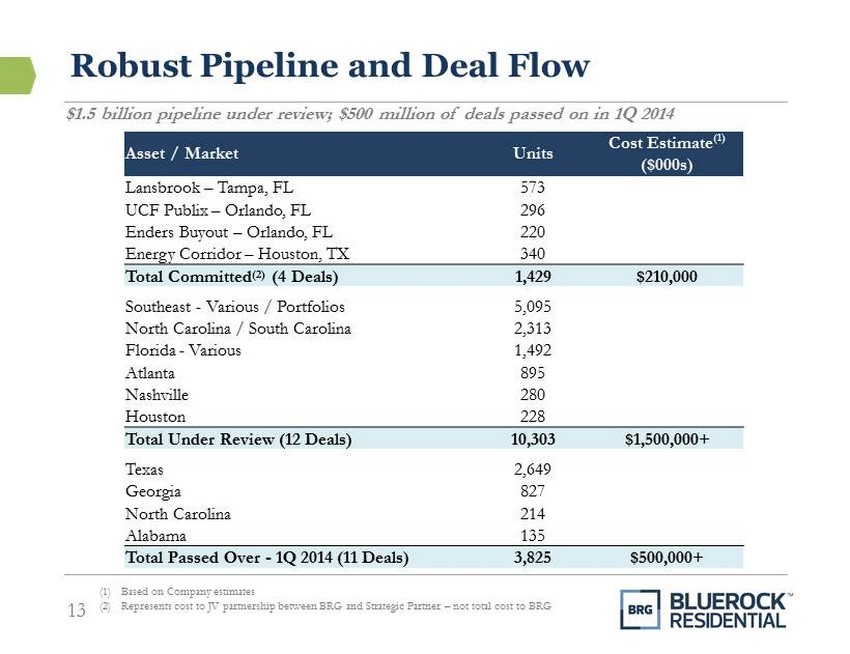

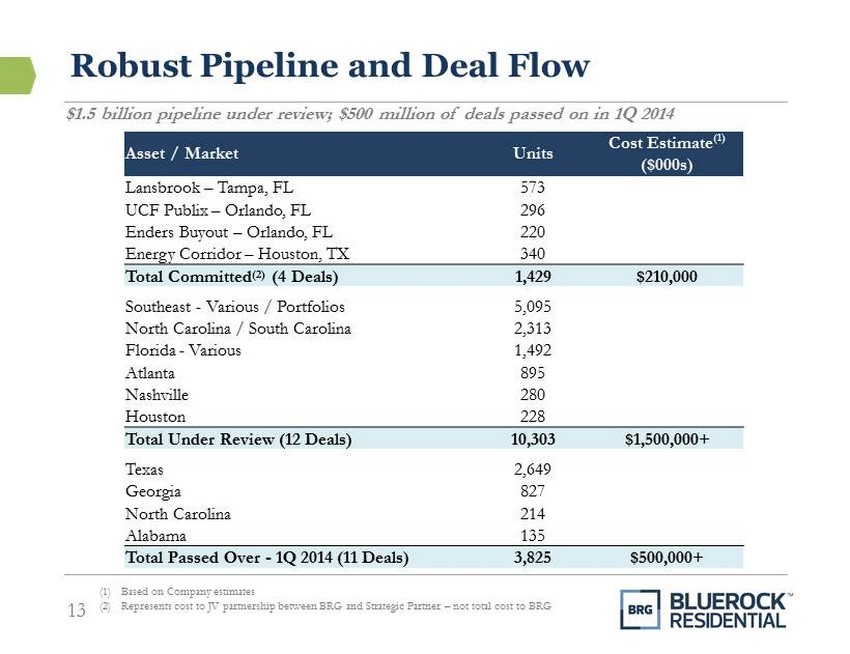

$1.5 billion pipeline under review; $500 million of deals passed on in 1Q 2014 Robust Pipeline and Deal Flow 13 (1) Based on Company estimates (2) Represents cost to JV partnership between BRG and Strategic Partner – not total cost to BRG Asset / Market Units Cost Estimate (1) ($000s) Lansbrook – Tampa, FL 573 UCF Publix – Orlando, FL 296 Enders Buyout – Orlando, FL 220 Energy Corridor – Houston, TX 340 Total Committed (2) (4 Deals) 1,429 $210,000 Southeast - Various / Portfolios 5,095 North Carolina / South Carolina 2,313 Florida - Various 1,492 Atlanta 895 Nashville 280 Houston 228 Total Under Review (12 Deals) 10,303 $1,500,000+ Texas 2,649 Georgia 827 North Carolina 214 Alabama 135 Total Passed Over - 1Q 2014 (11 Deals) 3,825 $500,000+

