Med Control has 6,000,000 shares of common stock issued and outstanding and is registering an additional 2,500,000 shares of common stock for offering to the public. The Company may endeavor to sell all 2,500,000 shares of common stock after this registration becomes effective. The price at which the Company offers these shares is fixed at $0.02 per share for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. Med Control will receive all proceeds from the sale of the common stock.

Termination of the offering | The offering will conclude when all 2,500,000 shares of common stock have been sold, or 90 days after this registration statement becomes effective with the Securities and Exchange Commission. Med Control may at its discretion extend the offering for an additional 90 days. |

Terms of the offering | The Company’s president and sole director will sell the common stock upon effectiveness of this registration statement. |

You should rely only upon the information contained in this prospectus. Med Control has not authorized anyone to provide you with information different from that which is contained in this prospectus. The Company is offering to sell shares of common stock and seeking offers only in jurisdictions where offers and sales are permitted. The information contained in here is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

Summary of Financial Information

The following summary financial information for the periods stated summarizes certain information from our financial statements included elsewhere in this prospectus. You should read this information in conjunction with Management's Plan of Operations, the financial statements and the related notes thereto included elsewhere in this prospectus.

Balance Sheet | As of July 31, 2008 |

Total Assets | $6,000 |

Total Liabilities | $2,722 |

Shareholder’s Equity | $3,278 |

Operating Data | July 1, 2008 (inception) through July 31, 2008 |

Revenue | $ - |

Net Loss | $2,722 |

Net Loss Per Share | $ 0.00 |

As shown in the financial statements accompanying this prospectus, Med Control has had no revenues to date and has incurred only losses since its inception. The Company has had no operations and has been issued a “going concern” opinion from their accountants, based upon the Company’s reliance upon the sale of our common stock as the sole source of funds for our future operations.

RISK FACTORS

Please consider the following risk factors and other information in this prospectus relating to our business and prospects before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

The Company considers the following to be the most significant material risks to an investor regarding this offering. Med Control should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount. Please consider the following risk factors before deciding to invest in our common stock.

Auditor’s Going Concern

THERE IS SUBSTANTIAL UNCERTAINTY ABOUT THE ABILITY OF MED CONTROLTO CONTINUE ITS OPERATIONS AS A GOING CONCERN

In their audit report dated September 2, 2008; our auditors have expressed an opinion that substantial doubt exists as to whether we can continue as an ongoing business. Because our officers may be unwilling or unable to loan or advance any additional capital to Med Control, we believe that if we do not raise additional capital within 12 months of the effective date of this registration statement, we may be required to suspend or cease the implementation of our business plans. Due to the fact that there is no minimum and no refunds on sold shares, you may be investing in a company that will not have the funds necessary to develop its business strategies. As such, we may have to cease operations and you could lose your entire investment. See “July 31, 2008 Audited Financial Statements - Auditors Report.”

Because the Company has been issued an opinion by its auditors that substantial doubt exists as to whether it can continue as a going concern, it may be more difficult to attract investors.

Risks Related To Our Financial Condition

SINCE THE COMPANY ANTICIPATES OPERATING EXPENSES WILL INCREASE PRIOR TO EARNING REVENUE, WE MAY NEVER ACHIEVE PROFITABILITY

The Company anticipates increases in its operating expenses, without realizing any revenues from its business activities. Within the next 12 months, the Company will have estimated costs related to:

# | Activities | Investment ($) |

1. | Development of the Med Time prototype | 7,000 |

2. | Market research | 3,500 |

3. | Legal and regulation research | 2,200 |

4. | Testing Med Time | 10,000 |

5. | Developing the Manufacturing Plan | 5,000 |

6. | Developing the Marketing Plan and Website | 10,500 |

7. | Developing the Sales Plan | 3,800 |

8. | Offering Costs | 5,700 |

9. | Administration expenses | 2,300 |

| Total | 50,000 |

There is no history upon which to base any assumption as to the likelihood that the Company will prove successful. We cannot provide investors with any assurance that our products will attract customers; generate any operating revenue or ever achieve profitable operations. If we are unable to address these risks, there is a high probability that our business can fail, which will result in the loss of your entire investment.

IF WE DO NOT OBTAIN ADEQUATE FINANCING, OUR BUSINESS WILL FAIL, RESULTING IN THE COMPLETE LOSS OF YOUR INVESTMENT

If we are not successful in earning revenues once we have started our sales activities, we may require additional financing to sustain business operations. Currently, we do not have any arrangements for financing and can provide no assurance to investors that we will be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the Company’s ability to attract customers. These factors may have an effect on the timing, amount, terms or conditions of additional financing and make such additional financing unavailable to us. See “Description of Business.”

No assurance can be given that the Company will obtain access to capital markets in the future or that financing, adequate to satisfy the cash requirements of implementing our business strategies, will be available on acceptable terms. The inability of the Company to gain access to capital markets or obtain acceptable financing could have a material adverse effect upon the results of its operations and upon its financial conditions.

Risks Related To This Offering

BECAUSE THERE IS NO PUBLIC TRADING MARKET FOR OUR COMMON STOCK, YOU MAY NOT BE ABLE TO RESELL YOUR STOCK

There is currently no public trading market for our common stock. Therefore there is no central place, such as a stock exchange or electronic trading system, to resell your shares. If you do want to resell your shares, you will have to locate a buyer and negotiate your own sale.

The offering price and other terms and conditions relative to the Company’s shares have been arbitrarily determined by us and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. Additionally, as the Company was formed recently and has only a limited operating history and no earnings, the price of the offered shares is not based on its past earnings and no investment banker, appraiser or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares.

INVESTING IN THE COMPANY IS A HIGHLY SPECULATIVE INVESTMENT AND COULD RESULT IN THE ENTIRE LOSS OF YOUR INVESTMENT

A purchase of the offered shares is highly speculative and involves significant risks. The offered shares should not be purchased by any person who cannot afford the loss of their entire investment. The business objectives of the Company are also speculative, and it is possible that we could be unable to satisfy them. The Company’s shareholders may be unable to realize a substantial return on their purchase of the offered shares, or any return whatsoever, and may lose their entire investment. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business and/or investment advisor.

BUYERS WILL PAY MORE FOR OUR COMMON STOCK THAN THE PRO RATA PORTION OF THE ASSETS ARE WORTH; AS A RESULT, INVESTING IN OUR COMPANY MAY RESULT IN AN IMMEDIATE LOSS

The offering price and other terms and conditions regarding the Company’s shares have been arbitrarily determined and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. Additionally, no investment banker, appraiser or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares.

The arbitrary offering price of $0.02 per common share as determined herein is substantially higher than the net tangible book value per share of Med Control’s common stock. Med Control’s assets do not substantiate a share price of $0.02. This premium in share price applies to the terms of this offering and does not attempt to reflect any forward looking share price subsequent to the Company obtaining a listing on any exchange, or becoming quoted on the OTC Bulletin Board.

