Fiscal Year 2022, Second Quarter October 29, 2021 EARNINGS CALL PRESENTATION

2 HORACIO ROZANSKI President and Chief Executive Officer LLOYD HOWELL, JR. Chief Financial Officer and Treasurer LAURA S. ADAMS Chief Accounting Officer and Interim Head of Investor Relations CALL PARTICIPANTS

3 DISCLAIMER Forward Looking Safe Harbor Statement Certain statements contained in this presentation and in related comments by our management include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include information concerning Booz Allen’s preliminary financial results, financial outlook and guidance, including forecasted revenue, Adjusted Diluted EPS, future quarterly dividends, and future improvements in operating margins, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. A number of important factors could cause actual results to differ materially from those contained in or implied by these forward-looking statements, including those factors discussed in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the fiscal year ended March 31, 2021, which can be found at the SEC’s website at www.sec.gov. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Note Regarding Non-GAAP Financial Data Information Booz Allen discloses in the following information Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow which are not recognized measurements under GAAP, and when analyzing Booz Allen’s performance or liquidity as applicable, investors should (i) evaluate each adjustment in our reconciliation of revenue to Revenue, Excluding Billable Expenses, operating income to Adjusted Operating Income, net income to Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses, Adjusted Net Income and Adjusted Diluted EPS, and net cash provided by operating activities to Free Cash Flow, and the explanatory footnotes regarding those adjustments, each as defined under GAAP, (ii) use Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted EBITDA Margin on Revenue Excluding Billable Expenses, Adjusted Net Income, and Adjusted Diluted EPS in addition to, and not as an alternative to revenue, operating income, net income or diluted EPS as measures of operating results, and (iii) use Free Cash Flow in addition to and not as an alternative to net cash provided by operating activities as a measure of liquidity, each as defined under GAAP. The Appendix includes a reconciliation of Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow to the most directly comparable financial measure calculated and presented in accordance with GAAP. Booz Allen presents these supplemental performance measures because it believes that these measures provide investors and securities analysts with important supplemental information with which to evaluate Booz Allen’s performance, long term earnings potential, or liquidity, as applicable and to enable them to assess Booz Allen’s performance on the same basis as management. These supplemental performance and liquidity measurements may vary from and may not be comparable to similarly titled measures by other companies in Booz Allen’s industry. With respect to our expectations under “Financial Outlook,” reconciliation of Adjusted Diluted EPS guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to our inability to predict our stock price, equity grants and dividend declarations during the course of fiscal 2022. Projecting future stock price, equity grants and dividends to be declared would be necessary to accurately calculate the difference between Adjusted Diluted EPS and GAAP EPS as a result of the effects of the two-class method and related possible dilution used in the calculation of EPS. Consequently, any attempt to disclose such reconciliation would imply a degree of precision that could be confusing or misleading to investors. We expect the variability of the above charges to have an unpredictable, and potentially significant, impact on our future GAAP financial results. For the same reason, a reconciliation of Adjusted EBITDA Margin on Revenue guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to our inability to predict specific quantifications of the amounts that would be required to reconcile such measures.

