UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

LINK RESOURCES INC.

(Name of small business issuer in its charter)

| | | | | |

| Nevada | | 1041 | | 98-0588402 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

392 Acadia Drive S.E., Calgary, Alberta, T2J 0A8, Canada

(403) 230-0945

(Address and telephone number of principal executive offices)

392 Acadia Drive S.E., Calgary, Alberta, T2J 0A8, Canada

(Address of principal place of business or intended place of business)

Nevada Agency and Trust Company

50 West Liberty Street, Suite 880, Reno, Nevada 89501

(775) 322-0626

(Name, address and telephone number of agent for service)

With copies to:

THE O’NEAL LAW FIRM, P.C.

14835 E. Shea Boulevard

Suite 103 PMB 494

Fountain Hills, Arizona 85268

Tel: (480) 812-5058

Fax: (888) 353-8842

Approximate date of commencement of proposed sale to public:

As soon as practical after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities At registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, and accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated Filer o Non-accelerated filer o Smaller Reporting Company ý

CALCULATION OF REGISTRATION FEE

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | | AMOUNT TO BE REGISTERED | | PROPOSED MAXIMUM OFFERING PRICE PER SHARE (1) | | | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE (1) | | | AMOUNT OF REGISTRATION FEE (1) | |

| | | | | | | | | | | | | | | |

| Common Stock | | 1,950,000 shares | | $ | 0.02 | | | $ | 39,000 | | | $ | 1.53 | |

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE RERGISTRATION SHALL BECOME EFFECTIVE ON SUCH A DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

SUBJECT TO COMPLETION, Dated August 20, 2008

PROSPECTUS

LINK RESOURCES INC.

1,950,000 SHARES

COMMON STOCK

The selling shareholders named in this prospectus are offering the 1,950,000 shares of our common stock offered through this prospectus. The 1,950,000 shares offered by the selling shareholders represent 56.5% of the total outstanding shares as of the date of this prospectus. We will not receive any proceeds from this offering. We have set an offering price for these securities of $0.02 per share of our common stock offered through this prospectus.

| | | Offering Price | | Underwriting Discounts and Commissions | | Proceeds to Selling Shareholders | |

| Per Share | | $ | 0.02 | | None | | $ | 0.02 | |

| Total | | $ | 39,000 | | None | | $ | 39,000 | |

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at 0.02 per share until such time as the shares of our common stock are traded on the NASD Over-The-Counter Bulletin Board electronic quotation service. Although we intend to apply for trading of our common stock on the NASD Over-The-Counter Bulletin Board electronic quotation service, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board electronic quotation service, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section of this Prospectus entitled “Risk Factors.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: August 20, 2008

As used in this prospectus, unless the context otherwise requires, “we”, “us”, “our” “ Link Resources”, or “Link” refers to Link Resources Inc. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. The following summary is not complete and does not contain all of the information that may be important to you. You should read the entire prospectus before making an investment decision to purchase our common shares.

Link Resources Inc.

We are in the business of mineral exploration. On April 1, 2008, we entered in a Mineral Lease Agreement whereby we leased from Timberwolf Minerals, LTD a total of two (2) unpatented lode mining claims in the State of Nevada which we refer to as the Goldbanks East Prospect. These mineral claims are located in Section 20, Township 30 North, Range 39 East, Mt. Diablo Baseline & Meridian, Pershing County, Nevada, USA, owned by Timberwolf Minerals LTD.

According to the lease Link has agreed to pay Timberwolf Minerals, LTD minimum royalty payments which shall be paid in advance. Link paid the sum of $5,000 upon execution of this lease. Link has agreed to pay $5,000 on or before the first anniversary of the lease, $10,000 on or before the second and third anniversary of the lease, $25,000 on or before the fourth anniversary of the lease and each annual payment after that shall be $75,000 plus an annual increase or decrease equivalent to the rate of inflation designated by the Consumer’s Price Index for that year with execution year as base year.. Link will pay Timberwolf Minerals, LTD a royalty of 3.5% of the Net Returns from all ores, minerals, concentrates, or other products mined and removed from the property and sold or processed by Link, quarterly. The term of this lease is for twenty (20) years, renewable for an additional twenty (20) years so long as conditions of the lease are met.

Our plan of operations is to conduct mineral exploration activities on the Goldbanks East Prospect in order to assess whether these claims possess commercially exploitable mineral deposits. (Commercially exploitable mineral deposits are deposits which are suitably adequate or prepared for productive use of a natural accumulation of minerals or ores). Our exploration program is designed to explore for commercially viable deposits of gold, silver, copper or any other valuable minerals. (Commercially viable deposits are deposits which are suitably adequate or prepared for productive use of an economically workable natural accumulation of minerals or ores). We have not, nor has any predecessor, identified any commercially exploitable reserves of these minerals on our mineral claims. (A reserve is an estimate within specified accuracy limits of the valuable metal or mineral content of known deposits that may be produced under current economic conditions and with present technology). We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on our mineral claims.

After acquiring a lease on the Goldbanks East Prospect, we retained the services of Robert Thomas, a Professional Geologist. Mr. Thomas prepared a geologic report for us on the mineral exploration potential of the claims. Mr. Thomas has no direct or indirect interest and does not expect to receive an interest in any of the Goldbanks East Prospect claims. Included in this report is a recommended exploration program which consists of mapping, sampling, staking additional claims and drilling. The recommendations of Mr. Thomas are further explained in the “Description of Business” section.

At this time we are uncertain of the extent of mineral exploration we will conduct before concluding that there are, or are not, commercially viable minerals on our claims. Further phases beyond the current exploration program will be dependent upon numerous factors such as Mr. Thomas’ recommendations based upon ongoing exploration program results and our available funds.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we have entered into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our property, or if such resources are discovered, that we will enter into commercial production of our mineral property.

As of May 31, 2008, we had $47,768 cash on hand and no liabilities. Accordingly our working capital position as of May 31, 2008 was $47,768. Since our inception through May 31, 2008, we have incurred a net loss of $6,232. We attribute our net loss to having no revenues to offset our expenses and the professional fees related to the creation and operation of our business.

Our fiscal year ended is May 31.

