September 28th, 2010

BY EDGAR AND FACSIMILE

Roger Schwall

United States Securities and Exchange Commission

Division of Corporation Finance

450 Fifth Street, N.W.

Washington, D.C. 20549-0405

Tel: (202) 551-3864

Ecopetrol S.A.

Form 20-F for Fiscal Year Ended December 31, 2009

Filed July 15, 2010

File No. 001-34175

Dear Mr. Schwall:

Ecopetrol S.A. (the “Company” or “we”) has received a comment letter dated August 30, 2010 from the staff of the Division of Corporate Finance (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) concerning the Company’s annual report on Form 20-F for fiscal year ended December 31, 2009 (the “Form 20-F”). We advise you as follows regarding your comments noted below:

General

| 1. | Please tell us what consideration you have given to providing disclosure regarding climate change matters. See SEC Release No. 33-9106, Commission Guidance Regarding Disclosure Related to Climate Change. |

Response

Ecopetrol is currently regulated by the Ministry of Environment for Colombian environmental issues, and this entity is responsible for establishing guidelines regarding Climate Change policies for the hydrocarbon sector in Colombia. We are in compliance with those guidelines and were so upon filing of the Form 20-F. In addition, our Form 20-F details currently known risk factors arising out of regulations which are already in effect, particularly in Colombia.

To date, the Ministry of the Environment has not proposed any specific steps for the implementation of the Kyoto Accords as regarding our operations, so we view any disclosure as to what they may do to be purely speculative. We continue to monitor the applicable requirements and will continue to take into account the Staff’s Interpretive Guidance in our annual reports in the future.

| 2. | We note under “Restrictions on banks and corporations” on page F-26 that a payment of $98,477 made by you to the Neuro Science Center of Cuba is currently being withheld by ABN Bank as part of the U.S. embargo against Cuba and OFAC regulations. Please tell us what the payment was for, the date you incurred the payment obligation and the date of the activity that is the basis for the payment obligation. |

Response

The payment corresponds to the lowest cost agreement we were able to sign with the Centro de Neurociencias de Cuba (Neuroscience Center of Cuba) on September 15th, 1997, which scope was to diagnose neurological alterations for 333 of our workers at the Barrancabermeja Refinery, that had been exposed to BTX (benzene, toluene and xylene), and to prescribe specialized medical treatments for those alterations.

The existing information in our accounting records relating to this payment is set forth below:

| Blocking institution: | ABN Amro Bank, N.V. |

| | 200 S. Biscayne Blvd. suite 2200 |

| | Miami, FL 33131 |

| | |

| Amount blocked: | U.S.$98,477.00 (original amount) |

| | |

| Date of Block: | November 18, 1997 |

| | |

| Remitter name: | Empresa Colombiana de Petroleos (Ecopetrol) |

| | |

| Remitting institution: | ABN Amro Bank, N.V. |

| | 200 S. Biscayne Blvd. suite 2200 |

| | Miami, FL 33131 |

| | |

| Beneficiary name: | Centro de Neurociencias de Cuba (Neuroscience Center of Cuba.) |

| | Avenida 25 No. 15202 Esq 158 |

| | Cubanacan, La Habana, Cuba |

Notwithstanding the aforementioned explanation, we would like to highlight that this transaction occurred many years before Ecopetrol´s shares were listed on the NYSE.

| 3. | We note June and September 2009 news articles reporting that you signed agreements with the Cuban government to explore for oil in Cuba and waters controlled by Cuba. |

We note a May 2003 news article reporting that you signed an agreement with Joshi Technologies, an Iranian company for oil exploration in Colombia.

We also note 2008, 2009 and 2010 news articles reporting that you signed agreements with a unit of Turkish Petroleum Corporation and Emerald Energy which have projects and/or assets in Iran, Syria and Sudan.

Iran, Syria, Sudan and Cuba are identified by the State Department as state sponsors of terrorism and are subject to U.S. economic sanctions and export controls. We note that your Form 10-K includes only limited information about contacts with Cuba and does not include disclosure regarding contracts with Iran, Syria or Sudan. Please describe to us the nature and extent of your past, current, and anticipated contacts with Cuba, and any past, current, or anticipated contacts with Iran, Syria and Sudan, whether through subsidiaries, resellers, distributors or other direct or indirect arrangements. Your response should describe any services or products you have provided to Cuba, Iran, Syria or Sudan and any agreements, commercial arrangements, or other contacts you have had with the governments of Cuba, Iran, Syria or Sudan, or entities controlled by these governments.

Response

We have diligently reviewed the official information released by Ecopetrol that is contained in our website and in our published Form 6-Ks, pursuant to regulations, and none contain such information.

We are aware that the Government of Cuba and the Minister of Mines of Colombia have been in discussions about Ecopetrol participating in oil exploration in Cuba. Nevertheless, there have not been any concrete developments arising out of these discussions as to Ecopetrol and Ecopetrol is not a party to any agreements with the Government of Cuba.

To confirm your requirement, the Company, its subsidiaries, resellers and distributors currently do not carry out any activities in Cuba, Syria, Iran or Sudan nor do any of them anticipate doing so in the future. Additionally, the Company, its subsidiaries, resellers and distributors have not entered into any agreements with any of such countries and none of them anticipate doing so in the future.

We confirm that the Company did enter into an agreement on December 20, 2000 with a Joint Venture (Unión Temporal) composed of Ismocol de Colombia S.A., Joshi Technologies International Incorporated (JTI), Parko Services S.A., and Petcar Ltda, in which JTI had a 42% interest. The contract is an Incremental Production Agreement for Palagua and Caipal fields. According to public sources consulted by Ecopetrol, JTI is an Oklahoma corporation, recently awarded the 2009 Governor’s Award for Excellence in Exporting.

Finally, Ecopetrol will continue monitoring its operations and transactions abroad and make the required disclosures as necessary.

| 4. | Please discuss the materiality of your contacts with Cuba, and any contacts with Iran, Syria and Sudan, described in response to the foregoing comment and whether those contacts constitute a material investment risk for your security holders. You should address materiality in quantitative terms, including the approximate dollar amounts of any associated revenues, assets, and liabilities for the last three fiscal years and subsequent interim period. Also, address materiality in terms of qualitative factors that a reasonable investor would deem important in making an investment decision, including the potential impact of corporate activities upon a company’s reputation and share value. As you may be aware, various state and municipal governments, universities, and other investors have proposed or adopted divestment or similar initiatives regarding investment in companies that do business with U.S.-designated state sponsors of terrorism. Your materiality analysis should address the potential impact of the investor sentiment evidenced by such actions directed toward companies that have operations associated with Iran, Syria, Sudan and Cuba. |

Response

As noted in the Company’s reply to the Staff’s comment #3 above, the Company does not have any agreements with Cuba, Iran, Syria or Sudan.

Our deep water drilling operations carried out by us, page 11

| 5. | In light of recent events involving the Gulf of Mexico, please review your disclosure to ensure that you have disclosed all material information regarding your potential liability in the event that one of the rigs operating in connection with one of your offshore projects is involved in an explosion or similar event in any of your offshore locations. For example, and without limitation, please address the following: |

| | · | Disclose the applicable policy limits related to your insurance coverage; |

| | · | Disclose your related indemnification obligations and those of any of the rig operators or your project partners, if applicable; |

| | · | Disclose whether your existing insurance would cover any claims made against you by or on behalf of individuals who are not your employees in the event of personal injury or death, and whether any of the rig operators or your project partners would be obligated to indemnify you against any such claims; |

| | · | Clarify your insurance coverage with respect to any liability related to any resulting negative environmental effects; and |

| | · | Provide further detail on the risks for which you are insured for your offshore operations. |

Response

As a preliminary matter, please note that Ecopetrol S.A. operates only onshore facilities.

Nonetheless, in the following table we summarize applicable policy limits related to the Company and its subsidiaries’ offshore projects:

| ITEM | ECOPETROL AMERICA INC | ECOPETROL OLEO E GAS DO BRASIL | SAVIA PERU |

| Current operation Status | Production in k2 Asset: 1200 MBOED. Ecopetrol is non operator | No production Exploratory asset Ecopetrol is non operator | Ecopetrol has 50% interest. Production: 13.500 MBOED |

| Energy Package Policy | | | |

| Section 1 All Risk Physical Damage | $ 29,992,000 | 0 | $ 56,000,000 |

| Section 2 Operators Extra Expense | | | |

| Drilling and workover wells. | $200,000,000 $100,000,000 in respect of all other wells. | $ 200,000,000 | $ 50,000,000 |

| Care, Custody and Control. | $ 1,000,000 | 0 | USD 5,000,000 |

| Other | | | |

| Commercial General Liability Coverage | $ 2,000,000 | USD 50,000,000 | USD 10,000,000 |

| Umbrella Liability Coverage | $ 25,000,000 | 0 | |

| Excess Commercial General Liability | $ 25,000,000 | 0 | $ 25,000,000 |

| | · | Disclose your related indemnification obligations and those of any of the rig operators or your project partners, if applicable; |

With respect to Ecopetrol America Inc., it is a party to Unit Operating Agreements (UOA) that include customary conditions and which contain similar terms and conditions to those in the American Association of Professional Landman (AAPL). In general, we can state that, pursuant to the UOAs in the Gulf of Mexico to which Ecopetrol America Inc. is a party, the contract parties are legally liable for all operations covered by the UOAs and, consequently, such parties share in all costs and expenses related to such operations. The only exception is when any damages result from an Operator´s gross negligence or willful misconduct, and, in such scenario, such operator would be 100% responsible for damages. On the other hand, with respect to third party claims, the UOA´s simply state that, in the case of a claim from a third party based upon damages sustained as a result of UOA operations, the Operators will be financially responsible for such a claim, provided that the parties to the UOA contribute according to their participation interest. The above rule also provides that, in case of damage caused by an Operator´s gross negligence or willful misconduct, any financial liability falling upon Non-Operators for whatever reason shall be reimbursed by the Operator.