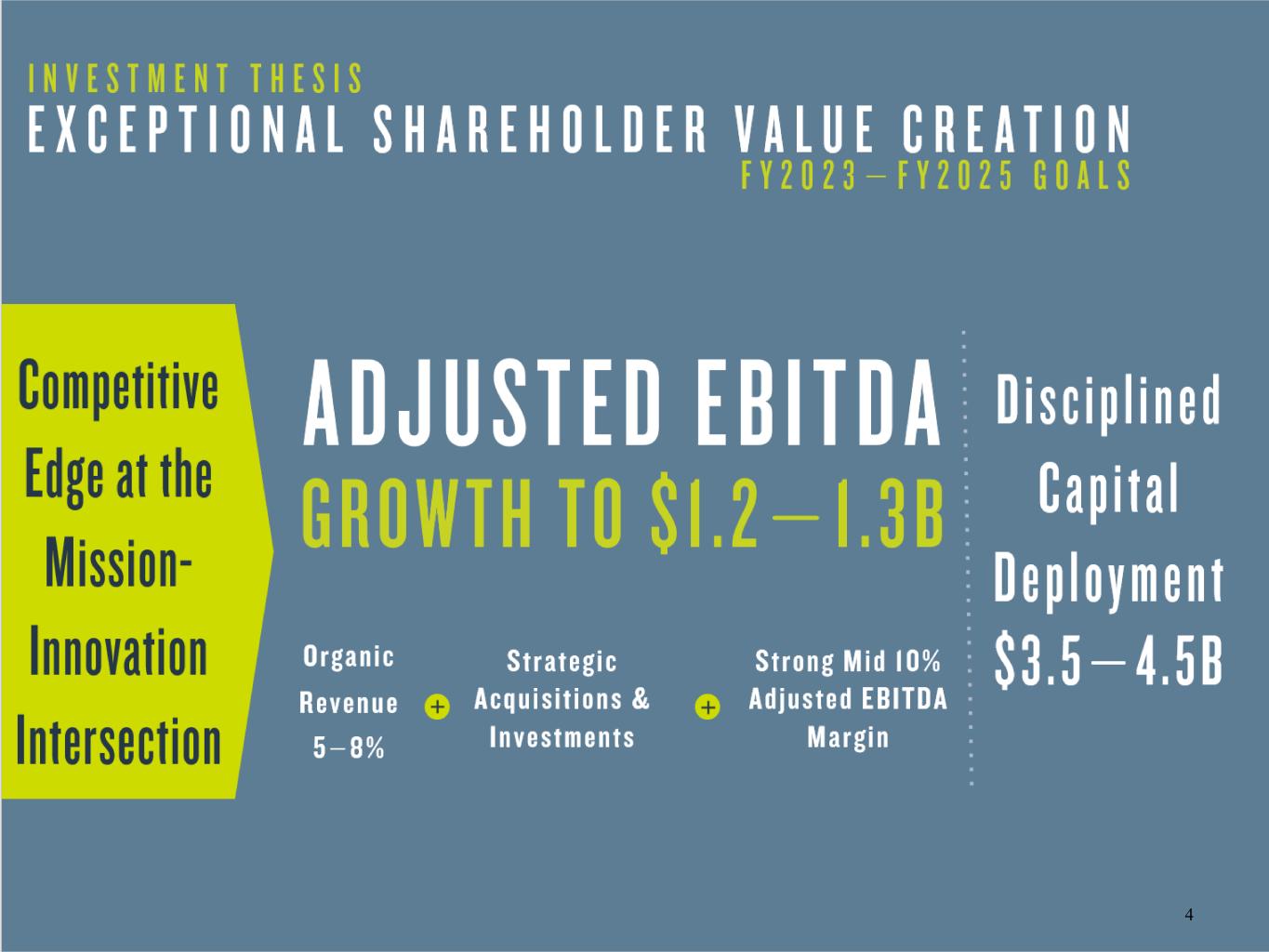

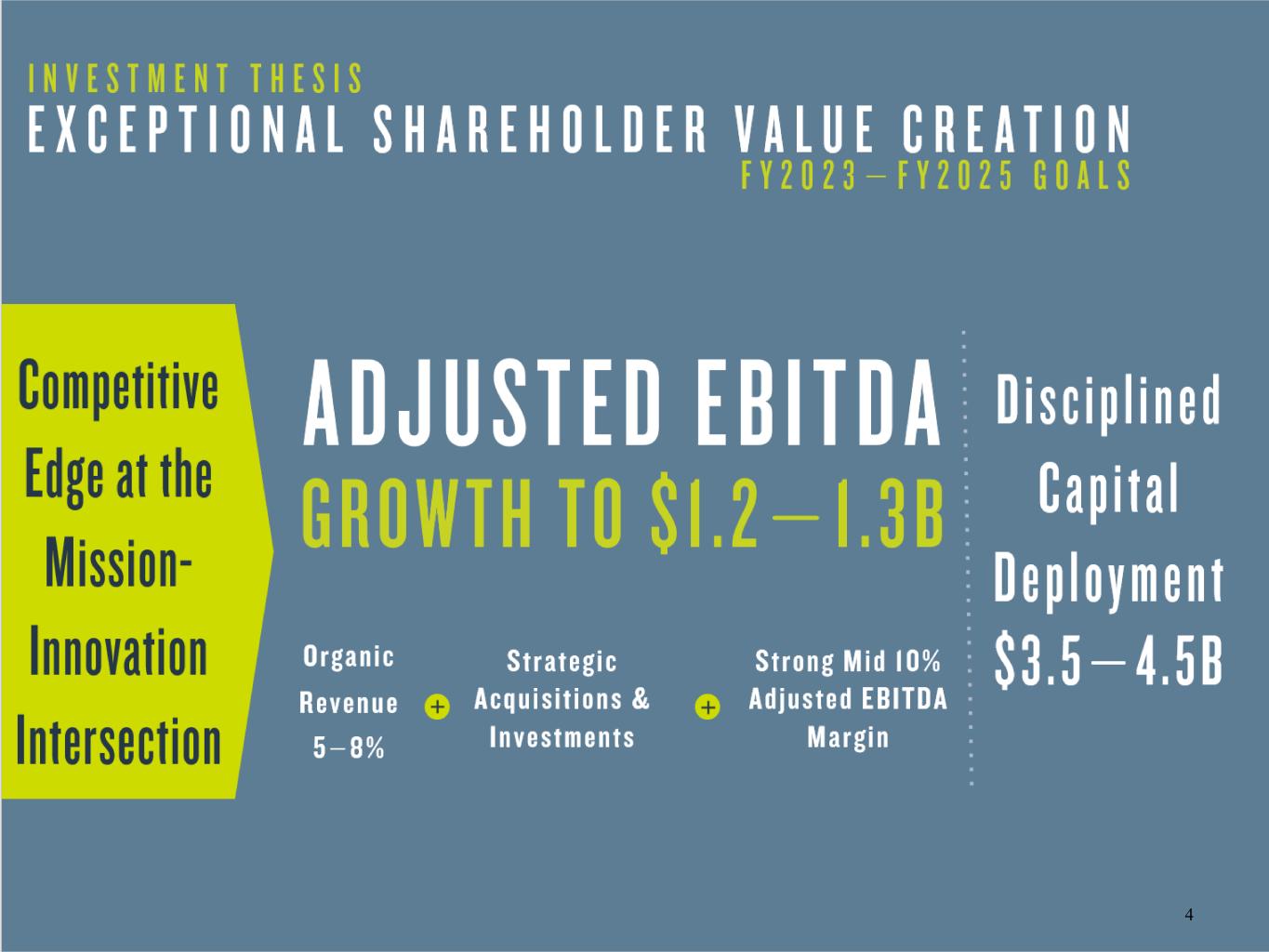

4 4

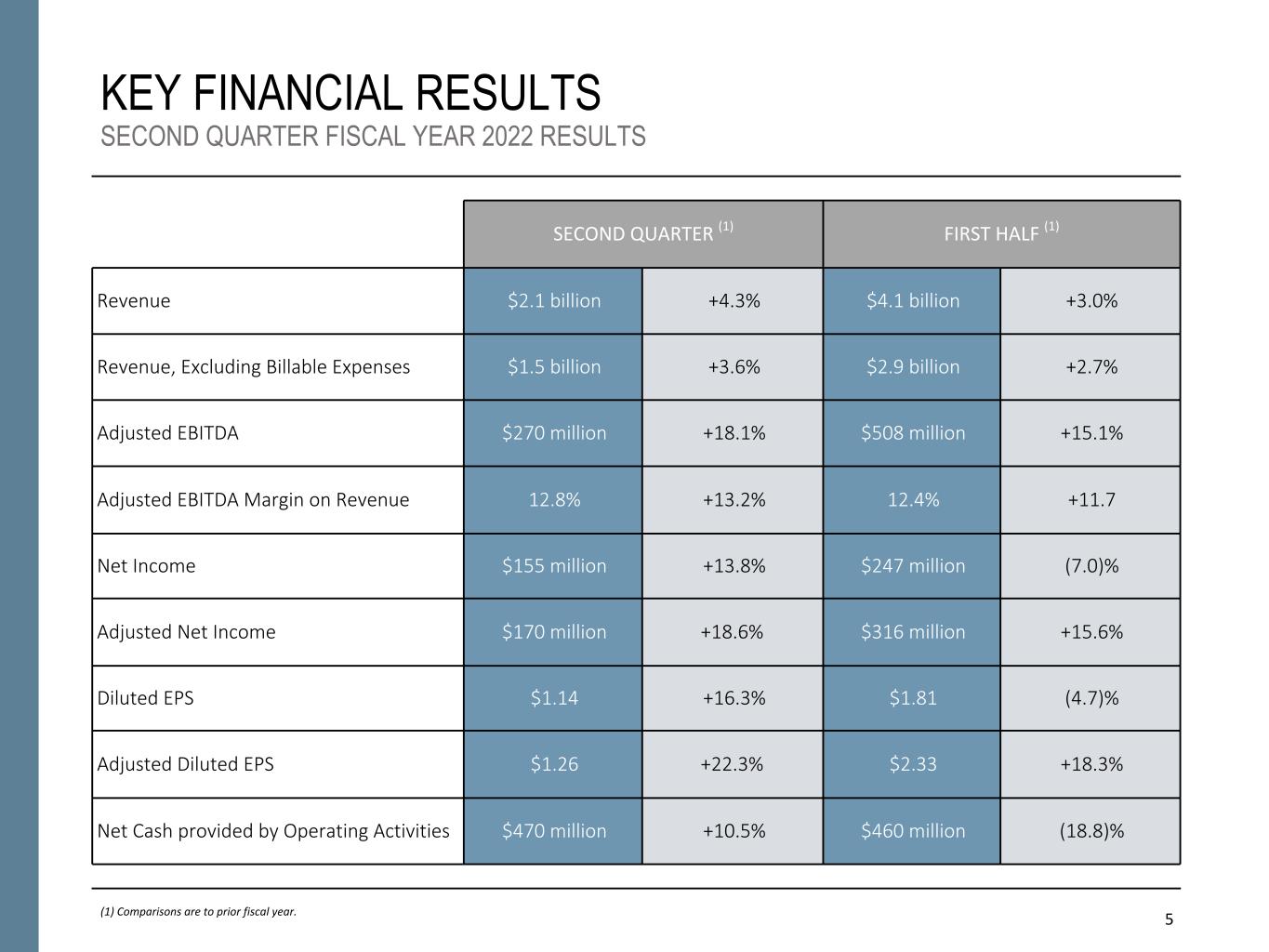

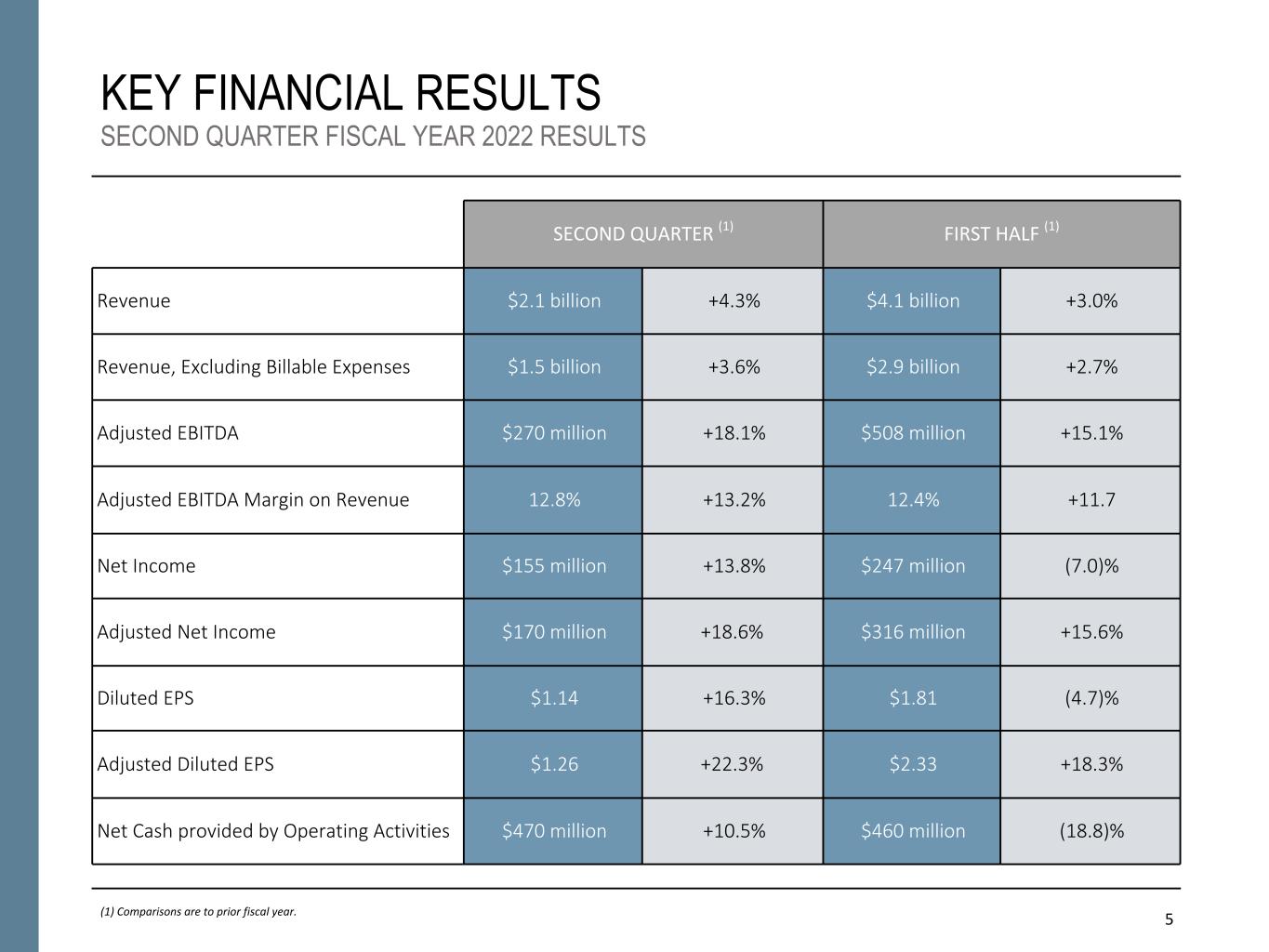

5 KEY FINANCIAL RESULTS SECOND QUARTER FISCAL YEAR 2022 RESULTS (1) Comparisons are to prior fiscal year. SECOND QUARTER (1) FIRST HALF (1) Revenue $2.1 billion +4.3% $4.1 billion +3.0% Revenue, Excluding Billable Expenses $1.5 billion +3.6% $2.9 billion +2.7% Adjusted EBITDA $270 million +18.1% $508 million +15.1% Adjusted EBITDA Margin on Revenue 12.8% +13.2% 12.4% +11.7 Net Income $155 million +13.8% $247 million (7.0)% Adjusted Net Income $170 million +18.6% $316 million +15.6% Diluted EPS $1.14 +16.3% $1.81 (4.7)% Adjusted Diluted EPS $1.26 +22.3% $2.33 +18.3% Net Cash provided by Operating Activities $470 million +10.5% $460 million (18.8)%

