UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2012

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-53401

Bohai Pharmaceuticals Group, Inc.

(Exact name of registrant as specified in its charter)

Nevada (State or other jurisdiction of incorporation or organization) | 98-0697405 (I.R.S. Employer Identification No.) |

c/o YantaiBohai Pharmaceuticals Group Co. Ltd. No. 9 Daxin Road, Zhifu District Yantai, Shandong Province, China | 264000 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number (including area code): +86(535)-685-7928

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer¨ | | Accelerated filer¨ |

| Non-accelerated filer¨ | | Smaller reporting companyx |

| (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨Nox

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).x

As of February 14, 2013, there were 17,861,085 shares of company common stock issued and outstanding.

Bohai Pharmaceuticals Group, Inc.

Quarterly Report on Form 10-Q

TABLE OF CONTENTS

| PART I – FINANCIAL INFORMATION | |

| | |

| Cautionary Note Regarding Forward-Looking Statements | 3 |

| | |

| Item 1. | Financial Statements (unaudited) | 4 |

| | | |

| | Condensed Consolidated Balance Sheets as of December 31, 2012 and June 30, 2012 | 4 |

| | | |

| | Condensed Consolidated Statements of Income and Comprehensive Income for the Three and Six Months ended December 31, 2012 and 2011 | 5 |

| | | |

| | Condensed Consolidated Statements of Changes in Stockholders’ Equity for the Six Months Ended December, 2012 | 6 |

| | | |

| | Condensed Consolidated Statements of Cash Flows for the Six Months ended December 31, 2012 and 2011 | 7 |

| | | |

| | Notes to Condensed Consolidated Financial Statements | 8 |

| | | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 26 |

| | | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 38 |

| | | |

| Item 4. | Controls and Procedures | 38 |

| | |

| PART II – OTHER INFORMATION | |

| | |

| Item 1. | Legal Proceedings | 39 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 40 |

| Item 3. | Defaults Upon Senior Securities | 40 |

| Item 4. | Mine Safety Disclosures | 40 |

| Item 5. | Other Information | 40 |

| Item 6. | Exhibits | 40 |

| | |

| SIGNATURES | 41 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this Quarterly Report on Form 10-Q contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. We cannot give any guarantee that the plans, intentions or expectations described in the forward looking statements will be achieved. All forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including those factors described in the “Risk Factors” section of our Annual Report for the fiscal year ended June 30, 2012. Readers should carefully review such risk factors as well as factors described in other documents that we file from time to time with the Securities and Exchange Commission.

In some cases, you can identify forward-looking statements by terminology such as “guidance,” “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “proposed,” “intended,” or “continue” or the negative of these terms or other comparable terminology. You should read statements that contain these words carefully, because they discuss our expectations about our future operating results or our future financial condition or state other “forward-looking” information. There may be events in the future that we are not able to accurately predict or control. You should be aware that the occurrence of any of the events described in our risk factors and other disclosures could substantially harm our business, results of operations and financial condition, and that upon the occurrence of any of these events, the trading price of our securities could decline. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, growth rates, and levels of activity, performance or achievements. Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include, without limitation:

| | § | our ability to generate or obtain through financing sufficient working capital to (i) fund the acquisition of Yantai Tianzheng (a total of $12,827,185 is currently due); (ii) satisfy our obligations under our convertible notes due April 5, 2013 (currently $8,464,500 is due), (iii) satisfy an approximately $12,680,000 payable in 2013 for a new land use right we acquired in November 2012 (due in two equal installments at June 30 and December 31, 2013) or (iii) otherwise to support our business plans; |

| | | |

| | § | our ability to integrate the business of Yantai Tianzheng and any future acquisitions into our business; |

| | § | our ability to expand or adjust the mix of our product offerings and maintain the quality of our products; |

| | § | the availability of government granted rights to exclusively manufacture or co-manufacture our products; |

| | § | the availability of national healthcare reimbursement of our products in the PRC; |

| | § | our ability to manage our expanding operations and continue to fill customers’ orders on time; |

| | § | our ability to maintain adequate control of our expenses allowing us to realize anticipated revenue growth; |

| | § | our ability to maintain or protect our intellectual property; |

| | § | our ability to maintain our proprietary technology; |

| | § | the impact of government regulation in China and elsewhere, including the support provided by the Chinese government to the Traditional Chinese Medicine and healthcare sectors in China; |

| | § | our ability to implement product development, marketing, sales and acquisition strategies and adapt and modify them as needed; |

| | § | our implementation of required financial, accounting and disclosure controls and procedures and related corporate governance policies; and |

| | § | our ability to anticipate and adapt to changing conditions in the Traditional Chinese Medicine and healthcare industries resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

We cannot give any guarantee that our plans, intentions or expectations will be achieved. All forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including those factors listed above and described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended June 30, 2012. Except as required by applicable law and including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | December 31, | | | June 30, | |

| | | 2012

(UNAUDITED) | | | 2012 | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash | | $ | 3,154,584 | | | $ | 18,386,288 | |

| Restricted cash | | | 8,407,565 | | | | 9,449,905 | |

| Accounts receivable | | | 42,866,521 | | | | 29,670,552 | |

| Inventories | | | 3,280,053 | | | | 3,795,915 | |

| Prepaid expenses and other current assets | | | 487,141 | | | | 879,696 | |

| | | | | | | | | |

| Total current assets | | | 58,195,864 | | | | 62,182,356 | |

| | | | | | | | | |

| Non - current assets: | | | | | | | | |

| Property, plant and equipment, net | | | 11,840,729 | | | | 11,681,272 | |

| Prepayment for property, plant and equipment | | | 2,626,567 | | | | 594,508 | |

| Intangible assets - pharmaceutical formulas | | | 13,823,121 | | | | 25,610,557 | |

| Long term prepayments - land use right, net | | | 37,388,468 | | | | 18,739,297 | |

| Other intangible assets, net | | | 29,762,154 | | | | 21,497,890 | |

| Goodwill | | | 5,096,740 | | | | 5,092,139 | |

| Total Non - current assets | | | 100,537,779 | | | | 83,215,663 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 158,733,643 | | | $ | 145,398,019 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Convertible notes, due April 5, 2013 | | $ | 8,464,500 | | | $ | 10,036,000 | |

| Accounts payable | | | 3,612,366 | | | | 3,334,101 | |

| Accrued expenses | | | 12,126,265 | | | | 8,478,054 | |

| Land use right payable | | | 12,681,102 | | | | 0 | |

| Income taxes payable | | | 2,772,175 | | | | 2,338,825 | |

| Acquisition purchase price payable - current portion | | | 0 | | | | 5,000,000 | |

| Derivative liabilities - investor and agent warrants | | | 0 | | | | 1,211,236 | |

| Due to Related Party | | | 44,044 | | | | 36,002 | |

| | | | | | | | | |

| Total current liabilities | | | 39,700,452 | | | | 30,434,218 | |

| | | | | | | | | |

| Non - current liabilities: | | | | | | | | |

| Acquisition purchase price payable - non-current portion | | | 12,827,185 | | | | 20,300,000 | |

| Deferred tax liability | | | 7,845,142 | | | | 8,161,269 | |

| Total Non - current liabilities | | | 20,672,327 | | | | 28,461,269 | |

| | | | | | | | | |

| TOTAL LIABILITIES | | | 60,372,779 | | | | 58,895,487 | |

| | | | | | | | | |

| COMMITMENTS, CONTINGENCIES, AND OTHER MATTERS | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY | | | | | | | | |

| Common stock, $0.001 par value, 150,000,000 shares authorized, 17,861,085 shares issued and outstanding as of December 31, 2012 and June 30, 2012, respectively | | | 17,861 | | | | 17,861 | |

| Additional paid-in capital | | | 24,615,353 | | | | 24,615,353 | |

| Accumulated other comprehensive income | | | 6,440,159 | | | | 6,236,076 | |

| Statutory reserves | | | 2,201,817 | | | | 2,201,817 | |

| Retained earnings | | | 65,085,674 | | | | 53,431,425 | |

| | | | | | | | | |

| Total stockholders’ equity | | | 98,360,864 | | | | 86,502,532 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 158,733,643 | | | $ | 145,398,019 | |

