Q2and First Half 2019 Results July 2019 1

SAFE HARBOR STATEMENT Forward Looking Statements In addition to historical information, this earnings presentation contains "forward‐looking" statements that reflect management's expectations for the future. A variety of important factors could cause results to differ materially from such statements. These factors are noted throughout GAIN Capital's annual report on Form 10‐K for the year ended December 31, 2018, as filed with the Securities and Exchange Commission on March 11, 2019, and include, but are not limited to, the actions of both current and potential new competitors, fluctuations in market trading volumes, financial market volatility, evolving industry regulations, errors or malfunctions in GAIN Capital’s systems or technology, rapid changes in technology, effects of inflation, customer trading patterns, the success of our products and service offerings, our ability to continue to innovate and meet the demands of our customers for new or enhanced products, our ability to successfully integrate assets and companies we have acquired, our ability to effectively compete, changes in tax policy or accounting rules, fluctuations in foreign exchange rates and commodity prices, adverse changes or volatility in interest rates, as well as general economic, business, credit and financial market conditions, internationally or nationally, and our ability to continue paying a quarterly dividend in light of future financial performance and financing needs. The forward‐looking statements included herein represent GAIN Capital’s views as of the date of this release. GAIN Capital undertakes no obligation to revise or update publicly any forward‐looking statement for any reason unless required by law. Non‐GAAP Financial Measures This presentation contains various non‐GAAP financial measures, including adjusted EBITDA, adjusted net income, and adjusted EPS. These non‐GAAP financial measures have certain limitations, including that they do not have a standardized meaning and, therefore, our definitions may be different from similar non‐GAAP financial measures used by other companies and/or analysts. Thus, it may be more difficult to compare our financial performance to that of other companies. We believe our reporting of these non‐GAAP financial measures assists investors in evaluating our historical and expected operating performance. However, because these are not measures of financial performance calculated in accordance with GAAP, such measures should be considered in addition to, but not as a substitute for, other measures of our financial performance reported in accordance with GAAP, such as net income. See the Appendix for a reconciliation of the non‐GAAP financial measures used herein to the most directly comparable GAAP measure. 2

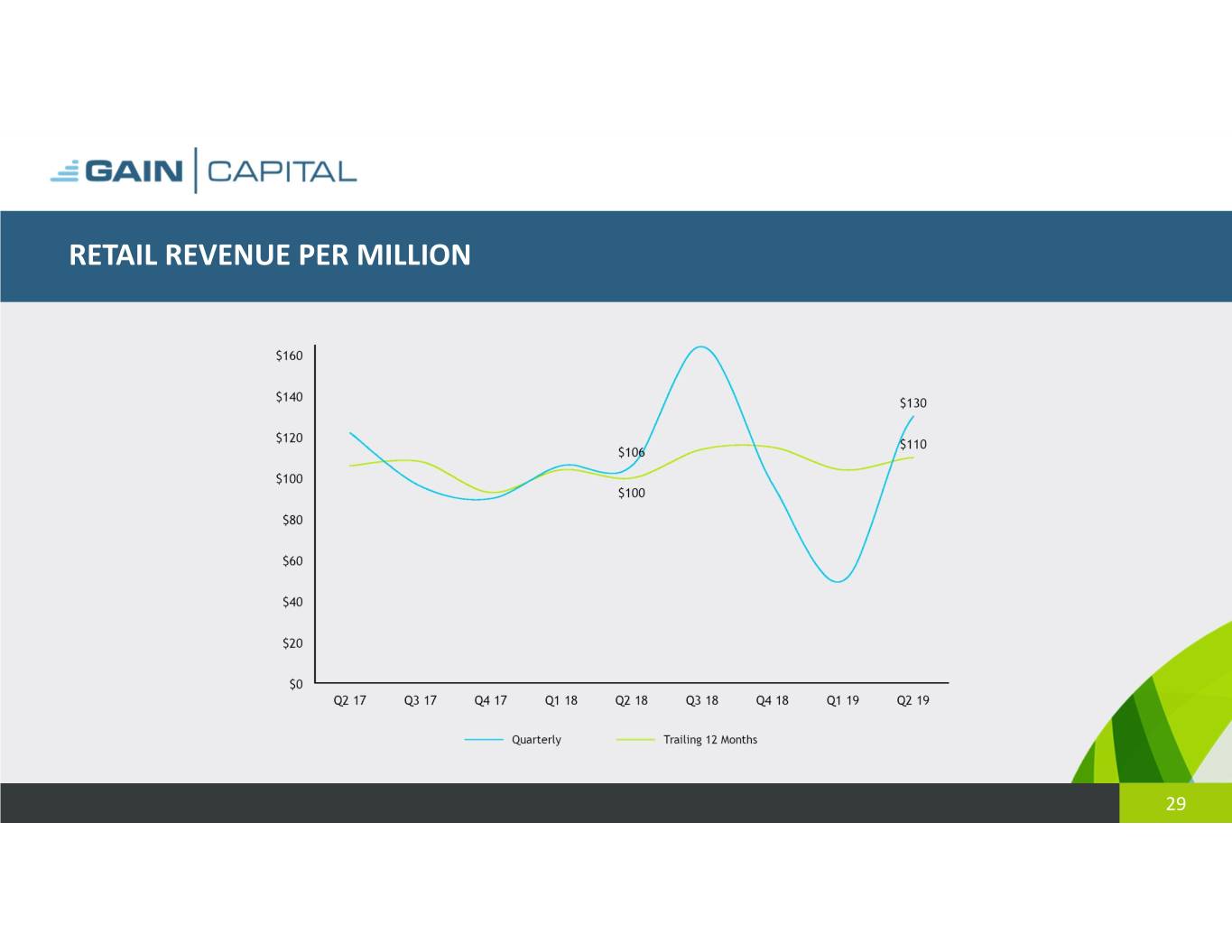

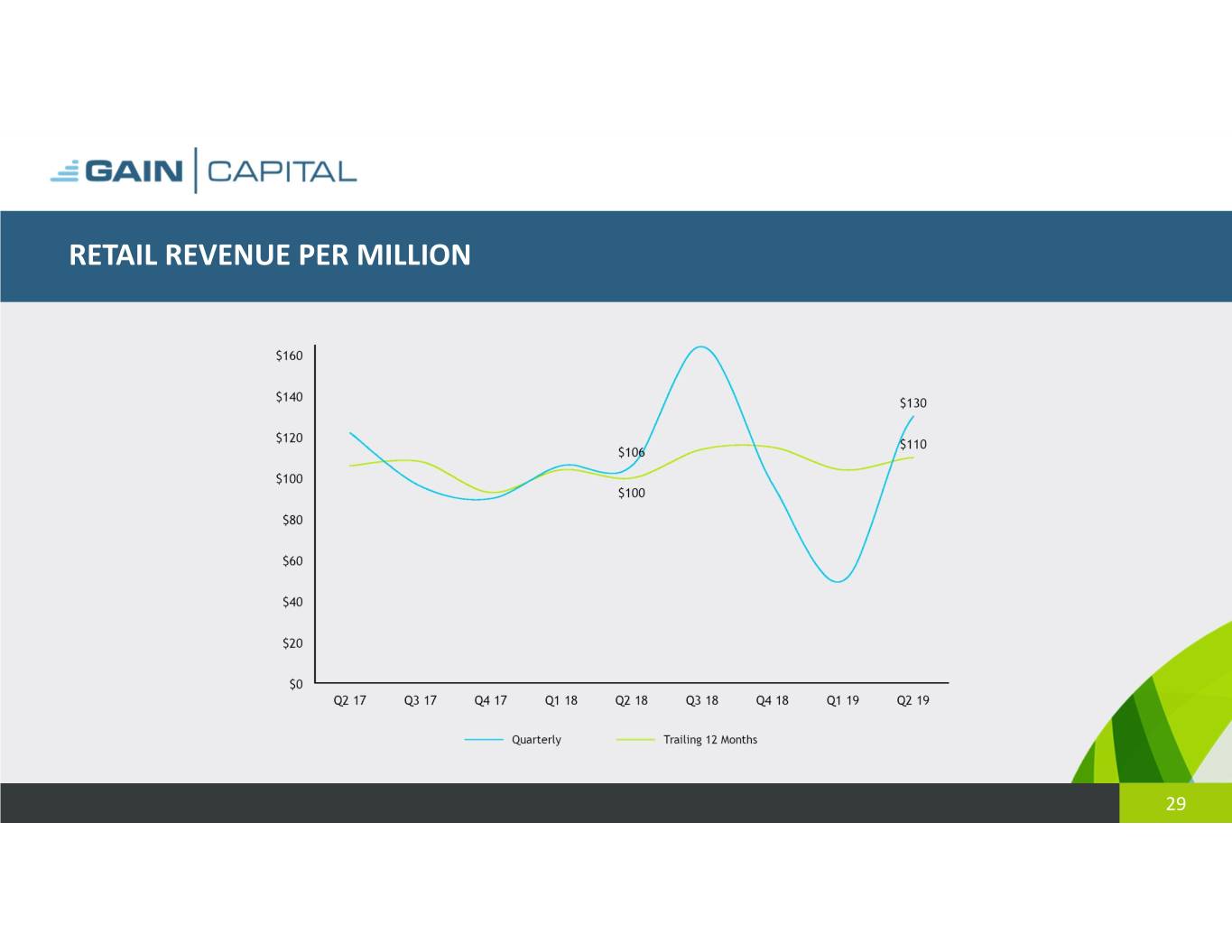

SECOND QUARTER 2019 MARKET CONDITIONS Eurodollar Retail Revenue Per Million $1.25 $0.08 $120 $1.20 $0.06 $110 $1.15 $100 $1.10 $0.04 $90 $1.05 $0.02 $80 $1.00 $0.00 Trailing 12 months Period Average Min‐Max Quarterly Spread Eurodollar Price Represents minimum and maximum RPM limits pre‐ and post hedging model • Market conditions remain challenged in the quarter, with CVIX dropping 17% under the Q1’19 low & VIX declining 8%, impacting overall client activity • EUR/USD, our most traded market, saw trading ranges 15% tighter than the previous quarter’s record • Pockets of volatility in British Pound and major indices drove increase in RPM to $130, well above our Q1’19 RPM of $50, and 18% above TTM average of $110 • Increase in open positions indicates building client engagement, which should drive trading revenue in future periods 3

SECOND QUARTER 2019 REVIEW • Q2 2019 net revenue of $75.5 million, compared to $84.2 million in Q2 2018 • Q2 2019 net income of $0.9 million, compared to net income of $6.8 million in Q2 2018 • Q2 2019 adjusted EBITDA of $13.0 million, compared to $18.9 million in Q2 2018 • Q2 RPM rebounded to $130, above the trailing twelve‐month average of $110 • Marketing investment drove new direct account growth of 83% year‐over‐year and 5% quarter‐over‐quarter, positioning us well for the return of normal market conditions 1. Continuing Operations includes financial information from the Company excluding results from the Institutional business. 4

OPERATING METRICS SHOWING POSITIVE SIGNS FOR FUTURE ORGANIC GROWTH New Direct Accounts1 Direct Volume per Active2 Increased 83% y/y and increased 5% q/q Decreased (23)% y/y and (4)% q/q • Step up in marketing investment delivering new direct account growth • Overall volumes and volume per active decreased y/y, in line with market volatility Trailing 3‐Month Active Accounts Volume Direct volume decreased (28)% y/y and (4)% q/q 1. New direct accounts are defined as organically acquired clients that opened an account during the corresponding period. By definition this figure will exclude the FXCM clients that were inorganically acquired in February 2017. 2. Includes FXCM beginning in Q2'17. 3. GVIX, GAIN’s volatility indicator, is a metric calculated daily by volume weighting the 5‐Day % average true ranges (ATR) of 6 of our major products (Dax, EUR/USD, GBP/USD, USD/JPY, Dow and Gold). The volume weights are based on the relative monthly volumes across these 6 markets. 5