We were incorporated on January 9, 2008 under the laws of the State of Nevada. Our principal offices are located at 392 Acadia Drive, SE, Calgary, Alberta, Canada. Our telephone number is (403) 230-0945.

The Offering

| Securities Being Offered | | Up to 1,950,000 shares of our common stock. |

| | | |

| Offering Price | | The offering price of the common stock is $0.02 per share. We intend to apply to the NASD Over-the-Counter Bulletin Board electronic quotation service to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transaction negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders. |

| | | |

| Minimum Number of Shares | | None |

| To Be Sold in This Offering | | |

| | | |

| Securities Issued and to be Issued | | 3,450,000 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing shareholders and thus there will be no increase in our |

| | | issued and outstanding shares as a result of this offering. The issuance to the selling shareholders was exempt due to the provisions of Regulation S. |

| | | |

| Use of Proceeds | | We will not receive any proceeds from the sale of the common stock by the selling shareholders. |

Summary Financial Information

| Balance Sheet Data | | May 31, 2008 (audited) |

| Cash | | $ | 47,768 | |

| Total Current Assets | | $ | 47,768 | |

| Liabilities | | $ | - | |

| Total Stockholder’s Equity | | $ | 47,768 | |

| | | | | |

| Statement of Loss and Deficit | | From Inception (January 9, 2008) to May 31, 2008 (audited) |

| Revenue | | $ | - | |

| Net Loss for the Period | | $ | 6,232 | |

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock, when and if we trade at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related To Our Financial Condition and Business Model

If we do not obtain additional financing, our business will fail

Our current operating funds will only cover initial stages of our exploration program. In order for us to carry out any further exploration or testing we will need to obtain additional financing. We currently do not have any operations and we have no income. We will require additional financing to conduct further exploration programs. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Although we have no arrangements in place for any future equity financing, in the case that we did conduct a financing from the sale of our common stock, this financing would have a dilutive impact on our stockholders and could negatively affect the stock price. Obtaining additional financing would be subject to a number of factors, including the market prices for gold and other minerals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

We have yet to attain profitable operations and because we will need additional financing to fund our exploration activities, our accountants believe there is substantial doubt about the company’s ability to continue as a going concern

We have incurred a net loss of $6,232 for the period from January 9, 2008 (Inception) to May 31, 2008 and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral project. These factors raise substantial doubt that we will be able to continue as a going concern.

Our financial statements included with this prospectus have been prepared assuming that we will continue as a going concern. Our auditors have made reference to the substantial doubt as to our ability to continue as a going concern in their audit report on our audited financial statements for the year ended May 31, 2008. If we are not able to achieve revenues, then we may not be able to continue as a going concern and our financial condition and business prospects will be adversely affected.

Since this is an exploration project, we face a high risk of business failure due to our inability to predict the success of our business

We are in the initial stages of exploration of our mineral project, and thus have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on January 9, 2008 and to date have been involved primarily in organizational activities and the acquisition of the Goldbanks East Prospect. We have not earned any revenues as of the date of this prospectus.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold or other minerals. The expenditures to be made by us on our exploration program may not result in the discovery of commercial quantities of ore. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Even if we discover commercial reserves of precious metals on our mineral claims, we may not be able to successfully obtain commercial production

Our mineral claims do not contain any known reserves of precious metals. However, if our exploration programs are successful in discovering commercially exploitable reserves of precious metals, we will require additional funds in order to place the mineral claims into commercial production. At this time, there is a risk that we will not be able to obtain such financing as and when

needed. It is premature to estimate the amount required to place the mineral claims into commercial production, as we do not have sufficient information.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

Because access to our mineral claims may be restricted by bad weather, we may be delayed in our exploration

Once exploration begins, access to the claim may be restricted through some of the year due to weather in the area. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. These limitations can result in significant delays in exploration efforts. Such delays can have a significant negative effect on our exploration efforts.

Because our president has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail

Because we are in the early stages of our business, our president will not be spending a significant amount of time on our business. Mr. Zaradic, our president, expects to expend approximately 10 hours per week on Link business. Competing demands on Mr. Zaradic’s time may lead to a divergence between his interests and the interests of other shareholders. Mr. Zaradic works full time as a Geophysical Technician and none of this work will directly compete with Link Resources Inc.

Because our president owns 43.47% of our outstanding common stock, investors may find that corporate decisions influenced by the president are inconsistent with the best interests of other stockholders.

Mr. Zaradic is our president, chief financial officer and sole director. He owns approximately 43% of the outstanding shares of our common stock. Accordingly, he will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of Mr. Zaradic may still differ from the interests of the other stockholders. Mr. Zaradic owns 1,500,000 common shares for which he paid $0.01.

Because our director is a Canadian resident, difficulty may arise in attempting to effect service or process on him in Canada

Because our sole director is a Canadian resident, difficulty may arise in attempting to effect service or process on him in Canada or in enforcing a judgment against Link’s assets located outside of the United States.

Because we lease the Goldbanks East Prospect, we face the risk of not being able to meet the requirements of the lease and may be forced to default on the agreement

Under the terms of the lease on the Goldbanks East Prospect, Link has agreed to pay minimum annual royalties on or before April of every year. If Link is unable to meet these obligations, we may be forced to default on the agreement and the lease may be terminated by the owner resulting in the lose of the property for Link.

Risks Related To Legal Uncertainty and Regulations

As we undertake exploration of the Goldbanks East Prospect we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the State of Nevada as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We currently have budgeted $1,000 for regulatory compliance.

Risks Related To This Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares

There is currently no market for our common stock and a market may never develop. Our stock is currently not traded on any market or exchange, and therefore our shares can only be purchased through private transactions. We plan to apply for listing of our common stock on the Over-the-Counter Bulletin Board electronic quotation service upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the Over-the-Counter Bulletin Board electronic quotation service or, if traded, a public market may never materialize. If our common stock is not traded on the Over-the-Counter Bulletin Board electronic quotation service or if a public market for our common stock does not develop, investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

If a market for our common stock develops, our stock price may be volatile

If a market for our common stock develops, we anticipate that the market price of our common stock will be subject to wide fluctuations in response to several factors, including: the results of our

geological exploration program; our ability or inability to arrange for financing; commodity prices for gold, silver or other minerals; and conditions and trends in the mining industry.

