©2024 Nevro Corp. All rights reserved. S000000 Third Quarter 2024�Earnings Conference Call November 11, 2024 Exhibit 99.2

©2024 Nevro Corp. All rights reserved. S000000 In addition to historical information, this presentation contains forward-looking statements reflecting the current beliefs and expectations of the company’s management, made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including: our full-year 2024 financial guidance; our belief that the actions we have taken and intend to take will further position us for a return to growth, success in the marketplace, profitability and shareholder value creation; our belief that the expansion of territories led by newly promoted associate sales reps and our reallocating marketing resources will allow us to return to sustainable growth; our belief that the market release of HFX AdaptivAI™ in U.S. and HFX iQ™ in Europe will successfully drive sales; our belief that evaluating and/or engaging in strategic opportunities will help us diversify and grow our business, which we believe may position us to accelerate our goals of profitability and maximizing shareholder value; and our beliefs with regards to the SCS market and factors impacting our results, including the duration in which those factors will continue to impact our results; and our beliefs in the catalysts for long-term growth. These forward-looking statements are based upon information that is currently available to us or our current expectations, speak only as of the date hereof, and are subject to numerous risks and uncertainties, including our ability to successfully commercialize our products; our ability to manufacture our products to meet demand; the level and availability of third-party payor reimbursement for our products; our ability to effectively manage our anticipated growth and the costs and expenses of operating our business; our ability to protect our intellectual property rights and proprietary technologies; our ability to operate our business without infringing the intellectual property rights and proprietary technology of third parties; competition in our industry; additional capital and credit availability; our ability to successfully integrate any future acquisitions we may make, including our acquisition of Vyrsa Technologies; our ability to attract and retain qualified personnel; our ability to accurately forecast financial and operating results; our ability to successfully evaluate and execute on potential strategic opportunities; and product liability claims. These factors, together with those that are described in greater detail in our Annual Report on Form 10-K, as well as any reports that we may file with the Securities and Exchange Commission in the future, may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our forward-looking statements. We expressly disclaim any obligation, except as required by law, or undertaking to update or revise any such forward-looking statements. Nevro's operating results for the third-quarter ended September 30, 2024, are not necessarily indicative of our operating results for any future periods. Forward-Looking Statements

©2024 Nevro Corp. All rights reserved. S000000 Management uses certain non-GAAP financial measures, most specifically Adjusted EBITDA, as a supplement to GAAP financial measures to further evaluate the company’s operating performance period over period, analyze the underlying business trends, assess performance relative to competitors and establish operational objectives. Management believes it is important to provide investors with the same non-GAAP metrics it uses to evaluate the performance and underlying trends of the company’s business operations to facilitate comparisons to its historical operating results and evaluate the effectiveness of its operating strategies. Disclosure of these non-GAAP financial measures also facilitates comparisons of the company’s underlying operating performance with other companies in the industry that also supplement their GAAP results with non-GAAP financial measures. EBITDA is a non-GAAP financial measure, which is calculated by adding interest income and expense, net; provision for income taxes; and depreciation and amortization to net income. In calculating non-GAAP Adjusted EBITDA, the company further adjusts for the following items: Stock-based compensation expense – The company excludes non-cash costs related to the company's stock-based plans, which include stock options, restricted stock units and performance-based restricted stock units as these expenses do not require cash settlement from the company. Amortization of intangibles – The company excludes amortization of intangibles from the acquisition of businesses. Change in fair value of contingent consideration – The company excludes the changes in the fair value of its contingent consideration liability. Change in the fair market value of warrants – The company excludes the changes in the fair market value of its warrant liability, which management considers not related to the underlying operating performance of the business. Litigation-related expenses – The company excludes legal and professional fees as well as charges and credits associated with certain legal matters, which management considers not related to the underlying operating performance of the business. Restructuring charges – The company excludes charges incurred as a direct result of restructuring programs, such as salaries and other compensation-related expenses. Supplier contract renegotiation charge – The company excluded one-time costs associated with the renegotiation of a supplier contract. Full-year guidance excludes the impact of foreign currency fluctuations. The non-GAAP financial measure should not be considered in isolation from, or as a replacement for, the most directly comparable GAAP financial�measures, as it is not prepared in accordance with U.S. GAAP. Non-GAAP Financial Measures

Business Overview Kevin Thornal Chief Executive Officer &� President Financial Overview Rod MacLeod Chief Financial Officer &� Senior Vice President

