Exhibit 99.1

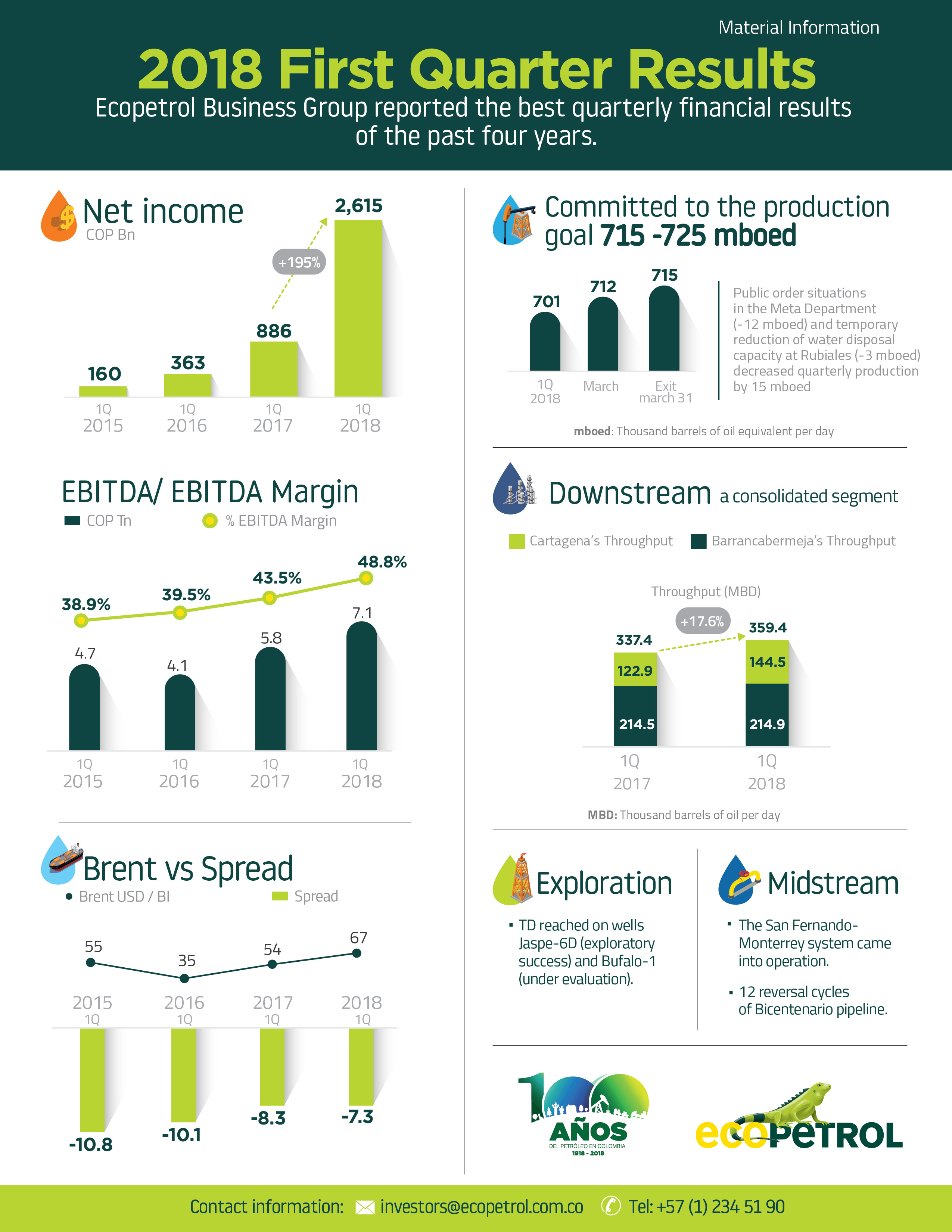

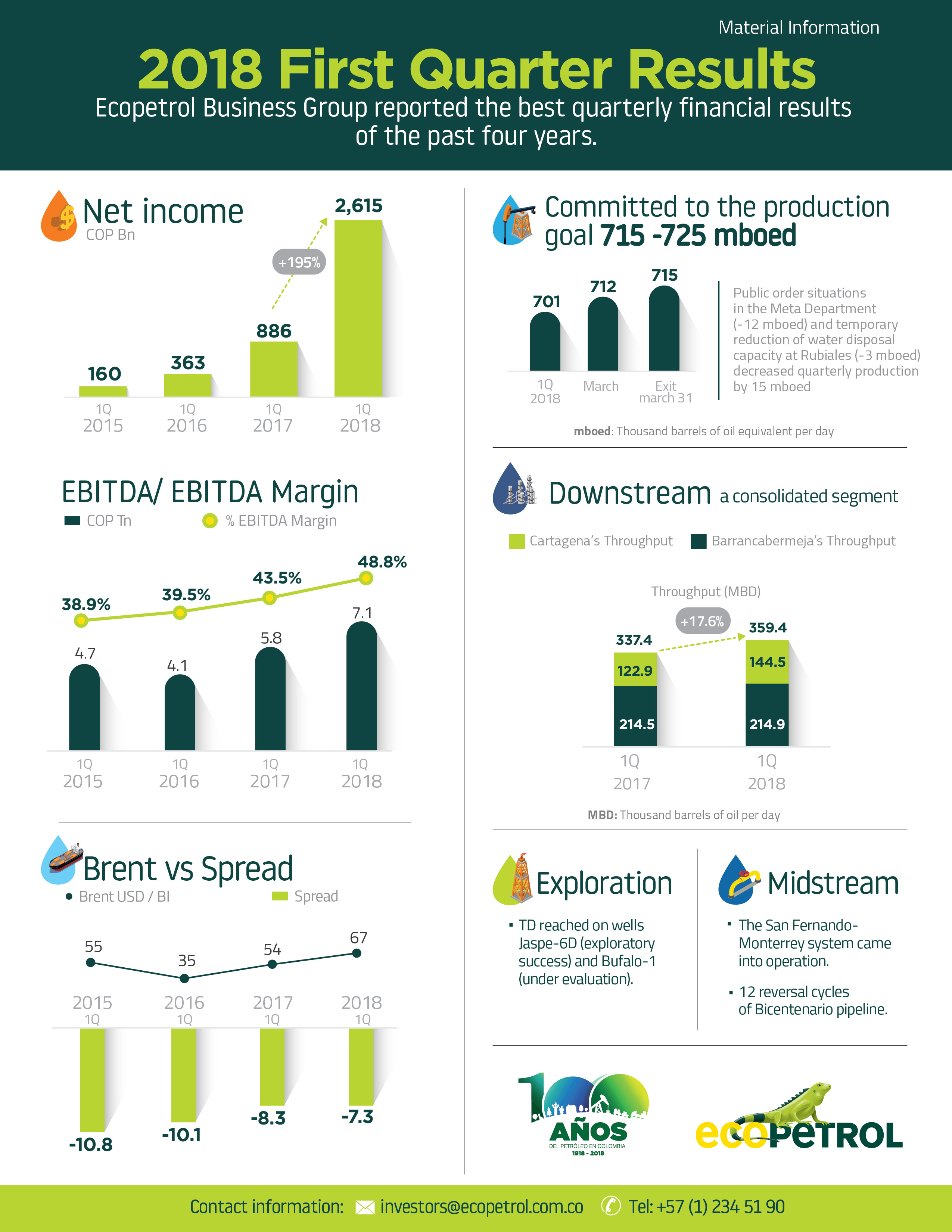

The financial results for the first quarter of 2018 were the best of the past four years. It is highlighted the EBITDA of COP 7.1 trillion and the EBITDA margin of 49%. Net profit totaled COP 2.6 trillion and net margin came in at 18%. We are maintaining a solid cash position at COP 16.6 trillion and a Gross Debt / EBITDA ratio of 1.7x, reflecting i) greater efficiency and cost reductions through the transformation plan, ii) capital discipline, iii) stabilization of the Cartagena Refinery, and iv) better crude prices and margins versus the Brent price.

Our commercial strategy continues to yield good results. We have succeeded in keeping our spread on the crude sales basket in the first quarter of 2018 at levels close to those of 2017, at -USD 7.3 per barrel, despite the increase in crude prices. The spread improved 12% versus the first quarter of 2017.

We took advantage of the favorable price environment we experienced during the quarter. Brent crude saw a 23% price increase as compared to the same period of 2017, increasing from an average of USD 54.6 per barrel to USD 67.2 per barrel.

Average production during the first quarter totaled 701 thousand barrels of oil equivalent per day, a result of a challenging public security environment. In February, certain communities in the Department of Meta blocked roads and attacked oil infrastructure, causing temporary closures at the Castilla, Chichimene and CPO9 fields. This event had an estimated negative impact of 12 mboed during the quarter (3 mboed averaged over the year). It is worth to highlight we did succeed at restoring operations in total compliance with security and environmental protocols. In March we resumed our production trend with a monthly average of 712 mboed, which increased to 715 mboed at the end of the first quarter.

Even with the attacks that occurred during the first quarter, we are keeping our 2018 production goal within a range of 715-725 mboed.

Our operating results remain solid. As part of the exploratory campaign, we drilled two wells during the quarter. The Búfalo-1 well, located in the Valle Medio del Magdalena basin, is under evaluation, while the Jaspe-6D well in the Llanos Orientales basin was declared successful.

| “We are keeping our annual production target within a range of 715-725,000 barrels of oil equivalent per day.” |  |

| | Ecopetrol S.A. CEO

Felipe Bayón Pardo |

In the transport segment, the San Fernando - Monterrey system has now entered into operation. This new system is key to our extra-heavy crude extraction strategy. Partial crude oil transport tests were also executed at up to 700 centistokes (cSt - a measure of viscosity) in some of our oil pipeline systems, with a view to achieving greater dilution efficiencies.

The reversal strategy on the Bicentenario Oil Pipeline, implemented since 2017, reduced the impact of the attacks on the Caño Limón - Coveñas oil pipeline, allowing us to maintain the flow of operations in Caño Limon field and other nearby fields. During the first quarter of 2018, the Caño Limón - Coveñas system was in operation 9 days, a situation that resulted in the execution of 12 reversal cycles.

In the Refining segment, we experienced stable operations in our refineries system, with total throughput of some 360 thousand barrels of oil per day. The Cartagena refinery achieved average throughput of 144 mbd during the quarter, exceeding the 2017 average figure of 136 mbd. The Cartagena refinery’s average gross refining margin totaled USD 11.5/bl, up 69% over the same period in the previous year (USD 6.8/bl). As a result of the refinery’s stable operations, we enjoyed seven consecutive months with a gross margin in double digits. During the quarter, the refinery’s crude diet used approximately 71% of domestic crudes, demonstrating consolidation in the process of optimizing the crude diet and operating costs.

| | 2 | |

| | | |

| |  | |

| | | |

We achieved a milestone in the country’s refining industry:

“We achieved the greatest throughput in the history of the Cartagena refinery, with an average of 160 mbd in March.”