In addition, if our common stock is traded on the Over-the-Counter Bulletin Board electronic quotation service, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price of our common stock.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline

The selling shareholders are offering 1,950,000 shares of our common stock through this prospectus. Our common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent approximately 56.52% of the common shares outstanding as of the date of this prospectus.

Because our stock is a penny stock, shareholders will be more limited in their ability to sell their stock

The shares offered by this prospectus constitute a penny stock under the Securities and Exchange Act. The shares will remain classified as a penny stock for the foreseeable future. Penny stocks generally are equity securities with a price of less than $5.00. Broker/dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. The penny stock rules require a broker/dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the Securities and Exchange Commission that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker/dealer must provide the customer with bid and offer quotations for the penny stock, the compensation of the broker/dealer, and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules: the broker/dealer must make a special written determination that a penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of price fluctuations in the price of the stock and may reduce the level of trading activity in any secondary market for a stock that becomes subject to the penny stock rules, and accordingly, investors in this offering may find it difficult to sell their securities, if at all.

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking

statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

The $0.02 per share offering price of our common stock was determined arbitrarily by us. There is no relationship whatsoever between this price and our assets, earnings, book value or any other objective criteria of value. We intend to apply to the Over-the-Counter Bulletin Board electronic quotation service for the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934 (the “Exchange Act”). If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders named in this prospectus. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders named in this prospectus.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

The selling shareholders named in this prospectus are offering all of the 1,950,000 shares of common stock offered through this prospectus. The selling shareholders acquired the 1,950,000 shares of common stock offered through this prospectus from us at a price of $0.02 per share in an offering that was exempt from registration under Regulation S of the Securities Act of 1933, as amended (the “Securities Act”) and completed on April 30, 2008. We will file with the Securities and Exchange Commission prospectus supplements to specify the names of any successors to the selling shareholders specified in this registration statement who are able to use the prospectus included in this registration statement to resell the shares registered by this registration statement.

The following table provides, as of the date of this prospectus, information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including:

| 1. | the number of shares owned by each prior to this offering; |

| 2. | the total number of shares that are to be offered by each; |

| 3. | the total number of shares that will be owned by each upon completion of the offering; |

| 4. | the percentage owned by each upon completion of the offering; and |

| 5. | the identity of the beneficial holder of any entity that owns the shares. |

| Name Of Selling Stockholder | | Shares Owned Prior to this Offering | | Total Number of Shares to Be Offered for Selling Shareholder Account | | Total Shares to be Owned Upon Completion of this Offering | | Percent Owned Upon Completion of this Offering |

| Leonid Beckovich | | 50,000 | | 50,000 | | Nil | | Nil |

| Lukov Beckovich | | 50,000 | | 50,000 | | Nil | | Nil |

| Joan Bloedel | | 25,000 | | 25,000 | | Nil | | Nil |

| Marisa Bosnjak | | 75,000 | | 75,000 | | Nil | | Nil |

| Barry Clay | | 50,000 | | 50,000 | | Nil | | Nil |

| Linda Clay | | 50,000 | | 50,000 | | Nil | | Nil |

| Olga Groysman | | 75,000 | | 75,000 | | Nil | | Nil |

| Ida Khitrina | | 75,000 | | 75,000 | | Nil | | Nil |

| Svetlana Khitrina | | 75,000 | | 75,000 | | Nil | | Nil |

| Boris Khitrine | | 75,000 | | 75,000 | | Nil | | Nil |

| Lev Khitrine | | 75,000 | | 75,000 | | Nil | | Nil |

| Larissa Klimanova | | 25,000 | | 25,000 | | Nil | | Nil |

| Aida Korablyov | | 50,000 | | 50,000 | | Nil | | Nil |

| Leonid Korablyov | | 50,000 | | 50,000 | | Nil | | Nil |

| Leonor Licardo | | 50,000 | | 50,000 | | Nil | | Nil |

| Marjorie Love | | 75,000 | | 75,000 | | Nil | | Nil |

| Chantall Lukwinski | | 75,000 | | 75,000 | | Nil | | Nil |

| Mark Lukwinski | | 75,000 | | 75,000 | | Nil | | Nil |

| Michael McComber | | 75,000 | | 75,000 | | Nil | | Nil |

| Jeffrey McLeod | | 25,000 | | 25,000 | | Nil | | Nil |

| Jonathan McLeod | | 25,000 | | 25,000 | | Nil | | Nil |

| Alexandre Mikhailov | | 25,000 | | 25,000 | | Nil | | Nil |

| Ivo Musa | | 75,000 | | 75,000 | | Nil | | Nil |

| Josip Musa | | 75,000 | | 75,000 | | Nil | | Nil |

| Jonathan Ottewell | | 25,000 | | 25,000 | | Nil | | Nil |

| Alexander Pilmeister | | 75,000 | | 75,000 | | Nil | | Nil |

| Raisa Pilmeister | | 75,000 | | 75,000 | | Nil | | Nil |

| Rimma Pilmeister | | 75,000 | | 75,000 | | Nil | | Nil |

| Kelly Power | | 25,000 | | 25,000 | | Nil | | Nil |

| John Secreto | | 25,000 | | 25,000 | | Nil | | Nil |

| Nadia Secreto | | 25,000 | | 25,000 | | Nil | | Nil |

| Martina Tomic | | 75,000 | | 75,000 | | Nil | | Nil |

| Matvey Wasserman | | 50,000 | | 50,000 | | Nil | | Nil |

| Veronica Wasserman | | 50,000 | | 50,000 | | Nil | | Nil |

| Andrey Zasmolin | | 25,000 | | 25,000 | | Nil | | Nil |

| Galina Zasmolina | | 50,000 | | 50,000 | | Nil | | Nil |

| | | | | | | | | |

| Total | | 1,950,000 | | 1,950,000 | | Nil | | Nil |

The named party beneficially owns and has sole voting and investment power over all shares or rights to these shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold.

