September 8, 2014

U.S. Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549

Senior Assistant Chief Accountant

| RE: | AmbiCom Holdings, Inc. |

Form 10-K for the Fiscal Year Ended July 31, 2013 Filed October 29, 2013

Form 8-K dated May 29, 2014

Filed June 3, 2014

File No. 000-54608

Dear Mr. James:

Please be advised that the undersigned is the duly elected Chief Executive Officer of AmbiCom Holdings, Inc. (the “Registrant”). The purpose of this letter is to respond to comments received from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in your letter dated August 27, 2014 (the “Comment Letter”) the text of which we have incorporated into this response letter for convenience.

1. We note from your response that you acquired assets from Veloxum on May 15, 2014. Please reconcile the date of acquisition with the disclosure that you acquired the assets on May 29, 2014 in your Form 8-K dated May 29, 2014. Please also explain to us how you valued the consideration issued in the acquisition, including the date that you used todetermine the fair value of the common stock issued. If available, please also provide us with a summary of the value attributed to each of the significant assets acquired.

As disclosed in the Current Report on Form 8-K filed with the Commission on May 8, 2014, the Registrant, entered into an asset purchase agreement with Veloxum Corp., a Delaware corporation (“Veloxum”) and certain shareholders of Veloxum on May 1, 2014, pursuant to which the Registrant agreed to purchase certain assets of Veloxum in exchange for the issuance of a number of shares of the Registrant’s common stock, equal to $3,000,000 calculated based on the average closing price of the Common Stock during the thirty trading days preceding February 25, 2014. On May 29, 2014, the Registrant consummated the closing of the Transaction and issued 13,100,437 shares of restricted Common Stock to Veloxum.