In summary, conditions are:

| | · | UOA´s parties’ responsibilities are not joint between them. |

| | · | All damages as a result of the operation are assumed by the UOA´s parties according to their participation interest. |

| | · | The only exception to the above rule is the case that an Operator has caused damages with gross negligence or willful misconduct, and then the Operator must assume 100% of them. |

| | · | If claims arrive from third parties as part of a case involving Operator´s gross negligence or willful misconduct, such Operator must pay 100%, and, if a Non-Operator is caused to pay damages for whatever reason other than their own gross negligence or willful misconduct, the Operator must reimburse such amount to the Non-Operator. |

| | · | The Operator must obtain insurance as required by the UOA. |

| | · | The Operator must have a HSE program in place and be in compliance therewith. |

Regarding Ecopetrol Oleo e Gas do Brasil Ltd and Ecopetrol S.A., the contract model to apply is Association of International Petroleum Negotiators (AIPN). Based on this model, the responsibility scheme is basically the same as above, with the following variations:

| | · | If claims arrive from third parties as part of a case not involving Operator´s gross negligence or willful misconduct, and the Operator pays such claims, all parties must concur and reimburse such claim amounts. |

| | · | In certain contracts, all environmental damages are distributed according the parties participation interest, regardless if were caused involving Operator´s gross negligence or willful misconduct. |

| | · | In certain cases, Non-Operators may intervene and directly verify compliance of with Operator’s HSE programs. |

| | · | Disclose whether your existing insurance would cover any claims made against you by or on behalf of individuals who are not your employees in the event of personal injury or death, and whether any of the rig operators or your project partners would be obligated to indemnify you against any such claims; |

The Third Party Liability insurance in effect is sufficient to cover claims against Ecopetrol made by third parties.

The Commercial General Liability, Umbrella Liability and Excess Liability coverages will pay on behalf of or indemnify amounts for which an insured becomes legally obligated to pay, including damages in respect of bodily injury, property, and copyright. Coverage of bodily injury and property damage is subject to a coverage territory during the policy period.

| | · | Clarify your insurance coverage with respect to any liability related to any resulting negative environmental effects; |

Ecopetrol S.A

Under our corporate insurance program we have a control of wells insurance and general third party liability (TPL) that would cover sudden and accidental pollution and clean up claims subject to policy conditions from named insured’s onshore oil or gas operations. We have separate general third party liability (TPL) for our offshore gas operation field in Guajira Colombia that would cover sudden and accidental pollution incidents occurring at insurable premises. Such coverage also applies to pollution clean-up costs from insured’s oil or gas operations including bodily injury or death.

Ecopetrol Oleo e Gas do Brasil

Both the Operators Extra Expense (OEE) and Third Party liability (TPL) would cover pollution and clean up claims subject to policy conditions being triggered.

Ecopetrol America Inc

The Commercial General Liability, Umbrella Liability and Excess Liability coverage’s include Sudden and Accidental Pollution Coverage, providing coverage for pollution incidents occurring at premises a named insured owns, leases or rents. Such coverage also applies to pollution clean-up costs from named insured’s oil or gas operations, including drilling and well servicing, and covers bodily injury and property damage for losses resulting from any non-oil and gas operations, in addition to covering losses from oil and gas operations.

Savia - Peru

The policy includes seepage and pollution, clean up and contamination expenses, and any expenses or damages in excess of those specified expenses are covered by excess liability coverage.

| 6. | In this regard, discuss what remediation plans or procedures you have in place to deal with the environmental impact that would occur in the event of an oil spill or leak from your offshore operations. |

Response

As stated in question 5 above, please note that Ecopetrol S.A. operates only onshore facilities.

In our onshore oil or gas s operations we have to follow internal guidelines, and procedures designed by our HSE Direction in compliance with international oil and gas best practices, to prevent oil spill events from happening and mitigate the environmental impact.

Additionally we need to comply with Colombian regulation decree 321 of 1999 and the National Contingency Plan, which are basically a set of guidelines that have to be followed by oil and gas companies in Colombia to prevent, and react in case of, operational events that could impact the environment. For offshore joint ventures (Ecopetrol is not an offshore operator), the Operator Partner has the responsibility of designing and implementing remediation plans and procedures to deal with operational emergencies.

Business Overview, page 21

| 7. | We note your discussion of your 2008 – 2015 strategic plan. We further note that you furnished a 6-K on July 14, 2010 where you announced that you extended your strategic plan to 2020 and that you are now implementing the 2011 – 2020 strategic plan. Please tell us why you did not include disclosure regarding the new strategic plan in your annual report on Form 20-F. |

The information presented in Form 20-F corresponds to a strategy that is still in place but that was complemented and extended to year 2020 and approved by the Board of Directors in its July session. The approval of this extension to 2020 was granted earlier than expected and in a date close to our filing, and as a consequence we were not able to update it. However, we made sure to timely inform our investors of the extension of the strategic plan by submitting a corresponding report on Form 6-K on July 14, 2010.

Compensation, page 94

| 8. | We note that you have omitted disclosure regarding compensation on an individual basis for directors and members of your administrative, supervisory or management bodies. Please expand your disclosure to provide such information, or explain why such disclosure is not required. See Item 6.B.1 of Form 20-F. |

Response

We did not disclose compensation on an individual basis for directors and members of our administrative, supervisory or management bodies in reliance on Item 6.B.1 of Form 20-F since individual disclosure is not required in the Company’s home country, Colombia, and is not otherwise publicly disclosed by the Company.

Loans to our Directors and Executive Officers, page 101

| 9. | We note that you provide loans to your executive officers. Please tell us how you have complied with Section 13(k) of the Exchange Act. |

Response

The loans listed on page 101 of the Form 20-F were in place prior to the Company becoming public, while it was wholly owned by the Government of Colombia. The loans were issued pursuant to a program by which housing loans are granted to every employee of the company, not only to executive officers. Interest rates are the same for all employees holding such loans and are not in any manner preferential or different for executive officers. Since becoming a public company, no modifications have been made to the policy and the only change to the Company’s disclosure has been to eliminate loans which have been repaid.

| 10. | Please clarify the interest rate payable on the loans to Messrs. Gutiérrez and Rosales. In that regard, we note that you have not defined the term “UVR.” See Item 7.B.2 of Form 20-F. |

Response

As stated on answer to question number 9 above, interest rates are the same for all employees holding such loans and are not in any manner preferential or different for executive officers. Interest rates for these housing loans is calculated based on UVR, which is currently 2.01% per year.

As the regulatory entity for these purposes, the Central Bank of Colombia (Banco de la República) defines the term “UVR” as Unidad de Valor Real (Real Value Unit), an accounting unit which reflects purchasing power based exclusively on the consumer price index variation certified by the National Statistics Department of Colombia (DANE). The UVR is used to calculate the cost of housing credits in Colombia. This account unit allows financial entities to adjust credit values to the cost of living increase in Colombia.

Disclosure Controls and Procedures, page 122

| 11. | We note your disclosure regarding the conclusions of your chief executive officer and chief financial officer regarding the effectiveness of your “financial” disclosure controls and procedures. Please disclose the conclusions of your officers regarding the effectiveness of your “disclosure controls and procedures” as such term is defined in Exchange Act Rule 13a-15(e). |

Response

The disclosure relates to disclosure controls and procedures in general. The word “financial” was not intended to be included in that statement, and as such was a typographical error in the filed English version of the Form 20-F.

| 12. | In light of the fact that a material weakness existed with respect to your process relating to the preparation and analysis of the differences existing between Colombian Government Entity GAAP and U.S. generally accepted accounting principles (U.S. GAAP), please tell us the basis for your officers’ conclusions that your disclosure controls and procedures were nonetheless effective as of the end of the period covered by the report. Please explain how you determined that your process relating to the preparation and analysis of the differences between Colombian and U.S. GAAP is not part of your disclosure controls and procedures. In addition, with a view toward disclosure, please describe to us your anticipated timeline for taking the remedial measures described at pages 123-124. |

Response

The preparation process and figures are assured under Colombian GAAP and U.S. GAAP, and as to which Ecopetrol complies. The material weakness arose with respect to the process of carrying out the reconciliation of accounts to U.S. GAAP when, as a consequence of four acquisitions made during 2009, new business combinations had to be prepared by the recently-acquired companies and their teams, as well as ours and were not fully prepared to properly identify the complete set of differences involved in this complex process. Thus, the Form 20-F was submitted later than June 30th, as we estimated needing more time to complete further reviews to assure the quality of the related disclosure given that certain differences were identified by our external auditors during their analysis of our U.S. GAAP-reconciled consolidated financial statements. However, this failure in the process did not affect the accuracy of the data presented, since, as stated by our auditors, final figures presented fairly, in all material aspects, the financial position of Ecopetrol and its subsidiaries. Thus, the whole process, with an emphasis on business combinations, had to be re-examined and refurnished to properly include new subsidiaries. Please note that, prior to 2009, Ecopetrol had only been involved in an acquisition process one time, prior to its September 2008 listing.