Between March 14 and 22, specific tests were performed at the Cartagena refinery in which a throughput of 165 mbd was reached through the period. These tests are a good indicator of opportunities to continue consolidating the optimization process.

At the Barrancabermeja refinery we noted stable throughput in the first quarter versus the same period of 2017, achieving an average of 215 mbd. The Barrancabermeja refinery’s average refining margin was USD 11.8/bl, primarily impacted by lower spreads in gasoline and fuel oil prices, consistent with performance on the international markets.

On March, 2018, an unexpected seepage of water and traces of crude oil occurred near the Lisama 158 well, located in the municipality of Barrancabermeja, in the village of La Fortuna. It is estimated that between March 12 and 15, 550 barrels of crude, mixed with mud and rainwater, seeped into the streams of La Lizama and Caño Muerto. Ecopetrol activated its contingency plan for containing the spill and permanently resolve this situation in accordance with its risk management and HSE protocols. As of March 30, flows from the Lisama-158 well had been controlled and a specialized “snubbing unit” equipment had been installed to record logs and identify the optimal means of permanently and safely shutting down the well.

Our priority and commitment has always been a safe operation to the people and the environment. In view of this unfortunate incident, we are committed to this region of the country and will continue to work closely with the communities and authorities to restore the environmental and social conditions as soon as possible, and determine the causes of the incident.

On April 19, Ecopetrol filed its annual report on form 20-F for the fiscal year 2017 with the US Securities and Exchange Commission (SEC), demonstrating our commitment to the highest standards of corporate governance and transparency.

Ecopetrol´s profitability outstands. The Company is totally committed to its growth and the country’s development. The Ecopetrol Group’s priority will continue to be the operational excellence, the commitment to ethics and transparency, safety as a basis for its operations, and proper care for the environment and the communities in which we operates, seeking shared prosperity at all times. We are focused on growth in the reserves, the profitable production and the operational excellence, delivering outstanding results to the benefit of shareholders, and the sustainability of both the company and the country.

Felipe Bayón Pardo

Ecopetrol CEO

| | 3 | |

| | | |

| |  | |

| | | |

Bogotá, May 3, 2018. Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC) announced today the financial results of the Business Group for the first quarter of 2018, prepared in accordance with International Financial Reporting Standards applicable in Colombia.

TABLE 1:

CONSOLIDATED FINANCIAL RESULTS -

ECOPETROL BUSINESS GROUP

| A | | B | | | C | | | D | | | E | |

| COP Billion | | 1Q 2018 | | | 1Q 2017 | | | ∆ ($) | | | ∆ (%) | |

| Total Sales | | | 14,642 | | | | 13,371 | | | | 1,271 | | | | 9.5 | % |

| Operating Profit | | | 5,180 | | | | 3,299 | | | | 1,881 | | | | 57.0 | % |

| Net Income Consolidated | | | 2,817 | | | | 1,073 | | | | 1,744 | | | | 162.5 | % |

| Non-Controlling Interests | | | (202 | ) | | | (187 | ) | | | (15 | ) | | | 8.0 | % |

| Net Income Attributable to Owners of Ecopetrol | | | 2,615 | | | | 886 | | | | 1,729 | | | | 195.1 | % |

| | | | | | | | | | | | | | | | | |

| EBITDA | | | 7,149 | | | | 5,813 | | | | 1,336 | | | | 23.0 | % |

| EBITDA Margin | | | 48.8 | % | | | 43.5 | % | | | | | | | | |

The figures included in this report are not audited. The financial information is expressed in billions of Colombian pesos (COP) or US dollars (USD), or thousands of barrels of oil equivalent per day (mboed) or tons, as so indicated where applicable. For presentation purposes, certain figures in this report were rounded to the nearest decimal point.

| I. | Ecopetrol Business Group Financial and Operating Results |

In the first quarter of 2018, the Ecopetrol Business Group reported the best quarterly financial results of the past four years, with earnings of COP 2.6 trillion, EBITDA of COP 7.1 trillion and an EBITDA margin of 48.8%. These results were achieved despite lower production as a result of a challenging public security environment that affected average production during the quarter.

Table 2: Income Statement – Ecopetrol Business Group

| A | | B | | | C | | | D | | | E | |

| COP Billion | | 1Q 2018 | | | 1Q 2017 | | | ∆ ($) | | | ∆ (%) | |

| Local Sales | | | 7,570 | | | | 6,731 | | | | 839 | | | | 12.5 | % |

| Export Sales | | | 7,072 | | | | 6,640 | | | | 432 | | | | 6.5 | % |

| Total Sales | | | 14,642 | | | | 13,371 | | | | 1,271 | | | | 9.5 | % |

| DD&A Costs | | | 1,771 | | | | 2,022 | | | | (251 | ) | | | (12.4 | )% |

| Variable Costs | | | 5,200 | | | | 5,401 | | | | (201 | ) | | | (3.7 | )% |

| Fixed Costs | | | 1,875 | | | | 1,723 | | | | 152 | | | | 8.8 | % |

| Cost of Sales | | | 8,846 | | | | 9,146 | | | | (300 | ) | | | (3.3 | )% |

| Gross Profits | | | 5,796 | | | | 4,225 | | | | 1,571 | | | | 37.2 | % |

| Operating Expenses | | | 616 | | | | 926 | | | | (310 | ) | | | (33.5 | )% |

| Operating Income | | | 5,180 | | | | 3,299 | | | | 1,881 | | | | 57.0 | % |

| Financial Income (Loss) | | | (568 | ) | | | (1,019 | ) | | | 451 | | | | (44.3 | )% |

| Share of Profit of Companies | | | 85 | | | | 31 | | | | 54 | | | | 174.2 | % |

| Income Before Income Tax | | | 4,697 | | | | 2,311 | | | | 2,386 | | | | 103.2 | % |

| Income tax | | | (1,880 | ) | | | (1,238 | ) | | | (642 | ) | | | 51.9 | % |

| Net Income Consolidated | | | 2,817 | | | | 1,073 | | | | 1,744 | | | | 162.5 | % |

| Non-Controlling Interests | | | (202 | ) | | | (187 | ) | | | (15 | ) | | | 8.0 | % |

| Net Income (Attributable to Owners of Ecopetrol) | | | 2,615 | | | | 886 | | | | 1,729 | | | | 195.1 | % |

| | | | | | | | | | | | | | | | | |

| EBITDA | | | 7,149 | | | | 5,813 | | | | 1,336 | | | | 23.0 | % |

| EBITDA Margin | | | 48.8 | % | | | 43.5 | % | | | | | | | | |

Note: Some Q1 2017 figures have been restated for comparison purposes.

| | 4 | |

| | | |

| |  | |

| | | |

The higher sales revenue during the first quarter versus the same period of 2017 is presented as a combined result of the following:

| a) | An increase in the average weighted basket price of crude oil, gas and refined products, of +USD 12/bl (+COP 2.58 trillion), largely due to the improved spread in export crudes and the performance of the benchmark Brent crude prices (USD 67/bl in Q1 2018 vs USD 55/bl in Q1 2017). |

| b) | A decline in the average exchange rate on revenue earned, from COP 2,873/USD (Q1 2017) to COP 2,842/USD (Q1 2018), negatively affecting total revenue (-COP 339 billion). |

| c) | Lower sales volume (-COP 879 billion). |

| d) | Lower services revenue (-COP 90 billion). |

Table 3: Sales volume - Ecopetrol Business Group

| A | | B | | | C | | | D | |

| Local Sales Volume (mboed) | | 1Q 2018 | | | 1Q 2017 | | | ∆ (%) | |

| Crude Oil | | | 7.3 | | | | 12.4 | | | | (41.1 | )% |

| Natural Gas | | | 71.0 | | | | 76.4 | | | | (7.1 | )% |

| Gasoline | | | 113.0 | | | | 109.2 | | | | 3.5 | % |

| Medium Distillates | | | 148.1 | | | | 146.3 | | | | 1.2 | % |

| LPG and Propane | | | 17.1 | | | | 18.1 | | | | (5.5 | )% |

| Fuel Oil | | | 9.1 | | | | 8.4 | | | | 8.3 | % |

| Industrial and Petrochemical | | | 20.4 | | | | 19.6 | | | | 4.1 | % |

| Total Local Sales | | | 386.0 | | | | 390.4 | | | | (1.1 | )% |

| | | | | | | | | | | | | |

| Export Sales Volume (mboed) | | 1Q 2018 | | | 1Q 2017 | | | ∆ (%) | |

| Crude Oil | | | 366.6 | | | | 439.8 | | | | (16.6 | )% |

| Products | | | 97.2 | | | | 112.5 | | | | (13.6 | )% |

| Natural Gas | | | 1.8 | | | | 1.5 | | | | 20.0 | % |

| Total Export Sales | | | 465.6 | | | | 553.8 | | | | (15.9 | )% |

| | | | | | | | | | | | | |

| Total Sales Volume (mboed) | | | 851.6 | | | | 944.2 | | | | (9.8 | )% |

Note: Some Q1 2017 figures have been restated for comparison purposes .

In the first quarter of 2018, volumes sold totaled 852 mboed, a decrease of approximately 9.8% as compared to the first quarter of 2017. This decrease was primarily due to lower crude availability caused by public security issues that forced the temporary closure of fields in the Llanos Orientales region, and lower demand for natural gas as further described below.

Market in Colombia (45% of sales):Domestic salesdeclined by 1.1% in the first quarter of 2018 as compared to the first quarter of 2017, primarily due to:

| · | Lower domestic sales of crude oil as a result of it being diverted to the Cartagena refinery and the international markets in order to obtain better realization. |

| · | Higher diesel sales primarily due to greater consumption in the mining sector and the recovery of demand in the transport sector. |

| · | Higher gasoline sales primarily due to the recovery of inventories of wholesale customers and higher domestic production supplies in border regions due to closures along the Venezuela border. |

| · | Lower sales of natural gas primarily due to decreased demand for thermal power generation and fewer deliveries to the industrial sector, as a result of operating contingencies on the Ballena-Barranca and Gibraltar-Bucaramanga gas pipelines. |

| | 5 | |

| | | |

| |  | |

| | | |

International market (55% of sales):International sales declined 15.9% as compared to the first quarter of 2017. This change is primarily due to the following:

| · | Fewer exports of refined products: |

| a) | Lower exports of diesel and gasoline primarily due to a commercial strategy focused on allocating higher volumes to the domestic market in order to obtain better prices and substitute imports by production from the Cartagena refinery. |

| b) | Lower exports of fuel oil primarily due to reduced production at the Barrancabermeja refinery as a result of better execution of processed alternative flows. |

| · | Lower crude exports primarily due to allocating greater crude to the Cartagena refinery and lower production due to public security issues. |