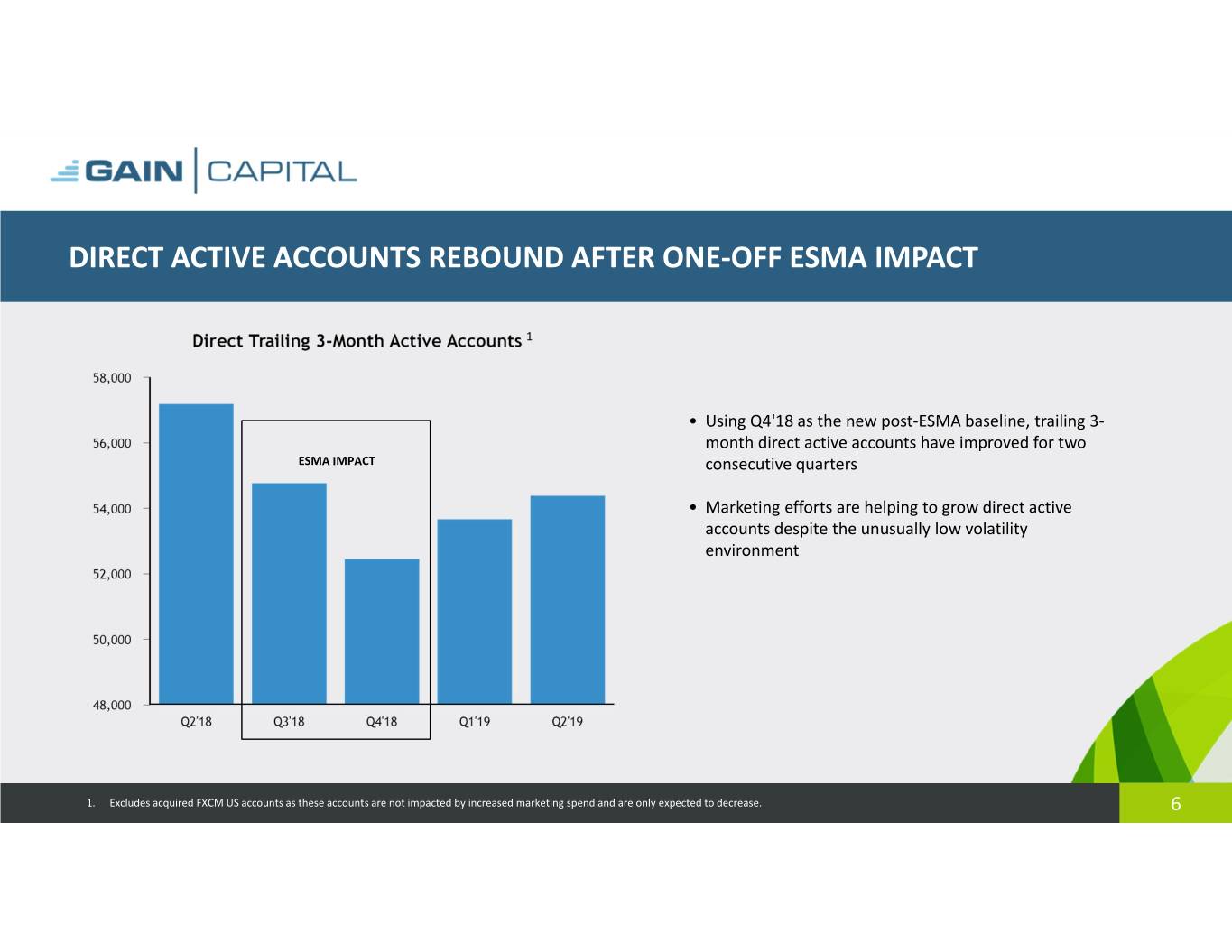

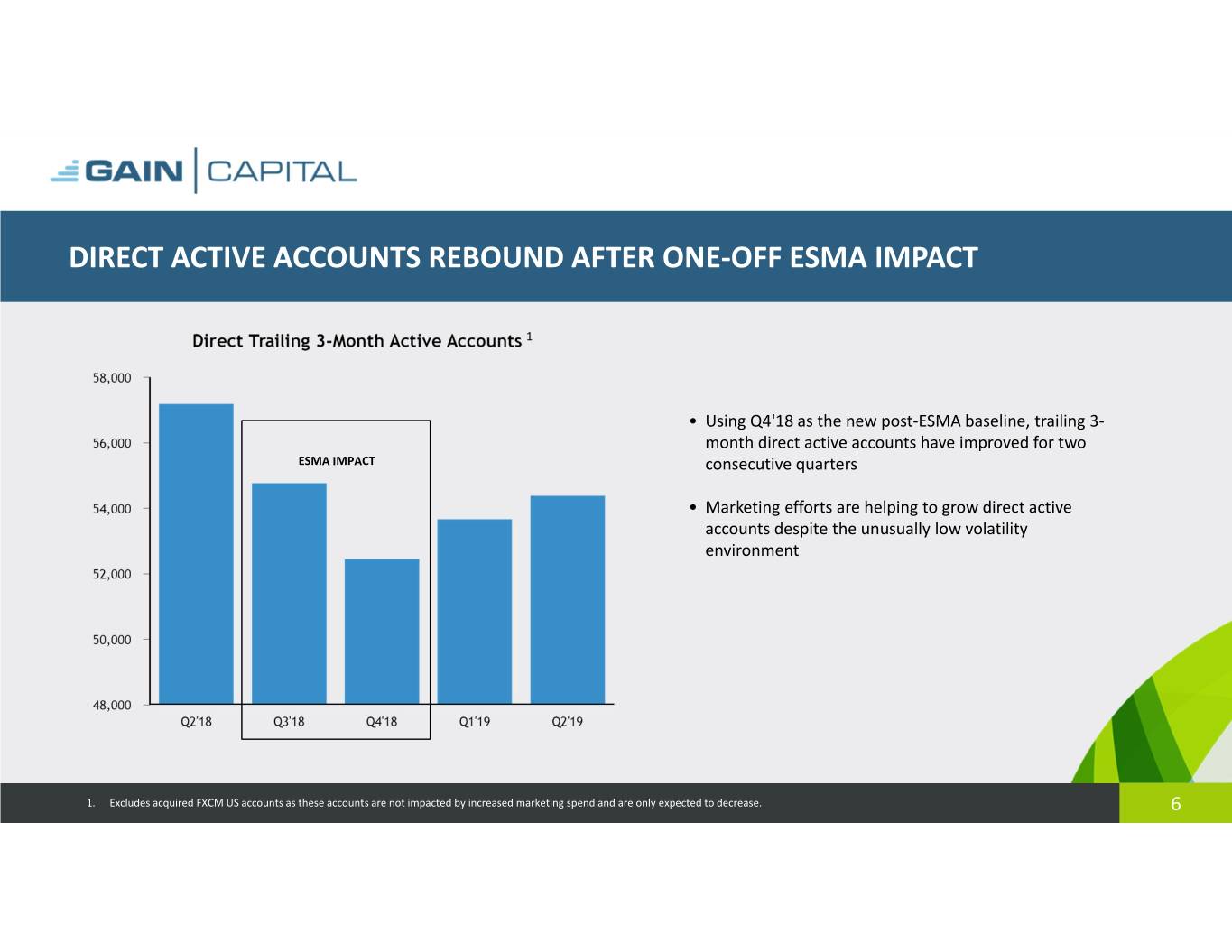

DIRECT ACTIVE ACCOUNTS REBOUND AFTER ONE‐OFF ESMA IMPACT 1 • Using Q4'18 as the new post‐ESMA baseline, trailing 3‐ month direct active accounts have improved for two ESMA IMPACT consecutive quarters • Marketing efforts are helping to grow direct active accounts despite the unusually low volatility environment 1. Excludes acquired FXCM US accounts as these accounts are not impacted by increased marketing spend and are only expected to decrease. 6

BENEFITS FROM INCREASED MARKETING INVESTMENT Cost Efficient Acquisition ROI Timeline on Track IRR Long Tail of Revenue After three quarters of increased Expected payback period on the Three‐year IRR at current With 57% of revenues from loyal marketing spend, we continue to new cohorts also well within marketing investment levels clients with tenure of >3 years, new track below our target cost per new acceptable range at the higher approximately 218%. cohorts expected to deliver long tail account. investment levels. of revenue beyond our three‐year ROI benchmark1 2019 marketing spend estimated at ~$50M, up approximately 40% year over year; Flexibility to adjust spend up or down based on results & market conditions. 1. 57% of total client transaction revenue from Q3’18 through Q2’19 7

LONG‐TERM STRATEGIC PRIORITIES TO ACCELERATE ORGANIC GROWTH Increase Leverage Innovate the Focus on Marketing Powerful Brand Trading Premium Clients Investment Assets Experience Supported by conversion Target two distinct Deliver best‐in‐class trading Executed through our brand optimization efforts to further customer segments with platforms, decision support strategy & the development of increase ROI on marketing our global brands: tools, and innovative new ways product and services tailored to spend GAIN Capital and FOREX.com to trade experienced traders 8

Financial Review 9

KEY FINANCIAL RESULTS & OPERATING METRICS 3 Months Ended June 30, First Half $ Change 2019 2018 2019 2018 Q2 First Half Net revenue from continuing operations $ 75.5 $ 84.2 $ 113.9 $ 182.5 $ (8.7) $ (68.6) Operating expenses(3) (62.5) (65.3) (124.4) (131.7) 2.8 7.3 Adjusted EBITDA(1) from continuing operations $ 13.0 $ 18.9 $ (10.4) $ 50.8 $ (5.9) $ (61.2) Adjusted EBITDA margin % 17%22%(9)% 28% (5%) (37%) Net income/(loss) from continuing operations $ 0.9 $ 6.8 $ (27.4) $ 18.7 $ (5.9) $ (46.1) Adjusted net income/(loss) (1) $ 3.6 $ 4.4 $ (26.5) $ 17.9 $ (0.8) $ (44.4) GAAP diluted EPS from continuing operations $ 0.02 $ 0.13 $ (0.73) $ 0.38 $ (0.11) $ (1.11) Adjusted diluted EPS(1) from continuing operations $ 0.10 $ 0.10 $ (0.71) $ 0.39 $ 0.00 $ (1.10) Operating Metrics(2) Retail OTC ADV (bns) $ 7.1 $ 10.6 $ 7.4 $ 11.5 $ (3.5) $ (4.1) Retail RPM $ 130 $ 106 $ 89 $ 106 $ 24 $ (17) Avg. daily futures contracts 31,401 32,401 30,114 33,871 (1,000) (3,757) Futures RPC $ 5.18 $ 5.37 $ 4.88 $ 5.14 $ (0.19) $ (0.26) Note: Dollars in millions, except per share data. Columns may not add due to rounding. (1) This is a non‐GAAP financial measure. Please see the appendix to this presentation for a reconciliation to the corresponding GAAP financial measure. (2) Definitions for operating metrics are available in the appendix to this presentation. 10 (3) Operating Expenses excludes Depreciation and Amortization, Purchased Intangible Amortization, and certain one‐off costs.

OPERATING SEGMENT RESULTS: RETAIL Retail Financial & Operating Results • Market conditions saw quarterly ADV 3 Months Ended June 30, First Half decrease 33% year‐over‐year to $7.1 billion 2019 2018 2019 2018 TTM 6/30/19 Trading revenue $ 60.4 $ 72.1 $ 84.7 $ 156.3 $ 228.6 • RPM of $130 for the quarter, above $106 in Other retail revenue 4.3 2.4 8.2 3.9 15.1 Q2'18 and $110 in the trailing twelve months Total revenue $ 64.7 $ 74.5 $ 92.9 $ 160.2 $ 243.7 ended Q2'19 Employee compensation and benefits 13.5 13.6 26.4 29.1 52.8 Selling and marketing 9.9 6.5 19.8 12.2 43.0 • Combined impact of ADV and RPM saw Q2'19 Referral fees 4.4 7.0 8.8 14.7 20.9 total retail revenue 13% lower year‐over‐year Other operating expenses 16.1 18.3 34.4 36.0 71.1 Segment Profit $ 20.9 $ 29.1 $ 3.6 $ 68.2 $ 55.8 •Overheads1 for the quarter and half year were Margin % 32% 39% 4% 43% 23% down 7% on the prior year Operating Metrics ADV (bns) $ 7.1 $ 10.6 $ 7.4 $ 11.5 $ 8.1 • Client assets improved 2% since Q4'18, 12 month trailing active OTC accounts 118,320 130,018 118,320 130,018 118,320 despite consecutive quarters of low volatility Client assets $ 638.4 $ 711.4 $ 638.4 $ 711.4 $ 638.4 RPM $ 130 $ 106 $ 89 $ 106 $ 110 1. Overheads defined as employee compensation and benefits plus other operating expenses. Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding. 11

OPERATING SEGMENT RESULTS: FUTURES Futures Financial & Operating Results • Futures average daily contracts decreased 3% 3 Months Ended June 30, First Half to 31,401 during Q2'19 2019 2018 2019 2018 TTM 6/30/19 Trading revenue $ 10.2 $ 11.1 $ 18.2 $ 21.8 $ 36.2 1 Other futures revenue 1.4 1.0 2.8 1.8 5.3 •Overheadsfor the quarter were 5% lower Total revenue $ 11.7 $ 12.1 $ 21.0 $ 23.6 $ 41.4 with half year down 8% on prior year Employee compensation and benefits 2.8 2.9 5.0 5.4 9.5 Selling and marketing 0.2 0.2 0.5 0.4 0.8 • H1'19 profit margin improved slightly to 15%, Referral fees 3.1 3.4 5.8 7.2 11.8 delivering similar profits despite 11% lower Other operating expenses 3.4 3.6 6.7 7.3 13.3 revenues Segment Profit $ 2.1 $ 2.1 $ 3.1 $ 3.3 $ 6.1 Margin % 18% 17% 15% 14% 15% ◦ Q2'19 profit margin remained stable year‐over‐year at 18% Operating Metrics Avg. daily contracts 31,401 32,401 30,114 33,871 29,744 12 month trailing active futures accounts 7,406 7,881 7,406 7,881 7,406 Client assets $ 217.3 $ 209.0 $ 217.3 $ 209.0 $ 217.3 Revenue/contract $ 5.18 $ 5.37 $ 4.88 $ 5.14 $ 4.84 1. Overheads defined as employee compensation and benefits plus other operating expenses. Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding. 12

