UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2008

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 333-153896

AXCAN INTERMEDIATE HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

74-3249870

(IRS Employer Identification Number)

22 Inverness Center Parkway

Suite 310

Birmingham, AL 35242

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (205) 991-8085

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ¨ No x*

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer x Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of March 31, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, there was no established public trading market for any of the common stock of the registrant and therefore, an aggregate market value of common stock of the registrant based on sales or bid and asked prices is not determinable. As of December 18, 2008, there were 100 shares of common stock of the registrant outstanding, all of which were owned by Axcan MidCo Inc.

Documents incorporated by reference: None.

| * | The registrant has not been subject to such filing requirements for the past 90 days. |

TABLE OF CONTENTS

- 2 -

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the U.S. federal securities laws. Statements other than statements of historical facts including, without limitation, statements regarding our future financial position, business strategy, budgets, projected costs and plans, future industry growth and objectives of management for future operations, are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “project,” “forecast,” “anticipate,” “believe” or “continue” or the negative thereof or variations thereon or similar terminology.

Although we believe that the expectations reflected in these forward-looking statements are reasonable, we can give no assurance that such expectations will prove to have been correct. Certain of the important factors that could cause actual results to differ materially from our expectations, or “cautionary statements,” include, but are not limited to, those discussed in “Item 1A. Risk Factors”, “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations”, as well as elsewhere in this Annual Report on Form 10-K.

We caution you not to place undue reliance on any forward-looking statements and we do not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect the occurrence of unanticipated events. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements.

- 3 -

PART I

Overview

Axcan Intermediate Holdings Inc. was incorporated in Delaware in 2007 and, together with its subsidiaries, is a leading specialty pharmaceutical company concentrating in the field of gastroenterology with operations in the U.S., Canada and the EU. Unless the context requires otherwise, references in this Annual Report on Form 10-K to “we”, “our”, “us”, “the Company” and “Axcan” means Axcan Intermediate Holdings Inc. and all of its subsidiaries. We market and sell pharmaceutical products used in the treatment of a variety of gastrointestinal diseases and disorders. Our main product lines include ULTRASE, PANZYTRAT and VIOKASE, which are pancreatic enzyme products for the treatment of exocrine pancreatic insufficiency; URSO / URSO 250, URSO FORTE / URSO DS, and DELURSAN, which are ursodiol products for the treatment of certain cholestatic liver diseases; SALOFALK and CANASA, which are mesalamine-based products for the treatment of certain inflammatory bowel diseases; CARAFATE and SULCRATE, sucralfate products for the treatment of gastric and duodenal ulcers; and PYLERA, a product for the eradication ofHelicobacter pylori in patients with duodenal ulcer disease. We also have a number of projects in all phases of clinical development, as further described below in the section “Products in Development.”

In addition to our marketing activities, we carry out research and development activities on products at various stages of development. These activities are carried out primarily with respect to products we currently market in connection with lifecycle management initiatives, as well as product candidates which are acquired or licensed from third parties. By combining our marketing capabilities with our research and development experience, we distinguish ourselves from other specialty pharmaceutical companies that focus solely on distribution of products and we offer licensors the prospect of rapidly expanding the potential market for their products on a multinational basis. As a result, we are presented with opportunities to acquire or in-license products that have been advanced to the later stages of development by other companies. Our focus on products in late-stage development enables us to reduce risks and expenses typically associated with new drug development.

Our reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, are available free of charge in, or may be accessed through, the “Investor Relations” section of the Company’s website at www.axcan.com as soon as reasonably practicable after the Company files or furnishes such material with or to the Securities and Exchange Commission, or the SEC. In addition, copies of these reports will be made available free of charge, upon written request to Isabelle Adjahi, Senior Director, Investor Relations and Communications, Axcan Pharma, 597 Laurier Blvd., Mont-Saint-Hilaire, Quebec J3H 6C4, Canada. Axcan Intermediate Holdings Inc. is located at 22 Inverness Center Parkway, Suite 310, Birmingham, AL 35242.

The information on the Company’s website is not included as part of, nor incorporated by reference into, this Annual Report on Form 10-K.

Transactions

The February 2008 Transactions

On November 29, 2007, Axcan Intermediate Holdings Inc., then known as Atom Intermediate Holdings Inc., entered into an Arrangement Agreement with Axcan Pharma Inc., or Axcan Pharma, pursuant to which we agreed to, through an indirect wholly-owned subsidiary, acquire all of the outstanding common stock of Axcan Pharma and enter into other various transactions in accordance with the Plan of Arrangement. We refer to such transactions collectively in this report as the Arrangement.

At a special meeting of Axcan Pharma’s shareholders on January 25, 2008, the holders of more than 99% of the outstanding common shares voted on a special resolution to approve the Arrangement. On January 28, 2008, the Superior Court of Quebec issued a final order approving the Arrangement.

- 4 -

On February 25, 2008, the Arrangement was completed and as a result,

| | • | | each share of Axcan Pharma common stock outstanding was deemed transferred to Axcan Intermediate Holdings Inc. and holders of such common stock received $23.35 per share of Axcan Pharma common stock, or the offer price, in compensation from us, without interest and less any required withholding taxes; |

| | • | | all granted and outstanding options to purchase common stock of Axcan Pharma under Axcan Pharma’s stock plans, other than those options held by Axcan Holdings Inc. or its affiliates, were deemed vested and transferred to Axcan Pharma and cancelled in exchange for an amount in cash equal to the excess, if any, of the offer price over the applicable exercise price for the option for each share of common stock subject to such option, less any required withholding taxes; and |

| | • | | all vested and unvested deferred stock units, or DSUs, and restricted stock units, or RSU, issued under Axcan Pharma’s stock option plans, were deemed vested and then cancelled and terminated. Each holder of a DSU or RSU received the offer price, less any required withholding taxes, for each DSU and RSU formerly held. |

The Arrangement was financed through the proceeds from the initial offering of $228.0 million aggregate principal amount of our 9.25% secured notes due 2015, or the secured notes, the initial borrowings under a credit facility composed of term loans and a revolving credit facility, collectively the new senior secured credit facilities, borrowings under a senior unsecured bridge facility maturing on February 25, 2009, or the senior unsecured bridge facility, equity investments funded by direct and indirect equity investments from the Sponsor Funds, or certain investment funds associated with or designated by TPG Capital, or the Sponsor, certain investors who co-invested with the Sponsor Funds, including investment funds affiliated with certain of the initial purchasers of the outstanding notes, or the Co-Investors, and the cash on hand of Axcan Pharma and its subsidiaries. The closing of the offering of the secured notes, the new senior secured credit facilities and the senior unsecured bridge facility occurred substantially concurrently with the closing of the Arrangement on February 25, 2008. We refer to the Arrangement, the closing of the transactions relating to the Arrangement, and our payment of any fees and expenses related to the Arrangement and such transactions collectively in this report as the February 2008 Transactions.

Subsequent to the February 2008 Transactions, we became an indirect wholly-owned subsidiary of Axcan Holdings Inc., or Holdings, an entity controlled by the Sponsor Funds and the Co-Investors, and Axcan Pharma became our indirect wholly-owned subsidiary.

The Refinancing

On May 6, 2008, we completed our offering of $235.0 million aggregate principal amount of our 12.75% senior unsecured notes due 2016, or the senior notes. The net proceeds from this offering, along with our cash on hand, were used to repay in full our senior unsecured bridge facility. We refer to this offering of our senior notes, along with the related use of proceeds, as the Refinancing and, collectively, with the February 2008 Transactions, as the Transactions.

Financial Information

When financial information for the fiscal year ended September 30, 2008 is presented, including product revenue, this information is presented as the mathematical combination of the relevant financial information of the Predecessor (from October 1, 2007 to February 25, 2008) and the Successor (from February 26, 2008 to September 30, 2008) for such period. The financial information presented for the Predecessor is the financial information for Axcan Pharma Inc. and its consolidated subsidiaries and the financial information presented for the Successor is the financial information for Axcan Intermediate Holdings Inc. and its consolidated subsidiaries.