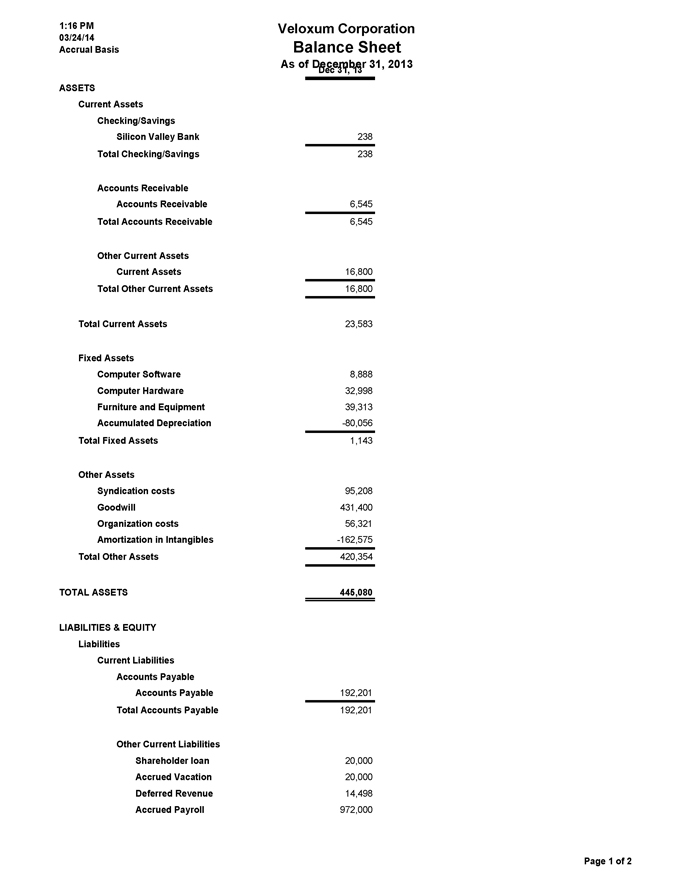

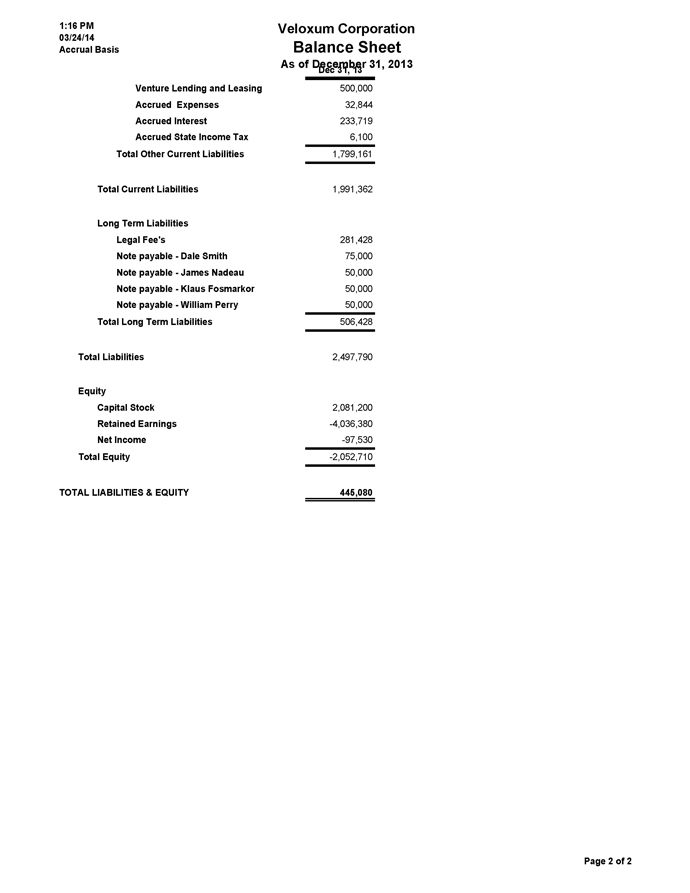

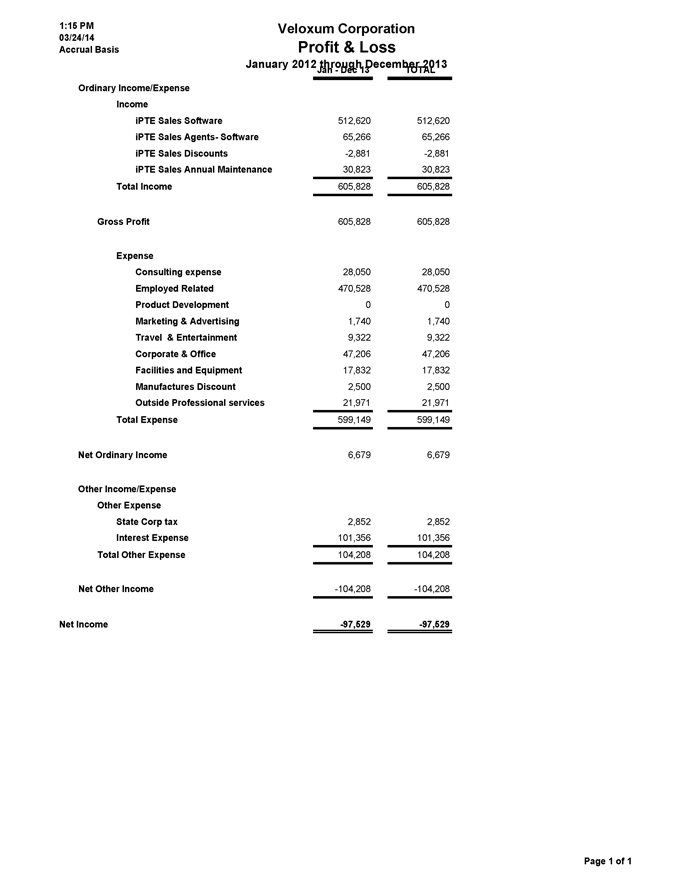

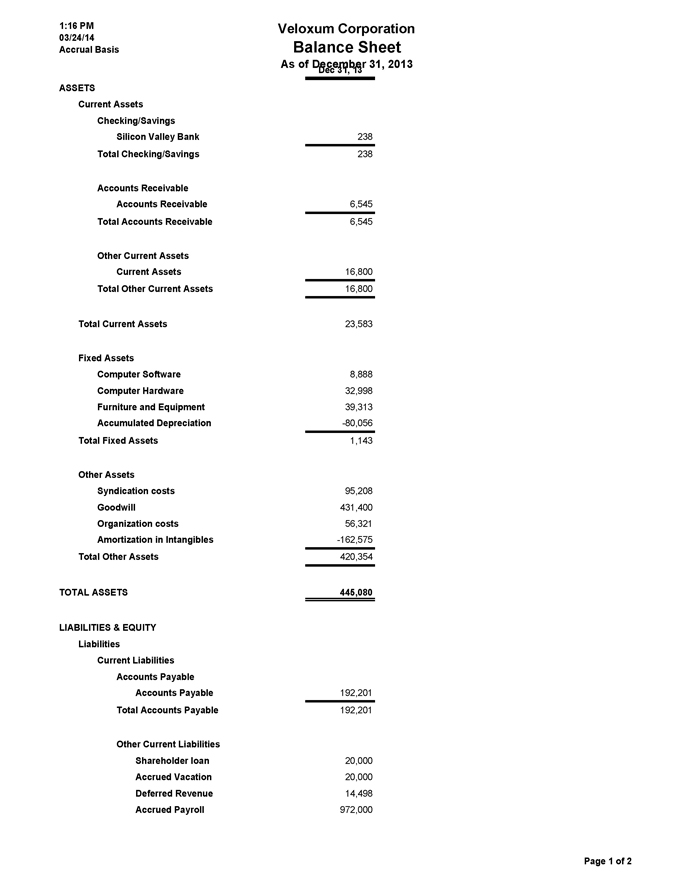

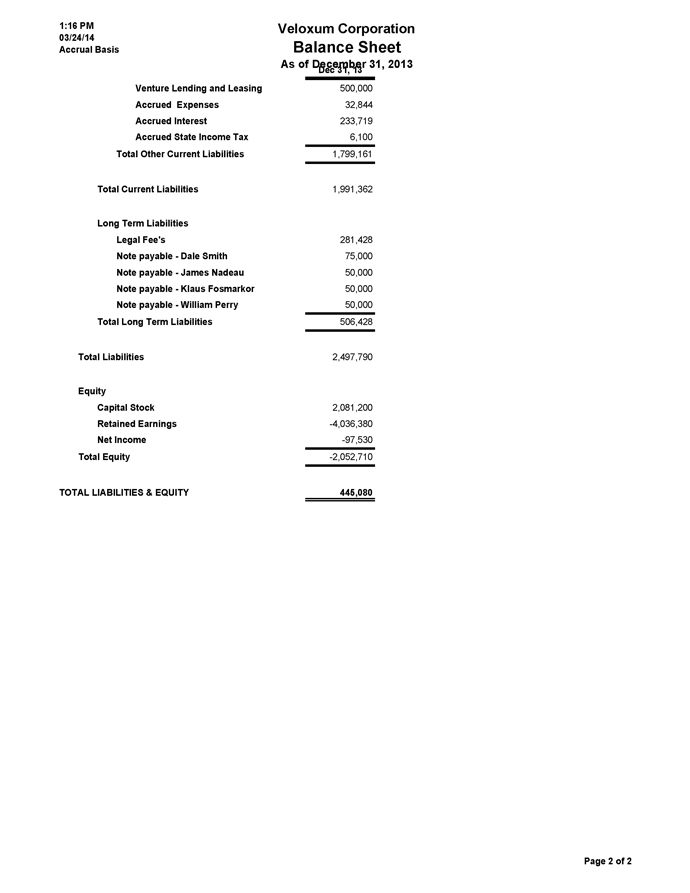

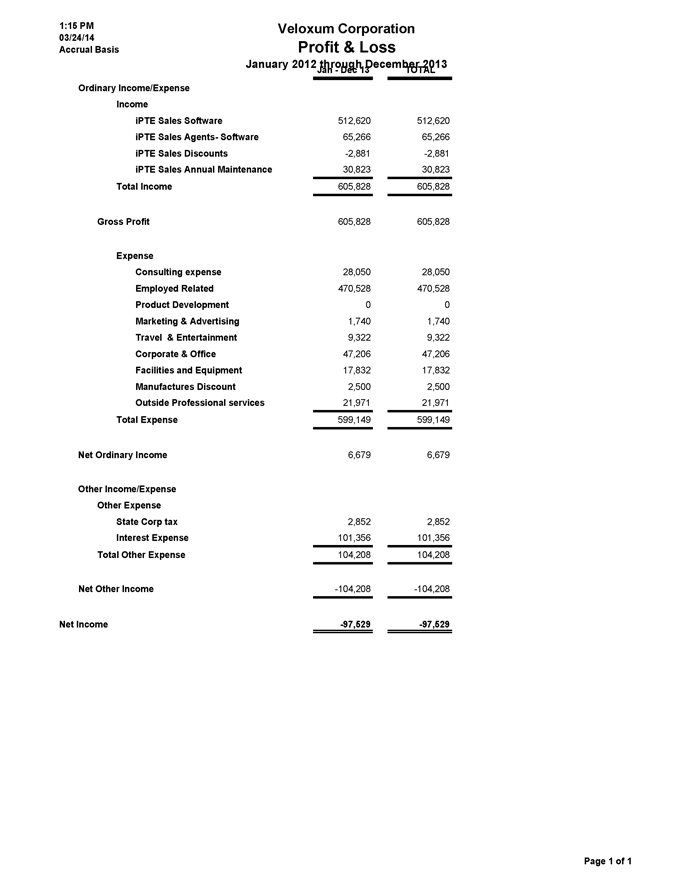

The Registrant hired a third party firm to value the assets purchased. According to the valuation of assets, the Registrant attributed $16,800 of the purchase price to the tangible assets purchased in connection with the acquisition, including $16,800 of prepaid expenses. The remaining $2,983,200 was allocated to the intellectual property intangible assets. The Registrant did not assume responsibility for any of the approximately $2.6 million in outstanding liabilities of Veloxum as a part of the transaction, nor did it receive any of the approximately $9,000 of outstanding cash or accounts receivable.

2. Further, you told us that you are accounting for the acquisition under FASB ASC 805-10-15-4(b), as you believe the assets acquired from Veloxum do not constitute a business. We note from the purchase agreement included as exhibit 9.01 of your Form 8-K dated May 1, 2014 that you acquired all of the assets sufficient for the conduct of normal and customary operations of the business as conducted by Veloxum. We also noted that Veloxum was engaged in the business of developing, supporting and marketing application software. Please tell us in sufficient detail about your analysis in determining that you did not acquire a business as defined in the FASB Master Glossary. Also refer to FASB ASC 805-10-55-4 through 55-9.