Other than Martina Tomic, the cousin of Anthony Zaradic our President, sole officer and director, none of the selling shareholders:

| (1) | has had a material relationship with us other than as a shareholder at any time within the past three years; or |

| | |

| (2) | has ever been one of our officers or directors. |

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

| 1. | On such public markets as the common stock may from time to time be trading; |

| 2. | In privately negotiated transactions; |

| 3. | Through the writing of options on the common stock; |

| 4. | In short sales; or |

| 5. | In any combination of these methods of distribution. |

The sales price to the public is fixed at $0.02 per share until such time as the shares of our common stock are traded on the Over-the-Counter Bulletin Board electronic quotation service. Although we intend to apply for trading of our common stock on the Over-the-Counter Bulletin Board electronic quotation service, public trading of our common stock may never materialize. If our common stock becomes traded on the Over-the-Counter Bulletin Board electronic quotation service, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

| 1. | The market price of our common stock prevailing at the time of sale; |

| 2. | A price related to such prevailing market price of our common stock; or |

| 3. | Such other price as the selling shareholders determine from time to time. |

The shares may also be sold in compliance with the Securities and Exchange Commission’s rule 144.

We can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders named in this prospectus.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders named in this prospectus must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. The selling shareholders and any broker-dealers who execute sales for the selling shareholders may be deemed to be an "underwriter" within the meaning of the Securities Act in connection with such sales. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

| 1. | Not engage in any stabilization activities in connection with our common stock; |

| | |

| 2. | Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and |

| | |

| 3. | Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

General

Our authorized capital stock consists of 75,000,000 shares of common stock, with a par value of $0.001 per share. As of August 20, 2008, there were 3,450,000 shares of our common stock issued and outstanding held by thirty seven (37) stockholders of record. There are no preferred shares authorized or issued.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy. Holders of our common stock representing thirty three and one-third percent (33 1/3%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Dividend Policy

We have never declared or paid any dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any dividends in the foreseeable future.

Pre-emptive Rights

Holders of common stock are not entitled to pre-emptive or subscription or conversion rights, and there are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of common stock are, and the shares of common stock offered hereby will be when issued, fully paid and non-assessable.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover laws

Nevada revised statutes sections 78.378 to 78.3793 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute does not apply to our company.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

John Kinross-Kennedy, C.P.A., our accountant, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in his audit report. John Kinross-Kennedy, C.P.A. has presented his report with respect to our audited financial statements. The report of John Kinross-Kennedy, C.P.A. on the financial statements herein includes an explanatory paragraph that states that we have not generated revenues and have an accumulated deficit since inception which raises substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The O’Neal Law Firm, P.C., our independent legal counsel, has provided an opinion on the validity of our common stock.

Glossary of Technical Terms

The following defined technical terms are used in our registration statement on Form S-1:

Ag: the chemical symbol for silver.

Au: the chemical symbol for gold.

Assay: qualitative or quantitative determination of the components of a material as an ore.

Commercially exploitable deposits: suitably adequate or prepared for productive use of a natural accumulation of minerals or ores.

Cyanidation: a process of extracting gold and silver as cyanide slimes from their ores.

Deposit: an informal term for an accumulation of ore or other valuable earth material of any origin.

Drilling: the creation or enlargement of a hole in a solid material with a drill.

Epithermal: Said of a hydrothermal mineral deposit formed within about 1 km of the Earth's surface and in the temperature range of 50 to 200 degrees.

Free-milling ore: ore containing gold that can be readily cyanided.

Geologic mapping: Representation of the geologic surface or subsurface features by means of signs and symbols and with an indicated means of orientation. Includes nature and distribution of rock units and the occurrence of structural features, mineral deposits and fossil localities.

Lode: a fissure in consolidated rock filled with mineral. Lode claim is that portion of a lode or vein and of the adjoining surface which has been acquired by a compliance with the law.

Mining claim: that portion of the public mineral lands which a miner, for mining purposes, takes and holds in accordance with mining laws.

Opaline: a rock with a ground mass or matrix consisting of opal.

Ore: The naturally occurring material from which a mineral or minerals of economic value can be extracted profitably or to satisfy social or political objectives.

Patent: a certificate of grant by a government of an exclusive right with respect to claims.

Pediment: a broad, gently sloping rock-floored erosion surface or plain of low relief.

Placer: a deposit of sand or gravel that contain particles of gold.

Porphyry: an igneous rock of any composition that contains conspicuous phenocrysts in a fine-grained groundmass.

Reserve: the quantity of material that is calculated to lie within given boundaries.

Reverse Circulation (RC): The circulation of bit-coolant and cuttings-removal liquids, drilling fluid, mud, air, or gas down the borehole outside the drill rods and upward inside the drill rods.

Sampling: collecting small rock chips from outcrop areas to obtain a representative sample for assay.

Sinter: a chemical sedimentary rock deposited as a hard incrustation on rocks or on the ground.

Unpatented claim: a mining claim to which a deed from the U.S. Government has not been received. A claim is subject to annual assessment work, to maintain ownership.

Vein: a mineral deposit in tabular or shell-like form, filling a fracture in a host rock.

In General

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We currently hold a lease on two (2) unpatented lode mineral claims that we refer to as the Goldbanks East Prospect. Further exploration of these mineral claims is required before a final determination as to their viability can be made. Although exploratory work on the claims conducted prior to our obtaining a lease on the property has indicated some potential showings of mineralization, we are uncertain as to the potential existence of a commercially viable mineral deposit existing in these claims. The results of previous exploratory work of prior companies are in the “History” section below.

Our plan of operations is to carry out exploration work on these claims in order to ascertain whether they possess commercially exploitable quantities of gold, silver, copper or any other valuable minerals. We will not be able to determine whether or not our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work concludes economic viability.

Mineral Lease Agreement between Link Resources Inc. and Timberwolf Minerals, LTD

We entered into a lease agreement with Timberwolf Minerals, LTD. effective April 1, 2008, granting Linl Resources Inc. the exclusive possession of the Property for mining purposes during the term of this agreement. The property consists of two (2) unpatented lode mineral claims located in Section 20, Township 30 North, Range 39 East, Mt. Diablo Baseline & Meridian, Pershing County, Nevada, USA, owned by Timberwolf Minerals Ltd. The property is hereon referred to as the Goldbanks East Prospect. We selected this property based upon a recommendation from Robert Thomas, Professional Geologist, and in Mr. Thomas’s technical report, dated April 7, 2008; he recommended that we further explore this property.