We confirm that our officers´ conclusions regarding effectiveness of disclosure controls and procedures as of December 31, 2009 are accurate, and that identified inadequacies did not affect our disclosure process. Such disclosure process was supported by representatives of all material departments in the company, and their related analyses and recommendations were fully included in our disclosure.

The table below sets forth the anticipated timeline for taking the remedial measures for the U.S. GAAP reconciliation process, described on pages 123 – 124 of the Form 20-F:

| Remediation Activities |

Planned for the 3rd Quarter 2010: |

| · | Creation of a compliance team for the U.S. GAAP reconciliation process for Ecopetrol and its subsidiaries (done) |

| · | Hiring experienced personnel to be part of the compliance team as well as to improve skills of the Company and its subsidiaries in U.S. GAAP (done) |

| · | Developing and implementing an automated system tool (SAP) to support the preparation and analysis of the differences between Colombian Government Entity GAAP and U.S. GAAP (done) |

| · | Establishing a formal procedure to review new U.S. GAAP – SEC regulation that may apply for the company and its subsidiaries (done) |

| · | Training for accounting personnel for both, Ecopetrol and its subsidiaries, looking for improvement in U.S. GAAP – SEC rules knowledge (in process) |

| · | Redefinition of the Company’s reconciliation processes with special attention on the subsidiaries matters involved (in process) |

| · | Update the Sarbanes – Oxley control procedures according to the new process developed (in process) |

Planned for the 4th Quarter 2010: (activities in process) |

| · | Improving monitoring activities on the U.S. GAAP process, establishing a formal method of revision by the personnel involved. |

| · | Developing standardized forms to collect information from Ecopetrol and its subsidiaries. |

| · | Conducting a reconciliation process as of September 30, 2010 identifying areas to improve the process and their related monitoring controls. |

| · | Developing qualitative activities for the year end closing process. |

| · | Training for accounting personnel for both, Ecopetrol and its subsidiaries, to learn from experiences of the reconciliation process planned for September 30, 2010. |

| · | Test internal controls included in Sarbanes – Oxley procedures based on September results. |

Financial Statements

Note 33 – Differences between Colombian Governmental Entity accounting principles and U.S. GAAP

C) 2. Supplemental consolidated condensed statements of income, page F-62

| 13. | We note non-operating expenses reported under Colombian GAAP include pension expenses, certain provisions and other miscellaneous income and expenses described in footnotes 27 and 29 that would typically be classified in operating expenses when reported in accordance with U.S. GAAP and Article 5 of Regulation S-X. Please provide the detail of the income and expense items that you have included in non-operating income, net in your U.S. GAAP consolidated statements of income and explain how you determine that your classification of these items as non-operating complies with U.S. GAAP and Article 5 of Regulation S-X. |

Response

We confirm that we did not for U.S. GAAP purposes reclassify pension expenses to operating expenses. Nevertheless, in our opinion, such reclassification is not material, as described below. The following table summarizes the net effect of these misclassifications:

| | | Before | | | After | | | Variation | | | % Variation | |

| | | | | | | | | | | | | | | | | |

| Operating Income | | | 6,457,354 | | | | 6,061,568 | | | | 395,786 | | | | (6 | )% |

| | | | | | | | | | | | | | | | | |

| Non-Operating Income, net | | | 549,981 | | | | 945,767 | | | | (395,786 | ) | | | 72 | % |

| | | | | | | | | | | | | | | | | |

| Income Before Income Tax | | | 7,007,335 | | | | 7,007,335 | | | | - | | | | 0 | % |

| | | | | | | | | | | | | | | | | |

| Net Income | | | 4,683,187 | | | | 4,683,187 | | | | - | | | | 0 | % |

The Company hereby informs the Staff that based on the adjustments mentioned above, the non-operating income for fiscal year ended December 31, 2009 would increase by Ps$395,786, from the amounts presented in the Form 20-F compensated with a decrease in the operating income for the same period, however, the income before income tax and the net income do not experience modifications. The change in the operating income was evaluated and determined to be not material. The misclassification has no impact on the key financial indicators made public to the investors such as Cash Flows (actual and forecasted), EBITDA, management compensation, dividend payments, earnings per share, and fulfillment of covenants requirements among others, that are determined based on the result under Colombian Government Entity GAAP.

For future fillings, the mentioned reclassifications will be taken into account in order to present the comparative financial information for future periods.

D) Summary of significant differences between Colombian Government Entity GAAP and U.S. GAAP and required U.S. GAAP disclosures

xvi. Asset Retirement Obligations, page F-91

| 14. | We note that for U.S. GAAP, your asset retirement obligation was revised upward by P$666,706 (millions) in 2009, an amount that is equal to nearly 51% of the beginning asset retirement obligation as of January 1, 2009. Please revise your disclosure to explain why these revisions were necessary, and explain to us how you determined that the revisions represented a change in estimates. |

Response

In response to the Staff comment, the Company´s assessment considered more detailed information available to estimate the Asset Retirement Obligation. Previously, the calculations were made based on layers that represent groups of assets, as an improvement, the Company detailed the assets eliminating the grouping and applying the analysis and calculations based on layers that represent asset by asset and field by field, providing further detail of abandonment expected costs and dates. The new basis was used to calculate the balances and amortization associated; the overall impact represents a 1.54% of the Total Assets and 3.30% of the Total Liabilities and was recognized during the period as it was considered a change in an accounting estimate per ASC 250-10-45-17 and 18, Change in Accounting Estimates.

Engineering Comments

Presentation of Information Concerning Reserves, page 4

| 15. | We note your statement, “Our hydrocarbon net proved reserves have been audited in 2009 by Ryder Scott, DeGolyer and MacNaughton and Gaffney, Cline & Associates (collectively, the “External Engineers”) and their reserves reports are included as exhibits herein.” We also note: |

| | · | Exhibit 99.1 begins, “At your request, Ryder Scott Company has prepared an estimate of the proved reserves, future production and income attributable to certain properties of Ecopetrol, as of December 31, 2009.” |