6 $22.0 HISTORICAL BACKLOG & BOOK-TO-BILL (1) For more information on the components of backlog, and the differences between backlog and remaining performance obligations, please see the Company's Form 10-K for the fiscal year ended March 31, 2021; totals may not sum due to rounding. (2) Backlog presented as of September 30, 2021 includes backlog acquired from the Company's acquisitions made during the six months ended September 30, 2021. Total backlog acquired was approximately $2.1 billion as of September 30, 2021. BACKLOG ($ IN BILLIONS) (1)(2) BOOK-TO-BILL TRENDS $20.5 $19.3 $19.9 $22.9 $22.0 $20.7 $23.0 $24.6 $23.3 $24.0 $26.8 $29.0 $3.5 $3.4 $3.2 $4.4 $3.5 $3.4 $3.4 $4.5 $3.6 $3.5 $3.5 $4.9 $4.5 $3.7 $4.4 $5.4 $5.3 $4.5 $4.7 $6.2 $6.0 $6.1 $9.0 $9.5 $12.4 $12.2 $12.3 $13.2 $13.1 $12.8 $14.8 $13.9 $13.7 $14.4 $14.3 $14.6 Funded Unfunded Priced Options 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 0.45x 0.36x 1.29x 2.68x 0.48x 0.38x 2.17x 1.77x 0.32x 1.38x 1.30x 2.03x Quarterly Book-to-Bill LTM Book-to-Bill 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22