THE COMPANY’S MANAGEMENT COULD ISSUE ADDITIONAL SHARES, SINCE THE COMPANY HAS 75,000,000 AUTHORIZED SHARES, DILLUTING THE CURRENT SHAREHOLDER’S EQUITY

The Company has 75,000,000 authorized shares, of which only 6,000,000 are currently issued and outstanding and only 8,500,000 will be issued and outstanding after this offering terminates. The Company’s management could, without the consent of the existing shareholders, issue substantially more shares, causing a large dilution in the equity position of the Company’s current shareholders. Additionally, large share issuances would generally have a negative impact on the Company’s share price. It is possible that, due to additional share issuance, you could lose a substantial amount, or all, of your investment.

AS WE DO NOT HAVE AN ESCROW OR TRUST ACCOUNT FOR INVESTORS' SUBSCRIPTIONS, IF WE FILE FOR OR ARE FORCED INTO BANKRUPTCY PROTECTION, INVESTORS WILL LOSE THEIR ENTIRE INVESTMENT

Invested funds for this offering will not be placed in an escrow or trust account. Accordingly, if we file for bankruptcy protection, or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. As such, you will lose your investment and your funds will be used to pay creditors.

WE DO NOT ANTICIPATE PAYING DIVIDENDS IN THE FORESEEABLE FUTURE

We do not anticipate paying dividends on our common stock in the foreseeable future, but plan rather to retain earnings, if any, for the operation, growth and expansion of our business.

AS WE MAY BE UNABLE TO CREATE OR SUSTAIN A MARKET FOR THE COMPANY’S SHARES, THEY MAY BE EXTREMELY ILLIQUID

If no market develops, the holders of our common stock may find it difficult or impossible to sell their shares. Further, even if a market develops, our common stock will be subject to fluctuations and volatility and the Company cannot apply directly to be quoted on the NASD Over-The-Counter Bulletin Board (OTC). Additionally, the stock may be listed or traded only to the extent that there is interest by broker-dealers in acting as a market maker in the Company’s stock. Despite the Company’s best efforts, it may not be able to convince any broker/dealers to act as market-makers and make quotations on the OTC Bulletin Board. The Company may consider pursuing a listing on the OTCBB after this registration becomes effective and the Company has completed its offering.

IN THE EVENT THAT THE COMPANY’S SHARES ARE TRADED, THEY MAY TRADE UNDER $5.00 PER SHARE AND THUS WILL BE A PENNY STOCK. TRADING IN PENNY STOCKS HAS MANY RESTRICTIONS AND THESE RESTRICTIONS COULD SEVERLY AFFECT THE PRICE AND LIQUIDITY OF THE COMPANY’S SHARES

In the event that our shares are traded and our stock trades below $5.00 per share, our stock would be known as a “penny stock”, which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission (the “SEC”) has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our common stock could be considered to be a “penny stock”. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established customers and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our securities, and may negatively affect the ability of holders of shares of our common stock to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile and you may not be able to buy or sell the stock when you want to.

SINCE OUR COMPANY’S SOLE OFFICER AND DIRECTOR CURRENTLY OWNS 100% OF THE OUTSTANDING COMMON STOCK, INVESTORS MAY FIND THAT HER DECISIONS ARE CONTRARY TO THEIR INTERESTS

The Company’s sole officer and director, Ms. Kato, owns 100% of the outstanding shares and will own over 70.6% after this offering is completed. As a result, she may have control of the Company and be able to choose all of our directors. Her interests may differ from those of the other stockholders. Factors that could cause her interests to differ from the other stockholders include the impact of corporate transactions on the timing of business operations and her ability to continue to manage the business given the amount of time she is able to devote to the Company.

All decisions regarding the management of the Company’s affairs will be made exclusively by our sole officer and director. Purchasers of the offered shares may not participate in the management of the Company and therefore, are dependent upon her management abilities. The only assurance that the shareholders of the Company, including purchasers of the offered shares, have that the Company’s sole officer and director will not abuse her discretion in executing the Company’s business affairs, is her fiduciary obligation and business integrity. Such discretionary powers include, but are not limited to, decisions regarding all aspects of business operations, corporate transactions and financing. Accordingly, no person should purchase the offered shares unless willing to entrust all aspects of management to the sole officer and director, or her successors. Potential purchasers of the offered shares must carefully evaluate the personal experience and business abilities of the Company’s management.

Risks Related to Investing in Our Company

WE LACK AN OPERATING HISTORY AND THERE IS NO ASSURANCE OUR FUTURE OPERATIONS WILL RESULT IN PROFITABLE REVENUES, WHICH COULD RESULT IN SUSPENSION OR END OF OUR OPERATIONS

We were incorporated on July 1, 2008 and we have not realized any revenues. We have very little operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the completion of this offering, our ability to attract customers and to generate revenues through our sales.

Based upon current plans, we expect to incur operating losses in future periods because we will be incurring expenses and not generating revenues. We cannot guarantee that we will be successful in generating revenues in the future. Failure to generate revenues will cause us to go out of business.

OUR OPERATING RESULTS MAY PROVE UNPREDICTABLE

Our operating results are likely to fluctuate significantly in the future due to a variety of factors, many of which we have no control. Factors that may cause our operating results to fluctuate significantly include: our ability to generate enough working capital from future equity sales; the level of commercial acceptance by the public of our products; fluctuations in the demand for medicine; the amount and timing of operating costs and capital expenditures relating to expansion of our business, operations, infrastructure and general economic conditions.

If realized, any of these risks could have a material adverse effect on our business, financial condition and operating results.

BECAUSE WE ARE SMALL AND DO NOT HAVE MUCH CAPITAL, OUR MARKETING CAMPAIGN MAY NOT BE ENOUGH TO ATTRACT SUFFICIENT CLIENTS TO OPERATE PROFITABLY. IF WE DO NOT MAKE A PROFIT, WE MAY HAVE TO SUSPEND OR CEASE OPERATIONS

Due to the fact we are small and do not have much capital, we must limit our marketing activities and may not be able to make our product known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably, we may have to suspend or cease operations.

AS THE COMPANY’S SOLE OFFICER AND DIRECTOR HAS OTHER OUTSIDE BUSINESS ACTIVITIES, SHE MAY NOT BE IN A POSITION TO DEVOTE A MAJORITY OF HER TIME TO THE COMPANY, WHICH MAY RESULT IN PERIODIC INTERRUPTIONS OR BUSINESS FAILURE

Ms. Kato, our sole officer and director, has other business interests and currently devotes approximately 5-10 hours per week to our operations. Our operations may be sporadic and occur at times which are not convenient to Ms. Kato, which may result in periodic interruptions or suspensions of our business plan. If the demands of the Company’s business require the full business time of our sole officer and director, she is prepared to adjust her timetable to devote more time to the Company’s business. However, she may not be able to devote sufficient time to the management of the Company’s business, which may result in periodic interruptions in implementing the Company’s plans in a timely manner. Such delays could have a significant negative effect on the success of the business.