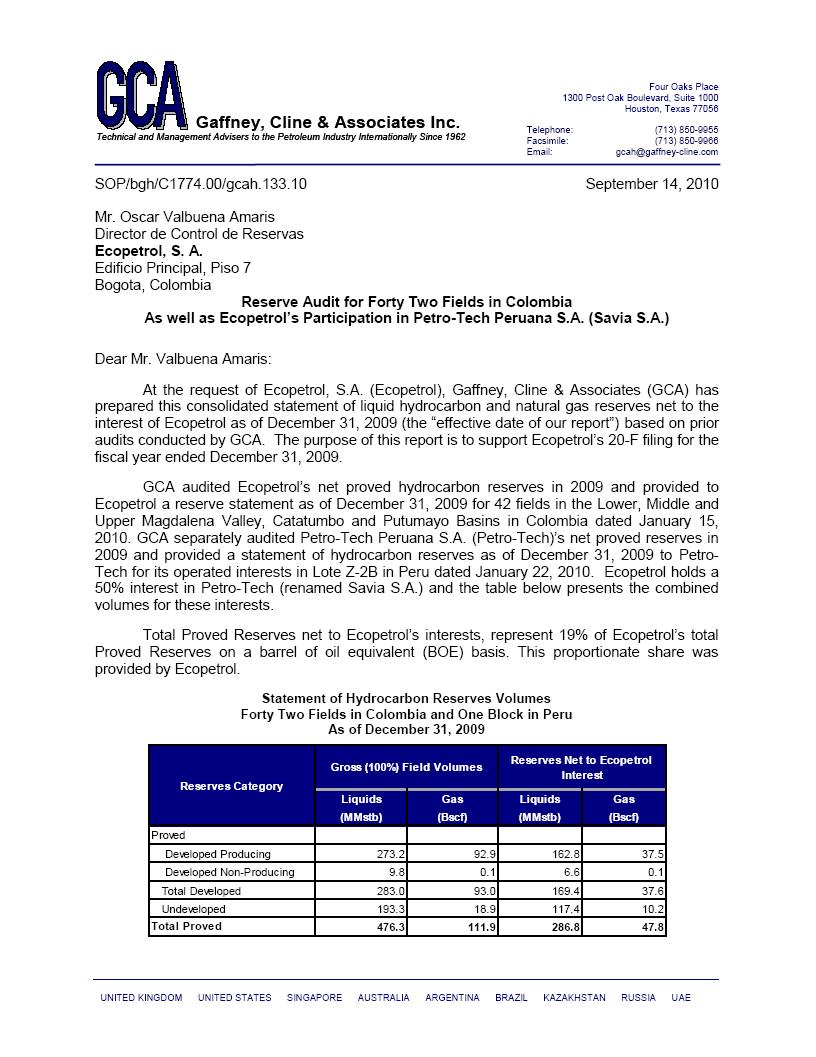

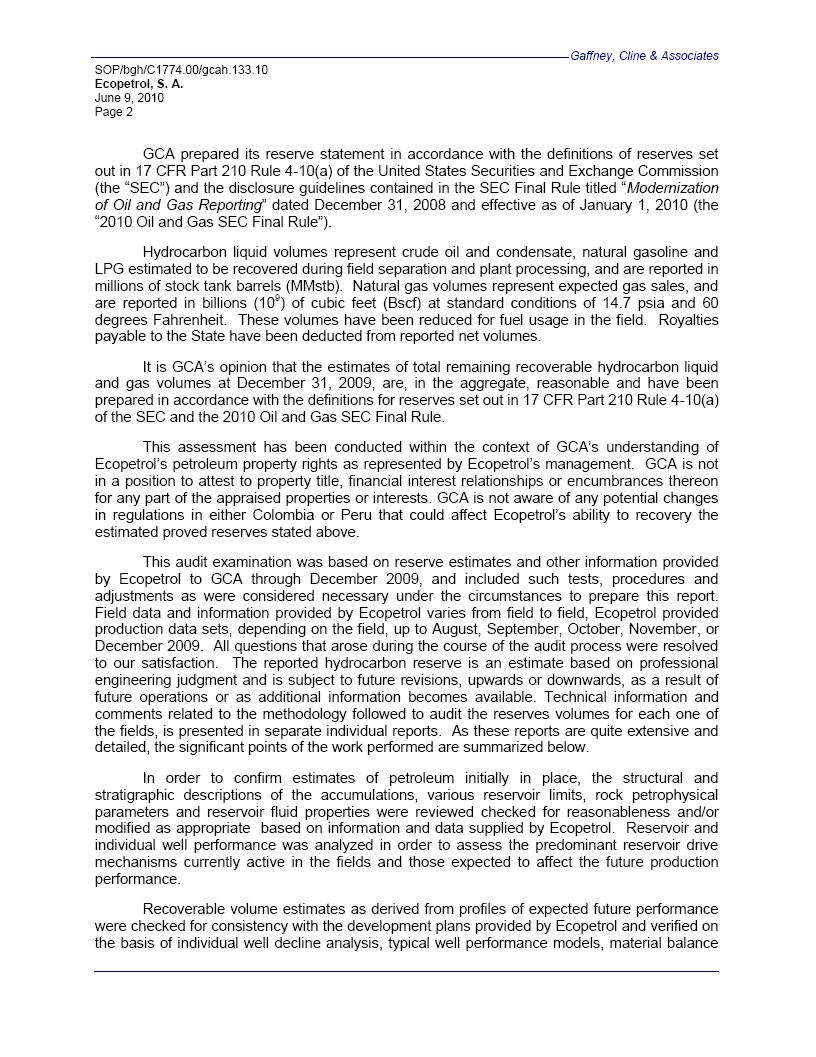

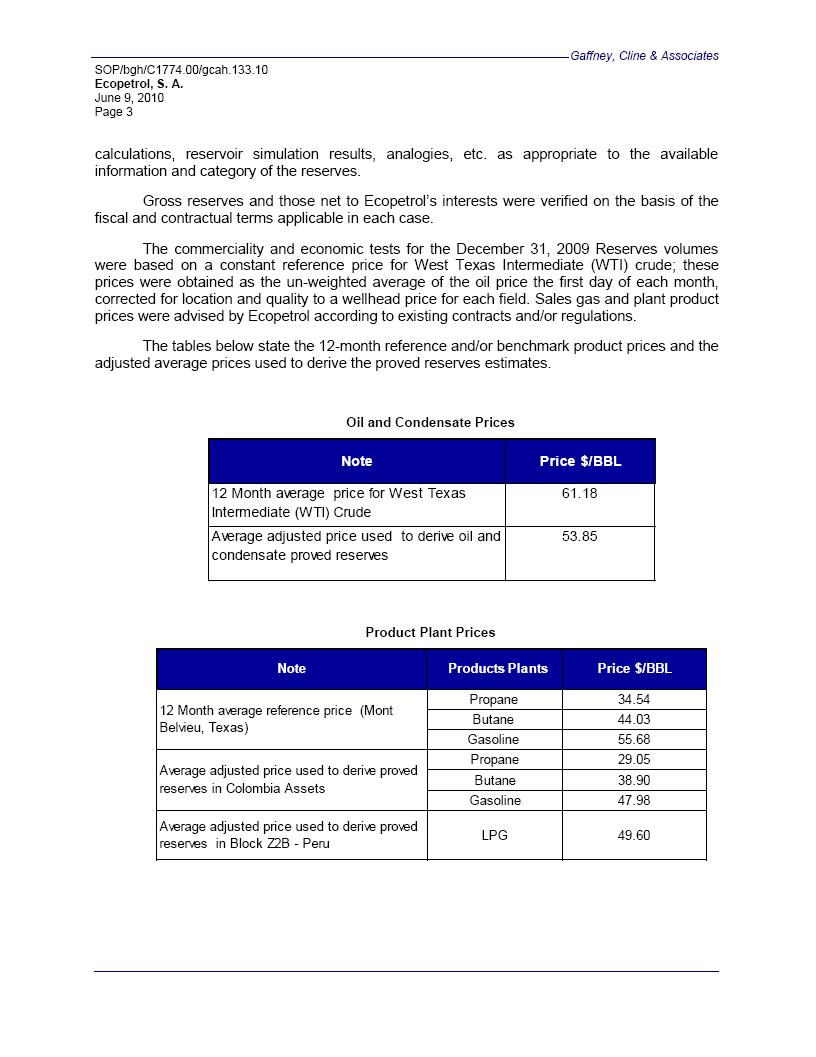

| | · | Exhibit 99.2 begins “At the request of Ecopetrol, S.A. (Ecopetrol)...Gaffney Cline & Associates (GCA) has conducted an independent audit examination as of December 31, 2009 (the “effective date of our report”) of the liquid hydrocarbons and natural gas reserves for the fields mentioned above. |

| | · | Exhibit 99.3 begins “Pursuant to your request, we have conducted a reserves evaluation of the net proved crude oil, condensate, and natural gas reserves, as of December 31, 2009, the effective date of this report, of certain selected properties in North America and South America owned by Ecopetrol S.A. (ECOPETROL).” |

Please amend your document here and on page F-113 and obtain modified engineering reports that disclose consistently the tasks performed by your external engineers. We have further comments pertaining to these engineering reports below.

Response

We confirm that in 2009, the External Engineers audited our hydrocarbon net proved reserves. The Company has obtained modified engineering reports that consistently disclose that external auditors performed an audit of hydrocarbon net proved reserves. Such modified engineering reports are attached as Annexes A – C of this letter. Once the Staff has confirmed it has no further comments to the modified engineering reports, the Company will file them with the Commission pursuant to a current report on Form 6-K.

Risk Factors, page 7

Our operations are subject to extensive regulation, page 9

| 16. | We note the statement, “We are required, as are all oil companies undertaking exploratory and production activities in Colombia, to pay a percentage of our production to the Government as royalties.” Please tell us whether your disclosed oil and gas reserve figures are net of such royalties. |

Response

We confirm that the Company’s disclosed oil and gas reserves are net of such royalties.

Information on the Company, page 20

Production Activities in Colombia, page 32

| 17. | Your footnote 3 states, “(3) Lifting costs per barrel are calculated based on total production, which includes royalties, and correspond to Ecopetrol’s lifting costs on an unconsolidated basis.” Instruction 5 to Item 1204 of Regulation S-K states “The average production cost, not including ad valorem and severance taxes, per unit of production should be computed using production costs disclosed pursuant to SFAS 69. Units of production should be expressed in common units of production with oil, gas, and other products converted to a common unit of measure on the basis used in computing amortization.” Please: |

| | · | Reconcile to us your 2009 historical unit lift cost disclosure – Ps$17,825 or $8.27 per barrel – with the unit production cost derived from the 2009 Results of Operations on page F-112 and your 2009 net production from page F-115 – Ps$6,493,549 million/159.7 million BOE = Ps$40,661/BOE. |

| | · | Amend your document to comply with Item 1204. |

| | · | Reconcile to us the difference between your historical unit production costs – Ps$40,661/BOE – and the estimated future production cost from your standardized measure on page F-116 – Ps$36,994,366 million/1538 million BOE = Ps$24,054/BOE and amend your document if it is appropriate. |

Response

The lifting cost reported for 2009 (Ps$ 17,825) reflects those costs required for Ecopetrol S.A. to extract one barrel of crude oil. Among those costs, ad valorem or severance taxes are not included as we do not have to pay royalties in cash. The royalties described in the footnote on page 32 are crude oil or gas volumes that belong to the Nation. As the reported lifting cost is used to evaluate the Company´s efficiency in extracting one barrel of crude oil, regardless of the ultimate recipient, such value is calculated over total crude oil produced, which includes those volumes the Nation receives as royalties at the production field.