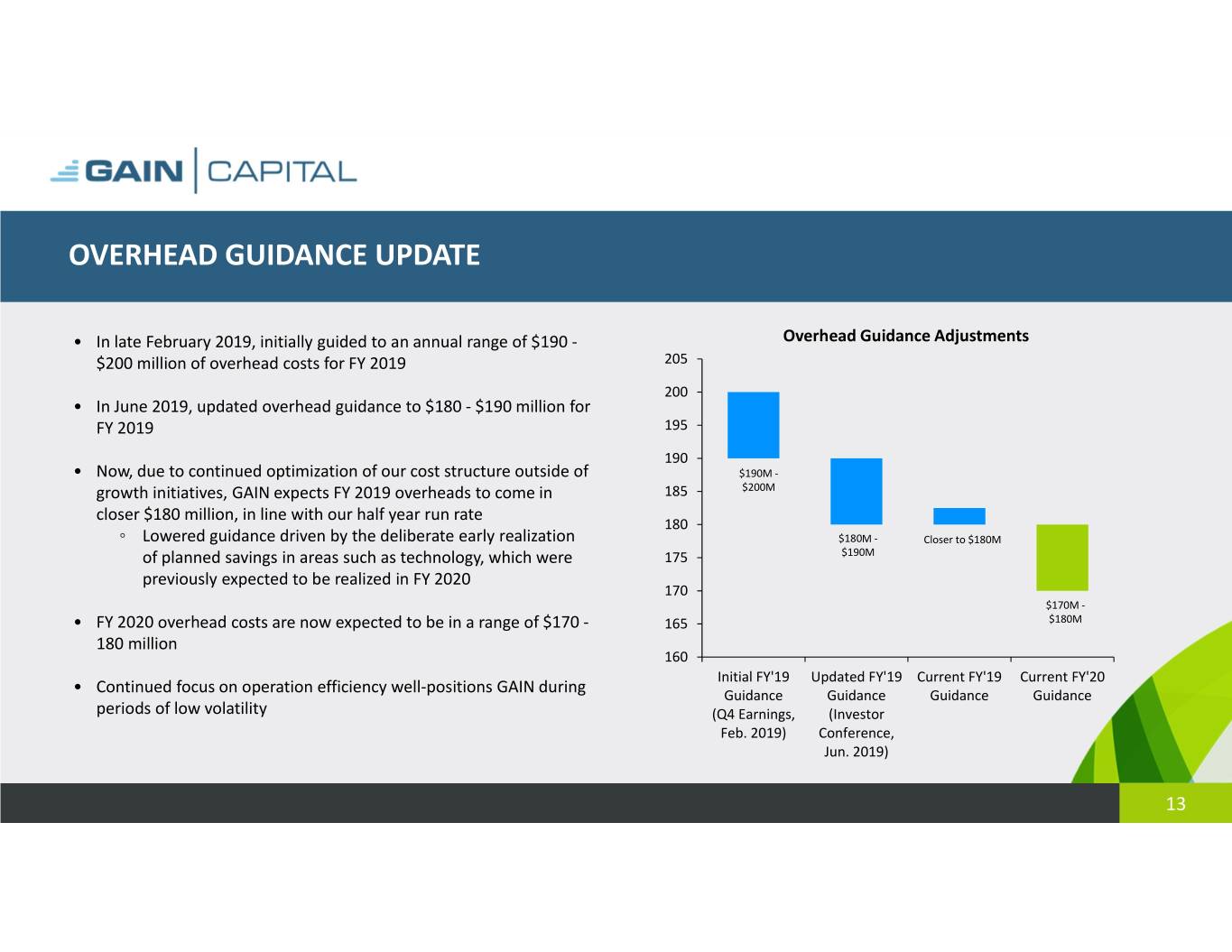

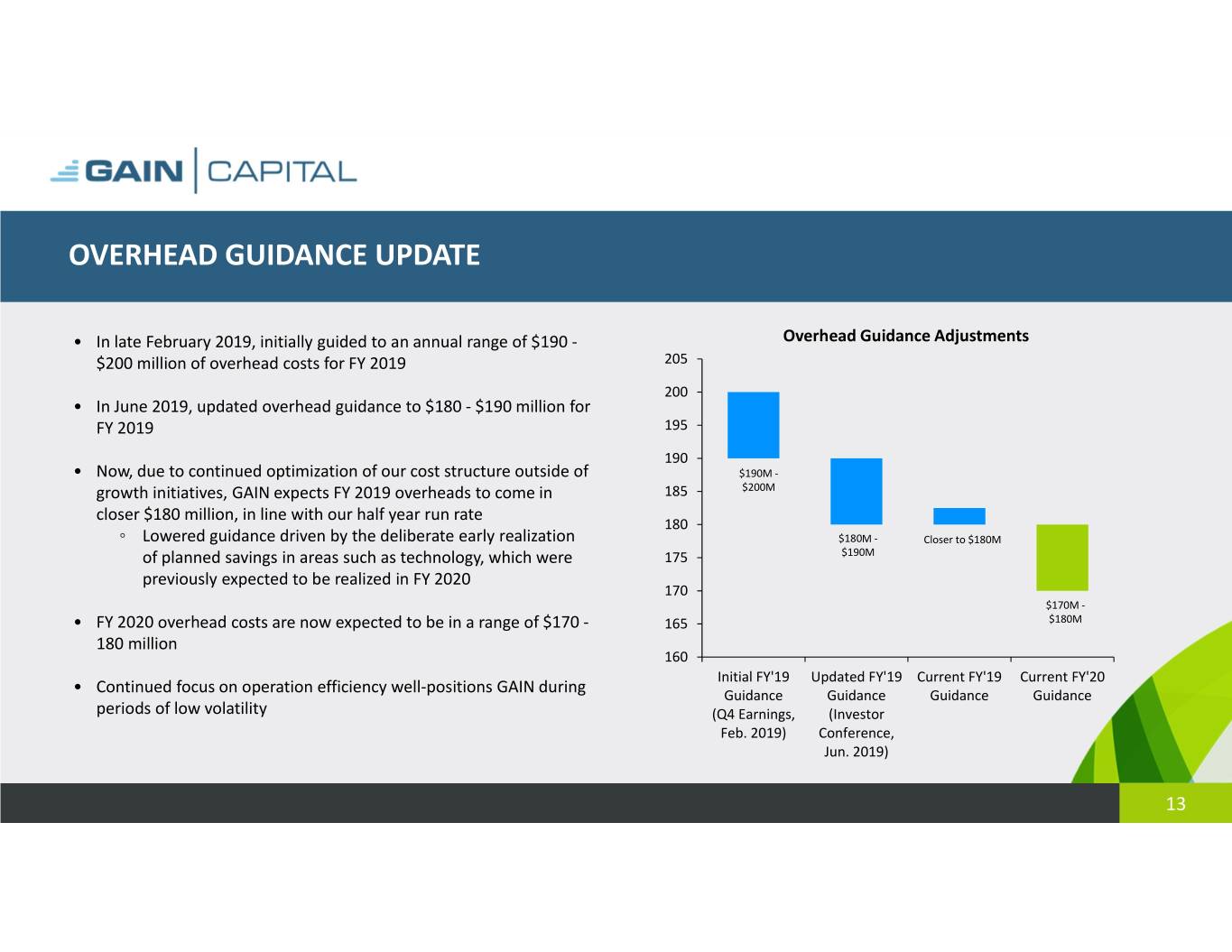

OVERHEAD GUIDANCE UPDATE • In late February 2019, initially guided to an annual range of $190 ‐ Overhead Guidance Adjustments $200 million of overhead costs for FY 2019 205 200 • In June 2019, updated overhead guidance to $180 ‐ $190 million for FY 2019 195 190 • Now, due to continued optimization of our cost structure outside of $190M ‐ growth initiatives, GAIN expects FY 2019 overheads to come in 185 $200M closer $180 million, in line with our half year run rate 180 ◦ Lowered guidance driven by the deliberate early realization $180M ‐ Closer to $180M of planned savings in areas such as technology, which were 175 $190M previously expected to be realized in FY 2020 170 $170M ‐ • FY 2020 overhead costs are now expected to be in a range of $170 ‐ 165 $180M 180 million 160 Initial FY'19 Updated FY'19 Current FY'19 Current FY'20 • Continued focus on operation efficiency well‐positions GAIN during Guidance Guidance Guidance Guidance periods of low volatility (Q4 Earnings, (Investor Feb. 2019) Conference, Jun. 2019) 13