According to the lease Link has agreed to pay Timberwolf Minerals, LTD minimum royalty payments which shall be paid in advance. Link paid the sum of $5,000 upon execution of this lease. Link has agreed to pay $5,000 on or before the first anniversary of the lease, $10,000 on or before the second and third anniversary of the lease, $25,000 on or before the fourth anniversary of the lease and each annual payment after that shall be $75,000 plus an annual increase or decrease equivalent to the rate of inflation designated by the Consumer’s Price Index for that year with execution year as base year.. Link will pay Timberwolf Minerals, LTD a royalty of 3.5% of the Net Returns from all ores, minerals, concentrates, or other products mined and removed from the property and sold or processed by Link, quarterly. The term of this lease is for twenty (20) years, renewable for an additional twenty (20) years so long as conditions of the lease are met.

Description and Location of the Goldbanks East Property

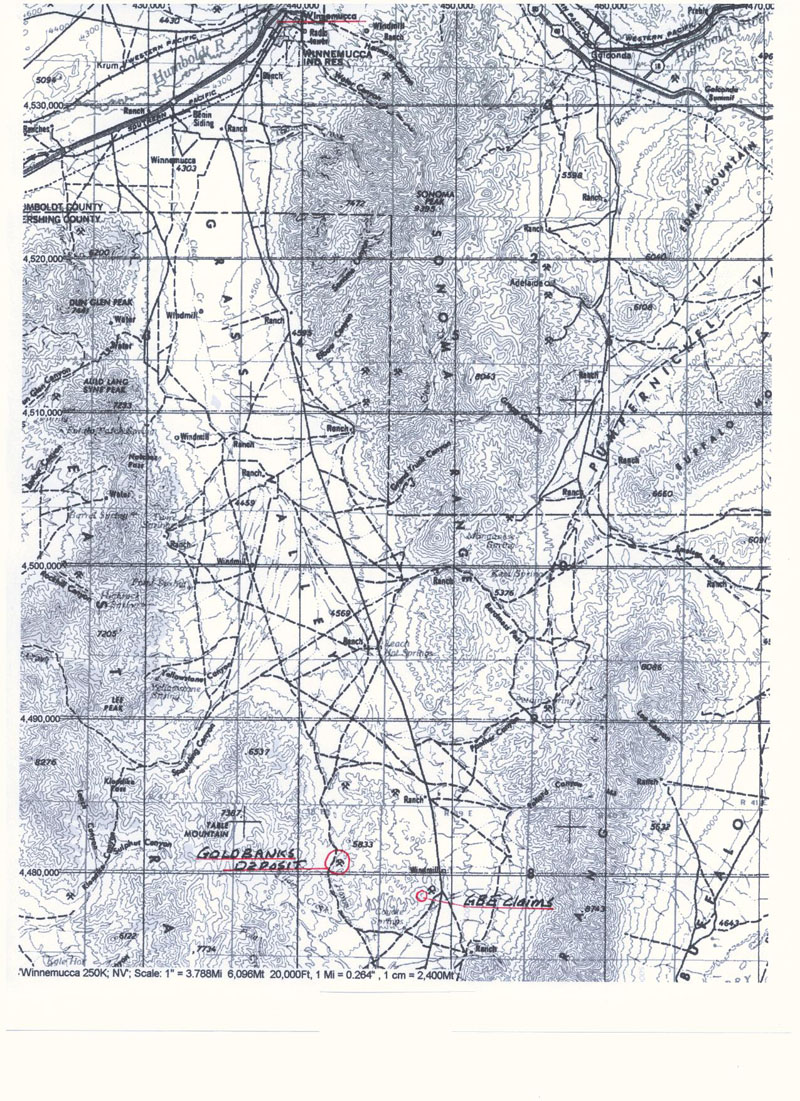

The property consists of two (2) unpatented 20 acre mining claims. The claims are named GB-1 & GB-2, BLM Serial No. NMC # 983672 and 983673. The claims are located in Section 20, Township 30 North, Range 39 East, Mt. Diablo Baseline & Meridian, Pershing County, Nevada, USA. These claims are owned by Timberwolf Minerals LTD.

The Goldbanks East Prospect is located approximately 40 miles due south of Winnemucca. Access to the property is on the Grass Valley – Pleasant Valley Road, which runs straight south from Winnemucca to the property. The area lies at in elevation of 1500 meters, and is accessible year-round.

The climate is western desert; hot, dry summers and cold, dry winters. It rarely gets below 20 degrees Fahrenheit and rarely more than 6 to 9 inches of snow at any given time. The property is accessible year-round. Local drainages in the mountain ranges just east of the property run year-round. The valleys would have water in local wells that would need to be drilled. As for power, rural electric lines are a few miles away, and generators could be used on site. It is approximately five to six miles to tension, high-power electric lines. Winnemucca, which is approximately 45 miles from the property is the closest source of fuel as well there is rail access there and the closest workforce.

History

Gold was discovered in the Goldbanks area in 1907, and led to the location and development of the Goldbanks Merger mines, located on the ridge just North East of the Goldbanks East claims. About 120 tons of ore averaging 0.75 oz Au and 1.0 oz AG were shipped from the property, beginning in 1908. The ore may have been free-milling ore, given that a small amount of associated placer gold is reported (Pershing County Geology, NBMG). However, at that early date, even those grades would have been marginal to sub marginal.

Mercury deposits were discovered on the west flank of the Goldbanks Hills in 1913, and at least 2600 flasks of mercury were produced between 1913 and 1969. The company working the area in 1969 reported a reserve of 133,000 tons of mercury ore at that time (Eng. & Mining Jour.,1969). Grade is not indicated, and the reserve is not verifiable.

The mercury deposits located west of the GB claims at Goldbanks occur at the surface in tabular zones of opaline to chalcedonic sinter silica formed from epithermal hot spring solutions. The near-surface mercury sinters zone downward into gold mineralization at depth. The gold zone at depth hosts the Kinross Goldbanks gold-silver resource, originally discovered by USMX in the mid 1980’s. Kinross’ claim block covers nearly the entire township to the west.