The unit production cost (Ps$40,661/BOE) derived from the Consolidated Results of Operations corresponds to the consolidated production of oil and gas for the Company and its subsidiaries, and includes other components, different to the crude oil lifting cost, such as:

· Gas lifting costs |

· Project costs related to Technical Production group |

· Production costs for our subsidiaries |

· Production cost from Savia Peru (in which the Company has a 50% interest) |

|

· Commercial and Administrative expenses |

Ecopetrol’s Crude Oil Lifting cost

| Total Ecopetrol’s crude oil lifting costs (Ps$ million) | | | 2,737,620 | |

| Ecopetrol’s crude oil gross production (royalties included) (million BOE) | | | 153.6 | |

| Average crude oil lifting cost (unconsolidated) (Ps$ / BOE) | | | 17,825 | |

Consolidated unit production cost

| Total Ecopetrol’s crude oil lifting costs (Ps$ million) | | | 2,737,620 | |

| (+) Total Ecopetrol´s gas costs | | | 186,272 | |

| (+) Project costs | | | 26,975 | |

| (+) Production costs for our subsidiaries | | | 1,248,318 | |

| (+) Production cost from Savia Peru | | | 160,697 | |

| (+) Inter-segment costs | | | 1,784,417 | |

| (+) Commercial and Administrative expenses. | | | 349,250 | |

| Results of Operations (Ps$ million) | | | 6,493,549 | |

| | | | | |

| Consolidated crude oil and gas Production (Million BOE) | | | 159.7 | |

| | | | | |

| Average consolidated production cost (Ps$ / BOE) | | | 40, 649 | |

As a result, the estimated future production cost from the standardized measure (Ps$24,054/BOE) could not be compared with the average consolidated production cost (Ps$ 40,649 / BOE), but rather with the historical average lifting cost.

Production Acreage at December 31, 2009, page 33

| 18. | We note the presentation of “Developed and Undeveloped” acreage. Please separate the developed acreage from the undeveloped acreage as specified by paragraphs (a) and (b) of Item 1208 of Regulation S-K. |

Response

The following chart shows the required disaggregation for the main regions in respect to crude oil. We propose to the Staff to disclose the information below in future filings.

| | | Crude Oil Production Acreage at December 31, 2009 | |

| | | Developed | | | Undeveloped | | | Developed and Undeveloped1 | |

| | | Gross | | | Net | | | Gross | | | Net | | | Gross | | | Net | |

| | | (in acres) | | | | | | | | | | | | | |

| Northeastern region | | | 38,659 | | | | 15,464 | | | | 161,691 | | | | 104,746 | | | | 200,350 | | | | 120,210 | |

| Mid-Magdalena Valley region | | | 39,113 | | | | 22,339 | | | | 796,257 | | | | 508,848 | | | | 835,370 | | | | 531,187 | |

| Central region | | | 27,293 | | | | 14,013 | | | | 437,661 | | | | 277,274 | | | | 464,954 | | | | 291,287 | |

| Catatumbo-Orinoquía region | | | 65,383 | | | | 32,327 | | | | 575,456 | | | | 357,342 | | | | 640,839 | | | | 389,669 | |

| Southern region | | | 33,277 | | | | 21,597 | | | | 1,442,922 | | | | 815,124 | | | | 1,476,199 | | | | 836,721 | |

| Minor fields | | | 5,680 | | | | 1,176 | | | | 552,987 | | | | 164,077 | | | | 558,667 | | | | 165,253 | |

| 19. | Please expand your acreage table here to disclose material undeveloped acreage subject to expiration per Item 1208. |

Response

Ecopetrol S.A. does not have undeveloped acreage subject to expiration. However, according to available information, Savia Perú, of which we own 50%, may have 10,891,608 undeveloped acres subject to expiration starting in 2023.

1 This was the information disclosed in our Form 20-F.

Reserves, page 39

| 20. | We note your statement that your year-end 2009 proved oil and gas reserves are 35% higher than those at year-end 2008 and your statement “The increase in our reserves in 2009 is mainly due to (i) revisions which include new development projects and reserves reclassification in our existing production fields and (ii) extensions and discoveries which include new acquisitions.” With a view towards disclosure, please explain to us the nature of these increases and reconcile the increase to your proved reserves with the line item changes presented in FASB ASC subparagraphs 932-235-50-5(a)-(f). For example, “revisions” should refer to changes in estimates from prior year(s). Please also address similar issues with your discussion of proved undeveloped reserve increases on page 43 and footnote (1) on page F-115. |

Response

We acknowledge that we classified changes due to revisions as extensions and discoveries not in accordance with the technical definitions of such terms in ASC 932. However, as discussed below, when classified based on such definition, the absolute change in volume is not materially different from the amounts presented. The footnotes on page 42 of the Form 20-F describe the nature of the changes. We respectfully submit to the Staff to incorporate these modifications in our future filings.

The following are our detailed explanations:

The Company’s crude oil reserves in 2009 increased to 1,123.3 million barrels of crude oil from 798.9 million in 2008 and the Company’s natural gas proved reserves increased to 2,329.4 million cubic feet (mcf) from 1,898.9 mcf in 2008.

The Company’s net proved reserves of crude oil and natural gas at December 31, 2009 totaled 1,538.2 million boe, which represents a 35.0% increase from the 1,137.0 million boe registered in 2008. In 2008, the Company’s proved reserves decreased 6.0% from the 1,209.9 million boe registered in 2007. The increase in the Company’s reserves in 2009 is a result of (i) a 342 mboe increase corresponding to revisions of previous estimates, which includes improved recovery (ii) a 90 mboe increase coming from purchases of minerals in place, (iii) a 129 mboe increase corresponding to extensions and discoveries, (iv) a 160 mboe decrease corresponding to production and (v) a 0 mboe decrease corresponding to sales of minerals in place.

The Company’s revisions during 2009 amounted to 342 mboe, deriving from reserve additions (393 mboe), economic limit and other small changes (-51 mboe). The reserves addition corresponds primarily to the following activities:

| | · | Rubiales Field: The Company engaged in successful drilling in not developed areas, which supported additional future drilling activities (110 mboe); |

| | · | Pauto Field: The Company updated its development plan and a new gas plant which will increase the gas processing capacity is under construction. The Company entered into gas sales contracts to sell that additional capacity (76 mboe); |

| | · | Cusiana Field: The Company entered into new gas sales contracts (70 mboe); |

| | · | Castilla Field: The Company engaged in successful drilling activities in areas not developed, which supported additional future drilling activities. Additionally, the Company entered into a work over program to open some undeveloped intervals of the field (45 mboe); and |

| | · | Chichimene field: The Company obtained better-than-expected production results (32 mboe). |

The activities described above represented 85% of the Company’s additions to reserves revisions in 2009, the remaining 60 mboe are distributed in several fields, including field K2 in the USA.

The Company’s purchases of minerals in place during 2009 amounted to 90 mboe, which corresponds to the Company’s acquisitions of Savia Perú along with KNOC (formerly Petrotech Peruana S.A.) and Hocol S.A. in Colombia.

The Company’s extensions and discoveries during 2009 amounted to 129 mboe, which correspond to 49 mboe of new discovered fields and 80 mboe of extensions of proved acreage. The extensions of proved acreage are 93% attributable to extensions at the Chichimene field (43 mboe) and the Castilla field (31 mboe). In both fields, such extensions are the result of drilling activities developed during 2009, which demonstrated that the proved area of each field was larger than expected. The remaining 7% of extensions of proved acreage correspond to extensions in several other fields.

In terms of proved undeveloped reserves, during 2009, our total proved undeveloped reserves increased by 108.8 mboe to 599.2 mboe at December 31, 2009 from 490.4 mboe at December 31, 2008. At December 31, 2009, 82% of our total proved undeveloped reserves corresponded to crude oil.

The reduction in our proved undeveloped reserves resulting from our conversion to proved developed reserves was more than offset by an increase in our proved undeveloped reserves of approximately 467 mboe. The increase in the Company’s proved undeveloped reserves in 2009 is a result of (i) a 303 mboe increase corresponding to revisions of previous estimates, which includes improved recovery (ii) a 35 mboe increase corresponding to purchases of minerals in place, (iii) a 129 mboe increase corresponding to extensions and discoveries;, (iv) a 0 mboe decrease corresponding to production; and (v) a 0 mboe decrease corresponding to sales of minerals in place.

In terms of proved undeveloped reserves, the Company’s revisions during 2009 amounted to 303 mboe, coming from reserves additions (388 mboe) and economic limit and other small changes (-85 mboe). The reserves additions correspond primarily to the following activities:

| | · | Rubiales Field: The Company engaged in successful drilling in areas not developed, which supported additional future drilling activities (110 mboe); |

| | · | Pauto Field: The Company updated its development plan and a new gas plant which will increase the gas processing capacity is under construction. The Company entered into gas sales contracts to sell that additional capacity (76 mboe); |

| | · | Cusiana Field: The Company entered into new gas sales contracts (70 mboe); |

| | · | Castilla Field: The Company engaged in successful drilling activities in areas not developed, which supported additional future drilling activities. Additionally, the Company entered into a work over program to open some undeveloped intervals of the field (45 mboe); and |

| | · | Chichimene field: The Company obtained better-than-expected production results (32 mboe). |

The activities described above represent 86% of the Company’s additions to reserves revisions of the category of proved undeveloped reserves in 2009, the remaining 55 mboe are distributed in several fields.

The Company’s purchases of minerals during 2009 amounted to 35 mboe (proved undeveloped reserves), which corresponds to the Company’s acquisitions of Savia Perú (formerly Petrotech Peruana S.A.) in Peru and Hocol S.A. in Colombia.