See accompanying notes to the condensed consolidated financial statements

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE INCOME

(UNAUDITED)

| | | For the Three Months Ended December 31, | | | For the Six Months Ended December 31, | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Net revenues | | $ | 40,932,506 | | | $ | 34,836,886 | | | $ | 76,281,326 | | | $ | 64,764,742 | |

| Cost of revenues | | | 8,632,261 | | | | 7,982,397 | | | | 17,224,365 | | | | 14,926,117 | |

| | | | | | | | | | | | | | | | | |

| Gross profit | | | 32,300,245 | | | | 26,854,489 | | | | 59,056,961 | | | | 49,838,625 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 22,546,807 | | | | 18,108,529 | | | | 39,753,923 | | | | 33,713,420 | |

Impairment Charge - drug formula | | | 1,688,486 | | | | 0 | | | | 1,688,486 | | | | 0 | |

| Depreciation and amortization | | | 1,343,204 | | | | 617,463 | | | | 2,302,094 | | | | 1,247,061 | |

| | | | | | | | | | | | | | | | | |

| Total Operating expenses | | | 25,578,497 | | | | 18,725,992 | | | | 43,744,503 | | | | 34,960,481 | |

| Income from operations | | | 6,721,748 | | | | 8,128,497 | | | | 15,312,458 | | | | 14,878,144 | |

| | | | | | | | | | | | | | | | | |

| Other income (expenses): | | | | | | | | | | | | | | | | |

| Interest income | | | 8,541 | | | | 16,924 | | | | 26,326 | | | | 38,166 | |

| Interest expenses | | | (426,323 | ) | | | (6,951,562 | ) | | | (939,356 | ) | | | (9,574,073 | ) |

| Other (expenses) income, net | | | 115 | | | | (1,322 | ) | | | (16,591 | ) | | | (8,402 | ) |

| Change in fair value of derivative liabilities | | | 713,234 | | | | (191,747 | ) | | | 1,211,236 | | | | 140,738 | |

| Total other income (expenses) | | | 295,567 | | | | (7,127,707 | ) | | | 281,615 | | | | (9,403,211 | ) |

| Income before provision for income taxes | | | 7,017,315 | | | | 1,000,790 | | | | 15,594,073 | | | | 5,474,933 | |

| Provision for income taxes | | | (1,758,578 | ) | | | (2,296,292 | ) | | | (3,939,824 | ) | | | (4,114,651 | ) |

| Net income (loss) | | $ | 5,258,737 | | | $ | (1,295,502 | ) | | $ | 11,654,249 | | | $ | 1,360,282 | |

| | | | | | | | | | | | | | | | | |

| Comprehensive income (loss): | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 5,258,737 | | | $ | (1,295,502 | ) | | $ | 11,654,249 | | | $ | 1,360,282 | |

| Unrealized foreign currency translation gain | | | 453,030 | | | | 1,040,980 | | | | 204,083 | | | | 1,655,580 | |

| Comprehensive income (loss) | | $ | 5,711,767 | | | $ | (254,522 | ) | | $ | 11,858,332 | | | $ | 3,015,862 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) per common share | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.29 | | | $ | (0.07 | ) | | $ | 0.65 | | | $ | 0.08 | |

| Diluted | | $ | 0.25 | | | $ | (0.07 | ) | | $ | 0.55 | | | $ | 0.08 | |

| Weighted average common shares outstanding | | | | | | | | | | | | | | | | |

| Basic | | | 17,861,085 | | | | 17,861,085 | | | | 17,861,085 | | | | 17,861,085 | |

| Diluted | | | 22,093,335 | | | | 17,861,085 | | | | 22,093,335 | | | | 17,861,085 | |

See accompanying notes to the condensed consolidated financial statements

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE SIX MONTHS ENDED DECEMBER 31, 2012

(UNAUDITED)

| | | Common stock | | | Additional | | | | | | | | | | | | Total | |

| | | Shares

outstanding | | | Amount | | | paid-in

capital | | | Accumulated other

comprehensive income | | | Statutory

Reserves | | | Retained Earnings | | | Stockholders’

Equity | |

| | | | | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2012 | | | 17,861,085 | | | $ | 17,861 | | | $ | 24,615,353 | | | $ | 6,236,076 | | | $ | 2,201,817 | | | $ | 53,431,425 | | | $ | 86,502,532 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | 0 | | | | 0 | | | | 0 | | | | 204,083 | | | | 0 | | | | 0 | | | | 204,083 | |

| Net income | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 11,654,249 | | | | 11,654,249 | |

| Balance at December 31, 2012 | | | 17,861,085 | | | $ | 17,861 | | | $ | 24,615,353 | | | $ | 6,440,159 | | | $ | 2,201,817 | | | $ | 65,085,674 | | | $ | 98,360,864 | |

See accompanying notes to the condensed consolidated financial statements

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | For the Six Months Ended | |

| | | December 31, | |

| | | 2012 | | | 2011 | |

| | | | | | | |

| Cash flows from operating activities: | | | | | | | | |

| | | | | | | | | |

| Net income | | $ | 11,654,249 | | | $ | 1,360,282 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| | | | | | | | | |

| Depreciation and amortization | | | 2,553,839 | | | | 1,452,600 | |

| Impairment of intangible assets - pharmaceutical formulas | | | 1,688,486 | | | | 0 | |

| Amortization of debt issue costs | | | 0 | | | | 472,140 | |

| Non-cash interest-convertible notes | | | 0 | | | | 8,597,701 | |

| Change in fair value of warrants | | | (1,211,236 | ) | | | (140,738 | ) |

| Stock based compensation | | | 0 | | | | 44,000 | |

| Deferred income taxes | | | (323,476 | ) | | | 460,185 | |

| | | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (13,168,118 | ) | | | (3,034,163 | ) |

| Prepaid expenses and other assets | | | 393,515 | | | | 887,328 | |

| Inventories | | | 519,251 | | | | (99,530 | ) |

| Accounts payable | | | 275,229 | | | | (405,731 | ) |

| Accrued liabilities | | | 3,637,723 | | | | 1,115,297 | |

| Income taxes payable | | | 431,203 | | | | 1,048,516 | |

| Advance from customers | | | 0 | | | | (78,257 | ) |

| Restricted cash | | | 0 | | | | 10,814 | |

| | | | | | | | | |

| Net cash provided by operating activities | | | 6,450,665 | | | | 11,690,444 | |

| | | | | | | | | |

| Cash flows used in investing activities: | | | | | | | | |

| Purchases of property, plant and equipment | | | (433,131 | ) | | | (1,220,889 | ) |

| Proceeds from disposal of property, plant and equipment | | | 0 | | | | 101,734 | |

| Land use rights payments | | | (6,340,048 | ) | | | (143,471 | ) |

| Property, plant and equipment deposits | | | (2,031,361 | ) | | | 0 | |

| Cash received in acquisition of business | | | 0 | | | | 1,358,078 | |

| Cash paid for acquisition of business | | | (12,472,815 | ) | | | (9,700,000 | ) |

| | | | | | | | | |

| Deposit of restricted cash-convertible note escrow deposit | | | 1,885,695 | | | | 407,186 | |

| Release of restricted cash- convertible note escrow deposit | | | (834,988 | ) | | | (407,186 | ) |

| | | | | | | | | |

| Net cash used in investing activities | | | (20,226,648 | ) | | | (9,604,548 | ) |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Repayment of short term borrowings | | | 0 | | | | (1,479,058 | ) |