KEY MANAGEMENT PERSONNEL MAY LEAVE THE COMPANY WHICH COULD ADVERSELY AFFECT THE ABILITY OF THE COMPANY TO CONTINUE OPERATIONS

The Company is entirely dependent on the efforts of its sole officer and director. Her departure or the loss of any other key personnel in the future could have a material adverse effect on the business. The Company believes that all commercially reasonable efforts have been made to minimize the risks attendant with the departure by key personnel from service. However, there is no guarantee that replacement personnel, if any, will help the Company to operate profitably. The Company does not maintain key person life insurance on its sole officer and director.

IT MAY BE IMPOSSIBLE TO HIRE ADDITIONAL EXPERIENCED PROFESSIONALS, IF NECESSARY, AND WE MAY HAVE TO SUSPEND OR CEASE OPERATIONS

Since our management does not have prior experience in the marketing of medical products, we may need to hire additional experienced personnel to assist us with the operations. If we need the additional experienced personnel and we cannot hire them, we could fail in our plan of operations and have to suspend operations or cease them entirely.

IN THE CASE IF THE COMPANY IS DISSOLVED, IT IS UNLIKELY THAT THERE WILL BE SUFFICIENT ASSETS REMAINING TO DISTRIBUTE TO THE SHAREHOLDERS

In the event of the dissolution of the Company, the proceeds realized from the liquidation of its assets, if any, will be distributed to the shareholders only after the claims of the Company’s creditors are satisfied. In that case, the ability of purchasers of the offered shares to recover all or any portion of the purchase price for the offered shares will depend on the amount of funds realized and the claims to be satisfied there from.

Risks Related to the Company’s Market and Strategy

SINCE WE ARE A NEW COMPANY AND LACK AN OPERATING HISTORY, WE FACE A HIGH RISK OF BUSINESS FAILURE WHICH WOULD RESULT IN THE LOSS OF YOUR INVESTMENT

Med Control is a development stage company formed recently to carry out the activities described in this prospectus and thus has only a limited operating history upon which an evaluation of its prospects can be made. We were incorporated on July 1, 2008 and to date have been involved primarily in the creation of our business plan and we have transacted no business operations. Thus, there is no internal or industry-based historical financial data upon which to estimate the Company’s planned operating expenses.

The Company expects that its results of operations may also fluctuate significantly in the future as a result of a variety of market factors, including, among others, the dominance of other companies offering similar products, the entry of new competitors into medical products industry, our ability to attract, retain and motivate qualified personnel, the initiation, renewal or expiration of our customer base, pricing changes by the Company or its competitors, specific economic conditions in the medical industry and general economic conditions. Accordingly, our future sales and operating results are difficult to forecast.

As of the date of this prospectus, we have earned no revenue. Failure to generate revenue will cause us to go out of business, which will result in the complete loss of your investment.

COMPANY'S ABILITY TO IMPLEMENT THE BUSINESS STRATEGY

The implementation of the Company’s marketing strategy will depend on a number of factors. These include our ability to establish a significant customer base and maintain favorable relationships with customers and partners, obtain adequate financing on favorable terms in order to fund our business, maintain appropriate procedures, policies and systems; hire, train and retain skilled employees and to continue to operate within an environment of increasing competition. The inability of the Company to manage any or all of these factors could impair our ability to implement our business strategy successfully, which could have a material adverse effect on the results of its operations and its financial condition.

WE MAY BE UNABLE TO GAIN ANY SIGNIFICANT MARKET ACCEPTANCE FOR OUR PRODUCTS OR ESTABLISH A SIGNIFICANT MARKET PRESENCE

The Company’s growth strategy is substantially dependent upon its ability to market its products successfully to prospective clients. However, its planned products may not achieve significant acceptance. Such acceptance, if achieved, may not be sustained for any significant period of time. Failure of the Company’s products to achieve or sustain market acceptance could have a material adverse effect on our business, financial conditions and the results of our operations.

THE COMPANY MAY BE UNABLE TO MANAGE ITS FUTURE GROWTH

The Company expects to experience continuous growth for the foreseeable future. Its growth may place a significant strain on management, financial, operating and technical resources. Failure to manage this growth effectively could have a material adverse effect on the Company’s financial condition or the results of its operations.

Risks Related to Investing in Our Business

BECAUSE WE HAVEN’T DEVELOPED OUR PRODUCT YET, THE PRODUCTION COST CAN EXCEED EXPECTATIONS

We have not developed our product, only a prototype, so we don’t know the exact cost of each product. In the case of a higher than expected cost of production, we won’t be able to offer our products at the expected price. If we are unable to offer MED TIME at a reasonable price, it could affect negatively our business which would result in the loss of your investment.

OUR SERVICE MAY NOT BE ABLE TO DISTINGUISH ITSELF IN THE MARKET

There are a wide range of companies that offer similar products. If we are unable to demonstrate clearly that MED CONTROL helps to control medicine doses and schedules, we may be unable to attract enough clients.

THE COMPANY MAY BE UNABLE TO MAKE NECESSARY ARRANGEMENTS AT ACCEPTABLE COST

Because we are a small business, with limited assets, we are not able to assume significant additional costs to operate. If we are unable to make any necessary change in the Company structure, do the proper negotiations with the suppliers or are faced with circumstances that are beyond our ability to afford, we may have to suspend operations or cease them entirely which could result in a total loss of your investment.

IF OUR MEDICAL INFORMATION OR THE PRODUCTS OF OUR ADVERTISERS ARE FOUND TO CAUSE INJURY, HAVE DEFECTS, OR FAIL TO MEET INDUSTRY STANDARDS, WE MAY INCUR SUBSTANTIAL LITIGATION, JUDGMENT, AND PRODUCT LIABILITY COSTS, WHICH WILL INCREASE OUR LOSSES AND NEGATIVELY AFFECT OUR BRAND NAME REPUTATION AND PRODUCT SALES.

Because the information we provide and the products our advertisers provide are of a medical nature, we may be subject to liability for any incidents that may occur in connection with the application of this information or the use of these products or due to claims of incompetency or of defective design, integrity or durability of the products. We do not currently maintain liability insurance coverage for such claims. If we are unable to obtain such insurance, product liability claims could adversely affect our brand name reputation, revenues and ultimately lead to losses. The occurrence of any claims, judgments, or product recalls will negatively affect our brand name image and advertising sales, as well as lead to additional costs.