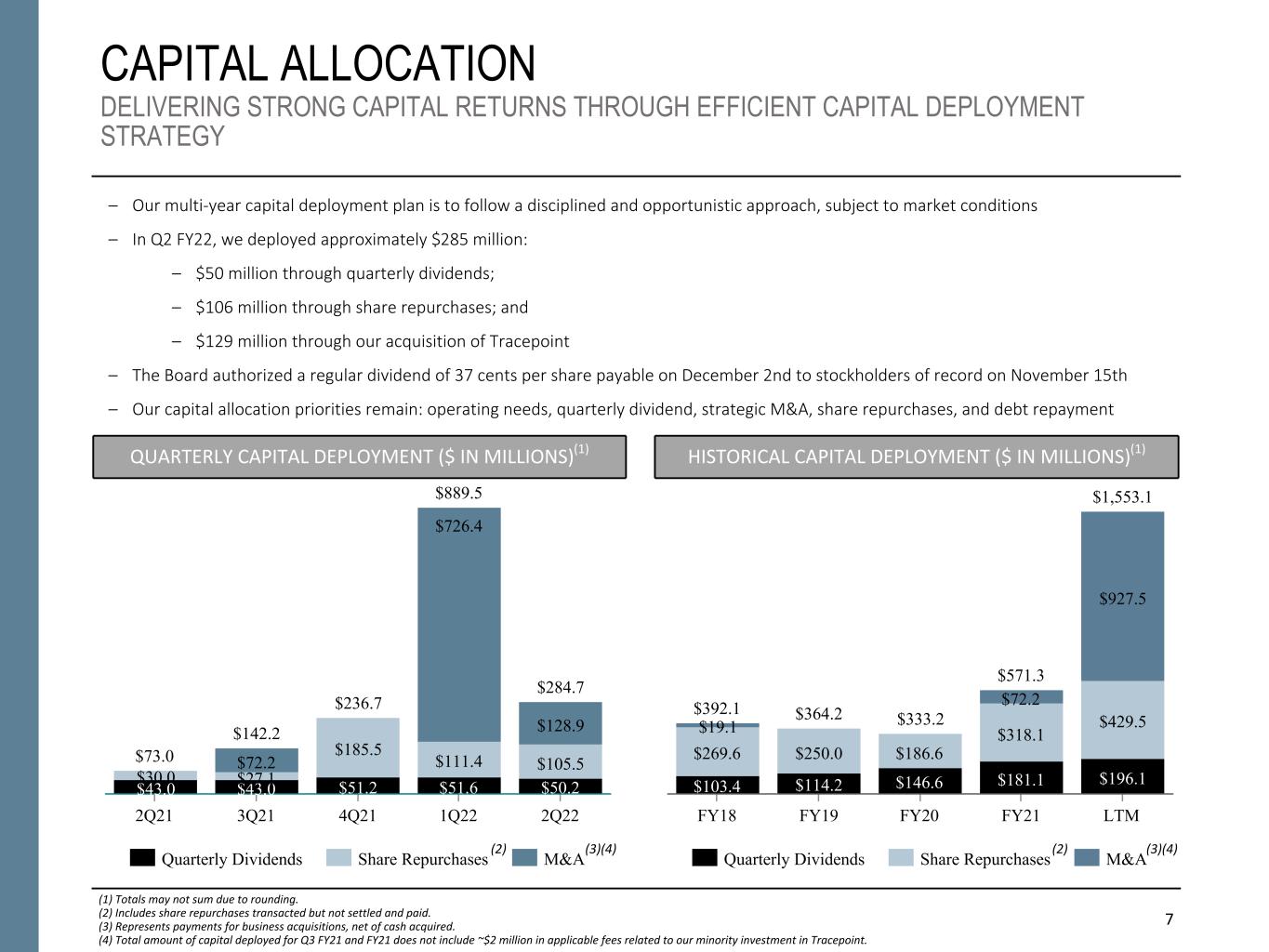

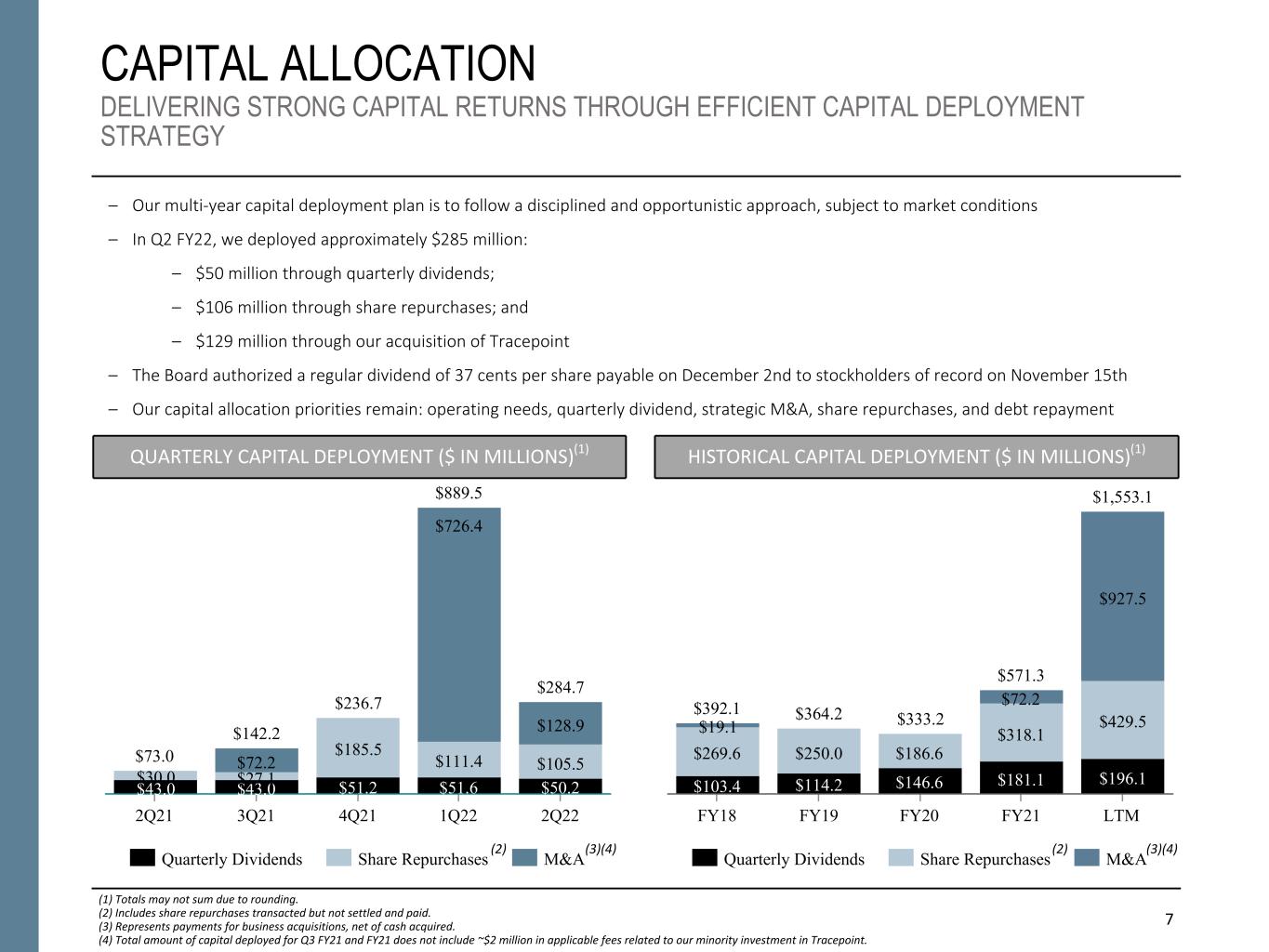

7 CAPITAL ALLOCATION DELIVERING STRONG CAPITAL RETURNS THROUGH EFFICIENT CAPITAL DEPLOYMENT STRATEGY – Our multi-year capital deployment plan is to follow a disciplined and opportunistic approach, subject to market conditions – In Q2 FY22, we deployed approximately $285 million: – $50 million through quarterly dividends; – $106 million through share repurchases; and – $129 million through our acquisition of Tracepoint – The Board authorized a regular dividend of 37 cents per share payable on December 2nd to stockholders of record on November 15th – Our capital allocation priorities remain: operating needs, quarterly dividend, strategic M&A, share repurchases, and debt repayment HISTORICAL CAPITAL DEPLOYMENT ($ IN MILLIONS)(1)QUARTERLY CAPITAL DEPLOYMENT ($ IN MILLIONS)(1) $73.0 $142.2 $236.7 $889.5 $284.7 $43.0 $43.0 $51.2 $51.6 $50.2$30.0 $27.1 $185.5 $111.4 $105.5$72.2 $726.4 $128.9 Quarterly Dividends Share Repurchases M&A 2Q21 3Q21 4Q21 1Q22 2Q22 $392.1 $364.2 $333.2 $571.3 $1,553.1 $103.4 $114.2 $146.6 $181.1 $196.1 $269.6 $250.0 $186.6 $318.1 $429.5$19.1 $72.2 $927.5 Quarterly Dividends Share Repurchases M&A FY18 FY19 FY20 FY21 LTM (3)(4) (1) Totals may not sum due to rounding. (2) Includes share repurchases transacted but not settled and paid. (3) Represents payments for business acquisitions, net of cash acquired. (4) Total amount of capital deployed for Q3 FY21 and FY21 does not include ~$2 million in applicable fees related to our minority investment in Tracepoint. (2) (3)(4) (2)