The Company’s extensions and discoveries during 2009 amounted to 129 mboe, which correspond to 49 mboe of new discovered fields and 80 mboe of extensions of proved acreage. The extensions of proved acreage are 93% attributable to extensions at the Chichimene field (43 mboe) and the Castilla field (31 mboe). In both fields, such extensions are the result of drilling activities developed during 2009, which demonstrated that the proved area of each field was larger than expected. The remaining 7% of extensions of proved acreage correspond to extensions in several other fields.

| 21. | Your statement, “The information presented below and elsewhere in this annual report referring to our 2009 net proved reserves estimates is based on those [External Engineers’] reports and on our own calculations for the remaining 3% of our hydrocarbon net proved reserves.” implies that only 3% of your disclosed proved reserve figures were estimated by your internal engineers and the remainder was taken from the reports of your External Engineers. If true, please confirm this to us. If not true, please amend your document to clarify the sources of your proved reserve figures. |

Response

In response to the Staff’s comment, we confirm that only 3% of our disclosed proved reserve figures were estimated by our internal engineers and the remainder was derived from the audited reserves reports of our External Engineers.

Notes to the Consolidated Financial Statements, page F-12

Reserve Information, page F-113

| 22. | We note your statement, “The use of the unweighted arithmetic average price of the first day of each month within the year, had an upward effect on reserves because the price was higher than the 2009 year-end prices applied under the previous rule.” The 2009 year-end price for WTI crude oil is about $79/barrel while the 2009 first-of-the-month average is about $61/barrel. Please amend your document to disclose the correct result from using first of the month average oil prices. |

Response

We confirm that the Company’s reserves during 2009 were calculated using first of the month average oil price, which was $61/barrel. The sentence that you specify was erroneously translated in page F-113 of the Form 20-F, Financial Statements, where its intention was to explain that the change in price had a downward effect on reserves. Numbers do not change since the $79/barrel was not used. In other segments of the document, such as Presentation of Information Concerning Reserves (Page 4), Reserves (page 82), as well as in our External Engineers letters this aspect is correctly stated so it is not considered to mislead the appraisal and understanding of the reader.

Table v – Standardized measure of discounted future net cash flows relating to proved oil and gas quantities and changes therein, page F-116, page F-116

| 23. | The three yearly amounts in the line item “Previously estimated development costs incurred during the period” are identical with the development cost figures presented in the Costs Incurred, Table ii, page F-112. Instead, these costs should be those that were previously estimated and included in the standardized measure calculation in prior years. Please amend your document to disclose the previously estimated costs that were incurred. |

Response

In future filings, we will use “Previously estimated development costs incurred during the period” for purposes of the standardized measure calculation in prior years in compliance with the requirements of ASU 2010-03. For your information, a revised 2009 table will appear in our future filings as follows:

| | | 2009 | |

| | | | |

| Net change in sales and transfer prices and in production (lifting) cost related to future production | | $ | 10,343,447 | |

| Changes in estimated future development costs | | | (4,601,401 | ) |

| Net change due to purchase and sales of minerals in place | | | 2,387,443 | |

| Net change due to revisions in quantity estimates | | | 13,532,916 | |

| Previously estimated development costs incurred during the period | | | 3,394,867 | |

| Other – unspecified | | | 6,761,466 | |

| Aggregate change in the Standardized measure of discounted future net cash flows for the year | | $ | 16,801,576 | |

Exhibit 99.1

| 24. | Item 1202(a)(8) of Regulation S-K specifies disclosure items pertaining to third party engineering reports. Please obtain modification of this report so that it presents: |

| | · | The proportion of your total proved undeveloped reserves that were examined; or the proved, proved developed and proved undeveloped oil and gas reserve figures resulting from the third party examination; |

| | · | The 12-month average benchmark product prices and the average adjusted prices used to determine reserves; |

| | · | A statement that the third party has used all methods and procedures as it considered necessary under the circumstances to prepare the report; |

| | · | The methods other than performance that were used to perform reserve estimates; |

| | · | Justification for the term “generally accepted petroleum engineering and evaluation principles” with a citation/reference to a compilation of these principles. Alternatively, this term could be omitted; and |

| | · | A statement disclosing whether the reserves are net of royalty due the government. |

Response

In response to the Staff’s comment, attached as Annex A to this letter is a modified engineering report from Ryder Scott Company, L.P. which addresses the items noted above. Upon confirmation that the Staff has no further comments to this modified engineering report, the Company will file it with the Commission pursuant to a current report on Form 6-K.

Exhibit 99.2

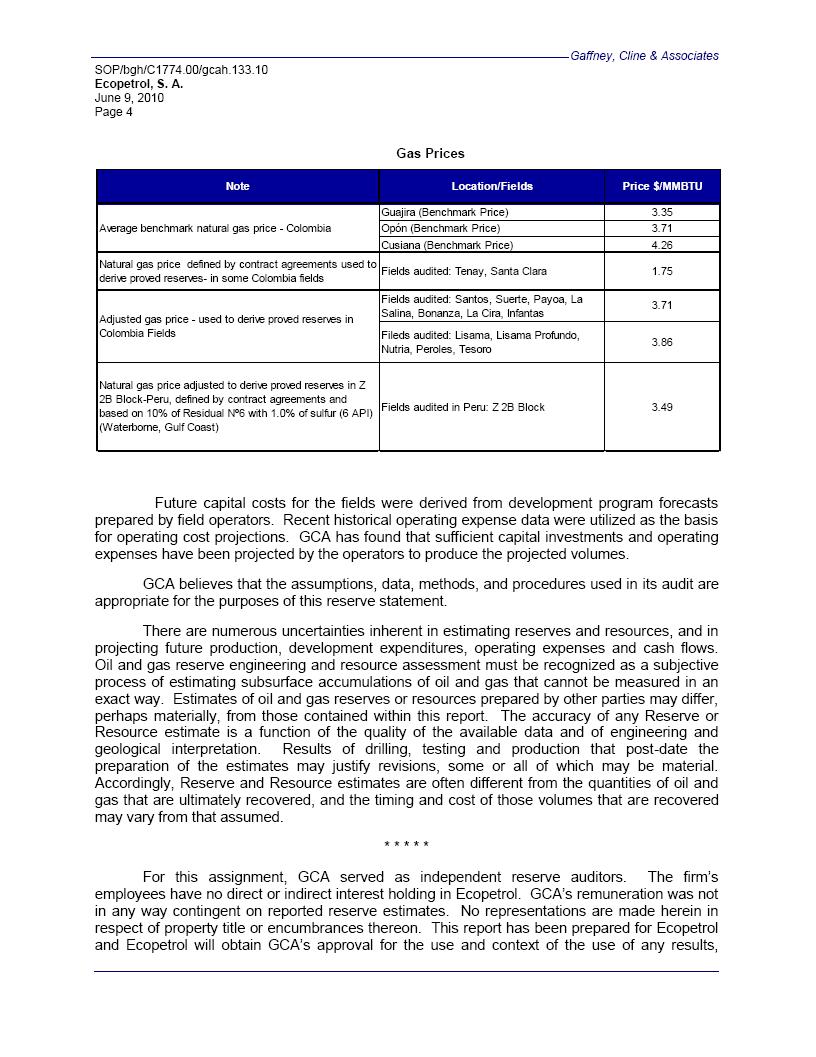

| 25. | Please obtain modification of this report so that it presents: |

| | · | The purpose for which the report was prepared; |

| | · | The 12 month average benchmark product prices and the average adjusted prices used to determine reserves; and |

| | · | A discussion of the possible effects of regulation on the ability of the registrant to recover the estimated reserves. |

Response

In response to the Staff’s comment, attached as Annex B to this letter is a modified engineering report from Gaffney, Cline and Associates Inc. which addresses the items noted above. Upon confirmation that the Staff has no further comments to this modified engineering report, the Company will file it with the Commission pursuant to a current report on Form 6-K.

Exhibit 99.3

| 26. | Please obtain modification of this report so that it presents: |

| | · | The purpose for which the report was prepared; |

| | · | The 12 month average benchmark product prices and the average adjusted prices used to determine reserves; and |

| | · | A statement disclosing whether the reserves are net of royalty due the government. |

Response

In response to the Staff’s comment, attached as Annex C to this letter is a modified engineering report from DeGolyer and MacNaughton which addresses the items noted above. Upon confirmation that the Staff has no further comments to this modified engineering report, the Company will file it with the Commission pursuant to a current report on Form 6-K.

******

In accordance with the requests at the end of your letter, the Company hereby acknowledges that it is responsible for the adequacy and accuracy of the disclosure in its filing; staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

If you have any questions or wish to discuss any matters relating to the foregoing, please contact me at 011-57-1234-4254, Ángela Rocío Sánchez, of the Corporate Finance Department of the Company, at 011-57-1234-3542 or our U.S. counsel, Antonia Stolper of Shearman & Sterling LLP, at (212) 848-5009.

| | Very truly yours, /s/ Adriana Echeverri Chief Financial Officer |

| cc: | Javier G. Gutiérrez - Chief Executive Officer – Ecopetrol S.A. |

| | Alejandro Giraldo – Investor Relations – Ecopetrol S.A. |

April 15, 2010

ECOPETROL

Calle 37 No. 8-43 Piso 12

Bogotá, D.C., Colombia

Ladies and Gentlemen:

At the request of ECOPETROL, Ryder Scott Company (Ryder Scott) has prepared an audit of the proved reserves attributable to certain properties of ECOPETROL, as of December 31, 2009. The subject properties are located in the country of Colombia.

