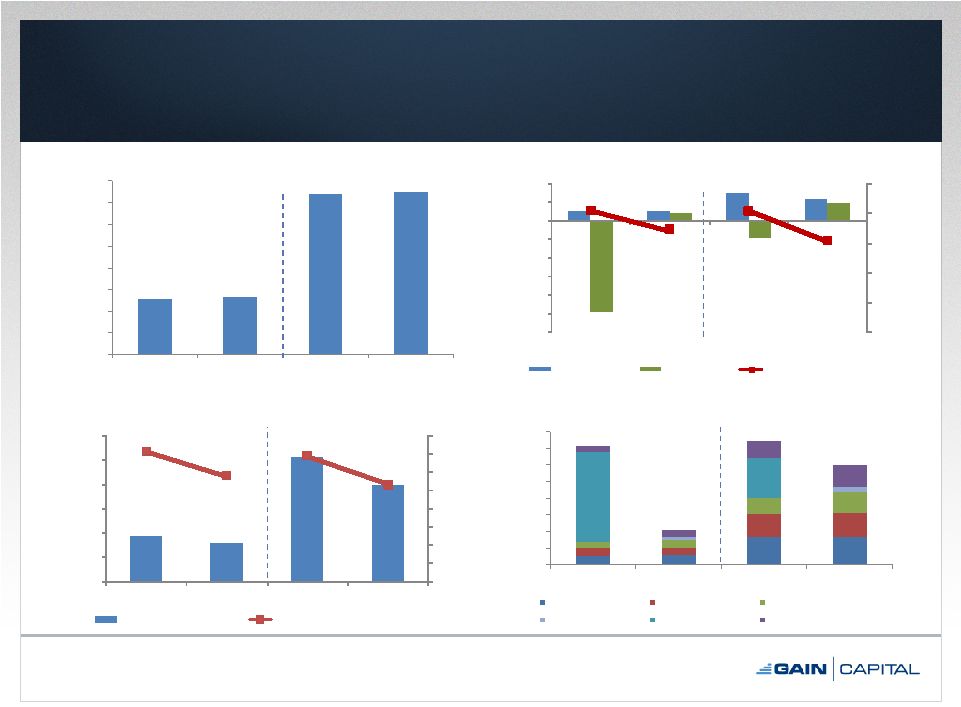

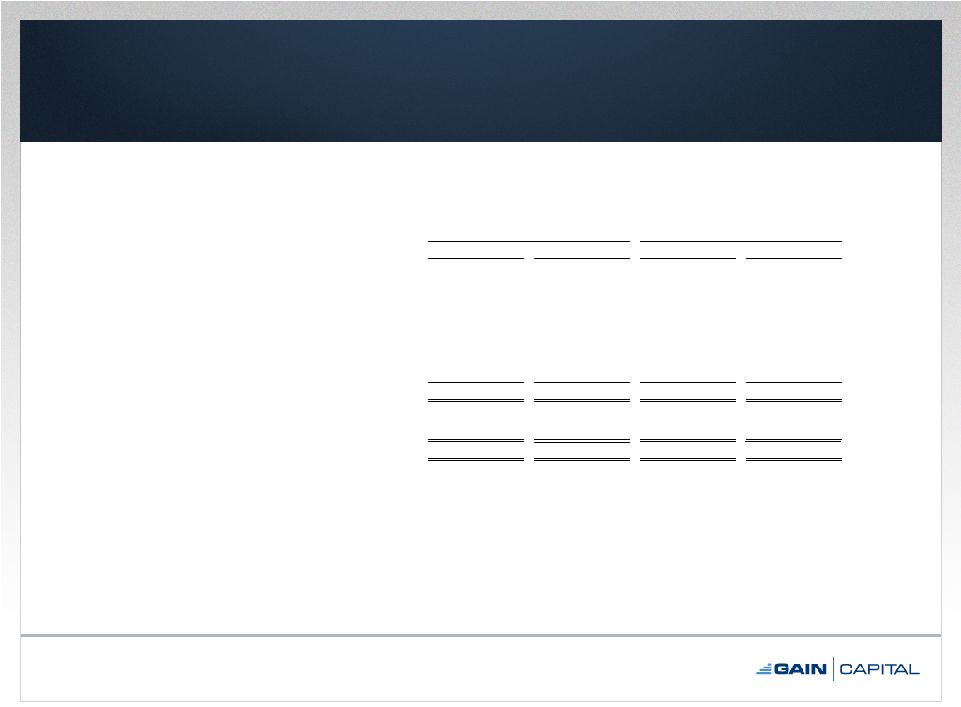

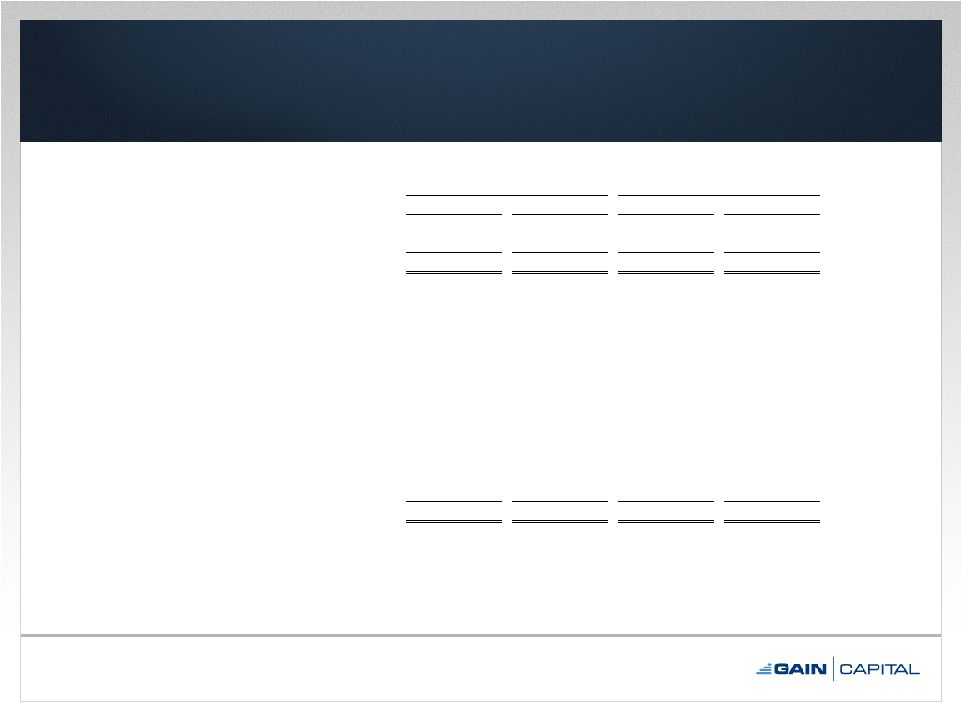

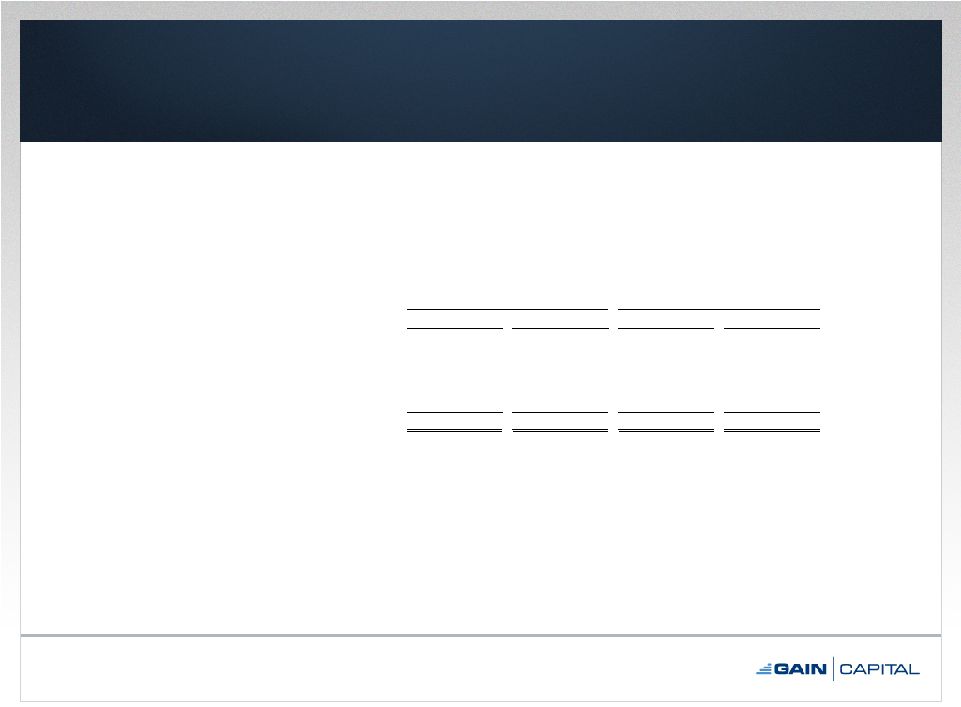

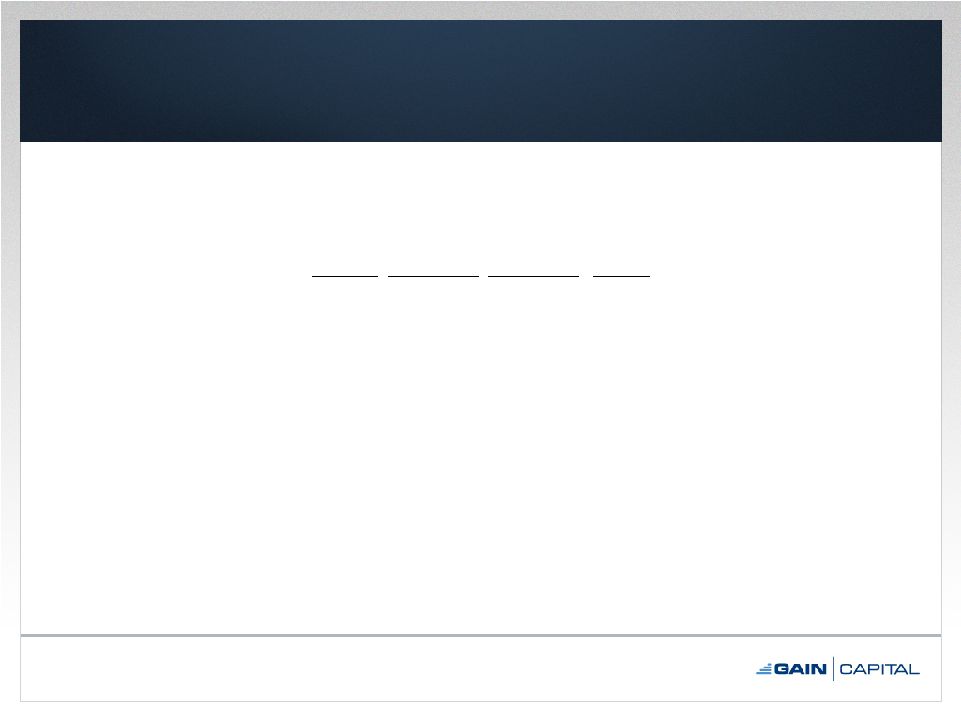

Condensed Consolidated Statements of Operations 18 2011 2010 2011 2010 Revenue Trading revenue 52.2 $ 51.2 $ 146.1 $ 147.7 $ Other revenue 2.0 0.7 4.6 1.9 Total non-interest revenue 54.2 51.9 150.7 149.6 Interest revenue 0.1 0.1 0.3 0.2 Interest expense (0.4) (0.5) (1.1) (1.7) Total net interest expense (0.3) (0.4) (0.8) (1.5) Net Revenue 53.9 51.5 149.9 148.1 Expenses Compensation and benefits 11.6 11.4 34.9 34.0 Selling and marketing 8.8 9.2 28.0 27.7 Trading expenses and commissions 9.9 6.3 25.5 18.6 Bank fees 1.3 1.0 3.4 3.2 Depreciation and amortization 1.0 0.9 2.9 2.5 Purchase intangible amortization 2.7 - 6.4 - Communication and data processing 0.7 0.8 2.1 2.2 Occupancy and equipment 1.2 1.1 3.5 3.0 Bad debt provision 0.2 0.2 0.8 0.5 Professional fees 1.9 0.5 3.8 1.5 Product development, software and maintenance 1.0 0.9 3.0 2.5 Change in fair