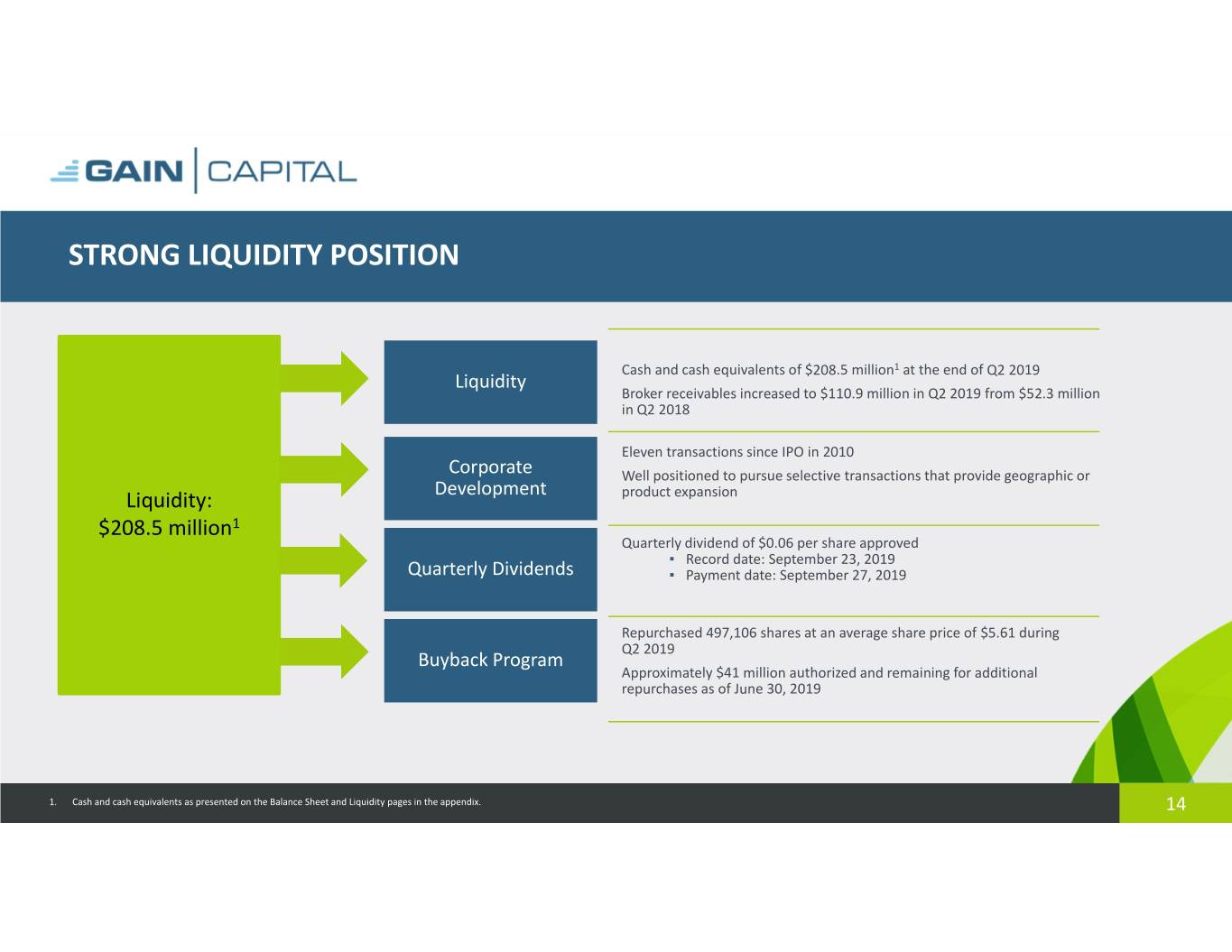

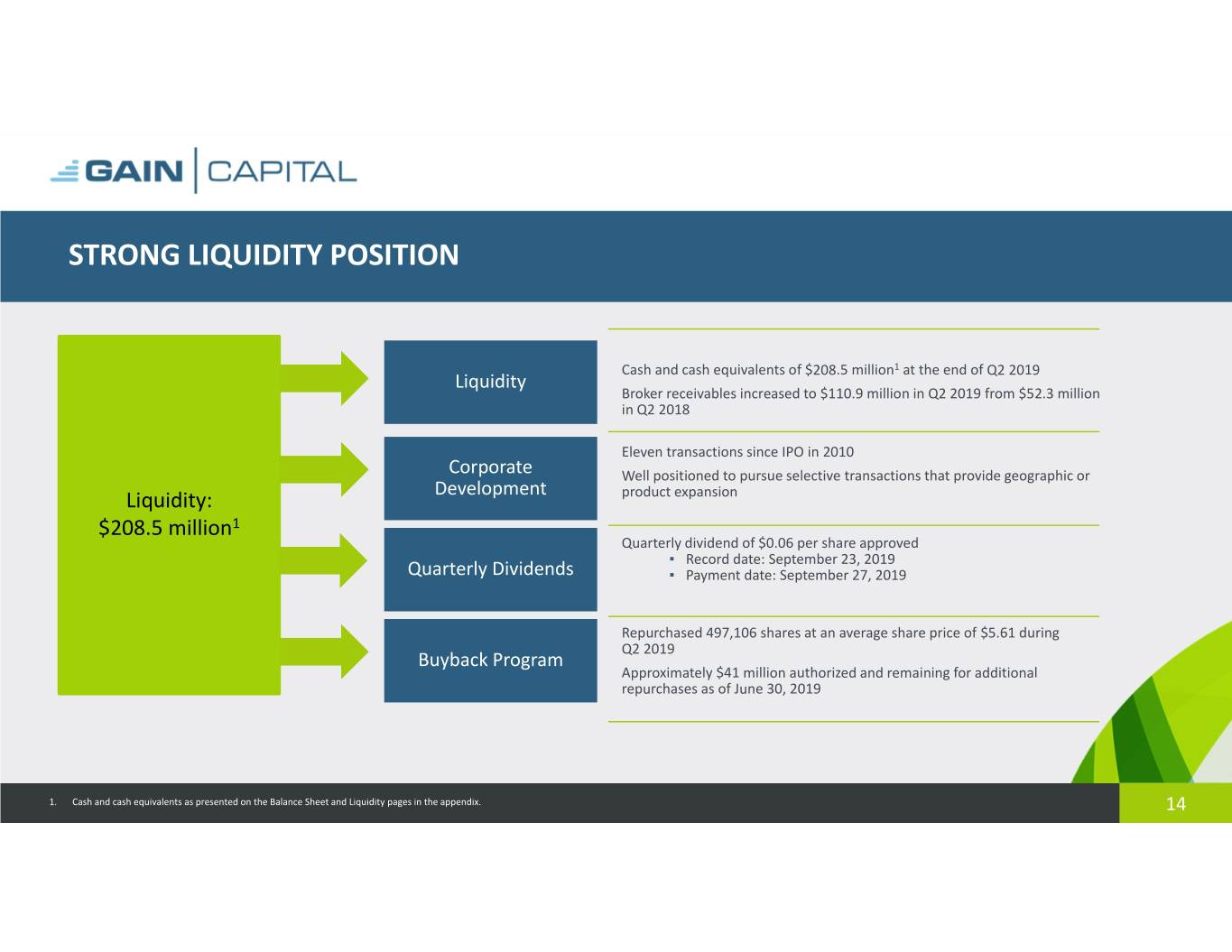

STRONG LIQUIDITY POSITION Cash and cash equivalents of $208.5 million1 at the end of Q2 2019 Liquidity Broker receivables increased to $110.9 million in Q2 2019 from $52.3 million in Q2 2018 Eleven transactions since IPO in 2010 Corporate Well positioned to pursue selective transactions that provide geographic or Development Liquidity: product expansion $208.5 million1 Quarterly dividend of $0.06 per share approved ▪ Record date: September 23, 2019 Quarterly Dividends ▪ Payment date: September 27, 2019 Repurchased 497,106 shares at an average share price of $5.61 during Q2 2019 Buyback Program Approximately $41 million authorized and remaining for additional repurchases as of June 30, 2019 1. Cash and cash equivalents as presented on the Balance Sheet and Liquidity pages in the appendix. 14

POSITIONED TO DELIVER LONG‐TERM VALUE Proven Leader in a Large, Attractive and Growing Market Diverse and Scalable Business Model Multiple Levers to Drive Growth and Operational Efficiency Risk Management Controls Limit Market Volatility Headwinds Strong Financial and Credit Profile 15

Appendix 16

2021 OPERATING AND FINANCIAL TARGETS FY 2018 Performance FY 2021 Outlook Operational New Direct Accounts 87.6K 38% to 42% growth Retail Volume $2.6 trillion 30% to 35% growth Financial Revenue1 $358 million $420 to $460 million Overhead Costs $190 million $190 to $200 million EBITDA Margin 24% 30% to 35% EPS $0.60 $2.15 to $2.40 1. Assumes long‐term average RPM of $106 17

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS Three Months Ended June 30, Six Months Ended June 30, 2019 2018 2019 2018 REVENUE Retail revenue $ 60.4 $ 72.0 $ 84.7 $ 156.2 Futures revenue 10.2 11.1 18.2 21.8 Interest and other revenue 4.8 1.0 11.0 4.6 Net revenue $ 75.5 $ 84.2 $ 113.9 $ 182.5 EXPENSES Employee compensation and benefits 22.6 22.5 42.9 46.8 Selling and marketing 10.1 6.8 20.3 12.7 Referral fees 7.5 10.5 14.6 21.9 Trading expenses 5.4 5.5 10.9 11.4 General and administrative 11.7 14.2 24.5 26.7 Depreciation and amortization 6.3 9.0 13.9 18.0 Communications and technology 4.8 5.5 10.5 10.9 Bad debt provision 0.5 0.3 0.9 1.4 One‐time expenses 0.0 0.0 0.0 (0.1) Total expenses 69.0 74.2 138.5 149.7 OPERATING PROFIT/(LOSS) $ 6.5 $ 10.0 $ (24.5) $ 32.9 Interest expense on long term borrowings 3.4 3.4 6.7 6.7 INCOME/(LOSS) BEFORE INCOME TAX $ 3.1 $ 6.6 $ (31.3) $ 26.2 Income tax expense/(benefit) 2.2 (0.3) (3.8) 7.4 Net income/(loss) from continuing operations $ 0.9 $ 6.8 $ (27.4) $ 18.7 Income from discontinued operations 0.0 60.6 $ 0.0 $ 65.0 NET INCOME/(LOSS) $ 0.9 $ 67.5 $ (27.4) $ 83.7 Net income attributable to non‐controlling interests 0.0 0.3 0.0 0.5 NET INCOME/(LOSS) APPLICABLE TO GAIN CAPITAL HOLDINGS, INC. $ 0.9 $ 67.1 $ (27.4) $ 83.2 Note: Dollars in millions, except share and per share data. Columns may not add due to rounding. (1) Total shares outstanding at June 30, 2019 was 37,387,671 18

CONDENSED CONSOLIDATED BALANCE SHEET As of 6/30/2019 12/31/2018 ASSETS: Cash and cash equivalents $ 208.5 $ 278.9 Cash and securities held for customers 855.7 842.5 Receivables from brokers 110.9 84.3 Property and equipment, net 29.0 30.6 Intangible assets, net 26.9 32.2 Goodwill 27.8 27.8 Other assets 44.9 36.4 Total assets $ 1,303.8 $ 1,332.5 LIABILITIES AND SHAREHOLDERS' EQUITY: Payables to customers $ 855.7 $ 842.5 Payables to brokers 0.0 1.6 Accrued compensation and benefits 5.0 11.2 Accrued expenses and other liabilities 44.1 41.6 Income tax payable 0.7 5.8 Convertible senior notes 135.3 132.1 Total liabilities $ 1,040.9 $ 1,034.8 Shareholders' Equity 262.9 297.8 Total liabilities and shareholders' equity $ 1,303.8 $ 1,332.5 Note: Dollars in millions. Columns may not add due to rounding. 19

LIQUIDITY $m Q2 19 Q1 19 Q4 18 Q3 18 TTM Cash & Equivalents Prior Period $ 218.0 $ 278.9 $ 362.3 $ 360.3 $ 360.3 EBITDA $ 13.0 $ (23.5) $ 5.2 $ 30.5 $ 25.2 Capital expenditures (4.0) (3.1) (3.3) (2.8) (13.2) Tax and convertible interest (2.5) (7.8) (1.4) (7.9) (19.6) Dividends, buybacks and convertibles (5.0) (6.5) (10.6) (5.9) (28.0) Corporate activity 0.0 (2.4) (50.0) (2.9) (55.3) Receivable from brokers (12.2) (14.4) (26.8) (5.2) (58.6) Working capital 1.2 (3.2) 3.4 (3.8) (2.4) Total Cash (Outflow)/Inflow $ (9.5) $ (60.9) $ (83.5) $ 2.0 $ (151.9) Cash & Equivalents Current Period $ 208.5 $ 218.0 $ 278.9 $ 362.3 $ 208.5 Note: Dollars in millions. Columns may not add due to rounding. 20

GROUP ADJUSTED EBITDA Continuing Operations 3 Months Ended June 30, First Half 2019 2018 2019 2018 Net revenue $ 75.5 $ 84.2 $ 113.9 $ 182.5 Operating expenses: Employee compensation and benefits $ 22.6 $ 22.5 $ 42.9 $ 46.8 Selling and marketing 10.1 6.8 20.3 12.7 Referral fees 7.5 10.5 14.6 21.9 Trading expenses 5.4 5.5 10.9 11.4 General and administrative(1) 11.5 14.2 24.3 26.7 Communication and technology 4.8 5.5 10.5 10.9 Bad debt provision 0.5 0.3 0.9 1.4 Total operating expenses 62.5 65.3 124.4 131.8 Adjusted EBITDA 13.0 18.9 (10.4) 50.8 Margin % 17% 22% (9)% 28% Depreciation and amortization $ 6.3 $ 9.0 $ 13.9 $ 18.0 Interest expense on long term borrowings 3.4 3.4 6.7 6.7 Adjusted Pre‐Tax Income/(Loss) 3.3 6.6 (31.1) 26.1 Adjusted income tax benefit/(expense) 0.3 (1.9) 4.5 (7.6) Non‐controlling interest 0.0 0.3 0.0 0.5 Adjusted Net Income/(Loss) $ 3.6 $ 4.4 $ (26.5) $ 17.9 Note: Dollars in millions. Columns may not add due to rounding. (1) Excludes a contingent provision of $0.2 million for 2019, which is a one‐off cost to arrive at adjusted EBITDA. 21