Industry Overview

The pharmaceutical industry is large and growing, enjoying one of the highest growth rates across all healthcare sectors, and, as of the end of the 2007 calendar year, has averaged 11.8% compound annual growth in terms of prescription spending since 1980. According to the Centers for Medicare and Medicaid Services, U.S. prescription drug spending has grown every year since 1980, including during recessionary periods. This growth has been driven by the introduction of new products, increasing utilization, population growth, aging population and price increases, none of which we believe are sensitive to economic cycles. This market dynamic creates opportunities for specialty pharmaceutical companies like us to successfully target attractive niches in therapeutic categories such as gastrointestinal diseases and disorders.

According to IMS, the U.S. market for gastrointestinal drugs was approximately $21 billion in 2006, of which approximately $15 billion was represented by proton pump inhibitors and H2 blockers for the treatment of symptoms associated with GERD. Our current marketed products do not address this segment of the market.

- 5 -

The remaining approximately $6 billion of the U.S. gastrointestinal pharmaceutical market consists of sales of products that are used to treat non-GERD gastrointestinal indications. The markets in the U.S. for products that are prescribed primarily by specialists to treat the diseases and disorders treated by our core product lines, including inflammatory bowel disease, cholestatic liver diseases, pancreatic insufficiency, gastric and duodenal ulcers and other related gastrointestinal disorders, are estimated to be approximately $682 million in the aggregate in fiscal year 2007. We believe that the stable historical growth rates of the markets in which we participate are primarily a function of the chronic nature of many of the disorders treated by our products.

Competitive Strengths

We believe we have a number of competitive strengths that will enable us to further enhance our position in the gastroenterology market.

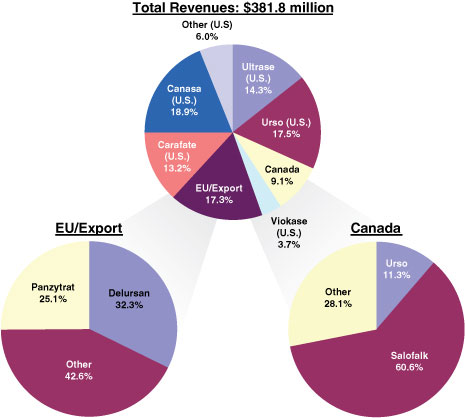

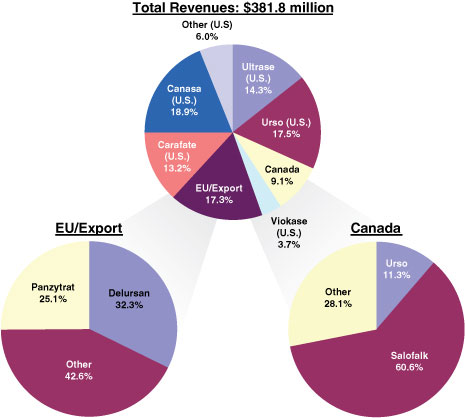

Diversified Portfolio of Branded Products.We currently market branded products in seven product categories that treat a broad range of gastrointestinal diseases and disorders. During fiscal year 2008, four product lines contributed 87.8% or more of our revenues, but no single product line accounted for more than 25.0% of our revenues. Our portfolio of products is also geographically diverse, with approximately 26.5% of our revenues being generated from sales outside the United States in fiscal year 2008. The following charts summarize our revenues in fiscal year 2008 by product line and by geography:

Leading Competitive Positions in Attractive Gastroenterology Markets.We have a strong track record of leveraging a product line’s unique market position to drive performance. CANASA and URSO are currently the only branded, actively-promoted products in their respective markets (in the U.S., with respect to CANASA and URSO 250 / URSO FORTE, and in Canada, with respect to URSO / URSO DS). CARAFATE is the only branded suspension-form sucralfate product in its market in the U.S. All these product lines enjoy leading market positions in terms of sales in their respective markets: CARAFATE is used to treat gastric and duodenal ulcers and accounted for 41.8% of the U.S. market for sucralfate products in terms of sales in fiscal year 2008; CANASA is used to treat ulcerative proctitis and colitis and accounted for 64.0% of the U.S. market for rectally-administered mesalamine products in terms of sales in fiscal year 2008; and URSO is the only ursodiol product indicated for the treatment of Primary Biliary Cirrhosis, or PBC, in the U.S. and accounted for 37.6% of the U.S. market for ursodiol products in terms of sales in fiscal year 2008. In addition, VIOKASE is the only branded non-enteric coated prescription pancreatic enzyme product in its market. VIOKASE is used to treat pancreatic insufficiency and, together with ULTRASE, accounted for 20.0% of the U.S. market for total prescriptions of pancreatic enzyme products in fiscal year 2008. We believe that our products are often the first line of treatment prescribed by physicians for these diseases and disorders. Many of the gastrointestinal diseases and disorders that our products are used to treat are chronic, and as a result, we believe that physicians tend to be reluctant to change a patient’s treatment program once the patient has been treated with and becomes accustomed to a particular product. As a result, we believe that our products experience a high degree of patient loyalty allowing us to maintain leading competitive positions in the markets in which we participate.

- 6 -

Non-Patent Barriers to Entry.Despite not having long-term patent protection, we believe that our core product lines benefit from a variety of regulatory, clinical, sourcing and manufacturing barriers to entry, including, depending upon the product line and the product, the requirement to obtain certain regulatory approvals by a specified date, the requirement to conduct clinical trials, the ability to source certain high-grade active pharmaceutical ingredients and the know-how required to manufacture certain dosage forms. We believe that these barriers to entry may create impediments for generic competitors to introduce and market generic versions of certain of our products, including products from our ULTRASE, VIOKASE, CANASA and CARAFATE product lines. See “Item 1A. Risk Factors—Risks Related to Our Business.”

Focused Sales Force with Market-Leading Performance.By focusing on establishing strong relationships with high-volume prescribing gastroenterologists, hepatologists and cystic fibrosis centers, we are able to effectively penetrate the gastroenterology market. As of September 30, 2008, our sales force is comprised of 151 sales representatives, with 82 located in the United States, 58 in the EU (including a contracted sales force in Germany that devotes its efforts exclusively to selling our products) and 11 in Canada.

Consistently Strong Historical Organic Growth and High Free Cash Flow Generation.Our business is characterized by strong free cash flows due to our robust operating history and minimal capital intensity. Over the last five fiscal years, we have increased revenue and adjusted EBITDA at compound annual growth rates of 16.3% and 22.7%, respectively. In addition, our capital expenditure requirements have historically been minimal, averaging 2.4% of revenues over the last six fiscal years, providing for strong free cash flow conversion. Over the last six fiscal years, we have generated cumulative free cash flow of approximately $385 million. We believe, but cannot guarantee, that our strong free cash flow will enable us to adequately service debt and will provide us with financial flexibility to invest in our business. For information regarding the risks we and our business face, please see “Item 1A. Risk Factors.”

Proven Track Record in Acquiring Products and Building Market Share.Our business development effort is focused on expanding our product portfolio by capitalizing on our core knowledge of gastrointestinal markets. Our experienced business development team uses a rigorous and disciplined approach to identify and acquire products that can be grown by our sales force using the strong relationships we have with gastroenterology practitioners. We have a strong record of acquiring and developing products and growing their market share, as evidenced by our leading position in a number of the markets in which we participate.

In addition to URSO, CANASA, CARAFATE, ULTRASE, SALOFALK and VIOKASE, after successfully completing Phase III trials for PYLERA and obtaining FDA approval in 2006, we launched PYLERA in the United States in May 2007. During the rolling quarter ended September 30, 2008, PYLERA had already successfully captured 15.8% of the U.S. market in terms of total prescriptions written by gastroenterologists for the eradication ofHelicobacter pylori, a bacterium recognized as being the main cause of gastric and duodenal ulcers.