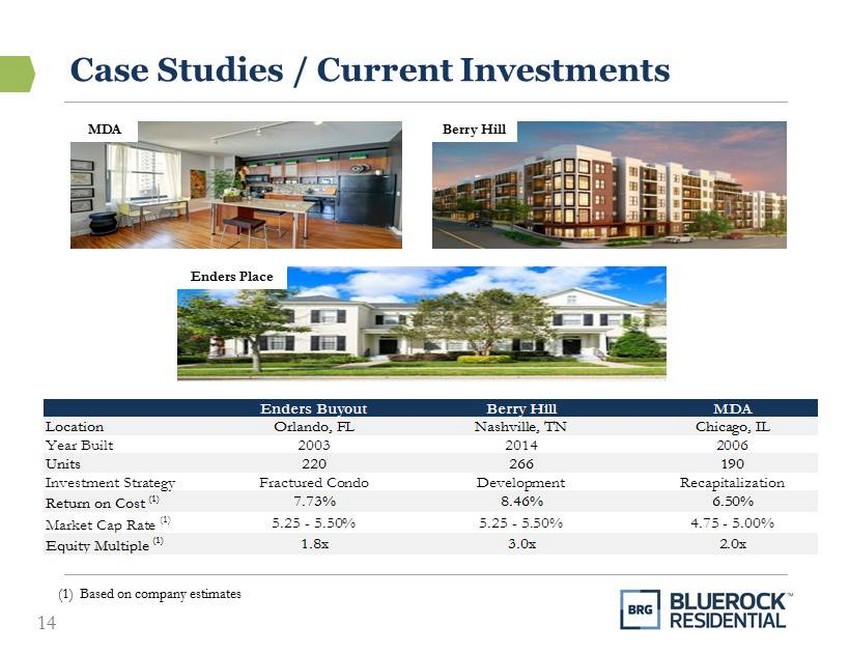

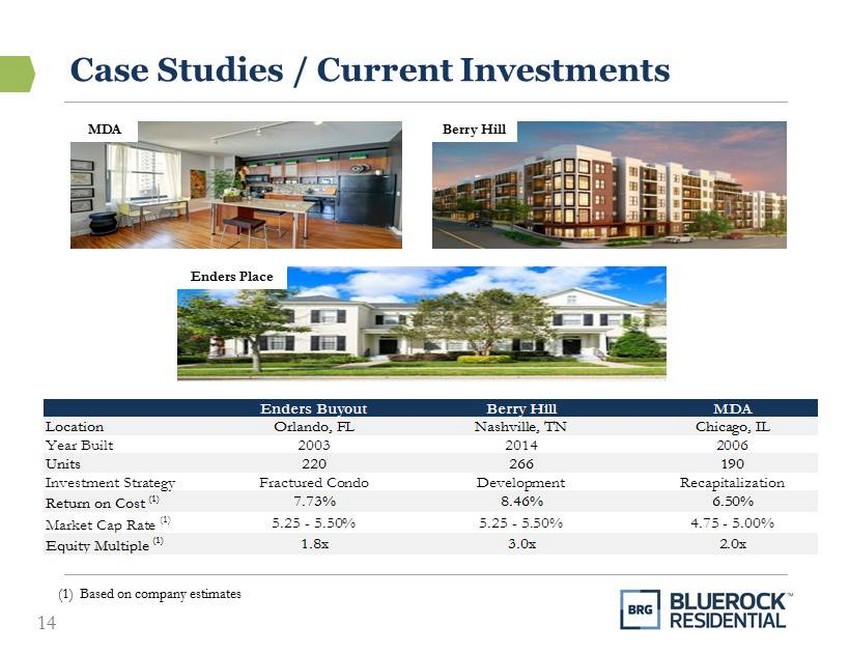

Case Studies / Current Investments 14 RK (1) Based on company estimates Enders Place Enders Buyout Berry Hill MDA Location Orlando, FL Nashville, TN Chicago, IL Year Built 2003 2014 2006 Units 220 266 190 Investment Strategy Fractured Condo Development Recapitalization Return on Cost (1) 7.73% 8.46% 6.50% Market Cap Rate (1) 5.25 - 5.50% 5.25 - 5.50% 4.75 - 5.00% Equity Multiple (1) 1.8x 3.0x 2.0x MDA Berry Hill

BRG’s properties are at various stages of unlocking NAV growth Embedded NAV Growth Potential 15 Springhouse Newport News, VA 1985 Value-Add 8.63% 6.75% 188 2.00x Enders Place Orlando, FL 2002 Fractured Condo 7.73% 5.25 - 5.50% 236 1.80x Enders Buyout Orlando, FL 2002 Partnership Buyout 6.25% 5.25 - 5.50% 88 1.90x Lansbrook Village Tampa, FL 1998-2004 Fractured Condo 7.40% 5.75% 165 2.00x 23Hundred @ Berry Hill Nashville, TN 2014 Completed Dev. 8.46% 5.50% 296 3.00x UCF Publix Orlando, FL 2016 Class A Core Dev. 7.50% 5.25 - 5.50% 213 1.90x Energy Corridor Houston, TX 2016 Class A Core Dev. 7.25% 4.75 - 5.00% 238 1.80x Property Year Built Strategy Market Cap Rate (1) Equity Multiple (1) Spread (bps) Stabilized Return on Cost (1) (1) Based on Company estimates

Stock price and statistics as of 5/30/14 Attractive Metrics Relative to Peers Premium Yield Large Discount to NAV Ticker Price Mkt Cap Yield Price / NAV Price/ 2014 AFFOx Price/ 2015 AFFOx AEC 17.29 995.3 4.40 85.0 15.2 14.0 TSRE 7.90 289.0 4.81 92.7 25.6 16.5 IRT 9.09 161.3 7.92 90.5 13.1 11.5 APTS 8.46 138.6 7.57 70.8 12.2 11.9 Average 396.0 6.17 84.8 16.5 13.5 BRG 12.80 71.1 9.06 72.1 11.7 10.6 Discount to Peer AFFO Multiples Multifamily Peers < $1 Billion Market Cap Source: SNL Financial 16