Table 4: Export Destinations - Ecopetrol Business Group

| A | | B | | | C | | | D | |

| Crude (mboed) | | 1Q 2018 | | | 1Q 2017 | | | ∆ (%) | |

| U.S. Gulf Coast | | | 138.9 | | | | 115.8 | | | | 37.9 | % |

| Asia | | | 115.6 | | | | 101.4 | | | | 31.5 | % |

| Central America / Caribbean | | | 65.5 | | | | 62.3 | | | | 17.9 | % |

| U.S. West Coast | | | 23.0 | | | | 62.6 | | | | 6.3 | % |

| Other | | | 12.7 | | | | 34.0 | | | | 3.5 | % |

| U.S. East Coast | | | 5.5 | | | | 42.8 | | | | 1.5 | % |

| South America | | | 5.4 | | | | 0.0 | | | | 1.5 | % |

| Europe | | | 0.0 | | | | 20.9 | | | | 0.0 | % |

| Total | | | 366.6 | | | | 439.8 | | | | 100.0 | % |

| | | | | | | | | | | | | |

| Products (mboed) | | 1Q 2018 | | | 1Q 2017 | | | ∆ (%) | |

| U.S. East Coast | | | 27.2 | | | | 14.2 | | | | 27.9 | % |

| Central America / Caribbean | | | 24.2 | | | | 43.2 | | | | 24.9 | % |

| Asia | | | 23.3 | | | | 20.4 | | | | 24.0 | % |

| U.S. Gulf Coast | | | 9.0 | | | | 10.7 | | | | 9.3 | % |

| South America | | | 8.8 | | | | 16.2 | | | | 9.0 | % |

| U.S. West Coast | | | 3.3 | | | | 0.0 | | | | 3.4 | % |

| Europe | | | 1.4 | | | | 6.9 | | | | 1.5 | % |

| Other | | | 0.0 | | | | 1.0 | | | | 0.0 | % |

| Total | | | 97.2 | | | | 112.6 | | | | 100.0 | % |

Note: Information subject to change after the close of the quarter because some destinations have been reclassified according to final export results.

Crude oil:In the first quarter of 2018, the US Gulf Coast was the principal export destination for crude oil thanks to better opportunities to sell to refiners in the region, in view of uncertainties in the supply of heavy crudes by competitors. Asia was the second-largest export destination, with an 8% increase in its relative share versus the same period in 2017, due to greater import requirements by China in a market environment characterized by strong refining margins.

Refined products:The principal export destination for refined products for the first quarter of 2018 was the US East Coast, due to sales of naphtha to gasoline production and marketing companies. The second destination was Central America and the Caribbean; however, this destination’s relative share declined by 13% due to direct sales of fuel oil to high-conversion refiners in the Gulf Coast and the lower availability of refined products for export. Asia increased its relative share by 6% due to greater coke exports to that market.

| | 6 | |

| | | |

| |  | |

| | | |

Table 5: Average Benchmark Crude Price and Basket Spread

| A | | B | | | C | | | D | |

| USD/Bl | | 1Q 2018 | | | 1Q 2017 | | | ∆ (%) | |

| Brent | | | 67.2 | | | | 54.6 | | | | 23.1 | % |

| Crude Oil Basket vs Brent | | | (7.3 | ) | | | (8.3 | ) | | | 12.0 | % |

| Product Oil Basket vs Brent | | | 6.8 | | | | 6.8 | | | | 0.0 | % |

Table 6: Average Weighted Sale Price - Ecopetrol Business Group

| A | | B | | | C | | | D | | | E | |

| USD/Bl | | 1Q 2018 | | | 1Q 2017 | | | ∆ (%) | | | Volume

(mboed)

1Q 2018 | |

| Crude Oil Basket | | | 59.9 | | | | 46.3 | | | | 29.4 | % | | | 373.9 | |

| Refined Products Basket | | | 74.0 | | | | 61.4 | | | | 20.5 | % | | | 404.9 | |

| Natural Gas Basket | | | 22.2 | | | | 23.3 | | | | (4.7 | )% | | | 72.8 | |

Crude oil:In the first quarter of 2018, Ecopetrol saw better spreads versus the Brent price on the sale of its crudes. The crude sales basket spread improved by USD 1.0/bl versus the results obtained in the first quarter of 2017. This result is largely explained by: i) a sales strategy focused on markets that generate greater value, ii) increased crude throughput in US and Chinese refineries, iii) uncertainties in crude supplies from competitors, and iv) strengthening of heavy crude prices given production cuts in intermediate and heavy crudes in OPEC countries.

The spread on crude sales was maintained at levels close to those of the fourth quarter of 2017, despite i) higher Brent prices, which resulted in greater crude discounts to offset higher refining costs, and ii) seasonal demand in the US due to the refineries’ maintenance season, which began in March.

Refined products:The spread on the sales basket of refined products versus the Brent price remained stable in the first quarter of 2018 as compared to the results of the first quarter of 2017. The prices of refined products followed the performance of international indicators, in which the strength of diesel and jet fuel prices offset the weakness in gasoline and fuel oil prices. This performance was a result of: i) increased demand of diesel due to the economic growth and the recovery in the exploration and production industry, ii) lower availability of jet fuel as a result of the increase of diesel production at the refineries, iii) gasoline demand growing at a slower rate than supply, resulting in excess inventory, and iv) weakness in fuel oil prices in the face of lower demand from bunkers in Asia and higher-than-expected exports from Russia.

Natural gas:The price per barrel equivalent declined by 4.7% in the first quarter of 2018 as compared to the first quarter of 2017, primarily due to the increase in quantities demanded under take-or-pay contracts which were close to the quantities committed, resulting in a reduction of the price per barrel.

Depreciation and amortization:The 12.4% decrease in the first quarter of 2018 as compared to the first quarter of 2017 is primarily the net effect of:

| a) | Effect of the incorporation of additional reserves in 2017 versus 2016, partially offset by: |

| b) | Greater depreciation in the K2 field as a consequence of the increase in Ecopetrol America’s share in that field since December 2017, and |

| c) | Greater depreciation as a result of the capitalizations recognized in 2017. |

| | 7 | |

| | | |

| |  | |

| | | |

Variable costs:The 3.4% decrease in the first quarter of 2018 as compared to the first quarter of 2017 is primarily due to:

| a) | Lower purchase costs related to crude, natural gas and refined products (-COP 393 billion), which is the net effect of: |

| · | A decrease in purchased volumes (-COP 1.25 trillion) due to: i) lower imports of fuels, specially diesel and gasoline (-COP 595 billion, -34 mboed) due to the substitution of imports by fuels produced at the Cartagena refinery, ii) lower imports of crude oil (-COP 636 billion, -45 mbd) to the Cartagena refinery due to the use of local crudes coming from Ecopetrol and iii) lower consumption of diluent as a result of the commercialization of crudes with high viscosity and the use of LPG as diluent (-COP 159 billion, -11 mboed). |

| · | A decrease in the average exchange rate applicable to purchases (-COP 108 billion), which decreased from COP 2,922/USD (Q1 2017) to COP 2,858/USD (Q1 2018). |

| · | An increase in the average price of domestic purchases and imports of refined products (+COP 968 billion). |

Table 7: Local Purchases and Imports – Ecopetrol Business Group

| A | | B | | | C | | | D | |

| Local Purchases (mboed) | | 1Q 2018 | | | 1Q 2017 | | | ∆ (%) | |

| Crude Oil | | | 158.8 | | | | 156.1 | | | | 1.7 | % |

| Natural Gas | | | 1.7 | | | | 1.8 | | | | (5.6 | )% |

| Refined Products | | | 11.3 | | | | 3.3 | | | | 242.4 | % |

| Diluent | | | 0.4 | | | | 2.8 | | | | (85.7 | )% |

| Total | | | 172.2 | | | | 164.0 | | | | 5.0 | % |

| Imports (mboed) | | 1Q 2018 | | | 1Q 2017 | | | ∆ (%) | |

| Crude Oil | | | 45.6 | | | | 90.5 | | | | (49.6 | )% |

| Refined Products | | | 49.2 | | | | 79.7 | | | | (38.3 | )% |

| Diluent | | | 48.0 | | | | 56.6 | | | | (15.2 | )% |

| Total | | | 142.8 | | | | 226.8 | | | | (37.0 | )% |

The decrease of local purchases and imports is explained as follows:

Crude oil:There were fewer imports of crude oil during the first quarter of 2018 as compared to the first quarter of 2017 due to higher Ecopetrol’s crude throughput at the Cartagena refinery.

Refined Products:There were fewer imports of diesel and gasoline during the first quarter of 2018 as compared to the first quarter of 2017 primarily due to higher production at the Barrancabermeja and Cartagena refineries. Local purchases also include the acquisition of sugar cane that increased as compared to the first quarter of 2017, given the advance in the stabilization phase at Bioenergy, which began operations in the first quarter de 2017.

Diluent:There were fewer imports and domestic purchases of diluents during the first quarter of 2018 as compared to the first quarter of 2017, in line with decreased production and thanks to the implementation of strategies for the transport of higher-viscosity crude.

| b) | Higher costs due to changes in inventory and other (+COP 193 billion), largely a result of i) lesser accumulation of inventory versus Q1 2017, ii) higher cost of processing materials, primarily due to the entry into operation of the San Fernando - Apiay system and the P-135 project at Ocensa, and iii) an increase in Ecopetrol America share in the K2 field since December 2017. |

Fixed costs:The 8.8% increase in fixed costs in the first quarter of 2018 as compared to the first quarter of 2017 is primarily due to:

| a) | Higher cost of contracted services (+COP 83 billion) due to the receipt of the Recetor field in May 2017 and an increase in Ecopetrol America’s share in the K2 field since December 2017. |

| | 8 | |

| | | |

| |  | |

| | | |

| b) | Higher labor costs (+COP 73 billion), primarily due to the wage increase applied in 2017 versus 2016. |

| c) | Other items (-COP 4 billion). |

Operating expenses for first quarter of 2018 declined by 33.5% as compared to the first quarter of 2017, primarily as a result of elimination of the wealth tax as of January 2018, which was recognized for the last time in the first quarter of 2017, primarily offset by greater seismic and exploratory activity, primarily at Ecopetrol Brasil and Hocol.

| 4. | Financial (non-operating) and other income |

The change infinancial incomein the first quarter of 2018 versus the first quarter of 2017 is presented as a net result of:

| a) | Change to income from the foreign exchange spread, of +COP 471 billion. In the first quarter of 2018 the foreign exchange spread was positive by +COP 22 billion versus a loss of -COP 449 billion in the first quarter of 2017, reflecting the reduced exposure to foreign exchange fluctuations due to optimization of our net dollar position. |

| b) | Lower net interest expenses (+COP 46 billion), primarily due to i) savings on the financial cost of our foreign-currency debt due to early loan payoffs made in 2017 totaling USD 2.4 billion, ii) a decrease in interest on domestic loans due to a lower interest rate indexed to the Consumer Price Index (CPI) and periodic capital payments, and iii) a positive impact of the peso’s appreciation against the dollar on our foreign denominated loan interest. |

| c) | A decrease in other financial expenses of COP 66 billion, primarily due to a decrease in our derivatives hedges operating profit during the first quarter of 2018 versus the first quarter of 2017. |

Theeffective income tax ratefor the first quarter of 2018 was 40.0%, a 13.6% decrease from the 53.6% rate applicable to the first quarter of 2017. The decline versus the previous year was largely due to better results at the Cartagena refinery and Ecopetrol América, and the drop of 300 basis points in the nominal tax rate.