| Borrowing from related party | | | 8,020 | | | | 0 | |

Repayment of receivable due from related party | | | 0 | | | | 9,497 | |

| Repayment of convertible notes | | | (1,571,500 | ) | | | 0 | |

| Capital contribution from shareholder | | | 0 | | | | 6,260,565 | |

| | | | | | | | | |

| Net cash flows (used in) provided by financing activities | | | (1,563,480 | ) | | | 4,791,004 | |

| | | | | | | | | |

| Effect of foreign currency translation on cash and cash equivalents | | | 107,759 | | | | 212,634 | |

| | | | | | | | | |

| Net (decrease) increase in cash and cash equivalents | | | (15,231,704 | ) | | | 7,089,534 | |

| | | | | | | | | |

| Cash and cash equivalents at beginning of period | | | 18,386,288 | | | | 13,344,426 | |

| | | | | | | | | |

| Cash and cash equivalents at end of period | | $ | 3,154,584 | | | $ | 20,433,960 | |

| | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Interest | | $ | 282,150 | | | $ | 506,046 | |

| Income taxes | | $ | 3,832,103 | | | $ | 2,656,241 | |

| | | | | | | | | |

| Supplemental cash flow information | | | | | | | | |

| | | | | | | | | |

| Non-cash investing and financing activities: | | | | | | | | |

| Land use right increase by land use right payable | | | 12,681,102 | | | | 0 | |

| Acquisition liability | | $ | | | | $ | 25,300,000 | |

See accompanying notes to the condensed consolidated financial statements

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED DECEMBER 31, 2012

| 1. | ORGANIZATION AND PRINCIPAL ACTIVITIES |

The Company’s Operations

Bohai Pharmaceuticals Group, Inc. (“BPGI”) was incorporated under the laws of the State of Nevada on January 9, 2008 under the name of Link Resources, Inc. Prior to January 5, 2010, BPGI was a public “shell” company. BPGI became a public operating company on January 5, 2010 pursuant to a Share Exchange Transaction completed on January 5, 2010.

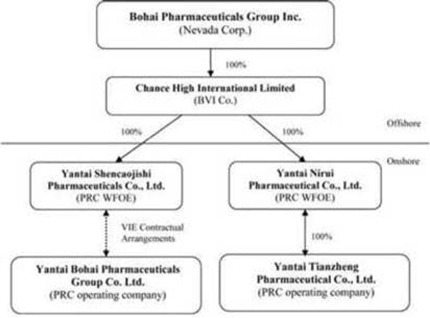

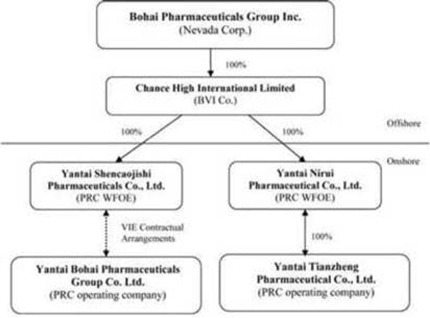

BPGI is engaged in the production, manufacturing and distribution of herbal pharmaceuticals based on traditional Chinese medicine (“TCM”) in the People’s Republic of China (“China” or the “PRC”) through the following two operating subsidiaries:

(i) Yantai Bohai Pharmaceuticals Group Co., Ltd., (“Bohai”) a PRC company and the Company’s original operating subsidiary BPGI controls Bohai through a variable interest entity arrangement (“VIE”) described below; and

(ii) Yantai Tianzheng Pharmaceuticals Company, Ltd., a PRC company (“Yantai Tianzheng”) which BPGI acquired effective July 1, 2011 through a newly formed PRC wholly-foreign owned enterprise subsidiary, Yantai Nirui Pharmaceuticals, Ltd. (“WFOE II”).

BPGI owns 100% of Chance High International Limited, a British Virgin Islands company (“Chance High”). Chance High owns 100% of the issued and outstanding shares of capital stock of a Chinese wholly-foreign owned enterprise known as Yantai Shencaojishi Pharmaceuticals Co., Ltd. (the “WFOE”). On December 7, 2009 (prior to the date of the Share Exchange Transaction), the WFOE entered into a series of variable interest entity contractual agreements (the “VIE Agreements”) with Bohai and its three shareholders, including Mr. Hongwei Qu, the Company’s current Chairman and Chief Executive Officer (“Mr. Qu”). Mr. Qu currently owns 96.7% of the outstanding equity interests of Bohai and two other shareholders who collectively own the remaining 3.3% of Bohai.

The VIE Agreements include (i) a Consulting Services Agreement, (ii) an Operating Agreement, and (iii) a Proxy Agreement, through which the WFOE has the right to advise, consult, manage and operate Bohai for an annual fee equal to all of Bohai’s yearly net profits after tax. Pursuant to these agreements, the WFOE indirectly owns but has 100% managerial and economic control of the business activities of Bohai including the right to appoint all executives and senior management and members of the board of directors of Bohai. Additionally, Bohai’s shareholders pledged their rights, titles and equity interest in Bohai as security for the WFOE to collect consulting and services fees provided to Bohai pursuant to an equity pledge agreement. In order to further reinforce the WFOE’s rights to control and operate Bohai, Bohai’s shareholders granted the WFOE an exclusive right and option to acquire all of their equity interests in Bohai through an option agreement. The VIE Agreements have perpetual terms unless otherwise determined by PRC law, and can (particularly in the case of the Consulting Services Agreement (which is the principal VIE Agreement) be terminated by the parties under certain circumstances, including material breach, the termination of Bohai’s business or a liquidation of Bohai. The WFOE (which is controlled indirectly by BPGI through Chance High) can also terminate the Consulting Services Agreement at will.

BPGI, its wholly owned subsidiary Chance High, WFOE, WFOE II, Bohai and Yantai Tianzheng are referred to herein collectively and as a consolidated basis as the “Company” or “we”, “us” or “our” or similar terminology. Mr. Qu currently serves the Company’s Chairman, Chief Executive Officer and President. As used herein, the term “Common Stock” means the common stock of BPGI, $0.001 par value per share.

BPGI is headquartered and maintains its principal operations in the city of Yantai, Shandong Province, China, and conducts business operations exclusively in the PRC.

Recent Developments

During the three months ended December 31, 2012, management performed an evaluation of the Company’s product portfolio based on a confluence of factors that have emerged within China’s pharmaceutical industry and consumer markets. These factors include, among others, (i) current economic conditions in China and management’s expectations of future economic trends, (ii) changes in China’s Essential Drug Laws, (iii) the PRC Central Government’s policy designating lists of specific drugs eligible for reimbursement, (iv) consumers’ preference for drug delivery systems in the forms of pills, tablets and ingestible liquids, and (v) competition from other drug manufacturing companies within China. Based on these factors, management determined that the Company will streamline its operations to focus on the continued distribution of Lung Nourishing Syrup, Tongbi Capsules, Tongbi Tablets, Fangfengtongsheng Granule, and Zhengxintai Capsules and certain other products. As a consequence, management determined that it would be in the best interests of the Company and its stockholders to commit to a plan of (i) fully abandoning plans to create new products from a limited number of formulas purchase in 2005, and (ii) indefinitely suspending plans to develop and produce a more diversified portfolio that would be derived from a series of other approved formulas that the Company purchased in 2010 and 2005.

As a result, the Company (i) recorded an impairment charge of $1,688,486 for the aggregate carrying amount of certain product formulas that the Company will abandoned in their entirety, and (ii) reclassified $10,121,956 for the carrying amount of certain other product formulas that the Company will hold as defensive assets. Formulas to be held as defensive assets will be amortized over a period of 8 years (Note 6).

| 2. | LIQUIDITY AND FINANCIAL CONDITION |

The Company’s net income amounted to $5,258,737 and $11,654,249 for the three and six-month periods ended December 31, 2012. The Company’s cash flows from operations amounted to $6,450,665 for the six months ended December 31, 2012. The Company had working capital of approximately $18,495,412 as of December 31, 2012, including an $8,464,500 convertible note obligation, which following a series of amendments thereto is set to mature on April 5, 2013 (see below and Note 10). The Company has historically financed its operations principally from cash flows generated from operating activities and external financing raised in the private placement of convertible notes described above.