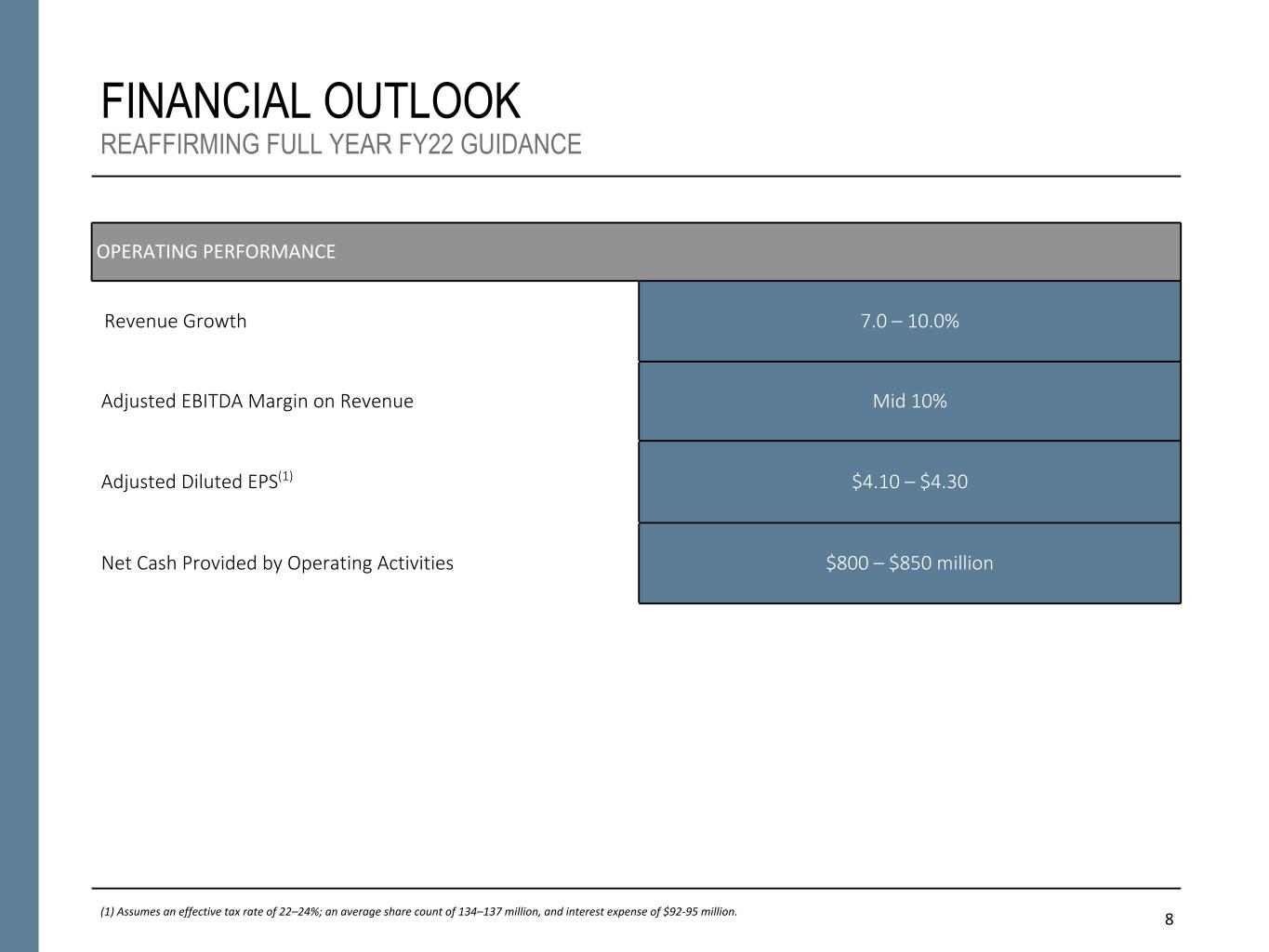

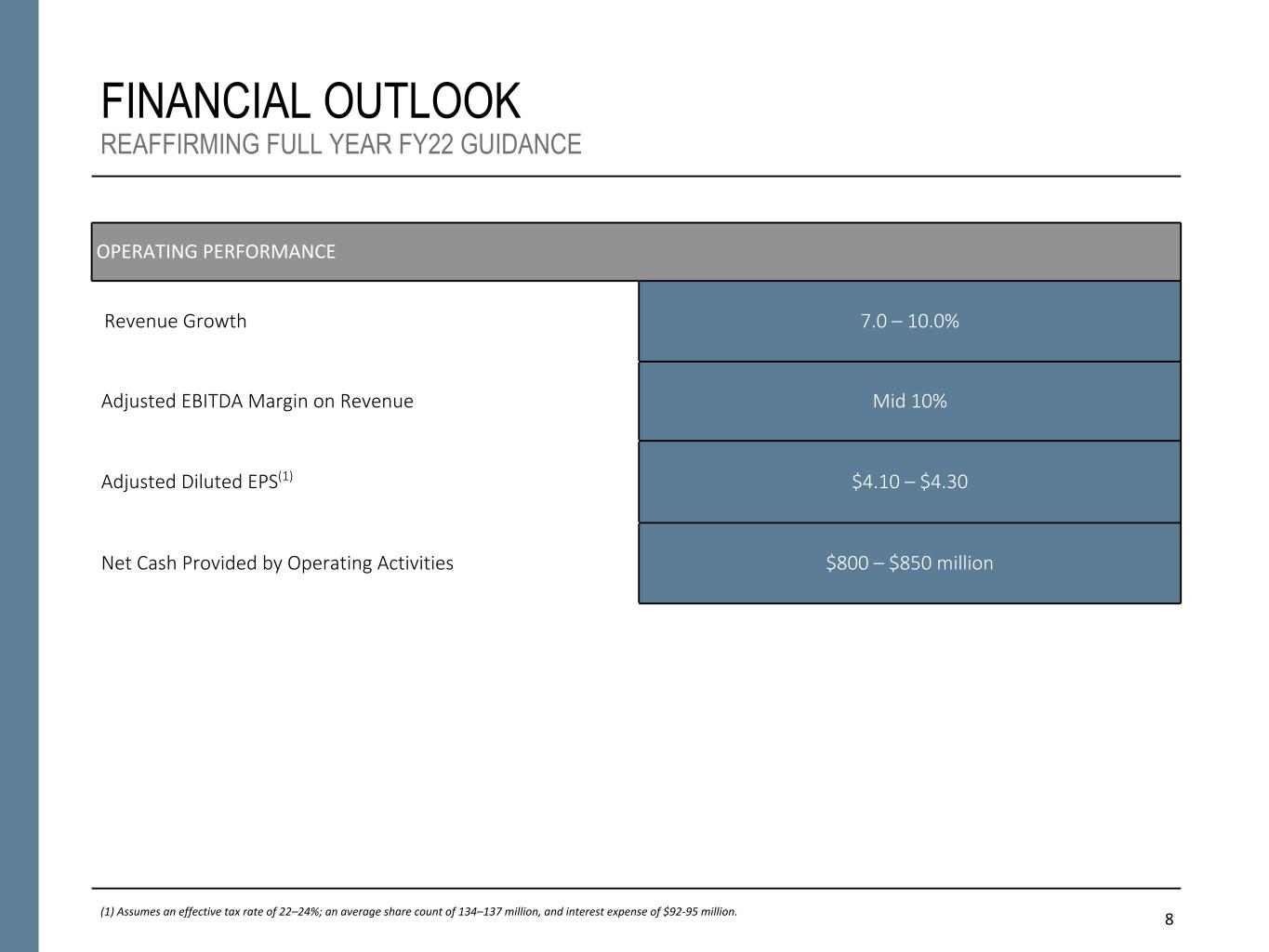

8 FINANCIAL OUTLOOK REAFFIRMING FULL YEAR FY22 GUIDANCE OPERATING PERFORMANCE Revenue Growth 7.0 – 10.0% Adjusted EBITDA Margin on Revenue Mid 10% Adjusted Diluted EPS(1) $4.10 – $4.30 Net Cash Provided by Operating Activities $800 – $850 million (1) Assumes an effective tax rate of 22–24%; an average share count of 134–137 million, and interest expense of $92-95 million.