The Goldbanks East Prospect is without known reserves and the proposed program is strictly exploratory in nature.

Geological Exploration Program in General

We have obtained an independent Geologic Report on the Goldbanks East Prospect and have acquired a lease on the property. Robert Thomas prepared the Geologic Report and reviewed all available exploration data completed on the mineral claims.

Mr. Robert D. Thomas is a graduate of the Wesleyan University, where he obtained a M.A. Degree in Geology in 1974. He has been engaged in his profession as a Professional Geologist since 1974.

Geologic Report for the Goldbanks East Prospect, Dated April 7, 2008

A primary purpose of the geologic report was to review information from previous exploration of the property and to recommend exploration procedures to establish the feasibility of a mining project on the property. The report summarizes results of the history of the exploration of the property, the regional and local geology and the structure and mineralization of the property. The report also includes a recommended exploration program.

Conclusions of the Geologic Report for the Goldbanks East Prospect

Based on the property and research of the property Mr. Thomas came to the following conclusion:

Geology, regional and local structure, alteration and mineralization all point to the covered areas of the Goldbanks East prospect area as highly favorable locations for hidden bulk tonnage “porphyry” gold deposits. Additional mapping and sampling of the numerous small outcrops and prospect pits along the margins of cover at Goldbanks East is needed to evaluate the best targets for nearby covered pediment gold targets.

Mr. Thomas recommended a three phase exploration program. Phase one consists of geologic mapping and sampling. Phase two consists of staking additional claims, and leasing the existing 6 claims. Phase three consists of drilling 4,000 feet of Reverse Circulation drill holes, as well as assays and will require bonding, permitting and other associated expenses. The implementation of Phase two is dependent on Phase one.

Competition

We are a junior mineral resource exploration company engaged in the business of mineral exploration. We compete with other junior mineral resource exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral resource exploration companies. The presence of competing junior mineral resource exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We also compete for mineral properties of merit with other junior exploration companies. Competition could reduce the availability of properties of merit or increase the cost of acquiring the mineral properties.

Employees

We have no employees as of the date of this prospectus other than our president. We conduct our business largely through the outsourcing of experts in each particular area of our business.

Research and Development Expenditures

We have not incurred any material research or development expenditures since our incorporation.

Subsidiaries

We do not currently have any subsidiaries.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Office Property

We maintain our executive office at 392 Acadia Drive, S.E., Calgary, Alberta, Canada, T2J 0A8. This office space is being provided to the company free of charge by our president, Mr. Zenith. This arrangement provides us with the office space necessary at this point. Upon significant growth of the company it may become necessary to lease or acquire additional or alternative space to accommodate our development activities and growth.

We are not currently a party to any legal proceedings.

Our agent for service of process in Nevada is Nevada Agency and Trust Company, 50 West Liberty Street, Suite 880, Reno, Nevada 89501.

No Public Market for Common Stock

There is presently no public market for our common stock. We anticipate making an application for trading of our common stock on the Over-the-Counter Bulletin Board electronic quotation service upon the effectiveness of the registration statement of which this prospectus forms a part. However, we can provide no assurance that our shares will be traded on the Over-the-Counter Bulletin Board electronic quotation service or, if traded, that a public market will materialize.

The Securities Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities' laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement.

Link Resources Inc. is subject to the penny stock rules, and disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock and stockholders may have difficulty selling those securities.

Holders of Our Common Stock

As of the date of this Registration Statement, we had thirty seven (37) shareholders of record.

Rule 144 Shares

None of our common stock is currently available for resale to the public under Rule 144. In general, under Rule 144 as currently in effect, a person who has beneficially owned shares of a company's common stock for at least 180 days is entitled to sell his or her shares. However, Rule 144 is not available to shareholders for at least one year subsequent to an issuer that previously met the definition of Rule 144(i)(1)(i) having publicly filed, on Form 8K, the information required by Form 10.

As of the date of this prospectus, no selling shareholder has held their shares for more than 180 days and it has not been at least one year since the company filed the Form 10 Information on Form 8K as contemplated by Rule 144(i)(2) and (3). Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about the company.

Stock Option Grants

To date, we have not granted any stock options.

Registration Rights

We have not granted registration rights to the selling shareholders or to any other persons.

We are paying the expenses of the offering because we seek to: (i) become a reporting company with the Commission under the Securities Exchange Act of 1934; and (ii) enable our common stock to be traded on the NASD over-the-counter bulletin board. We plan to file a Form 8-A registration statement with the Commission to cause us to become a reporting company with the Commission under the 1934 Act. We must be a reporting company under the 1934 Act in order that our common stock is eligible for trading on the NASD over-the-counter bulletin board. We believe that the registration of the resale of shares on behalf of existing shareholders may facilitate the development of a public market in our common stock if our common stock is approved for trading on a recognized market for the trading of securities in the United States.

We consider that the development of a public market for our common stock will make an investment in our common stock more attractive to future investors. In the near future, in order for us to continue with our mineral exploration program, we will need to raise additional capital. We believe that obtaining reporting company status under the 1934 Act and trading on the OTCBB should increase our ability to raise these additional funds from investors.

Index to Financial Statements:

Audited consolidated financial statements for the period ended March 31, 2008, including:

| | 24 | Auditors’ Report |

| | | |

| | 25 | Balance Sheet |

| | | |

| | 26 | Statement of Operations |

| | | |

| | 27 | Statement of Stockholders’ Equity |

| | | |

| | 28 | Statement of Cash Flows |

| | | |

| | 29 | Notes to Financial Statements |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To: The Board of Directors and Shareholders

Link Resources, Inc.

Reno, Nevada

I have audited the accompanying balance sheet of Link Resources Inc. as of May 31, 2008 and the related statements of operations, stockholders’ equity and cash flows for the period then ended. These financial statements are the responsibility of the Company’s management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered an initial loss and has not yet commenced operations. This raises substantive doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

In my opinion, based on my audit, the financial statements referred to above present fairly, in all material respects, the financial position of Link Resources Inc. as of May 31, 2008 and the results of its operations, its stockholders’ equity and its cash flows for the period ended May 31, 2008, in conformity with United States generally accepted accounting principles.