Experienced and Dedicated Management Team.We have a highly experienced management team at both the corporate and operational levels. Our team is led by Frank Verwiel, M.D., our President and Chief Executive Officer, formerly with Merck & Co., Inc. and a 20-year veteran of the healthcare industry, who joined Axcan Pharma Inc. as President and Chief Executive Officer in July 2005. David Mims, formerly with Scandipharm, Inc., is our Executive Vice President and Chief Operating Officer, having joined Axcan Pharma Inc. in such capacity in February 2000, as a result of the acquisition of Scandipharm, Inc. Mr. Mims brings 20 years of experience in the healthcare industry to Axcan. Steve Gannon, our Senior Vice President, Finance and Chief Financial Officer, joined Axcan Pharma Inc. in such capacity in April 2006, having previously served as Chief Financial Officer of CryoCath Technologies Inc. and held various senior financial roles at AstraZeneca and Mallinckrodt. Dr. Alexandre LeBeaut rejoined us as Senior Vice President and Chief Scientific Officer in September 2008 after previously holding such position with Axcan Pharma Inc. from May 2006 to February 2007 and holding various executive positions in the pharmaceutical industry, most recently as Vice President, Medical Units, U.S. Medical Affairs of Sanofi-Aventis Pharmaceuticals. Nicholas Franco joined Axcan Pharma Inc. as Senior Vice President, International Commercial Operations in July 2007, having formerly held various management positions at Novartis Pharma AG. Darcy Toms joined Axcan Pharma Inc. as Vice President, Business Development in January 2007, having formerly held positions at Biovail and Aventis. Richard Tarte, formerly a partner with the law firm of Coudert Brothers, joined Axcan Pharma Inc. as Vice President, Corporate Development & General Counsel in 2001 and brings 8 years of experience in the healthcare sector to Axcan. Overall, the foregoing members of our senior management team have an average tenure of 15 years in the healthcare industry.

- 7 -

Business Strategy

We intend to enhance our position as the leading specialty pharmaceutical company concentrating in the field of gastroenterology by pursuing the following strategic initiatives:

Focus on Gastroenterology Market. While large pharmaceutical companies are primarily focusing on developing “blockbuster” drugs, we concentrate our efforts on branded products in niche gastroenterology markets that we can effectively target with our sales force, which, as of September 30, 2008, consists of a total of 151 sales representatives based in the U.S., U.K., Canada, France and Germany. We currently market a range of established specialty pharmaceutical products intended for the treatment of symptoms associated with gastrointestinal diseases and disorders. We plan to continue to grow our revenues by building on our solid base business and introducing new products to the gastroenterology market. Given the niche nature of our markets and the focused audience, consisting of gastroenterologists, hepatologists and cystic fibrosis centers, our sales representatives are able to concentrate their sales and marketing efforts to effectively target the primary prescription writers of these products.

Grow Sales of Existing Products.We seek to drive growth in sales of our products by continuing to focus on high-volume prescribing physicians in the gastroenterology market and by leveraging the market position and unique nature of our product lines. We utilize extensive analysis of prescription data relating to our products and the products of our competitors to identify physicians who are high-volume prescribers of drugs that treat the diseases and disorders that our products address, and we then call on these high-volume prescribing physicians frequently to build strong professional relationships. We also seek to leverage the unique nature of our product lines to drive performance. Products from our CANASA and URSO product lines (URSO 250 / URSO FORTE) are currently the only branded, actively-promoted products in their respective markets. CARAFATE is the only branded suspension-form sucralfate product in its market in the U.S. ULTRASE, in addition to being promoted by our sales force, also is supported by physicians and caregiver programs which we believe helps to differentiate ULTRASE from competing products and to position ULTRASE as the drug of choice for many patients. In addition, VIOKASE is the only branded non-enteric coated prescription pancreatic enzyme product in its market. As a result, we believe our products are often the first line of treatment prescribed by physicians. We seek to leverage this position and what we believe is the high degree of patient loyalty to our products in order to maintain leading competitive positions in the markets in which we participate.

Take Advantage of Recent Regulatory Developments to Increase Market Share.Due to concerns about substantial variation among pancreatic enzyme products on the market, in April 2004, the FDA formally notified manufacturers of pancreatic enzyme products, including ULTRASE and VIOKASE that their products had to be approved by the FDA in order to remain on the market in the U.S. Under current requirements, manufacturers are required to file an IND for their pancreatic enzyme products by April 2008, to file an NDA by April 2009 and to obtain FDA approval by April 2010. We believe that the manufacturers of many of the generic, or unbranded, products that are currently on the market will not complete the required clinical trials by the deadline imposed by the FDA. As generic products currently on the U.S. market accounted for approximately 52% of prescription volume in 2007, this could result in a significant growth opportunity for branded products that are approved by the FDA. We have submitted our NDA for ULTRASE MT, the mini-tablet formulation of ULTRASE and have submitted our IND for VIOKASE. On July 1, 2008, we received an approvable letter from the FDA regarding our NDA for ULTRASE MT, citing certain chemistry, manufacturing and control data work concerns and we are currently preparing a response to the FDA’s comments in collaboration with our manufacturing partners and expect that required regulatory filings will be made in time to comply with the FDA’s guidelines.

Based on publicly available information, we believe that at least three other manufacturers of pancreatic enzyme products, Eurand N.V., or Eurand, Solvay Pharmaceuticals, Inc., or Solvay, and Digestive Care, Inc., have submitted or have begun to submit NDAs for their products. In August 2007, Solvay reported that it had received an approvable letter from the FDA citing certain chemistry, manufacturing and control data work and clinical concerns regarding CREON®, its pancreatic enzyme product and has not reported further regarding its NDA. In September 2008, Eurand announced that it had responded to an approvable letter from the FDA for its pancreatic enzyme product ZENTASE®, which cited certain chemistry, manufacturing and control data work concerns and that the only missing item was a response filing by its raw material supplier to the FDA’s questions relating to the Drug Master File, or DMF. In addition, Digestive Care, Inc. has recently announced that it has completed the submission of its NDA for its pancreatic enzyme product PANCRECARB®, which was granted a “Fast Track” designation by the FDA, which allows certain new drugs and biological products to proceed more rapidly through the regulatory review process.

- 8 -

Selectively Acquire or In-License Complementary Products.We intend to continue to seek to acquire or in-license new products that complement the strategic focus of our existing portfolio of product lines. Due to our core knowledge of gastrointestinal markets, our multinational sales and marketing capabilities, our reputation and our top-tier sales force, we believe that we are a preferred partner for companies looking to sell or out-license their products. Our experienced business development team uses a rigorous and disciplined approach to ensure that the product lines we acquire fit strategically within our portfolio. In recent years, we have successfully grown a number of product lines that we acquired or developed to become leaders in their markets, including URSO, CANASA, CARAFATE, ULTRASE, SALOFALK and VIOKASE.

Pursue Growth Opportunities Through Developing Pipeline.We will maintain our commitment to research and development in order to develop the next generation of products to address unmet needs in the gastroenterology market. Our internal development efforts focus primarily on extending proprietary protection of our products through product line extensions, rather than undertaking the costly, high-risk new drug discovery usually associated with large pharmaceutical and biotechnology companies. Our experienced product development team, which includes both our quality assurance and scientific affairs teams, consists of 102 scientists and technicians, approximately 39 of whom have a Doctor of Medicine (M.D.), Doctor of Philosophy (Ph.D.) or Doctor of Pharmacy (Pharm.D.) degree, has proven expertise in the development of line extensions and formulations and in the commercialization of our development efforts. After successfully completing Phase III trials for PYLERA, we obtained FDA approval in 2006 and, in May 2007, launched PYLERA in the United States. We believe that PYLERA constitutes a therapy that is less expensive and of shorter duration than its competitors. During the rolling quarter ended September 30, 2008, PYLERA had already successfully captured 15.8% of the U.S. market in terms of total prescriptions written by gastroenterologists for the eradication ofHelicobacter pylori, a bacterium recognized as being the main cause of gastric and duodenal ulcers, and we believe that we are well-positioned to continue to capture market share from PYLERA’s competitors. We also expect to launch PYLERA in the EU in 2010, subject to successful completion of clinical trials and regulatory approval, and have a number of additional products in our pipeline, including, among others, CANASA MAX-002, a smaller-form product for our CANASA product line to be used for the treatment of ulcerative proctitis; Cx401, an innovative biological product in development for the treatment of perianal fistula; and AGI-010, a controlled-release proton pump inhibitor to be used for the treatment of symptoms associated with GERD, and, in particular, to be used for the control of night-time gastric acidity, known as nocturnal acid breakthrough. Nocturnal acid breakthrough remains a significant unmet medical need, and is estimated to occur in more than 50% of GERD patients on a proton pump inhibitor therapy.