USE OF PROCEEDS

Our offering is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.02. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by the Company.

| If 25% of

Shares Sold | If 50% of

Shares Sold | If 75% of

Shares Sold | If 100% of

Shares Sold |

GROSS PROCEEDS FROM THIS OFFERING | $12,500 | $25,000 | $37,500 | $50,000 |

| ========== | ========= | ========== | ========== |

OFFERING EXPENSES | | | | |

Legal & Accounting | 4,200 | 4,200 | 4,200 | 4,200 |

Printing | 500 | 500 | 500 | 500 |

Transfer Agent | 1,000 | 1,000 | 1,000 | 1,000 |

TOTAL | $5,700 | $5,700 | $5,700 | $5,700 |

| | | | |

PRODUCT DEVELOPMENT | | | | |

Prototype Med Time | 800 | 3,000 | 4,700 | 7,000 |

Market Research | 500 | 1,500 | 2,500 | 3,500 |

Legal and Regulation Research | 300 | 1,100 | 1,600 | 2,200 |

Test Med Time | 1,700 | 3,500 | 7,500 | 10,000 |

Manufacturing Plan | 700 | 2,500 | 3,700 | 5,000 |

TOTAL | $4,000 | $11,600 | $20,000 | $27,700 |

| | | | |

SALES &MARKETING | | | | |

Marketing Planning | 800 | 2,700 | 3,500 | 5,000 |

Website Development | 1,000 | 2,500 | 4,000 | 5,500 |

Sales Planning | 600 | 1,800 | 2,800 | 3,800 |

TOTAL | $2,400 | $7,000 | $10,300 | $14,300 |

| | | | |

ADMINISTRATION EXPENSES | | | | |

Office supplies, Stationery, Telephone, Internet | 400 | 700 | 1,500 | 2,300 |

TOTAL | $400 | $700 | $1,500 | $2,300 |

| | | | |

TOTALS | $12,500 | $25,000 | $37,500 | $50,000 |

The above figures represent only estimated costs.

DETERMINATION OF OFFERING PRICE

As there is no established public market for our shares, the offering price and other terms and conditions relative to our shares have been arbitrarily determined by Med Control and do not bear any relationship to assets, earnings, book value, or any other objective criteria of value. In addition, no investment banker, appraiser, or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares.

DILUTION

The price of the current offering is fixed at $0.02 per share. This price is significantly greater than the price paid by the Company’s sole officer and director for common equity since the Company’s inception on July 1, 2008. The Company’s sole officer and director paid $0.001 per share, a difference of $0.019 per share lower than the share price in this offering.

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders. The following tables compare the differences of your investment in our shares with the investment of our existing stockholders.

Existing Stockholders if all of the Shares are Sold

Price per share | $ | 0.02 |

Net tangible book value per share before offering | $ | 0.0004 |

Potential gain to existing shareholders | $ | 50,000 |

Net tangible book value per share after offering | $ | 0.0061 |

Increase to present stockholders in net tangible book value per share after offering | $ | 0.0057 |

Capital contributions | $ | 50,000 |

Number of shares outstanding before the offering | | 6,000,000 |

Number of shares after offering held by existing stockholders | | 6,000,000 |

Percentage of ownership after offering | | 70.6% |

Purchasers of Shares in this Offering if all Shares Sold

Price per share | $ | 0.02 |

Dilution per share | $ | 0.014 |

Capital contributions | $ | 50,000 |

Percentage of capital contributions | | 89.3% |

Number of shares after offering held by public investors | | 2,500,000 |

Percentage of ownership after offering | | 29.5% |

Purchasers of Shares in this Offering if 75% of Shares Sold

Price per share | $ | 0.02 |

Dilution per share | $ | 0.015 |

Capital contributions | $ | 37,500 |

Percentage of capital contributions | | 86.2% |

Number of shares after offering held by public investors | | 1,875,000 |

Percentage of ownership after offering | | 23.8% |

Purchasers of Shares in this Offering if 50% of Shares Sold

Price per share | $ | 0.02 |

Dilution per share | $ | 0.016 |

Capital contributions | $ | 25,000 |

Percentage of capital contributions | | 80.6% |

Number of shares after offering held by public investors | | 1,250,000 |

Percentage of ownership after offering | | 17.3% |

Purchasers of Shares in this Offering if 25% of Shares Sold

Price per share | $ | 0.02 |

Dilution per share | $ | 0.017 |

Capital contributions | $ | 12,500 |

Percentage of capital contributions | | 67.6% |

Number of shares after offering held by public investors | | 625,000 |

Percentage of ownership after offering | | 9.5% |

PLAN OF DISTRIBUTION

6,000,000 common shares are issued and outstanding as of the date of this prospectus. The Company is registering an additional of 2,500,000 shares of its common stock for possible resale at the price of $0.02 per share. There is no arrangement to address the possible effect of the offerings on the price of the stock.

Med Control will receive all proceeds from the sale of those shares. The price per share is fixed at $0.02 until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. Prior to being quoted on the OTCBB, the Company may sell its shares in private transactions to other individuals. Although our common stock is not listed on a public exchange, we intend to seek a listing on the Over The Counter Bulletin Board (OTCBB). In order to be quoted on the Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved. However, sales by the Company must be made at the fixed price of $0.02 until a market develops for the stock.

The Company's shares may be sold to purchasers from time to time directly by and subject to the discretion of the Company. Further, the Company will not offer its shares for sale through underwriters, dealers, agents or anyone who may receive compensation in the form of underwriting discounts, concessions or commissions from the Company and/or the purchasers of the shares for whom they may act as agents. The shares sold by the Company may be occasionally sold in one or more transactions, either at an offering price that is fixed or that may vary from transaction to transaction depending upon the time of sale. Such prices will be determined by the Company or by agreement between both parties.

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those only if they have been registered or qualified for sale; an exemption from such registration or if qualification requirement is available and with which Med Control has complied.

In addition and without limiting the foregoing, the Company will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

Med Control will pay all expenses incidental to the registration of the shares (including registration pursuant to the securities laws of certain states).

DESCRIPTION OF SECURITIES

Common Stock

Our authorized capital stock consists of 75,000,000 shares of common stock, par value $0.001 per share. The holders of our common stock:

| * | have equal ratable rights to dividends from funds legally available if and when declared by our |

| | Board of Directors; |

| * | are entitled to share ratably in all of our assets available for distribution to holders of common stock |

| | upon liquidation, dissolution or winding up of our affairs; |

| * | do not have preemptive, subscription or conversion rights and there are no redemption or sinking |

| | fund provisions or rights; |

| * | and are entitled to one non-cumulative vote per share on all matters on which stockholders may vote. |

We refer you to the Bylaws of our Articles of Incorporation and the applicable statutes of the State of Nevada for a more complete description of the rights and liabilities of holders of our securities.

Non-cumulative Voting

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose and, in that event, the holders of the remaining shares will not be able to elect any of our directors. After this offering is completed, present stockholders will own approximately 70.6% of our outstanding shares.

Cash Dividends

As of the date of this prospectus, we have not declared or paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our Board of Directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings in our business operations.

Anti-Takeover Provisions

Currently, we have no Nevada shareholders and since this offering will not be made in the State of Nevada, no shares will be sold to its residents. Further, we do not do business in Nevada directly or through an affiliate corporation and we do not intend to do so. Accordingly, there are no anti-takeover provisions that have the affect of delaying or preventing a change in our control.

Stock Transfer Agent

We have not engaged the services of a transfer agent at this time. However, within the next twelve months we anticipate doing so. Until such a time a transfer agent is retained, Med Control will act as its own transfer agent.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

The financial statements included in this prospectus and the registration statement have been audited by De Joya Griffith & Company, LLC, Certified Public Accountants & Consultants, 2580 Anthem Village Drive, Henderson, NV 89052 to the extent and for the periods set forth in their report appearing elsewhere herein and in the registration statement. The financial statements are included in reliance on such report given upon the authority of said firm as experts in auditing and accounting.