Table 8: Statement of Financial Situation – Ecopetrol Business Group

| A | | B | | | C | |

| COP Billion | | March 31, 2018 | | | December 31, 2017 | |

| Current Assets | | | 25,214 | | | | 23,224 | |

| Non Current Assets | | | 93,356 | | | | 95,669 | |

| Total Assets | | | 118,570 | | | | 118,893 | |

| | | | | | | | | |

| Current Liabilities | | | 20,525 | | | | 16,847 | |

| Non-Current Liabilities | | | 50,214 | | | | 52,265 | |

| Total Liabilities | | | 70,739 | | | | 69,112 | |

| Equity | | | 47,831 | | | | 49,781 | |

| Total Liabilities and Equity | | | 118,570 | | | | 118,893 | |

Note: Some figures from December 31, 2017 were restated for comparison purposes.

The decrease inassetsas of March 31, 2018 as compared to December 31, 2017 is presented as the net effect of:

| a) | A decrease inproperty, plant and equipment, natural resources and intangibles(-COP 2.6 trillion), largely as a result of the effect of i) a lower conversion adjustment at subsidiaries using a functional currency other than the Colombian peso, primarily due to the peso’s appreciation against the dollar, ii) quarterly depreciation and amortization, partially offset by iii) an increase in capital expenditures during the quarter. |

| | 9 | |

| | | |

| |  | |

| | | |

| b) | An increase inother financial assets(+COP 2.2 trillion) primarily due to the investment in securities from excess cash earned from our operations. |

| c) | An increase intrade receivables and other accounts receivable(+COP 0.5 trillion) primarily due to the increase in accounts receivable from the Fuel Prices Stabilization Fund. |

| d) | Other movements totaling -COP 0.4 trillion. |

Liabilities and Net Equity

Total liabilities as of March 31, 2018 increased as compared to December 31, 2017 is presented as the net effect of:

| a) | An increase inaccounts payable(+COP 3 trillion) for the recognition of dividends to be distributed on 2017 income as decreed by Ecopetrol’s General Shareholders’ Meeting. |

| b) | An increase of COP 0.8 trillion ontaxes payable,associated with increased quarterly earnings. |

| c) | A decrease inloans and financing(-COP 2.6 trillion, primarily due to lower foreign currency debt balances as a result of the peso’s appreciation against the dollar. As of March 31, 2018, the Group’s debt totaled COP 40.9 trillion, 86% of which was denominated in foreign currency and 14% in domestic currency. |

| d) | Other changes in liabilities (+COP 0.4 trillion). |

The decrease innet equityis presented as the net effect of: i) the transfer to liabilities of dividends to be distributed on 2017 earnings, ii) the loss due to the conversion of assets and liabilities of subsidiaries using a functional currency other than the Colombian peso, partially offset by iii) higher earnings during the quarter.

Table 9: Cash Position1 – Ecopetrol Business Group

| A | | B | | | C | |

| COP Billion | | 1Q 2018 | | | 1Q 2017 | |

| Initial Cash and cash equivalents | | | 7,946 | | | | 8,410 | |

| (+) Cash generated from operations | | | 4,673 | | | | 4,455 | |

| (-) CAPEX | | | (1,195 | ) | | | (683 | ) |

| (+/-) Movement of Portfolio investments | | | (2,548 | ) | | | (2,942 | ) |

| (+/-) Other investment activities | | | 145 | | | | 136 | |

| (-) Proceeds (repayment of) from borrowings and interests | | | (668 | ) | | | (805 | ) |

| (-) Dividends paid | | | (245 | ) | | | (114 | ) |

| +(-) Exchange difference in cash | | | (242 | ) | | | (292 | ) |

| Final Cash and cash equivalents | | | 7,866 | | | | 8,165 | |

| Portfolio investments > 3 months | | | 8,774 | | | | 6,534 | |

| Total cash | | | 16,640 | | | | 14,699 | |

1Cash corresponds to available funds in the form of cash and cash equivalents, and investments in financial instruments, regardless of maturity.

| | 10 | |

| | | |

| |  | |

| | | |

| 6. | Results by Business Line |

Table 10: Quarterly Income Statement – By segment

| A | | B | | | C | | | D | | | E | | | F | | | G | | | H | | | I | | | J | | | K | |

| | | E&P | | | Refining&Petrochem | | | Transport.& Logistics | | | Eliminations | | | Ecopetrol Consolidated | |

| COP Billion | | 1Q 2018 | | | 1Q 2017 | | | 1Q 2018 | | | 1Q 2017 | | | 1Q 2018 | | | 1Q 2017 | | | 1Q 2018 | | | 1Q 2017 | | | 1Q 2018 | | | 1Q 2017 | |

| Sales | | | 9,963 | | | | 8,099 | | | | 8,075 | | | | 6,987 | | | | 2,729 | | | | 2,496 | | | | (6,125 | ) | | | (4,211 | ) | | | 14,642 | | | | 13,371 | |

| DD&A Costs | | | 1,195 | | | | 1,487 | | | | 297 | | | | 264 | | | | 279 | | | | 271 | | | | - | | | | - | | | | 1,771 | | | | 2,022 | |

| Variable Costs | | | 3,398 | | | | 2,890 | | | | 6,863 | | | | 5,848 | | | | 169 | | | | 114 | | | | (5,230 | ) | | | (3,451 | ) | | | 5,200 | | | | 5,401 | |

| Fixed Costs | | | 2,017 | | | | 1,637 | | | | 438 | | | | 382 | | | | 310 | | | | 406 | | | | (890 | ) | | | (702 | ) | | | 1,875 | | | | 1,723 | |

| Cost of Sales | | | 6,610 | | | | 6,014 | | | | 7,598 | | | | 6,494 | | | | 758 | | | | 791 | | | | (6,120 | ) | | | (4,153 | ) | | | 8,846 | | | | 9,146 | |

| Gross profit | | | 3,353 | | | | 2,085 | | | | 477 | | | | 493 | | | | 1,971 | | | | 1,705 | | | | (5 | ) | | | (58 | ) | | | 5,796 | | | | 4,225 | |

| Operating Expenses | | | 350 | | | | 485 | | | | 198 | | | | 362 | | | | 73 | | | | 136 | | | | (5 | ) | | | (57 | ) | | | 616 | | | | 926 | |

| Operating Profit (Loss) | | | 3,003 | | | | 1,600 | | | | 279 | | | | 131 | | | | 1,898 | | | | 1,569 | | | | - | | | | (1 | ) | | | 5,180 | | | | 3,299 | |

| Financial Income (Loss) | | | (589 | ) | | | (730 | ) | | | 293 | | | | (240 | ) | | | (272 | ) | | | (49 | ) | | | - | | | | - | | | | (568 | ) | | | (1,019 | ) |

| Share of profit of companies | | | 93 | | | | 27 | | | | 7 | | | | 4 | | | | (15 | ) | | | - | | | | - | | | | - | | | | 85 | | | | 31 | |

| Net Income (Loss) Before Income Tax | | | 2,507 | | | | 897 | | | | 579 | | | | (105 | ) | | | 1,611 | | | | 1,520 | | | | - | | | | (1 | ) | | | 4,697 | | | | 2,311 | |

| Provision for Income Tax | | | (967 | ) | | | (468 | ) | | | (275 | ) | | | (110 | ) | | | (638 | ) | | | (660 | ) | | | - | | | | - | | | | (1,880 | ) | | | (1,238 | ) |

| Net Income Consolidated | | | 1,540 | | | | 429 | | | | 304 | | | | (215 | ) | | | 973 | | | | 860 | | | | - | | | | (1 | ) | | | 2,817 | | | | 1,073 | |

| Non-controlling interests | | | - | | | | - | | | | - | | | | - | | | | (202 | ) | | | (187 | ) | | | - | | | | - | | | | (202 | ) | | | (187 | ) |

| Net income (Loss) attributable to owners of Ecopetrol | | | 1,540 | | | | 429 | | | | 304 | | | | (215 | ) | | | 771 | | | | 673 | | | | - | | | | (1 | ) | | | 2,615 | | | | 886 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA | | | 4,317 | | | | 3,321 | | | | 643 | | | | 558 | | | | 2,189 | | | | 1,935 | | | | - | | | | (1 | ) | | | 7,149 | | | | 5,813 | |

| EBITDA Margin | | | 43.3 | % | | | 41.0 | % | | | 8.0 | % | | | 8.0 | % | | | 80.2 | % | | | 77.5 | % | | | 0.0 | % | | | 0.0 | % | | | 48.8 | % | | | 43.5 | % |

| A. | Exploration and Production |

Table 11: Income Statement – Exploration and Production

| A | | B | | | C | | | D | | | E | |

| COP Billion | | 1Q 2018 | | | 1Q 2017 | | | ∆ $ | | | ∆ % | |

| Sales | | | 9,963 | | | | 8,099 | | | | 1,864 | | | | 23.0 | % |

| DD&A Costs | | | 1,195 | | | | 1,487 | | | | (292 | ) | | | (19.6 | )% |

| Variable Costs | | | 3,398 | | | | 2,890 | | | | 508 | | | | 17.6 | % |

| Fixed Costs | | | 2,017 | | | | 1,637 | | | | 380 | | | | 23.2 | % |

| Cost of Sales | | | 6,610 | | | | 6,014 | | | | 596 | | | | 9.9 | % |

| Gross profit | | | 3,353 | | | | 2,085 | | | | 1,268 | | | | 60.8 | % |

| Operating Expenses | | | 350 | | | | 485 | | | | (135 | ) | | | (27.8 | )% |

| Operating Profit (Loss) | | | 3,003 | | | | 1,600 | | | | 1,403 | | | | 87.7 | % |

| Financial Income (Loss) | | | (589 | ) | | | (730 | ) | | | 141 | | | | (19.3 | )% |

| Share of profit of companies | | | 93 | | | | 27 | | | | 66 | | | | 244.4 | % |

| Net Income (Loss) Before Income Tax | | | 2,507 | | | | 897 | | | | 1,610 | | | | 179.5 | % |

| Provision for Income Tax | | | (967 | ) | | | (468 | ) | | | (499 | ) | | | 106.6 | % |

| Net Income Consolidated | | | 1,540 | | | | 429 | | | | 1,111 | | | | 259.0 | % |

| Non-controlling interests | | | - | | | | - | | | | - | | | | - | |

| Net income (Loss) attributable to owners of Ecopetrol | | | 1,540 | | | | 429 | | | | 1,111 | | | | 259.0 | % |

| | | | | | | | | | | | | | | | | |

| EBITDA | | | 4,317 | | | | 3,321 | | | | 996 | | | | 30.0 | % |

| EBITDA Margin | | | 43.3 | % | | | 41.0 | % | | | 2.3 | % | | | | |

Exploration

Table 12: Exploratory Wells Drilled – Ecopetrol Business Group

| A | | B | | | C | | | D | | | E | | | F | |

| | | 1Q 2018 | |

| Company | | Hydrocarbon

Presence | | | Suspended | | | Under

Evaluation | | | P&A | | | Total | |

| Ecopetrol S.A | | | 1 | | | | - | | | | 1 | | | | - | | | | 2 | |

| Hocol S.A | | | - | | | | - | | | | - | | | | - | | | | - | |

| ECAS | | | - | | | | - | | | | - | | | | - | | | | - | |

| Ecopetrol America (EAI) | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total | | | 1 | | | | 0 | | | | 1 | | | | 0 | | | | 2 | |

Includes appraisal wells.

| | 11 | |

| | | |

| |  | |

| | | |

During the exploratory campaign of the first quarter of 2018, Ecopetrol completed drilling the Búfalo-1 and Jaspe-6D wells; the former is currently under assessment; the latter was declared successful upon discovering heavy crude in the Coal Basalt Sands formation.