Expand Internationally.Our current infrastructure in the U.S., Canada and the EU will form the basis of our efforts to expand internationally by increasing our sales and marketing footprint worldwide. We intend to continue to increase the geographic presence of our products, and to that end, for example, we expect to launch PYLERA in the EU in 2010, subject to successful completion of clinical trials and regulatory approval. We also plan to maintain and expand our network of third-party distributors that sell our products in countries where we do not have a sales force presence.

Products

Our focus is in the field of gastroenterology. Our current portfolio of commercial products includes a number of gastrointestinal products for the treatment of a range of gastrointestinal diseases and disorders such as inflammatory bowel disease, cholestatic liver diseases, pancreatic insufficiency, gastric and duodenal ulcers, and other related gastrointestinal disorders.

While our business focus is to sell products in the U.S., Canada and the EU, several of our products have been commercialized internationally through licensing and distribution agreements with marketing partners with expertise in their local markets.

We also have various products in development in the U.S., Canada and the EU. A discussion on these projects and on the regulatory process follows under the headings “Products in Development” and “Government Regulation.”

The majority of the products that we market do not benefit from any patent protection. We believe, however, that certain of our products benefit from other barriers to the entry of competitors or generics. Our products nevertheless remain subject to competition and generic product entries into their respective markets, which, especially in the case of generics, which are typically sold at a significant discount to reference drug prices, could significantly and negatively affect our revenues. As of September 30, 2008, our main product lines are CANASA, URSO 250 / URSO FORTE, ULTRASE, CARAFATE and PYLERA in the United States, SALOFALK and URSO in Canada and DELURSAN, PANZYTRAT and LACTEOL in the EU. In fiscal year

- 9 -

2008, the patent covering URSO 250 / URSO FORTE’s use in the treatment of PBC has expired in the United States (November 19, 2007) and the market exclusivity obtained on CANASA pursuant to the clinical investigation exclusivity provisions of the Hatch-Waxman Act, covering a change in the formulation of this drug from a 500 mg formulation to a 1,000 mg suppository formulation, has expired (November 5, 2007).

Our main marketed product lines, their sales, prescriptions, patent/regulatory protection and certain other barriers to entry are discussed below.

Pancreatic Enzyme Products

ULTRASE

We market as ULTRASE, certain pancreatic enzyme microsphere (ULTRASE MS) and mini-tablet (ULTRASE MT) products, designed to help patients with exocrine pancreatic insufficiency (including pancreatic insufficiency associated with cystic fibrosis) to better digest food. ULTRASE is marketed in the United States, Canada and a few export markets but this product line is actively promoted by us solely in the United States.

We reported net sales of $59.2 million, $47.9 million and $39.1 million for ULTRASE in fiscal years 2008, 2007, and 2006, respectively. ULTRASE competes with a number of pancreatic enzyme products including PANCREASE® (Ortho-McNeil Pharmaceutical, Inc.), CREON® (Solvay Pharmaceuticals, Inc.) and PANCRECARB® (Digestive Care, Inc.), as well as with various other unbranded products. ULTRASE, together with VIOKASE, has had the second leading market share for branded products in the U.S. for the last five years, both in terms of the number of prescriptions written for pancreatic enzyme products and sales of pancreatic enzyme products. IMS estimates that in 2007, 14% of the prescriptions written for pancreatic enzyme products in the U.S. were written for ULTRASE and VIOKASE.

ULTRASE is licensed exclusively from Eurand under an exclusive license and supply agreement. This agreement, which was entered into in 2000, initially was for a period of ten years with automatic renewals for subsequent periods of two years. This agreement was amended in 2007 and extended to 2015. We have paid Eurand licensing fees totalling $3.5 million, and we agreed to pay to Eurand royalties of 6% on annual net sales.

In April 2004, the FDA formally notified manufacturers of pancreatic insufficiency products that these drugs, which include ULTRASE, must receive regulatory approval under an NDA before April 2008 in order to remain on the market. The FDA recently extended this deadline to April 2010. We completed the submission of our NDA for ULTRASE MT. On July 1, 2008, we received an approvable letter from the FDA regarding our NDA for ULTRASE MT, citing certain chemistry, manufacturing and control data work concerns and we are currently preparing a response to the FDA’s comments in collaboration with our manufacturing partners and expect that required regulatory filings will be made in time to comply with the FDA’s guidelines.

ULTRASE does not currently benefit from patent protection. We believe that, upon approval of its NDA, ULTRASE will be entitled to receive New Drug Product Exclusivity pursuant to the Drug Price Competition and Patent Term Restoration Act, or the Hatch-Waxman Act, which would provide it limited protection from new competition in the marketplace. This exclusivity is expected to prohibit the FDA from approving ANDAs for products containing the same active moiety, for a period of five years. Further, in its guidelines (“Guidance for Industry—Exocrine Pancreatic Insufficiency Drug Products—Submitting NDAs”; April 2006), the FDA has stated that because of their complexity, pancreatic enzyme extract products are not likely to be appropriate for ANDA filings.

Based on publicly available information, we believe that at least three other manufacturers of pancreatic enzyme products, Eurand N.V., or Eurand, Solvay Pharmaceuticals, Inc., or Solvay, and Digestive Care, Inc., have submitted or have begun to submit NDAs for their products. In August 2007, Solvay reported that it had received an approvable letter from the FDA citing certain chemistry, manufacturing and control data work and clinical concerns regarding CREON®, its pancreatic enzyme product, and has not reported further regarding its NDA. In September 2008, Eurand announced that it had responded to an approvable letter from the FDA for its pancreatic enzyme product ZENTASE®, which cited certain chemistry, manufacturing and control data work concerns and that the only missing item was a response filing by its raw material supplier to the FDA’s questions relating to the Drug Master File, or DMF. In addition, Digestive Care, Inc. has recently announced that it has completed the submission of its its NDA for its pancreatic enzyme product PANCRECARB®, which was granted a “Fast Track” designation by the FDA, which allows certain new drugs and biological products to proceed more rapidly through the regulatory review process.

- 10 -

VIOKASE

We market as VIOKASE non-enteric coated pancreatic replacement enzymes for the treatment of exocrine pancreatic insufficiency. VIOKASE, although not actively promoted, is sold in the United States and Canada.

We reported net sales of $15.1 million, $11.2 million and $7.6 million for VIOKASE in fiscal years 2008, 2007 and 2006, respectively.

In April 2004, the FDA formally notified manufacturers of pancreatic insufficiency products that these drugs, which include VIOKASE, must receive regulatory approval under an NDA, before April 2008, in order to remain on the market. The FDA recently extended this deadline to April 2010. We have filed an IND and are currently advancing the completion of our NDA for VIOKASE and expect to comply with the FDA’s timeline for pancreatic enzyme product approval.

VIOKASE does not currently benefit from patent protection. We believe that it will be entitled to receive New Product Exclusivity pursuant to the Hatch-Waxman Act upon approval of our NDA. This exclusivity is expected to prohibit the FDA from approving ANDAs for products containing the same active moiety, for a period of five years. Further, in its guidelines, (“Guidance for Industry—Exocrine Pancreatic Insufficiency Drug Products—Submitting NDAs” - April 2006), the FDA stated that because of their complexity, pancreatic enzyme extract products are not likely to be appropriate for ANDA filings.