Law Offices of Thomas E. Puzzo, PLLC, 4216 NE 70th Street Seattle, Washington 98115, our independent legal counsel, has provided an opinion on the validity of our common stock.

DESCRIPTION OF BUSINESS

Business Development

On July 1, 2008, Ms. Eliane Mayumi Kato, president and sole director, incorporated the Company in the State of Nevada and established a fiscal year end of July 31. The objective of this corporation is to enter into the medical products industry.

Med Control’s mission is to help elderly persons get a healthier life, by providing easy-handled and reliable products. Our main product is called “Med Time”, an electronic and portable device aim to control the right doses and schedules of medications taken by elderly individuals.

Our business office is located at 112 North Curry Street, Carson City, Nevada, 89703; our telephone number is (775) 333-1182 and our fax number is 775-313-9805. Our United States and registered statutory office is located at 112 North Curry Street, Carson City, Nevada, 89703, telephone number (775) 882-1013.

The Company has not yet implemented its business model and to date has generated no revenues.

Med Control has no plans to change its business activities or to combine with another business and is not aware of any circumstances or events that might cause this plan to change.

Market Opportunity

The evolution of medical preventions and treatments in conjunction with better quality of food (more vitamins, nutrients, less fat, calories, etc.) are leading the population of different countries to leverage their life expectancy. Therefore, more people are living over 65 years, and, consequently, the age related illnesses are increasing too.

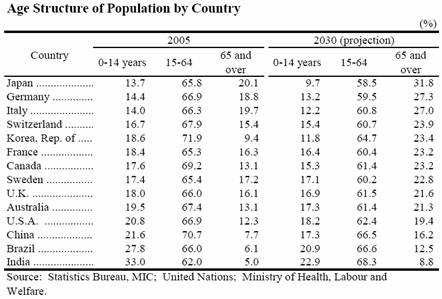

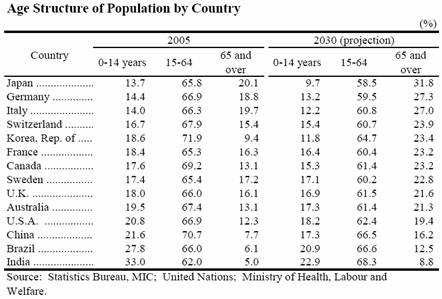

In a study held by the Statistic Bureau in Japan, as followed below, the projection for most of the countries is that, in 2030, the population over 65 years is going to grow more than 50%, comparing to 2005.

| Source: http://www.stat dot go.jp/english/data/handbook/pdf/c02cont.pdf |

The target is the American market of:

| • | The over-65-year-old population, which has a huge growth tendency (for 2020, approximately 56%, according to estimation of the Census Bureau) in USA, due to the increase of life expectancy; |

| • | The ones who have to take more than 3 different medicines in regular basis; |

| • | The ones who earn more than $25,000/year; |

| • | Also health institutions, such as hospitals, Nursing Homes, Living Centers, Long Term Care, which can use Med Time on their patients. |

Source: http://www.census dot gov/population/projections/52PyrmdUS2.pdf

Description of our Products

Our main product is called “Med Time”, an electronic and portable device aimed to control the right doses and schedules of medications taken by elderly individuals. Its projected main features are:

| • | There are 2 project types of Med time: Med Time Home and Med Time Portable. One can have 3 storage capacities up to 5, 10 or 15 different medicines; |

| • | The storage compartments can receive drops, pills, liquid or even powder; |

| • | Med Time may have a large, 320x480 color touch screen, which the person uses to access and program the device for the different prescriptions, according to the doctor directions; |

| • | 128MB of non-volatile flash memory to store programs and personal files; |

| • | One USB port to upload new programs or new prescriptions in MS Excel or Word format; |

| • | Wi-Fi 802.11b wireless technology, allowing connection to computers (for programming) or even the internet (updating routines or information download); |

| • | Long-life rechargeable lithium ion and AC adapter for power supply. |

Competitive Advantages

The medical products and materials market will continue to evolve and is extremely competitive, with competition likely to develop and intensify in the future. Management believes that we will be able to compete within the market by providing a high quality, user friendly device, where customers will be comfortable.

Although the market is highly competitive, Med Control believes there are significant market opportunities for the sales of medical products and materials. Management believes it may be able to set itself apart by focusing its resources on marketing and providing a comprehensive distributor catalog on a website easy to navigate and would provide quality information pertaining to the medical industry related to goods and our products.

Marketing

Med Control is currently in the process of the prototype of “Med Time”, which will be used to verify the benefits among a control group of customers.

Med Control’s marketing strategy to promote “Med Time” includes demonstrations of the product, showing how it can help dosage control to opinion makers such as physicians whose specialty is elderly persons and drugstore employees because they are in direct contact with our target customers.

The Company’s selling strategy is based in developing the following channels:

| • | Drugstores: direct touch to the target customers, by making alliances with major drugstores |

| • | Internet: by creating a website to sell our products online |

Currently, Med Control has bought a domain, but not fully developed its website (www.medcontrolpro dot com).

A huge selling potential lays in health institutions, like hospitals and Elderly Living Centers, once they have to deal with a variety of medications to different patients daily. Med Time would help not only to control the schedule and amount, but also to keep track of all the information of each individual, helping their treatment and improving their quality of life.

It is important to note that Med Control has not yet fully developed “Med time”, and there can be no assurance that Med Control will be able to implement any marketing campaigns and strategies successfully.

Med Control plans also to search for websites that are of similar interest to our target audience in order to place targeted links. These links will have the potential to increase targeted traffic to Med Control's website.

Intellectual Property

We intend, in due course and subject to legal advice, to apply for trademark protection and/or copyright protection in the United States, Canada, and other jurisdictions.

We intend to aggressively assert our legal rights under trademark and copyright laws to protect our intellectual property, including product design, product research and concepts and recognized trademarks. These rights are protected through the acquisition of trademark registrations, the maintenance of copyrights, and, where appropriate, litigation against those who are, in our opinion, infringing these rights.

While there can be no assurance that registered trademarks and copyrights will protect our proprietary information, we intend to assert our intellectual property rights against any infringer. Although any assertion of our rights can result in a substantial cost to, and diversion of effort by, our company, management believes that the protection of our intellectual property rights is a key component of our operating strategy.

Regulatory Matters

We are unaware of any government regulations that would restrict our ability to do business in North America and do not anticipate having to expend significant resources to comply with any governmental regulations of the medical products industry. We are subject to the laws and regulations of those jurisdictions in which we plan to sell our product, which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the development and operation of our business is not subject to special regulatory and/or supervisory requirements.