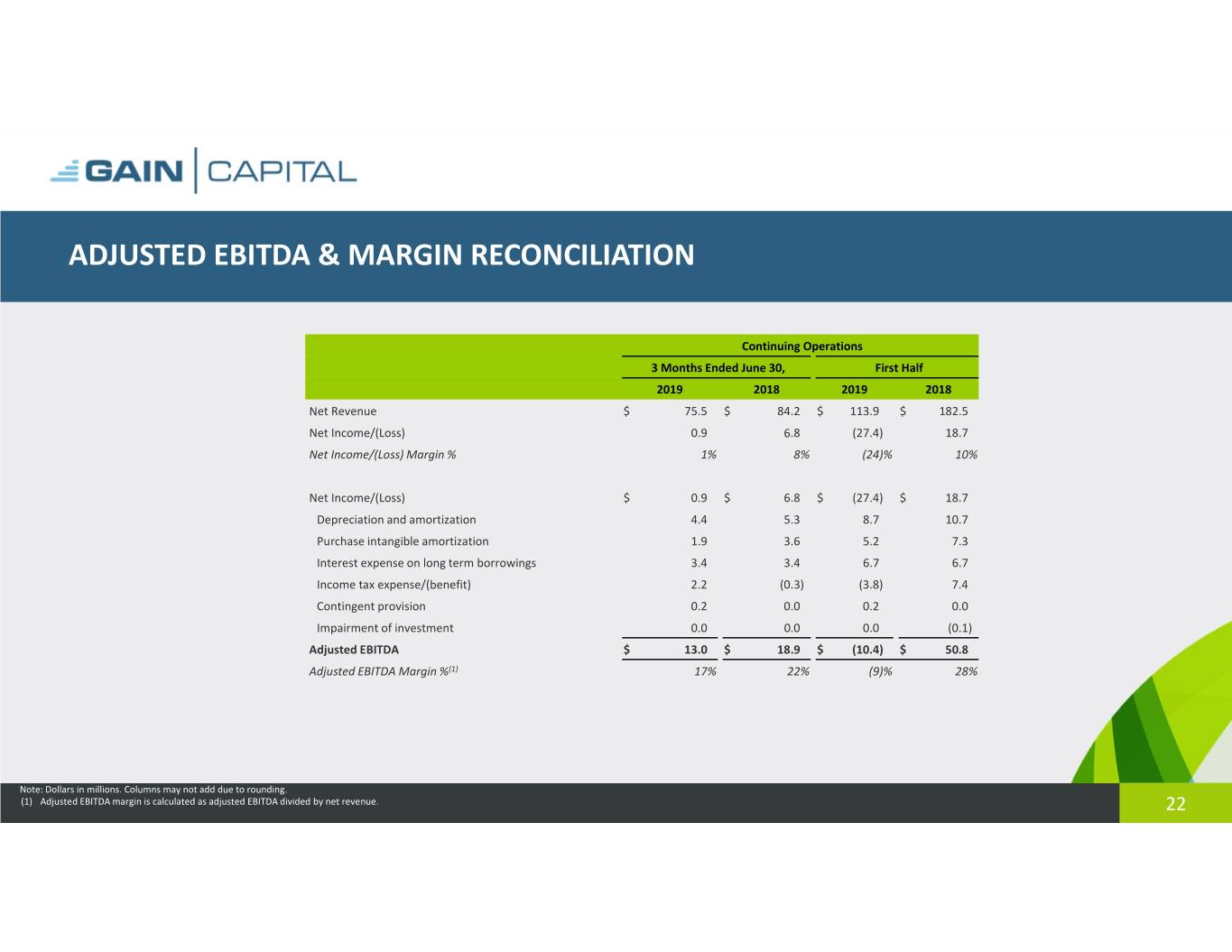

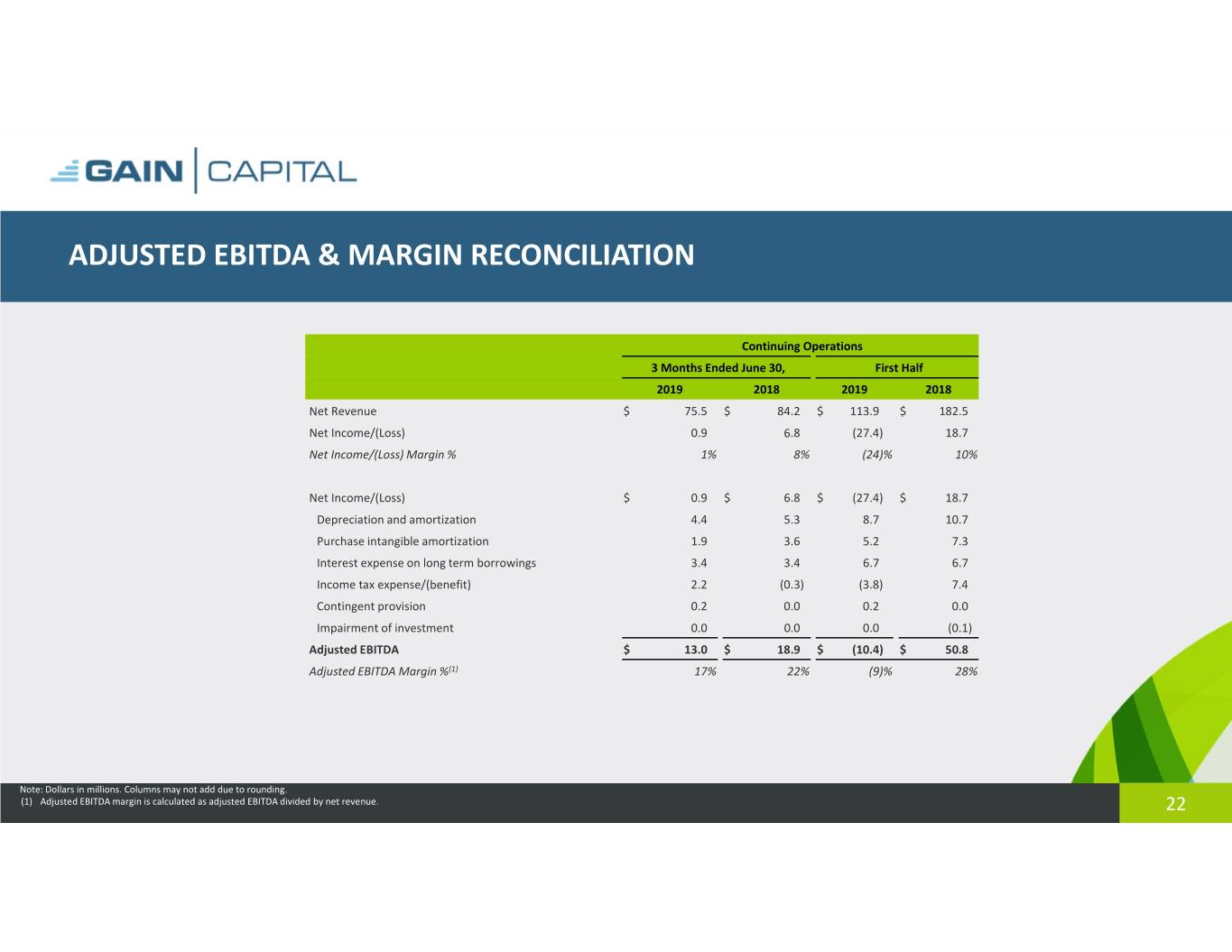

ADJUSTED EBITDA & MARGIN RECONCILIATION Continuing Operations 3 Months Ended June 30, First Half 2019 2018 2019 2018 Net Revenue $ 75.5 $ 84.2 $ 113.9 $ 182.5 Net Income/(Loss) 0.9 6.8 (27.4) 18.7 Net Income/(Loss) Margin % 1% 8% (24)%10% Net Income/(Loss) $ 0.9 $ 6.8 $ (27.4) $ 18.7 Depreciation and amortization 4.4 5.3 8.7 10.7 Purchase intangible amortization 1.9 3.6 5.2 7.3 Interest expense on long term borrowings 3.4 3.4 6.7 6.7 Income tax expense/(benefit) 2.2 (0.3) (3.8) 7.4 Contingent provision 0.2 0.0 0.2 0.0 Impairment of investment 0.0 0.0 0.0 (0.1) Adjusted EBITDA $ 13.0 $ 18.9 $ (10.4) $ 50.8 Adjusted EBITDA Margin %(1) 17%22%(9)%28% Note: Dollars in millions. Columns may not add due to rounding. (1) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue. 22

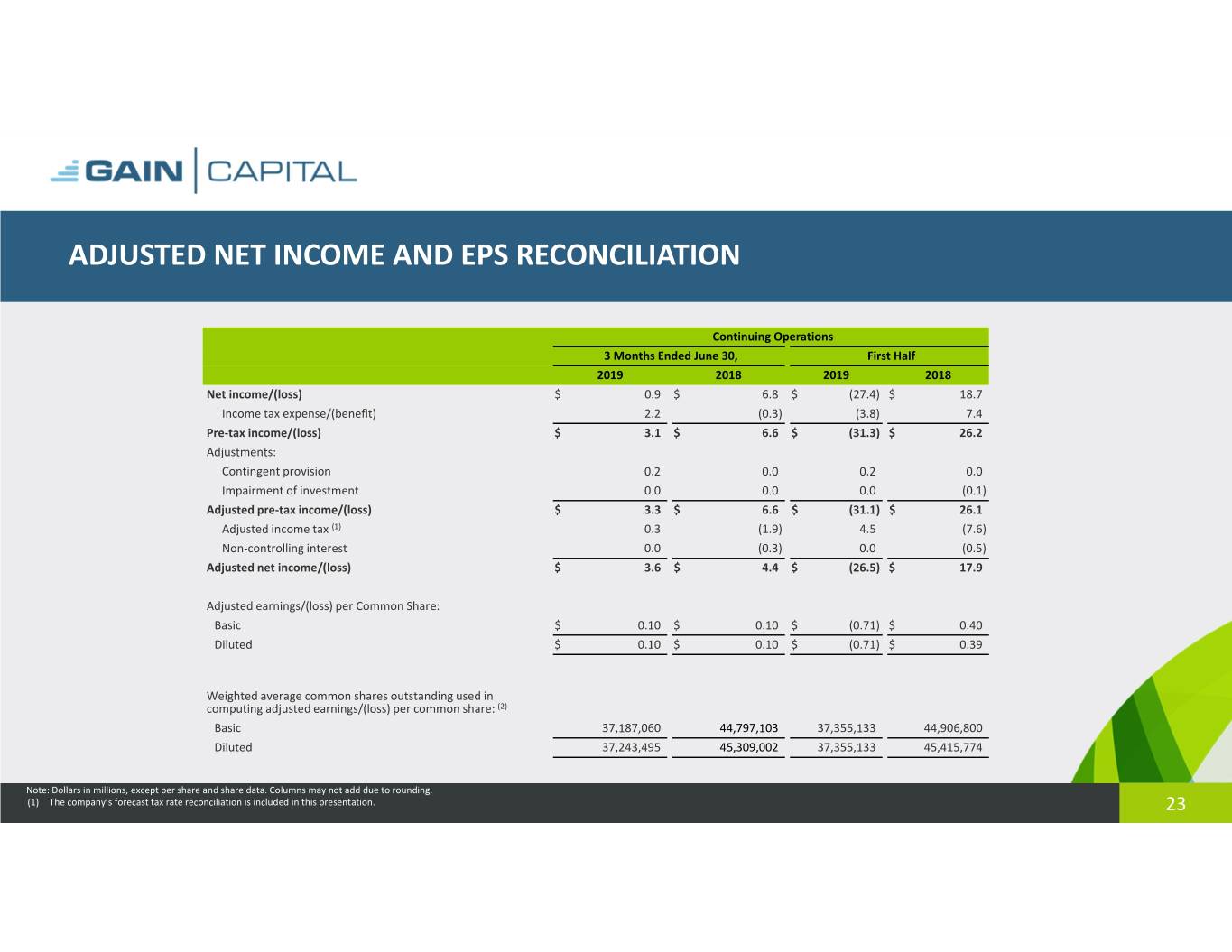

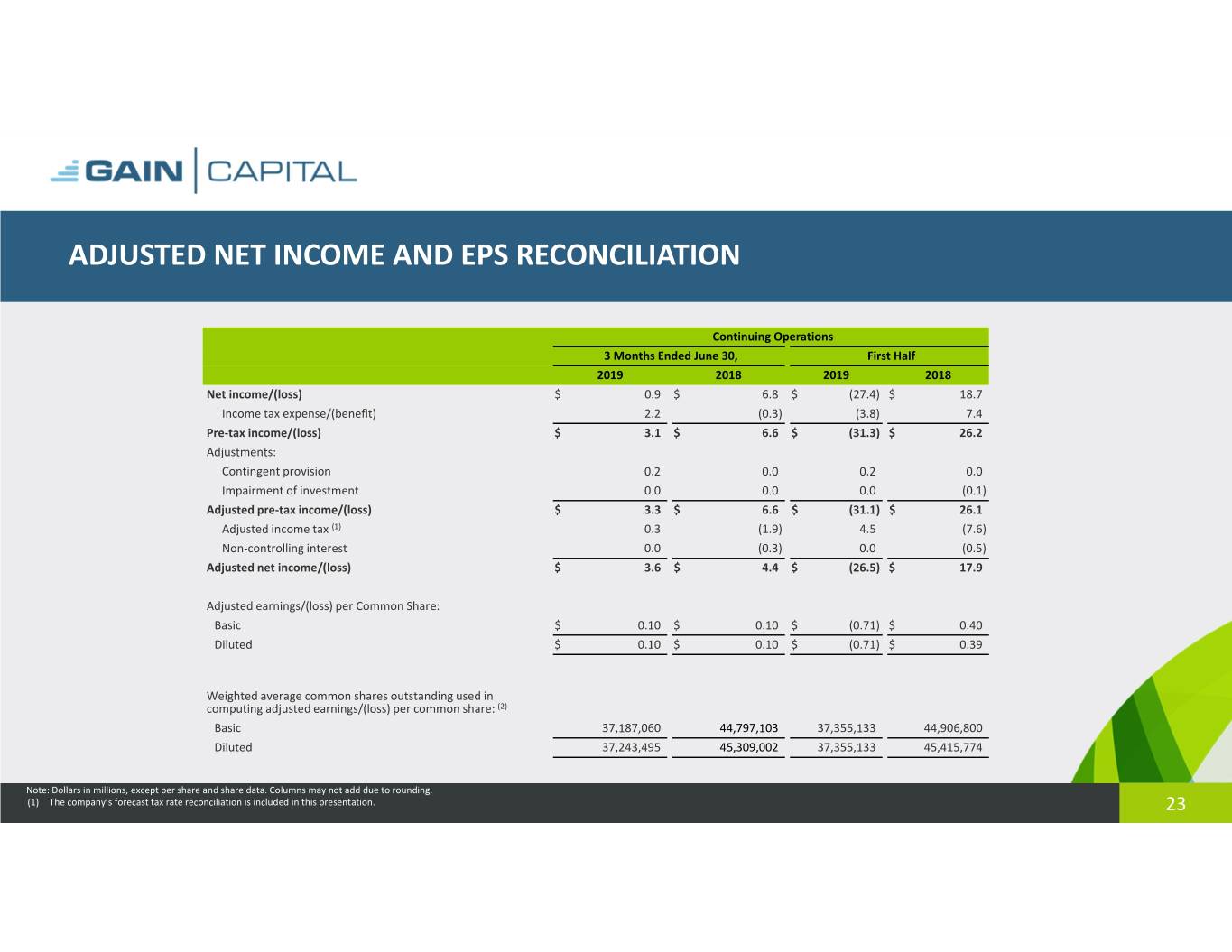

ADJUSTED NET INCOME AND EPS RECONCILIATION Continuing Operations 3 Months Ended June 30, First Half 2019 2018 2019 2018 Net income/(loss) $ 0.9 $ 6.8 $ (27.4) $ 18.7 Income tax expense/(benefit) 2.2 (0.3) (3.8) 7.4 Pre‐tax income/(loss) $ 3.1 $ 6.6 $ (31.3) $ 26.2 Adjustments: Contingent provision 0.2 0.0 0.2 0.0 Impairment of investment 0.0 0.0 0.0 (0.1) Adjusted pre‐tax income/(loss) $ 3.3 $ 6.6 $ (31.1) $ 26.1 Adjusted income tax (1) 0.3 (1.9) 4.5 (7.6) Non‐controlling interest 0.0 (0.3) 0.0 (0.5) Adjusted net income/(loss) $ 3.6 $ 4.4 $ (26.5) $ 17.9 Adjusted earnings/(loss) per Common Share: Basic $ 0.10 $ 0.10 $ (0.71) $ 0.40 Diluted $ 0.10 $ 0.10 $ (0.71) $ 0.39 Weighted average common shares outstanding used in computing adjusted earnings/(loss) per common share: (2) Basic 37,187,060 44,797,103 37,355,133 44,906,800 Diluted 37,243,495 45,309,002 37,355,133 45,415,774 Note: Dollars in millions, except per share and share data. Columns may not add due to rounding. (1) The company’s forecast tax rate reconciliation is included in this presentation. 23