On August 8, 2011, the Company, through WFOE II, signed a share transfer agreement with the shareholders of Yantai Tianzheng to acquire 100% of Yantai Tianzheng for total purchase consideration of US$35,000,000 (paid in its RMB equivalent, of which US$6,000,000 was paid as of the Execution Date of the acquisition and the remaining $29,000,000 was payable in series of installments which the Company at its discretion, could elect to defer (Note 11). The Company paid $19,700,000 to date (of which $10,000,000 was paid during the three months ended December 31. 2012) and elected to defer $15,300,000. The Company also made $2,472,815 of individual income tax payments to tax authorities on behalf of the former Yantai Tianzheng shareholders concurrent with the $10,000,000 of principal payments. The tax payments made on behalf of the former Yantai Tianzheng shareholders was applied as a reduction of the remaining principal balance of the acquisition purchase price payable. As of December 31, 2012, the balance of $12,827,185 is payable as follows; $7,827,185 is due on August 8, 2014, and the remaining $5,000,000 is due on February 8, 2015.

The Company is expecting to gain the benefits of the economies of scale that management believes could be realized by having combined and streamlining the cost structures of the historical Bohai and the acquired Yantai Tianzheng businesses. As described above, the Company has committed to a plan of streamlining the combined around the more focused portfolio of products that include non-prescription drug products acquired as part of the YantaiTianzheng’s product portfolio.

On June 8, 2010, Yantai Tianzheng signed an agreement with Yantai Huanghai Construction Co. to construct certain portions of a factory The total contract price amounted to approximately $3.07 million (RMB 19.5 million). Construction is estimated to be completed in April 2013. The remaining commitment of the contract was approximately $1.25 million (RMB 7.9 million) as of December 31, 2012.

On November 5, 2012, the Company acquired a new land use right of 266,668 square meters located in the high-tech development district of Laishan. The Company was granted the right to use the land for a period of 50 years at a total cost of approximately $19 million (RMB 120,000,000). As of December 31, 2012, the Company paid $6,340,550. The Company is obligated to make two remaining installment payments of $6,340,551 each by June 30, 2013 and December 31, 2013 (see Note 7).

Management believes, based on the Company’s historical ability to fund operations using internally generated cash flow and the progress made towards integrating the business of Yantai Tianzheng, and subsequent commitment to focus on a more streamlined higher margin product portfolio, that the Company’s currently available cash and funds it expects to generate from operations will enable it to operate the business and satisfy short term obligations through at least January 1, 2014. Notwithstanding, the Company still has substantial obligations described herein and there is no assurance that unforeseen circumstances would not have a material adverse effect on the Company’s financial condition.

As described above, the Company has ongoing obligations with respect to the Yantai Tianzheng acquisition, whether or not the intended benefits of the acquisition are realized. The Company also has amounts due under its 2012 acquisition of land use rights. The Company is also required to repay the remaining $8,464,500 convertible notes balance due as of December 31, 2012, which pursuant to a series of amendments to the original notes, is currently due on an extended maturity date of April 5, 2013. As described in Note 10, the Company has been unable to convert a sufficient number of RMBs into US dollars due to certain currency restrictions in China. As a result, the Company was unable to repay the notes upon their original maturity of January 5, 2012.

As described whereas herein, the Company has at times, been in temporary default of its obligation to repay the convertible notes at previously extended maturity dates. Should the Company be unable to repay the notes on April 5, 2013 in the absence of a further extension of the maturity date, this circumstance would constitute an event of default under the terms of loan agreement. The Company cannot predict what the implications of the non-payment of the loan would be other than it would continue to experience difficulty converting sufficiency currency and will maintain an escrow account of restricted funds intended to secure their repayment. The non-payment of the notes could have a material adverse effect on the Company should the note holders pursue further action.

The Company will require significant additional capital in order to fund these obligations and execute its longer term business plan. If the Company is unable to generate sufficient operating cash flows or raise additional capital, or encounters unforeseen circumstances that place constraints on its capital resources, management will be required to take various measures to conserve liquidity. Such measures could include, but not necessarily be limited to, curtailing the Company’s business development activities (as was done recently), suspending the pursuit of one or more elements of its business plan, and controlling overhead expenses. There is a material risk, and management cannot provide any assurances, that the Company will raise additional capital if needed. The Company has not received any commitments for new financing, and cannot provide any assurance that new financing will be available to the Company on acceptable terms, if at all. The failure of the Company to fund its obligations when needed would have a material adverse effect on its business and results of operations.

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of BPGI, its wholly-owned subsidiary Chance High, WFOE, WFOE II, Yantai Tianzheng and Bohai. All significant intercompany accounts and transactions have been eliminated in consolidation.

The Company, in determining whether it is required to consolidate investee businesses, considers both the voting and variable interest models of consolidation as required under applicable GAAP. The Company adopted FAS Accounting Standards Codification (“ASC”) 810-10-15-14 and also ASC 810-10-05-8, which requires that a VIE be consolidated if that company is entitled to receive a majority of the VIE’s residual returns and has direct ability to make decisions on all operating activities of the VIE. The Company controls Bohai through the VIE Agreements described in Note 1, under the following series of agreements entered into on December 7, 2009.

Under the Operating Agreement entered into between WFOE and Bohai, the WFOE has the direct ability to make decisions on all the operating activities and exercise all voting rights of Bohai. Under the Consulting Services Agreement entered into between WFOE and Bohai, Bohai agreed to pay all of its net income to WFOE quarterly as a consulting fee. Accordingly, WFOE has the right to receive the expected residual returns of Bohai. As such, the Company is the primary beneficiary of and maintains controlling managerial and financial interest in, Bohai in accordance with ASC 810-10-15-14. Accordingly, Bohai’s financial position and results of operations are consolidated with those of the Company for all periods presented.

We initially measured the assets, liabilities, and non-controlling interests of Bohai at their carrying amounts as of the date of the Share Exchange. We have subsequently accounted for the assets, liabilities, and non-controlling interest of Bohai as if it was consolidated based on voting interests. The usual accounting rules for which the VIE operates are applied as they would to a consolidated subsidiary as follows:

| · | Carrying amounts of the VIE are consolidated into the financial statements of the Company as the primary beneficiary, or Primary Beneficiary (“PB”); and |

| · | Inter-company transactions and balances, such as revenues and costs, receivables and payables between or among the PB and the VIE(s) are eliminated in their entirety. |

The carrying amount and classification of Bohai’s assets and liabilities included in the condensed consolidated balance sheets are as follows:

| | | December 31, | | | June 30, | |

| | | 2012

(unaudited) | | | 2012 | |

| | | | | | | |

| Total current assets* | | $ | 59,807,268 | | | $ | 51,470,381 | |

| Total assets* | | | 127,235,857 | | | | 99,899,826 | |

| Total current liabilities** | | | 29,839,063 | | | | 11,689,137 | |

| Total liabilities** | | $ | 33,416,087 | | | $ | 15,277,230 | |

* Includes intercompany accounts in the amounts of $25,319,663 and $20,338,295 in current assets as of December 31, 2012 and June 30, 2012, respectively, that were eliminated in consolidation.

** Includes intercompany accounts in the amounts of $3,443,860 and $2,490,528 in current liabilities as of December 31, 2012 and June 30, 2012, respectively, that were eliminated in consolidation.