value of convertible, redeemable preferred stock embedded derivative (1) - 109.2 - 48.9 Other 1.9 2.0 5.6 4.6 Total 42.2 143.5 119.9 149.2 Income before income tax expense and equity in earnings of equity method investment 11.7 (92.0) 30.0 (1.1) Income tax expense 4.1 6.7 11.0 18.2 Net income 7.6 (98.7) 19.0 (19.3) Net loss applicable to non-controlling interest - - - (0.4) Net income applicable to GAIN Capital Holdings,Inc. 7.6 $ (98.7) $ 19.0 $ (18.9) $ Earnings per share (2) : Basic 0.22 $ (32.38) $ 0.55 $ (6.31) $ Diluted 0.20 $ (32.38) $ 0.49 $ (6.31) $ Weighted averages shares outanding (2) Basic 34,625,525 3,047,974 34,313,987 3,001,057 Diluted 38,916,038 38,839,487 39,025,699 37,375,690 Three Months Ended September 30, Nine Months Ended September 30, Note: Dollars in millions. (1) For the periods prior to the closing of our initial public offering in December 2010, in accordance with Financial Accounting Standards Board Accounting Standards Codification 815, Derivatives and Hedging, we accounted for an embedded derivative liability attributable to the redemption feature of our previously outstanding preferred stock and amortization of purchase intangibles. This redemption feature and the associated embedded derivative liability was no longer required to be recognized following the conversion of all of our preferred stock to common stock in connection with our IPO. (2) In connection with the completion of our initial public offering in December 2010 (the “IPO”), the our board of directors approved a 2.29-for-1 stock split of our common stock to be effective immediately prior to the completion of the IPO. The 2.29-for-1 stock split, after giving effect to the receipt by us of 407,692 shares of common stock from all of our pre-IPO common stockholders (on a pro-rata basis) in satisfaction of previously outstanding obligations owed by such stockholders to us, resulted in an effective stock split of 2.26-for-1. Accordingly, all references to share and per share data have been retroactively restated for the three and nine months ended September 30, 2010 to reflect the effective 2.26-for-1 stock split. : |