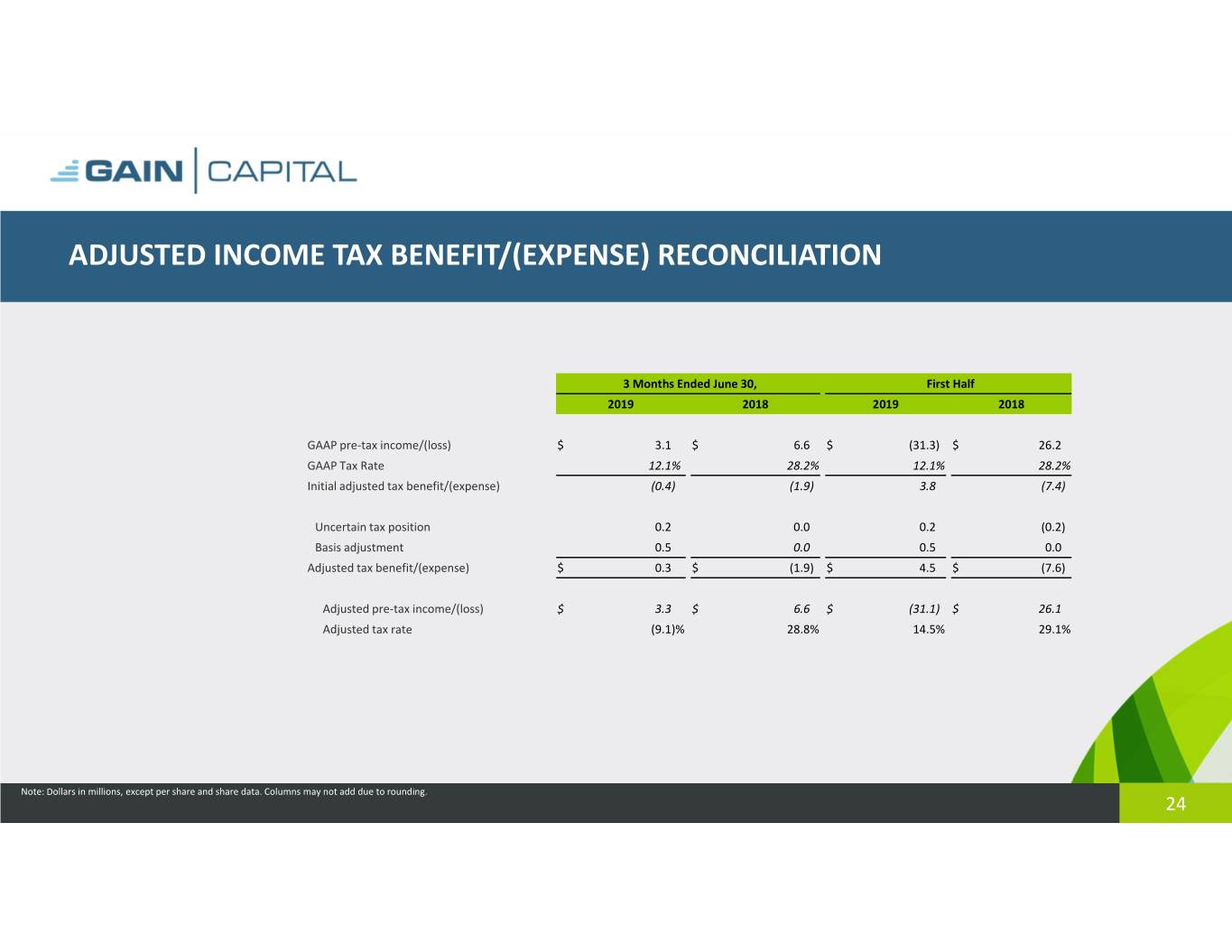

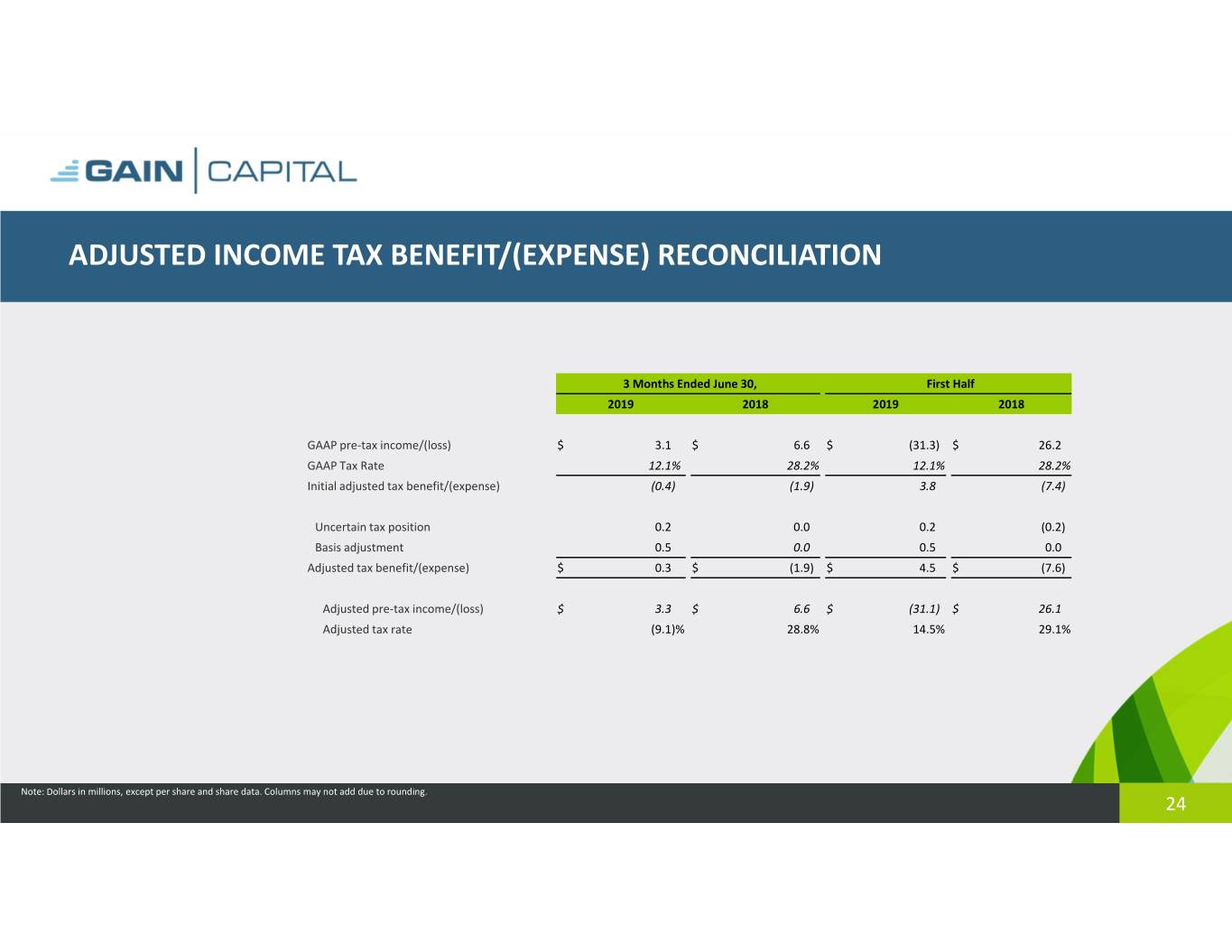

ADJUSTED INCOME TAX BENEFIT/(EXPENSE) RECONCILIATION 3 Months Ended June 30, First Half 2019 2018 2019 2018 GAAP pre‐tax income/(loss) $ 3.1 $ 6.6 $ (31.3) $ 26.2 GAAP Tax Rate 12.1% 28.2% 12.1% 28.2% Initial adjusted tax benefit/(expense) (0.4) (1.9) 3.8 (7.4) Uncertain tax position 0.2 0.0 0.2 (0.2) Basis adjustment 0.5 0.0 0.5 0.0 Adjusted tax benefit/(expense) $ 0.3 $ (1.9) $ 4.5 $ (7.6) Adjusted pre‐tax income/(loss) $ 3.3 $ 6.6 $ (31.1) $ 26.1 Adjusted tax rate (9.1)% 28.8% 14.5% 29.1% Note: Dollars in millions, except per share and share data. Columns may not add due to rounding. 24