Additionally, appraisal wells operated by Parex are currently being drilled: Coyote-2, located in the Valle Medio del Magdalena (De Mares block) and Capachos Sur-2, located in the Piedemonte (Capachos block).

As for 2D seismic activity, Hocol S.A. is advancing in the process of acquiring 294 Km in the SN-15, with progress currently at 60%.

Internationally, Ecopetrol Brasil acquired 4,197 square kms of 3D seismic and 874 kms of 2D seismic with the objective to evaluate the potential of the “pre-salt” play in Santos and Campos basins (Round 4 and 15 in Brazil).

Table 13: Breakdown of Exploratory Wells – Ecopetrol Business Group

| A | | B | | C | | D | | E | | G | | H |

| # | | Quarter | | Well | | Block | | Basin | | Status | | Fecha TD |

| 1 | | First | | Bufalo-1 | | VMM-32 | | Middle Magdalena Basin | | Under Evaluation | | 1/3/2018 |

| 2 | | First | | Jaspe-6D | | Quifa | | Eastern Plains Basin | | Hydrocarbon Presence | | 1/30/2018 |

Production

Table 14: Gross Production* - Ecopetrol Business Group

| A | | B | | | C | | | D | |

| mboed | | 1Q 2018 | | | 1Q 2017 | | | ∆ % | |

| Crude Oil | | | 532.5 | | | | 543.3 | | | | (2.0 | )% |

| Natural Gas | | | 107.9 | | | | 111.0 | | | | (2.8 | )% |

| Total Ecopetrol S.A. | | | 640.4 | | | | 654.3 | | | | (2.1 | )% |

| | | | | | | | | | | | | |

| Crude Oil | | | 20.8 | | | | 22.1 | | | | (5.9 | )% |

| Natural Gas | | | 7.2 | | | | 4.7 | | | | 53.2 | % |

| Total Hocol | | | 28.0 | | | | 26.8 | | | | 4.5 | % |

| | | | | | | | | | | | | |

| Crude Oil | | | 9.0 | | | | 11.5 | | | | (21.7 | )% |

| Natural Gas | | | 4.9 | | | | 4.3 | | | | 14.0 | % |

| Total Equion** | | | 13.9 | | | | 15.8 | | | | (12.0 | )% |

| | | | | | | | | | | | | |

| Crude Oil | | | 4.5 | | | | 4.4 | | | | 2.3 | % |

| Natural Gas | | | 0.4 | | | | 0.4 | | | | 0.0 | % |

| Total Savia** | | | 4.9 | | | | 4.8 | | | | 2.1 | % |

| | | | | | | | | | | | | |

| Crude Oil | | | 11.1 | | | | 8.5 | | | | 30.6 | % |

| Natural Gas | | | 2.2 | | | | 2.0 | | | | 10.0 | % |

| Total Ecopetrol America | | | 13.3 | | | | 10.5 | | | | 26.7 | % |

| | | | | | | | | | | | | |

| Crude Oil | | | 577.9 | | | | 589.8 | | | | (2.0 | )% |

| Natural Gas | | | 122.6 | | | | 122.4 | | | | 0.2 | % |

| Total Group's Production | | | 701 | | | | 712 | | | | (1.5 | )% |

* Gross production includes royalties and is prorated for Ecopetrol’s share in each company.

** Equión and Savia are incorporated through the equity method. - Note: Gas production includes white products.

In the first quarter of 2018, the Ecopetrol Group’s average production totaled 701 mboed. Production during the first quarter was affected by a challenging public security environment that resulted in temporary closure of the Castilla, Chichimene and CPO9 fields. In February, certain communities in Meta Department blocked roads and attacked infrastructure, which had a negative impact on average production for the quarter, estimated at 12 mboed (an average of 3 mboed for the year to date). Moreover, low waterflow levels at the Caño Rubiales River limited the quota of water discharges from the Rubiales field, resulting in a production decline in March, with an estimated impact of 2.7 mboed for the quarter. In March, the Ecopetrol Group was able to resume its trajectory of production growth, with an average of 712 mboed for the month and 715 mboed at the close of the quarter, in line with the established annual target (715-725 mboed).

| | 12 | |

| | | |

| |  | |

| | | |

To mitigate and meet the year’s production target, the Ecopetrol Group has taken a series of measures, including i) further work on wells and boosting of activity with an additional drill for the Castilla field, ii) anticipating the Apiay field development project, scheduled for 2019, iii) anticipating and accelerating the plan for the injection of water in 40 acres of the Chichimene field and iv) increasing workover activity at the Castilla field, among others.

At the Rubiales field, we are advancing our water injection work, anticipating the drilling campaign and well servicing activities.

In the first quarter of 2018, Ecopetrol’s subsidiaries contributed 60 mboed, i.e., 8.6% of total volume, an increase of 2.2 mboed (3.8%) as compared to the first quarter of 2017. The most significant growth was noted at Hocol and Ecopetrol América (EAI). Hocol now has more gas marketing contracts, which has allowed it to increase gas production by approximately 53.2% as compared to the first quarter of 2017. Further, EAI is reporting growth in crude production of approximately 3 mboed, largely due to its increased share of the K2 field as of December 2017.

In 2018, drilling activity has increased. In addition to the drilling in Castilla, Rubiales, Quifa and the Cira Infantas, campaigns have been reactivated in 7 fields (Dina, Arrayan, Tibú, Yarigui, Llanito, Akacias and Chichimene). In the first quarter there were 18 rigs in direct operation, which has doubled the number of rigs used in 2017. For the second semester, the simultaneous operation of 27 rigs is planned. While in the associated operation this year will have 25 more rigs. All this activity is addressed to achieve the production goal of the year between 715 and 725 mboed.

Projects to increase the Recovery Factor:

Since the creation of the Recovery Program, 42 pilot projects have been initiated. In 2018, seven additional pilots were included in the program; the results are presented in the following table:

Table 15: Recovery pilots - Ecopetrol Business Group

| A | | B | | | C | | | D | | | E | |

| BALANCE | | Total | | | Direct

operation | | | Operation with

parthers | | | In the process

of expansion | |

| Operation (1) | | | 21 | | | | 12 | | | | 9 | | | | 6 | |

| Finished (2) | | | 21 | | | | 14 | | | | 7 | | | | 10 | |

| Total recovery pilots | | | 42 | | | | 26 | | | | 16 | | | | 16 | |

| (1) | Of the pilots in operation, six (6) are in the visualization and expansion analysis phase (Chichimene WF, Castilla WF, Apiay WF, Suria WF, Casabe CEOR, Teca ICV). |

| (2) | Of the completed pilots ten (10) are in the expansion project structuring phase (Dina K CEOR, Llanito WF, Galán WF, Tello CEOR, Santa Clara WF, Rio Ceibas Gas, Palogrande CEOR, Cara-Cara ASP, Jazmín ICV, Las Monas WF), six (6) are being assessed for possible expansion, and five (5) were not considered for expansion. |

Of the 42 pilots, 21 are in operation (6 are in visualization and analysis of the expansion) and the remaining 21 are finalized. Among the pilots completed, there are 10 that are in structuring the expansion project, 6 pilots are in evaluation of the possible expansions, and 5 were documented for possible future expansion.

The different technologies being applied in these pilots will allow to increase the recovery factor. The processes of secondary recovery by water injection, estimate incremental recovery factor between 3% and 11%, the tertiary recovery by injection of improved water and gas estimate an incremental recovery factor between 5% and 11%, and with the tertiary recovery of injection of steam an incremental recovery factor greater than 20%.

| | 13 | |

| | | |

| |  | |

| | | |

In the first quarter of 2018, progress was made in the implementation of the improved water injection project of the Dina K field, where 7 wells of the 16 defined within the plan have been drilled and completed.

Table 16: Lifting Cost* - Ecopetrol Business Group

| A | | B | | | C | | | D | | | E |

| USD/Bl | | 1Q 2018 | | | 1Q 2017 | | | ∆ % | | | Explanation |

| Lifting cost * | | | 8.09 | | | | 6.67 | | | | 21.3 | % | | • Cost (+USD 1.24 /B):Higher cost in Ecopetrol S.A. and Ecopetrol America Inc, in processes of energy, subsurface maintenance and support. |

| | | | | | | | | | | | | | | |

| TRM | | | 2,858.9 | | | | 2,922.5 | | | | 2.2 | % | | • Exchange Rate (+USD 0.18 /B ): lower exchange rate COP -63.59/ USD.vs 1T 2017 |

* Calculated based on barrels produced without royalties.

The USD 1.42/bl increase in the lifting cost is primarily due to (includes exchange rate effect):

| · | Increased energy consumption, given the larger number of wells drilled, implementation of recovery techniques and additional water management (USD 0.39/bl) |

| · | Higher subsoil maintenance costs, due to the larger quantity and complexity of the interventions and well servicing, thereby maintaining the basic production curve (USD 0.27/bl) |

| · | Higher surface maintenance costs primarily due to the larger quantity of equipment intervened in order to maintain operational reliability and integrity in our production operations (USD 0.21/bl) |

| · | Increased operating costs with partners and Ecopetrol contracted services (USD 0.16/bl) |

| · | Savings due to the decline in the failure rate, facilities maintenance and other initiatives (-USD 0.13/bl) |

| · | Lower exchange rate (USD 0.18/bl) |

| · | Other factors (USD 0.34/bl) |

Table 17: Dilution Cost* - Ecopetrol Business Group

| A | | B | | | C | | | D | | | E |

| USD/Bl | | 1Q 2018 | | | 1Q 2017 | | | ∆ % | | | Explanation |

| Dilution cost | | | 3.88 | | | | 4.50 | | | | -13.8 | % | | • Cost (-USD 0.62/Bl): Lower cost in Ecopetrol S.A. due to the implementation of transport optimization strategies with higher viscosity, and lower diluyent consumption. |

* Calculated based on barrels sold

Our dilution strategy continues to be one of the principal levers of the Ecopetrol Group’s structural savings. In particular, our dilution costs declined from USD 6.7/bl in 2014 (representing a dilution factor of 20%) to USD 3.88/bl in the first quarter of 2018 (representing a dilution factor of 14.8%).