For the purpose of the audit, Ryder Scott estimated the reserves based on the definitions and disclosure guidelines of the United States Securities and Exchange Commission (SEC) contained in Title 17, Code of Federal Regulations, Modernization of Oil and Gas Reporting, Final Rule released January 14, 2009 in the Federal Register (SEC regulations). Our third party study, completed on January 25, 2010 and presented herein, was prepared for public disclosure by ECOPETROL in filings made with the SEC in accordance with the disclosure requirements set forth in the SEC regulations.

The properties evaluated by Ryder Scott account for a portion of ECOPETROL’s total net proved reserves as of December 31, 2009. Based on information provided by ECOPETROL, the third party estimate conducted by Ryder Scott addresses 45 percent of the total proved developed net liquid hydrocarbon reserves, 0.4 percent of the total proved developed net gas reserves, 32 percent of the total proved undeveloped net liquid hydrocarbon reserves, and 0.1 percent of the total proved undeveloped net gas reserves of ECOPETROL.

The estimated reserve amounts presented in this report, as of December 31, 2009, are related to hydrocarbon prices. The hydrocarbon prices used in the preparation of this report are based on the average prices during the 12-month period prior to the ending date of the period covered in this report, determined as the unweighted arithmetic averages of the prices in effect on the first-day-of-the-month for each month within such period, unless prices were defined by contractual arrangements, as required by the SEC regulations. Actual future prices may vary significantly from the prices required by SEC regulations; therefore, volumes of reserves actually recovered may differ significantly from the estimated quantities presented in this report. The results of Ryder Scott’s estimates are summarized below.

SEC PARAMETERS

Estimated Net Reserves

Certain Interests of

ECOPETROL

| | | Proved | |

| | | | | | | | | Total | |

| | | Developed | | | Undeveloped | | | Proved | |

| Net Remaining Reserves | | | | | | | | | |

| Oil/Condensate – MBarrels | | | 282,267.7 | | | | 158,180.8 | | | | 440,448.5 | |

| Sales Gas – MMCF | | | 6.829.0 | | | | 773.0 | | | | 7,602.0 | |

ECOPETROL

April 15, 2010

Page 2

Liquid hydrocarbons are expressed in thousand standard 42 gallon barrels. All gas volumes are reported on an “as sold” basis expressed in millions of cubic feet (MMCF) at a temperature base of 60 degrees Fahrenheit and pressure base of 14.696 psia. These proved reserves volumes are exclusive of royalties.

Reserves Included in This Report

The proved reserves included herein conform to the definition as set forth in the Securities and Exchange Commission’s Regulations Part 210.4-10(a). An abridged version of the SEC reserves definitions from 210.4-10(a) entitled “Petroleum Reserves Definitions” is included as an attachment to this report. The various proved reserve status categories are defined under the attachment entitled “Petroleum Reserves Definitions” in this report.

No attempt was made to quantify or otherwise account for any accumulated gas production imbalances that may exist. The proved gas volumes included herein do not attribute gas consumed in operations as reserves. Non-hydrocarbon or inert gas volumes have been excluded from the reserves reported herein.

Reserves are those estimated remaining quantities of petroleum that are anticipated to be economically producible, as of a given date, from known accumulations under defined conditions. All reserve estimates involve an assessment of the uncertainty relating the likelihood that the actual remaining quantities recovered will be greater or less than the estimated quantities determined as of the date the estimate is made. The uncertainty depends chiefly on the amount of reliable geologic and engineering data available at the time of the estimate and the interpretation of these data. The relative degree of uncertainty may be conveyed by placing reserves into one of two principal classifications, either proved or unproved. Unproved reserves are less certain to be recovered than proved reserves, and may be further sub-classified as probable and possible reserves to denote progressively increasing uncertainty in their recoverability. At ECOPETROL’s request, this report addresses only the proved reserves attributable to the properties evaluated herein.

Proved oil and gas reserves are those quantities of oil and gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward. The proved reserves included herein were estimated using deterministic methods. If deterministic methods are used, the SEC has defined reasonable certainty for proved reserves as a “high degree of confidence that the quantities will be recovered.”

Proved reserve estimates will generally be revised only as additional geologic or engineering data become available or as economic conditions change. For proved reserves, the SEC states that “as changes due to increased availability of geoscience (geological, geophysical, and geochemical), engineering, and economic data are made to the estimated ultimate recovery (EUR) with time, reasonably certain EUR is much more likely to increase or remain constant than to decrease.” Moreover, estimates of proved reserves may be revised as a result of future operations, effects of regulation by governmental agencies or geopolitical or economic risks. Therefore, the proved reserves included in this report are estimates only and should not be construed as being exact quantities, and if recovered, the revenues therefrom, and the actual costs related thereto, could be more or less than the estimated amounts.

The proved reserves reported herein are limited to the period prior to expiration of current contracts providing the legal rights to produce, or a revenue interest in such production, unless evidence indicates that contract renewal is reasonably certain. Furthermore, properties in the different countries may be subjected to significantly varying contractual fiscal terms that affect the net revenue to ECOPETROL for the production of these volumes. The prices and economic return received for these net volumes can vary significantly based on the terms of these contracts. Therefore, when applicable, Ryder Scott reviewed the fiscal terms of such contracts and discussed with ECOPETROL the net economic benefit attributed to such operations for the determination of the net hydrocarbon volumes and income thereof. Ryder Scott has not conducted an exhaustive audit or verification of such contractual information. Neither our review of such contractual information nor our acceptance of ECOPETROL’s representations regarding such contractual information should be construed as a legal opinion on this matter.

RYDER SCOTT COMPANY PETROLEUM CONSULTANTS

ECOPETROL

April 15, 2010

Page 3

Ryder Scott did not evaluate the country and geopolitical risks in the countries where ECOPETROL operates or has interests. ECOPETROL’s operations may be subject to various levels of governmental controls and regulations. These controls and regulations may include, but may not be limited to, matters relating to land tenure and leasing, the legal rights to produce hydrocarbons including the granting, extension or termination of production sharing contracts, the fiscal terms of various production sharing contracts, drilling and production practices, environmental protection, marketing and pricing policies, royalties, various taxes and levies including income tax, and foreign trade and investment and are subject to change from time to time. Such changes in governmental regulations and policies may cause volumes of proved reserves actually recovered and amounts of proved income actually received to differ significantly from the estimated quantities.

The estimates of proved reserves presented herein were based upon a detailed study of the properties in which ECOPETROL owns an interest; however, we have not made any field examination of the properties. No consideration was given in this report to potential environmental liabilities that may exist nor were any costs included for potential liabilities to restore and clean up damages, if any, caused by past operating practices.

Estimates of Reserves

The estimation of reserves involves two distinct determinations. The first determination results in the estimation of the quantities of recoverable oil and gas and the second determination results in the estimation of the uncertainty associated with those estimated quantities in accordance with the definitions set forth by the Securities and Exchange Commission’s Regulations Part 210.4-10(a). The process of estimating the quantities of recoverable oil and gas reserves relies on the use of certain generally accepted analytical procedures. These analytical procedures fall into three broad categories or methods: (1) performance-based methods; (2) volumetric-based methods; and (3) analogy. These methods may be used singularly or in combination by the reserve evaluator in the process of estimating the quantities of reserves. Reserve evaluators must select the method or combination of methods which in their professional judgment is most appropriate given the nature and amount of reliable geoscience and engineering data available at the time of the estimate, the established or anticipated performance characteristics of the reservoir being evaluated and the stage of development or producing maturity of the property.

In many cases, the analysis of the available geoscience and engineering data and the subsequent interpretation of this data may indicate a range of possible outcomes in an estimate, irrespective of the method selected by the evaluator. When a range in the quantity of reserves is identified, the evaluator must determine the uncertainty associated with the incremental quantities of the reserves. If the reserve quantities are estimated using the deterministic incremental approach, the uncertainty for each discrete incremental quantity of the reserves is addressed by the reserve category assigned by the evaluator. Therefore, it is the categorization of reserve quantities as proved, probable and/or possible that addresses the inherent uncertainty in the estimated quantities reported. For proved reserves, uncertainty is defined by the SEC as reasonable certainty wherein the “quantities actually recovered are much more likely than not to be achieved.” The SEC states that “probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.” The SEC states that “possible reserves are those additional reserves that are less certain to be recovered than probable reserves and the total quantities ultimately recovered from a project have a low probability of exceeding proved plus probable plus possible reserves.” All quantities of reserves within the same reserve category must meet the SEC definitions as noted above.

RYDER SCOTT COMPANY PETROLEUM CONSULTANTS

ECOPETROL

April 15, 2010

Page 4

Estimates of reserves quantities and their associated reserve categories may be revised in the future as additional geoscience or engineering data become available. Furthermore, estimates of reserves quantities and their associated reserve categories may also be revised due to other factors such as changes in economic conditions, results of future operations, effects of regulation by governmental agencies or geopolitical or economic risks as previously noted herein.

The proved reserves for the properties included herein were estimated by performance methods, the volumetric method, or a combination of performance and volumetric methods. The following table summarizes the approximate percent of reserves estimated by each of these methods.