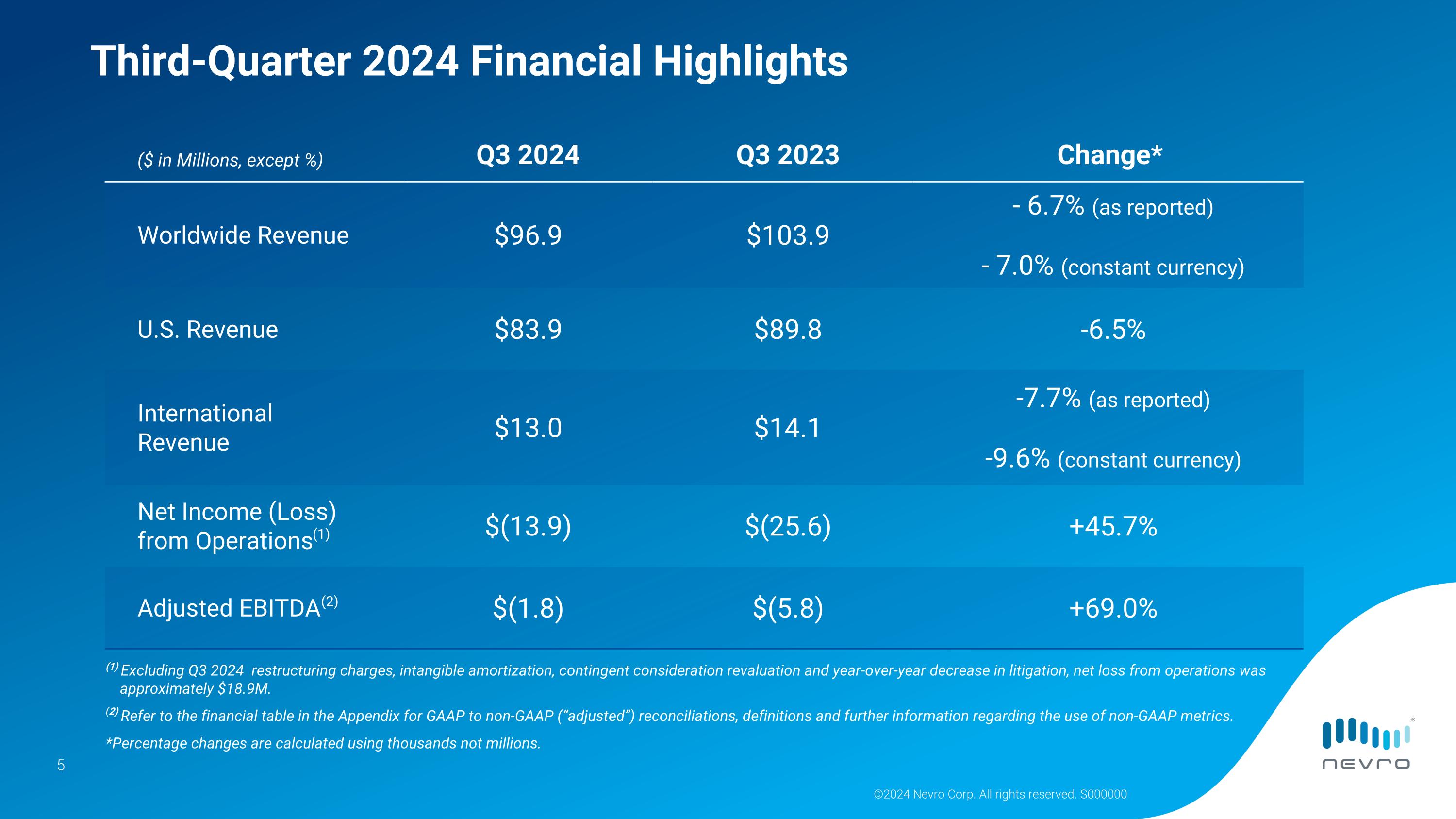

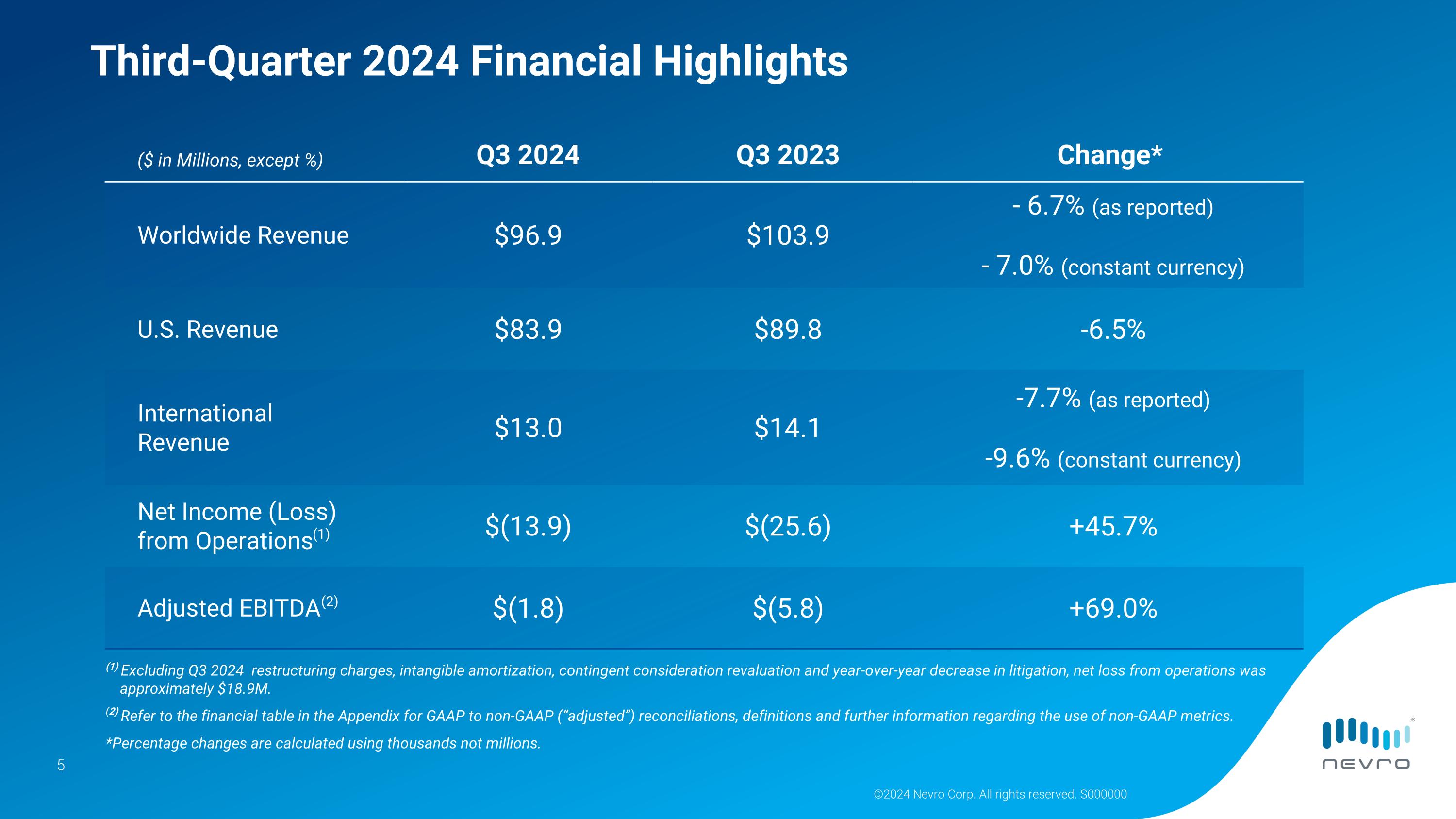

©2024 Nevro Corp. All rights reserved. S000000 Third-Quarter 2024 Financial Highlights ($ in Millions, except %) Q3 2024 Q3 2023 Change* Worldwide Revenue $96.9 $103.9 - 6.7% (as reported) - 7.0% (constant currency) U.S. Revenue $83.9 $89.8 -6.5% International�Revenue $13.0 $14.1 -7.7% (as reported) -9.6% (constant currency) Net Income (Loss) from Operations(1) $(13.9) $(25.6) +45.7% Adjusted EBITDA(2) $(1.8) $(5.8) +69.0% (1) Excluding Q3 2024 restructuring charges, intangible amortization, contingent consideration revaluation and year-over-year decrease in litigation, net loss from operations was approximately $18.9M. (2) Refer to the financial table in the Appendix for GAAP to non-GAAP (“adjusted”) reconciliations, definitions and further information regarding the use of non-GAAP metrics. *Percentage changes are calculated using thousands not millions.

