Fiscal Year 2018, Third Quarter FEBRUARY 5, 2018 EARNINGS CALL PRESENTATION

HORACIO ROZANSKI PRESIDENT AND CHIEF EXECUTIVE OFFICER LLOYD HOWELL CHIEF FINANCIAL OFFICER AND TREASURER CURT RIGGLE VICE PRESIDENT INVESTOR RELATIONS 1 CALL PARTICIPANTS

DISCLAIMER 2 Forward Looking Safe Harbor Statement Certain statements contained in this presentation and in related comments by our management include “forward‐looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward‐looking statements include information concerning Booz Allen’s preliminary financial results, financial outlook and guidance, including forecasted revenue, Diluted EPS, Adjusted Diluted EPS, future quarterly dividends, and future improvements in operating margins, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward‐looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward‐looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward‐looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward‐looking statements. A number of important factors could cause actual results to differ materially from those contained in or implied by these forward‐looking statements, including those factors discussed in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10‐K for the fiscal year ended March 31, 2017, which can be found at the SEC’s website at www.sec.gov. All forward‐looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward‐looking statements, whether as a result of new information, future events or otherwise. Note Regarding Non‐GAAP Financial Data Information Booz Allen discloses in the following information Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow which are not recognized measurements under GAAP, and when analyzing Booz Allen’s performance or liquidity as applicable, investors (i) evaluate each adjustment in our reconciliation of revenue to Revenue Excluding Billable Expenses, operating income to Adjusted Operating Income, net income to Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted Diluted Earnings Per Share, and net cash provided by operating activities to Free Cash Flow, and the explanatory footnotes regarding those adjustments, each as defined under GAAP, (ii) use Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, and Adjusted Diluted EPS in addition to, and not as an alternative to revenue, operating income, net income or diluted EPS as measures of operating results, and (iii) use Free Cash Flow in addition to and not as an alternative to net cash provided by operating activities as a measure of liquidity, each as defined under GAAP. The Financial Appendix includes a reconciliation of Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow to the most directly comparable financial measure calculated and presented in accordance with GAAP. Booz Allen presents these supplemental performance measures because it believes that these measures provide investors and securities analysts with important supplemental information with which to evaluate Booz Allen’s performance, long term earnings potential, or liquidity, as applicable and to enable them to assess Booz Allen’s performance on the same basis as management. These supplemental performance and liquidity measurements may vary from and may not be comparable to similarly titled measures by other companies in Booz Allen’s industry. With respect to our expectations under “Fiscal 2018 Full Year Outlook,” reconciliation of Adjusted Diluted EPS guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward‐looking basis due to our inability to predict our stock price, equity grants and dividend declarations during the course of fiscal 2018. Projecting future stock price, equity grants and dividends to be declared would be necessary to accurately calculate the difference between Adjusted Diluted EPS and GAAP EPS as a result of the effects of the two‐class method and related possible dilution used in the calculation of EPS. Consequently, any attempt to disclose such reconciliation would imply a degree of precision that could be confusing or misleading to investors. We expect the variability of the above charges to have an unpredictable, and potentially significant, impact on our future GAAP financial results.

HIGHLIGHTS KEY PERFORMANCE INDICATORS • Maintaining position as the government services industry organic revenue growth leader (1) – Accelerating growth in Revenue, Excluding Billable Expenses compared to the prior year period – Raising full‐year revenue and Adjusted Diluted EPS guidance • Experiencing strong client demand for innovative technology solutions – Highest Q3 book‐to‐bill since our IPO – Near‐record backlog • Prevailing in a competitive market for skilled labor – Strong year‐over‐year net headcount growth of more than 1,700 – 52% of our people doing client work are technologists or sit in technology roles, compared to 43% four years ago • Delivering strong capital returns – Returned $275 million to shareholders in the first three quarters through share repurchases and dividends 3 (1) Industry consists of CACI, CSRA, Engility Holdings, Leidos, ManTech, and Science Applications International Corp.