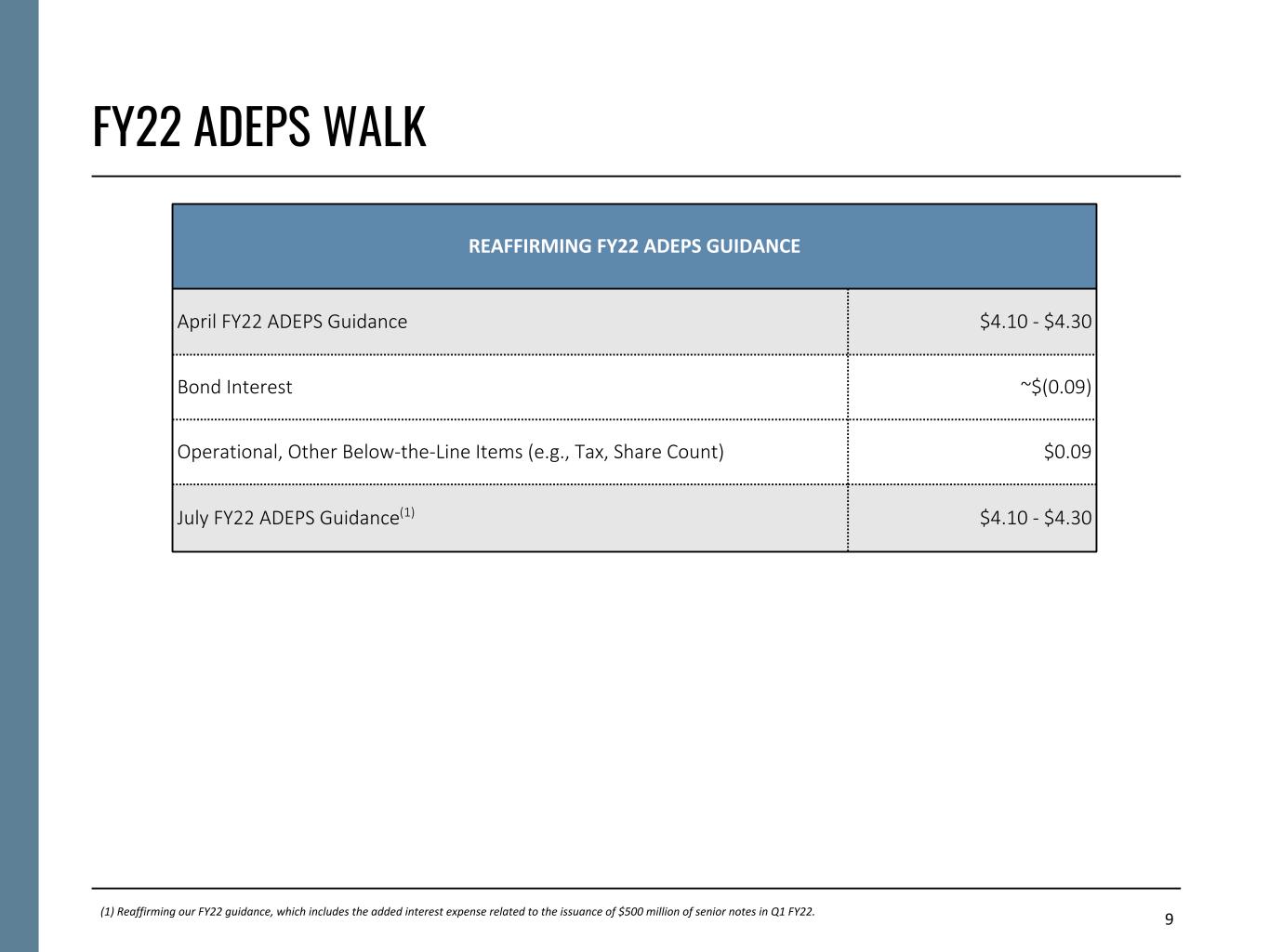

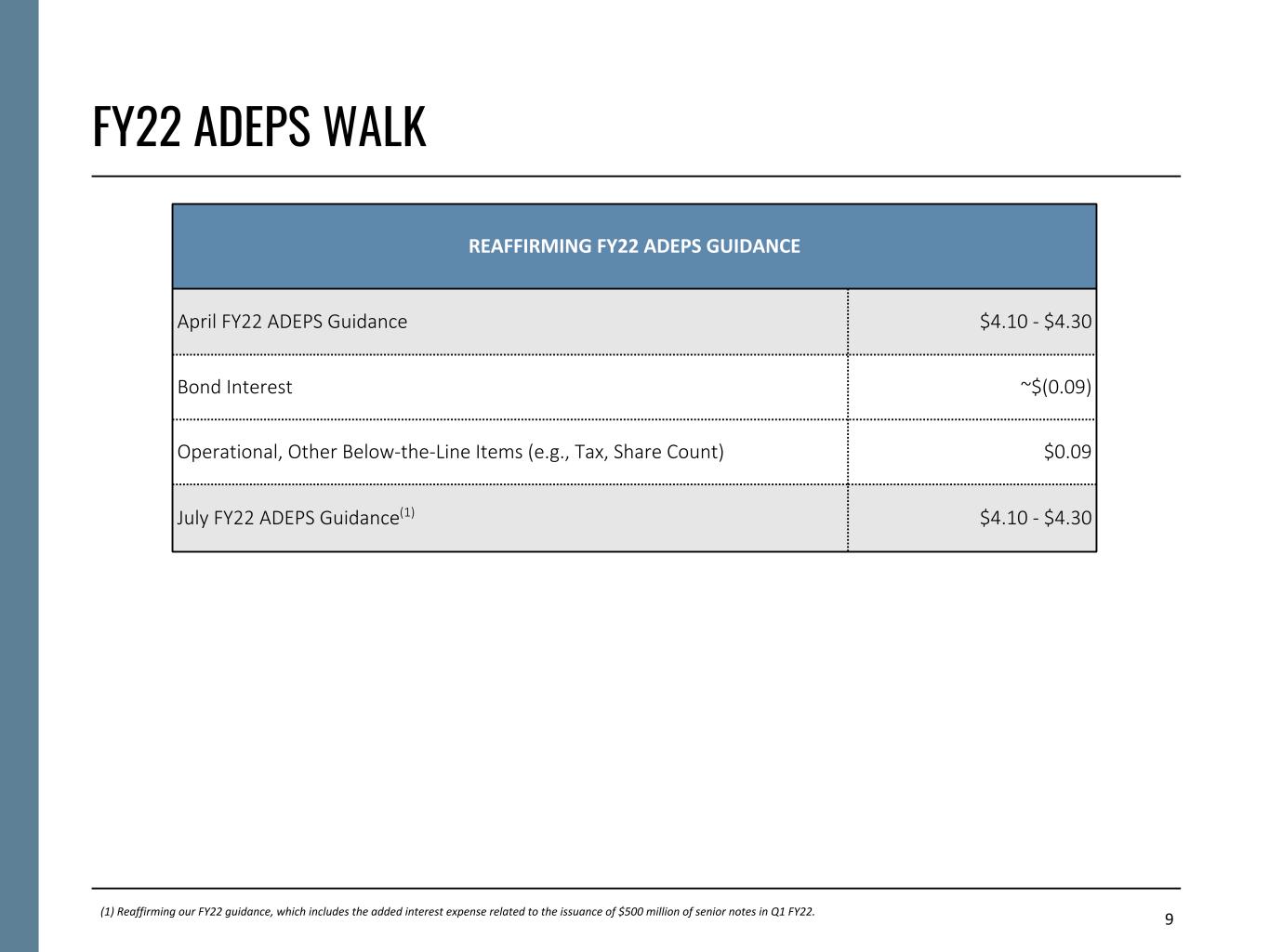

9 FY22 ADEPS WALK REAFFIRMING FY22 ADEPS GUIDANCE April FY22 ADEPS Guidance $4.10 - $4.30 Bond Interest ~$(0.09) Operational, Other Below-the-Line Items (e.g., Tax, Share Count) $0.09 July FY22 ADEPS Guidance(1) $4.10 - $4.30 (1) Reaffirming our FY22 guidance, which includes the added interest expense related to the issuance of $500 million of senior notes in Q1 FY22.