Employees and Employment Agreements

As the date of this prospectus, Med Control has no permanent staff other than its sole officer and director, Ms. Eliane Mayumi Kato, who is the President and Chairman of the Company. Ms. Kato is employed elsewhere and has the flexibility to work on Med Control up to 10 hours per week. She is prepared to devote more time to our operations as may be required. She is not being paid at present.

There are no employment agreements in existence. The Company presently does not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, the Company may adopt plans in the future. Management does not plan to hire additional employees at this time. Our sole officer and director will be responsible for the initial servicing. Once the Company begins building its Internet website, it will hire an independent consultant to build the site. The Company also intends to hire sales representatives initially on a commission only basis to keep administrative overhead to a minimum.

Environmental Laws

We have not incurred and do not anticipate incurring any expenses associated with environmental laws.

AVAILABLE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the common stock offered hereby. This prospectus, which constitutes part of the registration statement, does not contain all of the information set forth in the registration statement and the exhibits and schedules thereto, certain parts of which are omitted in accordance with the rules and regulations of the SEC. For further information regarding our common stock and our company, please review the registration statement, including exhibits, schedules and reports filed as a part thereof. Statements in this prospectus as to the contents of any contract or other document filed as an exhibit to the registration statement, set forth the material terms of such contract or other document but are not necessarily complete, and in each instance reference is made to the copy of such document filed as an exhibit to the registration statement, each such statement being qualified in all respects by such reference.

We are also subject to the informational requirements of the Exchange Act which requires us to file reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information along with the registration statement, including the exhibits and schedules thereto, may be inspected at public reference facilities of the SEC at 100 F Street N.E, Washington D.C. 20549. Copies of such material can be obtained from the Public Reference Section of the SEC at prescribed rates. You may call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Because we file documents electronically with the SEC, you may also obtain this information by visiting the SEC’s Internet website at http://www.sec.gov.

Reports to security holders

After we complete this offering, we will not be required to furnish you with an annual report. Further, we will not voluntarily send you an annual report. We will be required to file reports with the SEC under section 13 (a) or 15(d) of the Securities Act. The reports will be filed electronically. The reports we will be required to file are Forms 10-K, 10-Q, and 8-K. You may read copies of any materials we file with the SEC at the SEC’s Public Reference Room or visiting the SEC’s Internet website (see “Available Information” above).

LEGAL PROCEEDINGS

We are not currently a party to any legal proceedings.

FINANCIAL STATEMENTS

Our fiscal year end is July 31. We will provide audited financial statements to our stockholders on an annual basis; as prepared by an Independent Certified Public Accountant.

MED CONTROL, INC.

(A Development Stage Enterprise)

FINANCIAL STATEMENTS

July 31, 2008

(Audited)

De Joya Griffith & Company, LLC

CERTIFIED PUBLIC ACCOUNTANTS & CONSULTANTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Med Control, Inc.

Carson City, Nevada

We have audited the accompanying balance sheet of Med Control, Inc. (A Development Stage Company) as of July 31, 2008, and the related statement of operations, stockholder’s equity, and cash flows from inception (July 1, 2008) through July 31, 2008. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Med Control, Inc. (A Development Stage Company) as of July 31, 2008, and the results of its operations and cash flows from inception (July 1, 2008) through July 31, 2008 in conformity with generally accepted accounting principles in the United States.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered recurring losses from operations, which raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ De Joya Griffith & Company, LLC

Henderson, Nevada

September 2, 2008

2580 Anthem Village Drive, Henderson, NV 89052

Telephone (702) 588-5960 / Facsimile (702) 588-5979

MED CONTROL, INC.

(A Development Stage Enterprise)

BALANCE SHEET

(Audited)

| | As of July 31, 2008 |

| | |

ASSETS | | |

| | |

CURRENT ASSETS | | |

Cash | | $ 6,000 |

Total current assets | | 6,000 |

| | |

Total assets | | $ 6,000 |

| | |

LIABILITIES AND STOCKHOLDER’S EQUITY | | |

| | |

CURRENT LIABILITIES | | |

Accounts payable and accrued liabilities Due to related party | | $ 1,500 1,222 |

Total current liabilities | | 2,722 |

Total liabilities | | 2,722 |

| | |

STOCKHOLDER’S EQUITY | | |

Common stock, $0.001 par value, | | |

Authorized 75,000,000 shares of common stock, | | |

Issued and outstanding 6,000,000 shares of common stock | | 6,000 |

| | |

Deficit accumulated during the development stage | | (2,722) |

| | |

Total stockholder’s equity | | 3,278 |

| | |

Total liabilities and stockholder’s equity | | $ 6,000 |

The accompanying notes are an integral part of these financial statements

MED CONTROL, INC.

(A Development Stage Enterprise)

STATEMENT OF OPERATIONS

(Audited)

| | | | From inception (July 1, 2008) through July 31, 2008 |

| | | | |

REVENUE | | | | $ -- |

| | | | |

EXPENSES | | | | |

General and administrative | | | | 22 |

Professional fees | | | | 2,700 |

Total expenses | | | | 2,722 |

| | | | |

NET LOSS | | | | $ (2,722) |

| | | | |

BASIC NET LOSS PER SHARE | | | | $ (0.00) |

| | | | |

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING | | | | 1,111,111 |

The accompanying notes are an integral part of these financial statements

MED CONTROL, INC.

(A Development Stage Enterprise)

STATEMENT OF STOCKHOLDER’S EQUITY

FROM INCEPTION (JULY 1, 2008) TO JULY 31, 2008

(Audited)

| Common Stock | Deficit accumulated during the development | Total stockholder’s |

Number of shares | Amount | stage | equity |

| | | | |

Balance, July 1, 2008 | - | $ - | $ - | $ - |

| | | | |

Common stock issued for cash at $0.001 | | | | |

per share July 1, 2008 | 6,000,000 | 6,000 | - | 6,000 |

Net loss | | | (2,722) | (2,722) |

| | | | |

Balance, July 31, 2008 | 6,000,000 | $ 6,000 | $ (2,722) | $ 3,278 |

The accompanying notes are an integral part of these financial statements

MED CONTROL, INC.

(A Development Stage Enterprise)

STATEMENT OF CASH FLOWS

(Audited)

| | | From inception (July 1, 2008) through July 31, 2008 |

| | | |

| | | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | |

Net loss | | | $ (2,722) |

Changes in operating assets and liabilities: Increase in accrued liabilities | | | 1,500 |

| | | |

NET CASH USED IN OPERATING ACTIVITIES | | | (1,222) |

| | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | |

Due to related party Issuance of common stock | | | 1,222 6,000 |

NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 7,222 |

| | | |

NET INCREASE IN CASH | | | 6,000 |

| | | |

CASH, BEGINNING OF PERIOD | | | - |

| | | |

CASH, END OF PERIOD | | | $ 6,000 |

| | | |

The accompanying notes are an integral part of these financial statements

MED CONTROL, INC.