The Company has determined that it is not required to have, nor was I engaged to perform, an audit of the effectiveness of its documented internal controls over financial reporting.

John Kinross-Kennedy

Certified Public Accountant

Irvine, California

July 9, 2008

| LINK RESOURCES INC. |

| (A Development Stage Company) |

| Balance Sheet |

| As at May 31, 2008 |

| | | | |

| ASSETS |

| | | | |

| CURRENT ASSETS | | | |

| Cash and Cash Equivalents | | $ | 47,768 | |

| | | | | |

| TOTAL ASSETS | | $ | 47,768 | |

| | | | | |

| | | | | |

| LIABILITIES & STOCKHOLDERS' DEFICIT |

| | | | | |

| CURRENT LIABILITES | | | - | |

| | | | | |

| Commitments and contingencies (Note 4) | | | | |

| | | | | |

| STOCKHOLDERS' DEFICIT | | | | |

Common Stock, $0.001 par value, 75,000,000 shares authorized, 3,450,000 shares issued and outstanding | | | 3,450 | |

| Additional paid-in capital | | | 50,550 | |

| Deficit accumulated in the development stage | | | (6,232 | ) |

| | | | | |

| Total Stockholders' Equity (Deficit) | | | 47,768 | |

| | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | | $ | 47,768 | |

The accompanying notes are an integral part of these financial statements

| LINK RESOURCES INC. |

| (A Development Stage Company) |

| Statement of Operations |

| | | | | | | | | | |

| | | | | | | | | For the period | |

| | | | | | | | | of Inception, | |

| | | For the three | | | For the | | | from Jan. 9, | |

| | | months ended | | | period ended | | | 2008 through | |

| | | May 31, | | | May 31, | | | May 31, | |

| | | 2008 | | | 2008 | | | 2008 | |

| | | | | | | | | | |

| Revenues | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | |

| Costs and Expenses | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Mineral Lease | | | 5,000 | | | | 5,000 | | | | 5,000 | |

| Other General & Administrative | | | 1,166 | | | | 1,232 | | | | 1,232 | |

| | | | | | | | | | | | | |

| Total Expenses | | | 6,166 | | | | 6,232 | | | | 6,232 | |

| | | | | | | | | | | | | |

| Operating Loss | | | (6,166 | ) | | | (6,232 | ) | | | (6,232 | ) |

| | | | | | | | | | | | | |

| Net Income (Loss) | | $ | (6,166 | ) | | $ | (6,232 | ) | | $ | (6,232 | ) |

| | | | | | | | | | | | | |

| Basic and Dilutive net loss per share | | | (0.01 | ) | | | (0.01 | ) | | | | |

| | | | | | | | | | | | | |

| Weighted average number of shares outstanding, basic and diluted | | | 747,902 | | | | 747,902 | | | | | |

The accompanying notes are an integral part of these financial statements

| LINK RESOURCES INC. |

| (A Development Stage Company) |

| Statement of Stockholders' Equity (Deficit) |

| For the period ended May 31, 2008 |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | Additional | | | Deficit During | | | | |

| | | Common Stock | | | Paid-in | | | Development | | | | |

| | | Shares | | | Amount | | | Capital | | | Stage | | | Total | |

| | | | | | | | | | | | | | | | |

| Balances at January 9, 2008 | | | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Common stock issued for cash in | | | | | | | | | | | | | | | | | | | | |

| April 30, 2008 at $0.02 per share | | | 1,950,000 | | | | 1,950 | | | | 37,050 | | | | | | | | 39,000 | |

| Common stock issued for cash in | | | | | | | | | | | | | | | | | | | | |

| April 30, 2008 at $0.01 per share | | | 1,500,000 | | | | 1,500 | | | | 13,500 | | | | | | | | 15,000 | |

| Net loss, period ended May 31, 2008 | | | | | | | | | | | | | | | (6,232 | ) | | | (6,232 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Balances at May 31, 2008 | | | 3,450,000 | | | $ | 3,450 | | | $ | 50,550 | | | $ | (6,232 | ) | | $ | 47,768 | |

The accompanying notes are an integral part of these financial statements

| LINK RESOURCES INC. |

| (A Development Stage Company) |

| Statements of Cash Flows |

| | | | | | | | | | |

| | | | | | | | | For the period | |

| | | | | | | | | of Inception, | |

| | | For the three | | | For the | | | from Nov. 19, | |

| | | months ended | | | period ended | | | 2007 through | |

| | | May 31, | | | May 31, | | | May 31, | |

| | | 2008 | | | 2008 | | | 2008 | |

| | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | |

| Net Income (Loss) | | $ | (6,166 | ) | | $ | (6,232 | ) | | $ | (6,232 | ) |

| Adjustments to reconcile net loss to net cash | | | | | | | | | | | | |

| used by operating activities: | | | | | | | | | | | | |

| Change in operating assets and liabilities: | | | | | | | | | | | | |

| (Increase) Decrease in accounts receivable | | | | | | | | | | | | |

| Net Cash provided by (used by) | | | | | | | | | | | | |

| Operating Activities | | | (6,166 | ) | | | (6,232 | ) | | | (6,232 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Cash (used by) Investing Activities | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | |

| Proceeds from the sale of Common Stock | | | 39,000 | | | | 54,000 | | | | 54,000 | |

| | | | | | | | | | | | | |

| Net Cash provided by Financing Activities | | | 39,000 | | | | 54,000 | | | | 54,000 | |

| | | | | | | | | | | | | |

| NET INCREASE IN CASH | | | 32,834 | | | | 47,768 | | | | 47,768 | |

| | | | | | | | | | | | | |

| CASH AT BEGINNING OF PERIOD | | | 14,934 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| CASH AT END OF PERIOD | | $ | 47,768 | | | $ | 47,768 | | | $ | 47,768 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| CASH PAID FOR: | | | | | | | | | | | | |

| Interest | | $ | - | | | $ | - | | | $ | - | |

| Income Taxes | | $ | - | | | $ | - | | | $ | - | |

The accompanying notes are an integral part of these financial statements

Link Resources, Inc.