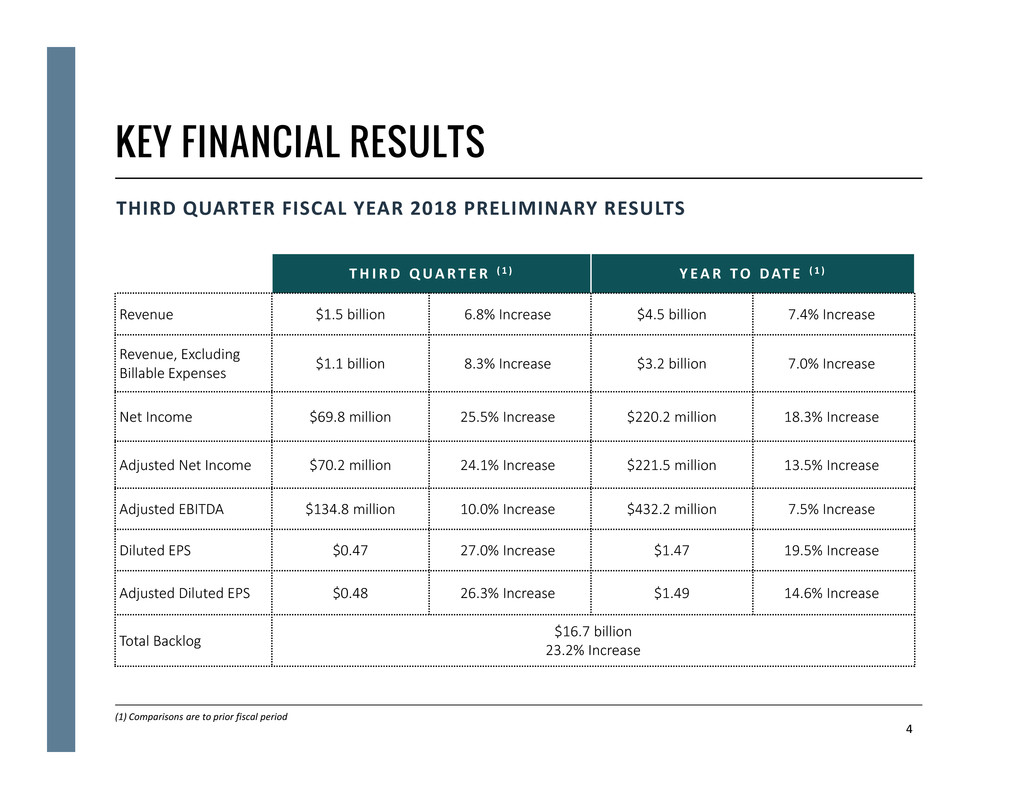

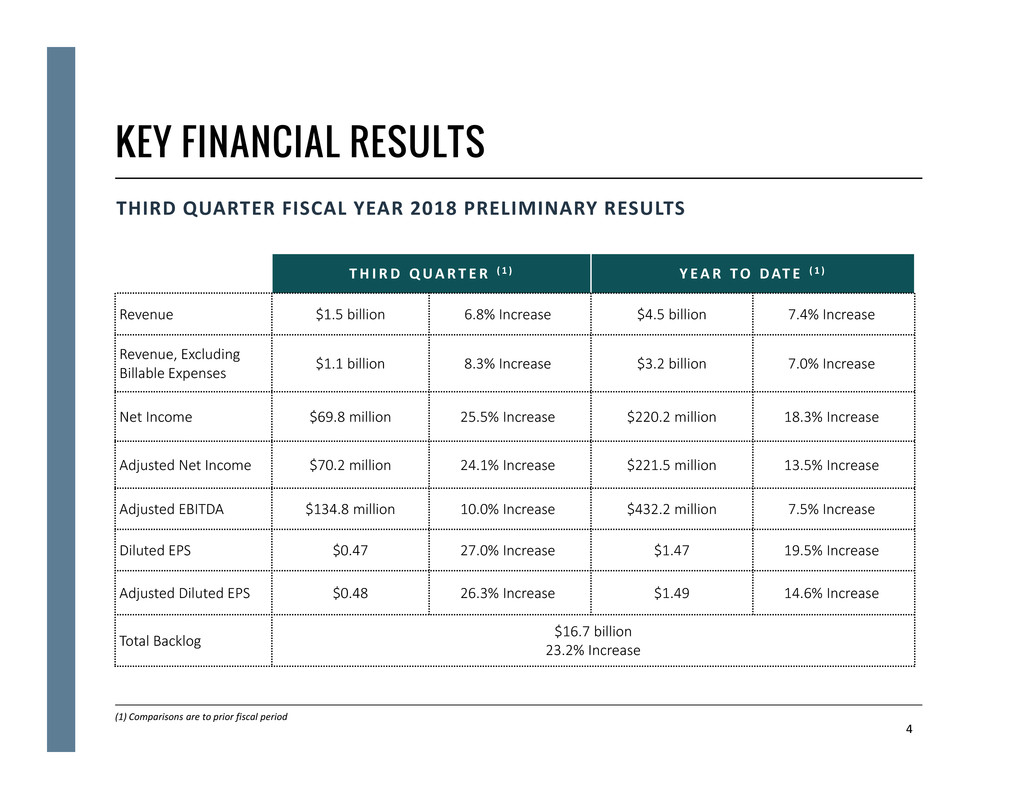

KEY FINANCIAL RESULTS THIRD QUARTER FISCAL YEAR 2018 PRELIMINARY RESULTS 4 (1) Comparisons are to prior fiscal period TH I R D QUART E R ( 1 ) Y E A R TO DAT E ( 1 ) Revenue $1.5 billion 6.8% Increase $4.5 billion 7.4% Increase Revenue, Excluding Billable Expenses $1.1 billion 8.3% Increase $3.2 billion 7.0% Increase Net Income $69.8 million 25.5% Increase $220.2 million 18.3% Increase Adjusted Net Income $70.2 million 24.1% Increase $221.5 million 13.5% Increase Adjusted EBITDA $134.8 million 10.0% Increase $432.2 million 7.5% Increase Diluted EPS $0.47 27.0% Increase $1.47 19.5% Increase Adjusted Diluted EPS $0.48 26.3% Increase $1.49 14.6% Increase Total Backlog $16.7 billion 23.2% Increase

TAX REFORM IMPACT SIGNIFICANT TAX RATE BENEFIT AND CASH TAX SAVINGS • ~8 cents added to ADEPS in the third quarter of fiscal 2018 due predominately to the ~$11 million reduction of income tax expense realized from the enactment of the new tax law • Anticipate significant cash savings in coming years, and a majority of the benefit from our lower income tax expense will drop to the bottom line, which will present additional opportunities to invest in our people and capabilities, as