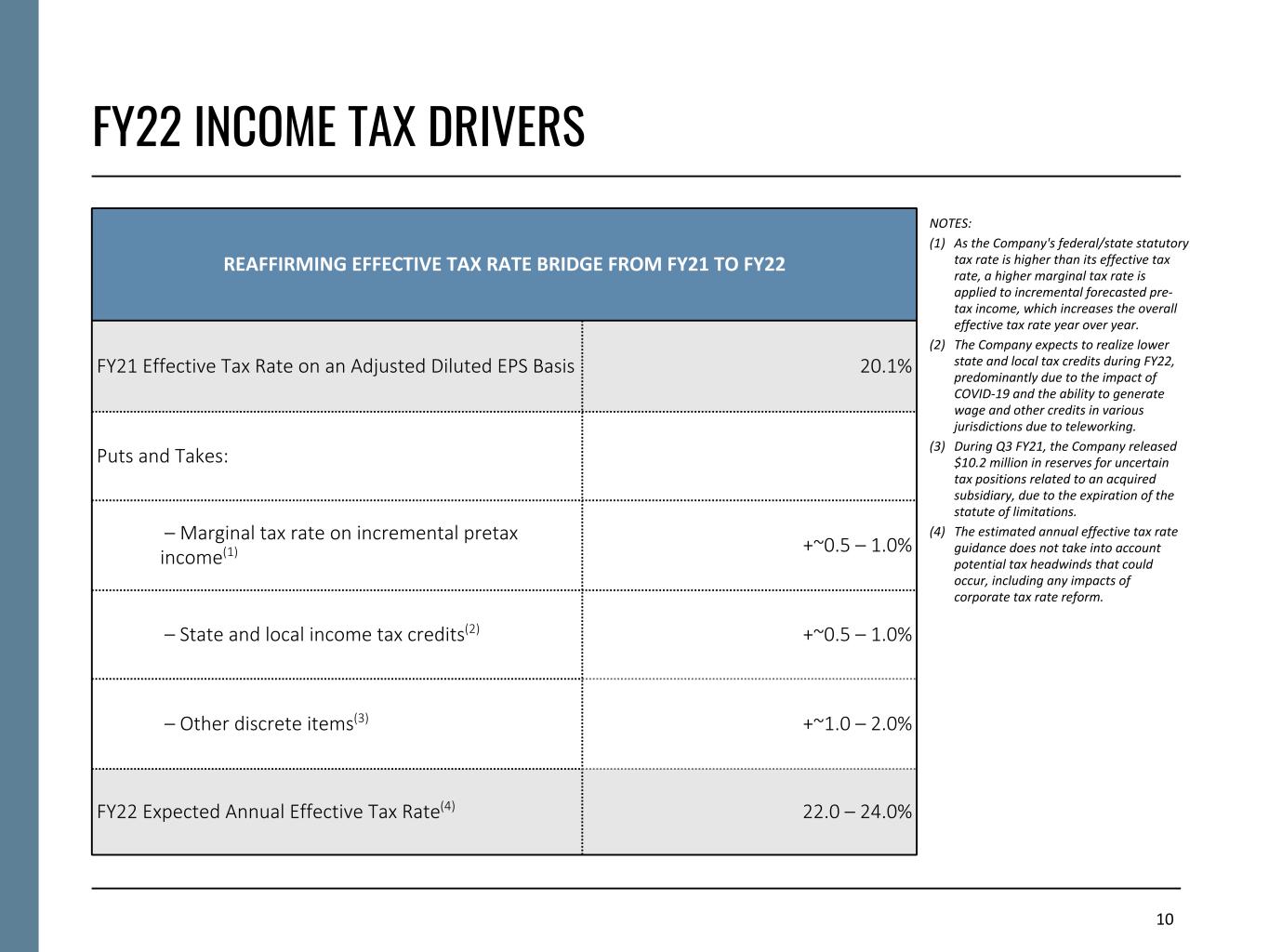

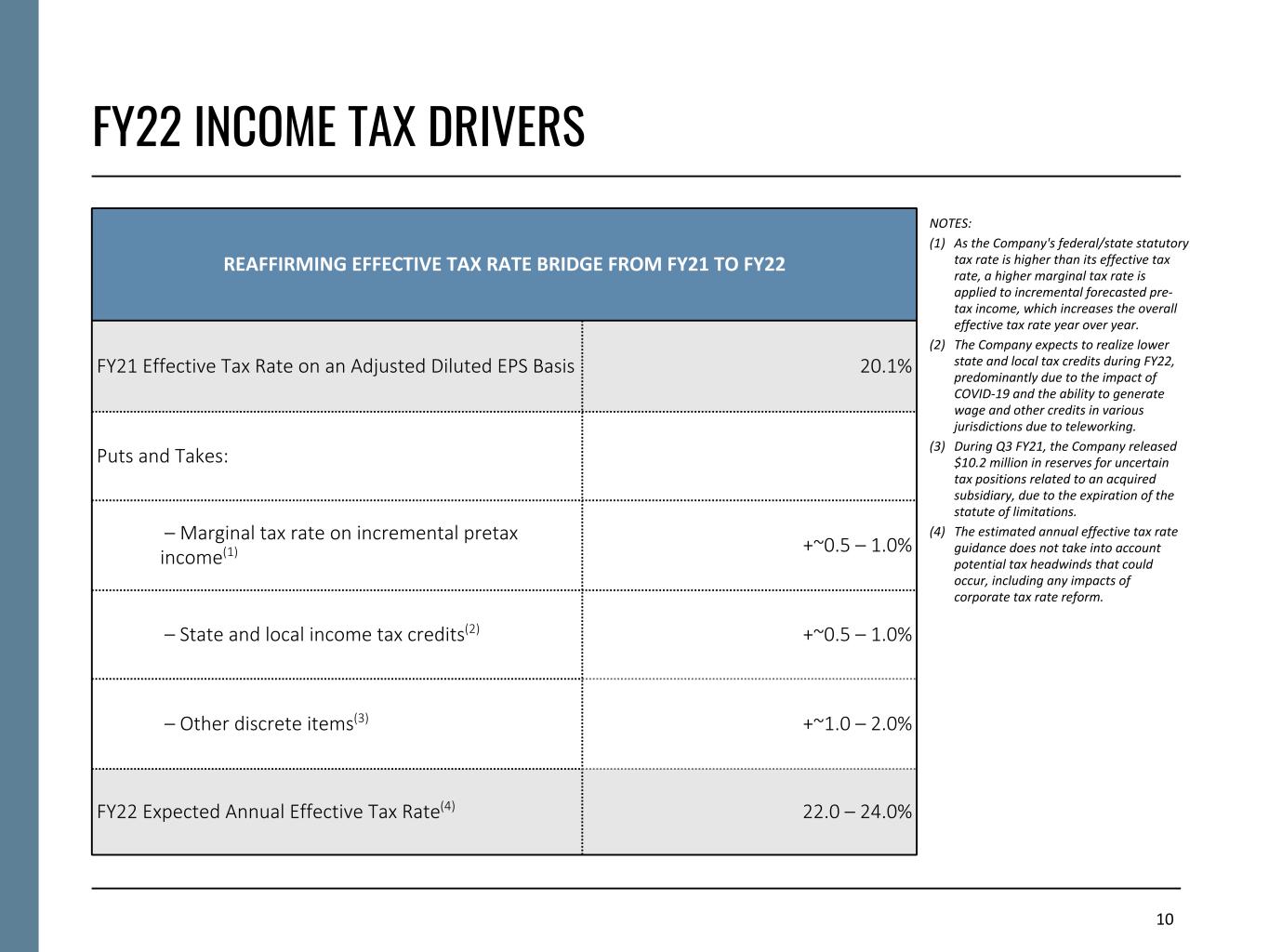

10 FY22 INCOME TAX DRIVERS REAFFIRMING EFFECTIVE TAX RATE BRIDGE FROM FY21 TO FY22 FY21 Effective Tax Rate on an Adjusted Diluted EPS Basis 20.1% Puts and Takes: '– Marginal tax rate on incremental pretax income(1) +~0.5 – 1.0% '– State and local income tax credits(2) +~0.5 – 1.0% '– Other discrete items(3) +~1.0 – 2.0% FY22 Expected Annual Effective Tax Rate(4) 22.0 – 24.0% NOTES: (1) As the Company's federal/state statutory tax rate is higher than its effective tax rate, a higher marginal tax rate is applied to incremental forecasted pre- tax income, which increases the overall effective tax rate year over year. (2) The Company expects to realize lower state and local tax credits during FY22, predominantly due to the impact of COVID-19 and the ability to generate wage and other credits in various jurisdictions due to teleworking. (3) During Q3 FY21, the Company released $10.2 million in reserves for uncertain tax positions related to an acquired subsidiary, due to the expiration of the statute of limitations. (4) The estimated annual effective tax rate guidance does not take into account potential tax headwinds that could occur, including any impacts of corporate tax rate reform.

11 APPENDIX

12 NON-GAAP FINANCIAL INFORMATION • "Revenue, Excluding Billable Expenses" represents revenue less billable expenses. We use Revenue, Excluding Billable Expenses because it provides management useful information about the Company's operating performance by excluding the impact of costs that are not indicative of the level of productivity of our consulting staff headcount and our overall direct labor, which management believes provides useful information to our investors about our core operations. • "Adjusted Operating Income" represents operating income before financing transaction costs, supplemental employee benefits due to COVID-19, and acquisition-related costs, including significant acquisition amortization. We prepare Adjusted Operating Income to eliminate the impact of items we do not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary, or non-recurring nature or because they result from an event of a similar nature. • "Adjusted EBITDA" represents net income before income taxes, net interest and other expense and depreciation and amortization and before certain other items, including financing transaction costs, supplemental employee benefits due to COVID-19, and acquisition-related costs. “Adjusted EBITDA Margin on Revenue” is calculated as Adjusted EBITDA divided by revenue. Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses is calculated as Adjusted EBITDA divided by Revenue, Excluding Billable Expenses. We prepare Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, and Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. • "Adjusted Net Income" represents net income before: (i) acquisition costs, (ii) financing transaction costs, (iii) supplemental employee benefits due to COVID-19, (iv) significant acquisition amortization, (v) gain on consolidation of equity method investment, (vi) research and development tax credits, (vii) release of income tax reserves, (viii) loss on debt extinguishment and (ix) amortization or write-off of debt issuance costs and debt discount, in each case net of the tax effect where appropriate calculated using an assumed effective tax rate. We prepare Adjusted Net Income to eliminate the impact of items, net of tax, we do not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary, or non-recurring nature or because they result from an event of a similar nature. We view Adjusted Net Income as an important indicator of performance consistent with the manner in which management measures and forecasts the Company's performance and the way in which management is incentivized to perform. • "Adjusted Diluted EPS" represents diluted EPS calculated using Adjusted Net Income as opposed to net income. Additionally, Adjusted Diluted EPS does not contemplate any adjustments to net income as required under the two-class method as disclosed in the footnotes to our condensed consolidated financial statements in our Form 10-K for the fiscal year ended March 31, 2021. • "Free Cash Flow" represents the net cash generated from operating activities less the impact of purchases of property, equipment, and software.