In accordance with FASB ASC 805-10-55-4, in order to be considered a business combination, a transaction must include inputs, processes, and outputs. The Registrant has prepared a careful review of the elements included in the transaction, and determined that all of the elements were not present to account for this as a business combination, and therefore should be accounted for as an asset acquisition under FASB ASC 805-10-15-4(b). According to the analysis performed, the Registrant determined that an input was present, as there was a core software code existing at the time of the acquisition, as well as patents that provided freedom to operate. However, at the time of the acquisition, Veloxum business operations had been suspended due to lack of market acceptance for its product offerings, and there was not an active process that could be considered an ongoing business. Lastly, The Registrant did not believe that the existing software code, which was being marketed to enterprise customers for computer network optimization, could be successfully sold to customers without substantial additional modifications. The Registrant does not have the internal resources, nor did it acquire any software engineering competencies in the acquisition, to accomplish these modifications themselves. The Registrant has entered into a development agreement with a qualified third party to provide an estimated two many years of software development work to enable a revised product code that will be marketed as a Software-as-a-Service offering to be used to optimize individual computers or mobile device downloads.

3. To help us understand your response, please provide us with copies of Exhibit 6 and schedules 1.1, 4.12, 4.15 and 4.20 of your agreement.

Attached to this correspondence as Appendix A are copies of Exhibit 6, attached as Appendix B are the documents which comprise Schedule 1.1, attached as Appendix C are the documents which comprise Schedule 4.12, and attached as Appendix D are the documents which comprise Schedule 4.15. There is no Schedule 4.20 to the Asset Purchase Agreement and Section 4.20 is merely a representation of Veloxum which provides:

4.20. Status of Seller. Seller is, at Closing, taking the Shares for investment and not distribution of the same. Seller is an accredited investor, or is owned by members each of whom is an accredited investor, as such term is defined in the Securities Act of 1933, as amended. Seller has reviewed Buyer’s filings made with the U.S.Securities and Exchange Commission (the “SEC”), including but not limited to, the risk factors set forth therein, and understands that the Common Stock presents certain risks for a holder of the same.

Should you have any questions or require any further information, please do not hesitate to contact the undersigned.

Very truly yours,

/s/ John Hwang

John Hwang,

Chief Executive Officer

EXHIBIT 6