well as return value to investors 5 E X P EC T F I S C A L 2 0 1 8 E F F E C T I V E TAX RAT E ~ 3 3 TO 3 4% ; E X P EC T F I S C A L 2 0 1 9 OF ~ 2 5 TO 2 7% Previous Fiscal 2018 Effective Tax Rate Guidance 37% ‐ 38% Puts and Takes: ‐ Federal statutory tax rate (1) ‐ ~3.5% ‐ State and local income taxes, net of federal tax + ~0.5% ‐ Tax credits and other discrete items (2) ‐ ~0.5% Revised Fiscal 2018 Annual Effective Tax Rate (3) 33% ‐ 34% Fiscal 2019 Expected Effective Tax Rate (4) 25% ‐ 27% NOTES: 1) The 21% federal statutory tax rate will predominately apply to the last three months of our fiscal 2018, resulting in an estimated lower blended federal statutory rate of ~31.5% 2) Includes additional ~$1 million of income tax benefit realized during the third quarter of fiscal 2018 due to the new accounting standard adopted early this year for treatment of stock‐ based compensation 3) Excludes any one‐time, non‐cash impacts due to the revaluation of our deferred taxes and/or any benefits we may realize from the completion of tax accounting method changes under the new law 4) Fiscal 2019 rate will reflect the 14% decline in federal statutory tax rate, offset by ~2‐4% rate impact on state and local taxes and other qualifying credits due to the new tax law