©2024 Nevro Corp. All rights reserved. S000000 ” Implementing actions to improve competitive positioning, drive market penetration, return to sustainable top-line growth and continue on path toward profitability Improving commercial execution by expanding territories led by newly promoted associate sales reps and reallocating marketing resources to return to sustainable growth Continued to build and leverage R&D pipeline with limited market releases�of HFX AdaptivAI™ in U.S. and HFX iQ™ in select regions of Europe Building on strong foundation of robust clinical data Cash position increased $3.3 million sequentially and remains strong�with $277.0 million in cash, cash equivalents and short-term investments�on balance sheet Reaffirming FY2024 worldwide revenue guidance and raising FY2024 adjusted EBITDA guidance Continue to explore strategic options to accelerate growth, diversify the product portfolio and deliver shareholder value Third-Quarter 2024 Key Messages

Implementing Actions to Improve Commercial Execution Promoted several new associate sales representatives (ASR) to lead newly created territories in 3Q24 with plan to add new territories in 2025 Expect ramp-up period in 2025 as new ASRs get established in their territories Allows sales team to reach more customers, go deeper with physicians provide high level of customer service and lays foundation for new product introductions Reallocating resources to marketing initiatives to drive patient lead generation and convert higher number of patient leads into spinal cord stimulation (SCS) trials Beginning to see patient interest and response to new DTC advertising campaigns and confident we will see meaningful improvement in SCS trialing activity in 2H2025

Building and Leveraging R&D Pipeline to Drive Market Penetration HFX AdaptivAI received U.S. Food & Drug Administration (FDA) approval and announced limited market release (LMR) in September 2024 The only SCS technology using artificial intelligence (AI) and built on foundation of landmark evidence, clinical research and big data First therapy to put patients in control of their pain relief while providing physicians with ability to monitor patient journey Early data demonstrates meaningful improvements in time to achieve pain relief Significant reductions in administrative and clinical burdens to our organizational infrastructure Commercial Execution HFX iQ™ with HFX AdaptivAI™ Received CE Mark Certification in Europe allowing Nevro to market HFX iQ in all countries that recognize CE certification Will be available in select regions of Europe through LMR in late November 2024 Anticipate full market release in select European countries in 1Q25 Regulatory Approval to Offer HFX iQ in CE-Marked Countries

Strategy to grow through expanded SCS therapy and alternative therapies earlier in the care continuum Continue to focus on growing painful diabetic neuropathy (PDN) business by educating physicians and raising patient awareness on benefits of SCS therapy New data published in Journal of Pain Medicine demonstrating long-term improvements in pain intensity with�high-frequency SCS therapy First study of SCS to demonstrate long-term, significant and clinically meaningful reductions in HbA1C and weight in participants with PDN and Type 2 diabetes who received high-frequency SCS therapy; initiated feasibility study to specifically evaluate use of 10 kHz therapy to affect HbA1C Senza-Sensory RCT interim analysis ongoing; expect readout in early 2025 Ramping and scaling sacroiliac (SI) joint fusion business Continue to receive positive feedback from physicians who are trained and performing SI joint fusion procedures Comparative biomechanical data on Nevro1™ accepted for publication; Nevro1 was found to provide equivalent �and superior motion reduction respectively with less invasive and less destructive approach while providing�largest surface area for fusion Long-Term Goal:�Become Leading Comprehensive Pain Management Company

Full-Year 2024 Guidance�(As of November 11, 2024) Full-Year 2024 Guidance Worldwide Revenue(1) $400 million to $405 million Gross Margin ~ 66% (Adjusted gross margin of ~ 68% excluding one-time supplier contract renegotiation charge) Operating�Expenses(2) ~$369.1 million (Previous guidance: ~ $383 million) Adjusted EBITDA(3) $(18) million to $(16) million (Previous guidance:$(20) million to $18 million) (1) Nevro's full-year 2024 guidance assumes that its Q4 2024 U.S. SCS trialing growth rate does not improve from Q3 2024. (2) Includes $10.8 million in charges related to the company’s 2024 restructurings and $5.1 million in intangible amortization and contingent consideration revaluations. (3) Refer to the financial table in the Appendix for GAAP to non-GAAP reconciliations, definitions and further information regarding the use of non-GAAP metrics.