Basis of Presentation

The condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial statements and with the instructions to Form 10-Q and Article 8 of Regulation S-X of the United States Securities and Exchange Commission (“SEC”). Accordingly, they do not contain all information and footnotes required by GAAP for annual financial statements. In the opinion of the Company’s management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary (consisting only of normal recurring accruals) to present the financial position of the Company as of December 31, 2012 and the results of operations and cash flows for the periods presented. The results of operations for the six months ended December 31, 2012 are not necessarily indicative of the operating results for the full fiscal year or any future period. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes thereto included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2012. The Company’s accounting policies are described in the Notes to Consolidated Financial Statements in its Annual Report on Form 10-K for the year ended June 30, 2012, filed on September 28, 2012, and updated, as necessary, in this Quarterly Report on Form 10-Q.

Business Segments

The Company’s operates its business through a single reporting segment.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made; however, actual results could differ materially from those results.

Significant estimates and assumptions include allocating purchase consideration issued in business combinations, valuing equity securities and derivative financial instruments issued in financing transactions and in share-based payment arrangements, accounts receivable reserves, inventory reserves, and evaluating the carrying amounts and useful lives of intangible assets. Certain estimates, including accounts receivable and inventory reserves and the carrying amounts of intangible assets (including present value of future cash flow estimates for the Company’s pharmaceutical formulas) could be affected by external conditions including those unique to the Company’s industry and general economic conditions. It is reasonably possible that these external factors could have an effect on management’s estimates that could cause actual results to differ from management’s estimates.

Company management re-evaluates all of accounting estimates at least quarterly based on these conditions and records adjustments, when necessary.

Cash and Cash Equivalents

We consider all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. We maintain bank accounts in the PRC and a checking account in the United States of America that principally consist of demand deposits. We also have restricted cash accounts in the United States that include funds designated for interest payments due to convertible note holders and for use in investor relations programs pursuant to a securities purchase agreement.

Restricted Cash

The Company is required by its Note holders to maintain deposits in escrow accounts to fund the principal and interest payments under convertible Notes obligation. Escrow account balances amounted to $8,407,565 and $9,449,905 as of December 31, 2012 and June 30, 2012, respectively. As of December 31, 2012, the Company had one escrow account in China amounting to $8,401,230 and one escrow account in US amounting to $6,335. As of June 30, 2012, the Company had one escrow account in China amounting to $9,343,870 and one escrow account in US amounting to $106,035.

Accounts Receivable

Accounts receivable consists of amounts due from customers. We extend unsecured credit to our customers in the ordinary course of business but mitigate the associated risks by performing credit checks and actively pursuing past due accounts. Company’s credit terms generally range from 90 to 180 days. The Company has one customer with payment terms of up to 360 days with an outstanding balance of $2,532,337 as of December 31, 2012. The Company’s policy with respect accounts receivable reserves is to establish an allowance for doubtful accounts based on management’s assessment of known requirements, aging of receivables, payment history, specific customer’s current credit worthiness, and the economic environment. The Company has a significantly low history of credit losses and no historical pattern of making any price or collection concessions with respect of its accounts receivable balances. Accordingly, an allowance for doubtful accounts is not considered necessary based on management’s assessment.

Inventories

Inventories are valued at the lower of cost, determined using the weighted average method, or market. Finished goods inventories include the costs of raw materials, direct labor and overhead associated with the manufacturing process. In assessing the ultimate realization of inventories, management makes judgments as to future demand requirements compared to current or committed inventory levels. Our reserve requirements generally increase/decrease due to management’s projected demand requirements, market conditions and product life cycle changes. As of December 31, 2012 and June 30, 2012, management does not believe that any inventory reserves are necessary.

Property, Plant and Equipment

Property, plant and equipment are carried at cost and are depreciated on a straight-line basis over the estimated useful lives of the assets that range from 5 to 10 years for office equipment, machinery, and vehicles and 30 to 40 years for buildings. The cost of repairs and maintenance is charged to expense as incurred; major replacements and improvements are capitalized. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition. We examine the possibility of impairment in the value of fixed assets when events or changes in circumstances reflect the fact that their recorded value may not be recoverable.

Intangible Asset – Pharmaceutical Formulas

The Company has purchased pharmaceutical formulas that were approved by the State Food and Drug Administration of China (“SFDA”). These formulas can be renewed every 5 years without limitation for a minimum fee and are subject to certain protections under PRC drug regulations for an indefinite period of time. These regulations mitigate competition and the ability of other suppliers to replicate the Company’s products or produce comparable substitutes. These intangible assets are measured initially at cost not subject to amortization and are tested for impairment annually or in interim reporting periods if events or changes in circumstances indicate that the carrying amounts of these intangible assets might not be recoverable.

During the second quarter of our fiscal year ended June 30, 2013, we determined that we will no longer manufacture or seek to develop a market for ten of our products due to a change in our business strategy as more fully described in notes 1 and 2. As a result of this decision, we recorded an impairment charge in the amount of $1,668,486 during the quarter ended December 31, 2012. In addition to the above, we reclassified certain other formulas with an aggregate carrying amount of $10,121,956 to other intangible assets. The Company has suspended plans to develop and manufacture products to be derived from these formulas but intends to retain them to mitigate competition and maintain the option of using these formulas should they be useful in the future. Accordingly, the Company has determined these formulas, which are approved by the State Food and Drug Administration, should be held as defensive assets. The Company determined that there formulas have an estimated useful life of 9 years as defensive assets.

Fair Value Measurements and Fair Value of Financial Instruments

We adopted the guidance of ASC 820 for fair value measurements, which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2 - Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3 - Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

The carrying amounts reported in the condensed consolidated balance sheets for cash, accounts receivable, other receivables, short-term borrowings, accounts payable and accrued expenses, customer advances, and amounts due from related parties approximate their fair market value based on the short-term maturity of these instruments.

ASC 825-10 “Financial Instruments,” allows entities to voluntarily choose to measure certain financial assets and liabilities at fair value (fair value option). The fair value option may be elected on an instrument-by-instrument basis and is irrevocable, unless a new election date occurs. If the fair value option is elected for an instrument, unrealized gains and losses for that instrument should be reported in earnings at each subsequent reporting date. We use Level 3 inputs to value the Company’s derivative liabilities.

The following table reflects gains and losses for the three and six months ended December 31, 2012 for all financial assets and liabilities categorized as Level 3.

| Liabilities: | | Three

months

(unaudited) | |

| | | | |

| Balance of warrant liabilities as of September 30, 2012 | | $ | 713,233 | |

| Change in the fair value of warrant liabilities | | | (713,233 | ) |

| Balance of warrant liabilities as of December 31, 2012 | | $ | - | |

| Liabilities: | | Six

months

(unaudited) | |

| | | | |

| Balance of warrant liabilities as of June 30, 2012 | | $ | 1,211,236 | |

| Change in the fair value of warrant liabilities | | | (1,211,236 | ) |

| Balance of warrant liabilities as of December 31, 2012 | | $ | - | |

Estimating the fair value of derivative financial instruments require the development of significant and subjective estimates that may, and are likely to, change over the duration of the instrument with related changes in internal and external market factors. The assumptions used to value the Company’s derivatives, which had a direct effect on the fair values described above are more fully described in Note 11. In addition, valuation techniques are sensitive to changes in the trading market price of the our Common Stock and its estimated volatility interest rate changes and other variables or market conditions not within the Company’s control that can significantly affect management’s estimates of fair value and changes in fair value. Because derivative financial instruments are initially and subsequently carried at fair value, the Company’s net income may include significant charges or credits as these estimates and assumptions change.

Foreign Currency Translation

The Company’s reporting currency is the U.S. dollar. The functional currency of the Company’s operating business based in the PRC is the RMB. For the Company’s subsidiaries and affiliates whose functional currencies are the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the exchange rate in effect as of the end of the period, and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the functional currency financial statements into U.S. dollars are included in comprehensive income.