We believe that VIOKASE is currently the only branded non-enteric coated pancreatic enzyme product commercially available in the United States, though it competes with a number of generic, or unbranded products.

PANZYTRAT

PANZYTRAT consists of enteric coated microtablets for use in the treatment of exocrine pancreatic insufficiency and pancreatic enzyme deficiency. PANZYTRAT is marketed in several countries, mainly Germany and the Netherlands as well as a few export markets. We reported net sales of $16.6 million, $14.8 million and $12.1 million for PANZYTRAT in fiscal years 2008, 2007 and 2006, respectively. The main competitor for PANZYTRAT in Germany and the Netherlands is CREON® (Solvay).

PANZYTRAT does not benefit from any patent protection, nor any other form of regulatory exclusivity in the main countries in which it is marketed, namely Germany and the Netherlands.

Ursodiol

URSO 250 and URSO FORTE (United States)

In the United States, we have been marketing URSO 250, a 250-milligram ursodiol tablet for the treatment of Primary Biliary Cirrhosis, or PBC, a chronic liver disease, since May 1998. URSO FORTE, a 500-milligram ursodiol tablet, was launched in November 2004.

We reported net sales of $67.0 million, $68.1 million and $49.3 million for URSO 250/ URSO FORTE in the United States in fiscal years 2008, 2007 and 2006, respectively.

In the United States, there is currently no therapy specifically approved to be marketed for the treatment of PBC other than URSO 250 / URSO FORTE. However, other ursodiol products, approved and prescribed for gallstone dissolution as associated with active weight loss, are sometimes used for the treatment of various other liver diseases, including PBC. These products include ACTIGALL™, a product provided by Watson Pharmaceuticals, Inc. and generic versions of ACTIGALL™. According to IMS, the market share of our URSO product lines, including URSO 250 / URSO FORTE and URSO / URSO DS, in terms of the number of prescriptions written for ursodiol products in the U.S. increased from 25% in 2003 to 30% in 2007. In 2007, sales of our URSO products accounted for 67% of the sales of ursodiol products in the U.S.

In addition, on November 19, 2007, the FDA Orange Book listed patent covering the use of URSO 250 / URSO FORTE, expired. URSO 250 / URSO FORTE do not benefit from any other patent protection or other form of regulatory exclusivity in the United States. As a result, if a generic ursodiol tablet were to be launched, it could have a significant negative impact on sales of URSO 250 / URSO FORTE in the United States.

We believe that certain product lifecycle managemen initiatives we have or may take to modify and improve the product, coupled with URSO’s recognized brand name, its specific approval for the treatment of PBC and its targeted marketing approach aimed at hepatology specialists provide a competitive advantage to URSO 250 and URSO FORTE in the United States and could allow us to maintain sales of URSO in the face of

- 11 -

generic competition. There is no assurance, however, that any of these measures will produce advantages over generic competition with respect to URSO and generic sales could have a significant negative impact on our sales of URSO. See “Item 1A. Risk Factors—Risks Related to Our Business.”

URSO and URSO DS (Canada)

In Canada, we market URSO (250 mg) and URSO DS (500 mg) for the treatment of cholestatic liver diseases, which include PBC and Primary Sclerosing Cholangitis, or PSC. URSO / URSO DS were covered by a patent relating to the use ursodiol for the treatment of PBC in Canada, which was to expire in 2010. However, in 2006, the generic product manufacturer, Pharmascience Inc., successfully challenged the validity of this patent under the Notice of Compliance Regulation procedures of Health Canada. In May 2006, generic versions of URSO and URSO DS received approval for sale in Canada and were launched in fiscal year 2007. The launch of these generic products has had a negative impact on sales of URSO / URSO DS in the second half of fiscal year 2007 and fiscal 2008.

URSO / URSO DS does not benefit from any other patent protection or other form of regulatory exclusivity in Canada.

We reported net sales of $3.9 million, $9.0 million and $11.4 million in net sales for URSO/URSO DS in Canada for fiscal years 2008, 2007 and 2006, respectively.

DELURSAN

DELURSAN is an ursodiol preparation marketed in France and indicated for the treatment of cholestatic liver diseases, including PBC, PSC and liver disorders related to cystic fibrosis.

DELURSAN does not have any patent protection or any regulatory exclusivity in France. As a result, if a generic ursodiol preparation were to be launched, it could have a significant negative impact on sales of DELURSAN in France. We reported net sales of $21.3 million, $16.7 million and $13.9 million for DELURSAN in fiscal years 2008, 2007, and 2006, respectively. In France, DELURSAN currently competes mainly with URSOLVAN® (Sanofi-Aventis S.A.).

Mesalamine

CANASA

CANASA is a mesalamine suppository, which is sold by us in the United States and which is indicated for the treatment of distal ulcerative proctitis, an inflammatory bowel disease. We believe that CANASA currently is the only commercially available mesalamine suppository in the United States.

We reported net sales of $72.1 million, $65.1 million and $53.1 million for CANASA in fiscal years 2008, 2007 and 2006, respectively.

CANASA competes with topical corticosteroid enemas and suppositories, as well as mesalamine enemas. In the United States, CANASA primarily competes with ROWASA® enemas provided by Alaven Pharmaceutical LLC and with various generic mesalamine enemas. According to IMS, CANASA’s market share in terms of the number of prescriptions written for rectally-administered mesalamine products in the U.S. has increased from 51% in 2003 to 63% in 2007. In 2007, sales of CANASA accounted for 61% of sales of rectally-administered mesalamine products in the U.S.

CANASA does not have any patent protection in the United States. On November 5, 2007, the previously granted clinical investigation exclusivity pursuant to the Hatch-Waxman Act, covering a change in the formulation of this drug from a 500 mg formulation to a 1,000 mg suppository formulation, expired. As a result, if a generic mesalamine suppository were to be launched, it could have a significant negative impact on sales of CANASA in the United States.

However, in June 2007, the FDA published a draft guidance on the requirements it expects manufacturers seeking approval of a mesalamine suppository to meet in order to obtain approval to launch such a product. The draft guidance specifies in part that a request of approval must be supported by placebo and reference-drug controlled clinical studies with clinical endpoints demonstrating safety and effectiveness in patients with ulcerative proctitis. We believe the FDA has issued this guidance based upon its assessment that CANASA activity is due to, among other reasons, local rather than systemic effects in the patient’s body and, as such, pharmacokinetic studies seeking to establish comparability based on amounts of the drug in the patient’s blood levels are not adequate to demonstrate the therapeutic equivalence of another product seeking approval. This belief was supported by a presentation delivered in September 2008 by Barbara M. Davit, Ph.D., J.D., acting director, Division of Bioequivalence 2, Office of Generic Drugs at CDER, FDA at the annual Regulatory Affairs Professional Society conference during which the FDA’s position on bioequivalence standards for certain locally-acting gastrointestinal drugs was presented. In the case of mesalamine suppositories, the FDA’s position that studies with clinical endpoints are required to demonstrate therapeutic equivalence was confirmed during Dr. Davit’s presentation.

On July 27, 2007, we filed a Citizen’s Petition requiring manufacturers seeking an ANDA approval for a generic version of CANASA to conduct clinical trials in patients and adult healthy volunteers in order to demonstrate therapeutic equivalence, to which the FDA has not yet provided a substantive response. Based on the FDA guidance discussed below, we believe this request to be consistent with the standards the FDA has previously applied to other comparable topically acting or non-systemically absorbed drugs, but cannot provide assurances that our request will be granted.

- 12 -

We believe that generic competitors may be unwilling to undertake the expense required for these types of clinical trials. In addition, we believe that it may be difficult for generic competitors to meet the requirements of this FDA draft guidance. However, we cannot provide assurances that any potential generic competitor will not be able to meet such requirements.