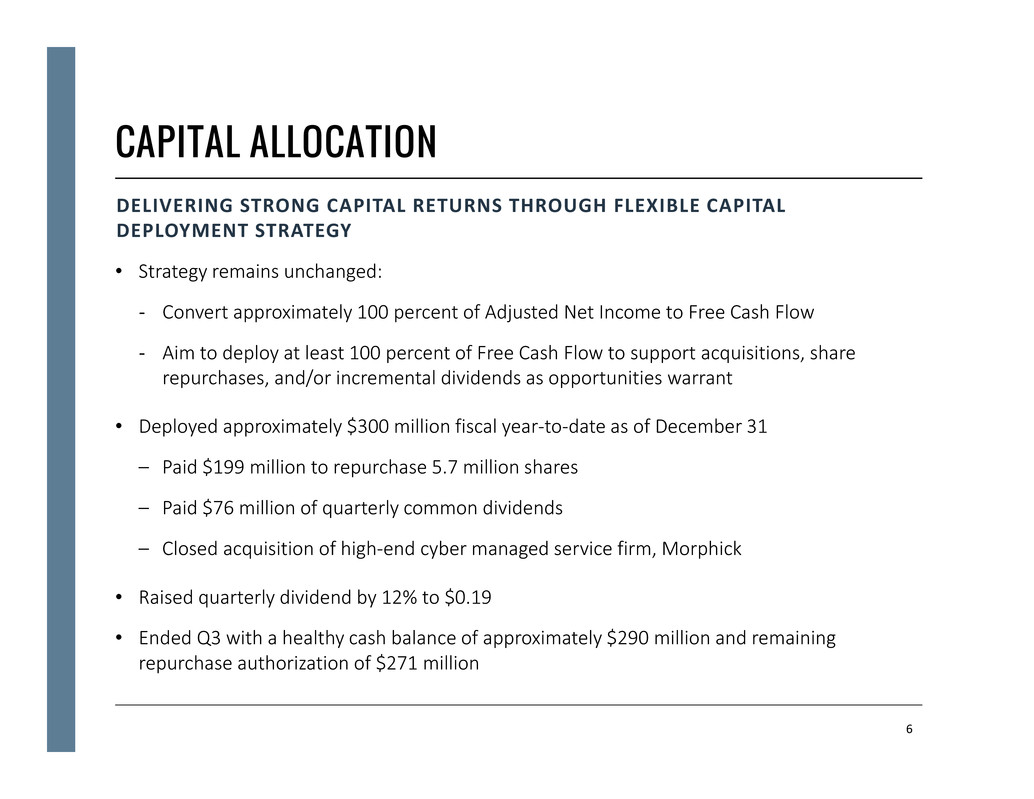

CAPITAL ALLOCATION 6 DELIVERING STRONG CAPITAL RETURNS THROUGH FLEXIBLE CAPITAL DEPLOYMENT STRATEGY • Strategy remains unchanged: ‐ Convert approximately 100 percent of Adjusted Net Income to Free Cash Flow ‐ Aim to deploy at least 100 percent of Free Cash Flow to support acquisitions, share repurchases, and/or incremental dividends as opportunities warrant • Deployed approximately $300 million fiscal year‐to‐date as of December 31 – Paid $199 million to repurchase 5.7 million shares – Paid $76 million of quarterly common dividends – Closed acquisition of high‐end cyber managed service firm, Morphick • Raised quarterly dividend by 12% to $0.19 • Ended Q3 with a healthy cash balance of approximately $290 million and remaining repurchase authorization of $271 million

FINANCIAL OUTLOOK RAISING FULL YEAR GUIDANCE 1) These EPS estimates are based on fiscal 2018 estimated average diluted shares outstanding of approximately 148.0 million shares and assume an effective tax rate in the range of 33 percent to 34 percent, which reflects changes in U.S. tax law. The estimated average diluted shares outstanding used for purposes of our revised guidance has been updated from approximately 149.5 million used in prior guidance, which excluded certain estimated legal expenses, to reflect the net effect of the repurchase of shares during fiscal year 2018. 7 F I SCAL 2018 FUL L YEAR OUTLOOK Revenue Growth in the Range of 5.5 to 7.5 Percent Diluted EPS (1) $1.86 ‐ $1.94 Adjusted Diluted EPS (1) $1.87 ‐ $1.95