Exchange gains or losses arising from foreign currency transactions are included in the determination of net income for the respective periods. All of the Company’s revenue transactions are transacted in the functional currency. The Company has not entered into any material transactions that are either originated, or to be settled, in currencies other than the RMB. Accordingly, transaction gains or losses have not had, and are not expected to have a material effect on the Company’s results of operations.

Period end exchange rates used to translate assets and liabilities and average exchange rates used to translate results of operations in each of the reporting periods are as follows:

| | | Six Months

ended

December 31, 2012 | | | Six Months

ended

December 31, 2011 | |

| Period end US$: RMB exchange rate | | | 6.3086 | | | | 6.3585 | |

| Average periodic US$: RMB exchange rate | | | 6.3091 | | | | 6.3892 | |

Period end US$ : RMB exchange rate as of June 30, 2012 is 6.3143. The RMB is not freely convertible into any other currencies. In addition, all foreign exchange transactions in the PRC must be conducted through authorized institutions. Accordingly, management cannot provide any assurance that the RMB underlying the condensed consolidated financial statement amounts could have been, or could be, converted into US dollars at the exchange rates used to translate the functional currency into the reporting currency.

Revenue Recognition

Revenue represents the invoiced value of goods sold recognized upon the delivery of goods to distributors. Pursuant to the guidance of ASC Topic 605 and ASC Topic 36, revenue is recognized when all of the following criteria are met:

| · | Persuasive evidence of an arrangement exists; |

| · | Delivery has occurred or services have been rendered; |

| · | The seller’s price to the buyer is fixed or determinable; and |

| · | Collectability is reasonably assured. |

We account for sales returns by establishing an accrual in an amount equal to management’s estimate of sales recorded for which the related products are expected to be returned. We determine the estimate of the sales return accrual primarily based on the Company’s historical experience regarding sales returns, but also by considering other factors that could impact sales returns. These factors include levels of inventory in the distribution channel, estimated shelf life, product discontinuances, and price changes of competitive products, introductions of generic products and introductions of competitive new products. For the three and six months ended December 31, 2012 and 2011, the Company’s sales return rate is low and deemed immaterial and accordingly, no provision for sales returns was recorded.

Shipping costs

Shipping costs are included in selling, general and administrative expense. Shipping costs amounted to $261,338 and $337,553 for the three months ended December 31, 2012 and 2011, respectively. Shipping costs amounted to $553,981 and $633,729 for the six months ended December 31, 2012 and 2011, respectively.

Advertising

Advertising and promotion costs are charged to expense as incurred. Advertising expense included in selling, general and administrative expenses amounted to $0and $1,261,285 for the three months ended December 31, 2012 and 2011, respectively. Advertising expenses included in selling, general and administrative expenses amounted to $0and $3,121,494 for the six months ended December 31, 2012 and 2011, respectively.

Income Taxes

We are governed by the PRC’s Income Tax Laws and the Internal Revenue Code of the United States. Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement and income tax base of assets and liabilities and operating loss and tax credit carry-forwards. Deferred tax assets are reduced by a valuation allowance to the extent that management concludes it is more likely than not that the benefit of such tax assets will not be realized in future periods. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the periods that include the enactment date.

We account for certain tax positions based upon authoritative guidance that prescribes a recognition threshold and measurement processes for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The guidance also provides direction on recognition, classification, interest and penalties, accounting in interim periods and related disclosure.

Our policy is to classify assessments, if any, for tax related to interest as interest expense and penalties as general and administrative expense.

Earnings per Share

We report earnings per share in accordance with ASC Topic 260, “Earnings Per Share”. Basic earnings (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share is computed by dividing net income by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during the period. Common equivalent shares are excluded from the computation of diluted shares in periods for which they have an anti-dilutive effect. Diluted shares underlying stock options and common stock purchase warrants are included in the determination of diluted earnings per share using the treasury stock method. Diluted shares underlying convertible debt obligations are included in the determination of diluted loss per share using the “if converted” method (Note 13).

Inventories consist of the following:

| | | December 31, | | | June 30, | |

| | | 2012

(unaudited) | | | 2012 | |

| | | | | | | |

| Raw materials | | $ | 2,129,554 | | | $ | 2,079,480 | |

| Work in progress | | | 665,887 | | | | 882,005 | |

| Finished goods | | | 484,612 | | | | 834,430 | |

| Total inventories | | $ | 3,280,053 | | | $ | 3,795,915 | |

| 5. | PROPERTY, PLANT AND EQUIPMENT, NET |

Property, plant and equipment consist of the following:

| | | December 31, | | | June 30, | |

| | | 2012

(unaudited) | | | 2012 | |

| | | | | | | |

| Buildings | | $ | 8,936,612 | | | $ | 8,928,545 | |

| Plant equipment | | | 2,878,432 | | | | 2,490,764 | |

| Office equipment | | | 221,026 | | | | 208,539 | |

| Motor vehicles | | | 285,868 | | | | 285,610 | |

| Total | | | 12,321,938 | | | | 11,913,458 | |

| | | | | | | | | |

| Less: accumulated depreciation | | | (2,477,830 | ) | | | (2,188,340 | ) |

| Construction in progress | | | 1,996,621 | | | | 1,956,154 | |

| | | | | | | | | |

| Property, plant and equipment, net | | $ | 11,840,729 | | | $ | 11,681,272 | |

Depreciation expense for property, plant and equipment for the three months ended December 31, 2012 and 2011 amounted to $144,367 and $99,734, respectively. Depreciation expense for property, plant and equipment for the six months ended December 31, 2012 and 2011 amounted to $287,490 and $ 236,391, respectively.

On June 8, 2010, Yantai Huanghai Construction Co. signed an agreement with Yantai Tianzheng to perform certain portions of a factory construction located at the premises of Yantai Tianzheng. The total contract price is approximately $3.07 million (RMB 19.5 million) and the construction is estimated to be completed by the end of April 2013. The remaining commitment of the contract was approximately $1.25 million (RMB 7.9 million) as of December 31, 2012.

| 6. | INDEFINITE LIVED INTANGIBLE ASSETS – PHARMACEUTICAL FORMULAS |

The Company purchased, and currently owns exclusive rights to, a series of pharmaceutical formulas that were approved by the State Food and Drug Administration of China (“SFDA”). This asset includes 14 formulas that are included in the Chinese government’s Essential Drug List (“EDL”) and an additional 5 medicines included in the National Drug Reimbursement List (“NDRL”). The intellectual property underlying these formulas can be renewed every 5 years without limitation for a nominal fee and are subject to certain protections under PRC drug regulations for an indefinite period of time. These regulations mitigate competition and the ability of other suppliers to replicate the Company’s products or produce comparable substitutes. These intangible assets are measured initially at cost not subject to amortization and are tested for impairment annually or in interim reporting periods if events or changes in circumstances indicate that the carrying amounts of these intangible asset might not be recoverable.

Pharmaceutical formulas with indefinite lives consist of the following:

| | | December 31, 2012 (unaudited) | | | June 30, 2012 | |

| | | | | | | |

| Pharmaceutical formulas, without amortization, at cost | | $ | 13,823,121 | | | $ | 25,610,557 | |

During the three months period ended December 31,2012, the Company recorded an impairment charge of $1,688,486,for a limited number of products formulas purchased in 2005 that will no longer be used to develop products. The Company also reclassified $10,121,956 for the cost of certain other SFDA approved drug formulas that the Company will retain as defensive assets, to other intangible assets (Notes 1 and 2). The Company has made a determination that that is in the Company best interests to retain these formulas to mitigate competition and provide the Company with the option of using them in future development efforts should it be advantageous to do so.

| 7. | LONG TERM PREPAYMENTS - LAND USE RIGHTS, NET |

| | | December 31, | | | June 30, | |

| | | 2012

(unaudited) | | | 2012 | |

| | | | | | | |

| Land use rights, at cost | | $ | 39,280,564 | | | $ | 20,240,623 | |

| Less: Accumulated amortization | | | (1,892,096 | ) | | | (1,501,326 | ) |

| Intangible assets – land use rights, net | | $ | 37,388,468 | | | $ | 18,739,297 | |

The Company acquired a new land use right for 266,668 square meters on November 5, 2012. The Company was granted the right to use the land for a period of 50 years at a cost paid of approximately $19m (RMB 120,000,000). As of December 31, 2012, the Company has made a payment of $6,340,550. The Company is obligated to make two remaining installment payments of $6,340,551 each by June 30, 2013 and December 31, 2013.