Financial results for the Exploration and Production segment

Revenue in the first quarter of 2018 increased, primarily due to the higher crude price basket and narrower spreads, which counteracted the effects of lower production.

The segment’s cost of sales increased versus the first quarter of the previous year, as a result of: i) higher costs of crude purchases and imports of naphtha, in line with the international price behavior, ii) higher cost of subsoil maintenance due to greater interventions, primarily in Orinoquía and Rubiales, and greater preventive maintenance of rotating and static equipment as well as construction projects; iii) greater purchases of pipeline materials and accessories to execute subsoil and surface maintenance; iv) high cost of services contracted due to the receipt of the Recetor field; v) greater transport costs given the capacity expansion at Ocensa under ship-or-pay conditions; and vi) public security issues that led to greater costs for the evacuation of crude from Caño Limón.

| | 14 | |

| | | |

| |  | |

| | | |

The decrease in the exploration and production segment’s depreciation and amortization expenses in the first quarter of 2018 as compared to the first quarter of 2017 is primarily due to the combined effect of: i) greater incorporation of reserves in 2017 versus 2016, ii) decline in quarterly production as a result of blocking by the community and temporary closure of the Castilla, Chichimene and CPO9 fields, iii) maintenance of the Cupiagua CPF and iv) greater depreciation due to the increase in Ecopetrol America’s share of the K2 field as of December 2017.

The decrease in the exploration and production segment’s operating expenses in the first quarter of 2018 as compared to the first quarter of 2017 is primarily due to: i) lower spending associated with the wealth tax and ii) lower fleet and moorage costs associated with lower imports, partially offset by iii) increase in exploratory expenses due to greater seismic activity and drilling of wells by our subsidiaries, Ecopetrol Brasil and Hocol.

EBITDA for the exploration and production segment in the first quarter of 2018 was better than the first quarter of2017 (+COP 996 billion), with a margin of 43%, demonstrating a solid recovery.

The exploration and production segment’s posted a smaller financial (non-operating) loss during the first quarter of 2018 as compared to the first quarter of 2017, primarily due to: i) a decline in the financial cost of loans as a result of debt prepayments made in 2017, and ii) a decrease in the average COP/USD exchange rate applicable to the segment’s foreign currency debt.

Table 18: Profit and Loss Statement – Midstream

| A | | B | | | C | | | D | | | E | |

| COP Billion | | 1Q 2018 | | | 1Q 2017 | | | Cambio $ | | | Cambio % | |

| Sales | | | 2,729 | | | | 2,496 | | | | 233 | | | | 9.3 | % |

| DD&A Costs | | | 279 | | | | 271 | | | | 8 | | | | 3.0 | % |

| Variable Costs | | | 169 | | | | 114 | | | | 55 | | | | 48.2 | % |

| Fixed Costs | | | 310 | | | | 406 | | | | (96 | ) | | | (23.6 | )% |

| Cost of Sales | | | 758 | | | | 791 | | | | (33 | ) | | | (4.2 | )% |

| Gross profit | | | 1,971 | | | | 1,705 | | | | 266 | | | | 15.6 | % |

| Operating Expenses | | | 73 | | | | 136 | | | | (63 | ) | | | (46.3 | )% |

| Operating Profit (Loss) | | | 1,898 | | | | 1,569 | | | | 329 | | | | 21.0 | % |

| Financial Income (Loss) | | | (272 | ) | | | (49 | ) | | | (223 | ) | | | 455.1 | % |

| Share of profit of companies | | | (15 | ) | | | - | | | | (15 | ) | | | 0.0 | % |

| Net Income (Loss) Before Income Tax | | | 1,611 | | | | 1,520 | | | | 91 | | | | 6.0 | % |

| Provision for Income Tax | | | (638 | ) | | | (660 | ) | | | 22 | | | | (3.3 | )% |

| Net Income (Loss) Consolidated | | | 973 | | | | 860 | | | | 113 | | | | 13.1 | % |

| Non-controlling interests | | | (202 | ) | | | (187 | ) | | | (15 | ) | | | 8.0 | % |

| Net income (Loss) attributable to owners of Ecopetrol | | | 771 | | | | 673 | | | | 98 | | | | 14.6 | % |

| | | | | | | | | | | | | | | | | |

| EBITDA | | | 2,189 | | | | 1,935 | | | | 254 | | | | 13.1 | % |

| EBITDA Margin | | | 80.2 | % | | | 77.5 | % | | | 2.7 | % | | | | |

Progress on key projects

San Fernando – Monterrey:The Commissioning of the system began on January 1, 2018, transporting 205.8 mbod on the San Fernando - Apiay system.

Bicentenario pipeline bi-directional operation:The strategy implemented since 2017 on the Bicentenario oil pipeline reduced the impact on the Ecopetrol Group’s oil production caused by the attacks on the Caño Limón-Coveñas oil pipeline, preventing the generation of deferred production in its fields of influence. In the first quarter of 2018, the Caño Limón-Coveñas system was operational only 9 days, resulting in the execution of 12 reversal cycles on the Bicentenario pipeline.

| | 15 | |

| | | |

| |  | |

| | | |

Preliminary test of transport of crudes with higher viscosity (700 cSt):Preliminary test of transport of crudes of Castilla was conducted in February, 2018. The results are on the analysis phase.

Table 19: Volumes Transported – Ecopetrol Business Group

| A | | B | | | C | | | D | |

| mbod | | 1Q 2018 | | | 1Q 2017 | | | ∆ % | |

| Crude | | | 795.7 | | | | 805.3 | | | | (1.2 | )% |

| Refined Products | | | 282.5 | | | | 265.8 | | | | 6.3 | % |

| Total | | | 1,078.2 | | | | 1,071.1 | | | | 0.7 | % |

Total crude volumes transported by oil pipeline fell by 0.7% during the first quarter of 2018 as compared to the first quarter of 2017, primarily due to lower production in the Castilla, Chichimene and CPO9 fields as a result of the public security situations described above.

In the first quarter of 2018, contingent operations were activated through the Bicentenario oil pipeline, equivalent to an average of 33 mbod transported. Operations in the country’s south were also affected in the first quarter of 2018, by the detection and removal of multiple illegal valves on the Trans-Andean oil pipeline.

Of the total crude oil transported by the Colombian oil pipeline system, approximately 70% is owned by the Ecopetrol Group.

For refined products, volumes transported were up by 6.3% in the first quarter of 2018 as compared to the first quarter of 2017, primarily due to the fact that in the first quarter of 2017, the Cartagena-Barranquilla line was out of operations for 21 days to address mechanical integrity issues.

Approximately 28% of the volume transported during the quarter by multi-purpose pipelines in Colombia corresponded to refined products owned by the Ecopetrol Group.

Table 20: Cost per Barrel Transported - Ecopetrol Business Group

| A | | B | | | C | | | D | | | E |

| USD/Bl | | 1Q 2018 | | | 1Q 2017 | | | ∆ % | | | Explanation |

| Transportation cost | | | 3.12 | | | | 3.41 | | | | 8.5 | % | | • Volume (-USD 0.02 /B): Higher volumes transported in products pipelines.

• Cost (-USD 0.34 /B): Lower expenses due to Wealth tax elimination. |

| | | | | | | | | | | | | | | |

| TRM | | | 2,858.87 | | | | 2,922.47 | | | | 2.2 | % | | • Exchange Rate (+USD 0.07 /B ): Higher cost due to lower exchange rate of 63.59 COP/USD |

In respect of the cost per barrel transported indicator, a change of methodology was applied in the first quarter 2018, aimed at measuring the efficiency of operating costs and expenses of the transport systems. The indicator’s cost basis includes fixed and variable operating and maintenance costs, as well as administration and commercialization expenses (cost per barrel transported = operating costs and expenses / barrels evacuated) and excludes financial expenses and income taxes.

As for volume, the new methodology takes extraction output at the country level, i.e., crude deliveries to port and refinery, as well as domestic deliveries of refined products by the multi-purpose pipeline network. The [prior] methodology took total volumes of extraction output by subsidiary, and for this reason volumes were larger.

| | 16 | |

| | | |

| |  | |

| | | |

Table 21: Comparative cost per barrel transported – Ecopetrol Business Group

(USD /Bl)

| A | | B | | | C | | | D | |

| Period | | Actual

indicator | | | Previous

methodology

indicator | | | Difference | |

| 1Q 2017 | | | 3.41 | | | | 3.61 | | | | (0.2 | ) |

| 2Q2017 | | | 3.12 | | | | 3.46 | | | | (0.3 | ) |

| 3Q2017 | | | 3.06 | | | | 3.43 | | | | (0.4 | ) |

| 4Q 2017 | | | 3.61 | | | | 4.00 | | | | (0.4 | ) |

| 1Q 2018 | | | 3.12 | | | | 4.06 | | | | (0.9 | ) |

Financial results of the Midstream segment

The increase in the midstream segment’s revenue in the first quarter of 2018 as compared to the first quarter of 2017 is primarily due to: i) transport of volumes by reversal of the Bicentenario oil pipeline which, together with the Araguaney-Monterrey system and Ocensa, allowed for crudes transport during the period of non-availability of the Caño Limón-Coveñas system, and ii) the entry into operation of the San Fernando - Apiay system in January 2018. It is highlighted the 9.3% increase in revenue in the first quarter of 2018, despite the lower COP/USD average exchange rate.

The decrease in the midstream segment’s cost of sales in the first quarter of 2018 as compared to the first quarter of 2017 is primarily the net result of the following: .i) fixed costs declined, primarily due to delays in maintenance activities, which were expected to occur in the coming months of the year and ii)variable costs increased as a result of higher volumes transported in the 12 reversal cycles of the Bicentenario oil pipeline during the quarter and the entry into operation of the San Fernando - Apiay system.

The decrease in the midstream segment’s operating expenses in the first quarter of 2018 as compared to the first quarter of 2017 is primarily, due to the elimination of the wealth tax in 2018, which last payment obligation was in 2017.

The significant increase in the midstream segment’s financial loss in the first quarter of 2018 as compared to the first quarter of 2017 is primarily due to the loss recorded on the segment’ foreign exchange spread associated with the segment’s net dollar position in assets given the lower COP/USD average exchange rate.

