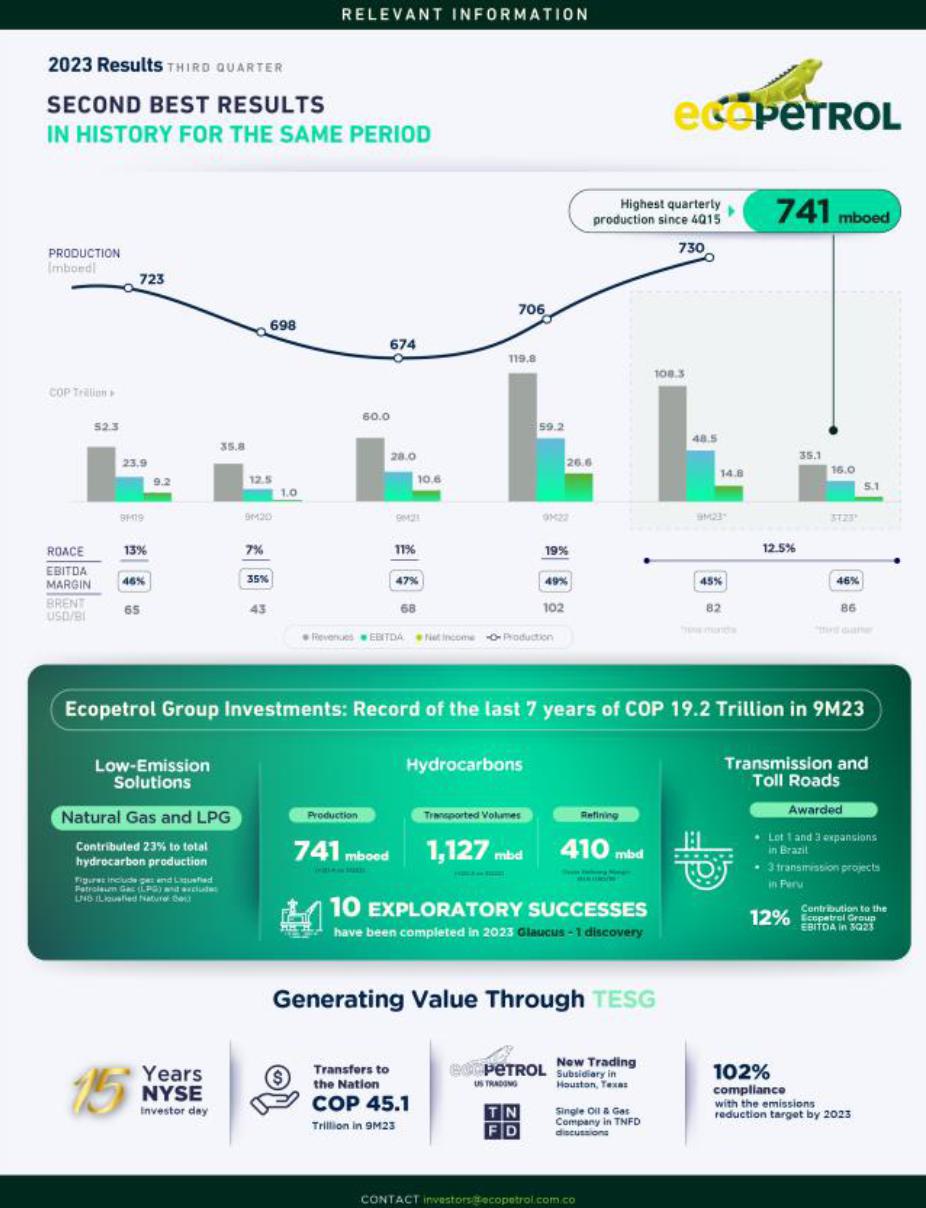

In terms of production performance, we achieved an average of 741 mboed during the quarter, marking an increase of 20 mboed in comparison to 3Q22. The contributions and production growth observed in key areas including the Caño Sur and Rubiales fields in Colombia, along with our operations in the Permian region in the United States are worth noting. Furthermore, decarbonization efforts remain a focal point, as evidenced by the successful reduction of carbon emissions of 351 thousand tCO2e in the first nine months of 2023 in the upstream segment. The midstream segment increased total transported volume by 52 mbd versus 3Q22, resulting in a total of 1,127 mbd transported in 3Q23. This growth is primarily attributed to the higher crude volumes transported, particularly associated with greater production levels in the Llanos region. Our refining segment attained a consolidated throughput of 410 mbd, and a combined gross margin of USD 20.6 USD/Bl. This combined gross margin represents the second highest achieved this year and ranks as the third highest historically. These achievements were possible because of the uninterrupted operation of the Cartagena Crude Oil Plant Interconnection project (IPCC), underpinned by an average operational availability of 95%. This performance compares favorably to 3Q22 when we reported a combined throughput of 395 mbd and a combined gross margin of 20.3 USD/Bl. On the commercial front, in addition to the opening of our trading subsidiary in Houston, we are pleased to highlight the improved realized prices of our export crude basket, increased international sales, and the performance of our subsidiary, Ecopetrol Trading Asia, which has successfully marketed over 100 million barrels of crude in the Asian market to date. In addition, our Carbon Trading desk is making considerable strides in advancing our decarbonization strategy within our commercial operations. Notably, in 2023, we have executed three carbon-offset crude oil shipments, offsetting a total of 181 thousand tons of CO2 emissions. During 3Q23, in our low-emissions solutions business line, natural gas and LPG collectively contributed 23% of the Group's overall hydrocarbon production. In renewable energy, our solar parks, including Brisas, Castilla, and San Fernando, alongside the Cantayús Small Hydroelectric Plant, collectively reduced emissions by 18,974 tons of CO2 equivalent by the end of September. Additionally, these initiatives yielded cost savings of nearly COP 28,155 million. | | Our transmission and toll roads business line continues to record positive operating and financial results. ISA accounted for 12% of the Group's EBITDA for 3Q23. During this same period, our subsidiary achieved total revenues of COP 3.2 trillion and an EBITDA of COP 1.9 trillion. During 3Q23, ISA, through ISA CTEEP, secured the winning bid for Lot One in Brazil, in addition to three expansion projects. In Peru, the Transmantaro Consortium was awarded three projects, and ISA finalized an agreement with Cenit for a pumping station connection contract at El Copey substation. In toll roads, we continue to make significant progress in the execution of the Ruta del Loa project, as well as ongoing work in the concessionaires Ruta de la Araucanía and Ruta de Los Ríos. The following are some of the most significant TESG milestones: Concerning the environment, Ecopetrol continued to demonstrate our commitment to integral water management practices during 3Q23, successfully reusing 38.8 million cubic meters of water in its operations, and effectively alleviating the pressure on local water resources. Furthermore, a total reduction of 423,199 metric tons of CO2 equivalent was reported as of September. This achievement represents a 102% compliance with our annual emissions reduction plan. During 3Q23, Ecopetrol introduced the “Taskforce on Nature-related Financial Disclosures (TNFD) recommendations framework, in which it actively participated as member. This engagement has allowed us to better identify environmental impacts and dependencies related to nature while effectively managing the associated risks and opportunities. In parallel, we presented our third specialized report on climate change management following the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). In the social dimension, by the end of 3Q23 we have allocated COP 298,589 million for the implementation of our Territorial Development Portfolio. This portfolio encompasses a range of strategic and mandatory investments in social, environmental, and community-related initiatives. |