(A Development Stage Enterprise)

NOTES TO FINANCIAL STATEMENTS

July 31, 2008

(Unaudited)

NOTE 1 – NATURE OF OPERATIONS AND BASIS OF PRESENTATION

Med Control, Inc. (the “Company”) was incorporated on July 1, 2008 in the State of Nevada and established a fiscal year end of July 31. The Company is a development stage enterprise organized to help elderly persons to get a healthier life, by providing easy-handling and reliable products. The main intended product is called “Med Time”, an electronic and portable device aimed to control the doses and schedules of medications taken by elderly individuals. The Company is currently in the development stage as defined in SFAS No. 7. All activities of the Company to date relate to its organization, initial funding and share issuances.

The financial information is audited. In the opinion of management, all adjustments necessary to present fairly the financial position as of July 31,2008 and the results of operations, stockholder’s equity and cash flows presented herein have been included in the financial statements.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The financial statements present the balance sheet, statement of operations, stockholder’s equity and cash flows of the Company. These financial statements are presented in United States dollars and have been prepared in accordance with accounting principles generally accepted in the United States.

Going concern

The Company’s financial statements are prepared in accordance with generally accepted accounting principles applicable to a going concern. This contemplates the realization of assets and the liquidation of liabilities in the normal course of business. Currently, the Company does not have material assets, nor does it have operations or a source of revenue sufficient to cover its operation costs and allow it to continue as a going concern. The Company has a deficit accumulated since inception (July 1, 2008) through July 31, 2008 of ($2,722). The Company will be dependent upon the raising of additional capital through placement of common stock in order to implement its business plan, or merge with an operating company. There can be no assurance that the Company will be successful in either situation in order to continue as a going concern. Accordingly, these factors raise substantial doubt as to the Company’s ability to continue as a going concern. The Company is funding its initial operations by way of issuing Founder’s shares. As of July 31, 2008, the Company had issued 6,000,000 Founder’s shares at $0.001 per share for net proceeds to the Company of $6,000.

The officers and directors have committed to advancing certain operating costs of the Company.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers highly liquid financial instruments purchased with a maturity of three months or less to be cash equivalents.

Use of Estimates and Assumptions

Preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Income Taxes

The Company follows the liability method of accounting for income taxes in accordance with Statements of Financial Accounting Standards (“SFAS”) No. 109, “Accounting for Income Taxes” and clarified by FIN 48

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

“Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109.” Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax balances. Deferred tax assets and liabilities are measured using enacted or substantially enacted tax rates expected to apply to the taxable income in the years in which those differences are expected to be recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the date of enactment or substantive enactment.

Net Loss per Share

Basic loss per share includes no dilution and is computed by dividing loss available to common stockholders by the weighted average number of common shares outstanding for the period. Dilutive loss per share reflects the potential dilution of securities that could share in the losses of the Company. Because the Company does not have any potentially dilutive securities, the accompanying presentation is only of basic loss per share.

Stock-based Compensation

The Company has not adopted a stock option plan and has not granted any stock options. Accordingly no stock-based compensation has been recorded to date.

Fair Value of Financial Instruments

In accordance with the requirements of SFAS No. 107 and SFAS No. 157, the Company has determined the estimated fair value of financial instruments using available market information and appropriate valuation methodologies. The fair value of financial instruments classified as current assets or liabilities approximate their carrying value due to the short-term maturity of the instruments.

Recent Accounting Pronouncements

SFAS 141(R) - In December 2007, the FASB issued SFAS 141(R), “Business Combinations.” This Statement replaces SFAS 141, “Business Combinations,” and requires an acquirer to recognize the assets acquired, the liabilities assumed, including those arising from contractual contingencies, any contingent consideration, and any noncontrolling interest in the acquiree at the acquisition date, measured at their fair values as of that date, with limited exceptions specified in the statement. SFAS 141(R) also requires the acquirer in a business combination achieved in stages (sometimes referred to as a step acquisition) to recognize the identifiable assets and liabilities, as well as the noncontrolling interest in the acquiree, at the full amounts of their fair values (or other amounts determined in accordance with SFAS 141(R)). In addition, SFAS 141(R)'s requirement to measure the noncontrolling interest in the acquiree at fair value will result in recognizing the goodwill attributable to the noncontrolling interest in addition to that attributable to the acquirer. SFAS 141(R) amends SFAS No. 109, “Accounting for Income Taxes,” to require the acquirer to recognize changes in the amount of its deferred tax benefits that are recognizable because of a business combination either in income from continuing operations in the period of the combination or directly in contributed capital, depending on the circumstances. It also amends SFAS 142, “Goodwill and Other Intangible Assets,” to, among other things, provide guidance on the impairment testing of acquired research and development intangible assets and assets that the acquirer intends not to use. SFAS 141(R) applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. We are currently assessing the potential impact that the adoption of SFAS 141(R) could have on our financial statements.

SFAS 160 - In December 2007, the FASB issued SFAS 160, “Noncontrolling Interests in Consolidated Financial Statements.” SFAS 160 amends Accounting Research Bulletin 51, “Consolidated Financial Statements,” to establish accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. It also clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. SFAS 160 also changes the way the consolidated income statement is presented by requiring consolidated net

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

income to be reported at amounts that include the amounts attributable to both the parent and the noncontrolling interest. It also requires disclosure, on the face of the consolidated statement of income, of the amounts of consolidated net income attributable to the parent and to the noncontrolling interest. SFAS 160 requires that a parent recognize a gain or loss in net income when a subsidiary is deconsolidated and requires expanded disclosures in the consolidated financial statements that clearly identify and distinguish between the interests of the parent owners and the interests of the noncontrolling owners of a subsidiary. SFAS 160 is effective for fiscal periods, and interim periods within those fiscal years, beginning on or after December 15, 2008. We are currently assessing the potential impact that the adoption of SFAS 160 could have on our financial statements.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities – an amendment of FASB Statement No. 133,” (SFAS “161”) as amended and interpreted, which requires enhanced disclosures about an entity’s derivative and hedging activities and thereby improves the transparency of financial reporting. Disclosing the fair values of derivative instruments and their gains and losses in a tabular format provides a more complete picture of the location in an entity’s financial statements of both the derivative positions existing at period end and the effect of using derivatives during the reporting period. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under Statement 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. SFAS No. 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. Early adoption is permitted.

In May 2008, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 163, “ Accounting for Financial Guarantee Insurance Contracts – An interpretation of FASB Statement No. 60 ”. SFAS 163 requires that an insurance enterprise recognize a claim liability prior to an event of default when there is evidence that credit deterioration has occurred in an insured financial obligation. It also clarifies how Statement 60 applies to financial guarantee insurance contracts, including the recognition and measurement to be used to account for premium revenue and claim liabilities, and requires expanded disclosures about financial guarantee insurance contracts. It is effective for financial statements issued for fiscal years beginning after December 15, 2008, except for some disclosures about the insurance enterprise’s risk-management activities. SFAS 163 requires that disclosures about the risk-management activities of the insurance enterprise be effective for the first period beginning after issuance. Except for those disclosures, earlier application is not permitted. The adoption of this statement is not expected to have a material effect on the Company’s financial statements.