APPENDIX 8

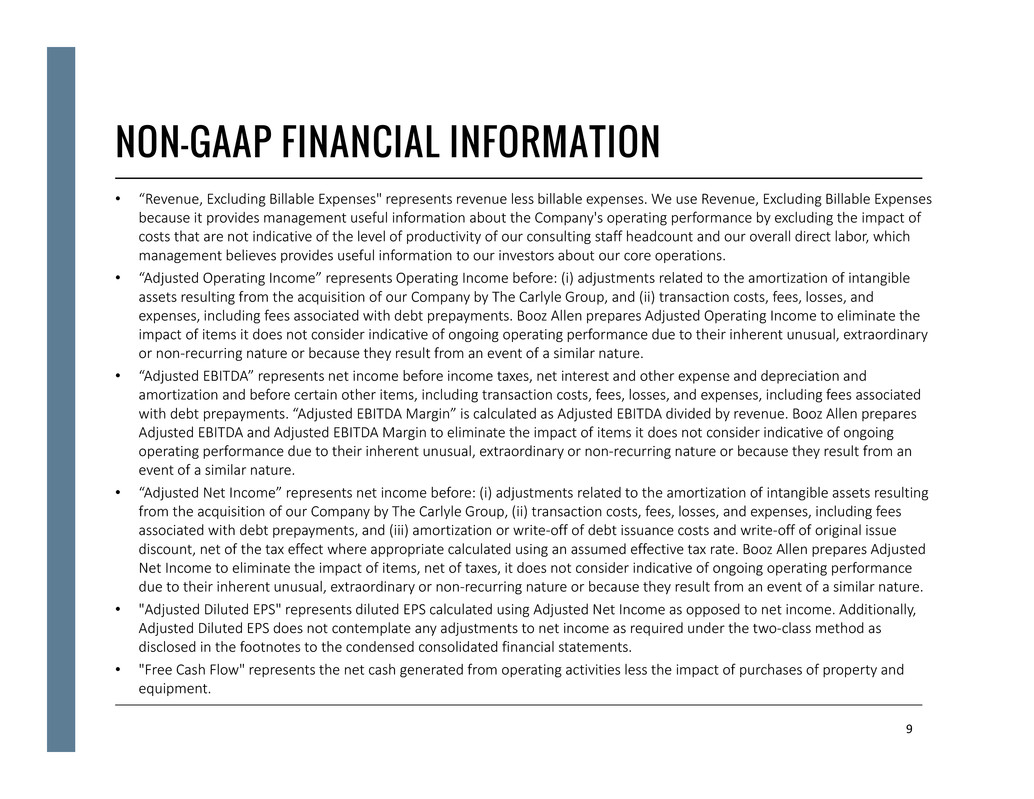

NON-GAAP FINANCIAL INFORMATION • “Revenue, Excluding Billable Expenses" represents revenue less billable expenses. We use Revenue, Excluding Billable Expenses because it provides management useful information about the Company's operating performance by excluding the impact of costs that are not indicative of the level of productivity of our consulting staff headcount and our overall direct labor, which management believes provides useful information to our investors about our core operations. • “Adjusted Operating Income” represents Operating Income before: (i) adjustments related to the amortization of intangible assets resulting from the acquisition of our Company by The Carlyle Group, and (ii) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments. Booz Allen prepares Adjusted Operating Income to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non‐recurring nature or because they result from an event of a similar nature. • “Adjusted EBITDA” represents net income before income taxes, net interest and other expense and depreciation and amortization and before certain other items, including transaction costs, fees, losses, and expenses, including fees associated with debt prepayments. “Adjusted EBITDA Margin” is calculated as Adjusted EBITDA divided by revenue. Booz Allen prepares Adjusted EBITDA and Adjusted EBITDA Margin to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non‐recurring nature or because they result from an event of a similar nature. • “Adjusted Net Income” represents net income before: (i) adjustments related to the amortization of intangible assets resulting from the acquisition of our Company by The Carlyle Group, (ii) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments, and (iii) amortization or write‐off of debt issuance costs and write‐off of original issue discount, net of the tax effect where appropriate calculated using an assumed effective tax rate. Booz Allen prepares Adjusted Net Income to eliminate the impact of items, net of taxes, it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non‐recurring nature or because they result from an event of a similar nature. • "Adjusted Diluted EPS" represents diluted EPS calculated using Adjusted Net Income as opposed to net income. Additionally, Adjusted Diluted EPS does not contemplate any adjustments to net income as required under the two‐class method as disclosed in the footnotes to the condensed consolidated financial statements. • "Free Cash Flow" represents the net cash generated from operating activities less the impact of purchases of property and equipment. 9