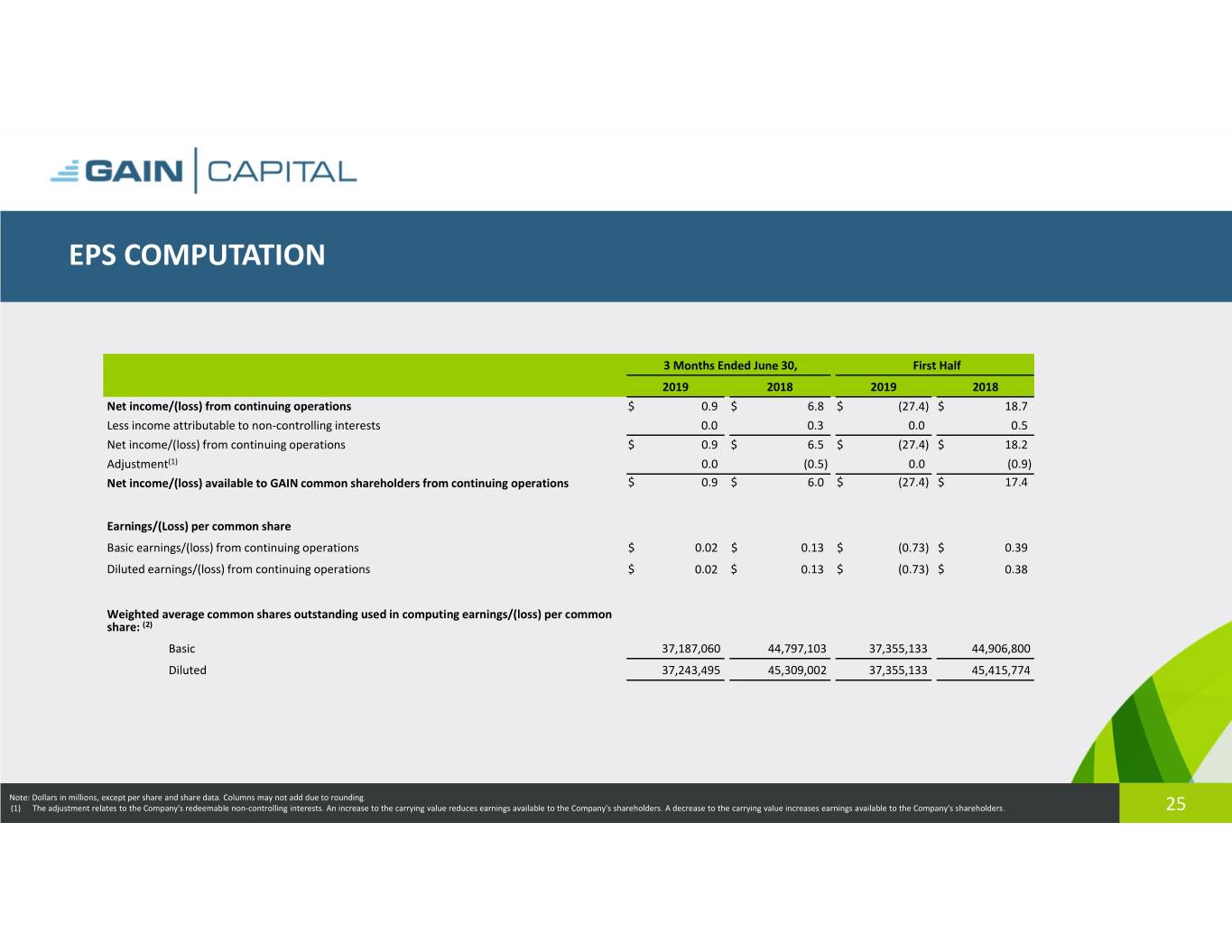

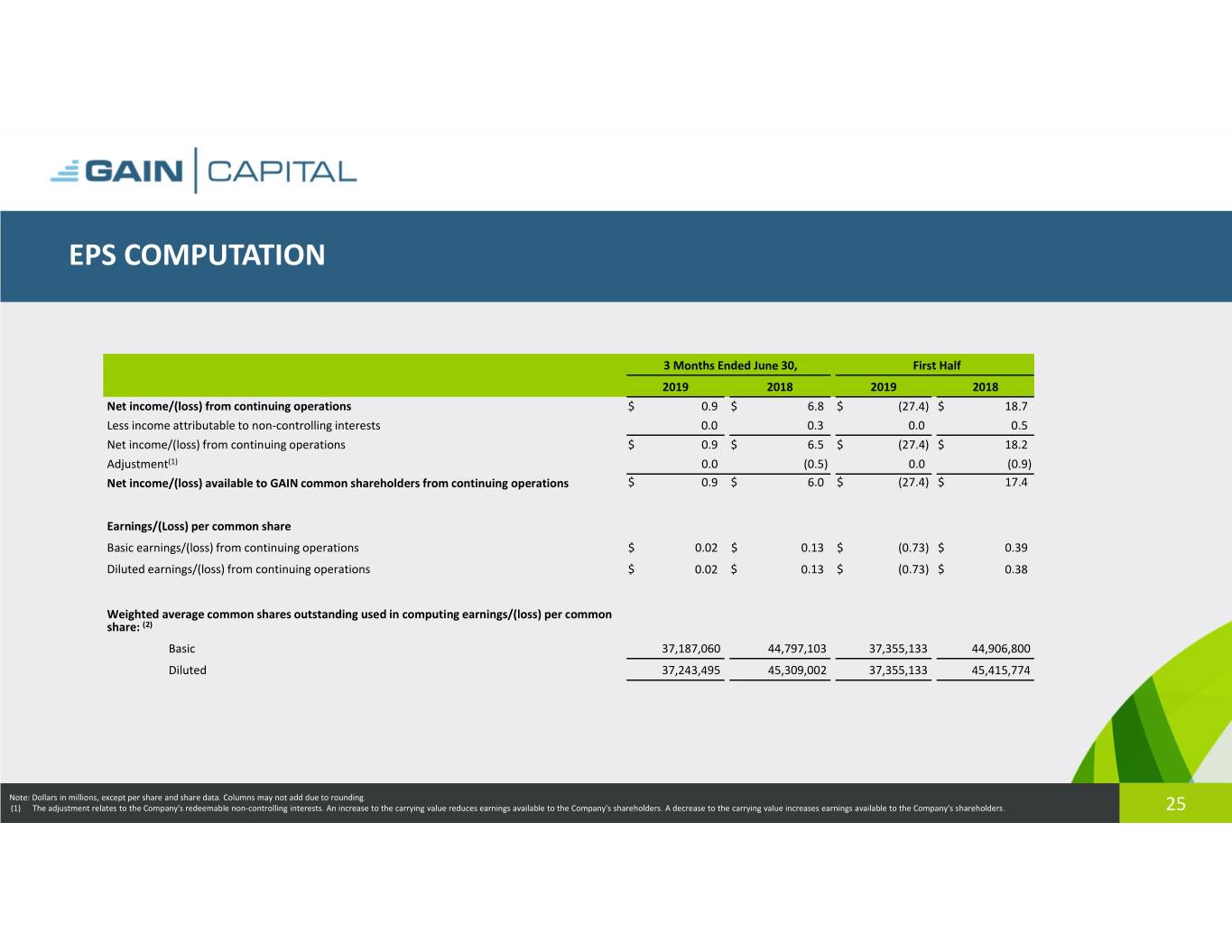

EPS COMPUTATION 3 Months Ended June 30, First Half 2019 2018 2019 2018 Net income/(loss) from continuing operations $ 0.9 $ 6.8 $ (27.4) $ 18.7 Less income attributable to non‐controlling interests 0.0 0.3 0.0 0.5 Net income/(loss) from continuing operations $ 0.9 $ 6.5 $ (27.4) $ 18.2 Adjustment(1) 0.0 (0.5) 0.0 (0.9) Net income/(loss) available to GAIN common shareholders from continuing operations $ 0.9 $ 6.0 $ (27.4) $ 17.4 Earnings/(Loss) per common share Basic earnings/(loss) from continuing operations $ 0.02 $ 0.13 $ (0.73) $ 0.39 Diluted earnings/(loss) from continuing operations $ 0.02 $ 0.13 $ (0.73) $ 0.38 Weighted average common shares outstanding used in computing earnings/(loss) per common share: (2) Basic 37,187,060 44,797,103 37,355,133 44,906,800 Diluted 37,243,495 45,309,002 37,355,133 45,415,774 Note: Dollars in millions, except per share and share data. Columns may not add due to rounding. (1) The adjustment relates to the Company's redeemable non‐controlling interests. An increase to the carrying value reduces earnings available to the Company's shareholders. A decrease to the carrying value increases earnings available to the Company's shareholders. 25

RECONCILIATION OF SEGMENT PROFIT TO INCOME BEFORE INCOME TAX EXPENSE 3 Months Ended June 30, First Half 2019 2018 2019 2018 Retail segment $ 20.9 $ 29.1 $ 3.6 $ 68.2 Futures segment 2.1 2.1 3.1 3.3 Corporate and other (10.1) (12.2) (17.4) (20.7) Segment profit/(loss) $ 12.8 $ 18.9 $ (10.6) $ 50.8 Depreciation and amortization $ 4.4 $ 5.3 $ 8.7 $ 10.7 Purchased intangible amortization 1.9 3.6 5.2 7.3 Restructuring expenses 0.0 0.0 0.0 0.0 Impairment of investment 0.0 0.0 0.0 (0.1) Operating profit/(loss) $ 6.5 $ 10.0 $ (24.5) $ 32.9 Interest expense on long term borrowings 3.4 3.4 6.7 6.7 Income/(loss) before income tax expense/(benefit) $ 3.1 $ 6.6 $ (31.3) $ 26.2 Note: Dollars in millions. Columns may not add due to rounding. 26

PRO FORMA RECONCILIATION Q1 2018 Q2 2018 GAIN Inst Cont Ops GAIN Inst Cont Ops REVENUE: Retail revenue $ 84.1 $ 0.0 $ 84.1 $ 72.0 $ 0.0 $ 72.0 Institutional revenue 8.5 8.5 0.0 7.9 7.9 0.0 Futures revenue 10.6 0.0 10.6 11.1 0.0 11.1 Interest and other revenue 3.6 0.0 3.6 1.1 0.1 1.0 Net revenue $ 106.9 $ 8.5 $ 98.5 $ 92.2 $ 8.0 $ 84.2 EXPENSES: Employee compensation and benefits 27.8 3.4 24.3 24.9 2.5 22.5 Selling and marketing 6.0 0.1 6.0 6.8 0.0 6.8 Referral fees 11.9 0.5 11.4 11.0 0.5 10.5 Trading expenses 8.5 2.7 5.8 8.3 2.8 5.5 General and administrative 13.0 0.5 12.5 14.8 0.5 14.2 Depreciation and amortization 5.7 0.3 5.4 5.4 0.1 5.3 Purchased intangible amortization 4.2 0.5 3.7 4.0 0.4 3.6 Communications and technology 5.5 0.1 5.4 5.6 0.1 5.5 Bad debt provision 1.1 0.0 1.1 0.3 0.0 0.3 Restructuring expenses 0.0 0.0 0.0 0.2 0.2 0.0 Legal settlement 0.0 0.0 0.0 0.0 0.0 0.0 Impairment of investment (0.1) 0.0 (0.1) 0.0 0.0 0.0 Total expenses 83.6 8.1 75.4 81.3 7.1 74.2 OPERATING PROFIT $ 23.3 $ 0.4 $ 22.9 $ 10.9 $ 0.9 $ 10.0 Interest expense on long term borrowings 3.3 0.0 3.3 3.4 0.0 3.4 INCOME BEFORE INCOME TAX $ 20.0 $ 0.4 $ 19.6 $ 7.5 $ 0.9 $ 6.6 Note: Dollars in millions. Columns may not add due to rounding. Q2 2019 not presented as there are no discontinued operations. 27

DISCONTINUED OPERATIONS Three Months Ended June 30, First Half 2019 2018 2019 2018 REVENUE: Institutional revenue $ 0.0 $ 7.9 $ 0.0 $ 16.4 Total non‐interest revenue 0.0 7.9 0.0 16.4 Interest revenue 0.0 0.1 0.0 0.1 Total net interest revenue 0.0 0.1 0.0 0.1 Net revenue $ 0.0 $ 8.0 $ 0.0 $ 16.5 EXPENSES: Employee compensation and benefits $ 0.0 $ 2.5 $ 0.0 $ 5.9 Trading expenses 0.0 2.8 0.0 5.4 Other expenses 0.0 1.9 0.0 3.9 Total operating expense 0.0 7.1 0.0 15.2 OPERATING PROFIT 0.0 0.9 0.0 1.2 Gain on sale of discontinued operations 0.0 69.6 0.0 69.6 INCOME BEFORE INCOME TAX BENEFIT 0.0 70.4 0.0 70.8 Income tax expense 0.0 9.8 0.0 5.8 NET INCOME FROM DISCONTINUED OPERATIONS $ 0.0 $ 60.6 $ 0.0 $ 65.0 Note: Dollars in millions. Columns may not add due to rounding. 28

RETAIL REVENUE PER MILLION 29

OPERATING SEGMENT RESULTS: CORPORATE & OTHER Corporate & Other Financial & Operating Results 3 Months Ended June 30, First Half 2019 2018 2019 2018 TTM 6/30/19 (Loss)/revenue $ (0.9) $ (2.4) $ 0.0 $ (1.3) $ (1.2) Employee compensation and benefits 6.3 6.0 11.5 12.4 22.9 Selling and marketing 0.0 0.1 0.0 0.1 0.2 Other operating expenses 2.9 3.7 5.8 7.0 12.6 Loss $ (10.1) $ (12.2) $ (17.4) $ (20.7) $ (36.8) Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding. 30