SALOFALK

SALOFALK is a mesalamine-based product line (tablets, suspensions and suppositories) sold by us in Canada for the treatment of certain inflammatory bowel diseases, such as ulcerative colitis, ulcerative proctitis and Crohn’s Disease. In Canada, SALOFALK does not have any patent protection, or any regulatory exclusivity.

We reported net sales of $21.2 million, $19.3 million and $16.5 million for SALOFALK in fiscal years 2008, 2007 and 2006, respectively.

In Canada, SALOFALK competes with several products containing mesalamine in controlled-release tablets or capsules, including ASACOL™, a product provided by The Proctor & Gamble Company, and DIPENTUM™, a product provided by UCB Pharma, Inc.

Sucralfate

CARAFATE / SULCRATE

Our CARAFATE / SULCRATE product lines are indicated for the treatment of gastric and duodenal ulcers. CARAFATE is sold in the United States as oral tablets and an oral suspension and SULCRATE as oral suspensions in Canada, where it is not actively promoted. Both product lines compete primarily against generic sucralfate tablets.

We reported net sales $52.5 million, $52.2 million and $43.1 million for CARAFATE / SULCRATE in fiscal years 2008, 2007 and 2006, respectively. CARAFATE / SULCRATE do not have any patent protection or any regulatory exclusivity in their respective markets. Patent protection for CARAFATE lapsed in fiscal year 2001. We are not aware of any generic versions of CARAFATE / SULCRATE oral suspension that are commercially available in the United States or Canada. If a generic version of these drugs were to be launched, it could have a significant negative impact on sales of CARAFATE / SULCRATE oral suspension in the United States and Canada. According to IMS, in 2007, CARAFATE accounted for 34% of the prescriptions written for sucralfate in the U.S. and 70% of sales of sucralfate in the U.S.

We believe, but cannot provide assurances, that due to the mode of action of CARAFATE oral suspension, the FDA will require manufacturers seeking an ANDA approval for a generic version of CARAFATE oral suspension to conduct clinical trials in patients and adult healthy volunteers in order to demonstrate therapeutic equivalence. Such requirement would likely make it more difficult for a competing generic product to be introduced in the United States. This belief was supported by a presentation in September 2008 delivered by Barbara M. Davit, Ph.D., J.D., acting director, Division of Bioequivalence 2, Office of Generic Drugs at CDER, FDA at the annual Regulatory Affairs Professional Society conference during which the FDA’s position on bioequivalence standards for certain locally-acting drugs was presented. During this presentation, the FDA confirmed its position that, due in part to the low levels of systemic absorption of sucralfate and the lack of appropriate in vitro or PD tests, studies with clinical endpoints are required to demonstrate therapeutic equivalence for sucralfate tablets. We believe, but cannot provide assurances, that the FDA apply the same requirement to demonstrate therapeutic equivalence to our CARAFATE oral suspension product.

Helicobacter PyloriEradication

PYLERA

Since May 7, 2007, we have been marketing as PYLERA a 3-in-1 capsule therapy for the eradication ofHelicobacter pylori, a bacterium recognized as being the main cause of gastric and duodenal ulcers. PYLERA is protected by patent claims covering triple and quadruple therapies forHelicobacter pylori eradication. These claims cover the treatment of duodenal ulcer disease (and in some countries reflux esophagitis and gastric ulcer) through the eradication ofHelicobacter pylori using a bismuth compound together with two or more antibiotics.

- 13 -

The expiry dates of these patents vary depending on the jurisdiction. In the United States, they expire in March 2010. The double capsule formulation of this product and its use in multiple therapies is also covered by patent in a number of countries. The U.S. patent expires in December 2018.

However, because the active pharmaceutical ingredients of PYLERA include antibiotics that were approved by the FDA prior to 1997, the U.S. patents covering PYLERA’s triple and quadruple therapies forHelicobacter pylori eradication and capsule formulation are not permitted to be listed in the FDA’s Orange Book and are not eligible to benefit from the automatic stay provisions or the market exclusivity provisions of the Hatch-Waxman Act.

Since its launch in May 2007, sales of PYLERA in the United States have amounted to $1.8 million for fiscal year 2007 and $6.6 million for fiscal year ended 2008.

Other blister pack products that compete with PYLERA include HELIDAC®, a product provided by Prometheus Laboratories Inc., and PREVPAC®, a product provided by TAP Pharmaceutical Products Inc.

Other Products

LACTEOL

LACTEOL is a product containing a specific proprietary strain ofLactobacillus Acidophilusin a lyophilized powder form. It is available in a number of dosage forms, including capsules, and is primarily indicated for the treatment of diarrhoea. LACTEOL, which is mainly sold in France and in over 40 export markets, does not have any patent protection or any regulatory exclusivity. However, the product is derived from a proprietary strain of bacterium for which the ultimate parent organism is protected by a number of security safeguards, such that access by third parties seeking to reproduce it for competitive or other purposes is limited and controlled.

We reported net sales of $19.0 million, $16.3 million and $18.1 million for LACTEOL in fiscal years 2008, 2007 and 2006, including $11.1 million, $9.9 million, and $9.1 million outside of France.

Sales in France significantly decreased in fiscal years 2007 and 2006 since, as part of new measures designed to reduce healthcare cost associated with the reimbursement of prescription drugs, the French government decided to stop the reimbursement of approximately 200 drugs, including LACTEOL. However, in the first three quarters of fiscal year 2008, we have seen an increase in our sales of LACTEOL from the fiscal 2007 bottom level. We believe our over-the-counter marketing strategy has been the primary reason for this sales trend.

LACTEOL competes with a number of generic products in most markets. As LACTEOL has been marketed for several decades, we believe the brand name LACTEOL constitutes a definite marketing advantage wherever the product is sold.

PHOTOFRIN / PHOTOBARR

We market (directly or through distributors) PHOTOFRIN / PHOTOBARR in the U.S., Canada, the EU and other selected markets. PHOTOFRIN / PHOTOBARR has received regulatory approvals in a number of countries, including for the treatment of high-grade dysplasia associated with Barrett’s Esophagus, obstructing esophageal cancer and non small cell lung cancer, as well as certain types of gastric cancers and cervical dysplasia. PHOTOFRIN / PHOTOBARR is a photo-sensitizer approved for use in photodynamic therapy, an innovative medical therapy based on the use of light-activated drugs. PHOTOFRIN / PHOTOBARR is covered by a number of patents claiming compositions (including product by process claims), methods of use in approved indications, methods of manufacture, as well as patents for certain devices used in connection with treatment with these products. In the United States, PHOTOFRIN / PHOTOBARR’s main market, patent expiries for this product range from June 2009 to May 2016.

We reported net sales of $6.5 million, $5.9 million and $5.5 million for PHOTOFRIN/PHOTOBARR in fiscal years 2008, 2007 and 2006, respectively.

To our knowledge, there are currently no other photo-sensitizers approved as drugs in Canada, the United States and the EU for the treatment of high-grade dysplasia associated with Barrett’s Esophagus, obstructing esophageal cancer and lung cancer, gastric cancer or cervical dysplasia.

- 14 -

Products in Development

Our Scientific Affairs team leverages its expertise in the field of gastroenterology to develop product line enhancements and modifications to existing products and complete the clinical development of new product candidates, consistent with our research and development growth strategy. For new product candidates, we mainly consider the development of late-stage (Phase II and beyond) novel molecules and innovative product candidates that, in our view, provide an acceptable risk/return profile.

We also seek to enhance and extend exclusivity through the staged introduction of product enhancements. These may include improvements in the frequency of administration of drug products, improvements in the convenience of administration, reduction in dose, reduction in side effects (improved tolerability), or improved therapeutic effect/benefit.

Our staff of research scientists has expertise in all aspects of the drug-development process, from pre-formulation studies and formulation development, to scale-up and manufacturing. In fiscal year 2007, our development efforts resulted in the approval of PYLERA in the United States, for the eradication of theHelicobacter pylori bacterium.