There is no private ownership of land in the PRC. All land is owned by the government, which grants land use rights for specified periods of time. Amortization expense for land use rights amounted to $226,819 and $123,915 for the three months ended December 31, 2012 and 2011, respectively. Amortization expense for land use rights amounted to $389,382 and $272,881 for the six months ended December 31, 2012 and 2011, respectively. Amortization is calculated over a period of 30-50 years. Amortization of land use rights for fiscal years ending subsequent to December 31, 2012 is as follows:

| | | Amortization | |

| Remainder of FY2013 | | $ | 516,183 | |

| 2014 | | | 1,032,366 | |

| 2015 | | | 1,032,366 | |

| 2016 | | | 1,032,366 | |

| 2017 | | | 1,032,366 | |

| Thereafter | | | 32,742,821 | |

| Total | | $ | 37,388,468 | |

| 8. | OTHER INTANGIBLE ASSETS, NET |

Other Intangible assets, net includes customer relationships and certain prescription drug product formulas. The Company acquired these assets in its business combination with Yantai Tianzheng. Customer relationships are amortized on a straight line basis over periods of 5 and 8 years. Pharmaceutical formulas are amortized on a straight line basis over periods of 8 years.

$10,121,956 for the carrying amount of certain other product formulas that the Company will hold as defensive assets reclassified from indefinite life drug formulas that will be amortized over a period of 8 years

Other intangible assets – net at December 31, 2012 as follow:

| | | Customer | | | YTP Drug | | | Defensive | | | | |

| | | Relationships | | | Formulas | | | Drug formulas | | | Total | |

| | | (unaudited) | | | (unaudited) | | | (unaudited) | | | (unaudited) | |

| Cost | | $ | 14,498,621 | | | $ | 10,130,774 | | | $ | 10,121,956 | | | $ | 34,751,351 | |

| | | | | | | | | | | | | | | | | |

| Accumulated Amortization | | | (2,768,602 | ) | | | (1,904,284 | ) | | | (316,311 | ) | | | (4,989,197 | ) |

| | | | | | | | | | | | | | | | | |

| Net carrying amount | | $ | 11,730,019 | | | $ | 8,226,490 | | | $ | 9,805,645 | | | $ | 29,762,154 | |

Amortization expense for customer relationships amounted to $462,608 and $489,422 for the three months ended December 31, 2012 and 2011, respectively. Amortization expense for customer relationships amounted to $922,794 and $943,328 for the six months ended December 31, 2012 and 2011, respectively.

Amortization expense for YTP drug formulas amounted to $319, 781 and $0 for the three months ended December 31, 2012 and 2011, respectively. Amortization expense for YTP drug formulas amounted to $637, 887 and $0 for the six months ended December 31, 2012 and 2011, respectively.

Amortization expense for defensive drug formulas amounted to $316,286 and $0 for the three months and six months ended December 31, 2012 and 2011, respectively. Amortization expenses are recorded in general and administrative expenses.

Amortization expense for fiscal years ending subsequent to December 31, 2012 is as follows:

| | | Amortization | |

| Remainder of FY2013 | | $ | 2,197,350 | |

| 2014 | | | 4,394,700 | |

| 2015 | | | 4,394,700 | |

| 2016 | | | 4,394,700 | |

| 2017 | | | 4,394,700 | |

| Thereafter | | | 9,986,004 | |

| Total | | $ | 29,762,154 | |

Accrued expense consists of the following:

| | | December 31, | | | June 30, | |

| | | 2012

(unaudited) | | | 2012 | |

| | | | | | | |

| Other accrued expense | | $ | 1,259,257 | | | $ | 1,557,472 | |

| Sales representatives commission and expenses | | | 7,059,280 | | | | 3,778,996 | |

| Other taxes payable | | | 2,362,928 | | | | 1,879,334 | |

| | | | | | | | | |

| Compensation and related cost | | | 334,323 | | | | 357,975 | |

| Interest | | | 850,197 | | | | 516,269 | |

| Advertising expense | | | 260,280 | | | | 388,008 | |

| Total | | $ | 12,126,265 | | | $ | 8,478,054 | |

| 10. | CONVERTIBLE PROMISSORY NOTES IN DEFAULT AND DUE ON DEMAND |

Convertible Notes

On January 5, 2010, pursuant to a Securities Purchase Agreement (the “Securities Purchase Agreement”) with 128 accredited investors (the “Investors”), BPGI sold 6,000,000 units for aggregate gross proceeds of $12,000,000, each unit consisting of an 8% senior convertible promissory note in the principal amount of $2 and one Common Stock purchase warrant (collectively, the “Investor Warrants”). By agreement with the Investors, each investor received: (i) A single Note representing the aggregate number of Notes purchased by them as part of the units (each, a “Note” and collectively, the “Notes”) and (ii) a single Investor Warrant exercisable at $2.40 per share subject to certain anti-dilution provisions. The majority of this debt is guaranteed by third-parties and our CEO, Mr. Qu, and a portion is secured by our inventories and fixed assets.

The Notes bear interest at 8% per annum, payable quarterly in arrears on the last day of each fiscal quarter of the Company. Principal is due on January 5, 2012. Each Note, plus all accrued but unpaid interest thereon, is convertible, in whole but not in part, at any time at the option of the holder, into shares of Common Stock at a conversion price of $2.00 per share, subject to adjustments for certain anti-dilution provisions.

The Convertible Notes were initially recorded at a discounted carrying amount of zero as a result of having allocated a portion of the proceeds to (i) the fair value of the warrants, which were recorded as liabilities stated at fair value, and (ii) a beneficial conversion feature that was not bifurcated as a free standing derivative at the time of issuance or at subsequent reporting dates based on periodic classification assessments. Accretion of the note discount amounted to $0 and $6,478,314 for the three months ended December 31, 2012 and 2011, respectively. Accretion of the note discount amounted to $0 and $8,597,701 for the six months ended December 31, 2012 and 2011, respectively. Accretion of the discount was recorded as a component of interest expense in the accompanying statements of income and comprehensive income. Contractual interest expense amounted to $0 and $6,687,314 for the three months ended December 31, 2012 and 2011, respectively. Contractual interest expense amounted to $0 and $9,015,701 for the six months ended December 31, 2012 and 2011, respectively. There is an aggregate of 4,232,250 shares of Common Stock issuable under all remaining convertible notes as of December 31, 2012.

The Notes contain certain events of default, including non-payment of interest or principal when due, bankruptcy, failure to maintain a listing of the Common Stock or to make required filings on a timely basis. No premium is payable by us if an event of default occurs. However, upon an Event of Default, and provided no more than 50% of the aggregate face amount of the Notes have been converted, the Investors holding Notes have the right to receive a portion, based on their pro-rata participation in the transaction, of 1,000,000 shares of our Common Stock that have been placed in escrow by our principal shareholder. The shares in escrow will be returned to our principal shareholder when 50% of the aggregate face amount of the Notes has been converted or, if later, when the Notes are repaid.