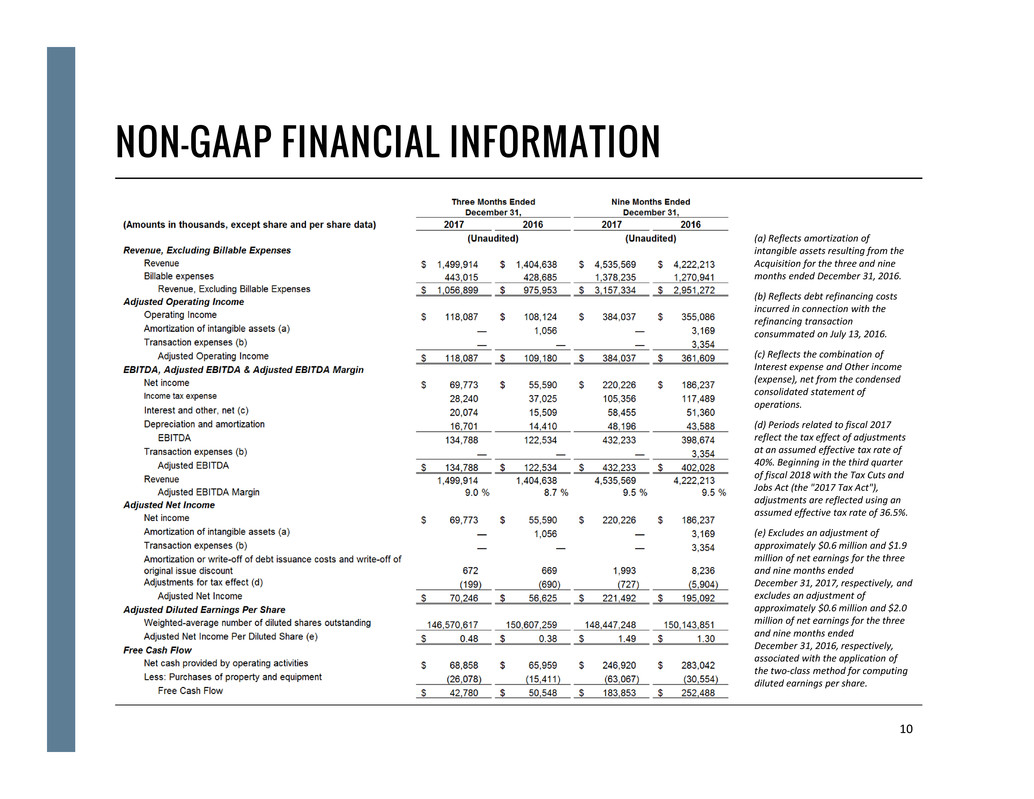

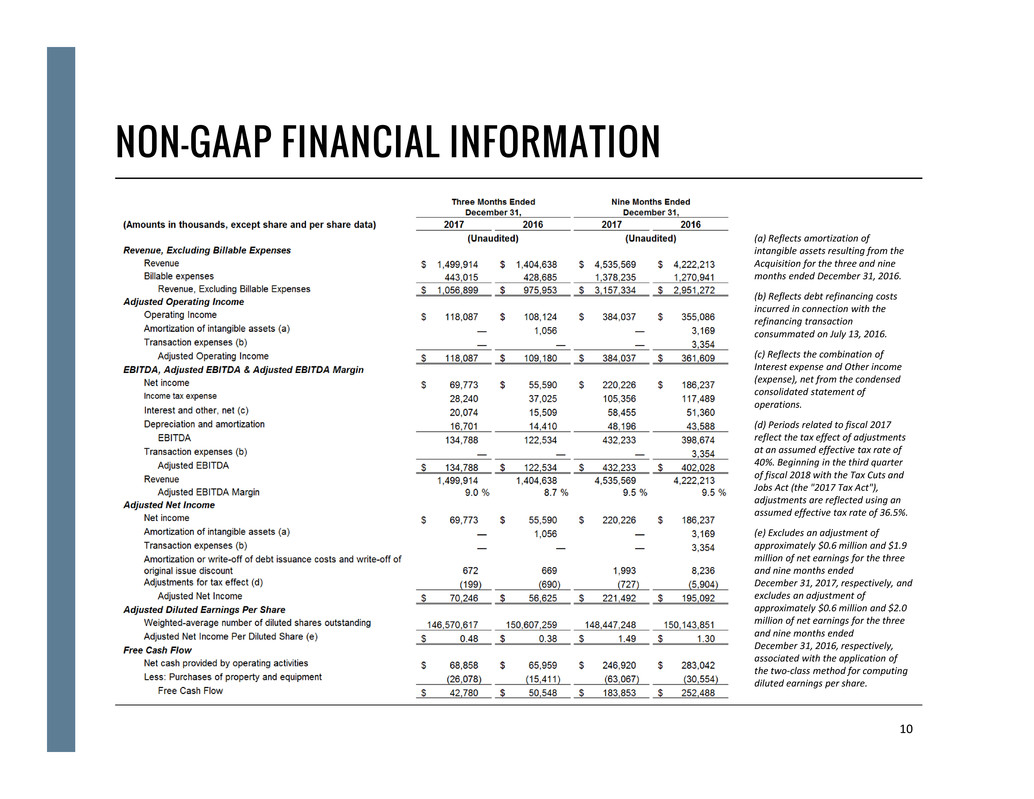

NON-GAAP FINANCIAL INFORMATION 10 (a) Reflects amortization of intangible assets resulting from the Acquisition for the three and nine months ended December 31, 2016. (b) Reflects debt refinancing costs incurred in connection with the refinancing transaction consummated on July 13, 2016. (c) Reflects the combination of Interest expense and Other income (expense), net from the condensed consolidated statement of operations. (d) Periods related to fiscal 2017 reflect the tax effect of adjustments at an assumed effective tax rate of 40%. Beginning in the third quarter of fiscal 2018 with the Tax Cuts and Jobs Act (the "2017 Tax Act"), adjustments are reflected using an assumed effective tax rate of 36.5%. (e) Excludes an adjustment of approximately $0.6 million and $1.9 million of net earnings for the three and nine months ended December 31, 2017, respectively, and excludes an adjustment of approximately $0.6 million and $2.0 million of net earnings for the three and nine months ended December 31, 2016, respectively, associated with the application of the two‐class method for computing diluted earnings per share.

FINANCIAL RESULTS – KEY DRIVERS Third Quarter 2018 – Below is a summary of Booz Allen’s results for the fiscal 2018 third quarter and the key factors driving those results as compared to the third quarter of fiscal 2017: • Revenue increased by 6.8% to $1.50 billion primarily due to increased client demand which led to increased client staff headcount, and an increase in direct labor. Total headcount increased more than 1,700 from December 31, 2016, and 522 as compared to September 30, 2017. • Revenue, Excluding Billable Expenses increased 8.3% to $1.06 billion primarily due to increased client demand which led to increased client staff headcount, and an increase in direct labor. • Operating Income increased 9.2% to $118.1 million and Adjusted Operating Income increased 8.2% to $118.1 million. Increases in both were primarily driven by the same factors driving revenue growth as well as improved contract profitability. • Net income increased 25.5% to $69.8 million. Adjusted Net Income increased 24.1% to $70.2 million. These increases were primarily driven by the same factors