13 NON-GAAP FINANCIAL INFORMATION (a) Represents costs associated with the acquisition efforts of the Company related to transactions for which the Company has entered into a letter of intent to acquire a controlling financial interest in the target entity. Acquisition costs primarily include costs associated with (i) due diligence activities, (ii) compensation expenses associated with employee retention, and (iii) legal and advisory fees associated with the completion of the acquisition of Liberty IT Solutions, LLC ("Liberty") and Tracepoint Holdings, LLC ("Tracepoint"). (b) Reflects expenses associated with debt financing activities incurred during the first quarter of fiscal 2022. (c) Represents the supplemental contribution to employees' dependent care FSA accounts in response to COVID-19. (d) Amortization expense associated with acquired intangibles from significant acquisitions. Significant acquisitions include acquisitions which the Company considers to be beyond the scope of our normal operations. Significant acquisition amortization includes amortization expense associated with the acquisition of Liberty for the first quarter of fiscal 2022. (e) Reflects the combination of Interest expense and Other income (expense), net from the condensed consolidated statement of operations. (f) Represents the Company’s remeasurement of its previously held equity method investment in Tracepoint to its fair value which resulted in a gain upon the acquisition of a controlling financial interest in Tracepoint. (g) Reflects tax credits, net of reserves for uncertain tax positions, recognized in fiscal 2021 related to an increase in research and development credits available for fiscal years 2016 to 2019. (h) Release of pre-acquisition income tax reserves assumed by the Company in connection with the Carlyle acquisition. (i) Reflects the loss on debt extinguishment resulting from the redemption of Booz Allen Hamilton Inc.'s 5.125% Senior Notes due 2025, including $9.0 million of the premium paid at redemption, and write-off of the unamortized debt issuance cost. (j) Reflects the tax effect of adjustments at an assumed effective tax rate of 26%, which approximates the blended federal and state tax rates, and consistently excludes the impact of other tax credits and incentive benefits realized. (k) Excludes adjustments of approximately $1.1 million and $1.5 million of net earnings for the three and six months ended September 30, 2021, respectively, and excludes adjustments of approximately $0.8 million and $1.5 million of net earnings for the three and six months ended September 30, 2020, respectively, associated with the application of the two-class method for computing diluted earnings per share. Three Months Ended September 30, Six Months Ended September 30, (In thousands, except share and per share data) 2021 2020 2021 2020 (Unaudited) (Unaudited) Revenue, Excluding Billable Expenses Revenue $ 2,106,038 $ 2,019,185 $ 4,095,104 $ 3,975,638 Less: Billable expenses 640,120 603,652 1,195,665 1,152,729 Revenue, Excluding Billable Expenses $ 1,465,918 $ 1,415,533 $ 2,899,439 $ 2,822,909 Adjusted Operating Income Operating Income $ 218,367 $ 207,221 $ 359,624 $ 399,108 Acquisition costs (a) 13,680 — 80,469 — Financing transaction costs (b) — — 2,348 — COVID-19 supplemental employee benefits (c) — 167 — 509 Significant acquisition amortization (d) 11,868 — 14,526 — Adjusted Operating Income $ 243,915 $ 207,388 $ 456,967 $ 399,617 EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue & Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses Net income $ 154,834 $ 136,081 $ 246,936 $ 265,410 Income tax expense 46,127 39,319 73,479 80,806 Interest and other, net (e) 17,406 31,821 39,209 52,892 Depreciation and amortization 37,602 21,015 65,347 41,747 EBITDA 255,969 228,236 424,971 440,855 Acquisition costs (a) 13,680 80,469 — Financing transaction costs (b) — — 2,348 — COVID-19 supplemental employee benefits (c) — 167 — 509 Adjusted EBITDA $ 269,649 $ 228,403 $ 507,788 $ 441,364 Adjusted EBITDA Margin on Revenue 12.8 % 11.3 % 12.4 % 11.1 % Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses 18.4 % 16.1 % 17.5 % 15.6 % Adjusted Net Income Net income $ 154,834 $ 136,081 $ 246,936 $ 265,410 Acquisition costs (a) 13,680 — 80,469 — Financing transaction costs (b) — — 2,348 — COVID-19 supplemental employee benefits (c) — 167 — 509 Significant acquisition amortization (d) 11,868 — 14,526 — Gain on consolidation of equity method investment (f) (5,666) — (5,666) — Research and development tax credits (g) — (2,928) — (2,928) Release of income tax reserves (h) — — — (29) Loss on debt extinguishment (i) — 13,239 — 13,239 Amortization and write-off of debt issuance costs and debt discount 816 563 1,703 1,017 Adjustments for tax effect (j) (5,381) (3,640) (24,279) (3,839) Adjusted Net Income $ 170,151 $ 143,482 $ 316,037 $ 273,379 Adjusted Diluted Earnings Per Share Weighted-average number of diluted shares outstanding 135,316,429 138,747,640 135,847,548 139,004,382 Adjusted Net Income Per Diluted Share (k) $ 1.26 $ 1.03 $ 2.33 $ 1.97 Free Cash Flow Net cash provided by operating activities $ 470,408 $ 425,606 $ 459,746 $ 566,024 Less: Purchases of property, equipment, and software (20,667) (18,026) (29,675) (38,084) Free Cash Flow $ 449,741 $ 407,580 $ 430,071 $ 527,940

14 FINANCIAL RESULTS – KEY DRIVERS Second Quarter Fiscal 2022 – Below is a summary of the key factors driving results for the fiscal 2022 second quarter ended September 30, 2021 as compared to the prior year period: • Revenue increased by 4.3% to $2.1 billion and Revenue, Excluding Billable Expenses increased 3.6% to $1.5 billion, primarily driven by solid operational performance and revenue from acquisitions during the quarter. This was partially offset by higher than normal staff utilization in the comparable prior year period. • Operating income increased 5.4% to $218.4 million and Adjusted Operating Income increased 17.6% to $243.9 million. The increase in operating income was primarily driven by strong contract performance, including the impact of acquisitions, and cost management of unallowable spending. The increase in Adjusted Operating Income was primarily driven by the same factors driving revenue growth. • Net income increased 13.8% to $154.8 million and Adjusted Net Income increased 18.6% to $170.2 million. These changes were primarily driven by the same factors as operating income and Adjusted Operating Income. Net income was also affected by the $13.2 million loss on debt extinguishment resulting from the redemption of $350.0 million of senior notes during the second quarter of fiscal 2021, not present in the current year, as well as a $5.7 million gain recognized during the second quarter of fiscal 2022 from the the Company’s purchase of the remaining interest in Tracepoint Holdings, LLC. Both the $13.2 million loss on the debt extinguishment and the $5.7 million gain were excluded from Adjusted Net Income. • EBITDA increased 12.2% to $256.0 million and Adjusted EBITDA increased 18.1% to $269.6 million. These increases were due to the same factors as operating income and Adjusted Operating Income. • Diluted EPS increased to $1.14 from $0.98 and Adjusted Diluted EPS increased to $1.26 from $1.03. The changes were primarily driven by the same factors as Net Income and Adjusted Net Income, respectively, as well as a lower share count in the second quarter of fiscal 2022. • As of September 30, 2021, total backlog was $29.0 billion, an increase of 18.0%. Funded backlog was $4.9 billion, an increase of 9.7%. • Net cash provided by operating activities was $470.4 million for the three months ended September 30, 2021 as compared to $425.6 million in the prior year period. The increase in operating cash flows was primarily driven by continued strong cash management, fueled by consistent operational performance. Free Cash Flow was $449.7 million for the three months ended September 30, 2021 as compared to $407.6 million in the prior year period. Free Cash Flow was affected by the same factors affecting cash provided by operating activities, as well as an increase in capital expenditures driven by investments for future growth.