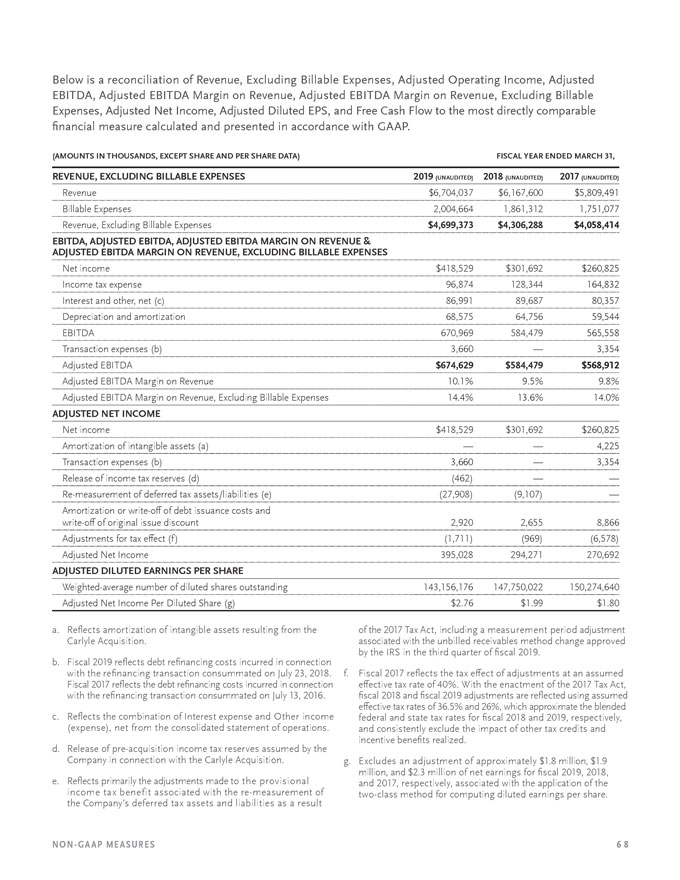

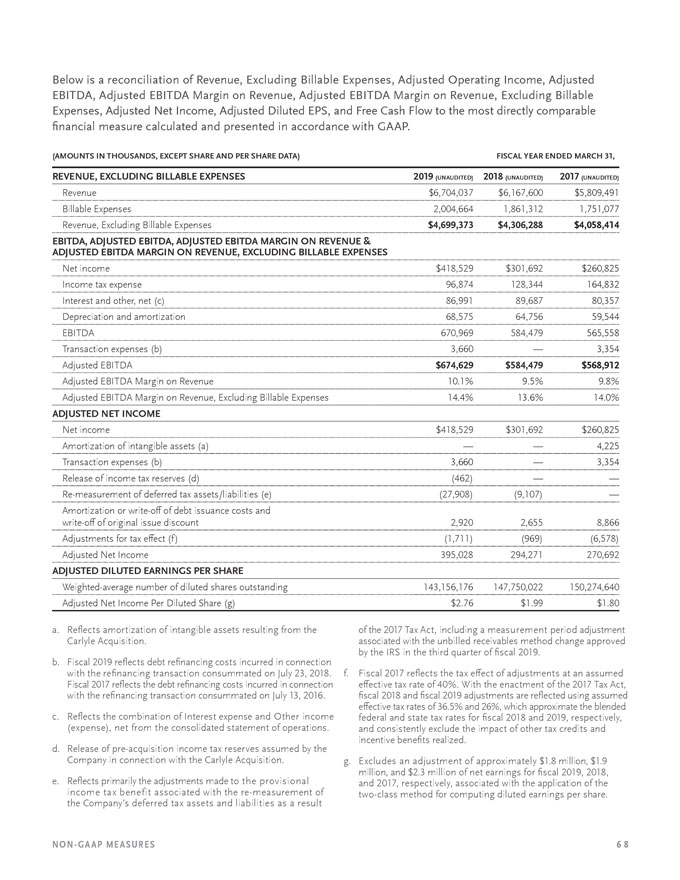

Below is a reconciliation of Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow to the most directly comparable financial measure calculated and presented in accordance with GAAP. (AMOUNTS IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA) FISCAL YEAR ENDED MARCH 31, REVENUE, EXCLUDING BILLABLE EXPENSES 2019 (UNAUDITED) 2018 (UNAUDITED) 2017 (UNAUDITED) Revenue $6,704,037 $6,167,600 $5,809,491 Billable Expenses 2,004,664 1,861,312 1,751,077 Revenue, Excluding Billable Expenses $4,699,373 $4,306,288 $4,058,414 EBITDA, ADJUSTED EBITDA, ADJUSTED EBITDA MARGIN ON REVENUE & ADJUSTED EBITDA MARGIN ON REVENUE, EXCLUDING BILLABLE EXPENSES Net income $418,529 $301,692 $260,825 Income tax expense 96,874 128,344 164,832 Interest and other, net (c) 86,991 89,687 80,357 Depreciation and amortization 68,575 64,756 59,544 EBITDA 670,969 584,479 565,558 Transaction expenses (b) 3,660 — 3,354 Adjusted EBITDA $674,629 $584,479 $568,912 Adjusted EBITDA Margin on Revenue 10.1% 9.5% 9.8% Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses 14.4% 13.6% 14.0% ADJUSTED NET INCOME Net income $418,529 $301,692 $260,825 Amortization of intangible assets (a) — — 4,225 Transaction expenses (b) 3,660 — 3,354 Release of income tax reserves (d) (462) — —Re-measurement of deferred tax assets/liabilities (e) (27,908) (9,107) — Amortization orwrite-off of debt issuance costs andwrite-off of original issue discount 2,920 2,655 8,866 Adjustments for tax effect (f) (1,711) (969) (6,578) Adjusted Net Income 395,028 294,271 270,692 ADJUSTED DILUTED EARNINGS PER SHARE Weighted-average number of diluted shares outstanding 143,156,176 147,750,022 150,274,640 Adjusted Net Income Per Diluted Share (g) $2.76 $1.99 $1.80 a. Reflects amortization of intangible assets resulting from the Carlyle Acquisition. b. Fiscal 2019 reflects debt refinancing costs incurred in connection with the refinancing transaction consummated on July 23, 2018. Fiscal 2017 reflects the debt refinancing costs incurred in connection with the refinancing transaction consummated on July 13, 2016. c. Reflects the combination of Interest expense and Other income (expense), net from the consolidated statement of operations. d. Release ofpre-acquisition income tax reserves assumed by the Company in connection with the Carlyle Acquisition. e. Reflects primarily the adjustments made to the provisional income tax benefit associated with there-measurement of the Company’s deferred tax assets and liabilities as a result of the 2017 Tax Act, including a measurement period adjustment associated with the unbilled receivables method change approved by the IRS in the third quarter of fiscal 2019. f. Fiscal 2017 reflects the tax effect of adjustments at an assumed effective tax rate of 40%. With the enactment of the 2017 Tax Act, fiscal 2018 and fiscal 2019 adjustments are reflected using assumed effective tax rates of 36.5% and 26%, which approximate the blended federal and state tax rates for fiscal 2018 and 2019, respectively, and consistently exclude the impact of other tax credits and incentive benefits realized. g. Excludes an adjustment of approximately $1.8 million, $1.9 million, and $2.3 million of net earnings for fiscal 2019, 2018, and 2017, respectively, associated with the application of thetwo-class method for computing diluted earnings per share.NON- GA AP ME A SURE S 68