as Operating Income and Adjusted Operating Income, as well as a decrease in income tax expense. The Company realized an additional income tax benefit of approximately $11 million during the third quarter of fiscal 2018 driven by the lower federal statutory tax rate as a result of the enactment of the Tax Cuts and Jobs Act on December 22, 2017. The Company also realized an additional income tax benefit of approximately $1 million during the third quarter of fiscal 2018 due to the adoption of the accounting standard ASU 2016‐09, which relates to share‐based compensation, in the first quarter of fiscal 2018. • EBITDA and Adjusted EBITDA each increased 10.0% to $134.8 million due to the same factors as Operating Income and Adjusted Operating Income. • Diluted EPS increased to $0.47 from $0.37 in the prior year period and Adjusted Diluted EPS increased to $0.48 from $0.38 in the prior year period. The increases were primarily driven by the same factors as Net Income and Adjusted Net Income, as well as a lower share count in fiscal 2018 as a result of share repurchases. • As of December 31, 2017, total backlog was $16.7 billion, an increase of 23.2% compared to December 31, 2016. The increase reflects continued backlog improvement across all categories, with total backlog at a near record level. Funded backlog increased 3.8%, while unfunded backlog and priced options increased 30.7% and 27.3%, respectively. 11

FINANCIAL RESULTS – KEY DRIVERS Nine Months Ended December 31, 2017 – Booz Allen’s cumulative performance for the first three quarters of fiscal 2018 has resulted in: • Net cash provided by operating activities was $246.9 million as compared to $283.0 million in the prior year period. The decrease in cash from operations is primarily the result of higher cash taxes paid during fiscal 2018 due to a benefit received in the prior year and the continued residual impact on cash collections due to changes in the processing of payments at one of the Company’s customer payment centers. Free Cash Flow declined $68.6 million from the prior year period due to the same factors affecting cash provided by operating activities, as well as an expected increase of $32.5 million in capital expenditures related to on‐going leasehold improvements to update existing office space. 12