For the first quarter of 2018, the midstream segment posted an EBITDA of COP 2.2 trillion, exceeding the results for the first quarter of 2017 by approximately COP 0.25 trillion, and yielding an EBITDA margin of 80%.

| | 17 | |

| | | |

| |  | |

| | | |

Table 22: Income and Loss Statement – Downstream

| A | | B | | | C | | | D | | | E | |

| COP Billion | | 1Q 2018 | | | 1Q 2017 | | | Cambio $ | | | Cambio % | |

| Sales | | | 8,075 | | | | 6,987 | | | | 1,088 | | | | 15.6 | % |

| DD&A Costs | | | 297 | | | | 264 | | | | 33 | | | | 12.5 | % |

| Variable Costs | | | 6,863 | | | | 5,848 | | | | 1,015 | | | | 17.4 | % |

| Fixed Costs | | | 438 | | | | 382 | | | | 56 | | | | 14.7 | % |

| Cost of Sales | | | 7,598 | | | | 6,494 | | | | 1,104 | | | | 17.0 | % |

| Gross profit | | | 477 | | | | 493 | | | | (16 | ) | | | (3.2 | )% |

| Operating Expenses | | | 198 | | | | 362 | | | | (164 | ) | | | (45.3 | )% |

| Operating Profit (Loss) | | | 279 | | | | 131 | | | | 148 | | | | 113.0 | % |

| Financial Income (Loss) | | | 293 | | | | (240 | ) | | | 533 | | | | (222.1 | )% |

| Share of profit of companies | | | 7 | | | | 4 | | | | 3 | | | | 75.0 | % |

| Net Income (Loss) Before Income Tax | | | 579 | | | | (105 | ) | | | 684 | | | | (651.4 | )% |

| Provision for Income Tax | | | (275 | ) | | | (110 | ) | | | (165 | ) | | | 150.0 | % |

| Net Income (Loss) Consolidated | | | 304 | | | | (215 | ) | | | 519 | | | | (241.4 | )% |

| Non-controlling interests | | | - | | | | - | | | | - | | | | 0.0 | % |

| Net income (Loss) attributable to owners of Ecopetrol | | | 304 | | | | (215 | ) | | | 519 | | | | (241.4 | )% |

| | | | | | | | | | | | | | | | | |

| EBITDA | | | 643 | | | | 558 | | | | 85 | | | | 15.2 | % |

| EBITDA Margin | | | 8.0 | % | | | 8.0 | % | | | (0.0 | )% | | | | |

Cartagena Refinery

Table 23: Throughput, Utilization Factor, Production and Margin – Cartagena Refinery

| A | | B | | | C | | | D | |

| | | 1Q 2018 | | | 1Q 2017 | | | ∆ % | |

| Throughput* (mbod) | | | 144.5 | | | | 122.9 | | | | 17.6 | % |

| Utilization Factor (%) | | | 87.9 | % | | | 65.3 | % | | | 34.6 | % |

| Refined Production (mboed) | | | 140.3 | | | | 119.7 | | | | 17.2 | % |

| Refining Margin (USD/Bl) | | | 11.5 | | | | 6.8 | | | | 69.1 | % |

* Corresponds to volumes actually loaded, not those received

The Cartagena refinery achieved a total sales volume of 151 mbd in the first quarter of 2018 (include 13 mbd of coke and 0.5 mbd of sulphur), of which 90 mbd corresponded to domestic sales and 61 mbd to exports. Sales represented revenue of USD 953 million in the first quarter of 2018, up 50% as compared to the first quarter of 2017 (USD 637 million), primarily as a result of stable operation at the refinery and the price increase.

The first quarter achieved an average throughput of 144 mbd, exceeding the average total for the year 2017 (136 mbd). The composition of the throughput in the first quarter of 2018 was 71% domestic crude and 29% imported, versus 39% domestic crude and 61% imported during the same period of 2017, which contributed to a reduction in cost of sales for the Ecopetrol Business Group.

In terms of gross refining margin, the first quarter achieved an average margin of USD 11.5/bl, up 69% as compared to the same period of 2017 (USD 6.8/bl). This result reflects the stable operations at the refinery, which has seen seven consecutive months (since September 2017) of double-digit gross margins, demonstrating the operation’s consolidation.

| | 18 | |

| | | |

| |  | |

| | | |

In March, the Cartagena refinery achieved its historically highest throughput (160.2 mbd), a result of the operating test at 165 mbd between March 14 and 22. With the test completed, the focus during the remainder of 2018 will be to seize margin opportunities for the refinery and define and implement initiatives to optimize operating and financial results in order to allow for a more efficient crude diet, maximize plant capacity and increase the availability of products to be marketed.

Barrancabermeja Refinery

Table 24: Throughput, Utilization Factor, Production and Margin – Barrancabermeja Refinery

| A | | B | | | C | | | D | |

| | | 1Q 2018 | | | 1Q 2017 | | | ∆ % | |

| Throughput* (mbod) | | | 214.9 | | | | 214.5 | | | | 0.2 | % |

| Utilization factor (%) | | | 83.6 | % | | | 78.2 | % | | | 7.0 | % |

| Refined Production (mboed) | | | 216.6 | | | | 216.4 | | | | 0.1 | % |

| Refining Margin (USD/Bl) | | | 11.8 | | | | 14.6 | | | | (19.1 | )% |

* Corresponds to volumes actually loaded, not those received.

Throughput and production remained stable in the first quarter of 2018 as compared to the first quarter in 2017. There was a 19.1% decline in the Barrancabermeja refinery’s gross refining margin, primarily due to: i) the increased spread in the price of the crudes basket versus the Brent price, which explains 14% of the change, in the face of ii) a decrease in the spread for refined products (primarily fuel oil and gasoline), which corresponds to the remaining 5% of the change, in line with performance in the international markets.

Table 25: Refining Cash Cost - Ecopetrol Business Group*

| A | | B | | | C | | | D | | | E | | J | |

| USD/Bl | | 1Q 2018 | | | 1Q 2017 | | | ∆ % | | | Explanation | | % USD | |

| Refining operating cash cost | | | 4.63 | | | | 4.89 | | | | -5.4 | % | | • Volume (-USD 0.28 /B): Higher charges due to stabilization and greater participation of national crudes in the REFICAR diet of Cartagena Refinery

• Cost (-USD 0.08 /B): Lower energy consumption in the Barrancabermeja refinery (gas). | | | 12.0 | % |

| | | | | | | | | | | | | | | | | | | |

| TRM | | | 2,858.9 | | | | 2,922.5 | | | | -2.2 | % | | • Exchange Rate (+USD 0.10 /B ): Higher cost due to lower exchange rate COP -63.59/ USD. | | | 12.0 | % |

* Includes Barrancabermeja and Cartagena refineries.

Financial results for the downstream segment

The increase in the downstream segment’s revenue in the first quarter of 2018 as compared to the first quarter of 2017 is primarily, due to better prices on the sale of refined products, in line with international price performance and higher output of valuable products (diesel and gasolines) at the Barrancabermeja and Cartagena refineries.

The increase in the downstream segment’s cost of sales in the first quarter of 2018 as compared to the first quarter of 2017 is primarily due to i) greater throughput at the Cartagena refinery, ii) higher price of the crudes basket at the two refineries, and iii) high cost of Essential raw materials and higher amount of sugar cane acquired by Bioenergy.

The decrease in the downstream segment’s operating expenses in the first quarter of 2018 as compared to the first quarter of 2017 is primarily due to the end of the stabilization period for the Cartagena refinery and the drop in project completion expenses, in addition to lower expenses incurred by elimination of the wealth tax as of 2018.

| | 19 | |

| | | |

| |  | |

| | | |

The refining segment posted financial (non-operating) income during the first quarter of 2018 as compared to a financial loss during the first quarter of 2017 primarily due to: i) the positive effect the Colombian peso’s appreciation versus the US dollar had on the segment’s net liability position in US dollars and ii) lower interest expense on loans as a result of debt prepayments made in 2017.

The segment showed a net profit in the first quarter of 2018 versus a loss for the same period of 2017, as explained by the stable operations of the refineries, lower expenses and the positive impact of the exchange rate difference.

This quarter showed good operating performance by the refineries as reflected in their 15% higher EBITDA versus the first quarter the previous year.

| 7. | Result of Efficiency Initiatives |

The Ecopetrol Group’s efficiency strategy continued in the first quarter of 2018, with a contribution of COP 462 billion, up COP 238 billion as compared to those reported in the first quarter of 2017.

It is important to highlight the efficiencies obtained at the Cartagena refinery, totaling COP 56 billion, primarily due to: i) the substitution of throughput from imported crudes to crudes produced by the Ecopetrol Group, yielding benefits totaling COP 36 billion, ii) greater use of throughput at the cracking and alkylation plants, generating savings of COP 14 billion and iii) structural cost efficiencies totaling COP 6 billion were reported, which positively impacted the Cartagena refinery’s cash cost by USD 0.17/bl. The remaining efficiencies for the downstream segment were contributed by the Barrancabermeja refinery, primarily due to the optimization of its raw materials.

Following is a breakdown of the principal savings:

Table 26: Principal structural savings initiatives in 2018

| A | | B | | | C | |

| COP Billion | | 1Q 2018 | | | 1Q 2017 | |

| Lower deferred production due to non-availability of pipelines | | | 213.1 | | | | 0.0 | |

| Optimization of drilling cost and facilities construction | | | 108.8 | | | | 60.9 | |

| Higher revenues and margins at refineries | | | 66.1 | | | | 55.5 | |

| Energy Strategy - Surplus sales + Cost optimization | | | 24.3 | | | | 0.0 | |

| Heavy crude oil dilution | | | 17.3 | | | | 51.4 | |

| Improved commercial strategy | | | 14.5 | | | | 0.2 | |

| Operative cost optimization | | | 13.7 | | | | 19.9 | |

| Optimization of O&M Midstream cost | | | 6.0 | | | | 0.0 | |

| Optimization of refinery cash cost | | | 0.0 | | | | 1.3 | |

| Savings on staff areas, maintenance of facilities and other | | | (1.5 | ) | | | 35.1 | |

| Total | | | 462.3 | | | | 224.3 | |

| | 20 | |

| | | |

| |  | |

| | | |

Investment as of March 31, 2018 totaled USD 405 million (78% in Ecopetrol S.A. and 22% in affiliates and subsidiaries), distributed as follows:

Table 27: Investments by Segment - Ecopetrol Business Group

| A | | B | | | C | | | D | | | E | |

| 1T 2018 (USD Million) | | Ecopetrol S.A. | | | Affiliates and

Subsidiaries | | | Total | | | Share | |

| Production | | | 288.6 | | | | 42.2 | | | | 330.8 | | | | 81.6 | % |

| Refining, Petrochemicals and Biofuels | | | 23.9 | | | | 10.8 | | | | 34.7 | | | | 8.6 | % |

| Exploration | | | 4.6 | | | | 23.3 | | | | 27.9 | | | | 6.9 | % |

| Transportation | | | 0.3 | | | | 11.7 | | | | 12.0 | | | | 3.0 | % |

| Total | | | 317.4 | | | | 88.0 | | | | 405.4 | | | | 100 | % |

Production:(81.6%) The Ecopetrol S.A. drilling campaign was concentrated in the Castilla field (13 wells). There were also notable advances made in the B3 Module of Rubiales (19 wells completed) and the Cupiagua condensates stabilization plant. In respect of affiliates and subsidiaries, drilling activities were carried out by Ecopetrol América in the K2 and Dalmatian fields, and by Hocol at the Espinal, Guarrojo and Corocora fields. During the first quarter the public order situations made us to delay close to USD 50 million of investments to the second quarter.