NOTE 3 – STOCKHOLDER’S EQUITY

The Company is authorized to issue an aggregate of 75,000,000 common shares with a par value of $0.001 per share. No preferred shares have been authorized or issued.

On July 22, 2008, the sole Director purchased 6,000,000 shares of the common stock in the Company at $0.001 per share for $6,000.

| Numbers of | | |

| Shares | | Amount |

|

Balance, beginning of period | - | $ | - |

Issued during the period for cash private placement | 6,000,000 | | 6,000 |

Balance, end of period | 6,000,000 | $ | 6,000 |

The Company received payment on July 22, 2008.

As of July 31, 2008, the Company has not granted any stock options and has not recorded any stock-based compensation.

NOTE 4 – RELATED PARTY TRANSACTIONS

As of July 31, 2008, the Company received advances from a Director in the amount of $1,222 to pay for incorporation costs and filing fees. The amounts due to the related party are unsecured and non-interest bearing with no set terms of repayment.

On July 22, 2008, the sole Director purchased 6,000,000 shares of the common stock in the Company at $0.001 per share for $6,000 (See Note 3 – Stockholder’s Equity).

NOTE 5 – INCOME TAXES

As of July 31, 2008, the Company had a federal operating loss carry forward of $2,722, which begins to expire around 2028. The provision for income taxes consisted of the following components for the year ended July 31, 2008.

Current:

| Federal | $ | - | |

| State | $ | - | |

| |

| Deferred | : | $ | - | |

| | | | | |

Components of net deferred tax assets, including a valuation allowance, are as follows at July 31, 2008

Deferred tax assets:

| Net operating loss carry forward | $ | 2,722 | |

| |

| Total deferred tax assets | 953 |

| Less: valuation allowance | (953) |

| Net deferred tax assets | $ | - |

The valuation allowance for deferred tax assets as of July 31, 2008 was $428. In assessing the recovery of the deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income in the periods in which those temporary differences become deductible. Management considers the scheduled reversals of future deferred tax assets, projected future taxable income, and tax planning strategies in making this assessment. As a result, management determined it was more likely than not the deferred tax assets would be realized as of July 31, 2008.

Reconciliation between the statutory rate and the effective tax rate is as follows at July 31, 2008:

| Federal statutory tax rate | (35.0) | % | |

| Permanent difference and other | 35.0 | % | |

| |

| | | | | | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This section of the Registration Statement includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our predictions.

Plan of Operation

The following steps would be necessary to be accomplished in order for Med Control to become fully operational:

| • | Develop the Med Time prototype and do all the necessary tests including the regulation research. Over the subsequent months, Med Control plans to roll a market research before starting the manufacturing process of the products. This would help to get more information and a better perspective of the possible success of Med Time in the market. This phase would take approximately 6 months. Potential investors should realize that as of the date of this Prospectus, Med Control is currently in the process of developing the prototype and at this time it is not fully functional. |

| • | After getting the approval of the prototype and all the information necessary for the product success is checked, we should develop a manufacturing plan. |

| • | Concurrently, Med Control plans to start the development of the website. Management has estimated the time frame to accomplish all these tasks to be about 4 months. |

| • | The future success and possible expansion of the business, beyond the initial development stages, as described above, would require significant well planned sales strategy, which we will also adapt accordingly with the results of the market research. These efforts may include negotiations of partnerships with doctors and retirement houses. We intend to devote about 2 months for this stage. |

Although management believes the above timeframes for the related business steps are conservative and can likely be accomplished by Med Control, potential investors should be aware that several unforeseen or unanticipated delays may stop Med Control from accomplishing the above-described steps such as:

| • | Problems may arise during the development of the Internet website with the programming and testing that management cannot overcome, creating a time delay and additional costs; and |

| • | Med Control may find that potential investors are unreceptive to its business plan and have no interest in investing funds. |

If either of these events may occur Med Control would not be able to continue and investors would lose all of their investment. In addition to the above factors, investors should carefully read the Risk Factors section.

In the event additional funds are needed by Med Control, there is no guarantee that the proposed marketing strategy will be effective in accomplishing the goals Med Control has set. This may force management to redirect its efforts and create the need for additional time, money, and resources, of which, Med Control may not be successful in providing.

At this time, management does not plan to commit any of their own funds towards the Company's development. If and when this changes, management will file the appropriate disclosures in a timely manner.

Results of Operations

For the period from inception through July 31, 2008, we had no revenue. Expenses for the period totaled $2,722 resulting in a net loss of $2,722.

Capital Resources and Liquidity

As of July 31, 2008 we had $6,000 in cash.

Our auditors have issued a “going concern” opinion, meaning that there is substantial doubt if we can continue as a going-concern business for the next twelve months unless we obtain additional capital. No substantial revenues are anticipated until we have completed the financing from this offering and implemented our plan of operations. Our only source for cash at this time is investments by others in this offering. We must raise cash to implement our strategy and stay in business. The amount of the offering will likely allow us to operate for at least one year.

Management believes that if subsequent private placements are successful, we will generate sales revenue within the following twelve months thereof. However, additional equity financing may not be available to us on acceptable terms or at all, and thus we could fail to satisfy our future cash requirements.

We are highly dependent upon the success of the anticipated private placement offering described herein. Therefore, the failure thereof would result in the need to seek capital from other resources such as debt financing, which may not even be available to the Company. However, if such financing were available, because we are a development stage company with no operations to date, it would likely have to pay additional costs associated with high risk loans and be subject to an above market interest rate. At such time these funds are required, management would evaluate the terms of such debt financing. If the Company cannot raise additional proceeds via a private placement of its common stock or secure debt financing, it would be required to cease business operations. As a result, investors would lose all of their investment.

We do not anticipate researching any further products or services nor the purchase or sale of any significant equipment. We also do not expect any significant additions to the number of employees.

As of the date of this registration statement, the current funds available to the Company will not be sufficient to continue maintaining a reporting status. The Company’s sole officer and director, Ms. Kato has indicated that she may be willing to provide funds required to maintain the reporting status in the form of a non-secured loan for the next twelve months as the expenses are incurred if no other proceeds are obtained by the Company. However, there is no contract in place or written agreement securing this agreement. Management believes if the Company cannot maintain its reporting status with the SEC it will have to cease all efforts directed towards the Company. As such, any investment previously made would be lost in its entirety.

Off-balance sheet arrangements

The Company has no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect or change on the Company’s financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors. The term “off-balance sheet arrangement” generally means any transaction, agreement or other contractual arrangement to which an entity unconsolidated with the Company is a party, under which the Company has (i) any obligation arising under a guarantee contract, derivative instrument or variable interest; or (ii) a retained or contingent interest in assets transferred to such entity or similar arrangement that serves as credit, liquidity or market risk support for such assets.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUTING AND FINANCIAL DISCLOSURE

There have been no changes in or disagreements with accountants regarding our accounting, financial disclosures or any other matter.

DIRECTORS AND EXECUTIVE OFFICERS

Identification of directors and executive officers