As part of our business strategy, we enter into licensing agreements with companies that are developing compounds and innovative products in the field of gastroenterology. These compounds and products are typically in-licensed with some combination of upfront payments, development milestone payments and/or royalty payments. In some cases, we have an option to acquire an ownership position in the company with which we have entered into such an agreement.

We currently have development efforts ongoing for eight products that we believe may, upon regulatory approval, provide clinically meaningful benefits to patients.

Our pipeline products are in various stages of development. Despite the reduced risk profile of our pipeline programs (relative to new chemical entities), they do carry development risk, and as such, we do not anticipate the commercialization of all of these products. In addition, we routinely review and prioritize our pipeline as new product candidates are added, which can result in the discontinuation or delay in other ongoing development programs which offer, in our estimation, a less attractive risk/return profile. This is normal practice in the pharmaceutical industry.

Given that the successful development of any pipeline program is dependent on a number of variables, it is difficult to accurately predict timelines for regulatory approval and accordingly clinical development expenses. In fiscal year 2008 our research and development expenses were approximately $28.1 million or 7.4% of our total revenues ($28.6 million or 8.2% of revenue in fiscal year 2007 and $39.8 million or 13.6% of revenue in fiscal year 2006).

We from time to time, review our portfolio of products under development to set priorities for the various development programs underway and to ensure that internal and budgeted resources are allocated accordingly. As a result of these reviews, the contents of certain development programs and related timelines may be modified or certain programs terminated.

The following is a description of our active and disclosed pipeline projects. The intellectual property around these projects is discussed below in “Patents and Trademarks.”

Pancreatic Enzyme Products

ULTRASE and VIOKASE

In April 2004, the FDA formally notified manufacturers of pancreatic enzyme products that these drugs, which include ULTRASE and VIOKASE, must receive NDA approval before April 2008, in order to remain on the market. This deadline was recently extended to April 2010. The FDA has also published final guidelines aimed at assisting manufacturers of pancreatic enzyme drug products in preparing and submitting these NDAs. We completed all the clinical trial and the chemistry, manufacturing and control data work required for the submission of our NDA for ULTRASE MT in the fourth quarter of fiscal year 2007, which filing was accepted by the FDA in the first quarter of fiscal year 2008. On July 1, 2008, we received an approvable letter from the FDA regarding our NDA for ULTRASE MT, citing certain chemistry, manufacturing and control data work concerns and we are currently preparing a response to the FDA’s comments in collaboration with our manufacturing partners and expect that required regulatory filings will be made in time to comply with the FDA’s guidelines. We have submitted our IND for VIOKASE and, assuming successful completion of the currently ongoing clinical trial, we expect to submit our NDA for VIOKASE in time to comply with the FDA’s required timeline for pancreatic enzyme product approval.

- 15 -

While we can provide no assurances, we believe that some of the manufacturers of prescription pancreatic enzyme products that are currently on the market in the United States may not be able to satisfy the FDA’s requirements for NDAs for these products, which could create a significant growth opportunity for us if we receive NDA approval for ULTRASE and VIOKASE before April 2010. See “Item 1A. Risk Factors—Risks Related to Our Business.”

NMK 150

We are developing NMK 150, a new high protease pancrelipase preparation developed for the relief of pain in small duct chronic pancreatitis, which represents an unmet medical need. A dose-ranging, animal study assessing the toxicity of NMK 150, which paid special attention to duodenal irritation, confirmed the safety profile of this compound. A Phase I, ascending, multiple-dose clinical study was also completed and confirmed the safety and tolerability of this compound alone and in combination with a proton pump inhibitor. We are currently reviewing the relevance of this product in our current pipeline.

Ursodiol

SUDCA (Ursodiol Disulfate)

We are currently studying the use of SUDCA, a new ursodiol derivative, in the prevention of the recurrence of colorectal adenomateous polyps, considered to be a pre-cancerous stage of colorectal cancer.

We had previously completed a Phase II study of the effectiveness of URSO 250 in preventing the recurrence of colorectal adenomateous polyps in the United States and Canada, for which 792 patients were randomized. The final analysis confirmed a trend in the sub-group of patients suffering from early stage colorectal cancer at baseline. However, in the overall study population, no statistically significant difference between the two groups was observed in terms of mean number of recurring polyps and average polyp size.

Preliminary results of studies conducted with SUDCA showed that ursodiol disulfate reduces the number of aberrant crypts in a rat model of colon cancer.

In addition to these animal studies, a single, ascending-dose Phase I clinical study was completed in early 2006, and a multiple, ascending-dose Phase I study was completed in September 2006, to evaluate the safety, tolerability and preliminary pharmacokinetics of SUDCA. Both studies confirmed the safety and tolerability of this compound. We are currently reviewing the relevance of this product in our current pipeline.

Mesalamine

CANASA MAX-002

We have initiated the CANASA MAX-002 program, a Phase III clinical trial to evaluate the efficacy and safety of a novel, high-concentration, 1-gram mesalamine suppository for the treatment of ulcerative proctitis.

Ulcerative proctitis is a subgroup of ulcerative colitis, one of the most common inflammatory bowel diseases. For approximately 30% of patients with ulcerative colitis, the illness begins as ulcerative proctitis where bowel inflammation is limited to the rectum. Currently, it is estimated that there are 1 million cases of inflammatory bowel disease in the U.S.

In June 2007, the FDA issued draft guidance on the type of clinical program required for the approval of mesalamine suppositories. Based on this draft guidance, we temporarily suspended the recruitment of this trial and expect to resume it in fiscal year 2009, upon completion of ongoing discussions with the FDA.

Helicobacter Pylori Eradication

PYLERA

Our Phase III clinical program with PYLERA in the EU to obtain approval to market this therapy for the eradication ofHelicobacter pyloriis well underway. This Phase III clinical trial in the EU is expected to be conducted on approximately 400 patients and is intended to compare our PYLERA regimen given in combination with omeprazole, to the widely used OAC triple therapy (20 mg of omeprazole, 1 g of amoxicillin and 500 mg of clarithromycin, all given twice a day). The trial is expected to be completed in the second half of calendar 2009. PYLERA was successfully launched in the United States in fiscal year 2007. Under the terms of FDA approval, we were required to conduct a post-marketing pediatric study of PYLERA in children. However, the FDA has recently granted us a waiver for this requirement.

- 16 -

Others

AGI-010

We and AGI Therapeutics, plc, or AGI. are co-developing AGI-010, a delayed/controlled release formulation of the proton pump inhibitor drug omeprazole, which is being developed for the treatment of symptoms associated with GERD, and, in particular, is to be used for the control of night-time gastric acidity, known as nocturnal acid breakthrough. Nocturnal acid breakthrough remains a significant unmet medical need, and is estimated to occur in more than 50% of GERD patients on a proton pump inhibitor therapy.

Development of the final formulation for this compound is ongoing and once completed, will allow both companies to make a decision on the most appropriate development and filing strategy for this product.

See “Patents and Trademarks—AGI-010” below for more information regarding certain milestone payments we may have to make related to the development of AGI-010.

Cx401

On September 30, 2007, we entered into an exclusive license and development agreement with Cellerix of Spain, for the North American (United States, Canada and Mexico) rights to Cx401, an innovative biological product in development for the treatment of perianal fistulas.

A Phase II trial conducted in 50 patients in the EU demonstrated the efficacy and safety of Cx401. This randomized, open-label, parallel assignment study evaluated the safety and efficacy of Cx401 in the treatment of perianal fistulas in Crohn’s and non-Crohn’s Disease patients. The primary endpoint for this study was photographically assessed complete closure and healing, and showed a 71% response rate in the acute phase, both in Crohn’s and non-Crohn’s Disease patients. Results of this study were presented atDigestive Disease Week in May 2007 (Garci-Olmo D. et al., “Expanded Adipose-Derived Stem Cells (Cx401) for the Treatment of Complex Perianal Fistula. A Phase II Clinical Trial” (Digestive Disease Week 2007; Abstract: 492)) and are pending publication.