Exploration:(6.9%) Ecopetrol S.A. engaged in viability activities at the Recetor, Condor, CPO-8, VMM-6 and PUT-13 blocks; completion and testing at the Lorito, Búfalo and Coyote wells; and environmental recovery at the Caño Sur and CPO-10 blocks. Hocol progressed in 2D seismic and Ecopetrol Brasil participated in rounds of new business in Brazil.

Refining, Petrochemicals and Biofuels:(8.6%) Major and operational continuity maintenance activities were executed on the UOP II unit of the Barrancabermeja refinery, as well as on compressor equipment, steam/gas turbines and major tanks at the Cartagena refinery.

Transport:(3.0%) Progress on system continuity and integrity activities was made at the Poblanco Diversion, and progress was also made in adapting the country’s jet fuel infrastructure. Additionally, Ocensa undertook the replacement of pumping equipment at the El Porvenir station.

| II. | Organizational Consolidation and Social Responsibility (Ecopetrol S.A.) |

| 1. | Organizational Consolidation |

Table 28: HSE (Health, Safety and Environment) Performance

| A | | B | | | C | |

| HSE Index* | | 1Q 2018 | | | 1Q 2017 | |

| Accident frequency index (accidents per million labor hours) | | | 0.69 | | | | 0.63 | |

| Environmental incidents | | | 3 | | | | 4 | |

* The results of the indicators are subject to change after the close of the quarter due to the fact that some accidents and incidents are reclassified according to the final results of the investigations.

** As of 2018, the results for the Ecopetrol Business Group are reported.

Environmental incidents consist of hydrocarbon spills of more than 1 barrel, with an environmental impact.

| | 21 | |

| | | |

| |  | |

| | | |

Lisama 158 / La Fortuna incident

On March 2, 2018, a seepage of water and traces of crude oil occurred near the Lisama 158 well, located at La Fortuna, in the Valle Medio del Magdalena region (Colombia). Ecopetrol activated its contingency plan for containing the spill and permanently resolve this situation in accordance with its risk management and HSE protocols. It is estimated that between March 12 and 15, 550 barrels of crude, mixed with mud and rainwater, went into the streams of La Lizama and Caño Muerto. As of March 30, flows from the Lisama-158 stopped and a specialized “snubbing unit” equipment had been installed to permanently and safely shutting down the well. Ecopetrol has ordered an investigation to determine the cause of the incident.

This incident was recorded in Ecopetrol’s HSE indicators.

Environment Management:

| · | Strengthening of direct relationships with governing and municipal authorities, coordinating actions by the company and local governments. |

| · | Construction of permanent dialog and communication scenarios with relevant players in the surrounding environment (community representatives), to build relations of trust and clarify their expectations with regards to Ecopetrol. Progress has been made in the creation of channels by which Ecopetrol reports on its activity, with permanent presence in the various municipalities through citizen participation offices, and professionals to manage environment relationship assigned to each municipality. |

| · | The Office of the Vice President for Sustainable Development and the Interior Ministry have established sub-commissions with governing entities, with the participation of city mayors, community delegates and Ecopetrol representatives, to address local issues such as goods and services, and social and environmental investment. |

| 2. | Corporate Responsibility |

Social investment:

As of March 31, 2018, voluntary socio-environmental funds had been invested totaling COP 11.443 billion. Funds invested in the first quarter of 2018 were intended for programs to reduce gaps in health and education, and to support sustainable production projects, infrastructure, institutional strengthening, water conservation and sustainable use, restoration and sustainable use of strategic ecosystems, and recreation, culture and sports.

General Shareholders’ Meeting:

The matters approved by Ecopetrol’s General Shareholders Meeting held on March 23, 2018 included i) approval of management reports, ii) approval of Ecopetrol’s unconsolidated and consolidated financial statements as of December 31, 2017, iii) opinion of Ecopetrol’s Statutory Auditor, iv) approval of the plan for the distribution of earnings, v) election of Ernst & Young as Statutory Auditor for 2018, vi) election of members of Ecopetrol’s Board of Directors for the 2017 - 2018 period, and vii) approval of amendments to Ecopetrol’s Bylaws.

| III. | Quarterly Results Presentations |

Ecopetrol management will make two online presentations to review the results of the first quarter of 2018.

| Spanish | English |

| May 4, 2018 | May 4, 2018 |

| 7:30 a.m. Bogotá | 9:00 a.m. Bogotá |

| 8:30 a.m. NYT | 10:00 a.m. NYT |

The online broadcast will be available at the Ecopetrol website:www.ecopetrol.com.co

The presentation via webcast will be available at the following links:

http://event.onlineseminarsolutions.com/wcc/r/1664951-1/87664B39E2B6F92BDBC83D5D456C0CDB(Spanish)

http://event.onlineseminarsolutions.com/wcc/r/1665313-1/7F16E6F3E53C5C077B9AA9AE0B8133C4(English)

| | 22 | |

| | | |

| |  | |

| | | |

Please be sure your browser allows for normal operation of the online presentation. We recommend the latest versions of Internet Explorer, Google Chrome and Mozilla Firefox.

Excel figures will be available at the following link:

https://www.ecopetrol.com.co/wps/portal/web_es/ecopetrol-web/investors/financial-information/quarterly-earnings

Statements on future projections:

This press release may contain statements of future projections relating to business prospects, estimates of operating and financial results, and Ecopetrol’s growth prospects. These are projections, and therefore are based solely on management’s expectations of the company’s future and its continuous access to capital to finance the Company’s sales plan. Achieving these estimates in the future depends basically on changes in market conditions, government regulations, competitive pressures, the performance of the Colombian economy and industry, and other factors; therefore, they are subject to change without prior notice.

Contact Information:

Capital Markets Manager

María Catalina Escobar

Telephone: +571-234-5190 - Email:investors@ecopetrol.com.co

Media Relations (Colombia)

Jorge Mauricio Tellez

Telephone: + 571-234-4329 - Email:mauricio.tellez@ecopetrol.com.co

| | 23 | |

| | | |

| |  | |

| | | |

| IV. | Ecopetrol Business Group Appendices |

Table 1: Gross Production per Region – Ecopetrol Business Group Net Interest

| A | | B | | | C | | | D | |

| mboed | | 1Q 2018 | | | 1Q 2017 | | | ∆ (%) | |

| La Cira-Infantas | | | 27.3 | | | | 22.5 | | | | 21.3 | % |

| Casabe | | | 14.0 | | | | 16.5 | | | | (15.2 | )% |

| Yarigui | | | 14.3 | | | | 15.8 | | | | (9.5 | )% |

| Other | | | 28.2 | | | | 31.3 | | | | (9.9 | )% |

| Total Central Region | | | 83.8 | | | | 86.1 | | | | (2.7 | )% |

| | | | | | | | | | | | | |

| Castilla | | | 109.2 | | | | 113.8 | | | | (4.0 | )% |

| Chichimene | | | 64.0 | | | | 68.9 | | | | (7.1 | )% |

| Cupiagua | | | 27.3 | | | | 41.1 | | | | (33.6 | )% |

| Cusiana (2) | | | 40.8 | | | | 34.9 | | | | 16.9 | % |

| Other (3) | | | 22.7 | | | | 17.0 | | | | 33.5 | % |

| Total Orinoquía Region | | | 264.0 | | | | 275.7 | | | | (4.2 | )% |

| | | | | | | | | | | | | |

| Huila Area (4) | | | 3.2 | | | | 3.2 | | | | 0.0 | % |

| San Francisco Area | | | 6.3 | | | | 6.5 | | | | (3.1 | )% |

| Tello Area | | | 3.8 | | | | 4.5 | | | | (15.6 | )% |

| Other | | | 12.1 | | | | 12.9 | | | | (6.2 | )% |

| Total South Region | | | 25.4 | | | | 27.1 | | | | (6.3 | )% |

| | | | | | | | | | | | | |

| Rubiales (1) | | | 114.4 | | | | 118.6 | | | | (3.5 | )% |

| Caño Sur (3) | | | 2.8 | | | | 1.3 | | | | 115.4 | % |

| Total East Region | | | 117.2 | | | | 119.9 | | | | (2.3 | )% |

| | | | | | | | | | | | | |

| Guajira | | | 24.7 | | | | 26.7 | | | | (7.5 | )% |

| Caño Limón | | | 24.5 | | | | 17.8 | | | | 37.6 | % |

| Piedemonte | | | 32.5 | | | | 28.6 | | | | 13.6 | % |

| Quifa | | | 20.0 | | | | 19.4 | | | | 3.1 | % |

| Nare | | | 12.7 | | | | 14.1 | | | | (9.9 | )% |

| Other | | | 35.6 | | | | 38.9 | | | | (8.5 | )% |

| Total Associated Operations | | | 150.0 | | | | 145.5 | | | | 3.1 | % |

| | | | | | | | | | | | | |

| Total Ecopetrol S.A. | | | 640.4 | | | | 654.3 | | | | (2.1 | )% |

| | | | | | | | | | | | | |

| Direct Operation | | | 492.5 | | | | 512.0 | | | | (3.8 | )% |

| Associated Operation | | | 147.9 | | | | 142.3 | | | | 3.9 | % |

| | | | | | | | | | | | | |

| Ocelote (**) | | | 12.4 | | | | 14.3 | | | | (13.3 | )% |

| Other | | | 15.6 | | | | 12.5 | | | | 24.8 | % |

| Total Hocol | | | 28.0 | | | | 26.8 | | | | 4.5 | % |

| | | | | | | | | | | | | |

| Piedemonte | | | 13.6 | | | | 14.5 | | | | (6.2 | )% |

| Tauramena/Rio Chitamena | | | 0.3 | | | | 0.2 | | | | 50.0 | % |

| Other | | | 0.0 | | | | 1.2 | | | | (100.0 | )% |

| Total Equión* | | | 13.9 | | | | 15.9 | | | | (12.6 | )% |

| | | | | | | | | | | | | |

| Lobitos | | | 1.3 | | | | 1.7 | | | | (23.5 | )% |

| Peña Negra | | | 2.9 | | | | 2.3 | | | | 26.1 | % |

| Other | | | 0.7 | | | | 0.8 | | | | (12.5 | )% |

| Total Savia* | | | 4.9 | | | | 4.8 | | | | 2.1 | % |

| | | | | | | | | | | | | |

| Dalmatian | | | 1.1 | | | | 1.3 | | | | (15.4 | )% |

| K2 | | | 5.0 | | | | 2.0 | | | | 150.0 | % |

| Gunflint | | | 7.2 | | | | 7.2 | | | | 0.0 | % |

| Total Ecopetrol America Inc. | | | 13.3 | | | | 10.5 | | | | 26.7 | % |

| | | | | | | | | | | | | |

| Total Affiliates | | | 60.1 | | | | 58.0 | | | | 3.6 | % |

| | | | | | | | | | | | | |

| Total Group's Production | | | 701 | | | | 712 | | | | (1.7 | )% |

* Equión and Savia do not consolidate within the Ecopetrol Business Group.

** Ocelote: Since Q1 2017, in the production of the Guarrojo contract, the Pintado and Guarrojo fields have been included along with Ocelote.