On December 31, 2011, the Company’s Chinese operating subsidiary determined it was unable to convert a sufficient number of RMB’s needed to repay the notes on their original maturity date of January 5, 2012. As a result, the Company entered into a series of amendments to the Notes with Euro Pacific as representative of the Investors to extend to the maturity date and increase the interest rate on the Notes. Pursuant to the most recent amendment, the maturity date of the notes was extended April 5, 2013 and the interest rate was increased to 12% per annum.

On June 27, 2012, Euro Pacific also agreed to release us from certain restrictions on our ability to incur debt, to incur liens or to make capital expenditures as stipulated in the note agreement. The purpose of the Third Amendment is to provide us with enhanced flexibility to seek potential sources of financing.

The Company has been in temporary default of this obligation at previously extended maturity dates. Should the Company be unable to repay the notes on the current extended maturity date of April 5, 2013 in the absence of a further extension of the maturity date, this circumstance would constitute an event of default under the terms of loan agreement. The Company cannot predict what the implications of the non-payment of the loan would be other than it would continue to experience difficulty converting sufficiency currency and will maintain an escrow account of restricted funds intended to secure their repayment. The non-payment of the notes could have a material adverse effect on the Company should the note holders pursue further action.

As of December 31, 2012 and June 30, 2012, the Company’s principal shareholder, Mr. Qu, is obligated to deliver 1,000,000 shares of Common Stock to the Investors if certain Events of Default occur.

| 11. | ACQUISITION PURCHASE PRICE PAYABLE |

On August 8, 2011, the Company, through WFOE II, acquired 100% of Yantai Tianzheng’s equity interests for total purchase consideration of US$35,000,000 (paid in its RMB equivalent) of which US$6,000,000 was paid as of the Execution Date of the acquisition the remaining $29,000,000 was due in a series of contractual installments.

Certain provisions in the acquisition agreement provided the Company with the ability to elect, at its own discretion, to automatically convert any portion or all of the installment payments due into a two-year term loan, with interest accruing at the rate of six percent (6%) per annum.

As of December 31, 2012, $19,700,000 was paid. The Company also made$2,472,815 of individual withholding tax payments on behalf of the former Yantai Tianzheng shareholders including $10,000,000 of principal paid during the three months ended December 31, 2012. The $2,472,815 of withholding tax payments were applied as a reduction of the remaining balance of the acquisition purchase price payable. As of December 31, 2012, the balance of $12,827,185 is payable as follows; $7,827,185 is due on August 8, 2014, and the remaining $5,000,000 is due on February 8, 2015.

| 12. | COMMITMENTS, CONTINGENCIES AND OTHER MATTERS |

| (a) | Contract Research and Development Arrangement |

On May 2009, the Company entered into a contract with Yantai Tianzheng Medicine Research and Development Co. to perform research and development on two new pharmaceutical products, namely Fern Injection and Forsythia Capsule. The total contract price is approximately $2,345,509 (RMB 15,000,000). Yantai Tianzheng Medicine Research and Development Co. committed to complete all research work required for the clinical trial within 3 years. As of December 31, 2012, the Company has paid $1,305,339 (RMB 8,300,000) and the remaining contract amount will be paid as the research services are performed. All payments of $1,305,339 (RMB 8,300,000) have been expensed. The Company extended the term of the contract to May 10, 2017 due to certain changes in government regulations that affected this research project. Research and development costs associated with this contract amounted to $0 for the six months ended December 31, 2012 and 2011.

| (b) | Supplier Concentrations |

We have the following concentrations of business with each supplier constituting greater than 10% of the Company’s purchases of raw materials or other supplies:

| | | Three

months | | | Three

months | | | Six months | | | | |

| | | ended | | | ended | | | ended | | | Six months | |

| | | December

31, | | | December

31, | | | December

31, | | | ended

December | |

| | | 2012

(unaudited) | | | 2011

(unaudited) | | | 2012

(unaudited) | | | 31, 2011

(unaudited) | |

| | | | | | | | | | | | | |

| Shandong Yantai Medicine Procurement and Supply Station | | | 25.9 | % | | | 10.0 | % | | | 26.4 | % | | | 11.9 | % |

| AnguoJinkangdi Chinese Herbal Medicine Co. Ltd | | | * | % | | | 11.1 | % | | | * | % | | | 10.5 | % |

| Anhui DeChang Pharmaceutical Co. Ltd. | | | * | % | | | 16.3 | % | | | * | % | | | 17.1 | % |

* Constitutes less than 10% of the Company’s purchases.

We had a commitment to purchase certain raw materials totaling $2,988,738 as of December 31, 2012 that was fulfilled upon the delivery of the goods in January 2013.

| (c) | Sales Product Concentrations |

Five of the Company’s products, namely Tongbi Capsules, Tongbi Tablets, Lung Nourishing Syrup, Zhengxintai Capsules and Fangfengtongsheng Tablets represented approximately 37.2 %, 14.1%, 17.1%, 11.0% and 15.3%, respectively, of total sales for the three months ended December 31, 2012.

Five of the Company’s products, namely Tongbi Capsules, Tongbi Tablets, Lung Nourishing Syrup, Zhengxintai Capsules and Fangfengtongsheng Tablets represented approximately 31.9 %, 12.0%, 16.1%, 11.3% and 16.8%, respectively, of total sales for the six months ended December 31, 2012.

Five of our products, namely Tongbi Capsules, Tongbi Tablets, Lung Nourishing Syrup, Zhengxintai Capsules and Fangfengtongsheng Tablets represented approximately 23.2%, 9.3%, 16.8%, 10.1% and 17.5%, respectively, of total sales for the three months ended December 31, 2011.

Five of our products, namely Tongbi Capsules, Tongbi Tablets, Lung Nourishing Syrup, Zhengxintai Capsules and Fangfengtongsheng Tablets represented approximately 22.8%, 9.3%, 17.2%, 10.0% and 17.1%, respectively, of total sales for the six months ended December 31, 2011.

| (d) | Economic and Political Risks |

The Company’s operations are conducted solely in the PRC. There are significant risks associated with doing business in the PRC, which include, among others, political, economic, legal and foreign currency exchange risks. The Company’s results may be adversely affected by changes in political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

| (e) | Concentrations of Credit Risk |

Financial instruments which potentially subject us to concentrations of credit risk consist principally of cash and trade accounts receivable. Substantially all of the Company’s cash is deposited in state-owned banks within the PRC, and no deposits are covered by insurance. We have not experienced any losses in such accounts and believe that the Company’s loss exposure is insignificant due to the fact that banks in the PRC are state owned and are generally high credit quality financial institutions. A significant portion of the Company’s sales are credit sales which are made primarily to customers whose ability to pay are dependent upon the industry economics prevailing in these areas. We continually monitor the credit worthiness of the Company’s customers in an effort to reduce credit risk.

At December 31, 2012 and June 30, 2012, the Company’s cash balances by geographic area were as follows:

| | | December 31, | | | June 30, | |

| | | 2012

(unaudited) | | | 2012 | |

| Country: | | | | | | | | | | | | | | | | |

| United States | | $ | 69,166 | | | | 2.19 | % | | $ | 23,406 | | | | 0.13 | % |

| China | | | 3,085,418 | | | | 97.81 | % | | | 18,362,882 | | | | 99.87 | % |

| Total cash and cash equivalents | | $ | 3,154,584 | | | | 100 | % | | $ | 18,386,288 | | | | 100 | % |

| (f) | Certificate of land use right |

The Company’s corporate headquarters is located at No. 9 Daxin Road, Zhifu District, Yantai, Shandong Province in China. Under the current PRC laws, land is owned by the state, and parcels of land in rural areas which are known as collective land are owned by the rural collective economic organization. “Land use rights” are granted to an individual or entity after payment of a land use right fee is made to the applicable state or rural collective economic organization. Land use rights allow the holder of the right to use the land for a specified long-term period.

We have 5 land use rights, for a total of approximately 3,675,364 square meters of land on which the Company maintains its manufacturing facility.