Approximate Percent Proved Reserves Estimated by the Various Methods

| | Gas | Liquid Hydrocarbons |

| Method | Developed | Undeveloped | Developed | Undeveloped |

| Volumetric | 0% | 0% | 0% | 5% |

| Performance | 100% | 0% | 84% | 25% |

| Combination | 0% | 100% | 16% | 70% |

These performance methods include, but may not be limited to, decline curve analysis and analogy which utilized extrapolations of historical production and pressure data available through December, 2009 in those cases where such data were considered to be definitive. The data utilized in this analysis were supplied to Ryder Scott by ECOPETROL and were considered sufficient for the purpose thereof. The volumetric method was used where there were inadequate historical performance data to establish a definitive trend and where the use of production performance data as a basis for the reserve estimates was considered to be inappropriate. The volumetric analysis utilized pertinent well and seismic data supplied to Ryder Scott by ECOPETROL that were available through December, 2009. The data utilized from the well and seismic data incorporated into our volumetric analysis were considered sufficient for the purpose thereof.

To estimate economically recoverable proved oil and gas reserves and related future net cash flows, we consider many factors and assumptions including, but not limited to, the use of reservoir parameters derived from geological, geophysical and engineering data that cannot be measured directly, economic criteria based on current costs and SEC pricing requirements, and forecasts of future production rates. Under the SEC regulations 210.4-10(a)(22)(v) and (26), proved reserves must be anticipated to be economically producible from a given date forward based on existing economic conditions including the prices and costs at which economic producibility from a reservoir is to be determined. While it may reasonably be anticipated that the future prices received for the sale of production and the operating costs and other costs relating to such production may increase or decrease from those under existing economic conditions, such changes were, in accordance with rules adopted by the SEC, omitted from consideration in making this evaluation.

RYDER SCOTT COMPANY PETROLEUM CONSULTANTS

ECOPETROL

April 15, 2010

Page 5

ECOPETROL has informed us that they have furnished us all of the material accounts, records, geological and engineering data, and reports and other data required for this investigation. In preparing our forecast of future proved production and income, we have relied upon data furnished by ECOPETROL with respect to property interests owned, production and well tests from examined wells, normal direct costs of operating the wells or leases, other costs such as transportation and/or processing fees, ad valorem and production taxes, recompletion and development costs, abandonment costs after salvage, product prices based on the SEC regulations, adjustments or differentials to product prices, geological structural and isochore maps, well logs, core analyses, and pressure measurements. Ryder Scott reviewed such factual data for its reasonableness; however, we have not conducted an independent verification of the data furnished by ECOPETROL. We consider the factual data used in this report appropriate and sufficient for the purpose of preparing the estimates of reserves herein.

In summary, we consider the assumptions, data, methods and analytical procedures used in this report appropriate for the purpose hereof, and we have used all such methods and procedures that we consider necessary and appropriate to prepare the estimates of reserves herein. The proved reserves included herein were determined in conformance with the United States Securities and Exchange Commission (SEC) Modernization of Oil and Gas Reporting; Final Rule, including all references to Regulation S-X and Regulation S-K, referred to herein collectively as the “SEC Regulations.” In our opinion, the proved reserves presented in this report comply with the definitions, guidelines and disclosure requirements as required by the SEC regulations.

Future Production Rates

For wells currently on production, our forecasts of future production rates are based on historical performance data. If no production decline trend has been established, future production rates were held constant, or adjusted for the effects of curtailment where appropriate, until a decline in ability to produce was anticipated. An estimated rate of decline was then applied to depletion of the reserves. If a decline trend has been established, this trend was used as the basis for estimating future production rates.

Test data and other related information were used to estimate the anticipated initial production rates for those wells or locations that are not currently producing. For reserves not yet on production, sales were estimated to commence at an anticipated date furnished by ECOPETROL. Wells or locations that are not currently producing may start producing earlier or later than anticipated in our estimates due to unforeseen factors causing a change in the timing to initiate production. Such factors may include delays due to weather, the availability of rigs, the sequence of drilling, completing and/or recompleting wells and/or constraints set by regulatory bodies.

The future production rates from wells currently on production or wells or locations that are not currently producing may be more or less than estimated because of changes including, but not limited to, reservoir performance, operating conditions related to surface facilities, compression and artificial lift, pipeline capacity and/or operating conditions, producing market demand and/or allowables or other constraints set by regulatory bodies.

Hydrocarbon Prices

The hydrocarbon prices used herein are based on SEC price parameters using the average prices during the 12-month period prior to the ending date of the period covered in this report, determined as the unweighted arithmetic averages of the prices in effect on the first-day-of-the-month for each month within such period, unless prices were defined by contractual arrangements. For hydrocarbon products sold under contract, the contract prices, including fixed and determinable escalations, exclusive of inflation adjustments, were used until expiration of the contract. Upon contract expiration, the prices were adjusted to the 12-month unweighted arithmetic average as previously described.

RYDER SCOTT COMPANY PETROLEUM CONSULTANTS

ECOPETROL

April 15, 2010

Page 6

ECOPETROL furnished us with the above mentioned average prices in effect on December 31, 2009. These initial SEC hydrocarbon prices were determined using the 12-month average first-day-of-the-month benchmark prices appropriate to the geographic area where the hydrocarbons are sold. These benchmark prices are prior to the adjustments for differentials as described herein. The table below summarizes the “benchmark prices” and “price reference” used for the geographic area included in the report. In certain geographic areas, the price reference and benchmark prices may be defined by contractual arrangements. In cases where there are numerous contracts or price references within the same geographic area, the benchmark price is represented by the unweighted arithmetic average of the initial 12-month average first-day-of-the-month benchmark prices used.

The product prices that were actually used to determine the future gross revenue for each property reflect adjustments to the benchmark prices for gravity, quality, local conditions and/or distance from market, referred to herein as “differentials.” The differentials used in the preparation of this report were furnished to us by ECOPETROL. The differentials furnished to us were accepted as factual data and reviewed by us for their reasonableness; however, we have not conducted an independent verification of the data used by ECOPETROL to determine these differentials.

In addition, the following table summarizes the net volume weighted benchmark prices adjusted for differentials and referred to herein as the “average realized prices.” The average realized prices shown in the table below were determined from the total future gross revenue before production taxes and the total net reserves for the geographic area and presented in accordance with SEC disclosure requirements for each of the geographic areas included in the report.

Geographic Area | Product | Price Reference | Average Benchmark Prices | Average Realized Prices |

| Colombia | Oil | WTI Cushing, Okla - SPOT | $61.18/Bbl | $51.30/Bbl |

Gas sales are minor from one field only and account for approximately 0.1 percent of the total proved gross revenues. The realized gas price of $3.60/Mcf is based on the domestic Opon residential price.

Costs

Operating costs used in our evaluation were based on the operating expense reports of ECOPETROL and include only those costs directly applicable to the evaluated assets. The operating costs include a portion of general and administrative costs allocated directly to the leases and wells. The operating costs furnished to us were accepted as factual data and reviewed by us for their reasonableness; however, we have not conducted an independent verification of the operating cost data used by ECOPETROL. No deduction was made for loan repayments, interest expenses, or exploration and development prepayments that were not charged directly to the assets.

Development costs were furnished to us by ECOPETROL and are based on authorizations for expenditure for the proposed work or actual costs for similar projects. The development costs furnished to us were accepted as factual data and reviewed by us for their reasonableness; however, we have not conducted an independent verification of these costs. The estimated net cost of abandonment after salvage was included for properties where abandonment costs net of salvage were significant. The estimates of the net abandonment costs furnished by ECOPETROL were accepted without independent verification.

RYDER SCOTT COMPANY PETROLEUM CONSULTANTS

ECOPETROL

April 15, 2010

Page 7

The proved developed and undeveloped reserves in this report have been incorporated herein in accordance with ECOPETROL’s plans to develop these reserves as of December 31, 2009. The implementation of ECOPETROL’s development plans as presented to us and incorporated herein is subject to the approval process adopted by ECOPETROL’s management. As the result of our inquires during the course of preparing this report, ECOPETROL has informed us that the development activities included herein have been subjected to and received the internal approvals required by ECOPETROL’s management at the appropriate local, regional and/or corporate level. In addition to the internal approvals as noted, certain development activities may still be subject to specific partner AFE processes, Joint Operating Agreement (JOA) requirements or other administrative approvals external to ECOPETROL. Additionally, ECOPETROL has informed us that they are not aware of any legal, regulatory, political or economic obstacles that would significantly alter their plans.

Current costs used by ECOPETROL were held constant throughout the life of the properties.

Standards of Independence and Professional Qualification

Ryder Scott is an independent petroleum engineering consulting firm that has been providing petroleum consulting services throughout the world for over seventy years. Ryder Scott is employee-owned and maintains offices in Houston, Texas; Denver, Colorado; and Calgary, Alberta, Canada. We have over eighty engineers and geoscientists on our permanent staff. By virtue of the size of our firm and the large number of clients for which we provide services, no single client or job represents a material portion of our annual revenue. We do not serve as officers or directors of any publicly-traded oil and gas company and are separate and independent from the operating and investment decision-making process of our clients. This allows us to bring the highest level of independence and objectivity to each engagement for our services.