Our goal is to become the leading comprehensive�pain management�company with a diversified, differentiated and innovative product portfolio SCS Indication Expansion Continue to Scale�Costa Rica Manufacturing�and Leverage Business Evaluate Strategic Opportunities Commercial Execution Penetrate SI Joint Fusion Market ©2024 Nevro Corp. All rights reserved. 11 Further Diversify Product Portfolio

Appendix 12

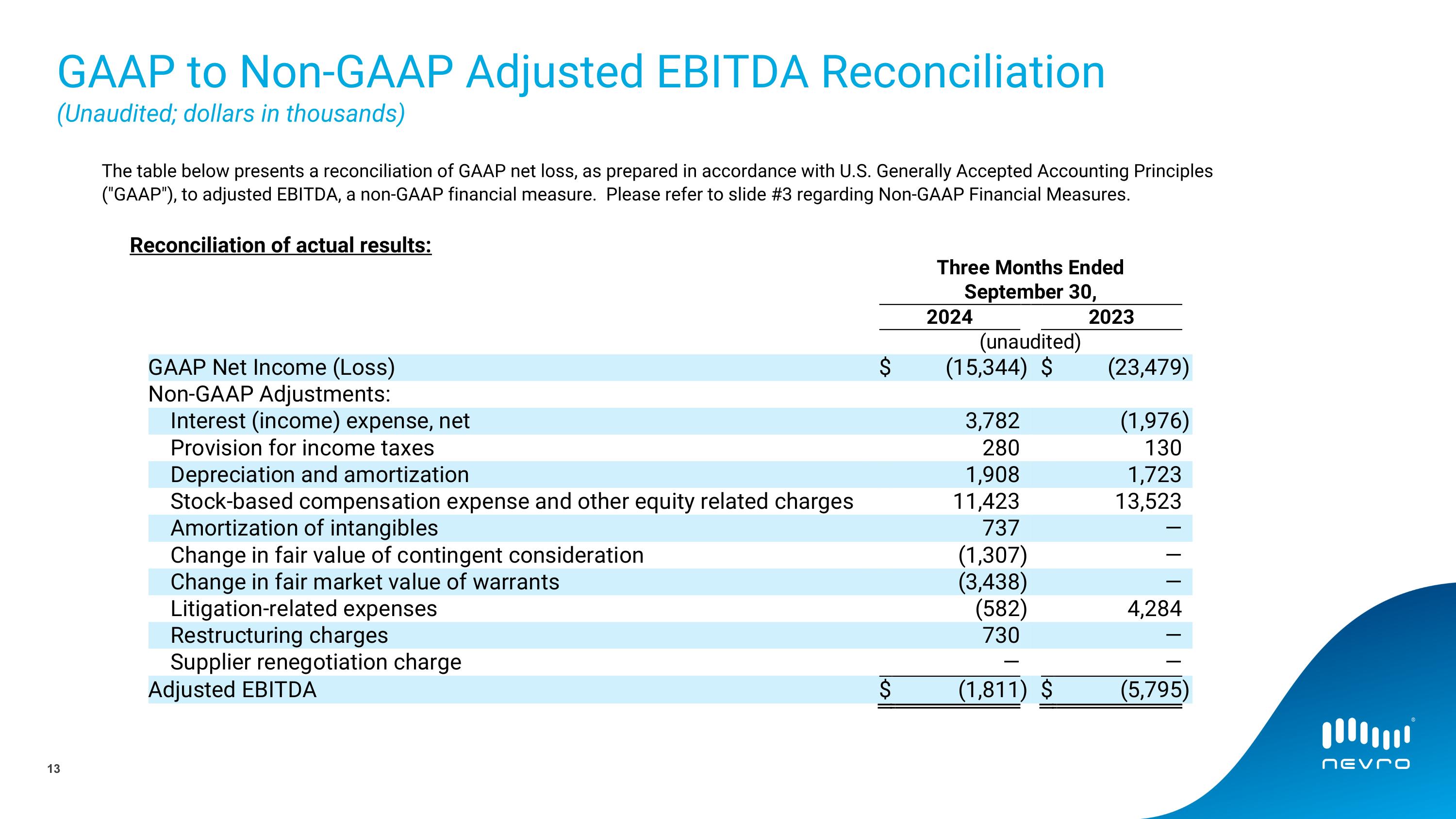

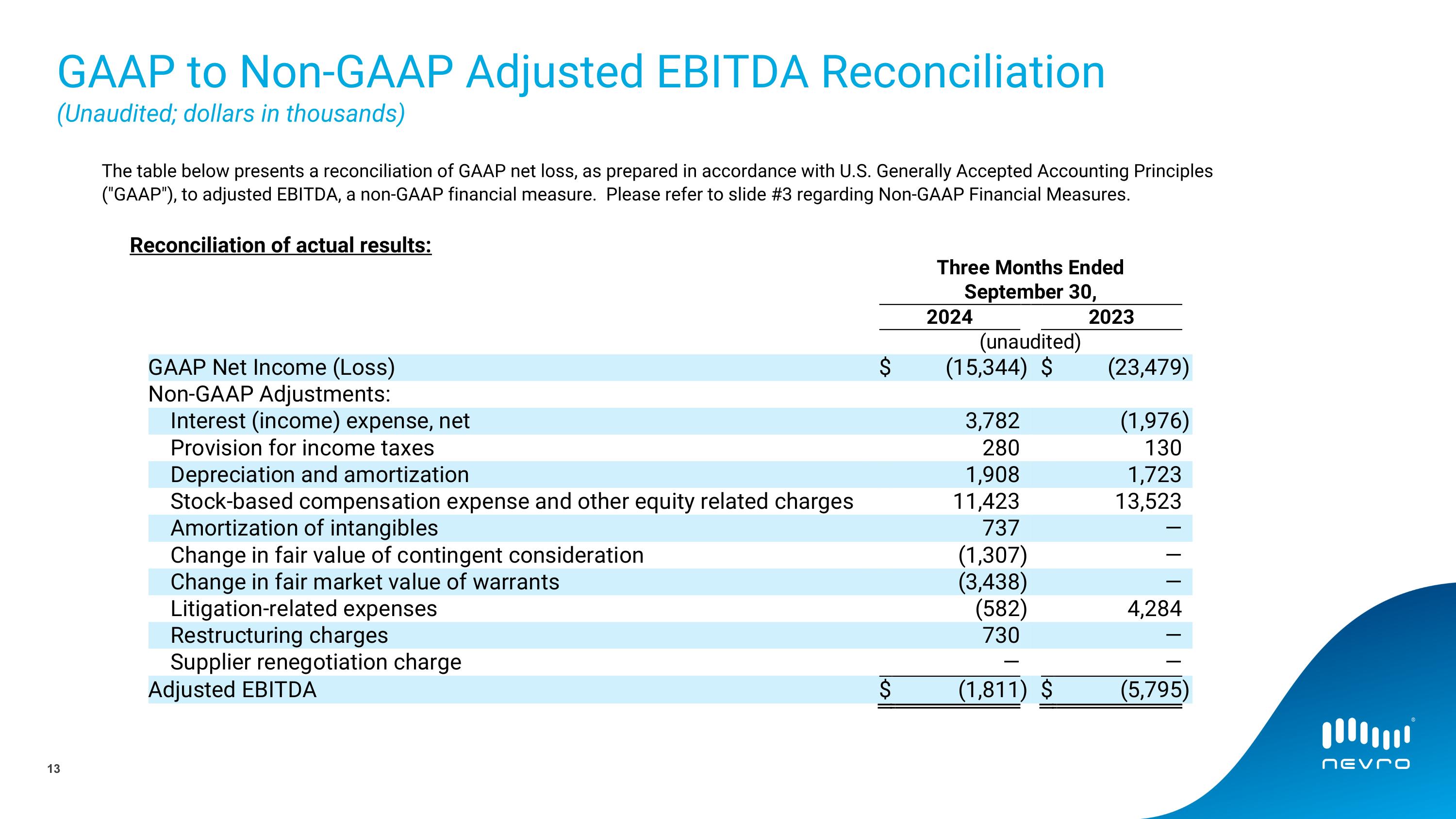

GAAP to Non-GAAP Adjusted EBITDA Reconciliation�(Unaudited; dollars in thousands) The table below presents a reconciliation of GAAP net loss, as prepared in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"), to adjusted EBITDA, a non-GAAP financial measure. Please refer to slide #3 regarding Non-GAAP Financial Measures. Reconciliation of actual results: 13

GAAP to Non-GAAP Adjusted EBITDA Reconciliation�(Unaudited; dollars in thousands) Note: Nevro has not provided a quantitative reconciliation of forecasted adjusted EBITDA to forecasted Net Loss because the company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. Reconciliation of FY24 guidance: 14

angeline.mccabe@nevro.com For more information about Nevro, contact: Angie McCabe VICE PRESIDENT, INVESTOR RELATIONS & CORPORATE COMMUNICATIONS Nevro Corp. (NYSE: NVRO) 15