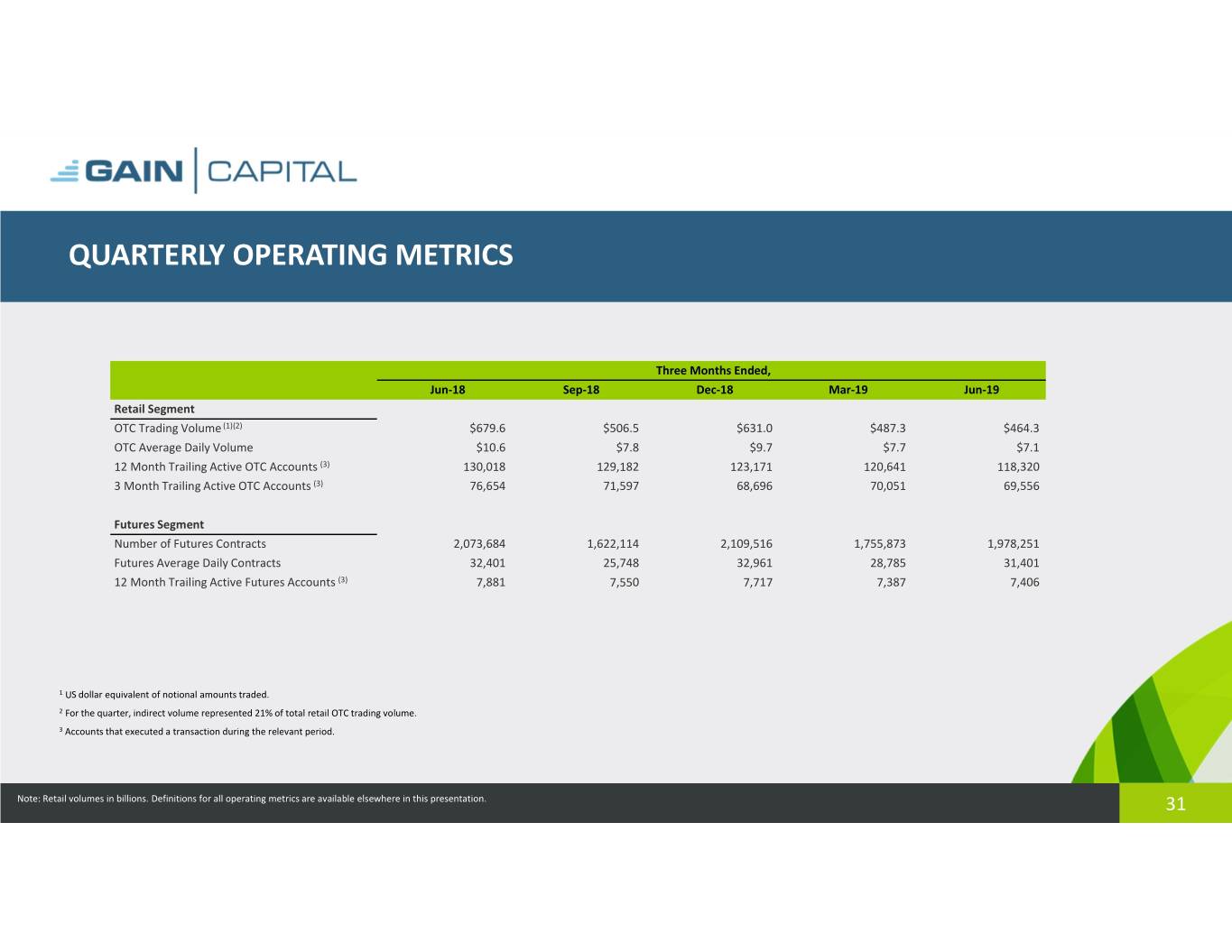

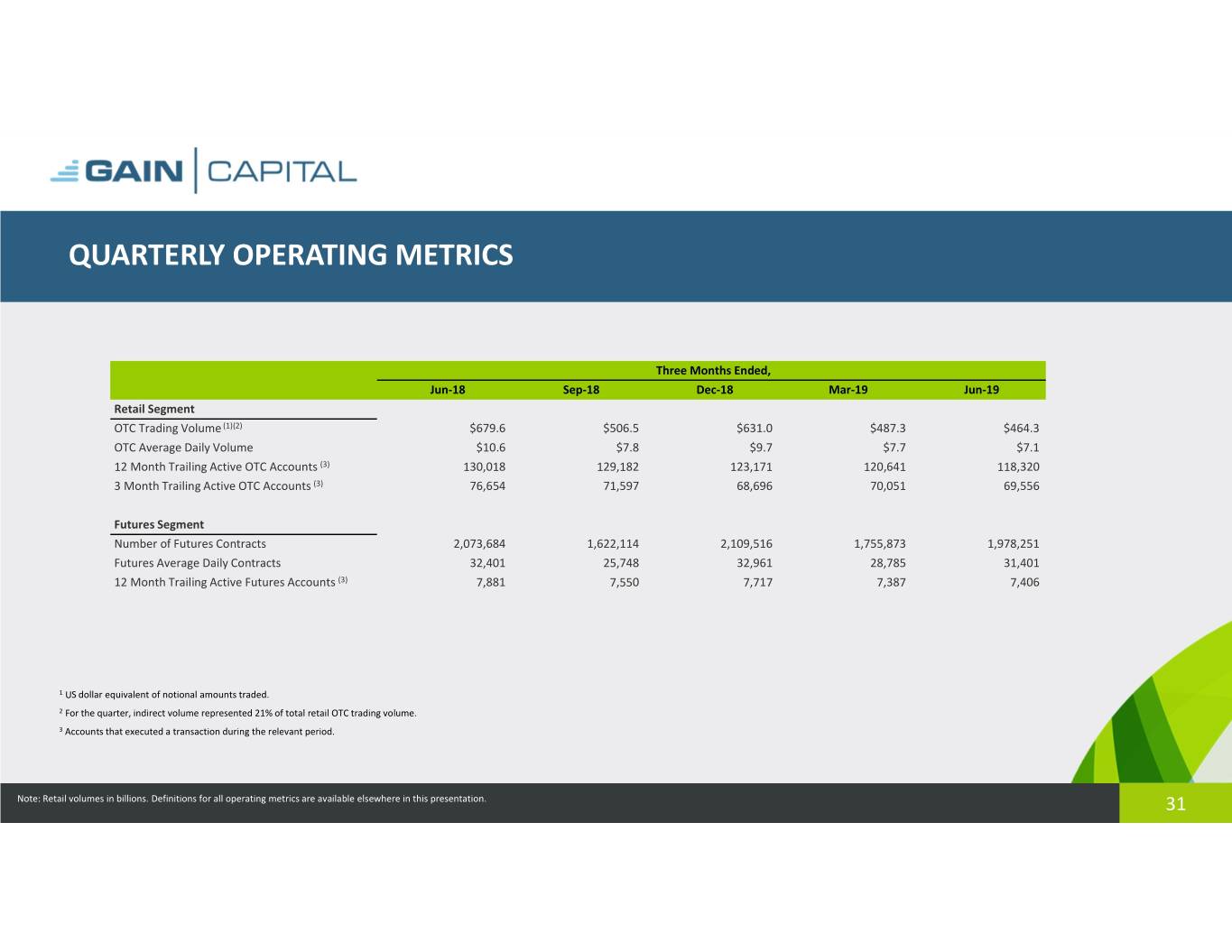

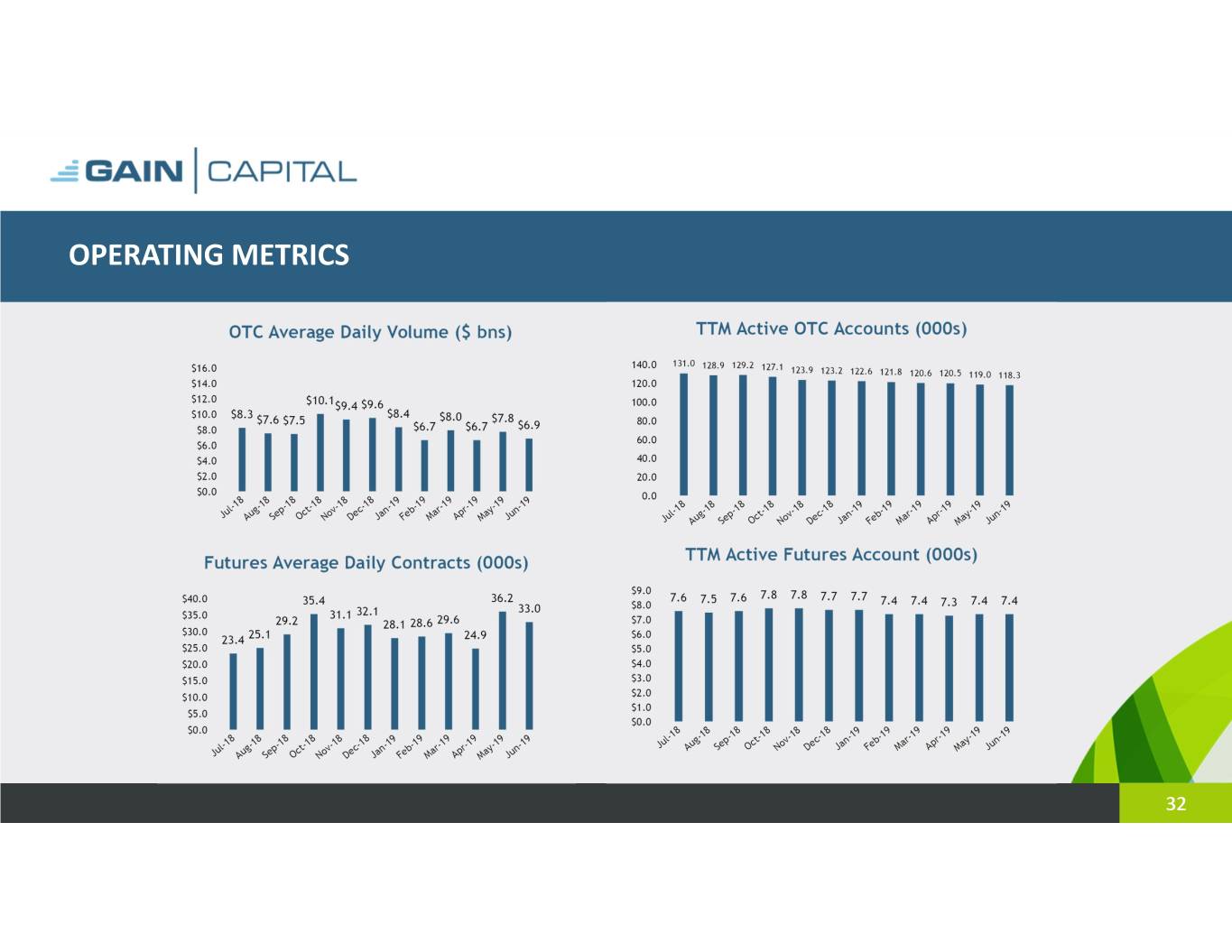

QUARTERLY OPERATING METRICS Three Months Ended, Jun‐18 Sep‐18 Dec‐18 Mar‐19 Jun‐19 Retail Segment OTC Trading Volume (1)(2) $679.6 $506.5 $631.0 $487.3 $464.3 OTC Average Daily Volume $10.6 $7.8 $9.7 $7.7 $7.1 12 Month Trailing Active OTC Accounts (3) 130,018 129,182 123,171 120,641 118,320 3 Month Trailing Active OTC Accounts (3) 76,654 71,597 68,696 70,051 69,556 Futures Segment Number of Futures Contracts 2,073,684 1,622,114 2,109,516 1,755,873 1,978,251 Futures Average Daily Contracts 32,401 25,748 32,961 28,785 31,401 12 Month Trailing Active Futures Accounts (3) 7,881 7,550 7,717 7,387 7,406 1 US dollar equivalent of notional amounts traded. 2 For the quarter, indirect volume represented 21% of total retail OTC trading volume. 3 Accounts that executed a transaction during the relevant period. Note: Retail volumes in billions. Definitions for all operating metrics are available elsewhere in this presentation. 31

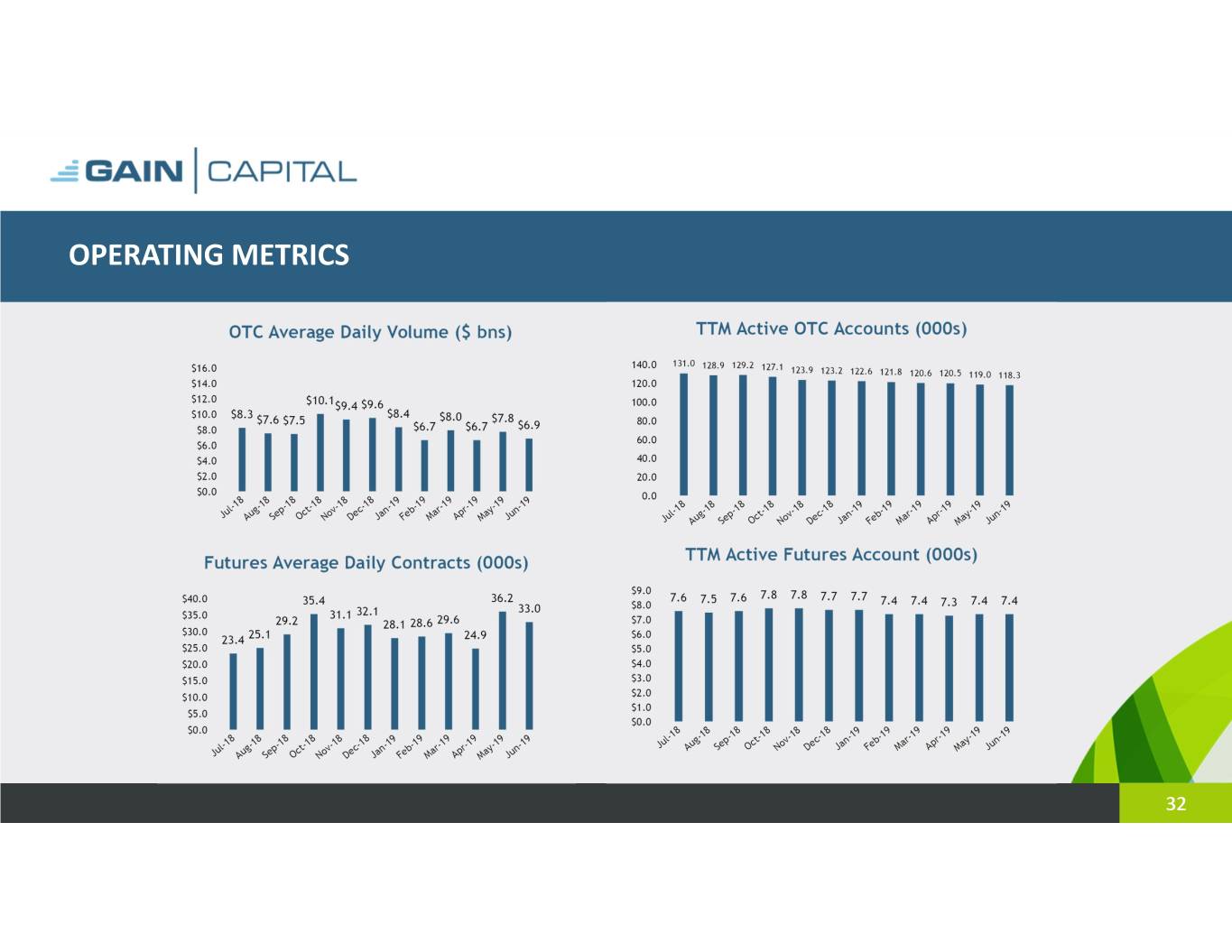

OPERATING METRICS 32

DEFINITION OF METRICS • Active Accounts: Accounts that executed a transaction during the period • Trading Volume: Represents the U.S. dollar equivalent of notional amounts traded • Customer Assets: Represents amounts due to clients, including customer deposits and unrealized gains or losses arising from open positions 33