(A Developmental Stage Company)

Notes to Financial Statements

May 31, 2008

1. Organization

Link Resources, Inc. (the “Company”) was incorporated under the laws of the State of Nevada January 9, 2008. The company was formed for mineral exploration in the United States. The Company entered into a Mineral Lease Agreement on April 1, 2008 for 2 mining claims in Pershing County, Nevada, in an area known as the Goldbanks East Prospect.

2. Summary of Significant Accounting Policies

Basis of Presentation

The financial statements of the Company have been prepared using the accrual basis of accounting in accordance with generally accepted accounting principles in the United States. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates which have been made using careful judgment.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, and reported amounts of revenue and expenses during the reporting period. Actual results could differ materially from those estimates. Significant estimates made by management are, among others, realizability of long-lived assets, deferred taxes and stock option valuation.

The financial statements have, in management’s opinion, been properly prepared within the reasonable limits of materiality and within the framework of the significant accounting.

Income Taxes

The Company utilizes SFAS No. 109, “Accounting for Income Taxes,” which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on the difference between the tax basis of assets and liabilities and their financial reporting amounts based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized. The Company generated a deferred tax credit through net operating loss carryforward.

However, a valuation allowance of 100% has been established, as the realization of the deferred tax credits is not reasonably certain, based on going concern considerations outlined as follows.

Going Concern

The Company’s financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs and to allow it to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease development of operations.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish its plans to exploit or lease its mining claim described in the initial paragraph, or engage a working interest partner, in order to eventually secure other sources of financing and attain profitable operations. The accompanying financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amount and classifications or liabilities or other adjustments that might be necessary should the Company be unable to continue as a going concern.

Development-Stage Company

The Company is considered a development-stage company, with limited operating revenues during the periods presented, as defined by Statement of Financial Accounting Standards (“SFAS”) No. 7. SFAS. No. 7 requires companies to report their operations, shareholders deficit and cash flows since inception through the date that revenues are generated from management’s intended operations, among other things. Management has defined inception as January 9, 2008. Since inception, the Company has incurred an operating loss of $6,232. The Company’s working capital has been generated through the sales of common stock. Management has provided financial data since January 9, 2008, “Inception” in the financial statements, as a means to provide readers of the Company’s financial information to make informed investment decisions.

Basic and Diluted Net Loss Per Share

Net loss per share is calculated in accordance with SFAS 128, Earnings Per Share for the period presented. Basic net loss per share is based upon the weighted average number of common shares outstanding. Diluted net loss per share is based on the assumption that all dilative convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby we used to purchase common stock at the average market price during the period.

The Company has no potentially dilutive securities outstanding as of May 31, 2008.

The following is a reconciliation of the numerator and denominator of the basic and diluted earnings per share computations for the period ended May 31, 2008:

| Numerator: | | | |

| | | | |

| Basic and diluted net loss per share: | | | |

| | | | |

| Net Loss | | $ | ( 6,232 | ) |

| | | | | |

| Denominator | | | | |

| | | | | |

| Basic and diluted weighted average | | | | |

| number of shares outstanding | | | 0 | |

| | | | | |

| Basic and Diluted Net Loss Per Share | | $ | (0.0 | ) |

3. Capital Structure

During the period from inception through May 31, 2008, the Company entered into the following equity transactions:

| April 30, 2008 | Sold 1,950,000 shares of common stock at $.02 per share realizing $39,000. |

| | |

| April 30, 2008 | Sold 1,500,000 shares of common stock at $.01 per share realizing $15,000. |

As of May 31, 2008, the Company has authorized 75,000,000 of $0.001 par common stock, of which 3,450,000 shares were issued and outstanding.

4. Commitments

On April 1, 2008 the Company entered into an indefinite lease agreement with the owner of 2 mining claims situated in Pershing County Nevada, in an area known as the Goldbanks East Prospect. The agreement requires a royalty of 3 ½ % of net smelter returns, as defined by the agreement, paid quarterly in arrears. Minimum royalty payments are to be paid on April 1st annually:

| | Due | |

1st year | April 1, 2008 | $ 5,000 Paid |

2nd year | April 1, 2009 | $ 5,000 |

3rd year | April 1, 2010 | $ 10,000 |

4th year | April 1, 2011 | $ 10,000 |

5th year | April 1, 2012 | $ 25,000 |

| Each year thereafter | | $ 75,000 plus rate of inflation |

In addition, Link Resources, Inc. is required by the agreement to pay mining claim maintenance or rental fees.

5. Contingencies, Litigation

There are no loss contingencies or significant legal proceedings against the Company with respect to matters arising in the ordinary course of business.

Our business plan is to proceed with the exploration of the Goldbanks East Prospect to determine whether there are commercially exploitable reserves of gold, silver or other metals.

We began Phase I in May 2008. Four days were spent mapping and sampling the Goldbanks East Prospect, surrounding the GB#1 & #2 lode claims held under lease by Link Resources. The purpose of this work was to evaluate the mineral potential of both the GB#1-2 claims, and the surrounding area precious metal mineralization. Detailed geologic mapping and geochemical sampling indicate the presence of lithologic-controlled structure and epithermal high-grade gold-silver silica veins and vein intersections. Epithermal gold veins in the Goldbanks East property assay 0.1-0.9 oz/t gold and as high as 1.0 – 2.0 oz/t silver. Phase one was carried out by David A. Wolfe and the end cost of the work was $3,924.71.

We have begun work on Phase two of our exploration program which consists of staking additional claims in the area. We have requested that a report on which claims are available for staking and the associated costs be prepared by David Wolfe to determine which claims the company wishes to stake. The estimated staking costs as well as the associated filing fees and maintenance fees are $6,000. The company expects to have these additional claims staked in the next 30 to 60 days. The company currently has sufficient cash reserves to proceed with this phase of its exploration program.

In a follow up to Phase two the company plans to conduct some additional mapping and sampling of the additional claims staked in the area. This is expected to take place in late October to Early November of 2008, and the company expects to have results before the end of 2008. The estimated cost of this follow up to Phase two is $5,000 to $7,000. This work will be carried out by David Wolfe. The company currently has sufficient cash reserves to proceed with this stage of its exploration program.