We will be responsible for the costs to develop and commercialize this product in North America. We expect to initiate a Phase IIb study in North America in the first half of fiscal year 2010. Depending on the outcome of further discussions with the FDA, filing could occur as early as 2012.

See “Patents and Trademarks—Cx401” below for more information regarding certain royalty payments we may have to make related to the development of Cx401.

Sales and Marketing

In the United States, we sell our products to most major wholesale drug companies and distributors, which in turn distribute our products to chain and independent pharmacies, hospitals and mail order organizations. As of September 30, 2008, we had 82 sales representatives, 9 regional sales managers managed by 2 zone directors and 5 national account managers in our managed care group, all located in the United States, who call on high-volume prescribing gastroenterology physicians, cystic fibrosis centres, hepatologists and transplant centres, potential and current PHOTOFRIN centres as well as third-party payors, clinical pharmacists and formularies administrators. Since the launch of PYLERA, in May 2007, sales representatives also visit general practitioners known to be high-volume prescribers ofHelicobacter pylori eradication therapies.

In Canada, we sell our products to hospitals and wholesale drug companies, which in turn distribute our products to pharmacies. Our major products are included in most provincial drug benefit formularies and are actively promoted by our 11 sales representatives, under the supervision of the regional sales manager, to gastroenterologists and internal medicine specialists with a particular interest in gastrointestinal diseases, as well as to colorectal surgeons.

In France, we sell our products to distributors, which in turn distribute them to wholesale drug companies, which in turn distribute them to pharmacies. As of September 30, 2008, we had 42 sales representatives who, under the supervision of 5 regional sales directors, regularly visit high-volume prescribing physicians to promote our other prescription products. In addition, in Germany, we have an exclusive contracted sales force that includes 15 sales representatives under the supervision of 1 regional sales director and in the United Kingdom, we have 1 sales representative.

This international sales structure is complemented by our sponsorship of high-level international medical meetings on topics related to our products and research activities. These events are recognized by leading institutions, and continuing medical education credits are awarded to attendees. As a consequence, we believe that we are recognized not only as a supplier of quality products, but also as an important link in the continuous medical education process.

- 17 -

Customers

While the ultimate end-users of our products are the individual patients to whom our products are prescribed by physicians, our direct customers include a number of large pharmaceutical wholesale distributors and large pharmacy chains. The pharmaceutical wholesale distributors that comprise a significant portion of our customer base sell our products primarily to retail pharmacies, which ultimately dispense our products to the end consumers.

Increasingly, in North America, third-party payors, such as private insurance companies and drug plan benefit managers, aim to rationalize the use of pharmaceutical products and medical treatments, in order to ensure that prescribed products are necessary for the patients’ disorders. Moreover, large drug store chains now account for an increasing portion of the retail sales of prescription medicines. The pharmacists and store managers of such retail outlets are under pressure to reduce the number of items in inventory in order to reduce costs.

We use a “pull-through” marketing approach that is typical of pharmaceutical companies. Under this approach, our sales representatives actively promote our products by demonstrating the features and benefits of our products to physicians and, in particular, gastroenterologists who may write their patients prescriptions for our products. The patients, in turn, take the prescriptions to pharmacies to be filled. The pharmacies then place orders with the wholesalers, to whom we sell our products.

The following table sets forth the percentage of total net sales for each of the last three fiscal years for each of our wholesale customers that accounted for ten percent or more of our total net sales in any of the last three fiscal years.

| | | | | | | | | |

| | | For the fiscal years ended

September 30, | |

| | | 2008 | | | 2007 | | | 2006 | |

Customer A | | 39.0 | % | | 41.2 | % | | 39.0 | % |

Customer B | | 26.6 | % | | 25.0 | % | | 24.4 | % |

Customer C | | 10.3 | % | | 11.1 | % | | 11.4 | % |

| | | | | | | | | |

Total | | 75.9 | % | | 77.3 | % | | 74.8 | % |

| | | | | | | | | |

Competition

Our business is highly competitive. Competition within the gastroenterology industry is primarily based upon product effectiveness, side effects and convenience, although price competition is an important factor as healthcare providers continue to be concerned with costs.

Our products face competition from both branded and generic products, sold by other pharmaceutical companies. Many of these competitors have greater financial resources and marketing capabilities than we do. Our competitors in the United States and abroad are numerous and include major pharmaceutical companies, and some of the manufacturers of our products. We believe that our focus on gastroenterology, combined with our strategy of funding and controlling all or most aspects of our business, will provide the cost savings, efficiencies in product development and acceleration of regulatory filings necessary for us to compete effectively with such companies. Our competitors, however, may succeed in developing products that are as, or more, clinically-or cost-effective than any that are being developed or licensed by us, or that would render our products obsolete or uncompetitive. In addition, certain of our competitors have greater experience than we do in clinical testing and human clinical trials of pharmaceutical products and in obtaining FDA and other regulatory approvals.

Competition for each of our key product lines is discussed in greater detail above in the “Products” section.

Manufacture and Supply

While we manufacture LACTEOL and SALOFALK at our French and Canadian facilities, respectively, we outsource all aspects of the manufacturing of our other products and product candidates. We maintain internal quality control, regulatory affairs and product planning resources to oversee the activities of these third party manufacturers. With the exception of LACTEOL, we currently rely, and expect to continue to rely, on third parties for supply of the active pharmaceutical ingredients in all of our products and product candidates and, with respect to our products other than LACTEOL and SALOFALK, for the manufacture of the finished forms of these drugs and packaging. These third parties act under contracts that expire at various times beginning in 2009 and generally provide for price increases based on inflation. We have no plans to establish

- 18 -

any additional manufacturing facilities for our products or product candidates. If any of our current manufacturers should become unavailable to us for any reason, we believe that there are a number of potential replacements, although we might incur delays in identifying and qualifying such replacements.

For all of our marketed products other than LACTEOL and SALOFALK, we have entered into agreements with third parties to manufacture the finished dosage form of the product. Depending on the particular arrangement, either we or the third party manufacturer source the active pharmaceutical ingredient. For most of the raw materials and active pharmaceutical ingredients in our products and product candidates, we rely on a sole source to supply our requirements. While we believe that there are alternative sources of supply for the active pharmaceutical ingredients and raw materials required for the manufacture of our products, if any of our current suppliers were unable to meet our needs, we may not be able to have these alternative suppliers qualified in a timely manner, and we may not be able to obtain the required materials on favorable terms. For some of our marketed products, the finished dosage manufacturer also packages the product, and for others, we use a separate third party packager.

Our agreements with our suppliers and manufacturers include customary supply terms, including product specifications, batch size requirements, price, payment terms, requirements forecasting, delivery mechanics and quality assurance. Under most of these agreements, we are obligated to purchase all or a specified percentage of our requirements for the product or active pharmaceutical ingredient supplied under the agreement. These agreements also generally permit the manufacturer or supplier to pass on to us increases in costs of production or materials.

With the exception of the manufacturers of ULTRASE, MODULON, PHOTOFRIN and PYLERA, and the manufacturer and supplier of CANASA, our manufacturers and suppliers are not restricted from supplying product to third parties. Eurand, our supplier for ULTRASE, has agreed to certain restrictions on its ability to supply any third party in the United States, Canada and certain Central and South American countries with certain pancreatic enzyme products. Eurand is permitted to commercialize its own pancreatic enzyme product line, for which it is currently seeking FDA regulatory approval in the United States, and which may be in competition with ULTRASE.

Our supplier of mesalamine and the manufacturer of CANASA have each agreed not to supply mesalamine or a mesalamine product to a third party in the United States or Canada.

Our agreements for the manufacture of our core products expire on various dates beginning in 2009 and continuing through 2015. We believe, but cannot assure, that we will be able to renew these agreements on satisfactory terms as they expire or find suitable alternative suppliers and manufacturers. If we are unable to renew these agreements on favorable terms or find suitable alternatives, however, our business could be adversely affected.